TRAVEL Cards

- Personal Loan

- New Car Loan

- Two Wheeler Loan

- Business Loan

- Credit Cards

- Forex & Remittance

Travel Cards

ICICI Bank Travel Card is the perfect travel companion for all your international trips. Get the Travel Card of your choice by browsing through the ‘Travel Cards – Variants’ section. The power-packed ICICI Bank Travel Card is a smart, convenient and secure alternative to carry foreign currency while travelling overseas. Now avoid currency rate fluctuations and save cross currency charges by loading your card with 15 foreign currencies - USD, GBP, EUR, CAD, AUD, SGD, AED, CHF, JPY, SEK, ZAR, SAR, THB, NZD, HKD. Load and instantly activate your Travel Card to start using it immediately for booking your international flight and accommodation. You can make payments only on international websites and merchant outlets overseas

Online Account Management facility

No need to visit a branch or call Customer Care. It’s time to relax and manage all your Travel Card functions yourself at comfort of your home. ICICI Bank Travel Cards is providing digital interfaces that are simple to use where end users would be able to view, handle minor issues and information requests that would otherwise go to the service desk. Now log on to ‘Self Care Portal’ or ‘Internet Banking’ or ‘iMobile app’ and start managing Travel Card with just a click.

Self Care Portal

'Self Care Portal' is an exclusive real-time account management portal designed for ICICI Bank Travel Card customers. This facility provides 24*7 access to monitor spends, block/ unblock card, reset ATM PIN, instant wallet to wallet fund transfer and much more.

Travel Card functions available through Self Care Portal

- Change/ Regenerate your ATM/POS PIN: My Profile My Setup Repin

- E-Com Activation: My Profile My Setup e-com Activation

- Change/Regenerate your online Login/Transaction passwords: My Profile My Setup Change Password

- View/download your transaction history: My Accounts Statement View

- Temporarily block/ unblock Travel Card: My Accounts Support Functions Change Card Status

- Instant Wallet to Wallet transfer: My Profile Fund transfer Wallet to Wallet transfer

How to register Travel Card to Self Care Portal?

- Enter your Travel Card number à Enter your 4-digit ATM PIN

- Define your User ID, Login Password and Transaction Password

- Set your security questions and their respective answers and Submit to create User ID

Manage Travel Card through iMobile/ Internet Banking

You can now link yours and your close relatives’ Travel Cards to your Savings Account to view, manage and update basic Travel Card details on the go through Internet Banking and iMobile app*.

Travel Card functions available through Internet Banking and iMobile:

- View Travel Card balance and last 10 transactions

- Instant reload of Travel Card

- Update e-mail ID & mobile number (domestic & international)

- Block or unblock Travel Card

- Online refund of Travel Card

- PIN generation of Travel Card

How to link your Travel Card?

Travel cards faqs.

Forex Prepaid Card is a smart, convenient and secure alternative to carry foreign currency while travelling overseas.

Forex Card/Money Card/Travel Card/Currency Card are Prepaid Cards. Once an amount is loaded in a currency wallet, it can be used for transactions by swiping at merchant outlets or at e-commerce sites, as well as for cash withdrawal at ATMs

ICICI Bank Forex Prepaid Card is a Prepaid Card offering 15 currency wallets. It is a smart, convenient and secure alternative to carry foreign currency while travelling overseas

Forex Prepaid/Travel Cards provide a convenient and secure alternative to carry foreign currency while travelling overseas. Moreover, it allows the customer to store multiple currencies in a single card, in case they are travelling to different countries. Unlike Credit and Debit Cards, there is no extra charge associated with POS and e-commerce transactions. They are universally accepted. Exchange rate is fixed during loading of the card and there are no Dynamic Currency Conversion charges

A multi-currency card features multiple wallets of different currencies in a single card. ICICI Bank currently offers loading of up to 15 currencies in a single multicurrency card.

Yes. Once requirement of forex is over, the remaining amount in the Forex Prepaid Card can be refunded to the linked bank account

Request for Forex Prepaid Card can be submitted at the nearest ICICI Bank Forex Branch. ICICI Bank Savings Account holders can apply through iMobile too.

You can put/load money in an ICICI Bank Forex Prepaid/Travel Card online, through Internet Banking or iMobile app. If the account is not linked, the request can be submitted at the nearest ICICI Bank Forex Branch by the cardholder or any third party

With a fresh load, the Forex/Travel Card will be automatically activated. However, if your ICICI Bank Forex Prepaid Card is inactive/temporary blocked, please call ICICI Bank Customer Care to get it re-activated.

If you are unable to withdraw funds from the ATM using your Forex Prepaid/Travel Card, kindly check:

The balance in the card for confirmation on whether you can withdraw the amount.

If there is balance, check that you are not exceeding the daily withdrawal limit (includes ATM withdrawal charges).

If it is within the limit and still you are unable to withdraw using an Active Forex Prepaid/Travel Card, please call ICICI Bank Customer Care.

The daily limit of withdrawal is USD 2,000 or equivalent (including withdrawal charges and tax), unless otherwise specified.

- Get CIBIL Score

- Get Call Back

- Give a Missed Call

- Follow us on :

- PERSONAL FINANCE

- REAL ESTATE

- LEADERS OF TOMORROW

- Financial Reports

- Weight Loss

- Men's Fashion

- Women's Fashion

- Urban Debate

- Baking Recipes

- Breakfast Recipes

- Foodie Facts

- Healthy Recipes

- Seasonal Recipes

- Starters & Snacks

- Car Reviews

- Bike Reviews

- Cars First Look

- Bikes First Look

- Bike Comparisons

- Car Comparisons

- India Upfront

- Bollywood Fashion & Fitness

- Movie Reviews

- Planning & Investing

- Real Estate

- Inspiration Inc

- Cricket News

- ASIA CUP 2018

- Comparisons

- Business News >

ICICI Bank Travel Card: Charges, benefits and other details

A travel card is a smart, convenient and secure alternative to carry foreign currency while travelling overseas. with such travel cards, travellers can now avoid currency rate fluctuations..

New Delhi: With time, more and more Indians are going on international trips for business or leisure. A recent Bain and Company report revealed that a total of 26 million international trips were taken by Indians in 2018 and they spent $22 billion on these trips in total. As more Indians travel abroad, travel cards are becoming rather popular in the country.

A Travel Card is a smart, convenient and secure alternative to carry foreign currency while travelling overseas. With such travel cards, travellers can now avoid currency rate fluctuations and save cross-currency charges. These cards can be loaded easily and can be used to make payments only on international websites and merchant outlets overseas.

One of India's largest private sector lender, ICICI Bank also offers travel card facilities. Presently, the delivery of ICICI Bank Travel Card is available only in 10 major cities namely Ahmedabad, Bangalore, Baroda, Chandigarh, Chennai, Delhi, Gurgaon, Hyderabad, Mumbai and Pune. ICICI Bank offers Goibibo Travel Card, Sappihro Travel Card, Coral Travel Card and Multi-currency Travel Card.

Here's everything you need to know about ICICI Bank travel card

Documents required:

1. Form A2 cum application and LRS declaration

2. Self-attested copy of PAN Card

3. Original Passport along with self-attested photocopy

4. Original Aadhar Card along with a self-attested photocopy

5. Self-attested copy of VISA. (for non-ICICI Bank customer)

6. In case VISA is on arrival then a copy of air ticket to be taken (for non-ICICI Bank customer)

7. Any other supporting document if required as per RBI guidelines

How to apply for the card

1. Net Banking Method:

Step 1. Login to ICICI Bank Internet Banking

Step 2. Click ‘Forex & Travel Cards’ under ‘My Accounts’

Step 3. Click ‘Buy a new Travel Card’

Step 4. Enter the requisite details

Step 5. The Travel card will be loaded and delivered at your doorstep within 3 working days.

iMobile app method:

Step 1. Open the iMobile app and go to 'Cards, Loans & Forex'

Step 2. Select 'Request Currency Notes or Travel Card' within Forex

Step 3. Fill in the requisite details

Step 4. Travel Card will be loaded and delivered at your doorstep within 3 working days.

ICICI Bank Forex Branch method:

Step 1. Walk into the nearest ICICI Bank Forex Branch

Step 2. Fill in the travel card application form

Step 3. Submit the requisite documents and show the original documents for verification

Step 4. Travel card kit will be provided immediately and the card will be loaded within one working day.

1. Joining fee: Rs 150, Reload fee: Rs 100, Inactivity fees USD 5.00 or equivalent for every 180 days of inactivity

2. Transaction fee: Point of Sale (POS)/Online - NIL; Cross currency fees: 3.5% + Goods and Service Tax (GST), Wallet to Wallet transfer fee: 2.5% of the transfer amount (from the destination wallet)

3. Cash Advance/ Cash at POS transactions fee: 0.5% of transaction amount. It is a facility through which ICICI Bank Travel Cardholders can withdraw cash by swiping their card at merchant outlets

4. Lost card replacement fee: International location – USD 20.00, Indian location – USD 3.00

5. Fee for uncapped ATM withdrawals: 0.75% of withdrawal amount

6. International SMS alert charges: Debited every 30 days from the highest order wallet with sufficient balance. In case of insufficient balance, the domestic mobile number will be updated by default

7. All fees and charges mentioned above are exclusive of taxes. Goods and Service Tax (GST) rate of 18% is levied

8. Additional fees for ATM transactions may be levied by the bank owning the overseas ATM used

Benefits:

1. You can load your Travel Card and use it for making purchases at various merchant outlets and for making payments towards online transactions.

2. 3D Secure authentication enabled on ICICI Bank Travel Card offers additional security through a simple checkout process that confirms your identity when you make payments.

3. You can buy, reload, Refund online through internet banking or iMobile app.

4. You do not need to visit a bank branch or call Customer Care as you can manage all your Travel Card services through the ‘Self Care Portal’.

5. Visa cardholders can avail up to 59% discount on dining, shopping, stay and much more while travelling overseas with the ICICI Bank Travel Card. Mastercard holders can register for 'Priceless Cities' and enjoy the local experiences and discounts at various merchant outlets over the world.

6. The ICICI Bank Multicurrency Travel Card kit comes with a free Replacement Card along with the Primary Card. If you happen to lose/ damage the Primary Card, you can easily activate the Replacement Card without paying anything.

7. Wallet to Wallet transfer available on Multicurrency travel card.

8. Duty-free shopping at Indian airports.

9. Free comprehensive travel insurance and emergency travel assistance.

Get all latest Business News , Market News , Income Tax News , Share Market, Sensex Today live updates on Times Now

- Latest business News

ICICI Bank Launches Sapphiro & Coral Forex Travel Cards

ICICI bank silently launches new gemstone collection of travel cards that are intended for international travellers spending in foreign currencies. The travel cards comes in two variants – Sapphiro & Coral just like their credit/debit card collection.

The benefits are surprisingly better with less fine prints in availing the offers linked to it. Let’s look into the cards in detail,

Table of Contents

Joining Fee

1. sapphiro travel card.

- Joining fee – Rs 2,999 + GST

- Annual fee – Rs 999 + GST from the second year.

- 0% mark-up charges on any cross-currency transactions (AMAZING!)

- 5% cashback on all Airlines and hotel spends done through online channels, capped to Rs 3,000 per month

- International lounge access: 2 complimentary lounge visits via DragonPass (digital access)

- Uber vouchers: Rs 1,000

- Avail of SRL Executive heath check-up worth Rs 2,750

- Protect your cards and wallet with OneAssist Complete Cards protection

- Lost Card/Counter card liability coverage of Rs 5,00,000

Its good to see Uber vouchers, maybe the right people read Cardexpert Super Premium Card Concept ?!

The only question here is the conversion rates on loading forex. As this info is not available for now, its pretty tough to conclude if we actually get 0% markup fee.

Rest of the features are amazingly crafted and as you can clearly see, the benefits are definitely greater than the fees charged. And hey, how can I miss about that stunning card design – its beautifully done!

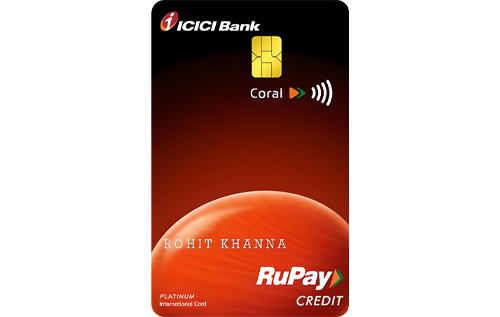

2. Coral Travel Card

- Joining fee – Rs 499 + GST

- Annual fee – Rs 299 + GST from the second year.

- Uber vouchers: Rs 1,000 (min. loading: USD 1000)

- Bookmyshow Vouchers: Rs.500

This is a very basic card and there is no discount on markup fee mentioned. Meaning, you’ll be charged 3.5%+GST or so. Hence, its safe to ignore this card and rather stick to premium credits cards like Regalia or other credits cards for international travel .

It looks like ICICI Bank is leaving no stones unturned when it comes to cards business. I’m super excited to see the kind of changes happening to the ICICI cards recently.

In a very short span of ~6 months, ICICI has made huge improvements on most things related to plastic cards. Good for them, good for us. 🙂

But…. you may still ask “Why Forex Cards?”

Well, as not everyone is credit card savvy, there still exists a huge demand for Forex cards in the country. So for them I believe ICICI Bank’s new Sapphiro travel card meets that premium traveller’s expectations. Hope there are no hidden terms!

But remember, as long as 5X/10X forex loading offers exists with HDFC, the HDFC Regalia Forex Card is always the best one.

What’s your take in ICICI bank’s move with gemstone collection of travel cards? Feel free to share your thoughts in the comments below.

Sign up for Weekly Newsletter

Get curated emails every week, so you don't miss any rewards.

Related Posts

19 thoughts on “ ICICI Bank Launches Sapphiro & Coral Forex Travel Cards ”

Now I am thinking to card change my Jet Sapphiro to Sapphiro Travel just for 0% mark-up charge.

I mean for international spends.

Jet Sapphiro is still great for forex spends, as long as you’ve trust in JPMiles at this time!

But yes, it makes sense anyway: low fee, more perks.

how to apply for this card?what is required as a minimum salary for this???????

To buy your ICICI Bank Coral Travel Card, you may visit the nearest ICICI Bank Forex Branch or contact your Relationship Manager. Usually there are no income expectations for forex cards.

so what will be the limit then ,,its how much u recharge?????and i dont have a coount with icici

I hold three cards from ICICI. The Rubyx, Sapphiro & Amazon Pay cards. I would like to close the Rubyx Card and request for an alternate option from the ICICI Card portofolio. Any recommendations? While lounge access would be an advantage, I would prefer a card with a good reward return rate. Does it still make sense to get a Jet co-branded Card given the present state of the airline ?

Is Credit card better or Forex cards? Thinking of availing a Regalia Forex card, and loading it with my moneyback credit card, as there is 10x offer on it. Your thoughts on this please?

Remember these are travel cards, which are prepaid. Also you don’t earn any reward points on these cards. Even HDFC Regalia forex card has 0% cross currency charges

Could this be used for PayPal?

I like the Sapphiro Travel Card, however had it been a credit card, it would probably have been the best. Something like 28 Degrees in Australia which is a credit card and charges 0% towards FCY

Hoping they launch a credit card also with zero mark up fee soon. That sure would be lapped up :)…Await for more inputs of people who have used the Sapphiro Travel card.

The question though, is, “What’s the currency loading fee ?”

How long is the Dragon Pass Membership valid? Is it just for the first year or is it also valid for subsequent years?

Hi Sir, I am travelling to Europe for a student exchange program for three months. Can u suggest me a forex card?

Got pre-approved offer for intermiles icici sapphiro credit card. No joining fees. Lifetime free. Went for it. Since now I am just a collector of free credit cards. 9th credit card.

Is Sapphiro providing a mix of amex and mastercard privileges to a single card (in Visa variant) ? I got a call from RM. But details are not available in internet. its is said to be LTF.

I spend a lot in AED and USD, so signed up for a Sapphiro card and paid the joining fee of nearly 4000. Only to find that there is no significant gain in charges at reload, the rate was the same as the figure I got for Transfer overseas from my ICICI account. Unless you load up only USD and spend in other currencies, this card does not make sense is what I feel. I’m considering the Debit card offering from RBL now.

Hey Sid Thanks for sharing information on travel forex cards. However, it has been 3 years since you’ve written an article on travel cards. It would be good to write an article on comparison of best travel cards, along with a summary of travel vs. credit cards for a short vacation.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Don't subscribe All new comments Replies to my comments Notify me of followup comments via e-mail. You can also subscribe without commenting.

About Contact

Terms of Use

Terms of Use Privacy Policy Advertising Policy

Subscribe to Emails

Love Credit Card Rewards? Then you would love the email newsletters too!

ICICI Student Forex Card: Features, Benefits, Rates & Apply

Team Fly Finance

April 1, 2024

A Forex card is a prepaid card that can be loaded with multiple currencies and help international students manage their finances when studying abroad. ICICI Bank Forex Card is one such option suitable for study abroad aspirants. These are designed to provide various facilities such as convenience, security, and cost-effectiveness.

The ICICI Forex card for students is the easiest way to easily carry foreign currency and make international transfers or regular transactions. Keep reading to know more about the ICICI Forex card, its benefits, charges, delivery time, and application.

Table of Contents

What is an icici forex card, why choose icici bank forex card, icici prepaid card types, features and benefits of icici forex card, icici bank multi-currency prepaid card, icici forex cards charges, how to buy an icici bank forex card, icici prepaid card delivery time, 5 tips for using icici bank forex prepaid card.

ICICI forex card assists customers in carrying their foreign currency and paying for expenses on their overseas trips. It is like a prepaid card that can store your foreign currency. Forex cards can be used as credit or debit cards to pay for the expenses incurred in a local currency.

ICICI student Forex cards can be loaded in multiple currencies (15 currencies) and ensures secure transactions. International students can set a limit on expenses on their Forex card and can safely carry money abroad.

Moreover, forex cards are universally accepted. The exchange rate of forex cards is fixed and no charges are levied for dynamic currency conversion. Similarly, no extra charges associated with POS and e-commerce have to be paid.

ICICI Forex card for students offers various benefits to students. It helps in making secure transactions that are super easy to make. Students also do not have to pay extra currency conversion charges. Below are the reasons you should choose an ICICI card:

- The ICICI student Forex prepaid card offers comprehensive travel insurance.

- A free replacement card is available in case of theft, loss, or damage to the main card. Moreover, the free replacement card will be activated instantly.

- The Forex card transactions are protected through the 3D secure authentication & chip pin technology.

- ICICI bank offers free emergency cash delivery services in case of loss or theft of cards overseas.

ICICI bank offers 4 variants of Prepaid Forex cards to its customers. These are beneficial to students who are looking to foreign exchange while studying abroad . Let us see the type of forex cards provided by ICICI along with the benefits provided by them:

Also Read: If you are coming back to India after your International travel and left with foreign currency, then check this blog on How to Exchange Foreign Currency to Indian Rupee?

ICICI card allows easy and secure payments. The user-friendly mobile app allows the convenience of making payments anytime and anywhere and skipping branch visits. ICICI Forex card for students also provides contactless transactions with many offers and discounts on it. Here are some detailed features and benefits of the card:

- Load Forex Prepaid cards and easily make payments at merchant outlets and through online transactions.

- The superior 3D Secure authentication adds to security and verifies the identity of the customer while making payments

- Easily buy, refund, or reload the ICICI bank forex card online

- 24/7’ self-care portal ‘allows the customer to skip the customer care office and manage all Forex card requirements online. That is, resetting an ATM pin, unblocking a card, wallet-to-wallet transfer, etc.

- Get exciting discounts and offers while shopping/dining with your ICICI Forex card

- The ICICI bank multi-currency forex card comes with a replacement card. The replacement card can be quickly activated in case of loss/theft.

- Use the ICICI Forex card for wallet-to-wallet transfers. Customers can also use the card for duty-free shopping at all Indian airports.

- Get free comprehensive travel insurance. For example, Personal air accident cover/death (INR 10 lakh) and lost card liability insurance cover (INR 2 lakh).

- Free emergency cash delivery service and 24/7 GCAS customer care assistance are provided to customers.

ICICI Forex card offers a total of 15 currency wallets. It is known to be one of the best multi-currency forex cards . Moreover, cross-currency rate fluctuations are not applicable in these currencies. They are:

- Great Britain Pound (GBP)

- United States Dollar (USD)

- Canadian Dollar (CAD)

- Australian Dollar (AUD)

- United Arab Emirates Dirham (AED)

- Singapore Dollar (SGD)

- Swiss France (CHF)

- Swedish Krone (SEK)

- Japanese Yen (JPY)

- South African Rand (ZAR)

- Saudi Riyal (SAR)

- New Zealand Dollar (NZD)

- Thai Baht (THB)

- Hong Kong Dollar (HKD)

Also Read: Learn all about making informed financial decisions by checking our blog on Navigating Currency Exchange Risks: What Every Study Abroad Student Should Know

ICICI Student Forex Card does charge specific fees such as joining fees (INR 499), renewal fees (INR 199), and reloading fees (INR 100). The bank also charges an amount of USD 5 if the ICICI forex card is inactive for more than 180 days. The table below provides the list of other charges and fees applicable for the ICICI Forex card are as follows:

An ICICI Forex card for students can be bought through Internet banking, iMobile pay apps, and Forex branches. With easy documentation, students can easily apply for ICICI bank student forex prepaid card online. After applying for the same, the activated card gets delivered to your mailing address within 4-5 working days. Here are the details of how to buy an ICICI Bank student forex card, in detail-

Internet Banking

To buy an ICICI Bank forex cad log in to Internet baking

- Next, select ‘forex and prepaid cards’ under the section ‘cards and loans

- Choose the option ‘apply for a new card’

- Select the variant, enter the required details, and ‘generate card’

- The Forex card will be delivered to the customer after activation. It would take around 5 working days for the same

iMobile App

To buy an ICICI Bank forex cad log in to the iMobile app

- Select ‘apply now’ under Forex prepaid card

- Next, select the card variant, and enter the requisite details to ‘generate card’

- The forex card will be delivered to the customer after activation. It would take around 5 working days for the same

Forex Branches

To buy an ICICI Bank forex card customers can walk into their nearest bank branch.

- Request the Forex Prepaid Card application form and fill in the details

- Submit the same with the required documents and show proof of original documents

- Forex prepaid card kit will be granted to the costumes

- The card will be activated within a single working day

The ICICI student Forex card delivery time is generally 4-5 working days. The activated card gets delivered to your mailing address after successfully applying for the same.

However, those who visit the bank branch to activate the card will get the card within 1 working day. That is, they will get the Forex card kit instantly. For Internet banking/mobile app registrations, it would take 5 days for the card to be delivered to the customer.

Also Read: If you are planning to pursue an undergraduate course in Germany and want to take an education loan, check this blog on How To Get an Education Loan without Collateral in Germany .

There are many ways to effectively manage your ICICI student Forex card. It is necessary to load it with the amount you actually need- neither too much nor too little. Make sure to always sign the receipt given by the merchant while swiping it at any shop or dining place. Here are some more tips that customers can use to better manage their Forex prepaid card:

- Most ATMs provide the facility to check the bank balance and withdrawal in the local currency. If the option is chosen, cross currency conversion rate may be applicable.

- Customers who lose the card need to inform the bank within 24 hours

- The SMS alert facility is only applicable to Indian mobile numbers. Otherwise, international roaming facilities have to be activated to receive SMS transaction alerts.

- Never allow a merchant to swipe the card in your absence. The cardholder needs to be present while the transaction is taking place.

- Additional charges may be applicable in some ATMs. Customers need to check the details before usage.

Yes. ICICI bank issues a Forex card for the customers who request it.

Yes, a Forex card is beneficial for customers who are taking an international trip. The conversion charges are less than converting money into cash. Hence, the cards are best for those who take international trips.

There is no limit to the money costumes can carry in their Forex card. Amount restrictions are applicable for those who travel back to India. That is, around USD 5000 – USD 10000.

There are various forex cards which are best for students . Student Contactless Forex Prepaid Card is known to be very helpful to International students. A forex card is a secure, and convenient method to carry foreign currency.

Yes, there are joining and annual fees associated with the type of ICICI forex card a student opts for. It ranges from INR I50 to INR 2000, and is subjective to change.

Yes the ICICI Bank forex card is good for international students. The ICICI Forex card provides plenty of benefits to its customers such as free replacement cards, free comprehensive travel insurance, and 24/7 self-care portals, among others.

Mainly there are four ICICI forex cards available to customers. They are Student Contactless Forex Prepaid Card, Sapphiro Forex Prepaid Card, Multi-Currency Forex Prepaid Card, and Coral Forex Prepaid Card.

This was all about ICICI Bank student forex prepaid card. This will surely enable you to manage your money efficiently. To know more about education loans , the best bank accounts for students , forex and banking experience for global students or international money transfers , reach out to our experts at 1800572126 to help ease your study abroad experience.

About Team Fly Finance

Leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Latest Blogs

Scholarships

Scholarships in Scotland for Indian Students

Student Bank Account

Saraswat Bank Zero Balance Account Opening Online

Saraswat Bank Online Account Opening: Eligibility, Charges, Documents

Education Loan

Saraswat Bank Personal Loan for Education: Interest, Eligibility, How to Apply

Interest Rate of Saraswat Bank for Education Loans

Education Loan Extension Letter to Bank

Education Loans against PF (Provident Funds): Amount, Interest Rates, Eligibility

Forex Cards , International Money Transfer

Saraswat Bank Forex Card: Features, Benefits, Eligibility

Education Loan Against Securities: Best Banks, Features, Benefits

SBI Loan Against FD: Features, Eligibility, How to Apply

Santander International Student Bank Account

Union Bank Online Account Opening for International Students

Student Budget

Minimum Bank Balance Requirement for a Schengen Visa

What happens to the Education Loan if the Borrower Dies?

Education Loan for Online Degree: Best Banks, Features, Eligibility

Latest Web Stories

© LEVERAGE ED-TECH PVT LTD

Send Money Abroad in

Request a callback, get an education loan at the lowest interest rate, thank you your call request has been submitted.

Our team will connect with your shortly

- Motor Insurance

- Health Insurance

- Travel Insurance

- Student Medical Insurance

- Home Insurance

- Other Products

- Claims & Wellness

- Customer Support

What is the limit of carrying foreign currency? : #TravelWorryFree

Vibhav Hathi, (Head FOREX Cards Business, ICICI Bank) answers questions on the limit of carrying foreign currency while on a foreign trip.

Q: How much amount of currency can I carry (on a foreign trip) and what is the best way to carry currency as well. Can you shed some light?

Ans. In a given year, RBI and FEMA regulations say that, it depends on the purpose for which you are going. If you are going on a vacation, you can take up to 10,000 dollars in a year. If are doing 2 trips, you can carry 5-5 thousand dollars. If you are going for business, you can today take 25,000 dollars per trip. So, there are different limits based on the purpose for which you are going. These vary by the FOREX laws. Typically, we recommend either banks or authorized dealers is what you should buy it from. In terms of how do you carry FOREX, increasingly we are seeing that FOREX cards, which are prepaid cards that the consumers can take in India and convert their rupees into let's say dollar or a Euro is the safest mode of carrying currency, compared to currency or travellers cheque. If you lose currency notes, you are stranded.

If you take travellers cheque, you have to spend more in encashing it. If you lose it, you cannot get it in time. FOREX prepaid cards give you a locked FOREX exchange rate. So, you know that you are converting a rupee (60 rupees to a dollar) and not being dependent on what the local guy in your destination abroad charges you. He will charge you 62, he will charge you 64, you don't know. So, you can plan, based on your expenses how much FOREX you want to take. That is emerging the best method of carrying at least 85% of your FOREX requirements when you go abroad.

Q: Interesting that you mentioned that 85%. Is there a rule that you carry X amount in cash and Y amount in any other form? What is your experience about this?

Ans. Our experience has been that nowadays FOREX cards are accepted everywhere. These are Visa or Master denominated cards, accepted across all ATM's and all locations. Even a cab accepts it. But, typically, given our Indian consumer mindset it is usually safer if you carry some amount of currency notes. So, we normally recommend between 10 to 15 % in cash or currency notes, and remaining you carry as FOREX prepaid cards. The beauty of FOREX prepaid cards, especially the ICICI Bank FOREX prepaid card is sitting over there, you can, you know, reload it on ICICI Bank Account through a remote mechanism. That is something that is good and the consumer can choose to load it again and again.

Concluding Remark by Interviewer: That's wonderful. Hence, you can have an option of even topping up or loading it whilst you are in another country and don't have to worry about carrying the entire amount there.

- Car Insurance

- Two Wheeler Insurance

- Student Travel Insurance

- Grievance Redressal

- Make Service Request

- Print your Policy

- Search your Quote

- Unclaimed Amount

- Insurance Information

- Insurance Updates

- Insurance videos

- Insurance Infographic

- Tools and Test

- Health Advisor

- Products Withdrawn

- Newsletter Archives

- Set Renewal Reminder

- Tax Benefits

- Testimonials

- Login to Online Manager

- Experts Blog

- Agents Locator

- Do Not Call Registry

- Corporate Agents

- Insurance Product

- Mediclaim Insurance

- Third Party Car Insurance

- Car Insurance Premium Calculator

- Car Models / Cities

- Two Wheeler Models / Cities

- Schengen Countries

- Health Care Award

- India Risk Management Award

- Privacy Policy

- Public Disclosure

- Whistle Blower Policy

- Insurance on mobile

- Download Insure App

- Get in Touch

- Spot our Branches

- Cashless Garages

- Cashless Hospitals

ICICI Lombard General Insurance Ltd. is one of the largest private sector general insurance company in India offering insurance coverage for motor, health, travel, home, student travel and more. Policies can be purchased and renewed online as well. Immediate issuance of policy copy online.

ICICI Group | ICICI Bank | ICICI Prudential Life Insurance | ICICI Prudential Mutual Fund | ICICI Direct | ICICI Home Finance | ICICI Home Search

Trade logo displayed above belongs to ICICI Bank Ltd. and Northbridge Financial Corporation and is used by ICICI Lombard GIC Ltd. under license. Insurance is the subject matter of the solicitation. The advertisement contains only an indication of cover offered. For more details on risk factors, terms, conditions and exclusions, please read the sales brochure carefully before concluding a sale. ICICI Lombard General Insurance Company Limited, ICICI Lombard House, 414, Veer Savarkar Marg, Near Siddhi Vinayak Temple, Prabhadevi, Mumbai - 400025. Reg. No.115. Fax no - 022 61961323. CIN: U67200MH2000PLC129408.

- Best Credit Cards

- Lifetime Free

- Forex Credit Cards

- RuPay Credit Cards

- International Travel

- Fintech Cards

- Credit Card Guides

- Credit Card News

- Offers & Rewards

- Credit Score Guide

- Credit Card Limit

- Lounge Access

Best ICICI Bank Credit Cards for Free Lounge Access

Some top travel credit cards by ICICI Bank are issued in two or more card networks, including Visa, Mastercard, and American Express. The features of all the variants are almost the same, but the airport lounges that can be accessed using different variants may vary. In this article, we will help you understand what some of the best ICICI Bank Credit Cards for airport lounge access are and which lounges are accessible using them. Keep reading for further information:

Table of Contents

ICICI Bank Coral Credit Card

Icici bank rubyx credit card, icici bank sapphiro credit card, icici bank emeralde private metal credit card, icici bank hpcl super saver credit card, makemytrip icici bank signature credit card.

Add to Compare

Joining Fee

Renewal fee, best suited for, reward type.

Reward Points

Domestic Lounge Access

Airport Lounge Access With ICICI Bank Credit Cards

Some of the best travel credit cards issued by the ICICI Bank in the premium category are given below, along with the travel benefits and lounge access provided by these cards:

The Sapphiro Credit Card is also offered in three variants and is one of the most popular offerings by ICICI Bank. It comes with a joining fee of Rs. 6,500 and a renewal fee of Rs. 3,500. From welcome benefits to reward rates to travel privileges, this card offers everything that one can expect from a premium credit card.

The ICICI Bank Rubyx Credit Card is another popular card issued by the bank that can also be listed among the decent travel credit cards in the country. It comes with a joining fee of Rs. 3,000 and a renewal fee of Rs. 2,000, which is not really that high if we look at its benefits. With a reward rate of up to 4 Reward Points on every spend of Rs. 100, it offers several other privileges across different categories, including travel, entertainment, and many more.

The MakeMyTrip ICICI Bank Signature Credit Card is one of the two co-branded cards offered by the bank in partnership with makemytrip.com. It comes with an annual fee of Rs. 2,500 and provides its customers with great travel benefits, including discounts on travel-related bookings, an accelerated reward rate, and complimentary lounge access.

The ICICI Bank Coral Credit Card is an entry-level but popular credit card as it comes with a very affordable annual fee and allows cardholders to avail of several great benefits across several categories. Being a basic card, it offers a decent reward rate and free lounge access to selected domestic airport lounges.

Free Airport Lounge Access List For Visa ICICI Credit Cards

For the complete list of lounges for Visa and Mastercard variants of premium ICICI Credit Cards, refer to Table 2 on this page .

Free Airport Lounge Access List For Mastercard ICICI Credit Cards

Icici bank amex credit cards airport lounges list.

Some ICICI bank Credit Cards are also issued on the American Express network, which has its own airport lounges list for its customers. If you have an ICICI Bank AmEx Credit Card with complimentary lounge access, you can visit the following airport lounges using it:

Important Note: To avail of complimentary airport lounge access per quarter on your ICICI Bank Credit Card, you need to spend Rs. 5,000 in a calendar quarter on your card to avail of this facility in the next calendar quarter.

Bottom Line

ICICI Bank has lots of great travel credit cards in its portfolio. From super-premium to entry-level credit cards, one can always find a card with complimentary airport lounge access, which allows them to avoid the noisy environment of the airport with minimal charges. Generally, you need to pay a fee to avail of the airport lounge facility, but with these ICICI Bank Credit Cards offering free lounge access, you can avoid those high charges. This is why having a credit card with lounge access is highly advisable for everyone who travels often via flight.

Discover incredible deals and find the perfect credit card for yourself by comparing the most rewarding options on our platform.

Quick Links

- Privacy Policy

- Terms & Conditions

How Can You Reach Us?

© Copyright 2024 Card Insider

Made With ❤ in India.

Type above and press Enter to search. Press Esc to cancel.

- New Prepaid SIM

- International Roaming

- Switch Prepaid to Postpaid

- Port to Airtel Prepaid

- Buy New Connection

- Port to Airtel

- Free Sim Delivery

- Buy New DTH Connection

- Upgrade Box

- Buy Second DTH connection

- View Account

- Get New Account

AIRTEL BLACK

Airtel finance.

- Credit Card

AIRTEL BLACK NEW

Best credit cards for insurance payment in india 2024.

Paying insurance premiums is an essential part of financial planning, ensuring that you and your loved ones are protected against unforeseen circumstances. Using a credit card for insurance payments not only simplifies the process but also offers various benefits. When you pay insurance premiums by credit card you can get cashbacks, reward points, and more. Here, let’s explore the best credit cards for insurance payments in India for 2024, helping you make an informed choice.

HDFC Bank Regalia Credit Card

If you’re looking for the best credit card for travel protection, HDFC Bank Regalia Credit Card would be your ideal choice. Known for its premium benefits, and high reward points, it is also among the best credit cards with travel insurance benefits. It’s also an excellent choice for those seeking a comprehensive insurance payment option.

Key Benefits:

- Reward Points: 4 reward points for every ₹150 spent.

- Travel Insurance: Complimentary travel insurance coverage.

- Airport Lounge Access: Complimentary domestic and international lounge access.

- Dining Privileges: Discounts at premium restaurants with complimentary Dineout Passport Membership.

Fees and Charges:

- Joining Fee: ₹2,500.

- Annual Fee: ₹2,500 (waived if annual spend exceeds ₹3 lakhs).

Also Read- How to Pay LIC Premium Through Credit Card?

SBI Card Elite

The SBI Card Elite is another great option for paying insurance premiums. It also gives you travel benefits and insurance payment offers on credit cards in the form of attractive reward points.

- Reward Points: 2 reward points for every ₹100 spent on insurance.

- Travel Benefits: Complimentary domestic and international lounge access.

- Dining Offers: Up to 10% off at select restaurants.

- Milestone Benefits: E-vouchers worth ₹5,000 on annual spends of ₹3 lakhs.

- Joining Fee: ₹4,999.

- Annual Fee: ₹4,999 (waived if annual spend exceeds ₹10 lakhs).

ICICI Bank Coral Credit Card

The ICICI Bank Coral Credit Card is a versatile card that offers decent benefits for insurance payments and other spends. You can even use this credit card for medical insurance payments and receive reward points.

- Reward Points: 1 reward point for every ₹100 spent on insurance categories.

- Travel Benefits: Complimentary domestic lounge access.

- Dining Discounts: Up to 15% off at partner restaurants.

- Entertainment Offers: Discounts on movie tickets.

- Joining Fee: ₹500.

- Annual Fee: ₹500 (waived if annual spend exceeds ₹1.5 lakhs).

Also Read- Credit Card Protection Plan

Axis Bank Vistara Signature Credit Card

For frequent flyers, the Axis Bank Vistara Signature Credit Card offers excellent travel and insurance benefits. For every LIC premium credit card payment, you receive Club Vistara points and complimentary lounge access.

- Reward Points: 4 Club Vistara points for every ₹200 spent.

- Travel Insurance: Complimentary travel insurance.

- Travel Benefits: Complimentary Vistara ticket vouchers on milestone spends.

- Airport Lounge Access: Complimentary access to domestic and international lounges.

- Joining Fee: ₹3,000.

- Annual Fee: ₹3,000 (waived if annual spend exceeds ₹4.5 lakhs).

Choosing the best credit card for insurance payments in India depends on your spending habits and the benefits you value the most. You can also consider the Airtel Axis Bank Credit Card that doesn’t exactly give benefits on insurance premium payments, but has several other perks such as annual cashback of up to ₹16,000 while cards like the HDFC Bank Regalia and SBI Card Elite offer comprehensive travel and reward benefits. Evaluate your needs and choose the card that best aligns with your financial goals.

Also Read- How to Check Credit Card Limit? – Guide

1. Can I pay my insurance premium using a credit card?

Yes, most insurance companies in India accept credit card payments for insurance premiums. Using a credit card can earn you reward points , cashback, and other benefits.

2. What is the best credit card for insurance premium payments in India?

The Airtel Axis Bank Credit Card is highly recommended due to its 1% cashback on insurance premium payments. Other notable options include the HDFC Bank Regalia Credit Card and SBI Card Elite.

3. Are there any additional charges for paying insurance premiums with a credit card?

Some credit cards might have processing fees for insurance payments. It’s advisable to check with your credit card issuer for any applicable charges.

4. Do credit cards offer travel insurance benefits?

Yes, several credit cards offer travel insurance benefits. Cards like the HDFC Bank Regalia Credit Card and Axis Bank Vistara Signature Credit Card provide comprehensive travel insurance coverage.

5. How can I maximise benefits from my credit card for insurance payments?

To maximise benefits, choose a credit card that offers cashback or reward points on insurance payments. Additionally, consider cards with travel and dining perks to get the most out of your spending.

You might also like

What is a Lifetime Free Credit Card

What is Add-on Credit Card?

Best Credit Card Offers on Flight Tickets in 2024

- Introduction to credit card travel insurance and standalone travel insurance

- What are credit card travel protections?

- What is travel insurance?

- Credit card travel protection vs. standalone travel insurance

- Frequently asked questions

Credit Card Travel Insurance vs Travel Insurance: A Comparative Guide

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

- Travel insurance and some credit cards can protect you from financial loss while traveling.

- Travel insurance offers more comprehensive coverage that includes emergency medical expenses.

- Credit card travel protection has more gaps but comes at no additional cost for cardholders.

Anything can happen while traveling. Flight delays, lost luggage, or even unexpected injury or illness can interrupt your vacation. When these things occur, travel insurance or the travel protections included with your premium credit card may be able to help, providing medical coverage, offsetting your financial losses, or even reimbursing you fully.

But do you need both travel insurance and credit card travel protections? Here are details on both and tips for deciding what the best travel insurance is for you.

Introduction to credit card travel insurance and stand-alone travel insurance

Many credit cards offer travel protections that can help you in certain unexpected travel situations. But they aren't exactly the same as a separate travel insurance policy.

Here's how the two differ at a high level:

- Travel insurance: Travel insurance is coverage that you purchase for a single trip or multiple trips in a year. It typically covers the costs associated with trip cancellation, trip delays, medical emergencies, and other unforeseen events that may occur while traveling.

- Credit card travel protections: These are benefits automatically included with certain consumer credit cards. They often provide coverage for delays, lost baggage, rental car collisions, and other events during travel. Credit cards sometimes advertise these protections as a type of travel insurance, though they're not a separate insurance policy.

Generally speaking, designated travel insurance is more exhaustive than the protections offered by a credit card. Still, it's worth it to compare both options, particularly if you're taking an expensive trip.

"It is always wise to check your credit card protection against a travel insurance plan," says Carol Mueller, a vice president at Berkshire Hathaway Travel Protection . "Credit card protection may not include the full, bundled, comprehensive coverage a travel insurance plan would."

What is credit card travel insurance ?

Many premium credit cards offer travel protections to cardholders, but the exact coverages depend on the credit card. Typically, only trips booked with that card qualify for coverage.

"Credit card travel insurance has one big advantage that interests travelers: it's usually free or included in the card's annual fee," says Daniel Durazo, director of external communications at Allianz Travel Insurance , a travel insurance provider. "Credit cards' travel benefits can be useful for smaller things, like travel delays or lost bags, but only travel insurance provides reliable protection in real emergencies, like expensive medical emergencies such as hospital visits and evacuations."

In some cases, however, a credit card may cover catastrophic accidents. The Chase Sapphire Reserve, for example, offers up to $1,000,000 worth of coverage for an accident that causes loss of life, speech, hearing, or use of a hand, among other life-altering injuries.

Additionally, credit card coverage limits tend to be much lower. The Chase Sapphire Reserve® offers up to $20,000 per trip in cancellation coverage, while a basic travel insurance plan from Travel Guard offers five times as much coverage.

Pros and cons of credit card travel protection

What is stand-alone travel insurance .

Travel insurance protects you from financial losses related to travel. "There are three main areas of coverage: protecting yourself, protecting your personal items, and protecting your investment," says Christina Tunnah, general manager of Americas and global marketing at World Nomads Travel Insurance , a travel insurance and safety services provider.

Travel insurance works much like any other insurance policy. When a covered event occurs, like your trip is canceled or you're hurt while traveling, you file a claim with your insurer. If accepted, the company reimburses you for the costs up to your coverage limits.

"Most people have no idea that their health insurance does not cover them abroad," says Shane Mahoney, founder of Lugos Travel, a travel advisory. "So, a broken arm from a slip and fall or a heart attack can be financially devastating."

Travel insurance customers typically have 90 days to file their claim. But once the event occurs, there's no waiting period, meaning travelers should file as soon as possible.

A major factor when filing a successful claim is proof of financial loss. You can use something as simple as a medical clinic receipt or a doctor's medical statement. Once the claim has been reviewed and approved, your insurer will reimburse you via check. Some modern travel insurance companies offer immediate payment via a debit card mailed to travelers before their trip.

Travel insurance providers go beyond your standard credit card or airline coverage. You can buy policies that cover sports equipment, medical, and other coverages. You can also buy Cancel for Any Reason insurance, which covers trip cancellations regardless of the reason. The best CFAR insurance can cover 100% of your costs, but many only cover a percentage.

Buyers can also price out annual travel insurance plans , which cover all of your trips within a 12-month period. Meghan Walch, director of the InsureMyTrip website, estimates a 4% and 10% travel insurance cost based on your total prepaid, nonrefundable trip costs. If you're buying an annual policy, this figure will change.

Pros and cons of stand-alone travel insurance

Credit card travel protection vs. stand-alone travel insurance.

Deciding between stand-alone travel insurance and credit card travel protection can be difficult. That said, it's worth mentioning that these choices aren't mutually exclusive. Even if you have a credit card that provides travel protection, you can still opt for additional coverage with a stand-alone travel insurance policy.

Cost considerations

The obvious difference between credit card insurance and a stand-alone policy is the cost. While credit card insurance is usually included in the cost of the card, traditional travel insurance is an additional expense, usually between 5% to 6% of the trip's worth, though rates can range from 4% to 12%.

However, travel insurance may pay for itself, covering emergency medical expenses and evacuation."Most people have no idea that their health insurance does not cover them abroad," says Shane Mahoney, founder of travel advisory company Lugos Travel. "So, a broken arm from a slip and fall or a heart attack can be financially devastating."

On the other hand, credit card travel protections don't come at any additional costs. However, many of the best travel credit cards come with annual fees. Additionally, a credit card's travel protection only applies to trips you book with that credit card. If you don't pay off the credit card immediately, you'll pay interest on your trip.

If you don't already have a credit card with travel insurance included, you'll also have to determine if the coverage is worth applying for a new credit card.

Comparing coverage and benefits

In most instances, traditional travel insurance policies will have more comprehensive coverage than credit card travel insurance. They'll cover more reasons for trip cancellation, and some may cover cancellations for no reason. They'll also cover medical emergencies, while credit card travel protections don't.

"Some travel insurance policies also provide epidemic coverage endorsements, which provide coverage to customers who become ill with COVID-19 or a future epidemic, are individually ordered to quarantine, or are denied boarding due to a suspected illness," says Durazo.

Separate travel insurance policies also tend to offer more robust cancellation coverage. Credit card protections often cap reimbursement at just $10,000 a trip, while travel insurance usually goes up to $100,000. Most credit cards will only cover trips purchased with the card or reward points.

Situations best suited for each

Both travel insurance and credit card protections can prove helpful if your trip is canceled or you experience some other loss while traveling, but the right choice will depend on the specifics of your exact trip and budget. "Every trip is different, and every traveler has different needs and concerns," Walch says.

For example, travelers with more health concerns may opt for stand-alone travel insurance. Longer, more expensive, and international trips may also warrant greater coverage that credit card travel insurance can't provide. Additionally, it may be a good idea to insure trips to high-risk areas, either politically unstable regions or areas with inclement weather.

On the other hand, Walch says, "For a short trip to a family member's house in the US, the travel insurance offered through the credit card may suffice."

Credit card travel insurance comparison frequently asked questions

Credit card travel insurance may offer basic coverage for international trips, but it often lacks comprehensive medical coverage.

Yes, you can use both for the same trip. Stand-alone policies can supplement areas where credit card insurance is limited, such as medical coverage.

Most credit card travel insurance does not cover pre-existing medical conditions. Many stand-alone policies don't cover pre-existing conditions, but you may find some coverage with certain stipulations.

Credit card travel insurance is usually automatically activated when you pay for a trip using that card. However, it's important to read the card's policy for specific activation requirements.

While credit card travel insurance can be more cost-effective since it's a benefit of the card, it may not provide as comprehensive coverage as a stand-alone policy. In the long run, you may end up losing money if you solely rely on credit card travel insurance.

- Real estate

- Main content

VIDEO

COMMENTS

Cash Advance/Cash@POS transactions fee: 0.5% of transaction amount. It is a facility through which ICICI Bank Forex Prepaid Cardholders can withdraw cash by swiping their Card at merchant outlets. Fee for uncapped ATM withdrawals: 1% of withdrawal amount. Lost card replacement fee: International location - USD 20.00, Indian location - USD 3.00.

ICICI Bank Forex Prepaid Card is the perfect travel companion for all your international trips. Get the Forex Card of your choice by browsing through the 'Forex Prepaid Cards - Variants' section. The power-packed ICICI Bank Forex Prepaid Card is a smart, convenient and secure alternative to carry foreign currency while travelling overseas.

ICICI Bank Travel Card is a smart, convenient and secure alternative to carry 15 foreign currency while travelling overseas. Apply the travel card from ICICIdirect now! ... If it is within the limit and still you are unable to withdraw using an Active Forex Prepaid/Travel Card, please call ICICI Bank Customer Care.

New Zealand Dollar (NZD) Hong Kong Dollar (HKD) Load your Forex Prepaid Card and activate it instantly to start using it for booking your international flights and accommodation right away. You can make payments with our Forex Prepaid Cards on international websites and in merchant outlets overseas only. BUY/RELOAD NOW.

Travel Cards. ICICI Bank Travel Card is the perfect travel companion for all your international trips. Get the Travel Card of your choice by browsing through the 'Travel Cards - Variants' section. ... If it is within the limit and still you are unable to withdraw using an Active Forex Prepaid/Travel Card, please call ICICI Bank Customer Care.

Login to ICICI Bank Internet Banking. Step 2. Click 'Forex & Travel Cards' under 'My Accounts'. Step 3. Click 'Buy a new Travel Card'. Step 4. Enter the requisite details. Step 5. The Travel card will be loaded and delivered at your doorstep within 3 working days.

ICICI Sapphiro Travel Card (Forex Card) Joining Fee. Joining fee - Rs 2,999 + GST. Annual fee - Rs 999 + GST from the second year. Benefits. 0% mark-up charges on any cross-currency transactions (AMAZING!) 5% cashback on all Airlines and hotel spends done through online channels, capped to Rs 3,000 per month.

The ICICI Bank MultiCurrency Platinum Travel Card also comes with features such as travel insurance, emergency assistance, advanced account management features. ... Forex cards have a limited withdrawal limit, and the withdrawal of cash through it is much cheaper or not at all.

Apply for the Card: Visit the ICICI Bank website or your nearest branch to apply for a Forex Card ICICI. You will need to provide the necessary documents and complete the application process. Once approved, you will receive your Forex card within a few working days. 2. Load Funds: After receiving your Forex card, you can load funds onto it.

Features and Benefits of the ICICI Bank Coral Travel Card. The features and benefits of the ICICI Bank Coral Travel Card can be listed as follows: Enjoy joining benefits of up to Rs.3,000. Avail a BookMyShow voucher worth Rs.500. Enjoy lost card or counter card liability coverage of up to Rs.5 lakh.

1. Card Issuance Fee: The first fee you need to be aware of is the card issuance fee. This fee is charged when you initially purchase the forex card. For the ICICI Bank Travel Card, the issuance fee is INR 150, while for the ICICI Bank Student Travel Card, it is INR 75. It is important to note that these fees are subject to change, so it is ...

Forex Prepaid Card in India - Buy or reload forex prepaid card for your foreign trips to save money at ICICI Bank. Buy smart, cost effective, convenient and secure Forex Prepaid card with ICICI Bank and enjoy your travelling aborad.

ICICI Bank Travel Credit Card 2024 & Offers for You to Apply. Designed to offer unlimited cashback and points, ICICI Bank Travel Credit Cards are a traveller's dream come true. These cards open doors to exclusive perks, including airport lounge access, attractive forex rates, and extensive travel insurance.

Hot Deals on Forex Card. Get ₹1000 voucher on loading $1000 or equivalent foreign currency in ICICI Bank Forex card, Get a Free Int'l SIM card for your travel abroad, Get complimentary Lounge access, 5% cashback on all airline and hotel spending, BookMyShow voucher and Uber voucher worth Rs 500. 4.8/5.

It is like a prepaid card that can store your foreign currency. Forex cards can be used as credit or debit cards to pay for the expenses incurred in a local currency. ICICI student Forex cards can be loaded in multiple currencies (15 currencies) and ensures secure transactions. International students can set a limit on expenses on their Forex ...

The limit to use the debit card at ATM is set by the bank while issuing the card. The withdrawal limit is shown at the respective ATM locations. The cash withdrawal limit for ICICI Bank ATM is up to Rs. 25,000 per day and Rs. 50,000 for HNI's. The maximum withdrawal limit also varies depending on different types of ICICI debit cards.

If you are going on a vacation, you can take up to 10,000 dollars in a year. If are doing 2 trips, you can carry 5-5 thousand dollars. If you are going for business, you can today take 25,000 dollars per trip. So, there are different limits based on the purpose for which you are going. These vary by the FOREX laws.

Get a free international sim card for your travel abroad. Lost Card/Counter Card liability coverage of INR 5,00,000. ... To avail a complimentary international SIM on ICICI Bank Visa Forex Prepaid Card, you need to first log in to vsim.webaccess.dreamfolks.in/ using your registered mobile number and follow the below steps:

The following table gives an overview of the various fees and charges that one has to pay as an ICICI Emeralde credit cardholder-. Interest Rate. 3.4% per month (or 40.8% annually), a lower interest rate of just 1.99% on cash withdrawals with the card. Foreign Currency Mark-up Fee. 1.5% of the transaction amount.

The MakeMyTrip ICICI Bank Signature Credit Card is one of the two co-branded cards offered by the bank in partnership with makemytrip.com. It comes with an annual fee of Rs. 2,500 and provides its customers with great travel benefits, including discounts on travel-related bookings, an accelerated reward rate, and complimentary lounge access.

ICICI Bank Coral Credit Card. The ICICI Bank Coral Credit Card is a versatile card that offers decent benefits for insurance payments and other spends. You can even use this credit card for medical insurance payments and receive reward points. Key Benefits: Reward Points: 1 reward point for every ₹100 spent on insurance categories.

Internet Banking. iMobile Pay App. Forex branches. Log in to ICICI Bank Internet Banking. Click on "Forex & Prepaid Cards" under "Cards & Loans". Click "Apply for Forex Prepaid Cards". Choose the variant, enter requisite details and 'Generate Card'. Forex Prepaid Card will be activated, linked and delivered within 5 working days.

Additionally, credit card coverage limits tend to be much lower. The Chase Sapphire Reserve® offers up to $20,000 per trip in cancellation coverage, while a basic travel insurance plan from ...

IMobile. Click on 'Debit Card' option. Select 'Modify Debit Card Limit'. Set your desired Card limit.

Welcome to the world of exclusive privileges of ICICI Bank NRI World Debit Card. At ICICI Bank we offer you services handpicked to complement your elegant lifestyle. We are pleased to offer you the NRI World Debit Card loaded with lifestyle privileges. ... High Withdrawal and Purchase Limits. Shop to your heart's content with higher ...