- Home ›

- Reviews ›

Asda Money reviews

Asda Money are rated Poor in 204 reviews

ASDA offer a simple way to order your travel money. Place your order online, over the phone or at an in-store Travel Money bureau all with zero commission and no fees if you pay with your Asda Money Credit Card or debit card. Note: these are ONLINE rates - you may get a lower rate in-store unless you order online in advance.

Reviews by day

Showing reviews 1-15 of 204

14 May 2024

Ordered a currency card

Appalling customer service. Cost more in fees and time. Had to use an alternative card which fortunately I had taken abroad with me. Will not use again

They are garbage , the app is abhorrent, I tried to check my balance , everything I entered my unique one time number it was rejected.

Viktor Bohdan

25 March 2024

Bought £200 worth of Euros

Went to Asda in Spondon, Derby. Exchanged 200 pound for euros. No questions asked, nothing explained. When i got home I found out that the lady charge me for exchange fees. How can you charge someone without explanation? Will never use their service ever again.

21 February 2024

I put £200.00 in my travel card went to make sure that it had gone onto the card but the money is nowhere to be seen contacted card services who then contacted Travelex and still no sign of the money, I have contacted my bank they are now looking into this.

28 January 2024

Bought travel money

Ordered local currency for Barbados. Ordered on Monday and told it would be a few days and we would be phoned. Not heard anything so went in Friday - going away next Thursday, nothing arrived. Telephone call Saturday afternoon to say they can’t get any! Very unreliable!

15 January 2024

Bought £50 worth of Euros

Got my travel money card today, and it was a piece of cake with the help of Millie in the Spondon branch. Any worries were put at ease, so helpful in how to setup it up and knowing how I can use the card when aboard. I was really happy with the service provided.

Bought £100 worth of Euros

quick straight forward service

18 December 2023

Bought £1 worth of US dollars

This is the fourth time I have attempted to use the service in Asda Fareham, as it is the only place within a few miles that sells foreign currency. 3 pre ordered and today randomly.

Each and every time there has been a note to say just popped out, be back at a certain time and this is not usually between 12 & 2. It is usually just after 3pm for pre ordered. Today, I randomly popped in at 12.20 and once again, there was a note to say that the person has popped out and will be back at 12.50. Surely if their website displays opening times, a member of staff should be there to serve customers or they should display opening hours open and not actually on lunch or gone out etc…it’s not cheap to keep having to drive backwards and forwards, 6 miles to be precise to not be able to get the money ordered or even randomly. Asda, this needs sorting out!

Had to put in an amount that I supposedly purchased to leave review.

7 November 2023

Like Sue Williams says on her review I was charged a buy back fee without an explanation.

As a pensioner £2.99 Charge for nothing is better in my pocket.

I was so mad I went back the next day. The same girl said I always explain this Charge!

Not to me you didn't as we never return Euros.

I insisted on having the money back, which she finally agreed to.

3 November 2023

Bought £500 worth of Euros

Had a great experience in the Blackburn asda with the help of a lovely women Heena. Was a great help with everything as it was my first time exchanging money. Great customer service from her. Would definitely recommend to go to the Blackburn asda will be going again.

29 October 2023

Bought £250 worth of Euros

I always go to the bureau in clayton green, I always get good service from the two ladies there, I got tips etc about where I was going last time and its always service with a smile and welcoming

21 October 2023

Bought £1 worth of Euros

Went to Asda Tamworth the customer service was diabolical there were two people serving behind the counter , neither of them had any customer service skills tutting because I queried the exchange rate no please and thank yous .. apparently they don’t accept Scottish

£20 even though it’s legal tender. Will avoid from now on and go where I’m welcome

Jeff Leahey

29 September 2023

What ever you do don’t get one of these Asda travel money cards. Ive waited over 4 days to get a response to an email regarding a problem registering my card. I’ve sent all information requested and yet I’m still waiting. I’m starting to panic as I’m getting low on cash. Dreadful customer service you try finding numbers from abroad. Trying that this doesn’t ruin holiday.

21 September 2023

Sold 500 US dollars

I went to Asda exchange some US Dollars to pounds today just after 5pm. The gentleman who was serving did not seem to be professional at all. I gave him the dollars, he counted, asked for ID, gave him ID, then he looked into his till, and he said to me he does not have enough money to exchange. He could only exchange half of it. This is an exchange place and they did not have money. They need more professional people there. Disappointed. This guy was not fit for the job. Sorry.

7 September 2023

Bought £250 worth of Danish kroner

Turned up to collect currency I ordered 4 days prior. I arranged to collect the travel money at 2.56pm and was told I couldn’t have it till after 3. Won’t used Asda again and staff was cocky

Write a review of Asda Money

Rate your experience.

Click or tap a star to rate

Write your review

What product or service are you reviewing.

These last questions are optional, but your answers will appear with your review and will help to give it some context.

What currency did you buy?

How much did you spend.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

Suggested companies

Salad money.

Asda Money Reviews

In the Non-bank financial service category

Visit this website

Company activity See all

Write a review

Reviews 4.6.

5,240 total

Most relevant

Look no further - Very flexible Travel Insurance cover

Seniors travel insurance! I got the best deal to suit my needs. Cruise cover YES - more than 30 days away YES - increased holiday costs YES All easily applied for online. When I compared like for like with other heavily advertised travel insurers I was shocked at the cost uplift they came back with. Even the comparison web sites could not come close. Add the 10% discount from Asda Rewards membership I was very pleased. My previous annual policy was World travel with them. But this time I cut it back to annual Europe. Would recommend you check them out. Joint policy for 77 and 74 year young cruisers.

Date of experience : 10 May 2024

Very pleasant helpful staff,phoned me…

Very pleasant helpful staff,phoned me once my money arrived,willingly printed a price range for me so id know what i would be spending whilst away,would definitely use Asda again,in fact i got my travel insurance also from Asda,it was best quote.

Date of experience : 13 May 2024

Asda Credit Card

Card arrived promptly and I also got £20 in my Cashpot for getting the card and setting up the direct debit and spending £50.

Date of experience : 12 May 2024

Reply from Asda Money

Hi, thank you for your review today! I am glad to hear that you are happy with the service we have provided. Kind Regards, Daniel - ASDA Money.

I have used Asda Money for my holiday…

I Have used Asda Money for my holiday insurance for the last 3 - 4 years and have always found the person I have spoken to be extremely helpful and they have explained everything clearly.

Date of experience : 09 May 2024

Asda Breakdown cover

I've been with Asda Breakdown cover a number of years now and needed help on a few occasions. On all occasions I have never waited longer than an hour, usually 30 mins or so. I always seem to get Danny who is always very helpful and friendly. I wouldn't go anywhere else for great value breadown cover. Sure there is cheaper breakdown cover out there but I know from past experience you can be waiting 6 hours. I'd rather pay a bit more to have a prompt reliable service.

Date of experience : 05 May 2024

It was very quick and easy to get our insurance …

It was very quick and easy to get our travel insurance and they were very helpful and the price was right

easy to apply simple to understand…

easy to apply simple to understand terms and conditions. card came quickly

This company is contributing positively…

This company is contributing positively to the need of people in all ways e.g sustaining family needs both in the financial area and shopping

Hi there, your positive feedback is not just a pat on the back for us; it's a testament to the hard work and dedication of our team. We are thrilled to know that we could meet and exceed your expectations. Kind Regards, Daniel - ASDA Money.

Prompt, courteous service at a very reasonable price. Would certainly use asda again, as I have done before

Great experience

Great experience, I would use again ,for my travel money and insurance

The guy I spoke to regarding travel…

The guy I spoke to regarding travel insurance was so clear and helpful

Absolute nightmare

Absolute nightmare! I’ve had the credit card a few weeks now without problems. Decided to use to purchase travel money £500 via Asda and it was declined (still within my credit limit etc) a little notification popped up saying stopped as we need to … but it disappeared before I could read it properly and now the account is blocked and under review with a ‘specialist team’ I’ve called to try and figure out what has happened and no one will speak to me to explain why or how it can be resolved after been passed around a million people on the phone just that I have to wait for the team to contact me but they can’t tell me how long that will take - a few days or a few weeks is anyone’s guess

Date of experience : 16 May 2024

Asda credit card help (chat)

Asda credit card help (chat). Really efficient, helpful and polite. I had three different people chatting. They were really professional. Thank you.

Date of experience : 08 May 2024

Chose guaranteed delivery and it did…

Chose guaranteed delivery and it did not arrive when expected. Money was fab but this was a near miss for my holiday spending money.

Date of experience : 15 May 2024

Really helpfull staff

Really helpfull staff. I cut her off but she phoned me back straightaway to complete the transaction. It arrived on time and in mixed denomination as asked for.

Date of experience : 03 May 2024

The phone operator was excellent so…Great very clear explained patiently

The phone operator was excellent so helpful and compassionate. Very clear voice explained everything. I will use them again

It is easy and quick response

It is easy and quick response, many options for lending also great help.

Foreign currency arrived late

Aside from sending the correct amount of required currency, the only requirement is to send it so that it arrives on the agreed delivery date. Via their FX provider TravelEx, my currency order failed to arrive on the date agreed.

Easy website to navigate and a good…

Easy website to navigate and a good price

Always had travel insurance with asda…

Always had travel insurance with asda don't need to shop anywhere else

Date of experience : 06 May 2024

Asda Travel Money 4+

Travelex global, designed for iphone.

- 4.7 • 1.3K Ratings

iPhone Screenshots

Description.

Take the hassle out of travelling with Asda Travel Money. Manage your Asda Travel Money Card or top your travel money on the go via the app. With the app you can easily reload your card, check your balance and recent transactions. The Asda Travel Money Card is the perfect travel companion with: 16 currencies to choose from Free ATM withdrawals worldwide* Safe and Secure No links to your bank accounts Millions of locations to choose from Pin protected to safeguard against fraud Lock in your exchange rates Accepted anywhere Mastercard® Prepaid is accepted 24/7 global assistance to replace your card or provide you with emergency cash You can also order cash in the app to lock in our very best rates on your foreign currency. Whether you are looking for euros, dollars or one of our other 50 currencies, we can deliver to your home or you can pick up in store. Want to get in touch? Email us at [email protected] *Although we at Asda Travel Money do not charge ATM fees, please check the ATM before using it as some operators may charge their own fees. Asda Money Currency Card is issued by PrePay Technologies Limited (PPS) pursuant to license by Mastercard International. PPS is an electronic money institution authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN:900010) for the issuing of electronic money and payment instruments, with its registered office at Floor 6, 3 Sheldon Square, London, W2 6HY, UK. PPS is registered in England under company number 04008083. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Asda Travel Money ordered via the app is provided by Travelex Currency Services Limited, registered number 04621879 with registered address Worldwide House, Thorpewood, Peterborough, PE3 6SB If you have any feedback on the experience of our app we’d love to hear it; email us at [email protected]

Version 30.5

Welcome to the new version of ASDA Travel Money! We've improved our app to make a smoother, faster, and more secure experience with exciting features added just for you. Now you can easily view your PIN and card details directly in the app, and enjoy an improved transaction history that makes tracking your spending effortless.

Ratings and Reviews

1.3K Ratings

Easy to use, if you don’t want to carry notes around, you can use this card aboard, even add extra on the app from your debit card. Would definitely recommend and use for future holidays

Developer Response ,

Hi. Thank you so much for your review! Kind regards, Online Support Team

Terrible app and customer service

I am currently in Spain, brought the Asda Travel Money card before departing the UK. I downloaded the app for ease. It took me around 20 plus attempts just to register my card! Once registered, it just keeps crashing. I can’t see my balance or top up the card. After many attempts, I reluctantly called customer service, which kept dropping the call. I tried one last time only to receive a voicemail saying they are having technical issues and to call back in 4 hours! I am due to head out for the day, but now have to stay at in as I cannot top up my card. Absolute shambles! You would think a multi billion pound company would have a workable app / service. I am trying to give you money for goodness sake! I would give it a zero if I could. Thanks for spoiling my holiday.

Hi, sorry to hear this, so we can investigate the issue further, please can we ask you to email us at [email protected] so that we can follow up and perhaps provide a resolution. Kind regards, Online Support Team

Get ready for a hassle

When opening the travel card at the Asda branch, they failed to inform me that this card has one of the most pointless policies I have ever heard, it can only be topped up once every 24hrs. Luckily I tried to top it up before my flight as I would have found myself with no money on the card before the initial 24hr period. Now, when registering on the app, I would continuously receive the prompt stating I have entered incorrect information. So had to call customer service and they confirmed the info was indeed correct and then they had to register my details on the account before setting up the app.

App Privacy

The developer, Travelex Global , indicated that the app’s privacy practices may include handling of data as described below. For more information, see the developer’s privacy policy .

Data Linked to You

The following data may be collected and linked to your identity:

- Financial Info

- Contact Info

- Identifiers

Data Not Linked to You

The following data may be collected but it is not linked to your identity:

- Diagnostics

Privacy practices may vary based on, for example, the features you use or your age. Learn More

Information

- Developer Website

- App Support

- Privacy Policy

Get all of your passes, tickets, cards, and more in one place.

More by this developer.

Travelex Travel Money

You Might Also Like

ASDA Money Credit Card

Sainsbury's Bank Travel Card

Hays Travel Currency Card

Cash Passport

Creation Credit Card

Suggested companies

Insureandgo uk, insurefor.com.

Asda Travel Reviews

In the Money & Insurance category

Visit this website

Company activity See all

Write a review

Reviews 2.0.

Most relevant

Awful card and customer service

Awful card and customer service - I’m still waiting for a response. I’ve spent more on fees and time! Fortunately I had a backup card when on holiday. I will not use this card again.

Date of experience : April 19, 2024

Fees coming out of my ears to load…

Fees coming out of my ears to load money on and exchange rates all together out of pocket by £60 in charges i was not even told About! Disgusting I've been soo stressed do not touch this Card!

Date of experience : May 08, 2024

Asda travel money Dagenham

I was served by a lady called Sarah for my Euros in Asda at Dagenham. She was polite, efficient and explained the different options and exchange rates. A quick and seamless transaction. I’ll be using them again.

Date of experience : April 20, 2024

Order not ready

Went 5 miles to pick up £100 in turkish lira that I had ordered, waited for ages to be served, only to be told to come back Tuesday because she didn't have enough. Not even an apology

Date of experience : April 26, 2024

I accidentally transferred my zloty to…

I accidentally transferred my zloty to euro then changed back Got charged 20 pounds absolute bloody joke Never wanted the card in first place I wanted cash and lost money in a mistake

Date of experience : April 17, 2024

I used Asda fx at Basildon and was…

I used Asda fx at Basildon and was served by a lady named Edit. She was extremely helpful , explained in detail about my options regarding the travel money card . So pleased to get such lovely service

Date of experience : February 26, 2024

What an absolute joke.

What an absolute joke. My claim hasn't been looked at for 5 months, now they want loads more documents before they will continue, funny they only asked for these documents when I chased them! I will get my money back from them, they are thieves!!! Do not use them, you've been warned.

Date of experience : September 15, 2023

Please introduce the options to can…

Please introduce the options to can manage our travel money card into the app, missing the following sections, Lost/Stolen card, request replacement card or block unblock the card, all this option are very important please. Will can manage the card from the Asda app at all. Waiting to hear from you soon. Thank you

Date of experience : November 21, 2022

I purchased euros from the Burnley…

I purchased euros from the Burnley branch of Asda, the woman miss sold me the buy back which I never asked for, I returned to the shop and asked for a refund, after a long wait as she made phone calls, she eventually took my card details and told me that the money would be back in my account in two to three days. money was deposited back into my account but £100 short. I will have to make another trip to the shop now to sort this mess out. Will I get my money back?

Date of experience : January 24, 2024

I have ordered some foreign currency on…

I have ordered some foreign currency on line , complete the order. All done, better exchange rate. Got email for comfirmation to pick my currency on Thursday. Went there on Thursday but counter was clossed. It made me angry as ASDA travel money didn't inform their customers as their foreign exchange desk is closed for the day. I tried ringing but no response, finally got the contact details for direct Asda travel money as they told me that their staff member is sick, but to my knowledge Asda should inform their customers as we made special journey to asda to pick my order.....it made me angry, upset, & frustrated. Luckily I have1 spare day to go, again went there next day to pick my order. Wasted time ...

Date of experience : November 16, 2023

Will never use again

Will never use again. These outlets are owned by Travlex. I ordered online the rate was ok. When I went to collect the outlet was closed as I was traveling next day I called them they arrange for me to collect from airport outlet. This was far to much trouble for a bit of holiday cash go else were .

Date of experience : February 12, 2024

My partner and i had travel insurance a…

My partner and i had travel insurance a few years back and a few hours before we were going to Malta on holiday her father passed away. They didn't pay out because we didn't supply full medical records from her fathers doctor. Death certificate wasn't enough and we didn't want to put her mother through anymore suffering by asking her to obtain these records. Absolutely disgusting way to treat someone who has just lost their father. They had the cheek a few weeks later to try and take renewal from us.

Date of experience : April 25, 2023

Holiday to poland was cancelled cut…

Holiday to poland was cancelled cut short due to coronovirus in Feb Proceeded and logged claim in march 19th. Sent documents allegedly no body had been in office as of 13 august Gentleman hung up from insurance team and on hold since Gentleman replied from travel service replied hung up disgraceful pr Do not use asda insurance

Date of experience : August 12, 2020

Don't be in a hurry.

Ordered on line but why on earth can I not collect until after 3pm on day of collection! ? I should be able to order and go collect, surely in this day and age. I could just turn up and buy in store so what's the difference? Shall not use again.

Date of experience : February 29, 2024

Amazing customer service from Asda Travel Money

Amazing customer service from Asda Travel Money, ordered and delivered within 2 days. Spoke to customer services before placing an order due to the poor reviews here but happy with my decision. Amazing exchange rate, fast (recorded and tracked) delivery. Thank you Asda!

Date of experience : May 07, 2020

Worse customer service ever

Worse customer service ever. They registered my travel card with my addres wrong. I was told to send an email and in 48 hours it would be updated. 8 days have passed now 7 emails sent, I called them 5 times and still the address is wrong therefore I cannot top up the card as if the address doesn't match it fails the transaction. I do not recommend this card at all.

Date of experience : January 18, 2024

Even if preordered be prepared to wait & bring extra money.!

Online I prepaid for Malaysian Ringitts to be collected 5 days ahead at Asda Dagenham. Arrived to collect had to wait for 45 minutes. Instead of it being pre prepared they did not have the right amount of notes. So they demanded more money, leaving me no choice. Later I formally complained giving them the chance to rectify. Apart from a standard apology email that took three weeks they seem disinterested. Don't go there, I won't again!

Date of experience : February 04, 2020

Got annual travel insurance today on…

Got annual travel insurance today on the phone and considering I have existing medical conditions Jade completed my policy within 15 minutes. Brilliant i had previously been talking to other insurance companies for over an hour and were a total waste of time. Now sorted for 12 months and a lot cheaper than all the other companies. Brilliant service.

Date of experience : October 27, 2023

Nine Months Later Still Waiting

Made a Claim to Asda Travel Insurance due to Covid.Followed there instructions and sent all relevant paperwork to them by Registered Post. They had just closed down due to Covid. They had No Arrangements in place to pick Claims up from offices so four weeks later finding this out I sent Claim by email. Seven weeks after original paperwork sent they opened claim. SEVEN Months later, after being told twice offer of settlement would be sent and third time it was being Prioritized, we are still waiting!. Shameful Company. Please Avoid.

Date of experience : December 23, 2020

No access to funds, no support. Supplier knows its an issue and has no fix

When it works its fine. HOWEVER! It suffers from serious app and access issues which sees your account lost or inaccessible. You will be unable to spend, top up or check balances which combined with little to no customer support. Makes for a stressful and likely holiday ruining experience. We where lucky to have friends with us on our trip whom could lead us money. Otherwise we would have found ourselves on day two of a seven day trip with no access to our money or anyway to sort it out. Will be unloading our money (over the phone as the app is broken) Paying back our travel buddies and closing the account. Just use someone else, plenty of choice and avoid this known issue with the Asda money card.

Date of experience : April 18, 2023

Is this your company?

Claim your profile to access Trustpilot’s free business tools and connect with customers.

Asda Money Transfer Review: FX & Overseas Payments

Updated on May 16, 2024

In the world of overseas payments, the rise and fall of a big player can tell an interesting story. Travelex, once a leading name with over 1,500 stores worldwide, went through tough times. This led to major changes 1 . In this exploration, I look at how Asda money transfer reviews show the toughness of currency exchange services. Asda and a recovering Travelex have teamed up to offer many travel money options, even adding new currencies like the Cambodian currency at Changi airport 1 .

Asda’s money transfer service highlights the importance of dependable foreign exchange services. Travelex saw its revenues jump 160% in 2022 from the year before 1 . This boost isn’t just numbers. It talks about recovery, growth, and job creation, with Travelex bringing over 1,200 jobs globally, 1,000 of which are in the UK 1 . Through this Asda money transfer review, I admire how quick the foreign exchange sector adapts and flourishes in a changing economic world.

With more people needing travel money for trips abroad, overseas payments need to match this demand. Travelex plans to open new bureaux and add 75 bureaux, kiosks, and ATMs by November 2023 1 . This spread will cover areas like the UK, Europe, and beyond. In my review, I’ll see how Asda compares with these plans. I want to find out if they really offer good deals and easy services as they promise.

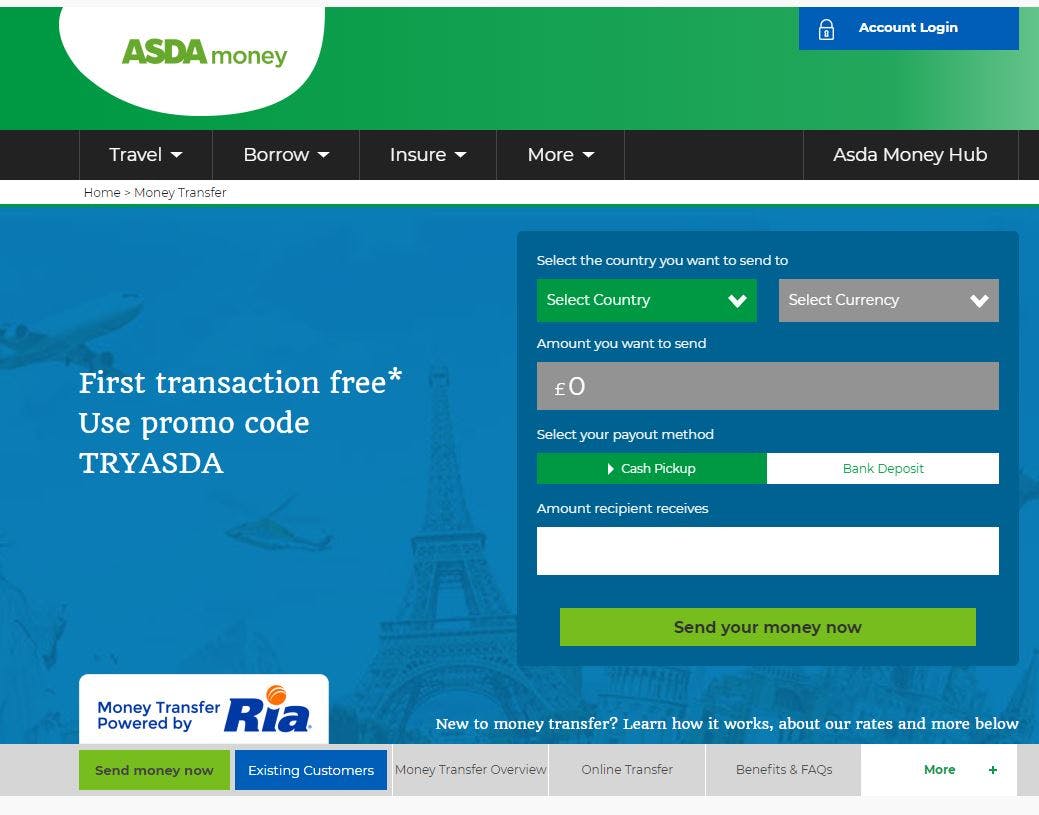

Introduction to Asda Money Transfer Services for FX and Overseas Payments

I explored Asda’s FX services and found a wide range of currency options. They focus on offering good exchange rates. Their site shows many choices for customers, like the Asda Travel Money Card for spending abroad. Let’s look at what makes their services stand out, including the costs.

- Asda FX services promise a range of APRs between 24.9% to 88.8%, showing diversity in their pricing structure to accommodate different users’ needs 2 .

- The potential for earning through cashback offers, which range from 0.5% to 1%, should not be overlooked, as it can add a small saving on transactions over time 2 .

- Accruing reward points also becomes a beneficial feature, with varying options from 1 point per £1 spent, to an enticing 20,000 bonus points for hitting certain spending thresholds 2 .

- I note that some services are accompanied by fixed fees, such as £3 monthly or £30 annually, which necessitates careful financial consideration from the user 2 .

- Moreover, introductory offers such as 5% cashback for the first three months or 20,000 bonus points for specific spending targets can significantly boost a customer’s initial experience with Asda FX services 2 .

When we look at other travel money cards, we see differences. Providers like the Post Office and Travelex offer many currencies but have some cash withdrawal fees. This could be a downside for those seeking clear costs 3 . But Asda Money and its rivals allow free ATM withdrawals, benefiting frequent travelers 3 . The EasyFX limit is £1,000 for withdrawals, showing loyalty programs’ growing role in the industry 3 .

Fees play a big role in choosing a card. More than half of the providers have top-up fees, potentially cutting into the savings from good exchange rates 3 . Cards like Revolut use the interbank rate, offering advantages like no fees for converting money on weekdays 3 . Still, there are some common fees to watch out for:

The world of financial services can be complex. However, learning about Asda FX services helps us understand the currency exchange field better. Remember to compare, contrast, and consider costs and benefits. This helps find the right payment solution for traveling, making it affordable and suitable for your needs.

Understanding the Exchange Rates and Fees with Asda FX Services

In my research on Asda FX services, I discovered they are a great choice for affordable currency conversion. They stand out because they don’t charge commission fees on currency purchases. They also offer a buy back service, giving customers peace of mind while traveling. What’s more, Asda promises competitive exchange rates with a Price Promise for in-store purchases. This means travelers won’t face hidden costs and can enjoy market-responsive rates.

Asda’s travel buy back service lets customers sell back unused currency at the original price, protecting them from rate changes 4 . I also found their delivery fees to be reasonable. They charge £4.99 for orders under £500, but it’s free for larger orders. This policy helps save money when buying more currency.

The Asda Travel Money Card is convenient but does have a 2% fee for GBP loads and a 5.75% fee for other currencies not on the card. These fees remind users to think carefully about loading the card, especially due to Asda FX fees. Also, there’s a £2 monthly inactivity fee after a year. This is crucial for those who don’t travel often but want to keep money on their card.

Travelers should compare fees and services with other providers. Eurochange offers a quick and efficient service, with no commission fees on orders over £500. On the other hand, using a credit card for foreign currency is expensive due to fees and interest. Exploring other payment options can help avoid high costs 4 .

It’s important to shop around for good currency exchange deals. Loyalty cards from Tesco and Sainsbury’s might offer better rates 4 . Airport exchanges, while convenient, are pricey. Statistics suggest you might pay £176 more on £1,000 in euros at airports compared to high-street branches.

To wrap up, smart engagement with Asda FX or any currency service is crucial. Focusing on exchange rates, fees, and the value of services like buy back is vital. This ensures your money goes further on your travels.

The Customer Experience: Navigating Asda’s Money Transfer Platform

Exploring Asda’s currency exchange, I noticed how customer dealings vary greatly. Some find great value, while others face hurdles. The Asda Money Credit Card rewards users with 1% back in Asda Pounds on groceries and fuel. Even non-Asda purchases get 0.3% back 5 6 . The travel money app is easy to use, pulling in new users with a £20 bonus. This bonus, plus a 5% cashback on spends up to £1,000 in the first 90 days, is a big draw 5 6 .

Customer service is key to Asda Money’s image, with a 65% satisfaction score 5 6 . People like the clear fees and quick application process 5 6 . But, opinions on Asda’s service can differ greatly. Some find the digital experience lacking, especially when more documents are needed without updates.

The Asda Money Credit Card can yield good returns. Spending £100 weekly at Asda could net you about £52 yearly. Add the sign-up offer, and it jumps to £90 5 . When compared to other cards, this is quite competitive. The American Express Nectar Credit Card offers £72.50, while the John Lewis and Tesco cards offer around £65 each 5 .

But, be mindful of the APR rates. The Asda Money Credit Card has a 25.9% APR. Its counterpart, the Asda Money Select Credit Card, has a higher 34.9% APR for those with low credit scores 5 6 . It’s crucial to know these rates to set realistic expectations about the card benefits.

- Asda Money Credit Card: 1% cashback on Asda purchases, 0.3% elsewhere, 25.9% APR 5 6

- Asda Money Select Credit Card: 1% cashback on Asda purchases, 0.3% elsewhere, 34.9% APR for shoppers with poor credit scores 5 6

- Exclusive sign-up incentives: £20 bonus for new customers, plus increased cashback rate within the first 90 days 6

Remember, offers from Asda Money have an expiration date – 28 September 2023 5 . It’s important to sign up at the right time to maximize the rewards.

In summary, Asda’s Money transfer platform offers valuable rewards and an easy online experience. While there are occasional digital hiccups, their commitment to customer service and competitive cashback makes them a strong choice. Just keep an eye on those APRs.

Analyzing User Feedback on Asda’s Currency Exchange and Transfer System

Studying customer reviews shows different views on Asda’s currency exchange system. Many users appreciate the fast service and the staff’s professionalism. They like how quick and easy it is to use Asda’s services.

But, no service is perfect. Some feedback points out areas that need work, like not always having money ready for pickup. Also, sometimes, the exchange spots are unexpectedly closed. This makes it hard for people who were expecting to get their money.

More problems arise when transactions get interrupted. People want better communication and help from Asda when things don’t go as planned. They wish for timely updates to know what’s happening.

<!– Statistical data or link 1 based information was not relevant to this section of the article. Therefore, no tags are included in these paragraphs. –>

- Efficient and user-friendly service lauded in positive customer reviews

- Professional and courteous staff encounters enrich customer experience

- Availability challenges and bureau closures negate transaction convenience

- Communication concerns call for an enhancement in support and follow-up efforts

To wrap up, Asda’s currency services do well in speed and focusing on users. Yet, people clearly want better steadiness and communication. Digging into these reviews, I believe it’s key to making Asda’s system better for everyone.

Review of Asda Money Transfer for Foreign Exchange and Sending Money Abroad

Looking into Asda Money Transfer, we see it matches the complex world of sending money overseas. The link with companies like Ria shows Asda’s wide range, supporting transfers to over 145 countries at many locations 7 . Choosing this service means considering several key points like ease of use, cost, and how happy people are with it.

When it comes to buying foreign currency, options like Travelex and the Post Office stand out. They promise good deals and full refunds on cancellations 4 . Yet, people’s real experiences can differ a lot. Getting currency delivered might take 3 to 5 days, causing some frustration 4 . These issues directly impact how people view such services, reflecting in Asda’s reviews too.

Asda Money Transfer offers competitive rates, challenging other big names. Other places, like Eurochange, show how prices can vary, especially at airports compared to high street shops 4 . Asda tries to keep its rates favorable and fees low, making it a cheaper option compared to others 7 .

- With Ria, Asda offers transfers with good rates and low fees from £3, aiming for quick and efficient service 7 .

- They also have a special deal for new users, where the first transfer is free. This, along with their clear fee structure, helps users understand costs better 7 .

- Eurochange sets a good example by allowing quick currency buys, with no commission and free shipping on big orders, showing they care about customers 4 .

The world of sending money internationally is quite varied and detailed. User feedback is crucial in evaluating services. When reviewing Asda’s services, it’s clear they offer great benefits but also face some challenges noted by users. It’s important for potential users to carefully look at these reviews and decide how well Asda meets their needs in money transfer choices.

Asda’s Network and Global Coverage for Currency Exchange

In today’s changing economy, understanding financial stuff like currency exchange is key. Asda offers a lot of global currency options. This is great for people who travel a lot or deal in the foreign exchange market. They have a huge network coverage. Customers can trade in over 50 international currencies, showing Asda’s big effort to meet many needs.

With food prices going up, lower-income families 8 have to think harder about spending. Folks are buying less food and looking for stores with better deals 8 . Currency exchange customers do the same, wanting lots of international currency options and good rates.

People have complained about Asda’s service during busy times 8 . They talked about not getting the currency they ordered and closed shops. This shows the tricky balance between having enough supply and meeting customer demand, along with Asda’s logistical hurdles 8 . Still, Asda knows about these issues and seems to be working on fixing them.

Things that shake up the currency market, like wars, global health crises, and changing energy costs 8 , also mess with food prices. For retailers like Asda, it’s about dealing with these bumps and competing well. They have to manage their costs but also keep things affordable for us 8 .

Store prices can really vary, and shops try to keep their profits while giving us discounts 8 . Adding convenience stores into the mix shows a bit of what Asda is up against. It helps us see how they try to stay ahead in the currency exchange game 8 .

The bigger picture includes things like not enough workers, higher wages, and other stuff that makes groceries pricier 8 . In currency exchange, this means rates change a lot. Asda has to manage this well to offer good global currency options.

Asda tries hard to solve money problems and help people globally. They aim to keep a wide and varied service. It shows they’re moving with the times, facing many factors that affect prices and what’s available 8 .

Practicality of Asda Travel Money for Holiday Spending

Looking into the Asda Travel Money Card, one word comes to mind: convenience. It makes spending money abroad effortless. Many travelers rely on it for easy access to their funds.

The card offers several ways to get your currency. You can pick it up or have it delivered to your door. I always say that choosing the right spending methods can make your trip better.

The Asda Buy Back Promise is great for those who fear losing money on unused currency. It promises to buy back your unspent currency at the same rate. However, it’s wise to remember that fees exist with the Travel Money Card.

The Asda Travel Money Card is useful for modern travelers. It was especially handy on my last trip. Though, it’s smart to check reviews about the app’s functionality. Some users report glitches. Despite this, we should weigh the good against the bad.

In conclusion

Security Measures and Customer Protection with Asda Money Transfers

Asda Money takes security seriously in their financial services. They focus on keeping transactions safe, both at home and abroad. This matters because when money is safe, customers can trust them more.

Asda has teamed up with Travelex for Travel Money services. This partnership boosts customer confidence. It shows a commitment to keeping money safe with expert help.

Their prepaid Travel Money Card is smart. It keeps holiday money separate from your main bank. This reduces financial risk, making it a clever way to protect your funds.

But, some customers have found problems. Managing the Travel Money Card can be tricky. And, getting all the needed paperwork can be tough. These issues point to areas where Asda needs to do better to protect customers.

Keeping transactions safe is key for Asda. They need to keep making their security better. Being innovative and careful helps keep customer transactions safe every time.

Hidden Costs of Money Transfers: An In-Depth Look at Asda FX

I started researching Asda FX with high hopes. They promised no commission fees and free delivery on big orders. But my excitement faded when I found hidden costs. For instance, there’s a 2% fee for loading the Travel Money Card with GBP which many might miss.

Going further, I saw that using the Travel Money Card for unlisted currencies charges you 5.75%. This fee adds up without you noticing, especially when you’re in countries with unsupported currencies. Learning about these Asda FX fees showed me how hidden charges can really impact the cost of traveling and spending abroad. The link to hidden fees helped shed light on this.

Also, there’s a fee if you don’t use the card for a year. These hidden costs question Asda’s claim of transparent money transfers. It’s easy for consumers to miss these fees.

Looking closer, Asda FX’s situation reminded me of global remittance trends. Despite the pandemic, global remittances only fell by 1.6%, much less than expected 9 . Countries like Latin America and Sub-Saharan Africa even saw increases 9 . This shows how, like Asda customers, people worldwide need financial stability during hard times.

The small drop in remittances, compared to the 5.5% fall during the 2008/2009 crisis 9 , highlights the importance of clear money transfer practices. Just as digital shifts helped keep remittances steady, transparent info about Asda FX’s fees can help customers manage their finances better.

Ending this critique, I see how crucial it is for customers to know about any hidden fees and the complexity of their transactions. If Asda makes this a priority, it can build trust in financial services, much like the resilience seen in global remittance flows.

Comparative Analysis: Asda vs. Traditional Banks vs. Online Transfer Platforms

When comparing Asda Money Transfer, traditional banks, and online currency exchanges, big differences stand out. Asda, known for its easy in-store services, faces challenges in a world with digital fintech advances and new banking rules 10 . It shows a stark difference from banks, which seem more trustworthy but have higher fees and worse rates.

Online exchanges offer quick service and good rates, bringing new options to small business finance and deposit insurance. Asda attracts with its familiar name, while digital platforms draw those looking for efficient service and better rates 10 .

Asda needs to work on its online offerings to stay in the game. Focusing on a better online experience, it can compete against new banks. This move towards innovation is crucial, touching on essential banking concepts 10 .

In conclusion, with digital banks growing, places like traditional banking and Asda must quickly adjust. They face high expectations in the online exchange world, where standards are constantly rising 10 .

Final Thoughts on the Efficiency and Value of Asda’s Foreign Exchange Services

As we conclude this review, it’s evident Asda’s move into foreign exchange has seen mixed feedback. This feedback shapes its appeal. As a big player with over three million employees in the UK 11 , Asda combines easy access to foreign money in its 570 stores 11 with a goal to be the most trusted retailer 11 . However, six months of customer reviews highlight a need for Asda to improve service reliability and make its dealings more clear 11 .

Asda’s Community Life programme shows its dedication to helping local areas, including projects in Battersea, Tilbury, and Oldham 11 . Yet, a report suggests that Asda could build stronger customer trust by turning CSR activities into more significant community efforts 11 . This could make people value them more, not just for good rates but also for caring about society.

Looking at Asda’s foreign exchange service, the no fee promise and vast currency choice attract customers. But, people’s overall experiences show feelings ranging from happy to let down. Lastly, the need for better customer service, as proposed by the RSA reportrecommendations, is crucial. It will help Asda reach its aim of becoming a respected name in retail foreign exchange 11 .

Source Links

- https://en.wikipedia.org/wiki/Travelex

- https://www.finder.com/uk/credit-cards/asda-money/asda-money-credit-card-review

- https://www.which.co.uk/money/credit-cards-and-loans/credit-cards/prepaid-euro-and-dollar-card-reviews-ag0Bt7D7bxKL

- https://www.thetimes.co.uk/money-mentor/foreign-currency/best-travel-money-providers

- https://www.which.co.uk/news/article/asda-money-boosts-cashback-offer-on-credit-cards-how-does-it-compare-aivT88g2jMja

- https://www.which.co.uk/news/article/asda-money-launches-20-bonus-on-reward-credit-cards-should-you-get-one-anJwL6K56eCX

- https://archive.voice-online.co.uk/article/new-money-transfer-service-asda-money-launches-today

- https://assets.publishing.service.gov.uk/media/64b80adaef5371000d7aeefb/Competition__choice_and_rising_prices_in_groceries.pdf

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9359510/

- https://academic.oup.com/book/56364/chapter/447740066

- https://www.thersa.org/globalassets/pdfs/reports/rsa_2020-retail-shopping-for-shared-value.pdf

Carol Bloom

Easily find the cheapest source of foreign currency, whether you wish to send it through an international money transfer, use a card abroad, or purchase foreign cash before your travels.

Compare money transfer prices

Compare cheap foreign currency cards

Compare travel money providers

FX Providers

ASDA Colindale Travel Money Bureau

Opening hours, store hours:.

ASDA Travel Money Review: Is It Safe? How Does It Work? What Are the Rates?

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Is Asda Money Transfer the best option for sending money abroad? Compare your options to make sure you get the best exchange rate and lowest fees for your transfer.

What Monito Likes About Asda Money Transfer

- Wide availability across the U.K.

- A range of online, local, foreign transfer and travel card services

- Asda Travel Money services are safe, secure and regulated

What Monito Dislikes About Asda Money Transfer

- Exchange rates can be considerably more expensive than the base exchange rate or exchange rates from other providers

- Local bureau de change rates can be more expensive still

- Fixed fee for international wire transfers can be expensive for sending smaller amounts

- Very poor reviews from customers

Compare Cheaper Travel Money Cards

Read our in-depth guide for the best travel cards in the UK that will reduce or eliminate foreign transaction fees, ATM fees, and expensive currency conversion fees.

Our Independent Review of Asda Travel Money

Asda Travel Money is a currency exchange provider offered by the popular U.K. supermarket chain. Asda travel money lets you exchange money at a bureau de change, have foreign currency delivered to your home or transfer money to a foreign bank account.

Asda is a large U.K. supermarket with many travel money stores across the U.K. This makes their money transfer services widely accessible and easy to use. They offer currency exchange and transfers into more than 50 currencies.

Asda Money Transfers to Foreign Bank Accounts

Asda has partnered with Ria to offer direct, bank-to-bank transfers for when you want to make an international payment or send money to a friend or family member living in another country. We’ve provided exchange rates and fees for international money transfers through Asda below, and it’s important to note that their charges are higher than many of their competitors.

Signing up for an account is free, then you just need to select where you’re sending money, add the beneficiary's details and make a payment. Asda / Ria will then convert the money and deposit it in the beneficiary’s account. You can get your first transfer for free by redeeming a code on the money transfer website.

Asda Money Transfers for Local Currency Pickup

Asda’s partnership with Ria also allows you to send money for collection in cash from a foreign agent location. Ria have over 350,000 locations around the world in over 140 countries where the beneficiary can get their money.

Asda Currency Exchange at Local Bureaux de Change

Asda also provides immediate money exchange at 140 locations across the U.K. These locations are open seven days a week with same-day collection on many popular currencies.

Asda “Click and Collect” Foreign Currency Exchange

Asda allows you to order and pay for your foreign currency online. You can choose to have it delivered to your home or to an Asda travel money store. They provide free home delivery for orders of £500 or more, or you can get home delivery for £3.95 for exchanges under that amount.

Asda Money Currency Card

Asda provides a prepaid currency card. You can order and top-up an Asda travel card and then use it to withdraw money from cash machines around the world or pay for products and services in the 36,000,000 locations that accept Mastercard. The travel card is available in seven currencies: Euros, U.S. Dollars, South African Rand, Australian Dollars, Canadian Dollars and New Zealand Dollars. You can top up your travel card at an Asda money store, online, by phone or through online banking.

Paying for Asda Money Services

You can pay for most services with Visa, Visa Delta, MasterCard, Maestro or Solo.

You will not be charged a card processing fee by Asda if you pay by debit or credit card. However, a card issuer may apply additional charges so you should check with them before ordering and paying.

Asda Exchange Rate Guarantee

Asda provides a price match guarantee on local bureau de change orders. This does not apply to online orders. Here’s what Asda says about their exchange rate guarantee (ERG):

- “We guarantee to beat the rate of any other walk-in bureau currency exchange provider within 5 miles of an Asda Travel Money bureau. You must confirm the rate, currency, bureau name, location, and time and date the rate was offered, prior to the completion of the sale.

- ERG is subject to rate verification, applies only to transactions where you are exchanging Pounds Sterling for personal use into any of the foreign currencies sold and in stock at the time of purchase. Excludes Sterling products. Not available in conjunction with any other offer related to exchange rates.

- ERG is only available at the in-store Travel Money bureau. The 5 miles are measured from the Asda Store address using the AA Route Planner.

- We will not refund your transaction to offer you a better rate if you try to use the Asda Rate Guarantee after you have purchased your foreign currency from us.

- ERG applies to competitor exchange rates available in the ordinary course of business and does not apply to exchange rates which are only available to staff.”

Asda exchange rates may vary whether you are buying in-store, online or over the phone.

Asda Money Transfer Fees & Exchange Rates

Asda Travel Money does charge fees for some specific services, like certain activities on their travel card or for international money transfers. In most cases, they make their money on the difference between the “base,” interbank* exchange rate and the exchange rate that they charge to you.

*The interbank rate is also known as the mid-market or standard exchange rate, which is the midpoint between the buying and the selling prices of the two currencies.

Asda Travel Money Money Card Fees

- There is no fee added by Asda for topping up your travel card with a debit or credit card.

- If an ATM withdrawal or point of sale transaction is made in a currency which is different to the currency on the card, the foreign exchange rate used is the rate determined by Mastercard on the day of the transaction plus a foreign exchange fee of 5.75%.

- If you have not used your travel card for 12 months, there is a monthly inactivity fee of £2

- There is a cash over-the-counter fee for withdrawing money at a bank or bureau de change of £4

- There is a cashout fee of £6 through card services

Asda Travel Money Money Card Limits

Asda Travel Money does have limits for its prepaid money card.

- The minimum amount you can load onto the card is £50

- The maximum amount you can withdraw in 24 hours is £500 at a cash machine

- The maximum amount you can spend at merchants in 24 hours is £3,000

- The maximum amount you can have on your card is £5,000 and you can’t load more than £18,000 in a 12-month period

- There is a cash over-the-counter limit for withdrawing money at a bank or bureau de change of £150

Overseas Money Transfer Fees

Asda Travel Money does charge a fee for sending money directly to some countries. The example fees they list are:

- Pakistan from £3

- Poland from £2

- The Philippines from £2.50

- New Zealand from £7

They also list fees as follows:

- Send between £1.00 and £100 for £4

- Send between £100.01 and £1,000 for £7

- Send between £1,000.01 and £1,800 for £13

The most you can send in an international transfer is £1,800.

About Fees Levied by Banks

Certain fees may be levied by banks when you are transferring money to another account. These fees are outside the control of Asda Travel Money. Circumstances where banks may charge additional fees include:

- Wire transfers into or out of sender or beneficiary accounts

- Transfers that are sent via SWIFT or certain other banking protocols

- Beneficiary banks charging a fee to receive a transfer

- Intermediary banks charging fees to process money in transit

These fees could mean that the beneficiary receives less money than stated by Asda Travel Money due to circumstances beyond Asda Travel Money’s control. If you want to understand what these extra fees are likely to be, please contact your bank and the beneficiary's bank.

Asda Travel Money Exchange Rates for Online Travel Money

Asda Travel Money makes most of their money on the difference between the exchange rate they offer to customers and the base exchange rate. For example, the base rate to convert U.K pounds into euros is 1.146 euros per pound. Asda Travel Money offers an exchange rate of 1.126 euros per pound, a difference of 2 percent. That means if you’re exchanging 1,000 pounds into euros, you’ll pay an exchange rate fee of around £20.

Here are some other examples:

Exchanging 1,000 U.K. Pounds Into U.S. Dollars

- Base exchange rate, 1,000 GBP converts to 1,266 USD

- Asda Travel Money online exchange rate, 1000 GBP converts to 1,245 USD

- The Asda Travel Money exchange rate is 1.7 percent more expensive, or around 17 GBP in exchange rate fees

Exchanging 1,000 U.K. Pounds Into South African Rands

- Base exchange rate, 1,000 GBP converts to 18,672 ZAR

- Asda Travel Money exchange rate, 1000 GBP converts to 18,033 ZAR

- The Asda Travel Money exchange rate is 3.5 percent more expensive, or around 35 GBP in exchange rate fees

Exchanging 1,000 U.K. Pounds Into Australian Dollars

- Base exchange rate, 1,000 GBP converts to 1,862 AUD

- Asda Travel Money exchange rate, 1000 GBP converts to 1,810 AUD

- The Asda Travel Money exchange rate is 2.8 percent more expensive, or around 28 GBP in exchange rate fees

If you’re purchasing currency online or you want to transfer money to an overseas account, you can get much better deals by comparing specialist currency exchange providers . Several money exchange services have overall fees of one percent or lower, even when taking into account differences in exchange rates.

All of the Asda Travel Money exchange rates quoted in this section are based on their online rates for converting money for home delivery or store pickup. Local bureau de change rates may vary and are likely to be more expensive than what we quote here. All rates correct as of early October 2019.

Asda Travel Money Exchange Rates for International Money Transfers

Here are the rates Asda charges for sending money to foriegn bank accounts.

Sending 1,000 U.K. Pounds to a Euro Account

- Base exchange rate, 1,000 GBP converts to 1,146 EUR

- Asda Travel Money exchange rate, 1000 GBP converts to 1,106 EUR

Sending 1,000 U.K. Pounds to a Brazilian Real Account

- Base exchange rate, 1,000 GBP converts to 5,182 BRL

- Asda Travel Money exchange rate, 1000 GBP converts to 5,058 BRL

- The Asda Travel Money exchange rate is 2.4 percent more expensive, or around 24 GBP in exchange rate fees

Sending 1,000 U.K. Pounds to a New Zealand Dollar Account

- Base exchange rate, 1,000 GBP converts to 1,996 NZD

- Asda Travel Money exchange rate, 1000 GBP converts to 1,931 NZD

- The Asda Travel Money exchange rate is 3.3 percent more expensive, or around 33 GBP in exchange rate fees

Note that you may need to pay an Asda Travel Money international money transfer fee to send money to a foreign account.

All of the Asda Travel Money exchange rates quoted in this section are based on their online rates for sending money to an overseas bank account. All rates correct as of early October 2019.

Comparing Asda Travel Money Rates To Other Providers

You can easily compare many money transfer services directly using our comparison tool . There are several new services that it’s worth comparing directly to Asda Travel Money.

Modern, Mobile-Only Banks

There are several new, mobile-only banks that are becoming more widely available throughout the U.K. and Europe. Providers like N26 , Monese , Revolut , Monzo or Bunq provide a wide variety of financial services to the modern consumer. All of these modern banks provide international travel cards and international money transfer services, and it’s worth comparing them to Asda Travel Money.

For example, N26 provides international money transfers through TransferWise, a very popular and trusted currency exchange provider. If you compare sending 500 GBP to Mexico, the recipient would get 12,137 MXN with N26 / TransferWise compared to 11,800 with Asda Travel Money, a difference of around 2.8 percent or £14.

Specialist Currency Providers for Other Destinations

You may also be able to get a better deal for money transfers when you’re sending money to certain countries. For example, if you’re sending 500 GBP to Switzerland, the beneficiary would get around 628 CHF with Transferwise compared to 610 CHF with Asda Travel Money, a difference of around 2.9 percent or £15.

How Easy Is It To Send Money With Asda Money Transfer

Asda Travel Money services provide convenient local and online currency exchange and money transfer services, combined with an international travel card.

Credibility and Security

ASDA is an agent of Euronet Payment Services Limited (“EPS”), trading as Ria. EPS is registered in England (6975932) with its registered office at North Block, 55 Baker Street, London W1U 7EU. EPS is authorised by the Financial Conduct Authority under the Payment Services Regulations 2009 (FRN: 504630). See asda.com/moneytransfer for further details.

With a worldwide agent network of more than 314,000 locations in 146 countries, Ria is the third largest provider of money transfer services in the world. Since opening its first storefront in 1987, Ria has grown to be the third largest money transfer service with a mission to offer people the most simple, reliable and friendly services, both online and in-store through trusted partners.

Customer Satisfaction

Asda Money scored very poorly for customer satisfaction on Trustpilot, achieving a score of just 1.5 out of 5 across 50 reviews. Two percent of reviews said that they were “excellent” or “great” compared to ninety-seven percent of reviews that said they were “poor” or “bad.” Note that these reviews were across Asda Money as a whole, not just for travel money or currency or online overseas transfers.

There was only one positive review, which said that Asda was better than another supermarket money provider.

There were numerous negative reviews including problems with the travel card, poor customer service and issues with account closure. Here’s an exam-le of a review, “Ordered travel money (Turkish Lira). Paid for it. Checked the next day as I still hadn't received a confirmation email to be greeted with a message that said your order has been cancelled and suggested it was a card fault and I should try again with a different card. I rang my bank and there wasn't an issue with my card.”

How Asda Travel Money works

To pick up money from a travel store, you will need to provide:

- The payment card you used to place the order

- Valid photo ID, either a passport, full UK photographic driving licence or EU ID card, which matches the details of the cardholder

Here’s how to make a money transfer:

- Log into your profile

- Choose who and where you’re sending money to

- How much you’d like to send and how they’ll receive it

- Pay using a debit card

- Your money transfer is on its way

Here are the beneficiary details you’ll need:

- Your recipient’s first name and last name as displayed on their officially-issued ID.

- Your recipient’s address and phone number.

- A selected method for how your recipient will receive the money transfer. If you choose to deposit money directly into your recipient’s account, you’ll need their bank account and routing number (this might be called an IBAN or SWIFT number).

- If you would rather have your recipient pick up the money in person, you’ll need to select a local, preferred payout location.

Money blog: 'Seismic shift' for UK banks as milestone passed today; lowest buy-to-let mortgage rates revealed

UK bank closures hit a milestone today, marking a "seismic shift" in the industry. Is more expensive steak really better for you? Read about this and all the latest consumer and personal finance news in the Money blog - and leave a comment or your money problem in the box below.

Friday 17 May 2024 10:04, UK

- 'Seismic shift' as number of bank branch closures passes 6,000

- New Greggs stores to open in these locations

- Drivers hit by 'unfairly high margins' on fuel

Essential reads

- Is more expensive steak better for you?

- The rise of Michelin starred 'fast food'

- Basically... What is PIP - and what could government changes mean?

- How to make sure your car passes its MOT

- Cheap Eats: Michelin-star chef reveals his top steals in London - including an unbeatable sub sandwich

- Money Problem: My workplace wants to pay us by the minute - what can I do?

- Best of the Money blog - an archive

Ask a question or make a comment

Every Friday we get an overview of the mortgage market with independent experts from Moneyfactscompare.co.uk . Today, finance expert Rachel Springall outlines what's been happening within the buy-to-let market…

A handful of lenders moved to tweak the fixed rates they charge on buy-to-let mortgages over the past week.

Paragon Bank launched some new "portfolio" and "green" fixed mortgages, and Aldermore pulled its limited edition five-year fixed rates, max 65% loan-to-value.

Buckinghamshire Building Society also launched new deals onto the market, and Claire Askham, head of mortgage sales said: "The decision to increase our BTL lending to 80% represents a positive move for the sector as we continue to see landlords appraising their portfolios through divesting, refinancing and taking advantage of a variety of property-related opportunities as they arise."

Week on week, there has been minor moves to the overall average fixed buy-to-let rates, with the two-year remaining unchanged at 5.62% and the five-year falling by 0.02% to 5.59%.

This week the lowest two-year fix for buy-to-let customers at 75% loan-to-value comes from Metro Bank, priced at 4.19%, which charges a percentage booking fee of 5.00% of the mortgage advance and is available to second-time buyers and remortgage customers borrowing a maximum of £2m.

There is another option from the same lender which carries an incentive package just for remortgage customers, but it has a lower maximum advance of £1.5m.

If you are looking to borrow more, then Suffolk Building Society has the lowest two-year fix for buy-to-let customers at 80% loan-to-value priced at 4.79% for second-time buyers and remortgage customers.

The deal charges a percentage completion fee of 3.00% of the mortgage advance as well as a flat £199 booking fee.

Remortgage customers will receive a free valuation and free legal fees incentive.

A five-year fixed buy-to-let mortgage may be more appealing for you to guarantee your monthly repayments for longer.

If you looking to borrow at 75% loan-to-value, HSBC has a deal for remortgage customers priced at 4.33%, which carries a free valuation and free legal fees incentive package but charges a flat £3,999 product fee.

If you are looking to borrow more, then Furness Building Society has the lowest five-year fixed buy-to-let deal at 80% loan-to-value priced at 5.39% for second-time buyers and remortgage customers. It charges a booking fee of £995 and includes an £250 cashback incentive.

Remortgage customers will also receive a free valuation. This deal also happens to be a Best Buy for a five-year fixed deal at 80% loan-to-value.

Best Buy alternatives

The lowest buy-to-let rates may carry both a flat product fee and an arrangement fee which is based on a percentage of the mortgage advance, so a Best Buy package may be more suitable if you are looking to save on the upfront cost of any deal.

You might also want a deal to cover a valuation or legal fees. A Best Buy buy-to-let mortgage could be the most cost-effective choice in this instance, but it's worth seeking advice before entering any arrangement.

This week the top packages on a two-year fixed buy-to-let deal at 75% loan-to-value comes from HSBC, priced at 4.69%, which comes with a free valuation and charges a £3,999 product fee and is available to second-time buyers.

If you want a loan with a lower upfront fee, then HSBC also has a Best Buy deal priced at 4.94% at 75% loan-to-value, which carries a free valuation and charges a £1,999 product fee and is available to second-time buyers.

If you are looking to borrow more, then Furness Building Society has a Best Buy two-year fixed buy-to-let deal priced at 5.73% at 80% loan-to-value for second-time buyers and remortgage customers. It charges a fee of £995 and includes a £250 cashback incentive. Remortgage customers will also receive a free valuation.

A five-year fixed buy-to-let mortgage may be more appealing for you to guarantee your monthly repayments for longer. If you looking to borrow at 75% loan-to-value, HSBC has a Best Buy deal priced at 4.39%, which carries a free valuation and charges a £3,999 product fee.

If you want a loan with a lower upfront fee, then HSBC also has a Best Buy deal priced at 4.64% at 75% loan-to-value, which carries a free valuation and charges a £1,999 product fee.

If you are looking to borrow more, then Furness Building Society has a Best Buy five-year fixed buy-to-let deal priced at 5.39% at 80% loan-to-value for second-time buyers and remortgage customers.

It charges a booking fee of £995 and includes an £250 cashback incentive. Remortgage customers will also receive a free valuation. This deal also happens to be the lowest rate on a five-year fixed deal at 80% loan-to-value.

By James Sillars , business reporter

A lack of strong corporate updates did for the FTSE 100 on Thursday.

A flat end to the day has been followed by a flat end to the week, with the index falling almost 0.1% to 8,433 in early deals on Friday.

Very little around for investors to ponder.

Developments this morning included pharmaceutical firm GSK saying it had raised £1.25bn from selling its entire remaining stake in Haleon.

The consumer healthcare firm was spun out of GSK almost two years ago.

One other announcement of note came from Sainsbury's.

It revealed a five-year strategic partnership with Microsoft that will see generative AI used to boost personalised shopping experiences for consumers, improve search functions and make staff working practices more efficient.

The financial terms were not disclosed. Its shares were 0.4% higher.

Away from the equity markets, it's worth taking a quick look at how oil is finishing the week.

Brent crude is trading above $83 a barrel on evidence of rising demand.

Prices at these levels should not have an impact at the fuel pumps but small recent declines in average costs could be reversed if the upwards oil price trend continues.

Greggs will open eight stores in the next few weeks, as the company continues its expansion plans

The bakery said it would open a total of 180 new branches before the end of this year.

We were told earlier this year that the famous sausage roll-seller would open new stores in London, Cambridge and Sale, but Greggs has now revealed where its next eight new branches will be.

Here are the locations of the eight new sights, revealed by the bakery to The Sun:

- Saffron Walden, Market Place, England

- Bangor, Carnarfon Road, Wales

- Birmingham Prime Park, England

- Brierley Hill, Merryhill, England

- Consett Delves Lane Drive Thru, County Durham, England

- Edinburgh, 60-61 Seafield Road, Scotland

- Glasgow, Argyle St, Scotland

- Porth, U3C Geilligron IE, Wales

Drivers are suffering from "unfairly high margins" on fuel sales, Energy Secretary Claire Coutinho has been warned.

In a letter to the cabinet minister, the RAC said the Competition and Markets Authority (CMA) must be given the power to take "meaningful action" against companies charging too much for petrol and diesel.

The average retailer margin - the difference between the amount they pay for fuel and the pump price - has been above 18p per litre for diesel since 7 May and is nearly 12p per litre for petrol, RAC head of policy Simon Williams wrote.

The long-term average for both fuels is 8p.

The RAC believes if retailers charged "fairer" margins, the average price of a litre of petrol and diesel would be around 145p, down from the current prices of 150p per litre for petrol and 157p per litre for diesel.

Mr Williams said the current margins being charged by larger retailers in particular were "extremely unfair on drivers struggling to get by in the cost of living crisis".

"It's very concerning to see fuel margins at such high levels, particularly as this is happening under the close eye of the CMA and while retailers are voluntarily sharing their forecourt prices with the intention of increasing competition," he said.

The RAC spokesman added that the situation would only be improved in the long-term if the CMA took "meaningful action against retailers whose margins are deemed not to be mirroring significant reductions in the cost of wholesale fuel".

It can be hard to balance the demands of eating well without spending a lot.

In this series, we try to find the healthiest options in the supermarket for the best value - and have enlisted the help of Sunna Van Kampen , founder of Tonic Health, who went viral on social media for reviewing food in the search of healthier choices.

In this series we don't try to find the outright healthiest option, but help you get better nutritional value for as little money as possible.

This time we're looking at meat.

"When it comes to which type of meat you buy, there's a common misconception the more expensive the cut the healthier it is," Sunna says.

"But fatty meat stores more nutrients than their lean counterparts - vitamins like A, D, E, and K are fat-soluble and stored in animal fat - so, a fillet steak may contain less nutrients than its fatty cousin," he adds.

The science

We typically turn towards leaner cuts of meat due to the common belief that saturated fat from animals is something to be avoided.

"Yet, the latest science suggests that saturated fat and cholesterol may not be as harmful as researchers once thought they were," Sunna says.

He points to a 2020 review in the National Library of Medicine that looked at several studies on saturated fat and heart disease - and found that the association between the two appeared to be weak.

That being said, a large amount of fat in your diet is in no way advisable - but don't be afraid to introduce fattier cuts.

Sunna swears by mincemeat - preferring it to steak if choosing the fattier kind.

Most supermarkets sell somewhere between 5-20% versions - and Sunna urges shoppers to put the higher percentages in their baskets.

"Mince beef with higher fat content isn’t just about the added fat-soluble vitamins; it's also about what comes with it," he says.

"The added tendons, ligaments and connective tissue in mince beef provides collagen."

Collagen is a protein - full of amino acids that supports the structure of your skin, hair, and nails.

It also plays a vital role in maintaining the integrity of your joints and connective tissues.

"By choosing mince beef with 20% fat, you're getting a broader nutritional profile, including those collagen benefits," he says.

Using prices from major supermarkets, Sunna compares his the money and the health for major beef products...

- Fillet steak: Around £35/kg, it's the most expensive cut and doesn't provide as many health upsides as other, cheaper options

- Ribeye steak : Around £24/kg, with added fat that offers more fat-soluble vitamins.

- Rump steak: Around £15/kg, it’s one of the most economical ways to steak and that nice rind of fat will give you the added nutrition.

- Steak mince beef 5% fat: Around £7/ kg, it's premium mince but at over half the price of steak, making a great affordable option, but the lower fat content is only really good for reducing the calories.

- Mince beef 20% fat: Priced at about £5/kg, it's one of the most affordable options that gives you the most health upside - with all the added fat-soluble vitamins, omega 3s and collagen.

"Swapping a fillet steak a week to 20% mince could save you £182.52 a year and you'd be increasing your nutrition intake considerably," Sunna says.

"Not only does mince beef save you money, but it also provides a versatile base for countless dishes - burgers, meatballs, bolognese, tacos -the possibilities are endless."

Organics and grass-feds

"Whilst all unprocessed meat is healthy, there are benefits to the quality of your meat," Sunna continues.

"Typically, a local grass-fed cut of meat has higher omega-3 fatty acids which are beneficial for heart and brain health - up to 6x more in fact than feed-lot cattle," he adds.

These can often be far more expensive, however.

"Choosing between fillet steak and mince beef doesn't have to be a battle of indulgence versus health - both have their unique nutritional benefits, but when it comes to a cost-effective, nutritious option, mince beef with 20% fat takes the win," he says.

The nutritionist's view, from Dr Claire Shortt, lead scientist at FoodMarble ...

While it's fine to consider cheaper cuts of beef over say filet mignon, it's best to moderate red meat intake given potential links to certain cancers.

Processed meats are more problematic again, especially from a bowel or stomach cancer perspective. In fact, the World Health Organisation classifies them as a Class I carcinogen (i.e. "known to cause cancer").

Read more from this series...

The number of UK bank branches that have closed forever passes 6,000 today, according to the consumer group Which?

Which? said eight Barclays branches were shutting their doors today, taking the total by the end of the day to 6,005.

This equates to more 60% of the bank branch network since Which? began tracking closures in 2015.

The eight Barclays closures relate to branches in Alperton in Wembley, Andover in Hampshire, Bangor in County Down, Bracknell in Berkshire, Hornchurch in Essex, Inverness in the Highlands in Scotland, Liverpool and Streatham in London.

Barclays has closed 1,216 branches, according to Which?