- Personal Travel World2Cover

For Australians who have the World2Cover and need comprehensive travel insurance that is value for money. Our global coverage, winter sports options, family benefits and simple claims process provides cover that has global coverage and great value.

World2Cover Benefits:

√ $Unlimited** medical You have $unlimited** medical benefit when travelling overseas

√ Dependent coverage Your children and grandchildren 25 and under are covered when they are travelling with you

√ 24/7 assistance Our Worldwide assistance team is available 24 hours a day – 7 days a week

√ Winter sport and ski cover We offer great winter adventure cover for skiing and snowboarding, check us out

√ New for old luggage# replacement

For more details, please visit the link to our product below:

**$unlimited means that generally there is no cap on the maximum dollar amount which may be paid out of this benefit, subject to the specific terms and conditions, sub-limits and exclusion apply to this benefit.

#Limits, sub-limits, exclusions and conditions apply.

Products & Services:

- Corporate Insurance Solutions

- Cyber Insurance

Want more details? Contact us now.

訪日外国人向け保険・インバウンド保険

TOKIO OMOTENASHI POLICY | Tokio Marine & Nichido

Overseas travel insurance for foreigners visiting japan (even if you are a japanese national returning to japan temporarily) for up to 31 days., = insurance for visiting japan =.

Chinese(Simplified) | Chinese(Traditional语言) | 한국 | 日本語

What is TOKIO OMOTENASHI POLICY?

TOKIO OMOTENASHI POLICY is an overseas insurance policy in case of sudden illness or injury for foreigners visiting Japan and or Japanese national’s returning to Japan temporarily for up to 31 days that can be purchased online. (Insurance can be purchased online).

If you need to see a doctor or hospital care is necessary the insurance company should be contacted and your medical expenses will be paid directly from the insurance company to your caregiver. (Cashless)

TOKIO OMOTENASHI POLICY is easy and reasonably priced because it is specialized for illness and injury, the premium is less expensive than general overseas travel insurance. (Easy and Reasonable). In addition by using the dedicated application, you will be able to use support functions for certain troubles and natural disasters that might occur during your stay in Japan.

( You can easily contact the insurance company via the app)

Click for Apprication ↓↓↓↓↓↓↓↓↓

For example, if something like this happens…

Sudden illness… Prepare for sudden illness during your stay in Japan.

Unlike your everyday life, the environment and food changes when you travel may or may not have an effect on your health.

Even if you are a foreign national that is accustomed to eating Japanese food and enjoy eating other local dishes or unusual foods that you have never seen before. It could be a difference in temperature or many other things that may affect your health.

We are no longer in a era where we can say, “That will never happen to me so I’m fine”

We are also prepared for the new type of Coronavirus (Covid-19)

Unexpected injury… You were supposed to be enjoying yourself…

Covers injuries that occur during sports such as skiing

Traveling is a fun time, but injuries that occur during such times are common occurrences.

But, you also need to be careful about injuries that may occur during sports such as skiing.

Injuries that occur during these times are normal, but you should also be careful about injuries that occur during sports such as skiing.

Injuries may also occur during normal, everyday life. We provide coverage for injuries caused by sudden, accidental, and outpatient accidents.

Expensive medical bills… No way Why me …

In some cases, hospitals won’t accept medical examinations…

Foreign travelers and others who do not have health insurance. (100% self-payment).

There are cases where you will be charged an outrageous amount of money… It is very common.

Credit cards are not accepted at hospitals… you have to pay in cash.

Even medium-sized hospitals such as municipal hospitals and city hospitals do not accept credit card payments.

Also smaller clinics are known not to accept credit card payments.

The insurance company will pay directly to the hospital or pharmacy

By contacting us before you go to the hospital, we contact the hospital first. We will contact the hospital before you go to the hospital so that you can concentrate on your treatment.

Please be aware that foreign visitors who fail to pay their medical expenses may be denied entry into Japan in the future. Japan National Tourism Organization (JNTO)

Non-payment of medical treatment by foreign travelers in Japan has become a problem, and the government has taken such measures.

Of course, Japanese nationals are no exception.

Incidental Services

The following services are also included in the package…

Lost or stolen passport or credit card…

Traveling is always fraught with problems, but there are some things you should never lose. (Available in a variety of languages)

Internet connection lost…

We provide information on useful apps for using public Wi-Fi provided at tourist spots. We provide information on useful applications (with free Wi-Fi functionality for an unlimited period of time)

Insurance Amounts

Coverage item: medical treatment and transportation expense coverage (for foreign visitors to japan).

Covers medical treatment expenses for sudden illness or injury.

If you contact the insurance company before going to the hospital, the insurance company will pay the treatment expenses directly to the hospital. (To contact the insurance company, you need to install the application.)

10,000,000 yen (including covid-19 infection)

Rest assured that 100% of your expenses for medical treatment, medicine, hospitalization, surgery, and medical transportation to your home country will be covered up to 10 million yen.

Insurance Premiums

Insurance premiums vary depending on the period of insurance.

Please check

There are some important points to note.

About the insurance period

The insurance period is from the day after the date of application or the day of entry into Japan , whichever is later, to the day of completion of departure procedures from Japan.

Example: ① If you apply after entering Japan and apply today, set tomorrow as the insurance start date.

Example: ②Even if someone in Japan applies, depending on the country of departure, someone arriving tomorrow or later may not be able to apply.

(Please apply after entering Japan)

If you are staying in Japan for more than 32 days. (You need someone living in Japan. You can not buy Insurance by yourself) >> Click Here <<

What if it happens outside of Japan?

This insurance policy covers medical and pharmaceutical costs arising from injuries or illnesses occurring in Japan, as well as the cost of repatriation of the patient to his/her home country.

(Accidents outside of Japan are not covered.)

The required documents

Since enrollment is completed online, there are no documents required.

However, please be aware that you may not be able to use the insurance if you make a false declaration.

Common example: An application was submitted more than 5 days after entry to Japan, but an error occurred, so an incorrect date of entry was entered and insurance was purchased. 【The insurance cannot be used】

Can I apply from abroad?

The application site can only be accessed from within Japan, Hong Kong, China, or Korea.

How can I confirm the operation of the screen before I leave Japan? >> Click Here <<

↓↓↓ Click the banner to apply ↓↓↓↓

<Recommended Environment>

PC Microsoft Windows 7, 8, 8.1: Internet explorer 11.0 or higher, latest version of chrome Microsoft Windows 10 : Internet explorer 11.0 or higher, Microsoft Edge , the latest version of chrome

Smartphones and tablets Android 4.4 or later: Latest version of chrome iOS 8.4 or later: Latest version of safari

Please note that there are some cases where Firefox cannot be used.

For those who cannot proceed to the TOKIO OMOTENASHI POLICY application page >> Check this page <<

If you have any questions, please contact us by e-mail. mail: [email protected]

Underwriting Insurer Tokio Marine & Nichido Fire Insurance Co.

Handling agency OFFICE21 Co., Ltd.

This homepage provides an overview of the insurance policy. Please be sure to read the “Explanation of Important Matters” carefully before you make a contract. If you have any questions, please contact our agent.

TM Xplora Travel Insurance

- 1 Trip Details

- 2 Plan Selection

- 3 Your Details

Please refer the notice on our website here .

What is travel insurance (tm xplora).

Travel Insurance (TM Xplora) is our commitment to let you travel the world, and be protected from major emergencies, as well as offering assurance against common travel inconveniences. As the region's travel and tourism industry booms, it's important that you are not caught off guard by accidents and mishaps, which could derail all your planning efforts.

Two types of travel insurance plans, catering to different needs.

Premier (travel Insurance): Offers an unparalled level of protection for total peace of mind.

Classic (travel Insurance): Caters to the traveller who would rather dedicate more of his funds on his experiences

Insured: Adult who is a person between 18 to 79 years of age next birthday.

"Single Trip" Family: Travel Insurance (TM Xplora) covers 1 or 2 adults travelling with at least one children. The 2 adults may not be related but each child must be related to either of the insured adults. The family must travel and return together.

"Annual Trip" Family: Travel Insurance (TM Xplora) covers Insured's legal spouse and their legal children

�Group�: Travel Insurance (TM Xplora) covers the insured person and their travelling companion(s) whose names must be declared and age must be between 21 and 70 years old (inclusive).

Have an agent serve you?

Use promo code.

Any 1 or 2 adults travelling with any number of children.

The 2 adults need not be related but the children must be the legal child, grand child, brother, sister, nephew, niece or cousin of either of the adults. The family must travel and return together.

Insured's family comprises of the insured's legal spouse and their children. The child/children covered as named in the scheduled must be accompanied by an adult inseured person in each trip

Individual refers to an adult who is a person between 18 to 79 years of age next birthday.

Family means :

1) For Single Trip policies, family refers to:

- one (1) or two (2) adults travelling with at least one accompanied child.

- The two adults need not be related, but the child(ren) must be the legal child or ward in the case of a legal guardian, grandchild, siblings, nephew, niece or cousin of either one of the adults.

- You must depart from and return to Singapore together at the same time as a family.

2) For Annual Cover policies, family refers to:

- a legal family nucleus of up to 2 adult persons with unlimited number of children who is/are related to one of the adult person by legal adoption or biological kinship.

- The child/children covered as named in the schedule must be accompanied by an adult insured person in each trip.

3) Child covered under family plan refers to one above the age of 6 months and below 25 years old (between 21 and 25 years provided they are full time studying in a recognized institution of higher learning).

Group refers to Insured Persons and their travelling companion(s) whose names must be declared and age must be between 21 to 70 years (inclusive).

When are you going?

Malaysia, Thailand, Indonesia, Brunei, Philippines, Vietnam, Laos, Myanmar, Cambodia, China (including Inner Mongolia), Hong Kong, Macau, Japan, Taiwan, South Korea, India, Sri Lanka, Australia and New Zealand

Countries as defined above in Zone A and the rest of the world (*excluding Afghanistan, Cuba, Congo, Iran, Iraq, Liberia, Sudan, Syria and Ukraine)

*The above list of excluded countries is not exhaustive and may be updated from time to time. Do check with Tokio Marine Insurance Singapore office for updates if you are unsure.

Note: All trip must originate from and back to Singapore. Single Trip plans allow for trips lasting 183 consecutive days. Annual plans allow trips lasting 90 consecutive days.

Tokio Marine Travel Insurance Review: Claim, Promotion, Policy Wording

Tokio Marine deserves a prize for being the most underrated insurance company in Singapore. The only thing most people know about them is that they’re a Japanese company like Daiso . But it would not have occurred to most of us to buy travel insurance from them.

Tokio Marine’s travel insurance plan is called TM Xplora Plus. It comes in two tiers:

This travel insurance plan you’ve never heard of is actually quite comprehensive, and go so far as to cover things like extra pet boarding costs and loss of frequent flyer points.

But how does Tokio Marine’s TM Xplora Plus plan match up to the competition? Here’s a detailed breakdown of the prices and coverage.

- Tokio Marine Travel Insurance: Summary

- Toko Marine Travel Insurance

- Tokio Marine Travel Insurance Covid-19

- Tokio Marine Travel Insurance Extreme Sports

- Tokio Marine vs Great Eastern vs AIA Travel Insurance

- Tokio Marine Travel Insurance Promotion

- Tokio Marine Travel Insurance Claim Review

- Should I buy Tokio Marine Travel Insurance?

1. Tokio Marine Travel Insurance Summary

Tokio Marine’s TM Xplora Plus comes in two tiers:

- Classic – up to $300,000 worth of overseas medical expenses

- Premier – up to $500,000 worth of overseas medical expenses

You also have the option of purchasing single trip plans of up to 183 days or annual plans, which cover you for unlimited trips within a year of up to 90 days each.

2. Tokio Marine Travel Insurance Coverage

As you know by now, TM Xplora Plus comes in two tiers, Premier and Classic.

Premiums vary depending on which zone countries you are travelling to fall under. Here are the zones:

- Zone A: Malaysia, Thailand, Indonesia, Brunei, Philippines, Vietnam, Laos, Myanmar, Cambodia, China (including Inner Mongolia), Hong Kong, Macau, Japan, Taiwan, South Korea, India, Sri Lanka, Australia and New Zealand

- Zone B: rest of the world (excluding Afghanistan, Cuba Congo, Iran, Iraq, Liberia, Sudan, Syria and Ukraine)

Here’s a summary of the plan’s key benefits and coverage.

How does this plan stack up compared to its closest competitors? Sompo travel insurance plans , to cite an example, are a bit less generous than Tokio Marine’s, but come at a higher cost if you are travelling anywhere further than Southeast Asia.

The two highest-tier plans of another competitor, AIA travel insurance , offer more generous medical and personal accident benefits but are stingier when it comes to travel benefits like baggage loss and delay. The higher tier plans also cost more than Tokio Marine’s if you’re travelling outside ASEAN.

Total Premium

Sompo Travel Insurance Essential

Key features.

Common travel insurance benefits such as personal accident, medical expenses overseas, travel delay, loss of personal belongings.

Protection against hefty overseas medical expenses, trip cancellation costs and other essential coverage if you are diagnosed with COVID-19

3. Tokio Marine Travel Insurance Covid-19

TM Xplora Plus automatically covers you in pandemic or epidemic situations, including Covid-19.

They don’t have a separate section for Covid-19 coverage, which is generally a good thing, as that means you’ll be entitled to the plan’s regular claim limits even for Covid-19-related claims. This makes them one of the most generous plans out there when it comes to Covid-19 coverage

Most insurers are actually less generous with their Covid-19 cover. For instance, Great Eastern travel insurance’s Classic and Elite travel insurance plans only cover up to $50,000 and $150,000 worth of Covid-related overseas medical expenses, and their hospitalisatjon allowance is only $50/$100 per day for up to 14 days.

Another competitor, MSIG travel insurance, is offering $75,000, $150,000 and $250,000 worth of Covid-related overseas medical expenses through their Standard, Elite and Premier plans. Their travel-related Covid coverage is way less generous as well, with a max of $3,000 for trip cancellation.

MSIG TravelEasy Premier

[ Score a Rolex, Apple iPhone, MVST Luggage & More! | MoneySmart Exclusive] • Enjoy up to 40% off your policy premium • Get an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$45 via PayNow OR 1 x Apple AirTag (worth S$45.40) and up to S$20 iShopChangi e-voucher with eligible premiums spent. T&Cs apply. BONUS: For a limited time only, there are over S$19,600 worth of gifts to be given away: • 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000) • 1x Apple iPhone 15 Pro 128GB (worth S$1,664.25) • 5x MVST TREK Aluminium Large Suitcase (worth S$790) • 1x Sony WH-1000XM5 Wireless Noise Cancelling Headphones (worth S$589) and many more! Increase your chances of winning when you refer friends today. T&Cs apply PLUS, score S$100 iShopChangi vouchers in our giveaway on top of existing rewards. T&Cs apply.

COVID-19 coverage of up to $250,000 medical cover and up to $5,000 travel inconvenience benefit for your trip protection.

Stay protected and enjoy a wide range of adventurous activities from sky diving, scuba diving, white-water rafting to winter sports like dog sledding, tobogganing, sledging and ice-skating.

Get covered across all TravelEasy Plan types with a high limit of S$1,000,000 for emergency medical evacuation & repatriation

MSIG provides cover for insolvency of licensed travel agencies registered with the Singapore Tourism Board (includes NATAS registered travel agencies)

4. Tokio Marine Travel Insurance Extreme Sports

If your idea of a good time is jumping out of a plane into the abyss, you’ll be glad to know that TM Xplora Plus offers coverage for adventure activities and sports, subject to some exceptions, of course.

In general, Tokio Marine will cover you so long as you are participating in the sport on a non-competitive, leisure basis, and that you use a licensed local operator and/or licensed, qualified guides or instructors.

Here’s a breakdown of TM Xplora Plus’s coverage for some common adventure sports:

This is pretty standard for plans that automatically offer protection for adventure sports. You can do almost anything that’s not competitive. Just make sure you check the limits of the coverage so you do not do something that will get your coverage excluded.

5. Tokio Marine vs Great Eastern vs AIA Travel Insurance

How does Tokio Marine’s travel insurance plans measure up to those of its most ardent competitors, Great Eastern and AIA? Let’s have a look.

Unlike Tokio Marine’s plan, which has only two tiers, Great Eastern travel insurance comes in three tiers. If you’re looking for a cheaper plan with basic coverage, Great Eastern would be more appropriate for you. However, when it comes to the higher tier plans, Great Eastern’s offers poorer benefits at a higher price.

AIA travel insurance also comes in three tiers, with a budget plan that Tokio Marine lacks. When it comes to their higher tier plans, they offer more generous medical coverage than Tokio Marine but worse travel coverage.

All that said, both Great Eastern and AIA’s Covid-19 coverage pales in comparison to Tokio Marine’s. If you haven’t had Covid-19 yet, your chances of getting it on the road are not slim. In that case, you might want to opt for Tokio Marine’s insurance to be safe.

6. Tokio Marine Travel Insurance Promotion

There aren’t any promo codes for Tokio Marine travel insurance at the moment, but check here from time to time so you don’t miss out on any deals.

7. Tokio Marine Travel Insurance Claim Review

Tokio Marine has a good reputation when it comes to being efficient with claims, however, as their travel insurance is not well-known in Singapore, we were hard pressed to find reviews.

Tokio Marine Hotline: +65 6221 6111 (Mon to Fri, 8.45am to 5.45pm)

Tokio Marine Travel Insurance Online Claims: You can make a claim online here . On the same page, you’ll find a step-by-step guide to making travel insurance claims in case you need some assistance.

Tokio Marine Travel Insurance Claims: If you like, you can also download the PDF claim forms and fill up a hard copy. Bundle that with your supporting documents and mail it to

Tokio Marine Insurance Singapore Ltd. 20 McCallum Street #09-01, Tokio Marine Centre Singapore 069046

8. Should I Buy Tokio Marine Travel Insurance?

Tokio Marine’s TM Xplora Plus is actually a solid travel insurance plan with great coverage at a reasonable price for both medical expenses and travel mishaps, even if you’re taking part in adventure sports. Its biggest strength is its generous Covid-19 coverage, which is better than what’s being offered by most other plans.

Shopping for travel insurance ? Find out if you really need travel insurance here.

Related Articles

Senior Travel Insurance for Elderly with Pre-Existing Medical Conditions (2022)

11 Best Annual Travel Insurance from $270 You Can Buy Online (2022)

5 Biggest Travel Insurance Mistakes People Make

ANA to Begin Introducing Travel Insurance for Customers Visiting Japan

- • Beginning March 17, ANA will provide access to travel insurance referral website for international visitors to Japan.

- • The service is available to international customers who have already booked and purchased an ANA international flight ticket to Japan.

- • Departure locations eligible for insurance coverage will continue to be expanded.

TOKYO, MAR. 17, 2022 - All Nippon Airways (ANA), Japan's largest and 5-Star airline for nine consecutive years, will provide access to travel insurance referral website in cooperation with Tokio Marine & Nichido Fire Insurance Co., Ltd. (Headquarters: Chiyoda-ku, Tokyo, "Tokio Marine & Nichido") for customers visiting Japan from abroad. The website will launch today and provides access to travel insurance provided by members of the Tokio Marine Group and its affiliated companies *1 to customers residing overseas who have already booked and purchased ANA international flight tickets on both ANA operated flights and codeshare flights to Japan. The introduction of this service is designed to simplify the travel preparation process, improve the customer experience, and offer added reassurance during the trip. ANA and Tokio Marine & Nichido will continue to work together as international travel resumes to ensure that travel is as comfortable and convenient as possible.

"By making travel insurance accessible through our website, ANA is taking another important step to simplify the travel process and offer our customers additional service", said Junko Yazawa, Executive Vice President, Customer Experience Management & Planning of ANA. "With global travel set to rebound, the ability to easily select an insurance plan for your trip to Japan will make the entire process more convenient and enjoyable. These number of departure locations eligible for insurance coverage will extend to meet emerging demand."

A link to the travel insurance portal *2 provided by Tokio Marine & Nichido will be featured on ANA's website and will be accessible from locations outside Japan. Through this portal, Tokio Marine & Nichido will guide customers to the relevant travel insurance websites in each country and region that are provided by members of the Tokio Marine Group and its affiliated companies *1 *3 .

Eligible departure cities as of March 17, 2022: All cities in the U.S., Bangkok, Ho Chi Minh City, Hanoi, Manila, Hong Kong and Taipei.

- *1 Includes Tokio Marine Group's overseas group companies and affiliated insurance companies.

- *2 The travel insurance website is operated by Tokio Marine & Nichido. The Terms of Use, Privacy Policy, and the descriptions, functions, and website services are managed under the responsibility of Tokio Marine & Nichido.

- *3 This is an optional insurance plan that requires customers to complete insurance registration procedures on their own. The insurance contract is concluded between the customer and the insurance company. All insurance products and services are provided by the insurance company. ANA is not an insurance agent or provider and cannot offer insurance advice.

- Contact: ANA Corporate Communications, TEL +81-3-6735-1111, [email protected]

About ANA Founded in 1952 with just two helicopters, All Nippon Airways (ANA) has grown to become the largest airline in Japan. ANA HOLDINGS Inc. (ANA HD) was established in 2013 as the largest airline group holding company in Japan, comprising 71 companies including ANA and Peach Aviation, the leading LCC in Japan. ANA is a launch customer and the largest operator of the Boeing 787 Dreamliner, making ANA HD the biggest Dreamliner owner in the world. A member of Star Alliance since 1999, ANA has joint venture agreements with United Airlines, Lufthansa German Airlines, Swiss International Airlines and Austrian Airlines - giving it a truly global presence. The airline's legacy of superior service has helped it earn SKYTRAX's respected 5-Star rating every year since 2013, with ANA being the only Japanese airline to win this prestigious designation for nine consecutive years. ANA also has been recognized by Air Transport World as "Airline of the Year" three times (2007, 2013 and 2018); it is one of only a select few airlines to win this prominent award multiple times. In 2021, ANA was awarded the 5-star COVID-19 safety rating by SKYTRAX, recognizing the airline's initiatives to provide a safe, clean and hygienic environment at airports and aboard aircraft, embodied in the ANA Care Promise. ANA is the only company in the aviation industry to receive the Gold Class distinction from the 2022 S&P Global Sustainability Awards and ANA HD has been selected as a member of the Dow Jones Sustainability World Index list for the fifth consecutive year and the Dow Jones Sustainability Asia Pacific Index list for the sixth consecutive year. For more information, please refer to the following link: https://www.ana.co.jp/group/en/

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

Best Price Guarantee By Comparing Top Providers In A Single Platform

- Buy online and get instant coverage by email

- 24/7 emergency assistance worldwide

- Over 100,000 verified customers with 5-star reviews and $3.5 billion in protected trip costs

- Includes coverage from theft, trip cancellations, baggage loss and delay, medical expenses for hospital treatments

- Policies from trusted providers including: Travel Insured International, AEGIS, Global Trip Protection, Arch RoamRight and others

- Travel Insurance

- Tokio Marine Review

Tokio Marine Atlas Travel Medical Insurance Review

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

How is Tokio Marine rated?

Overall rating: 4.4 / 5 (excellent), tokio marine plans & coverage, coverage - 4.5 / 5, emergency medical coverage details, baggage coverage details, tokio marine financial strength, financial strength - 4.6 / 5, tokio marine price & reputation, price & reputation - 4.6 / 5, tokio marine customer assistance services, extra benefits - 4.1 / 5.

Our Comments Policy | How to Write an Effective Comment

6 Customer Comments & Reviews

Related to travel insurance, top articles.

- Trip Cancellation Insurance – What is Covered?

- Do I Really Need Travel Insurance?

- Emergency Travel Insurance Coverage

- Common Parasites and Travel-Related Infectious Diseases

Suggested Comparisons

- Travel Guard Insurance vs. Travelex

- Allianz Global Assistance vs. Travel Guard Insurance

- Allianz Global Assistance vs. Berkshire Hathaway

- Allianz Global Assistance vs. Travelex

- Or via Email -

Already a member? Login

- MyNewMarkets.com

- Claims Journal

- Insurance Journal TV

- Academy of Insurance

- Carrier Management

Featured Stories

- Talc-Related Suit Goes After J&J for Bankruptcy Fraud

- Biden Overtime Pay Rule Challenged

Current Magazine

- Read Online

Tokio Marine Forecasts ¥1 Trillion 2024 Profit; ‘Drastic’ Growth Ahead

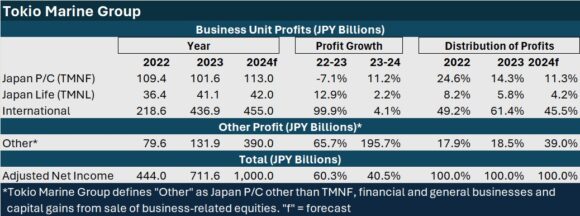

In Japanese yen, the profit figure that Tokio Marine Holdings projects for 2024 is ¥1 trillion. While the forecast may seem less extraordinary in U.S. dollars of roughly $6.7 billion, either way it’s a 40% jump over 2023.

Executives from the Japan-based international insurance group revealed the projection and a midterm plan for “drastic expansion” of value-creating opportunities during a virtual media event and via documentation for investors on the group’s website this week. The media event was open to reporters outside of Japan for the first time—a point noted at the outset by Brad Irick, the co-head of Tokio Marine’s international business. Irick said the broad invitation reflected the weight of year-over-year growth in insurance premiums and profits from insurers outside of Japan on overall results.

In fact, almost half of the $6.7 billion profit forecast and over 60% of 2023 recorded profit of $4.7 billion (¥711.6 billion) relates to business unit profits from their international insurers, including Philadelphia Insurance Companies, Delphi Financial Group (including Safety National) and Tokio Marine HCC in North America.

For 2023, business unit profits for Tokio Marine’s international insurance business nearly doubled—to $2.9 billion (¥436.9 billion) from $1.5 billion (¥218.6 billion) in 2022. Business unit profits for the North American insurers grew 29% to $2.4 billion (¥359.9), with net written premiums for the North American insurers growing 11% and their combined ratios averaging 90.7. A reversal from loss to profit in Asia business explained most of the remainder of the profit growth for Tokio Marine’s international insurance operations.

The forecast 2024 profit for international insurers is $3.0 billion (¥455.0), representing a 4% jump from $2.9 billion (¥436.9) in 2023.

Financial summaries for the various insurance entities reveal that business unit profits are essentially underwriting profits and investment profits (investment income and capital gains). Not included in the business profits, however, are capital gains from sales of “business-related equities” (shareholdings in clients in Japan), which are reported as “Other” profits in Tokio Marine’s financial statements.

While under 20% of the total income figures reported for 2022 and 2023 relate to “Other” profits, for 2024 the proportion of overall income from “Other” is nearly 40%.

Taro Arakawa, head of the Tokio Marine investor relations desk in New York, explained that the ¥1 trillion forecast includes profits from the accelerated sales of business-related equities. “Specifically, in 2024, we aim for equity sales of ¥600 billion, which alone will raise profits by ¥300 billion year on year,” he said.

Business-related equities refers to shareholdings in clients in Japan. These are being sold by Tokio Marine and other nonlife companies in Japan, after discussions with Japan’s regulator, in order to ensure there is no conflict of interest in dealings with clients. (Editor’s Note: In 2023, Japanese financial regulators also investigated and ordered Japanese insurers to end anti-competitive practices related to premium price fixing.

Related articles, “ Japan Casualty Insurers’ Shares Sink on Concerns Over Suspected Price Fixing ,” “ Japan Competition Watchdog Probes Insurers Over Price Fixing ,” “ Japan Orders 4 Non-Life Insurers to End Anti-Competitive Business Practices “)

Excluding the sales gains, 2024 profits will still increase but by only 2%, Arakawa said. A large-scale hail disaster that occurred in Japan in April and the absence of significant favorable prior-year reserve development in 2023 explain the lower profit growth rate from insurance underwriting and investment results, he said.

(Editor’s Note: “Adjusted Net Income” of ¥711.6 billion in 2023 and the forecast of ¥1 trillion for 2024, each representing the sum of business unit profits and other profits in the year, is not the bottom line figure recorded on Tokio Marine’s income statement. In 2023, the bottom line “net income” figure, ¥695.8 billion, includes items such as amortization expense of goodwill and other intangible assets.)

Looking Ahead: Midterm and Beyond

“We’re proud of these results and the growth that we continue to achieve,” Irick said during the media event, referring to 2023 results. “But the measure by which we judge ourselves is how they have been achieved and what the growth enables us to do in the future,” he said, introducing Arakawa to set forth details of the midterm plan titled “Inspiring confidence. Accelerating progress.”

“Over the past midterm plan, we stated our commitment to achieve top-tier EPS [earnings per share] growth and raise ROE [return on equity] to the level of our global peers, all while managing volatility. The new midterm plan will also follow the same trajectory,” Arakawa said, comparing the plan for the next three years (2024-2026) to one that had been in place for the prior three.

“Our journey continues. Specifically, EPS growth is targeted at over 8% CAGR [compound annual growth rate]—and with the inclusion of the sales gains from business related equities at over 16%.

According to Arakawa, Tokio Marine targets getting business-related equities outstanding down to “zero” in six years, with a 50% reduction built into the midterm plan for the next three years. “When possible and optimal, we will accelerate this as much as possible,” he stated.

Articulating a second goal of the three-year plan, he said that ROE is projected over 14%. ” The driver of this growth is enhanced capabilities of each individual business,” he said.

Finally, he announced increased dividends (an increase of 29% for 2024) and share buybacks (¥200 billion in 2024). “Our belief is that both the growth of our business and the increase of shareholder returns should be in step,” he explained.

“Our philosophy on capital policy remains unchanged—that is capital generated through organic growth…will first be allocated to M&As or additional risk taking that contributes to our ROE improvement. If such opportunities are not available, we have no intention of unnecessary accumulation of capital and we will execute share buybacks,” he stated.

A slide presentation posted on Tokio Marine’s website outlines five strategies—three pillars of growth and two pillars of discipline—that support the midterm plan and the group’s overall purpose “to protect customers and society in their times of need.”

The first of three growth pillars—”drastic expansion of domains where we can deliver our value”—involves developing and providing “best-fit insurance products for new risks” and also “new solutions other than insurance.”

The executives were not specifically asked about noninsurance possibilities, but they were asked about the “drastic expansion” language and potential “gaps” they might fill to perhaps diversify the group in other regions or insurance products.

Rejecting the term “gaps,” Irick said there are “opportunities” to be embraced instead. “I think there’s opportunities to grow within the Americas, including North America, despite that being already our largest international area,” he said, also making note of the group’s strong businesses in Asia. “I think we can do more to add to those over time,” he said.

“But again, we’re very disciplined,” he said, noting that M&A candidates have to meet the criteria of having a strong track record, a unique business model and also represent a good cultural fit.

Related article : “ Tokio Marine Has $10 Billion for Potential Acquisitions: Executive ”

“Beyond that, the organic capabilities of this group, really around the regions that we already are in, [are] really strong and will continue to grow over time,” he stated.

Earlier in the session, the executives addressed a specific question about the M&A landscape and the interplay between M&A opportunities and share buybacks.

Said Irick: “There’s not a deal in the world that happens without us having a chance to have a look,” noting that the co-heads of the international segment have a “real challenge” in assessing opportunities all around the world. “I don’t think there’s any one geography that we limit ourselves to,” he said, again calling out the Americas and Asia as places with more potential.

Through an interpreter, Arakawa reiterated the capital deployment policy. “When we have excess capital, we will seek use of that excess capital into M&A or additional risk-taking. And if we do not find those opportunities, we will take a disciplined manner in executing our share buyback in order to return to the capital market.”

The comment supports the second pillar of discipline listed on the website as part of the midterm plan: “Enhancement of business portfolio and capital management.”

The remaining pillar of discipline—”strengthening and improvement of internal control and governance”—and the other two growth pillars—”diversification of our distribution model” and “extensive improvement of productivity”—were not specifically discussed during the media session.

The online presentation, addressing the pillar about distribution diversification, refers to the expansion of “highly specialized distribution networks” and to “upgrading embedded and direct distribution models.”

Addressing longer-term aspirations out to the year 2035, the presentation includes a visualization of noninsurance solutions for “prevention, mitigation and recovery” and those that contribute to customer “well-being.”

Supporting initiatives include the accelerated use technology, including “thorough utilization of AI, to improve productivity, accelerate growth and enhance business quality,” and initiative related to human resource development and consolidation of common functions and services of group companies.

This article first was published in Insurance Journal’s sister publication, Carrier Management .

Topics Trends Profit Loss

Was this article valuable?

Thank you! Please tell us what we can do to improve this article.

Thank you! % of people found this article valuable. Please tell us what you liked about it.

Here are more articles you may enjoy.

Written By Susanne Sclafane

Sclafane is Executive Editor of Carrier Management, a publication of Wells Media Group serving property/casualty insurance carrier executives. She is a media professional with deep background in the P/C insurance industry including 25 years as editor and reporter for trade magazines, online news services, digital journals. Her prior experience includes 14 years as a casualty actuary.

Latest Posts:

- Where the AI Risks Are: Swiss Re’s Top 10 Ranking by Industry

- Progressive Set to ‘Maximize’ Growth, Building on Q1

- Berkshire’s ‘Most Important’ Biz Drives Q1 Results; GEICO Still Behind on Tech

Interested in Profit Loss ?

Get automatic alerts for this topic.

- Categories: International & Reinsurance News Topics: 107720 , 2024 financial results , financial results , Tokio Marine Holdings

- Have a hot lead? Email us at [email protected]

Insurance Jobs

- Senior Director – Health and Benefits - Charlotte, NC

- Inland Marine Commercial Underwriter, Account Executive - Saint Paul, MN

- Large Loss Property Adjuster – Field Estimating South Bend/Mishawaka, IN - Mishawaka, IN

- Dispatch Technician * - Chicago, IL

- Direct Business Insurance Sales Specialist-Base Plus Uncapped Commission-(Remote) - Chicago, IL

- Property Restoration Industry: A Culture in Need of Repair?

- Underwriters' Dilemma: Is AI a Cyber or Tech E&O Risk?

- 3 Things to Know About Condo Association Boards

- Why Millennials and Gen Z Just Aren’t Loving Insurance: How Organizations Can Win the Next Generations of Insurance Consumers

- A Look at the Liquor Liability Landscape

- Report: Attorney Representation Rates, Liability Litigation Rates Rising

- California Supreme Court Resolves Question on Coverage for COVID Business Shutdowns

- U.S. Agency Seeks More Details on Self-Driving Zoox Crashes

- Tesla to Recall 125,227 Vehicles Over Faulty Seat Belt Warning System

- Black Men Were Asked to Leave Flight Sue American Airlines for Discrimination

- June 6 Transit Risk in 2024

- June 13 Leading Modern Teams: Inclusive Leadership in Action

- June 20 Taking Orders or Providing Financial Security: How to Beat the Big Players

- June 25 How To Write: Media

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

IMAGES

VIDEO

COMMENTS

Atlas Travel Medical Insurance helps protect you from potential financial disaster while traveling abroad. Its benefits include inpatient and outpatient medical expenses, $1 million of coverage for emergency medical evacuation, coverage for lost checked baggage, and many other features. ... Tokio Marine HCC is a leading specialty insurance ...

Tokio Marine HCC is a leading provider of travel medical insurance plans to global travelers. Read a detailed review and compare their plans side by side with other providers and buy online. 1-877-906-3950 or

What is Tokio Marine Explorer? A worry-free travel plan which provides you with comprehensive and wide coverage (Now including Covid-19 cover) and extra add-on cover to suit individual's needs. Product information . Tokio Marine Explorer Brochure (English) PDF, 2.75 MB.

Explore the world assured by our travel products. Tee off in peace with our golfing protection. You are in (current) General Insurance Life Insurance Agents/Partners ... Tokio Marine Insurance Group shall not be responsible for any unauthorized disclosure or breach of confidentiality in relation to such information provided. Application for ...

Travel [Buy online now] Purchases can be made as early as 6 months before your next trip commences! Personal Business. Employee Benefits ... By clicking on "Continue to external site" below, you will leave Tokio Marine Insurance Group's website and you will be redirected to a third party website.

What is Tokio Marine Travel Partner Insurance? Travel insurance that protects against various risks and inconveniences that can occur, such as flight delays, damage or loss of luggage, sickness or accidents while traveling and various other risks. Product Information. Tokio Marine Travel Partner Insurance.

Get in touch with Tokio Marine Travel Assistance Services for the services available at your travel destination. 24/7 Hotline: (603) 7628 3877 or (603) 7841 5770 Level 20, Menara Hap Seng 3, Plaza Hap Seng, No. 1, Jalan P. Ramlee, 50250 Kuala Lumpur, Malaysia. T: (03) 2027 8200 / 2789 8800 F: 2022 2295 Customer Service Hotline: 1800 88 0812

For Australians who have the World2Cover and need comprehensive travel insurance that is value for money. ... Managing Agent in Australia for Tokio Marine & Nichido Fire Insurance Co., Ltd. ABN 80 000 438 291 AFSL 246548. GPO Box 4616 Sydney NSW 2001 Tel: 61 2 9225 7500 Fax: 61 2 9232 6374.

Asuransi Perjalanan Tokio Marine Travel Partner. Perjalanan bebas khawatir Anda tanpa batas. Pelajari selengkapnya. Hubungi kami. General Insurance. +62215725772. Lindungi perjalanan/liburan Anda dan keluarga dari berbagai risiko tak terduga.

WorldTrips is a full-service organization offering a comprehensive portfolio of travel medical and trip protection insurance products designed to address the insurance needs of travelers worldwide. WorldTrips is member of the Tokio Marine HCC group of companies. Tokio Marine HCC is a member of the Tokio Marine Group, a premier global company ...

TOKIO OMOTENASHI POLICY is an Travel insurance policy in case of illness / injury for person visiting Japan for up to 31days that can be purchased online. ... Tokio Marine & Nichido. Overseas travel insurance for foreigners visiting Japan (even if you are a Japanese national returning to Japan temporarily) for up to 31 days. ...

Tokio Marine HCC is an insurance group based in Houston, TX that offers specialty insurance products such as U.S. Property & Casualty, Professional Liability, and International Accident & Health coverage. The company currently underwrites insurance for companies located throughout 180 countries. Their Atlas International Plan can protect business and leisure tourists from unexpected financial ...

Travel Insurance (TM Xplora) is our commitment to let you travel the world, and be protected from major emergencies, as well as offering assurance against common travel inconveniences. ... Do check with Tokio Marine Insurance Singapore office for updates if you are unsure. Zone A Zone B. Note: All trip must originate from and back to Singapore.

Tokio Marine Travel Insurance Claim Review. Tokio Marine has a good reputation when it comes to being efficient with claims, however, as their travel insurance is not well-known in Singapore, we were hard pressed to find reviews. Tokio Marine Hotline: +65 6221 6111 (Mon to Fri, 8.45am to 5.45pm) Tokio Marine Travel Insurance Online Claims: You ...

WorldTrips is a service company and a member of the Tokio Marine HCC group of companies. WorldTrips' Atlas Travel Series and StudentSecure international travel medical insurance products are underwritten by Lloyd's. WorldTrips has authority to enter into contracts of insurance on behalf of the Lloyd's underwriting members of Lloyd's Syndicate ...

03-2783 8383. Tokio Marine Travel Assistance. 03-7628 3877. 03-7841 5770. Notify us. Notify the loss or damage to TMIM within 30 days by telephone or in writing, quoting your Certificate Number and details such as date of loss, nature of loss or section of the policy you are claiming. Make police report.

A link to the travel insurance portal *2 provided by Tokio Marine & Nichido will be featured on ANA's website and will be accessible from locations outside Japan. Through this portal, Tokio Marine & Nichido will guide customers to the relevant travel insurance websites in each country and region that are provided by members of the Tokio Marine Group and its affiliated companies *1 *3.

Tokio Marine Travel Partner. Tunjangan Hidup. Buy Online Tokio Marine Indonesia . General insurance . Insurance Products . Personal . Travel Insurance . Travel Insurance. Protect your trip/vacation and your family from various unexpected risks. Tokio Marine Travel Partner Insurance It's time for worry-free travel

A traditional Atlas Travel plan can provide you with coverage for a single trip abroad, but Atlas MultiTrip insurance is designed for individuals who will be taking multiple international trips in a one-year period. This annual insurance plan covers you for multiple trips of up to 30 or 45 days, whichever you elect, through the year.

Tokio Marine is the largest and oldest Japanese insurance company. The firm does business worldwide and is headquartered in Tokyo. In 2015, the company purchased HCC Insurance Holdings, a large American specialty insurer with experience in the travel insurance market.

You may call Tokio Marine Travel Assistance at 603-7628 3877 or 603-7841 5770 (reverse charge is available). Please contact Tokio Marine Travel Assistance prior to seeking care or as soon as possible. Covers terrorism. Tokio Marine Travel Assistance Services.

In Japanese yen, the profit figure that Tokio Marine Holdings projects for 2024 is ¥1 trillion. While the forecast may seem less extraordinary in U.S. dollars of roughly $6.7 billion, either way ...

1:56. Shares of Japanese insurers MS&AD Insurance Group Holdings Inc. and Tokio Marine Holdings Inc. surged after the companies announced stock buybacks, as well as plans to sell their holdings in ...