- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Best Travel Insurance for Backpackers

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What to consider when buying backpacker insurance

The best travel insurance providers for backpackers, finding the right plan for you, backpacker travel insurance recapped.

Are you currently backpacking or planning an epic around-the-world trip? Perhaps you're taking some time off from school, want a break from your job or you're a digital nomad. Whatever your situation, you may have realized that your current medical insurance may not be enough to protect you against everything you might encounter while backpacking — especially if you're abroad.

So, what is the best travel insurance for backpackers? Here's our guide to help you find the right policy for your situation, plus some top picks.

There is no one best travel insurance for backpackers. The right plan for you will depend on where you travel — Europe, Latin America, Asia? — and how long you plan to travel. You'll also want to consider the type of coverage you will need. Here are some things you might want to consider when looking for travel insurance as a backpacker:

Medical emergency insurance

If you need medical care when traveling outside your home country, you will want to have insurance that covers your costs. In the United States, many insurance plans don't cover international travel . Those that do typically consider most services performed outside of the United States to be out-of-network. This means, at a minimum, you'll likely pay higher deductibles and fewer services may be covered.

Travel disruptions

Flight delays and cancellations happen and you'll want to be prepared. Many travelers receive some trip interruption and trip delay insurance through their credit card, but coverage limits and exclusions vary depending on the type of card you hold. Coverage for travel disruptions can also be purchased as part of a travel insurance plan and help you recover your losses if your plans change due to various reasons, from flight delays to illness.

Emergency evacuation

If you need to be evacuated from a country, you might be able to get some coverage through the credit card you used to book your trip. However, not all credit cards cover every situation. For example, some cards may cover emergency medical evacuation but won't help if you must evacuate because of political unrest or sudden armed conflict.

» Learn more: The guide to emergency evacuation insurance

Repatriation of remains

If the worst should happen and you want your remains to be shipped home should you die overseas, you'll want to be insured for repatriation of remains. Out-of-pocket costs for repatriation can be upwards of $10,000, so it can be a good idea to include this coverage in your travel insurance.

Length exclusions

Some policies only offer coverage for trips of a particular duration, while others require you to return to your home country periodically. When selecting your travel insurance plan, pay special attention to what lengths of trips are covered and make sure your plan doesn't exclude the type of travel you plan to do.

Coverage in your home country

Be sure you understand what your travel insurance covers when visiting your country of residence, especially regarding medical costs. Often, travel insurance providers exclude or offer lower coverage amounts for travel within your country of residence.

Other types of coverage

There are various options and add-ons regarding travel insurance, and some may be more important to you than others. As you shop around, consider whether you want coverage for any of the following:

COVID-19 coverage .

Baggage delay insurance .

Pre-existing medical conditions .

Accidental death and dismemberment .

Rental car coverage .

Cancel For Any Reason coverage .

» Learn more: Best long-term travel insurance

1. World Nomads — Great insurance for up to six months

World Nomads provides comprehensive travel insurance. The company's standard plans include all the essentials: $100,000 of emergency medical coverage, $300,000 of emergency evacuation insurance, $2,500 of trip cancellation and interruption coverage and $1,000 against loss, theft or damage of your gear.

The coverage includes repatriation of remains, trip delay and accidental death and dismemberment coverage. More significant coverage limits are also available through the company's Explorer plan.

One downside to World Nomads is that their travel insurance isn't available if you will be gone for more than 180 days. So, if you're a backpacker or digital nomad traveling for longer than that, you'll want to look elsewhere.

2. Safety Wing — An option for long-term backpackers

Nomad Insurance by Safety Wing is an insurance product underwritten by Lloyd's. The Nomad Insurance policy includes medical coverage up to $250,000, including hospital stays, ambulance transportation and physical therapy. The policy also provides trip interruption, trip delay, emergency medical evacuation and political evacuation coverage.

Two notable benefits of Safety Wing are that you can purchase the insurance when you're already abroad and extend your coverage as you go — instrumental if you're not sure when you'll return home. In addition, if you sign up for an automatic renewal plan, Safety Wing will extend your insurance coverage every 28 days. Your insurance can continue indefinitely until you pick an end date.

3. Battleface — Coverage for adventurous backpackers

Some travel insurance providers exclude high-risk activities — such as scuba diving, skiing or rock climbing — from coverage. If you're more adventurous than the average backpacker and want coverage for these types of activities, consider Battleface.

The company offers policies that cover trip cancellation, interruption and delay. Its coverage also includes $250,000 of medical expenses and personal property protection. However, digital nomads or long-term backpackers may need to look elsewhere for coverage. Battleface's annual plan covers unlimited trips, but any trip can only be 40 days long.

4. Allianz — For frequent travelers who return home often

Allianz is a globally-known insurer that offers travel insurance. Its plans for travelers include coverage for emergency medical, emergency medical transport, lost or delayed baggage, travel delays, rental car damage or theft and more. Coverage levels depend on which plan you purchase, and some benefits — such as rental car insurance — are optional add-ons.

Allianz offers travel insurance per trip through its OneTrip plans and year-long coverage through its AllTrips offerings. However, most AllTrips plans only insure trips for up to 45 days, so if you travel but return home frequently, Allianz might be a good option.

» Learn more: How much is travel insurance?

When traveling, everyone's situation is different. What might be the best backpacking travel insurance for you might not work for your travel companion. To find the best plan for you, here are some things to consider:

Understand your travel plans

Your travel plans will dictate what insurance options are available to you. Are you planning on backpacking for a month, three months, a year, or indefinitely? Which countries do you plan on visiting? Will you return home frequently? Make sure that your travel insurance plan covers your situation.

Take inventory of what coverage levels you need

As you research, consider what coverage you think you'll need. You'll probably want basic medical and emergency evacuation coverage, at a minimum. Beyond that, consider your risk tolerance and the probability that you'll need to file a claim.

Start with our recommendations

Our recommendations are far from the only providers of backpacker insurance out there. Use them as a starting point, but get suggestions from friends and read reviews of different insurance providers before purchasing coverage.

Finding the right travel insurance will take some time and require research. Take a look at your travel plans, understand what coverage you need and use our list as a starting point. If you put in some time upfront to find the right backpacking travel insurance, once you're abroad, you can spend your time enjoying the journey.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies (May 2024)

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

5 Best Backpacker Travel Insurance Companies of 2024

Explore our top picks for travel insurance for backpacking trips and compare options to find the right coverage below.

in under 2 minutes

with our comparison partner, Squaremouth

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

The best travel insurance for backpacking trips is Travelex due to its affordable coverage for mult-destination trips. Travelex offers three plan options and a Travel America plan for backpackers making their way across the states.

From beachfront hostels in Thailand to campgrounds in Europe, a backpacker insurance policy can help you enjoy your adventure with peace of mind. Whether you’re traveling as a digital nomad or launching into adventure sports like trekking or scuba diving, travel insurance can cover the cost of unforeseen events or accidents during short or long-term backpacking trips.

Key Features To Look For in Backpacker Travel Insurance

Backpacker travel insurance is subject to your individual needs. According to the U.S. Department of State , the government does not cover medical bills overseas. Therefore, the agency recommends travel medical emergency insurance, especially if you’re participating in adventure activities. However, not all travel insurance companies cover adventure sports.

Trip interruption insurance can help you prepare for potential cancellations and flight delays, offering reimbursement of prepaid costs if interruptions occur for a covered reason. Emergency evacuation coverage is important in the event of natural disasters or civil unrest, especially if you plan on adventuring in rural areas. Ensuring your policy offers baggage and personal effects coverage also offers a financial safety net for lost or stolen belongings, including sporting gear.

While you may be able to find basic travel insurance with these features, the benefit limits may vary. It’s also important to note that not all policies cover adventure sports gear or medical expenses. Make sure to look for a plan with this coverage if you plan on adding sporting events to your backpacking trip.

Top 5 Travel Insurance Providers for Backpackers

Here is our list of travel insurance plans and providers to suit backpackers:

- Travelex Insurance : Our pick for families

- AIG Travel Guard : Our pick for families

- IMG Travel Insurance : Our pick for medical coverage

- Allianz Global Assistance: Our pick for concierge services

- World Nomads: Our pick for adventure travelers

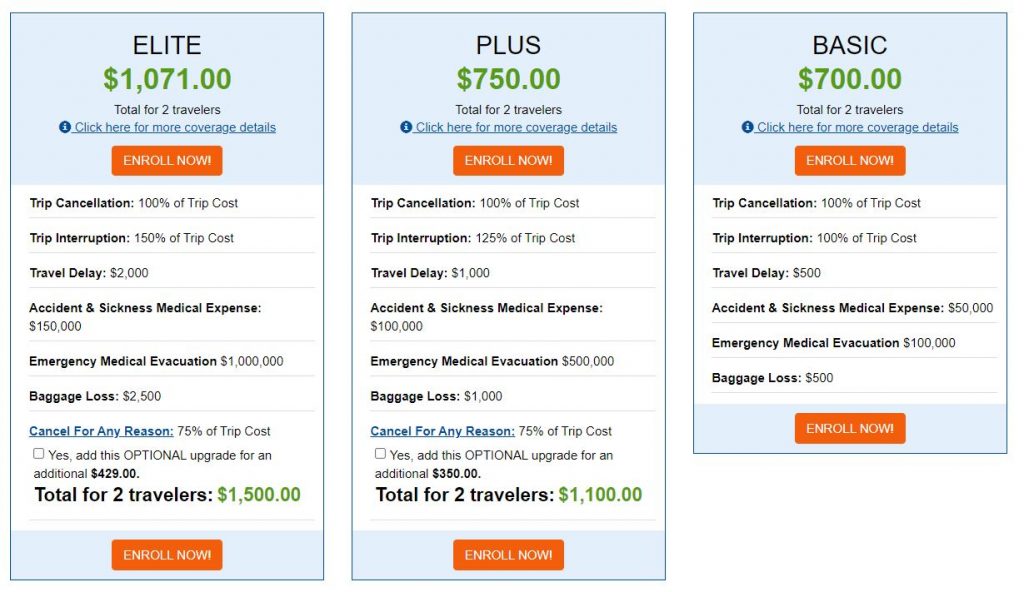

Compare Backpacking Travel Insurance Companies

We requested online quotes for our top travel insurance providers so you can see how much coverage costs . The chart below includes estimates for a 25-year-old backpacker from New York taking a three-week trip to Mexico, with a total trip cost of $2,500. Quotes are for basic plans with travel medical insurance, trip cancellation coverage and more. We also included unique coverage options, including cancel for any reason or CFAR coverage.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

Pros & Cons

You can choose from three plans with Travelex Insurance: Travel Basic, Travel Select and Travel America. Travel Basic is a budget-friendly option for backpackers with sufficient coverage. Five optional upgrades are available with the more comprehensive Travel Select Plan, with a $50,000 limit for emergency medical costs.

If you are planning to backpack around the U.S., the Travel America plan provides emergency medical expenses and reimbursement for canceled events, such as ski resort closures.

Coverage & Cost

Add-On Options

Travelex offers a variety of add-on options, depending on the plan you choose. Upgrades include:

- CFAR coverage

- Car rental collision

- Adventure sports coverage

- Additional medical coverage

- Flight accidental death and dismemberment

Based on our quote process, the Travel Basic Plan costs $87 for a 25-year-old traveler on a 20-day trip to Spain worth $3,000.

If you’re looking for a travel insurance policy for backpacking as a family, AIG Travel Guard plans include coverage for one child under age 17 with the rate for a paying adult. The Deluxe Plan offers high-level medical evacuation and healthcare coverage up to $100,000, while

the Preferred Plan features up to $50,000 for travel medical costs.

If you are on a budget during long-term backpacking trips, the Essential Plan covers the basics, with 24/7 emergency assistance and medical care coverage up to $15,000. The Pack N’ Go Plan is available if you plan a trip last minute and don’t need cancellation coverage.

AIG Travel Guard provides a range of add-ons depending on your chosen plan. Some examples include:

- Cancel for any reason (CFAR) coverage

- Rental vehicle damage coverage

- Security evacuations and interruptions bundle

- Adventure sports bundle

- Medical bundle

- Wedding bundle

- Baggage bundle

Based on the quote we requested for a 25-year-old backpacker traveling to Spain for 20 days on a $3,000 trip, the Essential Plan would cost $134.

*AM Best ratings are accurate as of June 2023.

From rafting to skydiving and bungee jumping, extreme sports fans can take advantage of IMG’s iTravelInsured Travel Sport Plan. It includes sports equipment rental reimbursement and natural disaster evacuation coverage.

For long backpacking trips, the most affordable option is the iTravelInsured Travel Lite Plan, which includes benefits for trip cancellation, travel delays and emergency medical assistance. You can also opt for more comprehensive options with the iTravelInsured Travel SE and iTravelInsured Travel LX plans.

IMG offers the following add-ons with the iTravelInsured Travel LX plan:

- Interrupt for any reason (IFAR) coverage (up to 75% of trip costs)

- CFAR coverage (up to 75% of the trip costs)

Based on our quote, the iTravelInsured Travel Lite Plan would cost $83 for a 25-year-old traveler backpacking around Spain for a 20-day trip worth $3,000.

Allianz offers a range of affordable plans for backpackers, including the AllTrips Basic Plan, a multi-trip policy with year-long protection. Or, if you’re primarily looking for health insurance and have a flexible itinerary with minimal prepaid expenses, you can save money with the OneTrip Emergency Medical Plan. It only covers post-departure benefits, including unexpected events after your trip begins.

While Allianz also provides comprehensive insurance policies, budget travelers may prefer the OneTrip Basic plan for affordable, all-around coverage.

Allianz Global provides the following add-on options, which you can add depending on your plan:

- OneTrip Rental Car Protector

- Terrorism Extension cover

- Required to Work cover

Based on our quote, the OneTrip Basic Plan would cost $91 for a 25-year-old backpacker taking a 20-day trip to Spain for $3,000.

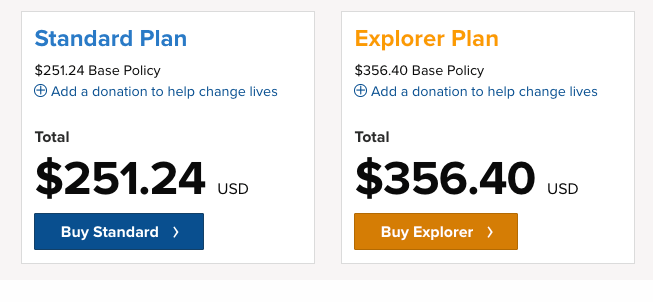

Whether you love Alpine skiing or rock climbing, World Nomads is a popular choice for adventurous backpackers. Its two policies, the Standard Plan and Explorer Plan, cover over 200 adventure activities and sports. The main difference between the plans is the Explorer Plan offers higher coverage limits.

World Nomads offers rental car damage coverage with the Explorer Plan.

We pulled quotes for both plans for a 25-year-old backpacker taking a 20-day trip to Spain. You could expect to pay $96 for the Standard Plan and $180 for the Explorer Plan.

Factors To Consider When Choosing the Backpacking Insurance

Everyone’s different, so choosing the best insurance for your backpacking trip means considering your personal needs. Ask yourself the following questions as you consider travel insurance policies:

- Does the travel insurance cover all the destinations you want to visit?

- How long is your backpacking trip and if needed, does the policy suit long-term travel?

- Does the policy include sufficient medical coverage for potential health issues or participation in sports?

- Are there adequate coverage limits for baggage, gear and high-value equipment?

- Does the policy sufficiently cover missed activities and flight cancellations ?

- Do you require coverage for a pre-existing conditio n and if so, does the policy include a waiver?

If you are planning a long-term backpacking trip, pay attention to the duration of your travel insurance policy. For example, if you apply for a multi-trip plan with six months versus a year of coverage. And if you plan to trek around the globe, make sure your policy includes your intended destinations.

It also helps to check the coverage you already have before purchasing a policy. For example, your credit card may include rental car coverage or other forms of travel insurance.

What Does Travel Insurance Not Cover?

Most travel insurance plans cover medical emergencies, trip cancellations and delays , and baggage loss or theft. However, most policies don’t cover the following:

- Alcohol and drug-related incidents

- Extreme sports such as cliff diving

- Non-emergency medical treatment

- Flexibility in trip cancelation, such as changing your mind about flights or destinations

- Incidents due to negligence

Some providers may offer add-on coverage for extreme sports, non-emergency medical treatment and cancellation flexibility (CFAR coverage).

Travel Tips for Comparing Backpacker Insurance

Before buying travel insurance, it’s important to shop around, compare prices and read customer reviews. We suggest obtaining online quotes from at least three providers before selecting a policy.

Once you’ve found a few options that suit your coverage needs and budget, read the policy documents to ensure the coverage is right for you. Look for any exclusions or limits that may impact your coverage, such as a lack of adventure sports protection. If you don’t understand something, speak to the provider directly before making your decision.

Is Backpacking Travel Insurance Worth It?

Backpacking is often an adventure of a lifetime, but it is also an investment. Safeguarding your prepaid and nonrefundable costs, along with having financial safety nets for unforeseen medical emergencies, can help you enjoy a stress-free journey.

Ultimately, it is up to you to decide if backpacking travel insurance is worth it . If you’re planning to launch into adventure activities, top providers such as World Nomads, IMG and Travelex offer extra coverage. You can also opt for a basic plan from Allianz or choose AIG Travel Guard if you need coverage for a child. Regardless of your choice, each of our top providers can provide affordable options with sufficient coverage for backpackers.

Frequently Asked Questions About Travel Insurance for Backpacking Trips

Should i purchase travel insurance for a backpacking trip.

While your need for travel insurance is up to you, purchasing a policy can be worth it. Travel insurance for backpacking can cover medical costs in an emergency. Policies can also safeguard you against financial loss by providing reimbursements if your trip is canceled or delayed or your baggage or gear gets stolen. Some providers offer add-ons to cover rental car damage, highly valuable items and more.

What type of insurance do you need for backpacking?

The type of insurance you need depends on your destination, the duration of your trip and the activities you plan to do. At a minimum, backpackers should consider a policy with the following coverage:

- Trip cancellation , interruption and delay

- Emergency medical expenses

- Emergency evacuation and repatriation

- Lost or stolen baggage

Consider policies with adequate add-on coverage, like if you plan on participating in adventure sports or need a rental car.

What is the difference between backpacking insurance and travel insurance?

Backpacking insurance is simply a type of travel insurance with coverage tailored to backpackers. While some providers offer adventure-specific policies, you may find that a standard travel insurance plan suits your backpacking trip. Researching policy options can help you find coverage for your unique needs, including annual multi-trip plans for long-term trips.

Methodology: Our System for Ranking the Best Travel Insurance Companies for Backpacking Trips

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

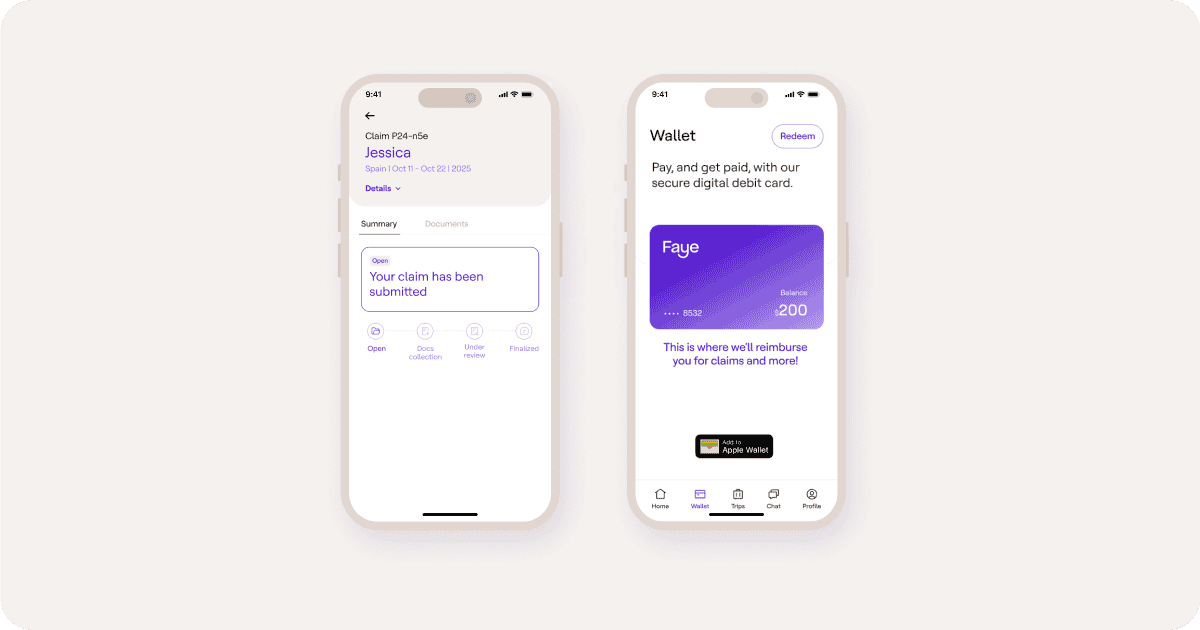

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

More Travel Insurance Guides

- Best covid travel insurance companies

- Best cruise insurance plans

- Best travel insurance companies

- Cheapest travel insurance

- Best group travel insurance companies

- Health insurance for visitors to usa

- Best senior travel insurance

- Best travel insurance for families

- Best student travel insurance plans

- Travel insurance for parents visiting USA

- Best travel medical insurance plans

- How much does travel insurance cost?

If you have feedback or questions about this article, please email the MarketWatch Guides team at editors@marketwatchguides. com .

More Resources:

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Backpacker Travel Insurance

Backpacker travel insurance

For travellers aged 18 – 60

Covers one trip of up to 18 months

Return home for up to 7 days on 3 occasions

Make sure you’re properly prepared for your adventure overseas

You've worked out where you're going, sorted out the passport and visas, and taken your vaccinations. Now you're ready to take on the world. Add backpacker cover to our economy travel insurance, and you’ll be good to go.

Medical Assistance Plus: 24/7 holiday health support

Have peace of mind when you travel knowing health professionals are just one click away.

Medical Assistance Plus, powered by Air Doctor, comes free with all our travel insurance policies (1). It gives you access to outpatient medical support while you’re away.

Through the service you can book an in-person or video consultation with a doctor. You can also get prescriptions delivered to your nearest pharmacy.

We’ll send you an SMS reminder about the service the day before you travel (for single-trip and backpacker cover) or the day before your policy begins (for annual multi-trip cover).

What’s covered?

Here’s a summary of the cover our backpacker policies provide. For full details check our policy documents.

An accident abroad

Few countries have total universal healthcare like the UK’s NHS. Most countries outside of the EU don’t have mutual healthcare agreements with the UK. This means the cost of getting treatment can be very expensive. Travel insurance is there to protect you and help when you’re at your most vulnerable

Lost valuables

Some holiday mishaps are down to sheer bad luck. Getting pickpocketed on a busy street. Your airline mislaying your bags. Or someone picking up the wrong rucksack at the bus stop. You just can’t plan for losing your valuables. But you can plan to get help with the replacement costs by getting a backpacker travel insurance quote with us

Sporting activities included

If you’re off travelling the world with a backpack, we’re willing to bet you can be tempted by the odd adventure sport or two. We cover over 100 sports and activities free of charge, but there are some we don’t cover at all. Check your policy wording for the full list and our terms and conditions, as some aren’t covered for personal injury or personal liability

How much cover do you get?

Our backpacker travel insurance comes with our economy cover. Here are some of the cover highlights.

Policy wording

Upgrade your cover with ease

Need cover for your policy that's not included as standard? Just pay a little more to add these upgrades – optional or mandatory depending on the trip type.

This optional extra helps protect you from the impact of airspace disruption, natural catastrophes, terrorist acts or Covid-19 (5)

If you’re happy with the cover offered, but worried about excess fees, you can opt for an excess waiver. For an additional premium, you can add it to any Post Office level of cover for zero excess fees (5)

Insure all your devices with our easy-to-add gadget cover. It’s perfect to protect all your smartphones, tablets, laptops and consoles (5)

Specialist cover is mandatory for winter sports like skiing and snowboarding. There’s greater risk of emergency costs. Make sure you’re protected on the pistes (5)

If you're going on a cruise, specialist cover is both important and mandatory. It covers missed departure due to breakdown, falling ill on board, being confined to your cabin, lost baggage and more (5)

Trip extensions are available up to 45 or 60 days, increasing from the standard 31 days (5)

All medical conditions considered

Living with a medical condition shouldn’t stop you seeing the world. And, with the right travel insurance in place, you can enjoy peace of mind on your adventures – just in case something unfortunate happens.

At Post Office, we cover most pre-existing conditions. Contact us for a quote to see if we can cover you. It’s important to declare upfront all your medical conditions and any medication you're taking.

If we can't help and yours is a serious pre-existing medical condition, check the Money and Pensions Scheme (MaPS) directory. It lists companies that may be able to help you. Or call 0800 138 7777 .

Ready to get a quote?

Let’s find the protection that’s right for your travels. Get a quote for Post Office Travel Insurance

Common questions

What is backpacker insurance.

Backpacker insurance is designed for those of us who like to travel the world – and we’ve taken a lot into account. So, you can return home for up to seven days as many as three times. And there are over 100 sports and activities included, so it’s designed with you in mind.

Am I eligible for backpacker travel insurance?

To be eligible for Post Office Backpacker Insurance you must:

- Be aged between 18 and 60 years

- Reside in Great Britain, Northern Ireland, the Channel Islands or the Isle of Man

- Be registered with a GP in one of these places

Conditions and exclusions apply. For full details of what's included with your cover, check the policy wording .

Will I need extra cover with backpacker insurance?

While we’ve included a lot of adventure sports as standard on Post Office Backpacker Insurance, you’ll still need extra cover for winter sports . You can add this to your policy for an additional premium.

You can also add excess waiver cover . With this added cover, you won’t need to pay any part of any claims that you make.

Before you buy travel insurance, you should thoroughly check our policy terms and conditions. This way you’ll be sure that any adventure sports or activities you want to take part in are fully covered. A good example is if you’re planning to do any voluntary manual work while you’re away. Please be aware that if you need to make a claim, the excess will increase to £250, and purchasing the optional excess waiver won’t remove this excess.

What’s covered with backpacker insurance?

Post Office Backpacker Insurance is similar to other forms of travel insurance. It’ll cover you for medical emergency, the cancellation or cutting short of your trip, and loss of your belongings. It’s available with our economy level insurance. It’s a good idea to check our policy documents to make sure it has all the cover you need for your trip.

Is there a discount for students?

Yes, there is. We’ve partnered with Student Beans to offer a student discount. Log in with your Student Beans account to claim your discount code . Or, if you don’t have one, you’ll need to register for a Student Beans account to verify you’re a student.

When getting a quote for Post Office Travel Insurance please enter your discount code into the promotion code box. The discount will be taken off your quote total.

Do you offer a discount for graduates?

Yes, we do. We’ve partnered with Grad Beans to offer a discount to students. To claim it, you’ll need to either register for a Grad Beans account (to verify your graduate status) or log in with your existing account . You’ll be given a unique code, which you’ll need to enter in the promotion code box that appears when getting your travel insurance quote. The discount will be taken off your quote total.

- Read more travel insurance FAQs

Need some help?

Travel insurance help and support.

For emergency medical assistance, to make a claim, manage your account online, find answers to common questions about our cover or get in touch:

Visit our travel insurance support page

Register your policy

If you haven’t yet registered your Post Office Travel Insurance policy, enter your details and create a log in so you can access it any time

Register policy

Travel insurance policy types

Backpacker cover.

- Cover for a one-off trip up to 18 months

- Option to return home for up to 7 days on 3 occasions.

- For people aged 18 – 60 wanting to travel the world for a gap year or career break

Single-trip cover

- Cover for a one-off trip in the UK or abroad

- Perfect for one-off trips or longer holidays of up to 365 days (3)

- No age limit

Annual multi-trip cover

- Cover for multiple-trips for a 12-month period

- 31-day trip limit, with extensions available up to 45 and 60 days

- Available for everyone aged up to 75 years

Related travel guides and services

Adventurous holidays can take many forms, from action-packed itineraries in ...

Whether you’re travelling solo because of business, you’re hoping to meet ...

The white stuff is alluring, so make sure you can enjoy it safely, are ready ...

Holidays for teenagers can take some imagination to make sure they’ve got the ...

Taking your best friend on holiday with you is everyone's ideal situation, but ...

Satisfy your travel craving while making your holiday budget go further. We’ve ...

Perched on the northern tip of Africa, Morocco’s long been a popular ...

It may be a short hop away, but a trip to France is not without its travel ...

Canada is a vast country of diverse delights – everything from bustling cities ...

For many UK holidaymakers, India is an intriguing and diverse culture with ...

Thailand’s idyllic beaches, azure-blue sea, buzzing cities and exciting ...

Make sure you’re travelling safely in Egypt with the latest advice and risks, ...

From airboarding to snow-tubing, here's our list of unusual winter sports ...

For your first time on the slopes, preparation can help you get the most out of ...

The whole idea of lounging around on the beach is to switch off and enjoy the ...

The status of Schengen visas for international students resident in the UK is ...

Every year, millions of holidaymakers from the UK head to Spain for its ...

A trip to Turkey offers toasty beaches and tourist treats aplenty. No wonder ...

The famous cliché of America is that it's big. And it is. Across its six time ...

Heading down under for a trip to or around Australia? Make sure you’ve got the ...

Today, Cuba is more accessible than it has been for many decades, and those who ...

Do UK residents need travel insurance for Ireland? And what healthcare is ...

Planning on living the high life with a trip to the UAE’s iconic mega-city, ...

Booking a last-minute holiday can get the blood pumping with the sudden thrill ...

Find out about medical care available to Brits in Mexico, as well as travel ...

Find out about the safety of travelling to Italy as well as the medical care ...

Some vaccinations for Thailand are recommended and some are mandatory in ...

There are several ways to get to the top of the class on your flight – whether ...

ATOL stands for Air Travel Organisers' Licensing, a scheme that helps make sure ...

Over 60 million people travel from the UK most years for holidays or business. ...

The last thing you want to happen on holiday is standing the luggage carousel ...

Having your son or daughter go on holiday without you for the first time can be ...

Going backpacking is one of life’s great adventures. But before you set off ...

The arrival of Airbnb has helped to transform the travel industry in recent ...

A ski packing list has the potential to run to many pages. With a bit of ...

If you're living with cancer but love to travel, can you get travel insurance ...

Travelling with high blood pressure is fine – but it’s important to make sure ...

As you get older, being able to go where you want when you want is all part of ...

In an average year, millions of Britons go abroad without the right travel ...

Lots of people who need assisted travel at airports are missing out simply ...

Learn the difference between embassies and consulates, and why you might need ...

Travel insurance for a holiday in the UK isn't something you must have, but it ...

With festivals overseas becoming the new norm, festivalgoers need to do a bit ...

You should be able to get the right cover to travel abroad if you’re diabetic, ...

Enjoy that precious time away with your grandchildren, and take some of the ...

Dark mornings, cold hands, heating bills and chapped lips are among the most ...

We all know the feeling – getting to the airport, then a wave of panic comes ...

It's a proud feeling when children turn eighteen and start holidaying on their ...

If you're travelling abroad as a family, it makes sense to take out insurance ...

Fancy trekking in a remote Asian rainforest? A wild time in New York? Flying ...

If you're travelling to an EU country from the UK, make sure you take a Global ...

Do you need travel insurance for your trip? Is travel insurance worth it? And, ...

Travel’s a great way to unwind, see the world, open the mind and expand ...

People flock to the Canary Islands from all over Europe. No wonder, with such ...

Greece and the Greek islands have long been a popular travel destination for us ...

If you’re jetting off to Japan soon make sure you have good travel insurance to ...

How safe is South Africa to visit and why is having travel insurance important ...

Find out what medical care Brits can access in New Zealand and travel risks to ...

Learn about the different types of travel insurance available from Post Office, ...

It’s your holiday too, and good preparation can take some of the worry out of ...

Finding out that your airline or holiday company has gone bust is a shock – ...

Travelling solo means freedom and independence, making new connections and ...

Exploring the globe can be scary, but there’s so much to find at the edge of ...

With the winter sports season upon us, we conducted a Winter Sports Survey for ...

The opportunities to combine business and leisure have never been greater. You ...

There’s no better feeling than planning an amazing trip to an exotic ...

There’s nothing worse than falling ill while away from home. Along with the ...

Ready to jet off on a much-needed break but worrying about what you can take ...

Most of the time, getting a flight is a hassle-free event. If you only take ...

Whether you’re heading to the beach for a much-needed break or boarding a boat ...

If you're the type of sunchaser who looks forward to that sizzling summer ...

It’s one of the most popular holiday hotspots for UK holidaymakers. But what ...

So, you’ve booked your flights, accommodation and activities. What next?

Policy documents

To access your policy documents, select your cover level then tell us the date you bought your cover.

Policy numbers starting with TC

Policies are underwritten by Collinson Insurance:

- Policy wording - purchased on or after the 28 March 2024

- Policy wording - purchased on or after 31 August 2023

- Policy wording – purchased on or after 17 August 2022

- Policy wording – purchased on or after 31 March 2022

About our travel insurance

Post Office® Travel Insurance is arranged by Post Office Limited and Post Office Management Services Limited.

Post Office Limited is an appointed representative of Post Office Management Services Limited which is authorised and regulated by the Financial Conduct Authority, FRN 630318. Post Office Limited and Post Office Management Services Limited are registered in England and Wales. Registered numbers 2154540 and 08459718 respectively. Registered Office: 100 Wood Street, London, EC2V 7ER. Post Office and the Post Office logo are registered trademarks of Post Office Limited.

These details can be checked on the Financial Services Register by visiting the Financial Conduct Authority website and searching by Firm Reference Number (FRN).

(1) This service is not available for trips taken in the UK, only for international travel. The service allows up to 3 separate medical events per person, per policy and for each medical event up to 3 appointments per person listed on the policy. All appointment charges are covered by your travel insurance policy. You will not need to pay any excess fees for this service.

For any online appointments or where the appointment was held at your accommodation, where a prescription is issued, you will need to pay for any medication and claim upon your return home. No excess will be applied for any prescription charges. If your appointment takes place at a clinic and they have a dispensing chemist, you will not need to pay for your prescription and all charges will be covered by your policy at the point of appointment. If there is no dispensing chemist at the clinic, you will either be given a prescription, or the prescription will be sent to a chemist by the treating doctor, and you will need to pay for any medication and claim upon your return home.

If your medical situation needs to be handed over from an outpatient case to an inpatient case and requires hospital admission, you will be handed over to our emergency medical assistance team in the UK. For any inpatient cases, no excess will be applicable.

(3) For economy, standard and premier policies, the single-trip policy will cover you for one trip up to:

- 365 days for those aged up to and including 70 years

- 90 days for those aged between 71 and 75

- 31 days for those aged 76 years and above

(5) Terms and conditions apply.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best COVID-19 Travel Insurance Options

Travelex Insurance Services »

Allianz Travel Insurance »

World Nomads Travel Insurance »

Generali Global Assistance »

IMG Travel Insurance »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best COVID Travel Insurance Options.

Table of Contents

- Rating Details

- Travelex Insurance Services

- Allianz Travel Insurance

Even though COVID-19 is no longer considered a global emergency, concerns around illness-related costs remain for many travelers. If you're looking for travel insurance that covers COVID – as well as other potential disruptions like flight delays and lost luggage – these are your best options.

- Travelex Insurance Services: Best Optional Coverage Add-ons

- Allianz Travel Insurance: Best for Multitrip and Annual Plans

- World Nomads Travel Insurance: Best for Active Travelers

- Generali Global Assistance: Best for Comprehensive Travel Insurance

- IMG Travel Insurance: Best for Travel Medical Insurance

Best COVID Travel Insurance Options in Detail

Plans include coverage for COVID-19

Optional CFAR coverage is available with Travel Select plan

Some coverages require an upgrade, including rental car collision, accidental death and dismemberment, and more

Not all add-ons are available with every plan

Allianz offers some travel insurance plans that come with an epidemic coverage endorsement

Single-trip, multitrip and annual plans available

COVID-19 benefits don't apply to every plan

Low coverage limits with some plans (e.g., only $10,000 in emergency medical coverage with OneTrip Basic plan)

24-hour travel assistance services included

More than 200 sports and activities covered in every plan

Low trip cancellation benefits ($2,500 maximum) with Standard plan

No CFAR option is offered

Free 10-day trial period

Some coverage limits may be insufficient

Rental car damage coverage only included in top-tier Premium plan

Offers travel medical insurance, international travel health insurance and general travel insurance plans

Some plans include robust coverage for testing and quarantine due to COVID-19

Not all plans from IMG offer coverage for COVID-19

Cancel for any reason coverage not available with every plan

Frequently Asked Questions

When comparing COVID-19 travel insurance options, you'll want to make sure you fully understand the coverages included in each plan. For example, you should know the policy inclusions and limits for COVID-related claims, including coverage for testing, treatments, trip cancellation or COVID-related interruptions that can occur. Meanwhile, you should understand how your coverage will work if you contract some other illness while away from home.

Also ensure your travel insurance coverage will kick in for other mishaps that occur, and that limits are sufficient for your needs. If you're planning a trip to a remote area in a country like Costa Rica or Peru , you'll want to have emergency evacuation and transportation coverage with generous limits that can pay for emergency transportation to a hospital if you need treatment.

You can also invest in a travel insurance policy that offers cancel for any reason coverage. This type of travel insurance plan lets you cancel and get a percentage of your prepaid travel expenses back for any reason, even if you just decide you're better off staying home.

It depends on your private health insurance provider and/or travel insurance policy. As of May 11, 2023, private health insurers are no longer required to cover the cost of COVID-19 testing. Out-of-pocket costs for COVID-19 test kits at local drugstores and on Amazon are relatively affordable, however.

As you search for plans that will provide sufficient coverage for your next trip, you'll find travel insurance that covers COVID-19 quarantine both inside and outside the United States. However, you'll typically need to have your condition certified by a physician in order for this coverage to apply. Also make sure your travel insurance plan includes coverage for travel claims related to COVID-19 in the first place.

Many travel insurance plans do cover trip cancellation as a result of COVID-19, although the terms vary widely. You typically need to be certified by a physician in order to prove your condition. Disinclination to travel because of COVID-19 – such as fear of exposure to illness – will generally not be covered. This means you will actually have to test positive for coronavirus for benefits to apply; simply not wanting to travel is not a sufficient reason to make a claim.

If you want more flexibility in your COVID-19 travel insurance, ensuring you have a cancel for any reason policy may be your best bet, but be sure to check with your chosen travel insurance provider to assess your options.

Why Trust U.S. News Travel

Holly Johnson is an award-winning writer who has been covering travel insurance and travel for more than a decade. She has researched the best travel insurance options for her own trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. Over the years, Johnson has successfully filed several travel insurance claims for trip delays and trip cancellations. Johnson also works alongside her travel agent partner, Greg, who has been licensed to sell travel insurance in 50 states.

You might also be interested in:

5 Best Travel Insurance Plans for Seniors (Medical & More)

Holly Johnson

Discover coverage options for peace of mind while traveling.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

- Capital Markets

- Sustainability

- Switch to Northern Ireland

AIB Travel Insurance

Wherever you’re going? Get a quote in seconds

Get a quote

Already have your AIB Travel Quote?

Get instant cover now and protect your travel plans

Retrieve your quote

AIB partner with Chubb to provide Travel Insurance. By clicking; get a quote or retrieve your quote you will be brought to a Chubb managed website to complete your journey.

Click and Protect with AIB Travel Insurance

Planning the trip of a lifetime or a last minute city break? Today, accommodation and flights can be arranged in seconds - and with AIB, great value Travel Insurance is just few clicks away too. Get a quote now, then get instant cover that’s perfect for your travel plans.

Key benefits

- 24/7 worldwide emergency assistance.

- Buy your policy online and get a 20% discount.

- Competitively priced policies for all travel occasions, including single trips, multi trips, winter sports and backpacking.

- Unlimited medical expense cover.*

- Instant cover - immediately after you purchase.

How much? Find out right now

Get a quote, retrieve your existing quote, common travel insurance faqs.

For Information on Coronavirus & AIB Travel Insurance Click Here . For urgent queries about your policy you can call us on 1800 24 24 67 (Monday to Friday, 9:00 to 17:00).

AIB has created a range of Travel Insurance covers to protect you. These policies are underwritten and serviced by our chosen underwriters, Chubb European Group SE. The Chubb Group is one of the world's largest property and casualty insurers with strong financial ratings from leading rating agencies.

An Irish resident is someone who has been living in Ireland (not Northern Ireland) for at least 180 days prior to the date the cover is applied for.

Your Travel Insurance cover details

Need some help? You’ll find answers to important questions about AIB Travel Insurance here .

For Information on Coronavirus & AIB Travel Insurance Click Here .

For details on remunerations, please visit our insurance remunerations page .

Need to talk?

If you are uncertain how to claim, or which form to use, please contact us on 1800 24 24 67 or +353 (0)1 440 1766 if calling from abroad.

To make a Travel Insurance claim, click here .

Related products

Aib home insurance.

Need flexible, affordable home insurance cover? You’re at the right address

AIB Car Insurance

Great value Car Insurance? Pull in right here.

Regulatory information

*limits apply to backpacker cover

Click to begin the quotation process to get insurance cover.

Some of the links above bring you to external websites. Your use of an external website is subject to the terms of that site. Allied Irish Banks, p.l.c. is an agent of AIB Insurance Services Limited for the provision of general insurance products. AIB Travel Insurance is exclusively underwritten by Chubb European Group SE. AIB Insurance Services Limited and Allied Irish Banks, p.l.c. are regulated by the Central Bank of Ireland.

Contact Details

More than 170 branches across Ireland makes us the perfect

solution no matter where you are.

Haven't found what you're looking for?

Our customer support team is here to help if you have any questions.

- TERMS OF BUSINESS

- INTEREST RATES

- DATA PROTECTION NOTICE

- ACCESSIBILITY

- PERSONAL FEES & CHARGES

Before proceeding please read our Site Use Terms and Conditions , Privacy & Cookie statements which apply to your use of this website. AIB and AIB Group are registered business names of Allied Irish Banks, p.l.c. Registered Office: 10 Molesworth Street, Dublin 2.

AIB Fraud & Security Centre Always safe & secure

Cards, Loans & Savings

Car & home insurance, pet insurance, travel insurance, travel money card, life insurance.

Extended Trip Travel Insurance for Backpackers

Perfect for your gap year or career break

Underwritten by Great Lakes Insurance UK Limited

Do you need backpackers travel insurance?

Your backpack’s packed and you’re ready to go. There’s just one thing left to do: get travel insurance. If you’re taking a life-changing gap year or a stressbusting six months exploring the world, get the best backpacker travel insurance to suit your needs.

Our extended trip policy works great as backpacker insurance or adventure travel insurance. It’ll protect you and your belongings on longer trips, or if you’re travelling across multiple countries.

Get ready for your adventure

A backpacking holiday is full of adventure and a chance to explore new things. But when you’re carrying personal belongings, you can be at risk. When you’re on the go, valuable holiday essentials like mobile phones and passports can easily get lost, damaged or stolen.

You’re also likely to be carrying travel money and important documents while staying in hostels and hopping on and off public transport. It’s easy to misplace items when you’re always on the move.

That’s where travel insurance comes in. It can insure your important documents, personal baggage and even travel money up to an amount set out in your policy.

If you become ill or injured during your trip, you may need medical assistance. And if you don’t have the right level of cover, you could face a large medical bill. Backpackers can get cover for unexpected medical expenses by taking out travel insurance that can insure you whether you’re travelling across one or many countries.

Choosing the right travel insurance

Anyone heading on an adventure abroad for a longer period should consider extended trip travel insurance .

There are a few things to think about when finding the best backpacker insurance for your adventure. Start by looking at what each long stay insurance policy offers and compare them based on your needs. Think about the policy’s maximum stay length and the amount your baggage is insured for. You can also look to see if cover for flight cancellations or disruptions is included.

Whether you’re a student backpacker travelling for a year abroad, or planning to work overseas, we understand that plans might change. And if you travel for longer than initially planned, you can usually extend the cover of your insurance from wherever you are in the world. With Sainsbury’s Bank Extended Trip Travel Insurance, it’s easy to do this, up to a maximum of 548 days.

Why Sainsbury’s Bank Travel Insurance?

You’ve planned your trip and now you need to decide on the best backpacker travel insurance. With our extended trip policy, you’ll get:

- Up to 20% off if you’re a Nectar member. Exclusions apply*

- Three levels of cover to choose from – Silver, Gold or Platinum

- Cover for up to 548 days of travel – depending on which level of cover you choose

- Compensation if your flight is delayed by 12 hours or more at your first international departure point in the UK

- Access to a 24-hour helpline available in case of medical emergencies while you’re away

- The cost of lost or stolen personal possessions covered, including important travel documents such as a passport

- Cover for a wide range of pre-existing medical conditions

Limits, exclusions and excesses apply.

Covid-19 Cover

Covid-19 cover is included as standard on all of our policies. Don’t forget to check the latest Foreign, Commonwealth and Development Office (FCDO) and local government travel advice before you go. You won’t be covered if you travel against it.

For full details of the Covid-19 cover provided on new and existing policies take a look at our policy booklet .

Optional winter sports cover

Heading down the slopes as part of your backpacking trip? If so, you can add our optional winter sports cover to your Sainsbury’s Bank Travel Insurance policy. Make sure you’re fully insured while away, including cover for your winter sports equipment.

Tips for your backpacker holiday

Whether you’re exploring the wonders of South East Asia or taking a trip down under in Australia, you should be prepared. We’ve pulled together some tips to help you blend in with the locals, stay safe and make the most of your adventure.

Pack medication

Backpacking is an exciting time, full of new experiences and cultures. However, in a medical emergency, not speaking the language can be difficult. If you have a pre-existing medical condition that requires medication, you should visit your doctor before you go and ask for an extended supply. Avoid the panic of trying to translate medical jargon or finding the local pharmacy by packing precautionary medication.

Remember that all of our travel insurance policies can cover a range of pre-existing medical conditions .

It’s also worth checking FCO travel advice before bringing medication into a foreign country.

Tell your bank

If you plan to use your card abroad to withdraw money, it's advised that you tell your bank about your travel plans. This will allow you to continue using your credit and debit cards without the fraud detection on your accounts being triggered, preventing you from using your cards. In some instances, your card may even be swallowed by the machine or blocked from further use. By letting your bank know about your travel plans before your trip, you should be able to use your card abroad with no issues.

Prefer not to use your bank cards or carry lots of cash while backpacking? A Sainsbury's Bank Multi-currency Cash Passport™ Mastercard® offers an easy and safe alternative to foreign currency. Load it online with up to 15 currencies, and you’re ready to start spending.

Keep a journal

Backpacking holidays are considered a trip of a lifetime. Why not capture your memories with a journal? Write down your experiences, any food you’ve tried and the contact details of people you’ve met. Take photographs at every opportunity so you can look back at the places you’ve visited and share memories with people back home.

You could even consider starting a travel blog, to document your wanderlust adventures and connect with other travellers.

Daydreaming about beach days and relaxing by the pool? Finding the best spots and nicest hostels can take a bit of planning. Before you jet off, spend some time researching places to visit and reading reviews of accommodation from like-minded travellers. When backpacking, you may want to strip back from luxuries and save on accommodation. Why not spend some time finding affordable hostels to book in advance?

Before you go, map out the places you want to visit and how long you want to spend in each one. Time flies when you’re having fun, so make sure you tick off everywhere on your bucket list by planning your route. Or don’t, and just go wherever you fancy, whenever you fancy it.

Before you pack your bags

Our useful travel guides will help to prepare you for your backpacking holiday.

Worldwide travel insurance

Purchasing travel insurance during the time of Covid can be overwhelming – will you be covered in case of cancellation, or do policies that offer medical assistance for Covid exist? Here, we break down the policies that offer Covid cover, plus what to look for in a travel insurance policy and whether your insurance is invalidated if the government advises not to travel.

What is the best travel insurance with Covid cancellation cover?

Yes, here goes... Note though, all policies currently have restrictions on claims relating to Covid-19 and be aware that the situation is changing fast, so double-check the latest cover before you buy.

All Clear Travel Insurance ( allcleartravel.co.uk ): cover is available to people of all ages but particularly suitable for travellers with pre-existing medical conditions that other insurers are reluctant to cover.

Axa ( axa.co.uk ): this long-established, French-owned company is one of the largest insurers, providing a wide range of different policies geared to a variety of travel types.

Battleface ( battleface.com ): geared to individuals and groups with an emphasis on adventurous activities abroad and travel to remote destinations.

Campbell Irvine Direct ( campbellirvinedirect.com ): this insurer was established more than 45 years ago, and policies offer cover for travel to challenging and adventurous locations, including conservation and volunteer projects.

CoverForYou ( coverforyou.com ): competitively priced policies include winter sports and backpacker cover with enhanced silver, gold and platinum options.

Holidaysafe ( holidaysafe.co.uk ): catch-all travel specialist with a portfolio of ‘niche’ policies covering specific sporting activities including triathlon, sailing and cycling .

LV Travel Insurance ( lv.com ): one of the UK’s largest and longest-standing insurers, founded in 1843, offering single and multi-trip cover.

PJ Hayman ( pjhayman.com ): strong on customer care, with cover for medical conditions and hazardous activities plus round-the-world and gap-year travel.

Puffin Insurance ( puffininsurance.com ): annual or single-trip policies for customers aged 18-74, covering more than 75 different activities with numerous optional add-ons.

Trailfinders ( trailfinders.com ): policy automatically includes children up to 21 years, free of charge (note those aged 19-21 must be in full-time education).

Can I get travel insurance during Covid?

In a word, yes. Some companies (see list above) say they will still sell you insurance – including the crucial medical-expenses cover – provided the UK's Foreign, Commonwealth and Development Office (FCDO) doesn’t advise against all or all but essential travel. Check the current FCDO list for the latest advice. Some insurers will also offer cover for destinations on the red list , but in the current climate of uncertainty, rules governing travel to individual countries can change fast. Travel-insurance specialist Battleface has a useful country travel restrictions tool on its website to help people check the latest developments based on a variety of factors including destination and departure dates.

Why is travel insurance important?

If you have a trip booked and don’t yet have insurance, it’s important to buy a policy as soon as possible. That way, if anything changes – FCDO advice for example – you will already have cover in place. The problem with choosing the best policy is that everyone has different requirements – it may depend on your destination, the type of trip (are you doing lots of adventurous activities , for example?) and quite detailed, nerdy stuff such as ‘travel disruption cover’, which is particularly useful at the moment if you are travelling independently. There is no shortcut to checking through the key provisions of any insurance you are considering.

What should I look for in a travel insurance policy during the pandemic?

This is the key problem. Insurers are obviously jumpy about how exposed they are to claims both for cancellations because of Covid-19 and for medical treatment as a result of catching it while you are abroad. So all have added restrictions and exclusions into their policies. You need to check exactly what those are and make sure you understand the limitations of the cover.

Does travel insurance cover Covid cancellations?

If you already have travel insurance it will normally cover your cancellation costs if you, or one of your travelling companions, falls ill before departure and can’t travel – though you will need a medical report from your doctor to confirm this. Some policies – though not many – cover losses incurred if you have booked independently and have to cancel because of FCDO advice. Look for ‘travel disruption cover’ or ‘journey disruption cover’ in the policy details, which may or may not include disruption due to epidemics (see below for more information). If you are forced to quarantine in a hotel after visiting a red list country, this is unlikely to be covered by any insurance companies. If you are simply nervous of travelling and want to cancel – which is known as ‘disinclination to travel’ in the insurance industry – no policy will cover you.

So what use is travel insurance during the Covid pandemic?

The key value of travel insurance is the medical cover it offers while you are travelling. This will underwrite the cost of treatment and if necessary a hospital stay if you fall ill on holiday. But whether or not you are covered for accommodation costs if you are diagnosed with Covid-19 and have to enter self-isolation or quarantine while you are abroad varies by policy. Some insurers, however, will pay up if you need a new flight home in these circumstances. In short – it varies, so be sure to read the small print.

Is my travel insurance invalidated if the FCDO advises not to travel?

In normal times, travel insurers won’t provide cover to countries or regions where the FCDO advises against all but essential travel. Traditionally, these areas might include destinations such as Afghanistan, Iraq or Yemen, but in recent times it has included much of Europe too, with countries being regularly added to and taken off the UK's quarantine list. However, some insurers now offer affordable policies that are designed for travellers heading to these European destinations, which may be of use once the lockdowns start to ease. As ever, it’s important to read the small print. For example, policies are invalidated during a government-imposed regional or national lockdown in the UK.

Can I get insurance cover if I catch Covid abroad?

Some insurers will cover against coronavirus if the FCDO has listed your destination as safe to visit before you head off. Some offer cancellation cover if you’re diagnosed with Covid-19 within a fortnight of departure, including emergency Covid-related medical expenses while abroad and repatriation, as well as cover in the event of a travelling companion contracting the disease. And you can find insurers that offer cover for medical expenses resulting from Covid-19 for all destinations including countries under FCDO and government essential and non-essential travel advisories.

So what happens if my holiday is cancelled?

If you have booked a package with a tour operator and the FCDO advises against all but essential travel to your destination, your tour operator is obliged to cancel the holiday and offer you a full refund. They might also offer you an alternative holiday, or suggest you postpone travelling dates, but you are entitled to get your cash back. If you can afford to, consider postponing your trip rather than cancelling it completely, should your health or updated government advice mean that you can’t go away as planned. There are a lot of people out there relying on us to keep spending on travel, with around 10 per cent of the world's population earning an income that is linked to tourism. To learn more about how important this is, see our guide to why you shouldn't cancel your holiday .

What if I booked my trip independently?

Travellers who have booked, say, a flight and accommodation separately, normally have no right to a refund if they cancel unilaterally, even if the FCDO has since advised against travel. In practice, however, most airlines are cancelling flights and refunding passengers in this situation. A hotel or villa company doesn’t have to give you your money back – though it is obviously worth talking to them; they may allow you to postpone your stay.

Will my insurance cover me if my airline collapses?

It’s vital to make sure you pay for flights with a credit card (if you are booking a flight directly with the airline and it costs more than £100 you can claim your money back from the credit card company), and check that any tour operator you book with has up-to-date Atol protection – or can show that it has an alternative bonding arrangement in place.

Which websites should I check for the best travel insurance information and advice?

A good website that gives the latest figures for every country reporting cases of Covid-19 is worldometers.info . For the latest formal FCDO advice on every country in the world see gov.uk and search for travel advice. The best health advice is at nhs.uk .

By Olivia Morelli

By Mary Lussiana

By Connor Sturges

Am I still covered by the EHIC scheme in Europe?

Yes and no. As of Thursday 31 December 2020, Britain left the EU, but anyone holding a valid EHIC (European Health Insurance Card) will be covered for state-supplied medical care while holidaying in Europe until it runs out. And while the EHIC card has been scrapped for anyone who doesn't currently hold one, it has been replaced by the very similar GHIC (Global Health Insurance Card).

Anything else I need to worry about?

Insurers have become very jumpy about pre-existing medical conditions in recent years because they add to the risk of expensive medical claims and cancellations. It is absolutely critical that you declare any conditions you may have when you buy a policy, otherwise – if you do need treatment while you are travelling – you may find your claim is refused.

- Meet the Team

- Work with Us

- Czech Republic

- Netherlands

- Switzerland

- Scandinavia

- Philippines

- South Korea

- New Zealand

- South Africa

- Budget Travel

- Work & Travel

- The Broke Backpacker Manifesto

- Travel Resources

- How to Travel on $10/day

Home » Budget Travel » World Nomads Travel Insurance – EPIC Review (2024)

World Nomads Travel Insurance – EPIC Review (2024)

Let’s be honest, travel insurance is not sexy and travel insurance is not fun. Actually, as a budget backpacker it is a colossal pain in the arse having to pay out for some policy which I am statistically unlikely to ever need.

BUT, after a decade of travelling and after some bitter realisations along the way, we can tell that travel insurance is a VERY important matter.

In this post, we will examine who may need it and what it can cover. And we will focus on World Nomads – a trusted, travel insure who we have known for years – and break down why we consider their cover to be amongst our personal favourite products.

The Broke Backpacker is supported by you . Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free content 🙂 Learn more .

Does World Nomads Travel Insurance Cover COVID?

What is the best travel insurance for backpackers, but hang on, do you need travel insurance, world nomads travel insurance, what is so special about world nomads, world nomads travel insurance cost, how to make an insurance claim via world nomads, personal experience with world nomads, how to buy world nomads travel insurance, staying safe on your adventure.

Let’s get this out of the way first shall we eh?