- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit cards

A traveler’s guide to the Chase Travel portal

Tamara Aydinyan

Julie Sherrier

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Updated 5:23 p.m. UTC Nov. 28, 2023

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

hocus-focus, Getty Images

For qualifying Chase cardholders, the easy-to-use Chase Travel℠ portal offers a flexible and convenient way to book hotels, flights, rental cars, cruises and more using points or a combination of points and cash.

What is the Chase travel portal?

A favorite among frequent travelers for its versatility and redemption options, Chase Ultimate Rewards® (UR) is one of the major transferable credit card rewards points programs and UR points are Chase’s flexible rewards currency.

The Chase travel portal works much like an online travel agency (OTA) similar to Orbitz or Priceline where you can book hotels, flights, cars, activities and cruises. But unlike a traditional OTA, with the Chase travel portal you can book travel with your Chase card’s rewards points, cash or a combination of the two.

Who can use the portal?

A handful of exclusively Chase-issued credit cards grant cardholders access to the Chase travel portal, but how you can utilize the portal and the value you can receive is card-specific.

The following credit cards are the only cards that earn Chase Ultimate Rewards points outright:

- Chase Sapphire Reserve®

- Chase Sapphire Preferred® Card

- Ink Business Preferred® Credit Card * The information for the Ink Business Preferred® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

But if you or a household member own at least one of the cards above, the rewards on the following cash-back credit cards can be combined with any of the cards listed above and used as Chase Ultimate Rewards points:

- Chase Freedom Flex℠ * The information for the Chase Freedom Flex℠ has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Chase Freedom Unlimited®

- Ink Business Cash® Credit Card

- Ink Business Unlimited® Credit Card

And while the points earned cannot be combined with any of the UR-earning cards, the following pay-in-full card does have access to the Chase travel portal:

- Ink Business Premier℠ Credit Card * The information for the Ink Business Premier℠ Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Is the portal worth using?

It’s often said that having the right travel credit card is important, but knowing how to redeem your miles and points can be as paramount as which card you use to earn them. However, not everybody has the patience or interest to learn the intricacies of different rewards programs to maximize the value of every mile and point.

So while transferring UR points to individual loyalty programs is still one of the best ways to get the most cents per point at a 1:1 basis, for those who value simplicity, the Chase travel portal offers a straightforward way to book travel, earn and redeem points and still receive a great deal. Best of all, you won’t be limited by any loyalty program or award space availability.

When transferring points, the minimum you can transfer is 1,000 points to the following UR travel partners with either the Chase Sapphire Reserve, Chase Sapphire Preferred or the Ink Business Preferred cards:

Regardless of how you’re using the Chase travel portal, it’s worth considering the pros and cons.

- The standard rate for Ultimate Rewards points when redeemed for travel through the Chase travel portal is 1 UR point = 1 cent, but can be worth significantly more with the UR-earning cards. The Chase Sapphire Reserve gets a redemption value of 1.5 cents per point through the Chase Travel℠ portal while the Chase Sapphire Preferred and Chase Ink Business Preferred cards each get 1.25 cents per point.

- Since you’re not limited to any loyalty programs, you can use your UR points to book boutique hotels that you’d otherwise only be able to book with cash.

- Flights booked through the Chase travel portal can earn frequent flyer miles and can be used toward advancing your elite status.

- You can earn a substantial amount of bonus points when booking through the Chase portal depending on the card you’re using.

- You can use a combination of points plus cash to purchase your reservation.

- Hotels booked through the Chase travel portal do not earn hotel points or credits toward elite status. Any elite status perks you’d receive if booking directly with the hotel will likely be forgone.

- If you experience any issues while traveling, you’d have to go through Chase to resolve the issue. For example, if there is a problem with your hotel reservation, you’ll have to contact a Chase representative for help resolving it since you didn’t book directly with the hotel. Dealing with a middleman during travel emergencies is less than ideal and something to be wary of when considering booking through the portal.

- Southwest Airlines flights do not show up in the UR travel portal, but can be reserved by calling the Chase Travel Center at 855-233-9462.

How to book travel through the Chase travel portal

You can access the Chase travel portal by logging into your Chase account and clicking on the Rewards balance on the right or by going to the Chase Ultimate Rewards website .

Once you’re logged in, if you have more than one UR-earning Chase card, you’ll be asked to select one to proceed with — a crucial step as each card has different earning and redemption rates.

After clicking on your selection, you will be taken to the Ultimate Rewards dashboard. If you click on the Earn / Use dropdown button, all of your Ultimate Rewards options will be presented. Click on Travel to proceed to the portal.

Once in the travel portal, you’ll have the option of selecting the type of booking you’d like to make.

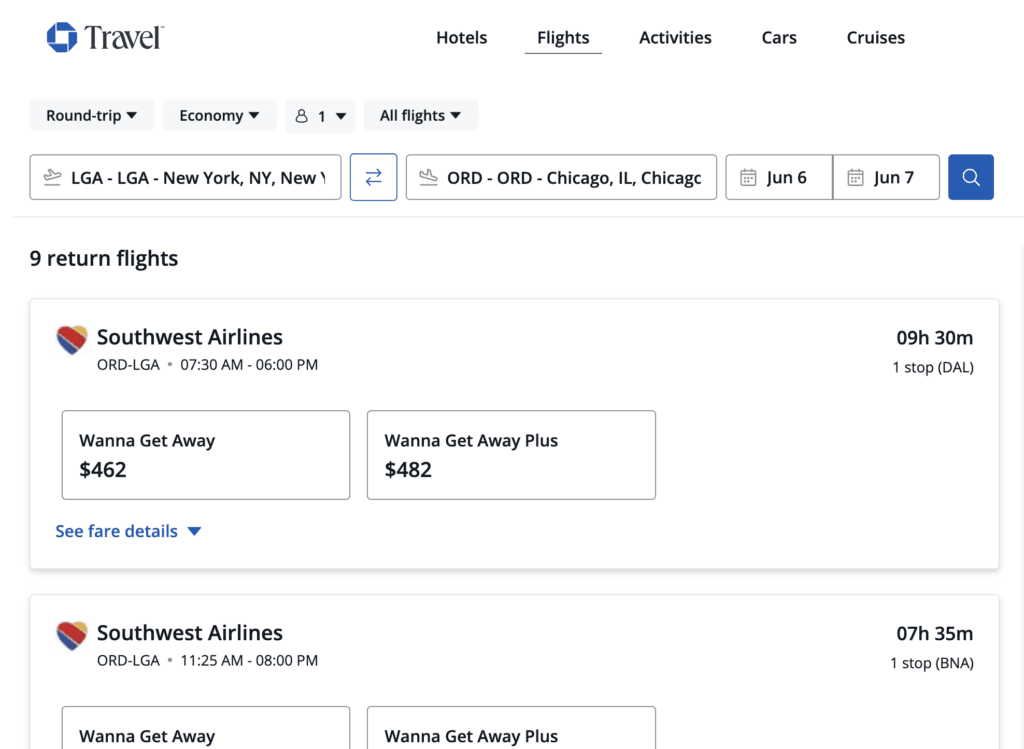

From there, your user experience will be similar to any other OTA where you can search your travel options.

Because the Chase travel portal doesn’t limit you to transfer partners or loyalty programs, you’ll be able to search almost all major airlines. One notable exception is Southwest Airlines, which is still bookable using UR points but will require a phone call to the Chase Travel Center to reserve your flight.

One difference compared to a traditional OTA is the option to buy in cash, points or a combination of both.

If you’re short on points or if you’d like to offset the cash price with some points, you’re given the option to choose how to pay.

After that, you’ll be prompted to enter your traveler information and you’re all booked. However, you will have to log into the specific airline with your reservation code in order to reserve seats.

Booking hotels through the Chase travel portal is a similar process. And with the portal’s easy-to-use search function, you can find boutique hotels that would otherwise be unbookable with loyalty-program-based points.

However, if you have elite status with a hotel chain, you’ll want to book directly rather than going through the Chase portal in order to access status benefits and have that hotel stay count toward achieving a higher status. Or, you can transfer UR points to one of three UR hotel loyalty program transfer partners, including Marriott Bonvoy, World of Hyatt or IHG One Rewards.

Rental cars can also be booked through the portal in a similar fashion. And as in many cases, being aware of which card you’re booking your car rental with can make a big difference in case of an accident as both the Chase Sapphire Reserve and Chase Sapphire Preferred offer primary car insurance , an uncommon, money-saving benefit, which saves you from having to file a claim with your private car insurance carrier first.

A quick guide to the Chase Ultimate Rewards program

As some of the most sought-after flexible points, Chase Ultimate Rewards can be accrued through several avenues. The most lucrative way is by applying for Chase credit cards and earning their respective welcome bonuses — but be wary of Chase’s 5/24 rule , which blocks applicants from opening a Chase credit card if they’ve opened five or more cards from any issuer in the past 24 months.

If you have two Chase cards that earn UR points, you can then transfer the rewards earned to the card that carries the most redemption value. For example, you can open the Chase Sapphire Preferred card and then the Chase Freedom Flex and move any points earned on the Flex card to the Preferred card, which has a boosted value of 25% more when redeemed through the portal.

Looking to add more than one new credit card to your wallet? Here’s why you shouldn’t apply for multiple cards at the same time.

Outside of regular credit card spending, you can also grow your Ultimate Rewards pile by using the Chase shopping portal. By adding just one extra step to your online shopping, you can earn bonus points for your future travels.

While transferring points to partners is one option to maximize the value of your Chase Ultimate Rewards points, there are numerous other ways to use the Chase Ultimate Rewards program to your benefit. Whether it’s redeeming your points as a statement credit for eligible, rotating categories throughout the year through the “Pay Yourself Back” feature, booking special dining experiences with your points or using the portal to book your next vacation, the Chase Ultimate Rewards program’s flexibility makes it a great option regardless of your lifestyle.

Frequently asked questions (FAQs)

Chase Ultimate Rewards (UR) are Chase Bank’s flexible rewards currency that can be earned on several of its credit cards.

The Chase travel portal can be accessed through the Chase app or the Chase website. After logging in, you can select the option to book travel.

You can use your Chase travel credit, like the up to $50 annual hotel statement credit offered by the Chase Sapphire Preferred, by booking your travel through the Chase travel portal. The statement credit will automatically be applied to your account within one to two billing cycles after your purchase posts to your account — up to an annual maximum accumulation of $50.

You can redeem your Chase Ultimate Rewards directly through the travel portal with almost all major airlines with the exception of Southwest Airlines, which can be booked over the phone. With Southwest, select the flight you want at Southwest.com and then call Chase Travel Center at 855-233-9462 with the flight details.

The value you receive from the Chase travel portal will depend on the credit card you’re using. For example, if you have either the Chase Sapphire Reserve or the Chase Sapphire Preferred, your points are worth either 50% or 25% more, respectively, when redeemed for travel.

*The information for the Chase Freedom Flex℠, Ink Business Preferred® Credit Card and Ink Business Premier℠ Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Tamara Aydinyan has been traveling the world with the help of miles and points for over a decade and enjoys teaching others to do the same. When she's not on the move, you can find her in Los Angeles or New York City, or on Instagram @deadlytravel.

Julie Stephen Sherrier is a personal finance writer and editor based in Austin, TX. She is the former senior managing editor for LendingTree, responsible for all credit card and credit health content. Before joining LendingTree, Julie spent more than a decade as the managing editor and then editorial director at Bankrate and CreditCards.com. She also served as an adjunct journalism instructor at the University of Texas at Austin.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Why did my credit card issuer just increase my credit limit?

Credit cards Michelle Lambright Black

Cash vs. credit: Which should I use?

Credit cards Sarah Brady

Capital One Venture X vs. Chase Sapphire Preferred

Credit cards Yury Byalik

Capital One Venture X benefits guide: Packed with premium perks for a lower fee than its peers

Credit cards Carissa Rawson

Credit card application rules by issuer

Credit cards Lee Huffman

Why the Chase Ink Business Unlimited is part of my core credit card setup

Credit cards Eric Rosenberg

U.S. Bank Business Platinum review 2024: It’s got one job – an intro APR for purchases and balance transfers

Credit cards Julie Sherrier

How to do a balance transfer with Capital One

Credit cards Harrison Pierce

Amex Gold vs. Chase Sapphire Reserve

Credit cards Natasha Etzel

How to avoid interest on a credit card

New Citi Strata Premier Card layers on the perks, replaces the Citi Premier Card

How do credit card refunds work?

Credit cards Tamara Aydinyan

I’m an expat, and here’s why I love my Bank of America Travel Rewards card

Credit cards Kelly Dilworth

Amex purchase protection benefits guide

Credit cards Ryan Smith

Limited-time 75K offers on Chase Sapphire Preferred and Sapphire Reserve

- What is the Chase Travel Portal?

- Benefits of Using the Chase Travel Portal

- Chase Ultimate Rewards Credit Cards

- Points Value

- How to Use the Portal to Book Travel

Chase Travel: Explore Destinations and Savings with Chase Ultimate Rewards

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Chase Freedom Flex℠, Chase Freedom® Student credit card. The details for these products have not been reviewed or provided by the issuer.

- The Chase Travel℠ portal is an online travel agency that lets you pay with Ultimate Rewards points.

- You can use points, cash, or a combination of both to book flights, hotels, rental cars, and more.

- Several Chase cards offer better redemption values or bonus points when you book through the portal.

Introduction to the Chase Travel portal

The Chase Travel℠ Portal is an online booking platform for flights, hotels, rental cars, cruises, activities, and vacation rentals, similar to an online travel agency (OTA). If you're a Chase Ultimate Rewards® cardholder, you can use points to book travel through the portal — or pay with your card or a combination of points and cash.

Overview of the Chase Travel portal and Ultimate Rewards benefits

The Chase Travel portal offers one of the most straightforward redemption opportunities for your Chase Ultimate Rewards . Chase boasts one of the most flexible and lucrative credit card rewards programs, and points earned on some travel cards are worth up to 50% more when redeemed through Chase Travel.

Here's everything you need to know about booking airfare, hotels, and more through the Chase travel portal — and how to make the most of your Chase Ultimate Rewards points.

What is the Chase Travel portal?

The Chase Travel portal is an online platform that acts as a third-party travel broker similar to Expedia, Booking.com, Travelocity, or Priceline. Through Chase Travel, you can book hotels, flights, rental cars, cruises, and vacation packages. You can choose to pay with one of your linked credit cards, or use your Ultimate Rewards balance to defray the cost.

You must be a Chase credit card customer to use Chase Travel℠ to book with cash or points — in fact, you can only access the Chase travel portal when you log into your account management page with Chase.

Benefits of using the Chase Travel portal

One of the primary benefits of using Chase Travel℠ is you can spend the rewards points you earn directly on the travel you want without having to worry about dealing with specific hotel or airline loyalty programs. Chase Travel℠ allows you to book travel directly with Chase Ultimate Rewards points, use your credit card to pay, or combine the two.

There are a few other key benefits to understand as well:

You'll still earn airline miles and work toward elite airline status

You won't earn points or elite night credits when you book a hotel stay with Chase Travel℠ because it's considered a third-party booking. However, you can earn airline and elite-qualifying miles on flights booked through Chase, as long as your frequent flyer number is attached to the reservation. (You can usually add that number, as well as your Known Traveler

Points are worth more on certain Chase credit cards

With a no-annual-fee card like the Chase Freedom Flex℠ or Chase Freedom Unlimited® , your points are worth 1 cent each toward travel booked through the portal.

But if you have a Chase travel credit card like the Chase Sapphire Reserve® , Chase Sapphire Preferred® Card , or Ink Business Preferred® Credit Card , you'll get 25% to 50% more value when you redeem your points for travel, plus the ability to transfer your points to Chase airline and hotel partners .

You can combine the points earned on the Chase Freedom Flex℠ or Chase Freedom Unlimited® with one of these travel cards: Points redeemed through the Chase Sapphire Reserve® are worth 1.5 cents apiece through Chase Travel, while points redeemed through the Chase Sapphire Preferred® Card or Ink Business Preferred® Credit Card are worth 1.25 cents apiece.

Some Chase cards also offer bonus points for paid bookings you make through the portal. Chase offers lucrative bonus categories on flights, hotels, and car rentals booked through the Chase Sapphire Reserve® and Chase Sapphire Preferred® Card, up to 10x Ultimate Rewards points per dollar.

The Chase Travel℠ portal is easy to use

If you don't want to deal with many hotel and airline award charts, booking through Chase Travel℠ can help keep your rewards game simple. You'll always be able to use your points for any booking you want without worrying about blackout dates or capacity controls you would normally encounter with loyalty programs.

Chase Ultimate Rewards credit cards

To be eligible to use the Chase Travel℠ portal, you'll need a Chase credit card that earns Chase Ultimate Rewards points .

No-annual-fee Chase credit cards available to new applicants:

- Chase Freedom Unlimited® (read our Chase Freedom Unlimited review )

- Chase Freedom Flex℠ (read our Chase Freedom Flex review )

- Ink Business Unlimited® Credit Card (read our Chase Ink Business Unlimited review )

- Ink Business Cash® Credit Card (read our Chase Ink Business Cash review )

Points earned on these cards are worth 1 cent each when redeemed through the Chase Travel℠ portal.

Chase travel rewards credit cards :

- Chase Sapphire Reserve®: Points worth 1.5 cents apiece through Chase Travel (read our Chase Sapphire Reserve review )

- Chase Sapphire Preferred® Card: Points worth 1.25 cents apiece through Chase Travel (read our Chase Sapphire Preferred review )

- Ink Business Preferred® Credit Card: Points worth 1.25 cents apiece through Chase Travel (read our Chase Ink Business Preferred review )

Points earned on these cards are worth more when redeemed through Chase Travel℠. You can also transfer Ultimate Rewards from these cards to more than a dozen airline and hotel partners, potentially for significantly more value.

Combining Chase points for increased value

You can transfer Chase Ultimate Rewards points between accounts if you hold more than one Chase card. It makes the most sense to pool your points in the account that gives you the best redemption value — for example, if you pair the Chase Freedom Unlimited® and Chase Sapphire Reserve®, moving all of your Chase Ultimate Rewards to your Chase Sapphire Reserve® account will increase the value of your points when you redeem through the Chase Travel℠ portal.

To pool your points onto one card, log into your Chase online account, navigate to the "Redeem" section for your Chase Ultimate Rewards card, then select the option to combine points in the "Earn/Use" tab:

From there, you can move your Chase points between accounts in any increment.

Points value in the Chase Travel portal

Certain Chase credit cards offer a bonus for redeeming points through Chase Travel℠. Here's how much your points are worth with each Chase card:

While these redemption rates are generous, you may get even more value by transferring your points to airline and hotel partners since Chase Ultimate Rewards points are worth, on average, 1.8 cents apiece based on Business Insider's points and miles valuations .

If you want to learn more about how (and when, and why) to transfer your points elsewhere, read our guide to understanding Chase Ultimate Rewards travel transfer partners .

How to use the Chase Travel℠ portal

Using the Chase Travel℠ portal is a breeze, but it all starts with logging into your online account management page. From there, you'll click on the right side of your screen where it shows your Chase Ultimate Rewards account balance.

Once you click on the account balance, you'll have the option to select the card you want to access. And remember, this step can be important because some cards give you more value from your points when you redeem them for travel.

How to book a flight through Chase travel

Once logged into your Chase Ultimate Rewards account, you'll see different travel options to search for at the top of the page.

To search for a flight, make sure the prompt is on "Flights" and begin searching for the flight you want. Enter your departure airport, destination, travel dates, and the number of passengers.

Once your flight options pop up on the screen, you can filter your results by the number of stops, the airlines you want to fly, and arrival times.

Note that each of your flight options will include a payment amount in points as well as a cash price.

You can also click on "Details and baggage fees" to find out the cost of carry-on luggage or checked baggage, as well as whether your flight charges any change fees.

When you click "Select" a flight option, you'll see a list of what is and isn't included in the fare you selected. You may also see a note that you can upgrade before you check out.

Once you settle on a flight you want, you'll be taken to the "Trip Details" page that shows the final cost of your flight in points or in cash, as well as a summary of the added costs you may be charged for baggage or change fees.

After you agree to the terms, you'll be taken to a final payment page where you can decide how you want to pay. You can cover your flight entirely in points if you want, but you can also choose to pay with your Chase credit card or a combination of points and your credit card.

During the booking process, add your frequent flyer number to your reservation so you can earn miles on your booking and have your flight count toward elite status requirements. You'll also want to add your Known Traveler Number or Redress number if you have one. However, if you forget this step during booking, you can add your frequent flyer information to your flight through the airline's website.

How to book a hotel through Chase travel

Booking a hotel through Chase is similarly easy, and you'll find a lot of different types of lodging options available. For example, you'll find properties from major hotel brands, but you'll also find rental condo options and boutique hotels.

To search for a hotel, enter the destination, dates, and the number of people you want to have in your room. Once you're presented with options, you can filter hotels based on the hotel name you're looking for, the area or neighborhood, price point, guest rating, property type, and more.

Once again, you'll see a price listed in points and a cash price per night.

These prices do not include taxes and fees, however, so your price in points or cash will be higher by the time you get to the final booking page. Also be aware that the price listed is the lowest you can get for the property, but that better or upgraded rooms and suites will cost more in points.

The major downside to booking a hotel through the Chase portal is that you won't earn hotel points or elite night credits for your stay, because it's considered a third-party booking. There's also a risk that the property won't recognize your hotel elite status or give you the perks you'd normally be entitled to, like late checkout or free breakfast . This shouldn't be an issue if you're booking an independent or boutique hotel, but it's something to be aware of if you're looking for hotel points or status.

You'll have the option to select a hotel you want and a room type at the property you're considering. You can also pay with your booking with points, your Chase credit card, or combine both payment methods.

How to book a rental car through Chase travel

You can also book a rental car through Chase Travel℠ using the same steps. Once you log into your Chase Ultimate Rewards account, click on "Cars" and select the destination and dates.

Once you are presented with your search results, you can select the types of cars you prefer, like an economy car or an SUV. You can also filter results based on a price range, the number of passengers you have, the rental car company, and the type of transmission you prefer (manual or automatic), as well as the total area you want to search in.

Note that, once again, taxes and fees are not included on the initial search page. Instead, they are added to your total cost when you select a rental car. You can also pay for a rental car through Chase with points, your credit card, or a combination of the two.

How to book activities with the Chase Travel portal

Chase also lets you book various activities through the portal, which they refer to as "Things to Do." Chase activities can include excursions like snorkeling or scuba diving, as well as tours of museums and historic sites. But you can also book more practical options through their activities tab, including airport pickups and other types of transportation.

To search for activities, enter the destination and dates for your trip. You'll be shown a price in points and in cash that does include taxes and fees. You can also filter options based on the type of activity, your interests, and more. Once again, you have the option to pay for activities with your points, your credit card, or a combination of the two.

How to book a cruise through Chase Travel

If you're a cruise enthusiast, you can also book cruises through Chase Travel℠. When you select "Cruises" at the top of the Chase Ultimate Rewards search page, you'll be presented with a list of featured cruises and cruise specials.

You can also search for cruises by destination or cruise line name. Note, however, that only cash prices are listed for each cruise on the portal and that you'll have to call Chase to make a booking.

Either way, you can use your Chase points to pay for all or part of your cruise. Just have your credit card number handy and call their customer service line at 855-234-2542.

How to book a vacation rental through Chase Travel

Chase also offers a selection of vacation rentals including condos, luxury villas, and more. To search, click "Vacation Rentals" at the top of the main page, then enter your destination, dates, and the number of people in your party.

Once you start your search, you'll have the option to filter results based on the local neighborhood you want, star ratings, price range, guest rating, property type, and more. Like hotels through Chase, the price you are shown excludes taxes and fees, but they will be added to your total once you make a selection.

Also be aware that the price shown in your search results is for the lowest-tier option for each property, and that a larger rental or upgraded rental may cost more in points.

When you book vacation rentals through Chase, you can pay with points, your Chase card, or a combination of the two.

Use the Chase Travel portal to book Luxury Hotel & Resort Collection properties

If you have the Chase Sapphire Reserve®, you can book properties within the Luxury Hotel & Resort Collection. This list of more than 1,000 properties can be reserved ahead of time, and you'll get extra benefits with each stay such as:

- Daily breakfast for two

- A special benefit worth up to $100

- Complimentary internet access

- Room upgrades when available

- Early check-in and late checkout

One detail to note with this program is the fact that you cannot pay with points. Instead, your online booking will reserve your room, and you'll be charged for the stay when you check out from the hotel.

Should you transfer Chase points instead?

While you can book travel directly through the Chase Travel℠ portal, many people prefer transferring points to Chase airline and hotel partners. Doing so could let you get more value for each point you redeem , but you'll have to run the numbers to find out for sure.

Here's a good example of how transferring points to a Chase airline or hotel partner can be a better deal, as well as the math you'll need to do to figure this out on your own. Take this one-way flight on Air France from Chicago to Paris, for example, and assume you have the Chase Sapphire Reserve® card. You're getting 50% more value when you redeem points through the Chase Travel℠ portal using points on this card.

If you were to book this flight through Chase Travel℠, you would owe 39,607 points with the Chase Sapphire Reserve®, compared with the cash price of $594.10.

However, you could book an award ticket on the exact same flight through Flying Blue (Air France's loyalty program) directly if you transferred your Chase points there first. In this case, the identical flight would set you back 22,000 miles plus $109.44. This means you would transfer 22,000 miles from Chase to your Flying Blue account, and pay the taxes and fees in cash, or by redeeming points for a statement credit to your account.

When you compare, you'll find that booking with miles directly is a better deal. After subtracting the taxes and fees from the cost of booking through Flying Blue, you wind up with a value of around 2.2 cents per mile.

With the Chase Travel℠ portal, on the other hand, you're forking over 39,607 points for the same flight, and you're getting a value of 1.5 cents for each point if you have the Chase Sapphire Reserve®.

Chase Travel portal frequently asked questions

Accessing Chase Travel℠ is simple. If you're a Chase credit cardholder with Chase Ultimate Rewards points, you can log in to your Chase online account. Once logged in, navigate to the 'Travel" or "Rewards" section, where you'll find the Chase travel portal. From there, you can search and book flights, hotels, and other travel services using your earned points or card benefits. It's a convenient way to plan and manage your travel adventures.

Chase Travel℠ refers to the travel booking and rewards platform offered by Chase Bank. It's part of the Chase Ultimate Rewards program, allowing cardholders to use their earned points to book flights, hotels, car rentals, and other travel-related expenses. Chase Travel℠ provides a convenient way to plan and book your trips while taking advantage of the rewards and benefits associated with Chase credit cards.

To earn 5% on Chase Travel℠, consider using a Chase credit card that offers bonus rewards on travel purchases. Cards like the Chase Sapphire Preferred or Chase Sapphire Reserve often offer 5 points per dollar spent on travel booked through the Chase travel portal. Additionally, taking advantage of limited-time promotions and special offers can also help you maximize your rewards when booking travel with Chase.

Maximizing rewards through Chase Travel

The Chase travel portal offers another way to maximize rewards earned with a Chase credit card. Before you pull the trigger, consider all your options and the value you're getting for your points.

Remember that, no matter which Chase credit card you have, you can use your rewards points in other ways. You can redeem Chase points for statement credits or cash back, or cash them in for gift cards or merchandise. And if you have a premier Chase travel credit card, you can transfer your points to Chase airline and hotel partners at a 1:1 ratio.

However, booking travel through Chase can make your life considerably easier — especially if you don't like dealing with complicated hotel and airline programs. You may not get as much value from your points as you would if you booked a premium flight with airline miles, but the Chase travel portal does offer the flexibility to book the flight you want without any blackout dates or hoops to jump through.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Chase Trip Cancellation Insurance: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Chase offers consumers several travel rewards credit cards , most of which help you earn points for a trip and offer travel protections should your journey go differently than expected. These benefits can help give you peace of mind and reduce stress, especially if your trip gets canceled.

Many Chase cards offer travel coverage that includes trip cancellation insurance, among other protections. Let’s take a look at Chase trip cancellation insurance, which cards provide it and what this benefit covers.

What is trip cancellation insurance?

Trip cancellation insurance can reimburse your prepaid, nonrefundable expenses — such as flights, hotel reservations or a cruise — should your trip be canceled due to unforeseen circumstances, such as extreme weather, an accident or a death in the family.

Coverage begins on the date you make your initial trip deposit and ends when you depart for your trip.

» Learn more: Does my Chase credit card have travel insurance?

Chase cards that come with trip cancellation insurance

The following cards include Chase trip cancellation insurance:

» Learn more: How does credit card travel insurance work?

What does Chase trip cancellation insurance cover?

Chase travel insurance covers nonrefundable prepaid travel expenses such as flights, hotels, cruises, train tickets and tours — whether you book with a travel agency or directly with the travel provider.

The benefits kick in when one of the following reasons occurs:

Accidental bodily injury, sickness or loss of life experienced by you or an immediate family member.

Severe weather.

Named storm warning.

Change in military orders for you or your spouse.

A call to jury duty or a court subpoena.

Fire, flood or a burglary to your or your traveling companion’s residence.

The death or hospitalization of your or your travel companion’s host at the destination.

Doctor-imposed quarantine.

Organized strikes affecting public transportation.

Terrorist incidents or travel warnings related to terrorism.

» Learn more: Will credit card travel insurance cover you on your next trip?

What isn’t covered by Chase trip cancellation insurance?

Event tickets, amusement park tickets, museum entry fees and golf course expenses aren’t eligible for reimbursement unless they’re included in a prepaid travel package.

Trip cancellation benefits don’t apply to losses caused by:

A change in plans or financial circumstances.

A pre-existing medical condition.

Loss due to voluntary surrender of unused tickets, vouchers or credits.

Travel arrangements scheduled after the 26th week of pregnancy.

Being on a waitlist for a medical treatment.

Trips taken for the purpose of obtaining medical treatment.

Unwillingness to travel due to civil unrest.

Failure to obtain required visas, passports or other paperwork necessary for travel.

Commission of illegal acts.

Attempted suicide or self-inflicted injuries.

Being under the influence of drugs.

Disinclination to travel or border closures resulting from a pandemic.

Financial insolvency of the common carrier, travel agency or tour operator.

War, insurrection, rebellion or revolution (except terrorism).

» Learn more: The guide to Cancel For Any Reason (CFAR) travel insurance

Who is covered by Chase trip cancellation insurance?

As the primary cardholder, you’re covered. The trip cancellation insurance also extends to your immediate family members, including:

Parents, step-parents and/or legal guardians.

Spouses or domestic partners and their parents.

Children, including adopted children and step-children.

Grandparents and grandchildren.

Aunts and uncles.

Nieces and nephews.

Your immediate family members don’t have to be traveling with you for the benefits to apply to them as well. However, you must have used the Chase credit card that includes trip cancellation insurance to pay for their trip.

» Learn more: How to find the best travel insurance

Which trips are eligible for Chase trip cancellation insurance?

Eligible trips can’t exceed 60 consecutive travel days. If your trip is longer, the coverage is still available, but the eligible prepaid nonrefundable expenses would be reimbursed as a pro-rated sum up to the first 60 days.

You must pay for all or a portion of the trip using an eligible Chase credit card or Chase Ultimate Rewards® for it to be eligible for the trip cancellation benefits. If your canceled trip results in a future credit or voucher, it won’t be covered.

How to file a trip cancellation insurance claim with Chase

To file a Chase trip cancellation insurance claim, you must contact the benefits administrator within 20 days of the cancellation. You can do this by calling the phone number listed in your credit card’s guide to benefits. If you wish to file a claim online, you can visit www.eclaimsline.com .

You’ll have to provide the following documentation within 90 days to support your claim:

Completed and signed claim form.

Travel itinerary.

Documentation confirming the reason for trip cancellation, such as medical records or a death certificate.

Credit card account statement listing the transaction related to the trip.

Copies of the cancellation and refund policies from the travel provider.

Any unused credits or vouchers.

» Learn more: Airline travel insurance vs. your credit card’s

Chase trip cancellation insurance recapped

Holding a credit card that provides travel insurance can help put your mind at ease when unexpected problems arise.

Chase’s insurance benefits cover you and your family members against expenses incurred due to trip cancellation, among other things.

However, it’s important to know what’s covered by the policy and what isn’t. Additionally, you’ll want to keep track of all documentation related to the cancellation and submit it before the deadline to receive reimbursement.

The information related to the Chase Freedom® credit card has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

- Airport lounges

- Dining & experiences

- Not a cardmember? Learn more

Explore all the benefits of Sapphire Reserve

Rewards to inspire your next adventure.

The Chase Sapphire Reserve card makes every purchase rewarding. Make your journey memorable with travel perks, private dinners, and VIP access at sought-after events. Explore your complete Guide to Benefits or learn more about your benefits below.

01 Travel

Get closer to your happy place

Earn points as you seek out new destinations. Book a hotel, make the most of airfare, hail rides around town and more.

$300 Travel Credit

Get reimbursed for up to $300 in travel purchases you make with your Sapphire Reserve card 1 each year. Each year, your first $300 in travel purchases will not earn rewards points. 2

Book through The Edit SM

Experience distinct benefits at a curated collection of hotels and resorts when you book through The Edit by Chase Travel SM , an exclusive benefit for Sapphire Reserve cardmembers. 7

10x on hotels through Chase Travel

Earn 10x total points on hotels (excluding The Edit) and car rentals purchased through Chase Travel after the first $300 is spent on travel purchases annually. 1

5x points on flights through Chase Travel

Earn 5x total points on flights purchased travel through Chase Travel after the first $300 is spent on travel purchases annually. 1

3x points on travel

Enjoy the trip even more with bonus points on travel purchases like airfare and hotels. 1

Unlimited points

There is no limit to the number of points you can earn. Points don’t expire as long as your account is open. 1

Enjoy more premium travel rewards

When you travel with Sapphire, plan on benefits ranging from generous statement credits to access to luxury properties worldwide.

Global Entry or TSA PreCheck ® or NEXUS fee credit

Receive a statement credit of up to $100 every four years as reimbursement for the application fee charged to your Sapphire Reserve card. 5

No blackout dates or restrictions

Book travel through Chase Travel and if a seat’s available, it’s yours.

No foreign transaction fees

Pay no foreign transaction fees when you use your card outside the United States. 6 For example, if you spend $5,000 internationally, you would avoid $150 in foreign transaction fees.

Elite hotel benefits at Relais & Châteaux

Enjoy great benefits like a VIP welcome and complimentary breakfast daily at select properties with Relais & Châteaux, a prestigious collection of luxury properties in over 60 countries. Call the Visa Infinite Concierge at 1-877-660-0905 for more details and to book your stay. 8

Special car rental privileges

Enroll in leading car rental rewards programs from National Car Rental, Avis and Silvercar. Log in to Chase Travel to access the special car rental privileges section of your travel benefits page to book with your card. Enjoy enhanced benefits, such as upgrades and car rental discounts, savings on luxury and premium rental car rates, plus promotions and other offers. 9

Ennismore hotel benefits

Your card gets you VIP access to benefits at Delano, Hyde, Mondrian, Morgans Originals and SLS hotels and resorts around the world. Cardmembers can stay a little longer with a complimentary 4th night, receive room upgrades and late check outs, along with priority access to cabana reservations, a $30 food and beverage credit and much more. 10

Free Lyft Pink

Get 2 complimentary years of Lyft Pink All Access when activated by Dec 31, 2024—a value of $199/year. 3 This includes member-exclusive pricing, free Priority Pickup upgrades, discounts on bikeshare and more. Membership auto-renews.

Don't forget as a Sapphire Reserve cardmember you'll still earn 10x total points on Lyft rides through March 2025. 4 That’s 7x points in addition to the 3x points you already earn on travel. Activate Lyft Pink All Access

02 Dining

Indulge in worldwide dining experiences

Whether visiting your local bistro or a restaurant on your bucket list, there are always special dining rewards with Sapphire Reserve.

Private dining series

Sit down for a memorable meal at some of the most sought-after restaurants in the country.

3x points on dining

Earn triple the points at restaurants, including takeout and eligible delivery services with your Sapphire Reserve card. 1 From Sunday brunch to a birthday dinner, meals out mean more rewards.

DoorDash & Caviar benefits

Takeout tastes even better with a complimentary DashPass membership on both DoorDash and Caviar. You’ll pay no delivery fee and lower service fees on eligible orders for a minimum of one year. Activate by Dec. 31, 2024 12 . Plus, as a DashPass member get a $5 monthly DoorDash credit automatically applied at checkout 13 .

03 Ultimate Rewards ®

Get the most from your rewards

Enjoy the flexibility of booking airfare, hotels and car rentals through Chase Travel or transfer points to other travel programs.

More value with travel redemption

Your points are worth 50% more when you redeem them for airfare, hotels, car rentals and cruise lines through Chase Travel—our easy-to-use portal that helps you maximize your travel spending. For example, 50,000 points are worth $750 toward travel. 14

Worldwide travel assistance

Whether you need help booking travel or modifying a reservation count on the full-service support of the Chase Travel team.

1:1 point transfer to leading frequent travel programs

Transfer points to participating frequent travel programs at a full 1:1 value—that means 1,000 points equals 1,000 partner miles/points.

No travel restrictions or blackout dates on airline tickets booked through Chase Travel.

1 point per $1 spent on all other purchases

In addition to earning 3 points per dollar on travel and dining at restaurants, you’ll earn 1 point for every dollar you spend on all your other purchases. 1

Flexibility

You can book airfare, hotels and car rentals through Chase Travel using your Sapphire Reserve card, your points or a combination of both—it's up to you.

More ways to get the most from your rewards

Redeem your points for statement credits, gift cards or choose from other flexible ways to make your points work for you.

Shop through Chase ®

Shop online with brands you already love. Earn 1x–15x bonus points at more than 450 popular retailers with Shop through Chase. 14

25% more value with Pay Yourself Back ®

Redeem points for statement credits toward your annual fee and eligible purchases for gas, wholesale clubs, and pet supplies & services by June 31, 2024.

Choose from a selection of over 150 gift cards from some of your favorite retailers and more.

Pay with points

Use your points to pay for all or part of your purchases with popular brands like Apple ® 17 and Amazon.com. 18

04 Lounges

Relax with airport lounge access

With access to Chase Sapphire Lounge by The Club and Priority Pass lounges, each trip becomes an invitation to indulge before you get there.

Enjoy complimentary Priority Pass TM Select membership

Departing for your destination is more relaxing with access to 1,300+ Priority Pass airport lounges in 600+ cities around the world, plus every Sapphire Lounge by The Club, after a one- time enrollment in Priority Pass Select.

Visit Sapphire Lounge by The Club

Relax and refresh at a Sapphire Lounge and enjoy locally inspired menus, a curated selection of beverages, an atmosphere to remember and more. Sapphire Reserve cardmembers, ensure you're enrolled in your complimentary Priority Pass Select membership for lounge access.

The Reserve Suites by Chase

Reserve cardmembers, treat yourself to The Reserve Suites at Sapphire Lounge by The Club at LaGuardia Airport in Terminal B. Enjoy caviar service on arrival, specially curated wine lists by Parcelle, exclusive menus by Jeffrey's Grocery, private bathrooms with spa showers and more. Chase Sapphire Reserve cardmembers can book a suite for a fee up to 72 hours prior to flight departure. Find details on the Chase Mobile ® app in Benefits & Travel. The Reserve Suites are limited and subject to availability.

05 Protection

Travel with peace of mind 20

When you take to the air or hit the road, we make security a priority. Here are some of the protection services built into your Sapphire Reserve card benefits.

Trip Cancellation / Interruption Insurance

If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours and hotels.

Auto Rental Collision Damage Waiver

Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary and provides reimbursement up to $75,000 for theft and collision damage for rental cars in the U.S. and abroad.

Emergency Evacuation and Transportation

If you or a member of your immediate family are injured or become sick during a trip far from home that results in an emergency evacuation, you can be covered for medical services and transportation up to $100,000.

Trip Delay Reimbursement

If your common carrier travel is delayed more than 6 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.

Travel Accident Insurance

When you pay for your air, bus, train or cruise transportation with your card, you are eligible to receive accidental death or dismemberment coverage of up to $1,000,000.

Baggage Delay Insurance

Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 5 days.

Roadside Assistance

If you have a roadside emergency, you can call for a tow, jumpstart, tire change, locksmith or gas. You’re covered up to $50 per incident 4 times a year.

Sapphire Reserve Benefits Guide

These are just some of the protection services built into your Sapphire Reserve card benefits. Your Guide to Benefits has more of what you need to know about your travel and purchase protection benefits.

Account security and protection

Your Sapphire Reserve card is equipped with the enhanced account and purchase protection you deserve.

Zero Liability Protection 21

Zero Liability Protection means you won’t be held responsible for unauthorized charges made with your card or account information. If you see an unauthorized charge, simply call the number on the back of your card.

Fraud protection

We help safeguard your credit card purchases using sophisticated fraud monitoring. We monitor for fraud 24/7 and can text, email or call you if there are unusual purchases on your credit card.

Fraud alerts

We monitor for fraud 24/7 and can text, email or call you if there are unusual purchases on your credit card. 22 Please sign in to chase.com and review your personal details to ensure your mailing address, phone and/or email are up to date.

Return Protection

You can be reimbursed for eligible items that the store won’t take back within 90 days of purchase, up to $500 per item, $1,000 per year. 20

Extended Warranty Protection

Extends the time period of the manufacturer's U.S. warranty by an additional year on eligible warranties of 3 years or less. 20

Chip-enabled for enhanced security and wider acceptance

A credit card with an embedded chip provides enhanced security and wider acceptance when you make purchases at chip-enabled card readers in the U.S. and abroad.

Purchase Protection

Covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per year. 20

06 Events

Exclusive access to events and experiences

Sapphire cardmembers enjoy priority ticketing and the best seats in the house for a wide range of events.

Reserved by Sapphire SM

Explore one-of-a-kind experiences from private dinners hosted by award-winning chefs to VIP access at the most sought after events. See where your Sapphire Reserve card can take you.

Events and experiences lounges

Enjoy comfortable seating at Chase Sapphire events in prime locations, complimentary food and drinks, plus a range of amenities, such as a dining concierge, charging stations, Wi-Fi and more.

Early-access tickets

Beat the crowds. Get your tickets to concerts and sporting events before they sell out.

Priority seating

Get up close to the court or the stage. Sapphire Reserve cardmembers can experience events from the best seats in the house.

07 Wellness

Earn 10x total points on Peloton

Work out your way — from HIIT rides to walks and hikes to strength training, and more: Get 10x total points on Peloton equipment and accessory purchases over $150 with a max earn of 50,000 points. Shop Peloton Bikes, Tread, Guide, or Row. Offer ends Mar. 31, 2025. 23

Shop Peloton

08 Services

Personalized assistance for Sapphire cardmembers

Turn to Sapphire for help coordinating travel, restaurant reservations, access to entertainment and more complimentary assistance and referrals.

24/7 access to customer service

Talk to a dedicated specialist whenever you need assistance. Simply call the number on the back of your card.

Visa Infinite Concierge Service 24

Contact Visa Infinite Concierge at 1-877-660-0905 for help with dinner reservations or Broadway, music and sporting event tickets.

Travel and emergency assistance

If you run into a problem away from home, call the Benefit Administrator for legal and medical referrals or other travel and emergency assistance. (You will be responsible for the cost of any goods or services obtained.)

Easily get more from your Sapphire experience

From mobile account access to contactless payment, cardmembers can enjoy many safe and convenient features.

Manage your account with ease

Create an account on chase.com and download the Chase Mobile ® app 25 to check account and points balances, pay bills and more.

Tap-to-pay contactless checkout

Simply tap to pay with your contactless Chase Sapphire card. Just look for the Contactless Symbol at checkout, then tap your contactless card on the checkout terminal. It's fast, easy and secure!

Add an authorized user

Maximize your reward earning potential by adding an authorized user to your account. 26

Go paperless

Get your statement online. Safely access up to 6 years of statements online. It's secure, convenient and reduces clutter.

Convenient ways to pay

Load your card into a digital wallet for a quick and secure way to pay with your mobile device and receive all the benefits and rewards of using your Sapphire Reserve card.

Earn points automatically

Grow your points balance by using your card as the primary payment method for:

- Online checkout Add your card to your favorite shopping apps and online merchants to conveniently build up your points balance.

- Monthly bills Use your card to make auto payments for monthly bills (e.g., cell phone and utility bills). 27

Redeem for travel

Use points toward your next getaway—they’re worth 50% more when you redeem them for travel through Chase Travel.

Pay Yourself Back ®

Your points have more value when you redeem them for statement credits after making eligible purchases on gas, wholesale clubs, and pet supplies & services by June 31, 2024.

Chase Dining SM

Order takeout at popular eateries around town or make reservations at restaurants, wineries and bars across the country.

There's so much for you

More Sapphire Offers

There’s so much more to make yours—top benefits, offers and experiences for Sapphire Reserve cardmembers.

Reserved by Sapphire SM

Your Sapphire Reserve card opens new doors to more flavors, sights and sounds. Explore the extraordinary lineup of experiences—including culinary, sports, music and entertainment.

Refer-A-Friend

Earn up to 75,000 bonus points per year by referring friends to either Chase Sapphire ® card.

Already a Sapphire cardmember?

Sign in to view your account, access exclusive content and take advantage of your Sapphire benefits.

Not a Sapphire cardmember yet?

We’re glad you’re here. Learn more about getting a Sapphire card.

Es posible que esta comunicación contenga información acerca de usted o su cuenta. Si tiene alguna pregunta, por favor, llame al número que aparece en el reverso de su tarjeta.

View the details of the Sapphire Reserve benefits offered on this page.

©2024 JPMorgan Chase & Co. JPMorgan Chase Bank, N.A. Member FDIC

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

Do You Need To Set Up a Travel Notice for Your Chase Credit Cards?

Katie Seemann

Senior Content Contributor and News Editor

347 Published Articles 54 Edited Articles

Countries Visited: 28 U.S. States Visited: 29

Director of Operations & Compliance

6 Published Articles 1178 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Table of Contents

Why would you want to notify chase of your travels, how to avoid foreign transaction fees, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If you aren’t a frequent traveler, you might be wondering about everything you need to do to prepare for a trip abroad. Of course, you’re considering what to pack and whether or not you should buy travel insurance , but what about your bank?

One of the things you might want to think about is adding a travel alert notification to your credit cards. While this isn’t required, it has historically been helpful to avoid the unnecessary hassle of credit card problems while traveling.

In this post, we’ll talk about setting up a travel notification on your Chase account , whether or not it’s even necessary, and how to avoid foreign transaction fees when using your Chase credit cards abroad.

So, why would you even want to add a travel notification to your accounts in the first place?

Previously, charges from outside the U.S. could trigger a fraud alert, which would temporarily shut down your credit card even if you were traveling abroad. That’s not a great way to start a vacation.

An easy way to avoid that risk was to place a simple travel notification on your Chase account. This allowed your Chase credit cards to be used outside the U.S. without problems.

Thankfully, it’s no longer necessary to set up a travel alert notification with Chase when you’re planning to travel outside the U.S.

Previously, you’d set up a travel alert on your Chase account online or through the Chase mobile app.

You would do this by going to your account, clicking on Profile & settings , navigating to Account Settings , and then clicking Travel .

Now, when you follow those same steps, you get a message from Chase saying that it’s not necessary to set up a travel alert notification anymore .

Setting up a travel alert notification on your Chase account is no longer necessary when you’re planning to travel outside the country.

While you no longer need to set up a travel alert for your Chase credit cards, choosing the right credit card is important to avoid foreign transaction fees.

Certain cards carry a 3% foreign transaction fee anytime you use them outside the U.S. The good news is plenty of cards waive this fee — just be sure to know which cards have no-additional fee and try to use only those on your trip.

Personal Chase Credit Cards With No Foreign Transaction Fees

Multiple Chase credit cards waive the standard 3% foreign transaction fee. Be sure to carry at least 1 of these while traveling abroad.

The following Chase credit cards do not have any foreign transaction fees :

- Aer Lingus Visa Signature ® Card

- Aeroplan ® Credit Card

- Amazon Rewards Visa Signature Card

- British Airways Visa Signature ® Card

- Chase Sapphire Preferred ® Card

- Chase Sapphire Reserve ®

- Iberia Visa Signature ® Card

- IHG One Rewards Premier Credit Card

- Instacart Mastercard ®

- Marriott Bonvoy Bold ® Credit Card

- Marriott Bonvoy Boundless ® Credit Card

- Marriott Bonvoy Bountiful™ Credit Card

- Prime Visa card

- Southwest Rapid Rewards ® Priority Credit Card

- Southwest Rapid Rewards ® Premier Credit Card

- The World of Hyatt Credit Card

- United Club℠ Infinite Card

- United℠ Explorer Card

- United Gateway℠ Card

- United Quest℠ Card

Business Chase Credit Cards With No Foreign Transaction Fees

- IHG One Rewards Premier Business Credit Card

- Ink Business Preferred ® Credit Card

- Ink Business Premier ® Credit Card

- Southwest Rapid Rewards ® Performance Business Credit Card

- United℠ Business Card

- United Club℠ Business Card

- World of Hyatt Business Credit Card

Adding an alert to your Chase account before you travel internationally is no longer needed. While this used to be a way to let Chase know you would be out of the country so international activity on your card wouldn’t trigger a fraud alert, today’s more sophisticated technology makes this step unnecessary.

The information regarding the Amazon Rewards Visa Signature Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Marriott Bonvoy Bold ® Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Marriott Bonvoy Boundless ® Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Marriott Bonvoy Bountiful™ Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding The World of Hyatt Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the United Club℠ Business Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

How do i set up a travel alert with chase.

You don’t. Setting up a travel alert with Chase is no longer necessary.

Do I have to let Chase know that I am traveling?

No, letting Chase know when you travel internationally is no longer required. It used to be common practice to set up a travel alert so international charges didn’t trigger a fraud alert on your credit cards, but today’s more sophisticated systems have made this step unnecessary.

Does Chase no longer require travel notice?

That’s correct. Chase doesn’t require a travel notice at all anymore. The ability to set up a travel notice on Chase’s website has been removed.

Do I need to notify Chase of International travel?

No, it’s no longer necessary to notify Chase of any upcoming travel, including international travel. The ability to add a travel alert notification has even been removed from Chase’s website.

Was this page helpful?

About Katie Seemann

Katie has been in the points and miles game since 2015 and started her own blog in 2016. She’s been freelance writing since then and her work has been featured in publications like Travel + Leisure, Forbes Advisor, and Fortune Recommends.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Top Credit Card Content

Buying Guides

- Best Credit Cards for High Limits

- Best Credit Cards for Young Adults

- Best Credit Card Combinations

- Best Credit Cards for Military

- Best Credit Card for Paying Monthly Bills

Credit Card Reviews

- American Express Platinum Card

- American Express Gold Card

- Chase Sapphire Preferred Card

- Chase Freedom Unlimited Card

- Capital One Venture X Card

Credit Card Comparisons

- Amex Gold vs Blue Cash Preferred

- Amex vs Chase Credit Cards

- Amex Platinum vs Capital one Venture X

- Amex Platinum vs Delta Platinum Card

- Chase Sapphire Reserve vs Amex Platinum Card

Recommended Reading

- How to Pay Your Credit Card Bill

- Credit Card Marketshare Statistics

- Debit Cards vs Credit Cards

- Hard vs Soft Credit Checks

- Credit Cards Minimum Spend Requirements

Related Posts

![chase travel help line Chase Freedom® Credit Card — Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2019/11/Chase-Freedom-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

UponArriving

Tips for Contacting Chase Sapphire Customer Service (Reserve & Preferred) [2020]

There’s a million reasons why you may need to call Chase customer service for your Chase Sapphire Preferred or Chase Sapphire Reserve but there are a few important issues that many people run into.

And as good as the customer service reps are for Chase, sometimes they only have a basic understanding of some of these topics and benefits, so it’s a good idea to get as well-versed as you can before contacting them.

In this review article, I’ll give you some tips for contacting Chase customer service so that you’ll be as informed as possible and won’t get tripped up in the process.

Interested in finding out the top travel credit cards for this month? Click here to check them out!

Table of Contents

Contacting Chase customer service

There are several methods for contacting Chase customer service for Sapphire cardholders.

Chase Sapphire customer service phone number

The Chase Sapphire Reserve customer service phone number is: 1-800-436-7970.

You can also call the number on the back of your card.

You should be able to quickly reach a live representative and not have to wait very long, which is one reason why I’m such a huge fan of the Sapphire customer service line — it saves me time. However, if you’re calling from a phone number not associated with your account, you’ll probably have to input your credit card details.

I usually call this line even when I have inquiries about my other Chase cards since it often expedites the process.

If you have more general questions for Chase you can call: the Chase Customer Service phone number at: 1-800-935-9935.