Everything you need to know about currency exchanges

We've partnered with American Express to bring you personal finance insights, advice and more. Check out Credit Intel, Amex's financial education center, for more personal finance content.

Any offers or benefits mentioned below are subject to change at any time, and may no longer be available.

It can be lot of fun to visit a foreign country, as you can have the chance to enjoy exotic foods, see unique sites and meet people from a variety of different cultures. But one of the more stressful things about visiting another country is figuring out the most cost effective ways to acquire and spend the local currency.

Currency exchange basics

Just like at home, the two common ways people make purchases in a foreign country are with cash or with a payment card, typically a credit or debit card. Even if you plan on using a credit or debit card, it's a good idea to carry some local currency with you, especially in countries where payment card acceptance isn't as universal as it is in the United States. For example, traditional markets are very common in many places (which are kind of like what we call flea markets), and those vendors often don't take credit cards. Cash can also be necessary to pay taxi drivers or to tip service providers.

There are several ways to exchange your US dollars for local currency. First, you can do so at home, by visiting an American Express Travel Service center . Alternatively, you can exchange currency when you arrive at your destination. Most airports are home to currency exchange companies, but you can expect these locations to charge very high commissions. Also note that currency exchanges rarely buy or sell foreign coins, just paper bills.

Alternatively, you can obtain foreign currency by using an ATM card. Just be aware that you may be charged fees by your bank and the ATM operator. Furthermore, you bank may also impose a foreign transaction fee on purchases or withdrawals made outside the United States. However, you're sure to get the most competitive exchange rate.

Using your credit card to make purchases outside of the United States

One of the great things about credit cards is that they are accepted in nearly every country in the world. For example, American Express cards are accepted in over 160 countries around the world. Credit cards also have very strong exchange rates. A possible drawback of using your credit card to make purchases in a foreign country is the potential to incur foreign transaction fees . These are fees that are imposed on transactions processed outside of the United States, which isn't a foreign currency conversion fee. For example, there are some countries that use US dollars and some foreign merchants may charge you in US dollars, but a foreign transaction fee will still apply. Most credit cards that have this fee charge 3% of the amount of the transaction, and some American Express cards have a 2.7% foreign transaction fee.

Further Reading: What You Should Know About Foreign Transaction Fees

Thankfully, there are a growing number of credit cards that no longer charge foreign transaction fees . Typically, these are travel rewards cards that are designed for the needs of international travelers. There are no foreign transaction fees for the following American Express cards:

(Photo by Atit Phetmuangtong/EyeEm/Getty Images)You can find out if a new credit card has foreign transaction fees by looking at the legally mandated table of rates and fees that card issuers must provide. To find out if your current cards have foreign transaction fees, you'll want to contact your card issuer.

Using your credit card to access cash outside of the United States

When your credit card has no foreign transaction fees , it can be among the least expensive ways to make a purchase in a foreign country. But when you use your credit card to access cash from an ATM, it will likely be one of the more expensive ways to acquire foreign currency. That's because most credit cards will impose a very large cash advance fee on these transactions, often $10 or 5% of the amount of each cash advance, whichever is greater. Furthermore, cash advance balances are immediately subject to interest charges, while you can generally avoid interest on purchases by paying your statement balance in full.

ATM transactions can also be subject to any foreign transaction fees imposed by the card issuer or other fees charged by the ATM operator. Therefore, you should consider using your credit card at an ATM as a last resort when you can't use your card directly with a merchant to make a purchase.

Further Reading: 7 Ways to Get More from Your Travel Points Credit Card

Understanding dynamic currency conversion

The last thing that you need to know about foreign currency exchanges is a "service" that some merchants offer called dynamic currency conversion. The idea is that a merchant will offer to charge your credit card in your home currency, which sounds reasonable enough. But while your receipt will appear in US dollars, you may be charged more than you would have been charged in your local currency.

Supposedly, merchants are required to request your permission before they impose this "service" on you. But between the limitations of foreign languages and the merchant's incentive to opt customers into it (merchants receive a commission on each transaction), it's not uncommon to find these extra charges added to you bill without your consent.

Bottom line

Once you know how foreign exchanges work, you can enjoy your trip to any country without having to worry about incurring unnecessary fees when you make purchases.

- For rates and fees of the American Express® Gold Card, click here .

- For rates and fees of The Platinum Card® from American Express, click here .

- For rates and fees of the Delta SkyMiles® Gold American Express Card, click here .

- For rates and fees of the Delta SkyMiles® Platinum American Express Card, click here .

- For rates and fees of the Delta SkyMiles® Reserve American Express Card, click here .

- For rates and fees of the Hilton Honors Card from American Express, click here .

- For rates and fees of the Hilton Honors American Express Surpass® Card, click here .

- For rates and fees of the Hilton Honors American Express Aspire Card, click here .

- For rates and fees of the Marriott Bonvoy Brilliant® American Express® Card, click here .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Traveling Internationally? Order Foreign Currency Before You Go

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Upon landing in a foreign country, expect a lot of lines. There’s immigration, passport control and customs inspection. But there’s one line you can — and absolutely should — skip: the airport currency exchange.

Not only does the airport currency exchange counter’s line cut into precious time abroad, but it’s typically a terrible money move. Airport currency exchange rates are among the worst you’ll find.

It’s not uncommon to see airport exchanges charging 14% more than the current International Monetary Fund (IMF) exchange rate. NerdWallet even found some premiums exceeding 17%. Some also charge additional fees on top of the poor exchange rate.

So what do you do if you need cash upon arrival to order a cab or tip the bellhop? Consider ordering foreign currency before you fly.

Most banks allow you to order foreign currencies, which you can typically pick up at a local branch before your trip. Some banks offer to ship currencies to you, and sometimes they don’t even charge extra for postage if you order a certain amount.

Plus, the exchange rate are usually quite good. For instance, at Bank of America, the exchange rates we checked in January 2024 average roughly 6% more than the IMF rates — and less than half of what the airport currency exchanges are charging.

Just check your own bank's exchange rate to ensure it's optimal before initiating the transaction.

» Learn more: The best travel credit cards right now

How to order foreign currency from your bank

While the exact process varies by bank, most major banks make it easy to order online.

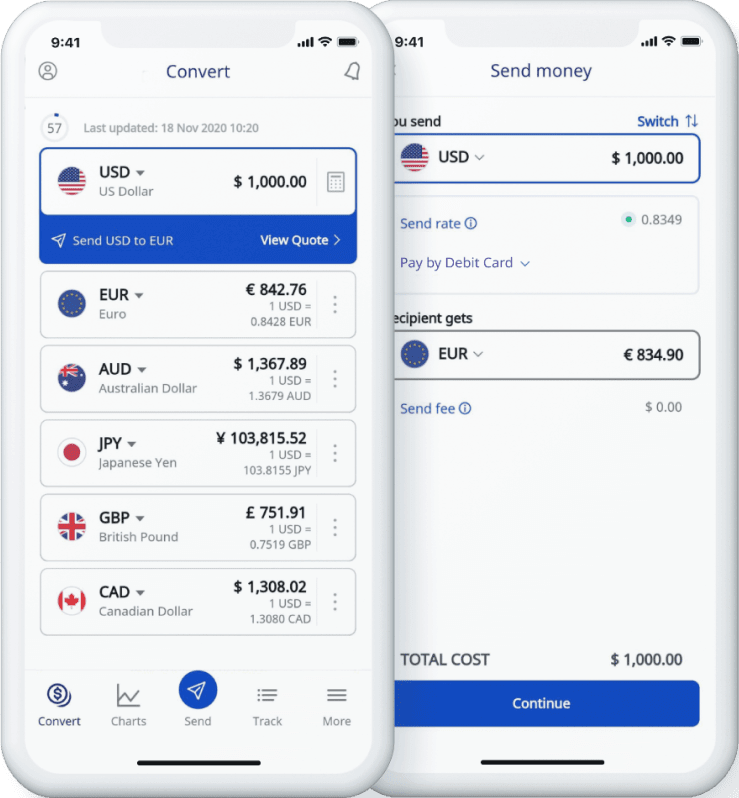

Typically you can access the currency exchange webpage through your bank’s website or mobile app, or by phone. From there, you usually enter the currency you need, add the desired amount, select the pickup method and place your order.

While you can generally expect a solid exchange rate, use a trusted source such as Reuters or the International Monetary Fund to find current exchange rates and ensure you get a fair deal.

Additionally, understand all the fees involved. For example, Citi charges a $5 service fee for transactions under $1,000, though it’s waived for clients with premium bank accounts .

Or you might get charged a shipping fee. Bank of America’s standard shipping costs $7.50, but overnight shipping is $20. Sometimes you can avoid shipping fees by opting to pick up the cash at a local branch or by being a loyal customer. Bank of America Preferred Rewards program members get free standard shipping.

There’s also generally a minimum amount of foreign currency you can order ($100 or $200 is common) and a maximum ($10,000 within a 30-day period is common).

Other good ways to pay abroad

If it’s too late to order foreign currency from your bank, here are other ways to curtail currency fees :

Find an in-network ATM abroad

Major banks usually have branches abroad or partner with other banks to create a network. Using those ATMs often provides a decent exchange rate while eliminating out-of-network ATM fees.

If you end up using a non-network ATM, pay attention to ATM fees , which vary but usually run about $5 per transaction. Given that, consider limiting ATM debit transactions by withdrawing the amount you think you’ll need for the entire trip, or at least a large portion of it.

ATM availability is more common in some places than others. Macau has the highest number of ATMs per capita with 316 ATMs per 100,000 adults, based on 2021 data from the World Bank Group. Uruguay, Canada and Austria are other destinations with the most ATMs per capita.

But other countries tend to have far fewer. For example, Kenya had fewer than 7 ATMs per 100,000 adults and Nepal had only 20 ATMs per 100,000 adults, according to the same data.

Pay with a credit card that doesn’t charge foreign transaction fees

Depending on the card, you might get dinged with foreign transaction fees of 1%-3% when you make purchases at non-U.S. retailers abroad.

That’s why it’s wise to carry a no-foreign-transaction-fee credit card abroad.

on Chase's website

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠. .

Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel. .

Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening. .

» Learn more: The best no-foreign-transaction-fee cards

And more international merchants are taking plastic. This wider card acceptance and increased security are reasons travelers are ditching cash, according to the Visa Global Travel Intentions Study 2023, which polled more than 15,000 people in the Asian Pacific region between April and June 2023.

While this type of card won’t help you pay at cash-only businesses or get money for tips, it’s otherwise one of the smartest ways to pay internationally.

» Frequent travelers: Consider a multicurrency account

Try paying in cash dollars

If all else fails, offer to pay in U.S. dollars. In fact, some merchants or individuals accepting tips prefer it in certain countries. You might find vendors willing to give you an even better deal if you pay with U.S. dollars.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Where Is the Best Place to Exchange Foreign Currency?

When choosing where to exchange currency, don't get caught converting your dollars at unfavorable rates with high currency exchange fees.

Best Place to Exchange Foreign Currency

Getty Images

Plan ahead of time for where you want to exchange foreign currency to avoid inflated exchange rates.

Key takeaways

- Before you leave the country, visit your bank or credit union so you can avoid paying ATM transaction costs and possibly receive a better exchange rate.

- The worst places to exchange your money for another currency are oftentimes the most convenient, like the airport.

- Using your credit cards, prepaid cards or even U.S. dollars for purchases can be good alternatives to exchanging currency.

Before you head off to the airport to catch a flight abroad, find out where to receive the best exchange rate for your money.

Some travelers prefer trading their U.S. dollars for euros or other currencies at their local bank so they have cash to tip taxi drivers or porters at the airport or buy a coffee or lunch. People who are traveling to more than one country with different currencies will find that planning ahead saves you the headache of exchanging money often.

The most expensive, yet most convenient and easily accessible, spots to exchange money include train stations, airports, hotels and tourist areas.

Here are the best places to exchange your money into the local currency before and after your vacation.

Use Phone at the ATM Instead of a Card

Ellen Chang Sept. 12, 2023

Best Place to Exchange Currency Before and After Traveling

The fees may only be a few dollars, but they can add up quickly, especially if you are traveling for more than a few days. Head to your bank or credit union before you leave to avoid paying ATM transaction costs. You may even receive a better exchange rate.

Credit unions and banks will exchange your dollars into a foreign currency before and after your trip when you have a checking or savings account with them. You won't face trying to spend your remaining euros before the end of your trip and can convert them back to dollars when you get home.

Some banks such as Citibank and Bank of America may not charge a fee and will provide options such as conducting the transaction online or even mailing you the currency. If you need amounts of $1,000 or more, most banks require you to pick up the currency in person at a branch.

You can check out the exchange rates online and see which bank is offering the best one.

It's a good idea to call your local bank first to see whether they have the currency you are seeking. Not all branches exchange currency, and exchange rates between banks can vary greatly, says Vaneesha Dutra, an associate professor of finance at Howard University.

"Don't expect to get the exchange rate you saw when you Googled it, as banks add a profit margin to these transactions, which will reduce the actual amount of foreign currency you will receive per U.S. dollar," she says.

How to Exchange Currency

Start by checking with your bank online to see whether the currency you are seeking to exchange is available. If you're traveling to a country that has restrictions on its currency for political or economic issues, your bank may not be able to access the currency. Currency from many African and Eastern European countries can only be exchanged at those countries' banks and ATMs.

Here is a checklist:

- Contact a bank or credit union to make sure it has the currency or will accept foreign currency, and check what the fees are.

- Find exchange rates through your bank, credit union or websites such as xe.com .

- Check the bank's exchange rate to make sure it's fair.

- Arrange for pickup or delivery.

"The saying 'cash is king' certainly holds when traveling abroad," Dutra says. "When you land in Medellin, your taxi driver is going to want Colombian pesos. You will find commerce while abroad fairly manageable if you carry foreign currency and a credit card with favorable travel terms."

Where Else Can You Exchange?

After you've reached your destination, it's a good idea to obtain more cash to pay for shopping and meals at mom-and-pop locales.

Using your bank's ATM, or an ATM in its network, and exchange providers like Travelex are common options. Another option is to use companies such as Wise, which specializes in currency transfers and offers a debit card. The company allows you to keep more than 40 currencies in your account, so if you travel frequently, you can switch to whatever currency you need, says Nicholas Lembo, former global head of above the line marketing and communications at Wise.

Check whether your credit or debit card provider offers additional security features like sending a text message when a transaction is done or requiring additional authorizations when the value of a transaction is higher than normal, says Dirk Schrader, vice president of security research at Netwrix Corporation, a cybersecurity provider.

How Many Bank Accounts Should I Have?

Jessica Merritt Dec. 8, 2023

Banks typically charge either a flat fee or a percentage, such as 1% to 3% of the amount you take out at an ATM in foreign currency. Determine your bank or credit union's policy on reimbursing ATM fees so you can plan ahead.

Download your bank's app ahead of time to help you locate nearby ATMs. Consider taking out a larger amount of cash if your bank charges a higher fee. If you use an ATM that is outside your bank's network, plan on paying extra fees.

Places to Avoid Exchanging Currency

The worst places to exchange your money for another currency are oftentimes the most convenient, such as:

- Airport kiosks.

- Tourist centers.

At those places, the conversion rates are usually not in your favor. Be aware of current exchange rates, especially if you cannot locate a local ATM, says Arica Tomlinson, a category managerof electronic displays and video distribution at GE Healthcare in Milwaukee.

"During a trip to Prague, I attempted to exchange some of my U.S. dollars for the local currency," she says. "For my $100, the currency exchange representative offered me the equivalent to $50 worth of koruna. After my protestations, they offered me an improved rate, but I took my money to a local bank for exchange instead."

If you have to exchange money in another country, plan on paying extra service fees and more for the exchange spread, the rate the business will give you when you are selling your U.S. dollars to them, says Derek Horstmeyer, a finance professor at George Mason University. The exchange spread could be 1% to 2%, he says.

Always be careful using mobile apps to transfer money in foreign countries, particularly apps that rely on texts, since there is the added risk of a potentially untrusted mobile infrastructure, says Sounil Yu, chief information security officer and head of research at JupiterOne, a Morrisville, North Carolina-based provider for cyber asset management and governance. "This is especially true if you are in the Eastern bloc or certain countries in Asia. Also, make sure that you don't download country-specific mobile applications for financial services, as that comes with additional unknown risks. In my opinion, airports are the worst place to exchange money, and banks are the best."

Alternatives to Exchanging Currency

- Credit cards.

- Prepaid cards.

- U.S. dollars.

- Mobile payment providers such as Google Pay, Android Pay or Apple Pay.

Using your credit cards, prepaid cards or even U.S. dollars for purchases can be good alternatives to exchanging currency. Even smaller businesses that are at a street food night market or festival will take electronic payments, and other countries such as Mexico or French Polynesia will accept the U.S. dollar. Your credit card company may also offer good exchange rates – check with it beforehand to see what the rates are. Paying for hotels, restaurants and rental cars with credit cards is often your best bet since they also offer protection on your purchases and additional reward points for transactions at various businesses.

It can be a good strategy to inform your credit card company about your trip when you ask about additional security features, Schrader says.

"Credit card or debit card details are stolen in milliseconds, using compromised ATMs or contactless readers, so a precaution can also be to reduce the limits on your cards for the period of travel, or even apply for an additional card just for the travel," he says.

Many credit or debit cards provide a 0% foreign transaction fee and are a good option to pay for dinner, a museum visit or sporting event tickets.

Using mobile payment providers also can help prevent fraud while you are traveling.

Tags: banking , Travel , currency

Popular Stories

Banking Advice

Best of Banking

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Personal Finance

5 best ways to exchange foreign currency.

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created independently from TIME’s editorial staff. Learn more about it.

Cashless transactions are becoming more commonplace worldwide as consumers increasingly use debit and credit cards, mobile payment apps, and other types of digital payments for everyday spending. Still, you might want to exchange some U.S. dollars for foreign currency when traveling abroad—either because cash is still king at your destination or you prefer globetrotting with at least a little cash in your pocket.

There are multiple ways to exchange currency, but the goal is to get the best exchange rate with the lowest fees—something easier said than done. To help point you in the right direction, here are our tips for exchanging currency and finding the best deals.

5 ways to exchange foreign currency

1. get cash at your bank or credit union before and after your trip.

Many banks and credit unions sell foreign currencies without charging a fee beyond the exchange rate. You can order currency by phone, online, or in person at your local branch and arrange to pick it up or get it delivered.

Some currencies will be "in stock" and available to exchange immediately, while others may require a few days to process. Once you return from your trip, you can convert any unused currency back to dollars—or stash it somewhere safe for your next adventure.

2. Withdraw cash from your bank's in-network ATMs

Once you reach your destination, an Automatic Teller Machine (ATM) is the best way to get currency to spend locally. ATMs generally offer competitive exchange rates, and you can avoid (or at least limit) fees by using ATMs in your bank's network. You can save on fees by withdrawing larger amounts of cash once or twice rather than making frequent, smaller withdrawals. Check with your bank to find out your daily and per-transaction ATM limits, and request an increase if you plan to access more cash.

3. Use a money transfer app

Money transfer apps let you send money to friends, family, and merchants worldwide. Most transfers are completed within minutes. The apps are free to use (though you'll generally pay a fee if you use a credit card instead of a linked bank account to fund the transfer). You may also pay a fee if the cash needs to change currencies.

4. Online currency converters

Another option is to order cash through an online currency converter. However, you may get a poor exchange rate. Also, the pick-up and delivery fees could be higher than the amount your local bank charges, depending on how much currency you exchange.

5. Airport kiosks and currency exchange counters

Airport kiosks, hotels, and tourist centers are convenient ways to exchange currency. However, the high fees and poor exchange rates mean less cash in your pocket. If you can plan ahead, you'll get a better deal exchanging currency at your local bank or credit union.

More about foreign currency

How does currency exchange work.

Currency exchange lets you swap one currency for another, such as trading U.S. dollars (USD) for euros. Because currency values continuously fluctuate, the exchange rate you receive depends on what's happening in the global markets at any given moment. It's rarely a 1:1 ratio. Instead, one USD might buy, for example, 0.93 euros, 16.32 Mexican pesos, or 151.83 Japanese yen.

Banks that exchange foreign currency for free

Many banks let you exchange USD for foreign currencies (and vice versa) for free, but you may need to be a customer—or have a premium bank account plan. Still, remember that the exchange rate you receive may include the bank's profit, fees, costs, charges, or other markups in the spread—meaning you're still paying for the exchange. Check with your bank for details.

Where to get foreign currency internationally

ATMs are often your best bet for getting foreign currency while traveling internationally. ATMs generally offer competitive exchange rates, and if you use ATMs in your bank's network, you can limit fees. Remember that the ATM (or its affiliate bank) may also charge a fee of several dollars or more. ATMs in touristy areas sometimes have higher fees than those in non-touristy parts of town.

Places to avoid exchanging currency

You won't have to go out of your way to trade in your dollars at airport kiosks, hotels, or tourist centers, but they are some of the worst places to exchange currency; the high service fees and poor exchange rates mean you'll get less bang for your buck. (Of course, it's best to avoid currency exchange shops in remote or sketchy areas—not only because of excessive fees and unfavorable exchange rates but also because of the security risks.)

Still, you can try negotiating for a better rate or lower fees—but you'll need to know the current exchange rate going into the transaction. A quick Google search will display real-time exchange rates. For example, a "USD to EUR" search shows that $1 buys 0.93 euros (as of May 5, 2024). You can also use an online currency converter like Oanda or Xe to view live exchange rates.

Alternatives to exchanging currency

Credit and debit cards are simple alternatives to exchanging currency. Many credit cards—and some premium debit cards—offer travel rewards and protection benefits, making them an even more attractive option. Still, there are a few things to keep in mind when using your card internationally:

- Credit and debit cards aren't accepted everywhere.

- Some merchants don't accept certain credit card networks, even if they accept others. Of the four main U.S. payment networks (Visa, Mastercard, Discover, and American Express), Visa and Mastercard are the most widely accepted cards globally.

- Many card issuers impose a foreign transaction fee that can add about 3% to your total costs—or $30 on a $1,000 hotel bill, for example. If you're a frequent traveler, consider getting a travel credit card with zero foreign transaction fees.

- Your card issuer may temporarily freeze your card or contact you if they see overseas card activity. To avoid inconvenience, set up a travel notification.

- Merchants may offer the option to pay in USD or the local currency (called dynamic currency conversion). Paying in USD might seem the better choice; however, you'll almost always get a better rate by choosing the local currency (even if the merchant tells you otherwise).

- Credit card cash advances are an expensive way to get currency and should be considered a last resort.

- A banking app can help you monitor your account activity in real-time and alert you of unauthorized transactions.

TIME Stamp: Know your options before you travel

Before you travel internationally, find out if the areas you’ll be visiting accept credit cards. If so, you may not need any foreign currency (unless the idea of traveling without cash makes you uncomfortable). Consider charging larger purchases, like hotels and organized tours, and getting cash at an in-network ATM for everyday expenses like coffee, street vendors, and tips.

Frequently asked questions (FAQs)

Can i exchange foreign currency at a bank.

You can exchange many—but not all—foreign currencies at a bank. Stable currencies, like dollars, euros, and British pounds, are generally easily exchanged worldwide. However, illiquid or heavily regulated currencies may be difficult (or impossible) to exchange in many parts of the world.

How do I exchange foreign currency without a fee?

Currency exchange isn't free. You’ll pay for the service through a fee or a spread on the exchange rate (or both). Still, an ATM withdrawal can be a low-fee option when using an in-network ATM. (Check your bank's app to find an ATM near you.) Before your trip, consider asking your bank to increase your daily and per-transaction withdrawal limits. That way, you can make fewer trips to the ATM and save money on fees.

What is needed to exchange foreign currency?

One of the easiest ways to get foreign currency is via an ATM withdrawal; you only need your ATM card and PIN. If you exchange currency anywhere else, you'll need a valid government-issued ID, such as a driver's license or passport. Depending on the exchange service and the amount of currency you exchange, you may also need proof of your address or other documentation.

What is the procedure for foreign currency exchange?

Before your trip, you can order foreign currency from your bank or credit union to pick up at your local branch. (You may also be able to have it delivered, although there may be a delivery fee.)

Another option is an online currency converter that delivers cash to your home address, but the rate will likely be less favorable than your bank offers. Once out of the country, your best option is to use your bank's ATM network.

Whether heading out of the country or returning from a trip, it's generally best to avoid exchanging currency at airport kiosks, hotels, and tourist centers; skip the high fees and poor exchange rates and keep more money in your pocket for your next adventure.

The information presented here is created independently from the TIME editorial staff. To learn more, see our About page.

- Money Transfer

- Rate Alerts

Trusted Global Currency Converter & Money Transfers

Best source for currency conversion, sending money online and tracking exchange rates

How to transfer money in 3 easy steps

1. create account.

It takes just a few minutes, and all you need is an email address.

2. Enter details

Add recipient (you'll need their address, bank account/IBAN, swift/BIC) and payment information.

3. Confirm and send

Check the currencies and amount are correct, get the expected delivery date, and send your money transfer.

Xe Live Exchange Rates

The world's most popular currency tools, xe international money transfer.

Send money online fast, secure and easy. Live tracking and notifications + flexible delivery and payment options.

Xe Currency Charts

Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

Xe Rate Alerts

Need to know when a currency hits a specific rate? The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs.

Xe Currency Data API

Powering commercial grade rates at 300+ companies worldwide

Xe Currency Tools

Recommended by 65,000+ verified customers.

Download the Xe App

Check live rates, send money securely, set rate alerts, receive notifications and more.

Over 70 million downloads worldwide

Daily market updates straight to your inbox

Currency profiles.

Leisure Travel

Extraordinary travel experiences require highly personalized service. Our travel experts will design a memorable trip that meets your exacting standards. We don’t just inundate you with off the shelf packages – we take the time to get to know you, determine what you want and present the best way to make your dream a reality.

Personalized attention

Our expertise lies in getting to know each client and presenting them with options that meet their needs. If you already know which hotel and flight you would like to book, we can add savings and VIP treatment to that reservation. Once you’re all booked, ALTOUR’s customized itineraries will keep you organized by synching to your phone & computer.

Priority rates with VIP treatment

With priority rates and exclusive amenities at over 1,700 of the finest properties across the globe – we bring you the VIP treatment you deserve.

Concierge service at your finger tips

Restaurant reservations, premium car service or even a private jet – responsive concierge service for your demanding lifestyle is only a call, email or text away.

Destination expertise

Our travel experts have the insider knowledge, resourcefulness and experience to create an authentic vacation you’ll never forget. We spend the time to get to know you so that we can recommend and book the best options that will make your vacation the perfect trip.

Cruise expertise

Our cruise experts know the ins and outs of every cruise line, and they use that knowledge to create a one of a kind getaway trip. They then add value to provide for even more great memories. Whether celebrating a special occasion, or just wanting to get away and relax, our cruise experts use their 20+ years of experience to guide you.

24 hour emergency support

After hours 24/7 support.

One call to ALTOUR’s 24/7 after-hours emergency desk is all it takes. Rapid re-accommodation. Assistance with flights, hotels and car rentals.

Responsive service when you need it most.

Passports and visas

Passports & visas.

Obtaining the correct travel documentation can be difficult and time consuming. Let us jump through the hoops for you.

Our experts understand the timing of a passport renewal - and when to put in a rush. We monitor breaking global events that could affect your visa application.

We partner with CIBT, the largest passport and Visa Company in the world. Last minute requests are our specialty. Relax. Let us simplify your journey.

VIP In-House Services. Call or Write Us.

Email [email protected] or call 212-897-5008

For more information on Passport and Visa requirements, please go to travel.state.gov or contact one of our Travel Advisors.

Currency exchange

Currency exchange.

Avoid the delay of bank currency exchange transactions. Skip the local money changers with poor exchange rates. For your convenience, ALTOUR offers foreign currency exchange at nine of our locations. Fast service with competitive rates. Peace of mind for international travelers, before you arrive.

Altour Financial Services.

1-888-490-2182

Private jets

All charters are not the same. Taking a regional flight is different than flying halfway around the world. When your travel needs change, we are available. This flexibility ensures that you will get exactly what you need at the very best price.

Safety and security

Prioritizing the safety of our clients is paramount. Our identity theft program, 24 hour support and medical repatriation services are here to give you peace of mind.

There is a new identity theft victim every 2 seconds. When traveling, you are up to 4 times as likely to be a victim of identity theft. Maintain peace of mind on your vacation with identity protection for you and your family.

Our identity protection program for travelers reduces the risk of identity theft by:

- Monitoring millions of data points for suspicious use of your sensitive personal information

- Alerting you at the earliest sign of fraud

- Quickly helping to resolve any incidents that occur.

If your wallet, passport, credit card, or other important document is lost or stolen, we’ll have them canceled and help get a replacement – no matter where you are in the world.

Learn about our Identity Theft Program

No Matter Where. No Matter When.

One call to ALTOUR’s 24/7 after-hours emergency desk is all it takes. Rapid re-accomodation. Assistance with flights, hotels and car rentals.

Foreign travel advice for UK Citizens.

Foreign travel advice for USA Citizens.

Get inspired

Our collection of blogs, podcasts and social channels have all you need to get inspired.

Just Got Back

Great inside tips from recent travelers.

Travel Talk

A weekly one hour podcast about all things travel.

What’s Worth It

Honest travel opinions direct from the travellers who have experienced it.

Designed Vacations

Ready to make your dream trip a reality, sign up for our newsletter.

By submitting your email, you are agreeing to receive ALTOUR’s newsletter. You can unsubscribe at any time. Please read our Privacy Policy to learn more on how we protect you and your data.

London design agency, Boldly studio.

American Express Foreign Currency Exchange and Better Alternatives

Jarrod Suda

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

American Express Company does offer currency exchange services that allow you to hold foreign cash. It also has a digital cross-border payment platform for making payments in foreign currencies and for saving foreign-denominated bank notes. However, these solutions are primarily designed for business clients and customers who want to risk investing their wealth in foreign currencies.

Banks use weak exchange rates and often charge commission fees. American Express currency exchange will not be your best option for currency exchange when you need foreign currency for your travels abroad and for sending money abroad. Even for business clients, better international business solutions exist for you.

In this guide, we will show you cheaper, faster, and more user-friendly currency exchange services like Wise for virtual travel cards, cash exchange, international money transfers, and business payments. Compare provider exchange rates with our live comparison engine 👈

Here are better options based on your needs:

- Travel : Instead of exchanging cash from AMEX, we think Wise is the cheapest and most convenient way to get foreign currencies at excellent rates. | Read the full review .

- Money Transfer : Remitly consistently ranks on Monito as one of the cheapest services worldwide, making it one of the best for international money transfers.

- Business : Unlike AMEX International Payments, Revolut Business offers transparent mid-market rates for cross-border payments and quality team management software. | Read the full review .

Which Applies to You?

- 01. I want to get foreign cash for travel scroll down

- 02. I want to send money abroad scroll down

- 03. I want to transact across borders for my business scroll down

- 04. Frequently asked questions about AMEX currency exchange scroll down

Foreign Currency For Travel in 2024

If you are a retail customer who wants to hold foreign cash for your travels, then we highly recommend you avoid using American Express currency exchange services. Large American banks and credit unions like American Express charge two very large fees , one that is transparent and another that is hidden:

- Bank Fee : This is a transparent fee that banks charge for the service. AMEX waives the fee, but you have to sign up for an AMEX exchange rate account.

- Exchange Rate Margin : While some banks may waive their flat fee, all of them will levy this hidden fee. At any given moment, there is a live mid-market rate between two currencies. American Express does not transparently publish their exchange rates, but will exchange your currency at a weaker rate (averaging between 4-7%) and pocket the difference.

A multi-currency account from a financial technology platform like Wise can be a convenient way to access foreign currency digitally. Wise offers competitive exchange rates on 50+ currencies through its smartphone app and travel debit card.

Wise's exchange rate is the same as the real exchange rate margin (i.e., the one you see on Google), and you only get charged a minute percentage fee for each currency conversion.

- Trust & Credibility 9.3

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

The Wise debit card provides multi-currency debit card access upon account sign-up. Standard delivery times apply. For travel needs, planning currency exchange ahead when possible allows utilizing preferable rates:

- Link bank account,

- Add desired currency amount,

- Make any exchanges,

- Conversion fees from Wise may be very low depending on currency, limits and timing,

- Mid-market exchange rates offered up to free allowance amounts,

- Use the card for overseas purchases.

Monito Currency Exchange Travel Tips

The above-mentioned digital multi-currency accounts are excellent options for buying foreign currency . To make your money go as far as it can, keep these additional travel tips in mind.

- Use Debit Cards at ATMs: We recommend using travel debit cards at ATMs abroad because the exchange rate used by MasterCard, Visa, and others will be stronger than American Express currency exchange, airport kiosks, and credit unions.

- Use Cards That Waive Foreign Transaction Fees : Two of the best on the market are Wise and Revolut.

- Don't Use Credit Cards at ATMs : Feel free to rack up those credit card points at point-of-sale transactions. Just avoid using credit cards at ATMs because cash advances accrue a higher interest.

- Pay in the Local Currency : If prompted by a payment machine, always choose the local currency (i.e. USD in the US, EUR in the EU, GBP in the UK, etc). Learn more about how to avoid dynamic currency conversions .

- Avoid Airport Bureaux de Change and ATMs in Tourist Areas : Instead, find a trustworthy Allpoint ATM or a Global ATM Alliance bank for free withdrawals. As a general principle, withdraw cash from ATMs connected to a legit bank and pay the fixed $2 to $5 fee instead of using a machine on a street corner.

Compare cheap flights now and save even more ✈️

Sending money abroad.

You can also use American Express foreign currency exchange to send money abroad via international wire transfers . If you have an account with AMEX, then you can go to your local banker to enact a wire transfer.

American Express Exchange Rate

Just the like the cash exchange services, American Express will charge you two expensive fees for sending wire transfers by SWIFT :

- Bank fee : 0;

- Hidden exchange rate margin : Mark-ups typically range from 4%-7%.

Online money transfer services are cheaper, faster, safer, and more transparent alternatives to American Express currency exchange online, which is why we recommend them without reservation. The ones we list below are excellent options for online payments abroad or sending remittances to family members overseas.

On Monito's comparison engine from Wed Jun 01 2022 00:00:00 GMT+0200 (Central European Summer Time) to Mon Jun 19 2023 00:00:00 GMT+0200 (Central European Summer Time), Remitly ranked as the overall cheapest for transfers from the United States.

While Wise ranked second overall and WorldRemit ranked third overall for transfers from the USA, rates often vary by destination. And since fee schedules change all the time, we recommend using Monito's comparison engine to find the cheapest exchange rates in real-time:

Find cheaper exchange rates than American Express:

Business payments.

Big American banks, like AMEX, have access to global capital markets. You can also get credit, loans, and other debt instruments for important corporate activities. To do so, you will need to contact an AMEX representative directly to get a quote for AMEX's FX solutions and wealth management services.

For other business owners, American Express might not be the best option for you. Neobanks (also called challenger banks) offer some of the easiest-to-use and lowest-cost international business bank accounts on the market today. Their accounts will help you do business with suppliers overseas and transact with your customer base abroad.

International Business Alternatives to American Express

All the neobanks we review on Monito are fully regulated and manage segregated bank accounts with licensed partner banks. Read our full article on the best international business account solutions to learn more about these providers:

- Revolut Business — 🏆 Best Overall for International Business Finance

- Payoneer — Best for E-Commerce

- Wise Business — Most Bank Account Details

- Novo — Best All-Rounder in the USA

- Starling Bank — Best Business Bank in the UK

Frequently Asked Questions About AMEX Currency Exchange

Yes, American Express does do foreign currency exchange but they charge commission fees as well as hidden exchange rate margins. Revolut and Wise exchange currency at the real mid-market rate and let you hold money in digital accounts on your smartphone.

Yes. Some banks and credit unions waive their fixed commission fees for foreign currency exchange. However, they will exchange your money at a rate that is weaker than the real mid-market exchange rate, and they will keep the difference. This is a hidden fee called an exchange rate margin.

You can exchange foreign currency at a bank or credit union, which will be expensive. Or you can use digital multi-currency accounts like Revolut and Wise , which are very powerful and cheap alternatives. We also recommend using debit cards to withdraw foreign cash at ATMs while abroad.

American Express will exchange your money at a rate that is around four to seven per cent weaker than the real mid-market exchange rate, and they will keep the difference. This is a hidden fee called an exchange rate margin.

The best place for currency exchange is actually neither a bank nor a credit union. Digital multi-currency accounts like the ones offered by Revolut and Wise are much cheaper alternatives for buying foreign currency. If you are searching for an international money transfer instead, online money transfer specialists like Remitly are your best bet for sending money to friends and family overseas.

No, it is not cheaper. Online multi-currency accounts like Revolut and Wise are cheaper because they exchange currency at the real mid-market rate. They even hold your money digitally on your smartphone.

No, American Express will charge a commission fee and an exchange rate margin on your currency exchange.

Traditional banks, like American Express, do not usually publicly disclose the exchange rates online. AMEX will often exchange your money at a rate that is around four to seven per cent weaker than the real mid-market exchange rate, and they will keep the difference. This is a hidden fee called an exchange rate margin .

Looking For Other Bank Currency Exchange Services Online?

Below, you'll find all our guides helping you to exchange money at other bank currency exchange services worldwide:

Other Guides on Foreign Currency and Bank Currency Exchange

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

You are using an outdated browser. Please upgrade your browser to improve your experience.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

It appears that JavaScript is either disabled or not supported by your web browser. JavaScript must be enabled to experience the American Express website and to log in to your account.

Redemption of American Express ® Travelers Cheques

Travelers Cheques have been a timeless addition to the world traveler’s carry-on for over 130 years. While new Travelers Cheques are no longer issued, your Cheques remain backed by American Express and have no expiration date.

REDEEM WITH AMEX ANYTIME

NO EXPIRATION DATE

24/7 CUSTOMER SERVICE

BACKED BY AMERICAN EXPRESS

HOW TO REDEEM

Travelers Cheques can no longer be purchased but can be redeemed in several convenient ways. Here’s how:

REDEEM WITH AMERICAN EXPRESS TRAVEL RELATED SERVICES COMPANY, INC.

REDEEM ONLINE

Quickly and securely redeem your Travelers Cheques online .

Call American Express Customer Service at 1-800-221-7282 or find additional contact numbers based on your location to redeem over the phone.

DEPOSIT WITH YOUR BANK

Confirm whether your bank allows account holders to deposit Travelers Cheques. Fees may apply.

EXCHANGE FOR LOCAL CURRENCY

Travelers Cheques can be exchanged worldwide. Find exchange locations . Fees may apply.

TRAVELERS CHEQUES EXCHANGE LOCATOR

Find the nearest exchange location.

Service Center

Have more questions?

Here are some common scenarios and what to do.

UNDERSTANDING TRAVELERS CHEQUES

Keep your Cheques secure until you’re ready to redeem.

Protect yourself in case of loss or theft by signing on the upper signature line.

Record the serial numbers and keep them in a safe place when you travel.

Keep your Cheques tucked away and hidden like you would cash.

When the time comes, sign your Cheque on the lower signature line in sight of the person accepting it.

Find documents you may need in case of claiming inherited Cheques, lost or stolen Cheques, and more.

DOCUMENTATION

Additional documents may be required based on the claim type. Typical documents include:

- Valid Photo ID (Passport, Driver's License or Government Issued ID)

- Copy of the Voided Travelers Cheque(s)

- Refund Details

UPLOAD DOCUMENTS

Once you have gathered the required documents and filled out any required documents and forms, upload here. Clear images will help expedite processing.

UNABLE TO UPLOAD?

If you’re unable to upload your completed documents, you can send hard copies directly to American Express .

INHERITED CHEQUES

How to redeem your inherited Travelers Cheques if the original owner is deceased or incapacitated.

1. OPEN A CLAIM

Call American Express Customer Service at 1-800-221-7282 or find additional contact numbers based on your location to begin a claim over the phone.

2. IDENTIFY & LOCATE REQUIRED DOCUMENTS

List of required documents and forms can be found here . You’ll need these to submit your claim.

3. UPLOAD REQUIRED DOCUMENTS

Be sure to upload clear images for faster processing.

4. IF YOU’RE UNABLE TO UPLOAD

As an alternative to submitting online, you can also mail hard copies of your documents to American Express .

*Travelers Cheque Encashment service is provided by American Express Travel Related Services Company, Inc.

Can I buy Travelers Cheques?

Travelers Cheques are no longer issued and so cannot be purchased.

Where can I redeem my Travelers Cheques?

There are thousands of foreign exchange partners in countries around the world where you can exchange your American Express Travelers Cheques for local currency. You can find places to redeem your Travelers Cheques using " Find Exchange Locations ". It may also be possible to redeem your Travelers Cheques directly for goods and services. Check first, though, with the merchant. American Express does not approve the use of its products, or any services related to its products, in the following territories: Crimea, Donetsk, and Luhansk Regions of Ukraine, Cuba, Iran, North Korea, Syria, Russia and Belarus.

Can I redeem my Travelers Cheques directly with American Express?

Yes, you can redeem your Travelers Cheques directly with American Express Travel Related Services Company, Inc. online . Alternatively, you can call American Express Customer Service at 1-800-221-7282 to register a redemption claim. You can find additional contact numbers based on your location. We may have to contact you with questions regarding your claim or to request additional information.

How do I redeem my Travelers Cheques?

You can redeem your Travelers Cheques directly with American Express Travel Related Services Company, Inc. Please refer the “How to Redeem” section above. Alternatively, simply present the Cheque at an eligible foreign exchange partner or merchant location. Make sure the acceptor watches while you countersign the Cheque on the lower signature line. Photo identification may be required. We strongly recommend you retain and carry your original Cheque purchase receipt with you when you travel. Commission charges may apply and can vary by country or exchange partner. Exchange limits may apply due to local regulations and exchange policies.

What happens if I sign my Travelers Cheques in the wrong place, or if my signatures don't match?

Acceptance of Travelers Cheques is based on the acceptor watching the customer sign the Cheque on the lower signature line, and then comparing that signature with the original signature on the upper signature line. The acceptor must observe the customer signing the Cheque. If the signatures are a reasonable match, the Cheque should be accepted. Photo identification may be required at the discretion of the acceptor. As always, if the acceptor is unsure, they should call an American Express Travelers Cheque Customer Service Center .

Is there a fee to cash Travelers Cheques?

Commission charges may apply and can vary by country and/or exchange partner. Before you travel, we recommend that you find the most convenient Travelers Cheque exchange locations using the Find Exchange Locations .

What happens if my Cheques are lost or stolen?

Lost or stolen Travelers Cheques may be refunded.* Please call Customer Service at 1-800-221-7282 or find the additional contact numbers for your current location. Have your recorder serial numbers on hand when you call.

* Terms & Conditions and restrictions apply. Identification and proof of purchase required.

How are Gift Cheques cashed?

When cashing a Gift Cheque, the recipient should fill out the "pay to the order of" line and countersign the Gift Cheque in the lower corner with the acceptor watching. If you encounter diffiulties in cashing a Gift Cheque in the United States, please encourage the merchant to call American Express for instructions at 1-800-221-7282 . If you are located outside of the U.S., you can find additional contact numbers to provide the merchant based on your location.

Can I redeem my Gift Cheques directly with American Express?

Yes, you can redeem your Gift Cheques directly with American Express Travel Related Services Company, Inc. online . Alternatively, you can call American Express Customer Service at 1-800-221-7282 to register a redemption claim. You can find additional contact numbers based on your location. We may have to contact you with questions regarding your claim or to request additional information. You can also find places to redeem your Gift Cheques using Find Exchange Locations . There also may be restrictions on the currency and method of redemption and the value of Gift Cheques that can be redeemed.

Still Need Help?

Call American Express Customer Service 24/7 at 1-800-221-7282 or find additional contact numbers based on your location.

American Express stopped issuing Travelers Cheques, so they’re no longer available for purchase. Support is available by phone and the American Express website for customers to redeem valid Travelers Cheques. Travelers Cheques remain backed by American Express and have no expiration date.

Members save 10% or more on over 100,000 hotels worldwide when you’re signed in

Elektrostal travel guide, visit elektrostal, check elektrostal hotel availability, popular places to visit, electrostal history and art museum.

You can spend time studying the exhibits at Electrostal History and Art Museum in Elektrostal. Take in the museums while you're in the area.

- Cities near Elektrostal

- Places of interest

- Ramenskii History and Art Museum

- Church of Our Lady of Kazan

- Malenky Puppet Theater

- Pavlovsky Posad Museum of Art and History

- Church of Vladimir

- Likino Dulevo Museum of Local Lore

- Shirokov House

- Fairy Tale Children's Model Puppet Theater

- Fifth House Gallery

- Art Gallery of The City District

Expedia Rewards is now One Key™

Elektrostal, visit elektrostal, check elektrostal hotel availability, popular places to visit.

- Electrostal History and Art Museum

You can spend time exploring the galleries in Electrostal History and Art Museum in Elektrostal. Take in the museums while you're in the area.

- Cities near Elektrostal

- Places of interest

- Yuri Gagarin Cosmonaut Training Center

- Peter the Great Military Academy

- Central Museum of the Air Forces at Monino

- History of Russian Scarfs and Shawls Museum

- Ramenskii History and Art Museum

- Balashikha Museum of History and Local Lore

- Pekhorka Park

- Balashikha Arena

- Drama Theatre BOOM

- Bykovo Manor

- Malenky Puppet Theater

- Pavlovsky Posad Museum of Art and History

- Saturn Stadium

- Church of Vladimir

- Likino Dulevo Museum of Local Lore

- Orekhovo Zuevsky City Exhibition Hall

- Noginsk Museum and Exhibition Center

- Fairy Tale Children's Model Puppet Theater

- Fifth House Gallery

- Malakhovka Museum of History and Culture

IMAGES

COMMENTS

Travel. American Express Travel, foreign exchange, travelers cheques and traveling with your Card.

Many U.S. banks will exchange USD for foreign currencies without charging a fee, but there are often stipulations. For instance, Bank of America customers can exchange foreign currencies for free ...

First, you can do so at home, by visiting an American Express Travel Service center. Alternatively, you can exchange currency when you arrive at your destination. Most airports are home to currency exchange companies, but you can expect these locations to charge very high commissions.

Airport currency exchange rates are among the worst you'll find. It's not uncommon to see airport exchanges charging 14% more than the current International Monetary Fund (IMF) exchange rate ...

Depending on the type of product you have, you may be charged foreign transaction fees to convert your international transactions into US currency.You can check if foreign transaction fees are waived for your Card through your online account. Otherwise, for personal and small business (OPEN) Cards we charge 2.7%, and for Corporate Cards, it's 2 ...

Best Wells Fargo Credit Cards Best American Express Credit Cards ... travel, you may also find currency exchange stores and kiosks. ... currency exchange services at the bank's branches, which ...

Currency from many African and Eastern European countries can only be exchanged at those countries' banks and ATMs. Here is a checklist: Contact a bank or credit union to make sure it has the ...

5 ways to exchange foreign currency. 1. Get cash at your bank or credit union before and after your trip. Many banks and credit unions sell foreign currencies without charging a fee beyond the ...

Get the best currency exchange rates for international money transfers to 200 countries in 100 foreign currencies. Send and receive money with best forex rates. ... These currency charts use live mid-market rates, are easy to use, and are very reliable. View charts. ... Travel Expenses Calculator. Currency Email Updates. More tools. Recommended ...

VIP In-House Services. Call or Write Us. Email [email protected] or call 212-897-5008. For more information on Passport and Visa requirements, please go to travel.state.gov or contact one of our Travel Advisors.

Foreign Currency For Travel in 2024. If you are a retail customer who wants to hold foreign cash for your travels, then we highly recommend you avoid using American Express currency exchange services. Large American banks and credit unions like American Express charge two very large fees, one that is transparent and another that is hidden:. Bank Fee: This is a transparent fee that banks charge ...

Call American Express Customer Service 24/7 at 1-800-221-7282. or find additional contact numbers based on your location. American Express stopped issuing Travelers Cheques, so they're no longer available for purchase. Support is available by phone and the American Express website for customers to redeem valid. Travelers Cheques.

Uncover Elektrostal's best with our Travel Guide for 2024. Expert tips & must see recommendations. Whether a tourist or local, plan your holiday today with this tourist guide!

Travel Guide. Check-in. Check-out. Guests. Search. Explore map. Visit Elektrostal. Things to do. Check Elektrostal hotel availability. Check prices in Elektrostal for tonight, Apr 20 - Apr 21. Tonight. Apr 20 - Apr 21. Check prices in Elektrostal for tomorrow night, Apr 21 - Apr 22. Tomorrow night.

Find handyman services near me on Houzz Before you hire a handyman service in Elektrostal', Moscow Oblast, browse through our network of over 42 local handyman services. Read through customer reviews, check out their past projects and then request a quote from the best handyman services near you. Finding handyman services in my area is easy on ...

Search 8 Elektrostal' arborists & tree trimming services to find the best tree service professional for your project. See the top reviewed local tree services in Elektrostal', Moscow Oblast, Russia on Houzz.