$1.2 Trillion US Travel Industry Is Plummeting, Says New Study

(Bloomberg) -- Plagued by ongoing staffing shortages, visa delays and even political division, the US travel industry has lagged competitors in reclaiming its share of international visitors since the Covid-19 pandemic. By the end of 2023, the sector reached just 84% of 2019 visitation levels, according to the US Travel Association.

Now, a first-of-its kind study from Euromonitor International , whose findings were first released to the public on Jan. 11, sheds additional light on how much the US is trailing its global competitors. Commissioned by US Travel, the independent market research firm’s study analyzed 18 countries’ travel industry performance—including France, the UK, Italy, Canada, Spain and South Africa. It examined data across four categories: government leadership and its engagement with the travel industry (25% weighting); global perception (20%); identity and security, which includes visa wait times and expedited clearance programs for low-risk travelers (35%); and travel connectivity, which includes international arrivals and flight access (20%).

The result: Across all categories and among 18 countries, the US came in at No. 17. The top performers were the United Kingdom and France.

China’s travel industry ranked last, at No. 18. This comes as less of a surprise given China’s long-delayed tourism restart; air routes heading there still remain thin . Surpassing the US in overall tourism industry performance were countries such as 13th-ranked Saudi Arabia, whose tourism economy remains nascent , and Turkey, which came in third despite political tensions and natural disasters over the past year. The study confirms that the American travel industry is less modern and efficient than its competitors—both established and up-and-coming—said US Travel , a nonprofit organization that advocates on behalf of the country’s travel sector.

Read More: Visa Delays, Divisive Politics Dampen US International Travel Recovery

“This should be a wake up call. To see the US ranked 17 in a list of 18 top travel markets is eye-opening, stunning, disheartening,” said Geoff Freeman, chief executive officer of US Travel , during a press call detailing the results of the study. “It's the type of thing that should force people on Capitol Hill to ask some very important questions.”

Freeman emphasized that the US share of the global tourism market has declined since 2019, while competitors are managing to increase theirs.

The grim findings from Euromonitor International, initially completed in fall 2023, were not published until now. They were revealed by US Travel as the motivation for creating a new Commission for Seamless and Secure Travel, which it also announced on Jan. 11. The commission, whose first official meeting will take place on Feb. 1, is chaired by Kevin McAleenan, former acting secretary of Homeland Security. It counts 12 private sector and government experts (with more to come), including former leaders at the Department of Homeland Security, the Transportation Security Administration, and US Customs and Border Protection, along with former US ambassadors.

The group will be tasked with hearing out tourism stakeholders that represent the various segments of US Travel’s membership, such as major hotel executives, small business owners, and airline and airport operators. Then it will create solutions for policymakers to modernize US travel across the board and to tackle issues that plague the industry. So far, Euromonitor’s study has helped identify several areas to prioritize, US Travel said, including customs, TSA passenger screening and visa processing. A set of recommendations will be submitted by the fall, Freeman tells Bloomberg in an interview.

At stake is the stability of America’s travel economy, which in 2022 amassed $1.2 trillion in spending from both international and domestic visitors. According to a separate report from market research firm Tourism Economics published in December 2023, failing to improve TSA’s outdated screening process could cause US travelers to forgo as many as 3 million domestic trips annually, resulting in a loss of $7.4 billion in spending this year. Another $150 billion could be lost over the next 10 years due to ongoing excessive wait times for visas, it noted.

When asked on the call where Freeman expects to find the funding to overhaul US travel, he pointed to the revenue that visitors bring—including the taxes they pay on accommodations and shopping. It’s a formula other countries have used to modernize their tourism industries, he noted.

“We are lacking the conviction to deal with these issues, to make travel a priority,” Freeman said, adding that he’s hopeful things will change.

Most Read from Bloomberg

- Citi to Cut 20,000 Roles in Fraser’s Bid to Boost Returns

- Google Lays Off Hundreds in Hardware, Assistant, Engineering

- BlackRock Buys Infrastructure Firm GIP for $12.5 Billion in Major Alternatives Push

- US and UK Strike Yemen’s Houthis After Red Sea Ship Attacks

- Hertz to Sell 20,000 EVs in Shift Back to Gas-Powered Cars

©2024 Bloomberg L.P.

6 Ways To Stand Out Among Competitors in the Travel Industry

Add a Cause to Your Services

Attach a story to your business, find your own travel niche, be passionate and knowledgeable about what you do, offer something unique.

The COVID-19 pandemic has put the travel industry on hold. In the years before 2020 , the industry was growing at a rapid pace globally. But with all the restrictions and travel bans, the whole industry suffered terrible losses.

The good news is that the whole industry is taking this time to perfect their services and prepare for when things get back to normal. Currently, the entire sector is working hard on improving their tech solutions to provide a better experience to their guests.

It’s about adding new digital solutions and differentiate themselves to s tay one step ahead of their competition . This has always been important and will remain after the pandemic comes to an end.

So, how can companies differentiate from competitors? We have collected a few pieces of advice and ways to take action . Check the text below to find out more.

People worldwide are becoming more conscious about the environment, social issues, animal rights, and other humanitarian causes. They want to help in any way they possibly can and have respect for companies that want to give back .

For example, if you are organizing tours in nature, you should consider allowing your guests to plant trees or engage in some activity that helps preserve nature. Another good example that any type of travel business can do is give a portion of all their earnings to projects that promote sustainability , or better, sustainable tourism.

No matter what you do, make sure to share how your business helps others and what causes you are fighting for. This can easily be the difference between someone choosing your services over another company. At the same time, this helps you build positive word of mouth and potentially get free press for your efforts .

Stories bring your business closer to customers. We’re not talking about marketing or selling your products or services directly. Your story showcases the core of your brand and lets guests connect emotionally to your brand or the services you provide.

A good story contains three essential ingredients :

The challenge helps you attract people’s attention and make them want to check out what you have to say. The second part of the story serves as an emotional journey that attaches people to the story. In the end, the solution to the story allows you to promote your services, brand, or your cause.

It allows you to call people to action in a subtle way . Your story can revolve directly around your business and why it exists, what drives you, and what your motivations are. On the other hand, the stor y can put your guests in the position of protagonists who can help a cause.

55% of customers say that they are more likely to get product/service if they love the story of the brand.

The whole travel industry is quite saturated. There are thousands of businesses in different sectors that offer similar services and look alike. It’s impossible to stand out in this crowd, especially now when many companies have already established their presence.

This is why you need to come up with your travel niche and offer something specialized. This might look like you’re limiting yourself to a narrower crowd, but it gives you the ability to reach more people whose needs haven’t been met. Check out this amazing list to get a better understanding of this subject.

If you are looking to generate real leads for your travel business, this article will help you do so in your travel niche.

Think outside the box and see the problems that people are facing, how you can make their travel easier, save their money, give them the luxury they need, or a type of service that still doesn’t exist. On the other hand, you can also approach the niche by targeting a specific demographic like students, women, or families.

Every new guest, traveler, or client is an opportunity for you to showcase your knowledge and passion for travel. No matter if you’re a guide that’s talking about history, nature, wildlife, or architecture, or you are a travel agent looking to present new offers, you need to immerse yourself in what you do.

This is why you should ideally start a travel business that focuses on something you love doing. People will recognize this about you and your organization and connect with you on an emotional level. At the same time, you will find it easier to learn vital information and help travelers in any way possible.

Running a business is hard work, but you will find it a lot easier if you’re passionate about it. At the same time, this level of commitment, knowledge, and passion will make your business memorable and stand out from the rest. Entrepreneurship always comes with some risks. If you want to know the most common ones in the travel industry and how to solve them, you should look at this article .

You probably heard it many times “create a unique brand.” But what does this mean when it comes to the travel industry? The first thing you need to know that the focus has shifted from “activities” to “experiences.”

Give your guests something they haven’t felt, done, or seen before. These experiences are what they will remember for a long time and share with other people. These experiences don’t have to be unique, but they can be delivered in a new way.

For example, you can offer a sightseeing tour in nature on dirt bikes. Add something fun, unorthodox, and exciting to your services; people like trying out new things, especially travel enthusiasts.

Think about what’s unique in your area of work and how you can promote that side of your service. This will make you memorable and distinctive in the sea of typical travel companies that only recycle the same experiences.

Last but no least, pay attention to your digital reputation. Apart from having a well-designed and functional website, you should also focus on social media and encite your audience to find out more about your services via several social media channels. Finally, don’t forget to keep an eye on your reviews .

In the end, remember to care about your clients. Make them feel safe during their whole experience and positive in your ability to help them out and deliver on what’s promised. After all, the travel industry is about people and giving them something to remember.

Work on your communication skills and care about your guests. The industry is constantly evolving, even now during the pandemic. Keep up by educating yourself, and it will reflect on the services you provide.

Subscribe to our newsletter

Yay you are now subscribed to our newsletter.

Ido, graduated from the College of Management Academic Studies, is Hotelmize Sales Operations Manager. He has a demonstrated history of working in the Sales & Marketing industry, and is paving his path in the Travel & Tourism industry. His skills in Negotiation, Interpersonal Relations, Team Management, Customer Service, and Sales Management, makes him a strong Sales Manager and a team player in the Travel Industry

Mize is the leading hotel booking optimization solution in the world. With over 170 partners using our fintech products, Mize creates new extra profit for the hotel booking industry using its fully automated proprietary technology and has generated hundreds of millions of dollars in revenue across its suite of products for its partners. Mize was founded in 2016 with its headquarters in Tel Aviv and offices worldwide.

Related Posts

What Is a Tourist Flow? 6 Characteristics

4 min. In recent decades, tourism has experienced a remarkable growth from an elitist activity to a mass phenomenon. According to the UNWTO, the turnover of tourism today equals, or even exceeds, exports of oil, automobiles or food products. It is a continuous flow of travellers that has become a key element in the socio-economic […]

From Screening to Hiring: A Guide to Effective Recruitment in the Travel Industry

6 min. The recruitment process of new employees is not based on a paradigm that applies across industries, instead, it revolves around best practices. The same goes for travel companies, including travel tech brands. We are talking about a very profitable market that reached $10.0 billion in 2023, attracting entrepreneurs and numerous workers. It simply […]

Unveiling the 13 Hottest Travel Trends of 2024

13 min. No one knows better than you how dynamic the realm of travel is. Dynamic shifts brought by technological strides, ever-changing traveler priorities, and global events are the new normal in 2024. How do you navigate this landscape that keeps transforming? You should familiarize yourself with the very travel trends that shape the world […]

- Stand Up for Free Enterprise

The State of the Travel Industry in 2023: Current Trends and Future Outlook

Kentucky chamber ceo: we must protect the free enterprise system, how franchising can help fuel the american dream, microsoft president: responsible ai development can drive innovation, suzanne clark's 2024 state of american business remarks, rhythms of success: the free enterprise tune of a small business.

January 12, 2023

Featured Guest

Tony Capuano CEO, Marriott International, Inc.

Chip Rogers President & CEO, American Hotel & Lodging Association (AHLA)

As COVID-19 restrictions have continued to ease, the travel and hospitality industries have seen a resurgence in customers. Companies like Marriott have seen percentage increases in revenue and rate, even topping pre-pandemic levels.

During the U.S. Chamber of Commerce’s 2023 State of American Business event, Chip Rogers, President and CEO of the American Hotel and Lodging Association , and Tony Capuano, CEO of Marriott International, Inc. , sat down for a fireside chat. Read on for their insights on the post-COVID state of the travel industry, a shifting customer base, and the outlook for 2023 and beyond.

2022 Demonstrated the Power and Resilience of Travel

After declines amid the pandemic, 2022 brought about a positive recovery for the travel industry.

“[2022] reminded us of the power and resilience of travel,” said Capuano. “If you look at the forward bookings through the holiday season, [you’ll see] really strong and compelling numbers … so we’re really encouraged.”

“The only caveat I would give you about that optimism is, as you know, the booking windows are much shorter than we’ve seen them in a pre-pandemic world,” he added. “So those trends can change more quickly than we’re accustomed to."

The ‘Regular’ Customer Segments Are Shifting

At the start of pandemic recovery, industry leaders believed leisure travel would lead travel recovery, with business travel closely behind and group travel at a distant third, according to Capuano. While some of those predictions have held, others have shifted.

“Leisure [travel] continues to be exceedingly strong, and group [travel] has surprised to the upside,” he explained. “Business travel is perhaps the tortoise in this ‘Tortoise and the Hare,’ slow-and-steady recovery.”

However, Capuano noted customer segments are becoming less and less strictly defined.

“[There’s] this trend we've seen emerge over the pandemic of blended trip purpose … [where] more and more folks are combining leisure and business travel,” he said. “If this has staying power, I think it’s absolutely a game changer, as we get back to normal business travel and hopefully maintain that leisure travel.”

To accommodate this shifting demand, Marriott has focused on expanding offerings to accommodate both the business and leisure sides of travelers’ trips.

“[We’ve had] a very big focus on [expanding bandwidth], so that if [we’ve] got 300 rooms full of guests on Zoom calls simultaneously, we’ve got the bandwidth to cover it,” Capuano added. “[We’re also] being more thoughtful about fitness, leisure, and food and beverage offerings — and having the flexibility to pivot those offerings as somebody sheds their business suit on Thursday and changes into shorts and flip flops for the weekend.”

2023 Offers Hope for Continued Growth in the Travel and Hospitality Sectors

As the travel and hospitality sectors continue to grow and shift in the post-pandemic era, Capuano shared reasons for optimism in 2023.

“Number one, it's our people,” he emphasized. “When you see their passion, their enthusiasm, their resilience, their creativity, and just how joyful they are to have their hotels full again … it's hard not to be filled with optimism.”

“If you look at how far the industry has come over the last few years,” Capuano continued, “any lingering doubts folks may have had about the resilience of travel — and about the passion that the general public has to explore cities and countries — it's hard not to be excited about the future of our industry.”

- Post-Pandemic Work

From the Series

State of American Business

View this online

US Travel Header Utility Menu

- Future of Travel Mobility

- Travel Action Network

- Commission on Seamless & Secure Travel

- Travel Works

- Journey to Clean

Header Utility Social Links

- Follow us on FOLLOW US

- Follow us on Twitter

- Follow us on LinkedIn

- Follow us on Instagram

- Follow us on Facebook

User account menu

Analysis on global competitiveness of american travel.

REPORT January 11, 2024

The U.S. is falling behind in the race to grow and modernize travel.

While the U.S. remains the world’s most desired destination for travelers, it ranks only third in visitation. While top global competitors are fully recovered from the pandemic and increasing market share, the U.S. is only 84% recovered and its market share has declined (from 5.4% in 2019 to 5.3% in 2023).

U.S. Travel Association commissioned Euromonitor International, a global research firm, to assess U.S. competitiveness against 17 other top countries for global travel so U.S. officials—and private sector partners—can better understand how to improve the overall travel experience, increase U.S. competitiveness and ultimately grow U.S. market share.

The study compared the 18 markets (including the U.S.) across four categories:

- National Leadership

- Brand and Product

- Identity, Security and Facilitation

- Travel and Connectivity

The findings are a wake-up call : Overall, the U.S. ranked 17 out of 18 countries analyzed—second to last. The U.S. notably underperformed in the categories of National Leadership and Identity, Security and Facilitation .

The U.S. is hindered by self-imposed barriers: Restrictive visitor visa policies and lengthy wait times, a lack of federal leadership and coordination, outdated security screening practices and decades of underinvestment prohibit the U.S. from reclaiming its spot as the top visited destination in the world—costing the U.S. economy billions in lost visitor spending and impeding future growth.

Our response: On January 11, U.S. Travel launched a solutions-oriented Seamless and Secure Travel Commission—which will bring together former government officials and private sector executives—to identify policy recommendations that can be realized in the near term. The commission will also establish a 10-year vision to create a more seamless and secure travel experience, outlining ways the federal government can work with the travel industry on opportunities to enhance the travel process and facilitate growth.

Seamless and Secure Travel Commission Members:

- Kevin McAleenan , Former Acting Secretary of Homeland Security; Former Commissioner & Deputy Commissioner, U.S. Customs & Border Protection (Commission Chair)

- Stewart Baker , Former General Counsel, National Security Agency; Former Assistant Secretary for Policy, Department of Homeland Security

- Seth Stodder , Former Assistant Secretary for Borders, Immigration, & Trade Policy, Department of Homeland Security

- John Sanders , Former Acting Commissioner & Chief Operating Officer, U.S. Customs & Border Protection; Former Assistant Administrator, Chief Technology Officer, Transportation Security Administration

- Patty Cogswell , Former Deputy Administrator, Transportation Security Administration

- John Pistole , Former Administrator, Transportation Security Administration

- Martha Bárcena Coqui , Former Mexican Ambassador to the United States

- Lucy Chadwick , Former Director General, International, Security & Environment Group, U.K. Department for Transport

- Michael Huerta , Former Administrator, Federal Aviation Administration

- Shawn Kinder , Global Corporate Development and Strategy Director, Ferrovial Airports

- John Holland Kaye , Former CEO of Heathrow Airport

Read the full release .

Member Price:

Non-Member Price: Become a member to access.

Meet the 17 changemakers shaping the future of the travel industry

- 2020 has upended the travel industry and challenged travel professionals to reexamine how their companies operate.

- Business Insider has identified 17 travel professionals who are shaping the future of the travel industry.

- We define a changemaker as someone who has anticipated changing traveler needs and has either pivoted their business or created a new one to adapt to the new normal.

- Our inaugural list of travel changemakers includes top executives at Delta, Airbnb, and Tripadvisor, as well as small business owners and startup founders.

- Do you know a travel changemaker? Please email [email protected] and [email protected] with tips.

- Visit Business Insider's homepage for more stories .

2020 has fundamentally upended the travel industry.

Between the pandemic, which brought international travel to a standstill earlier this year, and questions of racial justice brought to the forefront by the Black Lives Matter movement, the events of this year have challenged travel professionals to reexamine how their companies operate.

Even as countries begin to ease border restrictions and destinations reopen their doors to travelers, hotel occupancies remain at year-over-year lows . Travel giants have furloughed or laid off hundreds of thousands of employees to adjust to financial realities.

But with every fundamental shift comes innovation. Based on nominations and our own research, we have identified 17 changemakers who are shaping the future of the travel industry, either by pivoting their business, creating a brand new one, or anticipating changing traveler needs.

From executives at multinational companies to startup founders, meet the people on Business Insider's inaugural list of travel changemakers.

Catherine Powell, Global Head of Hosting for Airbnb

Initiative: Airbnb Online Experiences

When Catherine Powell joined Airbnb in January as head of Airbnb Experiences, the program touted 50,000 host-led tours, classes, and other offerings across 1,000 countries. Two months later, the pandemic hit the United States.

In late March, Airbnb paused the program for the health and safety of hosts and guests, but Powell was undeterred. On April 9 , her team rolled out Airbnb Online Experiences, a new platform allowing hosts to connect with travelers virtually.

Six months after program launch, Airbnb now offers upwards of 700 online experiences, which earned hosts over $2 million from launch through July. Airbnb reported that within that time period, the hosts of " Sangria and Secrets with Drag Queens " ($31 per person for 90 minutes) made $350,000 alone.

"Since launching, we've continued to find ways to empower communities deeply impacted by COVID-19 shutdowns," Powell told Business Insider. "Online Experiences are providing vital economic opportunities for Olympian and Paralympian athletes, chefs, and Broadway artists."

Powell, who was appointed Global Head of Hosting in July to oversee a unified hosting organization across Homes and Experiences, has continued to expand the program's offerings. In the last week of September, Airbnb launched " Field Trips ," a collection of 75 online extracurricular experiences designed for parents and children. The collection includes experiences hosted by shark scientists and astronomers, among other experts, which range in price from $7 to $100 per hour.

In the coming weeks and months, Powell says she will focus on building out tools for hosts to rebuild their businesses.

"For me, listening has been incredibly important. I have spent a lot of time listening to our guests and our hosts to really understand the needs and desires on both sides," she told Business Insider.

Caitlin Zaino von During, CEO and Cofounder of Porter & Sail; Deepak Shrivastava, Cofounder and CFO/COO at Porter & Sail

Initiative: Hotel Credits by Porter & Sail

In 2014, Caitlin Zaino and Deepak Shirvastava launched Porter & Sail, a digital concierge app that partners with luxury hotels to offer hotel guests services such as keyless entry and early check-in.

When the pandemic hit and hotel occupancies dropped to record lows, their business turned on its head.

"Contracts were canceled and our revenue was fully wiped out within a week. We did not know how we would survive," Zaino von During told Business Insider.

Over a period of 24 hours, their team pulled together a new business model. On March 17, they launched "Hotel Credits," an ecommerce system that allows travelers to purchase hotel stays at a discount. Credits can be redeemed up to two years out from the purchase date.

Hotel Credits started out with three hotels and has grown to a collection of 150 independent hotels across five continents and over 20 countries. The program has driven over half a million dollars worth of redeemable room nights for hotels since launch, according to analytics reviewed by Business Insider. "In the earliest days, we were the only source of cash flow for some of our hotel clients," Zaino von During said.

In the beginning, Porter & Sail didn't take commissions from Hotel Credits, but as the team has developed its product and hotels have reopened, they have converted to a commission-based structure. Porter & Sail is developing a feature that will allow purchase credits that aren't specific to one hotel, but can be used for any hotel or on their site.

"If we wanted to continue to survive, we had to build for what we knew was true right now," Zaino von During told Business Insider with regard to Porter & Sail's business pivot. "We also knew we had to invent the future of travel in order to own it."

Beth Santos, CEO and Founder of Wanderful; Karisma Shackelford, Director of Wanderful Creators

Initiative: Wanderful's "Moving Forward: An Anti-Racism Townhall for the Travel Industry" series

Over the past 11 years, Beth Santos has grown Wanderful from a blog dedicated to helping women travel safely into a global community that hosts events for over 45,000 female travelers, travel influencers, and travel professionals worldwide.

In this time, Santos has seen the industry become more inclusive of women, but she still considers it far from perfect. "Many of these experiences still focus very heavily on the experience of white women, disregarding our many intersectionalities of race, age, body type, sexual orientation, and beyond," she said.

When the Black Lives Matter movement gained momentum in the spring, Santos sat down with Karisma Shackelford, the founder of Color Me World , who works part-time developing programming for Wanderful content creators. The two brainstormed ways to discuss the movement with their members at a time when much the industry remained silent.

Within weeks, they launched Moving Forward: An Anti-Racism Townhall for the Travel Industry . The three-part virtual series created a platform for Black creators, allies, and brands to discuss actionable steps to foster anti-racism in the travel industry. Over 200 members and industry representatives attended the first session.

Santos and Shackelford have planned two additional town halls for October 17th and early 2021. They have also launched an anti-racism reading club and a new sub-community for members called BIPOC Women of Wanderful. Next year, the company plans to launch a global hosting network so women and gender-diverse people have safe and trusted spaces to stay in when they travel.

"This awakening and empowering time that we are in is demanding change, and those that don't change will find themselves going out of business like Blockbuster did back in 2010," Shackelford told Business Insider.

"Wanderful has always been at the forefront of discussing topics that others often felt was too challenging to address. This is one of the reasons why I have always loved this community, and Beth, the courageous and badass woman who leads it," Shackelford said. "Society has habitually silenced women and people of color, and Wanderful has always given a voice to the disempowered."

Yannis Moati, CEO and Founder of HotelsByDay

Initiative: HotelsByDay

Booking a hotel room by the hour once had seedy connotations. But nowadays, as travelers seek increased flexibility and safe, affordable staycations , the concept is becoming more popular.

Enter: HotelsByDay , a booking platform for day-use hotel rooms.

Yannis Moati founded HotelsByDay in 2015, launching initially in four cities: New York City, Chicago, Philadelphia, and Washington, DC. HotelsByDay now partners with hotels and allows users to reserve blocks of hours, with three-hour block minimums. And while Moati, a 20-year hospitality industry veteran who currently serves as the company's CEO, wasn't the first to come up with the idea — Day Use Hotels , for one, launched in 2010 in Paris — nor the last , HotelsByDay remains among the most prominent booking services of its kind, largely thanks to its quick booking platform.

"Hoteliers understand that 'business as usual' is over and we'll never get back to it," Moati told Business Insider. "The future of hospitality resides in unlocking flexibility in the otherwise rigid legacy business model."

During the pandemic, Moati's company has helped hoteliers maximize the revenue potential of what they call "dayroom inventory" — the combination of unsold rooms from the night before and early check outs the day following. Moati told Business Insider that HotelsByDay initially offered just one service (dayrooms), and now is able to offer customers the option to book working lounges, meeting rooms, coworking desks, day-use pool passes, and day-use parking passes.

Moati told Business Insider that HotelsByDay, recently nominated for the Travel & Hospitality Awards' Technology & Innovation category, has seen an increase in new hotel partner sign-ups by over 400% since the coronavirus unmoored the hospitality industry earlier this year.

Kanika Soni, Chief Commercial Officer at Tripadvisor; Lindsay Nelson, Chief Experience and Brand Officer at Tripadvisor

Initiative: Tripadvisor "Safe Travels" search tools

After weeks of lockdown measures, destinations in Europe and the US began lifting measures in May and June as coronavirus rates fell. Though domestic tourism became an option, travelers were faced with the overwhelming task of sorting through varying health and safety guidelines.

To help travelers sift through a sea of information, Lindsay Nelson and Kanika Soni launched Tripadvisor's " Travel Safe " suite of tools on June 24. The first initiative of its kind among competitors, the Travel Safe toolkit included the ability for businesses to display health and safety measures on their pages, a filter for travelers to look up participating businesses, and a Q&A function that allows travelers and businesses to connect directly through Tripadvisor.

Since launch, over 100,000 businesses have opted into the Travel Safe program, and hundreds of thousands of travelers use its suite of tools per month, according to Tripadvisor analytics reviewed by Business Insider. The company also reported that click-through rates to hotel and business detail pages have increased 16% since the program's launch.

Looking ahead, Nelson and Soni plan to expand the rollout of the Travel Safe program to more businesses and to integrate it with the Tripadvisor mobile app.

Both Nelson and Soni told Business Insider that being flexible and embracing the unknown has helped them succeed as leaders during this time. "Break the rules. Evaluate your company and brand's strengths and truly unique assets, and explore ways to create new revenue streams," Nelson told Business Insider.

How you communicate with your team goes a long way, Soni told Business Insider. "I love the phrase 'bounded optimism' — something I've always been guided by," she said. "Every day I strive to show up for my team with calm and compassion, acknowledging the uncertainty while attempting to reframe a difficult situation as a learning experience and a chance for innovation and positive change."

Joel Holland, Owner of Harvest Hosts

Initiative: Harvest Hosts

The Harvest Hosts membership program, which costs $80 a year , allows RVers to stay overnight for free at over 1,600 farms, wineries, breweries, distilleries, golf courses, museums, and other small businesses all over North America.

"Our mission is to help people live happier lives by getting off the couch and onto the open road, while also supporting small businesses that are the backbone of our country," owner and CEO Joel Holland told Business Insider of his company, which currently has 15 employees.

Holland reports that business crashed 80% when the virus outbreak initially gripped the US in March. But rather than scaling back the business, Holland boosted ad spending on Facebook. According to screenshots shared with Business Insider, Harvest Hosts' total Facebook ad spending topped $1.25 million between March 1 and September 30.

Holland's bet on a surge of interest in RV travel proved to be a smart one. New membership bottomed out on April 3, Holland told Business Insider, when Harvest Hosts logged only 18 new members. But membership reached an all-time high on August 26, when 1,336 new members signed on.

Holland believes that the burst of RV interest won't dissipate even after the pandemic is controlled. "We believe road-based travel will continue to be the predominant form of travel through at least 2021," he told Business Insider.

Pat Miller and Tom Brussow, Cofounders of The HUB Social Network

Initiative: The HUB Social Network

When travel came to a standstill in the spring, veteran travel agent Tom Brussow looked around for resources on how to advise clients in a world of travel restrictions. He didn't find what he was looking for.

In August, Brussow partnered with Pat Miller, a broadcast journalist turned small business consultant, and launched The HUB, an off-Facebook social network for travel agents and suppliers. Through The HUB, members gain access to a social dashboard where they can interact with each other via a public feed or direct message and access daily and weekly programming broadcasts.

Miller is currently hosting a weekly "Path to Prosperity" brainstorming series focusing on rebuilding consumer confidence and leveraging promotional sales. The HUB team is also piloting a "Destination Community" feature where destination representatives answer questions for agents. Costa Rica's community feature has already been built, with Los Cabos, Puerto Vallarta, Las Vegas, Hawaii, and the Lomas Travel Group scheduled to be completed by the end of 2020.

"The travel industry will return but to get to that point, agents and suppliers will have to communicate and build their businesses back together," Brussow told Business Insider.

Right now, membership consists of two-thirds travel agents and one-third suppliers, Miller told Business Insider. Brussow and Miller aim to grow their membership numbers to 1,000 by the end of 2020. Membership plans start at $19.99 per month.

"The pent-up public desire to travel is immense and as soon as the public opinion and health conditions warrant it, the travel industry will explode. The smart agents and suppliers are the professionals that are expanding their network, obsessively staying connected to their customers and improving their baseline capacity for doing business," Brussow said.

Ed Bastian, CEO of Delta Air Lines

Initiative: The Delta Air Lines CareStandard and Global Cleanliness division

Air travel has been one of the hardest-hit sectors in hospitality amid the pandemic. Many companies were forced to drastically reduce service, lay off employees en masse, or shutter entirely . Airlines that stayed in business needed to figure out a way to win back the trust of air travelers. Few have done this as effectively as Delta Air Lines, and that's largely thanks to the leadership of Ed Bastian.

Bastian, a 22-year veteran of the travel industry, assumed his role as Delta's CEO in 2016. This year, Bastian implemented a series of safety measures to keep customers and Delta employees safe. The result, the Delta CareStandard, is informed by healthcare and disinfection expertise from CVS Health, Mayo Clinic, Emory Healthcare, Quest Diagnostics and Reckitt Benckiser Group/Lysol. The more than 100 safety measures implemented as part of the CareStandard include blocking off middle seats and limiting capacity on flights, mask requirements both onboard and at the gate, an overhaul of cleaning procedures (including a 44-point cleanliness checklist ahead of every flight), and back-to-front boarding in order to support social distancing.

Bastian's team has currently been tasked with deploying technologies to keep surfaces and the air onboard clean, and with developing a clean audit program to ensure safety measures are being upheld consistently.

Bastian says that customer satisfaction has never been higher. "Delta's Net Promoter Score (NPS) — the measurement used to determine how likely customers are to recommend Delta — has been setting records since March 2020 and saw a new record high in August 2020," he told Business Insider.

Now predicting a three-year recovery period — and acknowledging that Delta will need to become a smaller airline in 2021 than it was in 2019 — Bastian says that recovery will depend on customers feeling comfortable traveling. And for that reason, the airline will continue to invest in its long-term commitment to clean .

Marilyn Markham, Director of Product Strategy at American Express Global Business Travel; James Griffin, Director of Risk, Compliance and Environmental, Social & Governance (ESG) at American Express Global Business Travel; and Cedric Lamielle, Senior Director of Travel Product Engineering at American Express Global Business Travel

Initiative: American Express Global Business Travel Travel Vitals™

When the coronavirus pandemic brought the travel industry to a halt this winter, corporate travelers had to figure out a way to navigate international trips in the safest way possible.

American Express Global Business Travel (GBT) stepped up its offerings as a result.

GBT is a travel management solutions and services company working with corporations and employees to coordinate corporate travel. Its 18,000 travel professionals across over 140 countries are tasked with managing $35 billion of business travel annually, according to company literature. In response to the pandemic, GBT launched Travel Vitals™ , a "travel briefing platform" that serves as a one-stop resource for all of the travel restrictions and relevant information business travelers need to know before embarking on a trip.

"I went back to basics to understand the new needs and expectations [travelers] have of travel agencies," Marilyn Markham, GBT's Director of Product Strategy, told Business Insider. "I found the greatest need was for accurate information to help them decide whether it is safe and practical to travel in this climate and how to prepare adequately."

According to James Griffin, GBT's director of Risk, Compliance and Environmental, Social & Governance (ESG), Travel Vitals™ grew out of the company's internal COVID-19 Response Team, which tracked coronavirus rates globally as the outbreak began to take hold. "We quickly realized the value of making that information available externally in a single, easily accessible location and began posting it daily to the GBT website," Griffin told Business Insider.

While this tool was created specifically in response to the coronavirus pandemic, GBT realizes its utility for business travelers in the future. Per Cedric Lamielle, the senior director of travel product engineering for GBT, part of the company's innovation will be to make the platform a standard tool for travelers seeking information about visa requirements, travel advisories, and specific geographical areas' risks.

Sarah Dusek and Jacob Dusek, Cofounders of Under Canvas

Initiative: Under Canvas

Under Canvas was founded in 2009 by Sarah and Jacob Dusek, making it one of the first major glamping — high-end, glamorous camping — companies. Under Canvas has glamping sites near a number of national parks and other landmarks, including Acadia National Park, the Grand Canyon, Yellowstone, and Mount Rushmore.

While Under Canvas was founded over a decade before the coronavirus pandemic hit, the team has worked to make outdoor travel an even safer and more appealing option. This includes a number of operational enhancements made in an effort to boost customer confidence, from streamlined check-in/out processes and rigorous sanitation of shared spaces to mandatory staff masking, limited and socially distanced dine-in seating, and an array of on-the-go food and retail options for visitors.

Today, Sarah, who was Under Canvas' original CEO and currently serves on its board of directors, reports that the company has over 500 employees and nine locations. Like other outdoor travel-focused businesses, Under Canvas has seen a surge of interest as travelers increasingly opt for more socially distancing-friendly vacations.

"I believe the future of travel will be outside for the foreseeable future. The need to be out in nature has never been more acute, to do that safely, with ease and comfort has never been more necessary," Sarah told Business Insider.

Under Canvas is focusing on expanding its offerings while remaining focused on sustainability. Its current environmentally conscious initiatives include low-flow toilets, auto-turn off faucets, and pull-chain showers at all camps, and the use of solar power wherever possible.

A Joshua Tree location is among those new outposts coming soon, as Under Canvas continues it expansion.

- Main content

- Publications

The Travel & Tourism Competitiveness Report 2019

World Economic Forum reports may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License , and in accordance with our Terms of Use .

Further reading All related content

Travel and tourism recovery: a perspective for South Asia and lessons for other regions in the age of COVID-19

What's in store for travel and tourism in South Asia after the coronavirus pandemic? What does recovery of the sector look like in the region and world?

Antarctica: the final coronavirus-free frontier. But will it stay that way?

The region has had close calls, including a cruise ship that was en route in April before 60% of the people on board tested positive for the coronavirus.

How global tourism can be more sustainable

One of the world’s biggest economic activities, tourism drives wealth, employment, and regional development.

Check out our new Consent management feature here

- Case Studies

- Book a Demo

Differentiating Your Travel Agency from the Competition

Discover effective strategies to set your travel agency apart from competitors in the ever-growing industry.

In the highly competitive travel industry, it is essential for travel agencies to find ways to differentiate themselves from the competition. By understanding the competitive landscape, defining a unique selling proposition (USP), enhancing service offerings, building a strong brand identity, and implementing effective marketing strategies, travel agencies can stand out in the market and attract more customers.

Understanding the Competitive Landscape in the Travel Industry

To differentiate your travel agency, it is crucial to have a comprehensive understanding of the competitive landscape in the travel industry. Research and analyse the market to identify your main competitors and their strengths. By studying their strategies and offerings, you can gain valuable insights and develop strategies to set your agency apart.

When it comes to the travel industry, competition is fierce. With so many travel agencies vying for customers' attention, it's essential to stay ahead of the game. Understanding the competitive landscape is like having a map that guides you towards success. It allows you to navigate through the challenges and make informed decisions.

One way to identify your main competitors is by conducting thorough market research. Look at other travel agencies operating in your target market and analyse their target audience, pricing, services, and marketing efforts. By understanding who you are up against, you can determine how to position your agency uniquely.

But it's not just about knowing who your competitors are. It's also about understanding their strengths. What sets them apart? Do they offer exclusive travel packages? Do they have a strong online presence? Are they known for their exceptional customer service? By studying their strategies and offerings, you can gain valuable insights that will help you develop your own competitive edge.

Identifying Your Main Competitors

Identifying your main competitors is the first step towards differentiation. However, it's not enough to simply know their names. You need to dig deeper and understand what makes them successful. What is their unique selling proposition? How do they attract customers? What are their strengths and weaknesses?

Take the time to research each of your main competitors individually. Visit their websites, read customer reviews, and observe their social media presence. This will give you a better understanding of their brand identity and how they position themselves in the market.

Additionally, consider attending industry conferences and networking events. This will not only give you a chance to meet other travel professionals but also provide insights into the latest trends and innovations in the industry. By staying connected and engaged, you can stay ahead of the competition.

Analysing Current Market Trends

Another aspect of understanding the competitive landscape is being aware of the current market trends. The travel industry is constantly evolving, with new destinations and travel preferences emerging all the time. To stay relevant, you need to keep an eye on these trends.

Stay informed about emerging destinations that are gaining popularity among travellers. Is there a new hotspot that everyone is talking about? By being the first to offer travel packages to these destinations, you can attract adventurous customers who are looking for unique experiences.

Consumer preferences also play a significant role in shaping the competitive landscape. Are travellers becoming more interested in sustainable tourism? Do they prefer all-inclusive packages or personalized itineraries? By understanding these preferences, you can tailor your offerings to meet the demands of the market and offer unique experiences to your customers.

Furthermore, technology is transforming the way people travel. Keep an eye on the latest technological advancements in the industry, such as virtual reality tours or mobile apps for seamless travel experiences. By embracing these innovations, you can stay ahead of the competition and provide your customers with cutting-edge solutions.

In conclusion, understanding the competitive landscape in the travel industry is vital for the success of your travel agency. By identifying your main competitors and analysing current market trends, you can develop strategies that set you apart from the crowd. Stay informed, be innovative, and always strive to provide exceptional experiences to your customers.

Defining Your Unique Selling Proposition (USP)

To differentiate your agency, it is crucial to define a clear and compelling USP that resonates with your target audience. This sets your agency apart from competitors and communicates the unique value you provide to customers.

When it comes to travel agencies, the market is crowded with countless options. From large, well-established companies to small, niche agencies, customers have a wide range of choices. So how do you make your agency stand out? The answer lies in your USP.

A USP, or Unique Selling Proposition, is a statement that defines what makes your agency special and why customers should choose you over others. It is the core message that sets you apart and captures the attention of your target audience.

Identifying Your Agency's Strengths

Identify the strengths of your agency and determine how they can be differentiated. Is your agency known for its exceptional customer service, wide range of travel packages, or specialised knowledge in a specific niche? Understanding your agency's strengths will help you craft a USP that aligns with your unique capabilities.

One strength that many successful travel agencies possess is their exceptional customer service. Going above and beyond to ensure customer satisfaction can make a significant difference in the travel industry. By providing personalized attention, prompt responses, and going the extra mile to meet customer needs, your agency can set itself apart from competitors.

Another strength could be the wide range of travel packages your agency offers. From exotic beach getaways to adventurous mountain hikes, having a diverse portfolio of options allows customers to find the perfect trip for their preferences. This variety can attract a broader audience and increase your chances of capturing their attention.

Crafting a Compelling USP

Once you have identified your agency's strengths, it's time to craft a compelling USP. Your USP should clearly communicate the unique benefits customers will receive by choosing your agency. Whether it's the promise of personalized itineraries, exclusive access to hidden gems, or a commitment to sustainable travel, ensure that your USP highlights your unique offerings and resonates with your target audience.

Imagine a USP that promises customers the experience of a lifetime with personalized itineraries tailored to their interests and preferences. By taking the time to understand each customer's desires and curating a trip that exceeds their expectations, your agency can create unforgettable memories and build long-lasting relationships.

Another compelling USP could be offering customers exclusive access to hidden gems. Imagine being able to take your clients to secret spots that only a select few have discovered. This sense of exclusivity can create a sense of excitement and adventure, making your agency the go-to choice for those seeking unique and off-the-beaten-path experiences.

Lastly, a USP that focuses on sustainable travel can resonate with environmentally conscious customers. By highlighting your agency's commitment to reducing the environmental impact of travel and promoting responsible tourism, you can attract a growing segment of travellers who prioritize sustainability.

In conclusion, defining a clear and compelling USP is essential for travel agencies looking to differentiate themselves in a competitive market. By identifying your agency's strengths and crafting a USP that highlights your unique offerings, you can attract and retain customers who resonate with your message and value proposition. So take the time to define your USP and watch your agency soar to new heights!

Enhancing Your Service Offerings

Providing exceptional service is key to differentiating your travel agency. Enhance your service offerings to exceed customer expectations and create unforgettable travel experiences.

Offering Unique Travel Packages

Create unique travel packages that cater to specific interests or demographics. Whether it's adventure travel, luxury vacations, or cultural immersion experiences, offer packages that go beyond the typical tourist offerings. Tailor your packages to provide authentic and memorable experiences that set your agency apart from the competition.

Providing Exceptional Customer Service

Exceptional customer service is a powerful way to differentiate your agency. Train your staff to provide personalised and attentive service throughout the customer journey, from the moment of inquiry to post-trip follow-ups. Foster a culture of customer-centricity and go the extra mile to ensure customer satisfaction. This will not only differentiate your agency but also build customer loyalty and generate positive word-of-mouth.

Building a Strong Brand Identity

A strong brand identity is crucial for differentiating your travel agency and building customer trust and loyalty. A consistent brand image helps customers understand what your agency stands for and creates a memorable impression.

Importance of a Consistent Brand Image

Develop a consistent brand image that reflects your agency's values, personality, and unique offerings. Ensure that your brand identity is reflected across all touchpoints, from your website design and marketing materials to your communication style. Consistency in your brand image builds trust and reinforces your unique positioning in the market.

Leveraging Social Media for Branding

Social media platforms offer an excellent opportunity to showcase your brand and engage with customers. Develop a social media strategy that aligns with your brand identity and target audience. Share compelling travel stories, stunning visuals, and useful travel tips to captivate your audience and create a community of brand advocates.

Implementing Effective Marketing Strategies

Effective marketing strategies are essential for differentiating your travel agency and reaching your target audience. Utilise digital marketing techniques and engage in community outreach and partnerships to increase brand visibility and attract more customers.

Utilising Digital Marketing Techniques

In today's digital world, digital marketing techniques are vital for differentiating your agency. Invest in search engine optimisation (SEO) to improve your website's visibility in search results. Use targeted online advertising campaigns to reach your ideal customers effectively. Leverage social media platforms to connect with your audience and drive engagement. By leveraging digital marketing techniques, you can reach a wider audience and establish your agency as a trusted and unique service provider.

Engaging in Community Outreach and Partnerships

Community outreach and partnerships are powerful tools for differentiation. Collaborate with local businesses, tourist boards, and travel influencers to create unique experiences and promote your agency to a wider audience. Participate in local events, sponsor community initiatives, and engage with your target audience directly. By actively participating in the community, you can differentiate your agency and build strong relationships with potential customers.

In conclusion, differentiating your travel agency from the competition is crucial to attract more customers and build a successful business. By understanding the competitive landscape, defining a compelling USP, enhancing service offerings, building a strong brand identity, and implementing effective marketing strategies, you can set your agency apart and create unique and memorable travel experiences for your customers.

The state of tourism and hospitality 2024

Tourism and hospitality are on a journey of disruption. Shifting source markets and destinations, growing demand for experiential and luxury travel, and innovative business strategies are all combining to dramatically alter the industry landscape. Given this momentous change, it’s important for stakeholders to consider and strategize on four major themes:

- The bulk of travel is close to home. Although international travel might draw headlines, stakeholders shouldn’t neglect the big opportunities in their backyards. Domestic travel still represents the bulk of travel spending, and intraregional tourism is on the rise.

- Consumers increasingly prioritize travel—when it’s on their own terms. Interest in travel is booming, but travelers are no longer content with a one-size-fits-all experience. Individual personalization might not always be practical, but savvy industry players can use segmentation and hypothesis-driven testing to improve their value propositions. Those that fail to articulate target customer segments and adapt their offerings accordingly risk getting left behind.

- The face of luxury travel is changing. Demand for luxury tourism and hospitality is expected to grow faster than any other travel segment today—particularly in Asia. It’s crucial to understand that luxury travelers don’t make up a monolith. Segmenting by age, nationality, and net worth can reveal varied and evolving preferences and behaviors.

- As tourism grows, destinations will need to prepare to mitigate overcrowding. Destinations need to be ready to handle the large tourist flows of tomorrow. Now is the time for stakeholders to plan, develop, and invest in mitigation strategies. Equipped with accurate assessments of carrying capacities and enhanced abilities to gather and analyze data, destinations can improve their transportation and infrastructure, build tourism-ready workforces, and preserve their natural and cultural heritages.

McKinsey Live event: Faces, places, and trends: The state of tourism & hospitality

Thursday, June 13 at 10:30 a.m EDT / 4:30 p.m CET

Now boarding: Faces, places, and trends shaping tourism in 2024

Global travel is back and buzzing. The amount of travel fell by 75 percent in 2020; however, travel is on its way to a full recovery by the end of 2024. More regional trips, an emerging population of new travelers, and a fresh set of destinations are powering steady spending in tourism.

There’s no doubt that people still love to travel and will continue to seek new experiences in new places. But where will travelers come from, and where will they go?

We share a snapshot of current traveler flows, along with estimates for growth through 2030.

The way we travel now

Which trends are shaping traveler sentiment now? What sorts of journeys do today’s travelers dream about? How much are they willing to spend on their trips? And what should industry stakeholders do to adapt to the traveler psychology of the moment?

To gauge what’s on the minds of present-day travelers, we surveyed more than 5,000 of them. The findings reveal disparate desires, generational divides, and a newly emerging set of traveler archetypes.

Updating perceptions about today’s luxury traveler

Demand for luxury tourism and hospitality is expected to grow faster than for any other segment. This growth is being powered in part by a large and expanding base of aspiring luxury travelers with net worths between $100,000 and $1 million, many of whom are younger and increasingly willing to spend larger shares of their wealth on upscale travel options. The increase is also a result of rising wealth levels in Asia.

We dug deeper into this ongoing evolution by surveying luxury travelers around the globe about their preferences, plans, and expectations. Some widely held notions about luxury travelers—such as how much money they have, how old they are, and where they come from—could be due for reexamination.

Destination readiness: Preparing for the tourist flows of tomorrow

As global tourism grows, it will be crucial for destinations to be ready. How can the tourism ecosystem prepare to host unprecedented volumes of visitors while managing the challenges that can accompany this success? A large flow of tourists, if not carefully channeled, can encumber infrastructure, harm natural and cultural attractions, and frustrate locals and visitors alike.

Now is the time for tourism stakeholders to combine their thinking and resources to look for better ways to handle the visitor flows of today while properly preparing themselves for the visitor flows of tomorrow. We offer a diagnostic that destinations can use to spot early-warning signs about tourism concentration, along with suggestions for funding mechanisms and strategies to help maximize the benefits of tourism while minimizing its negative impacts.

Six trends shaping new business models in tourism and hospitality

As destinations and source markets have transformed over the past decade, tourism and hospitality companies have evolved, too. Accommodation, home sharing, cruises, and theme parks are among the sectors in which new approaches could present new opportunities. Stakeholders gearing up for new challenges should look for business model innovations that will help sustain their hard-won growth—and profits.

Unbundling offerings, cross-selling distinctive experiences, and embracing data-powered strategies can all be winning moves. A series of insight-driven charts reveal significant trends and an outlook on the future.

RELATED ARTICLES

The future of tourism: Bridging the labor gap, enhancing customer experience

The promise of travel in the age of AI

From India to the world: Unleashing the potential of India’s tourists

- Skift Research

- Airline Weekly

- Skift Meetings

- Daily Lodging Report

Expedia and Booking in the Post-Pandemic Travel Landscape

Executive summary, travel industry context, booking vs. expedia recovery, booking’s u.s. expansion, web traffic trends, digital-native, marketing economies of scale, new technology and product offerings.

- Cross-Sector Offerings

Related Reports

- A Deep Dive into Google Travel Part III: Hotel Distribution From East to West April 2024

- India’s Travel Booking Landscape March 2024

- The Past, Present, and Future of Online Travel March 2024

- Skift Research Global Travel Outlook 2024 January 2024

Report Overview

We check in on the current state of Expedia and Booking Holdings, the big two online travel agencies in the U.S. and Europe, as they recover from the COVID-19 pandemic.

In the short-term, Booking Holdings and Expedia Group are both recovering nicely from the depths of the COVID-19 pandemic. We look at how growth rates, regional strategies, and marketing efficiency are shaping up into year end.

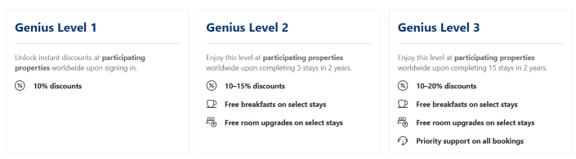

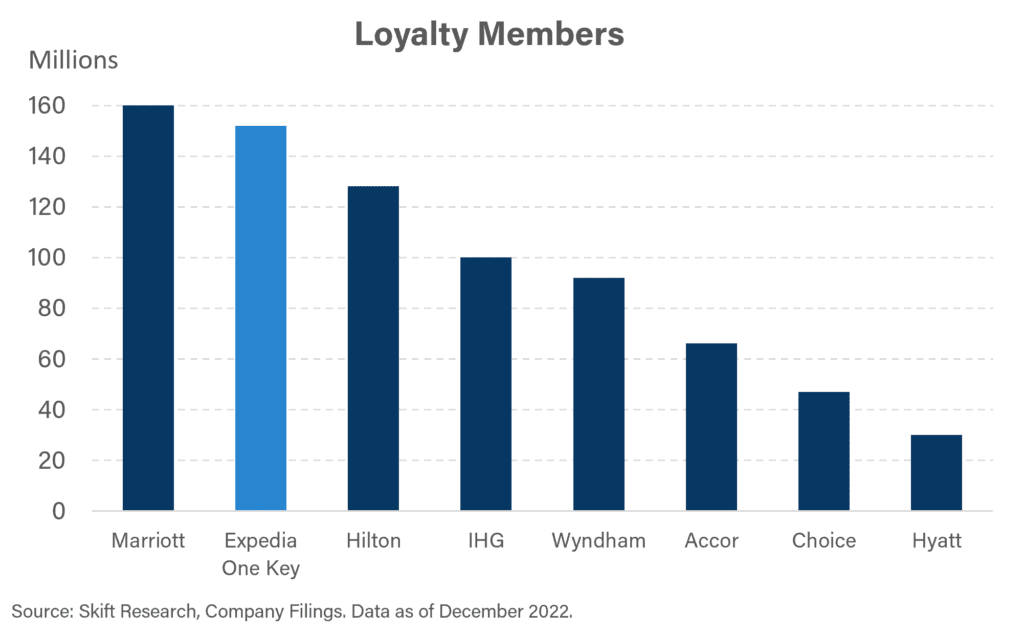

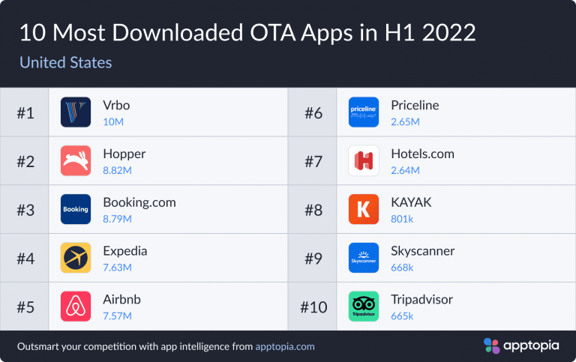

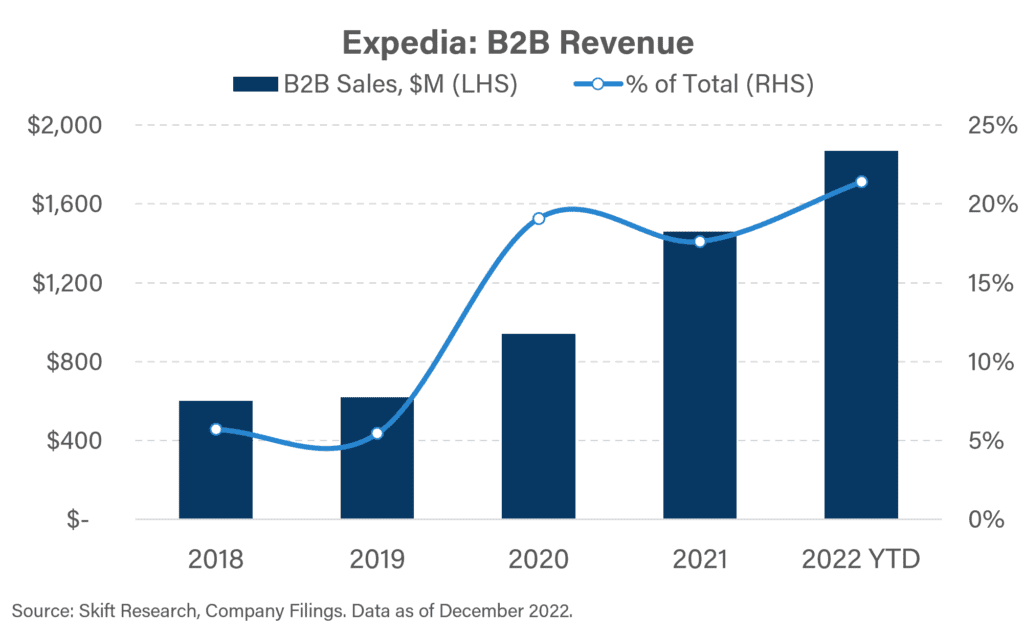

We also take a long-term perspective on how the online travel business model is evolving and what changes Expedia and Booking are making in return. Expedia is focused on launching loyalty and B2B partnerships. Booking Holdings is investing in new tech, including apps and fintech, and in matching Expedia’s cross-sector offering.

What You'll Learn From This Report

- How Expedia and Booking’s Gross Bookings, Revenue, and Profits are recovering post-pandemic.

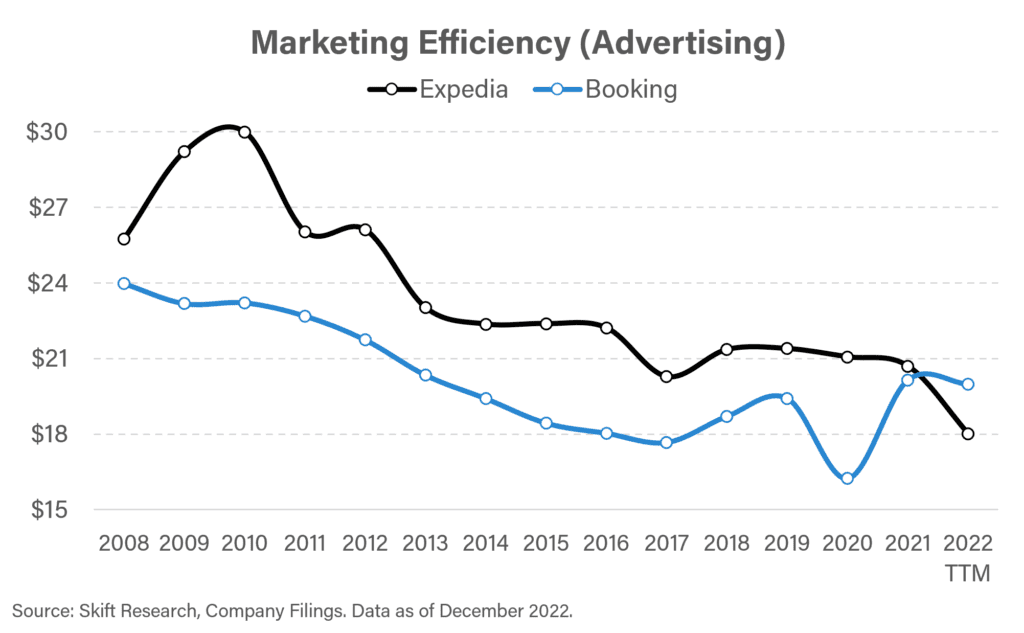

- Marketing efficiency for Expedia and Booking year-to-date including how web traffic is shifting and relative returns on investment.

- A look into the long-term dynamics that are redefining the online travel space.

- New initiatives that Expedia and Booking are investing in for 2023 and beyond.

We check in on the current state of Expedia Group and Booking Holdings, the big two online travel agencies in the U.S. and Europe, as they recover from the COVID-19 pandemic.

In the short-term, Booking and Expedia are both recovering nicely from the depths of the COVID-19 pandemic. Booking is growing faster as Expedia’s airline exposure is a drag. Booking continues to make headway in the U.S. and saw notable progress during the pandemic though Expedia still holds the lead in North America.

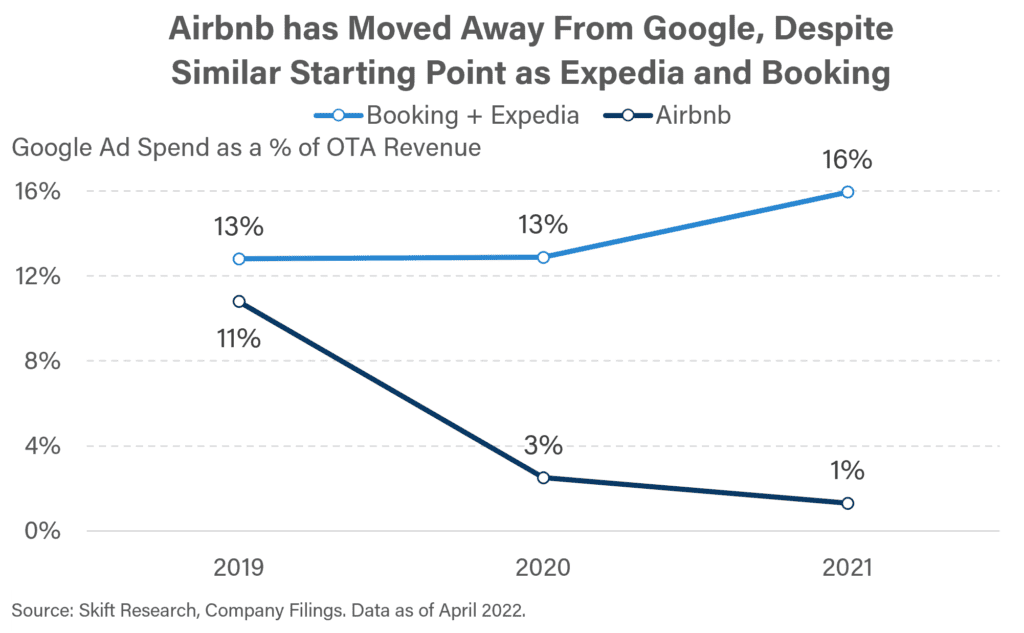

Sales and Marketing spend continues to be a major expense and we see little signs that performance marketing efficiency is improving post-pandemic. However, both have invested heavily in brand marketing, loyalty, and new product offerings to drive customer interest and are seeing these initiatives pay dividends in the form of direct or organic search traffic.

We also take a long-term perspective on how the online travel business model is evolving and what changes Expedia and Booking are making in return. Expedia is focused on launching loyalty and B2B partnerships. Booking Holdings is investing in new tech, including apps and fintech, and in matching Expedia’s cross-sector offering.

The travel industry is shifting and Expedia and Booking are revamping their strategies, but both remain formidable travel competitors.

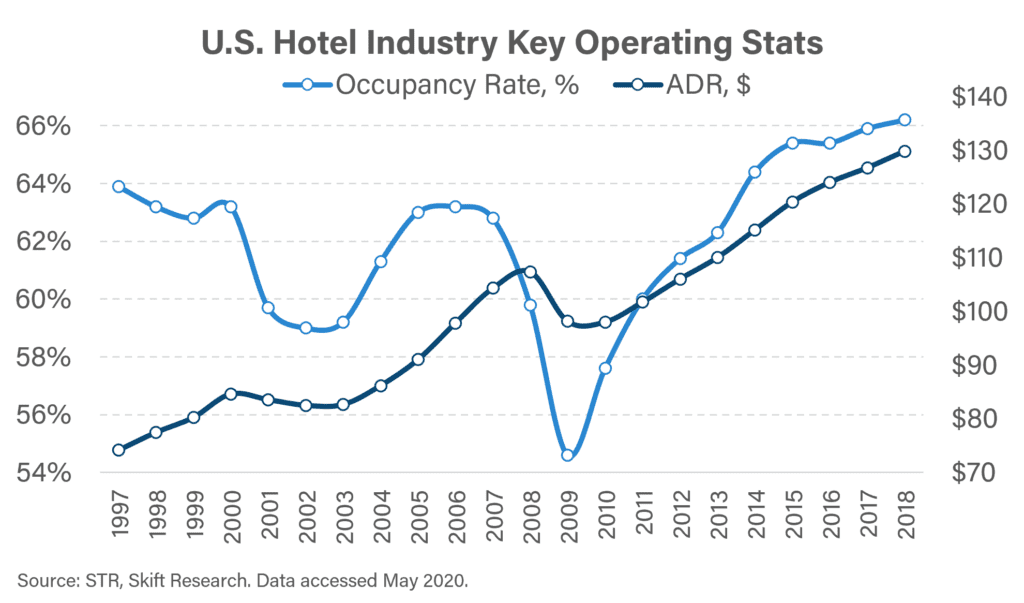

State of Recovery

Expedia Group and Booking Holdings as the big two online travel agencies in the U.S. and Europe are important bellwethers to understand how the online travel space is recovering from the COVID-19 pandemic. With third quarter 2022 earnings behind us, let’s check up on how these two businesses are performing.

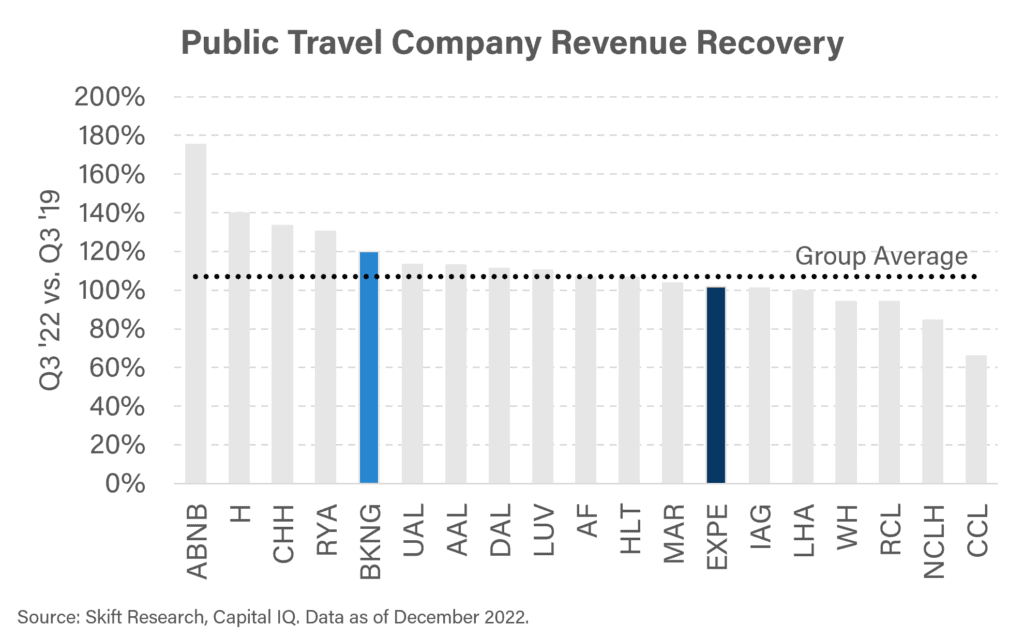

In terms of revenue recovery, online travel stacked up nicely compared to other travel public companies. Airbnb is the superstar leaving all others behind. Hyatt, Choice Hotels, and Ryanair outperformed Booking Holdings to round out the top five. Expedia is slower to recover, but still is above similar 2019 levels of revenue and is outperforming European airlines like IAG Group and Lufthansa, which were plagued by airport backups this summer. The worst ranking are, unsurprisingly, the cruise companies.

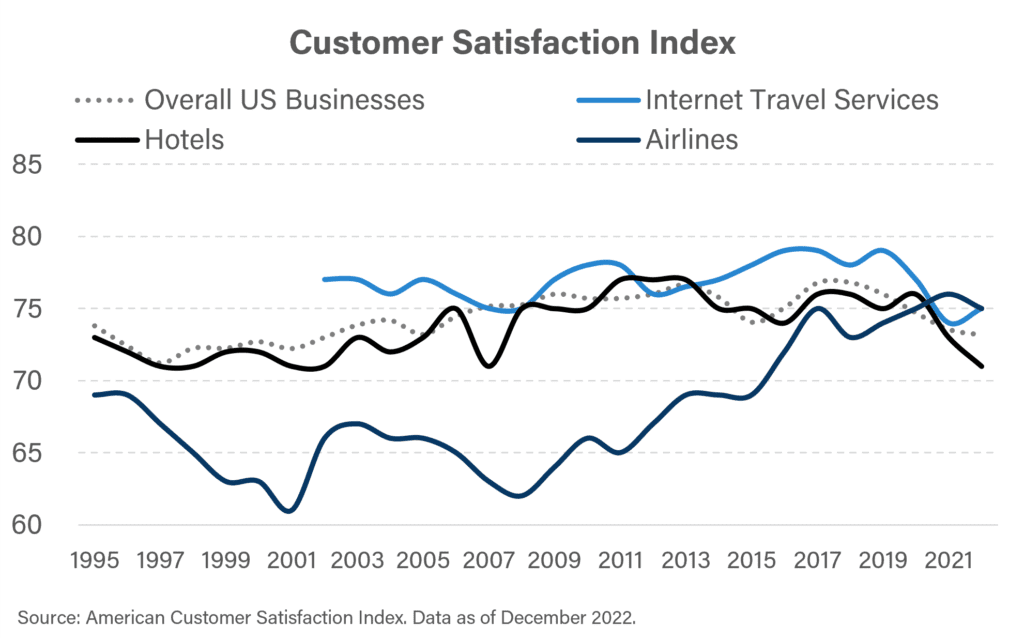

While we are comparing online travel agencies to other travel sectors, it is interesting to check in on customer satisfaction scores. The American Customer Satisfaction Index benchmarks how companies and sectors appeal to shoppers over time and relative to one another. Pre-pandemic, the online travel sector had higher satisfaction scores than the broader hotels or airline sector linked to value pricing, online convenience, and predictable experiences.

However, the pandemic appears to have plunged booking sites into a customer service crisis, with scores falling by four percentage points from 79 in 2019 to 75 today. In contrast the overall score for all U.S. businesses only fell by three points to 73. And surprisingly, airline scores grew by one point. Today for the first time ever, customers report the same level of satisfaction using an airline as they do using an OTA.

Online travel receives the lower satisfaction scores for their cancellation policies, promotions, and loyalty programs. We also think that a large part of the issue is that customers don’t trust online booking sites to deliver on complex itineraries when schedules break, as they so often have this summer and during the pandemic broadly.

On the plus side, OTA satisfaction was high with regards to mobile apps and ease of bookings. The ability to deliver a strong customer experience will become an increasingly important tool, in our mind, that booking sites will need to use to stand out from their competitors and peers.

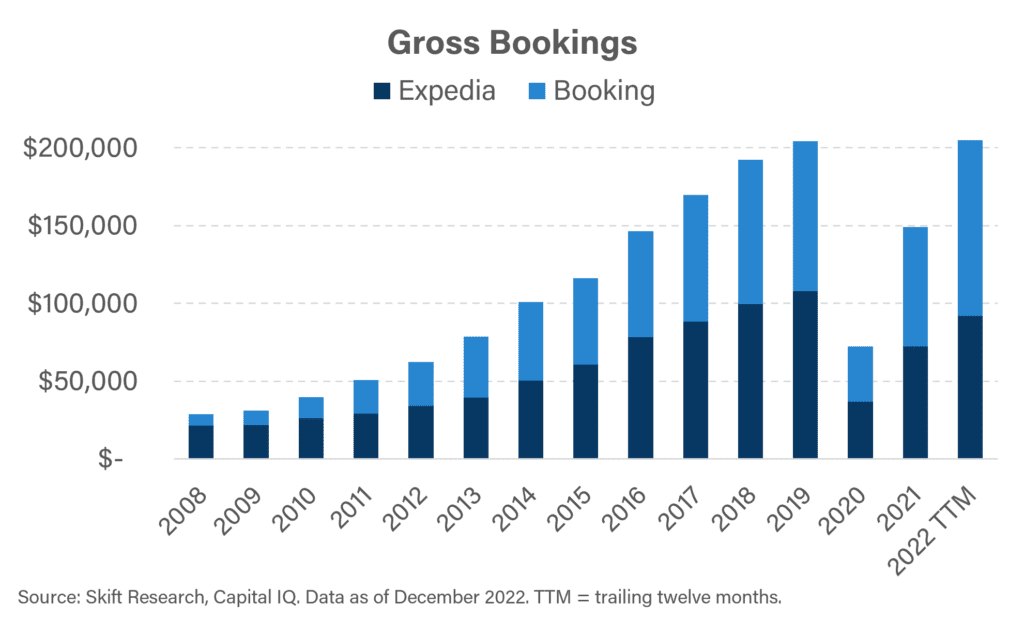

When looking at the big two in aggregate, we can see that the market for online travel gross bookings is reaching the point of full recovery. Together, Expedia Group and Booking Holdings drove $205 billion of gross bookings in the trailing twelve month period ended September 30, 2022. That puts the two just over their 2019 record of $204 billion gross bookings.

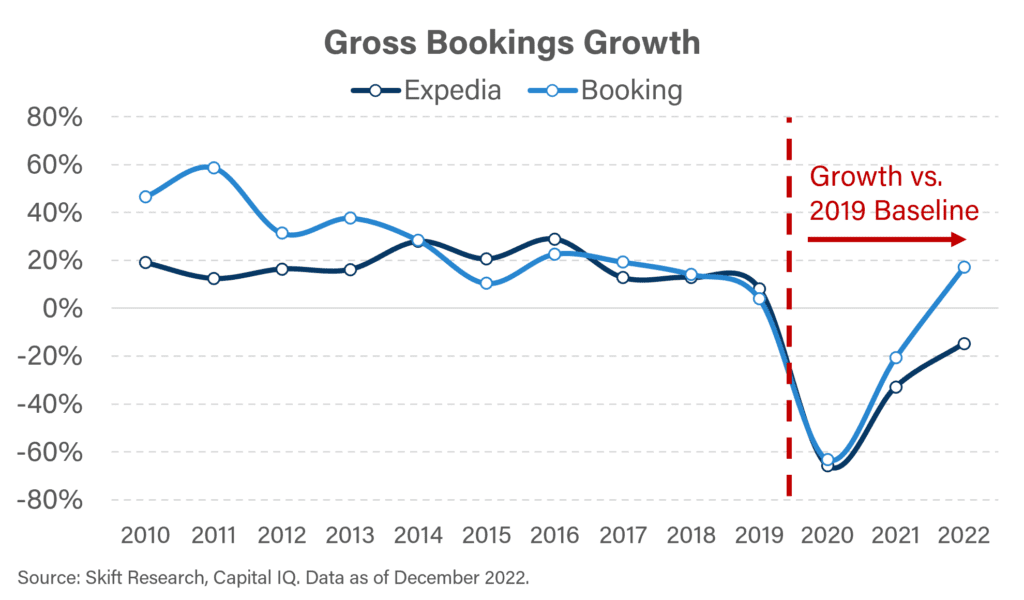

However, this top-level trend masks important company differentials. Expedia Group and Booking Holdings historically grew gross bookings at a very similar pace. Each grew at a mid-teens level before the pandemic and both fell by ~60% in 2020. Yet the two have performed quite differently to date with Booking Holdings achieving gross bookings 17% greater than in 2019 while Expedia Group is still 15% below that year.

We attribute this mainly to the different product mixes that each website offers. Booking.com’s inventory is almost entirely accommodations. Further bolstering Booking.com is that 30% of its room nights in Q3 ‘22 came from alternative accommodations – the hottest subsector in the entire travel industry (see Airbnb’s revenue recovery above). In contrast, Expedia has a larger mix of airline tickets in their bookings mix. Air was 6% of Expedia Group’s revenue in Q3 ‘2019 and that segment is still under heavy pressure.

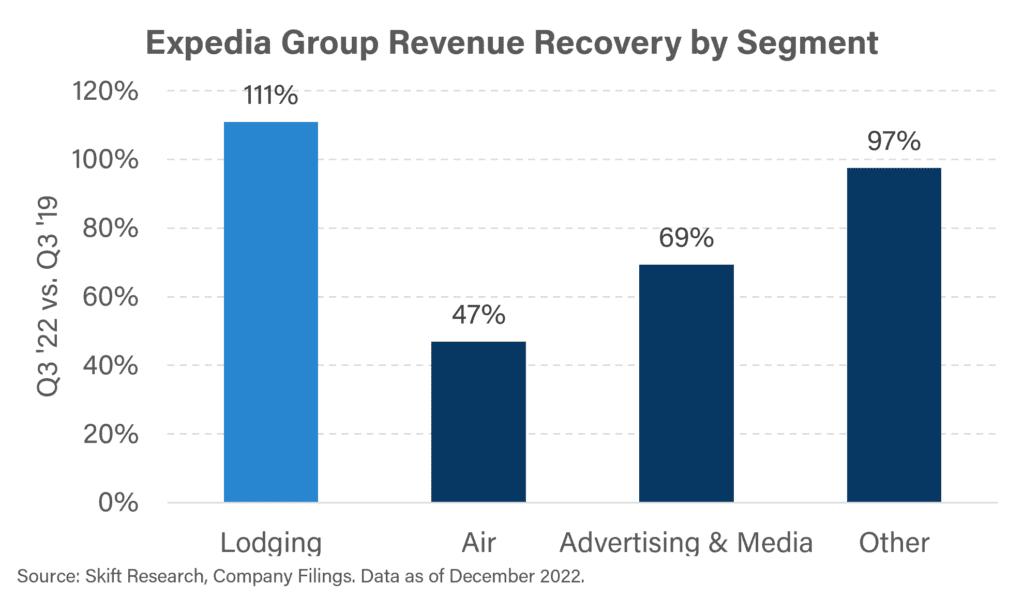

If we examine Expedia’s performance by segment we find that lodging revenue in Q3 2022 was 11% higher than in the same period in 2019, much closer to the performance that Booking Holdings is posting. But Air ticketing is not even half way back to equivalent 2019 levels. Advertising, primarily Trivago, is also holding back Expedia’s recovery.

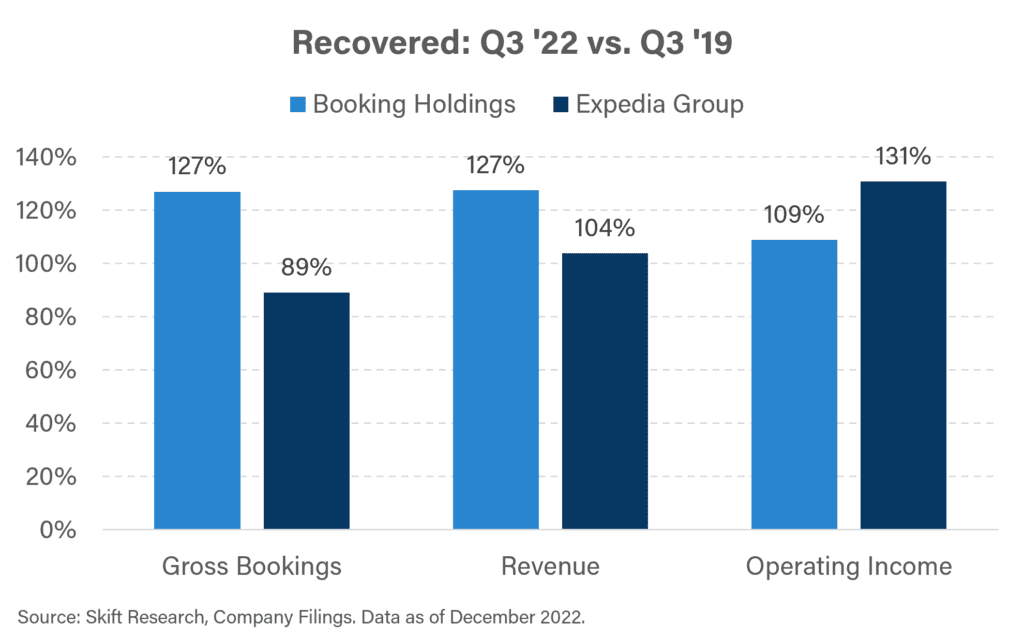

Let’s look at how other important financial measures stack up at Booking and Expedia in the third quarter of 2022 relative to 2019.

As discussed, Booking Holdings gross bookings are growing while Expedia lags, largely due to the lodging vs air mix. Despite this Expedia’s revenue has been made fully whole, because Lodging carries a significantly higher commission. And so while the shift away from lodging has held back Expedia’s Gross Bookings recovery, the mix has benefited its overall take rate and led to a much smaller differential between Expedia and Bookings on the basis of revenue recovery.

Interestingly, when it comes to operating profit, Expedia is actually outpacing its 2019 earnings by 31% while Booking is up 9%. Booking is still running a higher overall operating margin than Expedia, 42.6% vs. 22.1%, but Expedia was able to generate more incremental operating leverage through expense cuts over the last three years.

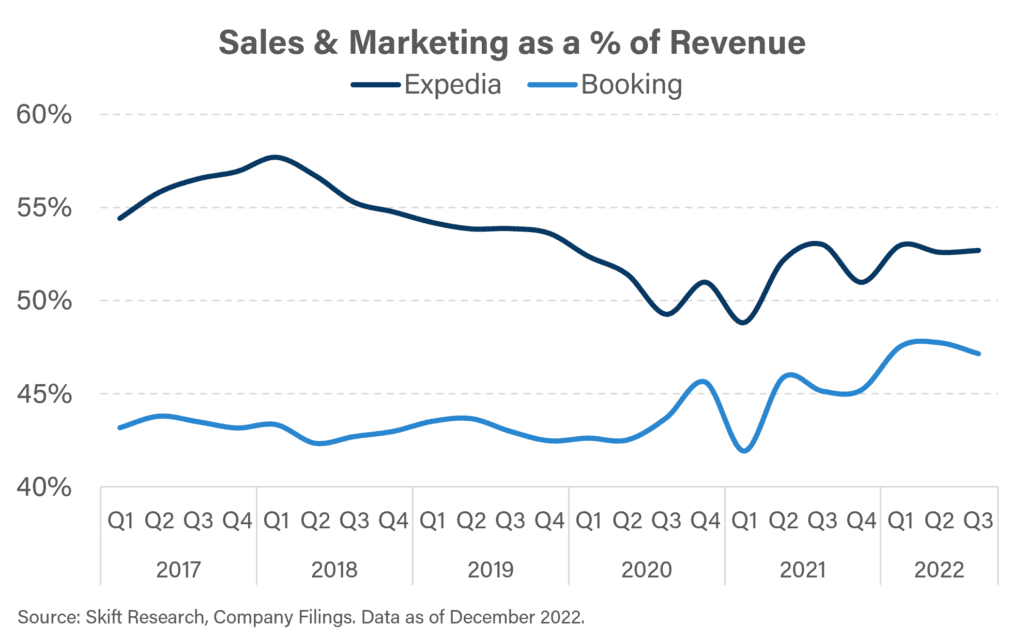

This trend of incremental operating leverage at Expedia while Booking retains an overall better margin, shows up clearly if we look at sales and marketing relative to revenue at each company. Sales and marketing is typically the single largest expense line item for an OTA and so examining it closely gives us a good understanding of overall margin.

Over the trailing twelve months leading up to September 2022, Expedia spent 53% of the revenue it earned on sales & marketing. That’s high. More than the equivalent invested by Booking Holdings. But in September of 2019, the same common size S&M metric for Expedia was 54% and in even earlier years like 2017 and 2018 that ratio could be as high as 55%+.

In contrast, Booking Holdings spent 47% of revenue on S&M in TTM Q3 ‘22, up from 43% in Q3 ‘19. Expedia saw a one point gain in S&M leverage while Booking experienced a four point decline – a net differential of 5 percentage points. These seem like small percentages but when multiplied by billions of revenue it adds up to major shifts in operating dollars. This explains why Expedia is at 131% of 2019 operating revenue while Booking is at 109% even as Booking saw a much faster recovery of Gross Bookings and a better overall operating margin.

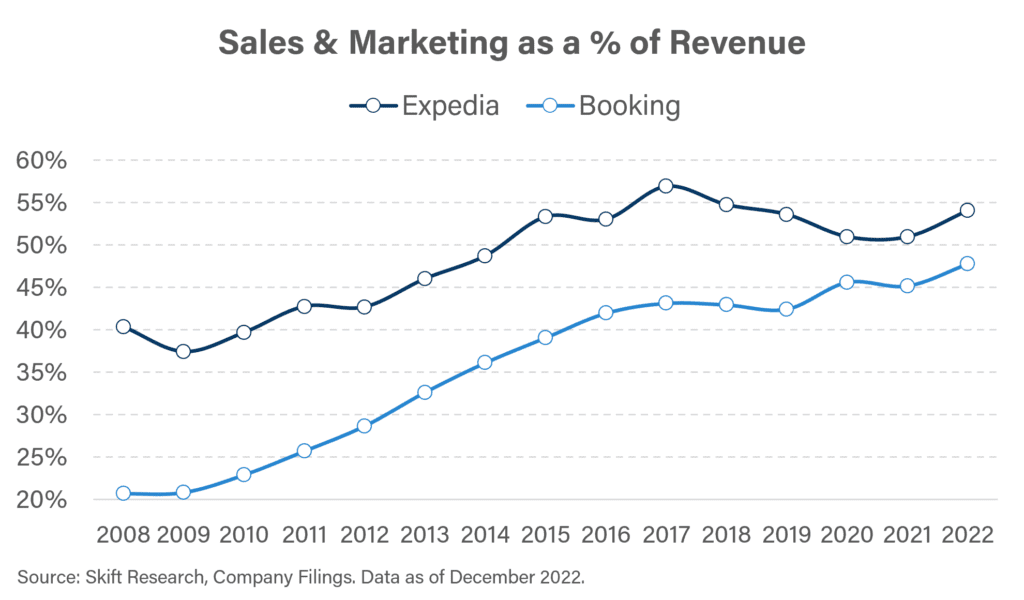

Common size sales and marketing dating back to 2008 shows a long-term trend of Expedia and Booking slowly converging towards parity on their marketing budgets but Booking still retains the overall edge.

Why is Booking stepping up its sales & marketing in relative terms faster than Expedia? One answer might be that Europe, Booking’s home base, has been slower to recover, thus creating a need for the company to invest in inorganic traffic to bolster sales. Another possibility is that Booking is investing heavily in expanding to the U.S. Booking has made clear it wants to expand even further into Expedia’s home turf but that won’t come fast or cheap.

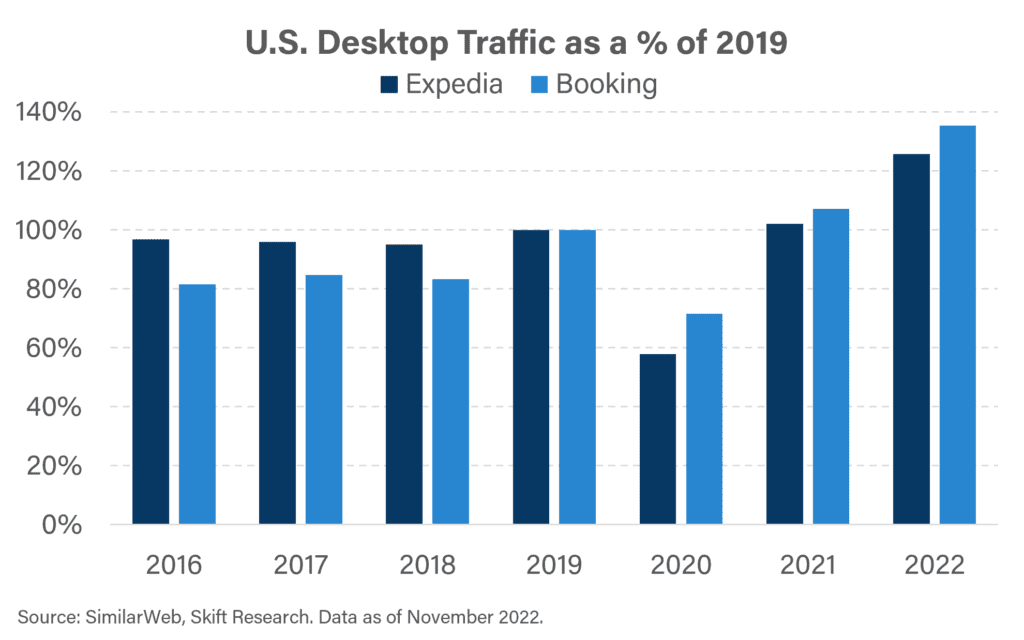

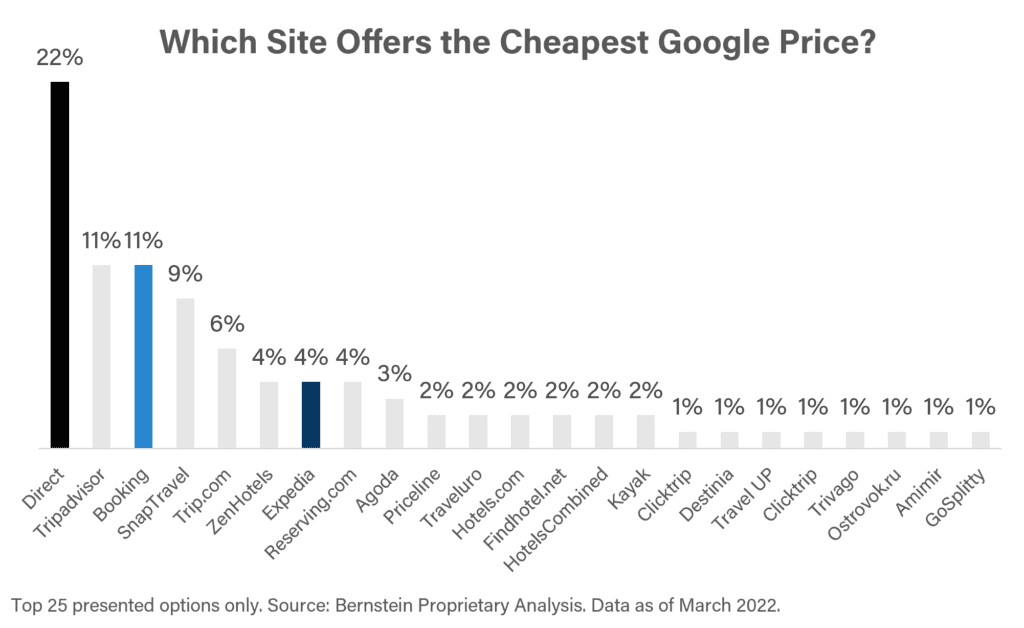

U.S. desktop traffic data from SimilarWeb suggests that booking.com is making headway against expedia.com. We started by aggregating average monthly U.S. desktop traffic volumes for each site by year. Benchmarked to a 2019 baseline booking.com’s traffic today is 35% higher than pre-pandemic while expedia.com grew by 26%.

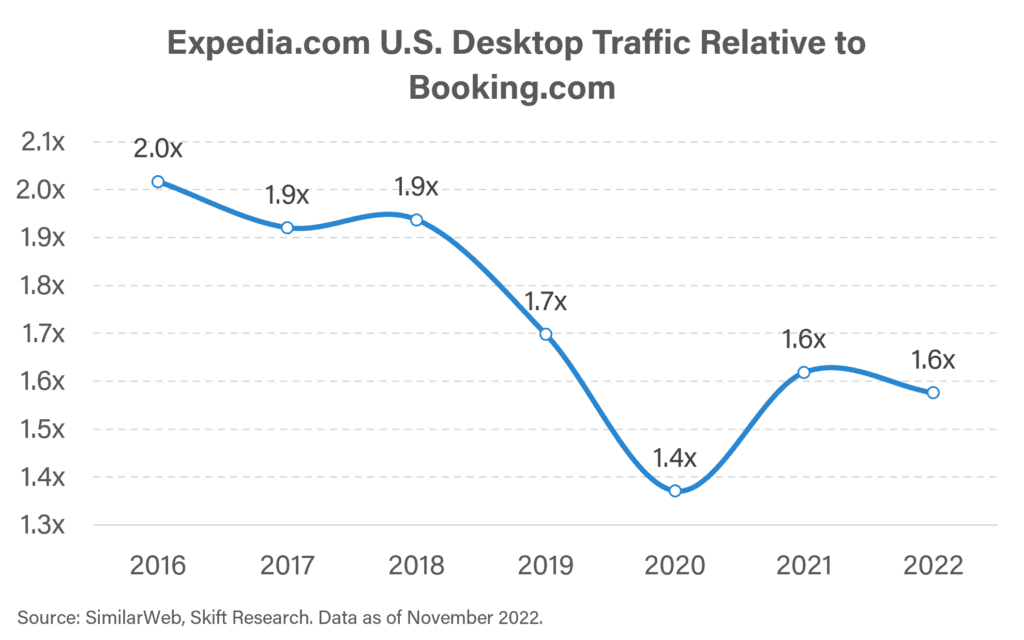

To chart that more clearly, we directly compared traffic volumes between the two sites, from 2016 – 2018 expedia.com would regularly receive ~2x as much traffic as booking.com. That dominance fell to 1.7x traffic in 2019. Today expedia.com receives 1.6x more traffic than booking.com

This is a basic analysis and doesn’t include mobile traffic or other Expedia Group domains like hotels.com or Orbitz. However, the directional trend is clear to us that Booking is slowly gaining traffic share over its rival in the U.S. even as it remains quite clearly the second fiddle across the pond.

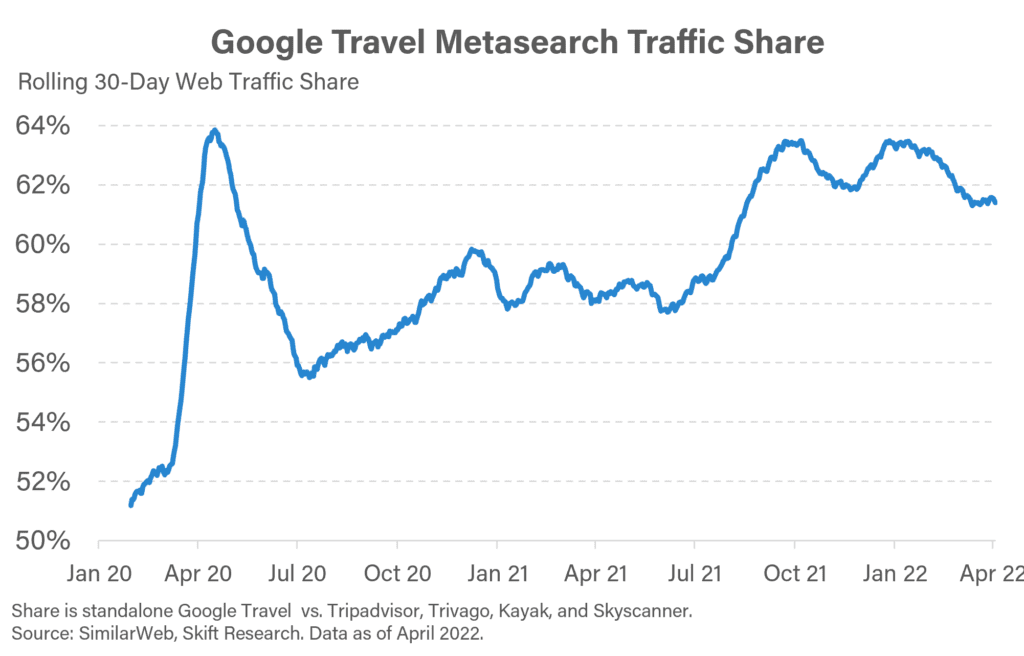

SimilarWeb is also able to give us a sense of web traffic sources for expedia.com and booking.com in the U.S. which we use as a proxy for their parent company performance.

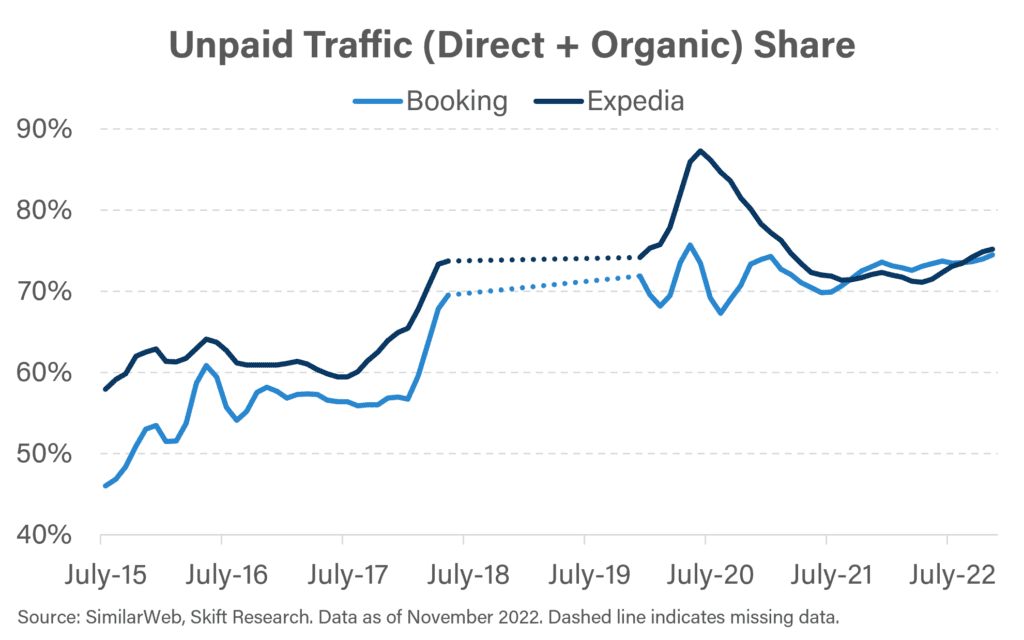

Its data suggests that unpaid traffic, as a share of total U.S. desktop visits, has grown at both expedia.com and booking.com during the pandemic. Both seem to have reached a parity of ~75% unpaid traffic, a noticeable uptick from the 55-65% traffic share that was the norm pre-pandemic.

This is a positive development for both brands, but just because the traffic is not directly paid for doesn’t mean it has no cost. We combine both organic search engine results and direct brand.com web visits in this bucket. And although neither incur a direct advertising cost paid to Google or other metasearch sites, both can be influenced by brand marketing.

We know that Expedia and Booking have both been leaning heavily into brand marketing on TV, online, and print to drive mindshare amongst consumers. This helps square the circle for us of how sales & marketing spend does not seem to have fallen dramatically even as unpaid traffic sources saw a 10+ ppt share gain. It seems to us that brand awareness marketing campaigns in the U.S. are having their intended effect of driving traffic and searches to these online travel brands without incurring the Google ‘tax.’

Long-Term Business Trend Updates

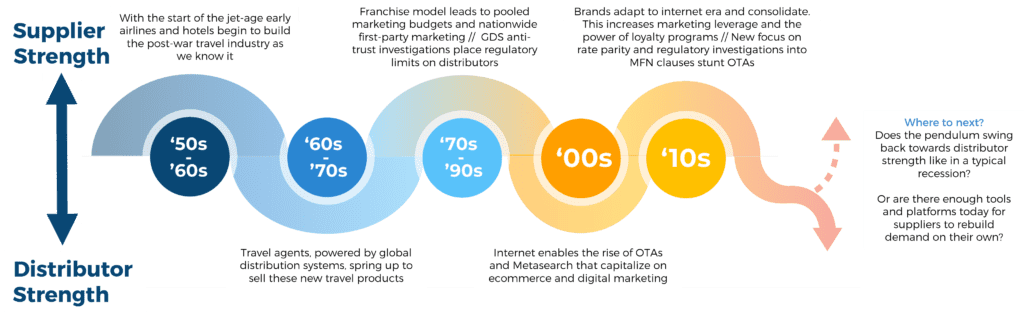

The travel industry has long been defined by a running series of channel wars between travel operators and their distribution partners. This balance of power is never static and swings back and forth between eras of relative advantages dating back to the start of the jet age.

Suppliers tend to do best in stable, growing economic environments while distributors are often the first to capitalize on disruption – both economic and technological. Distributors tend to move faster on changes in the tech landscape, with online travel agencies, as an example, early to capitalize on the long-term consumer shift to ecommerce. And in moments of economic disruption, recessions tend to make suppliers more willing to pay with margin for the ‘heads in beds’ that third-party channels can deliver.

We would argue that the pre-COVID period was an era of relative supplier strength as brands consolidated and launched book-direct campaigns based around loyalty. Our assumption heading into COVID was that, at a moment of extreme disruption for the travel industry, the pendulum would swing back in favor of third-party distributors.

But this initial assumption has not played out as expected. It is still very much up for debate whether the coming years will see a relative benefit for travel distributors. Brands are now skilled at online marketing. And long-tail platforms, like Google and soft-brand collections, are making it easier for suppliers to reach travelers without paying traditional commissions.

With this historical framework in mind, let’s examine the state of Expedia Group and Booking Holdings, the two largest online travel agencies and how their strategies are evolving to compete in a post-COVID travel world.

We believe Expedia and Booking have several sources of competitive advantage. Some of these sources of business edge are shrinking in the modern environment while new ones are being developed via growth experiments.

- Digital-Native // Status: The edge gained by being a digital-native business is shrinking as ecommerce becomes the norm.

- Discounting // Status: shrinking as operators drive enforcement of rate parity and incentivize direct booking.

- Wide Selection of Inventory // Status: growing as inventory continues to expand and as economic slowdown likely drives operator discounts.

- Marketing Economies of Scale // Status: shrinking as brands consolidate, driving ability to compete, and Google secures its place at the top of the funnel.

- New Technology and Product Offerings // Status: growing with investment in new technology, such as open APIs and fintech but facing competition from startups.

- Cross-Sector Offerings // Status: growing with new STR and tour operator inventory but needs investment and threatens margin dilution.