June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

We are in the business of assisting people. So whether you have a problem while you’re traveling, or you are having trouble with our website, we can help. This page is dedicated to providing you with the links and phone numbers you need to get the information you want.

Emergency Assistance Numbers

Within the United States, Canada, Puerto Rico and the U.S. Virgin Islands call toll free:

1-800-654-1908

Outside of the United States, call collect:

1-804-281-5700

Help is always a phone a call away with Allianz Global Assistance. Our staff of multilingual problem solvers is available to help you with medical, legal or travel-related problems.

> Read more about How We Can Help

We have 34 offices on five continents and a global network of 400,000 medical and non-medical providers.

Our medical assistance services include, but are not limited to, the following:

- Medical triage with referrals to local medical providers

- On-going medical monitoring

- Payment guarantee

- Emergency medical transportation.

We also cover a broad range of travel-related emergencies such as:

- Missed connections

- Lost/stolen travel documents

- Pre-trip information

- Lost baggage

- Prescription replacement

- Emergency cash

Help on the Website

We want you to have the best online experience possible, making it seamless to do what you need to do.

Our website allows you to file a claim , check on an existing claim and even make changes to your policy .

If you need proof of travel insurance to satisfy your destination travel requirements, please request Proof of Insurance here .

If you can't find what you're looking for online, please send us an email or use our online contact form to reach us. You may also give us a call at 1-866-884-3556 . Our customer service team can help you purchase a new policy, make changes to an existing policy, file a claim, or answer any questions you may have.

We also have a complete list of FAQs to help answer common questions.

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

[email protected] | 0861 000 234

0861 000 234 | [email protected]

Rates Calculator

Roadside Assistance

Emergency Services

Aa auto centre, aa financial services, get in touch, need help with something aa related, i need help choosing a product.

- * FIRST NAME * LAST NAME *

- MOBILE NUMBER * MOBILE NUMBER *

- Product * AA Membership AA Armed Response AA Warranties Car Insurance AA Connected Car AA Pet PLEASE SELECT A PRODUCT

Have a comment or a question?

We’re ready to help in any way we can – and your feedback is important to us too. Fill out the form below or call us on 0861 000 234. Our contact centre is available 24 hours a day, 7 days a week, 365 days a year.

0861 000 234

Emergency number (Open 24 hours Monday – Sunday) 365 days a year

Your feedback is important to us

- MOBILE MOBILE NUMBER *

- EMAIL * EMAIL *

- REASON * I have an enquiry I have a suggestion I have a compliment I have a complaint I want to become a member of the AA I want to renew my AA membership REASON *

- PREFERRED METHOD OF CONTACT * Phone preferred Email preferred PREFERRED METHOD OF CONTACT *

- MESSAGE * MESSAGE *

- Phone This field is for validation purposes and should be left unchanged.

Complaints and Claim Process

- All complaints SLA are 24 to 48 hours

- All refund/ Claim payments take 7 to 14 business days from the date all documents are obtained

- All Complaints or Claims can be sent to [email protected]

Head office

+27 (086) 524 2251

POSTAL ADDRESS

Customer Relations PO Box 596 Johannesburg 2000

PHYSICAL ADDRESS

Denis Paxton House 4 Hyperion Road Barbeque Downs Kyalami

GPS COORDINATES

25°59’54.0″S+28°04’21.4″E

VIEW MAP & DIRECTIONS

Value Added Products

Tools & calculators, what is your emergency.

Emergency Medical Assistance

AA Armed Response

AA Roadside Rescue

About the aa, corporate solutions, the automobile association of south africa.

For over 90 years, we’ve provided you with roadside rescue and security, so you know you can rely on the Automobile Association day and night.

We aim to empower you as a road user and add value to your life with our products and services.

Decrease in fatalities welcome – but more needs to be done

2024 to start on positive fuel note for consumers, good fuel news for motorists to start 2024, your aftermarket automotive repair expert, privacy overview.

Join AAA today Membership gives you access to Roadside Assistance, Deals, Discounts, and more.

- Add Members

- Gift Membership

- Member Benefits Guide

- The Extra Mile

- Renew Expires in 28 days

AAA Visa Signature® Credit Cards

Earn a $100 Statement Credit

After spending $1,000 on your card within 90 days of account opening.

- Advice back All Advice Travel Auto Money Home Life

- Destinations back All Destinations Northeast States Southeast States Central States Western States Mid-Atlantic States National Parks Road Trips International Travel Inspiration

- Connect back All Connect Community Stories Authors & Ambassadors

- Guides back All Guides Doing Your Taxes Protecting Your Valuables Winter Driving Buying and Selling a Car Buying and Selling a Home Getting Organized Home Improvement Improve Your Finances Maintaining Your Car Saving Money Staying Healthy Traveling

- Series back All Series AAA World Garden Road Trips Member News AAA's Take Good Question Car Reviews AAA Traveler Worldwise Foodie Finds Minute Escapes

- Premier Benefits

24 Hour Emergency Travel Assistance*

To access these services, call the Premier Member Services telephone number: 1-888-222-9688. The terms are defined under "summary of benefits" as outlined in the Travel Insurance Coverage portion.

Assistance translation services — If a Covered Person has the need to use any of the following Assistance Services, an Assistance Service representative will be available to translate or arrange for translation, by telephone, as needed for the purposes of providing the service.

Medical provider referrals, appointments, and admissions arrangements — If a Covered Person is in need of a doctor or medical facility, an Assistance Services representative will refer the Covered Person to the most appropriate doctors and facilities in the location they requested using a world–class proprietary database of leading hospitals ans physicians. If necessary, they will also assist the Covered Person in setting appointments and will also arrange the Covered Person's admission to a hospital or medical center. The Covered Person is responsible for all fees associated with the medical treatment received.

Emergency medical transportation arrangements — The Covered Person's benefits include access to a network of medical transportation and air ambulance providers. If a Covered Person has a medical emergency while traveling, an Assistance Services representative will arrange emergency medical transportation including evacuation. The Covered Person is responsible for any fees associated with such medical transportation.

Prescription replacement arrangements — If a Covered Person misplaces his prescription drugs, an Assistance Services representative will contact the Covered Person's pharmacy and obtain drug refill information on the Covered Person's behalf, if available. They will then make arrangements with a network doctor or pharmacist to supply a replacement to the Covered Person. The Covered Person will pay all associated costs.

Emergency visitation arrangements — If a Covered Person is hospitalized, such Covered Person's family may call an Assistance Services representative for help with travel arrangements to visit the Covered Person. The Covered Person and his family members are responsible for any costs of travel.

Emergency cash transfer arrangements — If the Covered Person's cash or Covered Person's checks are lost or stolen, or if he needs emergency funds for the payment of unanticipated expenses, an Assistance Services representative will make necessary arrangements for emergency cash to be transferred to the Covered Person. These funds, as well as any associated fees, will come from the Covered Person's family, friends, or credit accounts.

Emergency message center service — If the Covered Person is faced with an emergency, the emergency message center enables an Assistance Services representative to receive a message from the Covered Person and make appropriate attempts to deliver the message to its intended recipient. For example, if a Covered Person needs emergency surgery and is unable to reach his family, the representative will make repeated attempts to make contact until the family can be reached.

Lost ticket and document replacement arrangements — If a Covered Person loses a ticket or passport while traveling, an Assistance Services representative will provide information and help the Covered Person to obtain replacement documents, including tickets and passports. The Covered Person must pay for all associated fees.

Benefits apply during Covered Travel as defined under the Travel Accident Insurance section Individual Page for Travel Insurance Coverage

*Assistance benefits are provided and serviced by AGA Service Company.

- Membership Plans

- Renew Membership

- Upgrade Membership

- Contact AAA

Welcome to AAA

To enjoy customized local content, please enter your ZIP Code below.

Limited Time Offer!

Please wait....

- Domestic Travel Insurance

- International Travel Insurance

- Make a Claim

- COVID-19 FAQs

Advice for lodging your claim

We are currently dealing with a significant increase in claims and it can take up to 30 days to process your claim.

Please read below as the more evidence you can provide at the time of lodging your claim, the better, as this will help speed up the process and not require us to make additional contact to obtain further documentation.

If your claim includes;

Delayed or cancelled flights

When a flight is delayed or cancelled by the airline due to a fault of their own, i.e. For mechanical issues or staffing shortages, the onus is on the airline in the first instance to provide you with compensation. If, however, it is a weather disruption beyond the airline’s control, there is a provision to claim for the disruption.

For any claims submitted in either case, we require confirmation from the airline of the reason for the delay and the compensation, if any paid. Where an airline is unwilling to provide any compensation, we also require evidence, such as a letter or email confirmation from the airline.

Lost or delayed baggage claims

First and foremost, you must contact and seek compensation from the airline, even if you have travel insurance.

If the airline admits to the loss of checked baggage or if the checked baggage had not arrived at the expiry of 21 days from when it was due to arrive, you have the right to seek compensation from the airline under the Montreal Convention of 1999.

Once you have received an outcome from the airline, if you have not received the total amount you claimed from the airline, you have a provision to claim for the difference. At this point, you should submit a claim with Allianz Partners, inclusive of all the relevant documentation from the airline, detailing what was covered and what was not covered, providing receipts and as much proof of purchase as possible.

Proof of purchase/ownership for lost or stolen luggage

For claims relating to lost or stolen luggage and items, we require proof of purchase or ownership. Proof of purchase can be in the form of, but not limited to, receipts, bank/visa statements, warranties, photos etc. It is important to note that photos are not accepted for some items, such as electronic or high-value items – typically goods that have a value in excess of $250.

We understand that the traveller may not have receipts for all items; however, they do need to provide some proof of ownership.

A Covid-19 Claim

If you are overseas

Whilst abroad, it is important to note that you should abide by the destination country’s local Covid-19 isolation rules. For example, if you test positive for Covid-19 while travelling abroad and the destination has limited or no isolation requirements, we expect that you will act in accordance with those requirements. If there are no Covid-19 related isolation requirements in the country you are travelling in, but you are too sick to complete or continue your journey, you will need to provide a medical certificate from a Registered Medical Practitioner to support your claim (just as you would for any other medical related travel disruption claim).

However, if you test positive for Covid-19 in your destination country and you are required to isolate under current local Covid-19 isolation rules, and cannot complete your travel, then you should, in order to have a provision for claim, obtain and submit as evidence the below documents, including but not limited to:

A medical certificate from a Registered Medical Practitioner stating how long you are medically unfit to travel for

A dated supervised RAT or PCR test detailing a Covid-19 positive result in your name. (Large towns and cities abroad typically have Travel Health Clinics that offer supervised RAT tests).

Evidence of the isolation requirements in the destination country you tested Covid-19 positive in.

If you are denied boarding based on the suspicion that you have an Epidemic or Pandemic disease (please refer to the Policy Wording as a daily limit and maximum benefit applies), in order to have a provision for claim, you need to provide the below documentation as evidence, but not limited to:

Written dated confirmation from the public transport provider detailing your denied boarding and the circumstances.

It is important to note that Allianz Partners recognises that the Covid-19 environment and the global response have changed. Everyone’s situation is unique, and we will reasonably assess every claim with individual merit.

If you cannot fulfil the required evidential documentation detailed above, you need to be aware that it is your responsibility to provide as much information as possible that may support your claim. This may include logical date and location-sensitive, behavioural evidence supporting your claim.

As with any insurance policy, it is the your responsibility to prove you experienced a claimable event. We cannot accept any claims without sufficient evidence.

All claims must be of a reasonable nature, meaning a level comparable to the same nature and class as booked for the rest of your journey.

A single photo of a positive self-RAT test is not considered sufficient evidence. Below is an example of a recently accepted successful claim which was submitted without our preferred evidence:

Five iPhone photos of RAT self-tests from five days of being ill with Covid.

Each RAT test had a different serial number.

Each photo had evidence of the date and location it was taken at so we could see that it matched the insured's claimed dates.

A copy of a receipt for over-the-counter cold and flu medications.

Understandably we do not offer pre-approvals for any travel disruption claims, as we need time to assess all the relevant documentation and its variables. Typically for all travel disruption-related claims, you would pay in advance and then submit a claim with the required documentation.

If you are unsure at any point in time, please call our Customer Care team or our 24/7 Emergency Assistance service for advice and guidance on your unique situation.

Pre-departure Travellers

Before departing New Zealand, if you test positive for Covid-19 and you are required to isolate due to the New Zealand government’s local Covid-19 isolation rules, and you cannot commence your travel, the below evidence will be accepted:

A self-RAT test recorded on New Zealand's My Covid Record/My Health Account/Ministry of Health Covid-19 website at the time of testing.

There is no cover for lockdowns, changes in government alert levels, quarantine or mandatory isolation applying to a population or part of a population. As with any travel insurance, disinclination to travel due to fear or change of mind is not covered.

Terms, conditions, limits, sub-limits and exclusions apply and customers considering purchasing a travel insurance policy should read the Policy Wording to check what is and isn’t covered.

Claims portal attachments

The claims portal www.claimmanager.co.nz is the best way to lodge leisure and business policy claims.

Please ensure that all receipts are attached as individual files, i.e. pdf, jpg, gif, png and not embedded in an attached email or located in a drop box/google drive.

If an email with attachments is submitted, then any attachments to that email will not pull and appear with the claim, thus delaying the claim further, as a new copy of this documentation will be requested.

Alternatively, all documentation can be emailed to: [email protected]

Our customer care team are based right here in New Zealand and more than happy to help if you have any questions. We also provide access to 24/7 worldwide emergency assistance in case something crops up during your trip, no matter where you are in the world.

For general enquiries, call us on 0800 630 115

We're available Monday to Friday, 8:30am-5pm

PO Box 33313 Takapuna Auckland

Emergency trip assistance

Within New Zealand:

- 0800 630 115, 8:30am - 5pm Mon-Fri

- +64 9 486 6868 after hours

Global: +64 9 486 6868

If you need emergency assistance while you are travelling, contact the Emergency Assistance team as soon as it is possible to do so safely if you:

- Are about to be admitted to hospital

- Have had your luggage, travel documents, or money stolen. For credit cards, please contact the credit card company to cancel them immediately.

- Need to urgently change your travel plans or shorten your journey.

When you call, you'll be asked for:

- Your Policy Number and policy type (for example AA Travel Insurance Comprehensive plan)

- A contact phone number (including area code)

Our insurance partner

AA Travel Insurance policies are brought to you by the New Zealand Automobile Association Incorporated (AA), are issued and managed by AWP Services New Zealand Limited trading as Allianz Partners and underwritten by The Hollard Insurance Company Pty Ltd ABN 78 090 584 473 (Incorporated in Australia) ("Hollard"). You should consider the Policy Wording before making any decisions about this insurance policy. Terms, conditions, limits, sub-limits and exclusions apply.

Financial Strength Rating

The Hollard Insurance Company Pty Ltd ABN 78 090 584 473 (Incorporated in Australia), ("Hollard"), has been given a financial strength rating of A (Strong) issued by Standard and Poor's. View the full details on the Financial Strength Rating .

An overseas policyholder preference applies. Under Australian law, if The Hollard Insurance Company Pty Ltd is wound up, its assets in Australia must be applied to its Australian liabilities before they can be applied to overseas liabilities. To this extent, New Zealand policyholders may not be able to rely on The Hollard Insurance Company Pty Ltd’s Australian assets to satisfy New Zealand liabilities.

Financial advice

The New Zealand Automobile Association provides general information about AA Travel Insurance products and services so that you can make a choice that best meets your needs. Information provided does not take into account your personal circumstances, needs or goals and is not intended to be financial advice. If you'd like to receive financial advice, you can get professional advice from a registered financial adviser.

More information

Policy Wording Make a claim Terms and conditions AA Traveller Member Benefits

*AA Members can receive a 10% discount on AA Travel Insurance. Simply provide each traveller’s valid AA Membership number on application. Discount applies to AA Member cover premium, including any additional pre-existing cover, but does not apply to additional cover for high value items.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AAA Travel Insurance Review 2024: Is it Worth the Cost?

Elina Geller is a former Travel Writer at NerdWallet specializing in airline and hotel loyalty programs and travel insurance. Her passion for travel rewards began in 2011 when she flew first class to London and Amsterdam on British Airways and used hotel points to stay in both cities. In 2019, Elina founded TheMissMiles, a travel rewards coaching business. Elina's work has been featured by AwardWallet. She’s a certified public accountant with degrees from the London School of Economics and Fordham University.

Mary Flory leads NerdWallet's growing team of assigning editors at large. Before joining NerdWallet's content team, she had spent more than 12 years developing content strategies, managing newsrooms and mentoring writers and editors. Her previous experience includes being an executive editor at the American Marketing Association and an editor at news and feature syndicate Content That Works.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does AAA travel insurance cover?

Aaa single-trip plans, aaa annual plans, which aaa travel insurance plan is best for me, can you buy aaa travel insurance online, what isn’t covered by aaa travel insurance, aaa travel insurance, recapped.

- You don't need to be an AAA member.

- Annual or single-trip policies are available.

- Can add on a Rental Car Damage protector plan.

- Cheapest option doesn't include medical coverage.

- CFAR upgrade is only available for higher-cost plans.

Before going on a trip, it's important to give travel insurance some serious thought as it can protect you if anything goes wrong on your vacation. One provider to consider is AAA Travel Insurance.

The company’s policies are administered by Allianz Global Assistance, an insurer that serves 40 million customers in the U.S. and operates in 35 countries. You do not have to be a AAA member to purchase AAA travel insurance.

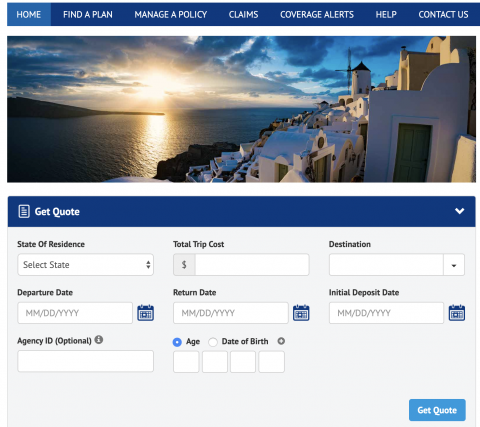

AAA offers annual or single-trip policies for domestic and international travel. The policies vary by state and travel destination, so the plans available in your home area may differ from the examples shown below. Use AAA's Get A Quote tool to see your specific pricing.

» Learn more: The majority of Americans plan to travel in 2022

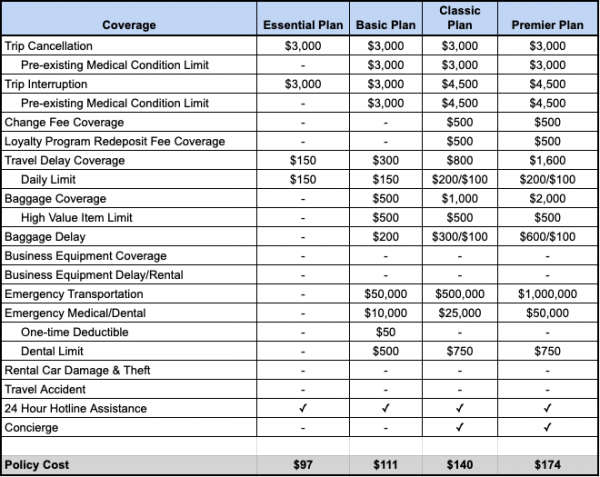

AAA’s single-trip plans are designed for travelers who are leaving their homes, visiting another destination, domestic or international, and returning. To get an idea of which plans are available, we input a sample itinerary of a $3,000, two-week trip to Spain by a 45-year-old from Indiana. For this itinerary, AAA offered four single-trip plans.

* Higher limit requires receipts to be submitted.

AAA single-trip plans cost

The Essential Plan ($97) is ideal for those who just want the basics of trip cancellation and trip interruption insurance and don't need the other protections. This is a good fit for domestic travelers who already have health coverage in the U.S. and don't plan on bringing business equipment.

The Basic Plan ($111) includes all the features of the Essential Plan, along with medical coverage and some increased protections for baggage and travel delays.

The Classic ($140) and Premier Plans ($174) are nearly identical, but the latter provides double emergency medical coverage, emergency transportation, trip delay and baggage delay limits.

The Classic Plan offers a "cancel for any reason" optional upgrade for $71, which would bring the total to $211.

There is also a Rental Car Damage protector plan for $135, which provides $1,000 of trip interruption and baggage loss coverage and $40,000 of rental car damage and theft benefits. This plan will cover your costs if the rental car is stolen or damaged. In addition, you’ll be reimbursed for the unused portion of your trip and if your bags are lost or damaged. This plan offers an alternative to purchasing coverage at the rental counter.

» Learn More: Cancel For Any Reason (CFAR) travel insurance explained

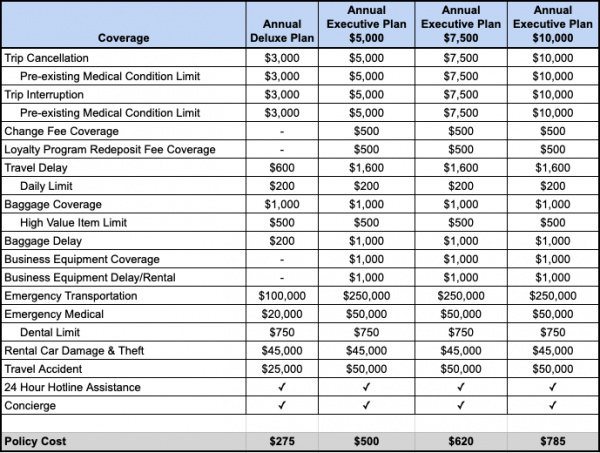

The annual policies provide 365 days of domestic and international coverage and are best suited for those who travel often. To see which plans are available, we input a $15,000 annual travel budget for coverage starting in July 2020 for a 30-year-old from New Hampshire. For this itinerary, AAA is offering four policies, with the three higher-end plans geared toward business travelers.

AAA annual plans cost

The Annual Deluxe Plan ($275) is designed for those who aren’t too concerned with pre-trip cancellation benefits or business equipment protections and are more interested in medical coverage while abroad. If you already have some travel insurance through a credit card, this plan may be sufficient.

The next three Annual Executive Plans ($500-$785) are tiered based on the amount of trip cancellation and interruption coverage provided ($5,000, $7,500 or $10,000). All the other protections under the Executive Plans are identical. All three plans include business equipment coverage as well as business equipment rental and delay protections. If you’re traveling for work, these plans may be your best bet.

Although all four of these are annual plans, no individual trip can exceed 45 days. For trips longer than 45 days, Allianz offers an AllTrips Premier plan , which provides coverage for up to 90 days per trip.

» Learn more: What to know before buying travel insurance

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re traveling.

If you have a premium travel card that already provides you with a sufficient level of trip cancellation coverage, you may only need to get a standalone emergency medical policy. For example, The Business Platinum Card® from American Express offers $10,000 per trip and $20,000 per year in trip cancellation benefits. Terms apply. Only the Annual Executive Plan ($10,000) has a comparable level of trip cancellation coverage.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card, then you might be better off with a comprehensive plan like one of the single or annual trip plans, depending on your travel goals.

If you’re a long-term traveler and expect to take many trips, the annual plans will be the most suitable. However, with coverage for each trip capped at 45 days, you’ll want to look at other options if you will be away from home for longer.

Yes, you can buy AAA Travel Insurance onlince. Head over to Agentmaxonline.com , input your trip details and choose “Get Quote” to see a list of available plans.

Trip insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

» Learn more: Will travel insurance cover winter weather woes?

Yes. However, plan choices depend on your state of residence and trip duration. We performed various searches for sample trips and found policies for single trips and annual trips. Single-trip plans are great for travelers who are traveling from their home to a different destination (domestic or international) and then returning. Coverage ends when the traveler returns home. Annual trip plans are designed for those who want to take several trips during a specific period of time, regardless of how many times they return home during the covered period.

The cost of a travel insurance policy depends on many factors , including the trip length, your state of residence and how much coverage you’d like. Our sample search for a $3,000 two-week trip to Spain showed policies ranging from $97 to $211, representing 3% to 7% of the total trip cost.

Yes, AAA’s travel insurance policies offer coverage for international travel. To check the type of plans available for your intended destination, visit AAA’s travel insurance site and enter your trip details.

Travel insurance offers a safety net so that if something goes wrong while you’re on vacation, you’re not alone. Whether it's a cancelled flight, lost luggage or emergency medical care, travel insurance coverage will come in handy. Although it's never fun to think about unexpected emergencies that can derail your trip, consider how much risk you’re willing to take before deciding to not purchase a policy. That will help you decide if travel insurance is worth it .

The cost of a travel insurance policy

depends on many factors

, including the trip length, your state of residence and how much coverage you’d like. Our sample search for a $3,000 two-week trip to Spain showed policies ranging from $97 to $211, representing 3% to 7% of the total trip cost.

Yes, AAA’s travel insurance policies offer coverage for international travel. To check the type of plans available for your intended destination, visit

AAA’s travel insurance site

and enter your trip details.

Travel insurance offers a safety net so that if something goes wrong while you’re on vacation, you’re not alone. Whether it's a cancelled flight, lost luggage or emergency medical care, travel insurance coverage will come in handy. Although it's never fun to think about unexpected emergencies that can derail your trip, consider how much risk you’re willing to take before deciding to not purchase a policy. That will help you decide if

travel insurance is worth it

AAA was found to be one of the best travel insurance companies according to NerdWallet's most recent analysis.

Before shopping for a policy, check to see what coverage you may already have. Some premium credit cards provide travel insurance. If you hold one of these credit cards and the coverage limits are adequate, you may only need a standalone emergency medical insurance policy . However, if your credit card doesn’t cover you sufficiently, a comprehensive travel insurance plan might be the right choice. AAA offers a few plans to pick from, but the choices boil down to annual or single-trip insurance plans.

No matter what type of traveler you are, AAA offers various trip insurance options to choose from. Rates and options vary by state, so be sure to input your information into the online tool.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

Enable JavaScript

Please enable JavaScript to fully experience this site. How to enable JavaScript

Allianz Trip Insurance

Protect your travel experience

Read about Allianz Trip Insurance’s COVID-19 insurance coverage limitations and accommodations.

U.S. coverage alert Opens another site in a new window that may not meet accessibility guidelines.

Top reasons to buy trip insurance

- Financial reimbursement if you have to cancel or interrupt your trip due to a covered illness, injury, jury duty, and more

- Emergency medical benefits in and outside the U.S. – where many personal health insurance policies (like Medicare) won’t cover you

- 24-hour emergency assistance to help you solve medical and other travel-related problems on the go

Types of trip insurance plans

Allianz Trip Insurance comes in a variety of plans to fit your specific needs. Single-trip plans can protect one trip, annual plans can protect all your trips for an entire year, and rental car protection plans can keep your budget safe from accidental collision and damage to a rental vehicle.

All insurance is recommended / offered / sold by 3rd party, Allianz Global Assistance, not American Airlines. Underwriter: Jefferson Insurance Company or BCS Insurance Company. AGA Service Company is the licensed producer and administrator of these plans. AGA Service Company is a licensed producer in all 50 states plus the District of Columbia.

Get a quote Opens another site in a new window that may not meet accessibility guidelines.

Trip insurance benefits

Reimburses your prepaid, non-refundable travel expenses if you need to cancel your trip due to a covered illness, injury, and more.

Reimburses the unused, non-refundable portion of your trip and increased transportation costs it takes for you to return home early or to continue your trip due to a covered illness, injury, and more.

Reimburses expenses related to covered emergency medical or dental care incurred on your trip.

Provides benefits for medically necessary transportation to the nearest appropriate medical facility following a covered injury or illness.

Reimburses extra meals and accommodations you may need if your flight is delayed for 6 or more hours for a covered reason.

Reimburses you if your luggage is lost, damaged or stolen during your trip—keeping your travel plans on track.

Reimburses the purchase of essential items if your luggage is delayed for more than 24 hours.

Turn your trip into a VIP experience. Our travel experts can give you destination information, make restaurant reservations, find tickets to shows, and more.

Help is just a phone call away. Our team of multilingual problem solvers is available to help you with medical and other travel-related emergencies.

Provides primary coverage with no deductible.

Review period

If you’re not completely satisfied, you have 15 days (or more, depending on your state of residence) to request a refund, provided you haven’t started your trip or initiated a claim. Plans are non-refundable after this period.

Additional assistance

Coverage by country of residence.

- Frequently asked questions

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best’s 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive,Richmond, VA 23233 or [email protected]

Email [email protected]

PLEASE BE ADVISED: This plan contains insurance benefits (which may include disability and/or health insurance benefits) that only apply during the covered trip. This optional coverage may duplicate coverage already provided by your personal auto, home, renter’s, health, life, personal liability, or other insurance policy or source of coverage but may be subject to different restrictions. You should review the terms of this policy with your existing coverage. If you have any questions about your current coverage, call your insurer/health plan or insurance agent/broker. This insurance is not required to purchase any other products/services. Unless licensed, travel retailers and their employees may provide general information about the insurance, including a description of coverage and price, but are not qualified/authorized to answer technical questions about terms, benefits, exclusions, and conditions of the insurance or evaluate the adequacy of existing coverage. Plans are intended for U.S. residents only and may not be available in all jurisdictions. Rental Car Protector is not available to KS and TX residents, except when purchased as a separate policy and is not available in all countries or for all cars. This coverage does not provide liability insurance or comply with any financial responsibility law, or any other law mandating motor vehicle coverage and does not cover you for any injury to another party. Additionally:

California Residents: We are doing business in California as Allianz Global Assistance Insurance Agency, License # 0B01400. California offers a toll-free consumer hotline at 1-800-927-4357.

New York Residents: The licensed producer represents the insurer for purposes of the sale. Compensation paid to the producer may depend on the policy selected, or the producer’s expenses, volume of business, or profitability. The purchaser may request and obtain information about the producer’s compensation, except as otherwise provided by law.

Maryland Residents: The purchase of travel insurance would make the travel insurance coverage primary to any other duplicate or similar coverage. The Commissioner may be contacted to file a complaint at: Maryland Insurance Administration, ATTN: Consumer Complaint Investigation Property/Casualty, 200 St. Paul Place, Suite 2700, Baltimore, MD 21202.

Texas Residents: Before deciding whether to purchase this insurance plan, you may wish to determine whether your own automobile insurance or credit card agreement provides you coverage for rental vehicle damage or loss and determine the amount of deductible under your own insurance coverage. The purchase of this insurance plan is not mandatory. This coverage is not all inclusive, which means it does not cover such things as personal injury, personal liability, or personal property. It does not cover you for damages to other vehicles or property. It does not cover you for any injury to any other party.

Plan charge includes the cost of insurance benefits and assistance services. See your Plan Details for more information, or call Allianz Global Assistance at 800-284-8300.

AGA Service Company dba Allianz Global Assistance (AGA) compensates their suppliers or agencies for allowing AGA to market or offer products to customers of the supplier or agency.

*Terms, conditions, and exclusions apply, including for pre-existing conditions. Plans may not be available to residents of all states. Insurance benefits are underwritten by either BCS Insurance Company or Jefferson Insurance Company, depending on insured’s state of residence. AGA Service Company is the licensed producer and administrator of these plans.

- Accessibility statement [Accesskey '0'] Go to Accessibility statement

- Skip to Content [Accesskey 'S'] Skip to main content

- Skip to site Navigation [Accesskey 'N'] Go to Navigation

- Go to Home page [Accesskey '1'] Go to Home page

- Go to Sitemap [Accesskey '2'] Go to Sitemap

- Private Banking

- International Banking

- Lloyds Bank Logo

Everyday banking

Online services & more

How to get online

- Set up the Mobile Banking app

- Register for Internet Banking

- Log on to Internet Banking

- Reset your logon details

Mobile Banking app

- Setting up our app

- App notifications

Profile & settings

- Change your telephone number

- Change your address

- Open Banking

Card & PIN services

- View your card details

- Report your card lost or stolen

- Order a replacement card

- View your PIN

- Payments & transfers

- Daily payment limits

- Pay someone new

- Cancel a Direct Debit

- Pay in a cheque

- Send money outside the UK

Statements & transactions

- See upcoming payments

- Search transactions

- Download statements

Help & security

We're here for you

Fraud & security

- Latest scams

- Lost or stolen card

- Unrecognised transactions

Money management

- Understanding credit

- Managing someone's affairs

- Financial planning

- Personal Tax Services

Banking near you

Life events

- Buying a home

- Getting married

- Family finances

- Separation & divorce

- Bereavement

Difficult times

- Money worries

- Mental health support

- Financial abuse

- Serious illness

Customer support

- Support & wellbeing

- Banking online

- Accessibility & disability

- Banking with us

- Feedback & complaints

- Current accounts

Accounts & services

- £175 switching offer

- Club Lloyds Account

- Classic Account

Silver Account

- Club Lloyds Silver Account

- Platinum Account

- Club Lloyds Platinum Account

- Youth & student accounts

- Joint accounts

Travel services

- Using your card abroad

- Travel money

Features & support

- Switching to Lloyds Bank

- Everyday Offers

- Rates & charges

- Save the Change

- Current account help & guidance

- Mobile device trade in service

Already bank with us?

Existing customers

- Upgrade options

- Mobile banking

Club Lloyds

The current account with exclusive benefits. A £3 monthly fee may apply.

Cards, loans & car finance

Credit cards

- Credit card eligibility checker

- Balance transfer credit cards

- Large purchase credit cards

- Everyday spending credit cards

- World Elite Mastercard ®

- Cashback credit card

- Loan calculator

- Debt consolidation loans

- Home improvement loans

- Holiday loans

- Wedding loans

Car finance

- Car finance calculator

- Car finance options

- Car refinance

- Car leasing

- Credit cards help & guidance

- Loans help & guidance

- Car finance help & guidance

- Borrowing options

Already borrowing with us?

- Existing credit card customers

- Existing loan customers

- Existing car finance customers

Your Credit Score

Thinking about applying for credit? Check Your Credit Score for free, with no impact on your credit file.

Accounts & calculators

- First time buyer mortgages

- Moving home

- Remortgage to us

- Existing Lloyds Bank mortgage customers

- Buying to let

- Equity release

Mortgage calculators & tools

- Mortgage calculator

- Remortgage calculator

- Get an agreement in principle

- Base rate change calculator

- Overpayment calculator

- Mortgage help & guidance

- Club Lloyds offer

- Eco Home offers

- Mortgage protection

Already with us?

- Manage your mortgage

- Switch to a new deal

- Borrow more

- Switch deal & borrow more

- Help with your payments

- Learn about Home Wise

- Your interest only mortgage

Club Lloyds mortgage offer

Our Club Lloyds customers could be eligible for an exclusive discount on their initial mortgage rate.

Accounts & ISAs

Savings accounts

- Instant access savings accounts

- Fixed rate savings accounts

- Club Lloyds savings accounts

- Children's savings accounts

- Joint savings accounts

- Compare savings accounts

- Compare cash ISAs

- Help to Buy ISA

- Stocks & Shares ISA

- Investment ISA

- Savings calculator

- Save the Change®

- Savings help and guidance

- ISAs explained

- Savings interest rates

Already saving with us?

- Top up your ISA

- Transfer your ISA

- Tax on savings interest

- Your personal savings allowance

- Your ISA allowance

Club Lloyds Monthly Saver

Exclusive savings rate with our Club Lloyds current accounts.

Pensions & investments

- Compare investing options

- Share Dealing ISA

- Share Dealing Account

- Invest Wise Accounts (18 - 25 year olds)

- Ready-Made Investments

ETF Quicklist

- Introducing our ETF Quicklist

- View our ETF Quicklist

Guides and support

- Understanding investing

- Research the market

- Investing help and guidance

- Transfer your investments

- Trading Support

- ETF Academy

- Our Charges

Pensions and retirement

- Ready-Made Pension

- Combining your pensions

- Pension calculator

- Self-employed

- Pensions explained

- Top 10 pension tips

- Retirement options

- Existing Ready-Made Pension customers

Wealth management

- Is advice right for you?

- Benefits of financial advice

- Services we offer

- Cost of advice

Already investing with us?

- Log on to Share Dealing

Introducing the new Ready-Made Pension

A simple, smart and easy way to save for your retirement.

Show me how

Home, life & car

View all insurance products

Home insurance

- Get a home insurance quote

- Compare home insurance

- Buildings & contents insurance

- Contents insurance

- Buildings insurance

- Retrieve a home insurance quote

- Home insurance help & guidance

- Manage your home insurance policy

Car insurance

- Compare car insurance

- Car insurance help & guidance

- Log on to My Account to manage your car insurance

Life insurance

- Critical illness cover

- Mortgage protection insurance

- Life cover help & guidance

Other insurance

- Business insurance

- Van insurance

- Landlord insurance

- Make a home insurance claim

- Make a life insurance claim

- Make a car insurance claim

Already insured with us?

Support for existing customers

- Help with your existing home insurance

- Help with your existing life insurance

- Help with your existing car insurance

Get up to £100 cashback

Take care of what you value most, and we'll take care of you - a cashback reward with our range of insurance products: home, motor and life. T&Cs apply.

- Help & Support

- Branch Finder

- Accessibility and disability

- Search Close Close

Internet Banking

Keep me secure

- Packaged Bank Accounts

- Travel Insurance

Packaged Bank Account Travel Insurance

Have peace of mind when you're on holiday with travel insurance that covers you.

About Travel Insurance as part of Packaged Bank Accounts

Travel Insurance, administered by AWP Assistance UK Ltd (trading as Allianz Assistance) and underwritten by AWP P&C SA, is just one of the insurance benefits that come with our Packaged Bank Accounts . Our Silver & Platinum Accounts are packed with benefits including Family travel insurance, AA Breakdown Family Cover and mobile phone insurance for a monthly fee to maintain the account.

Travel Insurance is also a benefit on the Premier , and Gold accounts however these are no longer available to new customers.

If you’re a Platinum, Premier, Gold or Silver account customer, please read our FAQs (PDF, 145KB) for more information about the travel insurance which comes with your account and COVID-19. You can also visit our payment disputes page , for help if your travel has been disrupted.

Compare accounts

How do I make a claim?

You can log your claim online using the Allianz Assistance Hub that can be securely accessed through your mobile banking app or by using Internet Banking. You can also make a claim by calling Allianz Assistance on +44 (0)345 850 5300 .

Eligibility for each account

I have a silver account expandable section.

If you have a Silver Account the account comes with European Travel Insurance for you and your family (if eligible) including Winter Sports. This insurance policy is administered by AWP Assitance UK Ltd (trading as Allianz Assitance) and underwritten by AWP P&C SA.

Am I eligible for cover?

- All cover under the policy stops on the account holders 65th birthday - as long as the account holder is under 65, their spouse, civil partner or partner will be covered until they reach 65 years of age.

- Children must be 18 or under, or 24 or under if they're in full time education and must travel with the account holder, their spouse, partner, civil partner or a responsible adult. There's cover for a dependent child where they are staying with a responsible adult even if they were not accompanied during their travel to the destination.

- Subject to continued eligibility, you and your family are covered for travel within Europe as long as your Silver account is open.

- Keep in mind the cover is provided only if you will be living in the United Kingdom for at least six months during each 12 month period where all trips must start and end.

Medical conditions that you or your family have (or have had), which are not all on the ‘No Screen Conditions’ list in your policy document are not covered by this policy. To see if these can be covered you must call the insurer declaring all medical conditions, including those on the list and an extra cost may apply. Before you book a trip you also need to let the insurer know of any new conditions or changes to existing ones. Please refer to the Silver welcome pack (PDF, 1.7MB) for full details of any exclusions.

Once your account has been opened should you wish to notify the insurer of any medical conditions please call the number below.

- Silver Account: 0345 603 1839

Lines are open 24/7.

Not all Telephone Banking services are available 24 hours a day, seven days a week. Please speak to an advisor for more information.

I have a Gold, Platinum or Premier Account expandable section

If you have a Gold, Platinum or Premier Account, the account comes with Worldwide Travel Insurance for you and your family (if eligible) including Winter Sports. This insurance policy is administered by AWP Assistance UK Ltd (trading as Allianz Assistance) and underwritten by AWP P&C SA.

- All cover under the policy stops on the account holders 80th birthday - as long as the account holder is under 80, their spouse, civil partner or partner will be covered until they reach 80 years of age.

- Subject to continued eligibility, you and your family are covered for worldwide travel as long as your Lloyds Bank Gold, Platinum or Premier account is open.

- Keep in mind there is only cover for losses suffered whilst you are a UK, Channel Islands or Isle of Man resident and are registered with a Doctor in the UK where all trips must start and end.

Medical conditions that you or your family have (or have had), which are not all on the ‘No Screen Conditions’ list in your policy document are not covered by this policy. To see if these can be covered you must call the insurer declaring all medical conditions, including those on the list and an extra cost may apply. Before you book a trip you also need to let the insurer know of any new conditions or changes to existing ones. Please refer to the relevant policy document for full details of any exclusions.

Once your account has been opened should you wish to notify the insurer of any medical conditions please call the appropriate number below.

- Gold Account: 0345 850 5056

- Platinum Account: 0345 850 5300

- Premier Account: 0345 604 0440

What does my insurance come with?

- Multi-trip European travel cover for you and your family (includes, if eligible, your spouse, civil partner or partner and children)

- Includes golf cover and cover for certain sports and leisure activities

- Covers UK leisure travel when two or more nights' accommodation is pre-booked (five nights for business trips)

- There's cover for you or someone covered under the policy if a booked trip needs to be cancelled because either you or they, or a companion you are travelling with is asked to quarantine on an individual basis because of exposure to a contagious disease

- Emergency medical cover (up to £10,000,000)

- Cancellation or curtailment cover (up to £5,000)

- Personal accident cover (up to £30,000)

- Baggage cover (up to £2,500, £500 of which for valuables)

- Travel disruption cover (up to £5,000)

Important note :

- The standard maximum trip duration is 31 consecutive days

- For Winter Sports maximum 31 days cover in any calendar year

- £75 excess per adult per incident may apply

- Other exclusions apply, see policy documents

Gold, Platinum and Premier Accounts

- Multi-trip Worldwide travel cover for you and your family (includes, if eligible, your spouse, civil partner or partner and children)

- The standard maximum trip duration is 31 consecutive days - unless you are a Premier account holder, which is 62 consecutive days

- Gold and Premier accounts unavailable to new customers

Policy documents expandable section

- Silver Account Welcome Pack opens in a new window (pdf, 2.1 MB)

- Gold Account Welcome Pack opens in a new window (pdf, 1.3 MB)

- Platinum Account Welcome Pack opens in a new window (pdf, 2.6 MB)

- Premier Account Welcome Pack opens in a new window (pdf, 1.4 MB)

Important and emergency telephone numbers expandable section

You can find out more information about your travel insurance, or make a claim using the appropriate membership numbers below.

- Silver Account: 0345 603 1839

- Gold Account: 0345 850 5056

- Platinum Account: 0345 850 5300

- Premier Account: 0345 604 0440

Lines are open 24/7. Not all Telephone Banking services are available 24 hours a day, seven days a week. Please speak to an advisor for more information.

24-hour assistance helpline (outside the UK): +44 (0)208 239 4010 .

Packaged Bank Account benefits

Explore the other benefits of a Packaged Bank Account. Our Silver & Platinum Accounts include Family travel insurance, AA Breakdown Family Cover and mobile phone insurance for a monthly fee to maintain the account.

Mobile phone insurance

AA Breakdown Family Cover

Existing customer?

Manage your account Find out how to manage your account, from reporting a card lost or stolen to things you can do online

Upgrade now Want to upgrade your existing account? Why not take a look at the other accounts we offer

Change account Change an existing current account with us by logging in

Help and guidance Useful guides on how to use our secure Mobile Banking app and Internet Banking services

Financial Services Compensation Scheme

Important legal information.

Lloyds Bank plc. Registered office: 25 Gresham Street, London EC2V 7HN. Registered in England and Wales No. 2065. Lloyds Bank plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 119278.

We may monitor or record telephone calls to check out your instructions correctly and to help us improve the quality of our service. Calls from abroad are charged according to the telephone service provider’s published tariff. Not all Telephone Banking services are available 24 hours a day, 7 days a week. Please speak to an adviser for more information.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

6 Best Cancel for Any Reason Travel Insurance Options

Travelex Insurance Services »

Allianz Travel Insurance »

Seven Corners »

AXA Assistance USA »

IMG Travel Insurance »

Squaremouth »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Cancel for Any Reason Travel Insurance Options.

Table of Contents

- Travelex Insurance Services

- Allianz Travel Insurance

- Seven Corners

Even the best travel insurance policies don't cover every "what if." "If you buy travel insurance, there are covered reasons for cancellation or interruption. If your situation doesn't fit those covered reasons, there's no coverage," explains Angela Borden, product strategist with Seven Corners .

That's why cancel for any reason coverage, or CFAR, can be a valuable add-on. With this type of policy, you can cancel your trip for any reason at all and still get a percentage of your prepaid travel expenses back (typically around 50% to 80% of what you’ve already paid; percentages vary by provider).

Read on to see the best cancel for any reason travel insurance options and the main policy details you should know about, as well as answers to common questions around this type of coverage.

- AXA Assistance USA

- IMG Travel Insurance

- Squaremouth

Can cancel trip up to 48 hours before departure

Emergency medical coverage is only $50,000

SEE FULL REVIEW »

Reimburses up to 80% of prepaid travel arrangements

Allows you to cancel trip as late as day of departure

"Cancel Anytime" coverage may not be available in every state

CFAR add-on offers up to 75% reimbursement for prepaid travel costs

CFAR coverage can be purchased up to 20 days after initial trip payment

Benefit not available in all states

Get up to 75% of prepaid travel expenses back when you cancel for any reason

10-day money back guarantee if dissatisfied (prior to your trip)

Must purchase CFAR coverage within 14 days of initial trip deposit

Get back up to 75% of the full cost of nonrefundable travel expenses

CFAR coverage can be purchased within up to 20 days of the initial trip deposit

CFAR coverage does not apply if the travel supplier goes out of business or refuses to provide services

Compare multiple plans with CFAR coverage in one place

Comparison tool makes it easy to price shop

CFAR coverage reimbursements and fine print vary by company

Frequently Asked Questions

Cancel for any reason insurance (also called CFAR coverage) is a type of trip cancellation insurance that lets you cancel your trip for a reason not listed as a covered reason in your plan. For example, you may decide not to travel due to an illness in your extended family or a specific financial issue you're dealing with. In either case, this time-sensitive coverage can help you get reimbursement for prepaid trip payments you have made toward airfare, hotel stays, tours and more.

CFAR coverage typically needs to be purchased within a sensitive period of time after making a trip deposit (usually ranging from 14 to 20 days after). Travelers only get back between 50% and 80% of prepaid travel expenses, depending on your policy, so this coverage won't lead to a full refund.

If you're worried how COVID-19 might affect your travel plans, you can purchase travel insurance that includes COVID-19 coverage . That said, CFAR protection can also be a good investment, particularly if you want the option to cancel based on last-minute disinclination to travel due to the coronavirus pandemic.

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world, and she has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – in their family media business.

You might also be interested in:

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

Holly Johnson

These are the scenarios when travel insurance makes most sense.

Flight Insurance: The 5 Best Options for 2023

Protect your flight (and peace of mind) with the top coverage plans.

Bereavement Fares: 5 Airlines That Still Offer Discounts

Several airlines offer help in times of loss.

The Safest Places to Travel During Hurricane Season

Amanda Norcross

Some destinations pose less of a risk than others.

Here’s What You Need to Know About Travel Medical Insurance

S ummer travel is well underway. Nearly 85% of all American adults, or almost 219 million people, intend to travel this summer, according to The Vacationer , a travel data tracking website. Roughly 23% of adults, or more than 59 million Americans, plan on traveling internationally. As you start planning your summer vacation, make sure to book early, budget more and plan on delays , thanks to the increase in travel.

You should also consider your options for travel insurance. While vacation is supposed to be a time of fun and relaxation, accidents can occur. For this reason, it’s better to be safe than sorry.

What is travel medical insurance?

Travel medical insurance can help you pay for emergency medical expenses that arise when you’re on a trip, such as if you become ill or experience an injury and need to go to the hospital. Even if you have a U.S. health insurance plan, most provide little or no coverage abroad. Medicare does not provide coverage abroad either.

Here’s what travel medical insurance covers:

- Emergency medical expenses: ambulance service, doctor and hospital bills, X-rays, etc.

- Medical evacuation

- Prescription medications

- 24-hour assistance services

- Accidental death and dismemberment

Travel medical insurance does not cover expenses incurred as a result of routine medical exams, elective care, extreme sport injuries or intoxication. Typically, pre-existing conditions are also not covered, unless you qualify for a pre-existing medical condition exclusion waiver.

You can choose from a number of policy types when deciding on a travel medical insurance policy.

Single-trip coverage: As the name suggests, a single-trip insurance policy provides coverage for a single trip, from the time you leave, to the time you return.

Multi-trip coverage: Also called annual trip insurance, multi-trip coverage covers all trips in a calendar year, as long as each trip does not exceed a certain number of days.

Primary coverage: Your travel medical insurance will pay out before any other health insurance you have.

Secondary coverage: Claims are first filed with your existing health insurance provider. If your U.S. health plan doesn’t provide coverage overseas or cannot cover all expenses, then you will file a claim with your travel insurance company.

When should you get travel medical insurance?

If you intend on traveling outside of the U.S. it’s a good idea to purchase some form of travel medical insurance, even if you're in good health. This way, you’re not stuck paying medical costs up-front in the case of an accident or emergency, since most U.S. health insurance policies don’t provide coverage abroad.

You may also consider opting for a comprehensive health insurance policy, which also offers trip cancellation, lost luggage and trip delay coverage, but it will cost more. These benefits usually come with premium travel credit cards .

A 2022 study from GeoBlue found that 13% of people have had medical issues while traveling abroad that required care. At the same time, the study found that 76% of consumers either don't know how they would pay for medical treatment abroad or likely won't have adequate coverage, and 46% expect to use their existing domestic health insurance plan.

United Healthcare recommends travel medical insurance for all travelers, particularly:

- Families with children

- Anyone visiting a country that speaks a different language

- People with chronic conditions

- Solo travelers

- Travelers to a remote location

How much does travel medical insurance cost?

How much travel medical insurance costs depends on a number of factors, including the country you're visiting, how old you are, deductible amounts, and how much coverage you'll need. How much you pay also depends on whether or not you're opting for individual coverage or need coverage for family members who are traveling with you, such as your spouse or kids.

According to Travelers.com , policies average between $40 and $80, but higher coverage limits and longer coverage terms typically increase the cost of the policy. Forbes , however, reports that the average price for a stand-alone travel medical insurance policy is a bit higher than this estimate, at $92.75 per trip. A search on InsureMyTrip to compare prices for a one-month trip to Germany in July 2023 for a 40-year-old showed single-trip insurance rates as low as $54.56.

Related Content

- When Is Travel Insurance Worth It?

- Travel Insurance to Protect Your Vacation

- What You Need to Know About Health Care Outside the U.S.

- Where Is Travel Insurance Still Required?

IMAGES

VIDEO

COMMENTS

In an emergency call Allianz Partners immediately for urgent assistance if. ... AA Travel Insurance policies are brought to you by the New Zealand Automobile Association Incorporated (AA), are issued and managed by AWP Services New Zealand Limited trading as Allianz Partners and underwritten by The Hollard Insurance Company Pty Ltd ABN 78 090 ...

Trip insurance provided by Allianz Travel Mexico. Contact by mail or phone. Allianz Travel Av. Insurgentes Sur 1602 - 302 Col. Crédito Constructor CP 03940 CDMX, México. From Mexico 01-800-999-9922 From the U.S. 866-328-4280 Collect (52) 55 53 77 3860. Contact by email. Send an email

Emergency medical benefits in and outside the U.S. - where many personal health insurance policies (like Medicare) won't cover you; 24-hour emergency assistance to help you solve medical and other travel-related problems on the go; Types of trip insurance plans. Allianz Trip Insurance comes in a variety of plans to fit your specific needs.

Get quick answers to your travel questions 24 / 7 with American's virtual assistant or chat with us live. Click the 'chat bubble' to get started. Check out our frequently asked questions. AAdvantage ® program FAQ Customer service FAQ Reservations and tickets FAQ

Lines are open Monday to Friday 9am to 5pm. Email [email protected]. Emergency Medical Assistance. +44 (0)147 335 6274. Lines are open 24/7 all year. Travel insurance enquiries. Policies purchased from 3 April 2023. Lines are open Monday to Friday 8:30am to 8pm, Saturday 9am to 5pm, Sunday 10am to 4pm.

AA International Travel Insurance Benefits. 10% discount for AA Members* AA Members can receive a discount on all policies. Simply provide your valid AA Membership number on application. 24/7 Emergency Assistance. With AA Travel Insurance, you'll have access to the Allianz 24/7 Emergency Assistance Team.

Emergency lines open 24/7. Calls cost no more than calls to geographic numbers 01 or 02. Claim for travel insurance purchased before 2 April 2023 Call: 0330 058 2991. Opening hours: Monday to Friday - 9am to 5pm Saturday - Closed Sunday - Closed. Or for Emergency Medical Assistance call: +44 (0)147 335 6274 . Emergency lines open 24/7.

Or visit aa.co.nz/autocentre. Directions magazine. T: 09 966 8800. PO Box 5, Shortland Street, Auckland 1140. Driver licensing. If you have questions about driver licensing rules or restrictions, please contact the NZTA Driver Licensing helpline on 0800 822 422. If calling from overseas: +64 6 953 6200.

24/7 Emergency Assistance. With AA Travel Insurance, you'll have access to the Allianz 24/7 Emergency Assistance Team. A single call will put you in touch with a specialist who will be able to help you. ... Simply provide each traveller's valid AA Membership number on application. Discount applies to AA Member cover premium, including any ...

*AA Members can receive a 10% discount on AA Travel Insurance. Simply provide each traveller's valid AA Membership number on application. Discount applies to the premium for each AA Member on standard policy and any additional pre-existing medical cover, but doesn't apply to additional cover for high value items.

You should follow the rules published by the Foreign, Commonwealth & Development Office (FDCO). Accordingly, you won't be covered for any event you were aware of when booking your holiday or buying your insurance. Nor is there valid cover if you fail to provide the required tests or documentation for travel, such as a negative coronavirus test ...

Phone - Call us on 0800 500 231, or if you are calling from overseas +64 9 927 2306. Our contact centre is open from 8am - 8pm Monday to Friday, and 8am - 6pm on weekends and public holidays. Email - You can email us at [email protected].

Allianz Travel Insurance page for emergency assistance and help while traveling. 24-Hour Hotline. June 1, 2020. Due to travel restrictions, plans are only available with travel dates on or after ... Emergency Assistance Numbers. Within the United States, Canada, Puerto Rico and the U.S. Virgin Islands call toll free: 1-800-654-1908.

We're ready to help in any way we can - and your feedback is important to us too. Fill out the form below or call us on 0861 000 234. Our contact centre is available 24 hours a day, 7 days a week, 365 days a year.

Purchase Travel Insurance. Find Agent Call 877.721.3977. Terms, conditions, and exclusions apply. Benefits/Coverage may vary by state, and sublimits may apply. Refer to your plan for restrictions and full details. Insurance coverage is underwritten by BCS Insurance Company, rated A- (Excellent) by A.M. Best Co., under BCS Form No. 52.201 or 52. ...

Report a breakdown quickly and track when your patrol will arrive. Report a claim with Accident Assist - whoever you're insured by. See your cover and membership details at a glance. Change your AA membership account details, address, vehicle or name.

24 Hour Emergency Travel Assistance*. To access these services, call the Premier Member Services telephone number: 1-888-222-9688. The terms are defined under "summary of benefits" as outlined in the Travel Insurance Coverage portion. Assistance translation services — If a Covered Person has the need to use any of the following Assistance ...

Emergency trip assistance. Within New Zealand: 0800 630 115, 8:30am - 5pm Mon-Fri. +64 9 486 6868 after hours. Global: +64 9 486 6868. If you need emergency assistance while you are travelling, contact the Emergency Assistance team as soon as it is possible to do so safely if you: Are about to be admitted to hospital.

Alternative phone numbers. If you're having difficulty using our main European breakdown number, try these alternatives: From a French landline: 0825 098 876 or 0472 171 200 If you've broken down on a motorway in France, you need to call the police on 112 first so they can move you to a safe location. From a UK mobile or other EU country landlines:

What is AA's Emergency Assistance number? Every travel insurer has a 24/7 helpline you can ring if you have an emergency while on your trip. With AA travel insurance, If you need Emergency Assistance you should call +44 (0)1473 356 274.

The cost of a travel insurance policy depends on many factors, including the trip length, your state of residence and how much coverage you'd like. Our sample search for a $3,000 two-week trip ...

Emergency medical benefits in and outside the U.S. - where many personal health insurance policies (like Medicare) won't cover you; 24-hour emergency assistance to help you solve medical and other travel-related problems on the go; Types of trip insurance plans. Allianz Trip Insurance comes in a variety of plans to fit your specific needs.

You can find out more information about your travel insurance, or make a claim using the appropriate membership numbers below. Silver Account: 0345 603 1839. Gold Account: 0345 850 5056. Platinum Account: 0345 850 5300.