- location of the visitor¡¦s home ¡¦ how far they traveled to the site

- how many times they visited the site in the past year or season

- the length of the trip

- the amount of time spent at the site

- travel expenses

- the person¡¦s income or other information on the value of their time

- other socioeconomic characteristics of the visitor

- other locations visited during the same trip, and amount of time spent at each

- other reasons for the trip (is the trip only to visit the site, or for several purposes)

- fishing success at the site (how many fish caught on each trip)

- perceptions of environmental quality or quality of fishing at the site

- substitute sites that the person might visit instead of this site

- The value of improvements in water quality was only shown to increase the value of current beach use. However, improved water quality can also be expected to increase overall beach use.

- Estimates ignore visitors from outside the Baltimore-Washington statistical metropolitan sampling area.

- The population and incomes in origin zones near the Chesapeake Bay beach areas are increasing, which is likely to increase visitor-days and thus total willingness to pay.

- changes in access costs for a recreational site

- elimination of an existing recreational site

- addition of a new recreational site

- changes in environmental quality at a recreational site

- number of visits from each origin zone (usually defined by zipcode)

- demographic information about people from each zone

- round-trip mileage from each zone

- travel costs per mile

- the value of time spent traveling, or the opportunity cost of travel time

- exact distance that each individual traveled to the site

- exact travel expenses

- substitute sites that the person might visit instead of this site, and the travel distance to each

- quality of the recreational experience at the site, and at other similar sites (e.g., fishing success)

- perceptions of environmental quality at the site

- characteristics of the site and other, substitute, sites

- The travel cost method closely mimics the more conventional empirical techniques used by economists to estimate economic values based on market prices.

- The method is based on actual behavior¡¦what people actually do¡¦rather than stated willingness to pay¡¦what people say they would do in a hypothetical situation.

- The method is relatively inexpensive to apply.

- On-site surveys provide opportunities for large sample sizes, as visitors tend to be interested in participating.

- The results are relatively easy to interpret and explain.

- The travel cost method assumes that people perceive and respond to changes in travel costs the same way that they would respond to changes in admission price.

- The most simple models assume that individuals take a trip for a single purpose ¡¦ to visit a specific recreational site. Thus, if a trip has more than one purpose, the value of the site may be overestimated. It can be difficult to apportion the travel costs among the various purposes.

- Defining and measuring the opportunity cost of time, or the value of time spent traveling, can be problematic. Because the time spent traveling could have been used in other ways, it has an "opportunity cost." This should be added to the travel cost, or the value of the site will be underestimated. However, there is no strong consensus on the appropriate measure¡¦the person¡¦s wage rate, or some fraction of the wage rate¡¦and the value chosen can have a large effect on benefit estimates. In addition, if people enjoy the travel itself, then travel time becomes a benefit, not a cost, and the value of the site will be overestimated.

- The availability of substitute sites will affect values. For example, if two people travel the same distance, they are assumed to have the same value. However, if one person has several substitutes available but travels to this site because it is preferred, this person¡¦s value is actually higher. Some of the more complicated models account for the availability of substitutes.

- Those who value certain sites may choose to live nearby. If this is the case, they will have low travel costs, but high values for the site that are not captured by the method.

- Interviewing visitors on site can introduce sampling biases to the analysis.

- Measuring recreational quality, and relating recreational quality to environmental quality can be difficult.

- Standard travel cost approaches provides information about current conditions, but not about gains or losses from anticipated changes in resource conditions.

- In order to estimate the demand function, there needs to be enough difference between distances traveled to affect travel costs and for differences in travel costs to affect the number of trips made. Thus, it is not well suited for sites near major population centers where many visitations may be from "origin zones" that are quite close to one another.

- The travel cost method is limited in its scope of application because it requires user participation. It cannot be used to assign values to on-site environmental features and functions that users of the site do not find valuable. It cannot be used to value off-site values supported by the site. Most importantly, it cannot be used to measure nonuse values. Thus, sites that have unique qualities that are valued by non-users will be undervalued.

- As in all statistical methods, certain statistical problems can affect the results. These include choice of the functional form used to estimate the demand curve, choice of the estimating method, and choice of variables included in the model.

- GolfSW.com - Golf Southwest tips and reviews.

- VivEcuador.com - Ecuador travel information.

- TheChicagoTraveler.com - Explore Chicago.

- FarmingtonValleyVisit.com - Discover Connecticut's Farmington Valley.

- View source

- View history

- Community portal

- Recent changes

- Random page

- Featured content

- What links here

- Related changes

- Special pages

- Printable version

- Permanent link

- Page information

- Browse properties

Travel cost method

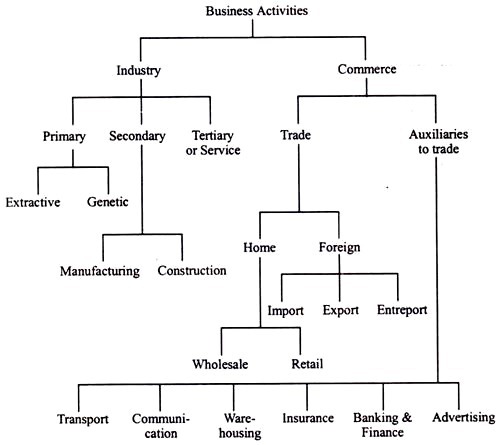

This article deals with the Travel Cost Method, which is often used in evaluating the economic value of recreational sites. This is particularly important in the coastal zone because of the level of use and the potential values that can be attached to the natural coastal and marine environment.

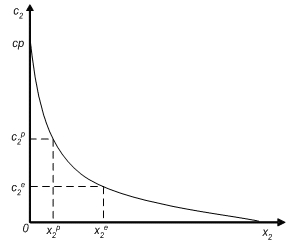

The Travel Cost Method (TCM) is one of the most frequently used approaches to estimating the use values of recreational sites. The TCM was initially suggested by Hotelling [1] and subsequently developed by Clawson [2] in order to estimate the benefits from recreation at natural sites. The method is based on the premise that the recreational benefits at a specific site can be derived from the demand function that relates observed users’ behaviour (i.e., the number of trips to the site) to the cost of a visit. One of the most important issues in the TCM is the choice of the costs to be taken into account. The literature usually suggests considering direct variable costs and the opportunity cost of time spent travelling to and at the site. The classical model derived from the economic theory of consumer behaviour postulates that a consumer’s choice is based on all the sacrifices made to obtain the benefits generated by a good or service. If the price ( [math]p[/math] ) is the only sacrifice made by a consumer, the demand function for a good with no substitutes is [math]x=f(p)[/math] , given income and preferences. However, the consumer often incurs other costs ( [math]c[/math] ) in addition to the out-of-pocket price, such as travel expenses, and loss of time and stress from congestion. In this case, the demand function is expressed as [math]x = f(p, c)[/math] . In other words, the price is an imperfect measure of the full cost incurred by the purchaser. Under these conditions, the utility maximising consumer’s behaviour should be reformulated in order to take such costs into account. Given two goods or services [math]x_1, x_2[/math] , their prices [math]p_1, p_2[/math] , the access costs [math]c_1, c_2[/math] and income [math]R[/math] , the utility maximising choice of the consumer is:

[math]max \, U = u(x_1,x_2) \quad subject \, to \quad (p_1+c_1)x_1+(p_2+c_2)x_2=R . \qquad (1)[/math]

Now, let [math]x_1[/math] denote the aggregate of priced goods and services, [math]x_2[/math] the number of annual visits to a recreational site, and assume for the sake of simplicity that the cost of access to the market goods is negligible ( [math]c_1 \approx 0[/math] ) and that the recreational site is free ( [math]p_2=0[/math] ). Under these assumptions, equation (1) can be written as:

[math]max \, U = u(x_1,x_2) \quad subject \, to \quad p_1x_1+c_2x_2=R . \qquad (2)[/math]

Under these conditions, the utility maximising behaviour of the consumer depends on:

The TCM is based on the assumption that changes in the costs of access to the recreational site [math]c_2[/math] have the same effect as a change in price: the number of visits to a site decreases as the cost per visit increases. Under this assumption, the demand function for visits to the recreational site is [math]x_2=f(c_2)[/math] and can be estimated using the number of annual visits as long as it is possible to observe different costs per visit. The basic TCM model is completed by the weak complementarity assumption, which states that trips are a non-decreasing function of the quality of the site, and that the individual forgoes trips to the recreational site when the quality is the lowest possible [3] , [4] . There are two basic approaches to the TCM: the Zonal approach (ZTCM) and the Individual approach (ITCM). The two approaches share the same theoretical premises, but differ from the operational point of view. The original ZTCM takes into account the visitation rate of users coming from different zones with increasing travel costs. By contrast, ITCM, developed by Brown and Nawas [5] and Gum and Martin [6] , estimates the consumer surplus by analysing the individual visitors’ behaviour and the cost sustained for the recreational activity. These are used to estimate the relationship between the number of individual visits in a given time period, usually a year, the cost per visit and other relevant socio-economic variables. The ITCM approach can be considered a refinement or a generalisation of ZTCM [7] .

[math]x_2 = g(c_2) . \qquad (3)[/math]

The demand function can also be estimated for non-homogeneous sub-samples introducing among the independent variables income and socio-economic variables representing individual characteristics [8] . Therefore, if an individual incurs [math]c_2^e[/math] per visit, he chooses to do [math]x_2^e[/math] visits a year, while if the cost per visit increases to [math]c_2^p[/math] the number of visits will decrease to [math]x_2^p[/math] . The cost [math]cp[/math] is the choke price, that is the cost per visit that results in zero visits. The annual user surplus (the use value of the recreational site) is easily obtained by integrating the demand function from zero to the current number of annual visits, and subtracting the total expenditures on visits.

Related articles

- ↑ Hotelling, H. (1949), Letter, In: An Economic Study of the Monetary Evaluation of Recreation in the National Parks , Washington, DC: National Park Service.

- ↑ Clawson, M. (1959), Method for Measuring the Demand for, and Value of, Outdoor Recreation . Resources for the Future, 10, Washington, DC.

- ↑ Freeman, A.M. III. (1993). The Measurement of Environmental and Resource Values: Theory and Method , Washington, DC: Resources for the Future.

- ↑ Herriges, J.A., C. Kling and D.J. Phaneuf (2004), 'What’s the Use? Welfare Estimates from Revealed Preference Models when Weak Complementarity Does Not Hold', Journal of Environmental Economics and Management , 47 (1), pp. 53-68.

- ↑ Brown, W.G. and F. Nawas (1973), 'Impact of Aggregation on the Estimation of Outdoor Recreation Demand Functions', American Journal of Agricultural Economics , 55, 246-249.

- ↑ Gum, R.L. and W.E.Martin (1974), 'Problems and Solutions in Estimating the Demand for and Value of Rural Outdoor Recreation', American Journal of Agricultural Economics , 56, 558-566.

- ↑ Ward, F.A. and D. Beal (2000), Valuing Nature with Travel Cost Method: A Manual , Northampton: Edward Elgar.

- ↑ Hanley, N. and C.L. Spash (1993), Cost Benefit Analysis and the Environment , Aldershot, UK: Edward Elgar.

- Definitions

- Articles by Paolo Rosato

- Integrated coastal zone management

- Evaluation and assessment in coastal management

- This page was last edited on 3 March 2022, at 21:18.

- Privacy policy

- About Coastal Wiki

- Disclaimers

Environmental Justice Organisations, Liabilities and Trade

Mapping environmental justice.

- Nuclear Energy

- Oil and Gas and Climate Justice

- Biomass and Land Conflicts

- Mining and Ship Breaking

- Environmental Health and Risk Assessment

- Liabilities and Valuation

- Law and Institutions

- Consumption, Ecologically Unequal Exchange and Ecological Debt

Travel-cost method

The travel-cost method (TCM) is used for calculating economic values of environmental goods. Unlike the contingent valuation method, TCM can only estimate use value of an environmental good or service. It is mainly applied for determining economic values of sites that are used for recreation, such as national parks. For example, TCM can estimate part of economic benefits of coral reefs, beaches or wetlands stemming from their use for recreational activities (diving and snorkelling/swimming and sunbathing/bird watching). It can also serve for evaluating how an increased entrance fee a nature park would affect the number of visitors and total park revenues from the fee. However, it cannot estimate benefits of providing habitat for endemic species.

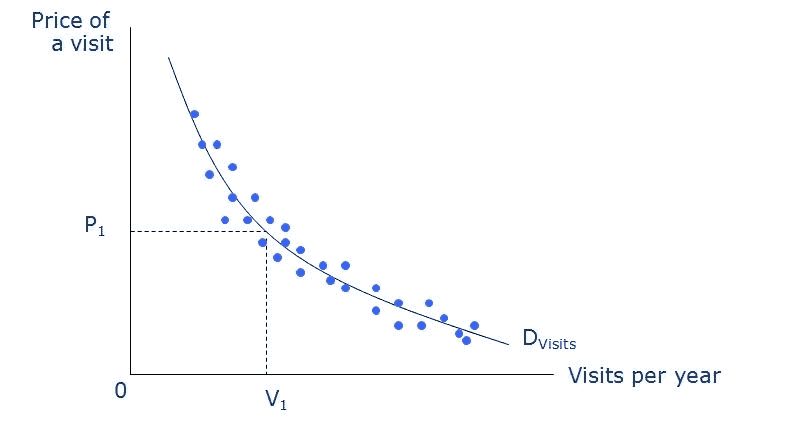

TCM is based on the assumption that travel costs represent the price of access to a recreational site. Peoples’ willingness to pay for visiting a site is thus estimated based on the number of trips that they make at different travel costs. This is called a revealed preference technique, because it ‘reveals’ willingness to pay based on consumption behaviour of visitors.

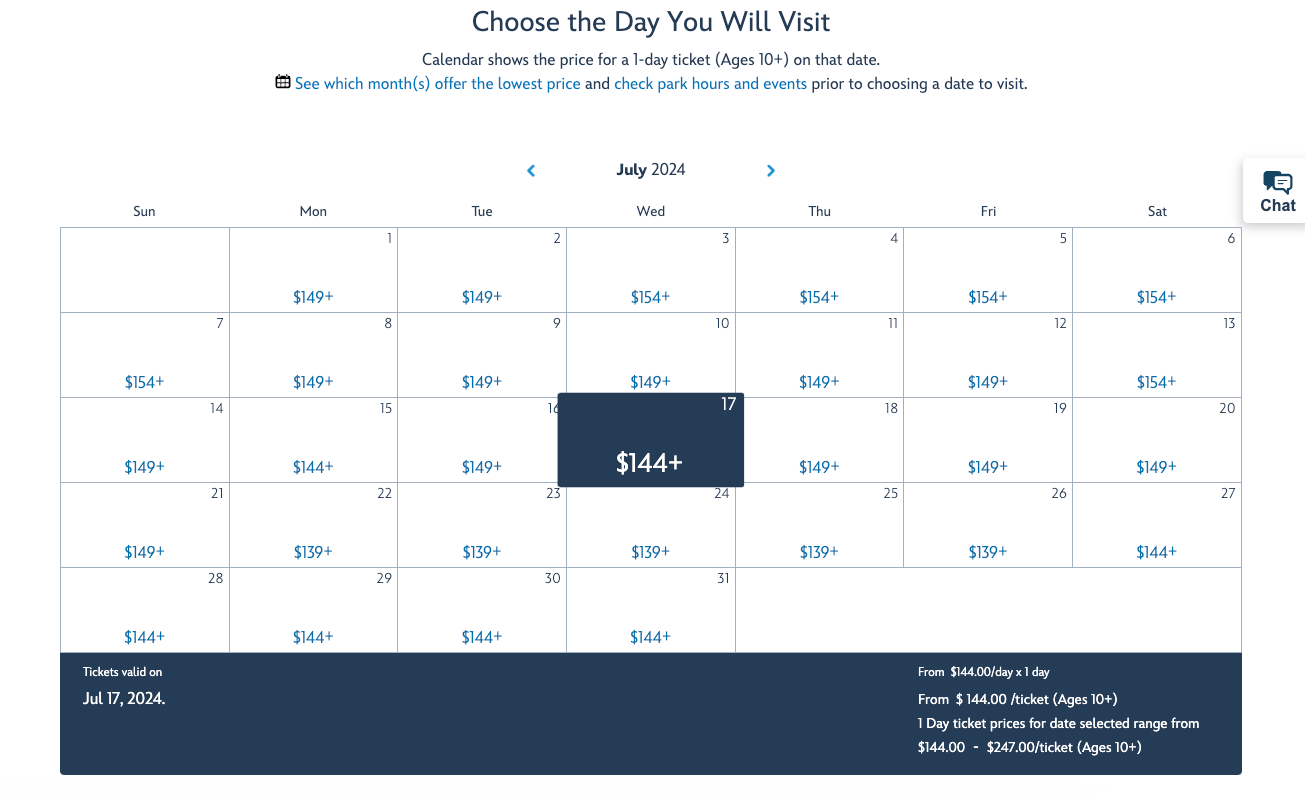

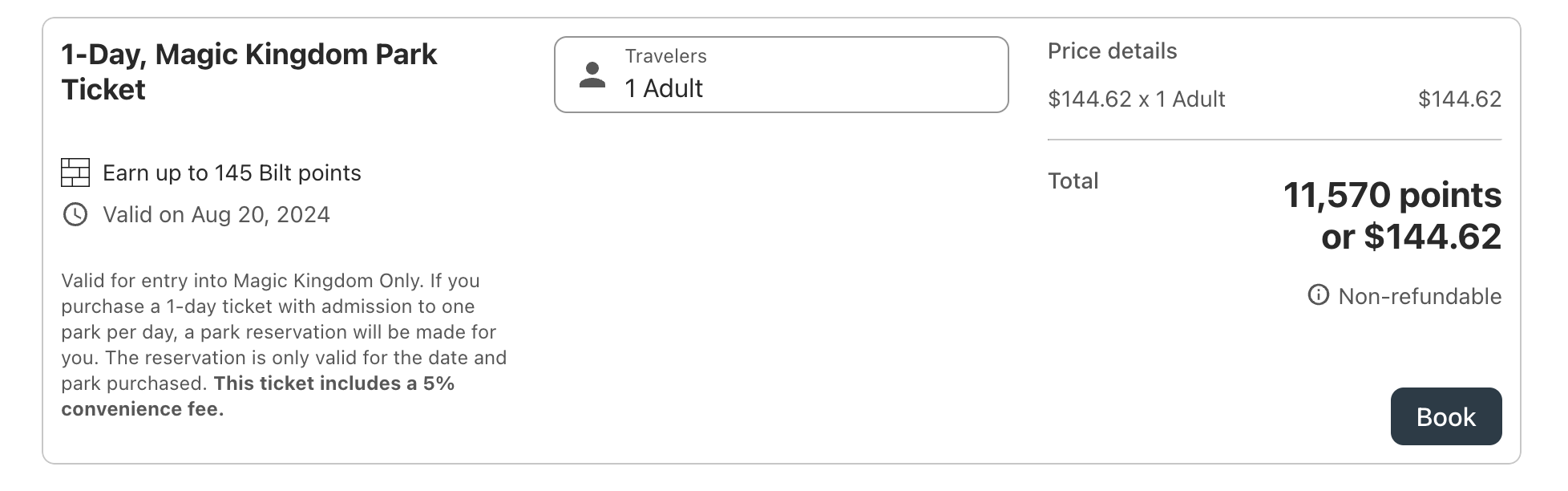

The information is collected by conducting a survey among the visitors of a site being valued. The survey should include questions on the number of visits made to the site over some period (usually during the last 12 months), distance travelled from visitor’s home to the site, mode of travel (car, plane, bus, train, etc.), time spent travelling to the site, respondents’ income, and other socio-economic characteristics (gender, age, degree of education, etc). The researcher uses the information on distance and mode of travel to calculate travel costs. Alternatively, visitors can be asked directly in a survey to state their travel costs, although this information tends to be somewhat less reliable. Time spent travelling is considered as part of the travel costs, because this time has an opportunity cost. It could have been used for doing other activities (e.g. working, spending time with friends or enjoying a hobby). The value of time is determined based on the income of each respondent. Time spent at the site is for the same reason also considered as part of travel costs. For example, if respondents visit three different sites in 10 days and spend only 1 day at the site being valued, then only fraction of their travel costs should be assigned to this site (e.g. 1/10). Depending on the fraction used, the final benefit estimates can differ considerably.

Two approaches of TCM are distinguished – individual and zonal. Individual TCM calculates travel costs separately for each individual and requires a more detailed survey of visitors. In zonal TCM, the area surrounding the site is divided into zones, which can be either concentric circles or administrative districts. In this case, the number of visits from each zone is counted. This information is sometimes available (e.g. from the site management), which makes data collection from the visitors simpler and less expensive.

The relationship between travel costs and number of trips (the higher the travel costs, the fewer trips visitors will take) shows us the demand function for the average visitor to the site, from which one can derive the average visitor’s willingness to pay. This average value is then multiplied by the total relevant population in order to estimate the total economic value of a recreational resource.

TCM is based on the behaviour of people who actually use an environmental good and therefore cannot measure non-use values. This method is thus inappropriate for sites with unique characteristics which have a large non-use economic value component (because many people would be willing to pay for its preservation just to know that it exists, although they do not plan to visit the site in the future).

The travel-cost method might also be combined with contingent valuation to estimate an economic value of a change (either enhancement or deterioration) in environmental quality of the NP by asking the same tourists how many trips they would make in the case of a certain quality change. This information could help in estimating the effects that a particular policy causing an environmental quality change would have on the number of visitors and on the economic use value of the NP.

For further reading:

Ward, F.A., Beal, D. (2000) Valuing nature with travel cost models. A manual. Edward Elgar, Cheltenham.

Ecosystem valuation [ www.ecosystemvaluation.org/travel_costs.htm ]

This glossary entry is based on a contribution by Ivana Logar

EJOLT glossary editors: Hali Healy, Sylvia Lorek and Beatriz Rodríguez-Labajos

One comment

I quite like reading a post that will make people think. Also, thanks for allowing me to comment!

Browse by Theme

Browse by type.

- Presentations

- Press Releases

- Scientific Papers

Online course

Online course on ecological economics: http://www.ejolt.org/2013/10/online-course-ecological-economics-and-activism/

Privacy Policy | Credits

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Environmental Valuation: The Travel Cost Method

Related Papers

isabel mendes

Working Papers

Journal of Leisure Research

John Loomis

Mahidi Hasan kawsar , Muha Abdullah Al Pavel , Md Abdullah Al Mamun

Estimation of recreational benefits is an important tool for both biodiversity conservation and ecotourism development in national parks and sanctuaries. The design of this work is to estimate the recreational value and to establish functional relationship between travel cost and visitation of Lawachara National Park (LNP) in Bangladesh. This study employed zonal approach of the travel cost method. The work is grounded on a sample of 422 visitors of the LNP. Results showed that the total value of environmental assets of the LNP is 55,694,173 Taka/Year. Moreover, our suggestion based on visitors' willingness to pay is that the park entrance fee of 25 Tk per person should be introduced that could generate revenue approximate 2.3 million Taka/ year, beneficial for the park management and conservation of biodiversity.

International Journal of Academic Research in Business and Social Sciences

Kamarul Ismail

Journal of Agricultural and Applied Economics

Clement Tisdell

Discusses the implications of the economic valuation of natural resources used for tourism and relates this valuation to the concept of total economic valuation. It demonstrates how applications of the concept of total economic valuation can be supportive of the conservation of natural resources used for tourism. Techniques for valuing tourism’s natural resources are then outlined and critically evaluated. Consideration is given to travel cost methods, contingent valuation methods, and hedonic pricing approaches before concentrating on current developments of valuation techniques, such as choice modelling. The general limitations of existing methods are considered and it is argued that more attention should be given to developing guidelines that will identify ‘optimally imperfect methods’. An overall assessment concludes this article.

Journal of environmental management

John Bergstrom

In this study we estimate selected visitors' demand and value for recreational trips to settings such as developed vs. undeveloped sites in U.S. national forests in the Southern United States using the travel cost method. The setting-based approach allows for valuation of multi-activity trips to particular settings. The results from an adjusted Poisson lognormal estimator corrected for truncation and endogenous stratification reveal that economic value per trip estimates are higher for wilderness compared to day-use developed settings, overnight-use developed settings, and general forest areas. Estimates of these economic values are important to resource managers because their management decisions and actions typically control recreational settings. For example, managers control developed campground capacity in a national forest, but typically not the number of campers below the capacity constraint and the number and types of activities visitors engage in during a multi-activity...

tesfaye etensa

Recreation is a human activity, which increases visitor’s wellbeing. Following an increase in population, income and mobility the demand for recreation has been increasing in many developing countries. Hence, valuation of environmental resources enables economists to integrate environmental values into economic decision-making processes.Putting a precise and acceptable value on recreation would be valuable in resource management and need to place values that reflect the true social costs and benefits. Thus, this book presents the economic valuation of recreational benefits of Wonchi Crater Lake. In this book, recreational benefits, demand function, price elasticity of demand, the optimum entrance fee, welfare implications associated with the site and perception of the visitors are evaluated. The analysis should assist any country who endowed by environmental and natural resources and who interest to grasp the concept economic valuation of recreational benefits, and should be used fo...

Tourism Management

Choong-ki Lee

RELATED PAPERS

Fatigue'99

Jaoued Ahmed

RePEc: Research Papers in Economics

Holly Sutherland

Joseph Baxter

Bruno Giesteira

John Lindsay

Mutation Research/DNA Repair

João Antônio Pegas Henriques

Frontiers in Conservation Science

Carly Sponarski

UDIK BUDI WIBOWO

美国原版学位证书真实工艺#UCI毕业证 Regina毕业证书(办网上可查的

Makara Journal of Science

Endang Saepudin

Rossana Stefanelli

Stephen Calveley

BMC Research Notes

Maria Teschler-Nicola

BHM Berg- und Hüttenmännische Monatshefte

Franz Rammerstorfer

Asian Journal of Probability and Statistics

Abubakar Yahaya

Journal of Animal Science

Jerry Spears

محمد محمد يونس علي

The Angle Orthodontist

AIBR. Revista de Antropología Iberoamericana

M.ª Pilar Panero García

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Advertisement

The Individual Travel Cost Method with Consumer-Specific Values of Travel Time Savings

- Open access

- Published: 24 June 2019

- Volume 74 , pages 961–984, ( 2019 )

Cite this article

You have full access to this open access article

- Mikołaj Czajkowski ORCID: orcid.org/0000-0001-5118-2308 1 ,

- Marek Giergiczny 1 ,

- Jakub Kronenberg 2 &

- Jeffrey Englin 3

11k Accesses

27 Citations

Explore all metrics

The treatment of the opportunity cost of travel time in travel cost models has been an area of research interest for many decades. Our analysis develops a methodology to combine the travel distance and travel time data with respondent-specific estimates of the value of travel time savings (VTTS). The individual VTTS are elicited with the use of discrete choice stated preference methods. The travel time valuation procedure is integrated into the travel cost valuation exercise to create a two-equation structural model of site valuation. Since the travel time equation of the structural model incorporates individual preference heterogeneity, the full structure model provides a travel cost site demand model based upon individualized values of time. The methodology is illustrated in a study of recreational birdwatching, more specifically, visits to a ‘stork village’ in Poland. We show that the usual practice of basing respondents’ VTTS on 1/3 of their wage rate is largely unfounded and propose alternatives—including a separate component of the travel cost survey aimed at valuation of respondents’ VTTS or, as a second best, asking if they wish if their journey was shorter and for those who do—use full hourly wage as an indicator of their VTTS.

Similar content being viewed by others

Impact of tourism development upon environmental sustainability: a suggested framework for sustainable ecotourism

The Relationship of Historical Redlining with Present-Day Neighborhood Environmental and Health Outcomes: A Scoping Review and Conceptual Model

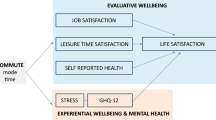

How commuting affects subjective wellbeing

Avoid common mistakes on your manuscript.

1 Introduction

This analysis proposes a structural model of the travel cost demand approach (TCM) that includes two components. One component is used to estimate the value of travel time for each individual in the sample. The second component incorporates that value of travel time into the travel cost variable that is used in the estimation of the site demand. While the travel cost demand curve is estimated using the widely applied count methodology, the travel time component of the model is based on a discrete choice stated preference method. Our approach avoids arbitrary assumptions about an individual’s value of time in an appealing way. It also allows quite intricate valuations since the stated preference portion of the model can accommodate a wide range of travel modes, time constraints, family situations and other considerations that can affect the value of one’s time when traveling for recreation.

The individual level approach to valuing travel time utilized in this analysis is made possible by relatively recent advances in modeling preference heterogeneity in stated preference studies. The advances allow the derivation of posterior estimates of each individual’s taste parameters . We argue that utilizing individual-specific values of travel time savings, based on respondents’ stated preferences, provides a feasible method for empirically incorporating the value of travel time into travel cost demand studies. Through an empirical illustration we show that the proposed approach is tractable. All it requires is the inclusion of only a few discrete choice experiment (DCE) questions in a TCM survey and a proper econometric treatment.

Our results show that using arbitrary assumptions concerning individuals’ value of travel time savings (VTTS) equal to a given share of their wage rate (e.g., 1/3) are largely unfounded. First of all, nearly half of respondents say they do not wish their journey to the site was shorter, indicating positive utility of leisure travel. Those who wished to shorten the journey were willing to pay amounts which appear only mildly correlated with their estimated wage rates. Overall, the average consumer surplus per trip calculated from the model with individual-specific VTTS were the closest to the model which used respondents’ full wage rate included for respondents who said they wish their journey was shorter (and zero for others). We suggest using this approach as the second best, in the case eliciting individual specific VTTS was not possible.

1.1 Economics of Time: What Do We Know

In 1965 Becker postulated that “time can be converted into money”. The basic idea is that people choose how much labor to supply, given a constraint that total time available is divided among work, leisure, and travel. At its bare bones, this model implies that travel time is valued at the after-tax wage rate. This is because the Becker model assumes that time can be transferred freely between work and leisure, so any marginal savings in travel time can be used to increase labor income. This model has been expanded in many directions. A common starting point is DeSerpa ( 1971 ). This model assumes that utility is affected by commodity bundles \(X = (X_{1} , \ldots ,X_{n} ,T_{1} , \ldots ,T_{n} )\) where \(X_{i}\) denotes some quantity of the i -th good, while \(T_{i}\) denotes the amount of time allocated to the i -th good. These goods can include both travel to a recreational site and time onsite. \(T_{w}\) denotes time spent at work (which may increase or decrease utility). Each activity has a minimum time requirement \(\bar{T}\) (hence constraint \(T_{i} \ge \bar{T}\) ). There is also an overall time constraint \(T_{w} + \sum {T_{i} } \le T^{0}\) . The budget constraint is \(P_{i} X_{i} \le Y + wT_{w}\) , where \(Y\) is unearned income. As a result, the problem can be stated as:

This problem can be solved by formulating a Lagrangian function, in which each constraint is associated with a Lagrange multiplier indicating how tight it is (i.e., the rate at which utility could be increased by relaxing it a little). Let \(\lambda\) , \(\mu\) , and \(\kappa\) be the Lagrangian multipliers for the budget constraint, the overall time constraint, and the activity-specific time constraints, respectively. The solution to the optimization problem yields:

Equation ( 2 ) states that value of time as a personal resource (or simply value of leisure) equals wage rate plus the value of utility from work. If \(T_{i}\) in Eq. ( 3 ) is not restricted to its minimum then by the virtue of complementary slackness condition its multiplier would be zero. Which in turn implies that VTTS = 0 and that \(\frac{{\partial U/\partial T_{i} }}{\lambda } = w + \frac{{\partial U/\partial T_{w} }}{\lambda }\) , that is, the value of marginal utility from the activity \(i\) would be equal to value of leisure. In other words, if a person spends on an activity more time than the minimum required (the constraint \(\sum\nolimits_{i = 1}^{n} {\kappa_{i} } (T_{i} - \bar{T}) \ge 0\) is not binding), such activity would be what DeSerpa ( 1971 ) calls a pure leisure good and its value equals to the value of time as a resource. On the other hand, if \(\sum\nolimits_{i = 1}^{n} {\kappa_{i} } (T_{i} - \bar{T}) = 0\) then \({{\kappa_{i} } \mathord{\left/ {\vphantom {{\kappa_{i} } \lambda }} \right. \kern-0pt} \lambda }\) can be interpreted as value of time saved (VTTS) in the activity \(i\) .

Most work in the transportation field assumes traveling is a means to an end and travel time is a disutility to be minimized. However, in the recent years new concepts emerged, including the so-called positive utility of travel, which suggests that travel can provide benefits and may be motivated by factors beyond reaching activity destinations (see, e.g., Mokhtarian and Salomon 2001 ; Mokhtarian 2005 ). Positive utility of travel implies that \(\partial U/\partial T_{i}\) is positive. In the extreme case, if positive utility of time offsets \(w + \frac{{\partial U/\partial T_{w} }}{\lambda }\) then VTTS would be zero. However, note that VTTS = 0 does not mean that the value of time is zero.

Time is scarce and the time spent on traveling to the site as well as the time spent on the site is time that could have been devoted to other activities. The value of those lost opportunities is the time cost of the trip. It is important to distinguish between VTTS and the value of time in terms of lost opportunities. If the main goal of the analysis was to estimate benefits from a new road or any other public investment that would result in time savings then the analysis should focus on monetizing benefits from time saved. However, if the goal is to estimate consumer surplus from visiting a given site then the analysis should focus on estimating the alternative cost of time. Unfortunately, in the cases when \(\frac{{\partial U/\partial T_{i} }}{\lambda } > 0\) , VTTS will underestimate the true value of time and the more similar the value of travel is to the value of time on-site, the larger the discrepancy between VTTS and the value of time in terms of lost opportunities will be.

1.2 Valuing the Opportunity Cost of Travel Time in Recreation Demand Models: Previous Research

The incorporation of the value of travel time in the TCM studies has been a source of concern since the earliest applications of this method (e.g., Clawson and Knetsch 1966 ; Johnson 1966 ). Researchers disagreed not only about how much the travel time is worth but also whether it should be included it in the model at all. Cesario ( 1976 ) provided an early cogent discussion of the incorporation of the value of time into travel cost models. Despite the decades of research into the value of time, Randall’s ( 1994 ) observation that “the cost of travel time remains an empirical mystery” remains valid and estimating the value of travel time (or, in most cases, rather the opportunity cost of time) remains a frequently discussed problem in the literature on TCM (e.g., Fletcher et al. 1990 ; Garrod and Willis 1999 ; Hanley and Barbier 2009 ).

Early on McConnell ( 1975 ) stressed the need to estimate the value of time before incorporating it in the demand function. However, uncovering the rate of substitution between money and time was long considered empirically intractable (as these trade-offs are endogenous and unobservable), even if conceptually possible. Cesario’s ( 1976 ) suggestion that commuter’s travel time values of 25–50% of an individual’s wage rate was widely adopted. Using a fraction of wage rate has remained probably the most common approach, with the compromise value of 33% being the most broadly accepted level (Hellerstein and Mendelsohn 1993 ; Englin and Cameron 1996 ; Garrod and Willis 1999 ; Gürlük and Rehber 2008 ; Egan et al. 2009 ; Huhtala and Lankia 2012 ). Critics of the wage-based approach note that it makes little sense for those without reported wages, the method would suggest their marginal utility of time is zero. That is clearly not the case (Feather and Shaw 1999 ; Parsons 2003 ). Footnote 1

Englin and Shonkwiler ( 1995 ) developed a model linking a count travel cost to a confirmatory factor analytic model. The confirmatory factor analytic portion allowed a travel time value to be imputed for each individual and incorporated into the cost of travel. In a further development, Feather and Shaw ( 1999 ) used shadow wages (the values of extra units of leisure time) as the opportunity cost of travel time and compared this with previous approaches (using a fraction of wage rate and hedonic wage equations). On average, their estimates were better adjusted to the observed wage rates for different employment categories of respondents, compared with the wage rate predicted by the hedonic model.

Recent work has focused on the relationship between one’s work and life schedule and the value of time in recreational travel. The early discussion of these issues was put forth by Bockstael et al. ( 1987 ) who proposed a general framework on how to incorporate time in TCM studies, based on insights from the labor literature. Demand for time depends on whether an individual can freely substitute recreation for work (interior solution) or has fixed work hours (corner solution). Most recently, Larson and Lew ( 2014 ) empirically implemented a system of joint labor-recreation equations to capture these effects. Palmquist et al. ( 2010 ) employed a joint revealed stated preference approach to deal with fundamental lack of substitutability of recreation time for other forms of time. Both of these efforts seek a structural analysis of the value of time that looks at the relationship between the demand for time and hence value and flexibility to substitute time.

A second recent strand of work has focused on revealed valuations of travel time. Fezzi et al. ( 2014 ) utilized a natural experiment where recreationists had a choice of a toll road which was faster or not paying a toll and taking more time to reach the recreation site. This is a novel approach and very robust but it is also specific to a particular site and so will be subject to the usual limitations if the values are transferred to other settings. Wolff ( 2014 ) utilized speeding behavior as a function of gasoline price to identify the value of time. This is also revealed preference approach and so is excellent for the area studied but again the values must be transferred to use in other settings.

Early suggestions to combine TCM with contingent valuation or contingent behavior questions (Cameron 1992a , b ; Adamowicz et al. 1994 ; Englin and Cameron 1996 ) explored the methodological issues without paying specific attention to the opportunity cost of time. For example, Englin and Cameron ( 1996 ) added contingent behavior questions to a TCM study but these questions referred to general trip costs and not specifically to the opportunity cost of time. Nevertheless, such an approach makes it possible to impose exogenously varying travel costs and could be applied to opportunity cost of time too. Álvarez-Farizo et al. ( 2001 ) adopted contingent valuation to estimate the value of leisure time for use in recreational models and confirmed a significant variation in leisure time values. Building on Shaw ( 1992 ), Casey et al. ( 1995 ) offered an alternative approach, indicating that individual preferences regarding time are better reflected by the opportunity costs of time associated with a particular aspect of recreation than the wage. After all, the latter measures the trade-off between work and leisure more generally. They complemented a standard travel cost survey with a contingent valuation question about peoples’ willingness to accept compensation to forgo a precisely defined recreational experience and used these results to derive the value of leisure time. Ovaskainen et al. ( 2012 ) directly elicited a stated value of time using a contingent valuation survey. Finally, Lloyd-Smith et al. ( 2019 ) in the context of recreation demand for fishing trips found that individual value of leisure time is substantially different from one’s implied wage rate.

In light of the above challenges of incorporating meaningful estimates of the opportunity cost of time into recreational demand models, in what follows we propose to combine TCM with a DCE that would indicate how much each respondent values travel time. Compared to most of the above ideas, ours is more flexible and it is very precise in that we obtain specific estimates on the opportunity cost of time for each respondent in any potential setting. We explain this approach by first reviewing the methodology required by the TCM and DCE studies, with a particular focus on econometric derivation of individual-specific values of travel time savings. We then move to an empirical illustration of our approach, which is compared with traditional treatments of value of travel time savings. Our case study not only serves as an example of the methodology we propose, but also illustrates that the usual approach of assuming that respondents’ values of travel time savings are proportional to their wages is largely unfounded. The last section offers discussion of the results and conclusions.

2 Methods and Econometric Treatment

2.1 the travel cost method.

The individual travel cost method treats trips to a site as the quantity demanded, while the cost of the trip as the price of access to the site. These assumptions result in a demand function of the following form:

where \(r_{i}\) is the number of trips taken by individual \(i\) to a given site during a given time period, \(p_{i}\) is the cost of access to the site (which usually consists of the cost of travel and opportunity cost of travel time), and \({\mathbf{z}}_{i}\) is a vector of individual characteristics that are believed to influence the number of trips an individual takes.

In this setting, the consumer surplus associated with accessing the site by an individual \(i\) is represented by:

where \(p_{i}^{0}\) is the current trip cost to the site and \(p_{i}^{ \cdot }\) is the cost level at which the number of trips goes to zero, also called individual \(i\) ’s ‘choke price’.

A standard practice is to model single-site recreation demand functions using count data distributions. The two most frequently used count models are Poisson and Negative Binomial. These models are flexible enough to handle truncation, a large number of zero trips in the data, and preference heterogeneity. The main advantage of the Poisson model is that it is a member of the linear exponential family and so its parameters are unbiased as long as the underlying demand relationship is linear exponential. However, the Poisson distribution has the property of equi-dispersion—the first two moments of a distribution are equal, i.e., \(E\left( Y \right) = \mu = V\left( Y \right)\) . If a particular data set does not satisfy this assumption, as is in the case of our study, then more efficient estimates of the parameters can be obtained from the negative binomial distribution as it does not require equi-dispersion.

A second area of consideration is the method used to sample the trip data. If the data was sampled on-site the frequency of visitation by a user affects the likelihood of being in the sample. This sampling bias is referred to as endogenous stratification. The more frequently one visits a site the more likely they are to be sampled. A second issue is that only visitors can possibly be sampled. As a result, the sample is also truncated at zero. The problem of endogenous stratification and truncation in the context of travel cost modeling has been addressed for the Poisson model by Shaw ( 1988 ). Englin and Shonkwiler ( 1995 ) extended the analysis to the truncated and endogenously stratified negative binomial model. Englin and Shonkwiler ( 1995 ) accommodated three features of on-site samples concerning count data: over-dispersion, truncation at zero, and endogenous stratification due to oversampling of frequent users of the site. In this model, the probability of individual \(i\) making \(y_{i}\) trips to the site is given by:

where \(\varGamma\) represents the gamma function, \(\lambda_{i}\) is the mean, which is typically modeled as a function of explanatory variables and \(\alpha_{i}\) is the over-dispersion parameter. Footnote 2

2.2 Discrete Choice Experiments

In environmental economics stated preference methods are commonly used for modeling consumers’ preferences and valuation (Carson and Czajkowski 2014 ). Respondents’ choices are typically modeled in a random utility framework, which assumes that the utility associated with any choice alternative can be divided into a sum of contributions that can be observed by a researcher, and a component that cannot, hence is assumed random. Specifically, consider the following empirical specification of a random utility multinomial choice model:

where \(U_{ij}\) represents respondent \(i\) ’s utility associated with selecting alternative \(j\) out of a set of \(J\) available alternatives, \({\mathbf{x}}_{ij}\) is a vector of respondent- and alternative-specific choice attributes, i.e., goods or their characteristics, and \({\varvec{\upbeta}}_{i}\) represents a vector of individual-specific taste parameters associated with marginal utilities of the choice attributes. Assumptions regarding parametric distributions of the taste parameters, such that \({\varvec{\upbeta}}_{i} \sim {\mathbf{f}}\left( {{\mathbf{b}},{\varvec{\Sigma}}} \right)\) , where \({\mathbf{b}}\) is a vector of sample means and \({\varvec{\Sigma}}\) is a variance–covariance matrix, allows to account for unobserved preference heterogeneity and possibly—correlations between random taste parameters.

The stochastic component of the utility function \(\left( \varepsilon \right)\) may be interpreted as resulting from researcher’s inability to observe all attributes of choice and all significant characteristics of respondents (McFadden 1976 ), or as decision maker’s choice from a set of his decision rules. Random utility theory is transformed into different econometric models by making assumptions about the distribution of the random error term and the random parameters. Typically, \(\varepsilon_{ij}\) is assumed to be independently and identically (iid) Extreme Value Type 1 distributed across individuals and alternatives. When unobserved preference heterogeneity is allowed in a way presented above, this leads to a Random Parameters Mixed Logit (RP-MXL) model (McFadden and Train 2000 ).

In what follows, we utilize Bayesian framework for estimating a RP-MXL model and deriving individual-level taste parameters and, as a result, individual-specific VTTS. The advantages of Bayesian approach over classical estimation include easier identification of a global maximum of the likelihood function, and handling correlated random parameters (Huber and Train 2001 ). In addition, in a Bayesian approach identification of individual-level parameters is less of an issue than in classical approach, since in extreme cases the prior can provide the necessary information.

Bayesian estimation procedures for the RP-MXL model do not require simulating choice probabilities. Instead, the likelihood of observing individual \(i\) making a sequence of \(T\) choices \({\mathbf{Y}}_{i} = \left\{ {y_{i1} , \ldots ,y_{it} , \ldots y_{iT} } \right\}\) is the product of standard logit formulas, conditional on \({\varvec{\upbeta}}\) :

The unconditional probability is the integral of ( 9 ) with respect to all values of \({\varvec{\upbeta}}_{i}\) , weighted by their multivariate probability density \(\psi \left( {{\varvec{\upbeta}}_{i} } \right)\) :

The Bayesian approach requires specifying priors for the model parameters \({\mathbf{b}}\) , \({\varvec{\Sigma}}\) and \({\varvec{\upbeta}}_{i}\) for all

\(i = 1..N\) . Typically, a diffuse normal distribution (with zero means and diagonal matrix of arbitrarily large variances \({\varvec{\Theta}}\) , allowing for almost flat distribution) is used as a prior for \({\mathbf{b}}\) , \({\mathbf{b}} \sim MVN\left( {0,{\varvec{\Theta}}} \right)\) , and inverted Wishart distribution (with the number of degrees of freedom \(K\) equal to the length of \({\mathbf{b}}\) , and parameter \(K{\mathbf{I}}\) , where \({\mathbf{I}}\) is a \(K\) -dimensional identity matrix) is used as a prior for \({\varvec{\Sigma}}\) , \({\varvec{\Sigma}} \sim IW\left( {K,K{\mathbf{I}}} \right)\) . The priors for each individual’s taste parameters \({\varvec{\upbeta}}_{i}\) are proportional to the assumed (population-level) distributions of taste parameters times the priors on \({\mathbf{b}}\) and \({\varvec{\Sigma}}\) ; as an aside, because of this hierarchy of parameters this procedure is often referred to as hierarchical Bayes. As a result, denoting choice sequences of all individuals at all choice occasions as \({\mathbf{Y}}\) , the joint posterior distribution on \({\mathbf{b}}\) , \({\varvec{\Sigma}}\) and each \({\varvec{\upbeta}}_{i}\) is:

Since using the parametric distributions which impose bounds on taste parameters may make direct drawing from the joint posterior distribution difficult, some variant of Metropolis–Hasting algorithm is usually used (Train 2009 ). Footnote 3

The approach that we propose in this paper extends the traditional TCM by utilizing individual-specific VTTS. In order to make this possible and, at the same time, allow for preference heterogeneity it is crucial to obtain individual-level taste parameter estimates. Although in this paper we adopt a Bayesian approach, Huber and Train ( 2001 ) showed that reliable individual-level parameters for discrete choice models can be obtained irrespectively of the estimation or inference framework. Within a Bayesian framework, the distribution of coefficients across the population is estimated and used as a prior, which combined with individual’s choices results in posterior estimates of each individual’s tastes (Rossi et al. 1996 ; Allenby and Rossi 1998 ). Similarly, in a classical setting, applying Bayes theorem, i.e., combining maximum likelihood estimates of the population distribution with individual choices, makes derivation of individual-specific parameter estimates possible (Revelt and Train 2000 ). Huber and Train ( 2001 ) showed that these approaches lead to largely equivalent results.

3 Empirical Study

In order to investigate differences resulting from applying individual-level estimates of travel time versus the traditionally assumed value of time we designed and implemented a joint TCM-DCE study in the context of recreational birdwatching.

3.1 Study Site, Experimental Design and Survey Administration

The study site selected for this application was Żywkowo, one of Polish ‘stork villages’—a term used by a recent New York Times article about them (Whitaker 2015 ). A stork village is a common name for a village with a white stork ( Ciconia ciconia ) breeding colony, often inhabited by more storks than people. Żywkowo, the best-known stork village in Poland, has approximately 40 white stork nests and 10 households, while it receives approximately 2000–5000 tourists annually, many of whom come from abroad. Żywkowo lays in the north-east of Poland, on the periphery of one of the most attractive parts of the country to tourists, the Masurian Lake District. It is not located near any major tourist attraction and is relatively far from larger cities; in addition, since there are no other attractions in the village it is visited solely because of birds, and more specifically—because of white storks.

The questionnaire was designed to collect the usual data necessary for a TCM study. We asked where the tourists came from, distinguishing between their most recent stop (if they visited more than one place during their trips) and their place of residence. We also asked how long the travel took, what means of transportation were used and the number of people travelling in a party. In order to identify respondents who, in general, had positive willingness to pay for travel time savings we asked if they had wished their travel time to the site was shorter. Footnote 4 After that, respondents who expressed general interest in making their travel time shorter were asked to participate in hypothetical discrete choice tasks designed to reveal their WTP for travel time savings. Finally, respondents were asked socio-economic questions, providing information about their age, gender, income, level of education, and basic birdwatching preferences. Questionnaires were available in Polish, German and English. Footnote 5

The DCE part of the survey was introduced as follows:

Now we would like to ask you to take part in an exercise that involves making some choices. Imagine that the trip from the last place of your stay could be shorter. However, it would require an additional cost. You would have to personally pay this cost and it would increase the current cost of your trip. Please assume that shortening the trip would not decrease the costs of your travel. You could spend the time that you would save in any preferred way, for example resting or working. In a moment you we will show you several hypothetical situations that present different combinations of time saved and the related cost. In each case, please choose a variant that you consider the best – from your own point of view (please think about yourself only). Bear in mind that the additional cost would reduce your budget available for other purposes. This is why we ask you to treat this cost as if you would really have to pay it. If you would not be willing to pay anything extra for the saved time, choose Alternative 1 – status quo.

The DCE utilized up to 6 choice tasks per respondent. Each choice task consisted of 3 alternatives—one status quo alternative associated with no travel time savings and no costs, and two alternatives associated with different travel time savings and additional cost. There were 3 versions of the DCE questions which differed in the utilized attribute levels, depending on respondent’s travel time and an additional version for self-administered surveys that used relative travel time reduction levels. The attribute levels are presented in Table 1 .

The design of each DCE version was generated using NGENE. We optimized each experimental design for the D-efficiency of an MNL model using Bayesian priors (Ferrini and Scarpa 2007 ). All prior estimates were assumed to be normally distributed, with their means derived from the MNL model estimated on the dataset from the pilot survey, and standard deviations equal to 0.25 of each parameter’s mean (with an absolute minimum for means that were very close to zero). Additionally, the design included constraints on attribute level combinations, to rule out dominated or repetitive alternatives.

Tourists visiting Żywkowo were surveyed on site between April and September of 2011, that is, since when the storks returned from their spring migration to when they left for autumn migration. Questionnaires were available to tourists visiting an exhibition room. Tourists were prompted to take part in the study by local employees and, additionally, by interviewers who assisted the local staff at times when the tourists were the most numerous. In 2011, 2850 tourists visited the exhibition room, of whom 583 agreed to complete the questionnaire, resulting in a response rate above 20%. Footnote 6 Socio-demographic characteristics of the sample and main descriptive statistics of the journeys are presented in Table 2 .

3.2 Deriving Respondent-Specific Values of Travel Time Savings with Discrete Choice Experiment Approach

We start by presenting the results of the discrete choice experiment estimated for respondents who indicated that they wished their journey to the study site had been shorter ( n = 247, 47%). Respondents who answered ‘No’ were assumed not to be ‘in the market’ for shortening their journey, and hence their WTP for travel time savings was 0. Footnote 7

The RP-MXL model was estimated using the Bayesian procedures described in Sect. 2.2. The choice attributes included travel time savings, cost and an alternative specific constant associated with the status quo alternative. All taste parameters were assumed random. Since economic theory indicates that utility associated with (negative) cost and travel time savings (for respondents who indicated that they wished their journey had been shorter) cannot be negative, we assumed that population-level parameters of these attributes were log-normally distributed. The parameter of the alternative specific constant for the status quo alternative was assumed to follow normal distribution.

The estimation was performed in Matlab. Footnote 8 In our application, we used 10 5 iterations for ‘burn-in’ (the iterations used by Metropolis–Hasting algorithm within which the draws converge to the target, conditional posterior distribution), and after that we retained every 11th iteration result for the total of 10 5 iterations used to conduct inference, i.e., from a classical perspective, deriving estimates of the parameters. Footnote 9 Finally, we used 10 6 draws per individual to simulate the estimated distributions of random parameters and to calculate simulated log-likelihood value. The step length for the Metropolis–Hasting algorithm was set to 0.3, well within the range suggested by Gelman et al. ( 2003 ).

The estimation results are presented in Table 3 . The first column represents the reference MNL model. The improvement in model fit from the MNL to the RP-MXL model with correlated parameters, as indicated by Akaike information criterion (AIC) and Bayesian information criterion (BIC), is an evidence of substantial heterogeneity in respondents’ preferences. This is confirmed by relatively large estimates of standard deviations of population parameters. The results of a likelihood ratio tests show that indeed, all parameters should be modeled as random.

The estimation results presented above allowed us to derive individual-specific parameters in a fashion described in Sect. 2.2. These parameters were in turn used to simulate Footnote 10 individual-level willingness to pay for travel time savings, following Small and Rosen ( 1981 ) and Hanemann ( 1984 ):

where \(\mu\) is the marginal utility of income (the parameter on price), \({\varvec{\upbeta}}\) is vector of estimated parameters of the indirect utility function, \({\mathbf{x}}_{0}\) are the levels of the attributes in the reference situation and \({\mathbf{x}}_{1}\) are the levels of the attributes in the improved situation. In our case, we assumed two alternatives ( \(n = 2\) ; status quo and non-status quo) and the improvement in the form of 1-h travel time reduction, which occurred in the non-status quo alternative of \({\mathbf{x}}_{1}\) .

Descriptive statistics of these individual-specific values of travel time savings for the sample of our respondents are presented in Table 4 . For comparison, the table also includes the statistics for respondents’ wage rates. Footnote 11

The results of this exercise allow for a few interesting conclusions. First of all, even a relatively simple discrete choice experiment can allow for calculating respondent-specific values of travel time savings. The descriptive statistics presented in Table 4 show that individual-specific values of WTP for travel time savings are plausible for virtually all respondents in our sample.

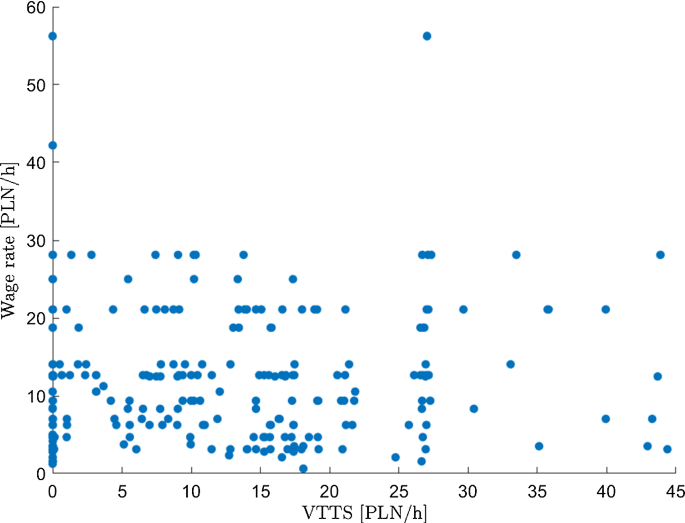

Secondly, we find that all respondents’ mean value of 1-h travel time savings is very close 1/2 of their mean wage rate. However, on closer inspection, 47% of respondents declared that they did not wish their journey was shorter, implying VTTS = 0. In addition, 29.81% of those who were generally ‘in the market’ for shortening their travel times still made choices which implied very low VTTS (e.g., did not choose the costly improvement alternative in any of the choice tasks). Footnote 12 Interestingly, mean VTTS of those who indicated they wished their journey was shorter is close to their (full) mean wage rate. Finally, we note that the correlation of respondents’ VTTS and their wage rate is very low (0.0411 for all respondents, 0.1191 for those who declared they wished their journey was shorter).

We investigate the relationship between respondents’ VTTS and wage rate further using graphical illustration provided in Fig. 1 . If VTTS and wage rates were correlated, we would expect a positive linear relationship. Instead, we find that respondents’ WTP for shortening their trip is largely independent of their wage rate.

Respondents’ wage rates and implied values of travel time savings

Overall, our results do not support using respondents’ wage rate as a proxy for their VTTS. Instead, we argue for utilizing stated preference methods for measuring individual level VTTS and in what follows, we demonstrate substantial differences resulting from utilizing individual-level versus aggregated versus traditional assumptions regarding the value of travel time in travel cost models.

3.2.1 Individual Heterogeneity with Respect to VTTS

In order to provide an insight into respondents’ heterogeneity with respect to their VTTS we present the logit model for ‘market participation’—respondents’ answers to the question if they (in general) would prefer that their journey was shorter and a simple linear regression model in which individual-specific VTTS are explained with respondents’ socio-demographic variables (Table 5 ).

The results show that respondents whose journeys were longer were more likely to answer that they indeed wished their journey had been shorter; the relationship is convex, as indicated by the negative coefficient associated with the travel time squared. Footnote 13 These results coincide with individual specific VTTS—respondents who had to travel longer were willing to pay more to shorten their journey (although at a decreasing rate). Additionally, we find that respondents with medium or high level of education are more likely to state that they wish their journey was shorter. Respondents from larger households are also statistically willing to pay more for travel time reduction, although this last effect is counterfeited for respondents with children. Finally, we note that once respondents’ socio-demographic characteristics are controlled for, their wage was not a significant explanatory variable of willing to shorten one’s journey, Footnote 14 and only weakly significant for explaining their individual VTTS. This is in stark contrast with the common practice of utilizing fraction of one’s income as a proxy for their VTTS (Parsons 2017 ).

These results have profound implications. Since respondents whose traveling times are larger have higher WTP for shortening their journey it clearly follows that using mean VTTS for every respondent in the sample will negatively bias the cost of travel time. This is because observations with higher individual-specific VTTS have higher weights in the utility function (more hours multiplied with higher cost per hour). In addition, since respondents’ VTTS appears statistically independent from their wage, using individual-specific wage rates as a proxy of VTTS is not convincing approach either. We illustrate this finding with the comparison of different modeling approaches in the next section.

3.3 Travel Cost Method with Consumer-Specific Values of Travel Time Savings

In this section we present the estimation results of 5 travel cost models with different assumptions with respect to respondents’ VTTS. Generally, visitor \(i\) ’s expected number of trips can be calculated as:

which serves as our travel cost recreation demand function. The \(TC_{i}\) represents individual \(i\) ’s cost associated with reaching the stork village and \({\mathbf{Z}}_{i}\) is a vector of individual characteristics that are considered to influence the number of trips \(i\) takes (in our case, since we intended to keep our approach as simple as possible, we only used a constant).

The average cost of traveling 1 km was assumed to be 0.45 PLN Footnote 15 ; however, when calculating cost per person we took a travelling party size into account. As far as the VTTS is concerned, the following alternative specifications were used:

VTTS = 1/3 of respondent’s wage rate;

VTTS = respondent’s wage rate;

VTTS = mean WTP derived from the MNL model;

VTTS = individual-specific WTP derived from the RP-MXL model.

In all cases, we only included the cost associated with the travel time for respondents who indicated that they wished their journey was shorter. The resulting travel costs, calculated under different assumptions with respect to VTTS, are presented in Table 6 .

We estimated the count data models in a Bayesian framework, applying the independence chain Metropolis–Hastings algorithm with a multivariate t distribution (with mean \(\left( {{\hat{\mathbf{\beta }}}} \right)\) equal to the mode of the posterior kernel, and variance equal inverted negative Hessian resulting from the maximum likelihood estimator subroutine evaluated at \({\hat{\mathbf{\beta }}}\) ) Footnote 16 as a candidate-generating density (Chib et al. 1998 ; Davis and Moeltner 2010 ). The Gibbs Sampler was implemented with 100,000 burn-in draws and 10,000 retained draws. Footnote 17

The estimation results are presented in Table 7 . As expected, the travel cost coefficient is negative and statistically significant at the 1% level in all the models. The constant and the over-dispersion parameter \(\alpha_{i}\) are also highly significant. Footnote 18 It is impossible to directly compare the models in terms of fit, as each one is essentially estimated on a different dataset, and hence they are not presented in Table 7 . A common theme is that the intercept term is relatively stable across specifications ranging from − 5.4125 to − 5.4966, virtually indistinguishable from each other statistically. The over-dispersion parameters are also similar. The slope parameters while not statistically different at conventional test levels follow the usual pattern of higher values of time flattening the slope of the estimated demand curve.

We now turn to presenting the welfare measures associated with the different VTTS assumptions made in Models 1 to 5. Consumer surpluses (CS) per person per trip were calculated as an inverse of the estimated travel cost parameter \(\left( {{{ - 1} \mathord{\left/ {\vphantom {{ - 1} {\beta_{TC} }}} \right. \kern-0pt} {\beta_{TC} }}} \right)\) . The 95% confidence intervals were simulated. The results are reported in Table 8 .

As the parameter estimates for the demand functions suggest will happen, the welfare estimates for flatter demand curves (ones with higher values for time) are higher. The individual random parameters model provides the highest welfare measures, however, all the CS are plausible (they are in the range of CS reported in other TCM studies conducted in Poland, e.g., Panasiuk 2001 ; Bartczak et al. 2008 ; Bartczak et al. 2012 ; Czajkowski et al. 2015 ; Kulczyk et al. 2016 ; Czajkowski et al. 2018 ; Gawrońska et al. 2018 ; Wiśniewska et al. 2018 ).

4 Discussion and Conclusions

In this paper we propose to combine the usual TCM data with respondent-specific estimates of the value of travel time savings. Although slightly more complicated and more strenuous for respondents, this approach is much more informative than utilizing values of times derived from respondents’ wage rate or stated preference results assuming common value for all individuals in the sample.

Our approach is different from those proposed so far in that we do not just extrapolate the appropriate wage rate based on the respondents’ socio-economic data combined with other sources, nor any structural analysis of the value of time for our respondents. Our DCE questions are more flexible than the approach of Fezzi et al. ( 2014 ), in that they are general and not specific to our study. At the same time, this approach limits the scope of researcher judgment necessary to estimate the opportunity cost of travel time, and it reduces the need for external data to be combined with survey data in an attempt to calculate the opportunity cost of travel time in a structural way.

In light of the difficulties and ambiguities related to the opportunity cost of travel time, some authors decided not to incorporate time costs in their travel cost models (Hanley et al. 2003 ; Alberini and Longo 2006 ; Alberini et al. 2007 ; Fleming and Cook 2008 ). Footnote 19 One of the reasons for this approach is the apprehension that incorporating time might bias the coefficient on the price downwards. Another problem might be that time spent in travel might have a value on its own—travelling might be generating utility for some travelers, resulting from enjoying landscapes and amenities, deriving pleasure from a particular means of transportation, adventure-seeking, variety-seeking and be otherwise productively used (Chavas et al. 1989 ; Lyons and Urry 2005 ; Mokhtarian 2005 ; Ory and Mokhtarian 2005 ). In our study, 47% of respondents declared that they would wish to reduce the travel time of their journey. These results are consistent with previous studies investigating the value of time spent on leisure journeys, which highlight that sometimes the time spent in travel may be worth more than on the final spot (Anable and Gatersleben 2005 ; Larson and Lew 2005 ). Indeed, Żywkowo is located in a remote but particularly picturesque part of the country, with narrow roads lined with large trees, and several other tourist attractions in the region. Clearly, our study helps to challenge the common assumption that “travel is a disutility to be minimized” (Mokhtarian 2005 , p. 93).

Our study indicates that it is not necessary nor adequate to use a fraction of hourly earnings because the opportunity cost of time can be measured more accurately by allowing respondents to express their preferences regarding the time they spend in travel. In this way, we move even further with the argument that the opportunity cost of travel time is defined endogenously—it is a function of visitor’s characteristics. We explicitly account for the opportunity cost of travel time perceived by respondents, as opposed to the real cost of travel time they may incur (Amoako-Tuffour and Martínez-Espiñeira 2012 ). Such a flexible approach allows us to account for the fact that travel time is decided by each individual who can choose longer or shorter routes, considering the consumptive value of travel time. The idea that the valuation of travel time is highly subjective was present in the discussion already since Cesario ( 1976 ). Indeed, we observed substantial heterogeneity in respondents’ preferences in our study, particularly with 47% of respondents declaring that they would not wish their travel time was shorter, and the VTTS of the other respondents very weakly correlated with their wage rates.

Our study has several limitations and it is important to acknowledge them. First, while the dominant empirical approach to infer VTTS in the transportation literature is based on experiments, in which respondents are asked to make hypothetical choices or personal travel time gains in exchange for travel costs paid from their own budget, this approach is no longer in line with the state-of-the-art stated preference valuation methodology. In particular, our DCE was not consequential (Vossler et al. 2012 ), it relayed on epsilon truthfulness and hence did not satisfy the incentive compatibility conditions (Carson and Groves 2007 ) and did not satisfy several other recommendations for stated preference studies (Champ et al. 2017 ; Johnston et al. 2017 ). As a result, we are unable to claim, that the estimated VTTS are unbiased. How to incorporate VTTS questions in a DCE component of a TCM survey remains an important area for future research (not only in the case of our study, but transport literature in general). Second, the hourly ‘wage rates’ that we used for comparisons were calculated on the basis of household income per adult. It remains an open question if household or individual income should be considered, as the basis for consumers’ purchasing decisions in the context of time savings. Finally, our study applied a single-site version of the TCM. Following Von Haefen ( 2002 ), all substitute sites are captured in the constant of our model. We acknowledge this as a possible limitation of our study. Footnote 20

Many applied researchers are rather conservative in their assumptions about how much the opportunity cost of time might add to the value of a visited site and preferred to use the lower bounds of the wage rate (Neher et al. 2013 ). For example, Hynes et al. ( 2009 ) suggested that it would be useful to determine individual opportunity costs of travel time to avoid a potential bias related to assuming an excessively high wage fraction as a reference. Meanwhile, a comparison of our approach with the key alternative specifications of the opportunity cost of time show that recreationists may actually value their time higher than it has been expected so far. Consumer surplus calculated with the RP-MXL model was more than twice as high as in the case of not including the travel time at all, or when the opportunity cost of travel time was assumed to be 1/3 of the wage rate. It was even higher than if the opportunity cost of travel time equaled full wage rate of those who did not say they wished their journey had been shorter.

More broadly, our study indicates a need to incorporate various components of the travel cost and to do so in a respondent-specific way. Indeed, travel is a complex issue, especially when related to recreational purposes, and it bears many unmeasured qualities which may be differently perceived and valued by the different travelers (Salomon and Mokhtarian 1998 ). Our study shows an opportunity to integrate different valuation methods and thus practically use the fact that they refer to different issues and can provide complementary information. Our empirical illustration of valuing recreational birdwatching in a stork village demonstrates the feasibility of this approach. It also shows that, as the minimum, future studies could directly ask respondents if they wish their journey was shorter, and include value of travel time of only those who agreed. In our case, and in line with Jara-Díaz et al. ( 2008 ) and Lloyd-Smith et al. ( 2019 ), those who were willing to pay to make their journey shorter declared WTP per hour on average close to their full wage rate, although more evidence is needed to verify if this finding is universal.

Notably, the transportation literature focusing on the estimation of the value of time has moved on from the rough approach of taking 33% of wage to more fine-tuned estimates taking into account, among other things, trip purpose, transport mode and difference between drivers and passengers (e.g., Börjesson and Eliasson 2014 ; Sartori et al. 2014 ; Mouter and Chorus 2016 ).

Amoako-Tuffour and Martínez-Espiñeira ( 2012 ) took this reasoning further and allowed the over-dispersion parameter \(\alpha_{i}\) to vary according to respondent characteristics (and they used their survey data to indicate which fraction of the wage rate best represented the respondents’ opportunity cost of travel time, making also this parameter a function of the respondents’ characteristics).

Interestingly, the results of the estimation procedure are asymptotically equivalent to the classical, maximum likelihood estimator. The results can thus be given a dual—classical and Bayesian—interpretation.

The exact wording of the question was: “Would you prefer the trip from the last place of your last stay to be shorter? (a) Yes; (b) No; (c) I do not know”. Respondents who answered (a) or (c) were considered to be ‘in the market’ for shortening their journey time.

More details about the survey are available in Czajkowski et al. ( 2014 ).

We are unable to compare the sample characteristics with the characteristics of the target population because the characteristics of the target population (visitors of the study site) are unavailable. However, we note that share of surveyed visitors was relatively large, the interviews were collected throughout the entire season and the respondents were selected randomly from the visitors available at a time (for parties traveling together, only respondents who actually paid for the trip were surveyed; in the case of more than one person paying for the trip (e.g., a family with joint budget or a party who shared costs)—the respondent was selected randomly).

This is consistent with early theoretical contributions to microeconomic time allocation theory and travel time valuation, which recognized that, in some cases, travel may be enjoyable (e.g., Becker 1965 ; Johnson 1966 ; Evans 1972 ). Another line of research related to why people do not want their trip to be shorter is related to non-shortest-path route choice. There is now numerous evidence of this type behavior (Agrawal et al. 2008 ; Bovy and Stern 2012 ; Broach et al. 2012 ). These studies evidence that people do not always choose the shortest, fastest, or cheapest route to their destination. It is well recognized in the transportation literature that positive utility of travel may be at play, if travelers want to travel farther than necessary or if they choose more scenic or enjoyable but out-of-the way paths.

The dataset and software codes for the models used in this paper are available from http://czaj.org/research/supplementary-materials .

We retained only every 11th draw in order to reduce the amount of correlation among the draws.

Only respondents who declared that they wished their journey was shorter were included in this analysis; the others were assumed not to be willing to pay for travel time savings (VTTS = 0). In simulation we accounted for effective means of the distributions which were modelled as truncated normal.

The wage rate was calculated as net (after tax) household income (including all sources of income, such as salaries, pensions, rents etc.) divided by the number of adults in a household and divided by 160 (regular number of working hours per month). While this is not strictly the individual’s wage per hour, it represents the family budget constraint, which is often the more appropriate measure of purchasing decisions (Lindhjem and Navrud 2009 ). For respondents who refused to disclose their household income, we arbitrarily assumed their income was equal to the sample mean.

As noted by one of the reviewers, this is a likely indication of a status quo bias that may have implications for our estimated consumer surplus indicators.

This result is consistent with the transportation literature findings that the satisfaction with the travel experience and travel liking tends to decrease with longer trip distances or durations (Rasouli and Timmermans 2014 ; Milakis et al. 2015 ; Morris and Guerra 2015 ) (e.g., Rasouli and Timmermans 2014 ; Milakis et al. 2015 ; Morris and Guerra 2015 ).

Wage remains insignificant even if (possibly correlated) education is not included as an explanatory variable, and if it is the only explanatory variable in the model.

We used the official average operating cost according to the Polish Automobile Association. This rate is commonly used for reimbursing employees who use private vehicles for official business.

The tuner elements for these t-distributions were set as the degrees of freedom = 8 for means and a scalar 2 for the variance. These settings led to desirable acceptance rates and efficiency measures.