We research all brands listed and may earn a fee from our partners. Research and financial considerations may influence how brands are displayed. Not all brands are included. Learn more .

- travel insurance

https://money.com/allianz-travel-insurance-review/

Allianz Travel Insurance Review

- Travelex Travel Insurance Review

- Nationwide Auto Insurance Review

- MetLife Auto Insurance Review

- 5 Best Vision Insurance Companies

- U.S. Bank Home Equity Loans Review

- ZipRecruiter Job Posting Sites Review

- What is Cash-Out Refinance?

- LendingTree HELOC Review

- Best Places to Travel in the Summer

- 6 Best Places to Travel in the Spring

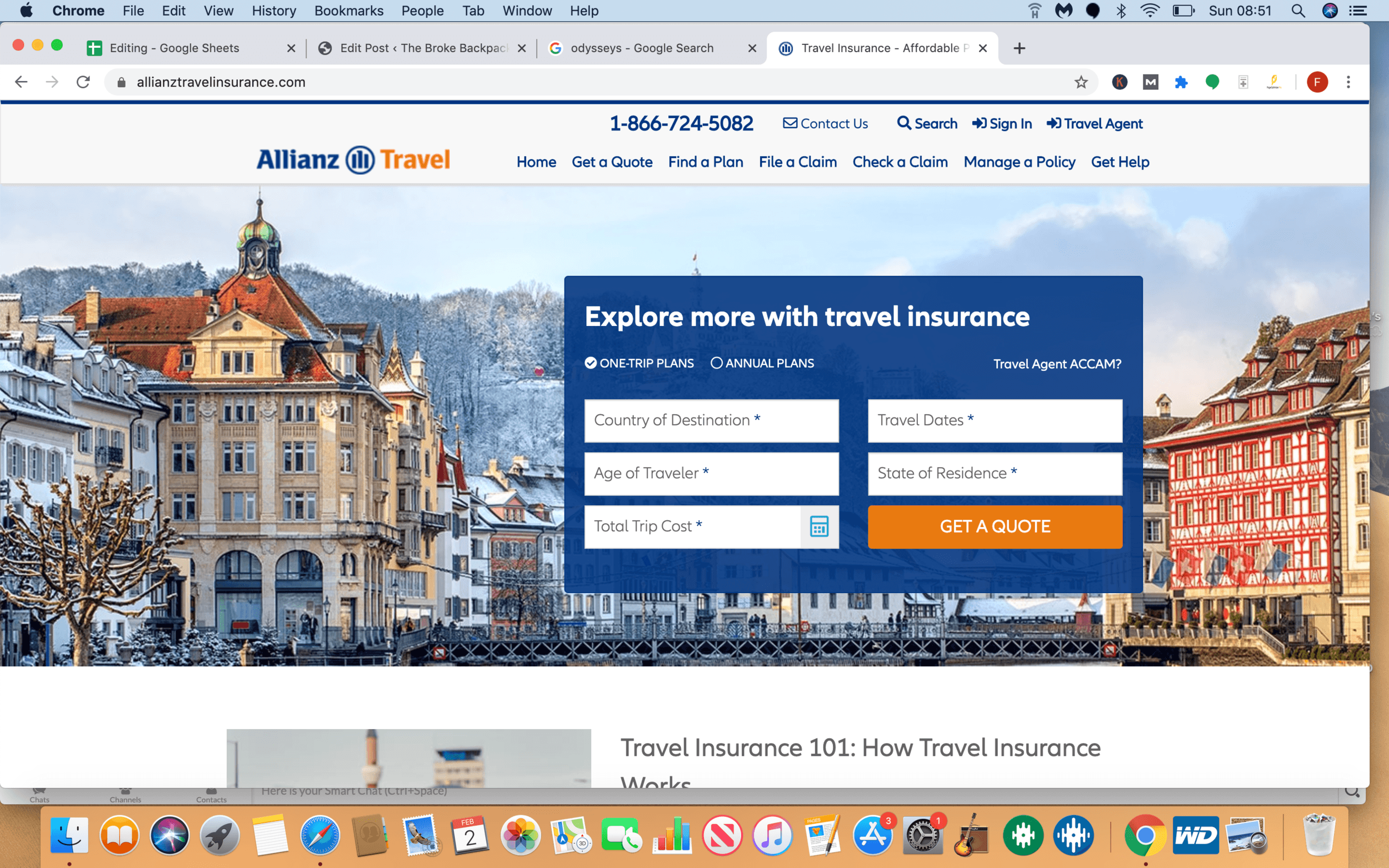

Allianz Travel Insurance is one of our picks for the best travel insurance , largely due to its plans for business travelers. Although it offers single-trip insurance, its annual plans are a better option for frequent travelers. You can even get coverage for stolen, lost, or damaged business equipment. Weary road warriors will benefit from their concierge service and work-related trip cancellation coverage.

Quote, compare and buy in a few minutes

Best Price Guarantee By Comparing Top Policies In A Single Platform

- Buy online and get instant coverage by email

- 24/7 emergency assistance worldwide

- Policies from trusted providers

- Over 100,000 verified customers with 5-star reviews and $3.5 billion in protected trip costs

- Includes coverage from theft, trip cancellations, baggage loss and delay, medical expenses for hospital treatments

Digital Travel Insurance

COVID-19 coverage is available and/or may be included as an add-on

- “Cancel For Any Reason” (CFAR) availability

- Includes trip cancellation, baggage delay/loss, and flight delays

- Emergency medical expenses coverage are included in the coverage

Largest selection of policies with Covid-19 coverage

- Largest selection of 100+ policies

- Award-winning customer service with an A+ BBB rating

- Reviewed by 47,691 customers with an average rating of 5 stars

- Coverage for trip cancellation/interruption, travel delay, medical emergency & evacuation and pre-existing conditions

- Group travel products available

- Coverage for trip cancellations, delays, medical emergencies, and more

- International Student Insurance available

- Top-rated cruise insurance plans, and adventure travel insurance

- Travel concierge services with premium plans

- Medical, cancellation, and baggage coverage

- Emergency evacuation and medical repatriation

- Offers cancellation coverage due to terrorism and natural disasters

Allianz Travel Insurance Pros and Cons

24/7 multilingual hotline assistance, offers annual plans for frequent travelers.

- Concierge services included in most plans

Lower-than-average medical expenses coverage limit

Limited cfar (cancel for any reason) coverage, pros explained.

One of the best features of Allianz Travel Insurance is access to expert help anywhere in the world and at any time. You can contact the company hotline within the U.S. via a toll-free number and abroad via a collect number.

The hotline is not just for medical emergencies or dire circumstances, it can also address any travel-related issues such as helping you communicate in another language or obtaining services for your pet. You can also access this feature with the help of the company’s TravelSmart app.

Allianz Travel Insurance allows you to get annual plans if you travel often. The coverage, however, depends on your chosen plan. There are four AllTrip options offered:

- AllTrips Basic

- AllTrips Prime Plan

- AllTrips Executive Plan

- AllTrips Premier Plan

These plans offer similar coverage as the single-trip plans, but they cover you for the full year. This allows frequent travelers to plan their trips without having to worry about getting trip protection. Another benefit of this coverage is that all of these plans include rental car protection.

Concierge services are in most plans

Concierge service is available with most of Allianz’s travel plans. This service assists with event and entertainment needs — like ticket or restaurant reservations — and information on local activities and venues such as golf courses or theaters. The concierge may also provide location information, including currency exchange rates and train schedules.

The concierge service can be useful if you need to find alternative accommodations or book additional transportation. Concierge specialists may also help you find specialty shops, get an interpreter and make other specialized requests. Reach the concierge via Allianz’s hotline or the phone number printed on your policy.

Cons explained

One of the significant drawbacks of Allianz Travel Insurance is its low medical coverage. While other providers have limits of $100,000 or more, Allianz Travel’s emergency medical insurance maximum coverage of $75,000 is available only in the One Trip Premier.

For the other plans, the emergency medical insurance maximum is $50,000. If you have an accident or need medical assistance while on your trip and your medical bills exceed the limit, you’ll pay the balance out of pocket.

Allianz recently started offering its own version of CFAR coverage called the Cancel Anytime upgrade. While this add on can potentially reimburse you up to 80% of the trip cost, it's only available for Allianz’s two most popular plans: the OneTrip Prime and OneTrip Premier.

Allianz Travel Insurance Plans

Allianz Global Assistance travel insurance plans come in two general categories – single trip and annual or multi-trip. The single trip plan has five options to choose from, while the annual or multi-trip plan has four options. Allianz also offers rental car coverage, either included in the plan or as an add-on.

Before signing up for travel insurance with Allianz, understand what each policy entails to determine which plan is best for you. Here are some details on the different Allianz Global Travel insurance plans:

Single Trip

The single-trip travel insurance plan has five options.

- One Trip Basic – This is an affordable plan for trip cancellation and interruption, medical emergency coverage, damaged or lost baggage and other post-departure benefits.

- One Trip Prime – Allianz touts this as their most popular plan. It offers higher limits than its basic plan, and gives you access to a long list of possible upgrades, such as cancellations due to work.

- One Trip Premier – This option has higher post-departure benefit limits than the Prime option, more cancellation reasons to add and access to optional upgrades.

- One Trip Emergency Medical – The plan designed for travelers on a tight budget who don’t want to travel without medical insurance coverage. This plan covers emergency and medical transportation and a few post-departure benefits like baggage delay and baggage loss or damage.

- One Trip Cancellation Plus – If your main concern is the possible financial loss resulting from an unexpected trip cancellation, this is the plan to get. Note that this doesn’t have any medical or health coverage, unlike the other four options and only covers the cost of trip cancellations, interruptions and delays. You’re covered for multiple reasons, including the death of a family member, if your destination is unlivable, if your traveling companion gets seriously sick, or even if you divorce your traveling companion before the trip.

Multi-Trip (Annual)

Allianz multi-trip or annual travel insurance plans come with four options, three of which are similar to the single-trip ones above.

- All Trips Basic – The basic plan has no trip cancellation or interruption benefits but offers emergency medical, baggage loss and delay benefits, travel delay and travel accident coverage. It also has rental car theft and damage coverage. However, as with all of these plans, the rental car coverage is not available for Kansas, New York or Texas residents, and Washington residents must look at their plan details to see if it's included.

- All Trips Prime – This plan does offer cancellation and interruption reimbursements, as well as pre-existing medical condition coverage. It has the same level of coverage as the basic plan regarding emergency medical, post-departure benefits and rental car coverage.

- All Trips Premier – As with the single plans, this version of the Premier offers more in terms of benefits. It’s similar to Prime, with pre-existing medical condition coverage and cancellation options. One thing you’ll notice with this plan's cancellation and interruption benefits is that it comes with varying options, so you can customize your plan to suit your budget and needs.

- All Trips Executive – This is a tailor-made plan for frequent business travelers Aside from the usual cancellation, interruption, emergency medical and baggage benefits, it also has business equipment rental coverage.

Rental Car Coverage

Rental car coverage by Allianz comes with reimbursements for trip interruption and lost or damaged baggage. It also covers any damage to your rental vehicle or if the car is stolen while in your possession.

Allianz Travel Insurance Pricing

The cost of each policy depends on several factors. To get a quote for your chosen single trip plan, you need to provide your age, place of residence, destination, total trip costs and travel dates.

The same factors are used for annual or multi-trip plan pricing but you'll also have to provide a start date of your coverage. These plans cover all trips within 365 days of the start date you provide.

The information needed for a custom quote for the rental car plan includes when you’re traveling, your age and where you live. The usual price for such a plan with Allianz Travel is $11 per day.

Allianz Travel Insurance Financial Stability

Allianz, which is Allianz Travel Insurance's parent company, has been in business for over 100 years and enjoys an A+ rating with both the Better Business Bureau (BBB) and A.M. Best. According to its 2021 annual report, the company has more than $86 billion in equity, $1.24 trillion in total assets and a total market value of $2.83 trillion.

Allianz Travel Insurance Accessibility

You can visit the Allianz Travel Insurance website to get a quote and sign up for a policy. From there, you’ll need to choose which plan you’re interested in and fill in the details that the plan specifies. There are resources, videos, and an email contact form to help you choose a plan and sign up.

Availability

Allianz Travel Insurance is available in all 50 states. However, certain plans and upgrades, such as rental car damage and theft coverage, are not offered to residents of Kansas, New York and Texas, and may not be available to Washington residents..

Contact information

Allianz Travel Insurance is under the umbrella of Allianz Global Assistance, located in Richmond, VA. You can contact the company through the Allianz website or:

Allianz Travel Insurance phone number : 1-866-884-3556

Allianz Travel Insurance mail address : P.O. Box 71533, Richmond, VA 23255-1533

Allianz Travel Insurance Emergency Assistance : In the U.S. 1-800-654-1908; International 1-804-281-5700

User experience

Allianz Travel Insurance provides users with an app that helps them track their plans and contact the concierge service. It also gives users access to their coverage benefits as well as a way of getting help when they’re traveling.

The app also lets you file claims and even shows you which providers in your current location are approved by the company.

Allianz Travel Insurance Customer Satisfaction

This provider has a hit-and-miss record when it comes to customer satisfaction. Some online customer reviews have reported that the customer service team needs to be clearer when explaining policies. A few customers have also noted that Allianz Travel Insurance refunds take a long time to be issued, while others have complained about the time it takes for claims decisions.

However, some policyholders give the company positive reviews, despite delays in getting their reimbursements.

Allianz Travel Insurance FAQs

Is allianz global assistance a reliable travel insurance company, how do i file a travel insurance claim with allianz, is allianz travel insurance worth it, how we evaluated allianz travel insurance.

We looked into several critical factors to evaluate Allianz Travel Insurance. These include the following:

- Available plans

- Benefits and coverage

- Diversity of offerings

- Claim filing process

- Customer service

- Customer reviews

- Financial stability

- Third-party ratings

Summary of Money's Allianz Travel Insurance Review

Allianz is considered one of the best travel insurance companies for business because of the adapted annual plans for frequent travelers.

Allianz’s staff is available 24/7 to answer questions and concierge services can help you during the trip. Allianz Travel Insurance is backed by a financially stable parent company and makes its plans available in most states. However, the company's coverage limits for medical expenses are lower than those of its competitors.

- Meet the Team

- Our Manifesto

- Work with Us

- Budget Travel

- Personal Development

- Work & Travel

- United Kingdom

- More of Europe

- Philippines

- More of Southeast Asia

- More of South America

- More of Central America

- South Korea

- More of Asia

- More of North America

- New Zealand

- Pacific Islands

- More of Oceania

- South Africa

- More of Africa

- More of the Middle East

- Travel Essentials

- Travel Gear

Home » Budget Travel » HONEST Allianz Travel Insurance Review – [Updated 2024]

HONEST Allianz Travel Insurance Review – [Updated 2024]

Planning and preparing for a trip can be fun and exciting. Personally I love flicking through Lonely Planets seeking out those “Must See” places and I even enjoy scouring through forums for insider advice. I relish the challenge of arranging sophisticated logistics and revel in finding bargain flights from London to the ends of the earth.

Indeed, the feeling I get during the days before I start a trip is both exciting and invigorating. In fact, sometimes I wonder whether I’m equally as addicted to this “state of leaving” as I am to travel itself – they do say that often anticipation is even better than the event itself.

What is far less exciting though, is comparing Travel Insurance policies. There are far too many policies and providers out there with far too many fine print details to scrutinise. Yep finding the best travel insurance is confusing, and finding cheap backpacker insurance can seem impossible. But, to make finding and buying Travel Insurance that bit easier for you, we have tried, tested and reviewed all of the major providers out there.

Allianz Travel Insurance Review

Do you need travel insurance, what does travel insurance cover, should i get insurance, who are allianz, allianz travel insurance policies, what’s covered by allianz travel insurance, what’s not covered by allianz travel insurance, who is allianz travel insurance suitable for, who isn’t allianz travel insurance suitable for, how much does allianz travel insurance cost, other travel insurance providers, when should you buy travel insurance, how to make an allianz travel insurance claim, final thoughts on allianz travel insurance.

- Buy Us a Coffee!

Today we are going to review Allianz Travel Insurance. I have spent hours going through their policies and breaking them down for you. By the end of this post, you should know whether Allianz is the right travel insurance for you.

It’s important that you take time to look at other good travel insurance providers too. Different providers suit different kinds of travellers. So you may be better suited elsewhere.

The Broke Backpacker is supported by you . Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free content 🙂 Learn more .

Before we begin the Allianz Travel Insurance review, do note that the terms and conditions of insurance policies are subject to changes and are always ultimately based on your individual circumstances. Therefore, it is very important that you read any policy terms and conditions yourself.

Hey you there! Before you delve any further or waste any more valuable time on this Allianz Travel Insurance Review, let me just tell you straight up front that we at The Broke Backpacker no longer use Allianz for our travel insurance needs.

We have nothing against them, we just found other providers more suited to the needs of travellers and backpackers whilst offering VERY competitive quotes.

If you are taking a single trip or going backpacking, we recommend World Nomads Insurance .

Alternatively, if you are a digital nomad working and travelling remotely from all over the world, then SafetyWing Insurance offer some very interesting travel insurance plans.

Ahem – Please note that insurance companies change their policies and product terms fairly regularly. We do our best to keep this review up to date but cannot guarantee that all of the information is 100% correct. Therefore, only use this review as a guide and check all policies yourself. Also note that some of the links in this post are affiliate links.

Unlock Our GREATEST Travel Secrets!

Sign up for our newsletter and get the best travel tips delivered right to your inbox.

Do you need travel insurance? Does anybody really need travel insurance ?

After shelling out for flights, visas, and a new backpack, having to find a few more bucks for travel insurance may feel a bit depressing. I mean, all you get is a “policy certificate” AKA a boring 100-page booklet to read. Aren’t there more sexy and fun things to be spending that money on?

After all, most trips, vacations, and odysseys end happily and safely without any ill occurrence. There is no definitive answer to this.

Our team at the Broke Backpacker , we have (collectively) spent more than a century backpacking the globe and we have visited over 100 countries. Most of those trips ended without incident. However, we have also clocked up a fair few mishaps along the way: inflected legs, tropical diseases, broken backs, and even gunpoint robberies.

These incidents were all bad enough in themselves, leaving physical and mental scars. Thankfully though, we were all insured at the time. This meant that we were spared the further trauma of paying out thousands in medical bills or replacing technologies.

Basically, insurance is one of those things that most people never actually need. But the ones who do are very lucky to have it.

So now, you get the picture: travel insurance is essential when it comes to staying safe on the road . But is Allianz travel insurance right for you? Or do other travel insurance options suit you?

So let’s take a look. Here are some things good travel insurance plans help with, and where you would be without them.

Lost Luggage

Luggage gets lost both on planes and in airports. It shouldn’t happen, but it sure as hell does.

That in itself is bad enough but replacing all your essential travel gear will cost. Any decent travel insurance policy usually covers lost luggage, usually up to at least $1000.

In fact, the aviation watchdog states that 5.73 items of luggage are lost for every 1000 passengers. That means that if you take 10 flights, then there is a 5% chance of your luggage getting lost forever. Some airports and airlines lose more baggage than others but all of them are equally as obtuse and obstructive when it comes to trying to make a claim.

Lost luggage can ruin your whole trip. I mean, imagine you head to Iceland and they lose all your cold weather gear?!

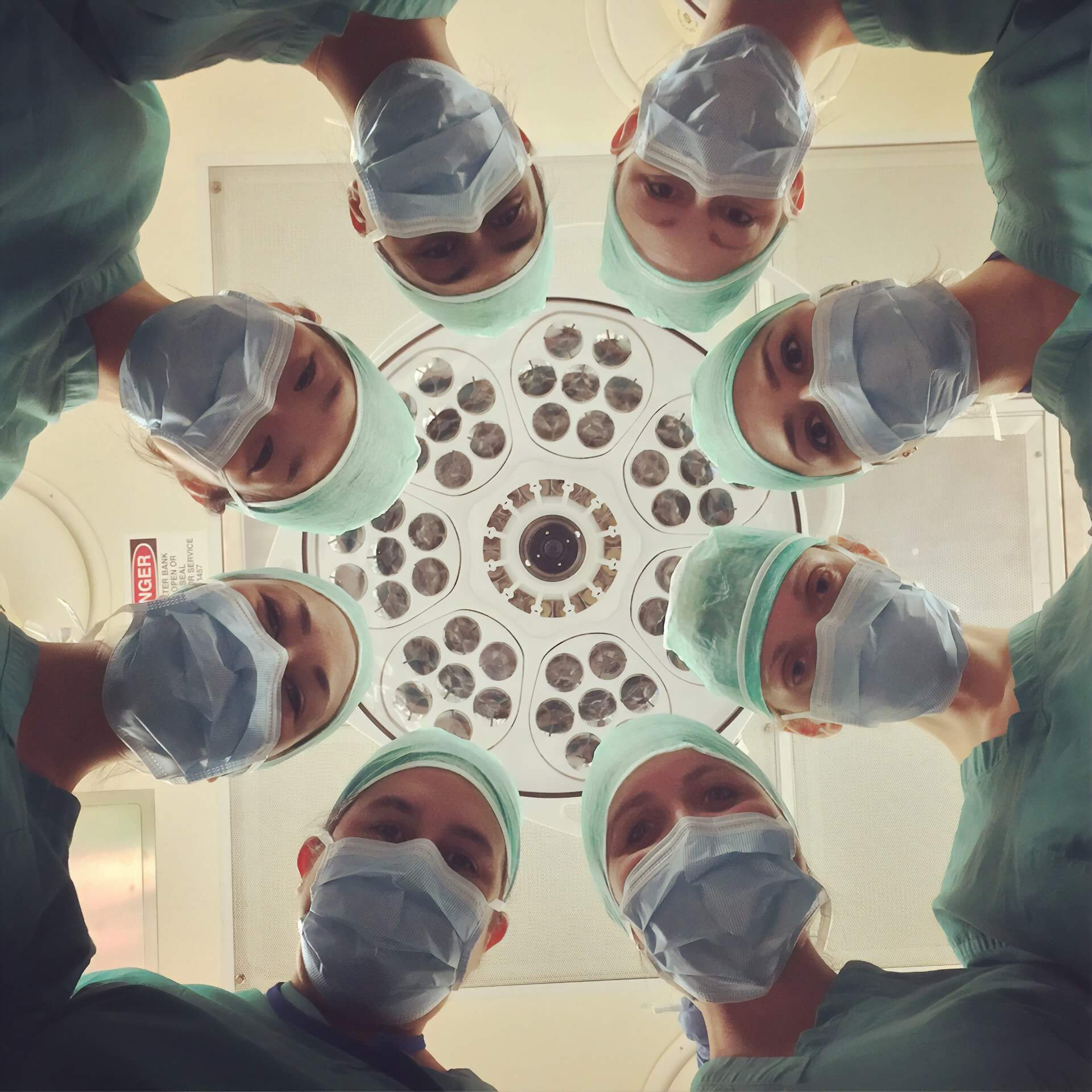

Medical Bills

Foreign medical care costs can be very high. A friend of mine was once hospitalised while backpacking in Costa Rica and ran up bills in excess of $10,000.

More recently he spent 1 night in a Thai hospital, was billed $1,000 and his passport was used as a ransom (that boy has no luck. Maybe he should stay at home?) . Personally, I don’t have $10,000 to pay to Costa Rican Doctors, but I do have maybe $50 to buy myself a travel insurance policy.

If you come from Europe, the cost of medical care in some parts of the world is quite a revelation. If you’re in the US, then you already know all about health extortion. But do remember, your domestic health insurance will most probably not cover you outside of the US.

Accidents happen (and without warning…) and ill health can strike any of us down at any time, anywhere. In fact, if you have experienced the driving or the hygiene standards in India, you’ll already know that you are at high risk of coming to some harm out on the road.

Trip Interruption Coverage

Trip interruption comes in all shapes and sizes. Claiming for flight delays or cancellations is annoying – and in the end, nothing’s guaranteed.

Every year a few airlines or travel agents go out of business leaving passengers stranded. Booking flights home at short notice is costly.

Not getting home on time on the other hand, can mean getting sacked from your job – ouch. If you have to stay a few more nights at your destination waiting for a flight home, then that can also stretch a maxed-out travel budget.

Having trip cancellation and interruption coverage can mean the difference between desperately raiding your overdraft or getting a few extra days of vacation, free of charge.

Theft Coverage

Sadly, tourists are a target for thieves in many parts of the world. Our team have been robbed with guns while backpacking South America . And I know people whose diamond jewellery and MacBooks were burgled from hotels.

Being robbed is scary. But theft coverage makes it suck a little less when you don’t have to fork out for your stolen iPhone.

Repatriation

In the unlikely event of your demise, your travel insurance can cover the cost of repatriation or sending your body home. The costs of this can otherwise run into several thousands of dollars.

Want to save money on accommodation?

We got you. For reals.

Nobody ever thinks it will happen to them. And yet, it does happen.

Furthermore, the law of averages dictates that if you travel enough, something, somewhere will eventually go wrong. Just like you should always look twice before crossing the road, and always wear your helmet before riding a bike, you really should get comprehensive travel insurance.

By the way, some countries require you to obtain insurance before even letting you enter. Imagine being turned back at the airport for the sake of a few quid?! I personally never leave home without first obtaining travel insurance plans from either World Nomads or SafetyWing.

If you’re reading this, then I guess you decided that you do need travel insurance. Yay! Welcome to the world of sensible adults (AKA accepting your own mortality and the fact that you have no control whatsoever over the universe, despite whatever bullshit “The Secret” may have told you).

Allianz travel insurance is perhaps one of the biggest insurance companies in the world. They have been trading for over 120 years and they have offices across the globe.

Though travel Insurance is by no means Allianz’s primary focus or modus operandi. But this is not a bad thing. Note that even “specialist travel insurers” are often, in fact, brands or shop fronts backed by big insurance companies like Allianz.

They are governed by the Financial Services regulators in pretty much every national market they trade in. This means that if you have a problem with them, you can squeal on them and have your case reviewed independently and fairly by an adjudicator free of charge.

Now that the introductions are out of the way, let’s take a look at the individual travel insurance policies they offer.

Allianz are a major financial service provider and as such, they offer different coverage options, policies and plans aimed at different travellers. Let’s quickly run through them.

Firstly, Allianz travel insurance offer travellers 2 main types of policy. Within these coverage types are little variations. The main policy types are OneTrip and AllTrips .

Within both the OneTrip and AllTrips umbrellas are 3 variations : Basic, Prime, Premier . These vary depending on how much cover you want and how much you want to pay.

As the name kind of suggests, OneTrip covers one single, specific trip generally with a fixed start and end date.

AllTrips covers any and all trips that you make in a one-year period. This annual plan runs from the date you take out the policy, or a date of your choosing, and lasts for 365 days (or 366 in a leap year) .

You can take an unlimited number of trips in the year and an unlimited number of days travelling. Do be sure that all your chosen destinations are covered by the annual travel insurance policy though, otherwise, you may need to obtain additional cover.

OneTrip Basic Plan

This travel insurance policy covers all travel insurance basics such as medical coverage, trip cancellation and lost luggage. Look at it as the entry-level “classic cover” if you like.

The plan may be able to offer;

- Emergency Medical and Emergency Dental Coverage up to $10,000 and $50,000 for Medical Evacuation. These amounts may seem high but are not enough if you need to be airlifted home from an accident, for example.

- Lost or Stolen Baggage Coverage up to $500 and $200 for Delayed Baggage. Now, $500 may be enough for your baggage depending on how expensive your clothes are, and whether you pack any specialist equipment. However, a solid travel backpack is usually worth around $200.

- Trip Cancellation Cover up to $100,00. One of the best features of the OneTrip Basic plan is that Allianz may be able to reimburse the full cost of your trip if you need to cancel early. However, the reason for cancellation needs to be one of Allianz Global Assistance’s list of acceptable cancellation reasons – not because you got bored or changed your mind.

This policy is a good all-rounder and ideal for travellers on a budget . However, it does have some limitations.

Some of the Allianz travel insurance OneTrip basic coverage is a bit on the tight side. Furthermore, OneTrip Basic plan does not include coverage for missed connections or airline change fees. There are also relatively fewer accepted reasons for claiming on the trip cancellation clause.

OneTrip Prime Plan

Broadly speaking, Allianz OneTrip prime plan is more or less the same as the basic – with increased coverage amounts. The policy may be able to offer;

- Emergency Medical Coverage and Dental Coverage up to $25,000 worth of and $500,000 worth of emergency evacuation coverage.

- Lost and Stolen Baggage Cover up to $1,000 which should cover most people’s hold luggage. However, the per-item max is $500. So if you pack your $8000 top-quality travel camera , you will only get $500 back for it. It also includes Baggage Delay Costs of up to $300.

- Missed Connection Coverage up to $800.

- Airline Change Fees up to $250.

OneTrip Premier Plan

In case you need a bit more on top of that, then we have the OneTrip Premier Plan. The Allianz OneTrip Premier policy is essentially the Prime with even higher coverage amounts. OneTrip Premier may be able to offer cover to;

- Emergency Medical and Dental Coverage of up to $25,000 to $50,000.

- Emergency Evacuation Coverage also increases to $1,000,000. With international evacuation averaging around $100,000, this amount is more than adequate to cover your transportation back home.

- Lost or Stolen Baggage up $2,000. However, like with the OneTrip Prime plan, you can only claim a maximum of $500 per item (up to $2,000 in total). $600 in Baggage Delay.

- Travel Delay coverage up to $1,600.

- Missed Connection Coverage up to $1,600.

Other Allianz OneTrip Options & Offshoots

In case that wasn’t choice enough for you, Allianz also offers 2 offshoots of their OneTrip policy. If you like, look at them as the highly specialised cousins of the OneTrip family.

OneTrip Cancellation Plus Plan

OneTrip Cancellation Plus Plan is definitely Allianz’s budget policy. With this plan, you are only covered against trip cancellation, interruptions, and delays. Medical coverage, medical transportation, and baggage loss are not included.

Personally, I would only consider this policy if (1) you are not checking luggage (2) you have medical coverage elsewhere. For example, this may be OK if you are an EU citizen taking a short break to another EU country where you only have your trusty carry-on luggage and an EU emergency healthcare card.

OneTrip Emergency Medical Plan

This policy is great for travellers who only want medical coverage on one single trip. It provides up to £50,00 in emergency medical coverage and $250,000 in emergency medical transportation coverage.

Remember that this plan only offers protection for medical expenses. If you are robbed, your cuts and bruises are covered but your stolen phone is not. If the airline loses your luggage it is not covered and neither is heartbreak. Trip cancellation coverage is also not included.

This plan is, therefore, for anybody whose sole and only concern is medical coverage.

Remember, the OneTrip policies cover one specific trip. The AllTrips policies we are going to detail below cover long, or multiple trips within a one-year period.

Note that AllTrips policies may also be able to offer rental car coverage for damage as well as dismemberment cover. On the flip side, trip cancellation coverage is either non-existent or limited.

AllTrips Basic Plan

The AllTrips basic may be able to offer coverage for the “classic” issues on multiple trips within a one-year period. Let’s see those numbers.

- Emergency Medical Coverage of $20,000,00 and $100,000 in Emergency Evacuation Coverage. Note that $20,00 on medical emergencies may still be a little on the low side in the event you get very sick in an expensive part of the world such as the US.

- Lost/Stolen or Damaged Baggage up to $1,000. Yes, this may be able to cover most checked bags but remember the $500 max item clause. Baggage Delay is offered up to $200 and then $300 for trip delay.

- Rental Car Damage Coverage up to $45,000. Note that additional premiums may apply.

Note that the AllTrips Basic plan does not come with Trip Cancellation or Interruption Coverage. Remember that means you will not be reimbursed in case you are unable to go on your trip!

AllTrips Prime

As you probably guessed, AllTrips Prime is more or less the same as the basic package with some increased coverage amounts. The policy may be able to offer;

- Emergency Medical Coverage of $20,000,00 and $100,000 in Emergency Transportation Coverage.

- Trip Cancellation or Interruption Coverage up to $2,000.00. Remember that the reason for cancellation needs to be one of Allianz Global Assistance’s list of acceptable cancellation reasons.

- Lost/Stolen or Damaged Baggage up to $1,000 and $200 for Baggage Delay.

- Trip Delays up to $300.

AllTrips Premier

If you want even more coverage, then we have AllTrips Premier. The Allianz AllTrips Premier policy is basically the Prime one with even higher coverage amounts. AllTrips Primer may be able to cover;

- Emergency Medical Coverage of $50,000,00 and $500,000 in Emergency Transportation Coverage.

- Trip Cancellation or Interruption Coverage up to $2,000.00.

- Trip Delays Coverage of up to $1,500.00.

- Dismemberment and travel accident up to $50,000 if you lose a limb or your eyesight when travelling.

Wanna know how to pack like a pro? Well for a start you need the right gear….

These are packing cubes for the globetrotters and compression sacks for the real adventurers – these babies are a traveller’s best kept secret. They organise yo’ packing and minimise volume too so you can pack MORE.

Or, y’know… you can stick to just chucking it all in your backpack…

We’re now going to drill down and look at the various things that may be covered by Allianz travel insurance. Remember that some of these are covered by some policy types but not others, and note that coverage amounts and excess’ also vary depending on the exact Allianz policy type.

Emergency Medical Coverage

Got food poisoning in Delhi? Got hit by a moped in Bangkok? Or maybe you just slipped in the shower and broke your wrist in Madrid?

These things can, and do, happen and will all require emergency medical care. Being sick, infirm, and unable to make TikToks is bad enough as it is, so the last thing you want is a hefty medical bill which you have to pay out of your own pocket.

Emergency accident and sickness coverage is quite likely the most important aspect of travel insurance plans.

Emergency Transportation

Emergency Medical Evacuation is when you need to be sent to your home country, or another country, for further or continued medical treatment, and are too sick to travel home normally as a regular passenger. For example – if you are stuck in a hospital bed on a drip in a leg cast.

Trip Cancellation

Reimburses for prepaid, non-refundable cancellation charges if you must cancel your trip (after the effective date of your insurance plan) due to covered sickness, accidental injury, or death of you, a family member or travelling companion; inclement weather, unforeseen natural disaster at home or at your destination, strike, or other covered reasons.

Trip Interruption

Trip Interruption Coverage includes the same stipulations as listed above in “Trip Cancellation”. It includes the caveat of covering the cost of accommodation to you if you are delayed.

Baggage Coverage for Loss/Damage

Being compensated for baggage loss of lost personal gear is likely the second most important aspect of your insurance. This is one of the most common reasons file a claim on your travel insurance.

This covers reimbursement for loss, theft, or damage incurred during the trip. It can be applied to all personal items that were lost, stolen, or else accidentally blown off the roof of a chicken bus travelling at top speed.

Baggage Delay

In the event your checked baggage is delayed or misplaced by the air carrier (for more than 12 hours) , you can claim reimbursement for any necessary items you need to purchase until your bag arrives. This will typically mean toiletries but may even mean some travel clothes if you can demonstrate the purchase is essential.

Trip Delay cover protects you when you’re unable to reach your destination on time due to circumstances beyond your control. If your airline cancels your flight due to a technical fault, Allianz travel insurance will reimburse you for any meals, transportation, or accommodation costs you incurred as a result. Note that delays of less than 6 hours are not covered.

Change Fee Coverage

Have you ever tried to change or vary a flight date or add or remove a passenger?! The fees can be insanely high. This is where Change Fee coverage comes in. If you have the AllTrips Executive, OneTrip Prime plan or OneTrip Premier plan, you can claim up to $500 to cover the cost of the airline change fee.

Travel Accident Coverage

If you are in an accident, you may be entitled to claim a compensation payment in addition to your medical/repatriation costs. This is usually reserved for loss of limb/eyesight type scenarios and you can’t claim for whiplash or emotional trauma from falling from a donkey!

The Travel Accident Coverage is also payable to your family in the event of your death.

Rental Car Damage and Theft Coverage

The AllTrips travel insurance polices also include rental car coverage. This can often prove considerably cheaper than obtaining insurance direct from the rental car provider.

If you are resident in the US, this feature may not be available to you. For clarity, we suggest you speak with Allianz travel insurance directly.

There are some notable omissions from Allianz’s cover. Let’s take a look at them.

Pre-Existing Medical Conditions

If you have a pre-existing medical condition which causes you problems on your trip, it is not covered under the Allianz policies. This is fairly common amongst insurers. It is important that you do declare any pre-existing conditions when taking the policy out.

If you do have a pre-existing medical condition, then you may be very interested to hear that SafetyWing can offer full coverage for PEMCs in their policies.

Things go wrong on the road ALL THE TIME. Be prepared for what life throws at you.

Buy an AMK Travel Medical Kit before you head out on your next adventure – don’t be daft!

Extreme Sports

Allianz Travel Insurance does not any kind of adrenaline sport such as Quad Biking and Parachuting. The lack of coverage for extreme or adventure actives is one of the many reasons why we now prefer World Nomads. To get full details of the kind of activities World Nomads can offer coverage for, head over to their site and get a tailer made quote.

So as you can see, Allianz Global Assistance offers a lot of different policy types for a lot of different people. Allianz Travel Insurance maybe suitable for the following kinds of travellers;

- Annual Travellers – With the Allianz annual plan, you may be covered for a whole rotative journey around the sun, no matter how many times you travel! Annual plans are great for frequent and long-term travellers to save you money in the long run. On the other hand, though, SafetyWing offers a month-by-month policy which you can stop and start depending on how much you travel; this may prove to be more cost-effective.

- Senior/Ageing Travellers – Allianz travel insurance policyholders are among the best senior travel insurances . They have no age limit. Believe us, not all insurers offer this and we have a LOT of queries from over 65’s & over 70’s who have struggled to find insurance elsewhere.

- Travelling Families – Allianz travel insurance policies may allow children under the age of 17 to travel with their parents for free, on selected plans. This is great for families with kids. My earliest travel memory is of a Spanish ER department, my parents were glad they had me on their policy. Otherwise my foot would still be bleeding 33 years later!

Whilst they do offer a myriad of different plans to cover most travellers types, Allianz is perhaps not the ideal travel insurance company for absolutely everybody out there.

- Adventure Travellers – Allianz Travel Insurance does not offer protection for extreme activity or sport of any kind! If you plan on doing any dangerous, adrenaline-type activities, then perhaps consider World Nomads who can offer coverage for over 201 different extreme sports. SafetyWing are also rapidly extending their extreme coverage.

- Travellers Wanting High Medical Coverage – We usually recommend travelling with at least $100,000 of emergency medical coverage. If you come down with a severe illness or are mangled by a badger, you might be stuck with thousands of dollars in medical bills so need to be prepared. World Nomads do offer $100,000 in medical emergency cover.

- Corporation Haters – Allianz are a major international finance company and we know some of you prefer not to deal with such organisations. That’s a perfectly legitimate point of view. However, remember that even a lot of “boutique” insurers are in fact ultimately shop fronts for big insurers such as Zurich, Lloyds, or even Allianz. In fact, all some boutique firms do is sell you the illusion of dealing with a small firm and charge you a hefty commission for the privilege.

So now we know the details, the next burning question is how much does Allianz Travel Insurance cost?

Well actually, it’s very difficult to say. The pricing details vary depending on a wide range of factors such as your age, location, your trip plans, if you have a pre-existing medical condition, and numerous other factors that only the gods of insurance can compute. It’s worth it to get in there and check yourself.

So, now, let’s talk about our trusty travel insurance plans for backpackers.

World Nomads

World Nomads offers coverage for backpackers and adventure trailers. They are one of our favourite travel insurance providers and we have used them for years.

Unlike Allianz travel insurance, World Nomads are a travel insurer with a focus on backpackers.

World Nomads offer 2 separate plans depending on how much cover you want and what exactly you intend to do. World Nomads can also offer trip cancellation coverage, electronic gadget, and theft coverage in the policies.

Word Nomads can cover over 140 countries (but not Pakistan which is a shame for us) . They can also cover a wide range of adventure stuff and extreme sports like mountaineering which Allianz travel insurance do not.

However, they do not offer home country cover and do not offer open-ended cover. If you are not planning on doing any adventure stuff though, then you may find World Nomads to be a bit expensive.

SafetyWing are a relatively new player on the scene. They are founded by travellers, for travellers, and their primary target is for those travelling as a digital nomad : people like me who move around the world working from our laptops. We can go many years without ever going “home” and SafetyWing recognises this and can offer open-ended cover.

What we LOVE about SafetyWing is that their insurance operates like a monthly subscription that you can stop and start as and when you need it. They are also one of the few providers who may be able to cover some pre-existing conditions and provide assistance with “routine” health stuff.

We’ve tested countless backpacks over the years, but there’s one that has always been the best and remains the best buy for adventurers: the broke backpacker-approved Osprey Aether and Ariel series.

Want more deetz on why these packs are so damn perfect? Then read our comprehensive review for the inside scoop!

By this point, you may well know which travel insurance is best for you. Maybe it’s Allianz travel insurance, or maybe it’s one of the others.

The question now then is, when should you buy travel insurance?

You can buy travel insurance up until the start date of your trip for most insurers. Many will not cover a trip that has already begun – with the exception of World Nomads and SafetyWing.

Note : if you ever do make a claim, you may well be asked to provide evidence of the start date. So I do not recommend trying to hoodwink insurers. Be totally honest or it will come back on you.

However, in our experience, the earlier you book your travel insurance, the better. This is for a number of reasons:

- Things sometimes go wrong before the trip even starts. For example, if the airline goes bust. This happens to 1000s of people every year. Or what if you get very sick a week before flying and have to cancel?! If you have the right travel insurance in place, your insurer may cover you in these scenarios.

- The vast majority of policies include a cooling off period . This is a period of time (usually 28 days) when you can cancel the policy and get all of your money back. We suggest using the cooling period to read through the policy documents and ensure that the cover fully meets your needs. Upon a closer look, if it does not suit you, you have time to contact the insurer and amend the policy, or cancel it and obtain more suitable travel insurance.

Personally, I usually book my travel insurance the very same day I book my flight. The only exception is if I already have long term or an annual plan. In these scenarios, instead, be sure to check the last date on your annual/long-term cover and make sure it covers your whole trip.

First up, it is unlikely you will ever need to make a travel insurance claim. Yipee!

In case you do though, you will be very pleased to hear that the process is pretty straightforward as long as you are dealing with a reputable company. If you are not then it may be a lot harder.

To initiate a travel insurance claim, all you need to do is contact (call) Allianz Global Assistance and chat with their 24-hour multilingual staff. You should do this as soon as possible or as soon as you know you will need to make a claim .

You will need to tell them about your claim including details of what has gone wrong, and what the damage seems to be. You can also initiate the process online by signing into your account.

If you are claiming lost or stolen items, you will need to write up a formal sworn statement of events, detailing what happened and what was lost. You will also need to have an official police report made up – it is highly important that you obtain this even if it means paying a fee/bribe or hassling the police to do it. Try to get it in both the native language and in English if possible.

The Insurance company may contact you to discuss your claim further. You may even be subjected to a an anti-fraud interview and your call may even be run through voice detection software designed to spot deceit! However, you have nothing to worry about if your claim is legitimate and in order.

It is very helpful to get all of your receipts and invoices together first and submit all expenses at once. Do keep copies of every expense, bill, invoice, and report as you will need to provide these to the claims team. They may pay out small amounts without a bill, but in the case of extra hotels, flights, or electronics, the rule is usually “no proof = no payment”.

After that is sorted, you upload all of your information and documents, review the claim and submit. The Allianz team will get cracking and stay in contact with you throughout this process. Note that resolution time does vary from case to case. It may be days, weeks, or sometimes months depending on the details of your claim.

I hope you found this Allianz Travel Insurance Review to be informative – it certainly took a lot of work on our part to put it together! Comprehensive travel insurance is important to safe travel and you need to carefully choose the best provider for your needs.

We really care about the safety of our readers. That’s why we do recommend travel insurance so strongly. We’ve seen ourselves what can go wrong – and we wouldn’t wish it on anyone.

So check for trip interruption coverage, get your gadgets covered, but most importantly, make sure any potential medical expenses are covered, especially emergency medical expenses. Shop around different providers to find the right one for you. Once again, we wish you an awesome and safe trip!

Buy Us a Coffee !

A couple of you lovely readers suggested we set up a tip jar for direct support as an alternative to booking through our links. So we created one!

You can now buy The Broke Backpacker a coffee . If you like and use our content to plan your trips, it’s a much appreciated way to show appreciation 🙂

Aiden Freeborn

![allianz travel insurance one trip basic Brutally HONEST Allianz Travel Insurance Review – [Updated 2023] Pinterest Image](https://www.thebrokebackpacker.com/wp-content/uploads/fly-images/716330/Allianz-travel-insurance-review-pin-260x337.jpg)

Share or save this post

Travel Insurance company reviews are almost redundant as many do not look into who they use for underwriters (who they pass your claim to for payment). When people take out insurance, what they really want to know is, if there is an emergency they are entitled to claim for, is it going to be paid out. I have spent numerous hours looking for a travel insurer who doesn’t use an underwriter who is clearly a crook who does not want to pay out. If someone has found one, PLEASE, I would sincerely like to know.

The author did a very nice job explaining the different types of insurance Allianz offers. But, until you have experienced their VERY POOR customer service and actual reimbursement procedures, you will not have the complete Allianz story.

I would never use Allianz Global Assistance for your trip insurance needs During a Viking River Cruise June, 2023, my husband came down with COVID. VIKING handled their end of any claims and taking care of us beautifully, BUT Allianz Global Assistance was a completely different story. We had Trip Interruption insurance (which included coming down with COVID) and trying to get reimbursement for all our medical expenses and a post trip to Amsterdam we had planned (not with Viking, but through our travel agent) has been one of the most frustrating ordeals I have ever dealt with. We are asking for approximately a $2,000 reimbursement and we have received $300.

If you need to file a claim, here is what you can expect after you complete the on-line claim form on Allianz’s website : 1. They will tell you they can’t read your receipts (even though you can read them on the email you send or they are PDFs from Viking or your TA). One Allianz customer service rep (probably the 7th person I talked to), told me to download a $50 app that makes receipts readable, which I did, and they still couldn’t read them. I finally snail-mailed copies of the receipts and they still declined 75% of them. 2. Phone calls with wait times of over an hour. This has happened to me 10+ times (not just a random occurrence), and I have tried all times of the day – same thing. 3. When you do talk to a rep, the call will always, and I mean always, disconnect before the issue is handled.

I could go on and on, but bottom line, I will NEVER use Allianz again or recommend them to anyone. We are out $2,000 + $1,000 we paid for the Trip Insurance. It is a big deal, but I can’t imagine if we had to rely on Allianz for the total trip reimbursement. Thank goodness Viking stepped up and provided the level of customer service they did.

Of course, we are aware that some customers sometimes have insurance claims denied. We also appreciate that others have bad customer service experiences with all kinds of different companies.

However are not privy to the finer details of your situation, and Allianz are not here to put across their side of the story either – furthermore this is not really the legitimate forum to air complaints about them. Still in the interest of openness and transparency we will let your comment stand.

Best of luck with your next trip.

Yes agreed – your statement about Allianz not offering unlimited medical cover is complete BS and misleading to readers. Are you paid to promote World Nomads Insurance? Please provide full disclosure to your readers.

I have just rechecked the Allianz policy information available on their website and what we have said appears to remain correct. If you feel we have missed something then please elaborate.

As for World Nomads, we have made it clear that some of the links in this post are affiliated.

Hi there, I found your article very informative, but I just wanted to make a couple of corrections. Im not affiliated with Allianz, but Ive been researching which insurance to buy and they have provided me with a quote and their PDS, which Ive read in full. The amounts that Allianz offers for overseas emergency assistance and overseas medical and hospital expenses under their comprehensive plan are both unlimited, and they do offer insurance for pre-existing medical conditions, you just have to pay an additional premium.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of followup comments via e-mail.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Allianz Travel Insurance Coverage Review — Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

327 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

46 Published Articles 3395 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

Table of Contents

Why purchase travel insurance, travel insurance and the covid-19 virus, types of travel insurance policies available with allianz, how to obtain a quote with allianz, additional travel insurance offered by allianz, how allianz compares, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

There are a lot of choices when it comes to travel insurance companies , so narrowing your selection to those that have a solid financial rating, offer products that provide good value, and receive high customer ratings should be baseline criteria.

Allianz Global Assistance company ( Allianz Travel) checks all of those boxes. Its parent company, Allianz SE, receives an A+ rating from A.M. Best (a leading insurance financial rating firm), and the company offers competitive individual trip and annual travel insurance products. It also serves over 45 million customers in the U.S. each year with 84% of those customers giving the company a 5-star rating.

Allianz has also been around a long time. In fact, the company was there to insure the Wright Brothers’ first flight and the construction of the Golden Gate Bridge — so you know you’re working with an established organization. You’ll also find that Allianz does business in more than 35 countries.

Let’s take a look specifically at Allianz Travel’s insurance products, show you how to obtain a quote, and give you some tips on purchasing and comparing travel insurance policies.

And while our focus is on Allianz Travel coverage, much of our information can apply to purchasing travel insurance in general.

Travel insurance can protect your trip investment with coverage for disruption due to unforeseen events such as severe weather, should you become ill, for illness in your family, missed connections, medical emergencies, and more.

Deciding whether to purchase travel insurance for your trip is an option each time you make a travel booking. The coverage is commonly offered by airlines, cruise companies, tour operators and other travel providers at the point of sale. If you travel infrequently and the cost is relatively low, you may just opt for the coverage during the booking process.

However, if you’re going to be taking several trips, you may be able to save money and receive better coverage if you compare with other travel insurance policies in the marketplace. Additionally, you’ll want to determine if it makes sense to purchase single insurance coverage for each trip or an annual all-trips-included policy.

Situations where it makes sense to purchase travel insurance include the following:

- You’re booking an expensive trip that includes a lot of non-refundable upfront expenses

- Your trip includes several travel providers (i.e. airlines, hotels, and tour operators)

While travel insurance is meant to cover unforeseen events, purchasing Cancel for Any Reason coverage may allow you to cancel your trip for any reason.

Bottom Line: If you’re uncomfortable with the amount of money you have at risk when you travel, securing travel insurance can provide immediate peace of mind . You’ll have solace in knowing that if you needed to cancel your travel plans due to a covered event or if your travel is disrupted, you’ll be able to recoup most, or all, of your investment.

Most travel insurance policies do not provide coverage for trip cancellation due to fear of the coronavirus pandemic . However, COVID-19 is an included illness on many travel insurance policies as it relates to certain coverages such as emergency medical care while traveling and canceling a trip if you become ill with the virus. You may also have coverage if a family member or travel companion contracts the virus and you must cancel your trip as a result.

The only way to cover trip cancellations due to fear of contracting COVID-19 is to purchase Cancel for Any Reason insurance. This coverage can be added to a comprehensive travel insurance policy (with limitations) and subsequently allows you to cancel your trip for any reason.

While Allianz does not offer Cancel for Any Reason insurance , it may cover COVID-19 related illness in the following circumstances:

- Emergency medical care while traveling

- Trip cancellation due to becoming ill with the virus

Allianz Epidemic Coverage Endorsement

Allianz recently announced that it is adding a new endorsement to select policies that will offer limited coverage for COVID-19 . Circumstances such as becoming ill with COVID-19 and having to cancel your trip, hospitalization, and trip delays due to such illness while traveling will have coverage.

Emergency transportation coverage has also been expanded to include COVID-19-related illness. Terms and conditions apply and the endorsement is not available on all policies Allianz offers.

You can find policies that offer Cancel for Any Reason insurance at TravelInsurance.com and Aardy.com .

Bottom Line: Travel insurance policies normally do not cover canceling your trip because of fear you might get ill. However, Cancel for Any Reason insurance allows you to cancel a trip for any reason you determine is necessary.

Allianz Travel offers 2 core types of travel insurance plans: single trip plans and multi-trip plans . Each plan allows you to select the level of coverage you want and subsequently, the level of premium you prefer to pay.

We’ve used criteria to obtain a quote for a traveler age 35, traveling for 1 week to Mexico on a trip costing $3,000 . All benefits are per person, per trip, unless otherwise noted.

OneTrip Plans — For Affordability and Select Coverages

The single trip option allows you to select from a Basic, Prime, or Premier plan. Premiums vary by plan and coverage levels. For the example we selected, the premiums ranged from $116 for the Basic to $192 for the Premier pla n .

OneTrip Basic Plan — the Most Affordable Plan

The OneTrip Basic plan offers basic trip protection at an affordable price.

OneTrip Prime Plan — the Most Popular Plan

Need more coverage but still want your travel insurance protection to be affordable? The OneTrip Prime plan offers higher coverage limits at a reasonable cost.

The following are the maximum coverage limits for OneTrip plans. These coverages can be found under the OneTrip Premier Plan:

- Trip Cancellation — up to $100,000 reimbursement for prepaid non-refundable expenses; pre-existing medical conditions included

- Trip Interruption — up to $150,000 reimburses for remaining non-recoverable expenses and increased cost of return transport due to trip interruption as the result of a covered event; pre-existing medical conditions included

- Emergency Medical — up to $25,000

- Emergency Medical Transportation — up to $500,000 for transportation to the nearest medical facility

- Baggage Loss/Damage — up to $1,000 for theft, loss, or damage

- Baggage Delay — up to $300 for delays 12 hours or more

- Trip Delay — up to $800 ($200/day for 4 days) for delays of 6 hours or more, for eligible expenses; an option to receive $100/day with no receipts required is also available

- Change Fee Coverage — $500

- Loyalty Program Re-deposit Fee Coverage — $500, covers re-deposit of points/miles due to covered trip cancellation

- 24 Hour Hotline Assistance

- Optional coverages include pre-existing medical coverage, rental car coverage, and required to work coverage — restrictions apply

Also worth noting is that kids age 17 and under are covered at no additional charge when traveling with a parent or grandparent.

Bottom Line: Allianz offers several levels of single-trip travel insurance plans that can fit every budget and level of coverage needed.

AllTrips Annual Plans — Cover All of Your Trips for a 12-Month Period

If you’re a frequent traveler and want to ensure all of your trips are covered without having to purchase individual travel insurance policies, one of the AllTrips plans might be an appropriate choice. All of the trips you book within the 12-month policy period are covered automatically.

Coverage limits are per person, per trip, but more than 1 person can be included in the policy. Children 17 and under are covered at no additional charge when traveling with a parent or grandparent.

The AllTrips Executive plan is the most comprehensive policy and includes the maximum coverage limits listed below . AllTrips Prime and AllTrips Basic have less coverage than the Executive plan but may still be appropriate for your situation.

For example, the AllTips Basic plan does not include trip cancellation/interruption insurance but has emergency medical, evacuation, trip delay, baggage insurance, and car rental insurance.

- Trip Cancellation — up to $10,000 reimbursement for prepaid non-refundable expenses

- Trip Interruption — up to $10,000 reimburses for remaining non-recoverable expenses and increased cost of return transport due to trip interruption as the result of a covered event

- Emergency Medical — up to$50,000

- Emergency Medical Transportation — up to $250,000 for transportation to the nearest medical facility

- Baggage Loss/Damage — up to $1,000 for theft, loss, or damage

- Baggage Delay — up to $1,000 for delays 12 hours or more

- Trip Delay — up to $200 per day for eligible expenses, up to $1,600 in coverage , for delays of 6 hours or more

- Rental Car Damage and Theft — up to $45,000

- Business Equipment Coverage — up to $1,000

- Change Fee Coverage — up to $500

- Loyalty Program Redeposit Fee — up to $500

- Travel Accident Insurance — up to $50,000

- Concierge Services

- Optional Pre-Existing Medical Coverage — restrictions apply

Bottom Line: Allianz’s AllTrips 12-month plans offer affordable options to cover every trip you have booked or have yet to book within a 12-month period.

Travel insurance is one of the easiest policies for which to obtain a quote and subsequently purchase a policy. Unlike auto or home insurance, you simply input some basic information about your trip, your age, where you reside, and your quote is instant.

You can then read through the coverages, select a policy that fits, and hit the purchase button. There is also no risk as you’ll have a free-look period where you can review the policy and decide whether to keep it or not.

If not, you can get a full refund. This period can be 10-14 days after purchase , depending on your plan and state regulations.

In addition to the travel insurance packages offered by Allianz, you can purchase these additional plans and coverages available for single trips:

OneTrip Emergency Medical Plan

If trip interruption/cancellation is not important to you, you’ll find this plan with emergency medical, baggage insurance , emergency transport, travel accident coverage , and trip delay an affordable alternative.

OneTrip Cancellation Plus Plan

If you need to cancel your trip for a covered reason or your trip is interrupted for a covered event, you’ll have coverage. Trip delay and 24-hour assistance are included.

Rental Car Damage Protector

For $9 per day, receive rental car damage/theft coverage, rental car trip interruption protection, and baggage loss coverage.

Hot Tip: If trip cancellation/interruption or trip delay coverage comes with your credit card is adequate for your trip but you want additional medical coverage, the Allianz’s OneTrip Emergency Medical plan may be a viable and affordable supplement.

When it comes to comparing travel insurance policies, it’s difficult to match apples to apples. Coverages vary widely, as well as terms and conditions. The lowest-priced policy is not always the best value for your needs. The flip side is possible, too. You may find a policy with plenty of coverage at a price that is more than you want to spend.

The best solution is when you find a balance between coverage and cost.

Here’s how Allianz’s travel insurance offerings compare with other travel insurance options.

Allianz vs. Credit Card Travel Insurance

The coverage that comes with your credit card does not compare with a comprehensive travel insurance policy . In addition to the limited travel insurance coverage credit cards offer, if you do have a claim, you’ll have the potential hassle of dealing with a third-party claims administrator.

With that being said, the trip cancellation, trip interruption, trip delay insurance, and primary rental car insurance coverages found on several credit cards may be more than adequate for your trip.

Here are some of the best credit cards for travel insurance:

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings through American Express Travel using your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card ® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $199 CLEAR ® Plus Credit: CLEAR ® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $199 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.¤

- Terms Apply.

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

American Express Membership Rewards

The Amex Platinum card comes with trip cancellation and trip interruption insurance with a benefit of $10,000 per trip, up to a maximum of $20,000 per account per 12-month period.

Pay for your trip with your eligible card and you, your immediate family, and eligible traveling companions are covered for non-refundable expenses paid to the travel provider. Trip interruption coverage will also reimburse for additional travel expenses incurred due to a covered loss during your trip.

Trip delay coverage is also included on the Amex Platinum card for delays more than 6 hours. Reimbursement for incidentals and eligible incurred expenses is limited to $500 per trip with 2 claims allowed per 12-month period.

The Amex Platinum card also comes with emergency medical evacuation coverage .

For more information, check out our detailed guide to the travel insurance benefits offered by the Amex Platinum card.

Chase Sapphire Preferred ® Card

A fantastic travel card with a great welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027.

- Member FDIC

- APR: 21.49%-28.49% Variable

Chase Ultimate Rewards

Pay for your trip with your eligible card for up to $10,000 in coverage per person, $20,000 per trip, and up to $40,000 in a 12-month period. You and your qualifying immediate family are covered.

You’ll also find primary car rental insurance on the Chase Sapphire Preferred card and the Chase Sapphire Reserve ® .

To learn more about the travel insurance benefits on the Chase Sapphire Preferred card , you’ll want to review this detailed article.

Chase Sapphire Reserve Card

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases through March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- $550 annual fee

- Does not offer any sort of hotel elite status

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- APR: 22.49%–29.49% Variable

In addition to the same trip cancellation/interruption/delay coverage as the Chase Sapphire Preferred card, the Chase Sapphire Reserve card offers up to $2,500 in emergency dental and medical coverage , emergency medical evacuation .

For more information check out this guide to all of the travel insurance benefits offered by the Sapphire Reserve.

Allianz vs. Other Travel Insurance Companies

Before purchasing any travel insurance policy, it’s wise to compare — fortunately that’s an easy task to execute. With comparison sites such as the ones listed here, you can compare as many as 100 travel insurance policies very quickly and find a policy that fits your situation and budget.

Keep in mind that insurance rates and coverages are highly regulated by the states . Insurance companies file a certain policy for a certain price with the state insurance commission, then the company is allowed to offer that policy, at that price, in that state.

For this reason, you won’t find the same policy offered at different prices. However, you could find a policy that is a better fit and possibly for less money by comparing several companies’ offerings.

Not all comparison sites include Allianz but when comparing similar policies, you’ll find that the company is competitively priced (a few companies lower and many companies higher). Individual results will vary based on your criteria.

Here are 4 websites that allow you to easily compare travel insurance policies.

- Insure My Trip — With over 60,000 customer reviews, 21 highly-rated travel insurance providers, and a best price guarantee, Insure My Trip makes it easy to find the right travel insurance policy.

- Travelinsurance.com — Compare major top-rated travel insurance company policies easily with this licensed online insurance search engine.

- SquareMouth — This popular travel insurance search engine offers easy comparisons of hundreds of policies offered by dozens of highly-rated insurance companies.

- Aardy — AardvarkCompare is a licensed travel insurance company with agents on staff to help you find the right travel insurance policy. Its website allows you to compare the policies of over 30 travel insurance providers.

There are also specialty companies such as World Nomads that do a great job providing travel insurance for active individuals. If you’re into outdoor sports, adventure activities, or even more risky activities such as skydiving, you can find coverage through World Nomads.