- Press Releases

- Press Enquiries

- Travel Hub / Blog

- Brand Resources

- Newsletter Sign Up

- Global Summit

- Hosting a Summit

- Upcoming Events

- Previous Events

- Event Photography

- Event Enquiries

- Our Members

- Our Associates Community

- Membership Benefits

- Enquire About Membership

- Sponsors & Partners

- Insights & Publications

- WTTC Research Hub

- Economic Impact

- Knowledge Partners

- Data Enquiries

- Hotel Sustainability Basics

- Community Conscious Travel

- SafeTravels Stamp Application

- SafeTravels: Global Protocols & Stamp

- Security & Travel Facilitation

- Sustainable Growth

- Women Empowerment

- Destination Spotlight - SLO CAL

- Vision For Nature Positive Travel and Tourism

- Governments

- Consumer Travel Blog

- ONEin330Million Campaign

- Reunite Campaign

Economic Impact Research

- In 2023, the Travel & Tourism sector contributed 9.1% to the global GDP; an increase of 23.2% from 2022 and only 4.1% below the 2019 level.

- In 2023, there were 27 million new jobs, representing a 9.1% increase compared to 2022, and only 1.4% below the 2019 level.

- Domestic visitor spending rose by 18.1% in 2023, surpassing the 2019 level.

- International visitor spending registered a 33.1% jump in 2023 but remained 14.4% below the 2019 total.

Click here for links to the different economy/country and regional reports

Why conduct research?

From the outset, our Members realised that hard economic facts were needed to help governments and policymakers truly understand the potential of Travel & Tourism. Measuring the size and growth of Travel & Tourism and its contribution to society, therefore, plays a vital part in underpinning WTTC’s work.

What research does WTTC carry out?

Each year, WTTC and Oxford Economics produce reports covering the economic contribution of our sector in 185 countries, for 26 economic and geographic regions, and for more than 70 cities. We also benchmark Travel & Tourism against other economic sectors and analyse the impact of government policies affecting the sector such as jobs and visa facilitation.

Visit our Research Hub via the button below to find all our Economic Impact Reports, as well as other reports on Travel and Tourism.

By: Bastian Herre , Veronika Samborska and Max Roser

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000.

Tourism can be important for both the travelers and the people in the countries they visit.

For visitors, traveling can increase their understanding of and appreciation for people in other countries and their cultures.

And in many countries, many people rely on tourism for their income. In some, it is one of the largest industries.

But tourism also has externalities: it contributes to global carbon emissions and can encroach on local environments and cultures.

On this page, you can find data and visualizations on the history and current state of tourism across the world.

Interactive Charts on Tourism

Cite this work.

Our articles and data visualizations rely on work from many different people and organizations. When citing this topic page, please also cite the underlying data sources. This topic page can be cited as:

BibTeX citation

Reuse this work freely

All visualizations, data, and code produced by Our World in Data are completely open access under the Creative Commons BY license . You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

The data produced by third parties and made available by Our World in Data is subject to the license terms from the original third-party authors. We will always indicate the original source of the data in our documentation, so you should always check the license of any such third-party data before use and redistribution.

All of our charts can be embedded in any site.

Our World in Data is free and accessible for everyone.

Help us do this work by making a donation.

- Publications

- Key Findings

- Interactive data and economy profiles

- Full report

Press release and related contributions

Tourism is back to pre-pandemic levels, but challenges remain.

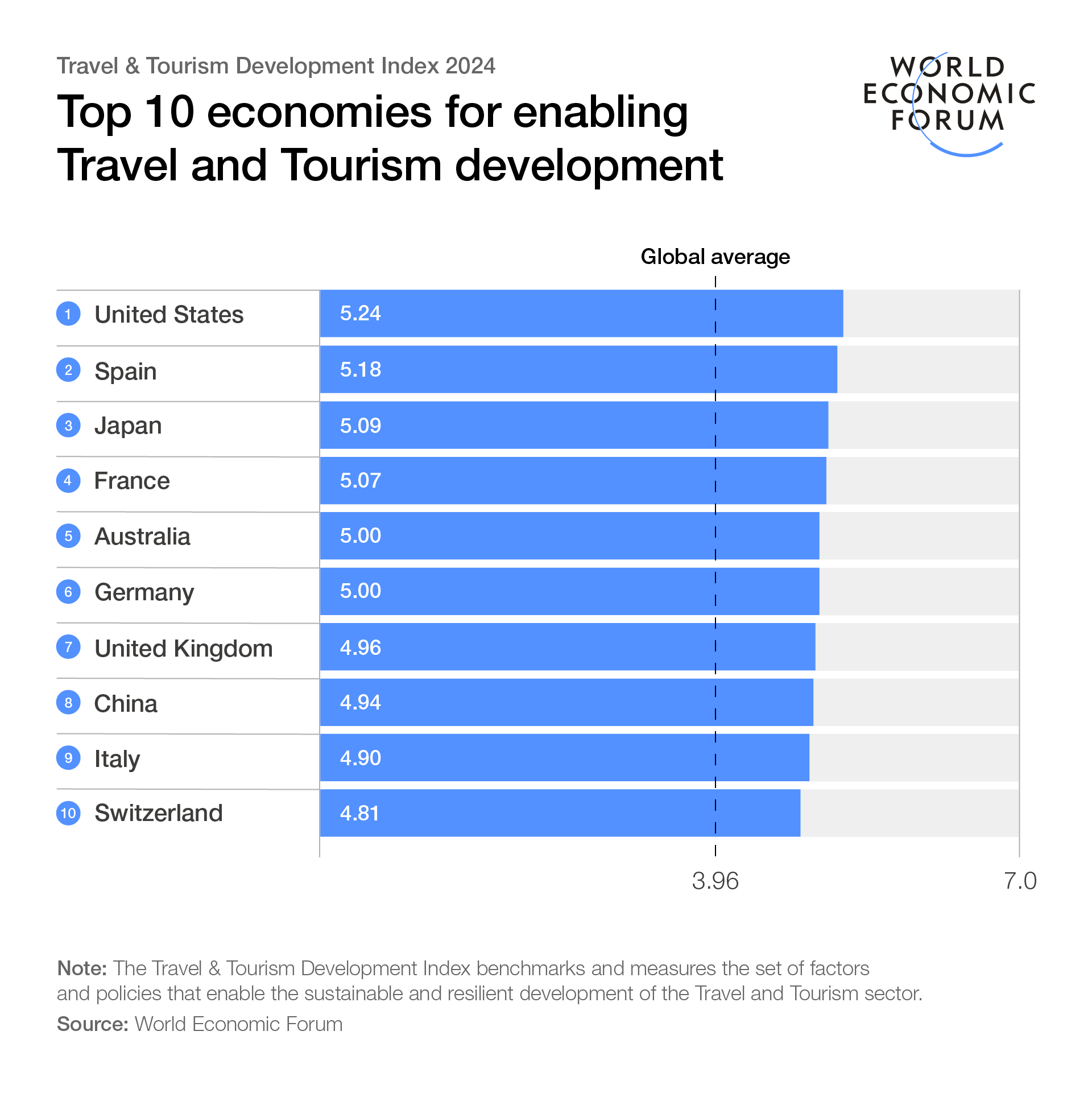

- High-income economies in Europe and Asia-Pacific continue to lead the World Economic Forum Travel and Tourism Index, with the United States, Spain and Japan topping the rankings again.

- Despite post-pandemic growth, the global tourism sector still faces complex challenges, with recovery varied by region; only marginal overall score improvements since the 2021 edition.

- Developing economies are making strides – who account for 52 out of 71 economies improving since 2019 – but significant investment is needed to bridge gaps and increase market share.

- Read the report here .

New York, USA, 21 May 2024 – International tourist arrivals and the travel and tourism sector’s contribution to global GDP are expected to return to pre-pandemic levels this year, driven by the lifting of COVID-19-related travel restrictions and strong pent-up demand, as per the new World Economic Forum travel and tourism study, released today.

Topping the 2024 list of economies are the United States, Spain, Japan, France and Australia. The Middle East had the highest recovery rates in international tourist arrivals (20% above the 2019 level), while Europe, Africa and the Americas all showed a strong recovery of around 90% in 2023.

These are some of the top findings of the Travel & Tourism Development Index 2024 (TTDI) , a biennial report published in collaboration with the University of Surrey, which analyses the travel and tourism sectors of 119 countries around a range of factors and policies.

“This year marks a turning point for the travel and tourism sector, which we know has the capacity to unlock growth and serve communities through economic and social transformation,” said Francisco Betti, Head of the Global Industries team at the World Economic Forum. “The TTDI offers a forward-looking window into the current and future state of travel and tourism for leaders to navigate the latest trends in this complex sector and sustainably unlock its potential for communities and countries across the world.”

Post-pandemic recovery

The global tourism industry is expected to recover from the lows of the COVID-19 pandemic and surpass the levels seen before the crisis. This is largely being driven by a significant increase in demand worldwide, which has coincided with more available flights, better international openness, and increased interest and investment in natural and cultural attractions.

However, the global recovery has been mixed. While 71 of the 119 ranked economies increased their scores since 2019, the average index score is just 0.7% above pre-pandemic levels.

Although the sector has moved past the shock of the global health crisis, it continues to deal with other external challenges, from growing macroeconomic, geopolitical and environmental risks, to increased scrutiny of its sustainability practices and the impact of new digital technologies, such as big data and artificial intelligence. In addition, labour shortages are ongoing, and air route capacity, capital investment, productivity and other sector supply factors have not kept up with the increase in demand. This imbalance, worsened by global inflation, has increased prices and service issues.

TTDI 2024 highlights Out of the top 30 index scorers in 2024, 26 are high-income economies, 19 are based in Europe, seven are in Asia-Pacific, three are in the Americas and one (the United Arab Emirates) is in the Middle East and North Africa region (MENA). The top 10 countries in the 2024 edition are the United States, Spain, Japan, France, Australia, Germany, the United Kingdom, China, Italy and Switzerland.

The results highlight that high-income economies generally continue to have more favourable conditions for travel and tourism development. This is helped by conducive business environments, dynamic labour markets, open travel policies, strong transport and tourism infrastructure, and well-developed natural, cultural and non-leisure attractions.

Nevertheless, developing countries have seen some of the greatest improvements in recent years. Among the upper-middle-income economies, China has cemented its ranking in the top 10; major emerging travel and tourism destinations of Indonesia, Brazil and Türkiye have joined China in the top quartile of the rankings. More broadly, low- to upper-middle-income economies account for over 70% of countries that have improved their scores since 2019, while MENA and sub-Saharan Africa are among the most improved regions. Saudi Arabia and the UAE are the only high-income economies to rank among the top 10 most improved economies between 2019 and 2024.

Despite these strides, the TTDI warns that significant investment is needed to close gaps in enabling conditions and market share between developing and high-income countries. One possible pathway to help achieve this would be sustainably leveraging natural and cultural assets – which are less correlated with country income level than other factors – and can offer developing economies an opportunity for tourism-led economic development.

“It’s essential to bridge the divide between differing economies’ ability to build a strong environment for their travel and tourism sector to thrive,” said Iis Tussyadiah, Professor and Head of the School of Hospitality and Tourism Management at the University of Surrey. “The sector has big potential to foster prosperity and mitigate global risks, but that potential can only be fully realized through a strategic and inclusive approach.”

Mitigating future global challenges

According to the World Economic Forum’s 2024 Global Risks Report, the travel and tourism sector faces various complex risks , including geopolitical uncertainties, economic fluctuations, inflation and extreme weather. Balancing growth with sustainability also remains a major problem, due to high seasonality, overcrowding, and a likely return of pre-pandemic emissions levels. The report also analyses persistent concerns about equity and inclusion. While the tourism sector offers a major source of relatively high-wage jobs, particularly in developing countries, gender parity remains a major issue for regions such as MENA and South Asia.

Despite these challenges, the sector can play a significant role in addressing them. To achieve this, decision-makers should prioritize actions such as leveraging tourism for nature conservation efforts; investing in skilled, inclusive and resilient workforces; strategically managing visitor behaviour and infrastructure development; encouraging cultural exchange between visitors and local communities; and using the sector to bridge the digital divide, among other policies.

If managed strategically, the travel and tourism sector – which has historically represented 10% of global GDP and employment – has the potential to emerge as a key contributor to the well-being and prosperity of communities worldwide.

About the Travel and Tourism Development Index 2024

The 2024 edition of the TTDI includes several improvements based on newly available data and recently developed indicators on the environmental and social impact of travel and tourism. The changes made to the 2024 Index limit its comparability to the previously published TTDI 2021. This year's report includes recalculated 2019 and 2021 results, using new adjustments. TTDI 2024 reflects the latest available data at the time of collection – end of 2023. The TTDI is part of the Forum’s broader work with industry communities actively working to build a better future enabled by sustainable, inclusive, and resilient industry ecosystems.

Notes to editors

Read the Forum Agenda also in Spanish | Mandarin | Japanese Learn about the Forum’s impact Check out the Forum’s Strategic Intelligence Platform and Transformation Maps Follow the Forum on social media: @wef | Instagram | LinkedIn | Facebook | TikTok | Weibo | Threads | WhatsApp

Watch Forum videos at wef.ch/videos | YouTube Get Forum podcasts at wef.ch/podcasts | YouTube Subscribe to Forum news releases

US Travel Header Utility Menu

- Future of Travel Mobility

- Travel Action Network

- Commission on Seamless & Secure Travel

- Travel Works

- Journey to Clean

Header Utility Social Links

- Follow us on FOLLOW US

- Follow us on Twitter

- Follow us on LinkedIn

- Follow us on Instagram

- Follow us on Facebook

User account menu

The latest travel data.

MONTHLY INSIGHTS March 04, 2024

U.S. Travel has temporarily paused our monthly data newsletter, however, the latest travel data is still available via the U.S. Travel Insights Dashboard . This dashboard is updated each month (member login required).

The U.S. Travel Insights Dashboard , developed in collaboration with Tourism Economics, is supported by more than 20 data sources. The dashboard is the most comprehensive and centralized source for high-frequency intelligence on the U.S. travel industry, tracking industry performance, travel volumes and predictive indicators of recovery including air and lodging forecasts, DMO website traffic, convention and group trends, travel spending and losses, traveler sentiment, among others to measure the health of the industry.

Key Highlights January 2024:

- Travel appetite started the year on a softer note, but overall growth continued. Air passenger growth remained positive, up 6% versus the prior year but lower than the double-digit growth seen through 2023. Foreign visits remained strong, up 24% YoY.

- Hotel room demand continued a trend of slight contraction falling 1% versus the prior year, while short-term rental demand grew 1%, a lower rate than 2023.

- A particular bright spot was that group room demand within the top 25 markets displayed solid growth of 9% relative to the prior year.

- The outlook for the economy remains fairly optimistic due to the strength of the labor market, looser financial conditions and healthy household and nonfinancial corporate balance sheets. This has filtered through to slightly higher consumer sentiment in February.

- Sentiment is also growing for upcoming leisure travel in 2024. The share of travelers reporting having travel plans within the next six months increased to 93% in January from 92% in December, according to Longwoods International’s monthly survey.

- Travel price inflation (TPI) fell slightly in January as a result of falling transportation prices. Sticky services inflation should see relief from decelerating wage growth. However, upside risks stem from rising healthcare costs, supply chain disruptions and slowing labor supply. Source: U.S. Travel Association and Tourism Economics

Member Price:

Non-Member Price: Become a member to access.

ADDITIONAL RESEARCH

Travel Price Index

Travel Forecast

Quarterly Consumer Insights

Additional monthly insights are available through the full U.S. Travel Monthly Data Report, exclusive to members. Please inquire with membership if you are interested in learning about becoming a member of U.S. Travel Association.

Travel, Tourism & Hospitality

Coronavirus: impact on the tourism industry worldwide - statistics & facts

The impact of covid-19 on global tourism industries, how has the tourism industry changed as a result of covid-19, key insights.

Detailed statistics

Global travel and tourism expenditure 2019-2022, by type

Travel and tourism: share of global GDP 2019-2033

COVID-19: job loss in travel and tourism worldwide 2020-2022, by region

Editor’s Picks Current statistics on this topic

COVID-19: global change in international tourist arrivals 2019-2023

COVID-19: job loss in travel and tourism worldwide 2020-2022, by country

Further recommended statistics

- Basic Statistic Travel and tourism: share of global GDP 2019-2033

- Basic Statistic Global travel and tourism expenditure 2019-2022, by type

- Premium Statistic Global international tourism receipts 2006-2022

- Basic Statistic COVID-19: job loss in travel and tourism worldwide 2020-2022, by region

- Basic Statistic COVID-19: job loss in travel and tourism worldwide 2020-2022, by country

Share of travel and tourism's total contribution to GDP worldwide in 2019 and 2022, with a forecast for 2023 and 2033

Total travel and tourism spending worldwide from 2019 to 2022, by type (in trillion U.S. dollars)

Global international tourism receipts 2006-2022

International tourism receipts worldwide from 2006 to 2022 (in billion U.S. dollars)

Employment loss in travel and tourism due to the coronavirus (COVID-19) pandemic worldwide from 2020 to 2022, by region (in millions)

Number of travel and tourism jobs lost due to the coronavirus (COVID-19) pandemic in selected countries worldwide from 2020 to 2022 (in million)

International tourist arrivals

- Premium Statistic Number of international tourist arrivals worldwide 1950-2023

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Premium Statistic International tourist arrivals worldwide 2019-2022, by subregion

- Premium Statistic Countries with the highest number of inbound tourist arrivals worldwide 2019-2022

- Premium Statistic Change in international tourist arrivals worldwide 2020-2023, by region

Number of international tourist arrivals worldwide 1950-2023

Number of international tourist arrivals worldwide from 1950 to 2023 (in millions)

Number of international tourist arrivals worldwide 2005-2023, by region

Number of international tourist arrivals worldwide from 2005 to 2023, by region (in millions)

International tourist arrivals worldwide 2019-2022, by subregion

Number of international tourist arrivals worldwide from 2019 to 2022, by subregion (in millions)

Countries with the highest number of inbound tourist arrivals worldwide 2019-2022

Countries with the highest number of international tourist arrivals worldwide from 2019 to 2022 (in millions)

Change in international tourist arrivals worldwide 2020-2023, by region

Percentage change in international tourist arrivals worldwide from 2020 to 2023, by region

Online travel companies

- Premium Statistic Revenue of leading OTAs worldwide 2019-2023

- Premium Statistic Change in revenue of leading OTAs worldwide 2020-2022

- Premium Statistic Total visits to travel and tourism website booking.com worldwide 2021-2024

- Premium Statistic Total visits to travel and tourism website tripadvisor.com worldwide 2020-2024

Revenue of leading OTAs worldwide 2019-2023

Leading online travel agencies (OTAs) worldwide from 2019 to 2023, by revenue (in million U.S. dollars)

Change in revenue of leading OTAs worldwide 2020-2022

Year-over-year percentage change in revenue of leading online travel agencies (OTAs) worldwide from 2020 to 2022

Total visits to travel and tourism website booking.com worldwide 2021-2024

Estimated total number of visits to the travel and tourism website booking.com worldwide from December 2021 to March 2024 (in millions)

Total visits to travel and tourism website tripadvisor.com worldwide 2020-2024

Estimated total number of visits to the travel and tourism website tripadvisor.com worldwide from August 2020 to March 2024 (in millions)

Accommodation

- Premium Statistic Monthly hotel occupancy rates worldwide 2020-2023, by region

- Premium Statistic Monthly change in rental bookings through OTAs due to COVID-19 2020-2022

- Premium Statistic Airbnb nights and experiences booked worldwide 2017-2023

- Premium Statistic Airbnb nights and experiences booked worldwide 2019-2023, by region

Monthly hotel occupancy rates worldwide 2020-2023, by region

Monthly hotel occupancy rates worldwide from 2020 to 2023, by region

Monthly change in rental bookings through OTAs due to COVID-19 2020-2022

Monthly change in short term rental bookings through selected leading online travel agencies (OTAs) worldwide from 2020 to 2022

Airbnb nights and experiences booked worldwide 2017-2023

Nights and experiences booked with Airbnb from 2017 to 2023 (in millions)

Airbnb nights and experiences booked worldwide 2019-2023, by region

Number of nights and experiences booked on Airbnb worldwide from 2019 to 2023 by region (in millions)

Food & drink services

- Premium Statistic Daily year-on-year impact of COVID-19 on global restaurant dining 2020-2022

- Premium Statistic Global quick service restaurant industry market size 2022-2023

- Premium Statistic Restaurant food delivery growth worldwide 2019-2020, by country

- Premium Statistic Online restaurant delivery growth worldwide 2019-2020, by country

Daily year-on-year impact of COVID-19 on global restaurant dining 2020-2022

Year-over-year daily change in seated restaurant diners due to the coronavirus (COVID-19) pandemic worldwide from February 24, 2020 to August 1, 2022

Global quick service restaurant industry market size 2022-2023

Market size of the quick service restaurant industry worldwide in 2022 and 2023 (in billion U.S. dollars)

Restaurant food delivery growth worldwide 2019-2020, by country

Restaurant food delivery growth in selected countries worldwide between 2019 and 2020

Online restaurant delivery growth worldwide 2019-2020, by country

Digital restaurant food delivery growth in selected countries worldwide between 2019 and 2020

Virtual tourism

- Premium Statistic Global virtual tourism market value 2021-2027

- Premium Statistic Guests interested in touring hotels using VR/metaverse technology worldwide 2022

- Basic Statistic VR tourist destination prices worldwide 2021

- Premium Statistic Comparison between digital and live exhibitions by visitors worldwide 2021

Global virtual tourism market value 2021-2027

Market size of the virtual tourism industry worldwide in 2021, with a forecast for 2027 (in billion U.S. dollars)

Guests interested in touring hotels using VR/metaverse technology worldwide 2022

Share of travelers that are interested in using a virtual reality/metaverse experience to tour a hotel before booking worldwide as of 2022

VR tourist destination prices worldwide 2021

Price of selected virtual reality travel experiences worldwide as of 2021 (in U.S. dollars)

Comparison between digital and live exhibitions by visitors worldwide 2021

Opinions on virtual versus in-person exhibitions and trade shows according to visitors worldwide as of 2021

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

An official website of the United States government

The Journal of the U.S. Bureau of Economic Analysis

- Articles by Date

- Articles by Subject

- Infographics

- Research Spotlights

U.S. Travel and Tourism Satellite Account for 2017–2021

By Sarah Osborne | February 9, 2023

Download PDF

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 64.4 percent in 2021 after decreasing 50.7 percent in 2020, according to the most recent statistics from the Travel and Tourism Satellite Account (TTSA) of the U.S. Bureau of Economic Analysis (BEA). 1 By comparison, the broader economy, as measured by real gross domestic product (GDP), increased 5.9 percent in 2021 after decreasing 2.8 percent in 2020. Revised statistics on travel and tourism reflect the incorporation of the annual update of the National Economic Accounts, which was released on September 29, 2022. The 2022 Annual Update of the National Economic Accounts ,” Survey of Current Business 102 (November 2022)."> 2

Highlights from the TTSA include the following:

- As the industry entered the recovery period of the COVID–19 pandemic, travel and tourism's share of GDP increased from 1.54 percent in 2020 to 2.15 percent in 2021 ( table A ).

- The travel and tourism industry's real output increased $362.0 billion in 2021 but has not fully recovered from the pandemic. Travel and tourism’s real output for 2021 was 81.1 percent of its 2019 level ( table B ).

- The increase in 2021 is the largest expansion in real output since BEA began measuring these statistics in 1998.

- In 2021, real output increased for 21 of 24 commodities. The largest contributors to the increase were food and beverage services and shopping.

- Prices for travel and tourism goods and services increased 7.7 percent in 2021 after decreasing 5.0 percent in 2020. The largest contributors to the increase were gasoline, traveler accommodations, and automotive rental and leasing ( table C ).

- The TTSA is available on the BEA website; see the box “ Data Availability .”

The remainder of this article includes a discussion of trends in travel and tourism output, prices, value added, and employment.

Trends in Output and Prices

Real output.

Travel and tourism real output increased 64.4 percent in 2021. The largest contributors were food and beverage services, shopping, domestic passenger air transportation services, and traveler accommodations (table B and chart 1).

The upturn in real output (from a decrease of 50.7 percent in 2020 to an increase 64.4 percent in 2021) was led by upturns in food and beverage services, shopping, domestic passenger air transportation service, and traveler accommodations.

[View larger chart]

Travel and tourism prices turned up in 2021, increasing 7.7 percent after decreasing 5.0 percent in 2020, with prices of 21 of 24 commodities contributing to the increase (table C and chart 2). The upturn was led by upturns in gasoline, traveler accommodations, and automotive rental and leasing and a smaller decrease in domestic passenger air transportation.

Total output

Total tourism-related current-dollar, or nominal, output increased to $1.70 trillion in 2021, up from $952.0 billion in 2020. In 2021, total output consisted of $987.7 billion in direct tourism output and $716.3 billion in indirect tourism output. The 1.73 ratio of total output to direct output in 2021 means that every dollar of direct tourism output requires an additional 73 cents of indirect tourism output (chart 3).

Direct tourism output includes goods and services sold directly to visitors, such as passenger air travel. Indirect tourism output includes sales of all goods and services used to produce that direct output, such as jet fuel to fly the plane and catering services for longer flights.

Tourism Value Added and Employment

Value added.

A sector's value added measures its share of gross domestic product. The travel and tourism industry's share of GDP was 2.15 percent in 2021, 1.54 percent in 2020, and 2.99 in 2019 (table A). This pattern indicates that travel and tourism industries contracted and expanded disproportionately to non-travel and tourism industries during the COVID–19 pandemic.

Direct employment

Direct tourism employment refers to jobs that are directly related to visitor spending on goods and services. Airline pilots, hotel clerks, and travel agents are examples of such employees. Overall, direct employment increased by 1.3 million jobs in 2021 after decreasing by 2.9 million jobs in 2020. The largest contributors to the 2021 increase were food services and drinking places, which gained 730,000 jobs in 2021; shopping, which gained 206,000 jobs; and participant sports, which gained 86,000 jobs (chart 4 and table D).

Total employment

Total tourism-related employment (the sum of direct and indirect jobs) increased to 7.4 million jobs in 2021 from 5.5 million jobs in 2020. The 7.4 million jobs consisted of 4.8 million direct tourism jobs and 2.6 million indirect tourism jobs (chart 5). While direct tourism employment includes jobs that produce direct tourism output, such as airline pilots, indirect tourism employment is generated by the businesses that supply goods and services to the tourism sector, such as refinery workers producing jet fuel. Data for 2021 indicate that for every 100 jobs supported directly by the travel and tourism industry, an additional 53 indirect tourism jobs are also required.

- All measures of travel and tourism activity not identified as being in “real,” inflation-adjusted terms are current-dollar, or nominal, estimates.

- For more information see “ The 2022 Annual Update of the National Economic Accounts ,” Survey of Current Business 102 (November 2022).

Subscribe to the SCB

The Survey of Current Business is published by the U.S. Bureau of Economic Analysis. Guidelines for citing BEA information.

Survey of Current Business

bea.gov/scb [email protected]

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

U.S. Department of Commerce

- Fact Sheets

Was this page helpful?

Fact sheet: 2022 national travel and tourism strategy, office of public affairs.

The 2022 National Travel and Tourism Strategy was released on June 6, 2022, by U.S. Secretary of Commerce Gina M. Raimondo on behalf of the Tourism Policy Council (TPC). The new strategy focuses the full efforts of the federal government to promote the United States as a premier destination grounded in the breadth and diversity of our communities, and to foster a sector that drives economic growth, creates good jobs, and bolsters conservation and sustainability. Drawing on engagement and capabilities from across the federal government, the strategy aims to support broad-based economic growth in travel and tourism across the United States, its territories, and the District of Columbia.

The federal government will work to implement the strategy under the leadership of the TPC and in partnership with the private sector, aiming toward an ambitious five-year goal of increasing American jobs by attracting and welcoming 90 million international visitors, who we estimate will spend $279 billion, annually by 2027.

The new National Travel and Tourism Strategy supports growth and competitiveness for an industry that, prior to the COVID-19 pandemic, generated $1.9 trillion in economic output and supported 9.5 million American jobs. Also, in 2019, nearly 80 million international travelers visited the United States and contributed nearly $240 billion to the U.S. economy, making the United States the global leader in revenue from international travel and tourism. As the top services export for the United States that year, travel and tourism generated a $53.4 billion trade surplus and supported 1 million jobs in the United States.

The strategy follows a four-point approach:

- Promoting the United States as a Travel Destination Goal : Leverage existing programs and assets to promote the United States to international visitors and broaden marketing efforts to encourage visitation to underserved communities.

- Facilitating Travel to and Within the United States Goal : Reduce barriers to trade in travel services and make it safer and more efficient for visitors to enter and travel within the United States.

- Ensuring Diverse, Inclusive, and Accessible Tourism Experiences Goal : Extend the benefits of travel and tourism by supporting the development of diverse tourism products, focusing on under-served communities and populations. Address the financial and workplace needs of travel and tourism businesses, supporting destination communities as they grow their tourism economies. Deliver world-class experiences and customer service at federal lands and waters that showcase the nation’s assets while protecting them for future generations.

- Fostering Resilient and Sustainable Travel and Tourism Goal : Reduce travel and tourism’s contributions to climate change and build a travel and tourism sector that is resilient to natural disasters, public health threats, and the impacts of climate change. Build a sustainable sector that integrates protecting natural resources, supporting the tourism economy, and ensuring equitable development.

Travel and Tourism Fast Facts

- The travel and tourism industry supported 9.5 million American jobs through $1.9 trillion of economic activity in 2019. In fact, 1 in every 20 jobs in the United States was either directly or indirectly supported by travel and tourism. These jobs can be found in industries like lodging, food services, arts, entertainment, recreation, transportation, and education.

- Travel and tourism was the top services export for the United States in 2019, generating a $53.4 billion trade surplus.

- The travel and tourism industry was one of the U.S. business sectors hardest hit by the COVID-19 pandemic and subsequent health and travel restrictions, with travel exports decreasing nearly 65% from 2019 to 2020.

- The decline in travel and tourism contributed heavily to unemployment; leisure and hospitality lost 8.2 million jobs between February and April 2020 alone, accounting for 37% of the decline in overall nonfarm employment during that time.

- By 2021, the rollout of vaccines and lifting of international and domestic restrictions allowed travel and tourism to begin its recovery. International arrivals to the United States grew to 22.1 million in 2021, up from 19.2 million in 2020. Spending by international visitors also grew, reaching $81.0 billion, or 34 percent of 2019’s total.

More about the Tourism Policy Council and the 2022 National Travel and Tourism Strategy

Created by Congress and chaired by Secretary Raimondo, the Tourism Policy Council (TPC) is the interagency council charged with coordinating national policies and programs relating to travel and tourism. At the direction of Secretary Raimondo, the TPC created a new five-year strategy to focus U.S. government efforts in support of the travel and tourism sector which has been deeply and disproportionately affected by the COVID-19 pandemic.

Read the full strategy here

An official website of the United States government

Travel and Tourism

Travel and tourism satellite accounts, 3rd quarter 2017.

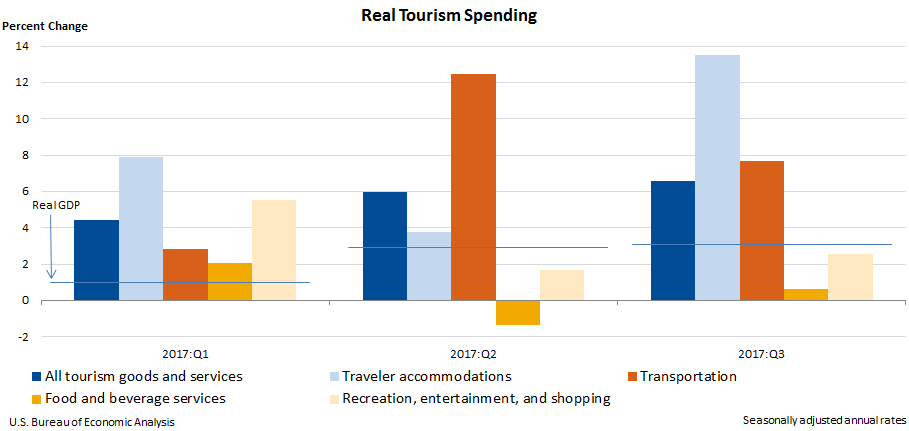

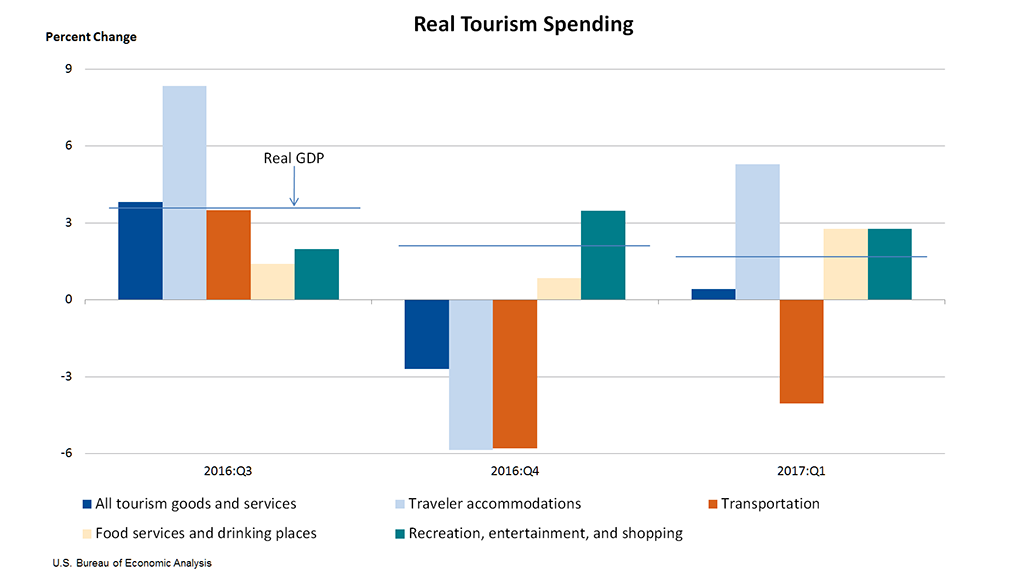

Real spending (output) on travel and tourism accelerated in the third quarter of 2017, growing at an annual rate of 6.6 percent after increasing 6.0 percent (revised) in the second quarter, according to new statistics released by the Bureau of Economic Analysis. Real gross domestic product (GDP) for the nation also accelerated, increasing 3.3 percent in the third quarter (second estimate) after increasing 3.1 percent in the second quarter of 2017.

Due to budget constraints, BEA is discontinuing production of quarterly travel and tourism estimates. Annual estimates, published each June in BEA’s Survey of Current Business , will continue to be produced with support from the Office of Travel and Tourism Industries, International Trade Administration, U.S. Department of Commerce.

Real Tourism Spending

Travel and Tourism Satellite Accounts, 2nd quarter 2017

Travel and tourism satellite accounts, 1st quarter 2017.

Real spending (output) on travel and tourism turned up in the first quarter of 2017, increasing at an annual rate of 0.4 percent after decreasing 2.7 percent (revised) in the fourth quarter of 2016, according to new statistics released by the Bureau of Economic Analysis. In contrast, real gross domestic product (GDP) for the nation decelerated, increasing 1.2 percent in the first quarter (second estimate) after increasing 2.1 percent in the fourth quarter of 2016.

Travel and Tourism Satellite Account: First Quarter 2017

Travel and Tourism Satellite Accounts, 4th quarter 2016

Travel and tourism satellite accounts, 3rd quarter 2016, travel and tourism satellite accounts, 2nd quarter 2016, travel and tourism satellite accounts, 1st quarter 2016 and annual revisions, travel and tourism satellite accounts, 4th quarter 2015, travel and tourism satellite accounts, 3rd quarter 2015, travel and tourism satellite accounts, 2nd quarter 2015.

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Search ITA Search

2020 Travel and Tourism Industry Impact on the U.S. Economy

Total economic output generated by travel and tourism in the united states decreased 50% in 2020 from 2019, decline in travel and tourism gdp accounted for more than half of the decline in u.s. gdp in 2020, decline in total tourism-related employment accounted for more than a third of the total employment decline in the united states in 2020 .

The National Travel and Tourism Office’s (NTTO) Travel & Tourism Satellite Account, produced annually by the Bureau of Economic Analysis, is the official U.S. Government estimate of the economic impact of the travel and tourism industry in the United States. The latest TTSA shows that in Calendar Year 2020:

Total economic output generated by travel and tourism fell $982.5 billion (-50.1%) from 2019 ($1.96 trillion) to 2020 ($978.4 billion).

- Among those sectors hardest hit, passenger air transportation services output declined by nearly $214.7 billion in 2020, followed by food services and drinking places/restaurants (down $131.1 billion), traveler accommodations (down $124.6 billion), and tourism-related shopping (down $123.5 billion).

- These four sectors accounted for 60.4% of the decline in total tourism-related output in 2020.

Total tourism-related employment declined from 9.5 million in 2019 to 6.3 million in 2020. This decline of 3.2 million in total tourism-related employment accounted for 34.2% of the overall 9.3 million employment decline in the United States from 2019 to 2020.

- Among those sectors hardest hit, employment supported by food services and drinking places declined by 972,000 in 2020, followed by traveler accommodations (down 685,000), air transportation services (down 338,000), and participant sports (down 262,000).

- These four sectors accounted for 70.8% of the decline in total tourism-related employment in 2020.

Travel and tourism value added, or GDP, (in nominal terms, not inflation adjusted) declined from $624.7 billion (2.9% of GDP) in 2019 to $356.8 billion (a historic low of 1.7% of GDP) in 2020 .This $267.9 billion decline in travel and tourism GDP accounted for more than half (56.0%) of the overall $478.8 billion decline in U.S. GDP from 2019 to 2020.

Domestic travel demand by resident households declined by 53.2% from 2019 to 2020. At the same time, domestic business travel demand declined by 40.9%; domestic government travel demand declined by 33.6%; and travel demand by nonresidents (international visitors in the United States) declined 82.4% — accounting for a fifth (20.7%) of the overall decline in total travel demand from 2019 to 2020.

Learn more on NTTO’s Travel and Tourism Satellite Account (TTSA) Program Page .

Travel and Tourism Satellite Accounts (TTSAs) allow the United States to measure the relative size and importance of the travel and tourism industry, along with its contribution to gross domestic product (GDP). Approved by the United Nations in March 2002 and endorsed by the U.N. Statistical Commission, TTSAs have become the international standard by which travel and tourism is measured. In fact, more than 50 countries around the world use travel and tourism satellite accounting.

View BEA’s Travel and Tourism Satellite Account .

Download WP Travel

Please enter your email to download WP Travel and also get amazing WP Travel offers and Newsletters.

Global Tourism Statistics 2024:Facts and Forecasts

Home » Blog » Global Tourism Statistics 2024:Facts and Forecasts

After the massive hit of the COVID-19 pandemic, global tourism’s future and trends tend to move towards an upward shift. This paradigm shift has a gigantic impact on tourism and related activities. So, we will delve more into Global Tourism Statistics 2024:Facts and Forecasts today.

There was a subsequent rise in GDP after the COVID-19 pandemic period . Statista predicted in 2022 that the tourism industry will get back on track as tourists tend to be inbound and outbound from place to place.

Table of contents

Global tourism analysis, global tourism statistics 2019, global tourism statistics 2020, global tourism statistics 2021, global tourism statistics 2022, global tourism statistics 2023, global tourism statistics 2024 | predictive analysis, international tourist arrivals in 2024.

- Global Tourism Contributions to GDP 2024

Global Tourism Growth Rate 2024

Global tourism revenue growth rate 2024.

The tourism industry and activities started to flourish after the pandemic. The number started to rise again. Global Tourism Statistics predicted that the travel and tourism business will experience 18% growth in 2024.

This is the highest point after the pandemic period. Hotel bookings, travel, and tourism businesses are expected to reach new heights. Experts suggest it’s the best time to start your own travel agency business.

- International tourist arrivals worldwide were around 95,000 at the beginning of 2019.

- The growth rate of tourist arrivals was slower.

- Nearly $1.9 trillion was spent by tourists in 2019.

- Travel receipts were around $9.3 billion in 2019.

Global Tourism was about $8.9 trillion in 2019 . Tourists love to explore beautiful countries. And popular destinations. France tends to hold the Number 1 position in 2019 as more than 90 million tourists visit the country.

(Top 5 visited countries 2019)

Moreover, 2019 tourism was slightly disturbed by covid 19 from July. However, there were many popular destinations loved by tourists worldwide.

In 2019, the total spending on world tourism reached a peak of $1.86 trillion, showing a growth of 1.81% compared to the previous year.

This indicates that people tend to spend more on travel and tourism activities, contributing to the overall tourism industry’s economic enhancement.

The increase in spending suggests a continued interest and investment in tourism experiences on a global scale.

There was a massive decline in the travel and tourism industry in 2020. The tourism industry declined by more than 67% compared to the previous year . This makes one of the greatest downward shifts in the tourism industry ever recorded after subsequent time.

Pacific island Fiji tends to face an economic crisis because of a decline in tourist and tourism activities. Countries relying totally on tourism were more affected this year.

From January to May 2020. International tourist arrivals declined by more than 56% similarly in April it was recorded with a decline of 97%.

(Decline in international tourist arrivals 2019 vs 2022))

The limited movement of people from place to place results in a massive loss for the aviation industry as well.

Air passenger was reduced by almost 60.2% compared to 2019 . This creates the worst conditions for the airline industry. Among many industries airline industry was one of the most impacted as there was a decline in tourist flow.

- GDP of tourism ( 2.9 of GDP) $624.7 billion was declined to $356.8 (1.7 of GDP) making it the greatest downfall of all time in tourism history.

- Total number of visitors in 2020 was comparatively low compared with the past 10 years of data.

- Tourism-dependent countries faced a major economic crisis.

Overall global tourism in 2020 didn’t grow that well the unpredictable circumstance has resulted in a massive decline in the GPD as well. There were approximately 1.5 billion tourist arrivals in 2019 and the number declined by more than 75% in 2020 the estimated tourist arrival in 2020 was around 381 million only. Compared with the 2019 tourist arrival the data fluctuation is very high.

The Tourism industry has gone through numerous uptrends and downtrends throughout the period. 2019 ended and 2020 was considered one of the most challenging years for the whole tourism industry. Regarding 2021 the tourism industry starts to rise at a minimal speed.

In 2021 tourism industry start to gain speed at a minimal rate according to the popular data analytical site Statista. Global tourism worldwide increased by 4% in 2021 compared to 2020.

Matter of fact the international tourist arrival was 79% down compared with the 2019 tourist inbound data.

Recovering from the mass decline of 2020 the tourism industry started to increase with several 64.4% in 2021. The travel and tourism increment number in 2020 was only 50.7%

(Decline in international tourist arrivals)

In 2021, the US had 22.1 million inbound arrivals, which is a 15% increase from 2020 and a 72% decrease from 2019.

- Overall increment in the tourism industry was recorded at more than 64.4 %

- Export revenues from international tourism dropped 59%.

- In 2021, the travel and tourism industry’s share of GDP increased from 1.54% in 2020 to 2.15% in 2021.

- Compared to 2019 the contribution of GDP was still down in 2021 ( 49.1% ) only.

- Recovering from the pandemic travel and tourism businesses tend to increase by more than 362 billion dollars.

Regarding 2021 tourism status it has shown a little increment in terms of number compared with the 2020 data. The industry recorded a substantial 64.4% growth , surpassing the incremental rate in 2020.

Export revenues dropped by 59%, while the industry’s share of GDP improved from 1.54% in 2020 to 2.15% in 2021 . Despite signs of recovery, the sector has not reached its growth level in 2020.

Comparing the tourism condition with the year 2021 the number and data start to shift toward an upward curve. Analyzing the data deeply in 2022 total international tourism receipt reached the threshold of $1 trillion which is massive compared to the 2022 number.

However, the total receipts were still not able to reach the number of pre-pandemic. In 2022 more than 900 million tourists travel internationally.

International tourist spending reached 64% of pre-pandemic levels. 2022 start to maintain sort of momentum to reach the peak point of travel and tourism activities.

(Travel and tourism contribution over GDP from 2019 to 2022 )

- The total earned export revenue was still below the line ( 34 % ) below pre pre-pandemic level.

- $7.7 trillion contribution to global GDP

- Significant growth in spending of international visitors ( about 20.4% increment )

- 2022 travel and tourism generated more than 22 million new jobs . Significantly high in number compared to 2021 data.

The travel and tourism sector ultimately makes a contribution of 7.7 trillion dollars to global gross domestic product ( GDP ). The number is shifting in an upward trend compared with other previous years.

The 2022 travel and tourism activities maintained a pace of recovery mode. The industry maintained to level up from the previous year. As it intends to create more jobs and contribute more to the global economy and GDP.

All the dimensions of the tourism industry in 2022 start to evolve and grow over time. Ultimately the revenue received from tourists hit a whopping $1 trillion and more than 900 million people travel globally.

The travel industry solely created millions of jobs and contributed to overall economic growth.

Popular website for travel and tourism data stated that more than 975 million tourists were traveling internationally in the year 2023. Compared with 2021 and 2022 this year seems to be beneficial for travel and tourism industries.

In the first quarter of 2023, there is a spike in the growth of tourist arrivals. International tourist arrival reached 80% of pre-pandemic level. This states that the year 2023 is a sort of recovery year for the tourism industry. After years the industry was able to reach this point.

The travel and tourism industry somehow was able to reach progress similar to the year 2019. Travel bookings were up r oughly 31% at the end of March 2023 compared to the same time in 2019.

The travel and tourism health progress up to 87% in the year 2023. The USA tends to be a prime actor as it was able to accumulate more than $190.39 billion U.S. dollars.

Followed by the supreme country China and Canada.

China accumulated around $154.02 billion U.S. dollars followed by Canada which is $16 billion U.S. dollars.

The total gap between Canada and the USA is around $174.39 billion U.S. dollars respectively. In terms of numbers, these countries seem to do well in the tourism industry.

(Top 5 Visited Countries 2023 )

- Over 975 million tourists traveled worldwide in 2023 ( Jan to Sep)

- The total projected contribution of travel and tourism was around $2.2 trillion U.S. dollars toward global GDP.

- The total international receipt projected in 2023 was around USD 1.4 trillion .

- Compared with other years in 2023, there were more than 171 nights spent compared to 2022.

- Rise in tourist traveling rate results into increment in increment in hotel occupancy rate up to 10% higher compared to the previous year.

Airline industries also tend to bounce back as revenues reach more than $803 billion , Comparatively it’s higher than 2022 as it reached around 9.7%.

Certain external factors do impact the travel business globally. The economic sanctions on Russia by different nations have resulted in delays in travel and tourism as well. Similarly, the zero COVID strategy promulgated by China has also affected the tourism industry overall.

The momentum of global tourism could potentially shift to an upward curve if all external factors don’t interrupt travel and tourism activities.

2024 is regarded as one of the important years for the travel and tourism sector. As the impact of COVID-19 started to overcome the travel and tourism business all across the world started to gain momentum throughout the time.

There are thorough predictions made for 2024 tourism. Multiple analyses tend to show potential opportunities for the tourism sector. From 2019 to 2023 the industry of tourism was scattered by COVID-19 after the interference of COVID-19 the cycle of 2024 tourism got into rollercoaster rides.

However, global tourism spending is predicted to reach $2 trillion in 2024 . After a long period, it’s predicted that international travel trips will exceed pre-pandemic levels in 2024, marking a 3% increase from 2019 .

The overall tourism market will get to a new level. The prediction is that the travel and tourism market will reach $927.30 billion in 2024 . Which is one of the big numbers compared to the previous year’s global tourism statistics.

After lot’s of ups and downs finally the travel and tourism industry is getting into momentum. It’s expected that tourist arrivals in 2024 will increase by 17.23% from the past year i.e. 2023. If the industry can meet the expectation there will be massive changes in the overall tourism business.

- The expected international tourists is about 1.53 billion which is significantly large compared to the previous year.

- the GDP contribution by tourism in 2024 will be 10.6%

- Year-to-year growth in 2024 will be increased by a large number as expectation of over 17.24 % is made.

- Ultimately the revenue will be around US 9.4 billion American dollars .

In 2024, the travel and tourism industry is on the rise after facing challenges. There’s a big anticipation of a 17.23% increase in tourist arrivals compared to 2023.

(International Tourist Arrival in 2024 )

If this expectation is met, it could bring significant positive changes to the overall tourism business.

The projected number of international tourists for 2024 is a substantial 1.53 billion, a noteworthy increase from the previous year.

The industry’s contribution to the global GDP in 2023 was 10.6%. Looking ahead, there’s an optimistic year-to-year growth forecast of over 17.24% in 2024.

In terms of revenue, the industry is expected to generate around US $9.4 billion . These promising figures indicate a strong recovery and growth for the travel and tourism sector in the coming year.

Global Tourism Contributions to GDP 2024

The travel and tourism industry is getting on track after facing challenges in recent years. For 2024, there is an optimistic growth outlook:

- Tourist arrivals are expected to increase by 17.23% from 2023 . If this matches the expectations, it could bring major positive impacts for the overall tourism business.

- International tourist projections sit at a substantial 1.53 billion for 2024, a significant jump from the previous year’s numbers.

- The industry contributed 10.6% to global GDP in 2023.

- For 2024, year-over-year growth forecasts are a promising 17.24%, indicating strong momentum.

- In terms of revenue generation, the travel sector could reach around USD 9.4 billion.

(2024 Global Tourism Contribution To GDP)

These numbers and projections point to a rapid recovery and expansion period for international and domestic travel over the coming year.

More people are expected to take vacations and business trips that could greatly benefit tour operators, hotels, airlines, and other travel entities after facing struggles not too long ago.

If the above expectations and forecasts are fulfilled, 2024 is shaping up to be a beneficial year for travel and tourism when looking at tourist arrivals, GDP contributions, growth percentages, and total revenue creation. There seems to be renewed optimism across the sector.

Overall ,the travel and tourism industry holds a positive growth approach in 2024 according to projections:

- Global tourism saw significant declines in 2020 and 2021 due to the COVID-19 pandemic. However, momentum picked back up in 2022.

- For 2023, the estimated growth rate in global tourism is between 30% to 35% as the industry rebounds.

- Looking ahead to 2024 , the global tourism growth rate is forecasted to be around 34.7%.

- This would represent a noticeable jump from the expected 30-35% growth in 2023 showing sustained positive momentum.

- If 2024 hits the projected 34.7% in tourism growth , it would take global travel significantly above 2019 volumes indicating a full industry comeback has been achieved.

- This global growth also implies strong performance in major tourism markets across different regions like Europe, Asia Pacific, the Americas, the Middle East, and Africa.

(Global Tourism Growth Rate 2024)

Ultimately, 2024 is setting up to be another very high growth year for travel globally with expectations of over one-third increase in tourism versus 2023 numbers.

So, we suggest that travel business owners be ready to create travel booking websites and generate revenue and growth substantially with huge scope.

All signals point to a sector that has recovered to pre-pandemic strength and managed to undo the large drops observed in 2020 and 2021.

International tourist arrivals are projected to reach 1.53 billion, representing a substantial recovery with an expected year-over-year growth of 17.24% from the 975 million arrivals in 2023.

After facing major challenges in 2020 and 2021, the tourism industry is all set for substantial revenue growth in 2024:

- Global tourism revenue saw a major decline of nearly 50% at the peak of the pandemic. This significantly impacted many travel businesses and destinations.

- A rebound is already underway in 2022 and is expected to continue accelerating through 2023 with an estimated 30-35% growth rate .

- For 2024, global tourism revenues are forecasted to grow around 34.7% year-over-year.

- Gaining a 34.7% revenue growth target would indicate tourism has fully recovered from the pandemic demand shock and is expanding rapidly again.

(Global Tourism Revenue Growth 2024)

If achieved, 2024 would likely represent the highest-ever revenues for the tourism industry globally surpassing pre-pandemic levels.

The projections for a nearly 35% boost in tourism revenues globally paint an extremely optimistic picture of what lies ahead for the sector in 2024 as demand swells.

This rapid growth trajectory beyond 2023 forecasts shows tourism maintaining great momentum as a key recovery success story among industries worldwide.

➤ Here is the complete list of tour operator software.

The overview for tourism in 2024 is highly positive across expected metrics. International tourist arrivals are forecasted to hit 1.5 billion, representing a rapid 17.23% increase from 2023’s estimates, elevating volumes well beyond pre-pandemic levels.

The sector’s contribution to global GDP, which recorded 10.6% in 2023, is also expected to rise considerably in 2024, reflecting its full rise in economic impact. Most notably, tourism revenues could grow up to 34.7% year-over-year, reaching around $9.4 billion globally .

This Global Tourism Statistics 2024:Facts and Forecasts would be the highest growth rate realized since before the COVID-19 downturn,, these projections point to 2024 being a standout year as the industry looks positively to completely negate pandemic losses and reach new historical highs across metrics like tourist arrivals, revenues, and GDP.

Yam Bahadur Chhetri is a content writer and vivid contributor to the WordPress community and a WordPress enthusiast with an experience of 7+ years in the relative field. He also loves to develop WordPress Themes, Plugins, and custom WordPress development for clients.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Get WP Travel Pro

Create Stunning , SEO friendly and Fully functional Travel website within minutes . No Coding Required !

Suitable for any

- Travel Agency

- Tour Booking Services

- Travel Bloggers

Drive more Sales and Revenues from today !

$ 99 99 USD per year

📢 Santa has sent the gift for Christmas and New Year sales on all WP Travel Pro plans. 🛍️ Use coupon code "XMAS_NEWYEAR2024" at checkout.

Related posts

Ultimate Guide to Content Marketing for Travel Agency (2024)

6 Pros of WordPress Travel Plugin for Online Booking System

8 Best WordPress Map Plugins For WordPress Free(2024)

Wp travel modules.

Need more features to save your time and to boost your travel business? WP Travel Pro comes with more powerful modules . While our core travel plugin provides almost all the features that a travel and trekking websites generally needs, our add-ons boost it’s capacity further to make it the best travel engine on WordPress. Whether you want to add new payment method to your site or brush up your trekking listings with beautiful maps show casing your trips, we have all your imagination covered. See all our add ons below to boost your travel website’s features further.

Weather Forecast

Import Export

Partial Payment

Connect with wp travel to join the travel conversation, documentation →.

Explore More

Customer Support →

We are here to help.

Facebook Group →

User Community Forum

Follow On Twitter →

Connect with us on Twitter

19 of the most surprising statistics about tourism

I t’s World Tourism Day, a time – these days – for much pontificating about sustainability and the impact of travel upon the planet. Instead, we’re going to take a look at some of the more surprisingly facts about the tourism industry. It’s all perfect fodder for your next pub quiz.

Aviation accounts for just 2 per cent of global carbon emissions

But first, a word on sustainability. Alongside giving up meat, taking fewer flights is usually billed as the best way for individuals to cut their carbon footprint, and with the recent “flight shaming” trend, it can feel like we’re being collectively bullied to stay on the ground. All of which might lead one to assume that aviation accounts for a considerable chunk of global emissions. The actual figure, therefore, may be smaller than you’d imagine. In 2022 aviation, when the industry reached 80 per cent of pre-pandemic levels, it accounted for just 2 per cent of global carbon emissions.

By 2030, one in four tourists will be Chinese

A few years ago, the China Outbound Tourism Research Institute (COTRI) predicted that overseas trips by the country’s residents would increase from 145m a year to more than 400m by 2030. In other words, it would account for around a quarter of international tourism. The pandemic put the brakes on such staggering growth, but expect things to start picking up again – fast.

Saudi Arabia wants to surpass France as a holiday destination

Speaking of 2030, that is the year when Saudi Arabia wants to start welcoming 100m annual visitors – more than the record 91.1m France, the world’s most visited country, welcomed in 2019. It’s all part of Vision 2030, the state’s grand plan to jettison its overreliance on oil. Central to that plan will be the launch of Riyadh Air, to take on the likes of Emirates, the construction of a vast new airport designed to accommodate up to 120m annual passengers, and the creation of two new coastal “cities” – Amaala and Neom – to lure sunseekers .

France’s number two tourist town?

Paris is number one – naturellement. But number two isn’t Bordeaux, Nice or Marseille. It’s Lourdes, a town of 13,000 residents that manages to attract 6m visitors every year thanks to the apparitions of a peasant girl called Bernadette. It has 279 hotels to choose from, according to Booking.com – only the French capital has more.

Only 0.07 per cent of the world’s population have been to Antarctica

You get that rough figure if you divide the number of people who visit Antarctica each year (100,000) by the number of people born each year (140m). But even fewer have been to the least visited country on Earth, Tuvalu – just 0.0026% of us (or 3,700 people a year).

More Britons visit the Canary Islands each year than Italy

Lying on a hot volcanic rock? It’s better than Rome, Florence, Venice, Tuscany, the Dolomites, the Cinque Terre and the Amalfi Coast rolled into one. That’s according to official figures which show that around 5m of us go to the Canaries each year, compared with the 4.1m who visit Italy.

The biggest hotel on Earth is not in Las Vegas

Twelve of the world’s 20 largest hotels, in terms of total rooms, are found in Sin City. But number one, the First World Hotel (which has a staggering 7,351 rooms), is somewhere rather more obscure. The Genting Highlands of Malaysia. It will soon lose the record, however. The US$3.5 billion Abraj Kudai in Mecca, under construction since 2015, will have 10,000 rooms.

And Macau makes more money from gambling tourists than Las Vegas

Another win for Asia. Macau has earned a reputation as the “Monte Carlo of the Orient”. Chinese games – like Fan Tan , a version of roulette – traditionally dominated its casinos, but the last 20 years have seen a move to embrace the many western-style ways of parting the punter from their money – to the extent that, in 2007, Macao overtook the Las Vegas Strip on gambling revenues.

Which is the most luxurious place on Earth?

What – or where – is the most luxurious place on earth? New York? Dubai? Abu Dhabi? Obviously, the answer depends on how you are defining “luxurious”. But if the key metric is “city with the greatest number of five-star hotels”, then the identity of the most gleaming metropolis may surprise you. It used to be London, but as of earlier this month, and the release of the 2023 edition of jet-set bible the Forbes Travel Guide , the place in focus is – again – Macau. Said chic dot on the map of the Far East now boasts 22 hotels in the uppermost bracket.

Inverness is more popular than Stratford-upon-Avon

With its Shakespeare connections, surely Stratford-upon-Avon welcomes more tourists than plucky little Inverness? Not so, according to VisitBritain. London is number one, by a mile (21.7m overnight visitors in 2019, the last “normal” year), followed by Edinburgh (2.2m), Manchester (1.6m) and Birmingham (1.1m). Stratford lags way down in 17th, with 271,000 arrivals, just below Inverness (which, we assume, is used by many as a launch pad for jaunts around the Highlands).

And Reading trumps Windsor

Both are in Berkshire, but only one can boast the largest inhabited castle on the planet, Britain’s branch of Legoland, and a picturesque riverside racecourse. Yet it is Reading that makes VisitBritain’s top 20 (237,000 visitors in 2019) at the expense of Windsor.

The Maldives really needs your money

The value of tourism to the Maldivian economy is more than US$2bn – or 32.5 per cent of its GDP. Only one destination (hello again Macau) is more reliant on your money . Needless to say, the last few years have been a struggle.

Tourists outnumber locals by 7,853 to 1 in the Vatican City

The Vatican City has just 764 permanent inhabitants, measures a titchy 0.2 square miles, and receives – according to some sources – 6m visitors a year. That’s 7,853 tourists per resident or 31.58m per square mile.

Bangladesh is the world’s least touristy country

At the other end of the scale is Bangladesh. With a population of 169.8m but only 323,000 annual visitors, it welcomes just 0.002 tourists per resident per year, making it perhaps the least touristy country on Earth.

Iran has 25 World Heritage Sites

This won’t surprise anyone who has been there – it’s a fascinating place packed with history (though currently off-limits, according to the Foreign Office). But those who don’t know it well might raise an eyebrow to learn that it trumps the likes of Japan, the US and Greece when it comes to World Heritage Sites .

Bicester Village is almost as popular as Buckingham Palace

Among Chinese visitors that is. Travellers from the world’s most populous country have some other curious destinations on their wishlist . Around 150,000 visit Trier every year, for example, making it the most sought-after German destination among Chinese globetrotters. Why? It is the birthplace of Karl Marx, of course. And Montargis, a small town south of Paris, is also inexplicably popular. That’s because hundreds of young Chinese scholars studied there in the early part of the 20th century, including many future stars of China’s Communist Party.

English really is the global language

Thanks to a combination of empire, mass tourism and invasive Western culture, English really is the global language. According to David Crystal’s book English as a Global Language, at least half the population of 45 countries speak it. There are also just 13 countries where fewer than 10 per cent of the population speak English, including China, Colombia, Brazil and Russia.

16 of the world’s 30 busiest airports are American

A combination of international travel slowdown and America’s ravenous appetite for flying meant that in 2022, 16 of the world’s 30 busiest airports (in terms of total passenger numbers) were on US soil. Number one, as it has been each year since 1998 (except for 2020, when it was temporarily unseated by Guangzhou Baiyun International Airport), was Hartsfield–Jackson Atlanta International Airport (93.7m passengers for 2022).

Albania is already welcoming more tourists than in 2019

The pandemic saw tourism slump across the planet, but some countries have recovered far quicker than others. They include Turkey, the fourth most visited country in 2022 (50.5m overseas arrivals, a shade under its 2019 figure of 51.2m), the UAE (22.7m arrivals in 2022 vs 21.6m in 2019) and, perfect for budget sunshine, Albania (6.7m arrivals in 2022 vs 6.1m in 2019).

Sign up to the Front Page newsletter for free: Your essential guide to the day's agenda from The Telegraph - direct to your inbox seven days a week.

UN Tourism | Bringing the world closer

Share this content.

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

International tourism reached 97% of pre-pandemic levels in the first quarter of 2024

- All Regions

- 21 May 2024

International tourist arrivals reached 97% of pre-pandemic levels in the first quarter of 2024. According to UN Tourism, more than 285 million tourists travelled internationally in January-March, about 20% more than the first quarter of 2023, underscoring the sector’s near-complete recovery from the impacts of the pandemic.

In 2023 international tourist arrivals recovered 89% of 2019 levels and export revenues from tourism 96%, while direct tourism GDP reached the same levels as in 2019.

UN Tourism’s projection for 2024 points to a full recovery of international tourism with arrivals growing 2% above 2019 levels. In line with this, the newest data released by the UN specialized agency for tourism show that:

Yet it also recalls the need to ensure adequate tourism policies and destination management, aiming to advance sustainability and inclusion, while addressing the externalities and impact of the sector on resources and communities

- The Middle East saw the strongest relative growth, with international arrivals exceeding by 36% pre-pandemic levels in Q1 2024, or 4% above Q1 2023. This follows an extraordinary performance in 2023, when the Middle East became the first world region to recover pre-pandemic numbers (+22%).

- Europe , the world's largest destination region, exceeded pre-pandemic levels in a quarter for the first time (+1% from Q1 2019). The region recorded 120 million international tourists in the first three months of the year, backed by robust intra-regional demand.

- Africa welcomed 5% more arrivals in the first quarter of 2024 than in Q1 2019, and 13% more than in Q1 2023.

- The Americas practically recovered pre-pandemic numbers this first quarter, with arrivals reaching 99% of 2019 levels.

- International tourism is experiencing a rapid recovery in Asia and the Pacific where arrivals reached 82% of pre-pandemic levels in Q1 2024, after recovering 65% in the year 2023.

UN Tourism Secretary-General Zurab Pololikashvili said: "The recovery of the sector is very welcome news for our economies and the livelihoods of millions. Yet it also recalls the need to ensure adequate tourism policies and destination management, aiming to advance sustainability and inclusion, while addressing the externalities and impact of the sector on resources and communities".

By subregions, North Africa saw the strongest performance in Q1 2024 with 23% more international arrivals than before the pandemic, followed by Central America (+15%), the Caribbean and Western Europe (both +7%). Southern Mediterranean Europe exceeded pre-pandemic levels by 1%, while South America virtually reached 2019 levels. Northern Europe recovered 98% of pre-pandemic levels, while Subsaharan Africa and North America both recovered 95%.

According to available data, many destinations across the world continued to achieve strong results in Q1 2024, including Qatar (+177% versus Q1 2019), Albania (+121%), Saudi Arabia (+98%), El Salvador (+90%), Tanzania (+53%), Curaçao (+45%), Serbia (+43%), Turks and Caicos (+42%), Guatemala (+41%) and Bulgaria (+38%).

The robust performance of international tourism can also be seen in the UN Tourism Confidence Index which reached 130 points (on a scale of 0 to 200) for the period January-April, above the expectations (122) expressed for this period in mid-January.

International tourism receipts reached USD 1.5 trillion in 2023, meaning a complete recovery of pre-pandemic levels in nominal terms, but 97% in real terms, adjusting for inflation.

By regions, Europe generated the highest receipts in 2023, with destinations earning USD 660 billion, exceeding pre-pandemic levels by 7% in real terms. Receipts in the Middle East climbed 33% above 2019 levels. The Americas recovered 96% of its pre-pandemic earnings in 2023 and Africa 95%. Asia and the Pacific earned 78% of its pre-crisis receipts, a remarkable result when compared to its 65% recovery in arrivals last year.

Total export revenues from international tourism, including both receipts and passenger transport, reached USD 1.7 trillion in 2023, about 96% of pre-pandemic levels in real terms. Tourism direct GDP recovered pre-pandemic levels, reaching an estimated USD 3.3 trillion in 2023, equivalent to 3% of global GDP.

Several destinations achieved remarkable results in terms of receipts in the first quarter of 2024 as compared to 2019 levels based on available data, including Serbia (+127%), Türkiye (+82%), Pakistan (+72%), Tanzania (+62%), Portugal (+61%), Romania (+57%), Japan (+53%), Mongolia (+50%), Mauritius (+46%) and Morocco (+44%).

Looking ahead to a full recovery globally in 2024

International tourism is expected to recover completely in 2024 backed by strong demand, enhanced air connectivity and the continued recovery of China and other major Asian markets.

The latest UN Tourism Confidence Index shows positive prospects for the upcoming summer season, with a score of 130 for the period May-August 2024 (on a scale of 0 to 200), reflecting more upbeat sentiment than earlier this year. Some 62% of tourism experts participating in the Confidence survey expressed better (53%) or much better (9%) expectations for this 4-month period, covering the Northern Hemisphere summer season, while 31% foresee similar performance as in 2023.

Challenges remain

According to the UN Tourism Panel of Experts, economic and geopolitical headwinds continue to pose significant challenges to international tourism and confidence levels.

IMF's latest World Economic Outlook (April 2024) points to a steady but slow economic recovery, though mixed by region. At the same time, persisting inflation, high interest rates, volatile oil prices and disruptions to trade continue to translate into high transport and accommodations costs.

Tourists are expected to continue to seek value for money and travel closer to home in response to elevated prices and the overall economic challenges, while extreme temperatures and other weather events could impact the destination choice of many travellers. This is increasingly mentioned by the UN Tourism Panel of Experts as a concern for the sector.

Uncertainty derived from the Russian aggression against Ukraine, the Hamas-Israel conflict and other mounting geopolitical tensions, are also important downside risks for international tourism.

As international tourism continues to recover and expand, fuelling economic growth and employment around the world, governments will need to continue adapting and enhancing their management of tourism at the national and local level to ensure communities and residents are at the center of this development.

Related links

- Download News Release on PDF

- Excerpt | World Tourism Barometer - Volume 22 • Issue 2 • May 2024

Category tags

Related content, international tourism to reach pre-pandemic levels in 2024, international tourism to end 2023 close to 90% of pre-p..., tourism’s importance for growth highlighted in world ec..., international tourism swiftly overcoming pandemic downturn.

Related Guides:

Moscow Neighbourhoods, Locations and Districts

(moscow, central federal district, russia), city centre, tverskoy district, arbat district, barrikadnaya. district, khamovniki district, chistye prudy district, zamoskvorechie district, zayauzie district.

© Copyright TravelSmart Ltd

I'm looking for:

Hotel Search

- Travel Guide

- Information and Tourism

- Maps and Orientation

- Transport and Car Rental

- SVO Airport Information

- History Facts

- Weather and Climate

- Life and Travel Tips

- Accommodation

- Hotels and Accommodation

- Property and Real Estate

- Popular Attractions

- Tourist Attractions

- Landmarks and Monuments

- Art Galleries

- Attractions Nearby

- Parks and Gardens

- Golf Courses

- Things to Do

- Events and Festivals

- Restaurants and Dining

- Your Reviews of Moscow

- Russia World Guide

- Guide Disclaimer

- Privacy Policy / Disclaimer

Plan Your Trip to Molzino: Best of Molzino Tourism

Explore molzino, essential molzino.

IMAGES

VIDEO

COMMENTS

Basic Statistic Contribution of travel and tourism to employment in the U.S. 2019-2022 Premium Statistic Most visited states in the U.S. 2022 Industry overview

In 2022, the global online travel market amounted to as much as 474.8 billion U.S. dollars, a figure that was forecast to exceed one trillion U.S. dollars by 2030. Some of the leading travel ...

Travel and Tourism Satellite Account for 2018-2022 The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA's Travel and Tourism Sate