Latest News

Top tips to experience wilderness living without compromising comfort

Mews survey reveals 80% of travelers prefer hotels with a completely automated front desk or self-service technology

AmaWaterways opens reservations on all 2026 river cruises

WTTC: Travel & Tourism could represent 9.6% of Egypt’s economy by 2034

Pivot tapped to manage The Scarlet Hotel, Lincoln, a Tribute Portfolio hotel

Boutique Hotel Alhambra becomes the first hotel in Croatia to join Small Luxury Hotels of the World’s ‘Finest Collection’

Antwerp Airport welcomed first flight to Oujda and prepares for Summer vacation

Air Canada launches new weekly flights from Québec City to Tulum this Winter

Pebble Beach Company partners with Ship Sticks for seamless golf travel

Puente Romano Beach Resort in Marbella launches world’s forst FENDI gastronomic experience

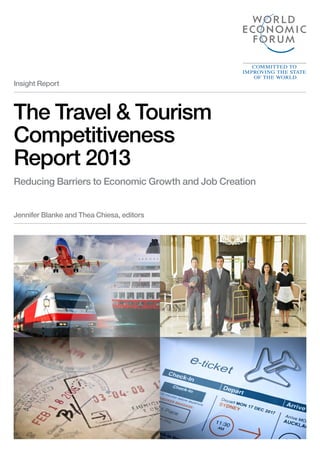

World Economic Forum – The Travel & Tourism Competitiveness Report 2013

This year’s Competitiveness Report 2013 is published under the theme “Reducing Barriers to Economic Growth and Job Creation,” which reflects the forward-looking attitude of the sector as it aims to ensure strong growth going into the future. The Travel & Tourism.

The Travel & Tourism (T&T) industry has managed to remain relatively resilient over the recent year despite the uncertain global economic outlook, which has been characterized by fragile global economic growth, macroeconomic tensions, and high unemployment in many countries. Indeed, the sector has benefitted from the continuing globalization process: travel has been increasing in mature markets and, particularly, has been driven by the rising purchasing power of the growing middle class in many developing economies.

In such a context, Travel & Tourism has continued to be a critical sector for economic development and for sustaining employment, in both advanced and developing economies. A strong T&T sector contributes in many ways to development and the economy. It makes both direct contributions, by raising the national income and improving the balance of payments, and indirect contributions, via its multiplier effect and by providing the basis for connecting countries, through hard and soft infrastructure -attributes that are critical for a country’s more general economic competitiveness. Although developing the T&T sector provides many benefits, numerous obstacles at the national level continue to hinder its development. For this reason, seven years ago the World Economic Forum, together with its Industry and Data Partners, embarked on a multi-year research effort aimed at exploring various issues related to the T&T competitiveness of countries around the world.

This year’s Report is published under the theme “Reducing Barriers to Economic Growth and Job Creation,” which reflects the forward-looking attitude of the sector as it aims to ensure strong growth going into the future.

Theodore Koumelis

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.

- Theodore Koumelis https://www.traveldailynews.com/author/theodore-koumelis/ AmaWaterways opens reservations on all 2026 river cruises

- Theodore Koumelis https://www.traveldailynews.com/author/theodore-koumelis/ Pivot tapped to manage The Scarlet Hotel, Lincoln, a Tribute Portfolio hotel

- Theodore Koumelis https://www.traveldailynews.com/author/theodore-koumelis/ Antwerp Airport welcomed first flight to Oujda and prepares for Summer vacation

- Theodore Koumelis https://www.traveldailynews.com/author/theodore-koumelis/ Pebble Beach Company partners with Ship Sticks for seamless golf travel

Related posts

Going to greece here’s what you need to know, says new york post, the vulnerability of hellenic tourism – new phase, rearrangements, the hotel vat increase in greece to 13% for 2015, the abolition of the reducted tax for the greek islands – interactive consequences, number of organizations objecting to iata resolution 787 expanding, previous post, gbta forecasts a return to double digit growth for brazil's business travel spend in 2013, more airports working on active carbon reduction.

Munich Airport, Lufthansa and Miles & More form a unique partnership

LATAM Airlines now available on APG Platform

Dream Hotels & Resorts and CityBlue Hotels forge strategic partnership to promote pan-African hospitality

ISO’s Atlantic reservation system takes EuroParcs to travel agencies

Travel & Tourism set to inject TND 23bn. into Tunisia’s economy this year

Travelport secures LCC content for agency customers with new participant AJet

United Airlines leads influencer discussions on X during H1 2024, reveals GlobalData

KSL Resorts celebrates employee excellence and bold moves at recent Platform Summit

Hyatt announces two new Senior Vice President roles to drive growth in EAME region

Marriott Hotels & Resorts most active hotel brand in sports sponsorship for 2024, reveals GlobalData

Evolvi Rail Systems appoints new Managing Director

Copa Airlines celebrates 20 years of connecting New York with Latin America and the Caribbean

GrowthCurve Capital acquires Duetto

GUEXT has opened the registration for trade visitors for GUEXT’s inaugural year

Curator expands its collection with four independent properties

Hawai‘i Tourism Authority launches Qurator

Surge in international event travel despite rising costs, reports Squaremouth

UFI welcomes Pierre Aurélien Vidon as Head of Marketing and Communications

Visit Greater Palm Springs celebrates Acrisure Arena’s $168.5m. economic boost in 2023

Fairmont Dallas expands operations and sales teams with new hires and promotion

Visit Panama City Beach announces new staff appointments and promotions

Corinthia Grand Hotel Astoria Brussels set to open in November 2024

JetBlue names Tracy Lawlor Chief People Officer

Roulette by day, reefs by night: The best casino Cruise itineraries from the UK

Key travel trends and market growth insights from MarketHub Europe 2024

FITUR 2025 is celebrating its 45th anniversary

Michelin starred Alain Ducasse continues partnership with The Dorchester

Augmented Reality and Cybersecurity: Frontiers of Technology in Travel

Zucchetti North America launches new CRS, booking engine features and functionality

How InsFollowPro can skyrocket your Instagram likes and views: An in-depth review

Traveling the world for less: Insider tips for budget travelers

iCoupon expands into South America with major travel retail wins

Hotel Granbaita Dolomites to reopen after further renovation

Lagos Business School and CityBlue Hotels partner to drive growth in the hospitality industry in Africa

Joyned and Volunteer World join forces to elevate the collaborative journey for global volunteers

Journey Mentor awarded five-year IT contract by travel giant TAS

Air Serbia to launch direct flights to Guangzhou on 30 September

Hawai‘i continues to exceed visitors’ expectations

Sabre integrates Etihad Airways’ NDC content

The Data Appeal Company: Insights into Mediterranean tourism beyond summer 2024

Updated ICAO global plan vital to strengthening aviation security

UrbanV and ICAD join forces to bring AAM in Saudi Arabia and in the Middle East

TAAG Angola Airlines to provide direct flights between Luanda and Oporto during Christmas and New Year

Hyatt expands in the Big Easy with two New Orleans hotels

4th of July travel: AirDNA reveals STR booking trends and most popular and budget-friendly destinations

Azamara Cruises welcomes agents onboard to mark the start of its largest ever ship visit programme in the UK

Duetto and SHR partner to transform casino loyalty pricing

Swan Hellenic accepted into global luxury travel group Virtuoso

Icelandair announces new route to Lisbon

MICE insights shared at Global DMC Partners’ 10th Connection

Cendyn and Glowing integration redefines omnichannel messaging for hotels

Logpoint names Gitte Hemmingsen SVP People & Culture

Cloud5 experiences strong first-half growth as hospitality industry demand continues

Parents are going into debt for travel in 2024, finds Forbes Advisor survey

Destinations Unlimited forms new DMC partnership with Sassy Events International

Miami-Dade Mayor and American Airlines announce new autonomous wheelchairs at Miami International Airport

Brussels Airport is all set for a busy summer, 5m. passengers expected in July and August

Kuzey Esener to become Director of Communications at TUI Cruises

Vitruvian Partners increases stake in Civitatis

Urban lifestyle hotel brand CityHub achieves B Corp certification

Ambassador Cruise Line opens new dedicated office and toll-free number in North America

Daniel Doyle Pleasantville discusses navigating the challenges of photography in various environments

MarketHub 2024: HBX Group’s Evolution Unveiled

European tourist guides sent open letter to Greek Tourism Minister regarding the certified tourist guides of Greece

The Hotel Group celebrates 40 years of hospitality greatness

CTO announces winners of Caribbean Media Awards

SeaDream Yacht Club introduces Grand Yachting Voyages

Azores Airlines offers new routes starting in June

Volotea and Abra Group (Avianca and GOL) announce joint venture agreement

American Marketing Group expands business development team

IGTM 2024 hits record number of North American buyers

WorldVia travel group offers select 2024 travel trend insights

hoper launches as the first scheduled helicopter airline in Greece

OTA ranking booster Otamiser secures $3m in funding to expand to 1k hotels and 100k short-term rentals worldwide

Curator Hotel & Resort Collection partners with eTIP

11th Annual ‘Promote Your Professionalism’ scholarship campaign underway with The Travel Institute

Strawberry’s Clarion Hotel Post adopts Vingcard’s mobile access with Google Wallet compatibility

UFI Global Congress – the exhibition industry’s annual global gathering to take place in Bahrain in 2026

New partnership between Wego and Madrid Turismo by IFEMA Madrid

KM Malta Airlines selects East2’s eUno Platform to deliver their next-generation KM Rewards program

Copa Airlines launches new route connecting Panama City, Panama to Raleigh-Durham

Alipay+ partner e-wallets transactions in Germany rose by 67% one week into UEFA EURO 2024

First Hospitality expands portfolio with first Georgia property

LG debuts AI-powered door-type service robot for hospitality and health care

CityBlue Hotels invests in agtech startup farm to feed

Travelport launches NDC content and servicing for Emirates on Travelport+

Meet Hawai‘i unveils enhanced website for meeting planners

Urban luxury at Radisson Blu Park Hotel Athens

Spending squeeze doesn’t dampen Europe’s appetite for summer travel, finds Allianz Partners survey

The Chatwal, New York appoints Matt Tobin as Director of Sales and Marketing

Lufthansa City Center International and Jerne announce innovative social media partnership

Accelya introduces ‘FLX Select,’ a new NDC service enabling fast & standardized implementation

Dar Global awards OMR 9.3m. infrastructure contract to Oman Shapoorji Company LLC for AIDA Phase 1

Ileshaa Nijhawan joins Fairmont The Norfolk and Fairmont Mara Safari Club as the new Cluster Commercial Director

Emirates unveils its newly designed, premium lounge in Paris Charles de Gaulle Airport

Blacklane Middle East projects 25% growth in airport transfers ahead of Dubai’s unprecedented travel season

Radisson Hotel Group bolsters African presence with 7 additional hotels and over 1,200 new rooms

Liberty Ace: Car carrier details and real-time position tracking

While traveling through Louisiana make sure to try these foods

Corfu hotel named Best of TRYP Hotels Award winner

Yosemite’s Tuolumne County gains over 300 rooms following trio of new openings

Accommodation ADR seeing fluctuations for sport but Taylor not having a swift effect, says SilverDoor

Top safety hazards to keep in mind when traveling to the U.S.

The best couple’s activities for your next getaway

68% of short-term rentals in Barcelona are concentrated in the centre of the city

Gen Z fuel growth in Latin America & Caribbean travel retail

How to prepare for a business trip to Sicily

Five emerging trends for travelling teenagers

Five emerging African safari trends

Minos Palace hotel & suites unveils revamped dining experiences this summer

Global Travel Collection announces ALTOUR Independent Advisor Integration at London event

BMA House launches complimentary event carbon calculator tool

James Haigh appointed as new Chair of ATTA

Confused.com joins eSIM Go’s Breeze affiliate program to delight travel insurance customers

How to find a luxury vacation rental in Malibu

Alaska Airlines unveils new state-of-the-art location at San Francisco International Harvey Milk Terminal 1

The National Museums of Kenya and CityBlue Hotels ink partnership

Five tips for glamping start ups

Destination DC announces Meade Atkeson as new board chairperson

Hilton Dubai Al Habtoor City launches 24/7 venue

LOT Polish Airlines appoints APG as its online GSA in Saudi Arabia

Five emerging trends for staycations in England

Mirai presents ‘Mirai Twin’ during Phocuswright Europe, anticipating importance of metaverse in hotel world

Five Greek island tourism trends

Duetto launches comprehensive full-service revenue solution at HITEC

Unforgettable horse riding adventures

easyJet to digitise onboard Aircraft Technical log to cut down on paper use and weight

Qatar Airways secures the ‘Airline of the Year’ title from Skytrax

Five things you should never do after a car accident while traveling

TUI develops new holiday destinations and accelerates growth in sub-Saharan Africa

Tech-enhanced entertainment: Unveiling Ontario’s premier gaming destinations

Sabre unveils the next evolution of hospitality retailing: SynXis Retailing

ICAO recognized by Canada’s legislative bodies, advancing cooperation with host state

Alaska Airlines launches seasonal, daily flight between Portland and New Orleans

Return of Chinese travellers to West: experts see opportunities but also challenges

Accor launches global leadership council to shape the future of corporate travel

Palladium Hotel Group Jamaica properties recognized With AAA 4-Diamond distinction

Canada hotel industry records highest performance since September 2023

Hotel Mousai Cancun by Tafer is now open

Third WestJet route begins at Edinburgh Airport

AHLA, Questex announce new speakers, programming for The Hospitality Show

Concord Hospitality shares uniqueness of managing a historic property as Capital Hotel celebrates 150 years

Phocuswright Europe – Beyond the Bed: Lodging companies craft unforgettable guest experiences

airBaltic reveals July 2024 top destinations from Riga

HomeToGo reveals 2024 Fourth of July forecast most popular destinations

Villa del Palmar at The Islands of Loreto by Danzante Bay appoints Rich Taylor as Director of Golf

Hospitality experts’ tech to boost hotelier revenue amid Taylor Swift’s ‘Eras Tour’ Summer

Aeroporti di Roma launches Digiport: WhatsApp chatbot and smart boarding

Air France opens a new lounge at Los Angeles International Airport

Double-digit growth for Italian conference tourism

Hotel Equities celebrates Marriott Select Brands Award winners

Barcelona implements ban on short-term tourism rentals

Sustainable energy generation at Munich Airport

CTO bestows inaugural women’s leadership awards at Caribbean Week in New York

Introducing Ostuni a Mare: A historic Puglian hotel reborn

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Travel & Tourism Competitiveness Report 2013 (WEF)

The Travel & Tourism Competitiveness Report 2013 assesses 140 economies worldwide based on the extent to which they are putting in place the factors and policies to make it attractive to develop the travel and tourism sector. The report explores how, on one hand, the travel and tourism industry has the potential to boost economic resilience and job creation but, on the other, a number of factors continue to hinder its development. Released by World Economic Forum

Related Papers

Mayra Henao Lizarazo

carlos meza

Izabel Silveira

Phùng Trần Mỹ Hạnh

GERMAN CASTRO

Ersen Bulut

Science Park Research Organization & Counselling

The aim of this study is to develop and adapt the methodology to assess the tourism industry competitiveness at the national level. International tourism as a source of both direct and indirect incomes of the state, encourages the development of different sectors, not specific to the tourism infrastructure, but through the multiplier effect. In this connection it is urgent to develop new methodological approaches to measure and assess the international competitiveness of countries in order to put countries in a better position in the current competition for tourism revenues. The problem of determining the tourist potential of a particular territory with a view to the most efficient use is a difficult research challenge. The Travel & Tourism Competitiveness Index (TTCI) has been put in the proposed methodology. The sub-indices, components and indicators that form the TTCI index are used as the parameters that characterize national economy. The application of factor analysis to the TTCI dimension components for the competitiveness of the twelve-dimensional space is reduced to two factors: socially-economic and resource-ecological factors. A two-step cluster analysis in the area of these factors allowed to group fifty-five countries selected for analysis in three homogeneous clusters. Countries, formed in clusters, have similarities in competitive advantages, factors and quality indicators of tourist resources and infrastructure. The comparative analysis of these clusters, using TTCI indicators, allows to describe the formation model of competitiveness in the tourism sector and to determine the qualitative position of the country not only among the closest countries in terms of tourism destination development, but also to draw conclusions about the preferred tourist specialization. Keywords: the travel & tourism competitiveness ındex, factor analysis, cluster analysis.

AARF Publications Journals

Sara Calle Herrera

World Neolithic Congress 2024

This session delves into human migrations dating back to the Neolithic period in the East Asian mainland, when ancient rice and millet farmers migrated from the core areas of early agricultural zones in Central China to various other regions, including different parts of China, Taiwan, Japan, Mainland and Island Southeast Asia, and the Pacific Islands. The session aims to present and analyze state-of-the-art evidence from archaeology, physical anthropology, genetics, and linguistics across the region. Participants in this session will offer insights into the timing, routes, motives, processes, and adaptations of these Neolithic dispersals, which have played a significant role in shaping the contemporary landscape of East Asia and the broader Indo-Pacific region.

RELATED PAPERS

Du papier à l’archive, du privé au public

Patrice Bret

Bekithemba Mpofu

Krzysztof Janc

Journal of Neurological Surgery Part B: Skull Base

ROMILSON CABRAL

Eugenio Zimeo

Giannerys Andreina

Revista Dynamis

Amauri Ferreira

Gusti Silvana

Adara model

Rosa Brancaccio

Superlattices and Microstructures

Adil Eddiai

Marine Fisheries : Journal of Marine Fisheries Technology and Management

Sugeng Wisudo

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

WEF Travel and Tourism Competitiveness Report 2013

1.1: The Travel & Tourism Competitiveness Index 2013

profiles show their rankings on each subindex and pillar, as well as those on each of the 79 indicators included in the Index. Europe In line with statistics on international tourist arrivals, Table 1 shows that Europe remains the leading region for Travel & Tourism competitiveness, with all of the top five places taken by European countries. Likewise, 13 of the top 20 countries are from the region. Table 3 shows the rankings for European countries only, with the first column showing the rank within the region, the second column showing the overall rank out of all 140 economies included in the Index this year, and the third column showing the score. As the table shows, Switzerland is ranked 1st out of all countries in the 2013 TTCI, a position it has held since the first edition of this Report in 2007. Germany, Austria, Spain, and the United Kingdom complete the top five, while France and Sweden are among the top 10 overall. Switzerland continues to lead the rankings, performing well on almost all aspects of the Index. Switzerland’s infrastructure, especially ground transport (3rd), is among the best in the world. The country also boasts top marks for its hotels and other tourism-specific facilities, with excellent staff thanks to the availability of qualified labor to work in the industry (ranked 2nd)— perhaps not surprising in a country that holds many of the world’s best hotel management schools. Switzerland also attracts tourists because of its rich and wellmanaged natural resources. A large percentage of the country’s land area is protected, environmental regulation is among the most stringent (3rd), and the T&T industry is considered to be developed in a sustainable way (7th). These good environmental conditions, combined with the high safety and security of the country (2nd), contribute to its solid T&T competitiveness. Switzerland is not only a strong leisure tourism destination but also an important business travel hub, with many international fairs and exhibitions held in the country each year, driving its showing on the cultural resources pillar (6th). Switzerland’s strong performance in all these areas enables the country to somewhat make up for its lack of price competitiveness (139th), which, together with a fairly restrained international visa policy, does indeed limit the number of arrivals. Germany ranks 2nd in Europe and out of all countries in the TTCI. Similar to Switzerland, its infrastructure is among the best in the world: it is ranked 6th for ground transport infrastructure and 7th for air transport infrastructure, facilitating connections both within the country and internationally. Germany also has abundant cultural resources (ranked 5th worldwide for its many World Heritage cultural sites) and is host to almost 600 international fairs and exhibition per year (2nd), while hotel prices are relatively competitive (55th). In addition,

14 | The Travel & Tourism Competitiveness Report 2013

Germany makes great efforts to develop in a sustainable way (4th), with the world’s most stringent environmental regulations—which are also among the best-enforced— and the strong support of international environmental efforts, as demonstrated through its ratification of many international environmental treaties. Austria ranks 3rd, improving by one position since 2011. Its strong performance is driven by factors such as tourism infrastructure, in which it ties for 1st place with Italy; a welcoming attitude toward visitors; a very safe and secure environment (7th); and, most importantly, its rich cultural resources. Austria hosts nine World Heritage cultural sites, has excellent creative industries, and attracts many travelers with several fairs and exhibitions organized every year. The country’s tourism industry is also being developed in a sustainable way (10th), with some of the most stringent (4th) and well-enforced (7th) environmental regulations in the world, driving its overall positive performance on environmental sustainability (ranked 6th). Spain is the country among the top 10 that sees the most improvement since 2011: moving up four places since the last assessment, it is now ranked 4th. Spain continues to lead in cultural resources, ranking 1st this year in this area because of its extremely numerous World Heritage sites (2nd) and its large number of international fairs and exhibitions (3rd), as well as its significant sports stadium capacity. Its tourism infrastructure is another strength, with its many hotel rooms, car rental facilities, and ATMs. Furthermore, its air transport infrastructure is highly developed and ranks among the top 10 worldwide. Spain has improved in a few areas since the last edition. In particular, starting a business has become less costly and onerous, according to the World Bank, and hotel prices have come down a bit. The government has also kept tourism high in its development agenda, making Spain a top 10 economy for prioritization of the industry. Spain has notably maintained its efforts on marketing activity and spending on the industry’s development amid difficult economic circumstances. The United Kingdom moves up by two more positions since the last edition of the Report, to reach 5th place this year. The country’s T&T competitiveness is based on its excellent cultural resources (ranked 3rd), with many World Heritage cultural sites, a large number of international fairs, and strong creative industries (all ranked within the top 10). The country has probably benefitted from two important events in 2012: the Olympic Games and the Diamond Jubilee of Queen Elizabeth II. Although the outcome is not yet fully reflected in the data, the United Kingdom has leveraged the preparation of these events in terms of tourism campaigns, generating interest in visiting the country and reinforcing their already-solid ICT and air transport infrastructure (ranked 10th and 5th, respectively). The

© 2013 World Economic Forum

Turn static files into dynamic content formats.

Travel and Tourism Competitiveness Index 2013

“The Travel & Tourism Competitiveness Report 2013 assesses 140 economies worldwide based on the extent to which they are putting in place the factors and policies to make it attractive to develop the travel and tourism sector.” This analysis highlights on one side how the travel & tourism sector can boost the economy + the job creation and on the other side, the factors that slow down its development.

The following Infographic displays the degree to which a country is attractive to explore the travel & tourism industry (click on the picture to explore the interactive index). So if you’re working in the area, this report is of interest and very useful to you.

Read here the full Travel & Tourism Competitiveness Report 2013 .

Share this blog post on your social media or email it to a friend

Related posts.

The Art of Upselling – How to Boost Your Travel Agency Revenue

5 Ways to Improve Corporate Travel Management for Your Clients

The Ultimate Guide to Saving Time and Money for Travel Agents

The Future of the Travel Industry: Travel Trends That Will Shape the Next Decade

Secrets No One Tells You to a Seamless Travel Agency Workflow

Leave a comment cancel reply.

Travel & Tourism Competitiveness Report 2013

The document is a report titled "The Travel & Tourism Competitiveness Report 2013" published by the World Economic Forum. It examines factors that make economies competitive destinations for tourism. The report was produced in collaboration with various partner institutes and includes country/economy profiles, data on tourism competitiveness factors, and selected issues related to tourism competitiveness. Read less

Recommended

More related content, similar to travel & tourism competitiveness report 2013, similar to travel & tourism competitiveness report 2013 ( 20 ), more from formazioneturismo, more from formazioneturismo ( 20 ), recently uploaded, recently uploaded ( 20 ).

- 1. Insight Report The Travel & Tourism Competitiveness Report 2013 Reducing Barriers to Economic Growth and Job Creation Jennifer Blanke and Thea Chiesa, editors

- 3. Insight Report The Travel & Tourism Competitiveness Report 2013 Reducing Barriers to Economic Growth and Job Creation Jennifer Blanke Thea Chiesa Editors © 2013 World Economic Forum

- 4. The Travel & Tourism Competitiveness Report 2013 World Economic Forum is published by the World Economic Forum within Geneva the framework of The Global Competitiveness and Benchmarking Network and the Industry Partnership Copyright © 2013 Programme for Aviation, Travel & Tourism. by the World Economic Forum All rights reserved. No part of this publication may be Professor Klaus Schwab reproduced, stored in a retrieval system, or transmitted, Executive Chairman in any form or by any means, electronic, mechanical, photocopying, or otherwise without the prior permission of Børge Brende the World Economic Forum. Managing Director, Government Relations and Constituents Engagement ISBN-13: 978-92-95044-40-1 ISBN-10: 92-95044-40-1 Robert Greenhill Managing Director, Chief Business Officer This report is printed on paper suitable for recycling and John Moavenzadeh made from fully managed and sustained forest sources. Senior Director, Head of Mobility Industries Printed and bound in Switzerland by SRO-Kundig. The full edition of the Report, with profiles of all 140 economies as well as an interactive data platform, is EDITORS available at www.weforum.org/ttcr. Jennifer Blanke, Senior Director, Lead Economist, Head of The Global Competitiveness and Benchmarking Network Thea Chiesa, Director, Head of Aviation, Travel & Tourism THE GLOBAL COMPETITIVENESS AND BENCHMARKING NETWORK Beñat Bilbao-Osorio, Associate Director, Senior Economist Ciara Browne, Associate Director Roberto Crotti, Quantitative Economist Margareta Drzeniek Hanouz, Director, Senior Economist, Head of Competitiveness Research Brindusa Fidanza, Associate Director, Environmental Initiatives Thierry Geiger, Associate Director, Economist Tania Gutknecht, Community Manager Caroline Ko, Junior Economist Cecilia Serin, Team Coordinator We thank Hope Steele for her excellent editing work and Neil Weinberg for his superb graphic design and layout. The terms country and nation as used in this report do not in all cases refer to a territorial entity that is a state as understood by international law and practice. The terms cover well-defined, geographically self-contained economic areas that may not be states but for which statistical data are maintained on a separate and independent basis. © 2013 World Economic Forum

- 5. Contents Partner Institutes v 1.6 Competiveness, Jobs, and Green 71 Growth: A “Glocal” Model by Geoffrey Lipman, Greenearth.travel and Victoria Preface xiii University Melbourne, and Terry Delacy and Paul by Børge Brende and Robert Greenhill, Whitelaw, Victoria University Melbourne World Economic Forum Executive Summary xv by Jennifer Blanke and Thea Chiesa, World Economic Part 2: Country/Economy Profiles and 79 Forum Data Presentation 2.1 Country/Economy Profiles 81 How to Read the Country/Economy Profiles...................................83 Part 1: Selected Issues of T&T Competitiveness Index of Countries/Economies.........................................................85 Country/Economy Profiles...............................................................86 1.1 The Travel & Tourism Competitiveness 3 Index 2013: Contributing to National Growth 2.2 Data Tables 367 and Employment How to Read the Data Tables........................................................369 by Jennifer Blanke, Thea Chiesa, and Roberto Crotti, Index of Data Tables......................................................................371 World Economic Forum Data Tables...................................................................................373 1.2 How to Succeed as a Tourism 43 Technical Notes and Sources 471 Destination in a Volatile World by Jürgen Ringbeck and Timm Pietsch, Booz & Company About the Authors 479 1.3 Visa Facilitation: Stimulating Economic 49 Growth and Development through Tourism Acknowledgments 481 by Dirk Glaesser and John Kester, with Márcio Favilla, Sandra Carvão, Lorna Hartantyo, Birka Valentin, Lisa Fürbaß, Kate Holmes, Jacinta García, and Alberto G. Uceda, World Tourism Organization (UNWTO) 1.4 The Economic Benefits of Aviation 57 and Performance in the Travel & Tourism Competitiveness Index by Julie Perovic, International Air Transport Association (IATA) 1.5 Travel & Tourism as a Driver 63 of Employment Growth by Rochelle Turner, World Travel & Tourism Council, and Zachary Sears, Oxford Economics The Travel & Tourism Competitiveness Report 2013 | iii © 2013 World Economic Forum

- 6. © 2013 World Economic Forum

- 7. Partner Institutes The World Economic Forum’s Global Benchmarking Barbados Sir Arthur Lewis Institute of Social and Economic Studies, Network is pleased to acknowledge and thank the University of West Indies (UWI) following organizations as its valued Partner Institutes, Judy Whitehead, Director without which the realization of The Travel & Tourism Belgium Competitiveness Report 2013 would not have Vlerick Business School been feasible: Priscilla Boiardi, Associate, Competence Centre Entrepreneurship, Governance and Strategy Albania Wim Moesen, Professor Institute for Contemporary Studies (ISB) Leo Sleuwaegen, Professor, Competence Centre Artan Hoxha, President Entrepreneurship, Governance and Strategy Elira Jorgoni, Senior Expert Endrit Kapaj, Expert Benin CAPOD—Conception et Analyse de Politiques de Algeria Développement Centre de Recherche en Economie Appliquée pour Epiphane Adjovi, Director le Développement (CREAD) Maria-Odile Attanasso, Deputy Coordinator Youcef Benabdallah, Assistant Professor Fructueux Deguenonvo, Researcher Yassine Ferfera, Director Bosnia and Herzegovina Argentina MIT Center, School of Economics and Business in Sarajevo, IAE—Universidad Austral University of Sarajevo Eduardo Luis Fracchia, Professor Zlatko Lagumdzija, Professor Santiago Novoa, Project Manager Zeljko Sain, Executive Director Armenia Jasmina Selimovic, Assistant Director Economy and Values Research Center Botswana Manuk Hergnyan, Chairman Botswana National Productivity Centre Sevak Hovhannisyan, Board Member and Senior Associate Letsogile Batsetswe, Research Consultant and Statistician Gohar Malumyan, Research Associate Baeti Molake, Executive Director Australia Phumzile Thobokwe, Manager, Information and Research Australian Industry Group Services Department Colleen Dowling, Senior Research Coordinator Brazil Innes Willox, Chief Executive Fundação Dom Cabral, Bradesco Innovation Center Austria Carlos Arruda, International Relations Director, Innovation Austrian Institute of Economic Research (WIFO) and Competitiveness Professor Karl Aiginger, Director Daniel Berger, Bachelor Student in Economics Gerhard Schwarz, Coordinator, Survey Department Fabiana Madsen, Economist and Associate Researcher Movimento Brasil Competitivo (MBC) Azerbaijan Carolina Aichinger, Project Coordinator Azerbaijan Marketing Society Erik Camarano, Chief Executive Officer Fuad Aliyev, Deputy Chairman Ashraf Hajiyev, Consultant Brunei Darussalam Ministry of Industry and Primary Resources Bahrain Pehin Dato Yahya Bakar, Minister Bahrain Economic Development Board Normah Suria Hayati Jamil Al-Sufri, Permanent Secretary Kamal Bin Ahmed, Minister of Transportation and Acting Chief Executive of the Economic Development Board Bulgaria Nada Azmi, Manager, Economic Planning and Development Center for Economic Development Maryam Matter, Coordinator, Economic Planning and Adriana Daganova, Expert, International Programmes and Development Projects Anelia Damianova, Senior Expert Bangladesh Centre for Policy Dialogue (CPD) Burkina Faso Khondaker Golam Moazzem, Senior Research Fellow lnstitut Supérieure des Sciences de la Population (ISSP), Kishore Kumer Basak, Research Associate University of Ouagadougou Mustafizur Rahman, Executive Director Baya Banza, Director The Travel & Tourism Competitiveness Report 2013 | v © 2013 World Economic Forum

- 8. Partner Institutes Burundi Cyprus University Research Centre for Economic and Social The European University Development (CURDES), National University of Burundi Bambos Papageorgiou, Head of Socioeconomic and Banderembako Deo, Director Academic Research Gilbert Niyongabo, Dean, Faculty of Economics & cdbbank—The Cyprus Development Bank Management Maria Markidou-Georgiadou, Manager, Business Development Cambodia and Special Projects Economic Institute of Cambodia Czech Republic Sok Hach, President CMC Graduate School of Business Sokheng Sam, Researcher Tomas Janca, Executive Director Cameroon Denmark Comité de Compétitivité (Competitiveness Committee) Danish Technological Institute, Center for Policy and Business Lucien Sanzouango, Permanent Secretary Development Canada Hanne Shapiro, Center Manager The Conference Board of Canada Ecuador Michael R. Bloom, Vice-President, Organizational ESPAE Graduate School of Management, Escuela Superior Effectiveness & Learning Politécnica del Litoral (ESPOL) Douglas Watt, Associate Director Elizabeth Arteaga, Project Assistant Cape Verde Virginia Lasio, Director INOVE RESEARCH—Investigação e Desenvolvimento, Lda Sara Wong, Professor Júlio Delgado, Partner and Senior Researcher Egypt José Mendes, Chief Executive Officer The Egyptian Center for Economic Studies (ECES) Sara França Silva, Project Manager Iman Al-Ayouty, Senior Economist Chad Omneia Helmy, Acting Executive Director and Director Groupe de Recherches Alternatives et de Monitoring du Projet of Research Pétrole-Tchad-Cameroun (GRAMP-TC) Estonia Antoine Doudjidingao, Researcher Estonian Institute of Economic Research Gilbert Maoundonodji, Director Evelin Ahermaa, Head of Economic Research Sector Celine Nénodji Mbaipeur, Programme Officer Marje Josing, Director Chile Estonian Development Fund Universidad Adolfo Ibáñez Kitty Kubo, Head of Foresight Fernando Larrain Aninat, Director MBA Ott Pärna, Chief Executive Officer Leonidas Montes, Dean, School of Government Ethiopia China African Institute of Management, Development and Institute of Economic System and Management, National Governance Development and Reform Commission Zebenay Kifle, General Manager Chen Wei, Research Fellow Tegenge Teka, Senior Expert Dong Ying, Professor Zhou Haichun, Deputy Director and Professor Finland China Center for Economic Statistics Research, Tianjin ETLA—The Research Institute of the Finnish Economy Markku Kotilainen, Research Director University of Finance and Economics Petri Rouvinen, Research Director Bojuan Zhao, Professor Pekka Ylä-Anttila, Managing Director Fan Yang, Professor Jian Wang, Associate Professor Hongye Xiao, Professor France Lu Dong, Professor HEC School of Management, Paris Bertrand Moingeon, Professor and Deputy Dean Colombia Bernard Ramanantsoa, Professor and Dean National Planning Department Sara Patricia Rivera, Advisor Gabon John Rodríguez, Coordinator, Competitiveness Observatory Confédération Patronale Gabonaise Javier Villarreal, Enterprise Development Director Regis Loussou Kiki, General Secretary Gina Eyama Ondo, Assistant General Secretary Colombian Private Council on Competitiveness Henri Claude Oyima, President Rosario Córdoba, President Marco Llinás, Vicepresident Gambia, The Gambia Economic and Social Development Research Institute Côte d’Ivoire (GESDRI) Chambre de Commerce et d’Industrie de Côte d’Ivoire Makaireh A. Njie, Director Jean-Louis Billon, President Mamadou Sarr, Director General Georgia Business Initiative for Reforms in Georgia Croatia Tamara Janashia, Executive Director National Competitiveness Council Giga Makharadze, Founding Member of the Board of Directors Jadranka Gable, Advisor Mamuka Tsereteli, Founding Member of the Board of Directors Kresimir Jurlin, Research Fellow vi | The Travel & Tourism Competitiveness Report 2013 © 2013 World Economic Forum

- 9. Partner Institutes Germany Ireland WHU—Otto Beisheim School of Management Institute for Business Development and Competitiveness Ralf Fendel, Professor of Monetary Economics School of Economics, University College Cork Michael Frenkel, Professor, Chair of Macroeconomics and Justin Doran, Principal Associate International Economics Eleanor Doyle, Director Catherine Kavanagh, Principal Associate Ghana Association of Ghana Industries (AGI) Forfás, Economic Analysis and Competitiveness Department Patricia Addy, Projects Officer Adrian Devitt, Manager Nana Owusu-Afari, President Conor Hand, Economist Seth Twum-Akwaboah, Executive Director Israel Greece Manufacturers’ Association of Israel (MAI) SEV Hellenic Federation of Enterprises Dan Catarivas, Director Michael Mitsopoulos, Senior Advisor, Entrepreneurship Amir Hayek, Managing Director Thanasis Printsipas, Economist, Entrepreneurship Zvi Oren, President Guatemala Italy FUNDESA SDA Bocconi School of Management Felipe Bosch G., President of the Board of Directors Secchi Carlo, Full Professor of Economic Policy, Bocconi Pablo Schneider, Economic Director University Juan Carlos Zapata, General Manager Paola Dubini, Associate Professor, Bocconi University Francesco A. Saviozzi, SDA Professor, Strategic and Guinea Entrepreneurial Management Department Confédération Patronale des Entreprises de Guinée Mohamed Bénogo Conde, Secretary-General Jamaica Mona School of Business (MSB), The University of the West Guyana Indies Institute of Development Studies, University of Guyana Patricia Douce, Project Administrator Karen Pratt, Research Associate Evan Duggan, Executive Director and Professor Clive Thomas, Director William Lawrence, Director, Professional Services Unit Haiti Japan Group Croissance SA Keio University Pierre Lenz Dominique, Coordinator, Survey Department Yoko Ishikura, Professor, Graduate School of Media Design Kesner Pharel, Chief Executive Officer and Chairman Heizo Takenaka, Director, Global Security Research Institute Jiro Tamura, Professor of Law, Keio University Hong Kong SAR Hong Kong General Chamber of Commerce Keizai Doyukai (Japan Association of Corporate Executives) David O’Rear, Chief Economist Kiyohiko Ito, Managing Director, Keizai Doyukai Federation of Hong Kong Industries Jordan Alexandra Poon, Director Ministry of Planning & International Cooperation The Chinese General Chamber of Commerce Jordan National Competitiveness Team Kawther Al-Zou’bi, Head of Competitiveness Division Hungary Basma Arabiyat, Researcher KOPINT-TÁRKI Economic Research Ltd. Mukhallad Omari, Director of Policies and Studies Department Éva Palócz, Chief Executive Officer Peter Vakhal, Project Manager Kazakhstan National Analytical Centre Iceland Diana Tamabayeva, Project Manager Innovation Center Iceland Vladislav Yezhov, Chairman Ardis Armannsdottir, Marketing Manager Karl Fridriksson, Managing Director of Human Resources Kenya and Marketing Institute for Development Studies, University of Nairobi Thorsteinn I. Sigfusson, Director Mohamud Jama, Director and Associate Research Professor Paul Kamau, Senior Research Fellow India Dorothy McCormick, Research Professor Confederation of Indian Industry (CII) Chandrajit Banerjee, Director General Korea, Republic of Marut Sengupta, Deputy Director General College of Business School, Korea Advanced Institute of Gantakolla Srivastava, Head, Financial Services Science and Technology KAIST Byungtae Lee, Acting Dean Indonesia Soung-Hie Kim, Associate Dean and Professor Center for Industry, SME & Business Competition Studies, Jinyung Cha, Assistant Director, Exchange Programme University of Trisakti Korea Development Institute Tulus Tambunan, Professor and Director Joohee Cho, Senior Research Associate Iran, Islamic Republic of Yongsoo Lee, Head, Policy Survey Unit The Center for Economic Studies and Surveys (CESS), Iran Kuwait Chamber of Commerce, Industries, Mines and Agriculture Kuwait National Competitiveness Committee Mohammad Janati Fard, Research Associate Adel Al-Husainan, Committee Member Hamed Nikraftar, Project Manager Fahed Al-Rashed, Committee Chairman Farnaz Safdari, Research Associate Sayer Al-Sayer, Committee Member The Travel & Tourism Competitiveness Report 2013 | vii © 2013 World Economic Forum

- 10. Partner Institutes Kyrgyz Republic Malta Economic Policy Institute “Bishkek Consensus” Competitive Malta—Foundation for National Competitiveness Lola Abduhametova, Program Coordinator Margrith Lutschg-Emmenegger, Vice President Marat Tazabekov, Chairman Adrian Said, Chief Coordinator Caroline Sciortino, Research Coordinator Latvia Stockholm School of Economics in Riga Mauritania Karlis Kreslins, EMBA Programme Director Centre d’Information Mauritanien pour le Développement Anders Paalzow, Rector Economique et Technique (CIMDET/CCIAM) Lô Abdoul, Consultant and Analyst Lebanon Mehla Mint Ahmed, Director Bader Young Entrepreneurs Program Habib Sy, Administrative Agent and Analyst Antoine Abou-Samra, Managing Director Farah Shamas, Program Coordinator Mauritius Board of Investment of Mauritius Lesotho Nirmala Jeetah, Director, Planning and Policy Private Sector Foundation of Lesotho Ken Poonoosamy, Managing Director O.S.M. Moosa, President Thabo Qhesi, Chief Executive Officer Joint Economic Council Nteboheleng Thaele, Researcher Raj Makoond, Director Libya Mexico Libya Development Policy Center Center for Intellectual Capital and Competitiveness Yusser Al-Gayed, Project Director Erika Ruiz Manzur, Executive Director Ahmed Jehani, Chairman René Villarreal Arrambide, President and Chief Executive Mohamed Wefati, Director Officer Rodrigo David Villarreal Ramos, Director Lithuania Instituto Mexicano para la Competitividad (IMCO) Statistics Lithuania Priscila Garcia, Researcher Ona Grigiene, Deputy Head, Knowledge Economy Manuel Molano, Deputy General Director and Special Surveys Statistics Division Juan E. Pardinas, General Director Vilija Lapeniene, Director General Gediminas Samuolis, Head, Knowledge Economy Ministry of the Economy and Special Surveys Statistics Division Jose Antonio Torre, Undersecretary for Competitiveness and Standardization Luxembourg Enrique Perret Erhard, Technical Secretary for Luxembourg Chamber of Commerce Competitiveness Christel Chatelain, Research Analyst Narciso Suarez, Research Director, Technical Secretary Stephanie Musialski, Research Analyst for Competitiveness Carlo Thelen, Chief Economist, Member of the Managing Board Moldova Academy of Economic Studies of Moldova (AESM) Macedonia, FYR Grigore Belostecinic, Rector National Entrepreneurship and Competitiveness Council (NECC) Centre for Economic Research (CER) Mirjana Apostolova, President of the Assembly Corneliu Gutu, Director Dejan Janevski, Project Coordinator Mongolia Madagascar Open Society Forum (OSF) Centre of Economic Studies, University of Antananarivo Munkhsoyol Baatarjav, Manager of Economic Policy Ravelomanana Mamy Raoul, Director Erdenejargal Perenlei, Executive Director Razato Rarijaona Simon, Executive Secretary Montenegro Malawi Institute for Strategic Studies and Prognoses (ISSP) Malawi Confederation of Chambers of Commerce and Maja Drakic, Project Manager Industry Petar Ivanovic, Chief Executive Officer Hope Chavula, Public Private Dialogue Manager Veselin Vukotic, President Chancellor L. Kaferapanjira, Chief Executive Officer Morocco Malaysia Comité National de l’Environnement des Affaires Institute of Strategic and International Studies (ISIS) Seloua Benmbarek, Head of Mission Jorah Ramlan, Senior Analyst, Economics Mozambique Steven C.M. Wong, Senior Director, Economics EconPolicy Research Group, Lda. Mahani Zainal Abidin, Chief Executive Peter Coughlin, Director Malaysia Productivity Corporation (MPC) Donaldo Miguel Soares, Researcher Mohd Razali Hussain, Director General Ema Marta Soares, Assistant Lee Saw Hoon, Senior Director Namibia Mali Institute for Public Policy Research (IPPR) Groupe de Recherche en Economie Appliquée et Graham Hopwood, Executive Director Théorique (GREAT) Massa Coulibaly, Executive Director viii | The Travel & Tourism Competitiveness Report 2013 © 2013 World Economic Forum

- 11. Partner Institutes Nepal Portugal Centre for Economic Development and Administration (CEDA) PROFORUM, Associação para o Desenvolvimento da Ramesh Chandra Chitrakar, Professor, Country Coordinator Engenharia and Project Director Ilídio António de Ayala Serôdio, Vice President of the Board Mahendra Raj Joshi, Member of Directors Hari Dhoj Pant, Officiating Executive Director, Advisor, Survey Fórum de Administradores de Empresas (FAE) project Paulo Bandeira, General Director Netherlands Pedro do Carmo Costa, Member of the Board of Directors INSCOPE: Research for Innovation, Erasmus University Esmeralda Dourado, President of the Board of Directors Rotterdam Puerto Rico Frans A. J. Van den Bosch, Professor Puerto Rico 2000, Inc. Henk W. Volberda, Director and Professor Ivan Puig, President New Zealand Instituto de Competitividad Internacional, Universidad The New Zealand Initiative Interamericana de Puerto Rico Catherine Harland, Research Fellow Francisco Montalvo, Project Coordinator Oliver Hartwich, Executive Director Qatar Nigeria Qatari Businessmen Association (QBA) Nigerian Economic Summit Group (NESG) Sarah Abdallah, Deputy General Manager Frank Nweke Jr., Director General Issa Abdul Salam Abu Issa, Secretary-General Chris Okpoko, Associate Director, Research Social and Economic Survey Research Institute (SESRI) Foluso Phillips, Chairman Hanan Abdul Ibrahim, Associate Director Norway Darwish Al Emadi, Director BI Norwegian Business School Romania Eskil Goldeng, Researcher SC VBD Alliance Consulting Srl Torger Reve, Professor Irina Ion, Program Coordinator Oman Rolan Orzan, General Director The International Research Foundation Russian Federation Salem Ben Nasser Al-Ismaily, Chairman Bauman Innovation & Eurasia Competitiveness Institute Public Authority for Investment Promotion and Export Katerina Marandi, Programme Manager Development (PAIPED) Alexey Prazdnichnykh, Principal and Managing Director Mehdi Ali Juma, Expert for Economic Research Stockholm School of Economics, Russia Pakistan Igor Dukeov, Area Principal Mishal Pakistan Carl F. Fey, Associate Dean of Research Puruesh Chaudhary, Director Content Rwanda Amir Jahangir, Chief Executive Officer Private Sector Federation (PSF) Paraguay Hannington Namara, Chief Executive Officer Centro de Análisis y Difusión de Economia Paraguaya Andrew O. Rwigyema, Head of Research and Policy (CADEP) Saudi Arabia Dionisio Borda, Research Member National Competitiveness Center (NCC) Fernando Masi, Director Awwad Al-Awwad, President María Belén Servín, Research Member Khaldon Mahasen, Vice President Peru Senegal Centro de Desarrollo Industrial (CDI), Sociedad Nacional Centre de Recherches Economiques Appliquées (CREA), de Industrias University of Dakar Néstor Asto, Project Director Diop Ibrahima Thione, Director Luis Tenorio, Executive Director Serbia Philippines Foundation for the Advancement of Economics (FREN) Makati Business Club (MBC) Mihail Arandarenko, Director Michael B. Mundo, Chief Economist Aleksandar Radivojevic, Project Coordinator Marc P. Opulencia, Deputy Director Bojan Ristic, Researcher Peter Angelo V. Perfecto, Executive Director Management Association of the Philippines (MAP) Seychelles Arnold P. Salvador, Executive Director Plutus Auditing & Accounting Services Nicolas Boulle, Partner Poland Marco L. Francis, Partner Economic Institute, National Bank of Poland Piotr Boguszewski, Advisor Singapore Jarosław T. Jakubik, Deputy Director Economic Development Board Anna Chan, Assistant Managing Director, Planning & Policy Cheng Wai San, Head, Research & Statistics Unit Teo Xinyu, Executive, Research & Statistics Unit Slovak Republic Business Alliance of Slovakia (PAS) Robert Kicina, Executive Director The Travel & Tourism Competitiveness Report 2013 | ix © 2013 World Economic Forum

- 12. Partner Institutes Slovenia Thailand Institute for Economic Research Sasin Graduate Institute of Business Administration, Peter Stanovnik, Professor Chulalongkorn University Sonja Uršic, Senior Research Assistant Pongsak Hoontrakul, Senior Research Fellow Narudee Kiengsiri, President of Sasin Alumni Association University of Ljubljana, Faculty of Economics Toemsakdi Krishnamra, Director of Sasin Mateja Drnovšek, Professor Aleš Vahcic, Professor Thailand Development Research Institute (TDRI) Somchai Jitsuchon, Research Director South Africa Chalongphob Sussangkarn, Distinguished Fellow Business Leadership South Africa Yos Vajragupta, Senior Researcher Friede Dowie, Director Thero Setiloane, Chief Executive Officer Timor-Leste East Timor Development Agency (ETDA) Business Unity South Africa Jose Barreto, Survey Manager Nomaxabiso Majokweni, Chief Executive Officer Palmira Pires, Director Joan Stott, Executive Director, Economic Policy Chambers of Commerce and Industry of Timor-Leste Spain Kathleen Fon Ha Tchong Goncalves, Vice-President IESE Business School, International Center for Competitiveness Trinidad and Tobago María Luisa Blázquez, Research Associate Arthur Lok Jack Graduate School of Business Antoni Subirà, Professor Miguel Carillo, Executive Director and Professor of Strategy Nirmala Harrylal, Director, Internationalisation and Institutional Sri Lanka Relations Centre Institute of Policy Studies of Sri Lanka (IPS) Ayodya Galappattige, Research Officer The Competitiveness Company Dilani Hirimuthugodage, Research Officer Rolph Balgobin, Chairman Saman Kelegama, Executive Director Tunisia Suriname Institut Arabe des Chefs d’Entreprises Suriname Trade & Industry Association (VSB) Ahmed Bouzguenda, President Helen Doelwijt, Executive Secretary Majdi Hassen, Executive Counsellor Rene van Essen, Director Turkey Dayenne Wielingen Verwey, Economic Policy Officer TUSIAD Sabanci University Competitiveness Forum Swaziland Izak Atiyas, Director Federation of Swaziland Employers and Chamber of Selcuk Karaata, Vice Director Commerce Sezen Ugurlu, Project Specialist Mduduzi Lokotfwako, Research Analyst Uganda Zodwa Mabuza, Chief Executive Officer Kabano Research and Development Centre Nyakwesi Motsa, Administration & Finance Manager Robert Apunyo, Program Manager Sweden Delius Asiimwe, Executive Director International University of Entrepreneurship and Technology Francis Mukuya, Research Associate Niclas Adler, President Ukraine Switzerland CASE Ukraine, Center for Social and Economic Research University of St. Gallen, Executive School of Management, Dmytro Boyarchuk, Executive Director Technology and Law (ES-HSG) Vladimir Dubrovskiy, Leading Economist Rubén Rodriguez Startz, Head of Project United Arab Emirates Tobias Trütsch, Communications Manager Abu Dhabi Department of Economic Development Taiwan, China H.E. Mohammed Omar Abdulla, Undersecretary Council for Economic Planning and Development, Executive Dubai Economic Council Yuan H.E. Hani Al Hamly, Secretary General Hung, J. B., Director, Economic Research Department Institute for Social and Economic Research (ISER), Zayed Shieh, Chung Chung, Researcher, Economic Research University Department Mouawiya Alawad, Director Wu, Ming-Ji, Deputy Minister Emirates Competitiveness Council Tajikistan H.E. Abdulla Nasser Lootah, Secretary General The Center for Sociological Research “Zerkalo” Rahima Ashrapova, Assistant Researcher United Kingdom Qahramon Baqoev, Director LSE Enterprise Ltd, London School of Economics and Gulnora Beknazarova, Researcher Political Science Adam Austerfield, Director of Projects Tanzania Niccolo Durazzi, Project Manager Research on Poverty Alleviation (REPOA) Robyn Klingler Vidra, Researcher Cornel Jahari, Assistant Researcher Johansein Rutaihwa, Commissioned Researcher Uruguay Samuel Wangwe, Professor and Executive Director Universidad ORT Uruguay Isidoro Hodara, Professor x | The Travel & Tourism Competitiveness Report 2013 © 2013 World Economic Forum

- 13. Partner Institutes Venezuela CONAPRI—The Venezuelan Council for Investment Promotion Litsay Guerrero, Economic Affairs and Investor Services Manager Eduardo Porcarelli, Executive Director Vietnam Ho Chi Minh City Institute for Development Studies (HIDS) Nguyen Trong Hoa, Professor and President Du Phuoc Tan, Head of Department Trieu Thanh Son, Researcher Yemen Yemeni Businessmen Club (YBC) Mohammed Esmail Hamanah, Executive Manager Fathi Abdulwasa Hayel Saeed, Chairman Moneera Abdo Othman, Project Coordinator MARcon Marketing Consulting Margret Arning, Managing Director Zambia Institute of Economic and Social Research (INESOR), University of Zambia Patricia Funjika, Research Fellow Jolly Kamwanga, Senior Research Fellow and Project Coordinator Mubiana Macwan’gi, Director and Professor Zimbabwe Graduate School of Management, University of Zimbabwe A. M. Hawkins, Professor Bolivia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Honduras, Nicaragua, Panama INCAE Business School, Latin American Center for Competitiveness and Sustainable Development (CLACDS) Ronald Arce, Researcher Arturo Condo, Rector Marlene de Estrella, Director of External Relations Lawrence Pratt, Director Liberia and Sierra Leone FJP Development and Management Consultants Omodele R. N. Jones, Chief Executive Officer The Travel & Tourism Competitiveness Report 2013 | xi © 2013 World Economic Forum

- 14. © 2013 World Economic Forum

- 15. Preface BØRGE BRENDE AND ROBERT GREENHILL World Economic Forum The World Economic Forum has, for the past seven industry and in online travel services. Resilience has years, engaged key industry and thought leaders also been demonstrated in the way that some aviation through its Aviation, Travel & Tourism Industry companies responded to erratic fuel prices by exploring Partnership Programme, along with its Global Agenda new business models and acquiring energy assets. Council on New Models for Travel & Tourism, to carry Additionally, industry players have made commitments out an in-depth analysis of the T&T competitiveness to a low-carbon economy through several initiatives of economies around the world. The resulting Travel & aimed at optimizing operations, retrofitting, recycling, and Tourism Competitiveness Report provides a platform for preserving the environment. multi-stakeholder dialogue to ensure the development Yet despite these many positive developments, the of strong and sustainable T&T industries capable need for greater openness remains one of the major of contributing effectively to international economic trends impacting the T&T sector, especially with regard development. The theme of this year’s Report, to the freer movement of people. The importance of “Reducing Barriers to Economic Growth and Job efforts in this area has been highlighted specifically Creation,” reflects the importance of the sector for this by the G20 Los Cabos communiqué in June 2012, in purpose. which the group recognized the importance of tourism Encouraging the development of the Travel & “as a vehicle for job creation, economic growth and Tourism (T&T) sector is all the more important today development” and furthermore committed to “work given its important role in job creation, at a time when towards developing travel facilitation initiatives in support many countries are suffering from high unemployment. of job creation, quality work, poverty reduction and The sector already accounts for 9 percent of GDP, a total global growth.” of US$6 trillion, and it provides 120 million direct jobs At the core of the Report is the fifth edition of the and another 125 million indirect jobs in related industries. Travel & Tourism Competitiveness Index (TTCI). The This means that the industry now accounts for one in aim of the TTCI, which covers a record 140 economies eleven jobs on the planet, a number that could even rise this year, is to provide a comprehensive strategic tool to one in ten jobs by 2022, according to the World Travel for measuring the “factors and policies that make & Tourism Council. it attractive to develop the T&T sector in different This edition of the Report comes at an uncertain countries.” By providing detailed assessments of the T&T time for the T&T sector. Although the global economy is environments of countries worldwide, the results can be showing signs of fragile recovery, the world is becoming used by all stakeholders to work together to improve the increasingly complex and interconnected. In this industry’s competitiveness in their national economies, context, it is notable that the T&T sector has remained thereby contributing to national growth and prosperity. It remarkably resilient in a number of ways. The number also allows countries to track their progress over time in of travelers has increased consistently over the past the various areas measured. year, notwithstanding the difficult economic climate The full Report is downloadable from www.weforum. and shrinking budgets. Indeed, the UNWTO reports org/ttcr; this contains detailed profiles for each of the 140 that international tourist arrivals grew by 4 percent in economies featured in the study, as well as an extensive 2012, and forecasts that they will continue to increase section of data tables with global rankings covering by 3 percent to 4 percent in 2013. Although this trend over 75 indicators included in the TTCI. In addition, is primarily driven by increasing demand from the it includes insightful contributions from a number of emerging-market middle class, the picture has also been industry experts. These chapters explore issues such as brightening for many developed economies. how visa facilitation can play a relevant role in stimulating The industry has responded to the changing economic growth, the importance of policymakers environment with a number of structural adjustments. leveraging local competitive advantages to thrive in a Indeed, 2012 witnessed a number of alliances, volatile environment, the impact of the tourism sector mergers, and strategic investments both in the aviation on employment creation, how the connectivity that the The Travel & Tourism Competitiveness Report 2013 | xiii © 2013 World Economic Forum

- 16. Preface aviation sector creates sustains economic development, and the essential role of green growth in enhancing the resilience of the sector. The Travel & Tourism Competitiveness Report 2013 could not have been put together without the distinguished thinkers who have shared with us their knowledge and experience. We are grateful to our Strategic Design Partner Booz & Company, and our Data Partners Deloitte, the International Air Transport Association (IATA), the International Union for Conservation of Nature (IUCN), the World Tourism Organization (UNWTO), and the World Travel & Tourism Council (WTTC) for helping us to design and develop the TTCI and for providing much of the industry-relevant data used in its calculation. We thank our Industry Partners in this Report—namely Airbus/EADS, BAE Systems, Bahrain Economic Development Board, Bombardier, Delta, Deutsche Lufthansa/Swiss, Embraer, Etihad Airways, Jet Airways, Hilton, Lockheed Martin, Marriott, Safran, Starwood Hotels & Resorts, and VISA—for their support in this important venture. We also wish to thank the editors of the Report, Jennifer Blanke and Thea Chiesa, as well as the project manager, Roberto Crotti, for their energy and their commitment to the project. Appreciation goes to other members of the competitiveness team: Beñat Bilbao-Osorio, Ciara Browne, Margareta Drzeniek Hanouz, Thierry Geiger, Tania Gutknecht, Caroline Ko, and Cecilia Serin. Finally, we would like to convey our sincere gratitude to our network of 150 Partner Institutes worldwide, without whose hard work the annual administration of the Executive Opinion Survey and this Report would not be possible. xiv | The Travel & Tourism Competitiveness Report 2013 © 2013 World Economic Forum

- 17. Executive Summary Executive Summary JENNIFER BLANKE AND THEA CHIESA World Economic Forum The Travel & Tourism (T&T) industry has managed to Council (WTTC). We have also received important remain relatively resilient over the recent year despite feedback from a number of key companies that are the uncertain global economic outlook, which has Industry Partners in the effort, namely Airbus/EADS, BAE been characterized by fragile global economic growth, Systems, the Bahrain Economic Development Board, macroeconomic tensions, and high unemployment in Bombardier, Delta, Deutsche Lufthansa/Swiss, Embraer, many countries. Indeed, the sector has benefitted from Etihad Airways, Hilton, Jet Airways, Lockheed Martin, the continuing globalization process: travel has been Marriott, Safran, Starwood Hotels & Resorts, and VISA. increasing in mature markets and, particularly, has been The TTCI is based on three broad categories of driven by the rising purchasing power of the growing variables that facilitate or drive T&T competitiveness. middle class in many developing economies. These categories are summarized into the three In such a context, Travel & Tourism has continued subindexes of the Index: (1) the T&T regulatory to be a critical sector for economic development and framework subindex; (2) the T&T business environment for sustaining employment, in both advanced and and infrastructure subindex; and (3) the T&T human, developing economies. A strong T&T sector contributes cultural, and natural resources subindex. The first in many ways to development and the economy. It subindex captures those elements that are policy related makes both direct contributions, by raising the national and generally under the purview of the government; the income and improving the balance of payments, and second subindex captures elements of the business indirect contributions, via its multiplier effect and by environment and the “hard” infrastructure of each providing the basis for connecting countries, through economy; and the third subindex captures the “softer” hard and soft infrastructure—attributes that are critical human, cultural, and natural elements of each country’s for a country’s more general economic competitiveness. resource endowments. Although developing the T&T sector provides Each of these three subindexes is composed in turn many benefits, numerous obstacles at the national level by a number of pillars of T&T competitiveness, of which continue to hinder its development. For this reason, there are 14 in all. These are: seven years ago the World Economic Forum, together 1. Policy rules and regulations with its Industry and Data Partners, embarked on a 2. Environmental sustainability multi-year research effort aimed at exploring various 3. Safety and security issues related to the T&T competitiveness of countries 4. Health and hygiene around the world. This year’s Report is published under 5. Prioritization of Travel & Tourism the theme “Reducing Barriers to Economic Growth and 6. Air transport infrastructure Job Creation,” which reflects the forward-looking attitude 7. Ground transport infrastructure of the sector as it aims to ensure strong growth going 8. Tourism infrastructure into the future. 9. ICT infrastructure 10. Price competitiveness in the T&T industry THE TRAVEL & TOURISM COMPETITIVENESS 11. Human resources INDEX 12. Affinity for Travel & Tourism The Travel & Tourism Competitiveness Index (TTCI) 13. Natural resources aims to measure the factors and policies that make it 14. Cultural resources attractive to develop the T&T sector in different countries. The Index was developed in close collaboration Each of the pillars is, in turn, made up of a number with our Strategic Design Partner Booz & Company of individual variables. The dataset includes both survey and our Data Partners Deloitte, the International Air data from the World Economic Forum’s annual Executive Transport Association (IATA), the International Union Opinion Survey (the Survey) and quantitative data from for Conservation of Nature (IUCN), the World Tourism publicly available sources, international organizations, Organization (UNWTO), and the World Travel & Tourism and T&T institutions and experts (for example, IATA, the The Travel & Tourism Competitiveness Report 2013 | xv © 2013 World Economic Forum

- 18. Executive Summary Table 1: The Travel & Tourism Competitiveness Index 2013 and 2011 comparison 2013 2011 2013 2011 Country/Economy Rank/140 Score Rank/139 Country/Economy Rank/140 Score Rank/139 Switzerland 1 5.66 1 Morocco 71 4.03 78 Germany 2 5.39 2 Brunei Darussalam 72 4.01 67 Austria 3 5.39 4 Peru 73 4.00 69 Spain 4 5.38 8 Sri Lanka 74 3.99 81 United Kingdom 5 5.38 7 Macedonia, FYR 75 3.98 76 United States 6 5.32 6 Ukraine 76 3.98 85 France 7 5.31 3 Albania 77 3.97 71 Canada 8 5.28 9 Azerbaijan 78 3.97 83 Sweden 9 5.24 5 Armenia 79 3.96 90 Singapore 10 5.23 10 Vietnam 80 3.95 80 Australia 11 5.17 13 Ecuador 81 3.93 87 New Zealand 12 5.17 19 Philippines 82 3.93 94 Netherlands 13 5.14 14 Trinidad and Tobago 83 3.93 79 Japan 14 5.13 22 Colombia 84 3.90 77 Hong Kong SAR 15 5.11 12 Egypt 85 3.88 75 Iceland 16 5.10 11 Dominican Republic 86 3.88 72 Finland 17 5.10 17 Cape Verde 87 3.87 89 Belgium 18 5.04 23 Kazakhstan 88 3.82 93 Ireland 19 5.01 21 Serbia 89 3.78 82 Portugal 20 5.01 18 Bosnia and Herzegovina 90 3.78 97 Denmark 21 4.98 16 Namibia 91 3.77 84 Norway 22 4.95 20 Gambia, The 92 3.73 92 Luxembourg 23 4.93 15 Honduras 93 3.72 88 Malta 24 4.92 26 Botswana 94 3.71 91 Korea, Rep. 25 4.91 32 Nicaragua 95 3.67 100 Italy 26 4.90 27 Kenya 96 3.66 103 Barbados 27 4.88 28 Guatemala 97 3.65 86 United Arab Emirates 28 4.86 30 Iran, Islamic Rep. 98 3.64 114 Cyprus 29 4.84 24 Mongolia 99 3.63 101 Estonia 30 4.82 25 Suriname 100 3.63 n/a Czech Republic 31 4.78 31 Kuwait 101 3.61 95 Greece 32 4.75 29 Moldova 102 3.60 99 Taiwan, China 33 4.71 37 Guyana 103 3.60 98 Malaysia 34 4.70 35 El Salvador 104 3.59 96 Croatia 35 4.59 34 Rwanda 105 3.56 102 Slovenia 36 4.58 33 Cambodia 106 3.56 109 Panama 37 4.54 56 Senegal 107 3.49 104 Seychelles 38 4.51 n/a Zambia 108 3.46 111 Hungary 39 4.51 38 Tanzania 109 3.46 110 Montenegro 40 4.50 36 Bolivia 110 3.46 117 Qatar 41 4.49 42 Kyrgyz Republic 111 3.45 107 Poland 42 4.47 49 Nepal 112 3.42 112 Thailand 43 4.47 41 Venezuela 113 3.41 106 Mexico 44 4.46 43 Tajikistan 114 3.41 118 China 45 4.45 39 Paraguay 115 3.39 123 Turkey 46 4.44 50 Uganda 116 3.39 115 Costa Rica 47 4.44 44 Ghana 117 3.38 108 Latvia 48 4.43 51 Zimbabwe 118 3.33 119 Lithuania 49 4.39 55 Swaziland 119 3.31 116 Bulgaria 50 4.38 48 Ethiopia 120 3.29 122 Brazil 51 4.37 52 Cameroon 121 3.27 126 Puerto Rico 52 4.36 45 Pakistan 122 3.25 125 Israel 53 4.34 46 Bangladesh 123 3.24 129 Slovak Republic 54 4.32 54 Malawi 124 3.22 121 Bahrain 55 4.30 40 Mozambique 125 3.17 128 Chile 56 4.29 57 Côte d’Ivoire 126 3.15 131 Oman 57 4.29 61 Nigeria 127 3.14 130 Mauritius 58 4.28 53 Burkina Faso 128 3.12 132 Uruguay 59 4.23 58 Mali 129 3.11 133 Jordan 60 4.18 64 Benin 130 3.09 120 Argentina 61 4.17 60 Madagascar 131 3.09 127 Saudi Arabia 62 4.17 62 Algeria 132 3.07 113 Russian Federation 63 4.16 59 Yemen 133 2.96 n/a South Africa 64 4.13 66 Mauritania 134 2.91 136 India 65 4.11 68 Lesotho 135 2.89 135 Georgia 66 4.10 73 Guinea 136 2.88 n/a Jamaica 67 4.08 65 Sierra Leone 137 2.87 n/a Romania 68 4.04 63 Burundi 138 2.82 137 Lebanon 69 4.04 70 Chad 139 2.61 139 Indonesia 70 4.03 74 Haiti 140 2.59 n/a xvi | The Travel & Tourism Competitiveness Report 2013 © 2013 World Economic Forum

- 19. Executive Summary IUCN, the UNWTO, WTTC, UNCTAD, and UNESCO). The also attracts tourists because of its rich and well- Survey is carried out among chief executive officers and managed natural resources. A large percentage of the top business leaders in all economies covered by our country’s land area is protected, environmental regulation research; these are the people making the investment is among the most stringent (3rd), and the T&T industry decisions in their respective economies. The Survey is considered to be developed in a sustainable way provides unique data on many qualitative institutional (7th). These good environmental conditions, combined and business environment issues, as well as specific with the high safety and security of the country (2nd), issues related to the T&T industry and the quality of the contribute to its solid T&T competitiveness. Switzerland natural environment. is not only a strong leisure tourism destination but also The details of the composition of the TTCI are an important business travel hub, with many international shown in Appendix A of Chapter 1.1; detailed rankings fairs and exhibitions held in the country each year, and scores of this year’s Index are found in Appendix B driving its showing on the cultural resources pillar (6th). of that chapter. Switzerland’s strong performance in all these areas enables the country to somewhat make up for its lack THE TRAVEL & TOURISM COMPETITIVENESS of price competitiveness (139th), which, together with a INDEX RANKINGS 2013 fairly restrained international visa policy, does indeed limit Table 1 shows the overall rankings of the 140 economies the number of arrivals. assessed in this edition TTCI, comparing this year’s Germany ranks 2nd in Europe and out of all rankings with those from the 2011 edition of the Report,. countries in the TTCI. Similar to Switzerland, its Switzerland maintains its top position in the rankings, infrastructure is among the best in the world: it is ranked which it has retained for five consecutive editions, since 6th for ground transport infrastructure and 7th for air the very first Travel & Tourism Competitiveness Report. transport infrastructure, facilitating connections both Tables 2–6 present the rankings in a regional context, within the country and internationally. Germany also has grouping economies into the following five regional abundant cultural resources (ranked 5th worldwide for its groups: Europe, the Americas, Asia Pacific (including many World Heritage cultural sites) and is host to almost Central Asia), the Middle East and North Africa, and 600 international fairs and exhibition per year (2nd), while sub-Saharan Africa. We discuss below a selection of hotel prices are relatively competitive (55th). In addition, countries from each region to provide a sense of the Germany makes great efforts to develop in a sustainable results and how they are interpreted at the national level. way (4th), with the world’s most stringent environmental More countries are discussed in detail in Chapter 1.1. regulations—which are also among the best-enforced— and the strong support of international environmental Europe efforts, as demonstrated through its ratification of many In line with statistics on international tourist arrivals, international environmental treaties. Table 1 shows that Europe remains the leading region Austria ranks 3rd, improving by one position since for Travel & Tourism competitiveness, with all of the 2011. Its strong performance is driven by factors such as top five places taken by European countries. Likewise, tourism infrastructure, in which it ties for 1st place with 13 of the top 20 countries are from the region. Table 2 Italy; a welcoming attitude toward visitors; a very safe shows the rankings for European countries only, with and secure environment (7th); and, most importantly, its the first column showing the rank within the region, rich cultural resources. Austria hosts nine World Heritage the second column showing the overall rank out of all cultural sites, has excellent creative industries, and 140 economies included in the Index this year, and the attracts many travelers with several fairs and exhibitions third column showing the score. As the table shows, organized every year. The country’s tourism industry is Switzerland is ranked 1st out of all countries in the 2013 also being developed in a sustainable way (10th), with TTCI, a position it has held since the first edition of some of the most stringent (4th) and well-enforced (7th) this Report in 2007. Germany, Austria, Spain, and the environmental regulations in the world, driving its overall United Kingdom complete the top five, while France and positive performance on environmental sustainability Sweden are among the top 10 overall. (ranked 6th). Switzerland continues to lead the rankings, Spain is the country among the top 10 that sees performing well on almost all aspects of the Index. the most improvement since 2011: moving up four Switzerland’s infrastructure, especially ground transport places since the last assessment, it is now ranked 4th. (3rd), is among the best in the world. The country also Spain continues to lead in cultural resources, ranking boasts top marks for its hotels and other tourism-specific 1st this year in this area because of its extremely facilities, with excellent staff thanks to the availability of numerous World Heritage sites (2nd) and its large qualified labor to work in the industry (ranked 2nd)— number of international fairs and exhibitions (3rd), as well perhaps not surprising in a country that holds many of as its significant sports stadium capacity. Its tourism the world’s best hotel management schools. Switzerland infrastructure is another strength, with its many hotel The Travel & Tourism Competitiveness Report 2013 | xvii © 2013 World Economic Forum