- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

5 Tips for Buying Schengen Visa Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

1. Decide which type of insurance you’d like

2. get multiple quotes, 3. use this as an opportunity to maximize credit card bonus points, 4. double-check the policy before purchasing, 5. consider using a credit card that provides trip insurance instead of buying a new policy, if you’re looking to buy travel insurance for a schengen visa.

Travel insurance can be a very important accompaniment to your trip, especially when you’re traveling throughout multiple countries. Europe is a prime example of this, where the border-free Schengen zone allows you to traverse multiple countries without passing passport control. Finding Schengen visa travel insurance isn’t always simple, however, and you’ll want to ensure that you have coverage regardless of your location.

There are plenty of things to think about before buying travel insurance when traveling throughout Europe, including: the coverage you’re looking for, how you’ll be paying and whether your credit card already offers insurance.

Let’s take a look at Schengen travel insurance and five easy tips for making sure you’re good to go — no matter where you travel within the region.

Although there aren’t generally any Schengen visa travel insurance requirements, there are multiple types of travel insurance coverage available depending on your needs. Consider carefully the type of coverage you’re looking for. Common types includes:

Travel medical insurance .

Trip interruption insurance .

Cancel for any reason insurance .

Trip cancellation insurance .

Lost luggage insurance .

Rental car insurance .

Accidental death insurance .

Emergency evacuation insurance.

Note that the U.K. left the Schengen zone a few years ago, so you’ll want to double-check whether coverage in the U.K. is valid for your travel insurance policy.

» Learn more: Is travel insurance worth it?

It’s always in your best interest to get multiple quotes before purchasing insurance. The amount you’ll pay will be heavily dependent on the type of coverage you receive, its length and any deductibles that you may have.

Cancel For Any Reason insurance, or CFAR, allows you to recoup most or all of your nonrefundable costs — no matter why you’ve chosen not to travel.

There are plenty of different websites that’ll allow you to compare different insurance plans such as TravelInsurance.com or SquareMouth.com (a NerdWallet partner), which will gather together multiple quotes in one easy search.

There are several details you’ll need to have on hand when looking for quotes. These include:

The total cost of your trip.

Your destination.

Your dates of travel.

The number of travelers.

The age of travelers.

Where you live.

When you booked your trip.

Once you’ve got all your information gathered together, it’s simple to find a policy that fits your need for travel insurance in the Schengen zone on one of the comparison websites.

» Learn more: What is travel insurance?

If you’re planning a vacation to Europe, hopefully you’ve already acquired a travel credit card or two. However, cards that focus on travel rewards won’t necessarily optimize insurance purchases.

» Learn more: How to choose a credit card for Europe travel

In this case, you’ll want to double down on rewards with a card that’ll maximize everyday spend. These cards will give you bonus points on all purchases, no matter their category. Great options for this include:

Capital One Venture Rewards Credit Card : Earn 2x Capital One Miles per dollar spent on all purchases.

Citi Double Cash® Card : Earn 2% cash back in the form of Citi ThankYou points on all purchases: 1% when you make your purchase and another 1% when you pay your bill. Plus, through the end of 2024, cardholders can get 5% cash back on hotel, car rentals and attractions booked through the Citi Travel portal .

Chase Freedom Unlimited® : Typically earn 1.5% cash back on all non-bonus category purchases.

The Blue Business® Plus Credit Card from American Express : Earn 2 American Express Membership Rewards on the first $50,000 in purchases each year. Terms apply.

Pair your Chase Freedom Unlimited® card with a Chase Sapphire Preferred® Card card or Chase Sapphire Reserve® card to unlock the full suite of Chase Ultimate Rewards® transfer partners. This strategy is sometimes referred to as the Chase Trifecta .

While you likely won’t be earning a ton of points for your travel insurance purchase (unless your costs are exorbitantly high), maximizing your earnings is always a good idea. Don’t leave money on the table.

» Learn more: The best travel insurance companies

Not all travel insurance policies are created equal. This is probably no great revelation, but it’s definitely something of which you’ll want to be aware.

This is especially pertinent when it comes to the current travel climate in the COVID-19 era. While you may purchase a health insurance plan that covers most medical costs, it may specifically exclude those incurred by COVID-19. And even if it does reimburse you for any hospital costs, it may not pay for a forced quarantine in the event of illness.

These are things you’ll want to check for when buying travel insurance for any trip. Be sure to read the terms and conditions of your policy carefully, and if there’s very specific coverage you’re looking for (such as that offering protection in the event you catch COVID-19), you can often use search filters to narrow down your options.

» Learn more: Is there travel insurance that covers COVID quarantine?

One great feature of travel credit cards is the complimentary trip insurance they often provide. In order for your trip to be eligible for coverage, you’ll need to use the card to pay for your trip. In exchange, however, you can receive some pretty powerful benefits without needing to pay out of pocket.

The Chase Sapphire Preferred® Card card, for example, provides primary rental car insurance. This means that when you decline the insurance offered at the counter, your entire rental will be covered against collision up to the actual value of the rental car.

What’s most powerful about this feature is that, as primary, it comes before your own personal insurance — possibly saving you expensive premium jumps and claims on your policy.

Other cards that include powerful travel insurance protection such as interruption, cancellation or baggage coverage include The Platinum Card® from American Express and the Chase Sapphire Reserve® card. Terms apply.

» Learn more: The cheapest flights to Europe on points

It makes sense to purchase travel insurance in many circumstances, especially with the uncertainty in today’s travel world. Take advantage of these five tips to make sure you’re properly prepared for your trip — whether you’re heading to France, Finland or any of the over two dozen Schengen countries.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Application Requirements

What expenses do Schengen visa insurance policies cover, and how much to pay for one

The cost of an EU or Schengen visa insurance policy depends on four factors:

- traveller’s age;

- the validity period of the insurance;

- list of risks.

For example, an insurance policy for a week-long relaxing holiday in the Schengen Area can be purchased for €20-40 if the insured person is between 20 and 45 years old. When calculating the cost of a policy for children and the elderly, an increased coefficient is applied.

Maximum validity period for a Schengen Visa insurance policy You can purchase a policy with a longer validity period, for example, a one-year policy. This is useful for those who make at least 10 trips to the Schengen states per year. Annual insurance costs start at €100.

The cost of insurance will increase if you add extra options. For instance, engaging in active recreation, such as skiing, increases the cost of insurance by 2 times. Engaging in freeride, which is an extreme sport, increases the cost of insurance by 4 times.

In addition to insuring life and health, a policy can also cover other situations:

- cancellation of the trip;

- flight delay;

- lost or delayed baggage by the airline;

- lost or stolen documents;

- forced quarantine;

- legal assistance;

- damage to the vehicle;

- civil liability — unintentional injury to another person or damage to someone else’s property.

Coverage for coronavirus treatment is included in most insurance plans by default. Travellers are compensated for emergency medical care, transportation to the clinic, and COVID-19 treatment in the hospital or at home.

Suppose there is no such clause in the contract. In that case, the insurance will only cover the cost of emergency medical care, and the traveller will have to pay for coronavirus treatment separately.

Additionally, a traveller can add PCR test coverage and coverage of transportation costs associated with a trip delay in cases of mandatory quarantining due to coronavirus contracting.

European travel insurance for Europe or the Schengen Area can be obtained either in person or remotely. Of all documents, you will only need a passport. To get an insurance policy for a child or a disabled person, you will need a passport of a parent, guardian, or legal representative.

Some visa application centres partner with insurance companies and offer to get insurance through them right before applying for a visa. In that case, the policy cost will increase at the expense of the centre’s visa application commission.

Applying for an insurance policy yourself is more cost-effective, but you need to do this before visiting the visa application centre.

To get insurance for a Schengen visa or EU online , you need to fill out a form on the insurance company’s website: enter your personal data, email address and trip information. After the payment, the policy will be sent to the provided email address.

To get a Schengen visa, the insurance policy must be printed out and included in the application documents. If the policyholder already has a valid visa to the Schengen states, printing is not needed — saving it on a smartphone is enough. Still, we recommend taking a printed copy with you on the trip in case your phone runs out of battery or gets stolen.

To get full-time insurance for a Schengen visa or Europe , you need to come to the office of the selected insurance company with your passport. The staff will clarify the trip details and recommend additional options based on them.

Getting insurance doesn’t take much time: you can get it on the day of applying for a visa or on the day of departure if the previous insurance has ended and the visa is still valid.

The policyholder and the insured can be different people. For example, if the whole family goes on a trip, one of the members can hold insurance for all of them. Also, the policyholder may be a legal entity.

If the insured person is a child or a disabled person, their legal representative should apply for assistance in an insured event. In all other cases, the insured can apply in person, even if they are not the policyholder.

A scenario: Michael acted as a policyholder and purchased a Schengen visa insurance policy for himself, his wife and his child. Michael contacted the insurance company when his son had a fever and required a doctor’s consultation. When Michael’s wife needed emergency dental care, she contacted the insurance company herself.

If an emergency occurs during your trip, you must:

- Call the 24-hour service centre of the insurance company; the phone number is always provided in the insurance policy.

- Describe the incident details to the operator.

- Follow the operator’s instructions.

- Save all receipts related to an insurance event, even if it’s a taxi ride bill.

If you need medical assistance, the operator will find a doctor and send a guarantee letter to the clinic so that the insured traveller will be accepted free of charge.

If you don’t require medical assistance, the operator will tell you what to do to cover your expenses.

Yes, all travellers who enter the Schengen Area with a visa must have an insurance policy . This rule is enshrined in the EU Visa Code .

Border control officers do not always ask for an insurance policy, so this is possible. However, this is also illegal: everyone travelling with a Schengen visa is required to have insurance .

To get an insurance policy , you only need a passport.

Yes, large insurance companies provide an opportunity to buy Schengen visa insurance online .

To do this, fill out a form on their website: enter your personal information, email address, and trip details. After payment, the policy will be sent to the specified email address: you will need to print out the insurance or save it to your phone.

The cost of a Schengen visa insurance policy depends on its validity period, the amount of coverage, the risk list, and the insured traveller’s age.

For example, an insurance policy for a one-week trip to the Schengen Area can cost from €20 to €40. Such insurance will not cover expenses related to active and extreme sports.

Schengen Area travel insurance must cover all expenses related to:

For an additional fee, you can include extra options in your insurance: active, beach and extreme vacations, chronic diseases, pregnancy, alcohol intoxication, natural disasters and terrorist attacks.

Yes, most insurance plans already have a default coronavirus treatment . However, this must be clearly stated in the contract.

Suppose there is no such clause in the contract. In that case, the insurance will only cover the cost of emergency medical care, and the rest of the coronavirus treatment will have to be paid separately.

The insured traveller calls the phone number listed on the insurance policy, tells the operator what happened, and follows the operator’s instructions.

If the traveller needs help or medical advice, the operator will find a suitable clinic. They will send a guarantee letter there so the insured patient can be accepted free of charge.

Visa Traveler

Exploring the world one country at a time

How to Buy Schengen Travel Insurance from VisitorsCoverage: A Step-by-Step Guide

Updated: September 8, 2023

VisitorsCoverage is a travel medical insurance broker headquartered in the US. They sell insurance for all international travel including US trips and Schengen Visa.

VisitorsCoverage’s Europe Travel Plus meets all the requirements of Schengen visa insurance such as the minimum policy cover, copay and visa letter.

VisitorsCoverage is also the cheapest Schengen travel insurance, costing about $1 per day.

In this article, you will learn how to buy Schengen travel insurance from VisitorsCoverage and how to cancel and get a refund in case of visa refusal.

Table of Contents

Documents needed before starting the purchase.

Keep the following documents handy before you start the purchase.

- Your passport

- Your travel dates

- A credit or debit card

Steps to Buy Schengen Travel Insurance

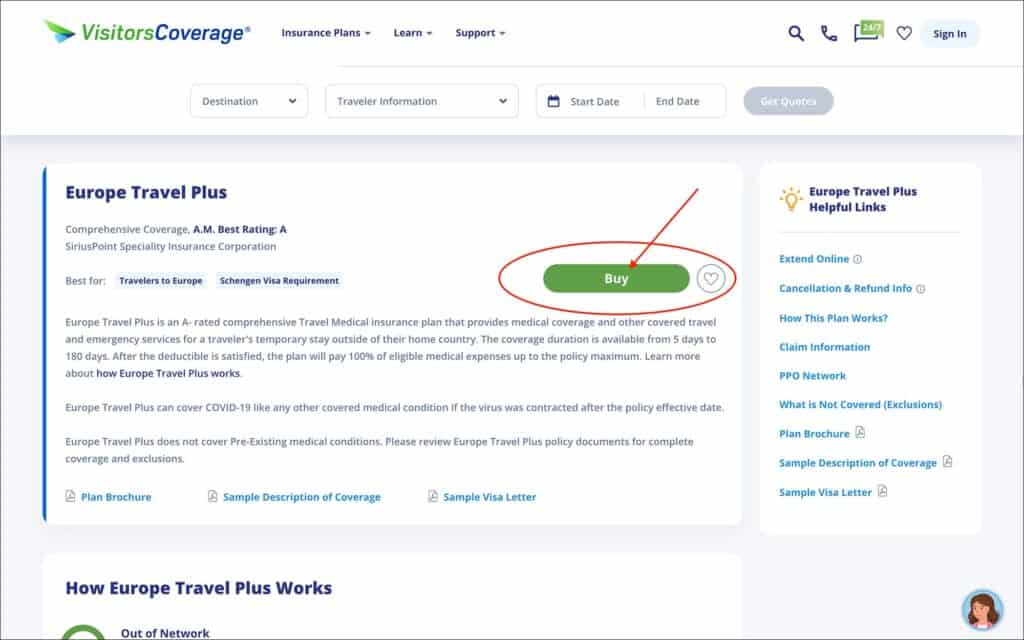

- Go to the VisitorsCoverage Europe Travel Plus page

- Click on the green “Buy” button.

You will be taken to the “Purchase Your Policy” page.

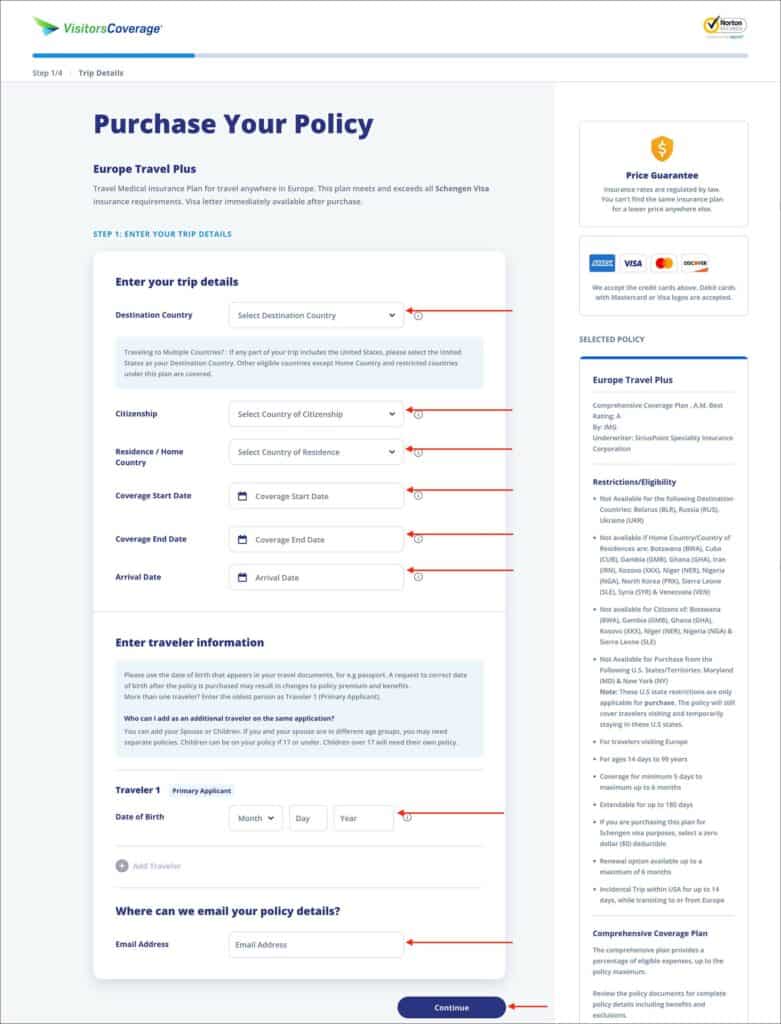

Step 1: Enter Your Trip Details

Enter the following information on the “Purchase Your Policy” page.

Section: Enter your trip details

- Destination Country [ Comment: Select your main Schengen country of application ]

- Citizenship [ Comment: Select your country of citizenship as per your passport ]

- Residence / Home Country [ Comment: Select your country of residence ]

- Coverage Start Date [ Comment: Select the policy start date ]

- Coverage End Date [ Comment: Select the policy end date ]

- Arrival Date [ Comment: Select your trip start date, which can be the same as the coverage start date ]

Destination Country Select the main Schengen country where you will be applying for your visa. For example, if you are applying for a Schengen visa at the France embassy or consulate, select “France” as your destination country.

Section: Enter travel information

- Traveler 1: Date of Birth [ Comment: Enter your date of birth as per your passport ]

Add more travelers and their date of birth by clicking on the + button.

Section: Where can we email your policy details?

- Email Address [ Comment: Enter the email address where you would like to receive your policy documents ]

Click on the blue “Continue” button.

You will be taken to the “Coverage Details” page.

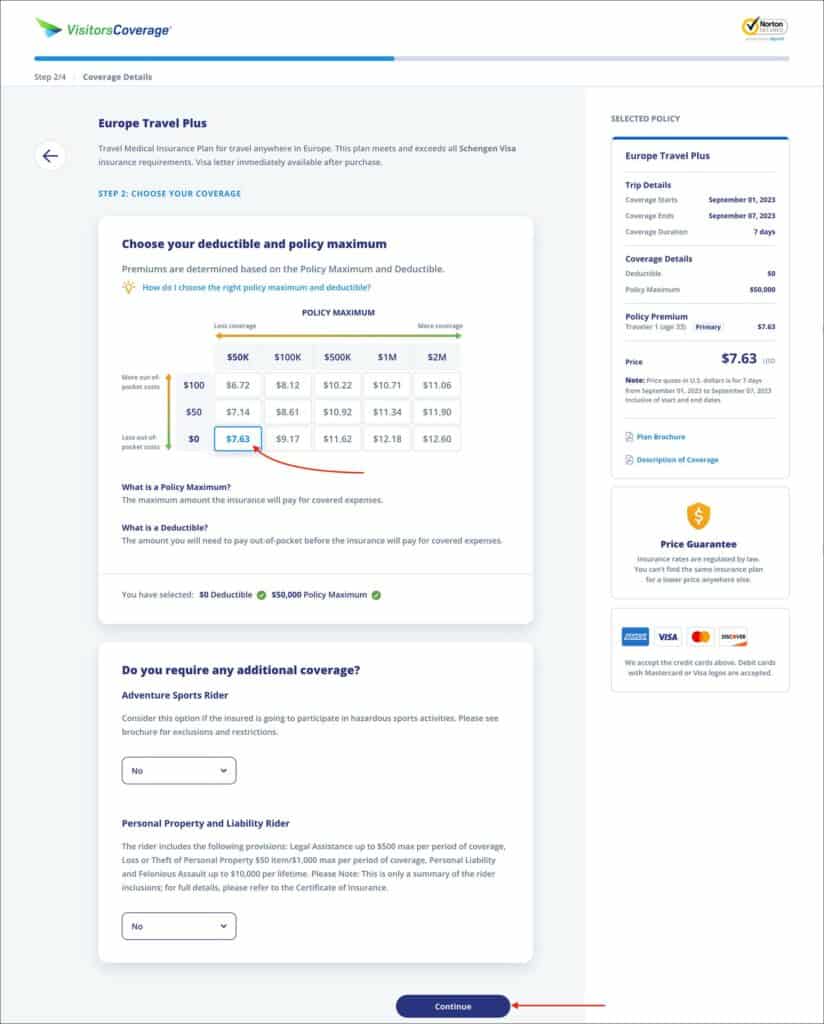

Step 2: Choose Your Coverage

Section: Choose your deductible and policy maximum.

- Deductible [ Comment: Select $0 ]

- Policy Maximum [ Comment: Select at least $50K ]

Deductible A deductible of $0 will be selected by default. Even then, make sure $0 is selected. $0 deductible is the Schengen visa insurance requirement. If you choose a different amount, the insurance will not be accepted for your Schengen visa.

Policy Maximum A policy maximum of $50,000 will be selected by default. You can increase your coverage if you prefer. But $50,000 is the minimum requirement for a Schengen visa.

Section: Do you require any additional coverage?

You can select the below additional coverage if necessary. But these are not required for a Schengen visa.

- Aventure Sports Rider [ Comment: This additional coverage may be beneficial if you plan to engage in adventure sports during your Europe trip ]

- Personal Property and Liability Rider [ Comment: This additional coverage may be beneficial if you prefer to insure your electronics, etc. ]

You will be taken to the “Applicant Details” page.

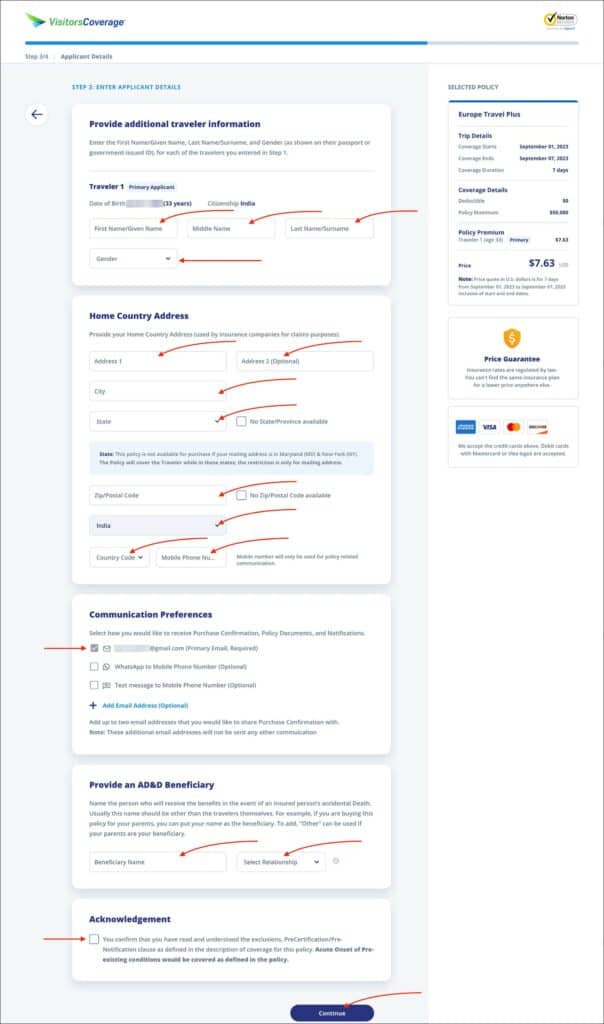

Step 3: Enter Applicant Details

Section: Provide additional travel information

Traveler 1: Primary Applicant

- First Name/Given Name [ Comment: If your passport has a Given Name, enter the given name here. If your passport has a First name, enter your first name here ]

- Middle Name [ Comment: If your passport has a Middle name, then enter the middle name here. Else leave it blank ]

- Last Name/Surname [ Comment: Enter your last name or surname as per your passport ]

- Gender [ Comment: Enter your gender ]

Traveler 2:

If you have more than one traveler in your policy, enter their details.

Section: Home Country Address

Enter your current residential address in the following fields.

- Address 1 [ Comment: Enter address line 1 of your current residential address ]

- Address 2 (optional) [ Comment: Enter Address line 2 of your current residential address ]

- City [ Comment: Enter your city ]

- State [ Comment: Enter your state ]

- Zip/Postal Code [ Comment: Enter your postal code ]

- Country [ Comment: Enter your country ]

Enter your current mobile phone number in the following fields.

- Country Code [ Comment: Enter the country code of your phone number ]

- Mobile Phone Number [ Comment: Enter your mobile phone number ]

Section: Communication Preferences

In this section, select how you would like to receive your purchase confirmation, policy documents and visa letter.

Email is mandatory, but you can also opt for phone or WhatsApp.

Section: Provide an AD&D Beneficiary

Enter the information of the beneficiary who will receive the benefits in case of accidental death of the insured.

- Beneficiary Name [ Comment: Enter the beneficiary’s full name as per their passport or ID card ]

- Relationship [ Comment: Select the relationship of your beneficiary ]

Section: Acknowledgement

Check the box to confirm that you have read and understood the coverage information.

You will be taken to the “Review and Pay” page.

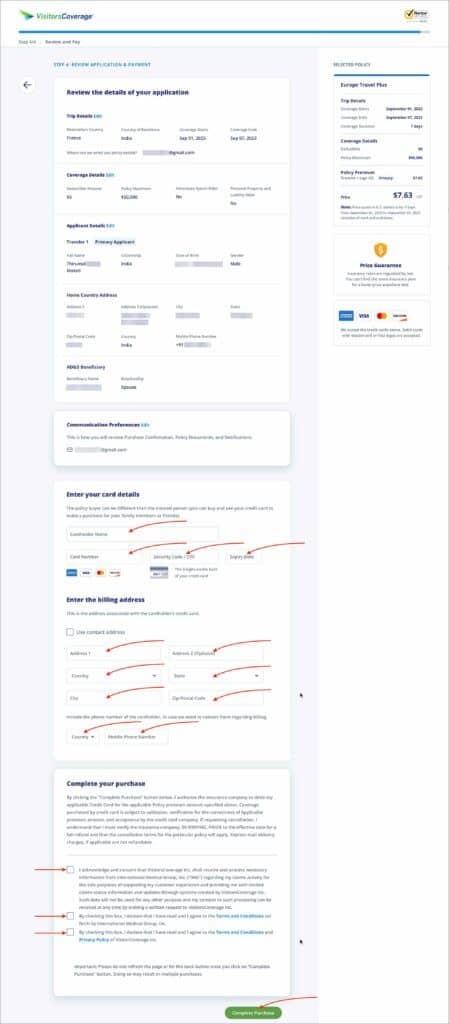

Step 4: Review Application and Payment

Section: Review the details of your application

Review all the information you have entered so far. Make sure the information is as per your passport.

Section : Enter your card details

In this section, enter your card details for payment.

Section : Enter the billing address

In this section, enter the billing address associated with your credit/debit card entered above.

Section : Complete your purchase

In this section, check all three boxes.

Click on the green “Complete your purchase” button.

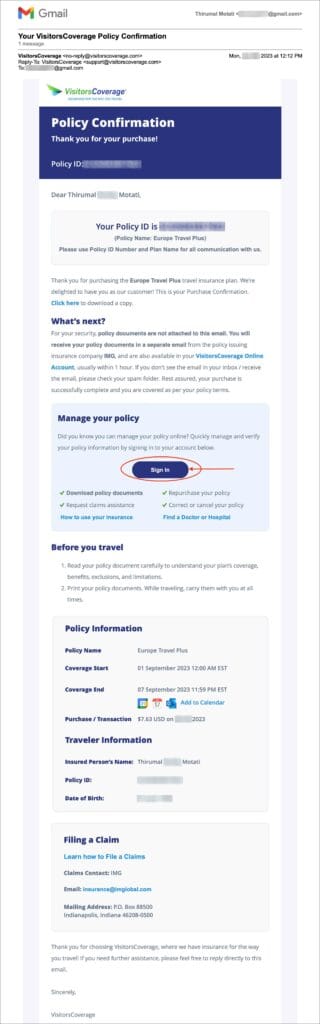

Once your purchase is complete, you will receive an email confirming your purchase.

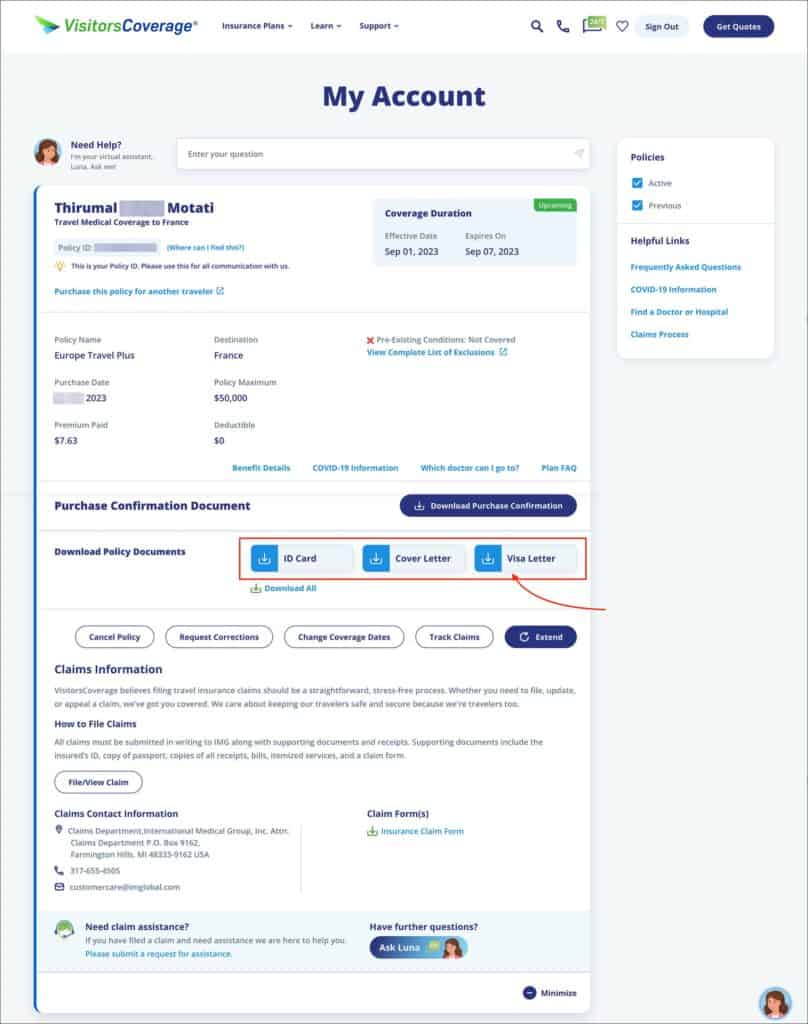

Steps to Download Visa Letter and Coverage Letter

You can download your visa letter and coverage document from the customer portal dashboard. You only need these two documents as proof of travel insurance for Schengen visa .

To go to the customer portal, you can click on the “Sign In” button in the email. Or you can follow the below steps.

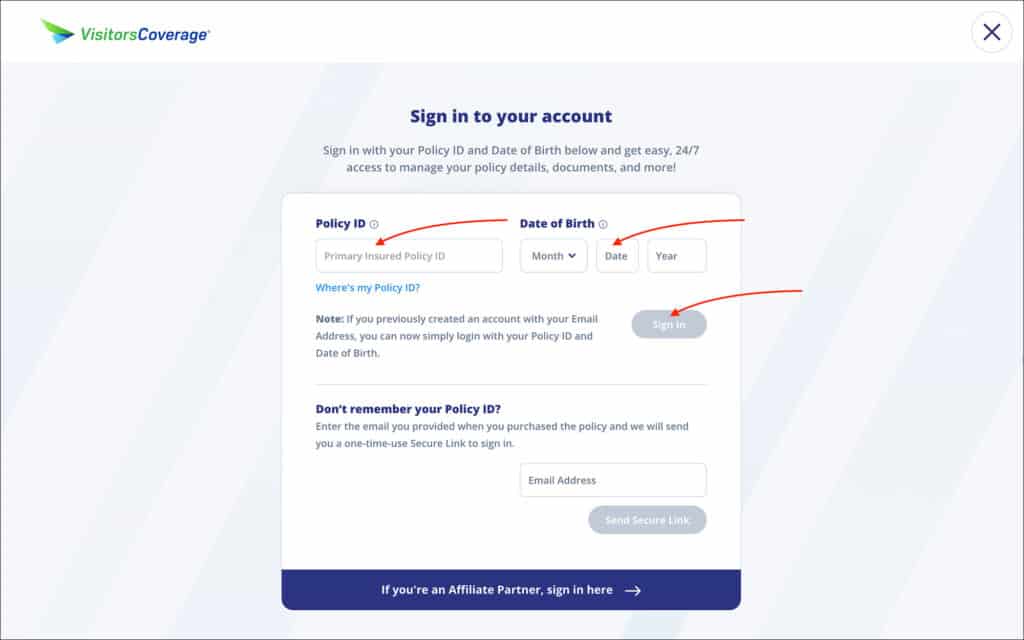

Log into Customer Portal

- Go to the VisitorsCoverage Customer Portal page

- Log in using your Policy ID and Date of Birth or using your Email.

Once you log in, you will see your policy details such as the names, policy types, coverage duration, etc.

Download your Visa Letter

In the “Download Policy Documents” section, click on “Visa Letter” to download the visa letter for your Schengen visa.

You can also download the coverage letter from IMG International by clicking the “Cover Letter” button.

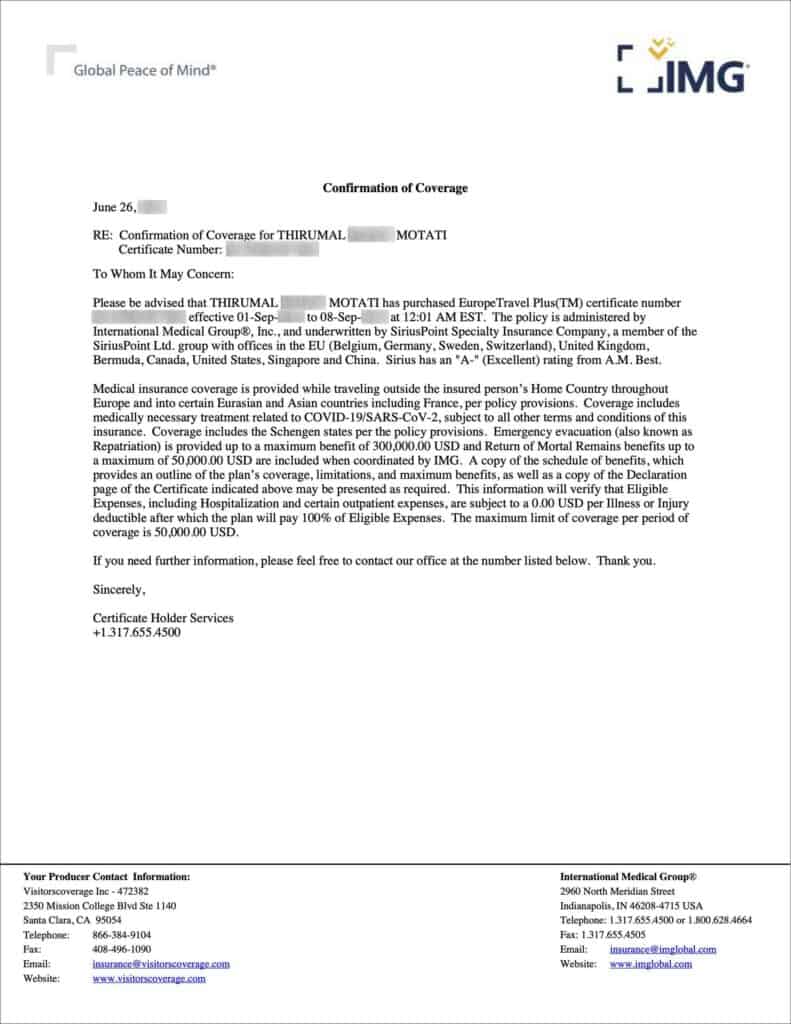

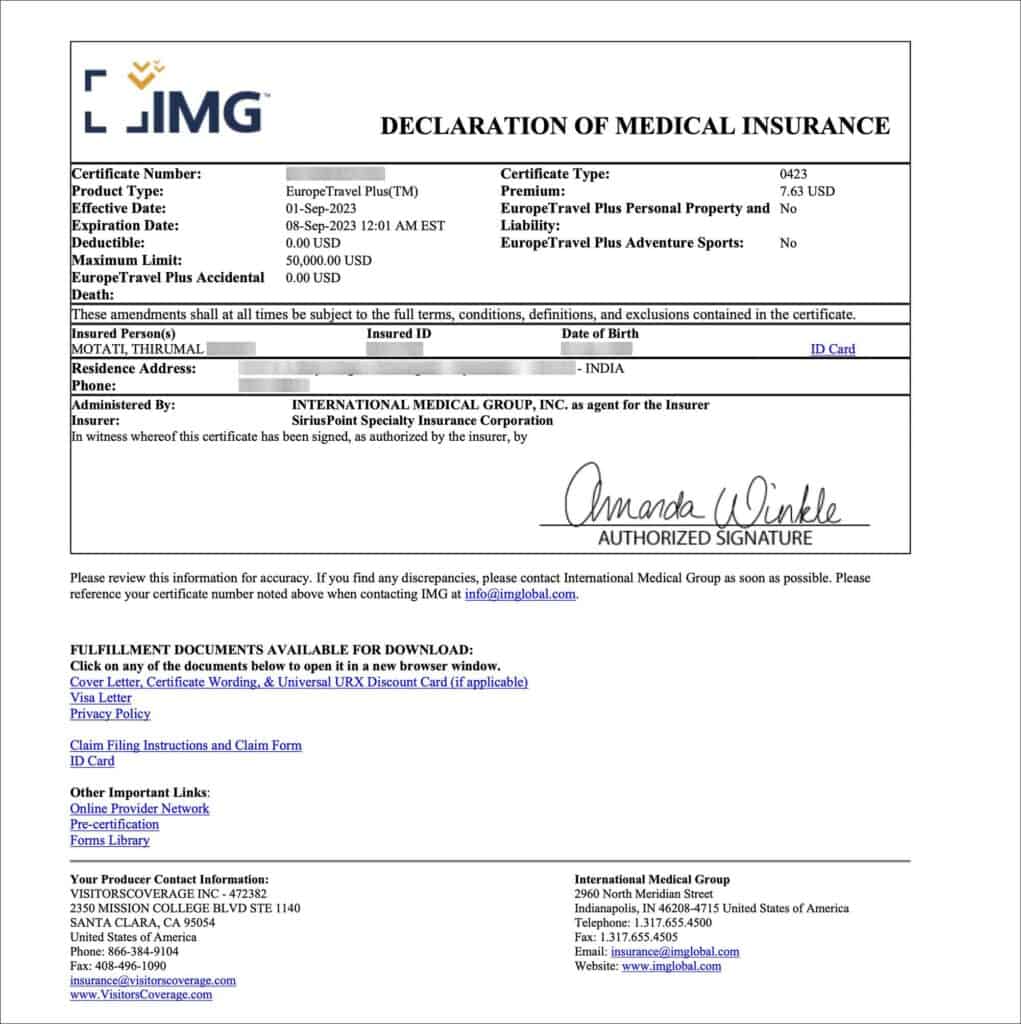

Sample Visa Letter from VisitorsCoverage

Sample Coverage Letter from IMG International

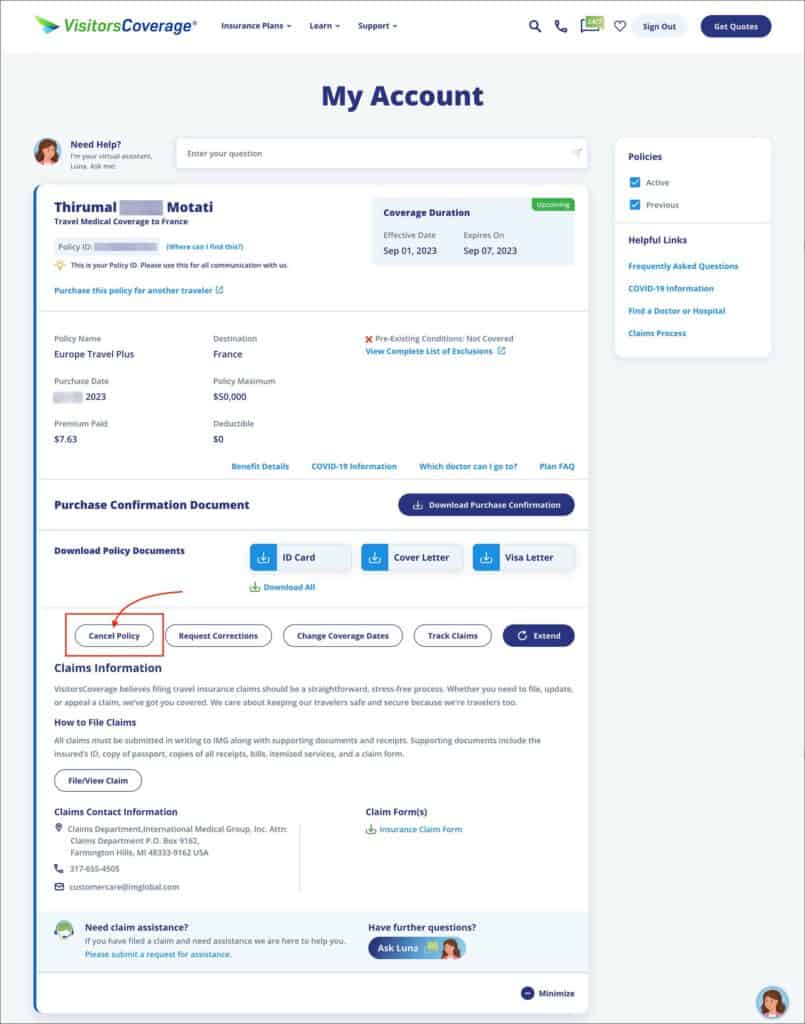

Steps to Cancel Your Policy in Case of Visa Refusal

In order to get a full refund, you must cancel your policy before the insurance start date. If your visa is refused, cancel your policy right away to avoid any issues with your refund.

Follow the below steps to cancel and receive a full refund of your policy.

- Go to VisitorsCoverage Customer Portal

Initiate Policy Cancellation

Within the “My Account” dashboard, click on the “Cancel Policy” button.

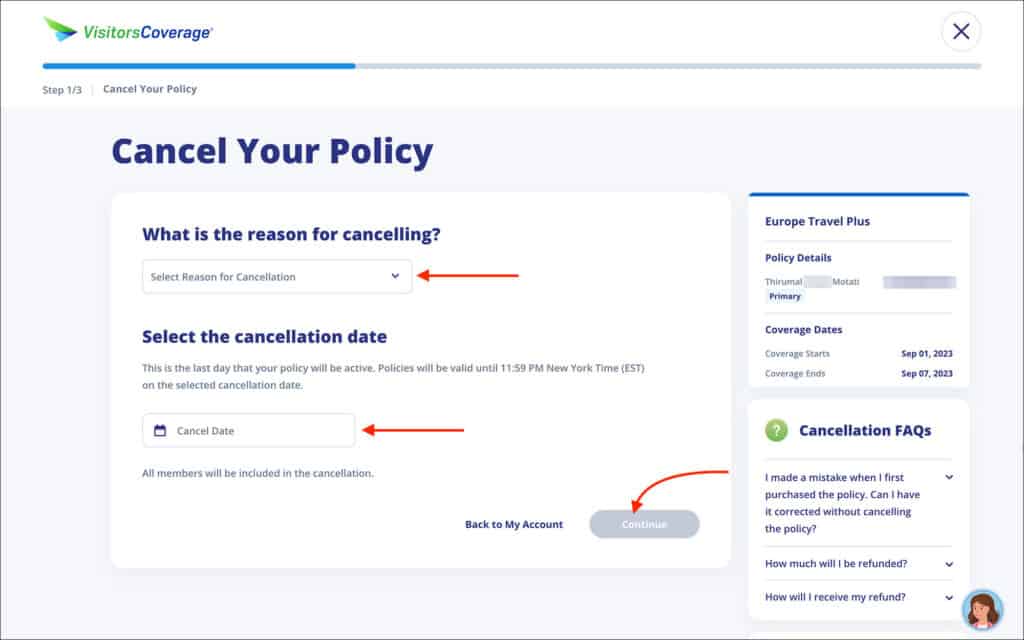

Step 1: Cancel Your Policy

- Travel plans changed

- Found a cheaper plan

- Purchased a wrong policy

- Accidentally submitted incorrect information

- Concerned with Coronavirus

- Select the cancellation date [ Comment: Select the most recent date so you can get your refund as soon as possible ]

You will be taken to the “Verify and Submit” page.

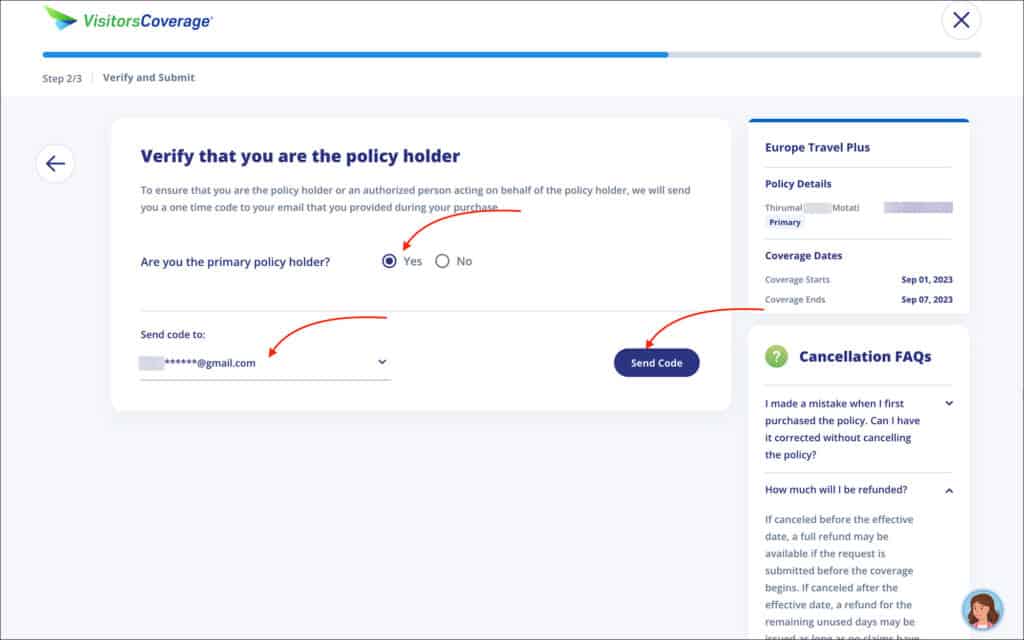

Step 2: Verify and Submit

- Are you the primary policy holder? [ Comment: Select “Yes” ]

- Send code to: [ Comment: Select your email from the dropdown ]

Click on the blue “Send Code” button.

Check your email for the verification code.

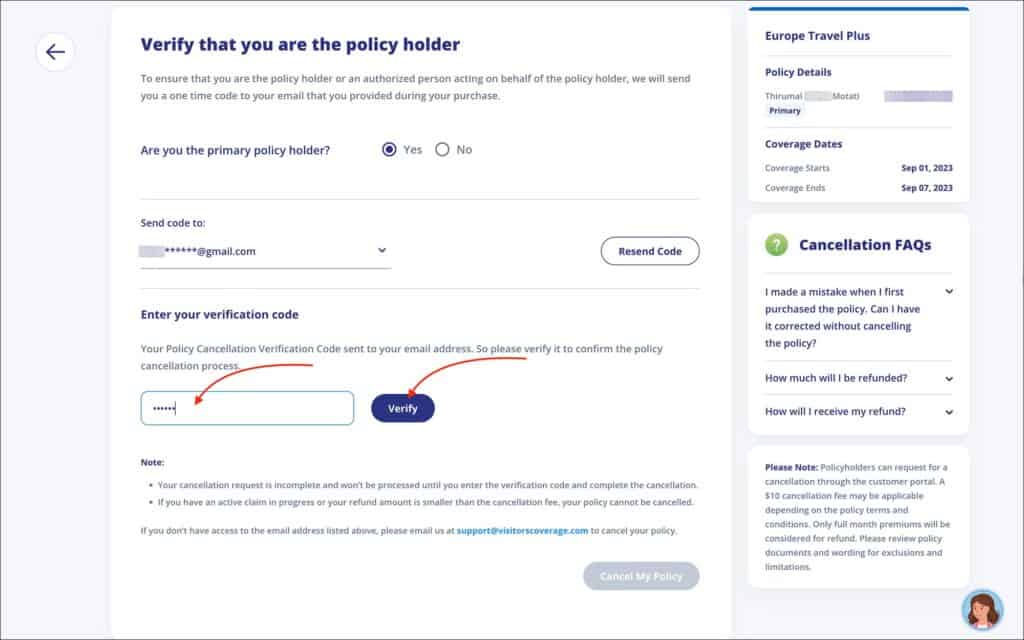

- Enter your verification code [ Comment: Enter the verification code that you received to your email ]

Click on the blue “Verify” button

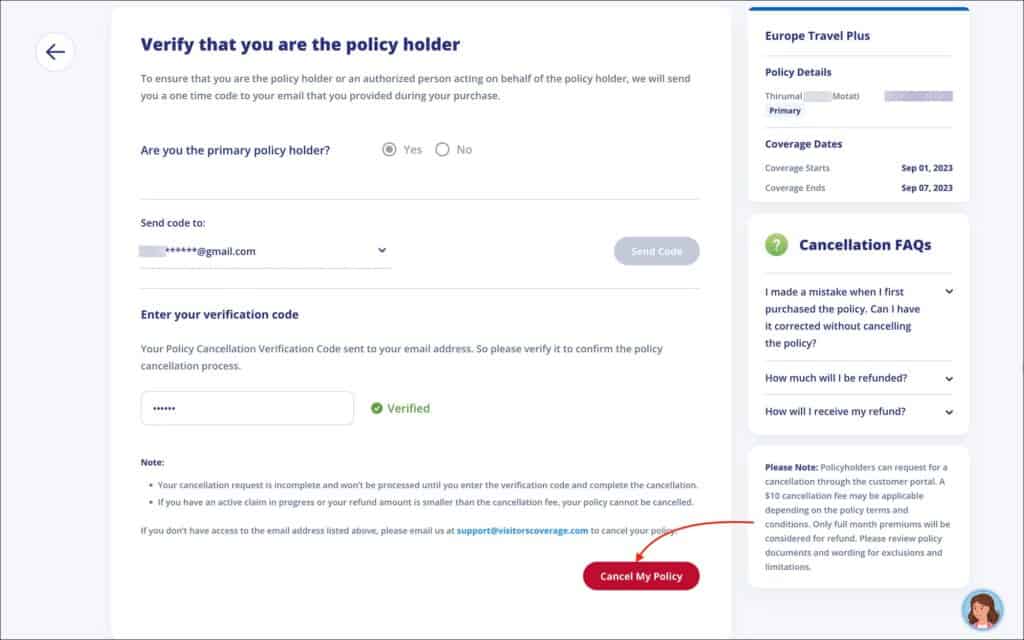

Then click on the red “Cancel My Policy” button.

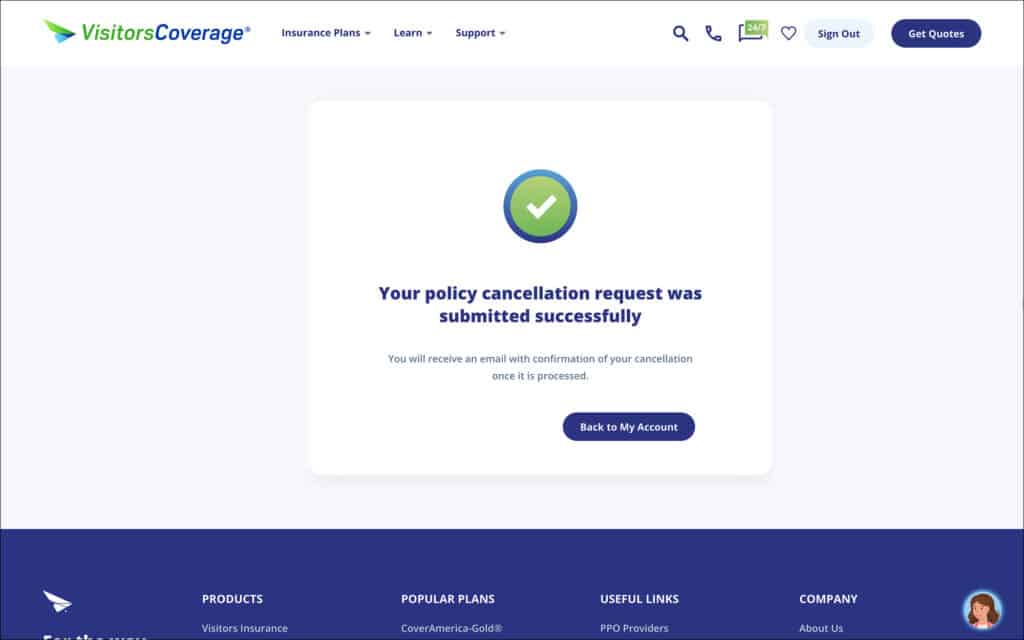

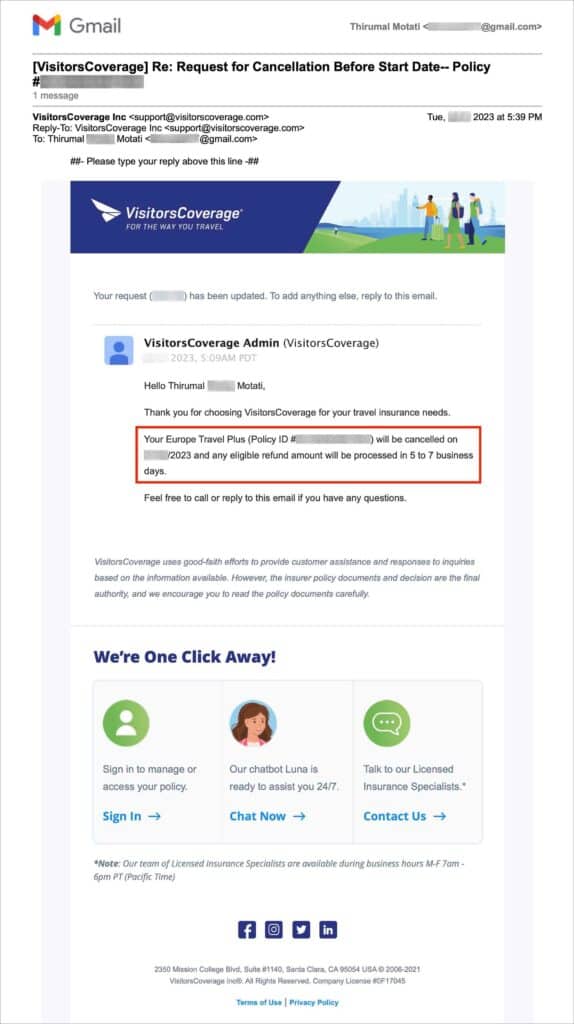

Step 3: Cancellation Success

You will be shown that your policy cancellation request was successfully submitted.

You will also receive emails from VisitorsCoverage and IMG International confirming your cancellation and refund. Save those emails as a reference if you need to contact VisitorsCoverage for any issues with refunds.

WRITTEN BY THIRUMAL MOTATI

Thirumal Motati is an expert in tourist visa matters. He has been traveling the world on tourist visas for more than a decade. With his expertise, he has obtained several tourist visas, including the most strenuous ones such as the US, UK, Canada, and Schengen, some of which were granted multiple times. He has also set foot inside US consulates on numerous occasions. Mr. Motati has uncovered the secrets to successful visa applications. His guidance has enabled countless individuals to obtain their visas and fulfill their travel dreams. His statements have been mentioned in publications like Yahoo, BBC, The Hindu, and Travel Zoo.

PLAN YOUR TRAVEL WITH VISA TRAVELER

I highly recommend using these websites to plan your trip. I use these websites myself to apply for my visas, book my flights and hotels and purchase my travel insurance.

01. Apply for your visa

Get a verifiable flight itinerary for your visa application from DummyTicket247 . DummyTicket247 is a flight search engine to search and book flight itineraries for visas instantly. These flight itineraries are guaranteed to be valid for 2 weeks and work for all visa applications.

02. Book your fight

Find the cheapest flight tickets using Skyscanner . Skyscanner includes all budget airlines and you are guaranteed to find the cheapest flight to your destination.

03. Book your hotel

Book your hotel from Booking.com . Booking.com has pretty much every hotel, hostel and guesthouse from every destination.

04. Get your onward ticket

If traveling on a one-way ticket, use BestOnwardTicket to get proof of onward ticket for just $12, valid for 48 hours.

05. Purchase your insurance

Purchase travel medical insurance for your trip from SafetyWing . Insurance from SafetyWing covers COVID-19 and also comes with a visa letter which you can use for your visas.

Need more? Check out my travel resources page for the best websites to plan your trip.

LEGAL DISCLAIMER We are not affiliated with immigration, embassies or governments of any country. The content in this article is for educational and general informational purposes only, and shall not be understood or construed as, visa, immigration or legal advice. Your use of information provided in this article is solely at your own risk and you expressly agree not to rely upon any information contained in this article as a substitute for professional visa or immigration advice. Under no circumstance shall be held liable or responsible for any errors or omissions in this article or for any damage you may suffer in respect to any actions taken or not taken based on any or all of the information in this article. Please refer to our full disclaimer for further information.

AFFILIATE DISCLOSURE This post may contain affiliate links, which means we may receive a commission, at no extra cost to you, if you make a purchase through a link. Please refer to our full disclosure for further information.

RELATED POSTS

- Cookie Policy

- Copyright Notice

- Privacy Policy

- Terms of Use

- Flight Itinerary

- Hotel Reservation

- Travel Insurance

- Onward Ticket

- Testimonials

Search this site

Visa application requirement

Schengen visa travel insurance & europe incoming insurance.

Schengen Travel Insurance

One of the most important requirements while traveling abroad is to have a valid travel health insurance policy in place to combat any unforeseen medical emergencies. A person traveling to the Schengen zone or the citizens of any country within the Schengen area are highly recommended to purchase a suitable Schengen Travel Visa Insurance for the expecting visitor from another country as the guarantor of the visitor.

In this article

Insurance requirements for the schengen visa applicants.

Schengen Visa Insurance coverage requirements have been designed to ensure high-quality medical benefits for individuals traveling within the European Union. To qualify, a Schengen Visa Insurance policy must provide comprehensive international health insurance with unlimited medical and emergency cost benefits. Coverage should include acute onset of pre-existing conditions, repatriation of mortal remains, both inpatient and outpatient care, hospitalization fees such as room and board, medications prescribed by a doctor, and more. To be eligible fore Schengen Visa insurance coverage all travellers must purchase coverage prior to their arrival in Europe that includes the entirety of their trip abroad and also demonstrates proof of eligibility before departure.

Health insurance for the Schengen Visa Application from an approved insurance company must meet the following requirements:

- Full Medical Coverage of at least Euro 30,000 to the policyholder

- Full coverage for the Medical evacuation/repatriation

Travelers visiting the designated Schengen area can easily buy the Schengen Visa insurance online with medical coverage in specified limits. The health insurance policy document should be presented at the Consulate from which you are applying for a Schengen Visa along with other Visa documents and should also be carried along on the trip to the Schengen countries.

The cost of Schengen Travel Insurance - Premium Comparison

Generally speaking, the cost of Schengen Visa Insurance can range from around $20 USD to upwards of a few hundred dollar depending on the length of your stay and the amount of coverage you require. You can purchase this insurance from a variety of providers, however, it is important to ensure the policy meets all requirements outlined by Schengen visa regulations before purchasing. Additionally, some insurance policies may also cover additional benefits that go beyond basic medical needs such as legal fees or lodging expenses, allowing travellers further peace of mind during their travels.

The cost of travel insurance to the Schengen zone depends upon several factors as discussed below-

- The duration of the trip – Higher the number of days of travel, more will be the premium

- Age and health of the insured- As the presumed risk increases with an increase in age, thus a higher age leads to higher premium

- Pre-existing medical condition – Conditions such as asthma or diabetes increases the cost of insurance

Several companies offer the benefit of availing add-on covers that enhance the coverage limits and inclusions thus adding to the final premium amount.

The importance of Schengen Visa Insurance

The majority of European countries come under the domain of Schengen regulations. The Schengen area includes-Austria, Belgium, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, and Switzerland.

All the above 27 countries mandatorily require Schengen travel insurance , without which it is not possible to obtain a Schengen Visa. Hence, anyone who is planning to travel to any country in the Schengen zone is needed to buy suitable Schengen travel visa insurance also known as Schengen Visa insurance or Schengen Visa health insurance .

Insurance Providers of Schengen & Europe Travel Insurance

Schengen Visa Insurance is a type of travel insurance that provides the traveller with coverage while they are visiting any of the Schengen Area countries . This insurance can provide coverage for a variety of scenarios such as medical emergencies, trip cancellation and interruption, loss or damage baggage and more. The reason why you need it for travel to a Schengen Zone country is because without it, you may be refused a visa into the country due to the Schengen Agreement’s requirement for visitors to have adequate documented proof that they have insurance that covers costs associated with their stay in the region. Having this insurance clearly demonstrates to the authorities that you will not be a financial burden on them if an unexpected event were to occur during your travels.

Make sure the insurance company you choose for your Travel insurance is licensed and accepted in the Schengen Area. Not every insurance provider is accepted by the embassy or consulate. There might be more companies, but the selected providers listed below are often reported to us that they are accepted by all European Embassies and Consulates worldwide and offer even more than the minimum requirements.

Allianz Schengen Travel Insurance

Learn more about Allianz Schengen Travel Insurance

AXA Schengen Visa Insurance

Learn more about AXA Schengen Visa Insurance

Europ Assistance Schengen Travel Insurance

Learn more about Europ Assistance Schengen Travel Insurance

MAWISTA Schengen Visa Insurance

Learn more about MAWISTA Schengen Visa Insurance

Is Schengen Visa Insurance compulsory?

Schengen Visa Insurance is a requirement if you are planning on applying for a Schengen Visa to visit any of the 27 countries in Europe. The insurance covers any medical emergencies that you may have while in these countries, up to a certain amount.

Travelers who wish to visit Schengen zone need to factor in any kind of unforeseen expenses that might crop up. There are several reasons why it is inevitable and should be considered with due seriousness. The importance of the Schengen Visa Insurance can be summed by the significant excerpt from Regulation (EC) No 810/2009 of the European Parliament and of the Council in 2009, which is as follows.

“… Applicants for a uniform visa for one or two entries shall prove that they are in possession of adequate and valid travel medical insurance to cover any expenses which might arise in connection with repatriation for medical reasons, urgent medical attention and/or emergency hospital treatment or death, during their stay(s) on the territory of the Member States.

The insurance shall be valid throughout the territory of the Member States and cover the entire period of the person’s intended stay or transit. The minimum coverage shall be EUR 30,000”.

Schengen Travel Insurance FAQ´s

One of the most commonly issued categories of the Schengen Visa is the short stay visa (category C) which is for the purposes of tourism, business, family or private visit. It is mandatory to have the travel insurance for this category.

The Schengen travel visa insurance in normal circumstances covers:

- Any kind of medical emergencies such as accident or sickness while in the Schengen Area

- Visa Insurance covers Emergency evacuation or repatriation of the mortal remains

- It covers Overseas funeral expenses in case of demise of the policyholder while in Schengen zone

Although the Schengen travel insurance insures you for most likely situations, not everything is covered in a Schengen travel insurance policy. Below are some of the exclusions-

- Any kind of pre-existing medical conditions unless it’s a life-threatening condition

- Any kind of expenses incurred due to any of the following conditions: a) Self-inflicted injuries or illnesses, b) Suicide attempt, c) Mental disorder, Anxiety, stress or depression, d) Alcohol/drug abuse, e) HIV/AIDS

- If the policyholder is traveling against the advice of physician and is hospitalized due to the negligence

- If the policyholder is specifically traveling to receive treatment abroad

- Theft or loss of passport due to negligence or if you don’t report the loss to local police authorities immediately

- Extreme situations such as War or nuclear threat in the country where you’re traveling

- Participation in high-risk activities such as extreme sports e.g., scuba diving, skydiving, etc., are generally not covered in the Travel insurance policies

Although the plan can be availed by most, there are some criteria for issuing a Schengen Visa travel insurance policy as mentioned below:

- The minimum and maximum age of the insured person which varies from company to company

- The person at the time of applying the travel health should be medically fit with no predetermined illnesses

This type of policy will typically provide comprehensive coverage and peace of mind not only while in the Schengen region, but also while in transit. Generally, these policies last up to 90 days and can be tailored to fit the needs of each individual traveller. It is important to understand that one single trip may not exceed the duration of 90 days – which means those planning multiple trips should consider purchasing a multi-trip Schengen Visa Insurance plan.

Yes, with the some of the insurance companies, the Schengen Visa Travel Insurance can be easily extended if your travel dates are changed due to any reason or your holidays are extended. This would not be possible with all insurance companies, so please clarify this option before you purchase an insurance cover.

Yes, various companies design travel insurance plans to meet both the requirements that of leisure and business based on the requirement. Individuals traveling abroad on business purpose can also avail the facility of overseas travel plan from the insurance company.

Each Schengen Visa applicant will need to be covered by a recognised travel insurance policy. Many of these policies offer products that provide protection for multiple members of a family, for example, the AXA Extended Protection Schengen Visa Insurance Policy.

When it comes to Schengen visa insurance, it is important to plan ahead and make sure you purchase the coverage prior to submitting your visa application.

Schengen Visa Goes Digital: What Travelers Need to Know

Exploring the impact of digital applications on simplifying the Schengen visa process, this article delves into the potential benefits and challenges of going digital for travelers.

Thailand, Cambodia, and Vietnam Explores Schengen Visa Style System for Seamless Southeast Asian Travel

Thailand, Cambodia, and Vietnam are considering a unified Schengen-style visa system to boost travel and tourism across Southeast Asia.

Romania and Bulgaria Launch First Flight Following Partial Schengen Zone Admission

The historic inaugural flight between Romania and Bulgaria after their partial Schengen admission, marking a significant milestone in European integration and boosting travel and tourism in both nations.

Privacy Overview

What Is Schengen Travel Insurance?

Quick answer.

S chengen travel insurance is a specific type of travel insurance policy tailored to meet the travel medical coverage requirements set by the 27 (soon to be 29) European destinations within the Schengen Area. Travelers must present proof of sufficient coverage as part of the Schengen visa application process.

Schengen member countries have abolished their internal borders, allowing more accessible travel within the area. While this is incredibly convenient, some travelers may need a visa to visit Schengen countries. And one of the requirements to obtain that visa is to purchase sufficient travel medical insurance coverage.

Read on to learn more about Schengen visa travel insurance requirements and find the best travel insurance policy for your upcoming trip.

Table of contents

What is schengen travel insurance, schengen countries, visa and travel insurance requirements for the schengen area, key coverages in schengen travel insurance, how to get schengen travel insurance, schengen travel insurance faqs, summary of money’s guide to schengen travel insurance.

Schengen travel insurance is designed for travelers entering the Schengen zone, which comprises 27 (soon to be 29) European nations that have abolished internal borders.

Many visitors, including citizens from non-EU countries like India and China, must obtain a travel visa to enter the Schengen Area. And a requirement for a Schengen Visa is to have insurance covering at least €30,000 (around $32,720) in medical costs.

However, there are exemptions. For example, U.S. citizens and residents of countries such as Canada, Brazil and Mexico don’t need a Schengen visa or travel insurance for stays of up to 90 days within a 180-day period.

The Schengen Area consists of a diverse tapestry of countries. Among the member nations are some of the best places to visit in Europe , including France, Italy, Germany, Spain, Greece and the Netherlands.

Here’s the complete list:

Ireland and Cyprus are the only E.U. member states not currently part of the Schengen Agreement.

Having a valid U.S. passport allows you to spend up to 90 days within a 180-day period in the Schengen Area, whether for tourism or business purposes.

Once officially admitted, you can travel freely within the member countries without passing through customs each time. Stays under 90 days don’t require a visa for U.S. nationals, but your passport should be valid for at least six months past your travel dates.

Short stays don’t require travel medical insurance either, though travel insurance may still be worth it . That could be especially true if you plan to participate in adventure sports or other high-risk activities.

Travel insurance generally also covers cancellations and delays. Purchasing a policy could pay off if you’ve booked expensive, non-refundable flights or accommodations and didn’t purchase them with one of the best travel credit cards that offer insurance.

European Travel Information and Authorisation System (ETIAS)

Travel requirements for European Union countries are projected to change by mid-2025. Visa-exempt travelers to all 27 (soon to be 29) Schengen countries and Cyprus will need an ETIAS authorization.

Here’s what you need to know:

- You must complete an online application and pay a small fee for an ETIAS authorization.

- The authorization is tied to your passport and is valid for three years or until your passport expires.

- With a valid travel authorization, you can enter 30 European countries for short stays of up to 90 days within a 180-day period.

- ETIAS authorization does not guarantee entry into any of these countries. You still have to present your passport and documents at the border.

- The above applies to people from the U.S., Canada and dozens of other countries, so check the E.U.’s official travel website or your country’s embassy for more information. An ETIAS is not a visa and doesn’t mandate travel medical insurance.

Schengen visa requirements

You’ll need a visa if you’re from a visa-exempt country, like the U.S., and planning to stay in the Schengen Area beyond the 90-day threshold. Regardless of the length of the stay, nationals traveling from certain countries always require a visa.

Determine which Schengen country you’ll spend most of your time in and check with their official tourism or embassy website for instructions on applying for a visa. The embassy will inform you about the required documentation and instructions to meet their regulations.

Schengen visa processing time can vary depending on your country of origin and your destination country, so be sure to start the process as early as possible.

Besides the application form, the following are required to obtain a Schengen visa:

- Valid passport: Your passport must be valid for at least three months after departure.

- Passport photo: You must submit a picture of yourself that complies with the International Civil Aviation Organisation (ICAO) standards.

- Travel medical insurance: You must carry at least €30,000 (approximately $32,720) in coverage for medical emergencies, hospitalization and repatriation that’s valid in the entire Schengen Area for the duration of your stay.

- Documentation: You must provide evidence of the purpose of your visit through supporting documentation, demonstrate you have the financial means to cover expenses and accommodations and show intent to return to your home country after the stay.

- Fingerprints: Most, but not all, applicants will be required to submit their fingerprints along with their application.

Consulates of particular countries may require additional documentation.

Understanding what travel insurance covers can help you plan a worry-free journey. While plans and coverage options vary by company, here’s a breakdown of what Schengen travel insurance generally covers.

- Medical expenses: Travel medical insurance covers the cost of treating unexpected illnesses or injuries you suffer during your trip, up to your policy limits. These include the cost of medications, hospitalization and other essential medical treatments.

- Medical repatriation: Some travel medical policies also include emergency medical evacuation or repatriation, which covers some of the costs of transporting you back home or to a different medical facility to receive necessary medical treatment.

- Repatriation of remains: As the name suggests, this coverage will pay (up to your policy limits) for expenses related to transporting your body or cremated remains to your home country or point of origin.

- 24/7 Travel Assistance: Travel insurance companies generally offer round-the-clock assistance services, including language support, help recovering lost passports or prescriptions and even booking accommodations and medical transportation.

Note that some companies may require you to meet a deductible for the travel medical plan to start paying out.

Other travel-related coverage options

Most travel insurers sell policies covering medical emergencies and travel-related inconveniences such as delays, cancellations, lost luggage, and more. While you don’t need these coverage options to obtain a Schengen visa, you may still find them worthwhile.

- Trip cancellation and trip interruption: Covers non-refundable expenses if you need to cancel or cut your trip short due to unforeseen events like illness or accidents.

- Baggage loss or delay: Helps cover the cost of replacing essential items if your baggage is lost or delayed by a specified number of hours.

- Delayed flights and missed connections: Provides compensation for additional expenses caused by inconveniences such as delays or missed connections.

It’s easy to buy travel insurance for your Schengen Area trip. Many providers offer policies that fulfill the visa requirement and include additional coverage that can be tailored to your needs.

Here are some steps to help you get the right coverage.

1. Research reputable travel insurance providers

Most travel insurers bundle travel medical insurance coverage with trip cancellation, interruption, and other coverage options. If you only want to satisfy Schengen visa requirements, look for a provider that explicitly markets Schengen travel insurance or offers stand-alone travel medical coverage.

2. Select a plan that meets your needs and get a quote

Remember that you may not need trip insurance beyond the €30,000 in travel medical coverage required for a Schengen visa, so read plan details carefully to avoid buying unnecessary coverage.

It also pays to shop around and get quotes from several insurers, as travel insurance costs between 3% and 14% of the total cost of your trip, depending on the company and policy you choose.

3. Read your policy details

When shopping for travel insurance online, you’ll typically find that most companies include a policy summary or schedule. This document outlines critical details such as the policy’s coverage limits and exclusions. Carefully reading it can help you avoid surprises and frustration if you ever need to file a claim.

If you still have questions after reading the policy summary, contact the insurer before finalizing your purchase.

4. Get to know the claims process

Similarly, reading about your insurance provider’s claims process can save you time and energy in an emergency. Your policy summary should include a list of documents you’ll be required to provide as part of the claims process, which may include receipts and medical bills.

After a covered incident, contact your insurer through the company’s website or mobile app as soon as possible. Most insurers also offer travel assistance services around the clock.

5. Purchase and safeguard your policy

You will need proof of your travel medical insurance plan to apply for a Schengen visa. Keep your insurance certificate in a secure yet accessible location, whether a digital version on your smartphone or a physical printout in your travel folder.

It may also be a good idea to share a copy of your policy with a trusted friend or family member back home so they can contact your insurance provider if you cannot request medical assistance due to an emergency.

Should I get travel insurance for Europe?

Travel insurance, especially within the Schengen Area, is not just recommended but often mandatory. To obtain a visa to visit the Schengen zone, you must show proof of having sufficient travel medical insurance.

How much travel insurance do I need for Europe?

What countries does europe travel insurance cover.

- The first step before you travel to any Schengen country is to determine whether you need a visa and, therefore, mandatory travel medical insurance for a Schengen visa.

- Check with your country’s embassy, Department of Foreign Affairs or the tourism website of the country you plan to visit for specifics about medical travel insurance for Schengen visa requirements.

- You don’t need a visa or international travel insurance if you have a valid U.S. passport and are visiting the Schengen zone for less than 90 days in a 180-day period.

- If you’re a U.S. national planning to visit the Schengen Area for more than 90 days, you must apply for a visa and secure adequate travel health insurance (at least €30,000 in travel medical and repatriation coverage).

© Copyright 2024 Money Group, LLC . All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer .

- What is a visa?

- Electronic Visa (eVisa)

- Visa on Arrival

- Appointment Required Visa

- Invitation Letter

- Arrival Card

- Passport Renewal

- Project Kosmos: Meet the man with the world's most challenging travel schedule

- Australia Visa and ETA requirements for US citizens explained

- Brazil eVisa for US citizens

- India Tourist Visa for UK citizens

- Possible B1/B2 Visa questions during the interview

Select Your Language

- Nederlandse

- 中文 (Zhōngwén), 汉语, 漢語

Select Your Currency

- AED United Arab Emirates Dirham

- AFN Afghan Afghani

- ALL Albanian Lek

- AMD Armenian Dram

- ANG Netherlands Antillean Guilder

- AOA Angolan Kwanza

- ARS Argentine Peso

- AUD Australian Dollar

- AWG Aruban Florin

- AZN Azerbaijani Manat

- BAM Bosnia-Herzegovina Convertible Mark

- BBD Barbadian Dollar

- BDT Bangladeshi Taka

- BGN Bulgarian Lev

- BIF Burundian Franc

- BMD Bermudan Dollar

- BND Brunei Dollar

- BOB Bolivian Boliviano

- BRL Brazilian Real

- BSD Bahamian Dollar

- BWP Botswanan Pula

- BZD Belize Dollar

- CAD Canadian Dollar

- CDF Congolese Franc

- CHF Swiss Franc

- CLP Chilean Peso

- CNY Chinese Yuan

- COP Colombian Peso

- CRC Costa Rican Colón

- CVE Cape Verdean Escudo

- CZK Czech Republic Koruna

- DJF Djiboutian Franc

- DKK Danish Krone

- DOP Dominican Peso

- DZD Algerian Dinar

- EGP Egyptian Pound

- ETB Ethiopian Birr

- FJD Fijian Dollar

- FKP Falkland Islands Pound

- GBP British Pound Sterling

- GEL Georgian Lari

- GIP Gibraltar Pound

- GMD Gambian Dalasi

- GNF Guinean Franc

- GTQ Guatemalan Quetzal

- GYD Guyanaese Dollar

- HKD Hong Kong Dollar

- HNL Honduran Lempira

- HTG Haitian Gourde

- HUF Hungarian Forint

- IDR Indonesian Rupiah

- ILS Israeli New Sheqel

- INR Indian Rupee

- ISK Icelandic Króna

- JMD Jamaican Dollar

- JPY Japanese Yen

- KES Kenyan Shilling

- KGS Kyrgystani Som

- KHR Cambodian Riel

- KMF Comorian Franc

- KRW South Korean Won

- KYD Cayman Islands Dollar

- KZT Kazakhstani Tenge

- LAK Laotian Kip

- LBP Lebanese Pound

- LKR Sri Lankan Rupee

- LRD Liberian Dollar

- LSL Lesotho Loti

- MAD Moroccan Dirham

- MDL Moldovan Leu

- MGA Malagasy Ariary

- MKD Macedonian Denar

- MNT Mongolian Tugrik

- MOP Macanese Pataca

- MUR Mauritian Rupee

- MVR Maldivian Rufiyaa

- MWK Malawian Kwacha

- MXN Mexican Peso

- MYR Malaysian Ringgit

- MZN Mozambican Metical

- NAD Namibian Dollar

- NGN Nigerian Naira

- NIO Nicaraguan Córdoba

- NOK Norwegian Krone

- NPR Nepalese Rupee

- NZD New Zealand Dollar

- OMR Omani Rial

- PAB Panamanian Balboa

- PEN Peruvian Nuevo Sol

- PGK Papua New Guinean Kina

- PHP Philippine Peso

- PKR Pakistani Rupee

- PLN Polish Zloty

- PYG Paraguayan Guarani

- QAR Qatari Rial

- RON Romanian Leu

- RSD Serbian Dinar

- RUB Russian Ruble

- RWF Rwandan Franc

- SAR Saudi Riyal

- SBD Solomon Islands Dollar

- SCR Seychellois Rupee

- SEK Swedish Krona

- SGD Singapore Dollar

- SHP Saint Helena Pound

- SLL Sierra Leonean Leone

- SOS Somali Shilling

- SRD Surinamese Dollar

- SVC Salvadoran Colón

- SZL Swazi Lilangeni

- THB Thai Baht

- TJS Tajikistani Somoni

- TOP Tongan Pa anga

- TRY Turkish Lira

- TTD Trinidad and Tobago Dollar

- TWD New Taiwan Dollar

- TZS Tanzanian Shilling

- UAH Ukrainian Hryvnia

- UGX Ugandan Shilling

- USD United States Dollar

- UYU Uruguayan Peso

- UZS Uzbekistan Som

- VND Vietnamese Dong

- VUV Vanuatu Vatu

- WST Samoan Tala

- XAF CFA Franc BEAC

- XCD East Caribbean Dollar

- XOF CFA Franc BCEAO

- XPF CFP Franc

- YER Yemeni Rial

- ZAR South African Rand

- ZMW Zambian Kwacha

Apply for and track your visa with our new app!

Download Now

Travel Insurance for Schengen Visa: How to Get One

The Schengen Agreement is a treaty that led to the creation of the Schengen Area, which agreed to abolish borders and allow free movement between them. The Schengen Area comprises 26 European countries . The Schengen visa is a short-stay visa that will enable people from non-Schengen countries to travel within the Schengen area.

The Schengen Area consists of these countries:

Although Norway, Iceland, Switzerland, and Liechtenstein are not members of the EU, they are also part of the Schengen area.

Medical expenses may arise when traveling to Europe or anywhere in the world in case of an accident or illness and for any unforeseen event. For this reason, insurance companies offer travel insurance plans.

Our iVisa expert advisors are here to help you with any questions about purchasing travel insurance for your Schengen visa. Below are some essential questions that will help you in your decision.

What is Travel Insurance for a Schengen Visa?

The Schengen travel medical insurance is a mandatory requirement to apply for the Schengen visa. However, it is still advisable that every traveler has travel insurance; the expenses that may arise for any eventuality are very high when traveling without travel medical insurance.

Who Needs to Get Travel Insurance for a Schengen Visa?

Anyone who travels temporarily to Schengen countries and needs to apply for a Schengen visa must purchase Schengen travel insurance. When you fill out the Schengen visa application, you will be asked for the travel insurance certificate.

People who do not need a Schengen visa are not obliged to take out travel insurance. Even so, the best recommendation is to always travel with insurance to protect you and have a pleasant and hassle-free trip.

What are the Schengen Visa Travel Insurance requirements?

The travel medical insurance must meet the following requirements:

It must have a minimum coverage of 30,000 euros for medical expenses.

It must be valid in all Schengen member countries to be used there.

It must cover the entire time you are traveling.

Most travel insurance companies provide a Schengen insurance certificate to apply for your Schengen visa. They also give you the alternative to extend your plan to have more coverage in various aspects to make your trip safer and more enjoyable.

How to Buy Travel Insurance for a Schengen Visa?

It is now simple to buy your Schengen travel insurance online because most travel insurance companies do all their business online.

When purchasing travel insurance, you only need to follow these simple steps:

Before filling out the application form, review all the questions and have all the information you will be asked for. Once you have everything ready, fill out the application form indicating your name, nationality, date of birth, the destination you are traveling to, and departure and arrival dates.

Consider obtaining additional coverage beyond those requested by the Schengen visa that you can acquire; knowing that your luggage is safe or that you can have all the ease in case your flight is delayed or canceled gives you the peace of mind to enjoy your trip.

Once you have checked everything is correct, make the payment; you can pay with a debit or credit card.

Download and print your travel insurance certificate; you must attach it with the other documents required to apply for the Schengen visa.

What is the cost of Travel Insurance for a Schengen Visa?

The price of Schengen travel health insurance depends on three factors:

The age: People over 60 have to pay higher premiums than younger people, which is why the insurance cost is higher.

The trip duration: Normally, travel insurance companies charge per day; for short trips, the price varies according to the number of days you travel.

Minimum coverage: The minimum coverage to apply for a Schengen visa is 30,000 euros. Insurance Companies have other plans with indemnities for medical emergencies of higher value and additional travel factors such as lost luggage, emergency trip cancellation, flight delays, etc.

It is always helpful to keep in mind that the price of travel insurance is minimal compared to the cost of the trip. But it guarantees any inconvenience and makes your trip more enjoyable.

What is the minimum Travel Insurance Requirement for a Schengen Visa?

When applying for a Schengen visa, purchasing travel health insurance with a minimum coverage of 30,000 euros is mandatory. This coverage must cover hospital and medical expenses, evacuation in case of accident or medical emergency, or repatriation in case of death.

What does Travel Insurance for Schengen Visa cover?

Schengen travel insurance plans for applying for a Schengen visa usually cover the following.

Medical expenses: In case of accident or illness, medical visits, medication, hospitalization, or surgery, the insurance covers all medical expenses.

Emergency medical evacuation or repatriation: In case of an accident or severe illness, the insurance covers the cost of an air ambulance to return you to your country if you need to be evacuated. In case of death, it covers all necessary expenses for repatriation to the country of origin. In addition to the minimum Schengen visa coverage, travel insurance companies also have plans that cover other critical factors during your trip:

Trip cancellation: If you have to cancel or interrupt your trip for reasons beyond your control, the insurance will reimburse you for non-refundable expenses.

Flight delay or cancellation: The insurance company covers meals and accommodation until the new flight if your flight is delayed or canceled.

Lost or delayed baggage: If your luggage does not arrive for your flight or is lost, we will cover the cost of the lost or delayed baggage.

Will I Get Covid-19 Coverage with Travel Insurance for the Schengen Visa?

Most travel insurance companies will cover medical expenses related to Covid-19 only if you follow the World Health Organization (WHO) recommendations. Travel insurance covers the following:

Medical emergencies related to COVID-19 include medical treatment, medicine, and hospitalization if necessary.

PCR test (only on some occasions).

Important tips when traveling to Europe

If you travel by train: Traveling by train in Europe is one of the best ideas. Before boarding the train, validate your ticket to avoid additional costs. You can also purchase rail passes that give you discounts.

Always have cash with you: Sometimes, cards are not accepted in small or typical places.

Water: The water from the taps is drinkable. In some restaurants, they can charge for water.

Carry your medications: Always carry a larger quantity of the medicines you take; in other countries, the medication is not the same, and you may not find yours.

Where can I contact you?

Our experienced iVisa customer service team is available 24 hours a day, all year round. They will be happy to answer any questions you may have. Additionally, if you wish to write to us, you can email us at [email protected] , where we will answer all your questions as soon as possible.

Related Articles

Schengen Visa application: Itinerary and the 90/180 rule example

Schengen Visa rejection: Common reasons and how to avoid it

All non-Schengen countries Indian citizens can travel to with a Schengen Visa

Welcome to our new site.

The Discovery Health Medical Scheme is an independent non-profit entity governed by the Medical Schemes Act, and regulated by the Council for Medical Schemes. It is administered by a separate company, Discovery Health (Pty) Ltd, an authorised financial services provider.

- INDIVIDUALS

- Online banking

How can we help?

Find your document.

You can find your personalised documents like your health plan guide, tax certificate and membership certificate as well as other plan benefit summaries when you log in.

Manage your claims

You can submit and track your claims online.

International travel benefit letter

You can get an International Travel Benefit letter as proof of your medical cover for visa application purposes.

Conditions we cover

The Chronic Illness Benefit (CIB) covers you for a defined list of chronic conditions. You need to apply to have your medicine covered for your chronic condition.

- About Discovery Health

- About Discovery Health Medical Scheme

- Scheme Rules

- Complaints and disputes

- Cookie policy

- Security & fraud

- Terms & conditions

Please click here to login into Discovery Digital Id

Your session will expire in 60 seconds.

To remain logged in, please click on the "Extend session" button below.

Log out to start a new session or go to the home page .

To secure your account you have been logged out

Log in to start a new session or go to the home page .

- Latest News

- Emergencies

- Ask the Law

- GN Fun Drive

- Visa+Immigration

- Phone+Internet

- Reader Queries

- Safety+Security

- Banking & Insurance

- Dubai Airshow

- Corporate Tax

- Top Destinations

- Corporate News

- Electronics

- Home and Kitchen

- Consumables

- Saving and Investment

- Budget Living

- Expert Columns

- Community Tips

- Cryptocurrency

- Cooking and Cuisines

- Guide to Cooking

- Art & People

- Friday Partner

- Daily Crossword

- Word Search

- Philippines

- Australia-New Zealand

- Corrections

- Special Reports

- Pregnancy & Baby

- Learning & Play

- Child Health

- For Mums & Dads

- UAE Success Stories

- Live the Luxury

- Culture and History

- Staying Connected

- Entertainment

- Live Scores

- Point Table

- Top Scorers

- Photos & Videos

- Course Reviews

- Learn to Play

- South Indian

- Arab Celebs

- Health+Fitness

- Gitex Global 2023

- Best Of Bollywood

- Special Features

- Investing in the Future

- Know Plan Go

- Gratuity Calculator

- Notifications

- Prayer Times

Eid Al Adha 2024: Is Montenegro visa on arrival for UAE residents?

Living in uae.

European adventure: Find out the conditions, required documents for UAE residents

Dubai: Thinking of a European Mediterranean escape during the upcoming Eid Al Adha or summer holidays? UAE expatriates can get visa on arrival to Montenegro, the small but vibrant European nation located on the Adriatic sea.

This captivating Balkan nation boasts stunning riviera landscapes, pristine sandy beaches, crystal-clear waters, primeval forests and ancient architecture.

So, if this sounds like the perfect vacation for you, there are a few conditions and requirements UAE residents need to meet before they book their tickets to Montenegro.

For how long is the visa on arrival is valid?

“The visa on arrival scheme is only for a specific period which is from May 1 to September 7, 2024 . After that, the tourist visa is issued on a case by case basis,” Eva Kanani, an operations manager at Vas Tourism LLC, a UAE-based destination management company (DMC) that specialises in Balkan tours, told Gulf News

According to the government of Montenegro’s website - www.gov.me, UAE residents can stay in the country for up to 10 days on this visa.

The visa on arrival scheme is only for a specific period which is from May 1 to September 7, 2024. After that, the tourist visa is issued on a case by case basis. - Eva Kanani, operations manager at Vas Tourism LLC.

What are the conditions for visa on arrival, for Montenegro, for UAE residents?

Kanani explained that UAE residents are eligible for visa on arrival but they have to meet specific conditions first.

“UAE expatriates who have a valid residency permit continuously for three years before travelling to the country are allowed visa on arrival. It is also important to note that some UAE residents with specific nationalities are not allowed visa on arrival. They can apply for tourist visa through the Montenegro Embassy in Abu Dhabi,” she said.

The government of Montenegro’s website - www.gov.me, states that the visa on arrival decision does not apply to nationals of Bangladesh, Afghanistan, Syria, Pakistan, Somalia and India.

She added that a direct return ticket to Dubai is also a requirement for getting the visa on arrival.

“As of now, the Montenegro government is allowing passengers flying with flydubai to be eligible for visa on arrival. The flydubai flights for Montenegro will start from June 14 . Flydubai is the only airline in the UAE that offers direct flights to Tivat but it is a seasonal route,” Kanani said.

According to the flydubai website, their summer season flights between Dubai and Tivat will operate from June 14, 2024 to September 7, 2024 .

“Another condition is to have proof of a paid tourist arrangement. This basically means that your trip should be organised by a travel agency. You will be asked to provide a receipt or document of the tourist arrangement. You must also have proof of accommodation,” she added.

She also clarified that sometimes visa rules and requirements can change, so it’s always best to check with the Montenegro embassy directly.

“However, travel insurance or proof of financial support is not necessary for UAE residents. We would suggest asking the embassy of Montenegro directly for specific information because rules can change,” Kanani said.

How to apply for a Montenegro tourist visa from the UAE?

If you are not eligible for visa on arrival, you can still go ahead and apply for a tourist visa.

“Montenegro is a popular destination for UAE residents because it’s a European country that is not in the Schengen zone, so the visa process is a little easier,” Husham Kattingeri, an outbound travel supervisor at Regal Tours Worldwide, told Gulf News.

Montenegro is a popular destination for UAE residents because it’s a European country that is not in the Schengen zone, so the visa process is a little easier - Husham Kattingeri, an outbound travel supervisor at Regal Tours Worldwide

Kattingeri explained that you can apply for a tourist visa through a travel agent or go to the Montenegro embassy to fill out the visa application form.

“It’s important to note that your personal appearance in the embassy in Abu Dhabi is required if the visa is processed and approved, and only then will they stamp the visa in the passport, which will be returned on the same day,” he said.

Required documents:

As per Kattingeri, these are required documents for the tourist visa:

• Passport copy and UAE residence visa copy. • Passport-sized coloured photo (35x45 mm in JPEG format). • Proof of accommodation. • Bank account statement for the last three months. • Return flight ticket. • Travel health insurance valid in Montenegro for the duration of stay. • Employment certificate mentioning monthly salary.

How long does it take to receive the visa?

According to Kattingeri, it takes 29 working days for the visa to be processed.

What is the validity of the tourist visa?

“There is no standard duration or validity for the tourist visa, it is decided by the embassy,” he said.

Cost – “The embassy fee for the visa application is Dh160 and the travel agency fee to complete the process can vary from Dh500 to Dh800 ,” Kattingeri said.

UAE citizens with a valid passport can stay in Montenegro for up to 90 days without a visa.

More From Living-Visa-Immigration

Pre-approved UAE visa on arrival for Indians explained

Eid break: How UAE expats can apply for Vietnam eVisa

UAE visit visa: Essential travel documents

How to cancel your UAE entry permit

- Visa + Immigration

- Telephone + Internet

- Safety + Security

- Taqdeer Award

Public holidays for next 2 years: All you need to know

Gratuity: What happens if I have several unpaid leaves?

Switch from Dubai Metro to bus, without paying extra

UAE Law: 7 things to know about your notice period

How to check black points on UAE driving licence

How to report a minor traffic accident in Sharjah

Get Breaking News Alerts From Gulf News

We’ll send you latest news updates through the day. You can manage them any time by clicking on the notification icon.

- Friday, May 31, 2024

- UPDATED 07:55 pm PKT

- Download App

- Social Media

- Top Headlines

Entertainment

- Crime & Justice

Follow us on

- Saudi Arabia

Business & Finance

- The ViralWorld

- Shocking & Amazing

Life & Style

- Health & Fitness

- Prayer Timings

- Seafood Recipes

- Soups, Stews and Chili Recipes

- Forex Exchange Rates

- Conversion Calculators

- Fuel Prices

- Bol Weather

- Commodities In Pakistan

loading....

- Mutual Funds

- Industrywise News

- Commodities Rates

- How to file ITR

- Calculators

- Crypto Currencies

- Snooker/Billiards

- Live Scores

- ICC WorldCup

- County Championship

- Trendspotting

- Tech & Internet

- Newsletters

- Tech and Gadgets

- Food & Drinks

- BMI Calculators

- BMR Calculators

- Diabetes Risk Calculator

- Home & Garden

- Relationships

Viral & Shocking

Minimum bank balance for Spain Schengen visa from Pakistan- May 2024

30th May, 2024. 12:09 am

PTI demands release of Hamoodur Rahman Commission Report

Petrol price in Pakistan cut by Rs15.40 to Rs257.70

10 accused involved in different crimes arrested in Karachi

The captivating mix of Barcelona’s bustling streets and Seville’s historic charm makes Spain a top tourist destination worldwide. Whether you’re attracted to Madrid’s lively fiestas or the peaceful beaches of the Costa del Sol, Spain provides an unforgettable experience for every traveler.

Pakistani citizens, like those from many other countries, need to obtain a short-term Schengen visa to visit Spain as tourists. Spain grants visit visas to applicants who meet the requirements, including providing a bank statement. Applicants must have a minimum bank balance of 3000 euros for stays of up to 30 days.

Documents Required for Schengen Visit Visa

Each applicant must complete and sign an official application form, filling in each of its sections. If the applicant is a minor, one of their parents must sign the application.

Valid passport or travel document

Documents accrediting the purpose and conditions of the planned stay

Return or tourist circuit ticket, in all cases.

For tourist or private visits, the confirmed reservation of an organized trip, or proof of accommodation, or letter of invitation from a private individual

Travel medical insurance with coverage of at least €30,000 or its equivalent in local currency.

Minimum Bank Statement for Spain Visit Visa

Travelers must provide proof of sufficient financial means for their intended stay in Spain.

The minimum required amount is 100 euros per person per day. Additionally, visit visa holders must have at least 810 euros or its equivalent in foreign currency.

As of May 29, 2024, with one euro equaling Rs302.26, this means you need approximately Rs906,780 plus Rs244,830 in your bank account for a 30-day stay in Spain.

Read More News On

- bank balance for Spain Schengen visa

- Minimum bank balance for Spain Schengen visa from Pakistan

- Spain Schengen visa

- Spain Schengen visa from Pakistan

Catch all the Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News .

End of Article

In the spotlight, atc summons pti founder in violation of section 144, pakistan, us vow to further strengthen bilateral relations, popular from pakistan, quordle answer today: saturday 1st april 2024, nerdle answer today: saturday 1st april 2024, wordle answer today: check #1078 hints and clues for 1st april 2024, who is nick pasqual age, career, & girlfriend, who was kim porter all about diddy’s ex, quordle answer today: friday 31st may 2024.

IMAGES

VIDEO

COMMENTS

As a Discovery Health Medical Scheme member, you have access to the International Travel Benefit. When you travel outside of South Africa, this benefit offers you and your family medical emergency cover for 90 days from your date of departure. This lets you enjoy your well-deserved holiday knowing that you and your family will receive quality ...

Schengen visa insurance must provide medical expenses coverage, including hospitalization, medical treatment and repatriation for medical reasons. It must also be valid in all Schengen countries ...

Get multiple quotes. 3. Use this as an opportunity to maximize credit card bonus points. 4. Double-check the policy before purchasing. 5. Consider using a credit card that provides trip insurance ...

Even though travel health insurance is worth having for all travellers to Europe, not everyone is required to have it. A travel insurance policy is mandatory only for travellers applying for a Schengen visa.This group of travellers is always required to have the needed coverage for the entire period of their stay in Europe, regardless if they go there for business, tourism, studying, holidays ...

Minimum Coverage. Your Schengen visa travel insurance must meet the minimum coverage requirement of €30,000. When purchasing Schengen visa travel insurance in USD, make sure the policy covers at least $50,000. This minimum coverage is applicable for any medical expenses, emergency evacuation, and repatriation of remains.