- Let's fly

- Explore hotels

- Travel insurance

- Pride Flight

- Featured sales

- Sign up to V-mail

- Change or cancel

- Upgrade options

- Redeem travel credits

- Disruption information

- Retrieve your Travel Bank details

- Rapid Rebook

- Flights to Sydney

- Flights to Melbourne

- Flights to Brisbane

- Flights to Perth

- Flights to Gold Coast

- Flights to Cairns

- Explore all destinations

- Flights to Bali

- Flights to Fiji

- Flights to Queenstown

- Flights to Tokyo

- Destinations

- Travel Inspiration

- Sydney to Melbourne

- Sydney to Brisbane

- Melbourne to Sydney

- Melbourne to Brisbane

- Brisbane to Sydney

- Adelaide to Melbourne

- Perth to Melbourne

- Sydney to Bali flights

- Melbourne to Bali flights

- Brisbane to Bali flights

- Sydney to Fiji flights

- Melbourne to Fiji flights

- Brisbane to Fiji flights

- Travel agents

- Cargo services

- Airline partners

- Specific needs and assistance

- Flying with kids

- Travelling with pets

- Group travel

- Travelling with airline partners

- Carry-on baggage

- Checked baggage

- Dangerous goods

- Baggage tracking

- Connecting flights

- Airport guides

- Transfer maps

- Cabin classes

- Onboard menu

- In-flight entertainment

- Get connected

- Health onboard

- Travel and entry requirements

- About the program

- Join Virgin Australia Business Flyer

- Partner Offers

- Why choose Virgin Australia

- Enquire now

- Velocity home

- Earning points

- Redeeming Points

- Transferring Points

- Buying Points

- Member benefits

- Transfer credit card points

- Points earning credit cards

- Shop to earn Points

- Shop using Points

- Status membership

- How to use Points for flights

- Flight status

- Travel insurance offers

Offers from our partners

- Car hire offers

- Hotel offers

- Former bookings

Get domestic and overseas cover today and travel knowing you are protected with Cover-More

24/7 emergency assistance, instant cover, easy online claims, earn velocity points.

Silver, Gold and Platinum members earn a 50%, 75% and 100% bonus Points respectively on top of the base Points earned when purchasing your travel insurance through the quote generator.

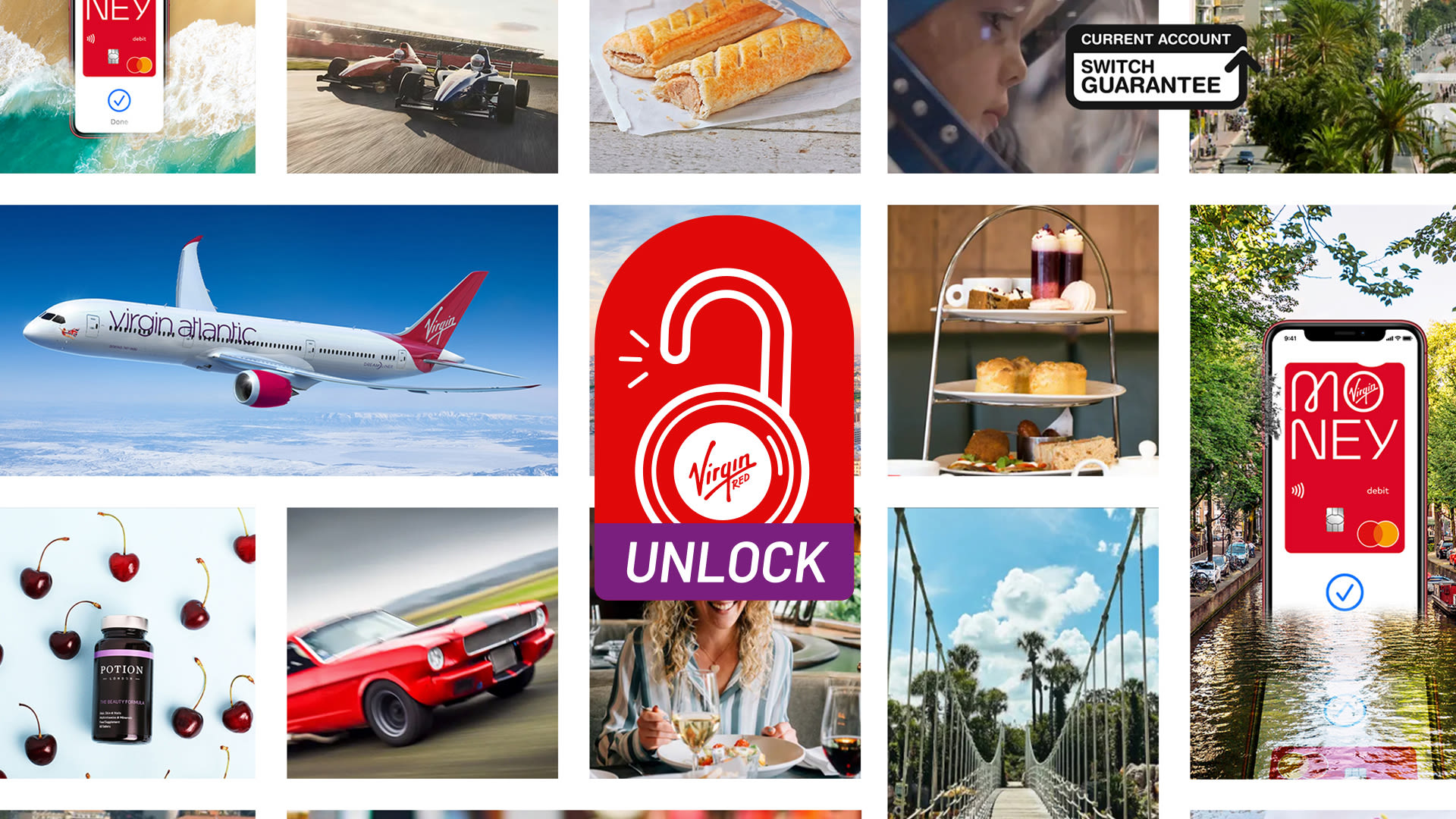

Virgin Money and Virgin Red offer exclusive Travel Insurance rewards for Virgin Red members

We know taking travel insurance out can be one of the least exciting ‘To Dos’ when planning for a trip, but that's all about to change with Virgin Red and Virgin Money . Virgin Red members will be rewarded for taking out travel insurance, so you can explore the world feeling safe and spoiled.

Virgin Money Annual Multi-trip Travel Insurance

If you’ve got a few trips coming up, Virgin Money’s annual multi-trip travel insurance will give you the peace of mind you need to truly relax.

What could be more relaxing than that? 3,500 Virgin Points that's what, from your friends at Virgin Red.

With Virgin Money’s Annual Multi-Trip insurance , you can choose up to 94 days’ worldwide cover per trip, with everything you care about covered – from your gadgets to your health.

Added benefits

Covid cover included - cancellation and medical expenses are covered by Virgin Money, as standard, if you’re diagnosed with Covid-19.*

Gadget cover as standard, plus optional extras - from Enhanced Gadget and Enhanced Covid Cover – to cover for winter sports, car hire excess, and more (fees apply).

On hand to help, 24 hours a day, 365 days a year - help is just a phone call away with Virgin Money’s worldwide medical emergency assistance helpline.

Your policy at your fingertips - looking after your policy is now a breeze, thanks to Virgin Money’s handy new online portal – from downloading docs to making a claim, all in one place.

*Please check your policy wording for full details and any exclusions.

The Virgin Money travel insurance has three levels of cover : Red, Silver and Gold, so you can choose which suits you and your needs best.

Managing your travel insurance is a breeze. Simply register online then unwind knowing you can do anything from updating your personal details, to making a claim, all in one place.

The fun part - spending your points

Virgin Red members are rewarded for everyday spending, and with everything from the biggest brands in retail, travel and entertainment to smaller treats or exciting new start-ups, there are so many different rewards which anyone would enjoy. Members can also use Virgin Points for good by supporting a number of different charities or helping develop technology to remove carbon from the atmosphere.

What will you put your points towards? Your next flight, getaway or holiday? Navigating the world of Virgin Wines? Or another Virgin Red treat, experience or exclusive? Enjoy deciding.

Buy your travel insurance today with Virgin Red and Virgin Money and earn 3,500 Virgin Points.

Terms and conditions

Who can take up this offer?

Virgin Red Members who are 18+ and resident in the UK.

How do you take up this offer?

It’s important that you follow these steps to make sure you are eligible for this offer. If you don’t, you might not get your points... and we don’t want that!

Buy a Virgin Money Annual Multi Trip Policy (the Policy) via the offer in the Virgin Red app or Virgin Red website.

You’ll see the offer listed in the “Earn Points” section of the Virgin Red app and website.

Just click on “Get Points” when you want to go ahead. This will link you to the offer page on the Virgin Money website.

From there, click on ‘Get a quote’ and fill in your policy requirements to receive a quote.

Make sure you choose the Annual Multi-trip Policy. The Policy start date must be within 45 days of buying the Policy.

When you’re happy to go ahead, pay for the Policy. o You will receive a confirmation email from Virgin Money.

You need to hold the Policy for at least 45 days to be eligible for the Offer before points are credited to your Virgin Red account. If you or Virgin Money cancel the Policy before 45 days, you won’t be eligible for points.

This offer can’t be used in conjunction with any other offer. Points are only offered in year one of the policy.

What is the offer?

If you meet the offer conditions, we’ll give you a Virgin Red promo code. You can redeem this code with our friends at Virgin Red to get 3,500 Virgin Points.

We’ll send you an e-mail with your promo code within 28 days of you meeting the offer conditions. We’ll send your code to the e-mail you gave when you bought the Policy. The email will provide instructions on how to redeem the code within the Virgin Red app or website.

Your Virgin Red promo code can be used until 30 April 2023. Make sure to redeem your code before then.

Only one Virgin Red promo code will be generated per eligible Policy.

After you’ve redeemed your Virgin Red promo code, the points are added to your Virgin Red account. There is no specific expiry date for using the points. You’ll be free to use them in line with Virgin Red’s programme terms. You can find the terms here [ http://policies.red.virgin.com/terms ].

We thought we should highlight a few key things from Virgin Red’s terms:

the points don’t have a cash value and they can’t be swapped for cash;

the available offers can change from time to time; and

the points cost for each offer can change too.

Although we’ll be working closely with our friends at Virgin Red on this promotion, we aren't responsible for their terms, their marketing, or any of the offers available through their app. Just contact Virgin Red or the relevant offer provider if you have any questions about these topics.

When can you take up the offer?

The offer will be available on an ongoing basis until we withdraw it. We can withdraw the offer without giving you any advance notice, but we’ll try to give some notice if we can.

The offer is subject to availability. This means we will definitely withdraw it when we’ve used up our stock of Virgin Red promo codes.

You don’t need to worry if we withdraw the offer when you’re part way through meeting the offer conditions. As long as you've bought the Policy before we withdraw the offer, you can still qualify. You’ll just need to continue to meet the rest of the conditions.

What else do you need to know?

You can only benefit from this offer once.

We’ll use your personal information to help us run the offer.

English law applies to the offer.

Standard Virgin Money Travel Insurance Policy conditions apply.

If something goes wrong, we’ll try to fix it. If we can’t because it’s something we can’t control, or it’s not our fault, then we may have to change the offer. This includes suspending the offer or ending it early. We can make such changes without giving you notice. However, we’ll try our best to avoid making changes. And we’ll try to minimise any disappointment to you when we make changes.

Who is the promoter?

We are Clydesdale Bank PLC trading as Virgin Money.

Our company number is SC001111.

Our registered office is 30 St Vincent Place, Glasgow, G1 2HL.

Virgin Red and Virgin Money give new customers 20,000 reasons to switch

Unlock Virgin Red: How to earn Virgin Points with a Virgin Money M Plus Account or Club M Account

Who wants to be a virgin points millionaire.

- Fly with Virgin Atlantic

- Upgrades and Extras

- Travel Insurance

Travel insurance

Selecting Allianz Travel Insurance at checkout is the easiest way to protect your investment, giving you more freedom to embrace your entire travel experience.

If you've already booked your flights, you can still find a plan to protect your trip.

Virgin Money credit card complimentary travel insurance

A virgin money credit card that offers complimentary travel insurance can help you save on the cost of overseas trips – so how much cover can you get.

In this guide

What Virgin Money cards have complimentary travel insurance?

What's covered by virgin money complimentary international travel insurance, what's not covered, what do i need to do to use virgin money credit card complimentary travel insurance, pre-existing medical conditions, how to make a claim, other types of virgin money complimentary credit card travel insurance, virgin money credit card complimentary insurance for shopping.

Virgin Money offers complimentary insurance on Virgin Australia Velocity High Flyer and Flyer credit cards, including complimentary international travel insurance on the Velocity High Flyer.

These policies are underwritten by Allianz Global Assistance (Allianz) and there are different conditions to get cover and make claims. That's why it's always best to read insurance policy documents. But if you just want an overview, here we have pulled out the key details for this cover.

Have a question or need to make a claim now? Call Allianz on 1800 072 791 (Australia) or +61 7 3305 7499 (overseas).

The Velocity High Flyer and Flyer credit cards offer different types of complimentary insurance. Here's a summary of what you can get with each card.

This insurance includes emergency medical cover, luggage and some cancellations. The actual cover you get is broken down into "benefits" based on what you can and can't claim. For some claims, you'll need to pay an excess before you'll get any money back if it's approved.

Here, we've broken down the key options for different types of benefits, with basic examples of when you might make a claim. But remember: you should always read the insurance policy booklet for complete details of the cover.

Medical, dental and emergencies cover

Cancellation, delays and transport, luggage and personal items cover, death, funerals and personal liability.

All insurance policies have details of when you will and won't get cover, so check the insurance booklet before you book a trip or make a claim. With Virgin Money credit card complimentary international travel insurance, some of the key situations that aren't covered include:

- If you don't follow advice from any government, official body or mass media announcements

- If the purpose of your trip includes getting medical treatment

- Participation in criminal or illegal acts

- Acts of war

- Dangerous activities, including rock climbing, white water rafting, bungee jumping, skydiving, water skiing, off-piste snow skiing or snowboarding, or for any professional sports

These are only a few examples of when you won't get cover under this policy. Check the Virgin Money credit card insurance policy booklet or call Allianz on 1800 072 791 for more details about the exclusions.

Does Virgin Money credit card international travel insurance cover COVID-19?

Yes, for claims made on or after 1 November 2023 there is some cover related to COVID-19. This includes:

- Overseas emergency assistance

- Overseas emergency medical

- Cancellation

- Additional expenses

To make a claim, you need to be positively diagnosed with COVID-19 (or another pandemic/epidemic disease) and meet all the other requirements for a claim. This also extends to an eligible spouse or dependants travelling with you – but won’t apply if you’re travelling against government advice. As there are lots of conditions to meet for this type of cover, make sure you read the policy booklet or call Allianz on 1800 072 791 before you travel.

If you need cover for a skiing trip, bungee jumping or other overseas adventures, check out adventure sport travel insurance costs and conditions.

If you're planning a trip and want cover through your Virgin Money credit card, you'll need to meet the following requirements:

- Spend at least $500 on your prepaid travel costs using your Virgin Money Velocity High Flyer Card.

- Use Velocity Points to book your overseas travel ticket.

- Redeem a Virgin Australia Gift Voucher for the overseas travel ticket.

- Length of travel. This cover is available if your trip is for 6 consecutive months or less.

- Account status. You need to have an active, eligible Virgin Money credit card in your name at the time of your booking.

Does Virgin Money credit card travel insurance cover family members?

Yes, your spouse and eligible dependants (i.e. your children) can also get cover when you meet the eligibility requirements for international travel insurance. For them, the key requirements to get cover are:

- They need to be an Australian resident or a holder of a visa issued under the Migration Act 1958 (Cth)

- They need to travel with you for at least 50% of the trip that you've got cover for

- They need to have a return overseas travel ticket before leaving Australia

- They need to be under 81 years of age at the time they became eligible for the cover

They also need to meet the other conditions of the insurance policy. Keep in mind that some claims have different limits for a spouse or dependants compared to what you (as the primary cardholder) get.

A pre-existing medical condition can affect your travel insurance cover and usually refers to health conditions you've recently been treated for or manage on an ongoing basis.

With Virgin Money's complimentary international travel insurance, you can only get cover for a pre-existing medical condition if you apply and get written confirmation from Allianz Global Assistance.

You can do this online or by calling Allianz on 1800 072 791 before you go overseas. If your request is approved, you’ll need to pay a $75 administration fee and will then be sent written confirmation that your pre-existing condition is covered.

Pregnancy cover

This policy offers limited cover for pregnancies, but the amount and type of cover varies.

For example, if you become pregnant after booking your trip and meeting the eligibility requirements for this cover, you’ll be able to get cover for any complications of your pregnancy that arise from injury or sickness.

There is no cover for childbirth, except if it is the result of injury or sickness. If you are pregnant or planning for pregnancy, make sure you check the insurance policy or contact Allianz directly for full details on cover.

First, contact Allianz as soon as anything happens by calling +617 3305 7499 from overseas or 1800 072 791 from Australia. They will be able to advise you on the claim or claims you want to make at the time.

You can then submit a claim online by following these steps:

- Go to the Allianz online claim portal at https://claimmanager.com.au/aga/agreement

- Confirm you agree with the terms and conditions, then click "Create new claim"

- Select the "Credit card insurance" option and provide details of your card

- Fill in the details on the claim form and upload your supporting documentation

You will hear back about your claim within 10 business days.

What to include in your claim

With insurance claims, including as much detail as possible makes it easier for the insurer to consider the claim and your eligibility for a payout.

So when you're travelling with this cover, aim to get as much written or photo evidence as you can for any claims you need to make. This could include:

- A referral or letter from a doctor or other professional you see in relation to a claim

- Official medical reports

- Police reports

- Photos of damaged items

- Emails or letters from airlines that relate to a claim

- Receipts or other proof of purchase

Tip: Use a travel wallet or create an online folder to keep all your important documents together. This could include your passport, itinerary, printed tickets, a copy of the Virgin Money card insurance policy booklet – plus anything that could become supporting documentation for future claims.

Domestic travel insurance

- What is it? Cover for specific issues that come up when you're travelling to a different state or territory in Australia. This can include costs relating to cancelled return flights, flight delays of 4 hours or more and delayed or lost luggage.

- When can I use it? You'll get cover for up to 28 days in a row if you have paid for the entire trip with your Virgin Australia Velocity High Flyer credit card, Velocity Points, a Virgin Australia Gift Voucher or a combination of these options. Your spouse and any dependants can also get cover if you use the same payment method for their return travel of 28 days or less and they will be with you for at least half the trip.

- Is there an excess cost? There is a $75 excess for claims that relate to additional expenses. There are no excess costs for other claims but there are maximum claim amounts, which vary depending on the type of claim.

Rental vehicle excess insurance in Australia

- What is it? Cover for damage or theft of a hire car, up to a maximum total of $10,000.

- When can I use it? When you’ve used your eligible Virgin Money credit card to pay for the full cost of the car hire.

- Is there an excess cost? $100 per claim.

To make a claim under one of these policies, download a claim form online at https://claims.agaassistance.com.au/ or call Allianz on 1800 072 791.

Virgin Money credit cards give you access to other types of insurance, which are also provided by Allianz. Here’s a basic explainer of each one:

- Purchase protection insurance: Offers cover for up to 90 days when you purchase new items with your eligible Virgin Money credit card and they are then stolen, accidentally damaged or lost. It covers household and personal items such as shoes, jewellery, glasses and new works of art.

- Extended warranty insurance: This cover doubles a manufacturer's warranty, up to a maximum period of 12 months, for eligible items bought with your card in Australia.

Don't have complimentary insurance on your credit card yet? Compare Virgin Money credit cards or check out other cards that offer insurance .

Amy Bradney-George

Amy Bradney-George was the senior writer for credit cards at Finder, and editorial lead for Finder Green. She has over 16 years of editorial experience and has been featured in publications including ABC News, Money Magazine and The Sydney Morning Herald. See full profile

More guides on Finder

Get up to 60,000 bonus Velocity Points, a yearly $129 Virgin Australia gift voucher and points per $1 on all eligible spending.

The Virgin Australia Velocity High Flyer has a bonus Velocity Points offer, lounge passes and a yearly flight benefit. So is it worth the $329 annual fee?

This Virgin Australia Velocity Flyer offer gives you 0% interest on a balance transfer for 24 months and a $0 annual fee for the first year.

As well as a competitive variable purchase rate, the Virgin Money Low rate card has a balance transfer offer that can help you save on existing debts.

Take advantage of no annual fee and up to 55 interest-free days on purchases with the Virgin No Annual Fee Credit Card.

Earn Velocity Points as you spend and save with 0% interest on purchases and balance transfers for 14 months with the Virgin Australia Velocity Flyer Card.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

10 Responses

Two questions. I am planning on an overseas trip beginning in February 2024 with my companion , paid in full with my Virgin Credit Card , is she covered by my Card

Hi Anthony, Yes, if your companion is considered as your spouse, they would get access to this cover when you meet the eligibility requirements. Here’s the definition of “spouse” in the policy document booklet: “a partner of the cardholder who is permanently living with the cardholder at the time the journey or trip starts”. If you have further questions about eligibility for cover or any other details of the insurance, you can contact Allianz (the insurance provider) 1800 072 791. I hope this helps.

I have a High Flyer Card and have booked a one-way cruise ship trip. We used our Velicity points to book the flights to the embarkation port (Hawaii). Does my High Flyer Card complementary insurance cover us fully on the cruise ship?

Hi Steve, You can check your eligibility and cover with the insurance provider, Allianz, by calling 1800 072 791. For reference, booking an overseas travel ticket with Velocity Points is listed as an option in the eligibility section of the insurance policy document. But there are other requirements and details about cruises so it’s a good idea to double-check with the insurer. I hope this helps.

I have purchased an overseas holiday with full payment being made through a travel company. The travel company has made the flight bookings on our behalf so I need to know if the travel insurance on my credit card will provide my wife and I with cover

Hi Tony, According to the terms and conditions, if you have a current, valid Virgin Australia High Flyer credit card, “charging the cost of the overseas travel ticket to the account holder’s card account” is one way to get cover for a trip of up to 6 months. As there are other eligibility requirements and conditions around pre-existing conditions, you may want to call the insurance provider, Allianz, on 1800 072 791 for full details of the cover. I hope this helps.

I do not know what type my Velocity credit card is, and I am 81 years old, so can I get travel insurance on it?

Hi Wendy, You can call Virgin Money on 13 37 39 to find out what type of credit card you have and if it offers travel insurance. Alternatively, you can compare travel insurance for people aged over 80 , including prices and what’s covered. I hope this helps.

Could you please forward a copy of the policy for complimentary travel insurance for use with Virgin High Flyer credit card. I’m assuming it is with Alliance Insurance.

Hi Deborah,

Here’s a link to the complimentary insurance terms and conditions document (pdf) effective 1 June 2022. That’s the version currently available on the Virgin Money website (at the time of writing).

Just keep in mind that they do get updated periodically. So if you need to reference it in the future, check the Virgin Money credit card forms and T&Cs webpage for updates to it. Hope that helps!

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

How to Find the Best Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What travel insurance covers

How much does travel insurance cost, types of travel insurance, how to get travel insurance, what to look for in travel insurance, best travel insurance comparison sites, which insurance company is best for travel insurance, when to skip travel insurance, travel insurance, recapped.

Travel insurance can cover medical expenses, emergencies, trip interruptions, baggage, rental cars and more.

Cost is affected by trip length, pre-existing medical conditions, depth of coverage, your age and add-ons.

You can get it through credit cards or third-party companies, & can shop on travel insurance comparison sites.

Before buying, evaluate risks, know existing coverage, obtain quotes online and review policy details warily.

Skip it if you buy flexible airfare and hotels, already have coverage or only book refundable activities.

Booking travel always carries some degree of uncertainty. Travel insurance provides a safety net so you can step out with confidence. You may not need travel insurance for inexpensive trips, but it can provide a sense of security when you prepay for pricey reservations, a big international trip or travel during cold and flu season, which can be unpredictable.

According to insurance comparison site Squaremouth, travelers in 2023 spent an average of $403 for comprehensive coverage, compared to $96 for medical-only policies. Comprehensive plans typically cost between 5% and 10% of the insured trip cost.

Since that price tag is no small amount, it helps to know how to shop smart for travel insurance. Here's how to find the right travel insurance plan for you and your next adventure.

Depending on the type of coverage you’re looking for, the chart below will help you determine what to look for when selecting a policy:

Depending on the policy, travel insurance reimburses you or offers services when something goes awry. There’s even coverage for the worst-case scenario: if you die in an accident while traveling. Accidental death coverage pays your beneficiary a lump sum in that case.

Before you buy, take a little time to get familiar with different types of travel insurance products, how it’s priced, and what it covers and excludes. If you’re traveling during these uncertain times, you’ll want to make sure that the policy you select covers coronavirus-related emergencies. Usually, the more thorough the coverage, the more it will cost.

Travel insurance costs vary depending on:

Length and cost of the trip: The longer and more expensive the trip, the higher the policy cost.

Cost of local health care: High health-care costs in your destination can drive up the price of trip insurance.

Medical conditions you want covered: Conditions you already have will increase the cost of travel insurance coverage.

Amount and breadth of coverage: The more risks a policy covers, the more it will cost.

Your age: Generally the older you are, the higher the price.

Any optional supplement you add to your policy : Cancel For Any Reason , Interrupt For Any Reason and more.

Keep these factors in mind when considering different travel insurance options.

You’ll find a wide selection of travel protection plans when you shop for a policy.

Typically, travel insurance is sold as a package, known as a comprehensive plan, which includes a variety of coverage.

Here are seven of the most common types of travel insurance:

Travel medical insurance

These plans provide health insurance while you’re away from home. Although in some ways these policies work like traditional health plans, generally you cannot use travel health insurance for routine medical events. For example, a routine medical checkup is usually not covered. In addition, these policies often include limitations on coverage and exclusions for pre-existing conditions.

Although most travel insurance plans cover many recreational activities, such as skiing and horseback riding, they often exclude adventure sports, such as skydiving or parasailing, or competition in organized sporting events. You may need to buy a special travel policy designed for adventure or competitive sports.

International travel insurance

Most likely, your U.S.-based medical insurance will not work while you’re traveling internationally, and Medicare does not provide any coverage once you leave the United States outside of a few very specific exemptions. If you plan on traveling abroad, purchasing travel medical insurance could make a lot of sense.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Trip cancellation, interruption and delay

Trip cancellation coverage reimburses you for prepaid, nonrefundable expenses if the tour operator goes out of business or you have to cancel the trip for one of the covered reasons outlined in the policy, such as:

Your own illness.

The illness or death of a family member who’s not traveling with you.

Natural disasters.

Trip interruption insurance covers the nonrefundable cost of the unused portion of the trip if it is interrupted due to a reason outlined in the policy.

Trip delay coverage reimburses you for expenses such as lodging and meals if you’re delayed during a trip (e.g., your flight gets canceled due to weather ).

Many package policies cover all three. These policies are different from the cancellation waivers that cruise lines and tour operators offer, the Insurance Information Institute says. Waivers are cheap, ranging from $40 to $60, and often include restrictions. For example, according to the institute, waivers might not refund your money if you cancel immediately before departure. Waivers are technically not insurance policies.

Some companies offer additional layers of coverage at extra cost. “Cancel For Any Reason” coverage will reimburse a large part of the trip cost, no matter why you back out. And some companies let you pay extra to cover pre-existing conditions if you cancel for medical reasons.

Some insurers and comparison sites let you customize a policy by choosing types of coverage a la carte. For example, TravelInsurance.com is a comparison site that provides quotes from different providers.

Baggage and personal belongings

How does lost luggage insurance work? This coverage reimburses you for baggage and personal belongings that are lost, stolen or damaged during the trip. Some plans also reimburse you for extra expenses if you experience a baggage delay for more than a certain period, such as 12 hours.

Your renters or homeowners insurance may cover personal belongings while you are traveling. It’s best to review your homeowners insurance policy to determine the level of coverage it provides so you do not end up paying for a benefit you already have.

» Learn more: Baggage insurance explained

Emergency medical assistance, evacuation and repatriation

This coverage pays medical expenses if you get sick or injured on a trip . Medical evacuation coverage pays for transporting you to the nearest hospital, and medical repatriation pays for flying you to your home country.

» Learn more: Can I get travel insurance for pre-existing medical conditions?

24-hour assistance

This service is included with many package plans. The insurer provides a 24-hour hotline that you can call when you need help, such as booking a flight after a missed connection, finding lost luggage, or locating a doctor or lawyer.

Generally, travel insurance companies do not cover sports or any activity that can be deemed risky. If you’re thinking of incorporating adventurous activities into your vacation, choose a plan that includes adventure sports coverage.

Most travel insurers cover a wide array of services, but the specific options vary. Some plans include concierge services, providing help with restaurant referrals, tee time reservations and more. Many services also offer information before the trip, such as required vaccinations. The only way to know what’s included is to read the policy.

» Learn more: Should you insure your cruise?

Accidental death and dismemberment insurance

This coverage pays a lump sum to your beneficiary, such as a family member, if you die in an accident while on the trip. Accidental death and dismemberment insurance policies also pay a portion of the sum to you if you lose a hand, foot, limb, eyesight, speech or hearing. Some plans apply only to accidental death in a plane.

This coverage may be duplicative if you already have sufficient life insurance, which pays out whether you die in an accident or from an illness. You may also already have accidental death and dismemberment insurance through work, so it's best to check your policies to ensure you’re not overpaying.

» Learn more: NerdWallet's guide to life insurance

Rental car coverage

Rental car insurance pays for repairing your rental car if it’s damaged in a wreck, by vandals or in a natural disaster. The coverage doesn't include liability insurance, which pays for damage to other vehicles or for the medical treatment of others if you cause an accident and are held responsible.

Ask your car insurance company whether your policy will cover you when renting cars on the trip. U.S. car insurance policies generally don’t cover you when driving in other countries, except Canada.

Car insurance requirements are complex because they vary among countries. You can usually purchase liability insurance from the rental car company. Learn about car insurance requirements by searching for auto insurance by country on the U.S. Embassy website .

» Learn more: Best credit cards for rental car coverage

A note about single vs. long-term policies

Single trip insurance plans are a great option for those going on a single trip for a specific length of time (e.g., a two-week vacation) and then returning home. The price of the policy is usually determined by the cost of the trip.

Long-term travel policies cover you for multiple trips, but there are limitations to how long you can be away from home, if you can return home during your travels and how many trips you can take. In addition, trip cancellation and interruption coverage is either not offered or capped at a dollar amount that can be significantly below the total cost of all the trips taken during the covered period.

Long-term travel insurance plans — often called 'multi-trip' or 'annual travel insurance' — are a suitable option for those who travel often and are satisfied with the amount of trip cancellation coverage for all the trips they take over the duration of the policy.

» Learn more: How annual (multi-trip) travel insurance works

Below, we include how to obtain travel insurance, along with the pros and cons of each option.

Some credit cards offer trip cancellation and rental car insurance if you use the card to book the trip or car.

When you book a trip with your credit card, depending on the card you use, you may already receive trip cancellation and interruption coverage.

» Learn more: 10 credit cards that provide travel insurance

Here are a handful of credit cards that offer varying levels of travel insurance coverage for purchases made with the card.

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Travel accident: Up to $500,000.

• Rental car insurance: Up to $75,000.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Travel accident: Up to $1 million.

• Rental car insurance: Up to the actual cash value of the car.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Terms apply.

Pros: Coverage is free.

Cons: You can’t customize the insurance to meet your needs. Most credit cards offer secondary car rental insurance, which pays for the costs not covered by your regular car insurance plan.

Travel agents and travel reservation sites

You can buy travel insurance when you book your flight, hotel and car rental.

Pros: Buying is as quick and easy as clicking “yes” when you book reservations. Coverage is inexpensive.

Cons: You can’t customize the coverage.

» Learn more: Airline travel insurance vs. independent travel insurance

Travel insurance comparison sites

You can compare different policies and review quotes at once based on the trip search criteria you’ve input into the search form. Examples include marketplaces like Squaremouth or TravelInsurance.com.

Pros: You can choose a policy that fits your needs and compare policies and pricing in one place.

Cons: Comparing multiple policies takes time.

Travel insurance companies

You can purchase travel insurance directly from an insurance provider.

Pros: You can choose a policy that fits your needs. Many travel insurer websites also offer information to help you understand the coverage.

Cons: You’ll need to go to multiple websites to compare coverage and pricing.

» Learn more: The best travel insurance companies right now

Keep these tips in mind when you’re considering a trip insurance policy.

Evaluate the financial risks you face when traveling. Can you bear those costs yourself, or do you want insurance?

Examine what coverage you already have: Does your credit card offer travel insurance? Do you have renters or homeowners insurance to cover belongings? What is the deductible? Will your health plan cover you in all the locations where you travel?

Get quotes for trip insurance online. Choose a package of the benefits you need and compare prices for similar coverage among carriers.

Narrow your choices and then read the policy fine print to understand what’s covered, what’s excluded and the limits on coverage. You may find that the lowest-priced policy is too restrictive and that paying a little more gets you the coverage you need. Or you might find that the cheapest, most basic policy fits the bill.

If you don’t know which provider to go with, it makes sense to browse a list of plans on a travel insurance comparison site. These online marketplaces will often include plans from the best travel insurance companies along with customer reviews.

Squaremouth

Compare plans from more than 30 providers.

Over 86,000 customer reviews of insurers.

Under its Zero Complaint Guarantee, Squaremouth (a NerdWallet partner) will remove a provider if any customer complaint isn't resolved to its satisfaction.

Has a filter option to see policies that provide COVID-coverage.

TravelInsurance.com

Compare plans from 13 providers.

See good and poor customer ratings and reviews for each insurer when you receive quotes.

“Learning Center” includes travel insurance articles and travel tips, including important how-to information.

Quotes provided from each provider include a link to COVID-19 FAQs, making it easy for customers to review what’s covered or not.

InsureMyTrip

Compare plans from more than two dozen providers.

More than 70,000 customer reviews.

“Anytime Advocates” help customers navigate the claim process and will work on behalf of the customer to help with appealing a denied claim.

Includes a link to plans that offer COVID coverage.

Compare plans from 11 providers.

Search coverage by sporting activity, including ground, air and water sports.

Many types of plans available for students, visiting family members, new immigrants, those seeking COVID quarantine coverage and more.

Compare different insurance plans from 35 providers.

Over 5,600 customer reviews on Trustpilot, with an average 4.9 stars out of five.

Formerly known as AardvarkCompare, AARDY includes a “Travel Insurance 101” learning center to help customers understand various policies and benefits.

Quote search results page includes COVID-coverage highlighted in a different color to make it easier for customers to review related limits.

Whether you’re looking for an international travel insurance plan, emergency medical care, COVID coverage or a policy that includes extreme sports, these providers have you covered.

Our full analysis and more details about each organization can be found here: The Best Travel Insurance Companies Today .

Allianz Global Assistance .

Travel Guard by AIG .

USI Affinity Travel Insurance Services .

Travel Insured International .

World Nomads .

Berkshire Hathaway Travel Protection .

Travelex Insurance Services .

Seven Corners .

AXA Assistance USA .

There are a few scenarios when spending extra on travel insurance doesn't really make sense, like:

You booked flexible airline tickets.

Your hotel room has a good cancellation policy.

It's already included in your credit card.

You haven't booked any nonrefundable activities.

» Learn more: When you don't need travel insurance

Yes, especially for nonrefundable trips and travel during the COVID-era. Whether you purchase a comprehensive travel insurance policy or have travel insurance from your credit card, you shouldn't travel without having some sort of travel protection in place to safeguard you and your trip. Travel insurance can protect you in case of an unexpected emergency such as a canceled flight due to weather, a medical event that requires hospitalization, lost luggage and more.

There are many good travel insurance policies out there and a policy that may be great for you may not be good for someone else. Selecting the best plan depends on what coverage you would like and your trip details.

For example, World Nomads offers a comprehensive travel insurance policy that has excellent coverage for adventure sports. Allianz provides coverage for trips of varying lengths of time through its single trip plans and multi-trip plans. Some providers offer add-on options like Cancel For Any Reason travel insurance. If you’re not sure which plan to go with, consider looking at trip insurance comparison sites like Squaremouth or Insuremytrip.

Yes, you can. However, it's better to purchase it sooner rather than later, ideally right after booking your trip because the benefits begin as soon as you purchase a policy.

Let’s say you’re going on a trip in a month and a week before departure, you fall and break your leg. If you’ve purchased a travel insurance policy, you can use your trip cancellation benefits to get your nonrefundable deposit back.

Most comprehensive travel insurance plans offer trip cancellation, trip interruption, emergency medical and dental, medical evacuation, trip delay and lost luggage coverage. Many plans offer COVID coverage, but you’ll always want to check to ensure that the policy you choose provides that benefit if you’re traveling during these times. Some plans may also allow you to add features like Cancel For Any Reason travel insurance.

It depends which credit card you have. Premium travel cards like the Chase Sapphire Reserve® and The Platinum Card® from American Express offer travel insurance benefits if you book a trip using your card or points.

However, the coverage provided by the credit cards is usually lower than if you purchased a standalone policy. Review the travel insurance benefits on your credit card and check that the limits are adequate before foregoing from purchasing a separate plan.

Let’s say you’re going on a trip in a month and a week before departure, you fall and break your leg. If you’ve purchased a travel insurance policy, you can use your

trip cancellation benefits

to get your nonrefundable deposit back.

It depends which credit card you have. Premium travel cards like the

Chase Sapphire Reserve®

The Platinum Card® from American Express

offer travel insurance benefits if you book a trip using your card or points.

Unpredictability is one of the mind-opening joys of travel, but travel insurance should contain no surprises. The time you spend to understand your options will be well worth the peace of mind as you embark on your next adventure.

Whether you’re seeking a single or a long-term policy, each travel insurance option offers different strengths and weaknesses. Choosing the right policy depends on your trip needs, your budget and how important various benefits are to you.

Keep reading

If you want to dig in deeper to world of travel insurance, these resources will point you in the right direction.

What is travel insurance?

How much is travel insurance?

Is travel insurance worth it?

What does travel insurance cover?

Does travel insurance cover COVID?

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Virgin Voyages Help & Support for Voyage Protection

- Help & Support

- / Before You Sail

- / Voyage Protection

Voyage Protection

Other topics related to "voyage protection".

- Flights and Hotels

- Booking Options

Need help getting the As to your Qs?

- Join CHOICE

Travel insurance

International travel insurance comparison

Buy smarter with choice membership.

Or Learn more

Reviews and ratings you can trust

Based on intensive lab testing across 200+ product and service categories.

Easy side-by-side comparison

Sort, compare and filter to find the right product to match your needs.

Find the best product for you

Our expert advice outlines the best brands and ones to avoid.

Fact-checked

Checked for accuracy by our qualified fact-checkers and verifiers. Find out more about fact-checking at CHOICE .

If you're going overseas, travel insurance is just as essential as your passport. Use our free comparison tool to narrow down international single trip and annual multi-trip policies from 27 insurers, offering cover for COVID-19, existing medical conditions, car rental and more.

Travel insurance is a portable version of health, home, contents, life, public liability, and car rental excess insurance all packaged in one to take on holidays with you. But with all those insurances piled into one product, navigating your way through the terms and conditions to find the loopholes can be very challenging.

Use our travel insurance comparison to narrow down your options and make sure you're getting the best cover for your needs when on holiday.

List of brands we tested in this review.

- Battleface 2

- Cover-More 5

- FastCover 4

- Flight Centre 4

- Go Insurance 4

- InsureandGo 3

- Southern Cross Travel Insurance (SCTI) 3

- Tick Travel Insurance 4

- Travel Insurance Direct 3

- Virgin Australia 5

- WAS Insurance 2

- World Nomads 2

- World2Cover 4

The average cost of the policy compared to other policies of the same type (single trip or annual multi-trip). One $ sign is the cheapest through to five $$$$$ the most expensive. NA means the policy wasn't included in the price rating.

enter value/s in increments of 1 between 0 and 0

Policy type

- One trip 65

- Policy age limit

In years (up to and including the number stated). For policies listed as '100+', there is no age limit.

Does the policy cover international cruises?

- Optional 71

Medical expenses for COVID-19

Whether the policy covers you for medical and emergency evacuation and repatriation expenses for claims arising directly or indirectly from COVID-19. Cover is assessed on individual circumstances.

Cancellation expenses for mental health

Whether the policy covers you for cancellation expenses for claims arising directly from recognised mental health disorders experienced for the first time such as depression, anxiety, schizophrenia, bipolar disorder or PTSD. Cover is assessed on individual circumstances.

- Cancellation for insolvency of a travel services provider

Whether the policy covers you for losses arising out of insolvency of a travel services provider (e.g. airline, accomodation provider, bus line, shipping line, railway company, motor vehicle rental agency). Cover is assessed on individual circumstances.

Cancellation expenses for a natural disaster

Whether the policy covers you for cancellation expenses for claims arising directly or indirectly from a natural disaster. Cover is assessed on individual circumstances.

Cancellation expenses for civil unrest

Whether the policy covers you for cancellation expenses for claims arising directly or indirectly from civil unrest such as political protests, riots and strikes. Cover is assessed on individual circumstances.

- Baggage cover

Are stolen or damaged personal belongings covered

- Limit for baggage expenses

The overall limit for stolen or damaged personal belongings.

- Limit for a smartphone

Limit for a smartphone. Cover is assessed on individual circumstances.

- Limit for a laptop or tablet

Limit for a laptop or tablet. Cover is assessed on individual circumstances.

- Limit for rental car excess

Limit for collision damage excess for a hire car. Cover is assessed on individual circumstances.

- Scuba diving

Does the policy cover scuba diving if you are appropriately certified or diving with a qualified instructor?

Skiing and snowboarding on-piste

Does the policy cover skiing and snowboarding on-piste?

- Optional 82

Skiing and snowboarding off-piste

Does the policy cover skiing and snowboarding off-piste withing the resort boundaries?

- Optional 72

Tobogganing

Does the policy cover tobogganing on snow?

- Optional 50

Does the policy cover riding a moped with an engine capacity 50cc or below, with a helmet and driving license valid in the country the policy holder is in, but without an Australian motorcycle license

- Optional 32

Moped 125cc

Does the policy cover riding a moped with an engine capacity 125cc or below, with a helmet and driving license valid in the country the policy holder is in, but without an Australian motorcycle license

- Optional 28

Does the policy cover riding a motorcycle with an engine capacity above 125cc with an Australian motorcycle license and a helmet?

- Optional 34

Included in this comparison

- Price rating

- Dependant age limit

- Cancellation

- Pregnancy stage covered

- Childbirth costs

- Pre-existing conditions covered without application

- Pre-existing conditions covered on application

- Time period for existing conditions

- Medical expenses

- Expenses for a person to accompany a sick policyholder

- Daily hospital cash allowance

- Hours of hospitalisation before receiving allowance

- Dental expenses for accident or injury

- Dental expenses for acute pain

- Overseas funeral costs

- Additional travel expenses for injury or sickness

- Additional expenses for interrupted travel

- Travel insurance extension for a delayed trip

- Additional expenses for a lost passport

- Additional expenses for a sick relative

- Additional expenses for resumption of journey interrupted for a relative

- Cancellation covered

- Cancellation expenses

- Cancellation for frequent flyer points

- Cancellation expenses for travel agent fees

- Cancellation for insolvency of a travel agent

- Cancellation expenses for redundancy

- Cancellation expenses for defence and emergency workers

- Cancellation expenses for cancellation of work leave

- Cover for transport incidents

- Cover for strikes

- Cover for mental health

- Cover for COVID-19

- Cover for pandemics

- Cover for natural disasters

- Cover for civil unrest

- Cover for terrorism

- Cover for war

- Additional expenses for a special event

- Additional expenses for pre-paid travel arrangements

- Limit for travel delay expenses

- Hours before travel delay covered

- Limit per 24 hours for travel delay

- Limit for a single unspecified item

- Limit for a video or photo camera

- Limit for prescribed medications

- Overall limit for specified items

- Cover for baggage in a car during the day

- Cover for baggage in a car overnight

- Cover for valuables in a car

- Cover for lost or stolen cash

- Limit for baggage lost temporarily

- Hours before cover applies for baggage lost temporarily

- Rental car excess

- Snow sports

- Mopeds and motorcycles

- Bungee jumping

- Horse riding

- High altitude hiking

- White water rafting

- Paragliding

- Hot air ballooning

- Hang gliding

Displaying all 91 products

- Brand (A-Z)

Limit for additional meal and accommodation expenses if scheduled transport is delayed.

Your filters

This overall score is based on our expert assessment of what the policy covers, price and how easy it is to understand and buy. A higher score is better.

1Cover Comprehensive

1Cover Frequent Traveller

1Cover Medical Only

AANT Annual Multi-Trip

AANT Basics

AANT Essentials

AANT Premium

AHM Comprehensive

AHM Comprehensive Multi-Trip

AHM Medical Only

Battleface Covid Essentials

Battleface Discovery

Cover-More Basic

Cover-More Comprehensive

Cover-More Comprehensive Multi-Trip

Cover-More Comprehensive Plus

Cover-More Comprehensive Plus Multi-Trip

FastCover Basics

FastCover Comprehensive

FastCover Frequent Traveller Saver

FastCover Standard Saver

Flight Centre Multi-Trip YourCover Essentials

Flight Centre Multi-Trip YourCover Plus

Flight Centre YourCover Essentials

Flight Centre YourCover Plus

Go Insurance Go Basic

Go Insurance Go Basic Annual Multi-Trip

Go Insurance Go Plus

Go Insurance Go Plus Annual Multi-Trip

InsureandGo Bare Essentials

InsureandGo Gold

InsureandGo Silver

Jetstar Comprehensive

Medibank Comprehensive

Medibank Medical Only

Medibank Multi-Trip Comprehensive

NIB Annual Multi-Trip

NIB Comprehensive

NIB Essentials

NRMA Comprehensive

NRMA Comprehensive Multi-Trip

NRMA Essentials

Qantas Annual Multi-Trip

Qantas International Comprehensive

RAA Essentials

RAA Multi-Trip

RAA Premium

RAC Annual Multi-Trip

RAC Comprehensive

RAC Essentials

RAC Medical Only

RACQ Annual Multi-Trip

RACQ Premium

RACQ Standard

RACT Annual Multi-Trip

RACT Comprehensive

RACT Essentials

RACV Annual Multi-Trip

RACV Basics

RACV Comprehensive

RACV Essentials

Southern Cross Travel Insurance (SCTI) Annual Multi-Trip

Southern Cross Travel Insurance (SCTI) Comprehensive

Southern Cross Travel Insurance (SCTI) Medical Only

Tick Travel Insurance Basic

Tick Travel Insurance Budget

Tick Travel Insurance Standard

Tick Travel Insurance Top

Travel Insurance Direct Annual Multi-Trip

Travel Insurance Direct Basics

Travel Insurance Direct The Works

Virgin Australia International Plan (bought with flight purchase)

Virgin Australia Travel Safe International

Virgin Australia Travel Safe International Multi-Trip

Virgin Australia Travel Safe Plus International

Virgin Australia Travel Safe Plus International Multi-Trip

WAS Insurance Covid Essentials

WAS Insurance Discovery

Webjet Travel Safe International

Webjet Travel Safe International Multi-Trip

Webjet Travel Safe Plus International

Webjet Travel Safe Plus International Multi-Trip

World Nomads Explorer

World Nomads Standard

World2Cover Annual Multi-Trip

World2Cover Basics

World2Cover Essentials

World2Cover Top

- Insurance provider

Product selected for a detailed comparison

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The Best Travel Medical Insurance of 2024

Allianz Travel Insurance »

Seven Corners »

GeoBlue »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Medical Insurance Plans.

Table of Contents

- Allianz Travel Insurance

- Seven Corners

Buying travel insurance is a smart move for any type of trip, but you may not need a policy that covers everything under the sun. If you don't need coverage for trip cancellations or delays because you're relying on your travel credit card to offer these protections, for example, you may find you only need emergency medical coverage that works away from home.

Still, travel medical coverage varies widely based on included benefits, policy limits and more. If you're comparing travel insurance plans and hoping to find the best option for unexpected medical expenses, read on to learn which policies we recommend.

Frequently Asked Questions

The term travel insurance usually describes a comprehensive travel insurance policy that includes coverage for medical expenses as well as trip cancellations and interruptions, trip delays, lost baggage, and more. Meanwhile, travel medical insurance is coverage that focuses on paying for emergency medical expenses and other related care.

Travelers need international health insurance if they're visiting a place where their own health coverage will not apply. This typically includes all international trips away from home since U.S. health plans limit coverage to care required in the United States.

Note that if you don't have travel health insurance and you become sick or injured abroad, you'll be responsible for paying back any health care costs you incur.

Many travel insurance policies cover emergency medical expenses you incur during a covered trip. However, the included benefits of each policy can vary widely, and so can the policy limits that apply.

If you're looking for a travel insurance policy that offers sufficient protection for unexpected medical expenses, you'll typically want to choose a plan with at least $100,000 in coverage for emergency medical care and at least that much in protection for emergency medical evacuation and transportation.

However, higher limits can provide even more protection from overseas medical bills, which can become pricey depending on the type of care you need. As just one example, Allianz says the average cost of emergency medical evacuation can easily reach up to $200,000 or more depending on where you’re traveling.

Your U.S. health insurance policy almost never covers medical expenses incurred abroad. The same is true for most people on Medicare and especially Medicaid. If you want to ensure you have travel medical coverage that applies overseas, you should purchase a travel insurance plan with adequate limits for every trip. Read the U.S. News article on this topic for more information.

The cost of travel medical insurance can vary depending on the age of the travelers, the type of coverage purchased, the length of the trip and other factors. You can use a comparison site like TravelInsurance.com to explore different travel medical insurance plans and their cost.

- Allianz Travel Insurance: Best Overall

- Seven Corners: Best for Families

- GeoBlue: Best for Expats

- WorldTrips: Best Cost

Coverage for preexisting conditions is available as an add-on

Easy to purchase as needed for individual trips

Relatively low limits for medical expenses

No coverage for trip cancellations or trip interruption

- Up to $50,000 in emergency medical coverage

- Up to $250,000 in emergency medical evacuation coverage

- Up to $2,000 in coverage for baggage loss and damage

- Up to $600 in baggage delay insurance

- Up to $1,000 for travel delays

- Up to $10,000 in travel accident insurance

- 24-hour hotline assistance

- Concierge services

SEE FULL REVIEW »

Purchase comprehensive medical coverage worth up to $5 million

Coverage for families with up to 10 people

Low coverage amounts for trip interruption

Medical coverage options vary by age

- Up to $5 million in comprehensive medical coverage

- Up to $500,000 in emergency evacuation coverage

- Up to $10,000 in coverage for incidental trips to home country

- Up to $25,000 in coverage for terrorist activity

- Up to $500 in accidental dental emergency coverage

- Up to $100 per occurrence in coverage for emergency eye exams

- $50,000 in coverage for local burial or cremation

- 24/7 travel assistance

- Up to $25,000 in coverage for accidental death and dismemberment per traveler

- Up to $500 for loss of checked baggage

- Up to $5,000 for trip interruptions

- Up to $100 per day for trip delays

- Up to $50,000 for personal liability

Qualify for international health insurance with no annual or lifetime caps

Use coverage within the U.S. with select providers

Deductible from $500 to $10,000 can apply

Doesn't come with any nonmedical travel insurance benefits

- Up to $250,000 in coverage for emergency medical evacuation

- Up to $25,000 for repatriation of mortal remains

- $50,000 in coverage for accidental death and dismemberment

High limits for medical insurance and emergency medical evacuation

Covers multiple trips over a period of up to 364 days

Deductible of $250 required for each covered trip

Copays required for medical care received in the U.S.

- Up to $1,000,000 of maximum coverage

- Up to $1,000,000 for emergency medical evacuation

- Up to $10,000 for trip interruptions

- Up to $1,000 for lost checked luggage

- Up to $100 per day for travel delays

- Up to $25,000 in personal liability coverage

- Medical coverage for eligible expenses related to COVID-19

- Ability to add coverage for your spouse and/or child(ren)

- Repatriation of remains coverage up to overall limit

- Up to $5,000 for local burial or cremation

- $10,000 to $50,000 for common carrier accidental death

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family media business.

You might also be interested in:

9 Best Travel Insurance Companies of 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

How to Get Airport Wheelchair Assistance (+ What to Tip)

Suzanne Mason and Rachael Hood

From planning to arrival, get helpful tips to make the journey easier.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

We're working on fixing the issue.

If you need to speak to us quote the following code and error:

Code: AKM-CYB-WEB-1

Error: 18.4d645e68.1717457956.a6f09d0

You are about to leave geico.com

When you click "Continue" you will be taken to a site owned by , not GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you provide directly to them is subject to the privacy policy posted on their website.

Travel Insurance

Get a travel insurance quote and protect your next trip

For flight insurance protection:

Aircare Flight Quote

For all-in-one trip insurance protection:

ExactCare Travel Quote

Manage Your Travel And Flight Insurance

Manage your policy online

Need a travel insurance quote?

Existing policyholder?

Take the worry out of your travels with affordable flight or trip insurance.

Looking to plan the vacation of a lifetime or flying home for the holidays? Trip insurance and flight insurance can provide the peace of mind you need for your next journey. The GEICO Insurance Agency, with Berkshire Hathaway Travel Protection (BHTP), offers comprehensive travel insurance coverage, with prompt service and global assistance. Get an online travel insurance quote today and confidently protect your next adventure.

AirCare Flight Insurance

If you only need to protect your travel costs for a flight, AirCare may be what you need. With affordable coverage for both domestic and international flights, AirCare flight insurance helps you plan with peace of mind.

ExactCare Travel Insurance

If you want to cover your flight and other trip arrangement's ExtraCare can help. An ExactCare Travel Insurance policy can help with the unexpected like:

- Trip Cancellations/Interruptions/Delays

- Lost/Stolen travel documents

- Unexpected medical expenses

What's the difference between flight insurance and travel insurance?

The main difference is that a flight insurance policy only covers your airfare. On the other hand, a travel insurance policy helps protect your flight as well as other parts of your trip. While you're planning your next trip, think about where you're going and what you'll be doing. Once you have that, it'll be easier to choose which policy works best for your trip.

What does a flight insurance policy cover?

AirCare Flight Insurance has a variety of benefits including emergency travel assistance, 24/7/365. Some common flight coverages are:

- Airfare incase flights are cancelled or you miss a connection

- Personal items like lost or delayed luggage

- Flight delays in your departure (at the gate or on the tarmac)

AirCare Quote

What does a travel insurance policy cover?

ExactCare Travel Insurance provides all-in-one travel protection, with family friendly pricing and worldwide emergency travel assistance 24/7/365. Common things covered by travel insurance are:

- Trip cancellation or interruption

- Personal items like passports and luggage

- Medical costs like hospital and doctor expenses, medical evacuations, and more

ExactCare quote

What is not covered by travel insurance?

Your coverage is based on the plan you choose. However, in general some things that aren't normally covered by travel insurance are:

- Action and team sports, for example auto racing, pro sports travel, or other extreme sport activities

- Travel to get medical care

- Trip Cancellation because you changed your mind

For more information, please check your policy.

Is travel or trip insurance worth the cost?

Travel insurance can help protect your vacation or trips from unexpected things happening. You can travel without trip insurance but doing so brings greater risk if something goes wrong or you encounter unexpected delays. Flight insurance or trip insurance coverage can include things like flight cancellation, lost luggage, trip cancellation, emergency medical transportation, and more. Learn more about travel insurance and why you should get a travel insurance quote today!

How much does travel insurance cost?

Travel insurance typically costs 5 to 10 percent of your total trip cost, though that can be influenced by several things.

- The cost of the trip

- The length of your trip and destination

- The amount of coverage selected

- The number of travelers covered under the policy

Worldwide service and claims information.

It's easy to manage your travel insurance..

Berkshire Hathaway Travel Protection (BHTP) has made it easy to manage your travel insurance. You can:

- Visit Berkshire Hathaway Travel Protection's website

- Email [email protected]

Is travel insurance worth it?

Yes. Things happen that are out of your control. Whether it's your flight being cancelled or delayed to a family emergency. Life happens and that's how travel insurance can help. Plan for the unexpected with a travel insurance policy so you can rest easy knowing you're covered.

Travel Insurance: Get the answers you're looking for.

- What travel insurance plans are available? BHTB offers AirCare (flight only) and 3 main plans: ExactCare Value, ExactCare, and ExactCare Extra. ExactCare Value provides great traveling insurance coverage for budget minded travelers. You can rest easy knowing you're covered for things like trip cancellation, trip interruption, and medical expenses. The main difference is the maximum amount that will be covered. ExactCare and ExactCare Extra's insurance cover the same things as ExactCare Value and add coverage for missed connections and accidental death & dismemberment. The overall amount covered is also increased for each plan respectively.

- Can I get trip insurance for an extended overseas stay? Yes. We can help you with getting insurance for overseas. Please visit our overseas insurance page for information about all the options we have for you!

- Is there travel insurance that can cover my vehicle while traveling to Mexico? Your US auto insurance policy won't cover your vehicle when you drive into Mexico. We're here to help you find the Mexico car insurance you need to insure your car.

- Tips for saving money on your next vacation. No one wants to overpay things. We're here to help. Check out our 5 ways to save your money on your next family vacation.

- Where you're going

- Number of days you're traveling

- Cost of your overall trip

- Coverage you pick

- Number of people covered under your policy

If you choose to get a rate quote or service your policy online, you will be taken to the Berkshire Hathaway Travel Protection website which is owned by Berkshire Hathaway Specialty Insurance Company, not GEICO. Any information that you provide directly to Berkshire Hathaway Specialty Insurance Company on its website is subject to the privacy policy posted on their website, which you should read before proceeding. GEICO assumes no responsibility for their privacy practices or your use of their website.

ExactCare is provided through Berkshire Hathaway Global Insurance Services, LLC. ExactCare and AirCare are underwritten by Berkshire Hathaway Specialty Insurance Company. Both coverages are secured through the GEICO Insurance Agency, LLC.

Benefits may vary by jurisdiction. Please contact a representative to confirm availability.

Please note: