- Skip to main content

- Skip to primary sidebar

- Skip to footer

Audit and Accounting Solutions

Travelling Expenses – Meaning, Examples and Journal Entries

March 17, 2022 Runner

The name itself indicates that this travelling expense relates to expenses incurred for travel by entity employees or directors. The purpose of travel shall be connecting to the entity’s business operations. Therefore, the purpose shall not be of personal nature.

Estimated reading time: 5 minutes

Travelling expenses Examples:

Let’s see a couple of instances relating to travelling expenses

- Directors Cost of travel to other City to attend some business meeting or Client meeting

- Cab Expenses (Local Travel)

- Air Fare and insurance charges, if any relating to the business travel

- Expenses incurred for the Meals, Communication charges and WIFI Charges

- Tips or Surcharge paid for using any of the above facilities as part of travel

- Parking Fees, Toll Charges, Cab Waiting Charges and Luggage Porter Charges

What’s the Journal Entry?

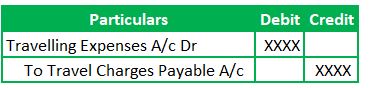

Travelling expenses is a Nominal Account that flows into the Profit and Loss A/c. As this GL is an expenditure Account, the appropriate accounting treatment is to debit this GL Account in the Journal Entry .

Let’s see what’s the corresponding Credit.

Credit is for the Liability Account. Here Liability Account is named Cab Charges Payable, Travel Charges Payable etc., based on the nature of the liability.

There might be instances where there is no requirement to recognize the liability like Meals, tips, parking fees etc. These expenditures are paid immediately, and there might not be any bills or invoices. So, the Credit, in this case, is the Cash A/c.

Journal Entry for recording the Travelling expenses:

(Being the travel charges incurred for ABC Manufacturing deal)

(Being the travel charges paid)

Frequently Asked Questions

1) are the travelling expenses of a salesman forms part of direct or indirect expenses.

The category of expenses depends on the nature of the entity’s business.

For Entities exclusively into the Marketing/Product Sales (not manufacturing), the Travel expense of a Salesman is a direct expense. That’s because those expenditures drive the business operations of the entity.

For Entities not falling into the above category, those travel expenses fall into the Marketing Expenses category, which is an indirect expense. Therefore, it depends on the business category in which the entity operates.

2) What does Accommodation expenses mean?

Accommodation Expenses are the expenses relating to hotel or motel stay. These expenses include the Food, Laundry Service, Telephone, Internet expenses, GST and Service Charges. So, these Accommodation expenses are part of travel expenses. Therefore, it qualifies for indirect business expenditure.

The thumb rule here is to check whether the accommodation expenses shall be relatable to the business operations. So, emphasis shall be given to business importance of the expenses.

3) Paid for travelling expenses journal entry:

Paid for Travelling expenses journal entry records the cash/bank payment done for the travel and related expenses incurred for the business purpose. Let’s see the nature of accounts and accounting rules applicable.

Accounts Involved – Travelling expense and Bank Account

Nature of Accounts –

Travelling Expenses is a Nominal A/c – Expenditure and Bank Account is Real A/c – Asset

Accounting Rules:

The Golden rules of accounting applicable in this scenario are below.

Nominal Account: Debit the expenses and Losses Credit the gains and incomes and

Real Account – Debit what comes in and Credit what goes out

Paid for travelling expenses journal entry is

Travelling expenses A/c Dr

To Bank A/c

4) Travelling expenses are debited to which GL account?

There are no rules for the Naming of an Account. The GL Description shall depict the nature of the Account. For example, if the GL relates to telephone expenses, it shall not fall into conveyance expenses. Therefore, the travelling expenses GL is used as a debit to record the travel expenses in general.

Conclusion:

Travelling expenses are the expenses incurred in relation to business travel . The purpose shall not be in a personal nature. The thumb rules are to check if those expenses help further business operations. This travel expenses category is wide enough to cover the accommodation charges, telephone, internet charges, ancillary charges incurred along with the hotel expenditure.

Debit the Travelling expense and Credit the Bank Account to record the Journal Entry. If the transaction happens on a credit basis, two entries are recorded. The first one is to debit the travelling expense, and the Credit is to the Liability Account. The second entry is to debit the Liability account and Credit the bank account. The net effect is knocking off the Liability Credit in the first entry and the Liability debit in the second. So, technically the journal entry is the same as the first scenario. It’s just deferment of recording the complete transaction effect.

Hope this article brings some clarity on the travelling expenses concept. If you have any questions then pls let us know through the comments below.

Recent Posts

- Journal entry for mileage expense

- Journal entry for new vehicle purchase

- Financial Statement Tie out

- Trial Balance vs Balance Sheet

- Fixed asset reconciliation

Blog Whereabouts

- Privacy Policy

Search Posts

Traveling Expenses Journal Entry

Traveling expense is the expense that company pays for conducting the business operation far away from the normal business location.

Many companies choose to spend their travel expenses on their employees. This is because it is often more cost-effective and efficient to have employees travel to client meetings, training sessions, and conferences rather than hiring outside consultants. In addition, it allows employees to build relationships with clients and colleagues and learn new skills. Spending on employee travel can also be a tax-deductible business expense. When done correctly, investing in employee travel can be a wise decision for both the company and the employees.

There are a few ways to help control these costs, such as negotiating discounts with airlines or hotel chains or consolidating travel bookings through a single travel agency. You can also encourage employees to make use of less expensive options whenever possible, such as flying economy class or staying in less expensive hotels. If your company spends a lot on travel expenses, it may be worth hiring a full-time travel manager to handle all of the details and help keep costs under control. By taking a few simple steps, you can help to ensure that your company’s travel expenses are reasonable and manageable.

This expense is normally treated as the operating expense report on the income statement. It is part of the company’s operation that company spend to send the employees to join the meeting, training, and other business operation.

However, some company allocates it as the cost of goods sold (cost of service). It can happen to the service company that provides different services to many customers. Only a few customers whose location requires the traveling expense. It depends on the company policy and the intention behind it.

Journal Entry for Traveling Expense

Traveling expenses are the expense that the company pays for the employee’s travel to perform service for clients.

The company needs to record the expense when the expense incurs rather than paid.

The journal entry is debiting travel expenses and credit cash.

The travel expense will be recorded as the expense on the income statement. It is part of the operating expenses. Some companies may record it as the cost of goods sold if they can allocate it to a specific project such as a service performed for the client.

Most of the travel expenses are paid by cash, so it will impact the company’s cash balance.

ABC is a consulting company that provides various services to clients in rural areas. The company needs to send the employee to inspect the client’s site in various locations. As a result, The company has spent $ 5,000 on travel expenses. It is not possible to make proper allocation of the expense to each client, so the company decides to record it in the operating expense.

The company has to record the traveling expense in the financial statement.

The journal entry is debiting traveling expenses $ 5,000 and credit cash $ 5,000.

For Agencies

Let's Talk: (844) 800 - 2211

Remembering Shay Litvak Our Co-Founder and CTO

November 1979 - September 2023

Examples of How to Record a Journal Entry for Expenses

Maddy Osman

Keeping track of the money that leaves your business may not be as fun as counting the revenue you bring in through sales . But understanding how much you spend is just as important as knowing how much money you make.

By maintaining records of your expenses, you can better understand the cost of running your business and calculate your profits .

Here's how to make your bookkeeping entries for expenses and common examples you may come across.

What Are Journal Entries for Expenses?

Journal entries for expenses are records you keep in your general ledger or accounting software that track information about your business expenses, like the date they were incurred and how much they cost.

Business expenses can include a range of things, like rent, payroll , and inventory .

In business, you record all transactions (including expenses) using a double-entry accounting system. In other words, each accounting record includes a debit and a credit, and the amount of debit and credit should be equal for each record.

Is an Expense a Debit or Credit in a Journal Entry?

An expense is considered a debit in a journal entry. This debit shows that your expense account has increased—or the transaction has increased your total costs.

That said, the debit is just one-half of the accounting entry. You need to balance it with a credit.

How Do You Record a Journal Entry for an Expense?

To record an expense, you enter the cost as a debit to the relevant expense account (such as utility expense or advertising expense) and a credit to accounts payable or cash, depending on whether you've paid for the expense at the time you recorded it.

You credit your cash account to record money leaving the business if you've paid for the expense. But if you have yet to pay for the expense, you credit accounts payable to show the money you owe.

While this might seem like a small distinction, accounting and financial statements are all about the details.

Let's see the accounting journal entries for cash, accounts payable, and other common expenses.

Examples of Journal Entries for Expenses

There are several types of expenses you can incur as a result of owning and operating a business.

Here are some examples showing the journal entries for some of the more common expenses.

Journal Entries for Cash Expenses

Let's say that you bought $1,000 worth of office supplies and you pay the vendor the same day.

The $1,000 debit shows that your total office supplies expenses increased by $1,000. The $1,000 credit to the cash account represents the money leaving your business's bank account.

Ready to transform your business into a profit-pumping machine? Learn how with our monthly newsletter.

Subscription implies consent to our privacy policy.

Journal Entries for Payments on Credit

Businesses that follow Generally Accepted Accounting Principles (GAAP) must use the accrual accounting method, which means that you record expenses and revenue on the day they are incurred.

But you don't always pay for your expenses on the same day they are incurred.

For example, let's say you placed that $1,000 order on Jan. 20. The vendor delivered the products and gave you an invoice on Feb. 1, but you didn't pay it until the products were delivered on Feb. 10.

If that's the case, you still need to record the expense when it was incurred on Jan. 20, but you'll use the accounts payable account for the credit. Generally, you incur expenses when you submit the order or are billed by the vendor .

Here's how the journal entry for the expense would look.

By crediting accounts payable, which is a liability account , this entry shows that you owe your vendor $1,000.

You'll create another entry on Feb. 10 when you pay the invoice.

This entry shows that you no longer owe the $1,000 because you paid it via the cash account. The cash account is an asset account , so the $1,000 credit represents a decrease in your cash.

Journal Entries for Estimates of Upcoming Expenses

In the previous example, you received an invoice and recorded the $1,000 of unpaid office supplies by crediting accounts payable.

But what happens for expenses that you're incurring but don't know how much the cost will be? For example, for electricity, you're billed after the fact based on the amount you use.

In that case, you can use accrued expenses (also known as accrued liabilities ) to record unpaid expenditures that you have to estimate, such as your utilities or income taxes.

Let's say that your electric company bills you every two months for service, but you want to record your monthly electricity expense. Based on past bills, you can estimate your monthly electricity expense. (We're assuming $500 in this example.)

Here's how you would record that expense for January.

Journal Entries for Payroll

Another common expense for business owners is the cost of paying employees. In this case, the total value of your payroll gets recorded in the payroll expense account.

Here's one example of preparing a journal entry for your payroll expenses.

Paying employees is often one of the most significant expenses for small business owners. Not to mention, there's more to payroll than just salary. With Hourly payroll software , you can automatically run payroll and calculate related costs, like taxes and workers' comp —all in one click.

Journal Entries for Depreciation

Depreciation is an accounting tool businesses use to record the loss in value of physical assets (like vehicles or machinery) over time. It's recorded on financial reporting documents, like balance sheets and income statements .

Typically, you record depreciation at the end of the year to show how much value the long-term assets have lost during the year.

For example, let's say you own a piece of machinery, and you've determined that it loses $1,000 in value each year.

Here's how you would record that expense.

Journal Entries for Your Customers' Unpaid Bills

When a customer can't pay off their account , you take on that expense. There are two ways to recognize these uncollectible accounts: the direct write-off method and the allowance method.

Using the direct method, when you realize an accounts receivable account is uncollectible, you write off the amount to bad debt.

For instance, say you have a customer with an outstanding bill worth $1,000. If that customer goes out of business and can’t pay the bill, here’s how you’ll record that expense using the direct write-off method.

Using the allowance method, you estimate the amount of receivables that will be uncollectible and reduce your accounts receivable balance with a contra account called allowance for doubtful accounts.

In business, doubtful accounts refer to any amount that you don’t expect to collect.

For instance, say you have outstanding receivables worth $100,000, and based on your history, you know 1% of your receivables will never be collected.

Here’s how you’ll record that allowance and the related expense:

Journal Entries for Adding to Your Petty Cash Fund

Petty cash is an account of cash that's usually kept on hand and used for small purchases, like office supplies.

While you don't need to make an accounting entry when you spend petty cash, you do need to record an entry when you move money from your cash account to the petty cash account.

Here's how.

Journal Entries for Prepaid Expenses

In some cases, you may end up prepaying for certain expenses. This can happen if you purchase business insurance or pay rent for a few months or an entire year upfront.

Let's say that you paid for six months of office rent upfront in January. The amount that was prepaid (rent for February through June) gets recorded as an asset in a prepaid rent account.

On the first day of February, you make a journal entry to move that month’s rent out of prepaids and into expenses:

This way, your monthly expenses take rent into account, even if you paid for it ahead of time.

Final Thoughts on Expense Tracking and Accounting

Keeping track of all of your business transactions shows you how cash flows in and out of your company.

When you prepare a journal entry for an expense, there are two steps: First, you debit the relevant expense account, which represents the increase in costs. Second, you need to record the same amount as a credit.

If you've paid for the expense, you'll credit your cash account, and if you still owe the money, you'll credit accounts payable or accrued expenses.

Now that you know how to record expenses in your general journal, you'll better understand how much you spend and what it costs to keep your business open.

What You Need to Know about Form 1099-NEC

Revenue vs. Profit: What You Need to Know

Buying a Car for Business: How-To, Pros and Cons

Sales Revenue Journal Entry

Complete Guide to Understanding Sales Revenue Journal Entries in Bookkeeping

Home › Examples › Journal Entries › Sales Revenue Journal Entry

- What is a Sales Revenue Journal Entry?

Components of a Sales Revenue Journal Entry

Key takeaways, for cash sales, for credit sales, identification of the sale, determination of accounts involved, recording the journal entry, scenario 1: cash sale, journal entry for cash sale:, explanation:, scenario 2: credit sale, journal entry for credit sale:, considerations for sales returns and allowances, importance of sales revenue journal entries, bottom line, what is a sales revenue journal entry in accounting, how do you record a cash sale in a journal entry, what accounts are affected by a credit sale journal entry, why is the sales revenue journal entry important in bookkeeping.

A sales revenue journal entry is an accounting entry recorded in the financial ledgers of a company to document the income generated from the sale of goods or services before any deductions, like returns or discounts.

This entry is crucial for capturing the essence of business transactions related to sales within a specific accounting period, reflecting the company’s operational success and its ability to generate earnings.

The sales revenue journal entry typically involves at least two accounts:

Revenue Account (Credit): This account is credited to reflect the increase in the company’s earnings due to the sale. It increases the owner’s equity because it represents income earned by the business. The specific account name can vary depending on the nature of the revenue (e.g., “Sales Revenue,” “Service Revenue”).

Cash or Accounts Receivable Account (Debit): Depending on whether the sale is made in cash or on credit, this component of the journal entry can vary:

Cash Account: For cash sales, the cash account is debited, indicating an increase in the company’s cash holdings.

Accounts Receivable Account: For credit sales, the accounts receivable account is debited, indicating an increase in the amount owed to the company by its customers.

Direct Impact on Financial Statements: Sales revenue journal entries critically affect both the income statement, by showing earned income, and the balance sheet, through changes in cash or accounts receivable and equity.

Essential for Performance Analysis: These entries provide essential data for evaluating a company’s sales performance and financial health, influencing strategic business decisions.

Double-Entry Accounting Compliance: Recording sales revenue requires adherence to double-entry bookkeeping, ensuring every transaction is balanced by debiting and crediting corresponding accounts, maintaining the accounting equation’s integrity.

How to Record a Sales Revenue Journal Entry

When a sale is made, whether for cash or on credit, two primary accounts are impacted: the Sales Revenue account and the Cash or Accounts Receivable account. The entry to record a sale involves a debit and a credit to these accounts, adhering to the double-entry accounting system.

Step #1: Debit the Cash account to increase the asset.

Step #2: Credit the Sales Revenue account to reflect the income.

Step #1: Debit the Accounts Receivable account to record the amount owed by the customer.

Step #2: Credit the Sales Revenue account to recognize the income earned.

Steps to Record a Sales Revenue Journal Entry

Initially, the specific details of the sale are identified, including the amount, whether the transaction is for cash or on credit, and the date of the sale.

Based on the nature of the sale, the relevant accounts are determined. For cash sales, the Cash account is used, while credit sales involve the Accounts Receivable account.

The sale is recorded by debiting the appropriate asset account (Cash or Accounts Receivable) and crediting the Sales Revenue account. The debit entry increases the asset, reflecting the receipt of cash or the right to receive cash. The credit entry increases the Sales Revenue, indicating the earning of income.

Sales Revenue Journal Entry Example

Let’s consider a practical example of a sales revenue journal entry in accounting, focusing on both a cash sale and a credit sale scenario.

ABC Electronics sells 10 laptops at $800 each for cash.

Total Sale: 10 laptops x $800 = $8,000

Debit Cash Account: $8,000

Credit Sales Revenue Account: $8,000

The cash account is debited to reflect the increase in ABC Electronics’ cash holdings due to the sale. The sales revenue account is credited to record the income earned from selling the laptops. This transaction increases both the company’s assets (cash) and its equity (through sales revenue).

ABC Electronics sells 5 desktop computers at $1,200 each on credit.

Total Sale: 5 desktops x $1,200 = $6,000

Debit Accounts Receivable Account: $6,000

Credit Sales Revenue Account: $6,000

The accounts receivable account is debited to indicate that ABC Electronics has sold the desktop computers and is expecting to receive $6,000 from customers. This reflects an increase in assets (accounts receivable). The sales revenue account is credited to show the income earned from the sale, which increases the company’s equity.

These examples illustrate how sales transactions, whether in cash or on credit, are recorded in the company’s journal. The key components include a debit to either cash or accounts receivable (showing an increase in assets) and a credit to sales revenue (indicating an increase in equity through earned income). Such entries are crucial for accurate financial reporting and analysis, providing insights into the company’s operational performance and financial health.

In instances where goods are returned or allowances are made, the Sales Returns and Allowances account, a contra-revenue account, is used to adjust the sales revenue.

The entry to record a sales return or allowance involves debiting the Sales Returns and Allowances account and crediting the Cash or Accounts Receivable account, effectively reducing the recorded sales revenue.

The sales revenue journal entry is fundamental to financial accounting as it impacts the income statement directly, showing the operational income generated from core business activities.

It also affects the balance sheet through changes in cash or accounts receivable and equity (via retained earnings). Accurately recording this entry is essential for assessing the company’s performance, profitability, and financial health.

The accurate recording of sales revenue is paramount in financial accounting, providing insight into the company’s revenue-generating activities. By adhering to the outlined steps and ensuring meticulous documentation, companies can achieve a true and fair view of their financial performance.

This guide serves as a foundational resource for understanding and implementing the journal entry process for sales revenue, a cornerstone of financial reporting and analysis.

Frequently Asked Questions

A sales revenue journal entry records the income earned from selling goods or services, debiting either Cash or Accounts Receivable and crediting the Sales Revenue account.

For a cash sale, debit the Cash account to increase assets and credit the Sales Revenue account to reflect earned income.

In a credit sale journal entry, the Accounts Receivable account is debited to note the amount owed by customers, and the Sales Revenue account is credited to record the income earned from the sale.

The sales revenue journal entry is crucial as it provides a clear record of income generated from sales, impacting both the company’s income statement and balance sheet, and helps in analyzing financial performance.

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

What is a Sales Journal? Example, Journal Entries, and Explained

A Sales Journal , also known as the Sales Day Book, is a specialized accounting journal used to record all credit sales of merchandise. It simplifies the bookkeeping process by providing a space where all sales transactions can be recorded chronologically rather than entering them directly into the general ledger or the customers’ subsidiary ledger accounts.

Explanation

While all companies maintain a single journal for bookkeeping records, some companies like to divide journals into multiple types which makes it easy to track down financial records. Some companies would have multiple sale journals for different types of products. These companies would keep multiple sales journals to track the sales of each product. The sales, their dates, and prices are all listed in chronological order. Sometimes, a specific identification number would also be added to track the product. This specific identification also helps track the inventory.

Consider a company that sells car accessories such as LED light bars and cleaning kits. The company keeps a Sales journal to keep track of its sales. The company does not provide any credit to buyers for purchase. The company sells an LED light for one hundred dollars. How would this sale be noted in the Sales Journal?

There are two sides to every accounting book; it is the same for a sales journal. One is the credit side and the other is the debit side. The sale of the LED light would bring 100 Dollars to the company. This cash would be noted on the credit side, whereas the LED light would be noted on the Debit side.

The company also has a tracking identification number for the LED light. This helps the company track the inventory. As inventory gets low, the company would order new LED lights from the suppliers.

Sales Journal Entry Format

There are six main parts of the entry format of a sales journal. All six of these are shown in figure 1 below:

Figure 1: Basic format of a sales journal

The six main parts of a sales journal are Data, account Debited, Invoice number, post Reference, Accounts Receivables, and cost of goods sold.

A detailed explanation of all the entry formats for a sales journal is given in detail below:

This is the very first column of a sales journal. Here, the dates of the sales are mentioned. Some journals even include a time column. Now, there is software that automatically enters the day, time, and even the name of the goods sold. This software also allows the inventory to be automatically updated when a specific good is running low on inventory, by automatically ordering that particular good from the supplier.

By mentioning the date, we can easily track when that particular good was sold. This allows the company to track the dates on which the goods were sold.

Account Debited

This is the second column in the sales journal as we can see from Figure 1. This column records the name of the buyer. When big clients purchase things from the suppliers such as Walmart when it purchases goods from one of its suppliers, the supplier has a credit account opened in its sales journals for that client. The account of that client is debited, meaning the supplier’s account is credited when that supplier purchases the goods.

The sales invoice number is mentioned in the third column as shown in figure 1. A copy of the sale invoice is also generated and handed down to the customer. The identification number mentioned in the invoice allows for helping track down that particular sale.

The invoice number is generated to help the clients. So, if a client wants to return the product the invoice number can be matched with the invoice number in the sales journal.

This is done to avoid the chances of fraud to avoid any unnecessary losses. This is all now done by software, where a person types the invoice number into the account and the software tracks down the sale.

Post reference entries

This is done by the suppliers to track their customers. Each client is given a certain number and the same number, post reference is different from the account debited, as this does not contain the amount of money for a particular order from the client.

A certain number represents the particular sale, and the same number is used to track the client. A certain number keeps changing, but the same number remains the same.

If ever some issue arises in the sale or delivery of the product to the client, the post reference entries help track the specific order and client.

Account receivables or sale

This is the second last entry in the sales journal. Account receivables are mentioned when the client purchases a product or service on credit, and sales are mentioned when the client purchases a product or service and pays for it through cash.

These two are basically the same columns but the name just changes depending on whether the client made a purchase on credit or by paying cash. If the payment is made in cash, the column becomes the sales column, but when it is paid on credit, the column becomes account receivables.

Cost of Goods Sold

This is the final column in the sales journal. It is also one of the most important columns. The cost of goods sold has a dual benefit. It does not only contain the price of the cost of goods sold, it also updates inventory.

Each product has a specific identification number. So, when a particular product’s amount goes down, the warehouse is notified of it, and they put more purchase orders for that particular.

In new accounting software, both functions of this column are happening simultaneously. The warehouses are updated constantly, so there is no delay and the company does not run out of product when clients are asking for it.

Frequently asked questions

What is a sales journal entry?

A sales journal entry is a sale entry made in the sales journal when a customer purchases a product. It does not only record the cost of purchase, the sales journal entry also notes the date, time, sales tax, and so much more in the sales journal.

Is sales debit or credit?

Sales are a credit side entry for the seller. This is because of the fact that sales are basically an income-generating operation, so sales are entered in the credit side of the sales journal. Sales returned are entered on the debit side.

Sales returned are also known as the return of goods. In this case, the money paid by the customers has to be returned, and as a result, these go on the debit side. So, whether sales are credit or debit depends upon whether sales are made or products are returned.

What is the difference between a purchases journal and a sales journal?

The sales journal records credit transactions. The purchase journals record debit transactions. Both journals are special types of journals. It is also clear from the name that sales journal records sale transactions, whereas purchase journals record purchase transactions.

Some businesses keep a different purchase and sale journal, while some journals keep the record of purchases and sales in the same journal.

How many types of sales journals are there?

There are four main types of sales journals. The name of the four sales journals is sales journals, cash receipt journals, purchase journals, and Cash Payments journals. Each type of sales journal has specific requirements. For example, cash receipt journals are used by merchant businesses to record cash receipt transactions.

Similarly, purchase journals are used to record the purchases of a company. Cash payment journals record the cash payments made by the clients of a company. Sales journals record sales and some other particular metrics related to sales.

Related Posts

General journal: definition, example, format, and explanation, what is the cash payment journal example, journal entries, and explained, what is a purchase journal example, journal entries, and explained, accounting for credit and cash purchase transactions (explained with journal entries).

Call Us (877) 968-7147 Login

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

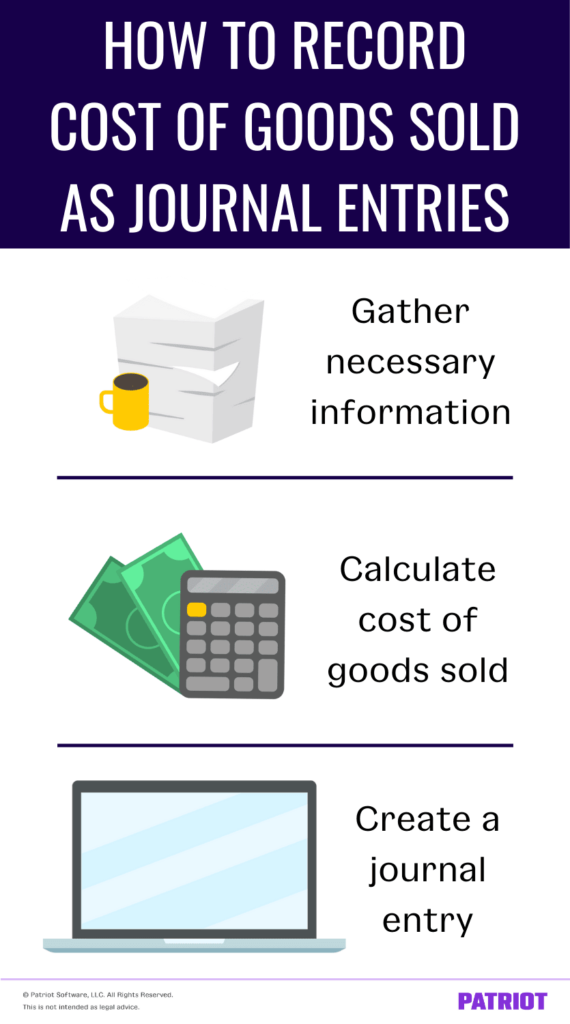

How to Record a Cost of Goods Sold Journal Entry 101

As a business owner, you may know the definition of cost of goods sold (COGS). But do you know how to record a cost of goods sold journal entry in your books? Get the 411 on how to record a COGS journal entry in your books (including a few how-to examples!).

What is COGS accounting?

As a brief refresher, your COGS is how much it costs to produce your goods or services. COGS is your beginning inventory plus purchases during the period, minus your ending inventory.

Simply put, COGS accounting is recording journal entries for cost of goods sold in your books.

When is cost of goods sold recorded? You only record COGS at the end of an accounting period to show inventory sold. It’s important to know how to record COGS in your books to accurately calculate profits. That’s where COGS accounting comes into play.

If you don’t account for your cost of goods sold, your books and financial statements will be inaccurate.

Calculating COGS

Before you can jump into learning about recording cost of goods sold journal entry, you need to know how to calculate COGS. Follow the formula below to calculate your COGS:

COGS = Beginning inventory + purchases during the period – ending inventory

Example of calculating COGS

Let’s say your business’s beginning inventory is $2,000 and you purchase $500 of supplies during the period. Your ending inventory is $200. Your COGS calculation would look like this:

COGS = $2,000 + $500 – $200

Your COGS would be $2,300.

Why is COGS important?

Your income statement includes your business’s cost of goods sold. This financial statement reports your profit and losses. It also shows your business’s sales, expenses, and net income .

Along with being on oh-so important financial documents, you can subtract COGS from your business’s revenue to get your gross profit . Gross profit shows you how much you are spending on COGS. Knowing your business’s COGS helps you determine your company’s bottom line and calculate net profit.

How to record cost of goods sold journal entry

Follow the steps below to record COGS as a journal entry:

1. Gather information

Gather information from your books before recording your COGS journal entries. Collect information ahead of time, such as your beginning inventory balance, purchased inventory costs, overhead costs (e.g., delivery fees), and ending inventory count.

2. Calculate COGS

Calculate COGS using the formula:

3. Create a journal entry

Once you prepare your information, generate your COGS journal entry. Be sure to adjust the inventory account balance to match the ending inventory total.

You may be wondering, Is cost of goods sold a debit or credit ? When adding a COGS journal entry, debit your COGS Expense account and credit your Purchases and Inventory accounts. Inventory is the difference between your COGS Expense and Purchases accounts.

Your COGS Expense account is increased by debits and decreased by credits.

When you purchase materials, credit your Purchases account to record the amount spent, debit your COGS Expense account to show an increase, and credit your Inventory account to increase it.

Here’s what your journal entry for COGS for materials purchased should look like:

COGS journal entry examples

Check out a couple of examples of recording COGS journal entries in your books.

Let’s say you have a beginning balance in your Inventory account of $4,000. You purchase $1,000 of materials during the accounting period. At the end of the period, you count $1,500 of ending inventory.

Debit your COGS expense $3,500 ($4,000 + $1,000 – $1,500). Credit your Inventory account for $2,500 ($3,500 COGS – $1,000 purchase).

The COGS entry would look like this:

Say your company makes computers and it costs you $200 to make each one. During the period, you sold 100 computers. Your COGS is $20,000 ($200 X 100). Here’s what it would look like as a journal entry:

Debit your COGS account and credit your Inventory account to show your cost of goods sold for the period.

This article has been updated from its original publication date of November 29, 2018.

This is not intended as legal advice; for more information, please click here.

Stay up to date on the latest accounting tips and training

You may also be interested in:

Need help with accounting? Easy peasy.

Business owners love Patriot’s accounting software.

But don’t just take our word…

Explore the Demo! Start My Free Trial

Relax—run payroll in just 3 easy steps!

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Relax—pay employees in just 3 steps with Patriot Payroll!

Business owners love Patriot’s award-winning payroll software.

Watch Video Demo!

Watch Video Demo

Journal Entry for Traveling Expenses Paid in Advance

Key takeaways.

- Accurate documentation of receipts and expenses is crucial for successful reimbursement.

- A journal entry is used to track expenses incurred during a trip, with expenses paid in advance recorded through a debit to the cash advance account and a credit to the cash account.

- Legitimate expense requests need to be documented and reported to ensure approval for reimbursement and prevent overspending.

- Reimbursable business travel expenses are subject to IRS regulations, and understanding these rules is important for correctly claiming expenses and deductions.

Travel Expense

The reimbursement of travel expenses involves careful consideration and accuracy in the documentation of receipts and other expenses. Travel expenses are typically composed of food, transport, accommodation, commute, and other associated services. Keeping accurate records and documents related to expenses is a must for successful reimbursement.

This record-keeping process is usually done through a journal entry for traveling expenses paid in advance. This entry is typically used to track any expenses incurred during the course of the trip. It is important to note that any expense incurred must be documented and reported to the employer in order to be approved for reimbursement.

Furthermore, it is essential to be mindful and attentive when requesting reimbursement of travel expenses. This is to ensure that the expenses are legitimate and will be approved for reimbursement.

Journal Entry for Traveling Expenses paid in Advance

An accounting transaction is recorded for the pre-payment of travel-related costs. This journal entry involves a debit to the cash advance account and a credit to the cash account.

This transaction will be made to give cash to the employees in advance. The actual expense will be recorded based on actual amount.

In this case, the journal entry would involve a debit to the travel expense account and a credit to the cash advance account.

This process is used to account for pre-payments of travel expenses and ensure that the employee is reimbursed for the actual cost. This method of accounting helps to keep track of travel expenses and ensure that accurate records are kept for the company. This also helps to ensure that the company does not overspend on travel-related costs. By tracking pre-payments of travel expenses, the company can manage its budget more effectively.

Travel Expenses And IRS

Reimbursable business travel expenses are subject to IRS rules and regulations. It is important to understand these rules in order to correctly claim travel expenses and deductions. The IRS considers business travel expenses when an employee works away from their tax home for longer than a normal work day.

Tax home refers to the region where a person normally works. Personal expenses are not eligible for reimbursement, nor are expenses related to visiting family or personal trips. To claim a tax deduction on travel expenses, the period of the business trip or assignment should be less than a year.

When traveling for business, it is important to ensure that all expenses are properly documented and accounted for in the books. Accurately journalizing expenses paid in advance is an important step in ensuring that the company is not subject to IRS penalties for mistakes or omissions.

The journal entry for traveling expenses paid in advance should include the date of the transaction, the amount paid, and the account to which the expense is charged. Accurately journalizing these transactions ensures that the company is in compliance with IRS regulations and can provide the necessary documentation in the event of an audit.

Proper accounting for travel expenses is essential to the success of any business.

Related Posts

Journal entry for prepaid rent non-refundable, journal entry for accounts receivable adjustment, journal entry for accounts receivable bad debts, journal entry for accounts receivable allowance for doubtful accounts.

- WordPress.org

- Documentation

- Learn WordPress

- View AMP version

Check the PageSpeed score

PageSpeed score is an essential attribute to your website’s performance. It affects both the user experience and SEO rankings.

You can hide this element from the settings

Checking...

We are checking the PageSpeed score of your Journal Entry For Sales And Cost Of Goods Sold Of Inventories page.

Journal Entry For Sales And Cost Of Goods Sold Of Inventories

Accounting Procedures for Jobs Completed and Products Sold: Journal entry for sales and Cost of goods sold of inventories very associated. During a month’s operations, the materials placed in process are accounted for through materials requisitions for the jobs, the labor in process is evidenced by time tickets, and the factory overhead is applied. The figures charged to the work in process account represent the total factory cost for a month’s operations.

Journal Entry For Sales On Credit

When finished products are delivered to credit customers, sales invoices are prepared. At that time a journal entry for sales is recorded as follows:

Accounts Receivable 88,000 Sales 88,000

Journal Entry For Sales At Cash

When finished products are delivered to customers at cash, sales invoices are prepared. At that time a journal entry for sales is recorded as follows:

Cash 88,000 Sales 88,000

Journal Entry For Delivery of Finished Goods

Each delivery necessitates a debit to Cost of Goods Sold and a credit to Finished Goods, using the cost figures recorded on the ledger cards.

Cost of Goods Sold 52,300 Finished Goods 52,300

Journal Entry For Receipt of Cash from Credit Customer

When cash is received from the credit customers, Journal Entry to record the transaction is-

Cash Dr. 88000

Accounts Receivable Cr. 88,000

Journal entry for Sales/COGS/Accounts Receivables is given as above.

When jobs are completed, cost sheets are moved from the in process category to a finished file. Completion of a job results in a debit to Finished Goods and a credit to Work-in Process. If the completed job is undertaken for the purpose of replenishing stock, quantity and cost are recorded on Finished Goods ledger cards which are the subsidiary record of the finished goods account. Sample Journal Entry to record finished goods is as follows:

Finished Goods ———-xxx Work-in Process——————-xxx

Or, if a separate Work-in Process is used to accumulate each cost element, the journal entry will be as follows:

Finished Goods ———-xxx Work-in Process[Materials]———-xxx Work-in Process [Labor]————-xxx Work-in Process[Factory OH]——-xxx

In factories with departmentalized operations, separate work in process accounts may be maintained for each producing department, and accumulated costs may be transferred from one department to the next based on the sequential work flow; or costs may be accumulated yet not transferred to subsequent departments until the job or the work is completed.

Knowledgiate Team

20 big differences between gaap and ifrs accounting, the tax game changer: how deferred tax could transform your company’s financial future, unlocking transparency and trust: exploring the significance of audited financial statements, understanding the multistep income statement: a comprehensive overview, unveiling the hidden tax benefits: the power of deferred tax assets, understanding the statement of cash flows: preparation, activities, uses, and analysis, why is ethical code necessary in accounting bodies, a case study on ias 19- employee benefits, top 7 famous celebrity accountants in the world, functions of cash budget in an organization, subscribe to our mailing list to get the new articles, oplan application :applying all your tips, costing system: installation of a costing system, related articles.

Different Components of a Master Budget

Different Types of Budgets in Finance and Accounting

7 Scope And Areas for Cost Reduction in a Manufacturing Company

Difference Between Cost Control and Cost Reduction

akun pro kamboja

slot thailand

mahjong ways

https://hoerakinderschoenen.nl/

https://bergeijk-centraal.nl/wp-includes/slot-deposit-gopay/

slot mahjong ways

https://www.job-source.fr/wp-content/slot-singapore/

https://tentangkitacokelat.com/wp-includes/slot-deposit-gopay/

slot server thailand

akun pro myanmar

slot garansi kekalahan

slot deposit dana

https://slot-myanmar.deparmotor.com/

https://slotserverluarnegeri.deparmotor.com/

https://slot777.devtmp.focim.edu.mx/

https://bet-200.devtmp.focim.edu.mx/

https://slot-thailand.devtmp.focim.edu.mx/

Slot Server Thailand

https://buggybrolly.com/wp-includes/idn-poker/

https://www.donchuystacoshoputah.com/

https://orderzenseafoodsushigrill.com/

https://www.saltedsalad.com/

https://tastebakerycafe.com/

https://www.order369ramenpokechinesefood.com/

https://www.suiviesante.fr/wp-content/slot-malaysia/

https://www.smokepitgrill.com/

https://www.ilovesushiindy.com/

https://yakikojapanesegrill.com/

https://www.themixxgrill.com/

https://chilangosbargrill.com/

https://tentangkitacokelat.com/wp-content/slot-pulsa/

https://winkelstueck-reparatur.de/wp-includes/slot-pulsa/

https://slot-pulsa.devtmp.focim.edu.mx/

https://kayanscarf.com/

https://www.garage-aymard.fr/wp-includes/slot-qris/

https://nexttech-tt.com/

https://dotnetinstitute.co.in/wp-includes/slot-deposit-gopay/

https://www.yg-moto.com/wp-includes/sbobet/

https://bergeijk-centraal.nl/wp-content/slot777/

https://www.anticaukuleleria.com/slot-myanmar/

https://bergeijk-centraal.nl/wp-includes/slot-bonus-new-member/

https://houseofgabriel.com/wp-includes/slot-bonus/

jurassic kingdom

https://houseofgabriel.com/wp-includes/pomo/slot-petir-merah/

https://houseofgabriel.com/wp-includes/pomo/slot-garansi-kekalahan-100/

https://lajme.org/wp-content/sbobet/

https://houseofgabriel.com/wp-includes/pomo/slot777/

https://houseofgabriel.com/wp-includes/pomo/mahjong-ways/

https://houseofgabriel.com/wp-includes/pomo/bca-slot/

https://houseofgabriel.com/

https://www.job-source.fr/wp-content/sugar-rush/

https://repairkaro.com/pragmatic-play/

pragmatic play

https://idn-poker.zapatapremium.com.br/

https://sbobet.albedonekretnine.hr/

https://mahjong-ways.zapatapremium.com.br/

https://slot777.zapatapremium.com.br/

https://baksobakarmantap.com/slot777/

https://www.entrealgodones.es/wp-includes/slot-pulsa/

https://slot88.zapatapremium.com.br/

https://slot-pulsa.zapatapremium.com.br/

https://hollyorchards.com/wp-content/pyramid-bonanza/

https://slot777.jikuangola.org/

https://slot777.nwbc.com.au/

http://wp.aicallcenter.ai/wp-includes/widgets/slot-deposit-pulsa/

https://choviettrantran.com/wp-includes/slot-deposit-pulsa/

https://kreativszepsegszalon.hu/wp-includes/slot-deposit-pulsa/

https://www.muaythaionline.org/wp-includes/slot-deposit-pulsa/

https://pgdownloads.enterprisedb.com/slot-deposit-pulsa/

https://ebook.franchise.7-eleven.com/slot-pulsa/

https://llohan.hollywood.com/slot-pulsa/

https://transition.site5.com/slot-pulsa/

https://fan.iitb.ac.in/slot-pulsa/

slot server myanmar

https://podcast.peugeot.fr/slot-pulsa/

https://mahjong-ways.softcia.com.br/

https://le-fief-fleuri.fr/core/wp-includes/sbobet/

https://le-fief-fleuri.fr/core/wp-includes/idn-poker/

slot myanmar

slot kamboja

slot bonus new member

bonus new member

https://ratlscontracting.com/wp-includes/sweet-bonanza/

https://quickdaan.com/wp-includes/slot-thailand/

https://summervoyages.com/wp-includes/slot-thailand/

https://aws-klinkier.pl/wp-content/idn-poker/

https://thewolfiscoming.com/wp-includes/slot-bonus/

https://www.handwerksform.de/wp-includes/slot777/

https://www.nikeartfoundation.com/wp-includes/slot-deposit-pulsa/

https://lepremier.miami/wp-content/slot-bonus/

https://www.anticaukuleleria.com/wp-content/cmd368/

https://candyhush.com/wp-content/slot-bonus/

https://showersealed.com.au/wp-content/sabasport/

https://tdapelsin.ru/wp-includes/slot-bonus/

https://kreativszepsegszalon.hu/wp-content/slot-bonus/

https://jakartaaids.org/wp-content/sbobet88/

https://ratlscontracting.com/wp-includes/ubobet/

situs slot nexus

slot bet kecil

slot gacor deposit 10 ribu

slot joker123

slot bet 100

slot deposit 10 ribu

big bass crash slot

spaceman slot

wishdom of athena

slot bonanza

slot spaceman

Rujak Bonanza

Candy Village

Gates of Gatotkaca

Adblock Detected

Accountinguide

Simple and Easy

Accounting for Pass-through Expense

Pass-through expenses are the expense that third party charge to the company and the company charge it directly to the clients. The company pass-through this cost to the client without any markup. The company does not provide any value on this service and it is not facing any risk. Third-party has obligation to complete the service directly to customers, who have liabilities to settle the payment base on contract.

Pass-through expenses are not the main part of the company’s business activities. They just act as the agent to collect revenue on behalf of the third parties. The company does not have obligation to complete the service or face the risk of uncollectible debt.

Pass-through Expense Example

Company ABC rent a condo to Mr. B, the rental fee is $ 500 per month, however, Mr. B has obligation to pay for utilities around $ 100 per month which depend on the consumption. Every month, Mr. B needs to pay a rental fee of $ 500 plus the utility expense to Company ABC.

Company ABC needs to record rental revenue of $ 500. For the utility expense, Company will not record it as revenue, it just the pass-through expense which third party bill to them and pass to the lessee.

Pass-through Expense Journal Entry

Based on the example above, utility expense is the pass-through expense, Company A need to record as the following:

- When Mr. B pays the utilities $100, Company needs to record debit cash $100 and credit payable to third party $ 100.

- When company ABC settle with the utility provider, they need to debit payable and credit cash.

Cash collect from pass-through expenses does not impact the revenue as we do not provide any service or add value to the customers. Third-party take full responsibility if something goes wrong. Cash paid to the third party is not considered as expenses as well.

Related posts:

- Unearned Revenue Journal Entry

- Journal Entry

- Accrued Expense and Prepayment

- Calculate Bad Debt Expense

- Expense Reimbursement

Detailed Guide To Travel Agency Accounting

- Post author By varun

- Post date December 1, 2022

As far and wide the services of a travel agency expand, so is the elaborateness of its accounting procedures. Being a business model operating with multiple parties under unique financing arrangements, these agencies need to keep the flow of funds fairly sorted. This needs to be done for a clear bookkeeping and accounting of money received or paid. And so, understanding the procedure and details of accounting becomes quite a necessity for someone planning to run or establish a travel agency.

Even though the availability of travel management platforms like Pathfndr has simplified accounting for these agencies, it is imperative to know the thick and thin of travel agency accounting if planning to run a travel agency.

Accountancy for travel agencies is a dedicated information system designed to provide the necessary details. These details can be related to the company’s monetary stature, its transactions, financial executions, and everything else related to its management.

The success of travel agency management is critically based on efficient recording, accuracy of such record maintenance and the financial statement preparation. For suitable formulation of strategic business decisions and plans, travel agency accounting can be the concrete support needed.

Travel agency accounting is also needed to assess the fair status of the company. It can be simply said to be a process that enables profitability assessment of the agency as well as its financial status in both short and long run. Platforms like Pathfndr only assist with the elaborate accounting system that a travel agency may need to follow.

Below given is a detailed guide on the types of books maintained for travel agency accounting along with the financial statement preparation requirements and other pertinent details related to the procedure. Meanwhile, it can be useful to check out the role that travel agency management platforms like Pathfndr can play in maintaining the books of travel agency accounting for these companies.

Books That Need to be Created for Travel Accounting

Travel agencies need to prepare a host of books, statements, and journals for the purpose of essential travel accounting. These companies would need to create one or more of the following records and statements to keep the travel agency accounting right in place.

Journal for cash receipt

A cash receipt journal allows you to record the receipt of all revenue generated for the travel agency. The journal is recorded for an annual period and receives entries for all transactions made in cash, cheques, and credit cards.

Whether the business receives payments for tour package sale and any commissions received from a partner operator, which can include airlines, bus operators, hotels, and the likes.

While you would need to make these entries manually, using an online travel management platform like Pathfndr simplifies these records as they are directly accounted for through necessary tools used on these platforms.

Sales journal

A sales journal is used to account for all transactions that a travel agency makes in credit. In case your travel agency extends credit facilities to partner operators and customers, the entries would form a part of the sales journal.

Usually, travel agencies operating on a large scale use these journals. With access to the likes of Pathfndr, all credit sale records are updated automatically to this journal.

Accounts receivable

A journal of accounts receivables is used to record transactions that the travel agency makes in credit in lieu of products and services received from supplying partners. It sums up the amount that the business would owe to its suppliers, sellers, and producers for the period involved.

Journal for cash disbursal

The total outflow of cash from the travel agency’s entirety of finances is recorded in the cash disbursement journal. A majority of this journal’s entry is made with respect to its operating cost for the period, including the likes of rents, administrative expenses, selling and/or distribution expenses, legal expenses and salaries/wages paid.

Also known as the cost journal, entries to this travel agency accounting record are mostly made for cheques and drafts issued. But all of these essential entries are simplified through automation processes that platforms like Pathfndr provide.

Payroll journal

A payroll journal is an altogether separate journal that is maintained as a record of salaries/wages and other financial benefits paid to its employees. It gives a detailed insight on the total employees working with the agency, the total outflow made in the form of salaries and wages, compensations, insurance protection provided, medical facilities, compensations, and other benefits that may be available to its employees.

Chief book of accounts

The chief book of accounts is primarily a ledger book and a summed point of accounting record for all the balance entries that the company may have. It is a critical bookkeeping record that can direct identification and verification towards all revenue sources, a total of cash and credit sales, commissions earned, and such other crucial travel agency accounting aspects.

The use of Electronic Data Processing or EDP systems in almost all travel agencies operating today simplifies all these entries, their identification and verification for performance evaluation. Platforms like Pathfndr are fast changing how these EDPs are integrated into the travel agency accounting system.

Travel Accounting System

A travel accounting system follows a design that aims to record all items related to the business’s balance sheet as well as its income statement. These items spread across the likes of the agency’s assets, liabilities, incomes, revenues, gains, losses, expenses, as well as the capital invested.

An automated travel accounting system is integrated into the operation of travel management platforms like Pathfndr to simplify the recording and identification of these accounting items of the business. It can thus be greatly useful to create your travel agency’s official website on these platforms with dedicated domains and other customized functionalities.

Below given is a list of items that are included in the accounting statements prepared as per the travel accounting system with their short descriptions.

Capital invested

The capital of a business in general, including a travel agency, comprises the contributions from the owners of the entity, company, partnership, or firm. The capital of the company comprises both paid and unpaid contribution of the owners to the company. It can be summed up as the net worth of the travel agency that it owes to the owners. Depending on the type of the company a travel agency is established as, the capital and ownership can either be considered as separate or as one and the same.

Irrespective of the ownership-entity divide, the items comprising the capital of the travel agency must be accounted for individually. In the case of a company form of travel agency, the capital can include its shares and debentures. For travel agencies formed as partnership firms, the contributions of individual partners comprises the capital of the agency. In case of individual owners, their entire investment comprises the capital of the travel business.

A travel agency runs on definite resources that it utilizes to generate revenue. Such resources are invested into the business to generate benefits from operations in the future. These resources that contribute to benefit generation over the time are known as assets of the company.

The identification of assets is intended to increase the business’s cash flow in the long run through cyclic usage. A travel agency’s, or any company’s for that matter, assets can be identified under two classes, namely fixed and current assets. It is crucial to identify these assets separately for the purpose of travel agency accounting .

Liabilities

A liability of a travel agency can be identified as a claim against the assets that it utilizes for revenue generation and profitability. These can also be understood as the future sacrifice of economic benefits that the business undertakes for asset generation or for providing services, ultimately leading to debt creation charged on these assets. Like assets, liabilities of a travel agency are also identified under two types, and are known as long-term and short-term (current) liabilities.

Be it assets, liabilities, or any other item of the accounting system that the travel agency needs to maintain can be easily identified under the aegis of travel management platforms like Pathfndr. These records are summed up at the end of each accounting period and can be accessed through website accounting automation processes run through Pathfndr.

Revenue/gains/income

The total value of services/products that a travel agency provides, the interest received from clients, commissions from partner operators and such other contributions that form a part of the total incoming monetary value can be identified under this accounting head. Revenue of the company is the total value of sales made, out of which the gains are identified as revenue minus the expenditure incurred.

The total cost that a travel agency incurs, including the cost in the long as well as short term, for running the business can be accounted for under the expenses head of the travel agency accounting system. Expenditures are also identified as the sum of cash outflow made by the agency in return of services or products received towards the entity’s operation in short as well as long run.

While maintaining the travel agency accounting system can be quite extensive for an agency, the use of travel management systems like Pathfndr can make the entire process of handling the business’s accounts simple and convenient, requiring minimal manual efforts and time.

Financial Statements That Need to be Prepared

For any accounting system, including that of travel agency accounting , the output of the records need to be formally created based on the identified and accepted statements. These statements are popularly known as the financial statements of the travel agency and are categorized under income statements and position statements.

Income statement: An income statement of a travel agency is also maintained as a profit and loss account for the company. It is created to assess the overall profitability of the company for an identified period based on the income and expenditure made for the said duration. It is an important part of travel agency accounting.

Position statement: A position statement of a travel agency is created to assess its overall financial health. It is a periodic statement, and is often created at the end of the definite term identified for the accounting cycle. It usually comprises the assets and liabilities of the travel agency on a said date and helps identify the resources used and their financing.

In the overall consideration of travel agency accounting system maintenance for the travel agency, creating a dedicated department and hiring the skilled personnel for the purpose can be an extensive process. It also involves resource allocation and can be a tedious process overall.

As an alternative, a travel agency can seek to automate the entire travel agency accounting system through necessary tools in place. One of the best ways to implement this automation is to create the business website through Pathfndr, a travel management platform that comes preset with all the tools necessary for accounting and bookkeeping of the agency.

The automated processing tools are well-designed to automatically record and compute the accounting results as and when desired. So, the travel agency does not have to go through an extensive travel agency accounting process periodically.

Travel agency accounting is a crucial aspect that a travel agency needs to take care of at all times, irrespective of its scale and geography of operation. The availability of travel management platforms like Pathfndr and their integration of automated accounting tools amps up the overall financial management of the company.

Creating your agency’s travel website through these platforms can benefit in so many more ways than just adequate and timely recording and assessment of the financial aspect of the business.

IMAGES

VIDEO

COMMENTS

This travel expenses category is wide enough to cover the accommodation charges, telephone, internet charges, ancillary charges incurred along with the hotel expenditure. Debit the Travelling expense and Credit the Bank Account to record the Journal Entry. If the transaction happens on a credit basis, two entries are recorded.

Sales Journal Entry Examples. Here are a few different types of journal entries you may make for a sale or a return depending on how your customer paid. Cash Sales Journal Entry. Let's take a look at an example of a journal entry for cash sales. In this case, we'll say that: You sold an item for $700. Sales tax is 10%.

The journal entry is debiting travel expenses and credit cash. The travel expense will be recorded as the expense on the income statement. It is part of the operating expenses. Some companies may record it as the cost of goods sold if they can allocate it to a specific project such as a service performed for the client.

The cost of goods sold journal entry is: This entry matches the ending balance in the inventory account to the costed actual ending inventory, while eliminating the $450,000 balance in the purchases account. Advanced version: ABC International has a beginning balance in its inventory asset account of $1,000,000.

For Sales: 1.877.683.3280. Hours. Mon - Fri, 5am - 6pm PST Sat - Sun, 7am - 4pm PST. ... in march do a journal entry, debit travel expense, credit pre-paid travel. View solution in original post. 0 Cheer Reply ... If cost is the issue, check desktop, miles ahead of QBO in functionality and pro is ahead of QBO+ too. ...

If a customer agrees to reimburse you for certain expenses, then you can record the reimbursed expenses as revenue. The underlying GAAP standard that addresses this issue is the Emerging Issues Task Force (EITF) issue number 01-14, "Income Statement Characterization of Reimbursements Received for Out-of-Pocket Expenses Incurred.".

When you prepare a journal entry for an expense, there are two steps: First, you debit the relevant expense account, which represents the increase in costs. Second, you need to record the same amount as a credit. If you've paid for the expense, you'll credit your cash account, and if you still owe the money, you'll credit accounts payable or ...

Example of the Sales Journal Entry. As an example of a sales journal entry, a company completes a sale on credit for $1,000, with an associated 5% sales tax. The goods sold have a cost of $650. The sales journal entry is: [debit] Accounts receivable for $1,050 [debit] Cost of goods sold for $650 [credit] Revenue for $1,000 [credit] Inventory ...

Here's one example of a sales journal entry that includes revenue, cost of goods sold, inventory, ... The sales journal entry for this sale on credit appears as the following: [Debit] Accounts receivable for: $1,050 [Debit] Cost of goods sold for: $650 [Credit] Revenue for: $1,000 [Credit] Inventory for: $650

This entry records the amount of money the customer owes the company as well as the revenue from the sale. Second, the inventory has to be removed from the inventory account and the cost of the inventory needs to be recorded. So a typical sales journal entry debits the accounts receivable account for the sale price and credits revenue account ...

Sales Revenue Journal Entry Example. Let's consider a practical example of a sales revenue journal entry in accounting, focusing on both a cash sale and a credit sale scenario. Scenario 1: Cash Sale. ABC Electronics sells 10 laptops at $800 each for cash. Total Sale: 10 laptops x $800 = $8,000. Journal Entry for Cash Sale: Debit Cash Account ...

There are six main parts of the entry format of a sales journal. All six of these are shown in figure 1 below: Figure 1: Basic format of a sales journal. The six main parts of a sales journal are Data, account Debited, Invoice number, post Reference, Accounts Receivables, and cost of goods sold. A detailed explanation of all the entry formats ...

Their total bill is $240. To create the sales journal entry, debit your Accounts Receivable account for $240 and credit your Revenue account for $240. After the customer pays, you can reverse the original entry by crediting your Accounts Receivable account and debiting your Cash account for the amount of the payment.

The normal balance of Sales is a credit, when we credit that account it also increases. Dr. Cash $1,000 Cr. Sales $1,000. Journal Entry for Inventory Sales Along with each sale of goods, there is a related cost of goods entry that must be booked to record the inventory being sold.

Solution: With the information in the example, we can calculate the cost of goods sold as below: Cost of goods sold = Beginning inventory + purchases - ending inventory. Cost of goods sold = $50,000 + $200,000 - $40,000 = $210,000. And the ending inventory is $10,000 ($50,000 - $40,000) less than the beginning inventory.

Follow the steps below to record COGS as a journal entry: 1. Gather information. Gather information from your books before recording your COGS journal entries. Collect information ahead of time, such as your beginning inventory balance, purchased inventory costs, overhead costs (e.g., delivery fees), and ending inventory count. 2. Calculate COGS.

A journal entry is used to track expenses incurred during a trip, with expenses paid in advance recorded through a debit to the cash advance account and a credit to the cash account. Legitimate expense requests need to be documented and reported to ensure approval for reimbursement and prevent overspending. Reimbursable business travel expenses ...

At that time a journal entry for sales is recorded as follows: Cash 88,000. Sales 88,000. Journal Entry For Delivery of Finished Goods. Each delivery necessitates a debit to Cost of Goods Sold and a credit to Finished Goods, using the cost figures recorded on the ledger cards. Cost of Goods Sold 52,300.

Top 10 Examples of Journal Entry. Example #1 - Revenue. Journal Entry Examples Video Explanation. Example #2 - Expense. Example #3 - Asset. Example #4 - Liability Accounting. Example #5 - Equity Accounting. Example #6 - Transaction with Journal Entries. Example #7 - Practical.

Pass-through Expense Journal Entry. Based on the example above, utility expense is the pass-through expense, Company A need to record as the following: When Mr. B pays the utilities $100, Company needs to record debit cash $100 and credit payable to third party $ 100. When company ABC settle with the utility provider, they need to debit payable ...

Sales journal; A sales journal is used to account for all transactions that a travel agency makes in credit. In case your travel agency extends credit facilities to partner operators and customers, the entries would form a part of the sales journal. ... Also known as the cost journal, entries to this travel agency accounting record are mostly ...

To M/s Albert Ltd. For $ 2,00,000.00 on credit,, the cost of goods sold Cost Of Goods Sold The Cost of Goods Sold (COGS) is the cumulative total of direct costs incurred for the goods or services sold, including direct expenses like raw material, direct labour cost and other direct costs. However, it excludes all the indirect expenses incurred by the company.

Jobs costing $1,680,000 to manufacture according to their job cost sheets were completed dur- ing the year. Jobs were sold on account to customers during the year for a total of $2,800,000. The jobs cost $1,690,000 to manufacture according to their job cost sheets Required 1. What is the journal entry to record raw materials used in production? 2.

The Business Journals features local business news from 40-plus cities across the nation. We also provide tools to help businesses grow, network and hire.