Get to know EF

Travelers share their own ef tour reviews.

We’ve got a lot to say about student travel. It’s why we’ve been bringing travelers on tour for over 55 years. But it helps to hear from other people. People like you, who’ve been through the whole experience. Before planning your trip, read these EF Explore America reviews to get a feeling for what it’s like to travel with us.

Read travel reviews about:

We know travel can be nerve wracking. Whether you’re leading a group, going yourself, or sending a child, safety is your first priority. In these EF reviews, past travelers reflect on the safety and security of their experiences.

Our approach to safety

EF did everything they could do

I have traveled with EF Tours internationally several times. This was my first domestic trip with EF Explore America and considering everything we were dealing with, all the closings due to Coronavirus, all the staff at EF did everything they could to ensure we had a great trip and we all made it home safely.

The thing that struck us is the level of detail

Safe and secure

Her school chose to go with EF Tours because of its reputation, attention to every last detail, and (most importantly) security as its number one priority. I highly recommend this company to anyone looking for a safe and secure, no-hassle, very reasonably priced experience.

Never once was I worried

I was invited to be an adult chaperone on our school’s spring break trip to Italy. At first, I was very anxious to travel abroad since I was new to the whole thing, but from start to finish, our trip was thorough, smooth, and well organized. Our tour leader was fantastic and great with the students. EF/our tour leader was very considerate of another adult on our trip with a severe nut allergy and made sure that her meals were always safe for her to consume. Every location that we visited was amazing and our tour guide was very patient with the varying needs and interests of our group. Never once was I worried for our safety.

Grateful to be part of the EF Family

I find solace, as well as pride, in the extraordinary care that EF is providing for them. These are some crazy times, but I have never been more proud of EF and grateful to be part of the EF FAMILY. You all are doing an amazing job under such trying and unprecedented circumstances.

I am so glad that we were traveling with EF

The response to the virus and rerouting us home early was bar none. While we were sightseeing in London, EF was busy providing transportation, hotel lodging, and flights home. I am so glad that we were traveling with EF and not on our own during this crisis. Again, I cannot say enough about the overall positive experience and thank you for getting us home safely!

EF was incredible

On Wednesday, March 11, 2020, my daughter was traveling in Germany with EF and her school program when the travel restrictions due to COVID-19 were announced. I felt completely powerless and uncertain how a route home could be achieved for my daughter, her entire group, and the multitude of other student groups traveling over Spring Break. Over the course of the next few days, I spoke with numerous employees at EF. Every single time, I was able to speak to a person who was concerned and engaged about the situation. They expressed understanding for my fears, assured me to the best of their ability (even when they had no new information to share), and emailed parents announcements as to the various flights being scheduled. That attention and kindness in and of itself was astonishing, knowing that they must have thousands of anxious parents calling and were likely working ceaselessly to get everyone home. What was even more astonishing was the professionalism in making sure at every leg of the journey—Munich, London, Toronto, and finally Dallas—was that the students were safely cared for, had very good lodgings, transportation to and from the airports, hot meals, and EF still educated them and made the most of the unplanned stops! EF was incredible. I will confidently book with EF knowing that they truly have the infrastructure to handle a crisis, that they care deeply for the students, and that they remain committed to sharing the wonder of travel.

I didn't have to constantly worry

The way that EF takes care of every detail makes the trip enjoyable for students and adults. As a chaperone, I didn't have to constantly worry about my students and their safety or their experience. There was constant feedback from the students about their enjoyment which made the trip more pleasurable for me as well.

How does seeing more of the world affect students? In these EF reviews, customers comment on the impact they’ve seen or experienced as a direct result from going on tour.

Our educational philosophy

Challenges them to step outside their comfort zones

Traveling with my students is just more than taking a summer “vacation” with the students. An educational travel experience helps students to put into practice the concepts they’ve learned in the classroom. It also challenges them to step outside their comfort zones and helps them develop skills, habits, and mindsets closely associated with future success. I have noticed that stepping out of their comfort zones is the most beneficial aspect they get out of our travel program. Rooming with kids they normally don’t room with. Flying on an airplane. Visiting cities and states that they would never get a chance to visit. These are the experiences that I enjoy offering to the kids.

EF plans itineraries with that education piece first and foremost

It’s fun watching that confidence being built

The first milestone on any trip is watching students and adults who have never flown during their first take off. We live in Mississippi, so we take a small plane to a larger airport. I usually film the new flyers. By the time we get to the first stop they’re strutting through the airport like seasoned travelers. It’s fun watching that confidence being built as they learn to navigate through new experiences.

I see the world through a new lens

Meeting larger than life people and having indescribable experiences was just a small part of this lasting experience. The experiences, although laden with horrific aspects of our nation's history, left me inspired, energized. These museums were created to memorialize the incredible people and accomplishments of the Civil Rights movement. These were markers of great pride and success. We met ordinary people who accomplished extraordinary things in one of the darkest hours in all of humanity. The museums are meant to inspire, to challenge visitors to see what has been accomplished and know and understand that we, too, can accomplish extraordinary things if we are willing to get off the sidelines and work together. I can say that I left this experience a better educator, a better father, and a better human. I see the world through a new lens and understand the true depth of the human spirit.

It's so important to change the mindset of students

I truly enjoy seeing my students experience different cultures during our travel time. For example, I had a student last trip that only ate burgers and fries. Once we experienced our French cooking class, he started to eat all the French foods we had. This was an awesome moment for me because he realized that he could experience other cultures through food. It’s so important to change the mindset of students by having them experience other cultures and understand that we are all the same with different experiences.

An inspiring feeling

I love traveling with my students because I get to know each one of them better and I get to see them at their best. As a history teacher, it’s an amazing feeling to see my students light up and get excited about “that thing we talked about in class." Not only do they get a rich educational experience but watching them transform from scared teenagers who have never left home into young adults who are eager to take on more travel is an inspiring feeling. I can easily say that after each trip, the students that traveled with me have been the ones that I have grown closest to and the ones who began to succeed more in my classes. On my last EF tour to England and France, there were too many memorable moments to count. I think one of my favorites was watching one student run circles in the craters left on Pointe du Hoc in Normandy and falling over. I also loved when the shortest, most shy of my AP European History students helped us get a table and order food for lunch in Saint-Malo because she spoke the best French. Finally, I always make my students keep a travel journal that they usually roll their eyes at, but are entertained by my own journal readings on the bus. While they may roll their eyes at having to write in their journal at first and certainly at sharing their entries, by the end of the trip, most of them want to share and take it home as their best souvenir. Listening to their journal entries is always a highlight on my EF trips.

Fun but also able to learn a lot

I really had an amazing time exploring Washington D.C. and I really love how we were able to be young adults and go out on our own and explore but still being managed by adults. I love that I was able to have fun but also able to learn a lot and learn new things. The trip was amazing!!

Educational, fun, and life-changing

This trip was very educational, fun, and life-changing. I learned so much about each country that I went to and my Tour Director gave me a very thorough tour of each place I visited. I went to many popular tourist spots as well as many places that were historic and not as popular for tourists but still very interesting and fun to learn about. It was just such an amazing experience and I encourage everyone to take the chance and go on this trip because you will not be disappointed. It was so nice to have the whole trip planned out for me and I didn’t have to worry about finding something to do because our Tour Director gave me tons of suggestions about shops to look in, restaurants to try, and some popular tourist spots around our location. I made a lot of new friends that I still keep in contact with on a regular basis and we are trying to plan another trip in the future. I felt like a part of the public and it was just so peaceful and fun. All five hotels were in a good area and were clean, nice, and the staff were very friendly and helpful. Our tour bus was clean, comfortable, and our driver was extremely friendly. The days were very well thought out and our Tour Director gave us the schedule each day so we knew everything that was happening throughout the day. Overall, this trip was a trip of a lifetime and I can’t wait to plan my next trip with EF!

There’s a lot of planning that goes into any travel excursion. In these EF Explore America reviews, customers talk about working with the EF team, whether it was during the months leading up to their trip or once arriving at their destination.

Meet our support team

Thanks to everyone who helped with this crisis

We haven’t lacked a single thing which we might have needed from EF since [the COVID-19] travel ban was announced. We were contacted shortly after the announcement, we received our flight information for our evacuation much sooner than we expected, and our Tour Director, Gavin, was there to help in any and every way up until we entered the security checkpoint at the airport. He even told us that he would wait there until our flight took off, just in case someone had a problem. I can’t think of a single thing that EF could have done better under these circumstances, and my travelers seem to agree with me. Thanks to everyone who helped with this crisis!

Genuinely care about my students, my community, my family

Every single time I go and do one of these experiences where I’m in contact with people from the company, I feel this deep resonance in caring about the experience of students, and making sure that those students are really experiencing everything that the world has to offer. The personal relationships that I’ve managed to build with people at this company—who genuinely care about my students, my community, my family—is inspiring to me. It means a lot to know that there are people working every single day who want what I want for my students and my community. And they’ve shown that to me. I’ve had conversations with my Tour Consultant, I’ve had conversations with the Regional Director that has worked with me, and they will remember students by name that I have mentioned. And that just means a lot to me as a teacher. When a company like EF can show that they care about my kids as much as I care about them, I know I’m working with the right people.

They think of everything and nothing is too much trouble

Can't wait to plan our next trip

I can't say enough good things about EF and its staff. They clearly have my student's best interest in mind when planning their tours. This first tour with them has been fabulous. Arianna and Devon made the process seamless. EF staff genuinely cares about introducing as many students as possible to travel. The value and lessons learned you won't find in textbooks. I can't wait to plan our next trip!

They helped with everything

Very personable, professional, and empathetic people. They helped with everything. Isabel was so patient and helpful with the process of funding our trip. Amanda is an amazing tour guide. She knows her information and is enthusiastic about her work. She's open to suggestions and is devoted to making the tour an educational and thought-provoking experience.

EF will take care of you

Support through it all

I have made a couple of hospital visits with students on tour, changed tour dates due to soccer championships, and, on my last trip, I had to get two of my travelers back home immediately due to a death in the family. EF had a representative in front of me making flight arrangements within 15 minutes—and that was in the heart of Paris during peak tourist season. I knew that although the coronavirus was going to change everything, we would be taken care of by a team of professionals. Knowing that EF had my back allowed me to be a source of stability and reassurance for students and parents on my 2020 tour.

Plans change. World events are unpredictable. Before making a commitment to taking a trip with us, read EF reviews from travelers who’ve encountered the unexpected before or during their tour.

Learn about all our policies

EF did it in a day!

Just today my Japan trip was rerouted to Belize for 72 people. EF did it in a day! This proved the commitment to safety and support of all the GLs, families, and students. I have been traveling with EF since 2006. I have always been impressed (that's why I am still with them), but their handling of the recent COVID-19 has been fantastic! I will keep traveling with my students with EF forever! They have worked quickly and mindfully while rebooking our group. They have been supportive every step of the way. Thank you for giving us options and for really standing behind your word.

Fully trust everyone on staff

Program is organized, flexible, and the pacing is great for students. There is enough to see and do to keep them going and it is great for adult chaperones too. Representatives from EF are quick to act and work with our tour guide to solve any issues that come up. I fully trust everyone on staff to take care of our students and ensure they have a great experience.

Contingency plans for everyone

A month before our departure, mainstream news was just getting a hold of the information regarding the virus outbreak. It was very shortly thereafter we heard from EF with options for travelers should they be very concerned about traveling. The travel advisories, at this time, were all only at a Level 2 for the countries we planned to visit, and those had been issued months before due to possible terrorism and protest issues, not due to the virus. Yet, here was EF giving my travelers options to ease their nerves—recognizing that for many, this was a once in a lifetime experience that might be greatly marred by their fear. My group was so impressed to be offered these choices, recognizing that, had they made these plans on their own, they would have few choices beyond travel or lose all the money paid out. EF went so far as to allow customers a chance to change their plans up to a week before their departure. I was so impressed with the amount of communication and calls I received from the company in this time. All of it reassuring me, and therefore my travelers, that EF was our watchdog—that they had our backs, and they had contingency plans for everyone.

Share your story

If you’ve traveled with us before, write your own EF Explore America review. Hearing from people who’ve been there and done that is a big help for those considering traveling with EF.

EF Tours Review: The Good, The Bad & The Ugly

Is EF Tours right for you?

So your kid just came home from school with a gorgeous full color brochure about an upcoming trip to Europe with EF Tours that one of their teachers is leading. He or she is super excited about all the cool things they get to do and is just begging you to let them go.

It sounds great, but as a responsible parent, you want to know exactly what you’d be sending your child off to do, and how things would actually work on this trip.

Well, lucky for you we took a 12 day visit to Europe with EF Tours, and have all the details to decide if taking an international trip with this company is right for you or your teenager.

We’re going to start with the breakdown of how things work with EF and what to expect as a participant or a parent, and then move on to our specific experience with our tour.

I always like to start my reviews by reminding you that I was not compensated in any way to write this post. All opinions are my own, and all costs were paid out of our pocket for this experience.

What is EF Tours?

EF Tours is a travel company that specializes in international tours for students.

According to their website , EF Tours has been in operation since 1965 and offers trips for students and teachers designed to “provide immersive, life-changing education.”

Basically, EF Tours organizes international trips for students to a wide variety of destinations, promising “compelling itineraries” full of “experiential learning.”

They also promise to have the “lowest price on the market” for this type of travel.

EF, as a company, offers may types of tours ranging from group trips for adults to organized gap years for high school graduates. While these options are available, the bread and butter of the company is the basic high school student tour which is what we took.

How do EF Tours work?

EF Tours have a pretty straightforward process during the sign up period, prior to departure and during your trip.

Before we get into that, it must be said that EF Tours operate fully independently of the local school district, and are not endorsed or supported by them whatsoever.

While this may seem like a school trip, it is not. It is a trip run by a business who just happens to recruit participants through the school system. Your local principals, school boards, etc. have zero control or influence on these trips. The school is only involved in the process as far as whether they allow teachers to hand out information in schools or not.

The EF in EF Tours stands for Education First. According to their website, EF claims to “design tours to help educators teach, and so students can learn more—about tolerance, other perspectives, and themselves.”

The Sign Up Process

EF Tours are set up to be “hosted” by a local teacher who is then designated as the “group leader.” Teachers are incentivized with free and reduced price travel to recruit students to join their tours.

Tours are advertised by the group leader/teacher to students at their school and to their local community. Interested students and parents are invited to attend informational meetings either in person or virtually where the group leader/teacher goes over the itinerary and any questions potential participants may have.

Students and parents can then sign up directly through the EF Tours website, and submit all payments directly to the company.

Trips are usually initially introduced about two years before the travel date so that participants can make smaller monthly payments to cover the cost of the trip. Costs for these trips can range widely, depending on the destinations and length of the trip.

EF has the group leader/teacher set up deadlines for signing up to go on the trip, sometimes including small discounts to encourage enrollment. This tends to give a false sense of urgency to the sign up process.

We found that participants can sign up just about any time before the trip departs. We signed up about a year out from the trip, while another student who traveled with us signed up just a month or two before we left.

Anyone was allowed to sign up for the trip. We were encouraged to invite friends and family to join us on the tour, whether or not they were associated with our school or even local to our area.

Adults did need to pass a background check in order to participate in the trip, since adult tour participants are traveling with minors.

We were not given specific dates for our trip, but instead we were given a window of time during which the trip would occur. Our dates were finally confirmed about two months before our departure.

There are usually two or three optional excursions that can be added to any tour. These usually include some special activity or visit to an additional landmark.

Tour participants may also choose to upgrade the insurance for the tour.

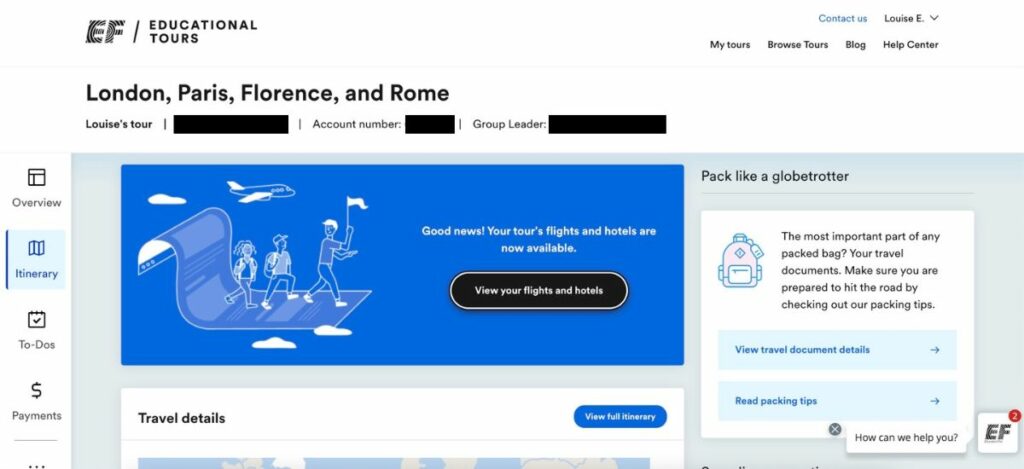

Before Your EF Tour

Once you’ve signed up for your EF Tour, you’ll be given access to a tour portal on the EF website where you can track your payments and what steps you need take next to participate in the trip. They also provide a fundraising page, where friends and family can pay EF directly to offset the cost of your trip.

Our group had a few in person meetings at a local restaurant prior to our trip where we discussed issues ranging from passports to packing for our trip to Europe , and got a chance to meet our fellow travelers. This may or may not be true or all groups that are traveling with EF.

Each participant in our tour was required to submit a copy of our passport to EF to insure that we had the proper documentation to travel.

Information about our flights was not available until about a month before our departure, and information about our hotels was not available until we were about three weeks out from leaving.

EF Tours uses a wide range of airlines, and travelers do not get to indicate a preference. EF books all travelers in economy class seats for all transportation methods. EF will book with whatever airline has space available for the lowest price for the group.

As for hotels, travelers know very little about where they are staying ahead of time. Per the website, tour participants are assured that “travelers can count on safe, clean and comfortable hotels with private bathrooms” but much beyond that the info is sparse.

Students can expect to room with one to three other students, and possibly have to share beds. Adults can expect to share a room with one other person. For a fee, a single room can be requested for the tour.

EF does indicate up front that hotels may have small rooms without air conditioning, television, or elevators, and that WiFi may not always be available.

During an EF Tour

All transportation arrangements are made by EF Tours, including flights, buses, trains, etc. They book all accommodations and attraction admissions for tour participants.

Two meals a day are included in the cost of a trip with EF Tours. Breakfast is provided each day at the hotel, usually continental style, but sometimes with hot offerings just depending on your hotel. Dinners are are pre-arranged with a preset menu by EF at local restaurants. EF will make accomodations for those with specific dietary needs, such as gluten free or dairy free meals.

While the teacher recruiting students is designated as your group leader, they don’t actually lead the tour once you start traveling. EF provides a Tour Director to accompany your group through the entire trip.

This Tour Director is supposed to handle just about everything on your tour, including all your pre-booked accommodations, meals, excursions, tickets, and transfers. This person is there to direct the group and handle any problems with logistics you may encounter along the way.

During the tour, your group will meet up with various local guides who will give you some sort of tour of the city or historic site that you’re visiting. These tours are usually walking tours, but sometimes are bus tours, depending on the location.

Tour participants are also given access to an EF Tours App, that just lists your daily itinerary for your trip.

Our EF Tour Review

Our specific tour featured quite a daunting itinerary. We toured Europe for 12 days, visiting sites in London, Paris, Florence, Rome, Pompeii and Capri, with no more than two nights in any destination.

Our tour consisted of 26 travelers from our high school: three teachers, seven adults and 16 students. We were combined with a group from upstate New York consisting of 14 travelers: one teacher, one adult, one child and 11 students. There were a total of 40 people on our tour.

What EF Tours Promised

Before our tour, the group leaded made sure every person who showed an interest in going on the trip got the glossy, full color brochure that outlined our itinerary and told us what to expect on the tour.

The brochure promised that participants would be “surrounded by the people, the language, the food, and the way of life” of the destinations on our itinerary. We were assured that our tour director would be “with us around the clock, handling local transportation, hotels, and meals while also providing their own insight into the local history and culture.”

We would be spending time in three different countries, seeing some of the most beautiful and historic cities in Europe.

The brochure also claimed that students could earn educational credit while on tour, and that all tours feature “experiential learning activities.”

Our tour left some of these promises unfulfilled, but did give us a glimpse at some fantastic destinations in Europe and some amazing memories.

Our hotels along the trip started out stellar but seemed to go downhill from there, unfortunately ending in truly unacceptable accommodations.

Even though this wasn’t guaranteed, all of our accommodations had some sort of air conditioning, with some that functioned better than others, and all of them had WiFi.

For the first four nights during our stays in London and Paris, we were sent to Hilton Hotels . They both were on the higher end of what I expected based on the descriptions provided by EF Tours of what our hotels would be like.

The rooms at these Hiltons were very new, immaculately clean and extremely comfortable. They were both located about an hour outside of the city center, but that wasn’t too much of a problem.

When we reached Italy, things changed a bit.

For a quick overnight in Milan on our way to Florence, we stayed at and AS Hotel in Limbiate. This hotel was a bit older than the Hiltons we’d stayed in, but it was clean, spacious, and comfortable.

Between Florence and Rome, we spent the night at the Hotel Villa Ricci (not pictured). This hotel was significantly older than the other three we had stayed at, but it was still clean and comfortable. While the room wasn’t much to write home about, some members of our group lucked out and got spectacular balconies.

Once we arrived in Rome, the Villa Aurelia was our home base for two nights. We learned that this hotel had once housed men studying to join a monastery, which explained the doritory feel of the place. Again, we found these rooms to be clean and pretty comfortable.

On our way to Southern Italy, we spent the night in Sorrento at Sisters Hostel . This was the only true hostel on our trip. While they still stuck with four students to a room, several of the student rooms had enough beds to sleep up to 12 people.

Though not quite as refined as the Hiltons, and a little slap-shot with the furniture, we found this place to be clean and welcoming. While it wasn’t quite as comfortable as some of the other places we’d stayed, it was completely acceptable and had a spectacular view of the Gulf of Naples from the rooftop terrace.

Things took a turn for the worse on our last night of the tour, when we stayed at Hotel La Pergola in Rome. This place was truly one of the worst hotels I’ve ever had the misfortune to stay at (and as a travel blogger, I’ve stayed at a LOT of hotels).

Things started off badly when we discovered that the lights in all the hallways were not on, and that we had to hunt around with our cell phone flashlights to find our way to our rooms. I asked the front desk to remedy this, but it was never addressed, and we had to repeat the blind search for our rooms every time we went up.

Upon arrival in my room, I found it to be extremely dirty. There was a layer of dusty film all over my bathroom and my pillow had an unidentified crusty stain on it. My daughter’s room had the same layer of dirt in the bathroom, plus a shoe print from where someone killed a bug on the wall. I checked our beds for bedbugs and thankfully did not find any.

The front desk did not seem to care and we were told no one was available to come clean the bathrooms.

But the worst experience in this hotel went to a dad on our trip, who’s single room contained only a sofa. Not a sleeper sofa, but just a hard couch. There were no linens or towels available to him whatsoever.

When he asked for these items at the front desk, he was told that we should have called earlier to request them since they were all locked up in a cabinet by the time we arrived at the hotel. He ended up sleeping on a towel laid out on the sofa with a travel neck pillow, that had been provided to him by his daughter from her room.

The front desk attendant seemed more than annoyed anytime someone from our group would approach them, and insisted that we all leave our keys at the front desk when leaving the hotel for dinner that night.

We weren’t left with much recourse, since this was a group trip and we were on our last night, so we decided to just grin and bear it, and did our best to get some sleep.

Overall, I’d say that the hotels provided were quite good, with the exception of Hotel La Pergola. For ten of the eleven nights of our trip, we were provided with clean, safe accommodations that lived up to what the EF Tours website told us to expect.

At the time of this publication, EF Tours has been notified of this unacceptable hotel and has yet to respond.

Meals on the tour ran the gamut from weird to stellar, but overall were not to bad. Breakfast and dinner every day were included in what we paid for our tour.

All breakfasts were served at our hotels. Sometimes they were just continental breakfasts with cold offerings, and sometimes we were given hot breakfasts with eggs, bacon, and such. Sometimes it was quite obvious where our group was supposed to go, and sometimes it wasn’t.

Overall, breakfasts were adequate throughout the trip.

Lunches were not included in the initial price of our trip and were paid out of pocket each day.

Lunches were always a gamble. It all depended on where we were and what was going on whether or not we’d get to select a restaurant on our own or if the group would be directed to eat at somewhere specific, and if we’d have lots of great choices or really limited options.

For example, on our first full day of the trip, we visited the Tower of London. We told to make sure we ate lunch after our tour, before rejoining the group to get on the bus. The only options available to us were food trucks along the river right next to the Tower complex.

It was the worst during our travel days. We were frequently told we could just grab a bite to eat at the train station or the airport, only to be left with minimal time and very limited options.

But some days lunch was great. During our time in Rome, lunch came with some free time to wander, so we were able to go out and select the restaurant of our choice.

Some days our tour guide would set up a lunch option for us, having arranged a preset menu and price with a local restaurant. Those options were usually something like a burger, pizza or a cold sandwich.

I’m not sure if the lunch situations were like this because of our tour guide or because of EF itself. Sometimes it seemed inevitable, like when we were stuck in an airport or train station. Other times it seemed like our guide might be creating these situations by not fully informing us what was available near by.

All dinners were set up at local restaurants before our arrival. We did not get to select from a menu and were all served the same thing each night, with the exception of those who had special dietary needs. Each meal came with water, but we were allowed to order additional drinks at our own expense if we choose to do so.

The worst dinners EF provided happened during the first few days of our trip. During our entire time in London, we were not once served any traditional English food. Our Tour Director said it was because “London is a melting pot of cultures,” but our group didn’t buy that.

Our first group dinner in London was at a Korean restaurant where the group was served a hot stone bibimbap with chicken. I’m normally a big fan of Korean food, but this wasn’t great.

The next group dinner was at a Polish restaurant where the group was served a fried chicken patty and french fries.

When it became apparent on the second night that we weren’t going to be getting any traditional English food, my daughter and I made arrangements to go get dinner on our own, and pay for it out of pocket. Four other members of our group chose to join us.

We simply got information from our Tour Guide when and where to meet up with the group after dinner and selected a nearby local pub so we could have a traditional English dining experience.

Dinners seemed to improve when we got to France. During our first night there we had a lovely traditional French meal of chicken with mushroom sauce in the back room of a small picturesque cafe with a ton of ambiance. On the second night we had a traditional Alsatian dish called Flammekueche, which was sort of like a pizza with a creamy sauce.

In Italy, the dinners were quite good. Of course we were served a lot of pasta, but we also had braised beef in tomato sauce, gnocchi, and pizza.

According to the folks on our trip who had special dietary needs, the dinners were pretty good for the most part. Although it did seem that everywhere we went in Italy, anyone who was gluten free or dairy free was served watermelon for dessert.

Before we left on our trip, we were told by our group leader that we shouldn’t need more that $25 US dollars per person per day for lunches and snacks. We found that that number was not quite accurate for us, especially if we ever wanted to stray from the planned meals that EF Tours had set up for us.

We also found that we frequently needed to buy water to stay hydrated in the high temperatures of Italy during the summer, and at most of the locations we visited, water was marked up quite a bit.

Overall, the meals on our trip were pretty good, but could definitely have been better.

Our Itinerary

We knew going into this tour that our itinerary would be extremely hectic. With no more than 48 hours in any location, we expected it to be jam packed. It was kind of like a tasting menu, where you got a little bit of each destination.

What we didn’t expect was the significant amount of wasted time and changes to our itinerary that happened on our tour.

Things started off poorly when our tour guide was an hour late to meet us at baggage claim and then our bus was over another hour late to pick us up at the airport.

While our tour guide was a very sweet, personable woman, she didn’t seem to understand how to manage the timing logistics for a group of 40 travelers.

Our group was quite good about being on time to meet up locations with a couple of small exceptions that could not be helped. No one wanted to be the person that made us late.

Our tour guide didn’t seem to have this mentality. She was frequently the last person downstairs at our hotels to meet our bus 15 to 20 minutes after the time she told us to meet her, and did not budget in adequate travel time to most of our destinations.

For example, while we were driving across Italy, she had our driver stop at a large gas station for a bathroom stop. She told us we only had five minutes to use the restroom and get back on the bus. It’s completely impossible for 40 people to make use of just a handful of bathroom stalls in five minutes.

We were late to our tours in London, Florence, and the Vatican. We were late to our tour of the Colosseum in Rome. We were late to our appointment at the Louvre. We were so late to our tour of Pompeii. This significantly hindered what we were able to see at our destinations, and made the whole tour seemed very rushed every day.

Things like this happened over and over again throughout the trip. This resulted in our group being habitually late to most of the tours we went on, and significantly cut into our time at some really important places.

The only times it seemed like we weren’t late was when we had to catch a flight, a train, or a ferry.

There were also some pretty significant changes to our itinerary.

Several items listed on our initial brochure were changed before the trip due to pandemic restrictions and travel challenges, which was fine. We had ample notice and knew what to expect.

But there were several instances where visits to certain locations were dropped off our itinerary completely, and visits to other non-advertised locations were added.

Sometimes this was a good thing, but sometimes it was incredibly frustrating.

In London, a walking tour of Piccadilly Circus, Covent Garden and Leicester Square was replaced with “free time” at the British Museum, which we really didn’t mind.

But in Florence, visits to San Miniato al Monte and Piazzale Michelangelo were dropped off the itinerary with no explanation.

On our way to Rome, our guide added a stop in Ovierto, a beautiful small town with picturesque views, wonderful dining and great little shops which we enjoyed immensely.

But in Paris, a visit to Montmartre was abandoned, even though our dinner restaurant was within a mile of the historic location.

The best unexpected addition to our trip in my opinion was the opportunity to see a musical in the West End of London. Our guide was able to secure tickets (for an extra fee) for those who wanted them to a performance of Wicked during our free evening. It was absolutely fantastic.

But in the most frustrating example, during our time in Paris a visit to the Frogonard Perfume Museum was added to our itinerary. No one asked to go there, and most of us seemed annoyed that we were stopping. We were assured that the stop there would only last 30 minutes, but it ended up taking three times that, leaving us only an hour and a half to visit the Louvre before we had to be back on the bus to catch a flight to Italy.

These added stops almost always involved additional costs as well, which we were not informed of before leaving for our trip. This caused problems for a few kids on our trip who weren’t expecting these costs, and they unfortunately had to miss out on some of the better additions.

There also seemed to be major sites in some of these cities that were not ever even an option to visit or see, due to our limited time in each city. We didn’t go to Westminster Abbey or St. Paul’s Cathedral while we were in London, and there were too many things to count in Paris that we didn’t even glimpse. While we were aware of this upfront before the tour, it really did feel like they didn’t allow enough time in any location to really see the cities we were in.

Despite these frustrations, the itinerary did take us to some fantastic places and we had some absolutely unforgettable experiences. We had a fantastic time seeing the Crown Jewels at the Tower of London. We enjoyed a truly magical and unexpected sunset under the Eiffel Tower in Paris. We got to listen to an orchestra perform in Piazza della Signoria in Florence. We were able to marvel at the unparalleled artwork inside St. Peter’s Basilica in the Vatican. We saw the stunningly beautiful sites of Capri from a private boat tour. Those memories are truly priceless.

During our trip there were extra excursions offered in any city we stayed in more than one night.

In London, the excursion was a visit to the London Eye, a giant ferris wheel type ride that gives riders a birds eye view of the city. In Paris, it was a trip to Versaille to tour the palace and the gardens. In Rome, it was a tiramisu cooking class.

We choose not to participate in the excursion in London because I’m not the biggest fan of heights, and in Paris because my daughter wanted the opportunity to spend some extra free time in the city.

I’m extremely glad we made those decisions.

While the London Eye excursion seemed to go well for those who went on it, it was over priced. EF Tours charged each participant $60. Tickets can be purchased individually at the ticket booth for just $42 USD or for groups ahead of time for just $24 USD. I’m not sure what EF added to the experience to warrant that upcharge.

By skipping the London Eye, we were able to have a bit more time to explore and plenty of time to enjoy our pub dinner that we mentioned earlier since the London Eye excursion was timed to happen right before dinner.

In Paris, those who went to Versaille told us the experience was underwhelming because of the limited time available inside the palace, and the lack of lunch options available to those who went.

The Versailles excursion seemed overpriced as well. EF Tours charged $114 USD to each participant. Tickets to the entire estate are free for those under 18 years old and cost under $30 USD for anyone else, and that’s without a group discount. Even if every single person had to buy a ticket, I can’t imagine that the cost for a group tour and the transportation to get the group there cost an additional $84 USD per person.

The tiramisu cooking class in Rome was not optional for our group for some reason. I think our group leader made that choice when she set up our trip. We paid an extra $85 USD above and beyond the base tour price to experience it. While I could not find information about individual class pricing, I highly doubt that EF paid that much per person for us to spend an hour making tiramisu.

I will say that the class was a fun experience at a great location, and we all enjoyed the desserts we made together.

Overall, unless an excursion is of special interest to you, I wouldn’t recommend participating in them, simply because they seem overpriced. Having extra free time to see the sites of your choice seemed to be the best option during our tour.

Education on an EF Tour

EF Tours makes a big deal out of their tours being focused on education. We were promised “experiential learning activities” during the trip. They even claim you can earn credit for going on these tour.

We found that there wasn’t that much education attached to our tour.

The local tour guides who showed us the sights of each city were the most informative folks on this trip, with extensive knowledge of the history and culture at each stop, but we were forced to use amplifying devices called Whispers in order to hear the guides. These Whispers often had glitches or were garbled, making it very hard to understand our guides.

Other than the local tour guides and maybe the tiramisu class, I wouldn’t call just visiting these historic places an “experiential learning activity.”

We also learned that our high school would not give any credit to students who participated in these trips, even though much was made of the educational credit during the pitch to get us to join the tour.

This isn’t to say that we didn’t learn anything on our trip. We did have some great cultural experiences while we traveled. But learning seemed to take a back seat to just being in another country in most circumstances.

Safety with EF Tours

As a parent considering an EF Tour for my teenager, I know safety was a big concern for me.

When my husband and I decided to send our daughter, we felt like one of us should go with her since she was only 15 at the time we went on the trip, and had not traveled internationally like this before.

For the most part, I felt quite safe during our trip.

Before our trip, our group leader did make sure to advise us about pickpocketing and theft at major tourist sites in Europe, and advised us to be prepared. She did make sure we were always wary of our passports and where we were keeping them during our travels.

While on tour, there was only one time that I felt like our group was taken to an unsafe area. That was during our terrible last night in Rome when we had to walk from our hotel to our dinner restaurant through some pretty sketchy areas of the city.

Although student were allowed to go out on their own during our free time, they were asked to go in groups of three or four and were left in pretty safe areas to spend their free time.

The biggest problem I saw with safety was when our Tour Guide would take off walking at a breakneck speed, frequently leaving half our group stuck at crosswalks or a few turns behind. She usually did a count to make sure everyone was there when we were ready to leave, but she did leave people behind at least twice during our trip and have to go back and get them.

Most of the time we had no idea where we were headed when we were walking to different locations. We were never given the names of the restaurants or addresses of where they would be unless we specifically asked for them. I think communicating with the group more about where we’re going could have avoided some sticky situations that a few of our travelers found themselves in when they were left behind.

We also didn’t have a way to contact our Tour Guide directly. Only a couple of people were given her contact information, which made communication confusing and difficult during our free time, especially when she got delayed during our free evening in Paris and our meeting time had to be pushed back significantly.

Curfews and group rules were left up to our group leader, who didn’t set many boundaries for our students.

Since the legal drinking age in the areas we visited was 18, student who met this requirement were allowed to drink alcohol on our trip, but were asked to limit it to one drink with dinner. By and large, our students respected this request and did not take advantage of the lowered drinking age to go and party it up.

Trips like this EF Tour require students to be pretty mature when it comes to safety. We had a wonderful group of kids who took their personal safety pretty seriously, and didn’t take unnecessary risks that would put them in jeopardy. Had it been a different group of personalities, I’m not sure how it would have gone.

EF Tours: Our Final Verdict

Would I travel with EF Tours again? That seems to be the question at hand here.

My EF Tours experience definitely taught me a lot about group travel. As someone who travels pretty frequently , I usually make most of my own travel arrangements, from flights to hotel reservations to activities. It was quite nice not to have to worry about any of that. It really did take a lot of pressure off to just let someone else do all that work.

But relinquishing that control does require a certain amount of trust. There were some areas that I would definitely trust EF to arrange again, and other areas where I really think they could do better.

For this trip it really came down to adjusting expectations once we were traveling. I really did expect there to be more education involved in what we did while on our tour. I really did expect to spend some quality time at these major historic sites.

Once I realized that time would be much more limited at every destination than I expected it to be, the trip went much more smoothly.

I think our experience would have been better with a more seasoned Tour Guide. Ours just didn’t seem quite ready to handle all the pressures and logistics that are required for managing a group of 40 people for 12 days.

EF Tours is definitely a budget tour company, and for the price, you do get a good experience.

Did EF Tours create the trip of my dreams? Not by a long shot.

Did they create a good experience for students who haven’t done a lot of international traveling? I’d say yes.

Do I regret going on an EF Tour? Absolutely not. I had some incredible experiences in some amazing locations with my only daughter, and I wouldn’t trade that for the world.

Would I go on another EF Tour? I think I would, but I would definitely choose a slower paced itinerary with more time in each destination.

Do you have any questions about EF Tours that I didn’t answer? Feel free to ask me in the comments!!

EF Tours Review: The Good, The Bad & The Ugly

Wednesday 29th of May 2024

We are the latest scapegoats of EF tours which is not worth 10$ for the time they make you wait doing round about trip for 40 hours for a travel worth 14 hours . THE most pathetic travel plan i have ever seen in my entire life. Instead of paying for this tour, I would have taken my entire family with much better planning saving time and money. JUST NOT worth it and am hoping to do something more than just commenting here to avoid atleast 1% of naive parents into signing up for future EF tours from school.PLEASE don't waste precious time

Tuesday 28th of May 2024

Hi Louise A great review, thank you. I am an EF tour director, though I only continue to lead tours where I have already worked with the Group Leaders (the teacher organizing). I won't defend EF, there's no getting around the fact it's heavily profit-driven and as such does not use resources on adequately training its staff, whether they are office based or TDs. They use the cheapest bus companies, negotiate the cheapest menus, the cheapest room rates but of course spend a huge budget on marketing and corporate BS - and it works, they are the biggest student tour operator out there not to mention all its other extensive enterprises. Everything is done last minute which hopefully gives some explanation as to why TDs are often beyond frazzled and they have to spend time away from the group, particularly in their hotel room each night emailing and sorting out things for the next day or next few days which should have been organized well in advance by the company. And given how early morning departures are and late finishes at hotels, you can see that they get very little sleep. More and more we complain that TDs are having to spend days and days in advance on admin to make the tour anything like acceptable - time when they are not being paid and think about it, they have chosen a job which is not office based but are being forced to do so much admin which any other company would handle in the office. We are either already on tour, so it is taking time away from our current group, or we have to spend less time with family when we are in between tours. Cheapest labor, in fact it is free labor! To say nothing of how late they pay us and even then they dispute a lot of payments so we have to wait even longer. Of course TDs should never be late, this is appalling. To play devil's avocate though, in my time I have bumped into colleagues along the way who are in floods of tears because of how their tour is going. Almost always to do with impossible itineraries, tickets not arriving and the company not supporting them, but also sadly, due to relations with travelers. The most likely is parents who have elected to travel on a student trip without understanding what they means for them (long days, staying in poor quality hotels, rushed meals etc.). And sometimes it just takes a bit longer to compose yourself before going back to meet the group. Often I have to be on a call and skip a visit that I was really looking forward to just to sort out some s*** so the tour goes well. Of course to maintain professionalism, I would never tell the group that I have been sorting out s***, they just assume I've been gorging on gelato. Sometimes we are not even provided with a ticket to go into a museum or theatre so we cannot join the group. All aspects of the job has got worse and worse over the years and many of the experienced TDs have jumped ship where they are better paid and generally treated more humanely. I think it is worth emphasizing the importance of strong leadership from the Group Leader. It s amazing that some are willing to travel with kids they have never met until they arrive at the airport. A good teacher will pick good chaperones and give them guidance to prepare for the tour. So free time can be very different between one group and the next. It may sound like kids are let lose, but it is almost always in a controlled environment and the teacher will have set up parameters the students have to keep to. Again the biggest trouble makers are typically parents who travel with the group. Regarding educational aspects of the tour, I would like to deliver more education and we certainly used to do more. But as hotels have got further and further from the centre, meaning longer and longer hours on the go with very little sleep, bus journeys means the students need to catch up on sleep. There are some EF tours which are more educational-focused such as STEM, WW2, And don't forget there is also the 'soft skills' element that should not be overlooked - for most students this is their first time travelling abroad, certainly without their families. So learning self-reliance, not losing their passport, budgeting their spending money, navigating teenage relations, meeting foreigners, starting to understand their own limitations and what they are willing to compromise on or not... there is so much that they are learning and absorbing which you will not find in a text book, but this is life learning and the most rewarding part of the job is to see the kids blossom. More often than not it is the students who are introverted, who make the biggest steps and make the most progress - starting to speak words in the local language, trying different foods, open their eyes wide. The confident kids often stick together and don't appear to grow as much. One of the biggest problems with this kind of tour is that the more things listed on the itinerary, the more people sign up. As an example. teachers often say that they offer a tour, get a few signing up, then they amend it to include Paris and boom, a full bus. Only the most experienced of travelers would look at the shiny marketing brochure and question how it is possible to pack everything in. But having everything in is what sells tours. Kind of a vicious circle. Versailles optional - this is a tricky one. It is overpriced, but is a bestseller and I would like to offer some perspectives. Don't forget to factor in the service you are getting - sure, go there alone, work out the route from which of the Versailles train stations you can work out you can get to and yes under 18s enter for free, work out how to get an adult ticket on your own, queue for a long time (just google the length of those lines), work out where the bathrooms are on your own, options to eat, what train to get back... There are more costs involved with a group. for this visit In order to skip those long queues, groups must pay for group reservation fee, whatever the age of the group. You have to pay for 2 guides if there is more than a certain number in the group, so they split the group in half and have 2 tours at the same time. The Whisper audio headsets have a fee. The bus has to have a separate fee and parking. So yes, it is very profitable, but perhaps not as much as you think. The travel business can be precarious, just look at the pandemic years. Imagine airlines going on strike or sudden weather changes. Tour companies need a little reserve to deal with emergencies and the profits from side trips like Versailles is useful for this. Of course when it is clear that this tour company makes a lot of money by being very cheap on meals, poor buses and hotels, this is hard to hear. Some side trips like the London Eye are absolutely a rip off and teachers should really be more wise to this. Now that I mainly work for companies that have a calmer itinerary, the difference is immeasurable. A good one for teachers and trip organizers to work with is Lingo Tours. Each tour is bespoke so you can bring them your itinerary ideas, they will work with you to come up with something that truly works. Meals are high quality and usually offer a choice and hotels are so much better quality and even if they are not very central, they are not far out like with EF. You will get sleep, you will get an experienced tour director (you can even bring your EF TD with you, we are all freelance after all), you won't pay more and you won't regret it! You won't feel like you are part of a factory product and you will have decisions explained to you so you know you are offering a quality product to people signing up. But, like your tour director, you need to have experience because taking students away on a tour is no easy task and it takes time to understand all that it involves. Another small company that will work with you to design your tour is Global Explorers LLC. ACIS is also good for brochure tour style, but generally works out more expensive, same with Passports. Explorica is the real rival to EF and has a similar set up and EF does not let TDs work for both companies. You have have to laugh, on the EF website it says "Reimagining student travel, one itinerary at a time". If reimagine means "providing a worse product and service than last year" then they have that written correctly. They certainly do not do one itinerary at a time, they do everything en masse and this is a problem - they never turn down business and have too many tours going at the peak season. Adjust expectations appropriately. I hope this comment helps some people to understand the challenges of student touring.

I am happy that I can be helpful. CHAOS and ADRENALINE is how these tours are run. It's a big pity, there is really enough money in the company for these to be great tours. The family who own EF are on the Forbes rich list. Their business school has a reputation like Trump's did! But the family are good at business themselves , very good. But at the end of the day, whether EF does a good job or not, we all need to understand that more people are traveling than ever and this has an impact on many aspects of trips, especially group trips.

Louise Emery

Thank you SO much for this info! Having a TD perspective is really fantastic, and does give insight to how things are run. I especially appreciate the recommendations at the end!

Friday 3rd of May 2024

Hi, I signed up for the 2025 Rome and Greece trip with this company. Was wondering what I should do there and if there is anything to not do. Let me know if I should cancel a certain hotel stay or guided trip.

Saturday 4th of May 2024

Not sure if you can cancel one portion without cancelling your participation in the whole trip.

Friday 12th of April 2024

I have gone on 4 EF tours (England and Scotland), (London and Paris), Rome, and one called Bell'Italia, which was basically a road trip through Italy. The meals are always meh, and the hotels were usually ok to good. I'm surprised at your lackluster tour guide. We have ALWAYS fallen in love with all 4 tour guides!!! They are all friends for life now. I wish you could have had that experience. The kids just adored them all. I did find the more jam packed the itinerary is, the more stressful the trip can be, but on the other hand, you get to see it all.

Thursday 14th of March 2024

Thank you so much for your insightful review! My daughter is headed to S. Korea in a few weeks and reading all these comments & your review...I'm just hoping for the best at this point. I wanted to ask about the tipping. Our group leader has requested $145 paid to her in cash, which I was completely caught off guard, considering the financial commitment of the trip itself, but reading this, it seems that it is quite normal. I contacted EF and the representative said that according to the tour itinerary, the total suggested guideline should be significantly less. Do you know what happens if there is a surplus or shortage with the tipping amount? I'm just wary about giving someone I don't even know (group leader) cash.

Saturday 13th of April 2024

@Louise Emery, I can't thank you enough for you review. My school is planning a trip to Rome, London, and Paris in June 2025. I've been honestly on the fence, and I still have time to cancel. I'm a teacher at the school, but not actually a chaperone. I have to pay the full cost for the trip, but I know I will likely still need to supervise the students during the day. I don't necessarily mind this, but I wonder if I'd be able to explore at night. What time did you typically get back to your hotel? I really hope we are not an hour away from the Rome, London, or Paris city centers. I would love to be able to go out for drinks on my own at night time once the students are in the hotels. Louise, do you think it might be better to plan my own trip to Rome, London, and/or Paris? I'm a single man with no kids hahah.

Tuesday 2nd of April 2024

I really am not sure what would be done with a surplus. I would definitely ask the group leader about the discrepancy between their request and the recommendation of EF.

EF Educational Tours

Review Highlights

“ Silke and Michal became part of our "family" for the entire 10 day tour . ” in 3 reviews

“ My two sons, ages 10 and 13, and I learned so much about Costa Rica and had so much fun!!! ” in 9 reviews

“ I just returned as a chaperone on the EF trip to Barcelona and Madrid. ” in 5 reviews

Location & Hours

Suggest an edit

2 Education Cir

Cambridge, MA 02141

East Cambridge

You Might Also Consider

Boston Sightseeing

6.6 miles away from EF Educational Tours

Boston Sightseeing is one of the best city sightseeing tour providers in Boston. With our double-decker open-top tour bus, you can experience a stunning panoramic view of the city. We offer hop-on, hop-off tours with our… read more

in Historical Tours, Bus Tours

1.4 miles away from EF Educational Tours

Alison M. said "This store is cute. I have an Away mid-size I ordered years ago online and I love it so it was fun to visit an actual store and browse. The holiday color is absolutely beautiful in person but I would cry after my first trip bc it…" read more

in Luggage, Travel Services, Airlines

Steven Klassner - Dream Vacations

Full service, local travel agency with a lowest price guarantee on ALL bookings! read more

in Travel Agents

About the Business

Established in 1965. It was 1960 and Swedish student Bertil Hult had spent years struggling with dyslexia. Unsure of his future, he moved to London for work. After only a few short months, he was fluent in English--a feat he never thought possible. That discovery inspired Bertil to launch EF Education First in 1965--a company built on experiential learning, cultural immersion and authentic connections. This experience is at the core of our educational philosophy. …

Ask the Community

Ask a question

Yelp users haven’t asked any questions yet about EF Educational Tours .

Recommended Reviews

- 1 star rating Not good

- 2 star rating Could’ve been better

- 3 star rating OK

- 4 star rating Good

- 5 star rating Great

Select your rating

Overall rating

231 reviews

I just can't get over how many corners EFtours cuts. They take you to CHEAP hotels and serve you CHEAP meals at restaurants rated 3 stars. This is alright for kids, but for adults that have any expectations, it's severely disappointing. It's been brought up countless times by other people and beaten like a dead horse, yet EFtours KEEPS DOING THE SAME THING. Please.... PLEASE change your business model! I'm tired of going to hotels that have roaches. I'm tired of going to hotels that claim that they have a gym/sauna and don't. I'm tired of going to hotels that have front doors that won't lock. I'm tired of going to hotels without working WIFI. I'm tired of going to dinner and getting served CHEAP no-topping cheese pizza and no drink options other than water. Diet anything or even tea would be great, but EF takes the free route with water. You'll pay $4000+ and they'll milk that for profits... that's all it is. On a positive note, our main tour guide was AWESOME.

They ensure to discuss the good things with the trip option but fail to mention that there is a $300 cancellation fee if for any reason the trip needs to be cancelled. You have the option to purchase travel insurance, so they are essentially charging you the insurance cost and still on top of that a $300 fee. I find it very distrustful to not mention this in the presentation like they mention everything else.

ABSOLUTE SCAM! I signed up for a tour through a school, then the school cancelled the trip. Now this place is holding on to over $500 and won't refund it even though there is NO TRIP NOW. NEVER NEVER NEVER GIVE THIS PLACE MONEY! You get NO TRIP and NO REFUND.

One of the worst and most unprofessional experiences I have ever had. My daughter goes to school in Boca Raton, and a few months before her trip to Japan, EF Tours offered a trip to Iceland. At the time we applied, my daughter was eligible, as we had received an offer. However, after she returned from the Japan trip, she was no longer eligible. I had already paid $350 towards the Iceland excursion, which my daughter could no longer attend. I called EF Tours customer service and kindly asked for my $350 back. They told me that I could not get a refund but could put the money towards another excursion, which I was willing to do. However, when I inquired about not wanting to send my daughter on any excursion, they said they would take the $350 as a cancellation fee and waive any other cancellation fees in advance. I was extremely disappointed that she was eligible earlier and now was not, and I could not get my money back. Instead, they charged me the money as a cancellation fee for something we couldn't use. It felt shady, unprofessional, and greedy. After I tried to resolve the issue, they blamed the school and said it was the school's fault. They advised me to reach out to the school chaperone to discuss my refund. I hesitated before sending my daughter on the excursion due to the bad reviews about the company. While my daughter had a great time, the incident and the company's unwillingness to help mean I will never use EF Tours service.

Me and 21 other teens were taking a trip. In the beginning, there was a storm in Dallas so we ended up getting delayed and then left behind. EF could not even get into contact with the airport and kept not answering. They also stated we had a hotel when we didn't. Highly unprofessional staff. Now our entire trip was cancelled and then we ate at a Denny's which they begrudgingly paid for with no way to get home until the next day. Had to sleep in airport

Giving one star because it won't let me give zero. Terrible customer support throughout the enrollment process and even worse during the refund process. Do NOT ever use this company ever. My refund has been stuck in their process for weeks and after calling the bank and calling them multiple times they finally send and email saying the refund will be electronically processed. But then calling to follow up they say a check has to be issued because the of something on their end. So they lied in an email then didn't deliver. Still waiting for that check but I won't hold my breath. Avoid at all costs; or it'll cost you.

Our a high schooler just got back from the EF tour in Costa Rica. He had an amazing time. He learned so much, loved the experience and can't wait to go on another trip. He said all the meals were really good too. He said every hotel they stayed at was very clean and he felt safe. He said the locals and tour guides were fun to talk to. He already misses being there. They visited areas you probably wouldn't go to if you were going on a resort vacation. He said the only negative on the trip was the snorkeling trip. He said the reef they explored had died and there weren't many fish left in the area. He said it was sad, and made him think more about the environment, so it wasn't a total loss. The confidence and life skills he gained on this trip were worth the price we paid. Things to consider if you're planning on sending your child on a tour. There are cancellation fees if you cancel the trip. You maybe driving your kid to the airport in the weee early hours of the morning. They are going on an educational tour and won't be staying in resort areas. A/C and Wfi is sometimes not available. The terms and conditions when you sign up outline everything you need to know about going on a trip and any cancellation fees. Read the terms and conditions and understand them before you sign up and pay. Your children will be sharing rooms and beds with other students. We upgraded our child to a private room since he didn't want to room with others. Whenever we had a question, we used their online chat. There was one time they required a phone call to fix and issue, but they gave us a call and were able to fix what we needed. The portal was great and gave us emails to remind us of what we needed to do to be ready for the trip. If his school hosts another trip, we will definitely sign up!

One of the waterfalls they visited

Terrible company. Do not travel with them. One of the hotels had bedbugs, roaches and mold. They tried to book way too cheap for the price we paid for the trip. There was a mixup with the airline where a middle name was entered wrong. My guide left me and my son at the gate in France and left with the rest of the group. I had to pay my own way to get us back with the group, after missing a half day in Rome waiting to catch the next flight. They claim the airline messed up, and tell me to contact them for a refund, but wont give me any communication with the airline. I cant prove who messed up and they wont help me. The descriptions are misleading, they say you 'visit' sites, but seeing them from a bus window, really is disappointing. The trip is not cheap, and it doesn't live up to the billing.

BEST TRIP EVER! Our school group just got back from a 10 day tour in Europe: Germany (Frankfurt, Rothenberg, Rodenberg, Dachau, Munich and Heidelberg; Innsbruck, Austria; Venice and Verona Italy; Lucerne, Switzerland; and Colmar, France. It was a trip of a lifetime! We had the best tour guide, "Silke" from East Berlin. She was amazing! She had every detail of our trip organized. From bathroom breaks to tour itinerary times. She made us feel safe throughout the whole trip. She gave us a history lesson for every sight, plus her personal experience which was very informative. Also as great, was our bus driver, Michal. He was the best driver ever. We felt very safe and he was accommodating to everyone. The bus, by the way was a luxury bus, and very comfortable! Silke and Michal became part of our "family" for the entire 10 day tour. It was sad to leave them! Our hotels were basic but very clean and safe (in a safe area also) and had a charm of their own that matched the region we stayed in. The food that was included in the trip was also good. We had a very pleasant experience. I feel so blessed to go on this trip that I got to share with my daughter and school group. I would highly recommend EF Tours! I can't imagine going on a trip like this without them. I would have no clue where to go. Don't hesitate to book with EF Tours!

Grace Christian School with our EF Tour leader, Silke!

Our family has used EF tours via my kid's schools twice and never really had any major issues with them. I love that they offer interest free payment plans for the trips and they have detailed itineraries from start to finish so you don't have to plan anything on your own! Plane tickets, hotel stay, transportation, breakfast and dinner are all included . Tour guides that have been assigned were all awesome. My only issue would be the hotel and food selections on some days that they selected could be so much better given the price paid.

84 other reviews that are not currently recommended

PreFlight Airport Parking

2.7 miles away from EF Educational Tours

Mariani D. said "I wrote a review a few months ago, but apparently it got lost in cyberspace. The reason why I even bothered to check my review again was because the driver who picked me up yesterday was the main reason why I wrote the review in the…" read more

in Airport Shuttles, Parking

Bygone Excursions

At Bygone Excursions, we believe in celebrating local culture and supporting small businesses. Our meticulously curated tours offer an intimate group experience like no other. Here’s what you can expect: 1. Personalized Tours: Each… read more

in Car Rental, Historical Tours, Wine Tours

Collections Including EF Educational Tours

By Alice M.

People Also Viewed

EF/GoAhead Tours

Odysseys Unlimited

Great Food Tours

EF Explore America

McGinn Bus Company

ACIS Educational Tours

EF Go ahead Tours

Durgan Travel Service

Best of Cambridge

Things to do in Cambridge

People found EF Educational Tours by searching for…

Tour Companies Cambridge

Browse Nearby

Restaurants

Arts & Entertainment

Bike Rentals

Whale Watching

Other Places Nearby

Find more Historical Tours near EF Educational Tours

Find more Travel Services near EF Educational Tours

Find more Walking Tours near EF Educational Tours

Related Cost Guides

Town Car Service

- WASHINGTON DC

- NEW YORK CITY

- PHILADELPHIA

- WILLIAMSBURG

- COLLEGE CAMPUS TOURS

- TALLAHASSEE

- SAN FRANCISCO

- QUÉBEC CITY

- Washington DC

- Presidential Inauguration DC 2021

- New York City

- Philadelphia

- Québec City

- Williamsburg

- Chattanooga

- Tallahassee

- Costa Rica, Pura Vida!

- Evening Parent Info-Session

- GO – Travel Scholarships

- School Trip Destination Posters

- Air & Space Museum Scavenger Hunt

- GO’s Report Card

- School Trip Packing List

- Trip Portal

- Travel Insurance Coverage

- Trip Cancellation

- Back To School Specials

- Destination Posters

- CFAR – Cancel For Any Reason Trip Coverage

- Travel Insurance

- Daily Safety Review

- We’re Hiring

- Vendor/Partners

- Privacy Policy

- Terms & Conditions

- Liability Insurance

- Travel Documents

- Accommodations

- Motorcoach Safety

- Plan a Trip

- Default HubSpot Blog

GO Educational Tours Blog

Below is a list of all the blog posts you are posting that your visitors might be interested in...

Best School Trip Company

Choosing the best school trip company is the first step to a memorable travel experience for your students.

Many factors go into creating a successful educational tour for middle and high school students.

Here are some of the reviews and comments we've received over the years. Some mention our professionalism and others about their experience on the trip. Each organizer has different approach and we adapt to these needs for all our groups.

"GO Education Tours is a great company to work with. They are flexible with the needs of your group as well as take on any stressful situations that occur while you are on the trip...The personalized service is key to us. We know what we are getting when we book with GO Education Tours each time. They work with us to make the trip successful and affordable for our kids."

Sandra in Kentucky mentions,

"I wanted to let you know our trip to DC was fantastic! The students had a great time and [our GO Leader] did an excellent job as our guide, her expertise, professionalism and her impressive historical knowledge were remarkable! She went out of her way to encourage and motivate our students, plus extended respect to each of us. Thank you for your assistance and for allowing us to see Washington DC with you!"

Amy from Connecticut:

"Thanks so much for another great trip! As always, you and your staff were wonderful and the kids had an amazing experience.

Thanks for all you do."

Karen from Tampa,

"Every time I think about all of the things you did to make our trip to DC so amazing and memorable, you do something else above and beyond. Lori and I both agree we would never do any student travel with anyone else because nothing could compare to the experience we had."

Matt from Vermont,

"There is a clear professionalism and excellent service. They were easy to communicate with and helpful in all phases of the trip. Our GO Leader was flexible with timing and used his knowledge of the area to manipulate our schedule effectively. He put pieces in and adjusted times thoughtfully and seamlessly."

As we you can we work very hard at being on e of the best school trip companies with every trip. Passion and dedication and having a lot of fun is what we do" Travel-Engage-Learn - Experience.

Topics: School Trip Companies , School trips , class trips

Leave Comment

Subscribe our blog, most popular, post by topic.

- School trips (93)

- GO Educational Trips (78)

- Washington DC (56)