ANNUAL TRAVEL INSURANCE Promo Code — 20% Off 2024

Why search for Annual Travel Insurance coupons?

Annual Travel Insurance

About our annualtravelinsurance.com promo codes, more annual travel insurance discounts & coupon codes.

Annual Travel Insurance Competitor Coupon Codes

Annual Travel Insurance Coupon FAQ

Does annual travel insurance have black friday or cyber monday deals, where can i find annual travel insurance coupons, how do i use my annual travel insurance discount code, my annual travel insurance promo code didn't work. what can i do, what's today's best annual travel insurance coupon, how often does annual travel insurance offer online coupons, how many coupons is annual travel insurance offering today, how we curate our codes, rely on dealspotr for the best annual travel insurance coupon codes, verified annual travel insurance coupon codes, collective savings power, rewards for engagement, dealspotr savings scorecard.

Our thriving community and cutting-edge technology work together to deliver the most up-to-date and reliable promo codes:

- Active Contributors (Last 30 days): 2,910

- Codes Added (Last 30 days): 126,000

- Codes Tested (Last 30 days): 616,860

- Number of Working Codes: 954,470

- Number of Merchants With Working Codes: 95,886

- Total Savings Impact (Last 30 days): $12,956,785

These numbers showcase our commitment to providing the most comprehensive and dependable promo code platform, helping shoppers save money on their online purchases.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

7 Best Cheap Travel Insurance Companies in July 2024

Sean Cudahy is a freelance reporter specializing in coverage of airlines, travel, loyalty programs and public policy. A journalist of nine years, Sean most recently served as a general assignment reporter at The Points Guy, following an eight-year run as a local television news reporter. He lives with his wife and their French Bulldog outside Raleigh, North Carolina.

Giselle M. Cancio is an editor for the travel rewards team at NerdWallet. She has traveled to over 30 states and 20 countries, redeeming points and miles for almost a decade. She has over eight years of experience in journalism and content development across many topics.

She has juggled many roles in her career: writer, editor, social media manager, producer, on-camera host, videographer and photographer. She has been published in several media outlets and was selected to report from the 2016 Summer Olympics in Rio de Janeiro.

She frequents national parks and is on her way to checking all 30 Major League Baseball parks off her list. When she's not on a plane or planning her next trip, she's crafting, reading, playing board games, watching sports or trying new recipes.

She is based in Miami.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Finding the cheapest travel insurance is often a priority for travelers hoping to protect themselves and their finances while away from home.

But is it better to err on the side of affordable travel insurance or opt for a more comprehensive plan? That depends on your needs .

On average, a comprehensive plan that covers some combination of trip cancellation and interruption costs, medical coverage and baggage protection (and perhaps a number of other things) will cost you 5%-10% of what you paid for the trip, according to NerdWallet partner Squaremouth, a travel insurance marketplace.

That means a comprehensive policy for a trip that costs you $3,000 could run you anywhere between $150 and $300. Factors like the cost and length of your trip, the age of the travelers and how much protection you want can significantly influence what you pay for your plan.

Ultimately, Squaremouth recommends “the least expensive policy that offers the coverage [travelers] need.”

» Learn more: The best travel insurance companies right now

Factors we considered when picking cheap travel insurance plans

We considered a few factors as we looked for the most affordable travel insurance plans.

Price: If your goal is to find cheaper travel insurance, you want the price to be affordable.

Breadth of coverage: The best budget travel insurance is typically going to be a plan that offers a wide range of protections at an affordable cost, ensuring you’re protected with at least some coverage for a wide range of scenarios.

Uniqueness or customizability : While many travel insurance plans have similar protections, some stand out for particular coverage that can be helpful to certain travelers, like those needing to Cancel For Any Reason , those going on a cruise, or travelers with preexisting health conditions. We didn’t spring for the priciest plans with broad, deep coverage; instead, we picked those that meet a sort of budget "sweet spot" when it comes to cost efficiency.

» Learn more: Is travel insurance worth getting?

An overview of the best cheap travel insurance plans

We looked at travel insurance quotes for a hypothetical 10-day trip to Italy in October 2023. The traveler is a 40-year-old man living in North Carolina who spent $2,000 on the trip, including airfare.

Reliable but cheap travel insurance providers

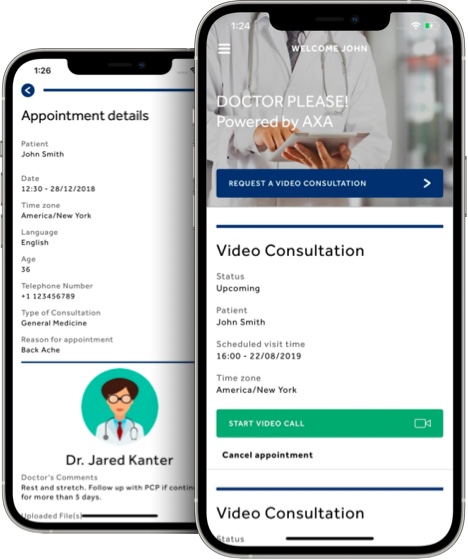

1. axa assistance usa (silver plan: $70).

Why we picked it:

The $500 missed connection benefit is great for cruise and tour participants. It covers additional transportation, accommodations and meal costs when you miss a cruise or tour departure.

Full trip cancellation and interruption coverage, along with up to $25,000 for out-of-pocket medical costs and baggage coverage.

Among the lowest prices we found.

If you’re willing to spend a bit more than AXA's $70 Silver plan, a Gold plan only costs $19 more and gets you deeper coverage amounts and up to $35,000 in collision rental car insurance.

2. Berkshire Hathaway Travel Protection (ExactCare Value plan: $56)

Cheapest plan we found while still offering a wide array of protections.

Includes a preexisting medical condition waiver.

Add-on rental car collision coverage optional for $10 per day. You can pick how many days you want the additional coverage — it’s not all or nothing.

At $56, this plan comes in at less than 3% of the $2,000 trip cost.

3. IMG (iTravelInsured Lite plan: $77)

Treats COVID-19 like any other illness, which is to say, if your claim accepts flu, strep throat or appendicitis as an acceptable, covered condition, the coronavirus is, too.

Covers costs related to trip interruption up to 125%

Higher than normal limits on dental expenses, at $1,000. If your teeth are your Achilles heel (or your biggest fear), this plan might be for you.

The iTravelInsured Lite plan doesn’t offer some of the bells and whistles that other plans do, like rental car coverage , Cancel For Any Reason coverage or waivers for pre-existing conditions. But you’ll have relatively solid across-the-board trip protections.

4. John Hancock (Silver plan: $93 for a mid-tier plan)

Mid-level plan (as opposed to a basic plan) at an affordable price for travelers who want more coverage without paying too much.

Includes an optional Cancel For Any Reason add-on for travelers wanting flexibility. It is a bit pricey, at half the cost of the insurance ($46.50 extra for a $93 plan).

Reimburses up to $1,000 for lost baggage , far more than many basic plans.

Add-on rental car coverage for $9 per day.

At $88, John Hancock’s basic (Bronze) plan isn’t particularly affordable. But for just $4 extra, you can tap into the benefits of a mid-tier plan at still less than 5% of the total trip cost.

5. Nationwide (Essential plan: $76)

Includes a preexisting conditions waiver.

Add-on rental car coverage for $90.

Covers trip interruption at 125% of the trip cost while providing comprehensive emergency medical and baggage coverage.

6. Seven Corners (Basic plan: $75)

On top of standard trip protections, it includes a relatively affordable Cancel For Any Reason option for $31.50 extra.

If you plan to rent expensive sporting equipment, you might consider paying $10 extra to cover lost, damaged, stolen or destroyed gear.

COVID-19 coverage reimburses you for costs incurred if you have to quarantine .

Rental car coverage comes in at an affordable $7 per day.

Seven Corners’ Basic plan stands out because it offers a little bit of everything, appealing to athletic travelers, those who need affordable trip protections, those who want the flexibility to cancel for any reason and those still concerned about getting quarantined due to COVID-19.

7. Travelex Insurance Services (Basic plan: $71)

Straightforward: What you see is what you get. This plan’s coverage has fewer rules and caveats than many.

While not sporting the highest coverage amounts, it offers a solid range of protections to ensure you get at least something back when your travel is disrupted or you have a medical emergency.

Offers add-on rental car coverage for $10 per day.

At $71, the Travelex Basic plan’s cost is just over 3% of the $2,000 trip’s cost.

If you want to get travel insurance at the cheapest possible rate, here’s a trick. Put $0 as your trip cost, Stan Stanberg, co-founder of comparison site Travelinsurance.com said in an email.

“When excluding trip cancellation and trip interruption coverage the cost of a travel insurance plan goes down significantly,” Stanberg said.

That means you won’t get reimbursed if you need to cancel your trip or if it gets interrupted. But you may still have access to the plan’s medical, trip delay , missed connection, baggage and other protections.

You’ll often find comprehensive travel insurance plans cost 5%-10% of your total trip cost, according to Squaremouth. This will often get you full trip cancellation and trip protection, baggage protection, emergency medical coverage and often other benefits.

Typically, the more you pay, the broader and deeper the coverage.

For many plans, you can purchase travel insurance up until you depart. However, to get access to the most protections possible, booking two days to two weeks after making your initial deposit is the best rule of thumb.

That means you won’t get reimbursed if you need to cancel your trip or if it gets interrupted. But you may still have access to the plan’s medical,

, missed connection, baggage and other protections.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

The Independent's journalism is supported by our readers. When you purchase through links on our site, we may earn commission. Why trust us?

- UK Politics

- News Videos

- Rugby Union

- Sport Videos

- Cathy Newman

- John Rentoul

- Mary Dejevsky

- Andrew Grice

- Marie Le Conte

- Sean O’Grady

- TV & Radio

- Photography

- Theatre & Dance

- Culture Videos

- Food & Drink

- Love & Sex

- Health & Families

- Royal Family

- Electric Vehicles

- Lifestyle Videos

- UK Hotel Reviews

- News & Advice

- Simon Calder

- North America

- Inspiration

- City Guides

- Sustainable Travel

- Politics Explained

- News Analysis

- Home & Garden

- Fashion & Beauty

- Travel & Outdoors

- Sports & Fitness

- IndyBest Videos

- Sustainable Living

- Climate Videos

- Electric vehicles

- Behind The Headlines

- On The Ground

- Decomplicated

- Binge Or Bin

- Millennial Love

- Crosswords & Puzzles

- Most Commented

- Newsletters

- Ask Me Anything

- Virtual Events

- Main categories

- Summer Sale UK

- Home & Living

- View all categories

- Booking.com

- Marks & Spencer

- Phase Eight

View all shops

Post Office Travel Insurance Discount Codes - July 2024

Post office travel insurance promo codes for insurance.

Get travel insurance for any upcoming holiday with a Post Office Travel Insurance discount code. They offer cover for various trip types, from your one-off single trip, to cover for a whole year, or flexible backpacking cover for the more adventurous. Add-ons such as gadget, trip disruption and winter sports are available too. Travel safe with an award-winning provider and take out cover to suit your needs with a verified Post Office Travel Insurance promotional code.

15% off quotes - Post Office Travel Insurance student discount

15% off graduate quotes with post office travel insurance, free kids' coverage with annual multi-trip family travel insurance, free quotes for post office travel insurance available.

Receive the latest codes and deals from popular brands

I would like to be emailed about offers, events and updates from The Independent. Read our privacy notice More info

How do I use a Post Office Travel Insurance discount code?

- Choose the code you want to use from our page and copy it.

- Head on over to the Post Office Travel Insurance website to get a quote and select a policy.

- When you are ready to checkout, just paste your code in the promo code box at the bottom of the page.

Does Post Office Travel Insurance have a student discount?

Yes, students and graduates can get 15% off at Post Office Travel Insurance.

What is the Post Office Travel Insurance NHS discount?

At the moment, Post Office Travel Insurance does not have an NHS discount. Should a discount for keyworkers or members of the NHS become available, we will be sure to add it to our vouchers page here.

About Post Office Travel Insurance

Whether you are looking to holiday within the UK or abroad make sure that you protect your upcoming travel plans as soon as you are booked** with Post Office Travel Insurance. Depending on which cover level you choose, you can get cover for loss of luggage and personal money as well as delayed* or missed departure*; for flights delayed by 1+hours you will get a £50 payment into your PayPal account or a Lounge Voucher^. Plus, there is no upper age limit on Single Trip policies and all medical conditions are considered.

On top of that, with our insurance you'll be covered for Covid-19 related reasons including:

- If you need to cancel your trip because you test positive for Covid within 14 days of travelling

- If you need to cancel your trip because a close family member passes away due to Covid

- Emergency medical treatment whilst abroad and costs to get you home if needed

For an additional premium you can add our Covid-19 upgrade cover if you need more protection than our standard policies, to include cover for missed departures, cutting your trip short & changes to UK testing or quarantine rules.

Post Office have won Best Travel Insurance Provider 2021, 2022 and 2023 at the Your Money Awards.

*not available on Economy levels of cover ^only available on Premier levels of cover

** For Annual multi-trip, cancellation cover starts from the start date that you apply to your policy. For cover to be in place straight away, the start date should be from the day you purchase the cover and not when the actual trip begins. For Single trip policies, cancellation cover starts from when you purchase the policy, up to the start date of your trip.

Expired vouchers that might still work at Post Office Travel Insurance

Ski & winter sports cover with post office travel insurance, sign up for medical conditions travel insurance, add up to £1000 optional gadget cover, explore single trip travel insurance from post office, upgrade travel insurance with trip disruption cover, outpatient holiday health support 24/7 with any travel insurance policy, free backpackers quotes at post office travel insurance, get a £100 gift card with over 50s life cover.

Rate our discount codes for Post Office Travel Insurance

Ratings with an average of out of 5 stars

Code Guarantee

- Code not working? Visit our support page

Post Office Travel Insurance offers for July 2024

Collinson Insurance Services Limited Sussex House Perrymount Road Haywards Heath RH16 1DN United Kingdom

Popular Brands

Ancestry Hyperoptic Broadband O2 Sixt NordVPN National Tyres and Autocare Autodoc Virgin Media ASOS Tommy Hilfiger Reiss Swarovski Debenhams Roman Originals Oliver Bonas Phase Eight Mint Velvet House of Bruar Boden Secret Sales Whistles size? CRAFTD London Treatwell Boots Notino Rheal Superfoods CurrentBody Alpinetrek.co.uk New Balance Nike GO Outdoors Protein Works Footasylum Sweaty Betty TUI Travelodge

Similar Brands

Heathrow Airport Parking Sky Mobiles.co.uk ATS Euromaster Udemy Curve Vistaprint Euro Car Parts Evri Kwik Fit Free Now Top CV Charles Tyrwhitt Boux Avenue Jack Wills WatchShop.com Desigual Levi's Moss Bros Simply Be Matalan Ray-Ban River Island Monsoon Timberland JoJo Maman Bébé Ted Baker Sunglass Hut JD Williams Gym King Jacamo Rohan T.M. Lewin Agent Provocateur Seasalt Cornwall LullaBellz Calvin Klein Vestiaire Collective Cupshe Pink Boutique Pangaia Modibodi Coggles Foot Locker Converse Vans Crocs UGG TOMS Camper Schuh AllSole Demon Tweeks Car Parts 4 Less Kaspersky Avis Domestika

- The Independent Discount Codes

- Services, Insurance & Utilities

- Post Office Travel Insurance

- Get in touch

- Submit an offer issue

- Work with us

- Meet the team

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best Annual Travel Insurance Plans of 2024

Allianz Travel Insurance »

AIG Travel Guard »

Seven Corners »

GeoBlue »

Trawick International »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Annual Travel Insurance Plans.

Table of Contents

- Allianz Travel Insurance

- AIG Travel Guard

Buying travel insurance can be a smart move for most trips, but those who travel more than a few times a year should consider an annual travel insurance policy. Whether you regularly travel for business and/or take several vacations a year, annual travel insurance plans can help you get the coverage you need without having to price out and purchase protection every time you leave home.

If you find yourself in a situation where an annual plan makes sense, know that not all travel insurance companies offer this kind of coverage. You'll also want to consider the available annual travel insurance plans to see which options make sense for your travel style and the level of coverage you want.

Frequently Asked Questions

Annual travel insurance plans all work in their own way, but the majority let travelers pay one annual premium for coverage that lasts for up to 364 days. These plans often limit the length of individual trips that are covered within the coverage year. Per-trip and annual limits on coverage can also apply.

In some cases, annual travel insurance plans require a deductible or coinsurance for certain types of coverage. If you're considering an annual travel insurance plan because you take multiple trips each year, make sure you read over the policy details and understand all coverage limits and trip limits that apply.

The cost of annual travel insurance typically varies based on factors like the age of the travelers applying, included benefits and coverage limits. You will want to shop around to compare plans across multiple providers using a platform like TravelInsurance.com or Squaremouth before you settle on a travel insurance policy.

To provide an example of the cost of annual travel insurance, U.S. News applied for a quote for two 40-year-old travelers seeking coverage for eight trips over a 12-month period. The Squaremouth travel insurance portal quoted policies with costs that range from $206 for the GeoBlue Trekker Essential plan to $610 for the Safe Travels Annual Deluxe plan by Trawick International.

Annual travel insurance can be worth it if you take multiple trips each year and want to make sure you always have coverage in place. After all, the alternative to having a multitrip policy is buying a new travel insurance plan for every vacation you take. That's not always feasible for frequent travelers who are always jetting off somewhere new – often at the last minute.

Just keep in mind that annual travel insurance plans tend to come with lower coverage limits than plans for single trips, and that you'll pay a premium for coverage that comes with comprehensive benefits and high limits for medical expenses and emergency evacuation.

- Allianz Travel Insurance: Best Overall

- AIG Travel Guard: Best for Basic Coverage

- Seven Corners: Best for Medical

- GeoBlue: Best for Expats

- Trawick International: Best for the Cost

Tailor your annual travel insurance plan to your needs

Most plans include coverage for trip cancellation and interruption, travel delays, medical expenses, and more

Lowest-tier plans (AllTrips Basic and AllTrips Prime) come with no or relatively low coverage limits for trip cancellation

Most annual plans (except for AllTrips Premier) do not cover trips longer than 45 days

- Trip cancellation coverage worth up to between $2,000 and $15,000

- Trip interruption coverage worth up to between $2,000 and $15,000

- Emergency medical coverage worth up to $50,000

- Up to $500,000 in emergency medical transportation coverage

- Up to $2,000 in coverage for lost or damaged baggage

- Up to $2,000 in coverage for baggage delays

- Travel delay coverage worth up to $1,500 ($300 daily limit)

- Rental car coverage worth up to $45,000

- Up to $50,000 in travel accident coverage

- 24-hour hotline assistance and concierge service

SEE FULL REVIEW »

Annual Travel Insurance Plan offers year-round travel insurance protection

Relatively high limits for medical expenses ($50,000) and emergency evacuation ($500,000)

No trip cancellation coverage and relatively low limit ($2,500) for trip interruption coverage

No coverage for preexisting medical conditions

- Up to $2,500 in coverage for trip interruption

- Up to $1,500 in coverage for trip delays of five-plus hours ($150 per day limit)

- Missed connection coverage worth up to $500

- Up to $2,500 in baggage insurance

- Baggage delay coverage worth up to $1,000 for delays of at least 12 hours.

- Up to $50,000 for emergency medical expenses ($500 for emergency dental sublimit)

- Up to $500,000 for emergency evacuation and repatriation of remains

- Up to $50,000 in accidental death and dismemberment (AD&D) insurance

- Up to $100,000 in protection for security evacuation

Provides coverage worth up to $250,000 for emergency medical expenses

Tailor other included benefit levels to your needs

Coverage only applies to trips up to 40 days

Deductible up to $100 applies for emergency medical coverage and baggage and personal effects

- Trip cancellation coverage worth up to between $2,500 and $10,000

- Trip interruption coverage worth up to 150% of the trip cancellation limit

- Up to $2,000 in trip delay coverage ($200 daily limit)

- Up to $1,000 in protection for missed connections

- Up to $250,000 in coverage for emergency medical expenses ($50,000 in New Hampshire)

- $750 dental sublimit within emergency medical coverage

- Up to $500,000 in coverage for emergency medical evacuation and repatriation of remains

- Up to $2,000 in coverage for baggage and personal effects

- Baggage delay coverage worth up to $1,000 ($100 daily limit)

- 24/7 travel assistance services

Get annual coverage for medical expenses and routine medical care

High limits for medical expenses and emergency medical evacuation

GeoBlue plans don't offer comprehensive travel protection

Deductibles and copays apply

- Ambulatory and therapeutic services

- Inpatient hospital services

- Emergency medical services

- Rehabilitation and therapy

- Preventive and primary care

Choose among three tiers of annual travel protection

Option for basic protection with affordable premiums

No coverage for preexisting conditions

Maximum trip duration of 30 days per trip

- Trip cancellation coverage up to $2,500 maximum per year

- Trip interruption coverage up to $2,500 maximum per year

- $200 per trip for trip delays (up to $100 per day for delays of 12 hours or longer)

- Up to $500 in coverage per trip for baggage and personal effects

- Baggage delay coverage up to $100 per trip

- Up to $10,000 for emergency medical expenses per trip

- Up to $50,000 in emergency medical evacuation coverage per trip

- Up to $10,000 in AD&D coverage

- 24-hour travel assistance services

Why Trust U.S. News Travel

Holly Johnson is a travel expert who has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world. On a personal level, her family uses an annual travel insurance policy from Allianz. Johnson works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – within their family media business and travel agency .

You might also be interested in:

The 5 Best Family Travel Insurance Plans

Holly Johnson

Explore the options to protect your family wherever you roam.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

The 6 Best Vacation Rental Travel Insurance Plans

Protect your trip and give yourself peace of mind with the top options.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

For the Frequent Traveler: The 11 Best Annual Travel Insurance Policies

Content Contributor

91 Published Articles 9 Edited Articles

Countries Visited: 197 U.S. States Visited: 50

Jessica Merritt

Editor & Content Contributor

98 Published Articles 520 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Keri Stooksbury

Editor-in-Chief

37 Published Articles 3306 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Table of Contents

The 11 best annual travel insurance policies, what is annual travel insurance, is annual travel insurance worth it, how much do annual travel insurance policies cost, does credit card travel insurance apply annually, choosing an annual travel insurance policy, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If you take multiple trips every year, insuring each one can be a hassle. There are forms to fill out, comparison shopping over and over again, and then remembering the policy documents for each specific trip. And then there’s the risk you might forget to take out travel insurance for one of your trips.

Plus, those costs add up. There must be a better way.

Enter annual travel insurance. Also known as multi-trip travel insurance, taking out an annual policy covers you for a whole year of travel. Not only is it simpler, it may be cheaper than taking out multiple single-trip policies. But is it right for you?

Annual travel insurance policies aren’t exactly the same as the trip insurance you’d buy for a weeklong holiday with your family. Here are the best annual travel insurance policies, what they do and don’t cover, and how to decide whether taking out a yearly policy might be right for you.

GeoBlue Trekker Choice

GeoBlue offers 2 Trekker plans for annual coverage, which are unique in several ways. These plans cover preexisting conditions, COVID-19, and all travel outside the U.S.

However, they don’t cover any trips inside the U.S. or provide any coverage for canceled, delayed, or interrupted trips. Instead, these are travel medical insurance plans . With the GeoBlue Trekker Choice plan , you’ll get higher maximum payouts in all categories and pay a lower deductible ($100). However, note that this is still secondary coverage .

You’ll get unlimited access to telemedicine and coverage for trips up to 70 days in length . Additionally, coverage is available up to age 95, which isn’t offered on most other policies.

GeoBlue Trekker Essential

The GeoBlue Trekker Essential plan offers the same pros and cons as the Choice plan. The main differences are the lower maximum payout values and the higher deductible ($200 instead of $100). You also won’t get the Choice plan’s lost baggage and personal effects coverage, which can provide up to $500 per trip. Again, this secondary medical insurance policy is only valid on trips outside the U.S.

Trawick International Safe Travels Annual Basic

Trawick International offers 2 annual plans, and the Safe Travels Annual Basic plan is more economical. You’ll have coverage for everything you expect in a trip insurance policy , such as 100% coverage for trip cancellation or interruption (up to a $2,500 annual maximum) and coverage for delays, lost luggage, delayed luggage, and even medical expenses. To make up for the lower cost of the plan, coverage limits are lower than what you’ll find elsewhere . However, if you want peace of mind while traveling, you can get it for a year and cover trips up to 30 days in length.

Trawick International Safe Travels Annual Deluxe

While Trawick International’s Safe Travels Annual Deluxe plan offers higher maximum coverage limits than the Basic plan, its maximum payouts for medical and evacuation benefits are lower than what you’ll find with competitors . Where this plan shines is in the coverage for change fees, lost deposits on tours, and coverage for lost items if an airline misplaces your luggage.

You’ll be covered for up to $300 per trip for prepaid excursions, up to 100% of your trip cost (with an annual maximum of $5,000) for trip cancellations or interruptions, and up to $150 per item and $750 per trip for personal effects. After signing up for a plan, you’ll also get a 10-day free look period.

Allianz Travel AllTrips Basic Plan

If you want an annual plan with a low price tag , this could be what you’re looking for. The Allianz Travel AllTrips Basic plan covers you for unlimited trips up to 45 days each over the course of a year. Coverage includes emergency medical, emergency medical evacuation, baggage loss and delays, travel delays, rental car theft and damage, and travel accident coverage.

However, there’s a fair list of exclusions from this plan . That includes trip cancellation, trip interruption, missed connections, and change fees. As the name implies, you’ll get basic coverage at a basic price.

Allianz Travel AllTrips Prime Plan

The Allianz Travel AllTrips Prime option covers 365 days of trips, though the maximum trip length is just 45 days. While you’ll get coverage for all the standard travel insurance benefits, including trip cancellation, trip interruption, emergency medical, delays, and baggage mishaps, there are limits you should know about with this plan.

The travel accident coverage, which applies to death or the loss of a limb, maxes out at $25,000 per trip, baggage delay maxes out at $200, and baggage loss or damage maxes out at $1,000. The maximum coverage for emergency medical is $20,000, and costs can exceed that quickly in a true emergency.

However, this is a decent option if you want a fair amount of coverage across numerous categories without a high price tag.

Allianz Travel AllTrips Executive Plan

For those worried about expensive business equipment or losing points and miles, this plan has you covered. On top of higher maximum payouts in categories such as trip cancellation, emergency medical transportation, or travel delays, you’ll also get rental car damage and theft coverage, change fee coverage, and reimbursement for renting business equipment if yours is lost, stolen, damaged, or delayed during a trip.

Moreover, you can be reimbursed up to $500 to cover fees for reinstating your points and miles if a covered trip is canceled or interrupted. The Allianz Travel AllTrips Executive plan also provides coverage for preexisting medical conditions if you meet certain criteria and buy at least 14 days before the first trip.

Allianz Travel AllTrips Premier Plan

Allianz also has a customizable AllTrips Premier plan , allowing you to choose between several payout tiers for trip cancellation and interruption. You’ll pay more when choosing higher maximums, but this allows you to choose exactly what you want in coverage and not pay for more than you need. Another positive is coverage for preexisting medical conditions if you meet certain criteria and buy your policy at least 14 days before your first trip.

You’ll also get rental car damage and theft coverage , $500,000 of emergency medical transportation coverage, $50,000 of emergency medical, and coverage for travel delay expenses after a delay of 6 hours or more. The baggage delay coverage is up to $2,000, but it requires a delay of 12 or more hours. The maximum trip length allowed is 90 days.

AIG Travel Guard Annual Travel Insurance Plan

The AIG Travel Guard Annual Travel Insurance plan isn’t available to Washington state residents. Still, it provides coverage for trip interruption, trip delay, lost baggage, delayed baggage, and missed connections, as well as both medical and security evacuation, accidental death and dismemberment, and travel medical expenses. However, the coverage limit for dental is just $500, and the maximum coverage for travel medical expenses is just $50,000. Those are lower limits than other plans. Additionally, trip cancellation isn’t included.

However, Travel Guard has some strengths. Trip delay coverage applies for up to 10 days and requires a delay of just 5 hours, and the missed connection benefit applies after just 3 hours. You get a “free look” period of up to 15 days to cancel for a refund, so long as you haven’t started your trip or filed a claim. Maximum coverage for any particular trip is 90 days.

USI Affinity Voyager Annual Travel Insurance

USI Affinity’s Voyager plan has a Silver and Gold option , and pricing is easy to determine from the chart. Simply find your age bracket and the associated cost. The key differences between the plans are in the higher maximum payouts for nearly every coverage type with the Gold plan, other than emergency dental and accidental death and dismemberment. However, the Gold plan also includes coverage types the Silver plan doesn’t: political and natural disaster evacuation, airline ticket change fees, and trip interruption. However, trip cancellation isn’t included with either plan .

The maximum trip length is 90 days, and coverage for Silver and Gold plans lasts for 364 days. An unlimited number of international and domestic trips are covered, and you’re covered for trips as little as 100 miles from home. That’s a lower requirement than most other plans (which tend to require 150 miles).

Seven Corners Travel Medical Annual Multi-Trip

This plan is ideal for those who don’t live in the U.S., as other plans on this list are only available to U.S. residents and citizens. While the plan technically lasts for 364 days, Seven Corners’ Travel Medical Annual Multi-Trip plan is customizable. It lets you choose a maximum trip length of 30, 45, or 60 days and include or exclude coverage for the U.S. Note U.S. citizens and residents cannot add coverage for inside the U.S.

Seven Corners also provides coverage for travelers aged 14 to 75 years, though maximum payouts decrease in some categories for those aged 65 and older. If you receive medical care in the U.S., Seven Corners will pay 90% of the first $5,000 of covered expenses and 100% of the cost afterward. You’re covered 100% outside the U.S. Note that coverage doesn’t apply to your home country (which includes the U.S. if you’re a citizen, even if you live in another country) and isn’t available in Antarctica, Cuba, Iran, Israel, North Korea, Russia, Syria, or Ukraine.

A Plan That Didn’t Make Our List

We considered another plan. Here’s why this annual travel insurance policy didn’t make our “best of” list.

IMG Patriot Multi-Trip International : For trips inside the U.S., you may be on the hook for 20% of your medical expenses if you visit a provider outside IMG’s PPO network. Additionally, the maximum trip length is 30 days, and coverage limits are quite low in multiple categories. These include $50,000 for emergency medical evacuation and $10,000 for political evacuation, a maximum of $50 per item and $250 overall for lost luggage, a $100 maximum for dental treatment, and $25,000 for accidental death and dismemberment 24/7 coverage.

Annual travel policy plans vary considerably. Most provide secondary medical insurance, so you may need to submit to your other coverage (home healthcare plan, credit card insurance provider, etc.) first and then submit to your travel insurance provider for any remaining expenses or deductibles. If you won’t have other coverage, you may want to look for a plan that provides primary health coverage instead. Also, understand that most plans provide reimbursement, so you would pay out of pocket for overseas hospital visits and then submit to your insurance provider for reimbursement after the fact.

Annual travel insurance covers you for many trips over the course of a year (or sometimes 364 days). Rather than needing to buy a travel insurance policy for each trip separately — which can add up — you can buy a single policy that covers all your trips for the next year. It’s important to understand the terms of these policies, though. Some may require buying coverage in advance, such as 14 days before your first trip, while that requirement normally doesn’t exist on single-trip travel insurance.

It’s also important to note which types of trips and destinations are covered by your policy — and which aren’t. Look for how far from home you must travel to be covered and whether domestic trips are included. Moreover, consider what benefits you’re looking for. These can vary from medical-only to all the bells and whistles, such as baggage delay and medical evacuation. Once you know the type of coverage you want, you can find a policy or policies that align with your needs, helping you narrow down your options to conduct a more effective comparison.

How Annual Travel Insurance Works

Annual travel insurance works as an umbrella policy, covering all your trips during the policy period. You don’t need to inform the policy provider about each trip’s start and stop dates or destinations. You simply buy a policy, and then you’re protected for every trip that meets the conditions while your policy is in effect. Some regions may be excluded from coverage, and you may be subject to a maximum trip length.

Trip length is an important element to pay attention to. Annual travel insurance doesn’t cover you for a year-long trip. It covers you for a year for many small trips within that time, typically up to 30 or 45 days per trip. If you’re looking for a plan to cover you during a year-long trip to another country, you should look for specialized plans for study abroad, mission work, or other situations that apply to you. Traveling full-time? You may need a policy geared toward digital nomads and backpackers.

When To Buy an Annual Travel Insurance Policy

You should buy your annual travel insurance policy as soon as you know you’ll have multiple trips in the next year and determine that the cost of insuring each alone would be higher than that of a single multi-trip plan. What’s the break-even point on that cost? It depends on the coverage you want.

Considering that single-trip plans can sometimes be found for $10, yet an annual trip is likely to cost $150 or more per adult, you’d need 15 trips to justify the annual policy. However, that’s not really an apples-to-apples comparison, as a $10 basic travel insurance policy won’t provide as much coverage as you’re likely to find on even the most basic of annual policies.

It’s also not just about the number of trips you take but the types of trips, the complexity of the trips, and money at risk in nonrefundable costs. The more of these you foresee in your next year of travels, the more likely an annual plan would be good for you.

What Annual Travel Insurance Policies Do and Don’t Cover

We already highlighted that annual policies don’t cover traveling nonstop for a year due to their restrictions on the maximum trip length. Annual travel insurance policies also restrict how far you must travel for coverage to kick in. Driving to the next town over may be a trip in your kids’ eyes, but it’s probably not far enough for your travel insurance to kick in.

While coverage varies by policy, you’ll typically have coverage for sickness, accidental death and dismemberment, lost or delayed luggage, trip cancellation, and possibly injuries during skiing or snowboarding. However, it’s important to read the terms of each policy because coverage maximums and inclusions vary widely. Some policies only provide medical coverage, while others offer robust coverage across the board.

Understanding Trip Length Rules

Each policy specifies a maximum trip length. How trips longer than that are treated can vary. Most policies won’t cover any expenses related to a trip longer than the maximum trip length. Suppose you take a trip of 41 days on a policy with a maximum of 40 days. In that case, claims for delayed luggage or medical expenses may be rejected when the claim evaluator asks for your trip confirmation details.

However, GeoBlue covers the first 70 days of any particular trip. If something goes wrong during that time, you’re covered. You’re on your own for anything that happens on days 71 or beyond. Still, you’re covered on those first 70 days, despite taking a longer trip.

If you foresee long trips in the future, make sure you understand these rules.

For some travelers, yes, annual travel insurance is worth it. For others, it’s not.

Annual travel insurance is worth it when it costs less than what you’d pay to insure each trip individually. It’s also worth it if you think you might forget to purchase some of those individual policies throughout the year and would prefer to be done with them for another 365 days.

However, annual travel insurance isn’t worth it if you only take a few trips a year, they’re mostly domestic, and you don’t have major nonrefundable expenses. If you’re traveling within the U.S. with your standard health insurance policy in effect and you have credit cards that provide trip insurance for delays or cancellations, that coverage may be sufficient.

Costs will vary by your home state, age, and number of people included in the policy. Here are the “starting at” costs for our best annual travel insurance policies, sorted from lowest to highest:

Yes and no. Using a credit card to pay for your trip can provide some built-in protections. However, you should be mindful of annual maximums on any policy. You may run into limitations such as a maximum of 2 claims per 12-month period or similar exclusions. If you take many trips, that could be an issue.

To better understand what is and isn’t covered, check out our complete guide to credit card insurance .

To choose the right policy, look beyond the cost alone. Rather than immediately choosing the cheapest policy, find the policy or policies that provide the coverage types you want with payout maximums that cover your travel plans for the next year — both confirmed bookings and likely plans.

Consider your coverage needs. Will you be carrying expensive items such as scuba equipment for a trip to the Galapagos or top-notch camera lenses for a bird-watching tour in Papua New Guinea? How many extreme sports will you participate in?

Conversely, how many “never heard of this airline before” flights will you take to get off the beaten path? These are flights where you may be worried about cancelations that lead to extra costs or a misplaced suitcase.

Consider the types of trips you’ll take and the up-front money at risk if something goes wrong or you get delayed, then look at which plans align with your travels. From there, choose the best plan that aligns best with your needs, which may or may not be the cheapest one.

As an annual travel policy holder myself, I promise you that having the right plan is important when you wind up in a remote hospital in Tanzania with malaria.

Annual travel insurance isn’t right for everyone. However, it makes sense for those who travel often and could save money by taking out a single policy instead of many separate policies. It also makes sense if you’d prefer to avoid filling out paperwork numerous times throughout the year for each trip.

Annual travel insurance policies aren’t great for those who tend to travel closer to home, don’t have major nonrefundable travel expenses, or need to customize coverage for each trip because their travels tend to vary. For example, you might need different coverage for a backcountry ski trip with friends versus a 2-hour drive with your family.

Look at what annual policies do and don’t cover and see if these align with your travel goals and needs. Then, consider the prices for the plans that align well with your situation. After taking an informed look, you should have a good idea of whether an annual policy is right for your situation.

Frequently Asked Questions

Is yearly travel insurance worth it.

For some, yes. For others, no. Annual travel insurance is worth it when the cost is less than what you’d pay to insure each trip separately or you would prefer to just sign up once then be done for a year. However, annual travel insurance isn’t worth it if you only take a few, mostly domestic, trips a year where your healthcare coverage works, and you don’t have major nonrefundable expenses.

How much does annual trip insurance cost?

Costs vary greatly depending on the type of coverage you want. Annual travel insurance plan costs range from $140 to $500 for a single person. If you take a lot of trips, the cost can be worth it over the course of a year, but each person’s situation is different.

When should I take out annual travel insurance?

You should buy your annual travel insurance policy as soon as you know you’ll have multiple trips in the next year and that the cost of insuring each alone would be higher than the cost of a single multi-trip plan. What’s the break-even point on that cost? It depends on the coverage you want. Look at the different types of coverage and your expected costs for insuring each trip separately, then see if it makes sense for you.

Does annual travel insurance automatically renew?

It varies by policy provider, but some companies have an auto-renew feature to ensure you don’t have gaps in coverage.

Was this page helpful?

About Ryan Smith

Ryan completed his goal of visiting every country in the world in December of 2023 and now plans to let his wife choose their destinations. Over the years, he’s written about award travel for publications including AwardWallet, The Points Guy, USA Today Blueprint, CNBC Select, Tripadvisor, and Forbes Advisor.

Discover the exact steps we use to get into 1,400+ airport lounges worldwide, for free (even if you’re flying economy!) .

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

5 Best Cheap Travel Insurance in 2024 (plus DISCOUNTS)

Home | Travel | 5 Best Cheap Travel Insurance in 2024 (plus DISCOUNTS)

When traveling abroad, get a policy from one of the best travel insurance companies . You can get a 5% discount on Heymondo , the only insurance that pays medical bills upfront for you, HERE!

If you’re taking a trip and looking for the best cheap travel insurance , you’ve come to the right place. Travel insurance may not be the most exciting topic, but it’s an essential part of planning a trip , so make sure you don’t leave home without it!

Besides, you can find affordable travel insurance for all types of budgets, so rest assured that you can get great coverage without spending a lot of money. In this guide, I’ll share the 5 cheapest international travel insurance companies to help you find the perfect fit for your trip needs.

5 Best cheap travel insurance in 2024

I will say upfront that we use Heymondo for all our trips. It’s one of the best travel insurance companies out there, offering tons of coverage and competitive prices. Plus, Heymondo is the only provider that pays your medical expenses upfront , so you don’t have to pay out of pocket and file a claim for reimbursement. Plus, you can get a 5% Heymondo discount just for being a Capture the Atlas reader.

5% OFF your travel insurance

Of course, there are other great options, such as SafetyWing , a cheap travel medical insurance that’s perfect for those on a tight budget who don’t mind having a deductible. Keep reading to see all the best options, compare prices, and see what inexpensive travel insurance should include.

Top 5 cheap travel insurance companies in 2024

In this guide, you’ll find the 5 best cheap travel insurance companies of 2024, so I’m sure you’ll find an option that’s perfect for you. To sum up, these are my top 5 recommendations:

- Heymondo , the best cheap travel insurance company

- SafetyWing , the best medical-only cheap travel insurance

- IMG , the best budget travel insurance for seniors

- Trawick International , a cheap travel insurance for pre-existing conditions

- Travelex , a cheap travel insurance for families

Keep reading to learn more about each company, including its prices, coverage limits, and other benefits, as well as a chart comparing the cheapest travel insurance policies.

Best cheap travel insurance price comparison

Before I get into details about each of these cheap travel insurance companies , I want to give you an overview of their prices and benefits. This chart will let you see each provider’s price per person, deductible, and coverage limits at a glance.

For this cheap travel insurance comparison , I used the example of a 30-year-old traveler from Canada who was going to Costa Rica for one week with a trip cost of $2,500. I also chose the most affordable plan for each company:

As you can see, Heymondo and SafetyWing are the two cheapest international travel insurance options. While Heymondo costs more, it also offers much higher coverage limits than SafetyWing, which is why it’s our favorite. It’s also the only provider that pays your medical expenses upfront , so you don’t have to pay out of pocket.

IMG Global, Trawick International, and Travelex offer similar coverage in some categories, but they also cost more. I recommend reading about each company below so you can determine which one best suits your needs .

1. Heymondo , the best cheap travel insurance company

Heymondo is one of the best cheap travel insurance companies overall, offering a high amount of coverage at a great price. With Heymondo, you’ll have comprehensive travel and medical-related benefits, including emergency medical expenses, trip cancellation insurance , and baggage loss.

There is also a $0 deductible for single-trip and annual multi-trip insurance, and the deductible for long-stay travel insurance is just $250 per claim. Best of all, they’re the only company that pays your medical bills upfront , so you don’t have to pay any medical bills and file a claim later to get a reimbursement.

Heymondo was also one of the first providers to include COVID coverage in its policies, which set the bar for other insurers. Moreover, the 24/7 traveler assistance app is another testament to Heymondo’s dedication and customer service. You can use it to get in touch with a team of doctors for advice and recommendations for the nearest clinic or hospital.

For all these reasons, we’ve been traveling with this insurer for 5 years, and we have a detailed Heymondo insurance review that you can read for more information. Overall, it’s the best value for money, and for just a bit more, you can upgrade your coverage to include adventure sports, cruises, and electronics.

Right now, we have the annual multi-trip policy from Heymondo, which is the cheapest international travel insurance for frequent travelers. If you decide to purchase from Heymondo, don’t forget to take advantage of our 5% Heymondo discount code by using our link .

2. SafetyWing , the best medical-only cheap travel insurance

Another affordable travel insurance to look into is SafetyWing . Their Nomad Insurance plan offers excellent, budget-friendly medical coverage with some travel-related benefits like baggage loss.

One of the most unique things about SafetyWing is that you can get coverage in your home country for 30 days after you’ve been abroad for 90 days, so it’s a good deal if you want supplementary protection for any medical issues. Moreover, this is a good, cheap travel insurance for families since it offers free coverage for up to two kids under the age of 10.

Keep in mind that while SafetyWing has cheap travel medical insurance , it focuses mostly on health-related benefits like emergency medical expenses and COVID coverage. That said, if you’re fine with having medical-only insurance for travel , it’s one of the best deals.

Another drawback of SafetyWing is that it has a $250 deductible per claim, so you’ll have to pay $250 toward your medical bills before the company will cover the rest. If you don’t want a deductible, Heymondo is a good alternative.

3. IMG Global , the best budget travel insurance for seniors

If you’re looking for travel insurance for seniors , then IMG Global is one of the best options. Finding budget-friendly travel insurance for seniors can be super tricky, but IMG Global has a plan specifically designed for travelers 65 and older.

The GlobeHopper Senior Single Trip plan offers travel and medical-related benefits and the option to choose a maximum coverage limit of $50,000, $100,000, $500,000, or $1,000,000. It’s also one of the few cheap travel insurances for pre-existing medical conditions , so it’s ideal for older travelers. While there aren’t as many travel-related benefits with this plan, it does offer lots of flexibility, as customers can choose a deductible of $0, $100, $250, $500, $1,000, or $2,500.

And for other travelers, IMG Global’s iTravelInsured Travel Lite plan is a good deal, with a $0 deductible and a good amount of coverage in all travel and medical-related categories. This includes emergency medical, evacuation, and trip cancellation/interruption benefits. In fact, its trip cancellation covers a wide range of reasons, including work transfers, job loss, passport/visa theft, natural disasters, and injury/illness.

However, this plan is among the most expensive options we found, so if you’re looking for cheaper single-trip travel insurance , I recommend Heymondo .

4. Trawick International , an affordable travel insurance for pre-existing conditions

Trawick International is another cheap travel insurance for pre-existing medical conditions , so if that’s something you’re looking for, I suggest getting a quote.

The company’s Safe Travels Explorer Plus plan is just a few dollars more than the Safe Travels Explorer plan, so it’s worth shelling out a bit more for its comprehensive coverage. This includes emergency medical expenses, repatriation, trip cancellation, baggage loss, and more, plus a $0 deductible. You can even add cancel for any reason travel insurance to your policy.

While Trawick International offers travel insurance for pre-existing conditions , you must purchase your plan within 7 days of the initial trip deposit date to enjoy this benefit. Also, it’s worth noting that the medical expenses coverage is on the lower end, at $250,000. If you don’t have a pre-existing medical condition and want higher medical coverage, you can get about five times more protection by going with Heymondo .

5. Travelex , a cheap travel insurance for families

Finally, Travelex is another cheap travel insurance company and a great option if you’re looking for domestic travel insurance for the USA . Travelex’s plans are affordably priced and offer comprehensive protection, including coverage for pre-existing medical conditions.

You can choose from the Travel Basic or Travel Select plan, although we recommend the latter, especially if you have a pre-existing condition or want a higher amount of coverage. That said, make sure to purchase your policy within 15 days of your initial trip payment so you receive a Pre-existing Medical Condition Exclusive Waiver.

Additionally, Travelex is a good option to consider if you want cheap family travel insurance since kids under 17 are included for free. Plus, you can upgrade your coverage to include things like rental cars, Cancel for Any Reason, and extra medical coverage.

Travelex’s benefits include coverage for baggage loss, trip cancellation, trip interruption, and evacuation and repatriation. While it also offers emergency medical expenses coverage, the limits are quite low, especially considering the price.

Also, for Canadian residents, there is a medical-only plan, which could be a good option if you’re looking for cheap medical-only travel insurance .

What does cheap international travel insurance cover?

When looking for the best deals on travel insurance , remember to check the policies carefully so you understand what’s included. Some cheap travel medical insurance plans include higher amounts of coverage compared to others with similar prices, so it gets a bit tricky.

Below, you’ll find the most important things to consider when browsing affordable travel insurance .

Emergency medical coverage

First, emergency medical expense coverage is one of the most crucial aspects of any cheap travel health insurance . You want to be covered for any unexpected costs that arise from an injury or illness while abroad. Emergency medical coverage includes things like hospitalizations, doctor-prescribed tests, treatments, and even dental procedures.

Emergency medical coverage with cheap travel insurance

Again, this is one of the most important benefits to look for, even if you want inexpensive travel insurance . It’s worth paying a bit more for a high amount of coverage, especially if you’re shopping around for travel insurance for the USA , where healthcare costs are through the roof.

Medical evacuation & repatriation

Another thing to look for when browsing the cheapest holiday insurance is medical evacuation and repatriation. The costs for these services are super expensive, so having this type of coverage is essential.

With medical evacuation and repatriation protection, you’ll be covered if you need to be transported from a remote area to a hospital or from your travel destination to your home country due to a serious injury or illness. It’s easy to overlook this benefit but should something happen and you don’t have this coverage, it could result in a huge financial loss.

Medical evacuation & repatriation coverage

Should an emergency arise, you don’t want to delay getting proper medical care, so having this type of coverage is very important!

Covid-related coverage

As I mentioned, Heymondo was one of the first providers to cover COVID-19 the same as any other illness, and many other insurance companies soon followed suit. While the height of the pandemic is over, it’s still worth having COVID coverage.

Besides, most cheap international travel insurance includes this type of coverage, so it won’t increase the price of your policy. If you do happen to contract COVID during your trip, you’ll be covered for the medical and travel-related expenses.

The exact terms and conditions depend on the company, but most insurers cover travelers for COVID testing, treatment, and quarantine.

Trip cancellation (and trip interruption)

Another thing you’ll want your plan to include is some type of trip cancellation coverage. This usually covers reasons like illness, inclement weather, strikes, and jury duty. However, you should always double-check your policy since providers vary on what they will and won’t cover.

Trip cancellation and trip interruption benefits

Also, be aware that cheap travel insurance typically doesn’t include Cancel For Any Reason (CFAR) but may offer it as an add-on. You can check our guide on the best cancel for any reason travel insurance for more information.

Along the same lines, trip interruption coverage will reimburse you if you need to cut your trip short due to a serious illness, injury, or the death of a family member. When buying cheap travel insurance , check to see if this benefit is included and what exactly falls under this category.

Lost or stolen baggage & delays

Lastly, baggage loss is something that even the most affordable travel insurance plans should cover. Anyone who has traveled knows that there is always the risk of your luggage getting lost, damaged, or delayed, so having this type of coverage is a good idea.

Under this benefit, you’ll receive a reimbursement so you can buy new toiletries, clothes, and other essentials if something happens to your luggage. The amount depends on the particular plan you choose.

What’s not covered by cheap travel insurance?

Now that you know the most important things to look for when shopping for travel insurance on a budget , let’s talk about what’s not covered. While cheap travel insurance can definitely offer comprehensive coverage, some policies only cover medical-related expenses, so you won’t be covered for travel-related issues.

Others exclude certain things like coverage for pre-existing medical conditions, natural disasters, and fear of travel. Again, it’s crucial that you look over your policy carefully so you know exactly what you’re getting.

Tips for buying travel insurance on a budget

Getting cheap international travel insurance isn’t just a matter of purchasing the least expensive policy you see. To get the best bang for your buck, keep these tips in mind:

- Pay attention to the policy limits to make sure you’re getting the best deal on travel insurance . While you might find lots of plans with low prices, that doesn’t mean they all offer the same amount of coverage.

- Buy at the right time . It’s better to purchase a policy as soon as you book your vacation so you know the exact price of your trip (this makes the claims process easier). Also, if you buy your policy just after booking your trip, you will have more benefits regarding the cancellation coverage.

- Shop around and compare cheap travel insurance policies from different providers.

- Only buy what you need and decline any unnecessary extras. For example, if you just need medical coverage, you don’t need to bother with things like trip cancellation and baggage loss coverage.

- If you travel more than three times a year, consider getting annual multi-trip insurance , which will save you money in the long run.

- Check to see if your credit card has travel insurance benefits . Some cards offer protection for trip cancellation or delayed/lost baggage (I’ll touch on this later).

By keeping these tips in mind, you can find cheap travel insurance for any type of trip.

Medical-only vs. cheap travel insurance

As you’re shopping for low-cost travel insurance , you’ll probably come across medical-only travel insurance . While they’re both affordable options, they aren’t the same, so it’s important to know the difference.

Cheap international travel insurance includes both medical and travel-related coverage. This means that you’ll be covered for health emergencies like sicknesses and injuries, as well as trip cancellation and baggage loss.

On the other hand, medical-only travel insurance will only apply to medical-related scenarios, and the coverage limits tend to be a lot higher. Of course, this really comes in handy when you’re traveling to countries where healthcare is exceedingly high, like the United States or Japan.

For our trips, we like to have insurance that covers medical and travel-related situations, which is why we always go with Heymondo travel insurance plans. This way, we’re covered for medical emergencies, trip delays, lost baggage, evacuation, repatriation, and more.

Is getting affordable travel insurance worth it?

Without a doubt, travel insurance is worth it , always! When you travel as much as us, you realize that anything can happen while you’re abroad, so it’s always a good idea to be prepared. We’ve had several scary experiences and mishaps, and if it weren’t for our annual travel insurance from Heymondo , we would’ve been stuck with huge headaches and financial losses.

Here are just a few examples of times when we’ve had to rely on our insurance:

- We had our most traumatic experience in the Peruvian Amazon when our boat capsized and tossed all of the passengers and their bags into the river . We were carried away by the water for about 15 minutes before we were able to get rescued and climb back on land. While Dan and I didn’t need medical attention, we lost a lot of equipment, including a couple of laptops and cameras, several lenses, two hard drives, and our passports. Fortunately, we were able to contact Heymondo via their 24/7 app, and they helped us connect with the Spanish embassy to return to Spain for new passports. Plus, our policy included $750 dollars each for Dan and me to cover our lost equipment.

- A less dramatic but still terrifying incident occurred in Alaska when Dan’s drone hit a tree and fell on me, cutting up my hand . I got freaked out by all the blood, and, in a rush, we drove to the nearest hospital for medical care. If we had contacted Heymondo first, they would’ve arranged the medical payments in advance, but since we forgot to, we had to pay the $3,000 bill upfront. Heymondo quickly reimbursed us, of course, but imagine if we hadn’t had trip insurance!

- In Ecuador, Dan got a stomach sickness that led to a hospital visit. Luckily, with our cheap holiday insurance , we were covered for this emergency medical expense.

So yes, getting insurance is totally worth it! Best of all, there are affordable travel insurance plans out there, as you’ve seen in this guide, so there’s no reason not to get it.

Credit cards with cheap travel insurance benefits

The last thing I want to touch on involves getting cheap travel insurance with one of the best credit cards for travel . While not all cards have this benefit, some offer trip cancellation protection or reimbursement for lost or delayed baggage.

For example, the Chase Sapphire Preferred credit card is one option that offers cardholders coverage for trip cancellation and interruption, as well as baggage loss/delay coverage. So, if you’re thinking about buying cheap travel insurance that mostly covers medical-related expenses, you might want to look into a credit card with travel-related benefits.

That said, I still recommend investing in a good travel insurance policy, especially if you’re a frequent traveler. You can find the best deals on travel insurance by looking into any of the providers I mentioned in this guide.

FAQs – Cheap travel insurance

To end this guide, I’m sharing the answers to the most common questions about affordable travel insurance :

What is the best affordable travel insurance?

In my opinion, Heymondo has the best cheap travel insurance on the market, although it’s also worth looking at SafetyWing , IMG Global , Trawick International , and Travelex .

How much does travel insurance cost?

You can buy cheap travel insurance for under $10 per week, although the amount of coverage varies.

What are the different types of budget travel insurance?

You can find cheap medical-only travel insurance or affordable insurance with travel and medical-related coverage.

The best cheap travel insurance covers emergency medical expenses, repatriation, baggage loss/delay, and trip cancellation.

What’s not covered by cheap travel medical insurance?

Some budget travel insurance policies won’t cover pre-existing conditions or travelers over a certain age.

When should I get travel insurance if I’m on a budget?

You should purchase your travel insurance as soon as you book your holiday.

Is buying cheap travel insurance worth it?

Yes, even if it’s a cheaper travel medical insurance , it’s still worth getting. This way, you’re covered in case anything goes wrong during your trip, so you can focus on enjoying yourself.

I hope this guide helps you find the best affordable trip insurance for your needs. Don’t forget that you can save money on a Heymondo policy by using our link .

If you have any other questions about budget travel insurance , feel free to leave me a comment below. I’d be happy to help you out.

Until then, have a great trip, and don’t leave home without travel insurance!

Don't miss a 5% discount on your HeyMondo travel insurance

and the only one that pays all your medical bills upfront for you!

Ascen Aynat

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

5% OFF your Heymondo travel insurance. It pays your medical bills upfront!

20% Off Annual Travel Insurance Promo Code (1 Active) 2024

Annual Travel Insurance Coupon: Get an Extra 20% Off Select Items

See Today's Travel Insurance Deals at Amazon + Free Shipping w/Prime

Get a $100k Funded Trading Account at TopStep Trader!

Get 30% Off Travel Insurance Using These Annual Travel Insurance Competitor Coupons (Active Today)

Try these unverified codes for annual travel insurance and get up to 30% off if they apply to your purchase, why search for annual travel insurance coupons.

eBay Savings: Save Up to 30% on Travel Insurance at eBay

Annualtravelinsurance.com coupon: get wintersports travel insurance from £28.95 at annual travel insurance.

Annual Travel Insurance Deal: Get Up to 20% Off Annual Travel Insurance at Walmart (Free Next-Day Shipping on Eligible Orders $35+)

Unverified promo codes for annual travel insurance, try this seasonal discount code at annualtravelinsurance.com, annual travel insurance promo codes: complete timetable.

Knoji is the largest database of AnnualTravelInsurance.com coupons and Annual Travel Insurance discount codes online. Our massive community of shoppers adds over 10,000 coupons per day and makes thousands of coupon edits, ensuring we have every working Annual Travel Insurance code available while minimizing the likelihood that you'll run into an expired code.

Every promotional code displayed on this table has been hand-verified by multiple members of our community. We show you this table so you have a complete record of Annual Travel Insurance promo codes , including older promotions that you can test yourself on Annual Travel Insurance's website. (In some cases, Annual Travel Insurance may have reactivated older codes, which may still work for discounts at annualtravelinsurance.com).

Why Trust Knoji for Annual Travel Insurance Coupon Codes

Verified annual travel insurance promo codes, site-wide discount codes, email discount codes, annual travel insurance free shipping coupons, community-powered savings, earning rewards.

- Active Contributors (Last 30 days): 2,900 Our vibrant community of savings enthusiasts actively shares and verifies promo codes, helping everyone save more.

- Codes Added (Last 30 days): 128,943 We constantly update our database with the latest promo codes, ensuring you never miss a chance to save.

- Codes Tested (Last 30 days): 617,117 Our advanced AI algorithms and community members rigorously test codes to guarantee their validity.

- Number of Working Codes: 936,958 We maintain an extensive collection of real-time, working promo codes for your favorite brands.

- Number of Merchants With Working Codes: 95,886 From major retailers to niche brands, we have working promo codes for a wide range of merchants.

Annual Travel Insurance: How to Save Money and Find Coupon Codes

Annual travel insurance coupon stats, annual travel insurance coupon faq, is annual travel insurance offering any coupons today, how often does annual travel insurance release new coupons, how do i find annual travel insurance coupons, what's annual travel insurance's best coupon discount right now, how do i use my promo code for annual travel insurance, how to apply your annual travel insurance discount code, holiday insurance products promo codes and deals - active today, why knoji is the best source for annual travel insurance promo codes, coupons & deals.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Review

- Best Car Buying Apps

- Best Sites To Sell a Car

- CarMax Review

- Carvana Review (July 2024)

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best Accounting Software

- Best Receipt Scanner Apps

- Best Free Accounting Software

- Best Online Bookkeeping Services

- Best Mileage Tracker Apps

- Best Business Expense Tracker Apps

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best SEO Services

- Best Mass Texting Services

- Best Email Marketing Software

- Best SEO Software

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans