Straits Times Index

S&p 500, bitcoin usd, cmc crypto 200, ftse bursa malaysia, jakarta composite index, amex travel insurance singapore (chubb travel insurance) review 2022.

If you have an American Express credit card, you’re probably familiar with Amex travel insurance . Technically, it’s actually Chubb travel insurance , but it’s sold under the brand American Express My VoyageGuard.

Yup, these days you can buy insurance from the nearest bank or credit card company. Kinda like when HMV reduced their CD section and started selling peripheral crap like hoodies and toys. (Anyone remember this… or am I just showing my age?)

Buying travel insurance from your credit card company is convenient, but what’s really in that American Express travel insurance plan? Let’s have a look.

Amex travel insurance at a glance

American Express travel insurance is sold under the My VoyageGuard brand, and it comes in 3 varieties: Essential, Standard and Superior. Here’s how they compare:

*All figures based on a 7-day trip to United States of America

Amex travel insurance promotions

You can stay up to date on the latest Amex travel insurance promotions here.

You can get free travel insurance coverage if you charge your full airfare to the Amex KrisFlyer Ascend credit card . However, this is only for travel accidents and delays, not for things like medical expenses, so it’s insufficient for most people.

Convenience & Perks for Frequent Flyers

American Express Singapore Airlines KrisFlyer Ascend Credit Card

Local Spend

Overseas Spend

More Details

Key Features

1.2 KrisFlyer miles = S$1

2 KrisFlyer miles = S$1 in foreign currency spent overseas on eligible purchases in June & Dec

3.2 KrisFlyer miles = S$1 for Grab Singapore transactions, capped at S$200 per month

Spend above S$15,000 on eligible purchases on singaporeair.com within first 12 months of Card approval and get upgraded to KrisFlyer Elite Gold Membership

Up to $1 million travel insurance coverage

See all card details

What does Amex travel insurance cover?

First of all, it must be said that the medical benefit of $500,000 under normal circumstances and $150,000 for COVID-19 related medical expenses is crazy high, especially for a basic plan. You’d typically need to upgrade to a more premium plan to get such a high coverage limit. (I guess buying travel insurance from an American company has its perks, right?)

Another thing that impressed me was that there was absolutely nothing at all in the Amex travel insurance policy wording to exclude outdoor activities or even extreme sports. Definitely one for adventurous #YOLO types.

However, apart from the impressive medical coverage limits and ultra-lenient policy, the other travel insurance benefits are merely so-so.

Chubb travel insurance claim procedure

Even though you buy this travel insurance from American Express channels, every aspect of the after-sales support is taken care of by Chubb Insurance.

Chubb has a very good international reputation for its emergency assistance, which is reassuring if your idea of a good time is trying to cheat death.

Emergency hotline: Call the Chubb Assistance emergency hotline at +65 6836 2922.

Online claims: Submit claims and supporting documents online through Chubb’s online portal . Alternatively, download the claims form PDF and email with documents to [email protected].

You’ll get an acknowledgement within 3 days.

Conclusion: Should you buy Amex travel insurance?

The answer would vary greatly depending on what the current Amex travel insurance promotion is like.

If there’s a good ongoing promotion off, then yes, the cheapest Essential is probably one of the best travel insurance plans you can buy in terms of medical coverage. This is something you’d want to consider if you’re going to a place known for expensive healthcare, such as Japan, Norway or the US.

The fact that Amex is super lenient and covers almost every death-defying experience you can think of makes it even more impressive. So if you’re that extreme, this might be the best travel insurance in Singapore for you.

On the other hand, if there isn’t a deep discount, then Amex travel insurance is pricier than average and won’t offer that much bang for your buck. Note that its benefits for stuff like personal accident and travel inconveniences aren’t really spectacular.

Looking to buy Amex travel insurance ? Compare all Singapore travel insurance policies by price and coverage first .

The post Amex Travel Insurance Singapore (Chubb Travel Insurance) Review 2022 appeared first on the MoneySmart blog .

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans , Insurance and Credit Cards on our site now!

The post Amex Travel Insurance Singapore (Chubb Travel Insurance) Review 2022 appeared first on MoneySmart.sg .

Original article: Amex Travel Insurance Singapore (Chubb Travel Insurance) Review 2022 .

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Latest stories

Under armour is collapsing — and kevin plank has to take the blame.

The Under Armour meltdown continues.

He fell in love with Thailand while traveling in his 20s. Now 40, he's back and has built his dream 'James Bond' luxury villa.

"It's much cheaper to build. The final product that I have here, I couldn't have afforded to buy that off the shelf," Johnny Ward told BI.

Pep Guardiola names next manager to become chief rival after Jurgen Klopp calls it a day

The Manchester City boss lauded the departing Liverpool manager before setting sights on his next would-be challenger

The COVID "FLiRT" Symptoms You Need to Know About

There are several COVID variants right now which have the same "set of mutations," and are being referred to as FLiRT. Here are symptoms to watch out for.

Man Utd end worst Premier League season – Erik ten Hag now has one shot at redemption

The Brighton fans at the final whistle were to the point.

Premier League team of the season: three Arsenal and Man City players but just one Liverpool star

Choosing a team of the season is an almost impossible task, not least because there is often more than one player excelling in a position.

Iranian president Ebrahim Raisi missing after helicopter crash in heavy fog

Forty rescue teams have been scrambled to find the missing aircraft in a border area

China is pushing. The Philippine forces are pushing back - with ship-killer missiles

For a country sharing a long and disputed maritime border with China, The Philippines was seriously lacking in military force for protecting that border.

11 best mee hoon kueh in Singapore that will leave you (hand)torn for choice

The post 11 best mee hoon kueh in Singapore that will leave you (hand)torn for choice appeared first on SETHLUI.com.

I Actually Think I Lost All Faith In Men After Learning Some Of The Things Women Have Accidentally Found In Men's Homes

"At least keep that stuff in the guest room…"

The top 10 best food neighbourhoods in Singapore, ranked by SethLui readers

The post The top 10 best food neighbourhoods in Singapore, ranked by SethLui readers appeared first on SETHLUI.com.

Russia-Ukraine war – latest: Putin loses more than 1,500 soldiers in faltering Kharkiv offensive

Zelensky says ‘world can stop Russian terror’ as he seeks more Patriots for Ukraine

Mauricio Pochettino explains why he didn't join Chelsea players for lap of appreciation

Blues boss walked straight down the tunnel at full-time

Biden Camp Has a Field Day With Wobbly Trump at Podium

XThe Biden campaign gleefully turned one of Donald Trump’s favorite digs against him on Saturday, branding the 78-year-old candidate as woefully geriatric in response to his embarrassing stumble at a Minnesota rally on Friday.Video from the event shared by Biden-Harris HQ on X showed Trump grabbing the lectern during his remarks on stage, after nearly toppling the podium over.A feeble Trump nearly falls down on stage after he leans on his podium too hard and then goes on an angry rant calling hi

Trump appears to freeze for 30 seconds on stage during NRA speech

Biden and Trump campaigns continue to trade barbs over accusations candidates are senile

Russia is finally getting serious about its war, and it spells trouble for Ukraine

Russian President Vladimir Putin's war machine looks different today than it did at the start of the conflict.

Man City’s 115 charges and Pep Guardiola’s exit are looming despite latest triumph

Nothing drew attention to the elephant in the room quite like the absence of the Premier League’s chief executive at the Etihad Stadium on Sunday.

Erik ten Hag: Everyone knows why Manchester United recorded worst ever Premier League finish

The club finished eighth this season despite winning on the final day

The Latest | Iran's president, foreign minister and others are found dead at helicopter crash site

Iranian President Ebrahim Raisi, the country’s foreign minister and others have been found dead at the site of a helicopter crash after an hourslong search through a foggy, mountainous region of the country’s northwest, state media reported. State TV gave no immediate cause for the crash in Iran’s East Azerbaijan province. With Raisi were Iran’s Foreign Minister Hossein Amirabdollahian, the governor of Iran’s East Azerbaijan province and other officials and bodyguards, the state-run IRNA news agency reported.

Father of murdered Israeli hostage Shani Louk 'relieved' as her body returns home

As a little girl Shani Louk would walk into the pine forests on the hills behind her home and pick flowers and look for animals. Of course we want that all these people will come back and I hope they will come back.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

The Guide to American Express Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

American Express travel insurance vs. coverage provided by AmEx cards

Complimentary travel insurance provided by amex cards.

Trip cancellation and interruption insurance

Trip delay insurance

Car rental loss and damage insurance

Baggage insurance

Premium global assist.

Global Assist Hotline

Standalone American Express travel insurance plans

Should you use the complimentary benefits or purchase a policy, amex travel insurance recapped.

You can get AmEx travel insurance via your card or as a standalone policy.

AmEx cards typically include coverage for trip delays, interruptions, cancellations, baggage and car rentals.

Coverage tends to be secondary.

Policies vary by card.

American Express has two different types of travel insurance offerings: standalone travel insurance plans that customers can purchase and travel insurance that is included as a complimentary benefit on certain cards.

So if you’re thinking about getting travel insurance before a trip, get familiar with American Express travel insurance benefits that are included on your credit cards. Knowing what protections you already have will prevent you from spending money on a separate policy with benefits that overlap.

A standalone travel insurance policy from American Express may offer more robust coverage, but depending on your needs, the travel insurance perks provided by your AmEx card may be sufficient.

If you primarily want specific coverage for cancellations, delays or rental cars and baggage, it’s likely your card will be enough.

If, however, you’re mainly concerned with emergency health coverage while traveling , you’re better off with a separate medical insurance policy because the benefits provided by credit cards are limited in those areas. You can purchase this from American Express directly or shop around other travel insurance companies .

» Learn more: How to find the best travel insurance

There are six travel insurance benefits offered on many American Express cards:

Trip cancellation and interruption insurance .

Trip delay insurance .

Car rental loss and damage insurance .

Baggage insurance plans .

Premium Global Assist Hotline .

Global Assist Hotline .

Here's a closer look at each.

Trip cancellation will protect you if you need to cancel your trip for a covered reason (more below), and you will be reimbursed for any nonrefundable amounts paid to a travel supplier with your AmEx card. Bookings made with Membership Reward Points are also eligible for reimbursement. Travel suppliers are generally defined as airlines, tour operators, cruise companies or other common carriers.

Trip interruption coverage applies if you experience a covered loss on your way to the point of departure or after departure. AmEx will reimburse you if you miss your flight or incur additional transportation expenses due to the interruption. American Express considers the following to be covered reasons:

Accidental injuries.

Illness (must have proof from doctor).

Inclement weather.

Change in military orders.

Terrorist acts.

Non-postponable jury duty or subpoena by a court.

An event occurring that makes the traveler’s home uninhabitable.

Quarantine imposed by a doctor for medical reasons.

There are many reasons that are specifically called out as not covered (e.g., preexisting conditions, war, self-harm, fraud and more), so we recommend checking the terms of your coverage carefully.

If you want a higher level of coverage for trip cancellation, consider purchasing Cancel For Any Reason (CFAR) travel insurance . CFAR is an optional upgrade available on some standalone travel insurance plans. This supplementary benefit allows you to cancel a trip for any reason and get a partial refund of your nonrefundable deposit.

Alternately, if you want what essentially amounts to CFAR insurance on your flights specifically, purchase your fares through the AmEx Travel portal and tack on Trip Cancel Guard for an extra fee. Trip Cancel Guard guarantees you an up to 75% refund on nonrefundable airfare costs when you cancel at least two days before departure, regardless of why. This isn't as comprehensive as other CFAR policies, but it can add some peace of mind for people who want the cash back (as opposed to a travel credit) for flights they may not take.

AmEx cards with trip cancellation, interruption coverage

The following American Express credit cards offer trip cancellation and trip interruption coverage:

on American Express' website

Additional AmEx cards that offer trip cancellation and interruption coverage include:

The Business Platinum Card® from American Express .

Centurion® Card from American Express.

Business Centurion® Card from American Express.

The Corporate Centurion® Card from American Express.

The Platinum Card® from American Express for Ameriprise Financial.

The American Express Platinum Card® for Schwab.

The Platinum Card® from American Express for Goldman Sachs.

The Platinum Card® from American Express for Morgan Stanley.

Corporate Platinum Card®.

Delta SkyMiles® Reserve Business American Express Card .

Terms apply.

Covered amount

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period. Coverage is secondary and applies after your primary policy provides reimbursement. Claims must be filed within 60 days. To start a claim, call 844-933-0648.

This benefit will reimburse you for reasonable, additional expenses incurred if a trip is delayed by a certain number of hours. Examples of eligible expenses include meals, lodging, toiletries, medication and other charges that are deemed appropriate by American Express. It makes sense to use your judgment in terms of what will get approved based on your policy's fine print.

Acceptable delays include those that are caused by weather, terrorist actions, carrier equipment failure, or lost/stolen passports or travel documents. There are also plenty of exclusions, such as intentional acts by the traveler.

AmEx cards with trip delay insurance

The reimbursable amount depends on which card you hold.

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Up to $300 per Covered Trip that is delayed for more than 12 hours; and 2 claims per Eligible Card per 12 consecutive month period.

As expected, the more premium travel credit cards offer higher compensation for shorter delays. Trip delay insurance is offered on the following American Express credit cards:

When you decline the collision damage waiver offered by the car rental agency, you will be covered if the car is damaged or stolen through your AmEx Travel Insurance. Depending on the card you have, the coverage is $50,000 or $75,000.

» Learn more: How AmEx car rental insurance works

In addition, the cards offering car rental damage and theft insurance up to of $75,000 also provide secondary benefits:

Accidental death or dismemberment coverage.

Accidental injury coverage.

Car rental personal property coverage.

To qualify, you must decline the personal accident coverage and personal effects insurance provided by your car rental company.

The entire rental must be charged on the American Express credit card to receive coverage for car rental loss and damage. And keep in mind that you do still need liability insurance when making your rental car reservation (you may have this through your personal auto insurance policy), as these credit card-provided coverage options don't include personal liability.

AmEx cards with car rental coverage

American Express lists over 50 different cards on its site that come with one of the two forms of car rental insurance. Cards that link to the Tier 1 policies are the $50,000-coverage cards, and Tier 2 policies are the $75,000 cards.

Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

Car Rental Loss and Damage Insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

The amount reimbursed is calculated as whichever is lowest:

The cost to repair the rental car.

The wholesale book value (minus salvage and depreciation).

The invoice purchase price (minus salvage and depreciation).

Here are some key exclusions to be aware of with this coverage:

These policies don't cover theft or damage that was caused by a driver’s illegal operation of the car, operation under the influence of drugs/alcohol or damage caused by any acts of war.

Policies don't cover drivers not named as "authorized drivers" on your rental agreement.

The benefit only covers car rentals up to 30 consecutive days.

Not all cars are included in the policy. Certain trucks, vans, limousines, motorcycles and campers are excluded from coverage.

Insurance protection doesn't apply in Australia, Italy, New Zealand and any country subject to U.S. sanctions .

You can file a claim online or call toll-free in the U.S. at 800-338-1670. From overseas, call collect 216-617-2500. Your claim must be filed within 30 days of the loss. Additionally, some benefits vary by state, so check the policy for your specific card.

» Learn more: The guide to AmEx Platinum’s rental car insurance

As an American Express cardholder, you are eligible to receive compensation if your luggage is lost or stolen. This benefit is in addition to what you may receive from the carrier. However, the AmEx policy is secondary, which means that it kicks in after the carrier provides any compensation for losses.

AmEx provides this insurance to "covered persons," who are defined as:

The cardmember.

Their spouse or domestic partner.

Their dependent children who are under 23 years old (there are age exceptions for handicap children).

Some business travelers (Tier 2 coverage only).

To qualify, all covered individuals need to be traveling on the same reservation and must be residents of the U.S., Puerto Rico or the U.S. Virgin Islands.

AmEx cards with baggage insurance

Naturally, the higher-end cards offer more protection — but even the basic cards have decent coverage. The compensation limits per person are as follows (note that the maximum payout per covered person for lost luggage is $3,000 on all of these cards).

Below are the limits for cardholders of the The Platinum Card® from American Express , The Business Platinum Card® from American Express , The American Express Platinum Card® for Schwab, The Platinum Card® from American Express for Goldman Sachs, The Platinum Card® from American Express for Morgan Stanley, Hilton Honors American Express Aspire Card , Marriott Bonvoy Brilliant™ American Express® Card, Centurion® Card from American Express and Business Centurion® Card from American Express:

Baggage in-transit to/from common carrier: $3,000.

Carry-on baggage: $3,000.

Checked luggage: $2,000.

Combined maximum: $3,000.

High-end items: $1,000.

Disclosure: Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

And here are the coverage limits for cardholders of the American Express® Gold Card , American Express® Business Gold Card , American Express® Green Card , Business Green Rewards Card from American Express , Hilton Honors American Express Surpass® Card , Marriott Bonvoy™ American Express® Card, Marriott Bonvoy Business® American Express® Card , Delta SkyMiles® Reserve American Express Card , Delta SkyMiles® Reserve Business American Express Card , Delta SkyMiles® Platinum American Express Card , Delta SkyMiles® Platinum Business American Express Card , Delta SkyMiles® Gold American Express Card and Delta SkyMiles® Gold Business American Express Card , The Hilton Honors American Express Business Card :

Baggage in-transit to/from common carrier: $1,250.

Carry-on baggage: $1,250.

Checked luggage: $500.

High-end items: $250.

Disclosure: Baggage Insurance Plan coverage can be in effect for Eligible Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier (e.g. plane, train, ship, or bus) when the entire fare for a Common Carrier Vehicle ticket for the trip (one-way or round-trip) is charged to an eligible Account. Coverage can be provided for up to $1,250 for carry-on Baggage and up to $500 for checked Baggage, in excess of coverage provided by the Common Carrier (e.g. plane, train, ship, or bus). For New York State residents, there is a $10,000 aggregate maximum limit for all Covered Persons per Covered Trip.

AmEx also offers limited reimbursement for high-end items (coverage varies by card), such as:

Sports equipment.

Photography or electronic equipment.

Computers and audiovisual equipment.

Wearable technology.

Furs (including items made mostly of fur and those trimmed/lined with fur).

Items made fully or partially of gold, silver or platinum.

Claims must be filed within 30 days of your baggage loss. To file a claim, call 800-645-9700 from the U.S. or collect to 303-273-6498 if overseas. You can also file a claim online.

» Learn more: Compare travel insurance options: airline or credit card?

This benefit helps with events like replacing a lost passport, missing luggage assistance, emergency legal and medical referrals, and in some instances, emergency medical transportation assistance.

The service can also help you figure out important travel-related details like customs information, currency information, travel warnings, tourist office locations, foreign exchange rates, vaccine recommendations for the country you’re visiting, passport/visa requirements and weather forecasts.

AmEx cards with Premium Global Assist

Premium Global Assistance is offered on the following American Express credit cards:

The Platinum Card® from American Express .

Delta SkyMiles® Reserve American Express Card .

Hilton Honors American Express Aspire Card .

Marriott Bonvoy Brilliant™ American Express® Card.

Services provided by Premium Global Assist Hotline

You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, the Premium Global Assist Hotline may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility.

The hotline isn’t so much a concierge as a service that provides logistical assistance, which can include the following:

General travel advice

Emergency translation if you need an interpreter to help with legal or medical documents (cost isn't covered).

Lost item search if your belongings are lost while traveling.

Missing luggage assistance if an airline loses your luggage. The hotline will contact your airline on a daily basis on your behalf to help locate your bags.

Passport/credit card assistance if your credit card or passport is lost or stolen.

Urgent message relay if you need to contact a family member and/or friend in the event of an emergency.

Medical assistance

Emergency medical transportation assistance if the cardmember or another covered family member traveling on the same itinerary gets sick or injured and needs medical treatment (there are many conditions for this coverage; review your policy’s fine print).

Physician referral if you need a doctor or dentist (cardmember is responsible for costs).

Repatriation of remains in the event of death.

Financial assistance

Emergency wire service to get help obtaining cash (fees will be reimbursed).

Emergency hotel check in/out if your card has been lost or stolen.

Legal assistance

Bail bond assistance if you need access to an agency that accepts AmEx (cardmember is responsible for paying bail bond fees).

Embassy and consulate referral if you need help finding or accessing local embassies.

English-speaking lawyer referral if you’re traveling and need a list of available attorneys (cardmember is responsible for any legal fees).

To use this benefit, call the Premium Global Assist Hotline toll-free at 800-345-AMEX (2639). You can also call collect at 715-343-7979.

The main difference between the Global Assist Hotline and the Premium version is that some of the services that are fully covered by Premium Global Assist aren't covered in the more basic version (cited examples include emergency medical transportation assistance and repatriation of mortal remains).

You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Third-party service costs may be your responsibility.

AmEx cards with Global Assist Hotline access

The Global Assist Hotline is available to holders of the following cards:

American Express® Gold Card .

American Express® Business Gold Card .

American Express® Green Card .

Business Green Rewards Card from American Express .

Delta SkyMiles® Platinum American Express Card .

Delta SkyMiles® Platinum Business American Express Card .

Delta SkyMiles® Gold American Express Card .

Delta SkyMiles® Gold Business American Express Card .

Delta SkyMiles® Blue American Express Card .

Hilton Honors American Express Surpass® Card .

Hilton Honors American Express Card .

The Hilton Honors American Express Business Card .

Marriott Bonvoy™ American Express® Card.

Marriott Bonvoy Business® American Express® Card .

The Amex EveryDay® Preferred Credit Card from American Express .

Amex EveryDay® Credit Card .

Blue Cash Preferred® Card from American Express .

The American Express Blue Business Cash™ Card .

The Blue Business® Plus Credit Card from American Express .

You can call the Global Assist Hotline toll-free at 800-333-AMEX (2639), or collect at 715-343-7977.

If you don’t have any of the credit cards above and are thinking about purchasing a policy from American Express or just simply want to price compare to see if you get better perks by purchasing a policy, you can go to the AmEx travel insurance website and input your trip plans to build a quote. You’ll need to provide your departure and return date, state of residence, age of traveler, number of travelers covered by the policy and the trip cost per traveler. Then, you can select the option of choosing a package or building your own.

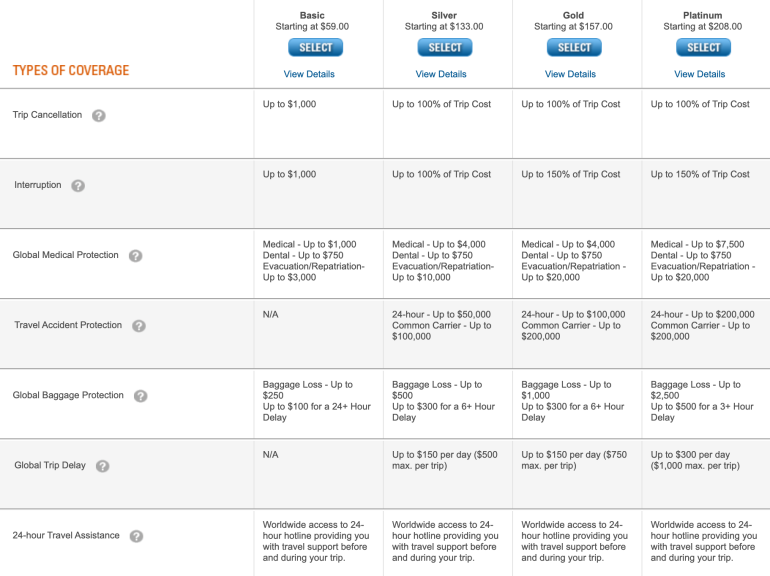

To see which plans are available, we input a sample $3,000, one-week trip by a 35-year-old from South Dakota. Our search result yielded four different plans ranging from $59 for a Basic plan to $208 for a Platinum plan.

Global medical protection (not included on AmEx cards)

Medical protection includes coverage for emergency healthcare and dental costs as well as medical evacuation and repatriation of remains . The limits increase as the plans become more expensive. Although AmEx cards offer an array of travel insurance benefits, medical coverage isn't included. So if medical protection benefits are important to you, a standalone travel insurance policy is what you’ll want to look for.

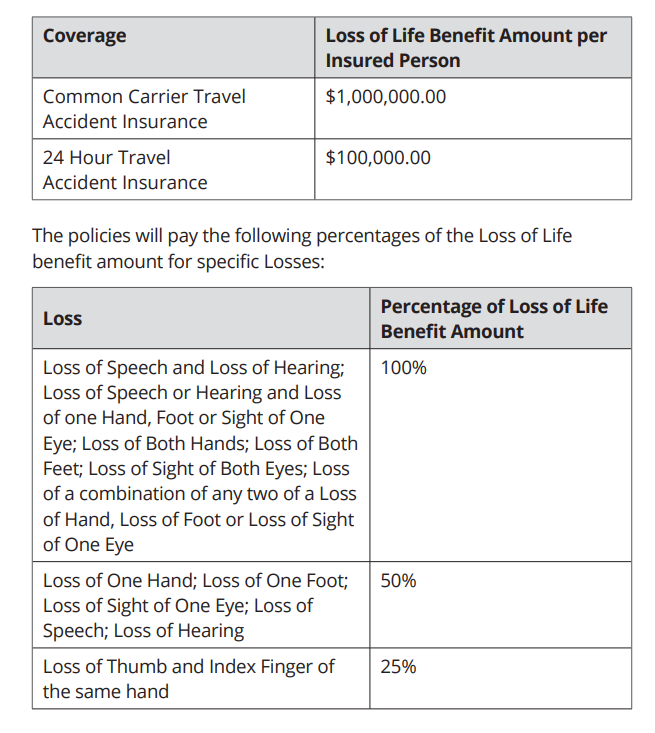

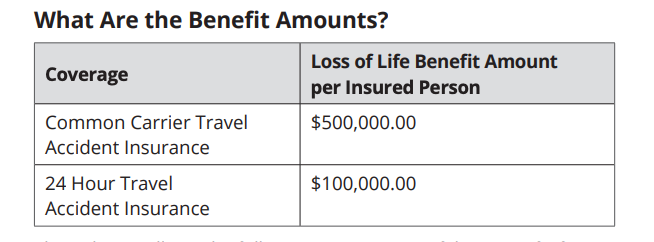

Travel accident protection (not included on AmEx cards)

Another benefit not included with AmEx cards is travel accident protection. This benefit provides coverage in case of death or dismemberment while traveling . Although this is a topic no one wants to think about, it's good to be familiar with this coverage. While travel accident protection isn’t offered on the Basic plan, all of the higher plans offer it.

Standalone policy benefits that are also included on AmEx cards

These elements of coverage are offered on the AmEx cards mentioned, although in some, the limits may be higher or lower.

Trip cancellation

The Basic plan only covers a trip up to $1,000, however, all the other plans cover 100% of the trip cost. To compare this with the perks included as a benefit on the cards, all AmEx cards that include trip cancellation coverage provide up to $10,000 per covered trip.

Keep in mind that, all the cards included have annual fees and the card with the lowest fee is the Hilton Honors American Express Aspire Card , with a $550 annual fee.

Trip interruption

Trip interruption coverage ranges from $1,000 on a Basic plan to 150% of trip cost on the Gold and Platinum plans. The trip interruption benefit offered by the AmEx cards is included on all the same cards that offer trip cancellation insurance, with the trip interruption limit capped at $10,000 per covered trip.

Global baggage protection

If your luggage is lost or stolen this benefit will provide monetary compensation to reimburse you for your lost items. AmEx cards offer baggage coverage as a complimentary benefit, with the higher-end cards naturally providing higher limits. Interestingly, the cards with the lower annual fees (i.e. Hilton Honors American Express Surpass® Card , annual fee $150 ) have a high limit as well, offering a total combined limit for lost luggage of $3,000, which is higher than the coverage offered by the standalone Platinum plan.

Global trip delay

If your trip is delayed, you’re eligible for reimbursement of any necessary expenses incurred up to a specific limit. The Basic plan doesn’t offer this benefit, but all the other plans do, with the Platinum plan providing up to $300 per day (maximum of $1,000 per trip). This coverage is also included on the higher-end AmEx cards.

AmEx cards offer key travel insurance benefits: trip cancellation and interruption insurance, trip delay insurance, car rental loss and damage insurance, baggage insurance, Premium Global Assist Hotline (or Global Assist Hotline). However, they don't offer any sort of emergency medical coverage. This is pretty typical of travel credit cards, as the travel insurance perks they offer don't provide coverage for emergency health care costs.

If you’re looking for emergency medical coverage, you’ll need to purchase a separate policy, such as the standalone one offered by American Express. The other limits provided in the American Express travel insurance policy are comparable to what you get on the AmEx cards, so it makes sense to shop around to make sure that the benefits you’re paying for are sufficient for your needs.

» Learn more: What to know about American Express Platinum travel insurance

Yes, if you have one of the cards listed above. If you have a credit card that isn’t listed in this guide or the card is no longer available by American Express, call the number on the back of your card for more information. Generally, AmEx offers a number of travel insurance benefits on its credit cards that shouldn't be overlooked.

Yes, but it depends on which card you have. To qualify for reimbursement, the trip cancellation must be for a covered reason. Refer to the section "Trip Cancellation and Interruption Insurance" for a list of cards and explanations of covered reasons.

American Express offers a solid range of travel insurance protection across its credit cards, with the premium cards providing the most coverage. However, if you need insurance benefits with higher limits, we recommend purchasing a separate travel insurance policy . If you only need emergency medical coverage , there are policies that provide that as well.

Call the number on the back of your card to ask for guidance. Some benefits may require authorization from American Express before coverage kicks in, so make sure you follow all the correct steps for reimbursement.

Refer to the AmEx credit card policy for the specific benefit because it will include instructions for submitting a claim. If you cannot find the policy, you should call the customer service number on the back of your American Express card for more assistance.

Yes. American Express offers travel insurance as a benefit of some of its cards, but it also sells standalone coverage that you can purchase out-of-pocket. The latter tends to be more comprehensive and customizable to your needs.

No, you do not get automatic travel insurance with American Express. It is available as a benefit on certain cards. Refer to your terms and conditions to learn if you are covered.

American Express cards do not include medical coverage; instead, you will want to purchase a standalone travel insurance policy with medical protections, such as repatriation of remains or medical evacuation coverage .

American Express offers a solid range of travel insurance protection across its credit cards, with the premium cards providing the most coverage. However, if you need insurance benefits with higher limits, we recommend purchasing a

separate travel insurance policy

. If you only need

emergency medical coverage

, there are policies that provide that as well.

American Express cards do not include medical coverage; instead, you will want to purchase a standalone travel insurance policy with medical protections, such as

repatriation of remains or medical evacuation coverage

American Express travel insurance offers a wide array of benefits, especially on its premium cards. Knowing what benefits are available to you is important in the event of unforeseen circumstances. Determine whether an individual policy is a better fit for your risk tolerance than coverage that is included on an eligible card, then go from there.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Underwritten by AMEX Assurance Company.

Baggage insurance plans

Please visit americanexpress.com/benefit sguide for more details.

Premium Global Assist Hotline

If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

Card Members are responsible for the costs charged by third-party service providers.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

6 Best Travel Insurance with COVID-19 Coverage in Singapore (Apr 2024)

COVID-19 might be the last thing on your mind…but it could be the first thing to ruin your next trip. Whether you end up quarantined overseas or have to cancel the holiday entirely, there are plenty of ways COVID-19 could make a vacation go awry. And that’s before you consider things like lost luggage, flight delays , getting pickpocketed, and more.

Good news—there’s an easy way out. Before you jet off to your dream travel destination , don’t forget to buy travel insurance . Covering you for your potential travel disruptions, travel insurance is the next most important thing besides your flight ticket!

Most insurance providers have added COVID-19 coverage to their travel insurance plans, but to varying extents. Some have COVID-19 as an optional add-0n that you have to purchase. Coverage wise, some providers offer far better COVID-19 protection than others.

Find out how to choose, what to look out for, and the cheapest travel insurance you can buy with our comparison of the best travel insurance with COVID-19 coverage in Singapore and their ongoing promotions. Promotions are generous this Apr 2024— you could even win a Rolex Oyster Perpetual , 124200 34mm Silver (worth S$9,000), all-expenses paid trip, or a 2D1N staycation!

Best Travel Insurance in Singapore with COVID-19 Coverage (2024)

- Best travel insurance with COVID-19 coverage

Bubblegum Travel Insurance

- FWD travel insurance

- Starr travel insurance

- MSIG travel insurance

- Singlife travel insurance

- Etiqa travel insurance

- Cheapest travel insurance in Singapore

- Does travel insurance cover COVID-19?

- How do I choose the best travel insurance policy with COVID-19 coverage?

- What do I do if I test positive for COVID-19 during or after travelling?

1. Best travel insurance with COVID-19 coverage

With the sheer number of travel insurance providers out there, it can be overwhelming to compare everything against everything else. We know that pain, because that’s exactly what we’ve just done. Wipe away those tears of exasperation— we’ve done the legwork for you and picked out the top 6 travel insurance plans in Singapore:

Why are these the top 6? We’ve compared them based on affordability, COVID-19 cover inclusion, emergency medical coverage, and trip cancellation coverage. (If you’re an adventure seeker, that’s more niche—refer to this article for all the best travel insurance for extreme sports and outdoor adventure instead.)

Ready to dive into the deets? We compared the coverage and prices of most popular travel insurance plans with COVID-19 coverage in Singapore. So if you’re looking for a specific type of coverage for your travel needs, e.g. high trip cancellation coverage, this is a better summary table for you to work with:

Note: All travel insurance options above are before promotional discounts are applied. Unless otherwise stated, all include COVID-19 coverage.

Back to top

2. Bubblegum Travel Insurance

Bubblegum Travel Insurance is a great option if you’re looking for fuss-free, essential coverage at affordable rates. Bubblegum’s travel insurance model is simple, offering just 1 travel insurance plan. Here are its pricing and coverage benefits:

If fuss-free, essential travel insurance is your top priority, we think Bubblegum is a good option for you. Their travel insurance is all-inclusive with coverage for travel inconveniences like cancellations and delays, and also gives you coverage for COVID-19 related expenses at no additional cost.

If you’re a thrill-seeker looking at adventurous activities, Bubblegum Travel Insurance will also cover you for hot air ballooning, scuba diving and skiing, with no restriction on height or depth.

Bubblegum travel insurance promotion

Total Premium

[Receive your cash as fast as 30 days*] • Enjoy 10% off your policy premium • Get an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$25 via PayNow and up to S$20 iShopChangi e-voucher with eligible premiums spent. T&Cs apply.

Key Features

Bubblegum offers just 1 affordable plan to suit all your travel needs to maximise your savings

Overseas medical expenses up to $150,000 SGD (Covid-19 sub-limit of $65,000 included)

24-Hour global Emergency Assistance services including Emergency Medical Evacuation and Repatriation

Covid-19 trip related cancellation/curtailment up to $600 SGD included

Adventurous activities like scuba diving and hot air ballooning are covered with no limit on depth or height.

Bubblegum is currently offering a 10% discount on all their travel insurance plans. That means you can cover a 7-day trip to ASEAN with just $38—about $5+ a day !

Truth is, the discount is even greater when you consider the fact that Bubblegum will also give you My Millennium Points and cashback when you purchase Bubblegum travel insurance:

- Get 2,400 My Millennium Points (worth $16) with every policy purchased.

- Plus, get $15 Cash via PayNow when you buy a Bubblegum Travel Insurance plan with a premium of $80 to $119.99 OR $25 Cash via PayNow with a premium of $120 and above.

Promotion valid till 30 Apr 2024.

3. FWD Travel Insurance

FWD travel insurance offers some of the cheapest travel insurance plans in Singapore, so this is a budget-friendly option which still offers you great value for every dollar. I like that coverage for emergency medical evacuation is unlimited for all tiers, and overseas medical expenses go up to a generous $1,000,000 (which is about as high as it gets).

Here’s a quick run-through of the price and benefits offered by FWD travel insurance plans:

When you’re purchasing FWD travel insurance, the COVID-19 benefits are an add-on. The price of the COVID-19 add-on costs between $11 to $22 depending on the part of the world you’re travelling to. If you choose to add it on, it’ll give you comprehensive coverage of the following:

- Trip disruption

- Trip cancellation

- Overseas hospital cash

- Hospital cash while in Singapore

- Medical expenses

- Emergency medical evacuation and repatriation

The plan reimburses your travel-related expenses if you are diagnosed with COVID-19 no more than 30 days before your scheduled departure date, or if you have to change your itinerary because of a COVID-19 diagnosis while overseas. You also get to claim medical expenses and a hospital cash benefit if you get hospitalised overseas or for up to 14 days in Singapore upon your return.

On top of that, there’s also an automatic policy extension of up to 21 days should you be prevented from travel as per foreign government regulations due to:

- You contracting COVID-19; or

- You or your travel companion needing to be self-isolated due to being in close contact with someone diagnosed with COVID-19

Read the full T&Cs of FWD’s COVID-19 coverage .

FWD travel insurance promotion

[ Win a Rolex, Samsonite Luggage & More! | MoneySmart Exclusive] • Enjoy 25% off your policy premium • Get S$20 iShopChangi e-voucher and Eskimo Global 1GB eSIM with every policy purchased. T&Cs apply. BONUS: For a limited time only, there are over S$11,000 worth of prizes to be given away in our Grand Draw . Stand a chance to score: • 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000) • 1x Samsonite Robez 68/25 EXP (worth S$550) weekly Increase your chances of winning when you refer friends today. T&Cs apply

Enjoy cashless medical outpatient treatment in Singapore, access to emergency assistance and your travel policy documents through the FWD SG app!

Add on coverage for COVID-19 available for both Single & Annual Trips for travel period of 90 days or less.

Optional add on coverage available when your trip is cancelled for any reason for Single Trips. (To be purchased within 7 days of your initial trip deposit for your trip).

Optional add on coverage available for pre-existing Medical Conditions for Single Trips plans (up to 30 days) with S$150,000 coverage for medical expenses incurred overseas and 50% co-payment for trip cancellation, postponement and more!

Plan Highlights

Covid-19 protection, leisure activities.

Currently, you can take 25% off the prices for all FWD travel insurance tiers. That brings the rate for a 7-day ASEAN trip down to $25 to $42, or just $3+ to $6 a day !

We haven’t gotten to the really good part yet. Purchase FWD Premium , FWD Business , or FWD First travel insurance and stand a chance to win over $10,000 worth of prizes in our Grand Draw ! Prizes include:

- Rolex Oyster Perpetual – 124200 34mm Silver (worth S$9,000)

- All Expenses Paid Trip

- 2D1N Staycation at any Millennium Hotels and Resorts and 15,000 My Millennium Points (worth up to S$550)

Promotions valid till 7 Apr 2024 (Prizes 2 and 3) / 30 Apr 2024 (Prize 1).

4. Starr Travel Insurance

Starr’s travel insurance Starr TraveLead Comprehensive is a leader in terms of how customisable their insurance is. When signing up, medical coverage (including COVID-19 coverage) is automatically included in all plans, but you can choose whether or not you want to add trip coverage (e.g. document loss, travel delay) and baggage coverage (e.g. baggage delay). Then, you can also easily add riders for Golf Protection, Cruise Vacation, Scuba Diving, and Snow Sports.

Starr TraveLead Comprehensive comes in 3 tiers: Gold , Silver and Bronze . While all are pretty comprehensive (as the name suggests), we advise you go for at least Silver . This affords you $500,000 overseas medical coverage, as well as $30,000 medical coverage for COVID-19 and $250 coverage for COVID-19 related trip curtailments and cancellations. You won’t get the COVID-19 trip curtailment/cancellation coverage in the Bronze plan, which only offers $15,000 for COVID-19 medical coverage. Better be safe and go for Silver or Gold.

Here are the prices and coverage amounts for each tier. Prices are given with trip coverage included in the plan.

Note: Starr also has a travel insurance called Starr TraveLead Essential, which also comes in Bronze , Silver and Gold tiers. They look very attractive because of their low prices—for example, Starr TraveLead Essential Bronze costs just $20 for a 7-day trip to an ASEAN destination.

However, unless you’re on a really tight budget, I wouldn’t recommend these plans because of their more limited coverage. For example, while the Starr TraveLead Essential Bronze plan does cover you for $200,000 worth of overseas medical expenses (which is already the bare minimum), it doesn’t cover you at all for trip cancellation and loss/damage of baggage. Neither do the Silver or Gold tier plans.

Starr Travel Insurance promotion

Starr TraveLead Comprehensive Silver

[ Win a Rolex, Samsonite Luggage & More! | MoneySmart Exclusive] • Enjoy an exclusive 58% off your policy premium for a limited time only ! Valid till 20 May 2024. • Get an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$20 iShopChangi e-voucher with eligible premiums spent. T&Cs apply. BONUS: For a limited time only, there are over S$11,000 worth of prizes to be given away in our Grand Draw . Stand a chance to score: • 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000) • 1x Samsonite Robez 68/25 EXP (worth S$550) weekly Increase your chances of winning when you refer friends today. T&Cs apply

For Cruise to nowhere insurance: Find out more here

Flexible coverage allows you to create a travel insurance plan with different types of coverage and add-ons that can adapt to your needs

Overseas Covid-19 related medical expenses of up to $30,000 SGD included (Excluding China).

Covid 19 Trip related cancellation/curtailment up to $250 SGD included (Excluding China).

Covers Travel Expenses for return of Child(ren) during the hospitalisation of the insured person.

No sublimit or restriction on outpatient expenses and number of visits

24 hours Global Emergency Assistance Services help you when you need it most, connecting you with medical treatment and transportation

Seamless and Cashless claims via PayNow

Please note that travelling to Russia and Ukraine is not covered in Starr’s insurance with immediate effect.

With the ongoing 42% discount promotion on Starr travel insurance, prices are very affordable. Coverage for a week-long ASEAN trip is just $24+ ($3+ a day), while a trip of the same duration to countries like USA costs $30+ ($4+ a day).

The best part? Purchase Starr TraveLead travel insurance of any tier and stand a chance to win over $10,000 worth of prizes in our Grand Draw ! Prizes include:

5. MSIG Travel Insurance

MSIG travel insurance is categorised into 3 plans— Standard , Elite , and Premier . The cheapest, basic plan still offers pretty adequate coverage in medical emergencies and trip cancellations or delays.

Here’s a quick run-down of the plan’s key benefits:

One more unusual area of coverage that MSIG includes is emergency dental expenses. You get $5,000 to $15,000 in coverage, depending on the travel insurance tier you select.

MSIG’s Areas A and B refer, roughly speaking, to ASEAN and Asia respectively. Here’s a more comprehensive list of the countries in each category:

- Area A : Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Thailand and Vietnam

- Area B : Australia, China (excluding Inner Mongolia and Tibet), Hong Kong, India, Japan, Korea, Macau, New Zealand, Sri Lanka, Taiwan and including countries in Area A

- Area C : Worldwide

MSIG Travel Insurance’s COVID-19 coverage is an automatic inclusion to its travel insurance plans and offers the following coverage:

- Trip cancellation, postponement, shortening, disruption

- Replacement of traveller

- Overseas medical expenses

- Emergency medical evacuation

- Overseas quarantine daily cash allowance

This is quite a decent list of benefits, but do note that daily hospital cash allowance is missing from the list.

MSIG travel insurance promotion

MSIG TravelEasy Standard

[ Win a Rolex, Samsonite Luggage & More! | MoneySmart Exclusive] • Enjoy up to 45% off your policy premium • Get an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$45 via PayNow OR 1 x Apple AirTag (worth S$45.40) and up to S$20 iShopChangi e-voucher with eligible premiums spent. T&Cs apply. BONUS: For a limited time only, there are over S$11,000 worth of prizes to be given away in our Grand Draw . Stand a chance to score: • 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000) • 1x Samsonite Robez 68/25 EXP (worth S$550) weekly Increase your chances of winning when you refer friends today. T&Cs apply

COVID-19 coverage of up to $150,000 medical cover and up to $1,500 travel inconvenience benefit for your trip protection.

Packaged tour coverage for insolvency of licensed travel agencies registered with the Singapore Tourism Board (includes NATAS registered travel agencies).

Get covered across all TravelEasy Plan types with a high limit of S$1,000,000 for emergency medical evacuation & repatriation

MSIG provides cover for insolvency of licensed travel agencies registered with the Singapore Tourism Board (includes NATAS registered travel agencies)

Currently, you can take 40% off all MSIG travel insurance plans with their ongoing promotion. That means your 7-day ASEAN trip now costs just $37 to $70 to cover compared to $62 to $116.

On top of the 40% discount, you’ll receive lots of goodies with your MSIG travel insurance purchase:

- Receive 2,400 My Millennium Points (worth $16) with every policy purchased.

- $15 cash via PayNow with a premium of $65 to $119.99

- $25 cash via PayNow with a premium of $120 to $239.99

- $45 cash via PayNow or an Apple AirTag (worth $45.40) with a premium of $240 and above .

Promotion valid till 12 Apr 2024.

6. Singlife Travel Insurance

Singlife travel insurance comes in 3 tiers— Lite , Plus , and Prestige . The price you pay and the coverage you’ll get increase with each plan.

Here are Singlife travel insurance’s key prices and benefits:

On top of the coverage above, Singlife also covers you for chiropractor and/or chinese physician treatment : $250 ($50 per visit) for Lite, $500 ($75 per visit) for Plus, and $1000 ($100 per visit) for Prestige.

As far as COVID-19 coverage goes, here’s a quick run-down:

- Emergency medical evacuation, repatriation

- Overseas quarantine allowance

- Trip cancellation, postponement, interruption

While Singlife travel insurance’s coverage for non-COVID medical expenses, travel delay and trip cancellation is comprehensive, we have to dock some points for the lack of overseas hospital cash allowance and pretty low COVID-19 trip cancellation coverage.

Also, do note that the lowest tier, Lite, doesn’t come with certain coverage, such as trip cancellation or postponement for any reason and COVID-19 overseas quarantine allowance.

Singlife travel insurance promotion

.png)

Singlife Travel Plus

[Receive your cash as fast as 30 days*] • Enjoy up to 28% off your policy premium • Get an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$30 via PayNow and up to S$20 iShopChangi e-voucher with eligible premiums spent. T&Cs apply.

Covers trip cancellation and trip curtailment for any reason, T&Cs apply.

Covers trip interruptions or cancellations due to COVID-19 and cover your medical treatment should you contract COVID-19 whilst overseas and in Singapore.

Coverage for loss of frequent flyers points, hotel points & credit card points.

Payout of S$100** should your trip be affected by excessive rainfall.

**For single trips (minimum 3 days) where more than 50% of trip duration is affected by rainfall levels of >6.4mm in a 24-hour period.

Seamless claims experience with PayNow

It’s a win-win situation—get 28% off your Singlife travel insurance premiums these goodies thrown in:

- $10 cash via PayNow with a premium of $65 to $129.99

- $20 cash via PayNow with a premium of $130 to $329.99

- $30 cash via PayNow or an Apple AirTag (worth $45.40) with a premium of $330 and above .

Promotion valid till 29 Feb 2024.

7. Etiqa Travel Insurance

Do you hate making travel insurance claims? I do. That’s why when a friend of mine told me that you don’t need to make any claim on Etiqa to receive compensation for your flight delay, I was very intrigued.

I’ve been fortunate—all my recent flights have left on time. But from what I’ve heard from friends who weren’t as lucky on their recent travels, it’s true that Etiqa has the most seamless claim process for flight delays . All you need to do is enter your flight details when purchasing your insurance. Etiqa will monitor your flight and know if your flight is delayed (to count as a delay, it needs to be pushed back at least 3 consecutive hours). If that happens, they’ll transfer money into your Etiqa TiqConnect eWallet—even if you don’t submit a claim! You can then encash that sum via PayNow.

On top of this travel delay claim benefit, Etiqa also provides flight check-in reminders and baggage belt collection details via SMS when you land. I’ve experienced this myself when I bought Etiqa’s travel insurance for my trip to the UK this year. Now that’s what I call service.

Etiqa’s travel insurance is called Tiq Travel Insurance and comes in 3 tiers: Tiq Entry , Tiq Savvy , and Tiq Luxury . Here are their costs and coverage components:

Tiq Entry is sufficient to give you essential coverage for travel disruptions. But if you’ve just a little more to spend, go for Tiq Savvy . This will more than double your coverage limit for overseas medical expenses from $200,000 to $500,000 for just an additional $5 a week—that’s less than $1 a day.

.png)

[MoneySmart Exclusive | FLASH SALE] • Enjoy 45% off your Single Trip policy premium and 60% off Covid-19 add-on for Annual Plans. T&Cs apply • Get S$10 iShopChangi e-voucher with every policy purchased. T&Cs apply. [Etiqa's 10th Year 2024 Grand Draw] Stand a chance to win S$10,000 cash or a Singapore Mint Lunar Dragon 1 gram 999.9 fine gold medallion (worth S$173) with eligible Etiqa/Tiq by Etiqa plans purchased. T&Cs apply.

Comprehensive COVID-19 add-on, protecting you before, during and after your trip

Covers Cruise to Nowhere

Get paid upon a 3-hour flight delay, even without submitting a claim

Instant claims encashment via PayNow

24-hour worldwide emergency travel support

The only disadvantage to Tiq travel insurance is that COVID-19 coverage is not included in the base price and you’ll have to pay for their optional COVID-19 Add-On to be covered. Some people might say this is an advantage—it gives you a greater degree of flexibility to decide if you want to have COVID-19 coverage or not, especially as COVID-19 becomes less and less prevalent. However, the fact remains that you need to pay extra for it compared to travel insurance plans where COVID-19 coverage is already included.

Here’s how much the COVID-19 Add-On will cost for a 7-day trip:

To be covered for travel disruptions and medical expenses related to COVID-19, you’ll need to add the costs above to the base Tiq travel insurance prices.

Etiqa travel insurance promotion

Comprehensive Covid-19 add-on, protecting you before, during and after your trip

Enjoy 40% off Tiq Single Trip Travel Insurance plans —that means your week-long ASEAN trip now costs just $23 instead of $39 under Tiq Entry.

Getting annual travel insurance instead? Get 60% off COVID-19 add-on for Annual Plans!

From now till 15 Aug 2024, purchase Tiq travel insurance to enter Etiqa’s 10th Year 2024 Grand Draw . 5 lucky winners will walk away with $10,000 cash , and 150 will receive a S ingapore Mint Lunar Dragon 1 gram 999.9 fine gold medallion (worth $173)!

8. Cheapest travel insurance in Singapore

When I buy travel insurance, I don’t really care whether the insurer has 900 years of experience or if the plan comes with extra coverage for Chanel bags. Just give me the cheapest travel insurance plan can l iao !

If that sounds like you too, you’ll be glad to know we’ve done the legwork for you. After assessing the most popular travel insurers in Singapore, the honour of cheapest travel insurance in Singapore goes to… FWD travel insurance .

FWD Premium

Optional add on coverage available for pre-existing Medical Conditions for Single Trips plans (up to 30 days) with S$50,000 coverage for medical expenses incurred overseas and 50% co-payment for trip cancellation, postponement and more!

But as the old saying goes, you get what you pay for. Will you regret being a cheapskate and lose out on important coverage if the only number you look at is the price?

In a way, yes. Because FWD travel insurance is only the cheapest option with 2 caveats.

Firstly, travel insurers have limited-time discounts all the time. This is no secret. It does, however, make it difficult to compare prices when an expensive plan is on 40% off but a cheaper one is on 10% off. That’s why for the table above, we compared base prices without discounts .

But when you take into account promotional prices, which plan is the cheapest? There’s no need to open a million tabs to compare every travel insurance plan out there. Just use our travel insurance comparison tool with the “Lowest Price” filter on. You’re welcome!

The second caveat is this: FWD came out the cheapest when we looked at its price without its COVID-19 add-on. If you’re looking for a travel insurance plan that includes coverage for disruptions due to COVID-19 (which you should!), the real winners are Amex travel insurance and Starr travel insurance .

Starr TraveLead Comprehensive Bronze

Personalise your travel insurance-Flexible coverage allows you to create a travel insurance plan with different types of coverage and addon that can adapt to your needs

Overseas Covid-19 related medical expenses of up to $15,000 SGD included (Excluding China).

Covers travel expenses for sending back an unattended child during the hospitalisation of the insured person

At the end of the day, ask yourself what specific travel insurance coverage you want to have, and assess the travel insurance options to find one that suits your needs.

Need some help? Read our travel insurance guide to understand all you need to know about choosing the best travel insurance. Don’t forget to use our travel insurance comparison tool to seamlessly compare plans across different providers in Singapore. We also have a comparison tool for travel insurance in Hong Kong !

9. Does travel insurance cover COVID-19?

When the COVID-19 pandemic started, most insurers did not extend their coverage to COVID-19-related mishaps. (Read more here .) The pandemic was quickly considered a “known event”, which insurers usually do not offer compensation for. So, if your flight got cancelled because of COVID-19, you’d be out of luck trying to get your insurance claims approved.

Now that practically all travel restrictions are lifted, insurance companies are rushing for a slice of the pie. Since the virus looks like it’s here to stay, most insurers are offering coverage that includes specific benefits for COVID-19. Where COVID-19 benefits aren’t already included in the policy, insurers offer an optional COVID-19 rider you can pay for to add on to the existing regular coverage.

Read your policy documents carefully to see if COVID-19 is covered, and add it on if you need to.

10. How do I choose the best travel insurance with COVID-19 coverage?

COVID-19 coverage can vary quite a bit from insurer to insurer . When you’re shopping for the best insurance policy, there are 4 things you want to look out for when it comes to choosing the best travel insurance with COVID-19 coverage:

- Medical expenses coverage

Do note that the plans still exclude travelling against a travel advisory put in place by the Singapore government or by the local authority at your trip destination. Meaning, if your destination country goes on red alert for COVID-19, visitors are highly likely to come into contact with the virus and your insurance is highly likely to reject any COVID-19 claims. So be sure to check announcements on both ends before you depart.

Another common exclusion is failing to take precautions against COVID-19. This is worded kinda vaguely in those lengthy insurance policies, but could include not following any COVID-19 regulations at your destination or on the plane. So make sure you wear your mask whenever it’s required (or even when it’s not, if you want to play extra safe) and don’t attend any illegal raves.

11. What do I do if I get COVID-19 during or after my travels?

First of all, when booking your trip, you should retain all receipts, tickets and itineraries in case your trip has to be cancelled or altered.

At the first sign of a COVID-19 infection or related travel disruption, you should call your insurer and ask for guidance. Many insurers maintain a 24-hour hotline for travel claims. Save that number before you depart Singapore so that you aren’t stuck somewhere without wi-fi or 4G to Google the hotline.

To make a claim , you will usually have to submit your insurer’s form with supporting documents by the deadline mentioned in your contract (usually 30 days). Don’t wait until you’re back in Singapore to check which documents you need.

If you catch COVID-19 while you’re in Singapore , you will likely have to submit the results of a PCR Swab Test or Antigen Rapid Test conducted at a clinic or hospital.

It gets a bit more complicated if you’re overseas . The insurer will likely require documentation from the hospital as well as a doctor’s letter stating that you are unfit to travel and/or recommending treatment.

If you need to be quarantined overseas , you should make sure you have a quarantine order from the government, otherwise you may not be able to claim for quarantine allowance. Remember to ask for this as not all countries automatically issue such documentation.

ALSO READ: COVID-19 Travel Insurance Claim Guide

Planning to get travel insurance for your next trip? Learn how to claim for COVID-19 here!

About the author

Vanessa Nah is a personal finance content writer who pens articles on the ins and outs of travel insurance, the T&Cs of credit cards, and the ups and downs of alternative investments. She’s a researcher at heart and leaves no stone unturned when it comes to breaking down complex finance concepts and making them easy to understand for the everyday Singaporean. When Vanessa’s not debunking finance myths, you’ll find her attending dance classes, fingerpicking a guitar, or (most im paw tently) fulfilling her life mission to make her one-eyed cat the most spoiled and loved kitty in the world.

Related Articles

Best Travel Insurance Policies for Places Prone to Natural Disasters (2024)

How to Choose an eSIM? 7 Recommended eSIM Options for International Travel

Best Travel Destinations and What To Do There, According to MoneySmart Staff

Travelling with Kids: 10 Possible Disasters and How to Avoid Them

How Much Does It Cost To Travel With Pets?

- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

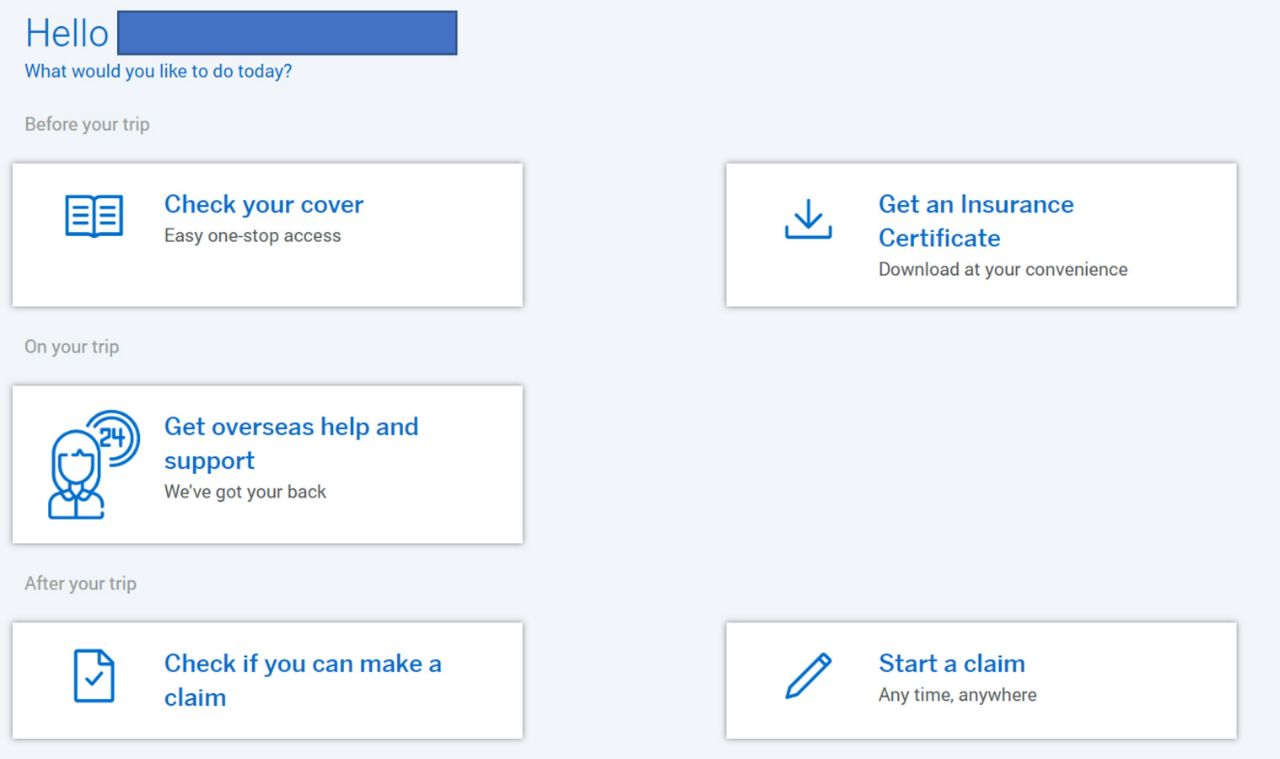

How to generate a travel insurance certificate for the AMEX Platinum Charge

Planning to use your AMEX Platinum Charge's complimentary travel insurance? Here's how to get proof of coverage.

While mandatory travel insurance requirements are starting to be scaled back around the world, some countries still require it for foreigners.

I firmly believe that no one should travel without insurance anyway, regardless of the rules, but what if your coverage comes from a credit card? Travel insurance from credit cards is just as valid as a stand-alone policy, but you won’t have that all-important one-page certificate with your name and details on it.

I’m not sure how it works for other cards, but thanks to Head for Points , I’ve learned it’s possible for AMEX Platinum Charge cardholders to generate personalised insurance certificates online.

AMEX Platinum Charge insurance

AMEX Platinum Charge cardholders enjoy complimentary travel insurance when they pay for their outbound and inbound travel with their card. For the record, coverage will apply if you redeem airline miles and use the AMEX Platinum Charge to pay for taxes and surcharges.

Coverage includes, among other things:

- S$1 million for death or total permanent disability

- S$1 million of medical expense coverage

- S$4,000 of emergency dental treatment

- S$150 hospital cash allowance

- S$10,000 trip cancellation and postponement

- S$400 for flight or baggage delays

COVID-19 medical expenses are covered as well.

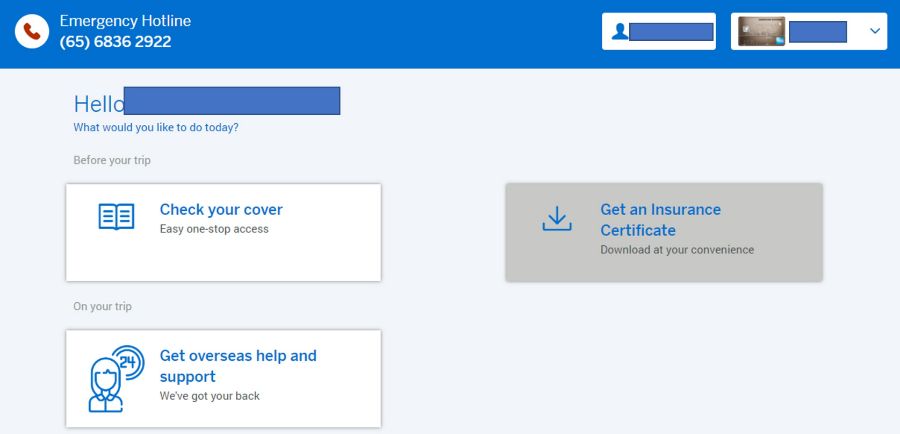

To generate an insurance certificate, head to this link and login with your American Express credentials.

Click “Get an Insurance Certificate”, then “English certificate”.

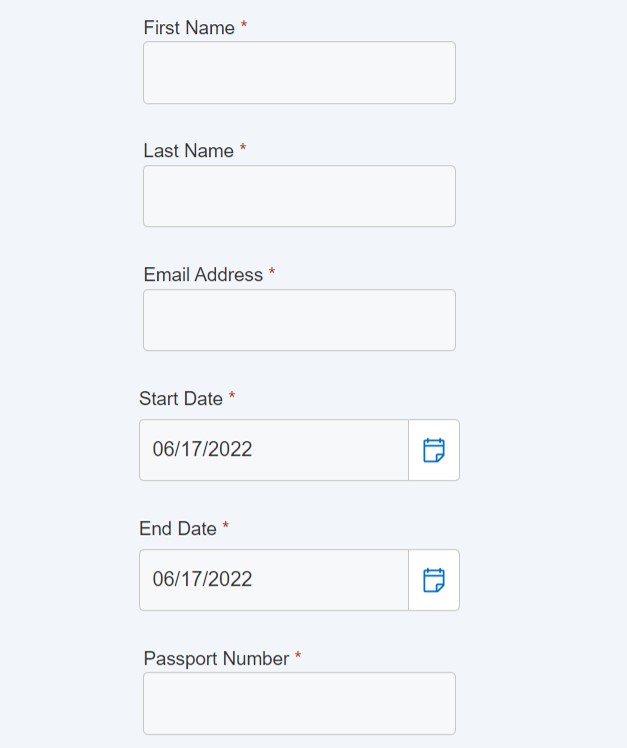

You’ll be prompted to fill in your first and last name, email address, trip dates and passport number.

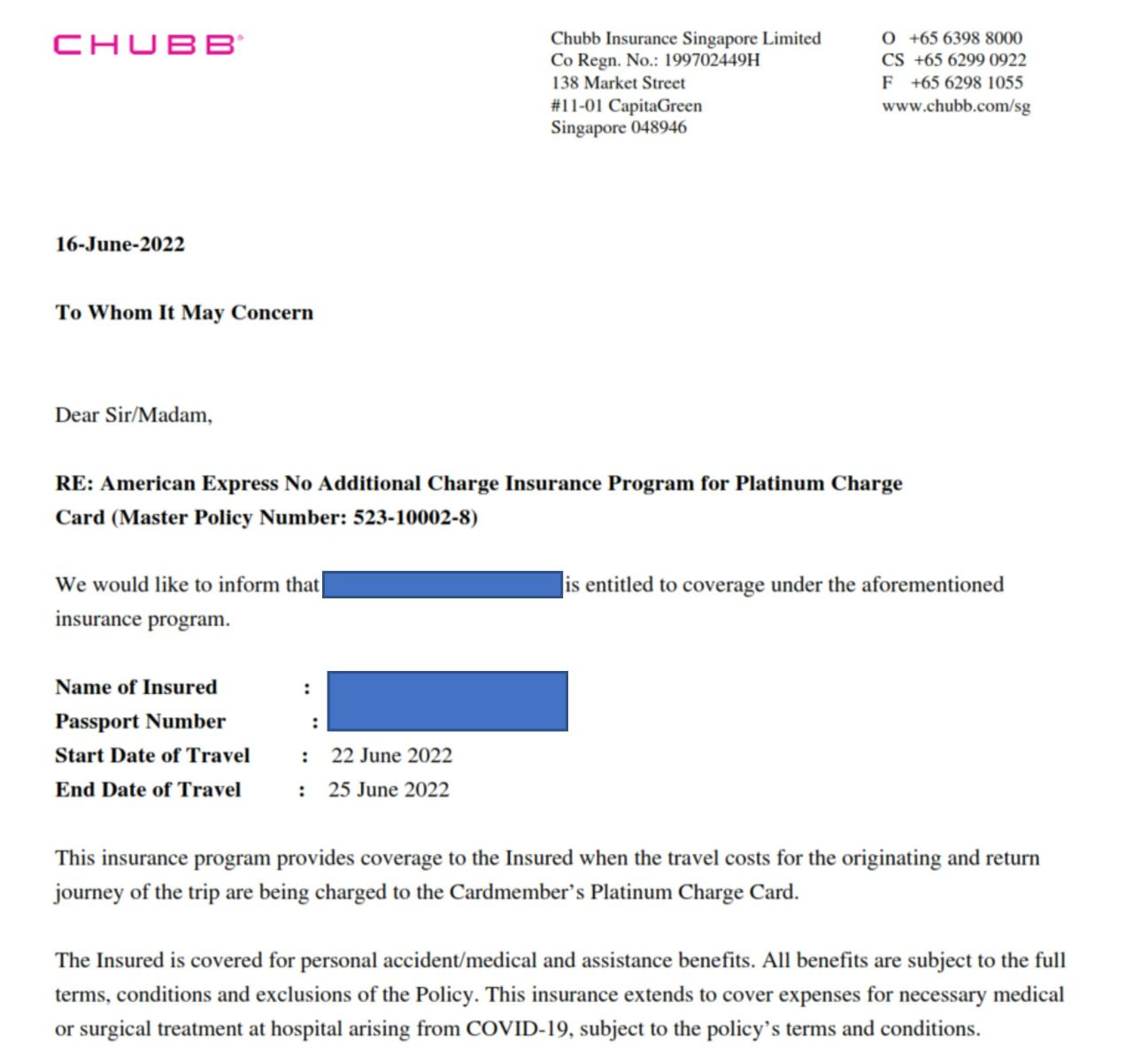

A PDF certificate from Chubb will be automatically generated and sent to your email.

Now, here’s what I find interesting.

As mentioned earlier, insurance coverage is only applicable if you use the AMEX Platinum Charge to pay for the outbound and inbound legs of the trip. However, you can generate an insurance certificate regardless of whether you’ve done this.

I think the legal team was careful to cover their bases here, as the letter only states that the individual is “entitled” to coverage, and adds the following clause:

“This insurance program provides coverage to the Insured when the travel costs for the originating and return journey of the trip are being charged to the Cardmember’s Platinum Charge Card”

Add the fact you can put anyone’s name on the certificate (understandable, given that the policy is meant to cover your spouse and dependent children as well) and it almost feels like a “generate your own insurance certificate” tool, something that could be easily abused. I mean, I can’t imagine the average check-in agent or immigration official could be bothered enough to cross reference your credit card statement and see if the coverage is actually active…

While other American Express cards like the AMEX KrisFlyer Ascend and AMEX Platinum Credit Card also come with complimentary travel insurance, the portal unfortunately does not allow you to generate certificates. In those cases, you’ll need to contact Chubb and see if they can assist you.

AMEX Platinum Charge cardholders can generate a personalised travel insurance certificate that provides documentary proof of coverage (though I wonder how the person reading the certificate will know if the coverage is active!). It only takes a few minutes to do, and delivery is instant.

For more information on travel insurance policies that cover COVID-19, refer to the link below.

Which travel insurance policies provide COVID-19 coverage?

- american express

- credit cards

- platinum charge

Similar Articles

How strict are credit card income requirements, amex highflyer card launches 24,600 bonus highflyer points welcome offer, 20 comments.

But why will you want to do that? The objective of buying insurance is to make sure you are covered, not really for the purpose of bypass the immigration.

Because… amex platinum charge insurance is just as good as purchased insurance

sometimes better

Hi, does the insurance also cover travelling partner who is not card holder?

Isn’t the covid-19 coverage mentioned right there in the certificate? Last paragraph…

Oh yes you’re right. I must be going blind. Thanks, will update

Do you know how I can do this fir HSBC Visa infinite

i think AMEX is the only one with this functionality. all others: call up the CSO

Does it work with Amex HighFlyer corporate card? even for this scenario if we redeem using our own Krisflyer miles “For the record, coverage will apply if you redeem airline miles and use the AMEX HF to pay for taxes and surcharges.”

Question: Did anyone actually get checked?

What was that email contact that could help in processing AMEX Plat Charge if your fixed incoming falls below 150K? Thanks Guys

Ddi you actually receive the pdf in email? How long does it take? I tried twice about a week back and have not received the cert via email so far.

got it almost instantly.

Is Amex Platinum charge card travel insurance comparable to the Chubb regular Travel Insurance policy for family? Are there anything that is not covered or should add on? Chubb travel agent does not have knowledge and couldn’t answers

Now getting this when I check the link above: Application is not availableThe application is currently not serving requests at this endpoint. It may not have been started or is still starting.

So I think no longer working.

Hello Aaron, do you know if the link has changed? No longer seem to be working for me.

yeah the link no longer works. haven’t found a replacement

I just discovered you can generate the insurance certificate from the Amex portal: 1) Login to https://www.americanexpress.com/en-sg/account/login/ 2) Click the top left menu > Insurance > Insurance Benefit Centre 3) Rest of the steps are then the same as what’s in this article

Can’t find the “insurance benefit centre” option. Seems to be missing

Spoke to the CSO, the below link worked for me. https://www.americanexpress.com/sg/insuranceportal

CREDIT CARD SIGN UP BONUSES

Featured Deals

© Copyright 2024 The Milelion All Rights Reserved | Web Design by Enchant.sg

Complimentary Travel Insurance with Citi Credit Cards

- Credit Cards

- Complimentary Travel Insurance

Travel Insurance

Simply charge the Full Fare of your travel ticket to your Citi Card and activate your Complimentary Travel Insurance before you travel.

Complimentary Travel Insurance feature is available for the following cards:

- Citi Rewards World Mastercard ® / Visa Signature Card

- Citi Cash Back World Mastercard / Visa Signature Card

- Citi Cash Back+ World Mastercard / Visa Signature Card

- Citi Lazada Visa Signature Card

Please note that with effect from 1 April 2019, complimentary travel insurance will only be offered to customers who charge their airfare to the Citi Cash Back Visa Signature Card and Citi Rewards Visa Signature Card.

Remember to activate your travel insurance prior to travel to enjoy the Complimentary Travel Insurance feature.

ACTIVATE YOUR TRAVEL INSURANCE HERE

Please note for Citi PremierMiles , Citi Prestige and Citi ULTIMA Cardmembers, complimentary travel insurance is auto-activated with either AIG or AXA upon full airfare charge. Kindly click on link for more details.