Top Travel Insurances for New Zealand You Should Know in 2024

.jpg?auto=compress,format&rect=0,0,1629,1629&w=120&h=120)

Byron Mühlberg

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

New Zealand is known for its breathtaking landscapes, including glaciers, fjords, and the Southern Alps, as well as its unique Maori history. Visitors also come to experience the adventure activities, such as hiking, skiing, and rafting, and to see the unique wildlife like the Kiwi bird. Although travelling to New Zealand can be an accessible holiday destination for many people, out-the-pocket healthcare costs in the country tend to be expensive, so it's a very good idea to arrive there with travel insurance under your belt.

Luckily, online global insurances (known as 'insurtechs') specialize in cost-savvy travel insurance to New Zealand and other countries worldwide. Our list below explores the four services we believe provide the best deals for young travellers, adventurers, everyday holidaymakers looking for comprehensive but affordable coverage, and longer-term expats.

New Zealand Insurance Profile

Here are a few of the many factors influencing the scope and cost of travel insurances for New Zealand:

Best Travel Insurances for New Zealand

- 01. Should I get travel insurance for New Zealand? scroll down

- 02. Best medical coverage: VisitorsCoverage scroll down

- 03. Best trip insurance: Insured Nomads scroll down

- 04. Best mix for youth and digitial nomads: SafetyWing scroll down

- 05. FAQ about travel insurance to New Zealand scroll down

Heading to New Zealand soon? Don't forget to check the following list before you travel:

- 💳 Eager to dodge high FX fees? See our picks for the best travel cards in 2024.

- 🛂 Need a visa? Let iVisa take care of it for you.

- ✈ Looking for flights? Compare on Skyscanner !

- 💬 Want to learn the local language? Babbel and italki are two excellent apps to think about.

- 💻 Want a VPN? ExpressVPN is the market leader for anonymous and secure browsing.

Do I Need Travel Insurance for New Zealand?

No, there's currently no legal requirement to take out travel insurance for travel to or through New Zealand.

However, regardless of whether or not it's legally required, it's always a good idea to take our health insurance before you travel — whether to New Zealand or anywhere else. For what's usually an affordable cost , taking out travel insurance will mitigate most or all of the risk of financial damage if you run into any unexpected troubles during your trip abroad. Take a look at the top five reasons to get travel insurance to learn more.

With that said, here are the top three travel insurances for New Zealand:

VisitorsCoverage: Best Medical Coverage

Among the internet's best-known insurance platforms, VisitorsCoverage is a pioneering Silicon Valley insurtech company that offers comprehensive medical coverage for travellers going abroad to New Zealand. It lets you choose between various plans tailored to meet the specific needs of your trip to New Zealand, including coverage for medical emergencies, trip cancellations, and travel disruptions. With its easy online purchase process and 24/7 live chat support, VisitorsCoverage is a reliable and convenient option if you want good value and peace of mind while travelling abroad.

- Coverage 9.0

- Quality of Service 9.0

- Pricing 7.6

- Credibility 9.5

VisitorsCoverage offers a large variety of policies and depending on your needs and preferences, you'll need to compare and explore their full catalogue of plans for yourself. However, we've chosen a few highlights for their travel insurance for New Zealand:

- Policy names: Varies

- Medical coverage: Very good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, mental health-related conditions, and many others.

- Trip coverage: Excellent - but only available for US residents.

- Customer support: FAQ, live chat and phone support

- Pricing range: USD 25 to USD 150 /traveller /month

- Insurance underwriter: Lloyd's, Petersen, and others

- Best for: Value for money and overall medical coverage

Insured Nomads: Best Trip Coverage

Insured Nomads is another very good travel insurance option, especially if you're adventurous or frequently on the go and are looking for solid trip insurance with some coverage for medical incidents too. With Insured Nomads, you can choose the level of protection that best suits your needs and enjoy a wide range of benefits, including 24/7 assistance, coverage for risky activities and adventure sports, and the ability to add or remove coverage as needed. In addition, Insured Nomads has a reputation for providing fast and efficient claims service, making it an excellent choice if you want peace of mind while exploring the world.

- Coverage 7.8

- Quality of Service 8.5

- Pricing 7.4

- Credibility 8.8

Insured Nomads offers three travel insurance policies depending on your needs and preferences. We go through them below:

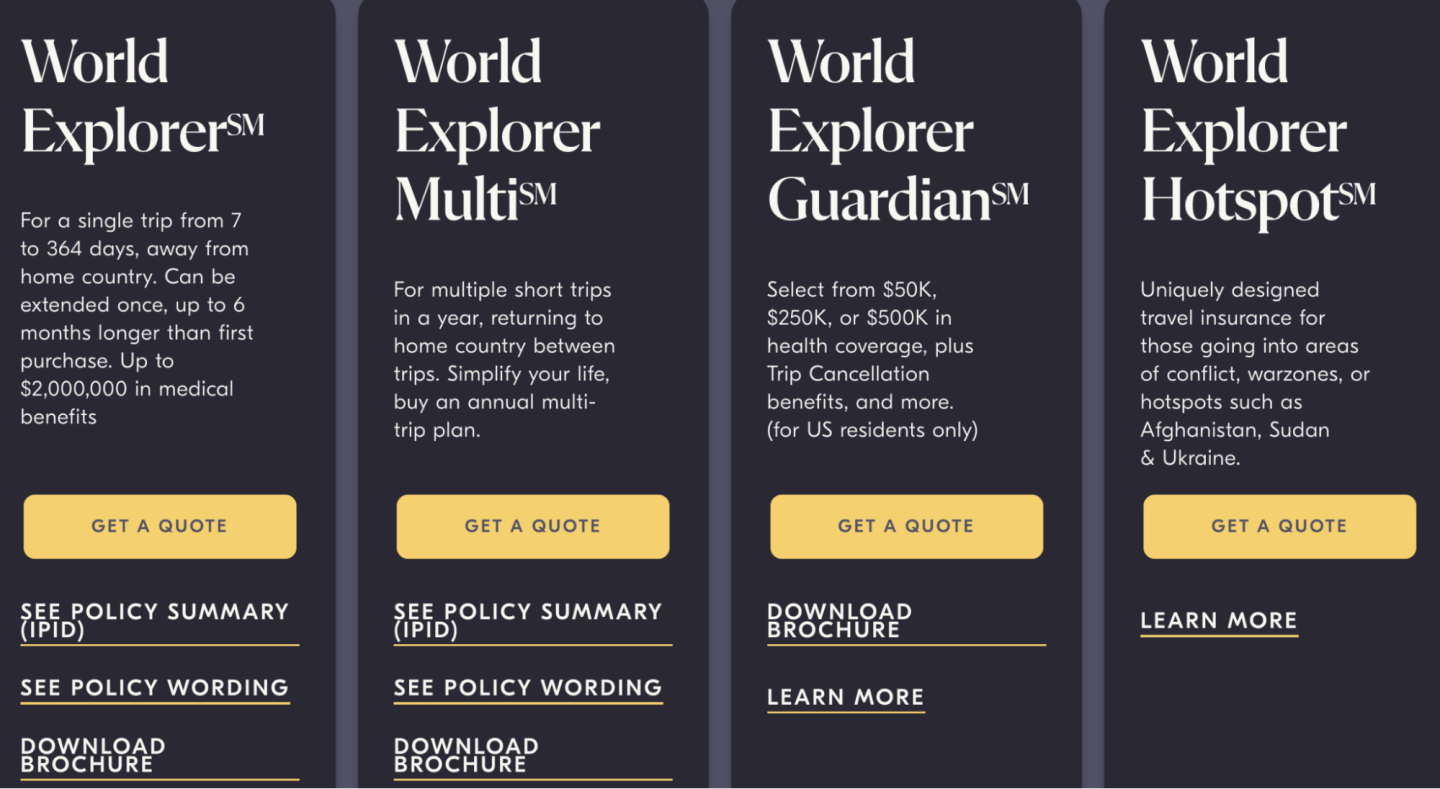

- Policy names: World Explorer, World Explorer Multi, World Explorer Guardian

- Medical coverage: Good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, and many others.

- Trip coverage: Good. Includes coverage for trip cancellation and interruption, lost or stolen luggage (with limits), adventure and sports activities, and many others.

- Customer support: FAQ, live chat, phone support

- Pricing range: USD 80 to USD 420 /traveller /month

- Insurance underwriter: David Shield Insurance Company Ltd.

- Best for: Adventure seekers wanting comprehensive trip insurance

SafetyWing: Best Combination For Youth

SafetyWing is a good insurance option for younger travellers or digital nomads because it offers flexible but comprehensive coverage at a famously affordable price. With SafetyWing, you can enjoy peace of mind knowing you're covered for unexpected medical expenses, trip cancellations, lost or stolen luggage, and more. In addition, SafetyWing's user-friendly website lets you manage your policy, file a claim, and access 24/7 assistance from anywhere in the world, and, unlike VisitorsCoverage, you can even purchase a policy retroactively (e.g. during a holiday)!

- Coverage 7.0

- Quality of Service 8.0

- Pricing 6.3

- Credibility 7.3

SafetyWing offers two travel insurance policies depending on your needs and preferences, which we've highlighted below:

- Policy names: Nomad Insurance, Remote Health

- Medical coverage: Decent. Includes coverage for doctor and hospital visits, repatriation, and many others.

- Trip coverage: Decent. Includes attractive coverage for lost or stolen belongings, adventure and sports activities, transport cancellation, and many others.

- Pricing range: USD 45 to USD 160 /traveller /month

- Insurance underwriter: Tokyo Marine HCC

- Best for: Digital nomads, youth, long-term travellers

How Do They Compare?

Interested to see how VisitorsCoverage, SafetyWing, and Insured Nomads compare as travel insurances to New Zealand? Take a look at the side-by-side chart below:

Data correct as of 4/1/2024

FAQ About Travel Insurance to New Zealand

Travel insurance typically covers trip cancellation, trip interruption, lost or stolen luggage, travel delay, and emergency evacuation. Some travel insurance packages also cover medical-related incidents too. However, remember that the exact coverage depends on the insurance policy.

No, you'll not be required to take out travel insurance for New Zealand. However, we strongly encourage you to do so anyway, because the cost of healthcare in New Zealand can be high, and taking out travel insurance will mitigate some or all of the risk of covering those costs yourself if you need medical attention during your stay.

Yes, medical travel insurance is almost always worth it, and we recommend taking out travel insurance whenever visiting a foreign country. Taking out travel insurance will mitigate some or all of the risk of covering those costs yourself in case you need medical attention during your stay. In general, we recommend VisitorsCoverage to travellers worldwide because it offers excellent value for money and well-rounded travel and medical benefits in its large catalogue of plans.

Health insurance doesn't cover normal holiday expenses, such as coverage for missed flights and hotels, but in case you run into medical trouble while abroad, it may cover some or all of your doctor or hospital expenses while overseas. However, not all health insurance providers and plans offer coverage to customers while abroad, and that's why it's generally best to take out travel insurance whenever you travel.

Although there's overlap, health and travel insurance are not exactly the same. Health insurance covers some or all of the cost of medical expenses (e.g. emergency treatment, doctor's visits, etc.) while travel insurance covers non-medical costs that are commonly associated with travelling (e.g. coverage for missed flights, stolen or lost personal belongings, etc.).

The cost of travel insurance depends on several factors, such as the length of the trip, the destination, the age of the traveller, and the level of coverage desired. On average, travel insurance can cost anywhere between 3% and 10% of the total cost of the trip.

A single-trip travel insurance policy covers a specific trip, while an annual one covers multiple trips taken within a one-year period. An annual policy may be more cost-effective for frequent travellers.

Yes, you can sometimes purchase travel insurance after starting your trip, but it is best to buy it before the trip begins to ensure maximum coverage. If you do need to buy insurance after you've started your trip, we recommend VisitorsCoverage , which offers a wide catalogue of online trip and medical insurance policies, most of which can be booked with immediate effect. Check out our guide to buying travel insurance late to learn more.

Yes, you can most certainly purchase travel insurance for a trip that has already been booked, although we recommend purchasing insurance as soon as possible aftwerwards to ensure all coverage is in place before your journey begins. Check out our guide to buying travel insurance late to learn more.

See Our Other Travel Insurance Guides

Looking for Travel Insurance to Another Country?

See our recommendations for travel insurance to other countries worldwide:

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

- Why Flying Kiwi

- Nz Travel Blog

- FIND A TOUR

- Total Aotearoa (23 days)

- Grand Traverse (16 days)

- Northern Light (7 days)

- Summer Blast (13 days)

- Southern Light (8 days)

- Wild West (6 days)

- Frequently Asked Questions

- Food on Tour

- Pick up Points

- What to Bring

- Travel Information

- Accommodation

- Photo Gallery

- Passenger & Tour Videos

- #FlyingKiwiMemories

- Free Activities & Inclusions

- Optional Activities

- Bay of Islands

- Kauri Coast

- Hot Water Beach (Coromandel Peninsula)

- New Plymouth & Waitomo

- Christchurch

- Lake Tekapo

- Milford Sound

- Glacier Country

- Abel Tasman

- Who Travels With Flying Kiwi

- The Flying Kiwi Story

- Flying Kiwi Team

- Responsible Tourism

- NZ's Best Value Travel

- Contact Flying Kiwi

- Search Results

Hit enter to search or ESC to close

Nomads Travel Insurance

New zealand tour insurance.

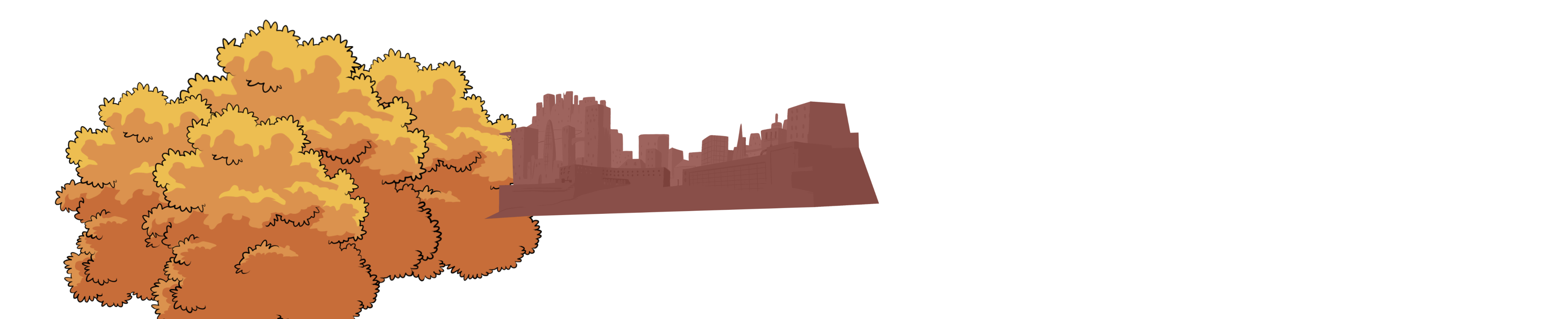

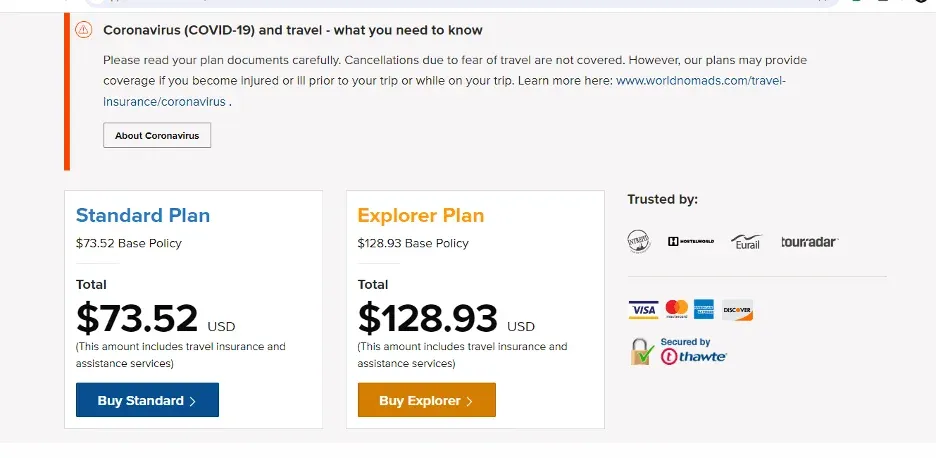

It is recommended that all travellers arriving into New Zealand are covered by comprehensive travel insurance. We recommend using a well known operator such as Nomads travel. You can get a quote from them direct using the tool below:

No one has commented on this page yet.

Full New Zealand Tours

- Grand Traverse - Auckland to Queenstown tour - 16 days

North Island Tours

- Northern Light North Island Tour - 7 days

South Island Tours

- Summer Blast South Island Tour - 13 days

- Southern Light South Island Tour - 8 days

- Wild West South Island Tour - 6 days

Sharon, 10/02/2015 from DE

Travel Insurance in New Zealand

Here at Planit NZ, we highly recommend you take out a comprehensive travel insurance policy before setting off on a trip to New Zealand.

When heading out on any adventure abroad, buying travel insurance should be a part of your pre-trip planning. You'll be buying much needed peace of mind that if something should go wrong while on your adventure in New Zealand, you're covered . Travel insurance provides a wealth of cover while traveling outside of your home country - medical care whilst abroad as well as protection in the case of:

- Lost or stolen luggage / personal belongings

- Trip cancellation

- Emergency dental treatment

- Emergency evacuation back to your country of residence

At Planit NZ, we have two main suggestions when considering travel insurance: First , we highly recommend World Nomads . Why? They offer great value travel insurance that is flexible, comprehensive and most importantly for your visit in New Zealand - they cover a wide range of adventure activities. Second , regardless of who you book your travel insurance with, be sure to read the policy fine print carefull y. We can guarantee it won't be the most exciting piece of reading you'll do before your adventure in New Zealand, but it's hugely important. Read the fine print and hone in on the exclusions .

Why We Reccommend World Nomads

World Nomads ' policies are designed with backpackers and independent travelers in mind. Their polices are comprehensive and the coverage they offer is good value for the price you pay. Equally important, you can easily buy their insurance online, extend your policy (because we know you'll love New Zealand) and heavens forbid if something goes wrong, you can even make a claim online .

What You Should Know about World Nomads

Reliable Underwriters :: World Nomads ' policies are backed by trusted underwriters who offer premium 24 hours a day, 7 days a week emergency assistance and customer support.

Flexible Coverage :: You can claim online and extend your cover indefinitely 24 hours a day, 7 days a week from anywhere in the world.

Coverage for a Range of Adventure Activities :: From white-water rafting, to skiing, to bungy-jumping or paragliding, World Nomads has you covered for New Zealand's adrenaline inducing activities .

Who can buy World Nomads? :: World Nomads travel insurance is available to residents of over 150 countries.

How to buy it? :: World Nomads insurance is only available to purchase online with a credit card.

Questions? :: We consider ourselves experts on New Zealand, but but don't claim to be experts on all travel insurance policies. If you happen to have more questions on what policy is right for you, check out the FAQ page and contact the World Nomads team directly from there.

If you decide to travel with your furry friend, we also recommend checking for a dog insurance comparison on sites like comparesies.com. Traveling with a dog can be challenging, and every issue could cost you a lot if you don't have it covered.

The Planit NZ Team uses World Nomads when exploring New Zealand or traveling overseas as we believe they offer a top-quality product designed with travelers like us in mind. If you choose to buy World Nomads and purchase the insurance following a link on this page, we might receive a small percentage of the sale. Thanks in advance.

Let Us Help You Plan Your Dream New Zealand Trip

Get help creating the perfect self-drive itinerary, finding the best deal on a car or campervan rental or booking the perfect tour. We offer personalized support prior to your trip. Contact us or fill out our FREE Travel Planning Service form below.

Recommended for you

Travelling With Kids: Your guide to a Family-Friendly Holiday in the South Island

Planning for New Zealand - Start Here

New Zealand for Lord of the Rings Fans

Guide to Finding Accommodation in New Zealand

Free New Zealand Travel Planning Service

Self Drive New Zealand Tours

What to Bring

Planning A Campervan Trip to New Zealand

- New Zealand Itineraries

When to Come

Custom self drive itineraries. Free travel planning advice.

Back to planning for new zealand, save 5% today, book two or more activities or excursions and save 5%, new zealand travel guide.

- Explore New Zealand

- Planning for New Zealand

- North Island

- South Island

- New Zealand Blog

TRAVEL BOOKING PORTAL

- Small Group & Adventure Tours

- Day Tours & Activities

- New Zealand Bus Passes

- Car & Campervan Booking

- Write for Us

- Testimonials

YOUR CENTRALIZE RESOURCES FOR PLANNING & BOOKING TRIPS TO NEW ZEALAND

Still need help? Email our travel desk: [email protected]

CONTACT | TERMS | INSURANCE

© Planit Travel Group, Middle Earth

Your First Name

- " id="mainPhoneNumber">

- Single Travel Insurance

- Annual Travel Insurance

- Cruise Travel Insurance

- Family Travel Insurance

- Seniors Travel Insurance

- Ski Travel Insurance

- NZ Travel Insurance

- Zoom Travel Insurance

- See more companies...

- Travel Insurance Guide

- Covid-19 Help

- Read Reviews

- Write a Review

Please Note - If you are cruising around Australia you need to select Pacific. With Regions, variances can apply for Bali, Indonesia, Japan and Middle East. You are not required to enter stop-over countries if your stop-over is less than 48 hours.

If you don’t know where you’re traveling to within the next 12 months, choose Worldwide to ensure you’re covered no matter where you go. If you’re travelling to multiple countries choose the region that you are visiting that is furthest away (excluding stopovers less than 48 hours). In most cases you will be covered for the closer regions as well. For example, if you choose Europe, you will also be covered in the Middle East, Asia and Pacific.

Worldwide means anywhere in the world

Americas means USA, Canada, South America, Latin America, Hawaii and the Caribbean

Europe means all European countries, including UK

Middle East refers to the area from Syria to Yemen; Egypt to Iran

Asia generally means Asia and the Indian subcontinent. For some insurers this excludes Japan*

Pacific means the South West Pacific, Australia and Indonesia/Bali*. Select Pacific for domestic cruises in New Zealand waters

New Zealand means domestic travel within New Zealand only

*Note: Variances apply for Bali, Indonesia, Japan and Middle East. Check that your destination is covered once directed to your chosen insurer’s site.

Which Is The Best Travel Insurance On The Market?

This is not as simply answered as you may think. When it comes to travel insurance, finding the best travel insurance for your trip requires you to think about the type of holiday you are going on and the level of cover you will need. It is about matching your needs to the various insurance policies on the market and weighing up the options.

The easiest way to explain this is:

Different travellers + different trips + different budgets = different travel needs.

1. Determine The Type Of Cover You Need

There are different levels of cover available to suit the needs and budgets of different travellers. Holidaymakers should look at the cover available and identify what you need and what you don’t need. There is no point paying top dollar for luggage cover, if you're only travelling with a backpack and fresh undies. The best travel insurance is one that covers you for your particualr trip, whether that's a big international trip or a domestic weekend break. Don't pay for more cover than your trip requires.

Overseas medical cover and personal liability cover are often considered to be the most essential coverage items. These are standard in most basic travel insurance policies. More comprehensive policies will include additional cover for things like cancellation cover and luggage and personal belongings. If you have pre-paid your flights and accommodation a comprehensive policy may be the best travel insurance for you.

2. Compare, Compare, Compare

Comparing policies is a great way to find the right travel insurance for your needs. All insurers offer different benefits and pricing, so once you’ve identified what level of cover you need, the next step is start comparing to find yourself a good deal.

Comparison sites such as ours will help you do this. You simply enter your details in the quote box and you’re provided with a comparison of all the features and price in seconds.

3. Cheapest Is Not Always The Best

One of the biggest mistakes travellers make is purchasing a policy based on the cheapest price. Selecting the cheapest can sometimes mean missing out on valuable coverage options. The key is to get the right level of cover at the best price.

4. Not All Policies Are Created Equal

When shopping around for travel insurance in New Zealand, you may notice that many different brands are underwritten by one of a few big insurers, such as Allianz Australia Insurance Limited, Certain underwriters at Lloyd's, QBE Insurance Limited and others. Whilst they look similar on first glance, they will almost certainly not be the same. Each insurer negotiates a product policy and chooses what to include or exclude. So think about your trip and planned activities that you need cover for.

5. Get The Best Bang For Your Buck

With so many travel insurers in the market, how do you really know who covers more than the other? The ideal policy is one that provides real value for money. Some insurers definately do cover more than others. Luckily we've done all the hard work for you. If you want to know who offers the best cover for expensive items, or who has the best single item limit - see who really covers more in our handy guide right here.

6. Read The Print - Small Or Not

Whilst it can be extremely boring, the fine print in any policy needs to be read and understood. Understanding the insurance exclusions and loopholes will help you to avoid placing yourself in situations that your insurer will not cover.

Some additional considerations when purchasing a policy are:

- Is the insurer reputable? Speaking with a few travellers and reading travel insurance reviews by customers can often reveal a very different tale to testimonials featured on the insurers’ site.

- Do they offer emergency assistance? A 24-hour medical assistance hotline will be extremely useful to you if you are having troubles overseas.

- What is the excess? The amount you pay in the event of a claim varies between insurers and may vary depending on the claim type. For instance, you may not have to pay an excess for medical claims but pay $200 for lost belongings claim. Make sure you’re comfortable with the excess amounts. You can often remove the excess by paying an additional fee around the $25 mark.

- Exclusions - Even the best policy won't provide cover for everything. You should pay attention to your policy's exclutions before you set off. Typically you're not covered if you put yourself in danger (e.g. some high risk activities like skydiving might not be covered); for any items that you leave unattended which are then lost or stolen; or for any medical conditions you had before you left for your trip.

The best travel insurance is out there. All travellers have to do is have a clear understanding of what they need cover for and match this to the right provider.

Compare Comprehensive travel insurance

**Please note, the table above shows the listed insurer's most comprehensive policy - international trips only ** The information provided is of a general nature only and does not take into account any particular personal objectives, financial situation or needs. Before making a decision you should consider the appropriateness of the information having regard to your personal objectives, needs and circumstances. Cover levels could change at any time.

WHAT DOES TRAVEL INSURANCE COVER?

24/7 Medical assistance

Don't fret should you get sick or injured on your trip, because this is exactly why you're buying protection for your holiday. Travel insurance covers your medical expenses for injury or illness including hospital stays, surgery, dental, prescription drugs and doctor visits.

cancellation cover

Sometimes trips just don't go to plan! Cancellation benefits cover the cost of rearranging or cancelling your journey because of unforeseen circumstances such as illness, accidents and extreme weather conditions. Remember, cover starts from the day you buy your policy not when your trip starts :)

Lost or damaged Luggage

It's a real pain in the ar*e when your stuff is lost, stolen or doesn't show up. At least if disasters happens on your holiday your policy will replace or reimbuirse you for your baggage and personal items if they disappear or are damaged.

Travel delays

Bummer, your flights delayed, now what!? If your transport is postponed due to an unforeseen reason, your out-of-pocket accommodation, meals, and transport costs would be covered until you get back-on-track. Note, this benefit probably won't kick in if you only have a short delay which is less than 6 hours.

family emergency

It's always a worry going on holiday leaving loved ones behind. Never fear, should a close relative, or the person you’re travelling with become seriously ill, injured or heaven-forbid die, your travel expenses would be claimable. Restrictions can apply for relatives age, medical conditions and where they live.

Personal liability

A lawsuit would certainly put a dampender on your dream holiday. Relax as you're covered in the event that you are found to be legally liable for accidental injury or damage you may have caused to another person or their property whilst on your trip.

WHAT DOESN'T IT COVER?

Other handy tips & guides.

What activities are covered?

Are you a self-confessed adrenaline junkie? If you’re planning on doing some risky activities on your trip make sure you know if they’re covered, as not all of them are!

Pre-existing medical conditions

Having pre-existing medical conditions doesn't mean you can't get cover or that it has to be expensive. It simply means that you need to dig a little deeper when doing your research.

Pregnancy travel insurance guide

Not all insurers will cover you automatically if you’re over 22 weeks gestation or have had pregnancy complications. See which companies offer cover for pregnant women.

Our Travel Insurance Comparision Helps You

Save time, worry and loads of money.

Stay up to date with our latest news, deals and special offers.

Your privacy is important to us.

CoverDirect NZ Limited (INC 3526051) owns and operates this website.

Our comparison is a free service that makes it easy for users to compare multiple quotes, saving both time and money. Our comparison ranks quotes according to price and is limited to those insurers that have agreed to participate on the site. CoverDirect NZ Limited does not hold a financial services licence. The comparison does not take your personal circumstances into account; as such, all information provided should be considered general and should not be considered as advice or a recommendation. Whilst we take all reasonable care when preparing this information, we do not warrant its accuracy. Pricing information is supplied by the insurance providers and ALL policy details should be verified with the before you purchase. This site links users to the website of the insurance provider to verify quotes and access the relevant PDS to understand what is, and is not, covered by a policy prior to purchase. We do not issue insurance. Users purchase directly from the travel insurance provider.

Loading Quotes...

Please login or register to continue. It'll only take a minute.

Login with Facebook

Login with Google

- There was an error logging in, please try again.

Enter your email and password

- There was an error on your registration, please try again.

Don't you have an account?

Just checking you are a human

Insurance for nomads

Travel medical insurance. We cover people from all over the world, while outside their home country.

Buy while abroad

Sign up for Nomad Insurance before you depart or at any point during your journey abroad.

Global coverage

Travel with continuous coverage across 180+ countries. US coverage is extra.

Simple claims process

Tell us what happened and submit supporting documents to get your money back.

24/7 human support

Our friendly customer care specialists respond in less than a minute via live chat.

Pricing calculator

Customize your policy to see how much Nomad Insurance will cost you.

Currently only available to non-US residents

US coverage

Adventure sports

Electronics theft

Paid every 4 weeks, cancel anytime

We've got you covered

Read the full policy to see what we cover as well as what we do not cover. If you have any questions, you can always reach out to our friendly customer care team.

If you get sick or injured while abroad

- hospital stays

- nursing care

- ambulance for hospitalization

- diagnostics like MRIs

- extended care after hospital

- prescriptions

- emergency dental (up to $1000)

- and more...

Evacuation to a better equipped hospital when you need it

Lost checked luggage

Injuries from leisure sports & activities

Motor accidents

Flights home if something bad happens

Meals & accommodations if you have a travel delay over 12 hours

Continued coverage for visits back home

Transporting your body home or a local burial if you die

Policy maximum limit

US$100,000 for US residents over 65

We do not cover

Our exclusions include high-risk or professional sport activity, pre-existing conditions, cancer treatment, lost or stolen personal belongings, trips that were cancelled before you left

Wesley Dekadt

Frequently asked questions

Where can i travel with nomad insurance, can i buy nomad insurance, what are the benefits of auto-extending my policy every 28 days, how do i cancel my plan, how do i file a claim, ready for your nomad adventure.

World Nomads Travel Insurance Review: Is it Worth it?

On my last trip across Europe, I lost a dental filling. Not the worst thing in the world, but overseas, that minor issue could have easily turned into a major expense. Luckily, I had travel insurance, saving me from a potential nightmare .

The thing is, your regular health insurance rarely covers you abroad. That's why having travel insurance is so important . World Nomads promises to protect your trip, your stuff, medical emergencies, and even all those adventurous activities you might try.

But does World Nomads actually live up to that promise? Whether you're an adrenaline junkie or, like me, prefer a leisurely stroll and a good restaurant, this review will help you decide. Ready to find out if it's worth it? Let's dive in!

World Nomads

World Nomads is one of the first travel insurance companies designed for adventurous, independent travelers. They offer flexible coverage for medical emergencies, trip cancellations, lost or stolen gear, and a wide range of adventure activities. Pros

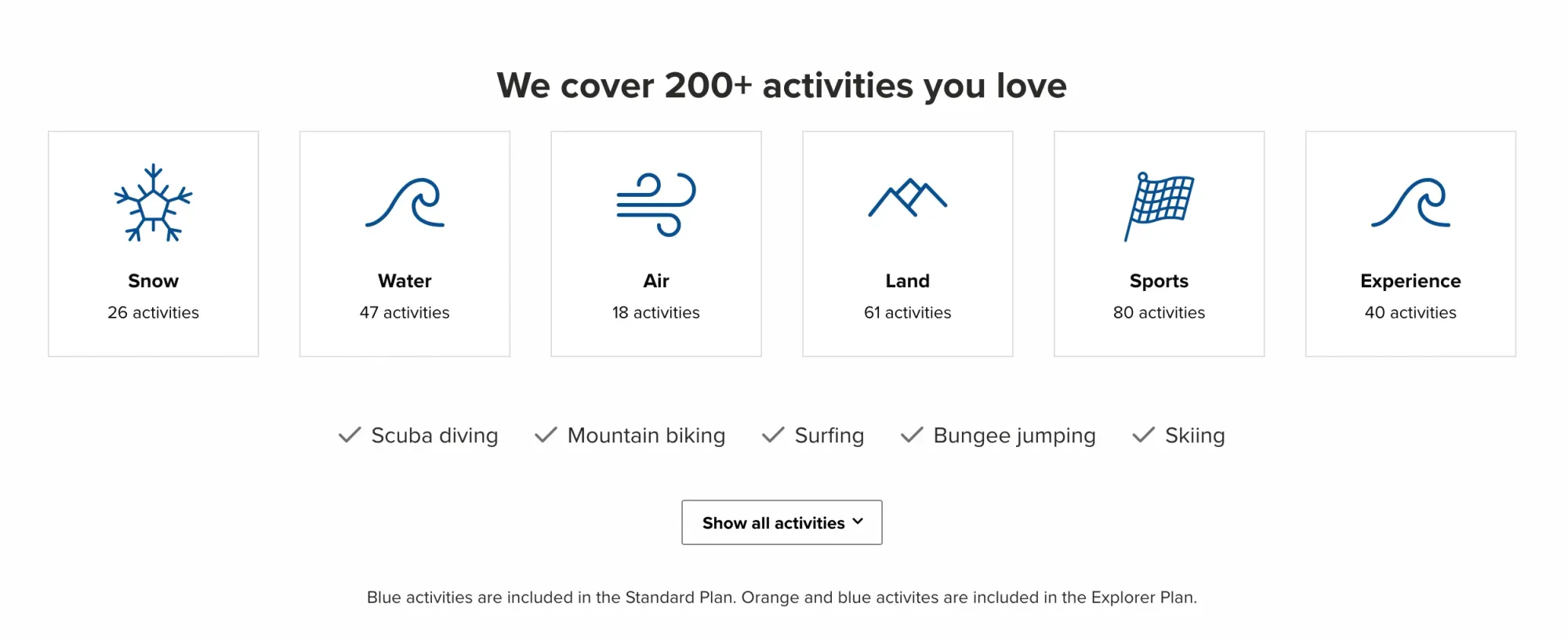

- Covers 200+ activities

- Offers multi-trip coverage

- Offers coverage up to 6 months

- For trips over 6 months the policy lapses and must be renewed

- Mixed customer service reviews

What We Like About World Nomads Travel Insurance

Getting protected is fast and easy.

One of the best things about World Nomads is how quick and simple they make it to get covered. Everything's done online – you can get a quote and buy your policy in just a few minutes, all on their website .

Your coverage kicks in as soon as your trip starts . And if you're the type who sometimes forgets things during pre-trip excitement (I know I do!), no worries. You can still get protected while you're already on the road , though there might be a short 72-hour waiting period.

Here's a quick rundown of how this travel insurance works:

Head to the World Nomads website and click "Get A Quote".

Pop in your travel details (where you're going, where you're from, and your dates).

Boom! Instantly see quotes for both their Standard and Explorer plans – pick the one that fits your adventure.

Double-check your coverage details and you're all set!

Plans are flexible and comprehensive

World Nomads always have the right plan for your trip, whether you're off on a short adventure or settling in abroad for a while. Let's break down what they've got.

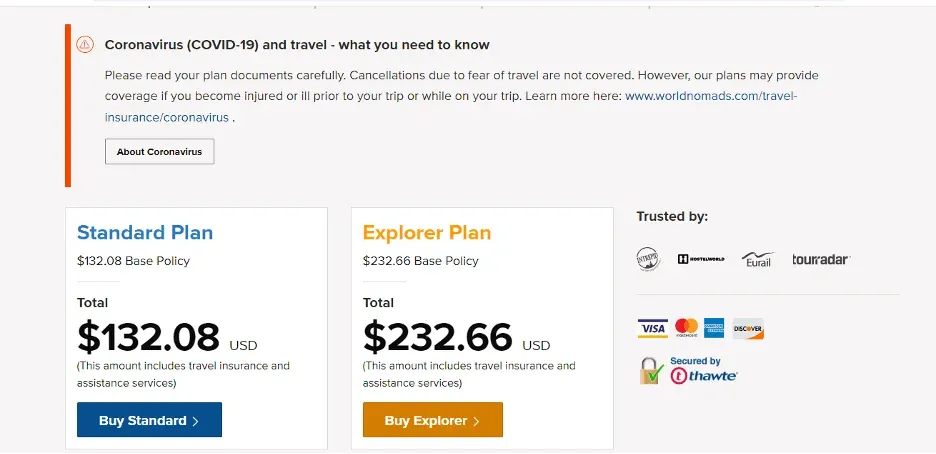

Standard Plans vs. Explorer Plans

World Nomads keeps things simple with two main plans: Standard and Explorer . Both cover the essentials like medical emergencies, cancellations, and your gear. Naturally, Explorer plans boost your coverage limits and protect more activities – but they also cost a bit extra .

Here's a quick side-by-side to make the comparison easier:

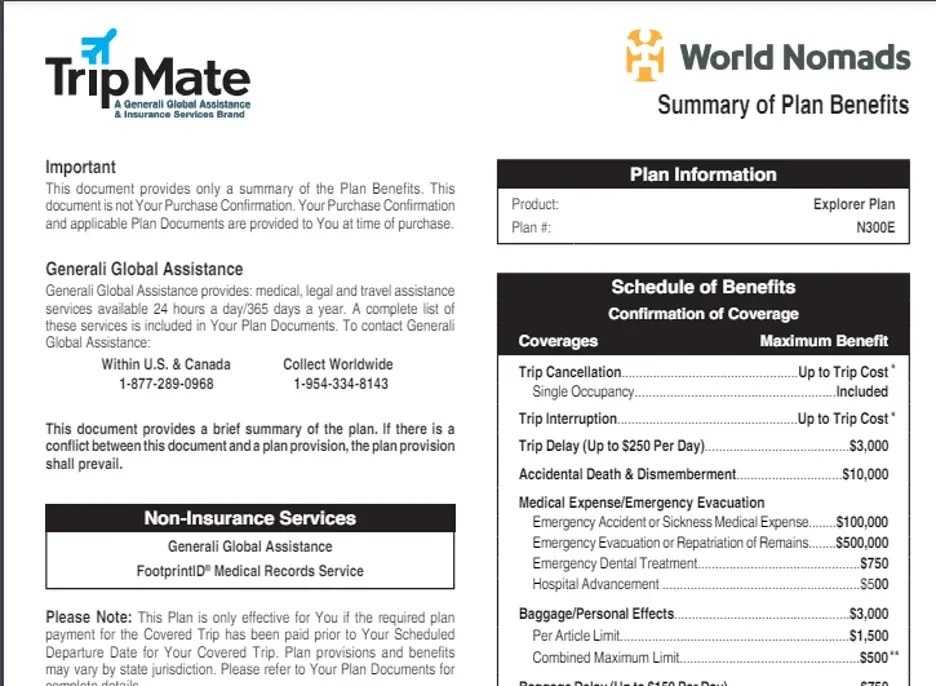

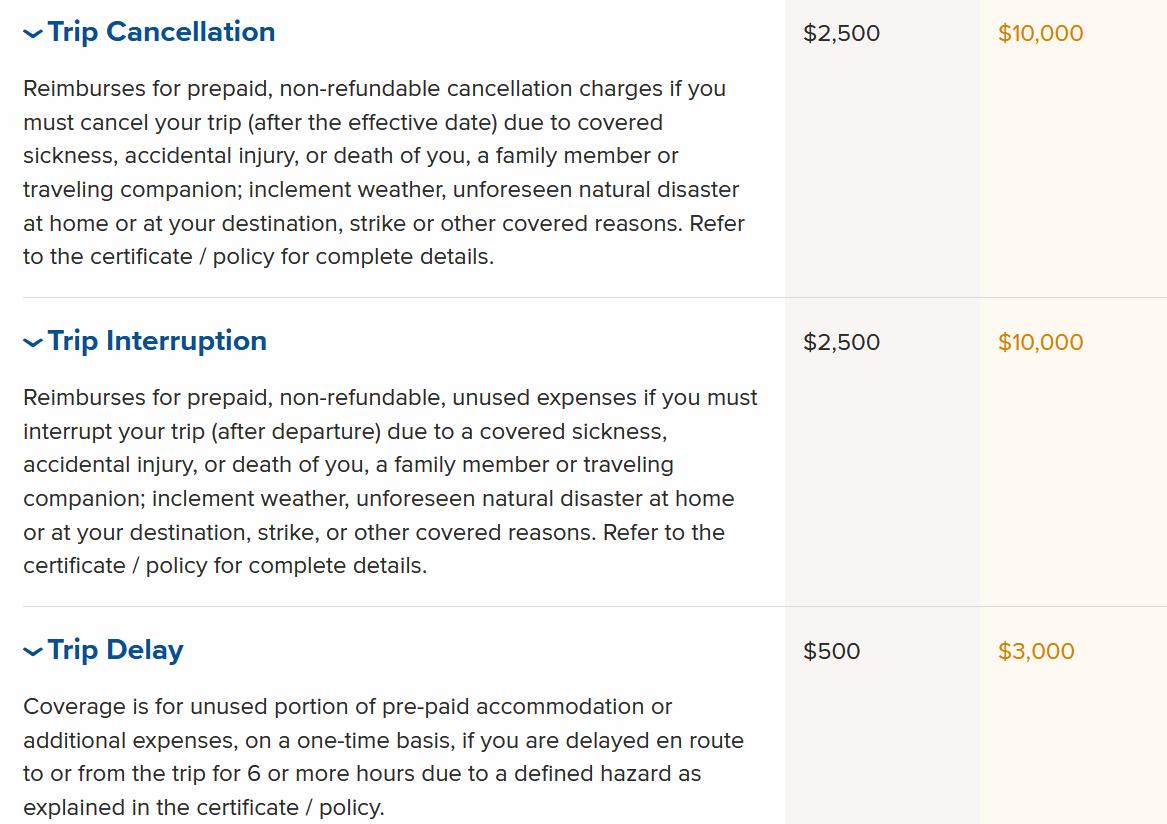

- Trip protection : Stuff happens, unfortunately. Both plans have your back if you need to cancel for reasons like a family emergency or a natural disaster. Standard plans cover up to $2,500 , Explorer bumps that up to $10,000.

- Emergency evacuation: This covers transportation if a serious situation arises, like a family member passing away or needing urgent hospitalization. Standard offers up to $300,000 , Explorer up to $500,000 .

- Emergency medical care: Accidents and sudden illnesses can happen anywhere. Both plans have you covered for up to $100,000 for those unexpected medical needs.

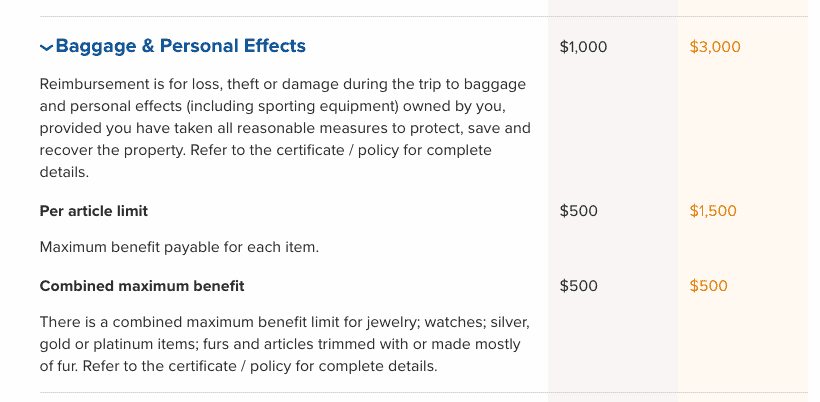

- Lost or damaged gear: Take it from someone who's been there – this is very important! Both plans help replace your damaged, lost, or stolen bags, tech – all the important stuff. Standard covers up to $1,000, Explorer up to $3,000.

- Activities: They cover over 200 activities , but if you're an adrenaline junkie, definitely double-check what's included. More on that later in this review!

- Accidental Death: Standard plans will pay a death benefit of $5,000 , if you pass away because of an accident or are dismembered. Explorer plans will pay $10,000 .

Single and Multi-Destination Coverage

World Nomads works whether you're sticking to one country or traveling to multiple destinations .

Their multi-destination plans make things super easy – a huge relief if something like your passport goes missing on the road!

Long-Term Coverage

If you're a US-based digital nomad , World Nomads has you covered for up to 6 months at a time .

And if you're loving your temporary home abroad and those 6 months fly by, renewing your policy is extremely easy – it kicks in right at midnight the next day .

Adventure Without Worry with World Nomads

They cover your favorite activities, wherever you roam.

They cover over 200 activities

Let's be honest, if you were just going to work the whole time, you might as well stay home! World Nomads gets that exploring is a major part of the digital nomad lifestyle! So, they offer one of the best travel insurances for adventurous travelers, covering over 200+ activities .

In their Standard plans alone, World Nomads covers over 70 sports and activities, including:

- Soccer (or football, whichever you prefer!)

- Weight training

- Martial arts

Explorer plans go even further! But hey, every insurance plan has its limits, and super high-risk activities usually aren't included. So, before you start packing those hiking boots or your scuba gear, be sure to double-check their website for the full list of what's covered .

Some Things to Keep in Mind about World Nomads Travel Insurance

Common exclusions still apply.

Like any insurance, World Nomads has some limits on what they'll cover. If you get hurt doing something illegal, while under the influence, or that's considered seriously reckless...chances are World Nomads won't be covering you .

Pre-existing medical conditions also tend to be excluded . For this reason, it's always smart to read the not-so-fun parts of your policy – those exclusions – to make sure you understand them and ultimately find the best travel insurance for your circumstances.

It's not the cheapest option out there

World Nomads is perfect for adventurous travelers . But for someone like me whose main sport in the morning is a gentle yoga routine, or a dip in the ocean, you might find more budget-friendly travel insurance options .

After all, World Nomads covers a ton of riskier activities and emergency medical care , which understandably comes with a slightly higher price tag .

To give you an idea, a World Nomad Standard plan for a 45-year-old US resident traveling to Europe for 90 days (about 3 months) is roughly 3% more expensive than a comparable SafetyWing plan . That difference gets even bigger for younger travelers – almost twice as much for someone who's 25.

You might also be interested in:

Customer service reviews are mixed

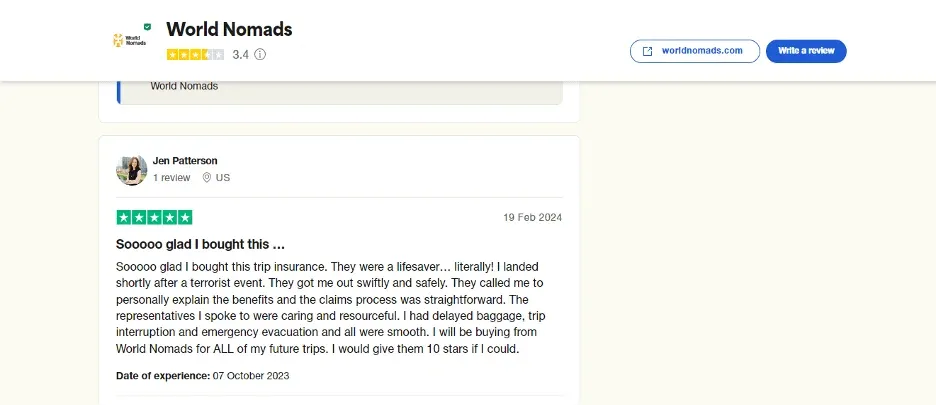

While World Nomads offers 24/7 emergency assistance (which is crucial!), their everyday customer service gets mixed reviews.

World Nomads travel insurance has 3.4 out of 5 stars on Trustpilot. There, you'll find plenty of happy customers praising their easy claims process and the support they felt in a crisis .

But, others mention issues with missing paperwork, their website, or frustrating claims experiences .

It's not ideal for long-term travelers

World Nomads does offer plans for longer trips, but if you're planning to be away for more than 6 months, there are some things to keep in mind:

- Coverage gaps: Ugh, the worst. Your policy will automatically expire after 6 months , and when you renew, there's a waiting period before your new coverage starts . Not ideal! Other travel insurance companies like Safetywing or Genki let you extend your policy without any breaks in coverage – kind of like a subscription service, which is definitely easier.

- Prices can vary: World Nomads prices your policy based on where you're going. Some other companies offer a flat rate for multiple destinations, which could potentially save you some money.

- Pre-existing conditions aren't covered : As discussed before in this guide, World Nomads excludes treatment for pre-existing conditions. You might find other travel insurance companies that provide that for long-term digital nomads or expats .

Making a Claim with World Nomads

World Nomads makes the claims process as straightforward as possible with an online guide – that's always a good sign!

But remember, they're not your everyday travel medical insurance . They're designed for those unexpected emergencies – hospital stays, evacuations, those major situations. For smaller issues, you'll probably need to pay upfront and get reimbursed later . And if it's a serious emergency, always contact their emergency assistance team first!

How you file a claim might change slightly based on your location, but the general process is the same:

Collect your receipts and keep them safe! You'll need them.

Head to their website , log in (or create an account) and click "Make a claim".

Select your policy in their dashboard and file a separate claim for each incident .

Answer their questions regarding your claim.

List your expenses and provide answers to their questions.

Upload those receipts and any other supporting documents they request.

Submit your claim – you'll receive an email confirmation from Trip Mate and your claims number.

If any further information is required, you'll be contacted by Trip Mate . Once all your information is received, they will make a determination about your claim within 20 business days . Claims are paid by electronic email or check .

Are There Any Travel Insurance Alternatives to World Nomads?

World Nomads isn't the only product on the travel insurance map. Other companies offer travel plans with different features and coverage amounts. Let's see the top alternatives.

SafetyWing offers pay-as-you-go coverage at affordable rates in over 180 countries . Their plans are nomad-friendly as you can pay upfront for a specific amount of time or continuously every 4 weeks, with the right to cancel at any time . Medical care doesn't have to be provided by a medical professional within their network, so you can visit any local provider and then file a claim.

The downside is the maximum amount of coverage they provide is $250,000 for medical coverage, property, and travel delay.

Genki provides both travel insurance and international health insurance . Their travel insurance plans resemble other policies regarding medical care, activities, and emergency transport. Where Genki really stands out is with its international health insurance plan, Genki Resident . This coverage is most like a comprehensive health insurance plan. It covers pre-existing conditions, check-ups, mental health treatments, pregnancy and more . You can choose a deductible to lower the cost of your travel health insurance and choose between the Standard and Premium of their international plans.

Heymondo offers annual multi-trip coverage and travel insurance with varying benefit levels to choose from. You can download their app to get assistance at the drop of a dime. You can chat, make emergency calls, and manage incidents all through the app.

The Bottom Line

World Nomads deserves kudos for becoming one of the first travel insurance companies to consider the needs of digital nomads , way before the world went remote due to Covid-19.

But the world of travel insurance has expanded since then , and so have our options as frequent travelers. If you're the type who needs coverage for serious adventure activities, World Nomads is still a great option. But, for those of us who prefer a budget-friendly plan with solid basics, there might be better deals out there .

So, before you commit to World Nomads, check out other travel insurance companies . You just might find the perfect fit for your travel style (and your wallet!).

Ready to Get Insured and Travel Safe?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

Sign up for our Newsletter

Receive nomad stories, tips, news, and resources every week!

100% free. No spam. Unsubscribe anytime.

You can also follow us on Instagram and join our Facebook Group if you want to get in touch with other members of our growing digital nomad community!

We'll see you there, Freaking Nomads!

Disclosure: Hey, just a heads up that some of the links in this article are affiliate links. This means that, if you buy through our links, we may earn a small commission that helps us create helpful content for the community. We only recommend products if we think they will add value, so thanks for supporting us!

Heymondo Review: Is It a Good Travel Insurance?

Wise travel debit card review: fees, exchange rates, limits and how to use it, how to set up and manage an esim on iphone.

- World Nomads Travel Insurance Review

World Nomads Plans Available

World nomads travel insurance cost.

- How to File A Claim with World Nomads Travel Insurance

Compare World Nomads Travel Insurance

World nomads travel insurance faqs.

- Why You Should Trust Us

World Nomads Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

If you're looking for travel insurance that allows you to confidently participate in a wide range of sports and adventure activities around the world, then World Nomads Travel Insurance might be right for you. The company's policies cover travel to almost anywhere on the globe and are available to residents of nearly every country.

World Nomads Travel Insurance Summary

Among the best international travel insurance companies , World Nomads is particularly good at insuring athletes, covering well over 300 sports, including skydiving, bungee jumping, and golf. World Nomads is also a great last-minute purchase, allowing you to purchase coverage even after your trip has started. However, if you purchase a plan after departure, you will have to wait 72 hours before your plan kicks in.

That said, World Nomads lacks crucial coverage options, such as cancel for any reason coverage and coverage for pre-existing conditions. It also doesn't insure travelers older than 70.

Additionally, the service has received middling reviews from customers, averaging 3.4 stars out of five across 2,510 reviews. Customers often complained about their lengthy claims processes and poor customer service.

Some also took issue with the "Nomads" branding, as some travelers with multiple destinations and long-term trips found their trip wasn't covered by Nomads' specific policies. It's worth noting that World Nomads was very responsive to positive and negative reviews on Trustpilot.

World Nomads has two basic policies: Standard and Explorer. Each covers essentially the same things, but Explorer has higher amounts than World Nomads is willing to pay out for claims. The company's policies cover more than 150 specific activities. These range from bungee jumping and rock climbing to hang gliding and hot-air ballooning. You can see the full list on the company's website.

Additional Coverage Options (Riders)

One of the most common upgraded features of a travel insurance policy is cancel for any reason (CFAR) , where you really can cancel for reason beyond what's in a standard policy. This is not available on every policy, but it is often a feature that travelers are looking for while shopping for travel insurance before their trip. At this time, World Nomads doesn't offer CFAR coverage.

At the time of this review, World Nomads also offers sports equipment coverage. In February of 2022, it expanded coverage to include more than 150 sports and activities including Pickleball and FootGolf. It currently covers over 300 sports. So, as you can imagine, plans with sports coverage will cover virtually any sport you might play.

You can obtain a quote from World Nomads on its website by providing details about you and your trip. Be prepared to provide the following information:

- Your destination(s)

- Duration of trip

- Your country of residence

- State of residence (if you're from the US)

- Number of travelers

- Traveler(s) age

Notably, World Nomads does not ask you for the price of the trip, which many travel insurance companies factor into the trip of your policy. As such, World Nomads may be a good option if you're going on a particularly expensive trip.

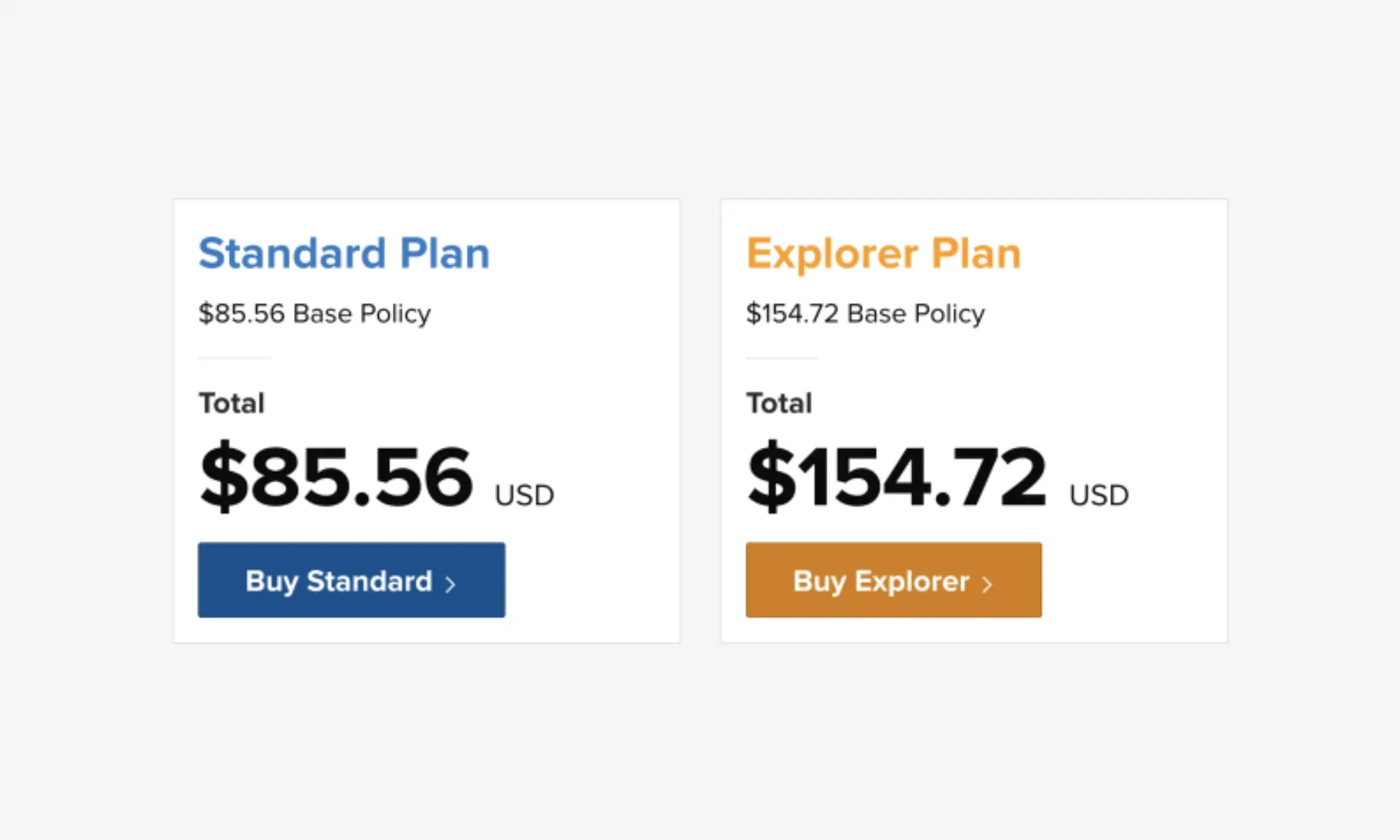

We ran a few simulations to offer examples of how much a World Nomads policy might cost. You'll see that costs usually fall between 5% and 7% of the total trip cost, depending on the policy tier you choose.

As of April 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following World Nomads travel insurance quotes:

- World Nomads Standard: $76.58

- World Nomads Explorer: $123.34

Premiums for World Nomads's plans are well below the average cost of travel insurance .

World Nomads provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

- World Nomads Standard: $85.83

- World Nomads Explorer: $155.06

Once again, premiums for World Nomads plans are between 2.2% and 3.8%, below the average cost for travel insurance.

A couple of 65-years of age looking to escape New York for Mexico for two weeks with a trip cost of $6,000 would have the following World Nomads quotes:

- World Nomads Standard: $152.96

- World Nomads Explorer: $276.34

Premiums for World Nomads plans are between 2.6% and 4.6%, once again below the average cost for travel insurance. This is especially impressive as travel insurance is often more expensive for older travelers.

How to File A Claim with World Nomad Travel Insurance

You can start an insurance claim by filing it on the company's website.

You can call toll-free in the US and Canada if you need to reach the company in an emergency at: (877) 289-0968.

Callers from outside the US and Canada can reach the company at: (954)-334-8143.

The email address is: [email protected]

You'll need to have the following ready to file a claim:

- Your policy number

- A contact number

- The nature of your problem

- Your location

- Prescribed medication (if any)

Keep any documents related to the claim you're filing, including receipts, notices, and invoices.

World Nomads is particularly good at insuring traveling athletes, but let's see how it stacks up against the best travel insurance companies .

World Nomads Travel Insurance vs. Allianz Travel Insurance

Allianz Travel Insurance is a strong competitor against World Nomads, especially for travelers looking for a more business-oriented option. The company has been in business for more than 120 years and offers a wide range of insurance, not just travel-related, around the world. A key difference between World Nomads and Allianz Travel Insurance is that Allianz Travel Insurance offers travel insurance that can cover multiple trips in the same year. You can take an unlimited number of trips within the same calendar year, but you do have to double-check that all of your destinations are covered by the policy you select.

Another difference is that Allianz Travel Insurance offers pre-existing condition waivers for qualifying customers. World Nomads doesn't have the same coverage, requiring that the pre-existing condition is fully stable in order for limited coverage with respect to trip cancellations or having to end a trip early.

Read our Allianz travel insurance review here.

World Nomads Travel Insurance vs. AIG Travel Guard

Travel Guard , a product backed by AIG Travel, is another potential alternative to World Nomads. AIG is a prominent player in the insurance industry, and the Travel Guard product represents true global coverage.

Unlike World Nomads, Travel Guard has coverage for pre-existing medical conditions, but there are conditions. Travelers must purchase their policy within 15 days of the initial trip payment to qualify for a pre-existing condition waiver.

Both travel insurance companies use a tiered approach, but Travel Guard has higher dollar amounts across the board. For example, trip cancellation for Travel Guard covers 100% of the trip cost, while with World Nomads the amount will depends on the tier of the coverage you purchase. Trip Interruption is also a fully covered event with Travel Guard's. Depending on the plan selected, it will either cover 100% or 150% of the trip cost.

If you're concerned about COVID-19 coverage with trip insurance, there's more coverage with World Nomads than Travel Guard. With Travel Guard, coverage for having to stay in a country past your original booking dates is an add-on, not a standard part of the policy.

Read our AIG Travel Insurance review here.

Compare World Nomad vs. Credit Card Travel Insurance

If you already have a major credit card in your wallet, you most likely have some travel insurance benefits that come with it. These benefits do vary from card to card. Be sure to check your card's specific policies.

Not all credit cards will feature travel insurance protection. The ones that do may have specific limitations. For example, many credit cards with travel protection require that your airfare is paid for with the card in question for protections to take effect.

Reimbursement isn't guaranteed. The credit cards do require that you file your claim and wait for a decision. World Nomads makes it easy to file a claim online and submit receipts and documentation. The response is fairly quick based on reviews from travelers who have actually had to file claims.

The more premium the credit card, the more likely expanded travel protections are part of its features. If you don't already have a premium credit card, it's better to get travel insurance. This is also the case if you have multiple trips planned. Some credit cards limit not just the total dollar amount, but the number of claims within a 12-month period.

Read our guide on the best credit cards with travel insurance here.

Yes, you can extend your World Nomads plan while traveling, but you cannot upgrade a standard plan to the Explorer plan.

World Nomads covers COVID-19 like any other illness under its emergency medical coverage.

You can file a claim on World Nomads's website, over the phone, or by mail. Make sure to provide as much documentation as possible to ease the claims process.

World Nomads currently covers 326 sports and adventure activities, from ziplining to zorbing.

Yes, you can purchase World Nomads insurance for a trip that has already started. However, a policy purchased during your trip will have a 72-hour waiting period before insurance starts.

How We Reviewed World Nomads Travel Insurance

To prepare this review on World Nomads, we started by detailing the company's travel insurance offerings. Then we looked at the best travel insurance plans and compared them to World Nomads. We looked at things like typical policy costs, coverage options, available add-ons, what's covered, and claim limits.

You can read more about how Business Insider rates insurance products here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

9 Best Nomad Travel Insurance Options

Elina Geller is a former NerdWallet travel writer specializing in airline and hotel loyalty programs and travel insurance. In 2019, Elina founded TheMissMiles, a travel rewards coaching business. Her work has been featured by AwardWallet. She is a certified public accountant with degrees from the London School of Economics and Fordham University.

Anya Kartashova is a freelance writer and full-time traveler based in Salt Lake City. She has written about travel rewards and personal finance for FrugalTravelGuy, Fodor's, FlyerTalk, 10xTravel and Reward Expert. Her goal is to visit every country in the world by offsetting the cost with points and miles.

Megan Lee joined the travel rewards team at NerdWallet with over 12 years of SEO, writing and content development experience, primarily in international education and nonprofit work. She has been published in U.S. News & World Report, USA Today and elsewhere, and has spoken at conferences like that of NAFSA: Association of International Educators. Megan has built and directed remote content teams and editorial strategies for websites like GoAbroad and Go Overseas. When not traveling, Megan adventures around her Midwest home base where she likes to attend theme parties, ride her bike and cook Asian food.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

1. World Nomads

2. safetywing, 3. atlas travel insurance, 4. allianz global assistance, 5. insured nomads, 6. img global, 7. heymondo, 8. travelex insurance, 9. aig travel guard, nomad travel insurance recapped.

Travel insurance can safeguard your nonrefundable reservations and reimburse you for any unexpected emergency medical costs that you incur while traveling. However, the travel health insurance needs of those taking several short vacations per year will vary from those of digital nomads, who may spend significant portions of the year living and working from abroad.

Digital nomads may also return home less often, travel with equipment (e.g., laptop, camera, etc.), participate in adventurous activities and want access to health insurance, especially if they don’t have that coverage back home.

Given the prevalence of remote work and increasing options to live and work from abroad, here you'll find some of the most popular nomad travel insurance options .

World Nomads is a travel insurance provider that offers coverage for residents of many countries and also allows you to extend your coverage mid-trip. It is underwritten by Nationwide Insurance. Regardless of which plan you choose, the health insurance limits are fairly good.

Importantly, the provider does not have a pandemic exclusion, so COVID-related claims are covered. However, World Nomads specifically states that fear of travel is not a valid reason for trip cancellation. So if you’d like the option to cancel a trip at your discretion, you’ll want to consider plans that offer Cancel For Any Reason coverage .

There are two trip insurance policies available from World Nomads: Standard and Explorer. The Standard Plan has lower coverage limits and includes more than 200 sports (including some adventure sports), while the Explorer Plan adds on 60 other activities and sports, including more dangerous ones such as shark cage diving, skydiving and paragliding.

The inclusion of athletic activities in both World Nomads plans is unique, since most traditional travel insurance plans exclude them.

Here's a list of what's included with World of Nomads coverage:

Trip cancellation, interruption and delay.

Emergency healthcare coverage, evacuation, repatriation and 24-hour assistance services.

Accidental death and dismemberment.

Nonmedical emergency transportation.

Baggage delay and loss.

Rental car damage (Explorer Plan only).

Adventure sports and activities.

And here are a few items of note that are excluded (not a comprehensive list):

Pre-existing conditions.

Self-harm or accidents occurring while intoxicated.

Finally, coverage can’t exceed 180 days, so if you’re traveling abroad longer than that, you’d have to renew your plan once the current coverage period ends.

To see how World Nomads compares to other travel health insurance providers, we considered a sample 180-day trip to multiple countries by a 30-year-old resident of Colorado.

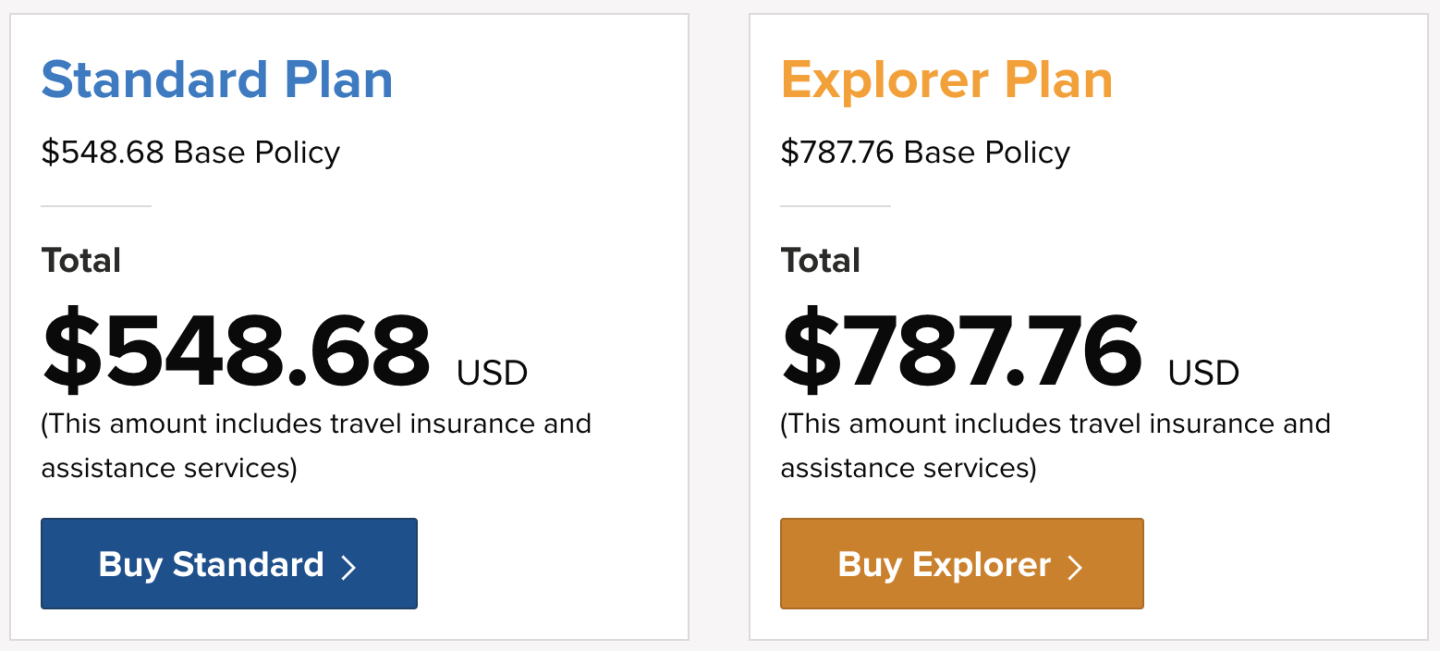

Due to the lower limits and less coverage for adventure activities, the World Nomads Standard Plan is priced at $549, which is meaningfully cheaper than the $788 Explorer Plan.

It's important to note that if your nonrefundable prepaid trip costs are more than $2,500, the Standard Plan will cover you only up to $2,500 on trip cancellation. In this case, you’d want to consider the pricier Explorer Plan, which provides coverage up to $10,000 on trip cancellation. Notably, emergency accident & medical coverage is $100,000 on both plans, which offers a lot of assurance, especially if you’re abroad for a long time.

The most significant advantage of World Nomads is coverage for adventure activities. In this case, assessing the suitability of the plan has more to do with the type of coverage you’re looking for than price. Because of the multitude of advantages of World Nomads plans over various providers, we've named World Nomads as one of the best travel insurance companies out there. Check out our full rationale here: Best Travel Insurance Right Now .

SafetyWing is another popular digital nomad travel health insurance option that also offers COVID coverage. You can purchase your policy while you’re abroad, which makes it easy for those who are already traveling and decide to get insurance coverage mid-trip.

Unless you are a resident of North Korea, Cuba or Iran, you can purchase a SafetyWing policy. The default length of coverage is 28 days, and the policy will continue to renew unless canceled (maximum policy length is 364 days).

SafetyWing also provides U.S. citizens with incidental coverage in the U.S. for up to 15 days out of every 90 days. Despite the U.S. coverage, SafetyWing is meant to provide medical and travel insurance coverage while you’re abroad; it does not meet the health insurance requirement under the Affordable Care Act.

Trip interruption and delay.

Emergency medical and dental expenses.

Emergency medical evacuation, repatriation of remains and accidental death.

Lost checked luggage and lost visa/travel documents.

Return of minor children and pets.

Political evacuation and border entry protection.

Excluded (not a comprehensive list):

Mental health disorders.

Intentional acts or damages sustained under the influence of drugs or alcohol.

The cost of a SafetyWing policy is based on your age and whether you’d like health insurance coverage while you’re in the U.S. For example, a four-week policy for someone aged 18 to 39 years old who doesn’t need health insurance coverage in the U.S. will cost $45. If you would like coverage while in the U.S., the policy cost jumps to $83.

A 180-day coverage comes out to $290 for a traveler between ages 10 and 39, but increases to $536 if you want to add on U.S. coverage. A deductible of $250 applies every time you start or renew a policy.

Overall, the options to purchase a plan mid-trip and receive health insurance coverage while in the U.S. are some of the main benefits of a SafetyWing policy.

Atlas Travel Insurance offers health insurance plans for digital nomads and long-term travelers looking for medical coverage (including for COVID-19) and some supplemental trip benefits (e.g., trip interruption). When selecting a policy, you’ll need to specify if you’d like to include the U.S. within your coverage area. Coverage limits decrease with age, and the plans offer varying levels of deductibles.

Medical expenses and emergency dental.

Emergency medical and political evacuation.

Trip interruption; travel delay.

Lost checked luggage and stolen visa/passport.

Natural disaster and border entry protections.

Repatriation of remains; accidental death and dismemberment.

Many adventure sports.

Various diseases including cancer.

Self-inflicted injuries and those arising when under the influence of drugs or alcohol.

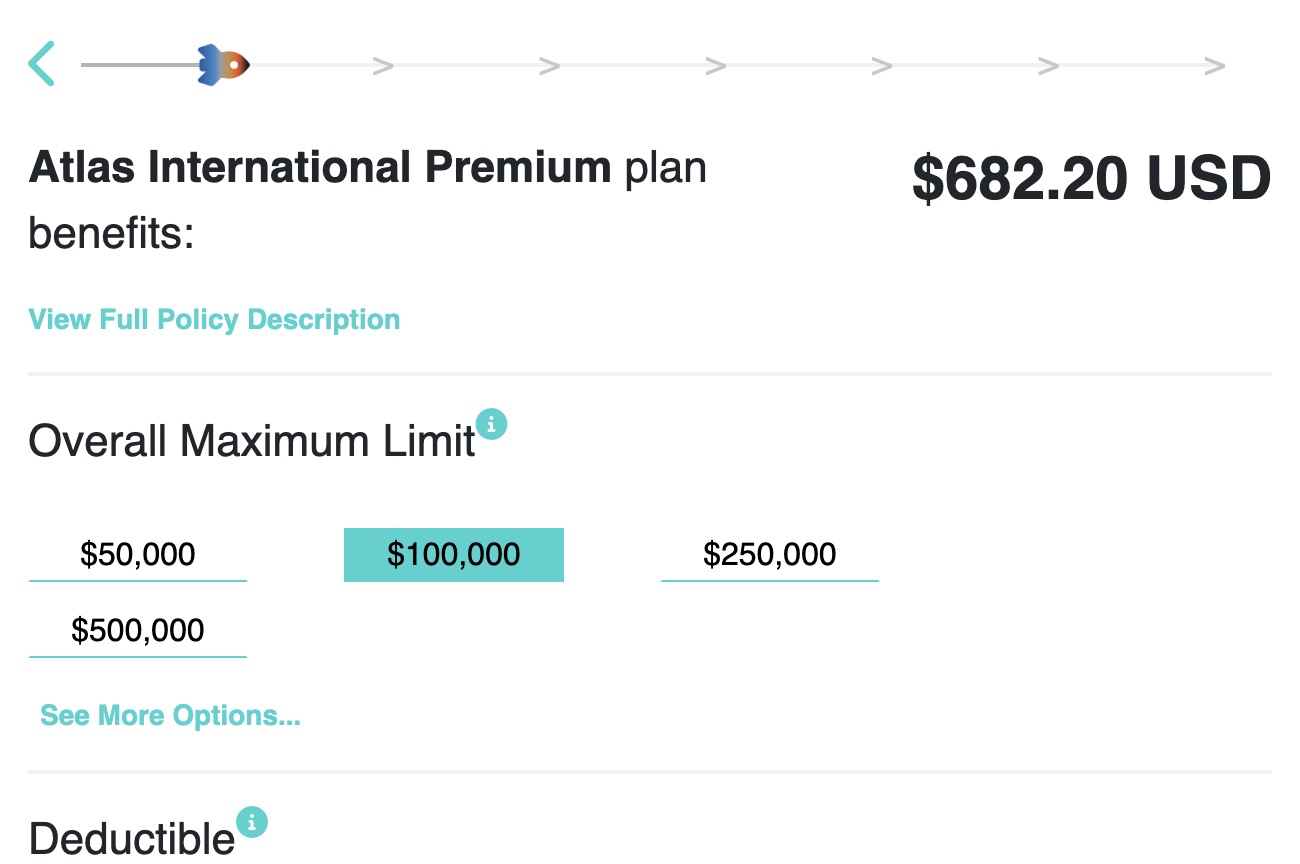

To compare these plans, we used the same parameters as the preceding example: a 180-day trip by a 30-year-old. Atlas offers two options to digital nomads: Atlas International and Atlas International Premium, which cost $274 and $682, respectively.

The main difference between these two Atlas plans is that the Premium option offers higher coverage limits.

It's also possible to customize the overall maximum limit and the deductible on both policies, so if you don’t want to go with the more Atlas International Premium plan, you can up the limits or change the deductible on the Atlas International plan.

Allianz Global Assistance offers affordable coverage for annual or multi-trip travel. It’s more cost-effective than purchasing coverage for separate trips individually. Allianz’s multi-trip policy covers trips up to 45 days in length.

Allianz is best for travelers who take multiple trips per year from their home base and not those who travel overseas for an extended period of time.

Covered illness.

Missed or delayed departures.

Baggage loss or delays.

A tropical storm (before it’s named).

Loss of passport.

Unforeseen pregnancy complications.

Losses that arise from foreseeable events.

War or civil unrest.

Participating in extreme or high-risk sports.

Flying an aircraft as pilot or crew.

Terrorist events.

Allianz plans limit or exclude coverage related to COVID-19 or resulting from Russia’s invasion of Ukraine.

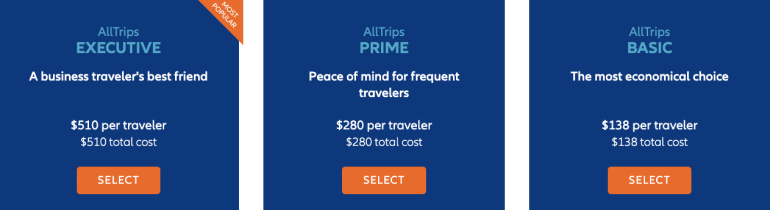

Allianz Global Assistance offers a few annual plan options to digital nomads. The plans last a full year, so keep that in mind when comparing costs with other nomad insurance providers. The plans are Basic, Prime and Executive, quoting $138, $280 and $510 per year, respectively.

The Basic insurance plan from Allianz is designed for medical emergencies and provides some travel coverage, but it doesn’t provide any trip cancellation or trip interruption coverage.

The Prime plan provides affordable trip protection and medical coverage abroad.

The Executive plan is designed for business travelers by providing higher coverage limits and rental car damage and equipment rentals. The Executive plan covers personal vacations in addition to business trips .

It's also possible to sign up for a Premier plan, which lasts up to 365 days but covers up to 90 days of consecutive travel.

Insured Nomads provides medical coverage, travel insurance and trip cancellation to digital nomads, remote workers and expats.

Insured Nomads offers four plans, and they all have their own function. For example, the World Explorer plan provides coverage for a single trip lasting between seven and 364 days away from home, and the World Explorer Multi offers coverage for multiple trips within a single year. Plans are available to citizens of any country, not just the U.S.

Depending on the plan, you’ll have the option to add adventure sports, pet insurance, accidental death and dismemberment and car rental insurance for an extra fee.

Medical benefits, including 24-hour emergency medical care.

COVID-19 coverage.

Acute onset of pre-existing condition.

Emergency dental treatment.

Local ambulance transport.

Natural disaster accommodations.

Evacuation and repatriation.

Airport lounge access for delayed flights.

Lost luggage.

War and terrorism.

Public health emergencies or natural disasters in countries deemed Level 4 by the U.S. Department of State.

Illegal acts.

Injuries sustained while under the influence of drugs or alcohol.

Extreme sports (unless an add-on was purchased).

The quote for a traveler between the ages of 30 and 39 looking to travel to Mexico for six months with the World Explorer plan costs $679. This plan has a medical benefit limit of $250,000 and a deductible of $100. Increasing the medical benefit maximum to $1,000,000 increases the premium to $830, and that’s without any of the additional benefits, such as adventure sports or marine activities.

» Learn more: How to find the best travel insurance

IMG Global offers an insurance plan just for expats and citizens of the world called Global Medical Insurance. It’s a medical-only plan that doesn’t offer trip protection, but offers medical coverage worldwide.

Several tiers of Global medical insurance from IMG Global are available: Bronze, Silver, Gold and Platinum. The more expensive the plan, the lower the deductible and the higher the policy maximum.

The following expat insurance rates are for a 30-year-old traveler whose primary travel destination is Spain.

The deductible amounts can be adjusted in every plan above to reduce the monthly payment. Additionally, the total coverage cost for the year can be reduced with an annual payment. An optional dental and vision rider is available for the policy you pick.

Undoubtedly, the cost is on the high end, but it does come with some noticeable extras, such as COVID-19 coverage , telemedicine and mental health professional counseling, that most travel insurance providers don’t cover.

It’s possible to purchase a World Explorer policy after you’ve left on your trip, and you can extend coverage by up to six months beyond the initial policy purchase.

In addition to the Global Medical Insurance, IMG Global offers the following plans to long-term travelers:

The Global Employer Option: Medical coverage for internationally assigned employees.

International Marine Medical Insurance: Health insurance for long-term (longer than one year) marine crew.

MP+ International: Group travel insurance for mission groups.

Heymondo offers comprehensive travel insurance plans to short-term and long-term travelers. Digital nomads and expats can purchase a Long Stay plan for trips longer than 90 days. The initial coverage is capped at 90 days, but you can renew if necessary. You can also add electronics and adventure sports riders to the Long Stay policy at an extra cost.

Coverage is available to travelers between 90 days old and 49 years old.

What’s included :

Emergency medical and dental coverage (with a $250 deductible).

Medical transport and repatriation home.

Baggage delay , theft and loss.

Travel delay or a missed connection.

Natural disaster.

Personal liability.

Accidental death or disability.

What’s not included (not a comprehensive list):

General medical check-ups.

Trips aimed at receiving medical treatment.

Burial, ceremony and coffin costs in the repatriation of remains.

Petty theft.

Damage caused by strikes, earthquakes or radioactivity.

Motor vehicles.

A 90-day global coverage that excludes travel to Canada and U.S. costs $257 upfront. You can renew coverage once it expires or prepay for additional coverage at the following prices:

30 days: $76.

120 days: $304.

180 days: $456.

275 days: $731.

Notably, medical coverage includes COVID-19, including medically prescribed PCR tests and extra lodging expenses when you’re prescribed a medical quarantine .

» Learn more: Best long-term travel insurance options

Travelex Insurance offers long-term nomad insurance with its Travel Select plan, which is one of the provider’s comprehensive travel insurance plans . This plan covers trips up to 364 days. You must select travel dates and provide the cost of your trip to get a quote.

A 30-year-old Colorado resident traveling to Italy for six months will pay $734 for a Travel Select plan from Travelex Insurance to cover a trip that costs $5,000. It comes with:

100% trip cancellation.

150% trip interruption.

$2,000 trip delay (with a $250 daily limit).

$1,000 baggage loss.

$200 baggage delay.

$50,000 emergency medical expense.

$500,000 emergency medical evacuation and repatriation.

$25,000 accidental death and dismemberment.

Pre-existing conditions waiver : available if purchase conditions are met (more on this below).

Add-ons to the Travel Select plan include double the medical expense, adventure sports rider, car rental collision protection , extra accidental death and dismemberment coverage and even Cancel for Any Reason coverage covering 75% of the insured trip's cost (though the covered trip cost maxes out at $10,000).

The good thing about this plan is it provides coverage for pre-existing conditions as long as you pay for insurance within 15 days of the initial trip deposit. Most annual policies notably exclude a pre-existing conditions waiver.

The bad thing is its high cost because of all the bells and whistles of a comprehensive plan.

AIG Travel Guard offers an annual plan that provides essential coverage to business and leisure travelers who are U.S. residents (not available for Washington state residents).

The Travel Guard Annual Plan is an option for travelers who take multiple trips within a single year (364 days), with a limit of 90 days per trip.

100% trip interruption.

Trip delay.

Missed connection.

Baggage loss or delay.

Medical expenses, including dental.

Emergency evacuation and repatriation of remains.

Non-flight accidental death or dismemberment.

Security evacuation.

War or acts of war.

Participation in a riot, civil disorder or insurrection.

Commission or an attempt to commit a felony.

Being under the influence of drugs or intoxicated above the legal limit.

Trips taken against a physician’s advice.

Release, escape or dispersal of nuclear or radioactive contamination, and pathogenic or poisonous biological or chemical materials.

A Travel Guard Annual Plan comes out to $242 for a Colorado resident, which is a pretty good deal considering all the inclusions — but remember that your trips cannot exceed 90 days each, so its usage is limited to remote workers taking shorter trips.

» Learn more: How much does travel insurance cost?

Expats and digital nomads have different travel health insurance needs than the average traveler, so choosing a policy that aligns with your travel style is advisable.

If you’re looking for adventure sports coverage, World Nomads, Insured Nomads, Heymondo and Travelex Insurance all have the option to add a rider to their policies.

However, if those benefits aren’t relevant to you and you’d instead prefer to have the option of medical coverage when you’re abroad (and to a certain degree while you’re in the U.S.), consider SafetyWing or Atlas, which offer this feature. For medical-only coverage, IMG Global provides some options, albeit pretty expensive ones.

Additionally, take into consideration your travel style. Are you taking one long trip or multiple shorter trips within one year? Because Allianz and AIG Travel Guard won’t work well if you plan to be abroad longer than the limit specified in the policy.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2023 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

HelloSafe » Travel Insurance » World Nomads

Is World Nomads travel insurance the best in 2024?

verified information

Information verified by Alexandre Desoutter