Flow through your inbox

Flowrite turns your instructions into ready-to-send emails and messages across your browser.

.png)

For companies

Mar 1, 2023

How to write a reimbursement email with 7 samples and template

Whatever your expense, this guide to reimbursement emails will ensure you're never short-changed or out of pocket.

Lawrie Jones

Table of contents

Reimbursement emails are professional correspondence to ensure you get paid for outgoings and expenses.

For example, you may have incurred costs for everyday expenses, run up medical bills, or be asking for a payout for lost or damaged items. Whatever your expense, our guide to reimbursement emails will ensure you're never short-changed or out of pocket.

Every reimbursement email must be clear about your costs, what they're for, and how you want to get paid. We can show you how to write an effective reimbursement email, including the correct format, suitable subject lines, and several samples to help you.

So stop waiting for the cash, and let's start writing...

How to write a reimbursement email

Reimbursement emails are formal emails that you'll write to get paid for expenses you’ve run up. The first lesson is, you must be clear and concise in every request for reimbursement. This isn’t the time to beat around the bush or go light on the details.

Firstly, start with an introduction about who you are and why you're getting in touch. Of course, this will differ if you're an internal team member or from the outside, but it always pays to be positive!

You'll want to justify why you're due a reimbursement. Basically, you have to be clear about what you are asking for repayment for any why. You'll also need to prove your expenses by providing all the necessary details and documentation.

Reimbursement email format

Reimbursement emails are based on a format that should be familiar to anyone in business. It's all based on three core parts: the subject line, body copy, and sign-off.

Remember to include attachments of relevant documentation, including invoices and receipts!

1. Reimbursement email subject line

We kick off with a professional and formal subject line. You want to ensure that it's clear and relevant to the request but also that it's attention-grabbing.

Why? Because reimbursement requests are easy to ignore. Don't give them a chance by ensuring your subject line stands out.

- Reimbursement request – (add details)

- Reimbursement claim attached – date

- Request for payment – (add details)

- Expenses attached – please confirm receipt

2. Reimbursement email body

Reimbursement emails are pretty simple to crack. You'll start by introducing yourself , explaining the purpose of your message, and providing any relevant background.

- My name is (your name), and I'm contacting you from (where you're from). I'm emailing you to request reimbursement for (include details).

Next, list out what you're asking to be paid for. Your request for reimbursement should be explicit and document everything. Use bullet points in your request for reimbursement to include all the details to make payment as simple as possible.

- I'm requesting reimbursement for the following:

- Include details...

You should add some relevant background to your message to provide context. This can act as a justification for reimbursement.

- The expenses were incurred while I worked for you on (insert details of costs).

You can expect anyone to pay out without proof, so always provide attachments, including all relevant documentation. You can attach copies of receipts and anything else required to process your payment.

You can end your reimbursement emails here or add a clear call to action and potentially a deadline.

- I have attached copies of my receipts to this email. I understand your payment terms are 28 days. Can you confirm that this is correct?

3. How to end reimbursement email

As a piece of professional business correspondence, you'll need a professional closing (here are 40 more) ! We always recommend adding a polite thank you before providing the following steps to ensure your expenses are reimbursed.

- Please confirm that you have received this message and provide details of when I can expect payment.

It's essential to add contact details so the recipient can clarify any details and confirm your payment.

- You can reach me at (insert details) if you need to contact me.

Finish with a suitable sign-off (kind regards, many thanks, etc.), and you're ready to send.

7 reimbursement email examples

We all love the theory, but sometimes you must see some examples to understand how it fits together.

So here we provide 7 reimbursement email examples that focus on using clear and concise language to get your cash!

Of course, we strike the right professional tone – friendly but formal. We've also provided spaces to slot in relevant details and tag receipts.

Ready to go? Here are reimbursement emails we can all use to make getting paid a priority!

1. Asking for reimbursement email sample

This simple reimbursement sample does everything we've outlined above (in some style!). We start by saying hi and following up with some introduction and background before laying out our request for reimbursement.

Next, we provide details of all expenses and, naturally, highlight the attachments of relevant documentation. Finally, we conclude with a clear call to action.

If you need one reimbursement sample that can do it all, it's this one.

- You can list your expenses here...

2. Sample email for reimbursement of travel expenses

Travel expenses are a common cause for a reimbursement email, so keep this sample ready for when it's required.

When it comes to expense reimbursement emails, include all details (dates, times, and travel methods) to make it as easy as possible for your claim to be paid. (It's worth checking out your company's rules on reimbursement before submitting a claim to ensure you include everything you need.)

Being as straightforward as possible is the most effective strategy for securing your reimbursement.

3. Sample email for reimbursement of travel expenses for the interview

Not all businesses will pay expenses for an interview, but if this one does – be sure to claim it!

You're not going to be familiar to the company, so you'll need to include lots of proof. Include dates, times, and details of the interview – and even consider copying the recruiting manager into your email.

Then, follow all the advice above, including stating who you are, why you're messaging, and the purpose (getting paid!).

OK, so you may not get the job – but with our interview expenses reimbursement template, you'll get your travel expenses back at least!

- You may want to call to share your bank details, but you have the option!

4. Reimbursement request email for lost or damaged items

Requesting reimbursement for lost or damaged items isn't easy. You need to prove you owned the items, describe the loss or damage, and push for payment.

In this example, we're claiming for damage to a phone. We include the contract as proof of purchase and images of the damage. We mention the insurance policy we have and our preferred method of compensation.

Be prepared to answer questions and offer more information, but keep going!

- Bullet points are a helpful way to provide lots of detail.

5. Sample email for reimbursement of medical expenses

Claiming repayment for medical expenses is familiar to our US cousins, and there are strict rules. Start by providing details of your insurance policy and coverage.

Next, you'll need to make a clear request for reimbursement and provide details of all medical expenses. Including receipts and details of all parties involved is critical to ensure rapid repayment.

Get well soon!

6. Request for reimbursement of advance payment email

In some cases, such as buying a travel ticket or equipment for work, you may request advance payment.

First, you'll need to provide a clear and convincing claim why you should receive an advance payment.

After this justification, you must confirm the agreement (including what's being paid for, when, and why). Finally, you'll want to set out any conditions for payment.

7. Follow-up email for reimbursement status

Sometimes (sadly) reimbursement emails aren't processed and paid. Often, they can be ignored as they're not usually a priority. If this happens, this follow-up email is for you.

It pays (literally!) to be polite and request the reimbursement status. After that, hit them up with a request for payment confirmation. Finally, request that they send an update and provide you with a deadline for payment.

Expense reimbursement email template

The samples above are great examples of how to create reliable reimbursement emails, but if they don't hit the spot, use this template. This template is entirely customizable, so just cut and paste the bits you need, and bin the rest. Here's how it works...

The template works through each part of the professional and formal format. It begins with some introduction and background, then goes straight in with a request for reimbursement.

Subsequent steps include details of expenses and a justification for reimbursement. We've also added all vital information and attachments, like invoices, receipts, and payment confirmations.

There's a professional closing and a clear call to action!

- Add details

Send reimbursement emails using Flowrite

If you're struggling with writing emails or want to get to inbox zero, Flowrite is your best help.

We developed an artificial intelligence tool that writes your emails for you, like this:

Final words on reimbursement emails

You should be bossing cashback claims by now, but we'll summarise the key tips for effective reimbursement emails.

Understand and follow the format, including introductions, information, and attachments. Always understand the rules around reimbursement, and follow them.

If we're owed money, we tend to get pushy – but we must always stay polite and professional. So focus on striking the right tone and take your time. It will pay off in the end!

Supercharge your communication with Flowrite

Write emails and messages faster across Google Chrome.

Explore Flowrite

.png)

Start using Flowrite today

Try it yourself

Payment reminder

Reply to: "

Received message

couldn’t charge your account update payment method subscription will be cancelled by the end of billing cycle

Generate a reply

Generate an outreach

Share this article

Related articles

Ask for approval by email – with 7 samples and a template

We've made it easier to get a 'yes' with our tips and 7 email approval samples suitable for professional use.

Vacation request email — 15 samples and template

Time to book a holiday? Here’s how to write a vacation request email to make sure you’re good to go (with 15 examples).

How to ask for something in an email with 9 examples

Learn how to write request emails that get results with our in-depth guide. This article breaks down the process of writing request emails for information, documents, contact details, favors and more.

We use cookies to analyze site performance and deliver a better experience for visitors.

%20(1).png)

Product updates

Read the latest →

%20(1).png)

About Flowrite

Get to know us →

Productivity

© 2023 Flowrite

Writing a Reimbursement Email – 7 Examples and Templates

- August 14, 2023

Ready to sail the choppy waters of crafting that flawless reimbursement email?

Well, grab your virtual pen (and maybe a pirate hat), because we’re about to dive deep.

Forget the days of boring templates and yawn drab emails; it’s time to mix a pinch of humor , a dash of expertise, and create an email cocktail that’s both persuasive and delightful.

Whether you’re looking to reclaim travel expenses or those sneaky extra charges, fear not!

This guide is your treasure map. Let’s set sail!

What is Reimbursement?

Reimbursement is a term you might have come across when dealing with expenses, especially if you’ve been in a situation where you’ve had to request reimbursement or send a reimbursement of expenses letter.

Picture this: you’ve traveled for a company event, and now you want to get back the money you spent . You’d write a request for a reimbursement letter or perhaps a more casual reimbursement email to your boss or finance department.

This process means you’re asking the company to cover the costs you’ve incurred – be it for travel, medical bills, or other professional expenses.

It’s like telling your company, “Hey, I’ve got this bill, so can you reimburse me?” And when they agree, it’s them essentially saying, “Sure, here’s your reimbursement for expenses.”

It’s essential, however, to always provide the necessary documentation , like receipts, when asking for reimbursement to ensure the process goes smoothly.

Key Elements of a Reimbursement Letter/Email

When you’re gearing up to send that crucial reimbursement email or letter, you’ll want to ensure you’ve got all the key elements in place. You know, those parts that make the difference between a smooth, quick reimbursement process and a back-and-forth headache.

Here are some essentials you’ll need:

Subject Line

The subject line is like the crow’s nest of our ship – the first thing that’s spotted from a distance. A clear and direct subject line , such as “Request for Travel Expense Reimbursement” or “Medical Expense Claim for October” , ensures your email isn’t lost in the vast ocean of an inbox.

It gives the recipient a heads-up about the content , making sure your email is opened and read.

Recipient's Details

When it comes to your reimbursement letter, addressing the right individual professionally is pivotal. It marks the initial step to ensure your request is both seen and acknowledged.

A little insider tip: always double-check names for the correct spelling . Including official designations can also make a world of difference, adding that extra layer of professionalism. And if you’re leaning towards a digital mode of communication, verifying the email addresses can save you from potential mishaps.

Purpose Statement

Every effective letter has a clear intent , and your reimbursement request is no different. Clearly stating your purpose right from the get-go cuts through any potential confusion and prepares the reader for your request’s specifics .

Here’s a simple pro tip for you: phrases like “I am writing to request reimbursement…” or “This is a formal request for reimbursement…” are your best friends. They’re straightforward , and they work wonders in setting the right tone.

Detailed Breakdown of Expenses

This is the heart of your reimbursement email. Consider it a blueprint of your claim . It’s where you list out the various expenses incurred, ideally in a tabulated format or as a summary.

Including specifics like date, amount, and nature of the expense (e.g., “Hotel Stay on 5th June – $150”) ensures transparency. This breakdown acts as a quick reference, making it easier for the processing team to validate your claims.

Documentation and Proof

Ever heard of the saying, “Seeing is believing” ? It stands true, especially when you’re making a reimbursement claim. Providing concrete evidence of your expenses can turn the tide in your favor. Always retain all your receipts; they’re the backbone of your claim.

For those who prefer the digital route, screenshots or PDFs of transactions come in handy. And if you’re looking for an organized approach, using a standardized reimbursement receipt template is a game-changer.

Total Amount

Now, onto one of the most vital parts: the amount. Clear and transparent communication about the funds you’re seeking not only helps maintain transparency but can also expedite the entire process .

Offering a detailed breakdown of expenses can be invaluable, especially when there are multiple items on the list. Always double-check your figures for accuracy. And a neat trick? Present your totals in both words and numerals—it leaves no room for ambiguity.

A Call to Action

The grand finale of your reimbursement letter should pack a punch. Drawing your letter to a close with a precise expectation of the next steps can be the gentle nudge that spurs quicker action. While you want to be assertive, always remember the golden rule of staying polite.

Phrases like “I kindly request timely processing…” or “I appreciate your prompt attention to this matter…” strike the perfect balance between assertiveness and courtesy.

7 Examples and Templates for Reimbursement Emails

Reimbursements are an essential aspect of professional and personal dealings. With the right approach, you can seamlessly request and receive the funds you’ve spent. Here are detailed insights into various reimbursement situations:

General Reimbursement Letter

There are times when you make expenditures on behalf of the company or someone else. Perhaps you purchased office supplies or paid for a subscription. A General Reimbursement Letter is perfect for these generic situations.

Our sample letter requesting reimbursement of expenses ensures you communicate effectively, outlining the nature of the expense, the total amount, and any relevant documentation. Remember, clarity is key , and with our email template , your request is bound to be straightforward and well-received .

Here’s an email template:

Subject: Request for Reimbursement for [specific expense]

Dear [Recipient’s Name],

I hope this email finds you well. I am writing to request reimbursement for expenses incurred on behalf of the company. The details are as follows:

Date of Purchase: [Date] Item/Service Purchased: [Specific item or service] Total Amount: [Amount] Purpose: [Brief description]

Attached are the receipts and any relevant documentation.

Thank you for your prompt attention to this request.

Warm regards,

[Your Name]

Requesting Travel Expenses

Business trips, training, or corporate meetings often mean travel. Once you return, you’ll want to reclaim the funds spent on flights, accommodation, and other related costs. This is where our template shines.

It’s crafted to address specifics like dates, locations, and the breakdown of expenses. Plus, there’s room to attach receipts or invoices , ensuring transparency and swift processing.

Subject: Reimbursement Request for Travel Expenses

I am reaching out to request reimbursement for travel expenses from my recent trip to [Destination]. Here are the details:

Travel Date: [Starting Date] to [Ending Date] Total Amount: [Amount] Breakdown: [Flight, Hotel, Meals, etc.]

I’ve attached all relevant invoices and receipts.

Thanks for your prompt attention.

Best regards,

Email to Insurance Company

Insurance claims often come with their own set of complexities. Whether you’re dealing with property, health, or vehicle insurance, ensuring you have a well-drafted letter can streamline the process .

Our reimbursement letter for insurance captures all necessary details — policy number, claim amount, and the nature of the claim. Designed to cut through the red tape, this template ensures your claim gets the attention it deserves.

Subject: Claim Request – Policy Number: [Your Policy Number]

Dear [Insurance Company Name],

I am writing to claim reimbursement as per my policy [Policy Number]. Details of my claim are as follows:

Nature of Claim: [e.g., Medical treatment, vehicle repair] Total Amount: [Amount]

Attached are all necessary documents, bills, and proof of the incident.

Looking forward to a swift resolution.

Asking for Additional Charges

Life’s unpredictable. You might encounter unexpected costs, be it in a project, a service, or a purchase. When you need to communicate these extra charges, clarity and tact are crucial .

Our sample email for additional charges does just that, detailing the reasons for the added costs, providing a breakdown, and requesting timely reimbursement . This way, you tackle the situation head-on without any misunderstandings.

Subject: Notification of Additional Charges – [Specific reason]

I’d like to bring to your attention additional charges incurred due to [specific reason]. Here’s the breakdown:

Original Amount: [Amount] Additional Charges: [Amount]

The total amount now stands at [New Total Amount]. Attached are the relevant bills and a detailed explanation.

Thank you for understanding.

Medical Reimbursement

Medical expenses, whether expected or sudden, can be hefty. If you’re part of a health plan or if your workplace offers medical benefits, you’ll need to request a refund of these bills.

With our medical reimbursement templates, you can effectively list out treatments , medicines , and other costs . Accompanied by the right documentation, such as medical receipts and prescriptions, this guide simplifies the daunting process of claiming medical expenses.

Subject: Medical Reimbursement Request

Dear [HR/Insurance Provider’s Name],

I hope this message finds you well. I’m writing to request reimbursement for recent medical expenses.

Treatment Date: [Date] Medical Facility: [Hospital/Clinic Name] Total Amount: [Amount]

Please find attached the medical bills, prescriptions, and any other supporting documents.

Thank you for your prompt attention.

Transportation Costs

Whether you’re commuting for work, attending meetings, or undertaking longer business journeys, transportation can be a significant expense . The transportation email template we offer covers various types of commutes — from daily local travels to longer out-of-town journeys.

By detailing distances, modes of transport, and associated costs, you present a comprehensive claim , making the reimbursement process smooth.

Subject: Request for Transportation Cost Reimbursement

I am writing to request reimbursement for transportation expenses incurred during [specific time period/task]. Here’s a summary:

Total Distance: [X miles/km] Mode of Transport: [Car, Train, etc.] Total Amount: [Amount]

Attached are the travel logs and receipts.

Thanks for your understanding.

Job Interview Travel Reimbursement

It’s always exciting when a company considers you worth flying out for an interview. While it’s a great sign, you shouldn’t be left covering the travel costs.

Our guide on how to ask for travel reimbursement for a job interview ensures you’re polite, clear, and precise . Detail your travel, stay, and even meal costs, so you can focus on acing the interview instead of worrying about the expenses.

Subject: Travel Reimbursement Request Post Interview on [Date]

Dear [HR Name/Interviewer’s Name],

Thank you for the opportunity to interview at [Company Name]. I’m reaching out to request reimbursement for my travel expenses:

Journey Date: [Date] Transport Mode: [Flight, Train, etc.] Total Amount: [Amount]

Attached are all the receipts and relevant documents.

Thank you for facilitating this process.

Potential Challenges in Reimbursement Process

Navigating the reimbursement process isn’t always a breeze. In fact, when you dive into the world of requesting reimbursement, you might stumble upon several potential pitfalls.

Whether you’re drafting a reimbursement email or submitting a detailed reimbursement request letter, being aware of these hurdles can make all the difference. Let’s break down some of the common challenges you might face:

- Incomplete Documentation : Perhaps the biggest hiccup is not having all your receipts or proofs. Without these, it's tough to validate your reimbursement request.

- Delay in Approvals : Sometimes, your reimbursement of expenses letter might get stuck in the bureaucratic maze, leading to frustrating waits.

- Unclear Company Policies : Not every company has a crystal-clear reimbursement policy. This ambiguity can lead to confusion about what's reimbursable and what's not.

- Errors in Submission : A minor oversight, like filling out a wrong date or amount, can hold up the entire process.

- Lost Receipts : It's all too easy to misplace a crucial receipt, making your reimbursement letter for expenses incomplete.

- Change in Rates : Especially with travel, rates might vary. If you're asking for reimbursement of travel expenses, you might face discrepancies between estimated and actual costs.

Remember, while these challenges might seem daunting, being meticulous and organized can help you navigate the reimbursement journey with relative ease. Always double-check your documentation, be patient, and stay proactive in following up on your requests.

Frequently Asked Questions on Reimbursement Emails

Diving into the realm of reimbursement emails, it’s only natural to be brimming with questions. And you’re not alone! Many individuals, just like you, often find themselves pondering the ins and outs of such correspondence.

To help shed some light, let’s tackle a few of the frequently asked questions that might be on your mind:

How long should I wait before following up on a reimbursement email?

While it’s tempting to expect immediate responses, especially when money is involved, patience is key . Typically, it’s courteous to give the recipient about a week to process your reimbursement request letter or email. Remember, there might be several internal processes or checks they have to go through.

However, if you haven’t heard back in a week or two, it’s perfectly okay to send a gentle follow-up email . It’s a balancing act between being assertive about your reimbursement request and understanding potential administrative delays.

Should I include original receipts in my reimbursement email?

This is a common concern when drafting a reimbursement email. Generally, it’s best to attach scanned copies or clear photos of your receipts . This provides proof without risking the loss of the original document.

But always keep the originals safe, as some companies might request to see them later, especially when large amounts are involved or if there’s a discrepancy in the reimbursement of expenses format.

How do I ensure the confidentiality of personal information in reimbursement emails?

When you’re sharing sensitive data, like bank account details or personal expenses, security becomes paramount . Ensure that the recipient’s email address is correct before hitting ‘send’.

Use a secure email platform and avoid sending such details through public Wi-Fi networks. If the information is highly sensitive, consider using encrypted email services or communicate the details through a more secure channel, like a secure company portal or encrypted messaging service .

Key Takeaways on Reimbursement Emails

Navigating the maze of reimbursement emails is more than just crafting a message; it’s about understanding the nuances , anticipating potential challenges, and addressing common queries.

Throughout our deep dive, we uncovered the essential components of a standout reimbursement letter and provided tailored templates for various scenarios , from general expense claims to specific ones like travel or medical reimbursements.

We also delved into potential hiccups in the reimbursement journey, emphasizing the importance of documentation and patience . Moreover, we addressed some burning questions that many face while dealing with such correspondence, offering insights into the ideal wait time for follow-ups and ensuring data confidentiality .

In essence, mastering the art of reimbursement emails boils down to being meticulous, patient, and proactive. And with the knowledge we’ve unpacked, you’re well-equipped to sail through your reimbursement requests with confidence and ease .

So, the next time you find yourself drafting that crucial email, remember these insights and make every word count!

To achieve the best results with email outreach, we recommend using a professional email automation software

13 best cold email platforms rated and compared

Edgar Abong

Table of contents.

Influno © 2024 All rights reserved

- Our story & team

- Contact & support

- Features & pricing

- Outreach guides

- Privacy policy

- Terms of service

Last Updated on August 14, 2023 by Edgar Abong

How To Write A Reimbursement Request Email

Welcome to this article on how to write a reimbursement email. In this article, we will provide you with a step-by-step guide on what to do before writing the email, what to include in the email, and even provide you with sample templates that you can customize and use.

So, if you’re wondering how to write an effective reimbursement email, you’re in the right place!

Here’s how to write a reimbursement email:

Table of Contents

What To Do Before Writing the Email

Before you sit down to compose your reimbursement email, it’s essential to gather all the necessary information and take a few important actions:

- Collect Receipts: Make sure you have all the relevant receipts and documentation to support your reimbursement request. This includes itemized bills, invoices, or any other proof of purchase.

- Review Company Policy: Familiarize yourself with your company’s reimbursement policy. Pay attention to any specific guidelines or requirements that must be followed when submitting a reimbursement request.

- Calculate Expenses: Calculate the total amount of expenses you are requesting to be reimbursed. Make sure to double-check your calculations to avoid any discrepancies.

- Identify the Recipient: Determine who the appropriate person or department is to address your reimbursement request. It could be your manager, supervisor, or someone from the finance department.

What to Include In the Email

When writing a reimbursement email, it’s crucial to include all relevant information to ensure a smooth and efficient reimbursement process. Here are the key elements to include:

Subject Line

In the subject line of your email, clearly state your request for reimbursement. Be concise and specific.

Start your email with a polite and professional greeting. Address the recipient by their appropriate title or name.

Introduction

In the opening paragraph, briefly introduce yourself and explain the purpose of the email. Clearly state that you are submitting a reimbursement request.

Expense Details

Provide a comprehensive breakdown of each expense you are seeking reimbursement for. Include the date, description, and amount for each item. Attach copies of receipts or supporting documentation if required.

Total Amount

Calculate the total amount of expenses and indicate it clearly in your email. Ensure that the amount is accurate and matches the supporting documentation.

Payment Method

Specify your preferred method of payment. This could be through direct deposit, a physical check, or any other payment option available within your company’s reimbursement policies.

Additional Notes

If there are any additional notes or comments you would like to include, do so in this section. Keep it concise and relevant to the reimbursement request.

End your email with a polite closing remark, followed by your name, job title, and contact information. Thank the recipient for their attention and express your willingness to provide any further information if necessary.

Email Template – Reimbursement Request Email

Subject: Reimbursement Request – [Your Name] Dear [Recipient’s Name], I hope this email finds you well. I am writing to request reimbursement for the following expenses: Date: [Expense Date], Description: [Expense Description], Amount: $[Expense Amount] Date: [Expense Date], Description: [Expense Description], Amount: $[Expense Amount] Date: [Expense Date], Description: [Expense Description], Amount: $[Expense Amount] The total amount of expenses is $[Total Amount]. I have attached all the necessary receipts and supporting documents for your review. Please process the reimbursement through direct deposit to the following account: Account Name: [Your Name] Account Number: [Your Account Number] If you require any additional information or documentation, please let me know, and I will be happy to provide it promptly. Thank you for your attention to this matter. I look forward to a favorable response. Best regards, [Your Name] [Your Job Title] Contact Information: [Your Phone Number / Email Address]

Writing a reimbursement email can be straightforward if you follow these guidelines. Remember to gather all necessary information, compose a clear and concise email, and submit your reimbursement request to the appropriate recipient.

Lastly, keep in mind that each company may have its own unique reimbursement policy and procedures. Adjust the templates provided accordingly to align with your specific requirements.

Good luck with your reimbursement request!

Team portal

Try for free

Talk to sales

How to Write Professional Reimbursement Emails

Sep 4, 2023

As a business owner, manager, or employee, there will be times when you'll need to reconcile expenses incurred on behalf of the company, which prompts the need for a 'reimbursement email'. This article is here to guide you on the art of formulating the perfect reimbursement emails that are both professional and effective, ensuring you have no bias or misunderstanding in your communications.

What is a reimbursement email?

A reimbursement email is a written communication requesting refunds for expenditures incurred. These are payments that an individual or organization has made and is requesting repayment from another party. Typically, employees write these emails to their HR or finance departments seeking refunds for expenses made on behalf of the company such as travel expenses, purchasing materials, or conducting client meetings.

Reimbursement emails serve several significant roles. Firstly, they're crucial in maintaining transparent financial transactions within an organization. Secondly, they reassure employees that the organization values their contributions and is ready to refund any personal expenses made on its behalf. Thirdly, they represent a vital record, should there be any need for audits or financial checks in the future.

Key points in writing effective reimbursement emails:

Be professional: Treat your reimbursement email as any business correspondence. Stick to a clear, concise, and professional tone.

Attach supporting documents: Always attach receipts or any additional supporting documents that corroborate your claim for reimbursement.

Follow the company policy: Understand your company's reimbursement policies and follow them while crafting your email.

Want a simple solution for drafting your reimbursement emails? Look no further than MailMaestro!

Writing the perfect reimbursement email can sometimes be challenging. However, with MailMaestro you can craft professional emails effortlessly. With MailMaestro you can choose to enhance an already existing draft or start an entirely new one , using MailMaestro feels like having your personal email assistant.

But there's more to it. MailMaestro's new release features Improve with AI which allows you to fine-tune specific sections without affecting the entire content. Once the draft is created, you can highlight a section or the entire text, then adjust it to meet your specific needs. Here's how it works:

Sample instructions for MailMaestro:

Resulting email from mailmaestro:.

Don't wait any longer - experience the convenience and professionalism of MailMaestro today. Download now and transform your email composition process!

Sample situations for reimbursement and how to approach them:

Different scenarios require unique approaches to writing reimbursement emails. Here are five possibilities with template examples:

Travel Expenses

When an employee travels for business purposes, they may require a refund for transportation, accommodation, or meals. An efficient approach will be to detail the nature of the journey, summarize the costs incurred, and adhere to the company’s travel policy.

Subject: Reimbursement Request – [Your Name] Business Travel Expenses

Dear [Recipient's Name],

Following my recent business trip for the sales meeting held in Toronto, I am writing to request reimbursement for my travel-related expenses as per our company's travel policy. The total expense for the trip is $500. I have attached all relevant receipts for your reference.

Best regards, [Your Name]

Client Meeting

Servicing clients effectively often requires creating a conducive atmosphere for business discussions, which may include hosting lunch, dinner, or other meet-up sessions. When you incur expenses during these client engagements, you may need to request reimbursement from your employer. In such a situation, you want to clearly state the nature of the engagement, including the client's name, the location, and the total expenses incurred for easy reference and verification.

Subject: Reimbursement Request – [Your Name] Client Meeting Expenses

I am writing to request a reimbursement for the expenses incurred during the client meeting with [Client's Name]. The total cost came to be $200, and I have attached detailed receipts to this mail.

Office Supplies

There are instances when you may have to purchase office supplies using your personal funds. This could be due to an emergency need or a lack of immediate funds in the petty cash. When requesting a refund, it's important to provide details about what the supplies are, why they were necessary, and provide an invoice or receipt as proof of purchase.

Subject: Reimbursement Request – [Your Name] Office Supplies Expenses

I've recently purchased some office supplies for our department, and I'd like to request a reimbursement of $120 for the same. I am attaching the relevant invoice.

Best, [Your Name]

Training and Conferences

Employee development and continuous learning are vital for business growth and competitiveness. So, when an employee attends a conference or training session, the fees for which they may have paid out of pocket, they can request a reimbursement from the company. It's important to explicitly describe the nature of the conference or training, the costs borne, and why such expenses should be covered by the company. Remember to attach the receipt or proof of the payment made for the courses or conference.

Subject: Reimbursement Request – [Your Name] Training Expenses

I have recently attended a training course on [Name of the Course] and have borne the expenditure of $400. I am writing to request a refund. I am attaching the necessary receipts for reference.

Medical Expenses

Healthcare benefits are an integral part of employee welfare. If your company includes a healthcare plan that covers certain medical expenses, you might need to apply for a reimbursement when you spend out of pocket for such eligible medical services. In such a case, ensure to fully describe the nature of the medical services you received, how much you spent, that it falls within the scope of the company's health benefits, and attach all necessary receipts or bills for confirmation.

Subject: Reimbursement Request – [Your Name] Medical Expenses

I am writing to request reimbursement for my recent medical expenses, which is covered under our company's health policy. The total cost incurred is $500; I am attaching the necessary documents for your perusal.

Warm regards, [Your Name]

Effective reimbursement emails are key to maintaining trust and financial clarity within your organization. With MailMaestro, crafting these emails becomes effortless and efficient. Download MailMaestro today and revolutionize your email drafting process.

How to Write a Letter Requesting Reimbursement Examples Included

A letter requesting reimbursement is a letter written to repay you for out-of-pocket expenses. When writing reimbursement letters, it is important that you follow the right steps and tick all the appropriate boxes. If a reimbursement letter isn’t written properly, there’s a chance you may be required to write the letter more than once, or worse, do not get reimbursed.

In this article, we are going to discuss what a reimbursement letter is, everything you need to know to write a reimbursement letter and the types. We’re going to round it up by providing different reimbursement letter samples to help you better understand how to write your own reimbursement letters.

Without further ado:

What is a Letter Requesting Reimbursement?

A reimbursement letter is a letter written to request compensation for out-of-pocket expenses by an employee. It could also be to request overpayment or refunds. While most reimbursement mainly deals with out-of-pocket expenses, it also cuts across other sections. For instance, there are reimbursements for payments such as insurance, taxes, etc.

Unlike other compensations, one of the perks of reimbursement is that it is not subject to taxation.

Reimbursements is generally for business expenses, so, before attending to your company’s needs out-of-pocket, ensure to read the company policy on these matters, or simply reach out to your manager or HR to ensure you’ll be reimbursed for your troubles.

Some of these business-related expenses may include travel-related expenses such as hotels, food, transportation, flights, etc. In some not-so-common cases, your company may even refund you for taking personal development training. This can be anything from getting a degree to a certification course.

As said earlier, do not assume your company is automatically going to reimburse you for all your business-related expenses. It is always good to have this information beforehand.

There are different avenues where you’re entitled to receive a reimbursement, such as tax refunds, insurance reimbursements, etc. The difference in most of these cases is that the reimbursements are done automatically. This means there’s usually no need to send any letter reminding the institution of the reimbursement.

How to Write Payment Received Emails: Samples Included

How to Write Reimbursement Letters

When writing reimbursement letters, you need to take extra caution than you would when writing other professional letters. If not done properly, reimbursement could open a can of worms and lead to disagreement. As such, when writing these kinds of letters, you need to make sure you follow the guidelines to the letter to ensure you’re reimbursed without much hassle.

In this section of this article, we’re going to look at some of the most important guidelines to follow when writing these kinds of letters.

1. Remember You’re Writing a Professional Letter

When writing a reimbursement letter, you need to remember you’re writing a professional letter. This means it must follow all professional writing etiquette. This includes using the right subject, addressing it with the appropriate honorifics, signing the letter off appropriately, etc.

2. Your Letter Should Be Straight to The Point

Like all professional letters, reimbursement letters should go straight to the point and not waste time with any unnecessary information. This means you shouldn’t include any information that doesn’t serve the general purpose of the letter. The first paragraph should go straight to the point and explain to your recipient what the letter is all about.

3. Include All the Appropriate Documents

Reimbursement letters are letters written to ask for repayment of any out-of-pocket expense. This means you’re presenting a case to your company telling them how much you spent and how much you want to be reimbursed. This means your letter should include all the documents that help your case. This should include all the invoices you paid out-of-pocket, all the hotel bills, taxi fees, and anything you spent during the course of the event.

4. Tally the Experience

You could also decide to take things up a notch by giving a brief description of each receipt you included. This is more important when you’re requesting reimbursement for activities that span through the course of days or weeks. If you’re reimbursed for a one-time event, you do not need to tally your experiences.

5. Send to The Right Party

Before sending a reimbursement letter, reach out to HR or your manager to find out who’s in a better position to receive your letter. When doing this, also remember to CC or Bcc the appropriate recipients. Doing this saves you the stress of having to send multiple emails and also ensures your reimbursement request gets the attention it deserves and is acted upon swiftly.

6. State how You’d Like to Receive the Refund

Before closing the letter, you can decide to include how you’d like to receive the reimbursement. If you feel unsure about this, you could simply ask that the recipient of the letter get back to you on how best to proceed.

Sample Reimbursement Letters

In this section of this article, we’re going to list out multiple samples of reimbursement letters for various instances to help you write the best reimbursement letters.

Reimbursement Letter Sample for Waste Charge

Reimbursement letter sample for electricity bill, reimbursement letter sample for expenses incurred on a trip, sample request reimbursement office expense, reimbursement mail to hr.

We have included everything you need to know to write a reimbursement letter in this article. When writing a letter of this kind, it is important to ensure all the necessary receipts are attached to save both you and the receipt from any unnecessary back and forth. Also, ensure that you communicate with the recipient before writing the letter to ensure they expect it.

About The Author

Jim Blessed

Related posts.

9 Tips You Need to Write and Respond to Emails Professionally

12 Rules of Writing Emails Professionally and Effectively

How to Write Professional Emails: 7 Critical Ingredients

8 Simple Lessons for Writing Irresistible Business to Business Emails

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Home » Email » Write an Email to HR for Travel Reimbursement – Sample Email for Reimbursement of Travel Expenses

Write an Email to HR for Travel Reimbursement – Sample Email for Reimbursement of Travel Expenses

Table of Contents:

- Sample Letter

Live Editing Assistance

How to use live assistant, additional template options, download options, share via email, share via whatsapp, copy to clipboard, print letter, sample request email for travel expense reimbursement.

To: __________@________.___ , [Receiver’s Email Address] From: ___________@________.___ , [Sender’s Email Address]

Date: __/__/____ (Date)

Subject: Request for travel reimbursement

Respected Sir/Madam,

Respected, my name is __________ (Name) and I work in ___________ (Department) department of your reputed company i.e. _________ (Company Name). My employee ID is ________ (Employee ID) and I work as _________ (Designation).

I want to state that I visited _________ (Location) for ____________ (Personal/ Professional work). This visit was done on __/__/____ (Date). Therefore, I request you to kindly reimburse the amount of the expense of __________ (Amount) which I spent. I am attaching a copy of the ________ (cab booking/ hotel reservation/ ticket/ invoice/ boarding pass) for your reference.

I shall be highly thankful for your kind support.

Thanking you, ___________ (Signature), ___________ (Name), ___________ (Employee ID)

Live Preview

The Live Assistant feature is represented by a real-time preview functionality. Here’s how to use it:

- Start Typing: Enter your letter content in the "Letter Input" textarea.

- Live Preview: As you type, the content of your letter will be displayed in the "Live Preview" section below the textarea. This feature converts newline characters in the textarea into <br> tags in HTML for better readability.

The letter writing editor allows you to start with predefined templates for drafting your letters:

- Choose a Template: Click one of the template buttons ("Start with Sample Template 1", "Start with Sample Template 2", or "Start with Sample Template 3").

- Auto-Fill Textarea: The chosen template's content will automatically fill the textarea, which you can then modify or use as is.

Click the "Download Letter" button after composing your letter. This triggers a download of a file containing the content of your letter.

Click the "Share via Email" button after composing your letter. Your default email client will open a new message window with the subject "Sharing My Draft Letter" and the content of your letter in the body.

Click the "Share via WhatsApp" button after you've composed your letter. Your default browser will open a new tab prompting you to send the letter as a message to a contact on WhatsApp.

If you want to copy the text of your letter to the clipboard:

- Copy to Clipboard: Click the "Copy to Clipboard" button after composing your letter.

- Paste Anywhere: You can then paste the copied text anywhere you need, such as into another application or document.

For printing the letter directly from the browser:

- Print Letter: Click the "Print Letter" button after composing your letter.

- Print Preview: A new browser window will open showing your letter formatted for printing.

- Print: Use the print dialog in the browser to complete printing.

- A: Address the recipient with "Dear Sir/Madam" or "Respected Sir/Madam" to maintain a professional tone.

- A: Ensure to include your name, department, employee ID, purpose of travel, dates, and total expenses incurred, along with any supporting documentation.

- A: Yes, it's important to attach copies of relevant documents such as cab bookings, hotel reservations, tickets, or invoices to support your reimbursement request.

- A: Sign off with "Thank you" or "Sincerely," followed by your signature, name, and employee ID.

- A: If you have any questions or need assistance, don't hesitate to reach out to the HR department or the designated contact person for reimbursement inquiries.

Incoming Search Terms:

- sample email for reimbursement of expenses

- email to hr for reimbursement of expenses

By lettersdadmin

Related post, write an email to decline job offer – sample email to decline job offer.

Write an mail to HR for attendance issue – Attendance Issue Email Sample

Sample maternity leave request email – sample email template requesting maternity leave from company, leave a reply cancel reply.

You must be logged in to post a comment.

Sample Job Joining Application for House Job – House Job Joining Application Sample

Complaint letter to employer about discrimination – complaint letter about discrimination at work, letter to editor complaining about loudspeaker nuisance – write a letter to the editor complaining about loudspeaker nuisance, write a letter to the editor about the noise pollution during the festival, privacy overview.

Emails In English

Email Sample, Free to Use Email Templates

Request Email for Reimbursement – Sample Email Requesting Travel Expense Reimbursement

To: _________@____.__ (Receiver’s email address) Bcc/Cc: _________@____.__ (Bcc/ Cc receiver’s email address)

From: _________@____.__ (Sender’s email address)

Subject: Request for Reimbursement of Travel Expenses

Respected Sir/Madam,

With due respect, I would like to inform you that my name is ____________(name) and I am an employee of your esteemed organization with employee ID __________ (mention your ID).

I am writing this email to bring to your notice that on __/__/____ (date), I had to visit for _________(site inspection/office-related work/mention purpose of visit) at __________(location). In this regard, I hereby request you to kindly reimburse the expenses incurred during this trip. The total amount spent was ________ (amount), and I have already attached the invoice for your reference.

I kindly request you to consider my reimbursement request and facilitate the necessary process. If in case you have any inquiries or require additional information, please feel free to contact me at ________(contact details).

Yours Truly, ____________ (Name), ____________ (Employee ID), ____________ (Contact details)

Incoming Search Terms:

- Sample Email for Requesting Travel Expense Reimbursement

- Email Template for Reimbursement of Business Travel Expenses

- Request for Travel Expense Refund - Email Format

- Email Request for Expense Reimbursement After Official Travel

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Privacy Overview

Tax Resources for Accountants and Small Businesses (U.S.)

- Expense Reimbursements / IRS / Meals and Incidental Expenses / Mileage / Payroll / Per Diem Rates / Small business

- Complete Guide to Reimbursing Employees for Travel Expenses

Published September 2, 2020 · Updated April 21, 2021

When an employee travels away from the office and incurs expenses, the company should reimburse them. Whether travelling across the world or just driving their car to a client’s location, getting the reimbursement right isn’t hard.

Keep reading to learn how to make proper employee reimbursements.

Accountable Plans

You’ll first need to decide if you will implement an accountable or nonaccountable plan. This is just as it sounds; either you’ll have employees be accountable for business expense reimbursements or not.

All businesses should have an expense reimbursement plan in writing. This includes corporations, sole proprietors, the self-employed, and non-profits. Non-profits should be extremely careful when reimbursing disqualified persons because nonaccountable plan reimbursements not properly approved or recorded can cause significant tax exposure to the charitable organization.

An accountable plan must follow the IRS guidelines for expense reimbursement. To qualify, the following rules must be met:

- Expenses must be for business purposes.

- Expenses must be adequately reported to the company in reasonable time.

- Any excess reimbursement or allowance must be returned in a reasonable amount of time.

Any expense that doesn’t meet these three criteria is considered a reimbursement under a nonaccountable plan.

This distinction between these two types of plans is important because accountable plan reimbursements are not taxable to the employee, whereas nonaccountable plans are taxable.

Business Purpose

Expenses incurred as an employee while completing work for an employer have a business purpose. Examples include things like registration fees for a conference, taxi rides to the airport for a business trip, or meals while away on a business trip.

If however, an employer reimburses an employee for dinner when the employee works late, this does not qualify as a business purpose. This reimbursement would be taxable to the employee because it was made under a nonaccountable plan.

Reporting in a Reasonable Time

While what is considered a reasonable amount of time is subjective, the general rule is that all reimbursable expenses must be submitted within 60 days of when they were incurred.

Adequate reporting involves providing a record, like an expense report, of all expenses incurred and providing evidence, like receipts, to support the expenses.

Excess Reimbursement

If an employee receives a travel advance to cover travel expenses but spends less than the advance, the difference is an excess reimbursement and must be returned to the employer to not be taxable. If the excess isn’t returned in a reasonable amount of time, it’s taxable.

A reasonable period of time in this instance is generally deemed to be within 120 days of when the expense was incurred.

With a travel advance, employees should submit an expense report and receipts to substantiate all expenses.

Mileage and Business Use of Personal Vehicle

When an employee uses their personal vehicle for company business, you’ll need to reimburse them. You have three options.

- Standard mileage rate

- Actual costs

- Monthly allowance

Standard Mileage Rate

If you use the standard mileage rate, it is 57.5 cents per mile for 2020.

You can pay more, but the IRS’ safe-harbor threshold of 57.5 cents per mile will allow you a tax deduction without having to substantiate the rate.

Note that the IRS typically updates rates in December. So, you can expect to see the 2021 rate announced in December 2020. IRS 2021 Mileage Rates are here.

IRS Standard Mileage Rates 2020

Actual Costs

Instead of using the standard rate, you can reimburse employees for actual expenses.

The employee will sum up all the costs of owning the vehicle including everything from fuel, maintenance, tolls, registration, and insurance. And based upon the percentage of business miles driven, that portion of the total actual costs is reimbursed.

Monthly Allowance

Using the monthly allowance method is relatively easy. Each month you provide a set dollar amount to the employee.

If you require the employee to provide a mileage log at the end of the month, this will determine if any part of the allowance is taxable. If no mileage log is required, the entire allowance is taxable under an unaccountable plan.

If a mileage log is provided and the employee drove less than expected, they should return the excess allowance within 30 days. If they don’t, the excess becomes taxable to them.

An employee’s commute from their home to their normal place of business is not a reimbursable expense. Any business miles driven in excess of the commute miles is reimbursable.

For example, an employee’s normal round-trip commute is 20 miles. On Fridays, the employee works on-site at a client’s office that is 30 miles away from the employee’s home. So, the employee drives 60 miles round-trip on Fridays. Since this is longer than he would drive if he commuted to the office, you’ll want to reimburse the employee for 40 miles (60 miles – 20 miles).

Mileage Logs

Employees should keep mileage logs when using a personal vehicle for business use. The log should include:

- Employee’s name

- Description of vehicle

- Date of business use

- Purpose of business use

- Starting mileage on odometer

- Ending mileage on odometer

- Approval authorization

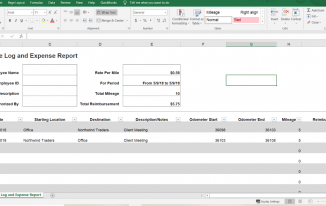

Here’s an example of a mileage log using Microsoft Excel.

Mileage log and expense report – employee reimbursement

Note that in this example, the employee drove from the office to a client and then back to the office. Therefore, there is no need to deduct commuting mileage.

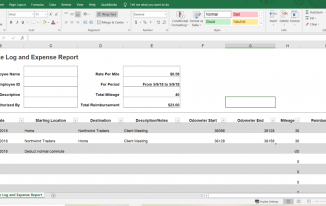

But suppose, like in our example from above, that on Fridays the employee drives from home to the client’s location and back home. His mileage log would look like this:

Mileage log and expense report example – employee reimbursement

But what if in this example, the drive to the client’s office from the employee’s home was shorter than his regular commute? In this case there is nothing to reimburse and the employee enjoys the benefit of less driving.

What would happen if this same employee didn’t normally work on Fridays or he always worked from home on Fridays? Then the entire drive to the client’s office would be reimbursable since the employee’s normal work schedule didn’t require him to commute on Fridays.

Many employees will forget to deduct their normal commute from mileage reimbursement requests. You’ll want to remind them.

Direct Expense Reimbursement of Travel Expenses

For employees who travel frequently, providing them with a company credit card is ideal. But for those times when an employee must use their own money for business expenses, you’ll want to reimburse employees quickly.

For easy recordkeeping, have employees complete expense reports when seeking reimbursements. Like the mileage log, it will detail who incurred the expense and when, what it was for, and the amount.

You can reimburse your employees with cash; however best practices would be to pay with check or some other trackable means, like ACH.

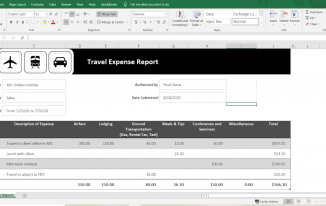

Here’s an example of an easy expense report in Excel.

Travel expense report example – employee reimbursement

For each expense, the employee should include receipts to support the amounts requested.

Receipts for purchases should contain the amount, date, place, and a brief description of the expense.

For example, hotel receipts should include:

- The name and location of the hotel.

- The dates stayed.

- Separate amounts for charges (i.e. lodging, meals, or food).

Restaurant and meal receipts should include:

- The name and location of the restaurant.

- The names of people in attendance.

- The date and amount of the meal.

You may choose to reimburse employees for meal tips. Be sure to have a clear policy of what will be reimbursed and what will not. For example, you’ll reimburse up to 20% for tips. Anything above that will not be reimbursed.

You’ll also need to consider your policy for lost receipts. You can still reimburse but have the employee fill out a missing receipt form to document the expense.

In lieu of direct expense reimbursement, consider using a per diem.

A per diem provides the employee with a specified dollar amount per day to use on meals, snacks, lodging, or other miscellaneous purchases. Larger expenses like airfare would be paid using the direct expense reimbursement method or paid for directly by the company.

Per diems should be prorated for partial days of travel. Acceptable methods include the ¾’s method or any other method you choose that is reasonable. The ¾’s method adds ¾ of a daily per diem rate on departure days and another ¾’s on return days.

The IRS sets per diem rates for cities and metropolitan areas. More expensive locales have higher daily rates than cheaper cities. For example, the daily rate for high cost cities like San Francisco, Vail, Colorado, and Nashville, Tennessee is $297. And many cities are designated high cost for only portions of the year. Miami and Park City, Utah are considered high cost only from December 1 – March 31.

And if you’re not in a high cost city, the daily rate is $200. These per diem rates are often updated each year. So you’ll always want to check for the current rates.

For example, Dave is travelling to Seattle for business. Seattle is a high cost locale. He’s leaving on Monday and returning on Thursday. Seattle’s maximum per diem rate is $297 per day. Dave will receive $222.75 ($297 x ¾) for Monday and Thursday and the full $297 for Tuesday and Wednesday.

Per diems are not taxable income to your employee if you use the IRS rates and your employee provides an expense report with receipts. However, using higher rates will create taxable income for the amount above the federal rate. And not submitting an expense report and receipts will make the entire per diem taxable because you’ll have an unaccountable plan and your company will not have the required receipts to support the tax deduction.

If your business operates in the transportation sector (i.e. shipping, trucking, or rail, etc…), it’s important to note that there are different per diem limits and rules you must follow.

Entertainment Expenses

With the 2017 Tax Cuts and Jobs Act, entertainment expenses are no longer tax deductible for companies.

As an employer, you may still reimburse your employees for entertainment expenses; however, these reimbursements will need to be segregated so that they are not included on your tax return. Examples of entertainment expenses include tickets to entertain clients at sporting events or country club fees for golf memberships.

What documentation you require for entertainment reimbursements is up to you but best practices suggest following the same requirements for travel or mileage reimbursements.

Commingling

If travel or meals involve both a business and personal aspect, only the portion of the expense that is business related is reimbursable. Expense reports and receipts should indicate whether there are any personal expenses.

For example, an employee makes a business trip to California from Georgia and elects to stay two days after business is finished for a mini-vacation. Best practices would have the employee check out of his hotel room and check back in using his personal credit card to pay the hotel bill for his extended stay. This way he has two different receipts; one for business and one for pleasure. However, if he doesn’t do that and the entire hotel stay is charged on the same receipt, you’ll need to back out the charges related to his personal stay.

None of this information should be taken as legal or financial advice, nor should it deter you from seeking the assistance of a licensed attorney, accountant, or financial services professional. But if you want to make sure your company’s policies for employee reimbursements are consistent with best practices, implementing these policies is a great place to start!

Tags: Business Use of Personal Vehicle Commingling Direct Expense Reimbursement employee Commuting reimbursement Employee Expense Reimbursement employee Monthly Allowance employees reimbursements entertainment expenses Excess Reimbursement Expense Reimbursement IRS Accountable Plans IRS Expense Reimbursement Mileage log and expense report Mileage Logs mileage on odometer Per Diem reimbursed expenses Reimbursing Employees Standard Mileage Rate travel expenses

- Next story 11 Facts about Employee Reimbursements Taxation

- Previous story Late Payment Calculator

- 2020 Mileage rates

- 2021 Mileage Rates

- Employee Reimbursements Taxation

- Gross from Net Calculator

- Reverse Sales Tax Calculator

- Taxation of Fringe Benefits

- IRS Mileage

Useful links

- Chamber of Commerce

Bistvo.com – Daily Inspiration

- 2020 Tax Calculator

- Accounting books

- Accounting education

- Accounting Jobs

- Accounting links

- Accounting software

- Accounting Software

- Accounting tutorials

- Additional Medicare Tax

- Annual Reports

- Calculators

- Chart of accounts

- Coronavirus

- Court decisions

- Depreciation

- EU Electronic Services

- European VAT on digital services

- Expense Reimbursements

- Federal income tax

- Federal Tax

- Financial statements

- FLSA – Fair Labor Standards Act

- Fringe Benefits

- Invoicing software

- Local Taxes

- Massachusetts

- Meals and Incidental Expenses

- Minimal Wage

- Minimum Wage

- Mississippi

- Net investment tax

- Nonprofits & Activism

- North Carolina

- OVDI Offshore Voluntary Disclosure Initiative

- Overtime pay

- Partnerships

- Payroll outsourcing

- Payroll software

- Penality and Interest

- Pennsylvania

- Per Diem Rates

- Principal business codes

- Professional tax software

- Retirement planning

- Self-Employed

- Small business

- Social Security and Medicare

- Sole Proprietorship

- State Licenses and Permits

- State Sales Tax

- Tax and Accounting Dictionary

- Tax calculators

- Tax court cases

- Tax Preparation Software

- Tax websites

- Title 26 – Internal Revenue Code

- U.S. Department of Labor (DOL)

- Underpayment Interest Rates

- Washinghton

- West Virginia

- West Viriginia

"Shoeboxed makes it stupid simple to scan receipts...”

What to know about travel expense reimbursement + templates.

The best way to establish an accurate reimbursement strategy for your employee and your company is to ensure that you have an expense reimbursement policy in place and that it is covered with all applicable employees during the onboarding process.

Caryl Ramsey

Published on

June 2nd, 2023

Shoeboxed is an expense & receipt tracking app that helps you get reimbursed quickly, maximize tax deductions, and reduce the hassle of doing accounting.

Employers and employees should understand the business’s guidelines for T&E or travel expense reimbursement policies so that neither runs into any issues over business-related expenses down the road.

The IRS is pretty flexible with employers when it comes to employee reimbursement for business travel expenses while away on a company trip.

Table of Contents

Does travel expense reimbursement qualify as a deductible travel expense?

What the IRS is not flexible about is whether or not the travel-related expenses incurred on the business trip qualify as a deductible travel expense.

Employers can deduct “ordinary and necessary expenses” of employees traveling away from their tax home.

According to the IRS, any reimbursement that does not qualify as a deductible travel expense is considered employee wages.

What are “accountable” and “non-accountable” plans?

There are two methods for reimbursing workers for expenses incurred when traveling for business. These are the “accountable plan” and the “non-accountable” plan.

An “accountable plan” is based on the Internal Revenue Service’s guidelines for reimbursing employees for the actual travel costs so that the reimbursable expenses incurred are not counted as income.

This means that the reimbursements are not subject to W-2 reporting or withholding taxes.

The expenses, however, must be business-related. To qualify for the “accountable plan,” expenses must be business-related, reported accurately, and excess reimbursements issued.

If the company’s reimbursement process doesn’t meet the guidelines under federal law for the “accountable plan,” then the expenses fall under the “non-accountable plan.”

If a reimbursed cost is non-accountable, then it is subject to being taxed as part of the employee’s compensation, therefore, it must be reported on the W-2 form and is subject to withholding.

What is travel expense reimbursement?

Travel expense reimbursement is when you pay employees back for business expenses incurred while traveling.

The expenses that are reimbursed are dependent upon the reimbursement policies determined by your business.

A travel reimbursement policy should be set up by your business that specifies the rules and procedures regarding reimbursement for travel-related expenses.

Many companies are using traditional expense management systems where staff can use a credit card and submit refunded trip expenses after the trip ends.

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. Expense reports don’t get easier than this! 💪🏼 Try free for 30 days!

What common types of travel expenses qualify for deductible expense reimbursement?

As an optional reimbursement provider, you have a choice on whether or not to reimburse employees for travel expenses .

Regardless, a clear reimbursement policy should be established within the company.

Some of the most typical reimbursable expenses include the following:

Transportation costs between your home and the business destination

Transportation between airport/station and hotel

Transportation between the hotel and the work location

Sending company-related supplies from your regular work location to your travel work destination

Business use of a rental car or the actual expenses of operating your personal vehicle when traveling away from home on business such as mileage reimbursement

The cost of parking your rental car can vary significantly depending on factors such as location, duration, and demand. Urban areas and popular tourist destinations often have higher parking fees, while off-peak times or less crowded areas may offer more affordable options

Lodging and meal expenses

Dry cleaning and laundry

Business communication expenses

Business related tips

Parking fees and tolls

How do expense reports play a role in a business’s expense reimbursement policy?

To prevent fraud and to keep company records updated and accurate, companies should use expense reports as part of their expense reimbursement policy.

The expense report should be used by employees to report incidental expenses such as travel expenses , business meals, and small purchases of supplies or equipment for the office.

Employees fill out these expense reports, which require the information of a typical transaction.

Some of the information found on an expense report include the vendor’s name, date paid, expense description, amount paid, and totals for each expense category .

Then the expense report is submitted to the company and according to the reimbursement policy, the employee is reimbursed.

See also: Expense Report Template Google Sheets: 4 Free Templates

Receipt requirements

It’s important to always have proof or documentation of the expenses that you incurred. The best proof is to provide the original receipt from the store, merchant, or a receipt book .

Therefore, when turning in an expense report, always attach any supporting documentation such as your receipts to the expense report.

This safeguards the company against expense fraud and ensures that the company will have the documentation needed for tax deductions and any audits if requested.

Processing expense reports for travel reimbursements

Once expense reports are submitted to the company, the company is responsible for the accuracy of the expense reports.

The company has an obligation to check the expense report against its business travel and reimbursement policies.

This is meant as an assurance system for ensuring accurate compliance with corporate policies.

Deadlines for expense reimbursement

Businesses should establish monthly or quarterly deadlines for expense reports. This ensures that the business can claim the expense as a tax deduction.

It also ensures that records are kept more accurate and up-to-date, that an expense doesn’t fall through the cracks, and that the company maintains a more efficient cash flow.

Not only should there be a deadline for the employee to submit an expense report, but there also should be a deadline for when the employee will be reimbursed by the company.

See also: Travel Nurse Expenses: Put Money Back in Your Pocket

4 Free travel expense reimbursement form templates

Whether you’re a new business looking for an easy way to keep up with eligible travel reimbursements or an employee that often travels for work, these free travel expense reimbursement form templates are a great way to record travel expenses and separate them from non travel reimbursements.

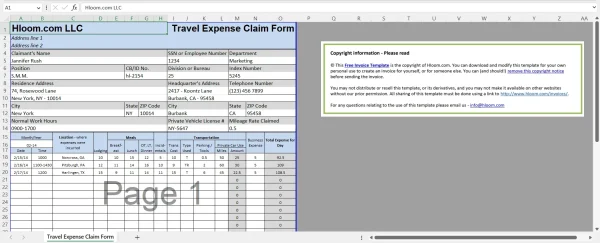

1. Hloom free travel expense reimbursement spreadsheet

Hloom free travel expense reimbursement spreadsheet for Excel.

Hloom offers a free travel expense reimbursement spreadsheet that you can use to report any travel expenses made while away on a business trip.

Employees’ travel expenses should be recorded in a concise, organized template so it’s easy to categorize eligible reimbursement claims, see if expenditures were within spending limits, and receive reimbursement all by looking at a single form.

Use this template to record:

The date, time, and location you traveled to

The meals you ate

The cost of lodging

Cost of transportation

Private vehicle license

This template is 100% free and customizable, so you can adjust the columns as needed to suit your company.

2. GeneralBlue simple free travel expense reimbursement form

This free travel expense reimbursement form by GeneralBlue is as easy as it gets. It’s an Excel template with 8 columns for recording the expenses incurred traveling for business.

With this straightforward form, you can record:

The date you traveled

A description of your trip

The cost of transportation

The cost of hotels

The cost of meals

Miscellaneous expenses

The total amount of travel expenses

There is also a line for employee and approval signatures so you have an official record of travel expenses and reimbursements.

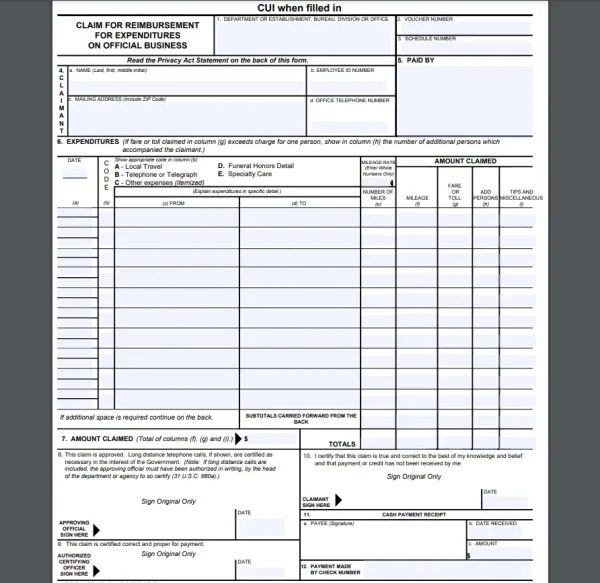

3. U.S. General Services Administration travel expense reimbursement template

Travel expense reimbursement template from the U.S. General Services Administration.

For state employees, the U.S. GSA offers a free travel expense reimbursement template that you can use to record spending while out on state business.

This template has everything an employee would need to record official business expenses, including:

Department or establishment

Official business categories

Mileage, including fare or toll

Date traveled

Additional persons

Tips and miscellaneous expenses

Spaces for authorizing signatures

The U.S. GSA travel expense template has to be printed and written as a paper copy.

4. Vertex42 travel expense reimbursement sheet

The Vertex42 travel expense reimbursement sheet is available for free and can be downloaded as an Excel file or Google Sheet .

This expense report includes: