We broke our monthly GMV record by 200% in March 2021 despite pandemic !

Easy-to-use front desk system that facilitates day-to-day hotel operations

Get more direct bookings. Commissions free. Local payment gateways

Self-servicing hotel check-in, check-out and walk-in guest reservation

Probably the most affordable Channel Manager that you have come across

User-friendly website content management system built for hotelier

Try Our Free Trial

Unlock More Value with Softinn today!

Customer Success Stories

You would love to hear how have our customers made a significant difference after using Softinn

Suitable For

Road to automation, reduce unnecessary operational hassle and generate more revenues

Stand out from the other competitors, build a strong online presence

Manage your hotel branches & franchises systematically regardless of the number of properties

All tools and reports that you need to manage properties owned by others

E-book & Offers

More that just an e-book. Tips, tricks and trends are included for knowledge enhancement

One-stop knowledge center for Softinn users from beginners to expert

New to Softinn? Book your slot to join our live training session

We create and curate useful contents about the topics that hoteliers are looking for

We constantly innovate. Read more on our latest product releases & feature updates

Hello from Softinn!

We are hotel technology service provider with a mission to make hoteliers work easier

We do what we do best, make I.T easy for hoteliers

We work and integrate with other amazing companies

Let’s get connected. We are more than happy to talk to you

Be part of our story. We are looking for passionate candidates

- Free Trial

- Login

- Property Management System

- Booking Engine

- Hotel Channel Manager

- Hotel Website CMS

- Hybrid Hotel Kiosk

- Independent & Boutique Hotel

- Hotel Groups

- Resort & Luxury Villa

- Bnb Management

- Knowledge Base

- Blog & Article

- Product Update

- Product Training

- Why Softinn

- Partner & Integration

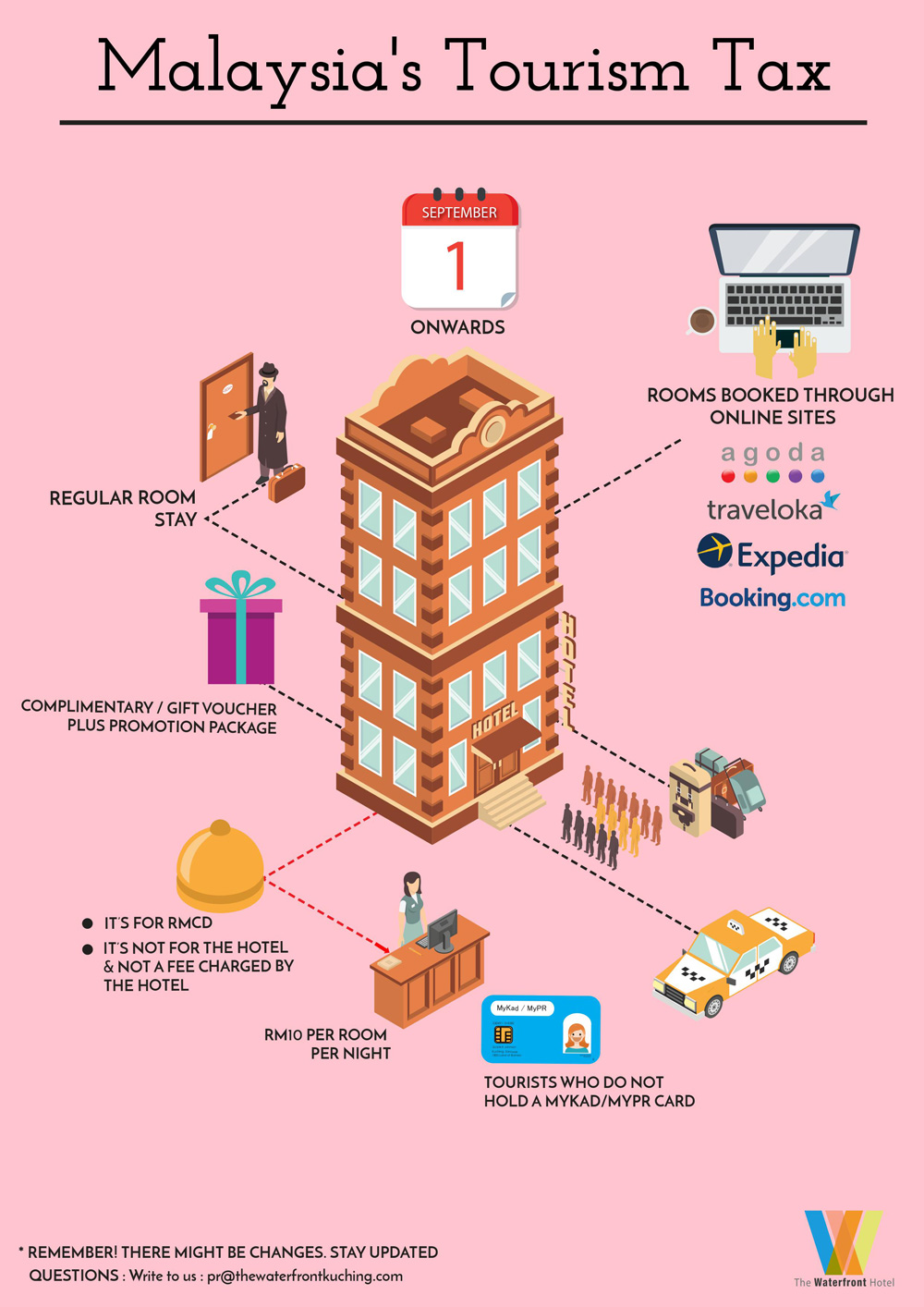

Malaysia Tourism Tax (TTX) 2023: What You Need to Know

In line with the announcement made by the Malaysian government regarding the Tourism Tax , I will talk about a series of questions that are commonly asked by hotel owners or operators, thus helping all of you to find the answers that are related to it.

1. What is a Tourism Tax?

Tourism Tax (TTx) is referred to as a tax charged for all foreign passport holders at accommodations premises collected by the operators effective from 1st September 2017 in Malaysia. It is charged at a fixed rate of RM10.00 per room per night. However, during the Covid-19 pandemic, The Malaysian Government has announced the exemption of the Tourism Tax for all foreign passport holders for hotel stays between 1st March 2020 and 31st December 2021 then further extends to 31st December 2022. Now, the Malaysian government has announced that the Tourism Tax will resume back starting from 1st January 2023.

2. How is the RM10 per room per night applied?

Assuming one room is booked for one night by John (who is a Filipino), the TTx charged to John will be RM10.00 x 1 room x 1 night = RM10.00 In the 2nd Scenario, assuming two rooms were booked by Dianne (who is an Indonesian) for three nights, so the TTx charged to Dianne will be RM10.00 x 2 rooms x 3 nights = RM60.00

3. How is this new to the travel industry starting January 2023?

Since September 2017, a guest who is a foreigner is subject to paying Tourism Tax when staying at any “accommodation premises” in Malaysia; this tax is collected by the operator at the accommodation premises upon check-in, regardless if the booking was made online or walk-in. However, starting from 1st January 2023. For any bookings made through digital platforms that provide reservation services such as booking.com, Agoda, and Expedia, the platform is the one to collect the Tourism Tax directly from the foreign guests when the guest made the booking and payment online through the platform. The digital platform provider shall remit the tax collected to the RMCD. Whereas, for booking that was made online through the platform but payment only upon arrival at the accommodation premises, the TTx shall be collected by the accommodation operator upon guest arrival. The responsibility of remitting the tax collected for this booking shall be by the accommodation operator instead.

We have just received the update that currently, only AGODA will collect the TTx directly from the guest together with the room charges if they made the payment online. Whereas, for other OTAs like Expedia, Booking.com & Traveloka, the TTx will be collected upon check-in by the property operator, UNTIL FURTHER NOTICE.

4. What if the booking has been made before 1st January 2023 for the check-in date after on or 1st January 2023?

If a foreign traveller has made a booking on a digital platform before 1st January 2023, for check-in on or after 1st of January 2023, the Tourism Tax must be collected by the accommodation operator upon guest arrival and the accommodation operator is required to remit the tax to the RMCD.

5. What if my property did not register for TTx?

We advise you to further consult with your business advisor or check with RMCD if you have not registered as a Tourism Tax registrant. Generally, if you are operating accommodation premises of 5 rooms or more, you are liable to be registered. You may also check this website https://www.myttx.customs.gov.my/ to further understand the registration.

6. If a Malaysian with his foreign friend both check into the same room and the booking was made and paid by the Malaysian, is TTx chargeable?

In this case, it is not subject to Tourism Tax because a local stayed and paid for the stay. However, the Tourism Tax is chargeable in the event that the foreigner stays and pays for the stay.

7. If the reservation has been made with full payment together with the TTx for the booking made via OTAs, then the guest request for the cancellation on a non-refundable policy, will the TTx will be refunded?

Unfortunately, we are unsure of this. Do let us know in the comment section if you have more information regarding this. What I can say is, you may refer to the T&C directly from the OTAs.

8. Will TTx subject to SST too?

No. The operator is not allowed to charge SST on the Tourism Tax.

9. Is day use chargeable to TTx?

No, if the day use charge is not equal to the room rate per night.

10. Is a Digital Platform provider compulsory to collect private data such as passport no. or ID no. to ensure nationality?

Yes. The Digital Platform provider should make an appropriate adjustment in its system to capture the information that is to identify the citizenship of the tourists.

11. John makes an accommodation booking online and provides inaccurate information which resulted in TTx not being collec ted. Who wi ll be responsible?

If due diligence has been done to obtain the information required from the tourists, the Digital Platform provider will not be responsible for any inaccurate information provided by the tourist, which may result in the under-collection of TTx.

Check out this video where we answer a frequently asked question regarding the Tourism Tax

That’s all 11 common questions that we heard so far regarding the Malaysia Tourism Tax. Please share this article if you find it useful and drop any questions in the comment sections if you think there are more questions that should be answered.

You're reading a blog compiled by Softinn. We're a hotel-technology company with the mission to make hotelier work easier. Do subscribe if you enjoy reading our blog or you may interact with us on our Facebook Page .

Get Monthly Updates

Other topics, ebooks & resources.

We won't spam your inbox. We promise to send a curated list of posts to your inbox once a month, nothing more.

Start your free trial now

No credit card required

Make hotelier work easier

Softinn builds the next-generation hotel management system for boutique hotels in Asia Pacific.

Term & Services | Privacy Policy

- Hotel Kiosk

- Softinn API

- Hotel Groups & Chains

- BnB Management

- Customer Success Story

- Blog and Articles

- Product Training (Basic)

- Product Training (Advanced)

- Pricing & Plan

© 2013-2023 Softinn Solutions Sdn. Bhd. (1029363-M) All rights reserved. Made with ♥ in Malacca, Malaysia.

Chinese (CN) / 简体中文

Chinese (HK) / 繁體中文(香港)

Chinese (TW) / 繁體中文(台灣)

Japanese / 日本語

Korean / 한국어(대한민국)

Malaysian Tourism Tax FAQs

Home > Partner Help > Your reservations > Malaysian Tourism Tax FAQs

Last updated: 11 months ago | 8 min read time

Malaysian Tourism Tax FAQs (CN)/简体中文

Malaysian Tourism Tax FAQs (HK)/中文 (香港)

Malaysian Tourism Tax FAQs (TW)/繁體中文

Malaysian Tourism Tax FAQs Japanese/日本語

Malaysian Tourism Tax FAQs Korean /한국어(대한민국)

Malaysian Tourism Tax FAQs Thai/ไทย

Malaysian Tourism Tax FAQs (MY)/Malay

This article will explain the Malaysian Tourism Tax and answer FAQs.

- Effective 1st Jan 2023 – 31 Dec 2025, Digital Platform Service Providers (DPSPs or Platform) are liable to collect and charge TTx from any tourists for reservations that are i) made through the DPSP’s platform and ii) where payment is made to a DPSP (such as Agoda) and remit such TTx to the Malaysian Customs Department. If payment of TTx has been made to the platform, then the accommodation premises should not collect the TTx again, provided proof of payment of TTx can be furnished; otherwise the accommodation premises shall collect TTx. For bookings where payment is made to accommodation premises in Malaysia directly (pay at property), it is the accommodation premise’s obligation as a registered operator to collect and remit TTx to Malaysian Customs Department.

- Starting on 1 Jan 2026, the government may choose to alter or continue with these rules.

- For more information, please visit myttx.customs.gov.my .

- a) Malaysian nationals (holders of a MyKad card)

- b) Permanent residents of Malaysia (holders of a MyPR card).

- If the property is listed and booked as one unit, then the Tourism Tax of RM10/room/night will be imposed to the unit only, so for 1 night, the applicable TTx = RM 10.

- If the property is listed on platform as three separate units (one bedroom per listing), then TTx shall be imposed on each of the rooms. So, if three rooms are booked for 1 night, the TTx would be RM 10/room/night x 3= RM 30.

- Q: Will this affect existing bookings, especially for Pay at Hotel existing bookings? A: Guests who are tourists have been subject to pay TTx since September 2017 when staying at any accommodation premises in Malaysia; this is normally collected by the operator i.e. accommodation premises operator. However, starting from 1 Jan 2023 and continuing until 31 Dec 2025, bookings made through platforms providing reservation services such as Agoda are liable to collect and charge TTx for any bookings made on the platform in which the platform collects the payment from bookers. If a traveler has made a booking on Agoda before 1 Jan 2023, and where TTx is applicable, the TTx must be collected by the property and remitted to the RMCD. For bookings of Malaysian properties made on Agoda on and after 1 Jan 2023 and continuing until 31 Dec 2025, Agoda as the platform is required to collect TTx if the payment for the booking is collected by Agoda. Agoda will endeavor to collect TTx on most bookings and issue a document as proof of TTx payment to the booker. However, for Pay Property bookings, TTx needs to be collected by the property from the booked guest at check-in.

- If the payment model “Pay to Agoda”, “Merchant Commission” and TTx applies – TTx is INCLUDED in the price and is collected by Agoda.

- If the payment model is “Pay to Agoda”, “Merchant Commission” and TTx doesn’t apply — TTx is NOT collected.

- If the payment model is “Pay at Hotel” and TTx applies — Malaysia Tourism Tax is INCLUDED in the price and collected by the property.

- If the payment model is “Pay at Hotel” and TTx doesn’t apply — Malaysia Tourism Tax is NOT collected.

- Q: How do I verify that TTx has been collected by Agoda? A: Agoda will issue to bookers proof of TTx collection (if collected by Agoda), unless TTx needs to be collected by the property as explained above.

- Q: My property did not register for Tourism Tax, does this apply to me? A: To determine whether you should be registered for TTx or not, please consult your business advisor or seek RMCD’s further guidance. The exemption from TTx for certain property types (Item 3, Tourism Tax Exemption Order 2017) e.g. homestay/kampungstay operator, operator with 4 accommodation rooms or less, does not apply when the reservation is made through a DPSP’s platform. Even if you are exempt from TTx, TTx would still be applicable when a booking of your property is made on Agoda by a qualified tourist.

- Q: If a tourist books accommodation through Agoda then subsequently extends their stay directly with the accommodation premise operator, who is liable to collect the TTx for the additional stay period? A: For tourists who book accommodation through a platform and extend their stay, the accommodation premise operator will collect any TTx for the additional stay. Platforms such as Agoda should not be liable to collect the TTx for the additional stay period, unless the additional stay period is booked using the online platform. Source: GUIDE ON TOURISM TAX (DIGITAL PLATFORM SERVICE PROVIDER) as of 13 Aug 2021.

- Q: If I have other questions on the Malaysian Tourism Tax, who should I contact? A: Please contact our Accommodation Service Team via the Need Help? button in YCS.

- Q: In case of a dispute by a customer, what should I do and who should I contact? A: Please contact our Accommodation Service Team via the Need Help? button in YCS.

- Q: Upon check in, I found that the guest is a foreign tourist, but the booking was made by a local. In this case, what should I do? Should I collect the tax and remit to RMCD? A: Yes. You should collect the applicable TTx in such case and remit to RMCD.

- Q: Is the guest still entitled to a TTx refund if the booking is non-refundable, but it is a no-show? A: TTx will in all cases be refunded to the booker if the stay at the premise does not take place. For more specific cases see below:

- If a full refund is triggered (cancellation on refundable booking) => Agoda refunds the entire amount. TTx will be refunded in full.

- If a booking is cancelled with 100% charge (cancellation on non-refundable booking) => Agoda keeps the original amount not related to TTx. Payment to the property should not be affected. However, TTx should be refunded to the booker.

- If a booking is cancelled with partial charges=> TTx will be refunded to the booker.

- If the booking is amended => Applicable tourism tax will be recalculated based on the new room nights of the amended booking. The amendment voucher should indicate the new value of tourism tax that has been paid.

Was this article helpful?

Thanks for your feedback!

Your reservations

Managing your reservations

How do I collect earnings from my bookings?

What is the Analytics Center?

What can I do if the guest did not show up (No-Show)?

How do I view booking transactions and past payments for ePass payments?

YCS Availability Center

How do I respond to booking inquires?

What should I do if I can’t accommodate a Property Collect booking?

What is Acknowledge Booking and how can I Acknowledge Booking?

How to handle guest requested changes?

How do I receive confirmation on my reservation?

How do I respond to a special request?

Can I make changes to a reservation?

What should I do if I can’t accommodate a guest?

Where can I see details of my reservations?

Recommended reads

Agoda celebrates Golden Circle Awards across Asia

Agoda celebrates golden circle awards across ....

We're thrilled to share that Agoda has recently hosted the Golden Circle Awards at in Bangkok, Phuket, Hong Kong, Seoul and Tokyo

We're thrilled to share that Agoda has recently hosted the Golden Circle Awards at in Bangkok, Phuke ...

11-Mar-2024

Agoda Partner Appreciation Night – Livestream

Agoda partner appreciation night – live ....

Thank you for joining us for industry insights from Agoda’s leaders!

20-Feb-2024

Protected: Agoda Partner Appreciation Night – Livestream

Protected: agoda partner appreciation night & ....

There is no excerpt because this is a protected post.

14-Feb-2024

Agoda Manila hosts ‘Coffee Session’ for Growth Team

Agoda manila hosts ‘coffee session̵ ....

Agoda Manila hosts 'Coffee Session' for Growth Team Partners

Agoda launches the 3rd edition Eco Deals Program at the ASEAN Tourism – Forum

Agoda launches the 3rd edition eco deals prog ....

Agoda, the global digital travel platform, announced at the ASEAN Tourism Forum (ATF) that it has broadened its collaboration with World Wide Fund for Nature (WWF), expanding its Eco Deals Program to support eight conservation projects across Southeast Asia.

Agoda, the global digital travel platform, announced at the ASEAN Tourism Forum (ATF) that it has br ...

Agoda Manila hosts “Bites & Insights” for Partners

Agoda manila hosts “bites & insigh ....

Partners feast on Bites & Insights in Manila

Agoda Partner Appreciation Night

Join us on 2 February from 18:00 (GMT+7) for industry insights from Agoda’s leaders.

23-Jan-2024

Jet-set into 2024: Agoda shares travel ideas for a year of new discoveries!

Jet-set into 2024: agoda shares travel ideas ....

As the new year begins, Thai travelers may find themselves curating their resolutions list, encompassing a wide range of aspirations from eating healthier and indulging in new experiences to reading more.

As the new year begins, Thai travelers may find themselves curating their resolutions list, encompas ...

More questions?

More support articles available!

Agoda Homes Support

Set up your property with Agoda

Agoda API Documentation

Yield Control System (YCS) Extranet

Policy and terms of use

Content Terms

Cookie policy

Terms of use

Agoda Business Partners Privacy Policy

Agoda NHA Host Privacy Policy

Advertise with us

Agoda Media Solutions

All Languages

This site uses cookies to offer you a better browsing experience and understand how you interact with our Site. Find out more on how we use cookies and how you can change your settings here Cookie Policy .

MYHRMIS Mobile

- Introduction

- Department History

- Organization Chart

- Malaysian Immigration Attaché

- Achievements & eAwards

- Client Charter Achievement

- Our Anthem & Oath

- Malaysian International Passport

- Passport Recipient and Issuance Offices

- Restricted Passport to Brunei

- Foreign Worker

- Entry Permit

- Malaysia My Second Home (MMH2) – En

- International travel

- Domestic Travel (Domestic)

- Enforcement

- Visa Requirement by Country

- Visa With Reference

- Apply for Visa

- Security Bond/Bank Guarantee Rates

- Endorsement of Exemption Section 66

- INTRODUCTION

- ELIGIBLE APPLICANTS

- REGULATORY AGENCY

- APPLICATION FORM

- Important Link

- Certification of Identity

- Special Programme

- Visitor’s Pass (Temporary Employment)

- Employment Pass

- Long Term Social Visit Pass

- Short Term Social Visit Pass

- Professional Visitor Pass

- Student Pass

- Residence Pass

- Required Documents

- Border Pass (Malaysia – Indonesia)

- Border Pass (Malaysia – Thailand)

- Foreign Domestic Helper (FDH)

- Restricted Travel Documents

- Document In Lieu of Internal Travel Document

- Prohibited Immigrant

- Frequently Committed Offences

- Entry Requirements for Ship Crew Member (Seaman)

- Address & Location

- Operation Hours

- Staff Directory

- Chief Information Officer

- Frequently Ask Question

Tuesday : June 11, 2024 - 5.28 pm

- E-Participation

- Tenders & Quotations

- Statistic Of Online Services Transaction

Immigration Department of Malaysia Headquarters (Ministry of Home Affairs)

No. 15, 1-7 Floor, (Podium) Persiaran Perdana, Presint 2, 62550 Putrajaya. T : 03-8000 8000 (MyGCC)

Portal Feedback: [email protected]

Copyright © 2021 | Immigration Department of Malaysia (Ministry of Home Affairs) Best viewed using the latest browser: Mozilla Firefox 4, Google Chrome or Internet Explorer 10.0 and above, with a resolution greater than 1024 x 768

Is Malaysia’s Tourism Tax Good Policy?

The tourism tax, which was first introduced in 2017, is currently levied on a flat, RM10-per-night basis for all foreign visitors to Malaysia – and also on some people who aren’t visiting at all!

They say the only sure things in life are death and taxes, and a general disdain for taxation is quite possibly one of the few things nearly all people agree on. But I also think that many, if not most, of us understand why taxes exist. And we accept the imposition of taxes more easily when we see good things arising from their collection.

But it’s a funny old business for sure. I remember many years ago – 1993 to be exact – when my home city of Denver, Colorado was awarded one of two major league baseball expansion teams. For the first two years, the team played in the city’s football stadium since the seasons for the two sports don’t really overlap. The fields for baseball and American football are, of course, completely different, so a lot of adjustments had to be made. Calls quickly began mounting for a dedicated baseball stadium, so accordingly, for the six-county area surrounding Denver, a tiny sales tax increase was proposed to fund the stadium’s costly construction. It was only 0.1% – just 1¢ for every $10 spent, the pitch proclaimed – and voters passed it. A genuinely beautiful new $300 million baseball stadium was built in downtown Denver, just over half funded by that tax, and in April 1995, Coors Field opened with its first game. Now, nearly three decades later, the stadium still stands.

Curiously enough, however, that 0.1% tax increase – ostensibly imposed to fund the construction of Coors Field – also still stands (albeit under a fresh new name). As many governments have discovered, once that magical tap of delicious tax revenue is turned on, it’s really hard to muster up the political will to turn it off.

TAXING THE TOURISTS

The one tax that I would very much like to see shelved here in Malaysia – or at least reviewed and modified – is the loathsome ‘tourism tax.’ Although many municipalities impose such taxes in some form or another, the way in which Malaysia levies it on a nationwide basis could probably use some tweaking.

No matter where you go in the country, no matter the room rate of the lodging in which you stay, a flat RM10 per room, per night tourism tax is levied, and innkeepers are required to collect this charge in full and typically upfront (though not always), separate from the bill paid at check-out. It is loudly and clearly announced, too, often noted on a prominent placard at the front desk: this is a tourism tax. Only Malaysian citizens and permanent residents are exempted. (More on this later.)

Does this not seem a bit unwelcoming and unfriendly, as though tourists are almost being openly penalized for choosing to come to Malaysia and spend their money? Officials have said that “most of the money” collected from this tourism tax, which is a significant haul, is used to further promote the country to other tourists, which just seems… odd. A tourist comes to visit and explore Malaysia and spend their money here, and they are taxed specifically so that more tourists can be enticed to come, and then also get taxed for visiting? To my mind, a country should pay, from its own general budget, for promoting itself overseas, not the tourists who have already chosen to visit.

Think of it in a different way. You go to a restaurant, but before you are taken to your table, a RM5 per dish charge is demanded and collected. It doesn’t matter if your selection costs RM150 or RM20. The same fee applies – RM5 per dish. “What is this for?” you ask. “Well,” they explain, pointing to the sign, “it’s our dining tax. We collect this cash from you, then use it to advertise our restaurant so we can get other diners to come. When they do, we’ll collect the same fee from them, then use that to buy even more advertising.”

Would this not elicit outrage? And wouldn’t most diners simply decide to eat elsewhere next time? I feel this is a pretty fair analogy for Malaysia’s tourism tax.

Does it bring in a lot of money? It surely does – early estimates of over RM100 million per 10% in occupancy rate were floated (e.g., about RM654 million for average nationwide occupancy rate of 60%). But is it good policy? That remains an open question.

Surely there must be a better way. Perhaps a blanket ‘occupancy tax’ that is levied universally , and on a modest percentage basis. Even on its face, this seems more equitable, because while paying an extra RM10 per night at a hotel whose rates start at RM900 might not seem like a big bite, how does that translate to paying the same extra RM10 a night for a room that’s RM80 a night? One guest is paying about 1.1% in tourism tax, while the other is paying 12.5%. Additionally, the tax penalty grows if a tourist stays longer in Malaysia, presumably spending more money and adding to the economy all the while. Seven nights? Well, that’ll be RM70 extra, please.

Tourism industry players ramped up calls in 2018 to abolish the tax , which they said was too “in your face” and counterproductive to the goal of stimulating tourist spending. Agencies and tourism groups decried the charge en masses , saying it was an “ unnecessary burden ” on both tourists and on accommodation operators. Despite months of pleading, however, the government pointedly said it had no intention of removing the controversial tax .

After all, the lucrative tap had been turned on, and just as in Colorado, officials found it much too tantalising to turn off.

BUT IT’S NOT JUST FOR TOURISTS

Possibly the most frustrating thing about this so-called tourism tax is that it is cheerfully imposed on working expats and resident MM2Hers, too – people who are in no way tourists in Malaysia. I’ve lived here for 15 years. I work here, I pay taxes here, I spend money here literally every day, contributing to the country’s economy. And yet, if I travel anywhere within the country, and check in to a hotel, I am asked to pay a tourism tax.

Like several other expats with whom I’ve spoken about the issue, I flatly refuse to pay it, explaining that I am not a tourist, but rather a long-time resident. Of course, I realize it’s not the hotel’s doing, and I tell them that – they’re simply executing Ministry of Tourism policy.

But perhaps it’s time to revisit that policy, and either include residents with long-term visas on the exemption list, or rethink the tourism tax approach altogether. Experts more knowledgeable than I have decried tourism taxes as ‘ bad tax policy ,’ saying that it shifts the cost burden unfairly, creates negative effects on consumers and business owners, and hinders the effective promotion of a destination – exactly the opposite effect intended. One comprehensive study found that a 10% increase in tourism tax resulted in a 5.4% decrease in tourist demand.

Moreover, many municipalities which do impose a tourism tax do so to help fund the infrastructure and attractions that tourists enjoy, preserve the environment, or encourage the development of sustainable tourism practices. Some even use the funds to pay for insurance policies to provide an umbrella of protection for visitors in the event of injury. And of course, in some instances – in this era of growing overtourism – some destinations impose taxes simply to disincentivize visits.

But not many places explicitly levy taxes on tourists for the purpose of funding the destination’s tourism marketing goals! And most places tend to impose these taxes a bit more discreetly or indirectly, working them subtly into international airline fares, occupancy taxes, or such.

TIME FOR A REVIEW?

Thailand, which in February 2023 approved a controversial and deeply unpopular 300-baht ‘tourism fee’ for visitors arriving by air (150 baht for land and sea arrivals), did not announce at the time exactly when it would be implemented. In mid-December 2023, they announced it would be postponed indefinitely, ‘until the industry recovers.’

Maybe a rethink of a policy that explicitly taxes tourists for choosing to come here is worth considering for Malaysia, too – and certainly a reversal of treating and taxing resident expats as tourists is in order.

Or maybe there’s just a better way to implement these taxes. If levied as a much lower, percentage-based occupancy tax across the board, it would not only be fairer, it could potentially even generate more revenue, as nobody would be exempt. And why should they be? After all, a Malaysian who lives in KL and visits Kuching is still very much a tourist. And if the funds are used to bolster and improve tourism facilities and keep places clean and sustainable, then locals derive every bit as much benefit from that as tourists – if not more!

Tourism is too important to Malaysia’s economy to implement flawed or unsustainable policy. The country has an abundance of incredible tourism assets and derives immense benefit from tourism, so it’s clear that adopting well-thought-out approaches to managing the resources and funding their upkeep will always be of critical importance.

Most Popular

Airport Autogate Facilities Extended to Nationals from 46 Countries

Burning Up the 5G Superhighway: Malaysia’s Speeds Are Second-Fastest in Asia Pacific

AirAsia Shifts Focus to Southeast Asia Region with New ASEAN Explorer Pass

Thailand to Recriminalise Cannabis by Year-End, Marking a 180-Degree Policy Change

Refresh your music with heineken.

Forest City’s Parent Company, Country Garden, Likely to Face Trade Suspension in China

Sabah Latest to Adopt a ‘Rich Tourists’ Pursuit?

IMAGES

VIDEO

COMMENTS

Tourism Tax (TTx) is referred to as a tax charged for all foreign passport holders at accommodations premises collected by the operators effective from 1st September 2017 in Malaysia. It is charged at a fixed rate of RM10.00 per room per night.

A: The Malaysian Tourism Tax (TTx) is a tax of RM10 per room per night charged on any tourist staying at any accommodation premises within Malaysia, collected by the operator under the Tourism Tax Act 2017 (TTx Act).

Visa Fee According To The Country. Countries. Single/Multiple Entry Visa (RM) Transit Visa (RM) Argentina. 20.15.

The tourism tax, which was first introduced in 2017, is currently levied on a flat, RM10-per-night basis for all foreign visitors to Malaysia – and also on some people who aren’t visiting at all!

Amendments to Malaysia’s legislation relating to tourism tax (TTx) and the departure levy (DLv) were gazetted on 18 October 2022, which include measures to grant certain additional administrative powers to the Minister of Finance (“Minister”) and the Royal Malaysian Customs Department (RMCD).

A1: Tourism tax shall be charged and levied on a tourist staying at any accommodation premises through service relating to online booking accommodation premises provided by a digital platform service provider.