- Privacy Policy

- Disclosures

- Do Not Sell My Information

Guide on How To Use United’s TravelBank

by The Frugal Tourist | Jan 6, 2024 | American Express , Travel , United | 22 comments

ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Additionally, the content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. All information about the Hilton Honors American Express Aspire Card has been collected independently by The Frugal Tourist. The card details on this page have not been reviewed or provided by the card issuer.

In this blog post, I will walk you through the steps on how to fund and use United’s TravelBank.

Since some credit cards provide travel credits that expire within a year, depositing money in United’s TravelBank is a viable option to utilize those credits so they won’t go to waste.

Funds diverted into United’s TravelBank have a 5-year lifespan, offering some level of longevity and a lot of flexibility, especially since travel is not expected to pick up again anytime soon.

Whether you have plans this year or in the near future, funding your United TravelBank with free cash from your credit cards is a wallet-friendly strategy that can potentially save you a few hundred dollars when the time comes that you need to book your next flight.

United TravelBank

According to United, your TravelBank funds can either be used alone or in combination with select forms of payment only when booking United or United Express flights .

Therefore, we are unable to use United TravelBank to purchase flight itineraries that include segments on partner airlines such as Air Canada, Lufthansa, etc.

I was also unsuccessful in tapping my TravelBank reserves to pay for taxes when booking an award ticket or paying additional fees to cover the airfare difference when redeeming a voucher or rebooking a travel credit.

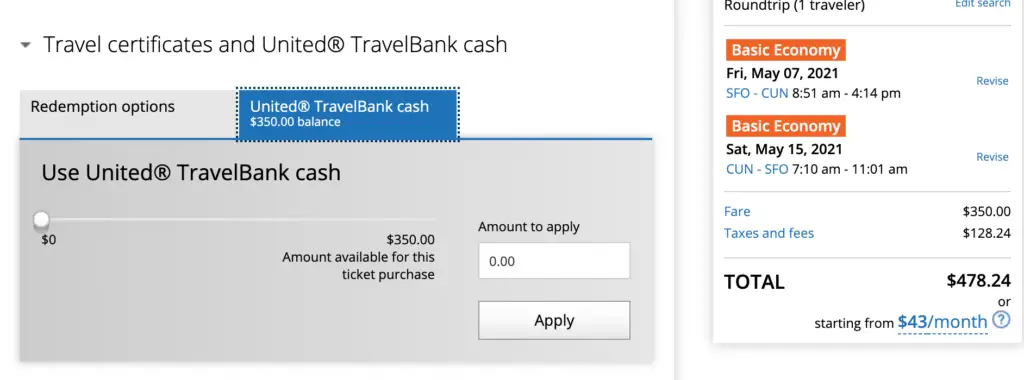

However, I did not encounter any roadblocks when I booked paid United tickets, even if the airfare was Basic Economy .

Terms and Conditions

The information below was taken from United.com

- Passengers can select from six purchase amount options, and once purchased, the value remains valid for five years from the date it is deposited in your TravelBank account.

- Purchases are not refundable and are limited to $5,000 per day per MileagePlus account.

- This purchase is also subject to all of the TravelBank terms and conditions .

- United has the right to terminate this promotion or to change the promotion’s terms and conditions, rules, regulations, policies and procedures, benefits, and/or conditions of participation, in whole or in part, at any time, with or without notice.

Guide on How to Fund United’s TravelBank

Access United TravelBank by clicking the button below. You will need to log in to your United Mileage Plus Account to purchase.

Do not have a United membership yet?

It is free and easy to register. Click the button below to enroll in United’s Mileage Plus Program.

After logging in, you will see your United Mileage Account, any United miles you have available for redemption, and your TravelBank Cash Balance.

Plus Points – a points system that passengers can utilize to upgrade their flights – will also show up, but we will not go over that in this post. You can read more about this program here.

Select the amount of travel cash you want to purchase.

As previously stated, there are six possible amounts that you can elect to deposit to your TravelBank.

The next page will ask for you to type in your Payment Information.

In this case, you would want to use a credit card that provides an Airline Credit.

I will list these credit cards in one of the sections below.

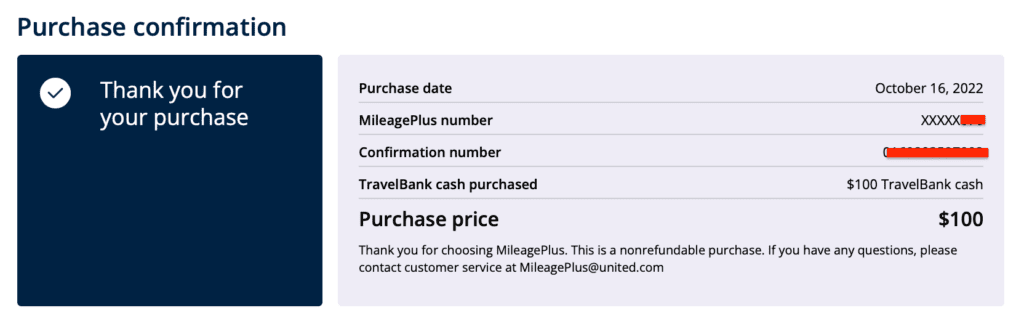

You will then get confirmation that your purchase was successful. A receipt will be emailed immediately after as well.

In this example, I used my The Business Platinum Card® from American Express to buy $100 worth of travel cash in United’s TravelBank.

Guide on How to Use Your United Travel Bank Cash

Thankfully, we are generously given five years to spend our travel cash.

Once you are ready to book your flight, log back on to your United.com profile and enter your travel details.

United TravelBank purchased using certain IHG Credit Cards has a shorter lifespan. Please check the terms of your IHG Credit Cards for the most current UnitedTravel Bank policy.

Select your particular flight, verify your personal information, and pick your seat.

Afterward, you will be directed to the Payment Page.

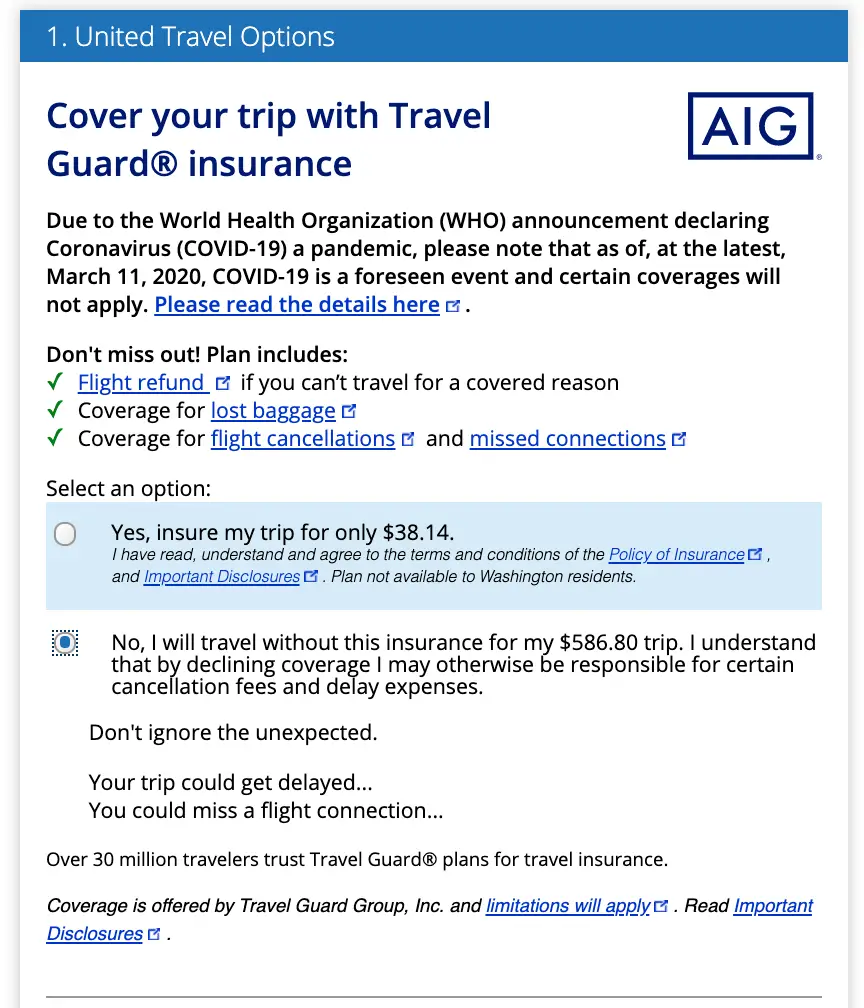

Next, United will offer you travel insurance (select yes/no), priority boarding, and miles for purchase.

Regardless of whether you decide or decline to purchase these additional bells and whistles, the payment section comes right after.

You have the following payment options:

- Pay In Full

- Pay Monthly

- Travel Certificates and United TravelBank Cash (if this option does not appear, then the ticket you’re buying is not a permitted purchase using travel cash.)

- Other Forms of Payments (PayPal, etc)

- Debit / Credit Card

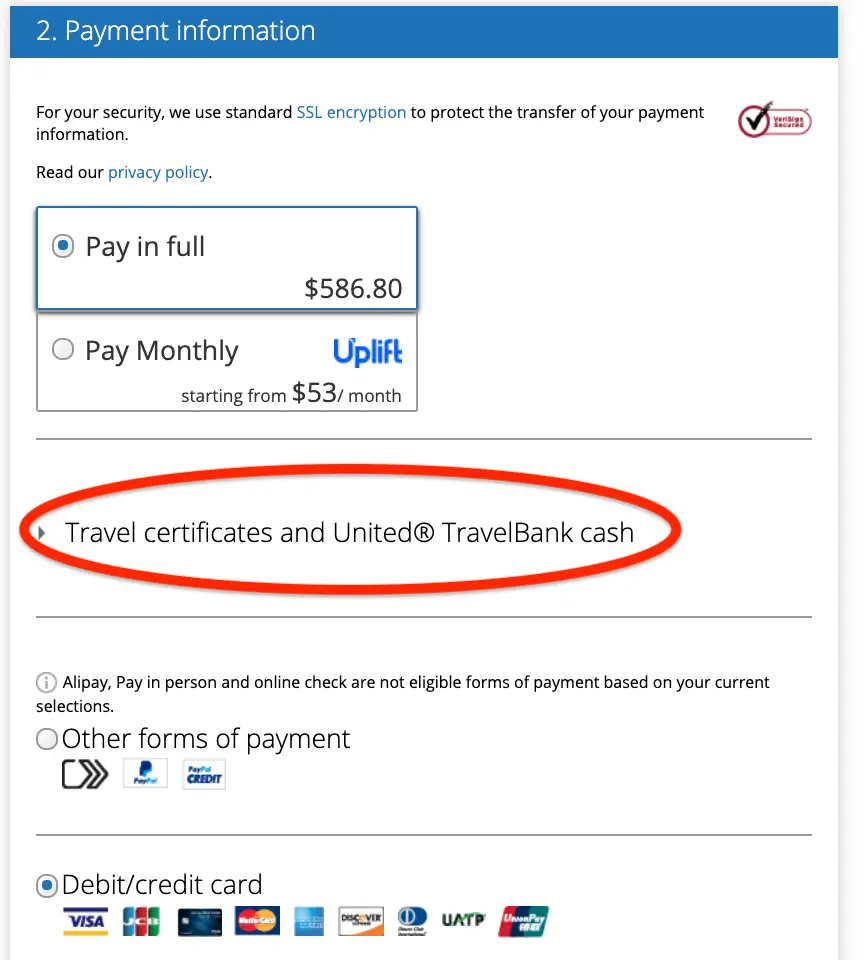

Select “Travel Certificates and United TravelBank Cash.”

As you can see, my $100 travel bank deposit is already reflected in my account.

Next, enter the amount you want to use for the flight you wish to book.

It is not necessary to spend your entire stash of United travel cash if you have other plans to spend it later.

Once you have a final amount in mind, click apply.

In this example, I decided to spend $75 of the $100 currently in my United TravelBank.

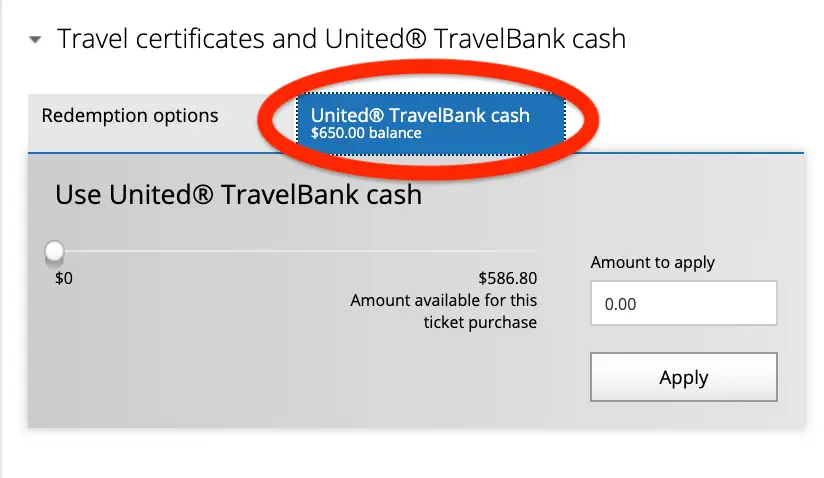

After your travel cash is deducted, the total amount you still owe will automatically be calculated.

Continue with your purchase by selecting the mode of payment you want to use for the remaining balance.

I highly recommend paying a portion of the flight with a credit card that offers travel protections, such as the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®.

Alternatively, you can purchase travel insurance to cover your entire trip.

Where Do I Find My TravelBank Account?

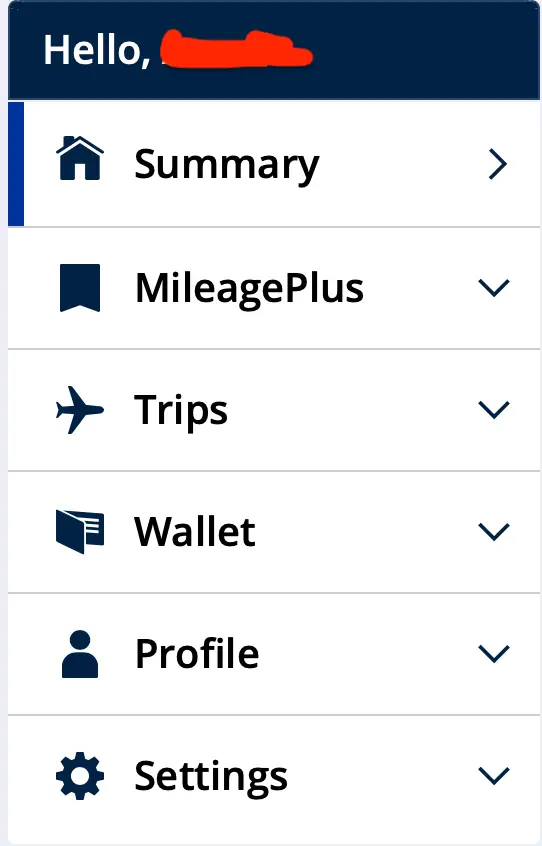

United has recently updated its website. You can find your United TravelBank account information and balance by navigating to your United Wallet on the app and the computer.

Troubleshooting Potential Issues

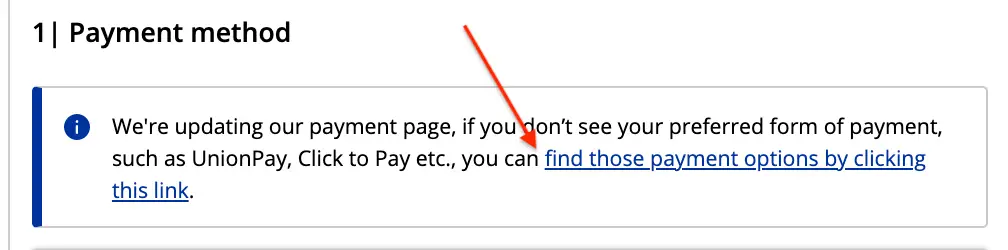

Issue 1: united travelbank does not show up.

A few readers have expressed that they are having difficulty locating the TravelBank option on United’s website.

It appears that United’s site is currently updating its payment page. When you see the notice below under “Payment Method, ” click the “find those payment options…” link.

This link will direct you to the “United Travel Options” section, where you can add travel insurance to your purchase. Make your selection.

Afterward, you will be directed to “Payment Information,” where the TravelBank option appears.

Click “Travel Certificates and United TravelBank Cash” and select Travel Cash as your mode of payment.

Type the amount you would like to spend.

As suggested, charge a small portion of your airfare on a credit card that provides travel insurance, like the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®.

You may also elect to purchase travel insurance for additional coverage.

Issue 2: United TravelBank Keeps On Freezing

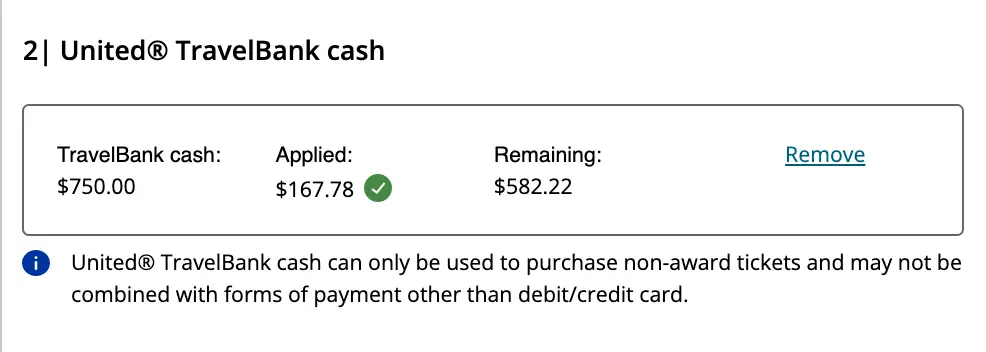

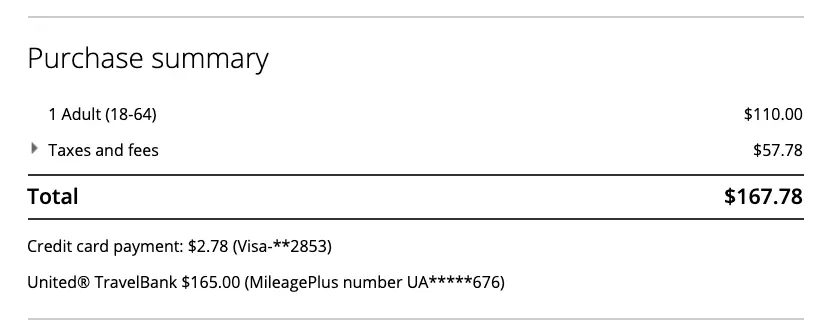

While booking a plane ticket to Cabo costing $167.78 recently, I found the United website struggling to process my TravelBank payment, ultimately freezing the payment page.

After attempting various troubleshooting strategies, I eventually made it work by typing a whole number into the TravelBank box.

In this case, I redeemed $165 of my TravelBank credits towards the purchase of this ticket and used a credit card that gives travel protections ( Chase Sapphire Reserve® ) to cover the remaining amount ($2.78).

Issue 3: TravelBank is Unable to Add a New Credit Card (Payment Error)

United.com can only save a certain number of credit cards on your profile.

If the website is not allowing you to add another credit card to your United TravelBank account, you will need to log in to your main United.com account, go to “Wallet,” remove the credit cards that you no longer use, and then add the ones you would like saved.

Once your new credit card is linked, note the last four digits of your card and its expiration date so you can easily find it on your list of saved cards when you try to purchase United TravelBank funds again.

Issue 4: Unable to Purchase

As mentioned above, your United TravelBank funds can either be used alone or in combination with select forms of payment when booking United or United Express flights only.

When Do United TravelBank Funds Expire?

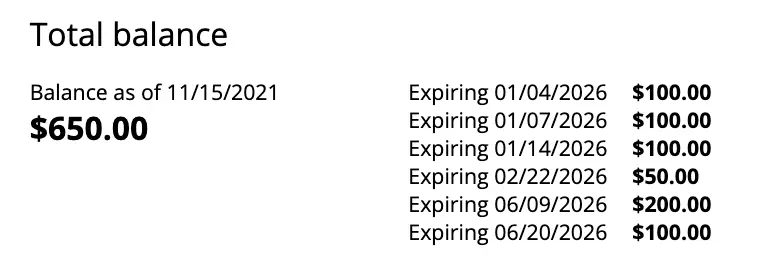

As of this update, TravelBank funds appear to expire after five years.

The screenshot below, captured from my TravelBank account, supports this assertion.

While the money deposited in our United TravelBank accounts has a 5-year validity, it can be forfeited if no activity is recorded in our TravelBank accounts for 18 consecutive months.

Therefore, ensure that you either add money to your TravelBank or use your TravelBank funds to purchase tickets at least once every 18 months.

Heads Up: United also stipulated that any re-deposited funds originating from canceled tickets purchased with TravelBank money do not qualify as an eligible activity. In short, any re-deposited funds will NOT reset the expiration date.

United may also change the expiration date of subsequent deposits or discontinue the program altogether. Only time will tell.

For now, this option to convert our credit card airline credits to some form of flexible currency is available, so certainly consider this method if you are running out of ways to redeem your expiring credits.

Which Credit Cards to Use?

You should only purchase TravelBank funds when you anticipate no other eligible travel-related purchases for the remainder of the year.

Chase Credit Cards

Chase sapphire reserve® (csr).

The Chase Sapphire Reserve (CSR) comes with a $300 travel credit that resets every year on the card member’s anniversary date and does not roll over onto the following year; therefore, you either use it or lose it.

I do not recommend using your CSR travel credits to purchase funds on United’s TravelBank, given that Chase provides an extensive array of valuable avenues to redeem this credit.

In addition to the traditional airfare purchase, you can also trigger the travel credit when paying for public transit, ride-sharing services, parking, hotels, campgrounds, cruises, etc.

Citi Credit Cards

Citi prestige® credit card.

This card is no longer available to new applicants.

This credit card comes with a $250 travel credit, which can now be conveniently spent on groceries, restaurants, and take-out.

Like the Chase Sapphire Reserve, this credit resets every calendar year and likewise does not roll over.

I do not suggest using your Citi Prestige travel credits to purchase United TravelBank funds because of other beneficial spending options you have at your disposal.

American Express Credit Cards

American express® credit cards with airline fee credits.

- The Platinum Card® from American Express ($200 Annual Airline Credit)

- The Business Platinum Card® from American Express ($200 Annual Airline Credit)

- Hilton Honors American Express Aspire Card ($50 Quarterly Airline Credit)

American Express’s airline fee credit is challenging to redeem compared to Chase’s and Citi’s more flexible identical offerings.

In the past several years, consumers consistently find themselves jumping through hoops in search of effective methods to capitalize on these generous offers.

First and foremost, Chase and Citi do not require activation – their credits apply to all airlines and other forms of travel.

Whereas Amex’s airline fee credit will not work unless you activate it.

Plus, it can only be used on one airline you pre-select, ideally at the beginning of the year.

Even though there are data points (DP) that Amex has been lenient in allowing the preferred airline to be changed via chat as of late, there is no way to predict until when they will allow this.

AMEX Airline Fee Credit Restrictions

AMEX has strict restrictions on what fees qualify under this credit.

Technically, only incidental purchases, such as seat assignments, baggage fees, change fees, lounge access fees, and food/beverage inflight purchases, are eligible.

As such, traditional expenses such as award fees, plane tickets, upgrades, and gift cards do not qualify.

But occasionally, we see additional methods that temporarily open up that trigger this airline fee credit – and for now, United TravelBank is one of them.

While no language explicitly states this particular purchase will not qualify, I have to underscore that Amex can undoubtedly claw back this credit at any moment if they deem that TravelBank is not eligible. So, just be aware of that possibility.

Hence, please utilize this tactic only if you do not anticipate using your airline fee credit throughout the rest of the year.

Steps in Selecting Your Airline With Amex

Before you go ahead with your purchase, follow the steps below on selecting your preferred airline, as AMEX does not make it simple to locate where to activate this benefit.

To optimize this TravelBank strategy, make sure that the airline you selected is United.

Go to AmericanExpress.com, then log in to your account.

Select the particular AMEX credit card that currently offers an airline fee credit.

- The Platinum Card® from American Express

- The Business Platinum Card® from American Express

- Hilton Honors American Express Aspire Card

On the main page, click “More, ” then select “ Benefits .”

On the Benefits page, scroll down to locate “ Airline Fee Credit. ”

This is where you can also change your selected airline for the year.

It bears repeating that you’re technically not allowed to change your preferred airline mid-year, so choose wisely.

With that said, there are data points from people reporting that they have successfully modified their airline choice by contacting AMEX through chat, but this is YMMV (your mileage might vary).

As of this writing, you can use your airline fee credit with the following U.S. carriers:

While on the Benefits page, enroll in all the offers available to you even if you are not sure you will use them.

It is practically money you had already paid for when you paid your annual fee, so you might as well take advantage of it.

At any rate, maximizing this airline fee credit is a fantastic way to offset the steep annual fees Amex charges on their ultra-premium cards.

Add funds to your travel credit using your AMEX card.

If you are unsure how much airline credit you have left, AMEX generates a tracker under this benefit to display your remaining funds.

Periodically check your Amex credit card to see if the airline fee credit was successfully triggered.

If not, Amex has likely terminated this redemption method.

Final Thoughts

Indeed, United’s TravelBank is a wonderful addition to the dwindling menu of possible purchases that can activate Amex’s elusive airline credit.

Being fully aware that this method is temporary, I try to take advantage of it while it’s still possible, especially when I am on the verge of running out of redemption alternatives for my Amex airline fee credit.

I hope that Amex follows Chase’s and Citi’s lead and relaxes this benefit, making it much easier to redeem in the future.

Until then, we will have to adjust to American Express’ policies.

Ultimately, I am glad that United’s TravelBank provides us with another fantastic alternative for using our travel credits.

Not only does it prolong the shelf-life of our funds, but it also affords us the flexibility we genuinely need.

EDITORIAL DISCLOSURE – Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. The content has not been reviewed, approved, or otherwise endorsed by any of the entities included within the post.

Related posts:

22 comments.

Bank of America Premium card also include benefits of $100 incidental travel credits, can I use it to purchase United Travel Bank fund too?

Hi Angie, I am not familiar with Bank of America rules but upon checking what qualifies under “incidental”, I got the following info: Get up to $100 in Airline Incidental Statement Credits annually for qualifying purchases such as seat upgrades, baggage fees, in-flight services, and airline lounge fees – automatically applied to your card statement.

It seems to me that this is similar to Amex. I would suggest purchasing the lowest allowed denomination of $50 to see if it would trigger it but if you have anticipated travel in the near future, I suggest redeeming the credits there instead.

Hi, I booked the ticket and when I entered the payment page, there is no Travel Bank part, I got 200+ dollars in travel bank and cannot seem to use it. Why is this? I can only see “Travel certificates” instead of “Travel certificates and United Travel Bank Cash”. What should i do?

Hi Tristan, thanks for asking. Sorry about that. Not all purchases in United.com are eligible. I wonder if the ticket you are purchasing includes a partner airline. From the Terms and Conditions: “TravelBank Cash is valid for air travel purchases on United and United Express® flights and as otherwise permitted by United. After a TravelBank Award is issued, a service charge may be imposed for each change or cancellation requested by the Member.”

I have encountered this exact problem and I am definitely booking a United airline airfare (from LAX – EWR): any more update on this?

HI Cindy, I had updated the post with hopefully a potential solution to your problem. Jump to the section “What to do? United Travel Bank Does Not Show Up”. I tried your route (LAX-EWR) and the steps I outlined worked in making Travel bank re-appear! Good luck and please let me know if it worked for you too!

Thank you for this post and the very detailed instructions!!! Really helpful as I’ll be using this as long as we can get that $200 credit from Amex Plat!

Thank you Tony for the kind feedback. I am glad you found it useful. Please feel free to ask questions anytime.

Great information, thank you!

Thank you so much!

Its unfortunate you can’t use your Travel Bank just to upgrade your seat. Or pay for the bundles upon checkout

I am sorry! Sadly, it is just not as flexible 🙁 But United might make some changes in the future that will allow us to use it for incidentals.

Newbie to United Travel Funds.

Is it possible to use it for booking a ticket for anyone else, any restrictions?

You can book it for anyone else. When they cancel though, the travel credits will be under their account.

This article saved me 30mins! I was typing a non-whole number to use my United Travel Bank and it would NOT take it. Apparently, it needs to be a WHOLE NUMBER. Thanks for the tip!

Glad you found it useful!

Can you combine miles and a travel bank balance? I have 33k miles I need to use and $600 in travel bank credits.

Unfortunately, you can not mix miles and travel bank balance. I’d use the travel bank first if you find cheap tickets as those expire. United miles do not expire.

Hi, how long does the Amex Airline Credit usually take? It’s been a week now and my credits have not shown up yet.

HI Kunal. It’s been about 10 days, on average, for me.

I wanted to add that you Travel Bank does not come up as an option to pay if your flight involves a leg operated by a partner airline (eg. Swiss Air).

I called United to see if they could book the ticket but it errored out for the representative and he gave me that as the reason.

This might be helpful to incorporate in your article.

HI Stephanie, thank you for sharing. That’s correct. Apologies that it was not clear in the article. Yes, it is sadly for United and United Express flights only. I highlighted that part of the article and added additional language under Troubleshooting so it’s much clearer. Thanks so much again for the feedback and Safe travels!

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

JOIN OUR FREE FACEBOOK TRAVEL MILES AND POINTS COMMUNITY!

TRAVEL MILES AND POINTS

- $15 Discount On $300+ Mastercard Gift Cards At Office Max / Depot

- Transfer American Airlines Business Credit Card Miles to AAdvantage Accounts

- $15 Discount On $300+ Visa Gift Cards At Office Max / Depot

- Earn 5X Chase Points Per Dollar: Staples Fee-Free Visa Gift Cards

- Earn 5X Travel Points: Staples Fee-Free Mastercard Gift Cards

FinanceBuzz

15 Ways to Avoid Baggage Fees Next Time You Fly

Posted: January 12, 2024 | Last updated: January 12, 2024

You don’t have to pay baggage fees when you travel. In fact, you can travel for nearly free by utilizing valuable travel planning secrets .

I’ve been using credit card rewards for over a decade to travel the world. Let’s explore how you can avoid baggage fees on your next flight.

Earn Points and Miles: Find the best travel credit card for nearly free travel

Apply for a travel credit card

This one is easy and straightforward.

Apply for a travel credit card with travel credit benefit, then use that travel credit to pay for your baggage fees.

The best travel credit cards could also help you earn travel rewards to reduce the cost of flights and hotel stays.

Get expert advice on making more money - sent straight to your inbox.

Use an airline credit card

Here’s another simple approach.

Apply for an airline credit card that gives you a free checked bag as a benefit. Then, you can pack everything you need while keeping money in your pocket.

Choose the best airline credit cards depending on which airlines you fly the most.

Earn elite status

Holding elite status with airline loyalty programs can provide valuable benefits, including free checked bags.

For example, Delta SkyMiles members receive their first checked bag free when traveling on a Delta or select airline partner flight, starting at the Silver Medallion tier.

Grow Your $$: 11 brilliant ways to build wealth after 40

Find the right travel partner

If you don’t have airline elite status or a credit card with a free checked bag benefit, maybe you know someone who does.

In many cases, free checked bag benefits from elite status or credit cards extend to a certain number of travel companions on the same itinerary.

Research bag fees

Every airline has different policies when it comes to baggage allowance and fees.

To ensure you know whether you’ll be charged for what you plan to pack, do your research ahead of time. You can typically find bag fees and other information by searching online for the airline and “baggage allowance” or “baggage policy.”

For example, search for “United baggage policy” to find information about fees and baggage restrictions when flying United Airlines.

It’s best to stick to the actual airline’s website when doing this type of research.

Invest in a scale

Once you’ve researched an airline’s baggage policy, it’s time to see if your bag meets the dimension and weight limits.

You can easily measure bag dimensions with a tape measure, but not everyone has a luggage scale handy to weigh their bags.

One smart Amazon hack is to buy a portable digital luggage scale for just $10 (or less) and get it quickly shipped if you have a Prime membership.

Retire Sooner: Take this quiz to see if you can retire early

Choose the right airline

Most major airlines don’t provide free checked bags unless you’re on a premium fare or flying to a specific destination.

However, you can still count on Southwest to provide two free checked bags to just about every destination it flies.

As long as you’re within the limits of the Southwest baggage policy, you get your first two checked bags for free. It’s as easy as that.

Avoid basic economy

Rather than get rid of free checked bags altogether, many airlines have opted to provide them as a benefit if you pay for a more expensive ticket.

That doesn’t necessarily mean you have to purchase a business or first-class ticket, but you typically can’t go with basic economy and expect a free checked bag.

Book a premium fare

Book a business or first-class ticket to help guarantee a free checked bag or two — or even three!

This typically isn’t a money-saving strategy since these types of tickets often cost much more than economy. But you can consider free checked bags a bonus on top of a better flight experience.

Remember that booking premium fares regularly is well within the realm of possibility if you use points and miles.

9 nearly secret things to do if you fly Southwest

A simple way to avoid baggage fees is not to have as much baggage. In other words, skip bringing a checked bag altogether.

If you pack light enough, you might be surprised you can get by with a personal item and carry-on bag. You also won't have to worry about grabbing your bag at baggage claim unless your carry-on was checked at the gate.

Wear extra clothing

Having issues packing light enough to skip bringing a checked bag? Consider wearing some of your bulkier clothing rather than packing it.

This doesn’t mean you have to be that person wearing multiple shirts, pants, and sweatshirts to avoid baggage fees. Instead, you could wear a bit bulkier clothes, like a jacket and jeans, to save room and weight in your luggage.

Steer clear of budget airlines

Budget airlines like Spirit and Frontier charge all sorts of fees for anything they deem to be “extra.” That typically includes bag fees, seat selection, and snacks, to name a few.

If you never want to worry about bag fees, your best bet is to avoid these budget airlines unless you have elite status or another way to avoid luggage fees.

Select a specific destination

You shouldn’t let baggage fees deter you from booking a trip to a dream destination. But if you’re open to going multiple places, consider destinations where you could get a free checked bag.

For example, American Airlines provides a first checked bag for free, excluding Basic Economy, if you’re flying to Argentina, Brazil, Chile, Japan, New Zealand, and more.

Fly international

While this isn’t always the case, you can typically find more free checked baggage allowance if you fly to an international destination.

As mentioned previously, certain airlines have specific lists of destinations where they might allow a free checked bag with different limitations.

The best credit cards for international travel could help you visit more countries without breaking the bank.

Try a baggage subscription

You can purchase a customizable United baggage subscription for yourself and up to eight companions. This is typically an annual subscription that costs at least a few hundred dollars per year.

I don’t think this type of subscription is worth it for most people because you could get a free checked bag benefit and other travel perks with a new credit card. But it might be worth it if you have a large family with lots of bag fees to cover.

Bottom line

Baggage fees are the worst, but you can avoid them with proper planning, research, and different tips and tricks.

So, stop throwing money away and save your cash for fun travel excursions so you can start traveling more for less.

More from FinanceBuzz:

- 7 things to do if you're scraping by financially.

- 6 genius hacks Costco shoppers should know.

- See what could happen if you add fine art to your investment portfolio.

- 9 simple ways to make up to an extra $200/day

More for You

More unpleasant legal surprises for Trump possible, newly revealed investigations suggest

New Predator Movie Badlands Brings In A Leading Lady With Sci-Fi Experience

8th Grade Teacher Shares the Wildest Things Students Have Ever Said to Her

Sleep experts say brushing your teeth right before bed is a common nighttime routine mistake — here's why

“He asked me if I wanted to play all the white guys”: Robert Downey Jr. on His Weirdest Role after Avengers: Endgame

Here's How Much the Average 60-Year-Old Has in Their 401(k)

Kansas City Chiefs' BJ Thompson, 25, 'still unconscious' after sudden cardiac arrest

10 Popular Dog Breeds That Most People Regret Getting

‘A new breed of commuter’: This North Carolina woman ‘super commutes’ 500 miles to work every other week to save $2K/month — what’s driving this emerging trend

What people should do about high blood pressure, according to a doctor

Donald Trump Wants Five Lawmakers Indicted

Appliance repairman demonstrates simple step to cool any room in minutes: 'Allowing you to ease off the AC'

I'm a 57-year-old Woman and People Think I'm in my 30's - Here's My Tips to Aging Gracefully

“It was enough that I… have an idea”: Taylor Sheridan Has Already Told Luke Grimes How Kayce’s Journey Ends

California retiree slams Social Security for ‘picking on the old people.’ She fought back — and won.

Doctor shares what happens to our bodies moments before we die

"The First Time I Visited The US I Thought This Was A Restaurant Scam": Non-Americans Are Sharing The Things That Are Totally Common In The US But Bizarre In Other Countries

Trump’s first Supreme Court appointee has once again broken from the conservative pack

Woman Fosters Stray Who Gave Birth To Her Puppies Alone In The Rain

Be Careful: These Android Apps Are Installing Malware, Stealing Your Data

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

United TravelBank Card: Closed to Applications, Replaced by United Gateway

What’s on This Page

The bottom line, pros and cons, detailed review, compare to other cards, benefits and perks, drawbacks and considerations, how to decide if it's right for you.

The card was suited to those who didn't travel much, but who flew United when they did travel. But it did not offer flexibility or traditional airline-card perks.

Rewards rate

Bonus offer

$150 in United TravelBank cash after you spend $1,000 on purchases in the first 3 months from account opening.

Ongoing APR

APR: 15.99%-22.99% Variable APR

Cash Advance APR: 24.99%, Variable

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater.

Foreign transaction fee

- Earn 2% in TravelBank cash per $1 spent on tickets purchased from United.

- Earn 1.5% in TravelBank cash per $1 spent on all other purchases

- No foreign transaction fees

- Enjoy 25% back as a statement credit on purchases of food, beverages and Wi-Fi onboard United®-operated flights when you pay with your United TravelBank Card.

- TravelBank cash is easy to use. $1 in TravelBank cash = $1 when used toward the purchase of a United ticket.

- Your TravelBank cash accumulates in your United TravelBank account on United.com.

- $0 Annual fee

High rewards rate

No annual fee

No foreign transaction fee

» This card is no longer available.

The United℠ TravelBank Card is no longer accepting applications. United Airlines and Chase have introduced a new credit card with no annual fee, the United Gateway℠ Card , which effectively takes the place of the TravelBank Card. Read our review of the United Gateway℠ Card , or explore other United Airlines credit card options . Below is our review of the United℠ TravelBank Card from when the card was still on the market.

If you fly United Airlines, the United℠ TravelBank Card might be tempting because of its annual fee of $0 . But it ultimately might not be worthwhile for most United flyers because of all that it lacks as an airline card.

The card has its own rewards currency that you can use to book free United flights. And its rewards rate is decent for both United spending and all other spending. It’s kind of like a cash-back card, where you can spend the cash only at United.

But you won't get free checked bags or early boarding like you do with many airline cards. And you won’t earn United MileagePlus miles, the airline’s frequent-flyer miles that have a chance at returning huge value.

If you want a card like this one, just get a true cash-back card . Then, you can spend your cash rewards on anything, not just United flights. Otherwise, ante up for a United card with an annual fee that comes with useful airline perks. There’s a good option in the United℠ Explorer Card .

» MORE: How to choose an airline credit card

United℠ TravelBank Card : Basics

Card type: Airline .

Annual fee: $0 .

2% in TravelBank cash per $1 spent on tickets purchased from United.

1.5% in TravelBank cash per $1 spent on all other purchases.

Sign-up bonus: $150 in United TravelBank cash after you spend $1,000 on purchases in the first 3 months from account opening.

Foreign transaction fee: None.

Interest rate: The ongoing APR is 15.99%-22.99% Variable APR .

Noteworthy perks:

25% back as a statement credit on purchases of food, beverages and Wi-Fi onboard United-operated flights when you pay with your card.

No foreign transaction fees.

Trip cancellation/interruption insurance.

Rental car insurance.

Purchase protection.

» MORE: Benefits of United Airlines credit cards

Simple rewards earning

With a typical airline card, you earn frequent flyer miles or points with every purchase. You then redeem those rewards for free flights or seat upgrades. But frequent flyer programs can be exceedingly complicated. The number of miles you’ll need for a particular flight depends on an array of factors. On top of that, the flight you want might not have award seats available. And your preferred travel dates might be “blacked out” — that is, reserved for paying customers.

The United℠ TravelBank Card eliminates the whole idea of miles. Instead, you earn “TravelBank cash,” which is redeemable for travel with United on a simple dollar-for-dollar basis.

The card earns 2% back on United purchases and 1.5% back on everything else. A $500 United flight, for example, would earn $10 in TravelBank cash. A $500 purchase elsewhere would earn $7.50.

Simple rewards redemption

When booking a flight with United, you can pay some or all of the fare with your accumulated TravelBank cash rewards. Consider a ticket that costs $400. If you had at least $400 in TravelBank cash, you could use it to pay the entire fare. If you had only $50 in rewards accumulated, you could apply it to the fare and reduce the cost to $350.

Some travel credit cards have annual fees measured in hundreds of dollars, while the typical airline card often charges a fee of close to $100 per year. This card has an annual fee of $0 .

Sign-up bonus

For a simple credit card with an annual fee of $0 , it’s a pleasant surprise to have a sign-up bonus: $150 in United TravelBank cash after you spend $1,000 on purchases in the first 3 months from account opening.

» MORE: NerdWallet's best airline cards

The United℠ TravelBank Card is light on flash compared with most travel cards, but it comes with minor perks:

In-flight discount: 25% back as a statement credit on purchases of food, beverages and Wi-Fi onboard United-operated flights when you pay with the card.

No foreign transaction fees: Travel cards generally don’t charge a fee — 3% is common — for making purchases abroad. This United card doesn’t, either. And it uses the Visa network, which is widely accepted abroad.

Travel-related insurances: Trip cancellation/interruption insurance and secondary rental car insurance are nice-to-haves on an airline card.

Purchase protection: Covers new purchases made with the card for 120 days against damage or theft, up to $500 per claim and $50,000 per account.

How it compares with other United cards

The United℠ TravelBank Card is one of three co-branded consumer United Airlines credit cards. Its siblings pack more perks.

Here’s how they compare on key features:

Business owners, even those with side gigs, might consider the United℠ Business Card .

» MORE: Full review of the United℠ Business Card

No checked bags or early boarding

At $35 per bag each way when you don't prepay, fees for first checked bags add up in a hurry, especially when you’re traveling with others on your itinerary. That’s why typical airline cards are so valuable. But this card has no checked-bag-fee waivers, so you’ll have to pay. And you won’t get boosted toward the front of the boarding line, because the card lacks a priority boarding perk. That could hurt you when looking for overhead bin space.

» MORE: Airline credit cards that offer free checked bags

The logical solution is the United℠ Explorer Card . It offers:

2 MileagePlus miles per dollar spent on purchases from United.

2 miles per dollar spent on restaurant purchases and hotel stays.

1 mile per dollar spent on all other purchases.

First checked bag free for you and a companion on your reservation, if you use the card to purchase your ticket.

Two United Club one-time use passes per year.

Global Entry/TSA Precheck statement credit every four years.

25% off in-flight purchases.

Sign-up bonus: Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

It has an annual fee of $0 intro for the first year, then $95 .

» MORE: Full review of the United℠ Explorer Card

You won’t earn United MileagePlus miles with this card. That keeps things simple, but you also lose the potential to reap outsize value by scoring a great awards seat — like a business-class international fare worth thousands of dollars — for relatively little spending.

Fewer benefits

Some airline cards give you perks at the airport. They might reimburse you the application cost of Global Entry or TSA Precheck to get through security lines quicker, or get you free or discounted passes to an airport lounge.

This card offers none of those.

» MORE: Cards that offer airport lounge access

Limited reward redemptions

Redeeming rewards is relatively simple, but you’re still locked into United Airlines. That's limiting compared with general travel credit cards , which allow you to apply rewards to a wide range of travel-related expenses.

An option for those looking to avoid an annual fee is the Bank of America® Travel Rewards credit card .

1.5 points per dollar spent.

3 points per dollar spent on eligible travel booked through the Bank of America® Travel Center.

A value of 1 cent per point when redeemed for travel credit and a little over half a cent per point for cash.

A sign-up bonus.

The Bank of America® Travel Rewards credit card isn't tied to an airline or hotel chain. Book travel any way you want, with no restrictions and no blackout dates, and then use points to wipe out the cost on your statement. Bank of America® also has one of the broadest definitions of "travel" of any major issuers. You can use points to get credit for airfare, hotel stays, cruises, car rentals, campgrounds, art galleries, amusement parks, carnivals, circuses, aquariums and zoos.

» MORE: Full review of the Bank of America® Travel Rewards credit card

The United℠ TravelBank Card offers a simpler way to earn free flights on United Airlines for casual flyers committed to that airline. But honestly, you’re better off with a cash-back credit card .

If you spread your flying among a number of carriers or want more flexibility, consider a general travel credit card . United loyalists are likely to get more value from the United℠ Explorer Card .

Information related to the United℠ TravelBank Card has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

This card earns bonus rewards in multiple categories, including dining and travel. You can transfer points on a 1:1 basis to about a dozen hotel and airline programs, including United, or you can use them to book travel through Chase at 1.25 cents per point. However, you won't get any airline-specific perks. Annual fee: $95 .

Looking For Something Else?

Methodology.

NerdWallet reviews credit cards with an eye toward both the quantitative and qualitative features of a card. Quantitative features are those that boil down to dollars and cents, such as fees, interest rates, rewards (including earning rates and redemption values) and the cash value of benefits and perks. Qualitative factors are those that affect how easy or difficult it is for a typical cardholder to get good value from the card. They include such things as the ease of application, simplicity of the rewards structure, the likelihood of using certain features, and whether a card is well-suited to everyday use or is best reserved for specific purchases. Our star ratings serve as a general gauge of how each card compares with others in its class, but star ratings are intended to be just one consideration when a consumer is choosing a credit card. Learn how NerdWallet rates credit cards.

About the author

Gregory Karp

Guide to Shipping Luggage Overseas Before You Travel

Ship Your Luggage Overseas For Less

Lost luggage, damaged bags, and delayed suitcases are a traveler’s worst nightmare. Unfortunately, with the increasing occurrence of extreme weather coupled with the global airport manpower crunch, this is more common than ever. But there is a silver lining: you can ship luggage abroad in advance thanks to international express shipping.

Why send your luggage abroad before departure?

Using international express shipping services like those offered by DHL Express has numerous benefits: you avoid the risks of luggage delays and eliminate the stress and cost associated with luggage mishaps.

These services also offer the added advantage of delivering your suitcases directly to your desired international destination , saving precious time waiting at the luggage carousel. And unlike with airlines, the bags you send with DHL Express can be tracked and traced internationally.

Heading to France, Italy, Germany, or Spain? Let DHL handle your suitcase

Ship your luggage to Europe! Prices starting at just $117 be sure to use a DHL promo code. You can start shipping your luggage either online, or by visiting one of our ServicePoints.

Key considerations of luggage shipping

When shipping luggage overseas, there are several things to keep in mind to make sure your suitcase is appropriately handled and arrives where you need it to be on time.

Ship luggage abroad safely with DHL Express

While packing your luggage carefully can significantly facilitate the shipping process, choosing a trusted logistics partner offers extra assurance that your important belongings arrive at their overseas destination quicker and more safely. As a leading logistics service provider, DHL Express US can offer reliable and cost-effective international shipping solutions such as time-definite delivery services , shipment value protection and more to meet your varied needs.

With an extensive global delivery network and rich industry experience, we can guide you through the entire shipping process, from baggage pick-up to shipping documentation and tracking in real-time . Let your summer vacation or next holiday be stress-free. Create your luggage shipment online now with just a credit card. You can schedule a pick up when you create the shipment or bring your labeled luggage to one of our DHL Express Service Point locations .

Ready to save time and money by shipping luggage to your destination?

What category of shipping does luggage shipping fall under?

Luggage is classified as personal effects, which are individual property usually worn or carried or has an intimate relation to the individual. Knowing this is essential before you send your suitcase overseas by post, as countries have different regulations for different categories of shipments. For instance, documents such as Form 12B and No Objection Certificate are required when shipping medication to India as personal effects, whereas other documents are necessary for other shipping categories.

By understanding your shipping category, you can ensure that all the required documents are prepared, avoiding delays caused by customs clearance issues and facilitating a smoother shipping experience.

How to pack and secure your luggage for shipping internationally

With an understanding of your shipping category, the next key consideration is how to pack your luggage securely. Deciding on the best way to do so involves considering the following factors:

Type of items in your luggage

If there are fragile items in your luggage, you will want to wrap them individually with a protective wrap and ensure that all empty spaces in the box containing them are filled with fillers. Meanwhile, if you plan to send musical instruments overseas, storing them inside hard cases is recommended. Like fragile items, filling up all void space is essential to prevent your items from shifting and becoming damaged during transit. To ensure that your baggage is handled with extra care, affixing a ‘fragile’ label on your outer shipping box will be helpful.

Mode of luggage shipping

Apart from the items you intend to send overseas, the shipping method you choose greatly affects how you package your items. If you plan to send your suitcase by sea, it is vital to seal moisture-sensitive items in waterproof bags. For extra protection, fit your luggage in a sturdy outer shipping box, such as a double-walled corrugated cardboard box.

When air shipping is used, the rate charged per kilogram is generally higher. As such, opting for lighter protective packaging can help keep the shipping cost low. Additionally, suitcases will tilt during the flight take-off and landing. Hence, you should also ensure that liquid items are sealed within leak-proof bags to prevent spillage from damaging other possessions in your luggage.

Intended shipping destination of your luggage

Each country has its parcel labeling requirements. Hence, a best practice is always to research the most recent customs regulations to ensure that your luggage meets the shipping requirements.

Weight of your luggage for shipping

If you are shipping heavy items overseas and your suitcase weighs 10 kilograms and above, a double or triple-walled cardboard box ensures that your parcel will not cave in under the weight of your items. Meanwhile, luggage between 30 to 70 kilograms should use a pallet, crate or a made-to-measure box that is sufficiently sturdy. For pieces weighing above 70 kilograms, consider using a fork-movable crate or loading your luggage onto a pallet, as handling equipment is often required to move them.

Similar Stories

PointsPanda LLC is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which PointsPanda LLC receives compensation for sending traffic to partner sites including but not limited to CreditCards.com. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants’ credit approval also impact how and where products appear on this site. PointsPanda LLC does not include the entire universe of available financial or credit offers.

CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Advertiser Disclosure

- Airline & Aviation News

Emirates Airlines Baggage; Fees and Allowance Information

Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

Emirates Airlines baggage policy is what makes it stand out from other airlines. Emirates Airlines has built a strong reputation for delivering exceptional customer service worldwide. One of the standout features of this airline is its highly accommodating baggage policy, which offers passengers ample flexibility to travel with various baggage options without incurring exorbitant fees.

Since its establishment in 1985, Emirates Airlines has made significant strides to become one of the largest and most successful airlines worldwide. Emirates Airlines is a leading airline headquartered in Dubai, United Arab Emirates, which is renowned for delivering exceptional services to travellers all around the world. Operating a vast fleet of over 270 aircraft that serve over 160 destinations across six continents. Emirates Airlines has earned multiple accolades and awards for its exceptional in-flight experience, spacious cabins, excellent dining options, and state-of-the-art entertainment systems.

Emirates Airlines Baggage Allowance

Emirates carry-on baggage allowance.

Emirates baggage allowance permits its passengers to carry on board is contingent on the class they are travelling:

Emirates Baggage Allowance For Boarding From India And For Travel From Brazil

Passengers who are boarding Emirates Airlines flights in India are allowed to bring a single piece of carry-on baggage. The dimensions of the carry-on baggage should not exceed 115 centimetres or 43.5 inches (length + width + height).

On the other hand, for all Emirates Airlines flights departing from Brazil, customers are permitted to carry up to 10kg/22 lbs carry-on baggage. However, for all flights destined for Brazil, customers are allowed to bring up to 7 kg/15 lbs carry-on baggage.

Infant Policy

Emirates Airlines permits customers travelling with infants to bring along either one carry-cot or a fully collapsible stroller with them into the cabin, as long as there is sufficient room. Infants are also entitled to bring along one carry-on bag for inflight food and other necessary items.

The carry-on bag should not exceed the dimensions of 22 x 15 x 8 inches (55 x 38 x 20 cm) and must not weigh more than 5kg/11 lbs. In the event that there is not enough space available in the cabin, these items will have to be checked; they will not be counted towards the passenger’s baggage allowance.

Read More: Emirates 777 Business Class & Dubai Lounge Review

Emirates Checked Baggage Allowance

Emirates Airlines applies different baggage allowance concepts depending on the route, fare, and travel class of the passenger. Generally, the weight concept is used for most routes, while the piece concept is used only for flights to and from the Americas and Africa.

Emirates Airlines Baggage allowances to and from the Americas and Africa (except flights within the Americas and between US and Europe) .

Emirates Airlines Baggage allowance for flights within the Americas and between US and Europe:

Outside of the Americas (weight applies)

Emirates Airlines allows passengers to check in multiple bags as long as their combined weight is within the allowance limit for their travel class. Additionally, each bag should not exceed the maximum weight limit of 32 kg/70 lbs.

Read More: Emirates A380 Business Class HONEST Flight Review

Emirates Airlines Baggage Fees(Additional/excess)

Emirates Airlines baggage varies based on several factors, including the route, travel class, fare category, and Emirates Skywards membership level. Passengers have the option to purchase additional Emirates Airlines baggage allowance online at a discounted rate compared to the airport rates.

To increase your baggage allowance under the Emirates weight model, you may purchase additional weight in increments of five kilograms, with a maximum limit of 25 kilograms. Buying extra weight online up to four hours before your departure can save you money, with the first additional five-kilogram pack being 50% cheaper than the check-in-desk price and each subsequent pack being 20 % less.

Emirates Airlines Baggage Fees – Buying Additional Weight At The Airport (based on the weight concept)

Emirates Baggage Fees(All rates are in USD/kg).

Emirates Baggage Fees – Buying Additional Pieces At The Airport

The option to add extra baggage pieces is available for tickets that have a piece-based Emirates Airlines baggage allowance. You can purchase additional pieces either online, at Emirates offices, or at the airport. The permitted weight allowance for each additional piece is 23kg for Economy Class and 32kg for Business and First Class.

Overweight/Oversized Emirates Baggage Fees (Within Your Baggage Allowance )

The airline will charge fees if the total size and weight limits of your allowed number of pieces are exceeded:

Overweight/Oversized Emirates Baggage Fees (With Purchased Additional Pieces )

Read More: Private: Emirates A380 Business Class – Flight Review

Emirates Airlines Baggage Allowance Exclusions And Waivers

If you are an Emirates Skywards member, you can receive an allowance for additional bags. The following table provides information for Skywards members based on weight as well as piece model:

Emirates Delayed or Damaged Baggage

If your baggage is delayed, you will receive a reference number (known as PIR). With the PIR you can use the tracker to track your bag, along with updates on the status of your bags. If you do not have access to the app, you can use the delayed or damaged baggage tracker on the Emirates website.

In case you face delay or damage to your baggage during your Emirates journey, it is advisable to inform the Emirates Airlines baggage services desk at the airport or submit a claim online within seven days of receiving your luggage. Emirates will then start the process of locating and returning your delayed baggage or compensating you for any damages or losses incurred.

It is important that you keep all the important information about your baggage like receipts for any necessary purchases made while waiting for your delayed luggage, as Emirates may reimburse you for these expenses. If your luggage is not found within three weeks, you can submit a claim for lost luggage.

Best Credit Cards For Travel With Emirates Airlines

Major credit cards, such as Amex, Chase, etc., transfer miles to Emirates Airlines. Emirates Airlines also provide co-branded credit cards, such as the Emirates Skywards Premium World Elite Mastercard. Here are some of the best credit cards you can use to earn or transfer miles to Emirates Airlines:

Chase Sapphire Preferred® Card

Chase Sapphire Preferred® Card is the top travel credit card and for those interested in accumulating Emirates Skywards Miles, Chase Ultimate Rewards credit cards like this card are an excellent option. Chase Sapphire Preferred® Card offers a transfer ratio of 1:1 , allowing for swift and effortless transfer of Chase points into Skywards Miles. on average, Chase Ultimate Rewards points are valued at around 1.5 to 2 cents per point when redeemed for Emirates flights.

Capital One Venture Rewards Credit Card

Capital One Venture Rewards Credit Card is considered one of the best credit cards for flat-rate travel rewards. It offers a simple rewards structure, and you can transfer miles earned with a Capital One Venture Rewards Credit Card to Emirates at a ratio of 1:1 . According to the Capital One Rewards Redemption Center, generally you can redeem your Venture miles for Emirates flights at a rate of 1 cent per mile .

Final Thoughts

Emirates Airlines baggage policy is a customer-centric approach to baggage allowance and compensation for lost or damaged baggage. The Emirates Airlines baggage policy provides various options based on the route, travel class, fare type, and Emirates Skywards membership tier. Overall, Emirates seems to prioritize passenger satisfaction through Emirates Airlines baggage policy and related services.

Interest in flying around the world using credit card points? Check out our site to learn the basics, and follow our blog for more tips on how to make your dream vacation a reality. Keep track of your spending categories and select a credit card that rewards you for your most frequent purchases. You can also sign up for our travel concierge and get unlimited credit card and travel assistance for one full year.

Pradeep Chandravanshi

Pradeep Chandravanshi is a copywriter and content writer focusing on maximising points and miles to stretch budgets and make luxury travel more accessible. He has a keen interest in travel and finance and serves as a writer at Points Panda.

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

You have successfully joined our subscriber list.

You might like

Aeroplan & Emirates Reveal Partnership Details

Emirates Airlines Customer Service – The Best Way to Reach Emirates

Which Points I Can Use to Book Emirates Flights

All You Need To Know About The A380 Emirates Aircraft

- Earn 75,000 Bonus miles after you spend $4,000 on purchases in the first 3 months from account opening.

- Earn 2X miles on everyday spend.

- Earn 10X miles on hotels and car rentals, and 5x on flights booked on Capital One Travel

- Receive 10,000 bonus miles every account opening anniversary.

- Get a $300 credit to use on Capital One Travel each year.

- Unlimited Access to Capital One Lounges and Priority Pass lounges internationally.

- $395 annual fee.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Leave a Reply Cancel reply

Leave a comment.

Save my name, email, and website in this browser for the next time I comment.

These 26 credit cards can get you free checked bags

Editor's Note

Checked bag fees can cost as much as $40 one-way — adding up quickly, especially if you travel with your family.

Unfortunately, over the years, checked bag fees have gone up, and as of recently, another round of increases across four major airlines in 2024 — United, Alaska, JetBlue and American Airlines — will continue to help the bottom line of these airlines.

But by carrying the right credit card, you may be able to get these charges waived completely , and possibly even for your travel companions.

In this guide, we'll go over the credit cards that feature free checked baggage as a benefit.

Alaska Airlines

Alaska Airlines charges a $35 fee for the first checked bag and $45 for the second on all its flights.

But for cardholders of the Alaska Airlines Visa Signature® credit card ($95 annual fee) and the Alaska Airlines Visa® Business card ($70 for the company and $25 per card annual fee), you'll be able to check a first bag for free for you and up to six additional passengers on the same reservation when you purchase your flight with your card.

These annual fees are well worth the cost, even if you travel with Alaska Airlines a handful of times yearly.

American Airlines

American Airlines charges $40 ($35 if you pay online) for your first checked bag for all domestic flights, including Puerto Rico and the U.S. Virgin Islands. For travel to and from Canada, Caribbean, Mexico, Central America, and Guyana, American Airlines charges $35 for the first checked bag and $45 for the second checked bag.

However, the carrier offers multiple cobranded credit cards from two issuers: Citi and Barclays. Both issuers offer a free checked bag, depending on the card you carry in your wallet.

Citi AAdvantage Cards

There are three Citi cobranded options that offer a first free checked bag on domestic itineraries:

- Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees )

- Citi® / AAdvantage® Platinum Select® World Elite Mastercard

- Citi® / AAdvantage Business™ World Elite Mastercard® (see rates and fees )

The Citi AAdvantage Platinum Select and the Citi AAdvantage Business extend this free checked baggage benefit to you and up to four traveling companions on your reservation. Both cards have $99 annual fees that are waived for the first year.

The information for the Citi AAdvantage Platinum Select World Elite Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Meanwhile, the Citi AAdvantage Executive World Elite Mastercard offers the same free checked bag benefit, but it extends to up to eight traveling companions on the same reservation. It has other benefits, such as Admirals Club lounge membership and a TSA PreCheck or Global Entry application credit.

Barclays Aviator cards

Issued by Barclays, the AAdvantage Aviator Red World Elite Mastercard ($99 annual fee) and the AAdvantage Aviator Business Mastercard ($95 annual fee) both offer a first bag checked free to the primary cardholder and four companions on domestic itineraries.

The information for the Aviator Red card and Aviator Business card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

None of these cards will waive the fee for your first checked bag on short-haul international flights.

Related: Best American Airlines credit cards

Delta Air Lines

Delta normally charges $35 each way for your first checked bag and $45 for your second bag on flights within the U.S.

However, through most of the carrier's consumer and business credit cards, you'll get one free checked bag for the cardholder and eight others traveling on the same itinerary. To utilize this benefit, attach your Delta SkyMiles number to your reservation.

Here are the six Delta cards that offer this perk:

- Delta SkyMiles® Gold American Express Card ($0 introductory annual fee for the first year, then $150, see rates and fees )

- Delta SkyMiles® Gold Business American Express Card ($0 introductory annual fee for the first year, then $150, see rates and fees )

- Delta SkyMiles® Platinum American Express Card ($350 annual fee, see rates and fees )

- Delta SkyMiles® Platinum Business American Express Card ($350 annual fee, see rates and fees )

- Delta SkyMiles® Reserve American Express Card ($650 annual fee, see rates and fees )

- Delta SkyMiles® Reserve Business American Express Card ($650 annual fee, see rates and fees )

Related: Best Delta credit cards

Hawaiian Airlines

Hawaiian charges $30 for the first checked bag and $40 for the second bag on flights from North America.

Hawaiian Airlines World Elite Mastercard from Barclays cardholders receive two free checked bags — however, travel companions aren't included in this benefit. The card comes with a $99 annual fee.

The information for the Hawaiian Airlines Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

JetBlue Airways

JetBlue charges different pricing for checked bags more than 24 hours before departure and less than 24 hours before departure. For flights within the U.S., Latin America, Caribbean and Canada, $35 ($45 if less than 24 hours) for the first checked bag and $50 ($60 if less than 24 hours) for the second.

JetBlue charges $65 for transatlantic flights for the first checked bag and $105 for the second.

Thankfully, you can avoid these charges if you carry the JetBlue Plus card or the JetBlue Business Card — both with a $99 annual fee. This free checked bag benefit extends to the primary cardholder (you) and three travel companions on your reservation.

The information for the JetBlue Plus card and the JetBlue Business Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Credit card showdown: JetBlue Plus Card vs. JetBlue Business Card

United Airlines

United charges $35 for the first checked bag if prepaid ($40 at check-in) and $45 for the second checked bag ($50 at check-in) on all domestic flights and other markets, but there's a total of four cards you can apply for to avoid checked bag fees .

The United℠ Explorer Card ($0 introductory annual fee for the first year, then $95) and the United℠ Business Card ($0 introductory annual fee for the first year, then $99) let you bring your first checked bag free for you and a companion on your reservation.

Meanwhile, the United Club℠ Infinite Card ($525 annual fee) and the United Quest℠ Card ($250 annual fee) let you check two free bags for the primary cardholder and one companion on the same reservation.

However, there's a big caveat here. Per the terms of this benefit, you must have your MileagePlus number on your reservation and purchase your ticket with the applicable card for the perk to apply. If you use a different card offering a better earning rate on airfare , you may miss out on the free checked bags.

Related: Best credit cards for United flyers

Other cards worth considering

While opening any of the airline credit cards above is a great way to save on checked bag fees, what happens if you fly with multiple carriers throughout the year? If you tend to prioritize price or convenience over sticking with a particular airline, it may not be worth it to apply for a cobranded credit card that offers perks solely on that one carrier.

An alternative is to apply for a credit card that comes with more general travel benefits and can reimburse you for checked bag charges:

- Chase Sapphire Reserve® ( $550 annual fee): Receive up to $300 in statement credits for travel purchases charged to your card each account anniversary year

- The Platinum Card® from American Express ($695 annual fee; see rates and fees ) and The Business Platinum Card® from American Express ($695 annual fee; see rates and fees ): Receive up to $200 in statement credits for incidental charges from one qualifying airline

- Capital One Venture X Rewards Credit Card ($395 annual fee, see rates and fees ), the Capital One Venture Rewards Credit Card ($95 annual fee, see rates and fees ) and the Capital One VentureOne Rewards Credit Card (no annual fee, see rates and fees ): Cover travel purchases on your statement by using your miles at a rate of 1 cent each

Related: What still triggers Amex airline fee reimbursements?

What you should know about checked bags

Here are some tips to keep in mind when taking advantage of your free checked bag benefit on your airline cards:

Free baggage benefits don't stack

There's a popular misconception that your credit card will offer an additional free checked bag rather than the first free checked bag. Unfortunately, these credit cards' fee waivers wouldn't apply if you already receive a free checked bag due to your elite status, class of service or travel to an overseas destination. Therefore, you will not receive an additional free checked bag beyond your existing allowance just for holding a credit card that offers this benefit. Some airlines make exceptions, but check your airline's policy before assuming a second bag will be covered.

Make sure to book your ticket correctly to use this benefit

With most of these offers, you only have to attach your frequent flyer number to your reservation to be given the free checked bag benefit. The exceptions are Alaska and United, which require you to purchase the ticket (or pay taxes and fees on an award ticket) using your airline credit card.

Be careful booking large groups on a single reservation

.It's nice that several of these credit cards offer free baggage for multiple companions, but there's a potential catch. When searching for flights, airlines will display a single airfare that applies to all tickets rather than offer lower fares for some passengers. So if only three seats are offered for $300 each, and the next best fare is $400, booking four people together in one reservation will cost $400 each.

Clearly, paying the extra $300 will not be worth it to receive a free bag worth $50 each round trip. So, before booking reservations for multiple people, be sure to check the price for a single passenger and consider your credit card's bag fee waivers before deciding whether to book your party with multiple reservations.

Book flights on Southwest

Southwest Airlines is the only domestic carrier not to charge checked bag fees for any traveler, offering two free checked bags weighing 50 pounds or less each on every single flight.

Bottom line

Airfare can be costly by itself, but additional bag fees can quickly add up — especially when traveling with a large family. Thankfully, there are several ways to avoid these costs. In fact, many of the airline cards on this list that offer a free checked bag carry annual fees under $100 .

Therefore, it's worth crunching the numbers. Even if you fly with that airline several times in one year, it's easy to justify paying the ongoing annual fee — and that's not even factoring in any welcome bonuses or other perks the cards offer.

For rates and fees of the Delta SkyMiles Gold, click here. For rates and fees of the Delta SkyMiles Gold Business, click here. For rates and fees of the Delta SkyMiles Platinum, click here. For rates and fees of the Delta SkyMiles Platinum Business, click here. For rates and fees of the Delta SkyMiles Reserve, click here. For rates and fees of the Delta SkyMiles Reserve Business, click here. For rates and fees of the Amex Platinum, click here . For rates and fees of the Amex Business Platinum, click here .

Updated as of 4/18/2024.

Chase Freedom Flex: Unique travel perks for a cash back card

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- Connect with Holly D. Johnson on Twitter Twitter

- Connect with Holly D. Johnson on LinkedIn Linkedin

- • Building credit

- • Credit card debt

- Get in contact with Liza Carrasquillo via Email Email

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- The Chase Freedom Flex is a unique cash back credit card that doubles as a great travel rewards card for those who know how to best take advantage of it.

- With no annual fee and the ability to redeem Chase Ultimate Rewards points for travel purchases, the Chase Freedom Flex can save you money without the added cost of carrying the card.

- Pairing the Chase Freedom Flex with other Chase credit cards can help you maximize your rewards and save even more.