- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

6 Best Travel Cards for Greece

Getting an international travel card before you travel to Greece can make it cheaper and more convenient when you spend in Euro. You'll be able to easily top up your card in USD before you leave the US, to convert seamlessly to EUR for secure and flexible spending and withdrawals.

This guide walks through our picks of the best travel cards available for anyone from the US heading to Greece, like Wise or Revolut. We'll walk through a head to head comparison, and a detailed look at their features, benefits and drawbacks.

6 best travel money cards for Greece:

Let's kick off our roundup of the best travel cards for Greece with a head to head comparison on important features. Here's an overview of the providers we've picked to look at, for customers looking for ways to spend conveniently overseas when travelling from the US:

Each of the international travel cards we’ve picked out have their own features and fees, which may mean they suit different customer needs. Keep reading to learn more about the features, advantages and disadvantages of each - plus a look at how to order the travel card of your choice before you head off to Greece.

Wise travel card

Open a Wise account online or in the Wise app, to order a Wise travel card you can use for convenient spending and withdrawals in Greece. Wise accounts can hold 40+ currencies, so you can top up in USD easily from your bank or using your card. Whenever you travel, to Greece or beyond, you’ll have the option to convert to the currency you need in advance if it’s supported for holding a balance, or simply let the card do the conversion at the point of payment.

In either case you’ll get the mid-market exchange rate with low, transparent fees whenever you spend in EUR, plus some free ATM withdrawals every month - perfect if you’re looking for easy ways to arrange your travel cash.

Wise features

Wise travel card pros and cons.

- Hold and exchange 40+ currencies with the mid-market rate

- Spend seamlessly in EUR when you travel

- Some free ATM withdrawals every month, for those times only cash will do

- Ways to receive payments to your Wise account conveniently

- Manage your account and card from your phone

- 9 USD delivery fee for your first card

- ATM fees apply once you've exhausted your monthly free withdrawals

- Physical cards may take 14 - 21 days to arrive

How to apply for a Wise card

Here’s how to apply for a Wise account and order a Wise travel card in the US:

Open the Wise app or desktop site

Select Register and confirm you want to open a personal account

Register with your email, Facebook, Apple or Google ID

Upload your ID document to complete the verification step

Tap the Cards tab to order your card

Pay the one time 9 USD fee, confirm your mailing address, and your card will be on the way, and should arrive in 14 - 21 days

Revolut travel card

Choose a Revolut account, from the Standard plan which has no monthly fee, to higher tier options which have monthly charges but unlock extra features and benefits. All accounts come with a smart Revolut card you can use in Greece, with some no fee ATM withdrawals and currency conversion monthly, depending on the plan you pick. Use your Revolut account to hold and exchange 25+ currencies, and get extras like account options for under 18s, budgeting tools and more.

Revolut features

Revolut travel card pros and cons.

- Pick the Revolut account plan that suits your spending needs

- Hold and exchange 25+ currencies, and spend in 150 countries

- Accounts come with different card types, depending on which you select

- All accounts have some no fee currency exchange and some no fee ATM withdrawals monthly

- Some account tiers have travel perks like complimentary or discounted lounge access

- You need to upgrade to an account with a monthly fee to get all account features

- Delivery fees may apply for your travel card

- Fair usage limits apply once you exhaust your currency conversion and ATM no fee allowances

- Out of hours currency conversion has additional fees

How to apply for a Revolut card

Set up your Revolut account before you leave the US and order your travel card. Here’s how:

Download and open the Revolut app

Register by adding your personal and contact information

Follow the prompts to confirm your address and order your card

Pay any required delivery fee - costs depend on your account type

Chime travel card

Use your Chime account and card to spend in Greece with no foreign transaction fee. You’ll just need to load a balance in USD and then the money is converted to EUR instantly with the Visa rate whenever you spend or make a withdrawal. There’s a fee to make an ATM withdrawal out of network, which sits at 2.5 USD, but there are very few other costs to worry about. Plus you can get lots of extra services from Chime if you need them, such as ways to save.

Chime features

Chime travel card pros and cons.

- No Chime foreign transaction fees

- No ongoing charges for your account

- Lots of extra products and services if you need them

- Easy ways to manage your money online and in app

- Virtual cards available

- You'll need to inform Chime you're traveling to use your card abroad

- Low ATM limits

- Cards take 7 - 10 days to arrive by mail

How to apply for a Chime card

Here’s how to apply for a Chime account and order a travel card in the US:

Visit the Chime website or download the app

Click Get started and add your personal details

Add a balance

Your card will be delivered in the mail and you can use your virtual card instantly

Monzo travel card

Monzo cards can be ordered easily in the US and used for spending in Greece and globally. Monzo accounts are designed for holding USD only - but you can spend in EUR and pretty much any other currency easily, with no foreign transaction fee. Your funds are just converted using the network exchange rate whenever you pay or make a withdrawal.

Monzo doesn’t usually apply ATM fees, but it’s worth knowing that the operator of the specific ATM you pick may have their own costs you’ll need to check out.

Monzo features

Monzo travel card pros and cons.

- Good selection of services available

- No foreign transaction fee to pay

- No Monzo ATM fee to pay

- Manage your card from your phone conveniently

- Deposits are FDIC protected

- You can't hold a foreign currency balance

- ATM operators might apply their own fees

How to apply for a Monzo card

Here’s how to apply for a Monzo account and order a travel card in the US:

Visit the Monzo website or download the app

Click Get Sign up and add your personal details

Check and confirm your mailing address and your card will be delivered in the mail

Netspend travel card

Netspend has a selection of prepaid debit cards you can use for spending securely in Greece. While these cards don’t usually let you hold a balance in EUR, they’re popular with travelers as they’re not linked to your regular checking account. That increases security overseas - plus, Netspend offers virtual cards you can use to hide your physical card details from retailers if you want to.

The options with Netspend vary a lot depending on the card you pick. Usually you can top up digitally or in cash in USD and then spend overseas with a fixed foreign transaction fee applying every time you spend in a foreign currency. You’ll be able to view the terms and conditions of your specific card - including the fees - online, by entering the code you’ll find when your card is sent to you.

Netspend features

Netspend travel card pros and cons.

- Large selection of different card options depending on your needs

- Some cards have no overseas ATM fees

- Prepaid card which is secure to use overseas

- Manage your account in app

- Change from one card plan to another if you need to

- You may pay a monthly fee for your card

- Some cards have foreign transaction fees for all overseas use, which can be around 4%

- Selection of fees apply depending on the card you pick

How to apply for a Netspend card

Here’s how to apply for a Netspend account and order a travel card in the US:

Visit the Netspend website

Click Apply now

Complete the details, following the onscreen prompts

Get verified

Your card will arrive by mail - add a balance and activate it to get started

PayPal travel card

PayPal has a debit card you can link to your PayPal balance account, to spend in Greece as well as locally, in person and online. One advantage of PayPal is that there are lots of easy ways to add money in USD - but bear in mind that when you spend in EUR you’ll likely pay a foreign transaction fee of 2.5%. ATM fees apply when you make out of network withdrawals, too, which can push up the costs depending on how you use your card.

PayPal travel cards aren’t connected to your checking account which makes them a handy and secure way to spend, particularly if you already have a PayPal balance account.

PayPal features

Paypal travel card pros and cons.

- Globally accepted card

- Easy ways to top up your PayPal balance including cash and check

- Popular and reliable provider

- Use your card for spending online easily as well

- 2.5 USD fee for out of network ATM withdrawals

- 2.5% fee when you spend in a foreign currency

- Other charges may apply depending on how you fund and use your account

How to apply for a PayPal card

Here’s how to apply for a PayPal account and order a travel card in the US:

Visit the PayPal website or download the app

Click Get Sign up or log into your existing account

Add your personal details to create an account, or tap Request a card if you already have a PayPal account

Follow the prompts to order your card

What is a travel money card?

A travel money card is a card you can use for secure and convenient payments and withdrawals overseas.

You can use a travel money card to tap and pay in stores and restaurants, with a wallet like Apple Pay, or to make ATM withdrawals so you'll always have a bit of cash in your pocket when you travel.

Although there are lots of different travel money cards on the market, all of which are unique, one similarity you'll spot is that the features and fees have always been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees for common international transactions like ATM withdrawals.

Travel money cards also offer distinct benefits when it comes to security. Your travel money card isn't linked to your United States Dollar everyday account, so even if you were unlucky and had your card stolen, your primary bank account remains secure.

Travel money vs prepaid card vs travel credit card

It's helpful to know that you'll be able to pick from several different types of travel cards, depending on your priorities and preferences. Travel cards commonly include:

- Travel debit cards

- Travel prepaid cards

- Travel credit cards

They all have distinct benefits when you head off to Greece or elsewhere in the world, but they do work a bit differently.

Travel debit and prepaid cards are usually linked to an online account, and may come from specialist digital providers - like the Wise card. These cards are usually flexible and cheap to use. You'll be able to manage your account and card through an app or on the web.

Travel credit cards are different and may suit different customer needs. As with any other credit card, you may need to pay an annual fee or interest and penalties depending on how you manage your account - but you could also earn extra rewards when spending in a foreign currency, or travel benefits like free insurance for example. Generally using a travel credit card can be more expensive compared to a debit or prepaid card - but it does let you spread out the costs of your travel across several months if you'd like to and don't mind paying interest to do so.

What is a prepaid travel money card best for?

Let's take a look at the advantages of using a prepaid travel money card for travellers going to Greece. While each travel card is a little different, you'll usually find some or all of the following benefits:

- Hold and exchange foreign currencies - allowing you to lock in exchange rates and set a travel budget before you leave

- Convenient for spending in person and through mobile wallets like Apple Pay, as well as for cash withdrawals

- You may find you get a better exchange rate compared to your bank - and you'll usually be able to avoid any foreign transaction fee, too

- Travel cards are secure as they're not linked to your everyday USD account - and because you can make ATM withdrawals when you need to, you can also avoid carrying too much cash at once

Overall, travel cards offer flexible and low cost ways to avoid bank foreign transaction and international ATM fees, while accessing decent exchange rates.

How to choose the best travel card for Greece

We've picked out 6 great travel cards available in the US - but there are also more options available, which can make choosing a daunting task. Some things to consider when picking a travel card for Greece include:

- What exchange rates does the card use? Choosing one with the mid-market rate or as close as possible to it is usually a smart plan

- What fees are unavoidable? For example, ATM charges or top up fees for your preferred top up methods

- Does the card support a good range of currencies? Getting a card which allows you to hold and spend in EUR can give you the most flexibility, but it's also a good idea to pick a card with lots of currency options, so you can use it again in future, too

- Are there any other charges? Check in particular for foreign transaction fees, local ATM withdrawal fees, inactivity fees and account close fees

Ultimately the right card for you will depend on your specific needs and preferences.

What makes a good travel card for Greece

The best travel debit card for Greece really depends on your personal preferences and how you like to manage your money.

Overall, it pays to look for a card which lets you minimise fees and access favourable exchange rates - ideally the mid-market rate. While currency exchange rates do change all the time, the mid-market rate is a good benchmark to use as it’s the one available to banks when trading on wholesale markets. Getting this rate, with transparent conversion fees, makes it easier to compare costs and see exactly what you’re paying when you spend in EUR.

Other features and benefits to look out for include low ATM withdrawal fees, complimentary travel insurance, airport lounge access or emergency cash if your card is stolen. It’s also important to look into the security features of any travel card you might pick for Greece. Look for a card which uses 2 factor authentication when accessing the account app, which allows you to set instant transaction notifications, and which has easy ways to freeze, unfreeze and cancel your card with your phone.

For Greece in particular, choosing a card which offers contactless payments and which is compatible with mobile wallets like Apple Pay could be a good plan. Card payments are extremely popular in Greece - so having a card which lets you tap and pay easily can speed things up and make it more convenient during your trip.

Ways to pay in Greece

Cash and card payments - including contactless, mobile wallet, debit, credit and prepaid card payments - are the most popular ways to pay globally.

In Greece card payments are common in most situations. You’ll be able to make Chip and PIN or contactless payments or use your favourite mobile wallet like Apple Pay to tap and pay on the go. It’s still worth having a little cash on you just in case - and for the odd situations where cash is more convenient, such as when tipping or buying a small item in a market.

Which countries use EUR?

If you have EUR, you should be able to use it in a few countries. You may decide to keep your travel card topped up with a balance for this trip to Greece or for the next time you’re headed somewhere which uses EUR.

What should you be aware of when travelling to Greece

You’re sure to have a great time in Greece - but whenever you’re travelling abroad it's worth putting in a little advance thought to make sure everything is organised and your trip goes smoothly. Here are a few things to think about:

1. Double check the latest entry requirements and visas - rules can change abruptly, so even if you’re been to Greece before it’s worth looking up the most recent entry requirements so you don’t have any hassle on the border

2. Plan your currency exchange and payment methods - you can change USD to EUR before you travel to Greece if you’d like to, but as card payments are common, and ATMs widely available, you can actually leave it until you arrive to get everything sorted as long as you have a travel money card. Top up your travel money card in USD and either exchange to EUR in advance or at the point of payment, and make ATM withdrawals whenever you need cash. Bear in mind that currency exchange at the airport will be expensive - so hold on until you reach Greece to make an ATM withdrawal in EUR if you can.

3. Get clued up on any health or safety concerns - get travel insurance before you leave the US so you have peace of mind. It’s also worth reading up on any common scams or issues experienced by tourists. These tend to change over time, but may include things like rip off taxis or tour agents which don’t offer fair prices or adequate services.

Conclusion - Best travel cards for Greece

Ultimately the best travel card for your trip to Greece will depend on how you like to manage your money. Use this guide to get some insights into the most popular options out there, and to decide which may suit your specific needs.

How does a Euro card work?

Getting a Euro card can make managing your money easier when you travel to Greece.

Your Euro card will be linked to a digital account you can manage from your phone, so you'll always be able to see your balance, get transaction notifications and manage your card no matter where you are. Just add money to your account in pounds, and - depending on your preferences and the specific card you pick - you can either convert your balance to Euro instantly, or just let the card do the conversion when you spend or make a withdrawal.

If your card gives you the option to hold a Euro balance, there's not normally any extra fee to spend the Euro you have in your account when you're in Greece.

Can I withdraw Euro currency with my card in Greece?

With some cards, you'll be able to add money to your card in United States Dollar, and then convert to Euro instantly online or in your card's app.

Once you have a balance in Euro you can spend with your card with no extra fees - just tap and pay as you would at home. You'll also be able to make cash withdrawals whenever you need to, with no extra conversion fee to pay. Your card - or the ATM operator - may charge a withdrawal fee, but this can still be a cheap, secure and convenient option for getting cash when you need it.

With other cards, you can't hold a balance in Euro on your card - but you can leave your money in United States Dollar and let the card convert your money for you when you spend and withdraw.

Some fees may apply here - including currency conversion or foreign transaction charges - so do compare a few different cards before you sign up, to make sure you're picking the one which best suits your specific spending needs.

Bear in mind though, that not all cards support all currencies - and the range of currencies available with any given card can change from time to time. If your card doesn't let you hold a balance in Euro you might find that fees apply when you spend in Greece, so it's well worth double checking your card's terms and conditions - and comparing the options available from other providers - before you travel, just in case.

Why should I get a Euro card?

Getting a Euro card means you can spend like a local when you're in Greece. You'll be able to check your Euro balance at a glance, add and convert money on the move, and use your card for secure spending and withdrawals whenever you need to. Best of all, Euro cards from popular providers often offer good exchange rates and low, transparent fees, which can mean your money goes further when you're on a trip abroad.

FAQ - best travel cards for Greece

When you use a travel money card you may find there’s an ATM withdrawal fee from your card issuer, and there may also be a cost applied by the ATM operator. Some of our travel cards - like the Wise and Revolut card options - have some no fee ATM withdrawals every month, which can help keep down costs.

Travel money cards may be debit, prepaid or credit cards. Which is best for you will depend on your personal preferences. Debit and prepaid cards are usually pretty cheap and secure to spend with, while credit cards may have higher fees but often come with extra perks like free travel insurance and extra reward points.

There’s no single best prepaid card for international use. Look out for one which supports a large range of currencies, with good exchange rates and low fees. This guide can help you compare some popular options, including Wise, Revolut and Monzo.

Yes, you can use your local debit card when you’re overseas. However, it’s common to find extra fees apply when spending in foreign currencies with a regular debit card. These can include foreign transaction fees and international ATM charges.

Usually having a selection of ways to pay - including a travel card, your credit or debit card, and some cash - is the best bet. That means that no matter what happens, you have an alternative payment method you can use conveniently.

Yes. Most travel debit cards have options to make ATM withdrawals. Check the fees that apply as card charges do vary a lot. Some cards have local and international fees on all withdrawals, while others like Wise and Revolut, let you make some no fee withdrawals monthly before a fee kicks in.

Both Visa and Mastercard are globally accepted. Look out for the logo on ATMs and payment terminals in Greece.

The cards you see on this page are ordered as follows:

For card providers that publish their exchange rates on their website, we used their USD / EUR rate to calculate how much Euro you would receive when exchanging / spending $4,000 USD. The card provider offering the most EUR is displayed at the top, the next highest below that, and so on.

The rates were collected at 09:36:26 GMT on 25 May 2024.

Below this we display card providers for which we could not verify their exchange rates. These are displayed in alphabetical order.

Send international money transfer

More travel card guides.

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

The 6 Best Travel Money Cards for Greece 2024

Greece is an easily accessible travel destination from the UK which has loads to offer, whether you’re into history and culture, food and drink, beachside getaways or party vibes. Plus, using a travel debit, prepaid or credit card can help cut the overall costs of spending in euros so you can do more while you’re in Greece.

Different travel money cards have their own benefits and drawbacks. Join us as we look through your key travel money card options, and introduce a couple of our favourites from each category so you can see if any suit your preferences and needs.

Wise - our pick for travel debit card for Greece

Wise accounts can hold and exchange 40+ currencies, and you can get a linked Wise card for a one time delivery fee. Top up your account in GBP and switch to EUR before you travel. All currency conversion uses the mid-market exchange rate, with low fees from 0.41%. Here are some of the pros and cons of the Wise travel money debit card, to help you decide if it’s right for you.

Hold and exchange 40+ currencies , including GBP-EUR

No fee to spend any currency you hold, low conversion fees from 0.41%

Mid market exchange rate on all currency conversion

Some fee free ATM withdrawals every month

No ongoing fees and no interest to pay

7 GBP delivery fee

No option to earn points or rewards

Click here to read a full Wise review

What is a travel money card?

A travel money card is a debit or credit card that’s been optimised to help you cut costs whenever you spend in foreign currencies.

Depending on the specific card you pick, you could hold a balance in euros and multiple other currencies, benefit from low or no foreign transaction fees, or get cash back and rewards for spending and withdrawals overseas. Greece uses the euro which means as well as easy ways to spend, you could decide to get an account which lets you get paid flexibly by others in EUR, too.

This guide walks through the most common options for travel money cards for Greece and globally so you can pick the right one for you.

What are different types of travel cards?

We’ll walk through the features and benefits of a selection of different travel cards in a moment, but first it helps to know that most UK travel cards are one of the following card types:

Travel debit cards

Travel prepaid cards

Travel credit cards

Quick summary: Best travel cards for Greece

There’s no single best travel card for Greece, so the best one for you will depend on how you tend to transact, what you’ll be up to while you’re there, and whether or not you intend to use your card regularly in Greece or other overseas destinations. To help you weigh up some different options, we’ve included reviews of 2 of our favourite travel money cards from each category to help you choose. Here’s what we’ll be looking at:

Wise travel debit card : Hold 40+ currencies including EUR, with no ongoing fees, and spend with the mid-market exchange rate with no foreign transaction fee and low conversion costs from 0.43%

Revolut travel debit card : Hold 25+ currencies including EUR, in one of 4 different plan types, including some with no monthly fee, and some which comes with ongoing costs but which unlock more benefits and no fee transactions

Post Office travel money card : Hold EUR and 21 other currencies, with no fee to spend a currency you hold - 3% fee applies if you don’t have the currency required in your account

Monese travel money card : Hold a balance in GBP or EUR with some currency conversion available with no fees, up to your plan’s limit. Different plans on offer, including Simple which has no ongoing fees to pay

Barclays Rewards Visa travel credit card: Spend with the Visa exchange rate, and earn 0.25% cash back, with no foreign transaction fee and no cash advance fee. Interest and penalties can apply

Halifax Clarity Mastercard travel credit card: No foreign transaction fee, no annual fee, and no cash advance fee if you withdraw money at an ATM. Variable interest and penalties can apply

Travel money cards for Greece compared

Here’s a brief comparison of all the cards we’ve picked out - in a moment we’ll also look at each card in more detail.

Different travel money cards have their own features which makes them more suitable for different customer needs. If you want a low cost travel card you can use to hold, send, spend, and receive a really broad range of currencies as well as euros, the Wise travel debit card might suit you.

If you’d prefer a card which allows you to pick different subscription plans to unlock the specific features and benefits you need, it's worth looking at Revolut and Monese. Or if you want a credit card, we’ve got some smart travel credit cards coming up later too - great for spreading the costs of travel, as long as you don’t mind paying interest.

Travel Debit Cards for Greece

Travel debit cards from specialist providers come with their own digital multi-currency accounts which are managed online or through an app. Because EUR is a major global currency you’ll be able to find a travel debit card which lets you hold a balance in euros easily, and you can also choose an account with local bank details to get paid in EUR by others if you need it. Different cards have their own features and fees, but the good news is that there are several great options for EUR travel cards - let’s look at a couple in more detail:

Travel debit card option 1: Wise

There’s no fee to open a personal Wise account , but you’ll pay a one time card order fee of 7 GBP. After that there’s no minimum balance and no monthly charge. Wise accounts can support 40+ currencies for holding and exchange, with low fees from 0.43% when you convert currencies, and transparent ATM fees when you exhaust the monthly free transactions available with your account. Accounts come with local bank details for EUR so you can get paid easily.

No fee to open a personal Wise account, no minimum balance requirement

7 GBP one time fee to get your Wise card

2 withdrawals, to 200 GBP value per month for free, then 0.5 GBP + 1.75%

Hold 40+ currencies, convert between them with the mid-market rate

Get local account details to receive GBP, NZD, EUR, USD and a selection of other major currencies conveniently

Travel debit card option 2: Revolut

Revolut has a selection of different account tiers for personal customers in the UK, including Standard plans with no monthly fee, to the top end Ultra plan which has a 45 GBP/month fee and comes with loads of perks including a fancy platinum plated card. You can hold around 25 currencies, and convert currencies with the mid-market rate to your plan’s allowance. The higher account tiers also come with extras like various different forms of complimentary insurance, discounts, cash back opportunities and travel benefits.

No monthly fee for a Standard Revolut account, or upgrade to one of 4 different account plans which have monthly fees running from 3.99 GBP/month to 45 GBP/month

All accounts have some no fee weekday currency conversion with fair usage fees after that which are 1% for Standard plan holders

Standard plan holders can withdraw 200 GBP overseas per month for free

Hold around 25 currencies

Pros and cons of using debit travel cards in Greece

How much does a travel debit card cost.

Using a travel debit card can mean you pay less overall when you’re spending in euros - but it’s not usually completely free. You’ll need to check through your preferred card fee schedule before you sign up, particularly looking at transaction fees and limits, and monthly costs.

The good news is that you can select the provider and card that works best for you easily. Wise has a one time fee to get your card, but then no monthly charges or minimum balance requirements. Revolut customers in the UK can choose from different account plans, including one with no ongoing charges, or several different account options with a monthly fee in exchange for extra perks and benefits.

How to choose the best travel debit card for Greece?

There’s no single best travel debit card for Greece. If you travel in Europe or elsewhere often it might be worth considering a travel debit card which supports a good variety of currencies as well as EUR, with no ongoing charges, like the Wise card or the Standard Revolut card, to try out whether or not a travel debit card suits you.

Is there a spending limit with a travel debit card in Greece?

You’ll probably find there’s a spending limit for your travel debit card. However, this limit can vary quite significantly, depending on the provider you pick. You can also usually adjust your spending limits for security in the provider’s app which means you can set the limit you’re comfortable with.

For the providers mentioned above, Revolut UK travel debit card holders have some spending caps based on merchant and transaction type. This applies to things like sending money to others, buying travellers cheques or money orders, and betting. Wise caps monthly card spending at 30,000 GBP but you can also move your limit lower if you’d like to, for security reasons.

ATM withdrawals

ATM withdrawals with a travel debit card are also likely to be subject to limits. Revolut applies a 3,000 GBP limit based on any given 24 hour period. Wise ATM withdrawal limits are 4,000 GBP per month. Both providers allow you to make some no fee ATM withdrawals monthly, but the exact amount you can withdraw will depend on your account type.

Prepaid Travel Cards for Greece

Prepaid travel cards from a non-bank provider like the Post Office or Monese offer multi-currency balance options, which usually cover euros. Prepaid cards need topping up in advance of travel, and can have quite different fee structures compared to a travel debit card. Let’s look at these options in more detail.

Prepaid travel card option 1: Post Office Travel Money Card

You can order a Post Office Travel Money Card online or pick one up in person at a branch as long as you have a valid ID on you. You’ll be able to top up and hold in 22 currencies, although bear in mind a fee applies if you add money in GBP. There’s no fee to add foreign currencies. The exchange rate used when you top up or convert may include a markup, but once you hold a currency balance in your account you can spend it with no further charges.

EUR and 21 other currencies are supported for holding and exchange

No fee to spend a currency you hold on your card

3% cross border fee if you spend in an unsupported currency

2 EUR ATM withdrawal fee

Manage your account and card from the Post Office travel money app

Prepaid travel card option 2: Monese Travel Money Card

Monese offers several different account plans which come with linked cards you can use while overseas. Depending on the plan you pick you’ll get some free international spending and some free ATM withdrawals. Simple account plans have no monthly fees, but are more limited in terms of no-fee transactions compared to the other account tiers. While Monese does offer foreign currency account plans, these are not available in AUD.

- Pick the account plan that suits your needs, including a Simple plan with no monthly costs and some plans which do have a fee to pay every month

- Accounts offered in GBP, EUR and RON

- Simple account plan holders can spend up to 2,000 GBP a month in foreign currencies with no fees - other account plans have unlimited overseas spending with no extra fees

- All accounts have some fee free ATM withdrawals every month, with variable limits based on account plan

- Virtual cards available

Pros and cons of using prepaid travel cards in Greece

How much does a prepaid card cost.

Prepaid travel cards fees can include monthly maintenance fees, currency conversion charges, top up costs, and account dormant fees. If you choose the Post Office card, there’s a fee of 3% to spend in a currency you don’t hold in your account, while some Monese cards only offer a limited amount of no fee foreign currency spending, depending on the account plan you pick. Weighing up a few different prepaid travel cards is the only way to decide which is the best value for your particular needs.

How to choose the best travel prepaid card for Greece?

There is no single best prepaid travel card for Greece. That means you’ll need to shop around and compare a few to find the best fit for your needs and preferences. The good news is that because EUR is a common currency, there are quite a few travel card options out there, so you’re sure to find a good match with a little research.

Prepaid travel card spending limit

The Post Office travel card lets you top up to 5,000 GBP at a time, with the maximum balance at any given time set at 10,000 GBP, or 30,000 GBP annually. Monese accounts may have different limits based on the tier you pick - usually set at a maximum holding balance at any time of 40,000 GBP. You may be limited to spending up to 7,000 GBP a day, depending on your account type.

With the Post Office card, you can make up to 450 EUR maximum daily withdrawals and each withdrawal costs 2 EUR. Monese accounts may have a maximum ATM withdrawal of 300 GBP a day, depending on the specific account you pick, so it’s worth reading the fee schedule carefully to understand the details.

Travel credit cards for Greece

Travel credit cards have been optimised for travel and can offer perks like no foreign transaction fee or more rewards and cash back for overseas spending. If you prefer to spend on a credit card while you’re on holiday you could get a slightly lower overall cost with a travel credit card which offers network exchange rates with no foreign transaction fees, and no annual fee. Bear in mind though that while credit cards can be safe and convenient, interest and penalty costs mean that they’re often more expensive than a debit or prepaid card.

Travel credit card option 1: Barclaycard Rewards Visa

The Barclaycard Rewards Visa credit card is a good, straightforward option for UK customers looking for a credit card which does not have foreign transaction fees, and which doesn’t have an annual fee. As with any credit card, some costs can apply including interest fees if you don’t clear your bill monthly, but you’ll be able to earn 0.25% cash back on all your card spending at home and abroad.

No annual fee, with 0.25% cash back on card spending

Currency exchange uses the network rate and no foreign transaction fee

No ATM withdrawal fee - but interest can still apply

28.9% representative APR, with penalty fees for late payments

Secure spending with extra protection on some purchases

Travel credit card option 2: Halifax Clarity Mastercard

The Halifax Clarity Mastercard has a variable interest rate which is based on your creditworthiness, but doesn’t use different rates for different transaction types as some cards do. There’s no foreign transaction fee when you spend or withdraw in foreign currencies, but bear in mind that an ATM operator might charge a fee, and interest accrues instantly for cash advance transactions.

No foreign transaction fee when spending or making a cash withdrawal overseas

Interest applies instantly when making cash withdrawals

Same interest rate applies on all purchase categories

Variable APR based on your credit score - you’ll need to check your eligibility online to see the APR you’d be offered

Spending is covered by the Consumer Credit act which means extra protections for purchases from 100 GBP to 30,000 GBP in value

Pros and cons of using credit cards for Greece

How much does a travel credit card cost.

As with any credit card, you may find that you run into fees when you use a travel credit card. While the travel credit cards highlighted above have no annual charge, and no foreign transaction fee, interest applies if you don’t pay your bill in full every month. If you’re late making a payment, penalties can also apply. Consider carefully if using a credit card is right for you to avoid running up unexpected or unmanageable bills.

How to choose the best travel credit card for Greece?

There’s no single best travel credit card for Greece but choosing a card with no annual fee, and the lowest available interest rate is usually a smart plan, just in case you can’t always repay your bill monthly. If you can also get a card with some cash back or reward options that can also be attractive - although you’ll need to check that the rewards outweigh any costs you’ll incur.

Travel credit card spending limit

Your travel credit card spending limit will be set by the card provider, and will depend on your credit score. You’ll be shown details of your spending limit when you’re approved for a travel credit card.

The cards we’ve looked at earlier don’t charge a cash advance fee, but this is a common cost when using a credit card at an ATM, so worth looking out for when you select any credit card. It’s also worth noting that it’s very common for ATM withdrawals to start accruing interest instantly, so you’ll end up needing to repay some charges whenever you use your credit card in an ATM.

How much money do I need in Greece?

Greece has a massive tourism industry which means there are accommodation and food options for people on a budget, as well as anyone looking for a luxury getaway. That can make budget planning a bit tricky, and will mean you have to do some research into what you can get for your money wherever in Greece you’re heading. Here’s a quick look at some common costs in Greece:

Conclusion: Which travel money card is best for Greece?

Using a travel money card for your trip to Greece can help you to avoid unnecessary costs and make your money go further. However, there are several different card types and provider options, so you’ll need to shop around a bit to find the right card and account for you.

Consider a Wise travel debit card if you need ways to pay and get paid in EUR, with the mid-market rate and low fees. Or as an alternative, check out a Monese travel prepaid card which also supports holding euros, or a travel credit card like the Barclays Rewards Visa for cash back opportunities and ways to spread your costs over several months if you need to.

FAQ - Best travel cards for Greece

Can you withdraw cash with a credit card in greece.

Yes. You can use your credit card to make an ATM withdrawal at any ATM in Greece where your card network is accepted. However, bear in mind you’ll pay interest instantly when you use a credit card in an ATM. Choosing to withdraw with a low cost travel debit card from Wise or Revolut may bring down your overall fees.

Can I use a debit card in Greece?

Yes. Debit cards can be used in many places in Greece, although cash is still a popular option and you may struggle to pay by card at some independent merchants or at markets. Carrying a prepaid or travel debit card which you can use to pay with, or to make an ATM withdrawal to get some euros in cash if you need them is a smart plan.

Are prepaid cards safe?

Yes. Prepaid cards are not linked to your normal UK bank account which means that they’re safe to use. Even if you were unlucky and someone stole your card while you’re in Greece, they would not be able to access your main account - and you could freeze your prepaid card in the app easily if you needed to.

What is the best way to pay in Greece?

Paying for things with a specialist travel debit, prepaid or credit card in Greece is most convenient. However, having a few options for payment is a good plan, just in case your preferred payment method can’t be used for some reason. Consider getting a travel card from a provider like Wise or Revolut, which has some no fee ATM withdrawals so you can also conveniently get cash as a back up, and for when card payments aren’t offered.

Best ways to spend travel money in Greece: Debit and prepaid cards

Learn more about the best card to use, if you should use a uk debit card and other ways to take spending money to greece..

In this guide

Low cost travel money options for Greece

How many euros do i need to take to greece for a week, exchanging cash at greek banks, exchange rate history, travel card, debit card or credit card, things to consider before travelling to greece, buying euros in the uk, bottom line.

The country needs little introduction, but there are a million reasons to travel to Greece. It’s the very cradle of Western civilisation, offering mouth-watering food and best of all, a fantastic climate.

Best for cashback

- Rewards when you spend

- Interest when you don't

- No fees abroad from Chase

Promoted for switching incentive

- Open an account in minutes

- Tailored spend insights

- 24/7 award-winning service

Promoted for cashback

- Avoid fees abroad without switching banks

- Secure iOS & Android App

- No monthly fees

How we chose these accounts

Can i use my debit card in greece.

Generally speaking, yes. Most shops, restaurants and bars accept debit cards from UK banks, however some smaller businesses may not accept them and it would be worth taking cash too. Also be aware that your bank may charge overseas fees each time you make a transaction or withdraw money.

When you choose a debit card, currency conversion fees and foreign ATM transaction fees should be among the features you compare. Barclays, Lloyds, NatWest and other banks will charge a non-sterling transaction fee.

There are a number of banks and e-money providers with low or no overseas transaction charges.

Using a prepaid travel card

Travel cards allow you to load British pounds, and then transfer them to euros to spend in Greece. You can avoid currency conversion fees for purchases and ATM withdrawals, just watch out for reload fees and ATM fees (some travel cards waive these fees).

Travel money cards make sense in a place like Europe. With so many countries so close together all using the same currency, a travel card gives you the freedom to explore Greece and the rest of the European continent without needing to change currency.

Using a credit card

Look out for cards that don’t charge a currency conversion fee. If you only use your credit card to pay for over the counter purchases, use another type of card (debit or travel) to withdraw money from the ATM — cash withdrawals on credit are a quick way to end up in debt. If you pay your balance off each month to take advantage of interest-free days, credit cards can be a great travel money option for Greece.

Some credit cards give you complimentary travel and purchase protection insurance when you meet conditions too. A credit card is also a good idea to have as a backup for large or emergency purchases.

Using traveller’s cheques

Don’t worry about traveller’s cheques, the days of carrying a physical cheque are pretty much done. Credit, debit and travel card providers all give you a money back guarantee if you’ve genuinely been the victim of card fraud, such as skimming, and there are fewer places than ever where you can actually cash your cheques anyway.

Paying with cash in Greece

Greece is a nation of a thousand islands famous for history, hedonism, nature and nightlife. Given the current economic climate, take heed of the following:

ATMs running dry

Reports during the peak tourist season of ATMs running out of cash at the weekend, and not being restocked until mid-week, are common.

- Always have an emergency supply of cash with you in Greece, and a back-up card you can use over the counter in case.

- Don’t be afraid to try the ATMs that don’t have signs written in English. Often, especially during tourist season, ATMs with English signs will run out of money first, and, even if the machine is in Greek, when you insert a foreign card, the ATM display will usually pop up in English.

- Tip: Whether genuine or not, vendors in small shops that cater to tourists seemingly never have any change. If you are planning to purchase little souvenirs, presents or other bits and pieces, it’s better to take a collection of smaller denominations with you to avoid the ‘no-change situation’. You can change larger notes at banks, although even banks will sometimes be less than gracious about changing 500 euro notes.

Travellers frequently look for advice and estimates about the cost of a holiday in Greece, or want to know how much money they should take. The answer is relative. A holiday here can be very expensive if you’re in the mood for indulgence, but it can also be a great budget destination if you know how to do it.

Find out some typical Greek holiday prices

While there is no limit to the amount of cash you can bring into Greece, you must declare anything over 10,000 euros. Traveller’s cheques, bank bills, personal cheques and money orders are all considered ‘cash’. There are restrictions on the amount of money you can take out, but the majority of people don’t need to worry about this limit.

Banks tend to have the best exchange rates and are open from 8am to 2:30pm on weekdays. Come prepared for a wait though; long lines are a frequent occurrence here. Automatic foreign exchange machines are also a common feature in tourist centres, which offer a convenient and wait-free way to change your cash. But be advised: they charge a sizeable commission.

Greece has been through a period of instability as a result of the economic crisis, with fluctuations in deflation and inflation. The price of goods and services relative to the value of the currency is likely to change marginally in the future as the economy corrects itself. Brexit may also be having an effect on exchange rates and prices, so make sure you’re aware of what costs what.

*2024 average rate from 1 January to 24 March 2024.

Greece is a European Union member, and euros have been the official currency used since 2001. All travel cards will allow you to load and spend using euros. The advantage of a travel card is you avoid the fee for international transactions.

However, some debit cards and credit cards give you this feature too. If you’ve booked a holiday on a particular island that is a little more off the map, do a quick search before you go to see if it has an ATM. It will be a tiring first day if you need to take a boat back to the mainland so you can pay for your hotel or apartment.

Most digital banking apps , which are a great option owing to very low transaction and withdrawal fees, come with either a Visa or Mastercard bank card . They work as normal bank accounts do, so the “topping up” process simply consists of transferring money into the account.

- UK credit cards, debit cards and travel cards will work in Greece. The government has assured travellers capital control measures do not apply to transactions made with a debit or credit product issued in the UK.

- ATMs may be short of cash. It’s advised to take cash from the UK (pounds or euros) so you don’t run out.

- Take a combination of travel money options to Greece. A combination of cash, credit, debit or travel cards is the best approach.

Economic uncertainty is the word in Greece at the moment. Euros in your pocket when you land can give you peace of mind for the start of your trip. Your bank will be able to give you euros in cash, but have a look at our travel money providers to get the most competitive rates before buying your money.

A combination of travel money products is the best way to finance your Greek trip, especially since there may be times when you can’t get cash from an ATM. If this is the case, you’ll need to rely on making over the counter purchases — a no currency conversion card is best in this situation.

If you want to avoid paying ridiculous charges, never use your credit card at an ATM to get cash. This is a cash advance and there are fees and immediate interest charges to think about.

If you want to avoid charges altogether then you should definitely consider using a digital banking app, such as Starling, Revolut or N26. These apps offer zero fees on transactions and withdrawals in most if not all currencies, and can be managed easily from your phone. Not only can you save on the hassle of incurring charges, but you can also save yourself the stress of getting travel money. If you do choose this option, though, try not to misplace your phone.

Greece is a magical destination with much to discover for any kind of traveller. If you are planning a trip there, do some research, have a think about what kind of trip you would like and choose a travel money product that suits you.

We recommend taking multiple cards to give yourself peace of mind. Just a travel card or credit card often won’t cut it, so make sure you have a variety of options available to make the most of your trip.

We show offers we can track - that's not every product on the market...yet. Unless we've said otherwise, products are in no particular order. The terms "best", "top", "cheap" (and variations of these) aren't ratings, though we always explain what's great about a product when we highlight it. This is subject to our terms of use . When you make major financial decisions, consider getting independent financial advice. Always consider your own circumstances when you compare products so you get what's right for you. Most of the data in Finder's comparison tables has the source: Moneyfacts Group PLC. In other cases, Finder has sourced data directly from providers.

Charlie Barton

Charlie Barton was a publisher at Finder. He specialised in banking and investments products, including banking apps, current accounts, share-dealing platforms and stocks and shares ISAs. Charlie has a first-class degree from the London School of Economics, and in his spare time enjoys long walks on the beach. See full profile

More guides on Finder

Customers of the buy now, pay later (BNPL) service can no longer use it to buy items. But here’s why missing repayments can harm your credit.

Raspberry Pi recently went public with an initial public offering (IPO), listing on the London Stock Exchange (LSE) – here’s what we know so far and what might happen next.

Charles Schwab now offers a brokerage service to UK investors. Find out what Finder’s investing expert thought when testing and using this broker.

Find out the cost and car insurance group of BMW i3, and see how much you could pay based on age, location and model.

Are switching deals worth the stress these days? Here’s how to bag the most cash and keep your cool in the process.

A recent Freedom Of Information request made by the comparison site, Finder, has found that millions of people could be trapped in Help To Buy (H2B) ISAs, with nearly 2.2 million H2B ISAs currently open.

Full members can now redeem their Yonder points on any flight booking.

Advertising features from our award-winning team are finance like you’ve never seen it before. Here’s how it works.

Sponsored content from our award-winning team is finance like you’ve never seen it before. Here’s how it works.

Premium content with sponsorship is made by our award-winning team. It’s finance like you’ve never seen it before. Here’s how it works.

10 Responses

My son and his friend’s are going on their first holiday to Laganus in Zante. I don’t want them taking a lot of cash. Do the clubs and bars accept debit or travel money cards?

Thank you for getting in touch with Finder.

There are establishments in Laganas, Zante where they may see which cards are accepted but cash is generally preferred by the locals. ATMs are accessible since most of them are situated at most resorts or hotels or other popular and crowded places.

I hope this helps.

Thank you and have a wonderful day!

Cheers, Jeni

I’ve got a wedding in August 2019 for my daughter in Lindos, will I need to take cash? I was told last week that most restaurants only want cash.

Hello Danny,

Thank you for your comment.

Upon checking, recent reviews on using cards in most restaurants in Lindos confirm that they accept cards. There may be other merchants that do not accept cards so best to also bring cash for back up.

Should you wish to have real-time answers to your questions, try our chat box on the lower right corner of our page.

Regards, Jhezelyn

I’m off to Paxos with my family in April 2019. Do you know if there are ATMs on the island?

Hello Michael,

As per reviews, you are recommended to use cash in Paxos. You’ll be able to withdraw from two machines in Gaios and one in Lakka. Some of the restaurants in Paxos accepts credit cards but it is still preferred to use cash.

Hi I’m going to Corfu in September 2018 do you advise me to take euro’s with me or get them in Corfu this is my first time going to Greece Thank you

Thank you for reaching out to finder.

While we are unable to give advise, you may take into consideration these helpful information in deciding what will work for you.

If you are comfortable carrying large amount of cash (Euros) with you, please keep in mind that although there is no limit with the amount of money you can bring to Greece, you need to declare anything over 10,000 Euros. Also, when bringing large amount of money, make sure you have a proper storage like a safety box for safekeeping your money during your entire trip. On the other hand, when you exchange your money before leaving, you don’t have to look for banks or money exchange facilities where you can get the best exchange rates when you get there.

Aside from bringing Euros, one option you can look at is using ATM machines. This can be a convenient way to withdraw money whenever you need it and as you go. However, charges may apply which varies from bank to bank. Please note that ATM machines may run out of cash especially during peak tourist season so it’s always good to have backup like credit cards or travel cards in case of emergencies.

Hope this helps. Enjoy your trip!

Cheers, Charisse

I have recently recieved euros for my holiday but they have sent me a lot of 50s and 100s euro notes Is there anywhere I can change them for smaller notes(I’m in the UK)?

Thank you for getting in touch with finder.

For your 50 and 100 notes some hotels are still accepting them so you may keep some of them. You may try your luck exchanging them in some banks around you and please don’t forget some documents.

Probably best to take them to a bank next time you are in a euro-zone country, although depending on how many you have there and might be some searching questions as to their provenance.

Have a great day!

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Real Greek Experiences

Greek Culture, Travel Information, Itineraries, Life in Greece

Buying A SIM Card In Greece – Best Options For 2024

Everything you need to know about the best prepaid SIM card you can buy in Greece. Includes information on local operators in Greece, where to buy a Greece SIM card, what documents you need, available data packages and more.

How to buy a SIM Card for Greece

Where can I get a Greece SIM card? Tourists and expats traveling to Greece ask this question all the time, as they want to get a Greece SIM card for mobile broadband as soon as they arrive.

It’s hardly surprising! These days, it’s super important to stay connected with friends and relatives around the world. Not to mention posting all the amazing Greece photos from your holiday 🙂

This guide to the prepaid SIM cards you can get for Greece is here to help. It includes information on:

- the main providers in Greece

- the various SIM plans and packages each provider offers

- what documents you need to get a new SIM

- where to get your Greek SIM card – stores, street vendors, the Athens airport

- activating your SIM card and buying bundles

- coverage, 4G and 5G in Greece

- eSIM and tourist SIM information

- why contract phones are not worth it, even if you are living in Greece.

Greece prepaid SIM card providers

There are three local providers in Greece: Cosmote , Vodafone Greece and Nova , formerly known as Wind. Each of these companies offer several types of prepaid SIM cards.

If you are only here for a few days or weeks, any Pay As You Go Greek SIM card you buy will be fine. Whichever operator you choose, your SIM will usually work well at popular destinations such as Athens , Santorini or Mykonos .

Generally speaking though, Cosmote has the best network coverage around Greece. So if you are planning to do lots of traveling in Greece, the best SIM card to get is probably Cosmote.

My top suggestion for the best Greek prepaid card to buy would be Cosmote Frog – if you can find it. This is the best SIM deal for Greece. Alternatively, go for either Cosmote WhatsUp, or Vodafone CU.

I have included more info on all these SIM cards later on in the article.

Greece SIM vs EU SIM

If you already have an SIM card from any EU country, there are no roaming charges. So, there is no real reason to get a Greek SIM if you are only here for a short time, unless you need a local phone number.

To be honest, most SIM cards from the EU (and often the UK) are better value than the Greek ones. Just make sure you are familiar with your provider’s fair usage policy. Plus, note that your EU SIM might not work perfectly everywhere.

Greece SIM vs overseas SIM

In my opinion, if you are visiting from outside the EU, you should definitely get a local SIM. Your provider (e.g. Verizon or T Mobile in the USA) will likely have overseas data plans. However, these will always be a lot more expensive, and may even end up in unexpected costs.

Also, while WiFi is very common in Greece, there will always be a time that you desperately need the Internet and it won’t be available.

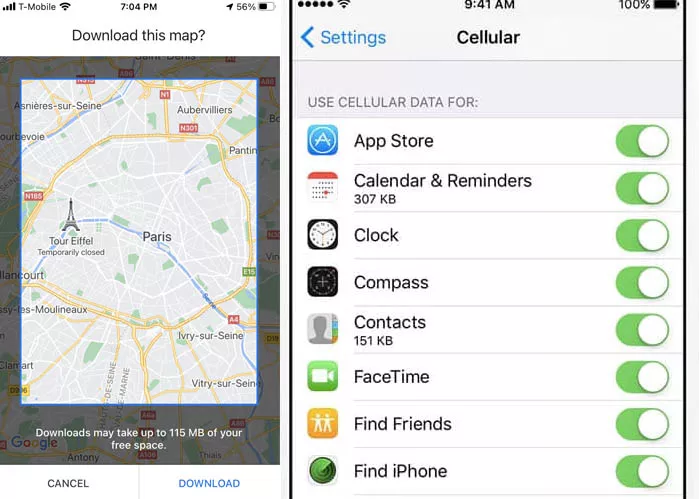

A good example is when you are driving around Greece , or if you get lost walking around Ancient Athens . Even with downloading the offline Google Maps, it’s always best to actually have an internet connection.

Finally, a Greek SIM card can also come in handy if you want to book ferry tickets , train tickets, or just confirm your reservation with your hotel. As you will get a local number, you can easily use it for apps like Viber, WhatsApp etc.

What do I need to buy a prepaid Greece SIM card?

To buy a prepaid SIM card for Greece, you will need to show a valid ID document, such as a passport . Wherever you go to get your new card, the seller will either photocopy or take a photo of your passport – this is normal!

According to Greek legislation, you can only purchase a SIM card if you are over 18 years old . If your teenage children want their own SIM cards, you can buy two or more cards using the same passport.

Where to buy a SIM card in Greece

The best places to get your SIM card in Greece are either designated stores, or street vendors in the bigger cities. It’s possible to buy a SIM card at the Athens Airport, but it’s a lot more expensive.

To use your new card, you will need to have an unlocked phone. Some mobile phones come with a dual SIM option, so you can also use your original SIM if you prefer.

Buying a Greece SIM card in a store

All three providers have hundreds of shops across the country where you can easily get a new Greece SIM card. Cosmote SIM cards are also sold at a store chain called Germanos.

Here are some of the stores where you can get a SIM card for Greece around Syntagma Square and Plaka , close to the main shopping areas in central Athens:

- Cosmote Syntagma Square – Mitropoleos 1

- Cosmote Monastiraki – Athinas 45

- Germanos Syntagma Square – Stadiou 10

- Vodafone Syntagma Square – Stadiou 9

- Vodafone Acropolis – Veikou 72

- Nova Kolonaki – Patriarchou Ioakim 7

- Nova Acropolis – Veikou 1

If you are starting your trip at Thessaloniki or one of the Greek islands, you can use Google Maps to find the nearest shop that sells SIMs.

Expect to pay about 10-15 euro to get your new SIM card, including some credit that will enable you to buy data packages, minutes or text bundles. More on this, later.

Getting a Greece SIM card from a street vendor

If you are in Athens, you can also get prepaid SIM card deals from street vendors. These cards are perfectly legitimate, and typically offer much better value than the SIM cards you would find at the stores.

Usually, these vendors have detailed boards out, explaining what they offer and how much it costs. In fact, they are probably the best place to get your SIM card for Greece 🙂

You can find these street vendors close to busy metro stations , such as Syntagma, Monastiraki, Omonia and Victoria. Most of them are young, and they speak at least some level of English as they often work with foreign visitors.

And while it might feel strange having a random person on the street take a photo of your passport, you would still have to do the same thing if you went to a store.

Again, you can expect to pay around 10-15 euro for your new SIM card along with some credit which you can use to get a package. The difference is, you will typically get more GB / more minutes than a card you’d find in a shop.

Buying Greek SIM cards at the Athens International Airport

Some visitors would prefer to get hold of a Greece SIM card as soon as they’ve landed at the Athens International Airport. While this is possible, it won’t get you the best deal, plus you may have to face long queues.

Still, you can get a local SIM card at the airport in Athens. You will need to find the SIM LOCAL kiosk at the Arrivals Level, and check their current offers. In summer, their opening hours are usually 6.00-22.00 every day.

At the time of writing, the only available option is a special travel pass Vodafone Greece package providing 15 GB of data, 200 minutes of calls to local numbers, and 120 minutes of calls to international numbers.

Along with the activation fee, this comes at a total price of 35 euros, which is rather steep when compared to the local services. Still, it’s an option if you want to be connected on the way to your hotel.

Related: Tips for taking the Athens airport metro

Buying a package for your new Greek SIM card

At the time you purchase your new SIM card, you will also need to buy some credit. The vendor will explain how to use your credit, and what packages are available.

You will then need to activate a package that suits your needs. I can’t stress this enough!

Unless you get a package, your credit will disappear in zero time! The easiest way to activate these packages is through an app which you will download on your mobile phone.

In summer, all providers offer unlimited GB deals that are valid for 30 days and cost about 11-13 euros. This is by far the best available deal you can get. You can just ask the seller to activate this, and you are done!

If you are visiting outside summer, you’ll have to check the available packages at the time. Generally speaking, you can buy a package with a certain number of GBs for a set period of time – a day, a week, or a month. Or you can buy a package which gives you both GBs and some minutes / SMS to local phone numbers.

A quick overview of prepaid SIM cards for Greece

Let’s have a quick look at the prepaid SIM cards you are most likely to find in Greece.

Cosmote WhatsUp

I switched from a Cosmote contract to a Cosmote WhatsUp prepaid card about a decade ago, and never looked back. Even if you move to Greece, contract phones are really not worth it in my opinion. Not only do they tie you to a 2-year contract, but they also work out to be more expensive.

With the WhatsUp package I spend an average of about 15 euro per month for all the GBs and minutes I need… and as I travel a lot around Greece, I need loads!

This SIM card offers many different bundles, including 100 GB for 13.50 euro in summer. There’s also a DIY bundle that you can customize, and any unused data / minutes are carried over to the next month.

If you want a cheap data only SIM, this is a great option. Since June 2024, the WhatsUp app is also in English (finally). Customer service or the street vendor can help you activate it and top it up.

You can find more info here (in Greek).

Cosmote Frog

In my opinion, Cosmote Frog is the best SIM card in Greece for tourists and expats. It uses the Cosmote network, offers slightly better value than Cosmote WhatsUp, and the app is also in English.

Unlike Cosmote WhatsUp, with Frog you only pay per second when making a call – which does make a difference. Plus, it gives you several different options for calls abroad.

In Athens, you can get the Cosmote Frog SIM at their flagship store. Their address is Stadiou 51 , very close to Omonia metro. Otherwise, you can always try the street vendors or perhaps order it here .

Overall, Cosmote Frog is not the easiest SIM card to find. Hopefully this will change in the future, as they have great customer service over messenger.

You can find more info here: Cosmote Frog .

Cosmote Cosmokarta

This service from Cosmote is more geared towards people who want to talk a lot. In my opinion, it doesn’t offer any benefits compared to the other Cosmote products, and prices can be higher.

You can find more info here: Cosmote Cosmokarta

Vodafone CU

This is another good option for visitors. In summer, they usually offer an unlimited data package valid for a month for 10.90 euro. Their app can be switched to English, so you can use it on your own. I’ve heard mixed opinions about their customer care, but I haven’t used them myself so I don’t have an opinion.

You can find more info here: Vodafone CU

Vodafone You

Offers fairly flexible bundles, but there’s no unlimited data option. If you are a traveler, Vodafone CU will probably suit you better.

You can find more info here: Vodafone You (in Greek)

Vodafone International

Another package from Vodafone Greece, which focuses on call minutes to several different countries. There’s a fairly good option for monthly data as well.

You can find more info here: Vodafone International (in Greek)

This is another option offering unlimited data for 10.60 euro in summer. There’s also a bundle for EU calls.

You can find more info here: Nova F2G

A good selection of bundles, including some with call minutes to international numbers. Unlike some other SIM cards, you only pay per second when making a call.

You can find more info here: Nova MyQ

Tips for expats and nomads staying longer in Greece

If you are only in Greece as a tourist, you initial credit should cover you for the duration of your trip. Your SIM card will remain active for a period of time, so if you are visiting again soon you can re-use it.

However, if you are planning to stay in Greece for a few weeks or months, you will need to top up your credit at some point. You can do it online with a credit card / PayPal, buy a scratch-card with credit at a periptero (kiosk), or top-up in a shop.

With most plans, you can carry any unused part of the package over to the next month, provided that you add some credit and renew your package before it expires.

It’s important to know that a tax is charged on any top-up voucher. For example, if you top up 13 euro, your balance will only be 11.81. Take that into account if you are planning to buy a package which costs over this amount.

And, in all circumstances, do not forget to buy a new bundle – otherwise, your new credit will run out super quickly!

Also, have a look at this guide with helpful websites for expats in Greece .

Things to know about network coverage in Greece

While 4G (and, sometimes, 5G coverage) is available in Greece, in practice you might experience a slow connection. In fact, the speed of your mobile data can vary a lot, depending on your exact location.

Some carriers work better than others in certain areas – so if you are planning to stay somewhere for long, ask your neighbors what provider they are using. On the whole, Cosmote is probably the most reliable one.

If you are visiting remote islands like Nisyros , Kalymnos or Tilos , or even upcoming islands like Milos , don’t expect to have signal 24/7.

Reception can be affected by weather conditions, such as the meltemi winds . Yes… I’m talking from experience!

It’s also a good idea to ensure that your cell phone is NOT on automatic network selection. If you are traveling to the Dodecanese islands, like Rhodes or Kos , your phone can automatically log on to Turkish networks, and you can easily lose any remaining credit.

Last, but not least – it is possible to use your phone as a hotspot for all your devices. I have done this many times on various islands where the WiFi was slow, and found that an unlimited data SIM was very useful.

Note that this option might not be able to support some services, such as streaming videos or making a video call. But it still might be useful if the Wi Fi signal is poor.

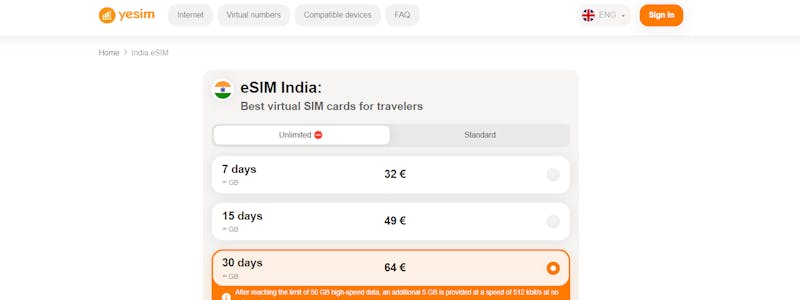

Using an eSIM / International SIM card in Greece

There are a bunch of International SIM cards / travel SIM cards out there that frequent travelers like to use.

In addition, if your phone supports an eSIM option, you can use an eSIM instead of buying a card in Greece. This will save you some time as you won’t have to find a shop and go through the procedure.

These are some of the companies that I am aware of which come highly recommended. Note that these SIM deals are generally more expensive than a Greek SIM card:

- Trip Roaming

As I haven’t used an eSIM in Greece yet, I don’t have a personal opinion. If you’ve used any of these, or any others, please comment below with your experience!

FAQs about SIM cards in Greece

Here are a few questions about Greece SIM cards often asked by visitors:

How much do SIM cards cost in Greece?

You should expect to pay around 10-15 euros for a Greek SIM card along with some credit which you can use to buy a bundle of data / calling minutes.

Which SIM card is best in Greece?

There are three Greek providers, Cosmote, Vodafone and Nova. While they all offer similar packages, Cosmote has slightly better coverage. The best SIM cards in Greece are Cosmote Frog, Cosmote WhatsUp, and Vodafone CU.

How do you get a Cosmote SIM card?

To buy a Cosmote prepaid package, you will need to go to a Cosmote or a Germanos store. Alternatively, you can also buy it from a street vendor. Eitherway, you will need your passport. There is no shop at the Athens airport.

Can I get a SIM card at Athens airport?

You can get a special Vodafone SIM card at the Athens airport. However, that card it is a lot more expensive than the cards you can get in central Athens.

Is data roaming free in Greece?

If you have a SIM card from an EU country and a few more countries in Europe, you should be able to use your data in Greece. Make sure you are aware of your operator’s fair usage policy.

If you are coming from outside the EU, check if your provider offers any special roaming passes, or other mobile phone deals for when you travel abroad. In my experience, it will be cheaper to get a Greek SIM!

Other travel guides about Greece

If you found this article useful, have a look at these other ones:

- Best apps for your trip to Greece

- The best souvenirs to buy in Greece

- How to spend 2 weeks in Greece

- What to pack for Greece for every season

- The Greek alphabet and 20 useful words

- More useful Greek words and phrases

- How to open a bank account in Greece

- How to book a train in Greece

- 50 iconic Greek dishes – with photos!

8 thoughts on “Buying A SIM Card In Greece – Best Options For 2024”

hi we have a mobile dongle for our house in Greece with the price of data card on the uk can you recommend witch is the best Greek company to get e data sim card thanks M Thompson

In my experience, Cosmote has the best coverage in Greece, so I suppose it would be the same for esims.

Hi, I am grateful to rich information over SIM-card in Greece, but I am wondering if these offers have some kind deal of 100minutes free call and so on??? In hotel, data volume is not a problem at all but the calls are really a headack, right?

Second, no travellers in Greece will only stay there for the whole holiday months (normally two months or more) and will move to other countries such as Italy, France, UK or Danmark. I would like to know which prepaid SIM (first arrival country) can be used in these countries as enough money is re-charges when on the way travelling?