This browser is not supported. Please use another browser to view this site.

- All Save & Spending

- Credit cards

- Newcomers to Canada

- All Investing

- ETF finder tool

- Best crypto

- Couch potato

- Fixed rates

- Variable rates

- Mortgage calculator

- Income property

- Renovations + maintenance

- All Insurance

- All Personal Finance

- Finance basics

- Compound interest calculator

- Household finances

- All Resources + Guides

- Find a Qualified Advisor

- Monthly budget template

- ETF Finder Tool

- Student money

- First-time home buyers

- Guide For New Immigrants

- Best dividend stocks

- Best online brokers

- Where to buy real estate

- Best robo-advisors

- All Columns

- Making sense of the markets

Ask a Planner

- A Rich Life

- Interviews + profiles

- Retired Money

Advertisement

By Winston Sih and Courtney Reilly-Larke on March 31, 2022 Estimated reading time: 6 minutes

TD First Class Travel Visa Infinite Card review

This premium TD card lets travellers redeem flexible rewards through a partnership with Expedia.

With a plethora of travel-focused credit cards on the market, the TD First Class Travel Visa Infinite Card may not be the obvious choice—especially considering how many Aeroplan cards TD currently has on its roster. That said, the TD First Class Travel Visa Infinite Card is worth considering. Why? It boasts a flexible redemption program and a partnership with Expedia. Cardholders get access to Expedia For TD online portal to redeem rewards for flights, hotels and car rentals on expediafortd.com.

Add to that comprehensive insurance coverage and generous earn rates and the TD First Class Travel Visa Infinite Card becomes a solid choice for avid travellers.

TD First Class Travel Visa Infinite Card

- Annual fee: $139 (annual fee rebate—conditions apply to qualify)

- Earn rates: Up to 8 TD Rewards points per $1 on travel; 6 points per $1 on groceries and restaurants; 4 points per $1 on recurring bills; and 2 points per $1 on all other purchases

- Welcome offer: You can earn up to $800 in value, including up to 100,000 TD Rewards Points and no Annual Fee for the first year. Conditions apply. Account must be approved by June 3, 2024. Plus, you get an annual birthday bonus of 10% of your previous year’s points (up to 10,000 points).

- Annual income requirement: Personal income of $60,000 or household income of $100,000

- Point value: 1 TD Rewards point = $0.005 when redeemed for travel via Expedia For TD or $0.004 when redeemed through other providers and websites

- Recommended credit score for approval: 725 or higher

- Interest rates: 20.99% on purchases, 22.99% on cash advances, 22.99% on balance transfers

- Cardholders can get an annual $100 credit when they book with Expedia for TD.

- Cardholders get an annual birthday bonus of 10% of their yearly purchases back as TD Rewards points.

- There are no travel blackouts, restrictions, or expiry on TD Rewards Points.

- You have to book with Expedia for TD to get the $100 travel credit.

- There’s a cap of 10,000 TD Rewards points for the birthday bonus.

- The minimum personal annual income is $60,000 and the household income is $100,000.

The TD First Class Travel Visa Infinite Card

- Three things you need to know about the TD First Class Travel Visa Infinite Card

- How to redeem your TD Rewards

- What are the best ways to benefit from this card?

Are there any drawbacks to the TD First Class Travel Visa Infinite Card?

4 things to know about the td first class travel visa infinite card, 1. the you earn points under the td rewards program.

T he TD points system is easier to understand than the point system for the bank ’ s Aeroplan credit cards. Your Point values stay the same no matter where you ’ re flying, so it ’ s easy to work out how much they ’ re worth. Plus, TD Points can be redeemed on any airline, not just Air Canada or Star Alliance Partners. While Aeroplan Miles are valuable, if you prefer simplicity the TD First Class Travel Visa Infinite Card might be more up your alley.

2. Your points go farther when you book with ExpediaForTD.com

If you already use Expedia to book your travel, this card is a savvy choice. When you book travel online through Expedia For TD, you earn 8 TD points per $1.

3. The card comes with a generous welcome bonus

You can earn up to $800 in value, including up to 100,000 TD Rewards Points and no Annual Fee for the first year. Conditions apply. Account must be approved by June 3, 2024.. Plus, earn a birthday bonus of up to 10,000 rewards points (conditions apply). You can also receive a $100 TD travel credit when you spend at least $500 at Expedia for TD.

4. You’ll get great travel insurance

The TD First Class Travel Visa Infinite Card comes with up to $2 million of travel medical insurance coverage for the first 21 days of a trip. Trip cancellation, trip interruption, common carrier travel accident insurance, travel assistance services, flight delay insurance, auto rental collision insurance, and delayed and lost baggage insurance round out the card’s benefits. For a premium rewards card, The TD First Class ’ s insurance is fairly standard, however; so, if you ’ re looking for more comprehensive credit card insurance , you could consider a card like the National Bank World Elite Mastercard, * which comes with up to $5 million in out-of-province-of-residence medical/hospital insurance for trips up to 60 days (if you ’ re under 54).

How to redeem your TD Points:

You can redeem your TD Points for travel in two ways. The best—and most valuable—way is through the Expedia For TD online portal, where you can redeem 200 TD points per $1 in travel credit (0.5%) and pay the balance of the cost (if any) using your credit card (you’ll also earn Points on this spend).

Your other redemption choice is the “Book Any Way” option, which lets you book via other travel websites; however, your bookings can cost up to 25% more if you go this route. When using “Book Any Way” you’ll redeem at 250 TD points per $1 (0.4%) applied as a statement credit on your first $1,200 in travel purchases and 200 TD points per $1 (0.5%) for your travel purchases over $1,200. In comparison, with Expedia For TD, you’ll get a better and more consistent return of 0.5% on all your travel spending.

In both cases, the TD First Class Travel Visa Infinite Card allows you to redeem for any seat on any airline. Additionally, you can redeem points for rewards in small increments (minimum 200), so this means you don’t need to build up a large pool of points before you’re able to apply them towards travel.

Finally, through the TD Rewards site, you can shop for items such as a Vitamix blender, a Dyson vacuum or gift cards. However, you won’t get the same value as you would booking travel. For example, a $50 gift card at Best Buy will cost you 20,000 TD points, whereas you can use the same amount of points for $100 in travel on the Expedia For TD portal.

How to optimize the TD First Class Travel Visa Infinite Card

Ultimately, your best bet is to redeem points for travel from ExpediaForTD.com . Generally, prices on the website are similar to those on the main Expedia website, and you’ll be able to redeem at the rate of 200 points per $1. If you redeem points for travel outside of the TD portal, your points can lose up to 25% in value; however this could be a smarter route if you find a really good deal on another travel portal.

If you do find a better hotel or flight deal elsewhere, you have the option to price match, but there are some restrictions: you must have booked within the last 24 hours; your travel plans must be at least 48 hours away; and travel dates, and flight and hotel classes must all be the same to submit a claim.

Does the TD First Class Travel Visa Infinite Card have travel insurance?

With this card you’ll get an extensive suite of travel insurance coverage, for big and small emergencies. For frequent travellers and those who cross the border often, this is a must. The card includes travel medical insurance of up to $2 million of coverage for the first 21 days. (If you or your spouse are over 65 or older, you’re only covered for the first four days of your trip.) You’ll also get up to $1,500 of trip cancellation insurance with this card up to a maximum of $5,000 for all insured persons. For trip interruption insurance, you get $5,000 per insured person, up to $25,000 for all the insured people on the same trip.

You’ll also get common carrier travel accident insurance, emergency travel assistant services and delayed/lost baggage insurance (up to $1,000 per insured person if your baggage is delayed for more than six hours or gets lost ultimately).

There is a minimum personal income requirement of $60,000 or a household income of $100,000. However, this is a common requirement for many cards in the same category.

Other cards offer more incentive to spend in categories like groceries, dining and entertainment. The TD First Class Travel Visa Infinite Card only offers three times the Points earn on travel booked through the Expedia For TD portal (4.5%)—everything else is at the base three TD points per $1 (1.5%) rate. To compare, the Scotiabank Gold American Express has a five-times Points accelerator on restaurants and groceries (5% per dollar).

Finally, the TD First Class Travel Visa Infinite Card doesn’t offer airport lounge access , and you’ll be charged foreign transaction fees . So, if you like to use airport lounges, or you often find yourself shopping in a foreign currency, you may want to consider a card that offers those perks.

Bottom line

TD’s unique partnership with Expedia, accelerated earn rates and incremental points redemption structure make the TD First Class Travel Visa Infinite Card a worthwhile consideration as a travel credit card . However, the biggest boost in earning points you’ll get with this card is by booking with ExpediaForTD.com. If you don’t want to be locked into booking that way, you may want to explore other travel card options.

More on credit cards :

- Canada’s best travel cards 2022

- Canada’s best credit cards for gas

- Canada’s best credit cards for grocery purchases 2022

- Best cash back credit cards

What does the * mean?

Affiliate (monetized) links can sometimes result in a payment to MoneySense (owned by Ratehub Inc.), which helps our website stay free to our users. If a link has an asterisk (*) or is labelled as “Featured,” it is an affiliate link. If a link is labelled as “Sponsored,” it is a paid placement, which may or may not have an affiliate link. Our editorial content will never be influenced by these links. We are committed to looking at all available products in the market. Where a product ranks in our article, and whether or not it’s included in the first place, is never driven by compensation. For more details, read our MoneySense Monetization policy .

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

Comments Cancel reply

Your email address will not be published. Required fields are marked *

One of the TD First Class Infinite VISA Benefits List include : “ Earn 3 points per $1 on everything spent “ Could you clarify why on my recent Bill Statement, showed $5 earned for 1,178 points Wouldn’t 1,178 points translate into 1178 divided by 3 ?

I have this card, but rarely use except for buying something on a trip to get the insurance coverage. The issue I have is I like to book my travel through web sites like tripcentral.ca (better for packages), VRBO (for condo rentals) and booking.com (much better selection), so only end up rarely using Expedia for TD and end up getting 1.2% back on my purchases, unless I want to wait until I have over $1,200 of points and then buy a major trip, getting 1.5% on the part over $1,200.

So, its pretty good and the insurance is good, but its not as great for travel as they like to claim.

I have had this card for about 2 years now and I am so dessapointed with it. I will stop using it from now on and I will tell everybody I know NOT to get this card or anything related to TD Bank. I changed to this card because they assured me I have full trip coverage with it so I booked my last vacation with it and considering that I did not get what I wanted on my trip they will take some responsibilities and give me some refund after my claim was with them for 8 months. They kept asking me for documents that I provided every time they asked and at the end they kept asking for documents I already submitted three times before. TD is a disgrace for Canadians. I wish the government take actions and do a deep audit on these guys. I will slowly withdraw everything I have with TD to go to another bank. Anything is better than this. Please people, do not do anything with this bank and definitely nothing with this credit card. I am been having issues with this bank since 2008 and it’s time to move on to a better service.

This is the all lying I have issues with that I lost my luggage on my way back home and my flight cut and delayed for 5 months they don’t cover anything’s this massage is for the Visa highly in-charge manager if you guys don’t find me solution I have to take legal step and say bye to TD my whole family since they denied my claim it’s really really broke my heart. I was really trust them never ever again.

I want to redeem my points from my business travel which I have accumulated as I switched to the rewards cash card now .How do I do this June 15,2022

This card is excellent and works well if you are looking to use it for travel specifically. I find it comes in handy when even needing a car rental or a hotel stay on the fly.

We have this card and use it often, we had enough points to use it for 5 hotels on our roadtrip last spring (booked them through expedia). I guess it all depends on what you plan to do. We often go on little roadtrips to Canmore, Banff or Jasper and use it to stay there as well so it really saves us for accommodations. Also not having to get separate car insurance for rental cars is a big plus.

I just got back from Cuba. Unfortunately my flight from Ottawa to Cuba was delayed by 4 hours. And from Cuba to Ottawa for 14 hours. I want to be reimbursed because I bought a ride on my The TD First Class Travel Visa Infinite. Please give me the contact information to whom to apply for compensation. Thank you,

I have First Travel Visa card. My trip is more than 21 days. How can I get travel insurance for the days after first 21 days?

This is incorrect. the $100 travel credit is only for hotels and vacation rentals ALONG with flights. Not if your travel consists only of flights. It is a Hotel credit and NOT a travel flight credit. Beware! This credit card is absolutely useless.

Related Articles

Home Insurance

Does home insurance cover wildfire damage?

Here’s what’s covered if your home or rental apartment has been damaged in a wildfire and how to file...

Canada’s inflation rate falls to 2.7% in April, driving up odds of June rate cut

The inflation reading gives some economists more confidence that the Bank of Canada will cut its benchmark interest rate...

You have to sell a cemetery plot—will you owe capital gains tax?

Cemetery plots in some big Canadian cities can be worth $50,000 or more. Their sale or deemed disposition may...

Canada’s inflation rate—and what it means for your investments

The Consumer Price Index shows inflation fell slightly in April. How should inflation influence your choice of stocks, bonds,...

How to become a contractor: The real costs

Sponsored By

Alberta wildfires’ effects on tourism in Canada

Wildfires cast smoky shadow over tourism industry ahead of unofficial start of summer.

Renovations

How to save money on home renovations (even if you’re not handy)

You don't have do be a DIYer to pitch in and reduce the cost of your next home improvement...

The best travel insurance credit cards in Canada for 2024

Each of these cards offers a suite of features to help you worry less on your next trip, from...

Making sense of the markets this week: May 19, 2024

U.S. inflation is down, Walmart hits all-time highs, Canadian utilities plod along, and did you think it was “game...

How much income do I need to qualify for a mortgage in Canada?

- Credit Cards

- TD First Class Travel Visa Infinite Card Review

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

TD First Class Travel® Visa Infinite* Card Review 2024

Updated: Apr 25, 2024, 4:56pm

Fact Checked

Frequent travellers will find plenty of value in this card. Considering that it earns a minimum of 2 TD Rewards points on every dollar, it has flexible redemption options, plenty of insurance coverage, a travel credit of $100 when you book travel through Expedia ® for TD and a birthday bonus of up to 10,000 points, it easily earns its spot in your wallet.

- High earn rate for rewards with Expedia.

- Exclusive travel benefits.

- Expensive annual fee.

- Low annual net rewards earnings for average spenders.

Table of Contents

Introduction, quick facts, td first class travel visa infinite card rewards, td first class travel visa infinite card benefits, how the td first class travel visa infinite card stacks up, methodology, is the td first class travel visa infinite card right for you, advertising disclosure.

- Earn up to $800 in value†, including up to 100,000 TD Rewards Points, no Annual Fee for the first year† and additional travel benefits. Conditions Apply. Account must be approved by June 3, 2024.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†.

- Earn 80,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- Earn a Birthday Bonus of up to 10,000 TD Rewards Points†

- Get an annual TD Travel Credit† of $100 when you book at Expedia® For TD.

- To receive the first-year annual fee rebate for the Primary Cardholder, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024.

- This offer is not available for residents of Quebec.

- † Terms and conditions apply.

The TD First Class Travel Visa Infinite Card is considered to be one of Canada’s higher end travel credit cards, even though its annual fee makes it quite affordable. With easy earning potential, a flexible rewards program, and a generous insurance package, it’s definitely worth considering if you are a frequent traveller.

The travel perks and benefits aren’t quite as inclusive as other high-end credit cards. The absence of lounge access is a big one to note. Another downside is that the points cannot be converted into other rewards programs. That being said, for its price point, it’s quite competitive and still gives good value.

- Get an Annual Fee Rebate for the first year†. To receive the first-year annual fee rebate for the Primary Cardholder, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024.

- Cardholders will earn points for every dollar spent with accelerated rates on groceries, restaurants, recurring bill payments and travel booked through Expedia® For TD.

- Cardholders will benefit from an annual $100 travel credit when they book travel through Expedia® For TD as well as an annual birthday bonus of up to 10,000 TD Rewards Points.

- Cardholders can redeem points for a range of options at any time as long as they have at least 200 TD points available.

- No travel blackouts, no seat restrictions and no expiry for your TD Rewards Points as long as your account is open and in good standing.

Earning Rewards

Earning rewards with the TD First Class Travel Visa Infinite card is easy as you can earn on every purchase you make.

- Earn 8 TD Rewards Points for every $1 you spend when you book travel through Expedia For TD

- Earn 6 TD Rewards Points for every $1 you spend on groceries and restaurants

- Earn 4 TD Rewards Points for every $1 you spend on recurring bill payments

- Earn 2 TD Rewards Points for every $1 you spend on other purchase

- Earn an annual Birthday Bonus of up to 10,000 TD Rewards Points, or 10% of the total number of TD Reward Points earned in the previous 12 months

There is an annual spend cap of $25,000 for each of the accelerated categories. Once you exceed that maximum, you’ll earn 2 TD Rewards Points for every dollar spent.

Here’s an example of how many TD Rewards Points you could get in the first year, including 100,000 TD Rewards Points (20,000 welcome bonus plus 80,000 points when you spend $5,000 within 180 days of account opening):

Redeeming Rewards

Rewards can be redeemed at any point, in increments of 200 points. You can redeem them for options such as travel (you’ll get the best rewards value if you book through Expedia For TD), Amazon purchases, gift cards, cash credits, and education credits. Redeeming points is easy and the multiple rewards options are attractive. However, some other top-tier credit cards allow you to convert points to other programs like airline or hotel partners for more flexibility, which this card is lacking.

Credit card reward perks include:

- Redeem your TD Rewards Points for your next trip at ExpediaForTD.com and get access to exclusive deals

- Link your eligible card to earn 50% more TD Rewards Points and Starbucks Stars

- Redeem your TD Rewards Points towards purchases at Amazon.ca with Amazon Shop with Points.

Rewards Potential

Cardholders will get the best value for their points by booking travel through Expedia For TD. However, if you like to book directly with hotels or airlines to get status points then it’s not the best rewards potential out there, since booking outside of Expedia For TD lowers the value of your points. With Expedia for TD, 200 points are equal to $1 off travel purchases. For travel booked outside of Expedia For TD, you need 250 points for that same dollar value.

That said, based on average Canadian spending, Forbes Advisor estimates this card could earn $127.34 in rewards value per year with Expedia and $111.67 with other travel partners (both calculations factor in the cost of the annual fee).

- Comprehensive travel insurance coverage.

- Discounts on car rentals with Avis and Budget Rent-A-Car.

- Link your card to Starbucks Rewards to earn 50% more TD points and Starbucks Rewards on Starbucks purchases.

More Card Benefits and Features

TD Rewards Program Benefits:

- Go places on points and redeem through Expedia for TD (where your points are worth more) or book through any other travel agency or website and use your points within 90 days of purchase.

- Shop online for merchandise and gift cards through TDRewards.com

- Pay with rewards and pay down your credit card balance with points.

Travel Benefits:

- Annual $100 TD Travel Credit on your first eligible travel credit purchase of $500 or more made with Expedia for TD

- Travel medical insurance, up to $2 million of coverage for the first 21 days (or the first four days if you or your spouse is aged 65 or older)

- Flight/trip delay insurance, up to $500 in coverage if your flight is delayed for over four hours

- Trip cancellation, up to $1,500 per person with a maximum of $5,000 for all insured persons

- Trip interruption, up to $5,000 per person, with a maximum of $25,000 for all insured persons

- Common carrier travel accident insurance, up to $500,000

- Emergency travel assistance services

- Delayed and lost baggage insurance, up to $1,000 per person if your baggage is delayed more than six hours or lost

- Auto rental collision/loss damage insurance, up to 48 consecutive days

- TD’s Credit Card Travel Insurance Verification Tool lets you check your insurance benefits

- Hotel/motel burglary insurance, up to $2,500 of coverage

Additional Benefits and Features:

- TD Payment Plans let you turn purchases of $100 or more into manageable six, 12 or 18 month payment plans

- Save a minimum of 10% off the lowest available base rate with Avis Rent A Car and Budget Rent A Car in Canada and the U.S. and 5% internationally

- Use Apple Pay, Google Pay or Samsung Pay where contactless payments are accepted

Visa Infinite Benefits:

- Complimentary Visa Infinite Concierge 24/7

- Receive seven exclusive benefits when you book your stay through the Visa Infinite Luxury Hotel Collection featuring over 900 hotels

- Visa Infinite Dining Series gives you access to exclusive gourmet events

- Visa Infinite Wine Country Program gives exclusive benefits at over 95 participating wineries in B.C., Ontario and Sonoma Valley, including discounts on wine purchases, complimentary tastings, private vineyard tours and more

- Visa Infinite Entertainment Access provides exclusive access to tickets to curated events

- Visa Infinite Troon Golf provides elevated Troon Rewards Silver Status at over 95 courses and 10% off green fees, merchandise and lessons

- Mobile device insurance, up to $1,000 of coverage in the event of loss, theft, accidental damage or mechanical breakdown

- Chip and PIN technology provides an added level of security

- Purchase security and extended warranty protection within 90 days or purchase, or double the warranty period (up to 12 months) if the item comes with a manufacturer’s warranty

- Visa Secure provides you with increased security and convenience when you shop online

- Instant TD Fraud Alerts whenever there is any suspected suspicious activity

- Set transaction limits, block international purchases or lock your credit card in the TD app

- Pay online with Click to Pay

Optional Benefits:

- Optional TD Credit Card Payment Protection Plan helps you with your payment obligations in the event of a covered job loss, total disability or loss of life

- Optional TD Auto Club Membership that provides 24/7 emergency roadside assistance

Interest Rates

- Regular APR: 20.99%

- Cash Advance APR: 22.99%

- Foreign Transaction Fee: 2.50%

- Annual Fee: $139 (Get an annual fee rebate in the first year; account must be approved by June 3, 2024)

- Any other fees: Additional cardholder $50.00 (To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024)

TD First Class Travel ® Visa Infinite* Card vs. TD ® Aeroplan ® Visa Infinite* Privilege

While both travel cards, the TD Aeroplan Visa Infinite is a luxury travel card. The annual fee is a hefty $599, but it comes with considerably more perks and benefits. including lounge access and NEXUS card rebates. It also uses Aeroplan rewards rather than TD rewards. The TD Aeroplan Visa Infinite is a strong card, but it’s best for those who travel frequently and can offset the cost of the card with the included benefits.

TD First Class Travel ® Visa Infinite* Card vs. Scotiabank Scene+ Visa Card for Students

Students studying away from home may consider a travel card like the TD First Class Travel Visa Infinite Card to help offset the cost of flights home. However, with the annual fee and rewards earning potential, you might be better off sticking to a $0 annual fee card geared towards student spending. The Scotiabank Scene+ Visa card for students allows you to earn points that can be used for day-to-day expenses like dining out, entertainment and even banking.

TD First Class Travel ® Visa Infinite* Card vs. TD ® Aeroplan ® Visa Platinum* Card

With an annual fee of $89, the TD Aeroplan Visa Platinum is a bit more affordable. The earn rates aren’t as high, but it’s also a different rewards program. While TD Rewards points are best with Expedia, Aeroplan points are best with Air Canada. So your choice between these two cards should depend on who you are most likely to book travel with to get the best value for your points.

When determining a rating for individual credit cards, the Forbes Advisor Canada editorial team factors in an exhaustive list of data points. With the TD First Class Travel ® Visa Infinite*, the scoring model used takes into account factors such as, but not limited to, rewards rates and categories, fees, welcome bonuses and other benefits and features. Keep in mind, what may be best for some people might not be right for you. Conduct informed research before deciding which cards will best help you achieve your financial goals.

The TD First Class Travel ® Visa Infinite* Card is a decent travel card . It’s easy to earn and redeem points and the suite of travel insurance is a huge perk. However, it has the best value for those who like to book their travel via Expedia. If you prefer to book directly with hotels or airlines or via other travel portals, then there are better travel credit cards out there where your rewards will go further.

Related : What is the best Canadian credit card

Frequently Asked Questions (FAQs)

Does the td first class travel visa infinite card have airline lounge access.

No, this card does not include airport lounge access .

Does the TD First Class Travel Visa Infinite Card have foreign exchange fees?

Yes, this credit card charges foreign exchange fees (or FX fees) at a rate of 2.5%. If you’re looking for a credit card without without foreign exchange fees , there are plenty available.

How many TD points do you need for a flight?

You need a minimum of 200 TD points to redeem them for rewards. If you book your flight through Expedia ® For TD the points value is 200 TD points per dollar.

Why should you get a travel rewards credit card?

A travel rewards card helps you earn points on everyday purchases (like groceries) that can be redeemed for travel-related expenses, like flights and hotels. You even earn points on travel-related bookings, earning 8 TD Rewards Points for every $1 you spend when you book travel through Expedia for TD.

How do you earn TD Rewards Points?

You earn points with travel bookings, shopping at a grocery store or eating at a restaurant, on recurring bill payments and everyday purchases.

How do you redeem TD Rewards Points?

You can redeem your TD Rewards Points when you book travel online through Expedia for TD, or any other travel provider. You can redeem your points on Amazon.ca with Amazon Shop with Points or shop for merchandise on TDRewards.com. Finally, you can also redeem TD Rewards Points to pay your credit card account balance on the TD app or EasyWeb.

Our partners are not responsible for anything reported by Forbes Advisor. To the best of our knowledge, everything is accurate at the time of publishing as of the date posted. For full information and details, please visit the advertiser’s website.

Hannah Logan is a Canadian freelancer writer and blogger who specializes in personal finance and travel. You can follow her adventures on her travel blog EatSleepBreatheTravel.com or find her on Instagram @hannahlogan21.

- Best Credit Cards

- Best Travel Credit Cards

- Best Airport Lounge Access Credit Cards

- Best Cash Back Credit Cards

- Best Credit Cards for Bad Credit

- Best Aeroplan Credit Cards

- Best No Foreign Transaction Fee Credit Cards

- Best Balance Transfer Credit cards

- Best Rewards Credit Cards

- Best Mastercards

- Best Student Credit Cards

- Best Secured Credit Cards in Canada

- Best Business Credit Cards

- Best of Instant Approval Credit Cards

- Best Prepaid Credit Cards

- Best No-Annual-Fee Credit Cards

- Best Low-Interest Credit Cards

- Best Neo Financial Credit Cards

- Best Visa Cards

- Best Air Miles Credit Cards

- TD Aeroplan Visa Infinite Privilege Review

- EQ Bank Card Review

- TD Aeroplan Visa Platinum Card Review

- Scotiabank Platinum American Express Card

- TD® Aeroplan® Visa Infinite* Card

- KOHO Prepaid Mastercard Review

- MBNA Rewards World Elite Mastercard

- MBNA True Line Mastercard Review

- The American Express Business Edge Card Review

- TD Rewards Visa Card Review

- RBC Avion Visa Infinite Review

- Scotiabank Gold American Express Card

- Neo Secured Credit Card Review

- Home Trust Secured Visa Review

- American Express Aeroplan Card Review

- Tangerine Money-Back Card Review

- TD Cash Back Visa Infinite

- TD Platinum Travel Visa Card Review

- Scotiabank Scene+ Visa Card

- Credit Card Interest Calculator

- Credit Card Minimum Payment Calculator

- Credit Card Expiration Dates: What You Need To Know

- What Is The Highest Limit Credit Card In Canada?

- What Is The Highest Credit Score Possible?

- Money transfer from Credit Card to the Bank

- How To Get Cash From A Credit Card At An ATM

- The Stack Mastercard Is No More

- How Is Your Credit Card Interest Calculated?

- How To Pay Your Mortgage With A Credit Card

- Does Applying For A Credit Card Hurt Your Credit?

- How To Check Your Credit Card Balance

- Cathay Pacific and Neo Financial Are Launching A Credit Card

- 4 Ways To Consolidate Credit Card Debt

- How To Get A Business Credit Card

- Canceling Credit Cards: Will I Get My Annual Fee Back?

- Can I Use A Personal Card For Business Expenses?

More from

Tim hortons credit card (tims card) review 2024, cibc costco mastercard review 2024: avid costco shoppers should not leave home without it, pc world elite mastercard review 2024, pc insiders world elite mastercard review 2024: earn the most pc optimum points in canada, cathay world elite mastercard review 2024: the only credit card in canada that earns asia miles, ja money card review 2024: earn cash back while learning about money management.

- Small Business

- English Selected

Your region is currently set to

Get Started with My Credit Card

Looking for a credit card? View TD Credit Cards .

EasyWeb Online Banking / Online Statements

Additional Cardholders

Tips to Protect Credit

- Cardholder Agreement

View Cardholder Agreements

Td® aeroplan® visa infinite privilege* card.

For this card you can find:

- Aeroplan Rewards Terms and Conditions for TD Credit Cards

- The TD Privacy Policy

- Benefit Coverages Guide

- Product Summaries (For Quebec Residents Only)

TD® Aeroplan® Visa Infinite* Card

- Welcome Guide

TD® Aeroplan® Visa Platinum* Card

TD First Class Travel Visa Infinite* Card

- TD Rewards Program Terms And Conditions

- Updates for Quebec Cardholders

TD Platinum Travel Visa* Card

TD Cash Back Visa Infinite* Card

- TD Cash Back Program Terms And Conditions

TD Green® Visa* Card

- Insurance Updates

TD Emerald Flex Rate Visa* Card

TD Rewards Visa* Card

TD U.S. Dollar Visa* Card

TD Cash Back Visa* Card

TD Low Rate Visa* Card

- TD Privacy Agreement

Find out more about our credit cards

Credit cards to fit my needs.

Explore all our credit cards and find the one that suits you best.

Use my credit card features

Get to know the features that come with your TD Credit Card.

Get the most out of my credit card

From paying bills to credit limit, take advantage of all your card's benefits.

Manage my credit card in the TD app

Set transaction limits, block international purchases or lock your credit card or view your statements.

Have a question? Find answers here

Popular questions, helpful related questions, did you find what you were looking for.

Sorry this didn't help. Would you leave us a comment about your search?

See you in a bit

You are now leaving our website and entering a third-party website over which we have no control.

TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank Group. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

TD Personal Banking

- Personal Home

- My Accounts

- Today's Rates

- Accounts (Personal)

- Chequing Accounts

- Savings Accounts

- Youth Account

- Student Account

- Credit Cards

- Aeroplan points

- Travel Rewards

- No Annual Fee

- U.S. Dollar

- Personal Investing

- GIC & Term Deposits

- Mutual Funds

- TFSA - Tax-Free Savings Account

- RSP - Retirement Savings Plan

- RIF - Retirement Income Options

- RESP - Education Savings Plan

- RDSP - Disability Savings Plan

- Precious Metals

- Travel Medical Insurance

- All Products

- New To Canada

- Banking Advice for Seniors (60+)

- Cross Border Banking

- Foreign Exchange Services

- Ways to Pay

- Ways to Bank

- Green Banking

TD Small Business Banking

- Small Business Home

- Accounts (Business)

- Chequing Account

- Savings Account

- U.S. Dollar Account

- AgriInvest Account

- Cheque Services

- Overdraft Protection

- Line of Credit

- Business Credit Cards

- Business Mortgage

- Canada Small Business Financial Loan

- Agriculture Credit Solutions

- TD Auto Finance Small Business Vehicle Lending

- Invest for your Business

- Advice for your Profession or Industry

- TD Merchant Solutions

- Foreign Currency Services

- Employer Services

TD Investing

- Investing Home

- Direct Investing

- Commissions and Fees

- Trading Platforms

- Investment Types

- Investor Education

- Financial Planning

- Private Wealth Management

- Markets and Research

TD Corporate

- Investor Relations

- Environment

- Supplier Information

- TD Newsroom

Other TD Businesses

- TD Commercial Banking

- TD Asset Management

- TD Securities

- TD Auto Finance

U.S. Banking

- TD Bank Personal Banking

- TD Bank Small Business Banking

- TD Bank Commercial Banking

- TD Wealth Private Client Group

- TD Bank Personal Financial Services

Your province is set to

- Customer Service

TD First Class SM Visa ® Signature Credit Card

Travel rewards – Earn triple miles on travel and dining

Compare TD cards >

Read complete terms and conditions for details about APRs, fees, eligible purchases, balance transfers and program details.

Offer details, rates, fees and terms

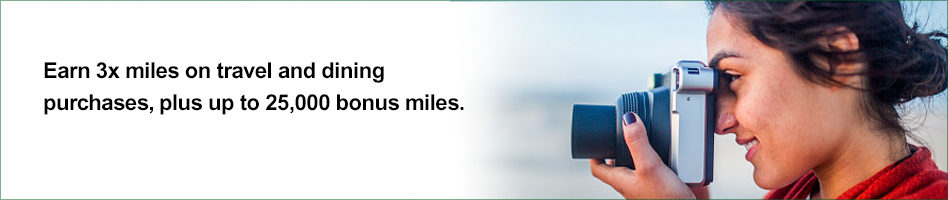

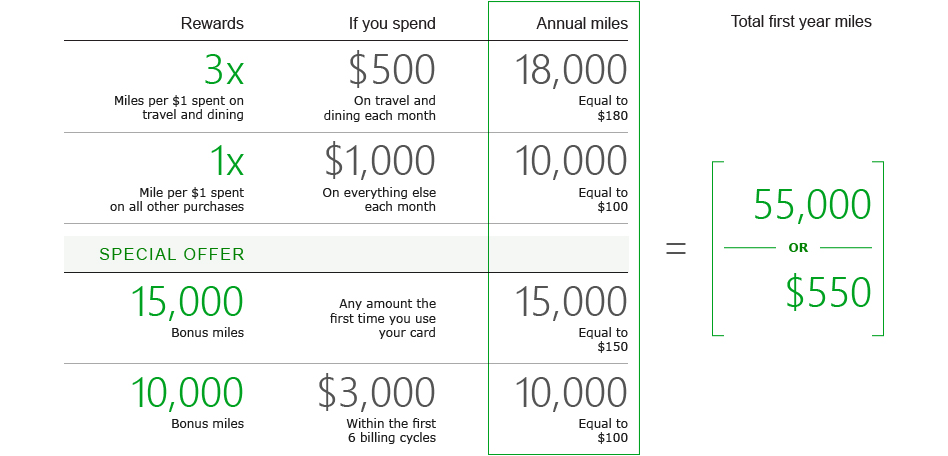

Bonus miles offer.

Earn up to 25,000 bonus miles within the first 6 billing cycles of account opening, which equals a $250 statement credit towards travel or dining purchases

Bonus miles will be reflected on your credit card statement 6 to 8 weeks after a qualified first purchase and/or 6 to 8 weeks after $3,000 in total net purchases made within the first 6 billing cycles of your credit card account opening date. This offer is non-transferable. This online offer is not available if you open an account in response to a different offer that you may receive from us. This online offer is not available if you open an account in response to a different offer that you may receive from us.

Rewards details

3X First Class miles on travel and dining purchases , including flights, hotels, car rentals, cruises and dining, from fast food to fine dining

1X First Class miles on all other purchases – no categories or gimmicks and earn points that never expire as long as your account is open and in good standing.

Rates and fees

Need more information?

Take a look at our terms and conditions or personal cardmember agreement .

Earn unlimited points with every purchase, and triple the miles on travel

See how many miles you can earn from travel and other purchases.

Redeem your First Class miles for a statement credit toward travel and dining purchases >

To earn and redeem points, your account must be open and in good standing.

Credit Card FAQs

Manage your card, security you can count on.

Don't worry-we're protecting your every move. Our built-in chip technology helps guard you against fraud. Plus, you get the benefits of Visa Zero Liability 2

Managing your account is easy

Get the service you need, when you need it. Log in to your account or talk to a TD Bank representative 24/7 at 1-877-468-3178.

Redeem your rewards

Visit the td first class rewards site >.

TD First Class Travel Visa Infinite Cardholder Agreement and Benefit Coverages Guide

TD First Class Travel ® Visa Infinite* Cardholder Agreement and Benefit Coverages Guide The TD First Class Travel Visa Infinite Cardholder Agreement and Benefit Coverages Guide

This document contains important and useful information about your TD First Class Travel Visa Infinite Card. Please keep this document in a secure place for future reference. A copy of this document is also available online at tdcanadatrust.com for future reference. This document includes:

• TD First Class Travel® Visa Infinite* Cardholder Agreement

• Definitions...... 1

• Using the Account...... 2

• Unauthorized Transactions...... 3

• Credit Limit and Overlimit...... 4

• Minimum Payment...... 4

• Payment Due Date...... 4

• Grace Period and Interest...... 4

• Foreign Currency Transactions...... 6

• Statements...... 6

• How We Communicate with You...... 7

• Lost or Stolen Cards...... 7

• Making Payments...... 7

• How We Apply Payments...... 7

• Our Rights if you do not Follow this Agreement...... 8

• Payments and Credits...... 9

• Ownership of Card...... 9

• Responsibility for Services...... 9

• Electronic Services; Use and Protection of a Card, PIN or Password...... 9

• Limits on our Damages...... 10

• Pre-Authorized Payments...... 11

• Cancelling Additional Cardholder Cards...... 11

• Changes to this Agreement and the Account...... 11

• Transfer of Rights...... 12 • Ending this Agreement...... 12

• Liability...... 12

• Headings...... 12

• Enforceability...... 12

• What Law Applies...... 12

• Language (For Quebec Only)...... 12

• Privacy Agreement...... 12

• If You Have a Problem or Concern...... 17

• Travel Rewards Program Terms and Conditions...... 17

• Travel Medical Insurance...... 25

• Trip Cancellation/Trip Interruption Insurance Certificate...... 39

• Common Carrier Travel Accident Insurance Certificate...... 54

• Delayed and Lost Baggage Insurance Certificate...... 60

• Emergency Travel Assistance Services...... 65

• Auto Rental Collision/Loss Damage Insurance Certificate...... 66

- Book Travel

- Credit Cards

7 Reasons to Apply for the TD First Class Travel® Visa Infinite* Card

If you’d like to earn TD Rewards Points to put towards flights, hotels, short-term rentals, vacations, and more, be sure to check out the current offer on the TD First Class Travel® Visa Infinite* Card .

Until March 4, 2024, there’s a record-high welcome bonus of up to 135,000 TD Rewards Points† up for grabs, and beyond that, there are many reasons to keep the card in your wallet year after year.

Let’s look at 7 reasons why the TD First Class Travel® Visa Infinite* Card should be part of your overall credit card travel strategy.

- Earn 20,000 TD Rewards Points upon making your first purchase †

- Earn 80 ,000 TD Rewards Points upon spending $5,000 within 180 days of account opening †

- Plus, earn up to 10,000 TD Rewards Points back on your birthday †

- Plus, earn 8x TD Rewards Points † on eligible travel purchases when you book through Expedia ® for TD †

- Get an annual TD Travel Credit † of $100 when you book through Expedia ® for TD †

- Use your rewards for any travel bookings available on Expedia ® for TD †

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $139, rebated for the first year †

- Application must be approved by June 3, 2024 to receive this offer

In This Post

1. record-high welcome bonus, 2. first-year annual fee rebate, 3. elevated category earning rates, 4. 10% annual birthday bonus, 5. flexible redemptions with td rewards points, 6. annual travel credit, 7. strong insurance coverage.

The current welcome bonus on the TD First Class Travel® Visa Infinite* Card matches the highest we’ve ever seen.

If you apply and are approved for the card by March 4, 2024,† you can earn up to 135,000 TD Rewards Points in the first year.†

To unlock the full welcome bonus, you’ll need to meet the following conditions:

- Earn 20,000 TD Rewards Points upon first purchase †

- Earn 115,000 TD Rewards Points upon spending $5,000 in the first six months †

In other words, you’ll need to spend an average of $833 on eligible purchases in each of the first six months as a cardholder to earn the full welcome bonus.

Plus, you’ll benefit from earning more points along the way, thanks to the card’s category earning rates, which we’ll discuss below.

When it comes time to redeem, you can redeem 135,000 TD Rewards Points for up to $675 worth of travel booked through Expedia® for TD, or for up to $540 for travel booked directly with vendors with the Book Any Way feature.†

The structure of the current offer is such that you have a sizeable welcome bonus paired with a reasonable minimum spending requirement , and a full six months to complete it.

With a record-high welcome bonus up for grabs, there’s no better time to apply for the TD First Class Travel® Visa Infinite* Card ; however, there are many other compelling reasons to have this card, which we’ll discuss below.

The TD First Class Travel® Visa Infinite* Card normally comes with an annual fee of $139.†

In tandem with the historically high welcome bonus, the current offer includes a first-year annual fee rebate, which applies to both the primary cardholder and the first supplementary cardholder.†

While the TD First Class Travel® Visa Infinite* Card would certainly be worthwhile even with a $139 annual fee, the first-year annual fee rebate really makes this offer even more compelling.

Plus, if you have a TD Unlimited or All-Inclusive banking account, you can have the annual fee waived on one TD credit card of your choice, including the TD First Class Travel® Visa Infinite* Card , on an ongoing basis.

The TD First Class Travel® Visa Infinite* Card also has a four-tier earning structure, which allows you to earn more points on many eligible everyday purchases.

These category multipliers are useful as you work to meet the minimum spending requirement, as well as when you continue to pad your TD Rewards Points balance over the long-term.

Currently, the earning rates on the TD First Class Travel® Visa Infinite* Card are as follows:

- Earn 8 TD Rewards Points per dollar spent on eligible travel booked through Expedia® for TD†

- Earn 6 TD Rewards Points per dollar spent on eligible groceries and restaurants†

- Earn 4 TD Rewards Points per dollar spent on eligible recurring bills†

- Earn 2 TD Rewards Points per dollar spent on all other eligible purchases†

It’s worth noting that there’s an annual spending cap for the elevated earning rates in the groceries, restaurants, and recurring bill payment categories.

After you’ve spent $25,000 within the year, the earning rates in these categories will be lowered to 2 TD Rewards Points per dollar spent.†

If you redeem TD Rewards Points for a value of 0.5 cents per point by booking travel through Expedia® for TD, these rates are equivalent to a 4%, 3%, 2%, or 1% return, respectively.

These are solid earning rates, which will help you quickly earn points to offset the cost of travel throughout the year.

Plus, on your cardholder anniversary date, you’ll get a further boost to your balance with one of the card’s other hallmark features.

In addition to the strong earning rates on day-to-day spending, you’ll also receive a 10% Birthday Bonus in the form of TD Rewards Points .†

Each year on your cardholder anniversary date, you’ll earn an additional 10% bonus on all the TD Rewards Points you’ve earned over the past 12 months, up to a maximum of 10,000 points.†

To maximize this benefit, which is worth up to $50 if you redeem the points for travel booked through Expedia® for TD, you’d need to earn a total of 100,000 TD Rewards Points organically throughout the year.

To put this into perspective, you’d need to spend around $1,380 per month on eligible groceries and dining purchases†, or any other combination to bring you across the threshold of 100,000 points.

When it comes time to redeem your points, you’ll be happy to know that TD Rewards Points are fairly flexible.

While you can’t transfer your points to any external airline or hotel loyalty programs, the best (and most valuable) way to redeem TD Rewards Points is for travel, either booked through Expedia® for TD or directly with any vendor.

In fact, TD Rewards Points are particularly useful to have on hand when it comes to filling the gaps for travel that can’t be booked through other loyalty programs.

The most valuable way to redeem TD Rewards Points is through Expedia® for TD, which will give you a value of 0.5 cents per point.

On the platform, you can book flights, hotels, car rentals, cruises, tours, and even Disney tickets, among other things, and get the maximum possible value from your points.

Since many of these expenses are typically difficult to book with other points currencies, using TD Rewards Points to book travel at a fixed value of 0.5 cents per point is an excellent redemption opportunity, and could end up saving you a significant amount of cash on your next trip.

On the other hand, if you want to book travel directly with vendors, you can still redeem TD Rewards points for those purchases by exchanging the points for a statement credit at a fixed rate of 0.4 cents per point against eligible travel purchases charged to the card.†

For example, with the Book Any Way feature, you can book directly with an independent hotel and then apply your TD Rewards Points as a statement credit to offset the cost.

Plus, if you redeem your TD Rewards Points against larger Book Any Way travel expenses, you’ll gain access to an improved redemption rate of 0.5 cents per point for any amount over $1,200.†

To redeem TD Rewards Points against travel purchases booked directly with vendors, you’ll have to login to the TD Rewards website and redeem points within 90 days of the original travel purchase.†

One of the other features on the TD First Class Travel® Visa Infinite* Card that makes it worthwhile to keep for the long-term is the $100 annual travel credit. †

The $100 annual travel credit helps to offset the card’s $139 annual fee, bringing it down to an effective $39 annual fee year-after-year. However, with an eligible bank account , you’ll enjoy an annual fee rebate anyway, which makes the $100 annual travel credit even more attractive.

Beginning in the second year of card membership, you’ll earn a $100 travel credit each year on your cardholder anniversary date, which can then be used towards accommodations and vacation packages booked through Expedia® for TD.

Importantly, the credit applies to eligible purchases of $500 or more. Therefore, you can also think of it as up to a 20% discount on accommodations or vacation packages on one of your next trips.

Keep in mind that by paying for the remainder of your expense with your TD First Class Travel® Visa Infinite* Card, you’ll earn 8 TD Rewards Points per dollar spent†, too.

Lastly, the TD First Class Travel® Visa Infinite* Card comes with competitive insurance coverage. This is a key feature for a strong travel credit card, and one that you’ll certainly want to be aware of as a cardholder.

The comprehensive insurance coverage offered by the card can best be divided between travel insurance and retail insurance.

In terms of travel insurance, the card provides the following:

- Emergency medical insurance: Up to $2 million for trips up to 21 days for those aged 64 and under, and up to four days for those aged 65 and older†

- Trip cancellation: Up to $1,500 per person (maximum of $5,000 per trip)†

- Trip interruption: Up to $5,000 per person (maximum of $25,000 per trip)†

- Common carrier travel accident insurance: Up to $500,000 of coverage for losses while travelling on a common carrier (bus, ferry, plane, train, or car rental)†

- Flight delay: Up to $500 per person for delays of four hours or longer†

- Baggage delay: Up to $1,000 per person for delays of six hours or longer†

- Car rental: Up to 48 days of insurance on a vehicle with an MSRP of up to $65,000†

- Hotel/motel burglary insurance: Up to $2,500 of coverage per occurrence of stolen personal items that belong to the cardholder or eligible family members travelling with the cardholder†

With the exception of emergency medical insurance, you’ll need to charge the full cost of your trip to be eligible for the other benefits.†

Not only can the included travel insurance coverage on the card save you money, but you’ll be assured that you won’t incur any additional expenses in the event of disruptions to your travel plans.

When it comes to retail insurance benefits, cardholders can benefit from the following:

- Mobile device insurance: Up to $1,000 in the event of loss, theft, accidental damage, or mechanical breakdown for eligible mobile devices.†

- Purchase security: You’ll be protected if an item is stolen or damaged within 90 days of purchase.†

- Extended warranty protection: If you purchase an item that comes with a manufacturer’s warranty, you’ll receive double the warranty up to a maximum of 12 additional months.†

Of these, mobile device insurance and extended warranty protection can be particularly useful if something happens to an eligible product purchased on the card.

As always, it’s important to read the insurance booklet to fully understand what’s covered and eligibility criteria for your unique situation.

The TD First Class Travel® Visa Infinite* Card is an impressive card that comes with strong travel benefits and competitive earning rates.

If you’re in the market for a new credit card, you should certainly consider the TD First Class Travel® Visa Infinite* Card , especially with its record-high welcome bonus and first-year annual fee rebate.

Be sure to apply and be approved for the card by March 4, 2024, to take advantage of this best-ever offer.

† Terms and conditions apply. Refer to the card issuer’s website for complete, up-to-date information.

I am a regular expedia user and books about 100 trip elements a year on there for myself and colleagues. What’s the expedia for TD system look like? is it similar to regular expedia? Also worthy of note is that if I book hotels through Expedia I earn about 2% return. By using this credit card I’m forfitting 2% return to get 4% return. Not bad but not great either. But flights are a different story. You earn next to nothing on flights through expedia but 4% through this card? Wow!

Can you ad your hotel reward number (and receive the benefits) when booking via Expedia

I don’t think so, even if it does allow you to, most hotels won’t honor your status as 3rd party travel agencies like expedia charges 30% from the room rate, most hotels don’t want that. To encourage guests from booking indirectly, they don’t honor your status with the hotel and won’t be providing any elite status benefit when you book with 3rd party travel agency. Airlines are different as they charge very little little, so elite stauts benefit usually applies still

it should be mentioned in order to get the $100 travel credit, you need to make purchase of $500 or more made with Expedia for TD for hotel or vacation packages only.

Thank you for your comment. I took a 2nd look, and we did mention it: “Importantly, the credit applies to eligible purchases of $500 or more. Therefore, you can also think of it as up to a 20% discount on accommodations or vacation packages on one of your next trips.”

It’s below the photo so perhaps it’s easily overlooked.

Hope that helps 🙂

If you use the TD Reward points you earn with this card to make a flight purchase on Expedia for TD, does the strong insurance cover your trip?

Hi, yes they do 🙂

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Prince of Travel is Canada’s leading resource for using frequent flyer miles, credit card points, and loyalty programs to travel the world at a fraction of the price.

Join our Sunday newsletter below to get weekly updates delivered straight to your inbox.

Have a question? Just ask.

Business Platinum Card from American Express

120,000 MR points

American Express Aeroplan Reserve Card

85,000 Aeroplan points

American Express Platinum Card

100,000 MR points

TD® Aeroplan® Visa Infinite Privilege* Card

Up to 85,000 Aeroplan points†

Latest News

Buy Air France KLM Flying Blue Miles with a 70% Bonus

Deals May 21, 2024

Review: American Express Platinum Card

Reviews May 21, 2024

How to Use FlightConnections Like a Pro

Guides May 21, 2024

Recent Discussion

Rob davidson, best credit cards for costco, review: st. pancras renaissance hotel london, alaska airlines launches new seattle–toronto route, the complete guide to qatar airways first class, prince of travel elites.

Points Consulting

- Customer Service

- En Español

Securities and other investment and insurance products are: not a deposit; not FDIC insured; not insured by any federal government agency; not guaranteed by TD Bank, N.A. or any of its affiliates; and, may be subject to investment risk, including possible loss of value.

SECURITIES AND OTHER INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT; NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; NOT GUARANTEED BY TD BANK, N.A. OR ANY OF ITS AFFILIATES; AND, MAY BE SUBJECT TO INVESTMENT RISK, INCLUDING POSSIBLE LOSS OF VALUE.

Data as of March 2018. Comparison of longest average store hours in the regions (MSAs) in which TD Bank operates compared to major banks. Major banks include our top 20 national competitors by MSA, our top five competitors in store share by MSA and any bank with greater or equal store share than TD Bank in the MSA. Major banks do not include banks that operate in retail stores such as grocery stores, or banks that do not fall in an MSA.

©2022 TD Bank, N.A. All Rights Reserved.

IMAGES

VIDEO

COMMENTS

Cash Advances applies to your TD . Visa. Cheque. If you accept a promotional offer on a TD . Visa. Cheque, this Agreement will continue to apply to that TD . Visa. Cheque and any additional terms we set out in the promotional offer will also apply to that TD . Visa. Cheque. Transaction. means any use of a Card or the Account to purchase goods

7 The TD Rewards Birthday Bonus applies only to the Primary Cardholder of a TD First Class Travel ® Visa Infinite * Card. ... TD Rewards Points must be redeemed in minimum increments of 200 or 250 TD Rewards Points as fully explained in the TD Travel Credit Cardholder Agreement for your Card. We can decrease the required minimum TD Rewards ...

TD First Class Travel® Visa Infinite* Card. Compare Card. This card is made from 90% recycled plastic. Special Offer. Earn up to $800 in value FCT-ROC-18, including up to 100,000 TD Rewards Points UDI-NQ-EN-11 and no Annual Fee for the first year UDI-NQ-EN-11. Conditions Apply. Account must be approved by June 3, 2024. See product details below.

TD First Class Travel® Visa Infinite* Cardholder Agreement. Important Notice Please read this insert to learn about changes to the TD Travel Rewards Program, along with changes to the Trip Cancellation Insurance and Travel Medical Insurance coverages, that will affect your TD First Class Travel Visa Infinite Account effective August 16, 2015.

First, use your TD First Class Visa Signature credit card to make your travel arrangements (for example, purchase an airline ticket, book a hotel room, make a car rental reservation) or to charge a meal at a restaurant. Next, call the TD Rewards Center at 1-877-468-3178 within 180 days of the charge. We will verify the travel/dining purchase ...

Annual interest rates, fees and features are current as of November 5th 2017 unless otherwise indicated and subject to change. 1 Must apply by December 1, 2019. Welcome Bonus of 20,000 TD Points will be awarded to the TD First Class Travel Visa* ("Account") only after the first Purchase is made on the Account.Rebate of the Annual Fee is for the first year for the Primary Cardholder only and ...

TD First Class Travel Visa Infinite Card. Annual fee: $139 (annual fee rebate—conditions apply to qualify) Earn rates: Up to 8 TD Rewards points per $1 on travel; 6 points per $1 on groceries ...

The TD First Class Travel Visa Infinite Card is considered to be one of Canada's higher end travel credit cards, even though its annual fee makes it quite affordable. With easy earning potential ...

Key facts about the TD First Class Travel Visa Infinite Card. Annual Fee: $120 - 50% First Year Annual Fee Rebate (Primary Cardholder only, First year only) that's $60 in savings! Annual fee for authorized user card: $50 (maximum of three) Credit limit: $5,000 minimum. Purchase interest rate: 19.99%. Cash advance interest rate: 22.99%.

TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Rewards details. 3X First Class miles on travel and dining purchases, including flights, hotels, car rentals, cruises and dining, from fast food to fine dining. 1X First Class miles on all other purchases - no categories or gimmicks and earn points that never expire as long as your account is open and in good standing.

Cardholder Agreement and Benefit Coverages Guide. This document contains important and useful information about your TD Cash Back Visa Card. Please keep this document in a secure place for future reference. A copy of this document is also available online at tdcanadatrust.com for future reference.

Account for Cash Advances applies to your TD Visa C heque. If you accept a promotional offer on a TD Visa C heque, this Agreement will continue to apply to that TD Visa C heque and any additional terms we set out in the promotional offer will also apply to that TD Visa Cheque. Transaction. means any use of a Card or the Account to purchase goods

about your TD Credit Card Cardholder Agreement (Click for more information) 10155 IS EM E 1214 1) Updates to the Cardholder Agreement ... TD Emerald Visa Card - Variable. At TD, we want to make the agreements and disclosures for your accounts ... appear on your statement for the first time. We also added a new sub-heading "How We

This document contains important and useful information about your TD First Class Travel Visa Infinite Card. Please keep this document in a secure place for future reference. A copy of this document is also available online at tdcanadatrust.com for future reference.

In tandem with the historically high welcome bonus, the current offer includes a first-year annual fee rebate, which applies to both the primary cardholder and the first supplementary cardholder.† While the TD First Class Travel® Visa Infinite* Card would certainly be worthwhile even with a $139 annual fee, the first-year annual fee rebate ...

First use your TD First Class Visa Signature credit card to make your travel arrangements (purchase an airline ticket, book a hotel room, make a car rental reservation) or to charge a meal at a restaurant. Next call the TD Rewards Center at 1-877-GO-TD1ST (1-877-468-3178) within 180 days of the charge. We will verify the travel/dining purchase ...

Cardholder Agreement and Benefit Coverages Guide. This document contains important and useful information about your TD Platinum Travel VisaCard. Please keep this document in a secure place for future reference. A copy of this document is also available online at. tdcanadatrust.com for future reference.

Cardholder Agreement and Benefit Coverages Guide. This document contains important and useful information about your TD Business Visa Card. Please keep this document in a secure place for future reference. A copy of this document is also available online at tdcanadatrust.com for future reference.

Cardholder Agreement and Benefit Coverages Guide. This document contains important and useful information about your TD Cash Back Visa Infinite Card. Please keep this document in a secure place for future reference. A copy of this document is also availableonline at tdcanadatrust.com for future reference.