- Movie quotes

- National Lampoon's Senior Trip

“National Lampoon's Senior Trip” quotes

“- Miss Tracy Milford: Students, J. Edgar Hoover was the founder and director of the FBI from 1924 until his death in 1972. He was a great American. - Herbert Jones: He was a fascist transvestite and I hope he rots in Hell!” Valerie Mahaffey - Miss Tracy Milford Michael Blake - Herbert Jones

“- Reggie Barry: Pop quiz, hotshot: You have 10 underage students craving alcoholic beverages in a store containing your high school principal. What do you do? What-do-you-do? - Mark 'Dags' D'Agastino: Take out the principal.” Rob Moore - Reggie Barry Jeremy Renner - Mark 'Dags' D'Agastino

“- Senator John Lerman: We're due at the capitol and you're porking the math teacher ? - Miss Tracy Milford: Keyboarding teacher . - Senator John Lerman: Whatever.” Lawrence Dane - Senator John Lerman Valerie Mahaffey - Miss Tracy Milford

“I've been thinking about our impending relationship. Which I think is a good idea . As long as you don't talk too much, you let me call the shots, and my parents never, never, never find out about you, I think it could work out between us.” Fiona Loewi - Lisa Perkins

“- Barry ' Virus ' Kremmer: What about Meg? - Mark 'Dags' D'Agastino: Meg's gay . - Barry ' Virus ' Kremmer: Well, if anyone can change her, it's you.” Danny Smith - Barry 'Virus' Kremmer Jeremy Renner - Mark 'Dags' D'Agastino

“- Lisa Perkins: Nobody likes me. Everyone thinks I'm a frigid headcase. - Mark 'Dags' D'Agastino: Well, Virus and Reggie do... but I don't. Look, why don't you prove them wrong by coming to the back and partying with us? - Lisa Perkins: Okay. I can be fun.” Fiona Loewi - Lisa Perkins Jeremy Renner - Mark 'Dags' D'Agastino

“- Ish: Hey! I want no trouble from you people! You hear me? Behave ! - Mark 'Dags' D'Agastino: I hate when I get blamed for something before I do anything wrong.” Marvin Ishmael - Ish Jeremy Renner - Mark 'Dags' D'Agastino

“- Herbert Jones: What we need is a miracle. - Meg Smith: Yeah. Like that time when the school got torched right before finals.” Michael Blake - Herbert Jones Nicole de Boer - Meg Smith

“- Miosky: You know what I wanna do? I wanna do a Jap. - Barry ' Virus ' Kremmer: Hey! How about Carla Morgan? I hear she's half Jewish! - Miosky: Not that kind of Jap. A real Jap from China. With silky soft skin, almond eyes and straight blonde hair.” Eric Edwards - Miosky Danny Smith - Barry 'Virus' Kremmer

“Wouldn't it be cool to screw in the principal's bedroom?” Tara Strong - Carla Morgan

“People think that we're nothing but a generation of losers. Sitting on our butts, playing video games and watching MTV. That's not true!” Sergio Di Zio - Steve Nisser

“- Mark 'Dags' D'Agastino: I am concerned about you, Lisa. One day, you're gonna wake up and realize that you wasted all of your high school years studying. - Lisa Perkins: And you're gonna wake up one day and realize that you're a loser!” Jeremy Renner - Mark 'Dags' D'Agastino Fiona Loewi - Lisa Perkins

- encouragement

- imagination

- relationships

- homosexuality

- wine and spirits

MovieQuotes.com © 1998-2024 | All rights reserved

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

- Culture and Lifestyle

- Quotes and Sayings

75 Retirement Quotes That Will Resonate With Any Retiree

:max_bytes(150000):strip_icc():format(webp)/3d7f81c2-e2a103d31af44005bb00b1cfe93f2b66.jpeg)

The word " retirement " strikes a chord with all human beings, but it means many things to many different people. If you're looking for a retirement quote to match a particular situation, we've got you covered. We've found several retirement quotes and sayings that will fit every personality and season of life. Browse these retirement quotes to celebrate any retiree.

Inspirational Retirement Quotes

Southern Living

- "Often when you think you're at the end of something, you're at the beginning of something else." —Fred Rogers

- "Retirement is not the end of the road. It is the beginning of the open highway." —Unknown

- "There is a whole new kind of life ahead, full of experiences just waiting to happen. Some call it 'retirement.' I call it bliss." —Betty Sullivan

- "For many, retirement is a time for personal growth, which becomes the path to greater freedom." —Robert Delamontague

- "Retirement is the only time in your life when time no longer equals money." —Unknown

- "Retire from your job, but never retire your mind." —Unknown

- “And in the end it's not the years in your life that count. It's the life in your years.” —Abraham Lincoln

- “You are never too old to set a new goal or dream a new dream.” —C.S. Lewis

- “The key to retirement is to find joy in the little things.” —Susan Miller

- “Retire from work, but not from life.” —M.K. Soni

- “Don't simply retire from something; have something to retire to.” —Harry Emerson Fosdick

- “Retirement is wonderful if you have two essentials—much to live on and much to live for.” —Unknown

- "I see retirement as just another of these reinventions, another chance to do new things and be a new version of myself." —Walt Mossberg

- "Living each day as if it were your last doesn't mean your last day of retirement on a remote island. It means to live fully, authentically and spontaneously with nothing being held back." —Jack Canfield

Funny Retirement Quotes

- "Retirement is wonderful. It's doing nothing without worrying about getting caught at it." —Gene Perret

- "The best time to start thinking about your retirement is before the boss does." —Unknown

- "A retired husband is often a wife's full-time job." —Ella Harris

- "When a man retires and time is no longer a matter of urgent importance, his colleagues generally present him with a watch." —R.C. Sheriff

- "Retirement is not in my vocabulary. They aren't going to get rid of me that way." —Betty White

- "He who laughs last at the boss's jokes probably isn't far from retirement." —Unknown

- "Retirement: That's when you return from work one day and say, 'Hi, Honey, I'm home —forever.'" —Gene Perret

- "I enjoy waking up and not having to go to work. So I do it three or four times a day." —Gene Perret

- "Retirement: It's nice to get out of the rat race, but you have to learn to get along with less cheese." —Gene Perret

- "My father calls acting 'a state of permanent retirement with short spurts of work.'" —Chris Pine

- “What do you call a person who is happy on a Monday? Retired.” —Unknown

- "When a man retires, his wife gets twice as much husband for half as much money." —Chi Chi Rodriguez

- "Half our life is spent trying to find something to do with the time we have rushed through life trying to save." —Will Rogers

- "My retirement plan is to get thrown into a minimum security prison in Hawaii." —Julius Sharpe

Retirement Quotes About Age

- “Age is an issue of mind over matter. If you don't mind, it doesn't matter.” —Mark Twain

- "You have to put off being young until you can retire." —Unknown

- "Don't act your age in retirement. Act like the inner young person you have always been." —J. A. West

- "Retirement: When you stop lying about your age and start lying around the house." —Unknown

- "My parents didn't want to move to Florida, but they turned sixty and that's the law." —Jerry Seinfeld

- "Retirement at sixty-five is ridiculous. When I was sixty-five I still had pimples." —George Burns

- "You know you're getting old when you stoop to tie your shoelaces and wonder what else you could do while you're down there." —George Burns

- "Age is just a number, but retirement is one of the greatest gifts to mankind." —Unknown

- "How do you know it's time to retire? It's when you stop lying about your age and start bragging about it." —Unknown

- "When men reach their sixties and retire, they go to pieces. Women go right on cooking." —Gail Sheehy

- “Aging seems to be the only available way to live a long life.” —Kitty O'Neill Collins

- "Do not grow old, no matter how long you live. Never cease to stand like curious children before the great mystery into which we were born." —Albert Einstein

Retirement Quotes For Friend Or Co-Worker

- “If you look at what you have in life, you'll always have more. If you look at what you don't have in life, you'll never have enough.” —Oprah Winfrey

- "There's never enough time to do all the nothing you want." —Bill Waterson

- "Say goodbye to tension and hello to your pension." —Unknown

- "Retirement, a time to enjoy all the things you never had time to do when you worked." —Catherine Pulsifer

- "Retirement: No job, no stress, no pay!" —Unknown

- "Retirement isn't the end of the road, but just a turn in the road." —Unknown

- "The best part about being retired is never having to request time off." —Unknown

- "Retirement: World's longest coffee break." —Unknown

- “Retirement is like a long vacation in Las Vegas. The goal is to enjoy it to the fullest, but not so fully that you run out of money.” —Jonathan Clements

- “You don't stop laughing when you grow old, you grow old when you stop laughing.” —George Bernard Shaw

- "Men do not quit playing because they grow old; they grow old because they quit playing." —Oliver Wendell Holmes

- "It's time to say goodbye, but I think goodbyes are sad, and I'd much rather say hello. Hello to a new adventure." —Ernie Harwell

- "Stay young at heart, kind in spirit, and enjoy retirement living." —Danielle Duckery

- "Count your age by friends, not years." —John Lennon

Quotes For Those Who Don't Want To Retire

- "I need to retire from retirement." —Sandra Day O'Connor

- "The harder you work, the harder it is to surrender." —Vince Lombardi

- "The trouble with retirement is that you never get a day off." —Abe Lemons

- "We spend our lives on the run: we get up by the clock, eat and sleep by the clock, get up again, go to work—and then we retire. And what do they give us? A bloody clock!" —Dave Allen

- "I find the biggest trouble with having nothing to do is you can't tell when you are done." —Unknown

- "I will not retire while I've still got my legs and my make-up box." —Bette Davis

- "I wanted to have more time to play and reflect, but I find retirement more stressful than having a nice, steady job because I have to make decisions about where I want to be." —Walter Cronkite

- "I'm always announcing my retirement. I'm still not retired." —Dick Van Dyke

- "Choose a work that you love and you won't have to work another day." —Confucius

- "Well, I didn't grow up with that word 'retirement' as part of my consciousness. I didn't grow up with professionals that retired. I thought retiring was when you are tired and go to bed." —Ruby Dee

- "You can never have the comeback if you don't have the retirement." —Chael Sonnen

Quotes For Those Who Are Ready To Retire

- "A lot of our friends complain about their retirement. We tell 'em to get a life." —Larry Laser

- "Retirement means doing whatever I want to do. It means choice." —Dianne Nahirny

- "Working people have a lot of bad habits, but the worst of these is work." —Clarence Darrow

- "I'm not just retiring from the company; I'm also retiring from my stress, my commute, my alarm clock, and my iron." —Hartman Jule

- "I have never liked working. To me a job is an invasion of privacy." —Danny McGoorty

- "There are some who start their retirement long before they stop working." —Robert Half

- “Retirement is a blank sheet of paper. It is a chance to redesign your life into something new and different.” —Patrick Foley

- “Retirement gives you the time literally to recreate yourself through a sport, game or hobby that you always wanted to try or that you haven't done in years.” —Steven Price

- “Time is more valuable than money. You can get more money, but you cannot get more time.” —Jim Rohn

- “Retirement is when having a good time is your only job.” —Unknown

Related Articles

National Lampoon's Senior Trip (1995)

Tommy chong: red, photos .

Quotes

Principal Todd Moss : Open the door!

Red : [Driving away] Sorry, man we got a schedule to keep.

Red : What's the magic word?

Principal Todd Moss : Please!

Red : [Opens the door] The magic word is "Rock and Roll," man.

Red : Hey, hold it, hold it, hold it, hold it. Where do you think you're going?

Principal Todd Moss : Getting on the bus.

Red : You're on the wrong bus, dude. This is the magic bus.

Principal Todd Moss : I'm counting on you to stick to the schedule. It's percisley 8:06. Let's get going.

Red : [to himself, after Moss walks by] Principal Dickhead.

Red : You kids, Man, you sure don't know how to party. When I was your age, well... we partied, Man.

[Principal Moss is passed put]

Miss Tracy Milford : Principal Moss? Principal Moss? Principal Moss!

Reggie Barry : Is he dead?

Red : Nah, he ain't dead, man. He's just in a coma.

Miss Tracy Milford : What?

Red : Yeah, I guess that car-sick pill is working on him. It should, man, it's a Red. Horse tranquilizer.

Miss Tracy Milford : But I saw you take a handful of them.

Red : Oh, they don't work on me, man. That's why they call me Red. I'm immune!

Reggie Barry : [to everyone in the back of the bus] Hey! Moss is in a coma. Let's party!

Release Dates | Official Sites | Company Credits | Filming & Production | Technical Specs

- Full Cast and Crew

- Release Dates

- Official Sites

- Company Credits

- Filming & Production

- Technical Specs

- Plot Summary

- Plot Keywords

- Parents Guide

Did You Know?

- Crazy Credits

- Alternate Versions

- Connections

- Soundtracks

Photo & Video

- Photo Gallery

- Trailers and Videos

- User Reviews

- User Ratings

- External Reviews

- Metacritic Reviews

Related Items

- External Sites

Related lists from IMDb users

Recently Viewed

National Lampoon's Senior Trip

National Lampoon's Senior Trip is a 1995 teen comedy film starring Matt Frewer and Valerie Mahaffey , and is directed by Kelly Makin .

- 1 Principal Todd Moss

- 2 Steve Nisser

- 3 Travis Lindsey

- 5 External links

Principal Todd Moss

- It's now officially 8:01, people; let's move it! Come on, come on, while we're young! Herbert Jones, get off my car! Quickly, quickly, quickly. Come on, look lively, people, come on. Keep climbing; you won't get a nosebleed. Button that up, Carla. Herbert. Early bird. Worm. Think about it. Pull, Wanda. Pull.

- Well, now that you've enlightened me as to the real problem here, perhaps you should tell the President about your concerns. In fact, I think you should all pool your ideas together. I want you to draft a 500-word letter to the President on what you'd like the Government to do in order to save our education system. Now, Mr. Diplo will be in charge today. Mr. Diplo, I've given these students an assignment. Make sure they finish it by 1:00. If they're not finished, they can stay later.

- If you'll all check your itineraries, you'll see that this is the only stop we're making between now and Washington. So I suggest you take care of whatever necessities come to mind. Now, I'm setting the alarm on my watch for ten minutes. When this alarm goes off, the bus will leave with or without you.

Steve Nisser

- Look, even though I'm probably going to get into Yale, doesn't mean that I don't suffer from the effects of teen angst. But I'm here to tell you that drugs and alcohol are not the answers to your problems!

- As student body president, I am proud to bring you this special assembly. So, without any further ado, I give to you, direct from Salt Lake City, the music of High On Life!!

- Now wait just a minute. Have any of you considered the consequences if Principal Moss finds out?

- That's it! That does it! You leave me no choice! As student body president, I am placing you all under citizens' arrest! You are all confined to your rooms until I get Principal Moss!

- Lay one hand on me and I'll sue! PRINCIPAL MOSS!!

Travis Lindsey

- Captain's log, 94237.4. I just received a priority communication from Starfleet Command that an alliance between the Klingons and the Romulans will occur right here on Earth. Our mission: to infiltrate the Klingon crew and to kidnap the Romulan leader. Computer, scan file on Klingon crew. Computer, identify Klingon leader. Just as I thought. Computer, identify Romulan leader. Mr. Spock, your analysis? Uh-huh. Uh-huh. Uh-huh. Uh-huh. Uh-huh. I agree. We have to stop him. Lieutenant Uhura, accompany me to the transporter. Mr. Spock, you have the bridge.

- Travis. Yes, Admiral Kirk, I understand. Travis out. New orders from Starfleet. The Klingon leader is to be terminated. Phasers on kill, Lieutenant. Phasers on kill.

- Spock. Shuttlecraft has encountered strange alien matter. Have Chekov scan computer bank. Wong, proceed.

External links

- National Lampoon's Senior Trip quotes at the Internet Movie Database

- National Lampoon's Senior Trip at Rotten Tomatoes

- American films

- Comedy films

Navigation menu

(Article is below...)

- Funny Quotes

- Relationship

- ParentsCorner

National Lampoon's Senior Trip Quotes

National Lampoon's Senior Trip is a television program that first aired in 1970 . National Lampoon's Senior Trip ended in 1970.

It features Wendy Grean, and Peter Morgan as producer.

National Lampoon's Senior Trip is recorded in English and originally aired in United States. Each episode of National Lampoon's Senior Trip is 91 minutes long. National Lampoon's Senior Trip is distributed by New Line Cinema.

The cast includes: Danny Smith as Barry 'Virus' Kremmer, Jeremy Renner as Mark 'Dags' D'Agastino, Tara Strong as Carla Morgan, Fiona Loewi as Lisa Perkins, Matt Frewer as Principal Todd Moss, Tommy Chong as Red, Eric "Sparky" Edwards as Miosky, Rob Moore as Reggie Barry, Michael Blake as Herbert Jones, Lawrence Dane as Senator John Lerman, Valerie Mahaffey as Miss Tracy Milford, George R. Robertson as President Davis, Eric "Sparky" Edwards as Mioski, Fiona Loewi as Ish, Sergio Di Zio as Steve Nisser, Kay Tremblay as Mrs. Winston, Kevin McDonald as Travis Lindsey, Kay Tremblay as Mrs. Woo, Nicole de Boer as Meg Smith, and Kathryn Rose as Wanda Baker.

Rob Moore as Reggie Barry

- (Rob Moore) "People, um, say that acid causes, um, brain damage. What did you say?"

- (Rob Moore) "Um, Dags, I just saw that psycho crossing guard guy in a car with Lt. Uhura"

- (Jeremy Renner) "Sure, dude."

- (Rob Moore) "Oh, I have a mission for you."

- (Pablo) "You want me to torch the principal's house, huh?"

- (Rob Moore) "Okay. But, uh, first, we need provisions, man."

- (Rob Moore) "Pop quiz, hotshot: You have 10 underage students craving alcoholic beverages in a store containing your high school principal. What do you do? What-do-you-do?"

- (Jeremy Renner) "Take out the principal."

- (Rob Moore) "Heroin, huh?"

- (Michael Blake) "Insulin."

- (Rob Moore) "Can I, like, buy some from you?"

Tommy Chong as Red

- (Tommy Chong) "Hey, hold it, hold it, hold it, hold it. Where do you think you're going?"

- (Matt Frewer) "Getting on the bus."

- (Tommy Chong) "You're on the wrong bus, dude. This is the magic bus."

- (Matt Frewer) "I'm counting on you to stick to the schedule. It's percisley 8:06. Let's get going."

- (Tommy Chong) "Principal Dickhead."

- (Tommy Chong) "You kids, Man, you sure don't know how to party. When I was your age, well, we partied, Man."

Matt Frewer as Principal Todd Moss

- (Matt Frewer) "Well, this was an interesting field trip."

- (Valerie Mahaffey) "What are we going to do now?"

- (Rob Moore) "Go home."

- (Fiona Loewi) "No, we can't let this happen."

- (Nicole de Boer) "But if we go and try to stop him, we're only gonna make the President look worse."

- (Rob Moore) "Just like Vietnam -- no way to win."

- (Michael Blake) "What we need is a miracle."

- (Nicole de Boer) "Yeah. Like that time when the school got torched right before finals."

- (Jeremy Renner) "Oh. That was us."

- (Matt Frewer) "That was you?"

- (Jeremy Renner) "Yeah. Now, if we can stop finals, we certainly can stop some Bunghole senator."

- (Matt Frewer) "It's now officially 8:01 people, let's move it."

- (Matt Frewer) "Dags and Reggie invite you to Total Destruction. 12:00, 637 Stratford Road."

- (Kay Tremblay) "Why that's your house."

- (Matt Frewer) "Stop. That man is mentally challenged."

- (Matt Frewer) "I'll bet you're wondering why I asked you here in the middle of the night. I have a favor to ask of you, Steve, something that will be our little secret. You up to it?"

- (Matt Frewer) "What are you doing?"

- (Sergio Di Zio) "I thought you wanted --"

- (Matt Frewer) "I don't want that, you idiot."

- (Matt Frewer) "Must be another senior skip day. D'Agastino thinks he can outsmart me. Not in my domain."

- (Matt Frewer) "What are you kids trying to do to me? We're not even in Washington yet and we already have -- a fatality."

- (Matt Frewer) "Open the door."

- (Tommy Chong) "Sorry, man we got a schedule to keep."

- (Tommy Chong) "What's the magic word?"

- (Matt Frewer) "Please."

- (Tommy Chong) "The magic word is "Rock and Roll," man."

- (Matt Frewer) "This is the only stop we'll be making between here and Washington D.C. So I suggest you take care of whatever necessities come to mind."

- (Danny Smith) "Like takin' a wiz."

Tara Strong as Carla Morgan

- (Tara Strong) "Wouldn't it be cool to screw in the principal's bedroom?"

- (Tara Strong) "Hey Virus, I bet you've never made moves like this in your chess club. Wanna screw?"

- (Danny Smith) "Excuse me."

- (Tara Strong) "Yeah it was great for me, too."

- (Tara Strong) "If I don't get laid tonight, everyone's gonna think I'm a loser. By the way, have you seen those Kennedy boys? I hear they're lots of fun."

Lawrence Dane as Senator John Lerman

- (Lawrence Dane) "We're due at the capitol and you're porking the math teacher?"

- (Valerie Mahaffey) "Keyboarding teacher."

- (Lawrence Dane) "Whatever."

- (Lawrence Dane) "That's an out-and-out lie."

- (Kathryn Rose) "You're the liar."

- (Lawrence Dane) "No, no, I -- I cannot take any credit for this. This is the President's decision. I had nothing to do with this whatsoever. I am only an errand boy."

- (Lawrence Dane) "Have you kids given any thought to what you might say to the committee about education reform?"

- (Jeremy Renner) "Yeah, we're going to tell them the education system sucks."

- (Rob Moore) "Sucks dick."

- (Matt Frewer) "That's not what they mean, sir."

- (Lawrence Dane) "Why not? I think it's great. Now, remember. The president invited you kids down to Washington because he wants you to tell the nation how you really feel about school. If you think the education sucks dick, then by golly you tell them. Can I have your promise on that?"

- (Rob Moore) "I promise."

- (Lawrence Dane) "What? I don't believe it. They blew out Hoover's Flame? My God, these kids are bigger s***heads then I thought."

- (Lawrence Dane) "How did you get a hold of this?"

- (Rob Moore) "That information's on a need-to-know basis."

- (Lawrence Dane) "You're out of your league, boy."

- (Valerie Mahaffey) "Senator Lurman, I can't believe what I'm hearing."

- (Lawrence Dane) "Oh, shut up, you little slut."

Nicole de Boer as Meg Smith

- (Nicole de Boer) "Miss Milford, there you are. We've been looking for you. We wanted to let you know how cool it's been. You showing us around Washington and everything."

- (Valerie Mahaffey) "Really?"

- (Kathryn Rose) "So, we bought you a box of candy."

- (Valerie Mahaffey) "I don't know what to say. How do you know that I like chocolate?"

- (Kathryn Rose) "Because it's all you ever eat."

Kathryn Rose as Wanda Baker

- (Kathryn Rose) "Did you ever wonder if Jason has nightmares and if Freddy can invade his nightmares?"

- (Rob Moore) "Yeah."

- (Kathryn Rose) "I think about that all the time."

- (Kathryn Rose) "Hey, I know you. You're that smart girl. You wanna get high?"

Kay Tremblay as Mrs. Winston

- (Detective) "We're dredging the water right now, but there's no sign of your "Star Trek" man. We're gonna have to submit you to a breathalyzer test, Mr. Woo."

- (Kay Tremblay) "I told you not to pick him up, asshole."

- (Kay Tremblay) "My late husband once wrote a little poem called "Little-" --"

Sergio Di Zio as Steve Nisser

- (Sergio Di Zio) "That does it, you leave me no choice. As student body president, I'm placing you all under citizens arrest. You're all confinded to your rooms until I get Principal Moss."

- (Jeremy Renner) "Miosky, take care of this guy."

- (Sergio Di Zio) "Lay one hand on me and I'll sue. Principal Moss."

- (Sergio Di Zio) "People think that we're nothing but a generation of losers. Sitting on our butts, playing video games and watching MTV. That's not true."

Jeremy Renner as Mark 'Dags' D'Agastino

- (Jeremy Renner) "This guy totally trashed your car."

- (Rob Moore) "Not my new Buick?"

- (Jeremy Renner) "We tried to chase him and everything, but he got away."

- (Rob Moore) "He, um, was wearing a Billy Joel T-shirt."

- (Jeremy Renner) "Total destruction."

- (Rob Moore) "Any harm?"

- (Jeremy Renner) "I don't think so."

- (Rob Moore) "Wait, there's a scratch."

- (Jeremy Renner) "Where? Here?"

- (Rob Moore) "Uh-oh."

- (Jeremy Renner) "Let's do some Van Damme-age."

- (Jeremy Renner) "It's the government, man."

- (Michael Blake) "The government sucks."

Fiona Loewi as Lisa Perkins

- (Fiona Loewi) "Dags?"

- (Jeremy Renner) "Yeah? W-what?"

- (Fiona Loewi) "I've been thinking about our impending relationship. Which I think is a good idea. As long as you don't talk too much, you let me call the shots, and my parents never, never, NEVER find out about you, I think it could work out between us."

- (Fiona Loewi) "Hey -- are you paying attention to me?"

- (Fiona Loewi) "Hey. I want no trouble from you people. You hear me? Behave."

- (Jeremy Renner) "I hate when I get blamed for something before I do anything wrong."

Valerie Mahaffey as Miss Tracy Milford

- (Valerie Mahaffey) "Well now, students; J. Edgar Hoover was the founder and director of the FBI from 1924 until his death in 1972. He was a great American."

- (Michael Blake) "He was a fascist transvestite and I hope he rots in Hell."

- (Valerie Mahaffey) "Hmm."

- (Nicole de Boer) "Why can't we see Kennedy's eternal flame?"

- (Matt Frewer) "You people don't deserve Kennedy."

- (Kathryn Rose) "Who's Kennedy?"

- (Valerie Mahaffey) "Principal Moss? Principal Moss? Principal Moss."

- (Rob Moore) "Is he dead?"

- (Tommy Chong) "Nah, he ain't dead, man. He's just in a coma."

- (Valerie Mahaffey) "What?"

- (Tommy Chong) "Yeah, I guess that car-sick pill is working on him. It should, man, it's a Red. Horse tranquilizer."

- (Valerie Mahaffey) "But I saw you take a handful of them."

- (Tommy Chong) "Oh, they don't work on me, man. That's why they call me Red. I'm immune."

- (Rob Moore) "Hey. Moss is in a coma. Let's party."

Eric "Sparky" Edwards as Miosky

- (Eric "Sparky" Edwards) "Hi. I'm Miosky. I'm here to save you."

- (Du Mi Wong) "What happened?"

- (Eric "Sparky" Edwards) "Uh -- I don't know. Don't move, I'm coming in."

- (Du Mi Wong) "I'm scared."

- (Eric "Sparky" Edwards) "Don't be scared. I'll protect you. Uh, what's your name?"

- (Du Mi Wong) "Du Mi."

- (Eric "Sparky" Edwards) "Wha --"

Kevin McDonald as Travis Lindsey

- (Kevin McDonald) "Follow that bus, Mr. Sulu."

- (Mr. Woo) "Sulu? I'm Mr. Woo."

- (Kevin McDonald) "I see. Traitors to the Federation."

- (Kevin McDonald) "Nobody moves."

- (Wong Woo) "Hey, is that a Walther PPK semi-automatic?"

- (Kevin McDonald) "Yes."

- (Wong Woo) "Great. You cover Dad --"

- (Wong Woo) "I'll cover Mom."

- (Kevin McDonald) "They never listen to me. Fools. Never listen to me."

Michael Blake as Herbert Jones

- (Michael Blake) "We don't need this A space, J space, Put a Little Love in Your Heart s***. We need a challenge."

Danny Smith as Barry 'Virus' Kremmer

- (Danny Smith) "What about Meg?"

- (Jeremy Renner) "Meg's gay."

- (Danny Smith) "Well if anyone can change her back, it's you."

- (Danny Smith) "Surprise. Happy birthday --"

George R. Robertson as President Davis

- (George R. Robertson) "Son, what do you see as the problems that are effecting our school system."

- (Eric "Sparky" Edwards) "What?"

Add or Update Quotes

If you have a quote to add or change and want to let us know, please fill in the form below. Include the time in the film/video if possible so we can find it.

Additional Film and TV Quotes

- Privacy Policy

- Terms and Conditions

You Might Like

- Rhyme Generation

- Poetry Generator

- Poetry Forms

- 10 Greatest Love Poems

- Elements Of Poetry

- Love Calculator

- How To Write A Poem

- Film and TV Quotes

- Copyright © 2004-2022 All rights reserved. This site uses affiliate links and may earn commissions for purchases made.

Steve Nisser quotes

Browse links

- © 2024 BuzzFeed, Inc

- Consent Preferences

- Accessibility Statement

47 Senior Quotes So Good You'll Kinda Want To Steal Them

BuzzFeed Contributor

It's graduation season! Which, for all you seniors out there, means it's time to pick a yearbook quote. Not to put any pressure on you, but this is the most important decision* you'll make this year. This is how you'll be remembered by your classmates, teachers, and history itself. It's up to you whether you choose something poignant and wise or silly and ridiculous.

*Just kidding! It isn't.

But don't worry! We put together this list of senior quotes with the help of Reddit and Twitter to help you make this crucial choice. Even if you don't end up picking a quote from this list, one of them might be your jumping-off point to find the perfect one. Inspiration or not, we can promise these will make you laugh. Or chuckle, at least.

1. "the truth will set you free, but first it will piss you off." — gloria steinem.

2. "Don't worry about the world coming to an end today. It's already tomorrow in Australia." - Charles M. Schulz

3. "i wouldn't want to belong to any club that would have me as a member." —groucho marx.

4. "The trouble with having an open mind, of course, is that people will insist on coming along and trying to put things in it." - Terry Pratchett

5. "hakuna matata." — the lion king.

6. "I'm not sure what the future holds, but I do know that I'm going to be positive and not wake up feeling desperate." - Bill Murray

7. "attention campers, lunch has been canceled due to lack of hustle. deal with it." —tony perkis ( heavyweights ).

8. "The best way to predict the future is to create it." - Peter Drucker

9. “i'll say this to you, my friend, with all the love in my heart and all the wisdom of the universe: take it sleazy.” —michael ( the good place ).

10. "I'm not a businessman; I'm a business, man." - Jay-Z

11. "long story short, i survived." —taylor swift.

12. "The only place where success comes before work is in the dictionary." - Vidal Sassoon

13. "gotta blast" — jimmy neutron.

14. "If you're going to do something tonight that you'll be sorry for tomorrow morning, sleep late." - Henny Youngman

15. "life is what happens to you while you're busy making other plans." —john lennon.

16. "Life's a garden, dig it!" —Joe Dirt

17. "i've done my waiting 12 years of it in azkaban" —sirius black ( harry potter and the prisoner of azkaban ).

18. "Life's too mysterious to take too serious." —Mary Engelbreit

19. "never gonna give you up, never gonna let you down, never gonna run around and hurt you." —rick astley.

20. "Don't sweat the petty things and don't pet the sweaty things." —George Carlin

21. "true terror is to wake up one morning and discover that your high school class is running the country." —kurt vonnegut.

22. "Follow your heart, but take your brain with you." —Alfred Adler

23. "were we supposed to have a quote" —ann paul veal ( arrested development).

24. "It's supposed to be hard. If it were easy, everyone would do it." —Jimmy Dugan ( A League of Their Own )

25. "love all, trust a few, do wrong to none." —william shakespeare.

26. "You met me at a very strange time in my life." —The Narrator ( Fight Club)

27. "i am ready to face any challenges that might be foolish enough to face me." —dwight schrute ( the office).

28. "Be so good that they can't ignore you." —Steve Martin

29. "you can be the ripest, juiciest peach in the world and there's still going to be someone who hates peaches." —dita von teese.

30. "I tried being reasonable, I didn't like it." —Clint Eastwood

31. "when i'm sad, i stop being sad, and just be awesome instead. true story." —barney stinson ( how i met your mother).

32. "It's not your job to be likable. It's your job to be yourself." —Chimamanda Ngozi Adichie

33. "all my life i've had one dream: to achieve my many goals." —homer simpson ( the simpsons ).

34. "Mr. Stark, I don't feel so good." —Peter Parker ( Avengers: Infinity War )

35. "wanna fly, you got to give up the shit that weighs you down." —toni morrison ( song of solomon ).

36. "May I never be complete. May I never be content. May I never be perfect." —Chuck Palahniuk

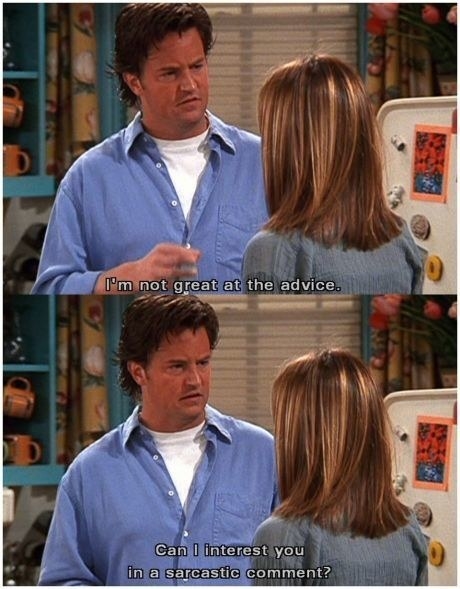

37. "i'm not great at the advice. can i interest you in a sarcastic comment" —chandler bing ( friends ).

38. "'You miss 100% of the shots you don't take. —Wayne Gretzky'" —Michael Scott ( The Office )

39. "shoot for the moon; if you miss you will die in outer space, which is cool." —katya zamolodchikova.

40. "If I die, turn my tweets into a book." —Gina Linetti ( Brooklyn Nine-Nine )

41. “do your thing and don't care if they like it.” ―tina fey ( bossypants).

42. "Blessed are the flexible, for they shall not be bent out of shape." —Anonymous

43. "i did meet some of the most insufferable people, but they also met me." —shane madej.

44. "We are all in the gutter, but some of us are looking at the stars." —Oscar Wilde ( Lady Windermere’s Fan)

45. "my stummy hurt." —playboi carti.

46. "That's hot." —Paris Hilton

47. "goodbye everyone, i'll remember you all in therapy." —plankton ( spongebob ).

This article contains content previously curated by Dave Stopera, Michelle Rennex, Syd Robinson Hattie Soykan, and Shyla Watson. It was compiled by Kelly Rissman.

Share This Article

Election latest: Starmer's 6pm finishes on Fridays to spend time with his kids attacked by minister who says she works '20-hour days'

Rishi Sunak says he has never finished before 6pm, and health minister Maria Caulfield has told Sky News she works 20-hour days, in an attack on Sir Keir Starmer after he said he'd continuing finishing at 6pm on Fridays to spend time with his kids if Labour won the election.

Tuesday 2 July 2024 08:01, UK

- General Election 2024

Election week

- Post Office minister 'urgently' investigating delays to postal ballots

- Starmer's 6pm finishes on Fridays to spend time with his kids attacked by minister who says she works '20-hour days'

- Sunak in 5am Ocado trip with press pack as polling day looms

- Explained: Why 'supermajority' warnings don't add up

- Sky News Daily: Five things main parties aren't talking about

- Live reporting by Faith Ridler

Expert analysis

- Rob Powell: PM's talking like Labour's already won

- Ed Conway: The science and security of the exit poll

- Matthew Thompson: What's a good result for the Lib Dems?

Election essentials

- Manifesto pledges: Conservatives | Greens | Labour | Lib Dems | Plaid | Reform | SNP

- Trackers: Who's leading polls? | Is PM keeping promises?

- Follow Sky's politics podcasts: Electoral Dysfunction | Politics At Jack And Sam's

- Read more: Who is standing down? | Key seats to watch | What counts as voter ID? | Check if your constituency is changing | Guide to election lingo

- How to watch election on Sky News

The government is "urgently" investigating delays to postal ballots being delivered, health minister Maria Caulfield has said.

It comes after postal affairs minister Kevin Hollinrake criticised Royal Mail for apparently failing to deliver some votes in time for the general election, which is due to take place on Thursday.

Ms Caulfield told Sky News: "Kevin is taking this very seriously. He's in direct contact with the Royal Mail.

"It doesn't seem to be an issue in my constituency, but I know a number of colleagues where people haven't received their postal votes and are worried about that.

"Kevin is investigating this urgently. I know there's extra resources going into this to try and do a sweep of all the sorting offices and make sure they're out there.

"If people have only just received their postal vote, they can take it to their polling station on election day and it will still be counted."

Postal votes must arrive at counts before polls close at 10pm to be counted, but can arrive by hand if delays to their arrival make this impossible.

It has been reported that voters across 90 constituencies have voiced concerns over delays, which have been blamed on a short turnaround time for processing applications, problems with printers and issues with Royal Mail deliveries.

But Downing Street played down the issue on Monday, claiming that Number 10 is "aware of some concerns", but it will not have an impact on results.

Health minister Maria Caulfield has admitted "your family does suffer" when you work in politics after Sir Keir Starmer suggested he would not work beyond 6pm on Fridays as prime minister.

The father-of-two said he would continue to have "protected time for the kids" at the end of the week if he were to take over the top job on 5 July.

He told Virgin Radio that he would "not do a work-related thing after 6pm pretty well come what may", adding that these protected Friday evenings would continue in Number 10.

The Conservatives were quick to condemn this idea, with Rishi Sunak saying: "I haven't finished at 6pm ever."

Asked about this, Ms Caulfield said "it is slightly concerning" that the Labour leader would take this approach.

She sought to claim that Sir Keir would want to work a "four-day week" as prime minister.

The Labour leader has never said this.

The minister said: "He has indicated that he wants to kind of have a more flexible working life approach. That's just not possible.

"I'm just a junior minister and I work seven days a week, often close to 20-hour days at times. So, it is slightly concerning that that's the approach he's taken."

She added: "When you're running the country, you do have to put the country before your party and a lot of other things as well.

"Your family does suffer - there's no doubt about it."

Ms Caulfield added that, to be successful in politics, you have to "put in the hours".

Nothing says two days from polls opening like a 2.45am start on a campaign battle bus.

By 5am the pack of bleary-eyed reporters following the Tory campaign were shivering in the refrigerated section of an Ocado distribution centre near Luton.

Here, we were shown the "grid" – something best described as a giant metal frame populated by hundreds of R2-D2-like "bots" that whizz around within 5mm of each other picking up crates of food and dropping them at stations where human workers finish the job of sorting the products for delivery.

We're told the prime minister especially enjoyed this visit, hardly a surprise given his Silicon Valley "tech bro" credentials.

There is perhaps a parallel electoral universe where Rishi Sunak spent more of his campaign at sites like this talking about high tech, high productivity investment and how it feeds into his vision of what a modern UK economy looks like.

But that's not where we are.

Instead, today will likely again be taken up with attempts to punch holes in the Labour campaign and unsettle voters about the prospect of a Starmer majority.

By Paul Kelso , business correspondent

Hulme Grammar School in Oldham doesn't feel like a bastion of privilege, but the children whose parents pay around £15,000 a year for them to attend are nevertheless among an elite minority.

A selective fee-paying school, Hulme is one of around 2,500 independent schools that educate 7% of the school population, a minority that is the target of one of Labour's few unapologetically tax-raising policies.

If elected, Labour says it will end the VAT exemption on fees, making them subject to 20% tax, raising an estimated £1.6bn the party says will be used to hire 6,500 teachers in the state sector that educates 93% of children.

Private school parents fear the increase will be passed on directly, pricing some children out, while industry bodies claim some schools will close.

It's the final week of election campaigning and leaders are leaning on all the old favourites in a bid to woo voters.

Sir Keir Starmer's hammering home the need for change, Ed Davey is auditioning for a future series of Total Wipeout, and the PM has been warning voters not to hand Labour a "supermajority".

It's a term the Tories have been banding about for weeks - but what does it mean, and why does Rishi Sunak think it'll work?

What's the PM getting at?

"Supermajority" is being used by Mr Sunak to refer to the scale of the Labour victory being projected by many pollsters - with some saying they could top the 419 seats won by Tony Blair in 1997.

That gave Labour a majority of 179, but with the Tories tipped to do even worse than they did back then (165 seats), Sir Keir Starmer could end up enjoying the biggest parliamentary advantage on record - well over 200 seats according to some projections.

Mr Sunak has said such a "supermajority" would make it harder for the Labour Party to be held to account in the Commons.

Is he right to sound the alarm?

Well, no - because the concept of a supermajority is meaningless in British democracy.

It's a familiar phrase in US politics, where a supermajority of two-thirds really does matter in some votes.

For example, Congress is required for particularly significant legislation like impeaching a president to hit that two-thirds threshold.

In the UK, a governing party only has to hold more than half of the 650 seats in the Commons, whether that be 326 or much more.

A majority of one could be just as effective as something much bigger - as long as the majority party keeps its MPs in line.

Some have argued the "supermajority" concept isn't without merit, for example in referendums, but it's certainly not relevant to this election despite the Tories' best efforts to make it so.

Whether it's healthy for parliament to be as dominated by one party as it could be from 5 July is another question - but whatever the majority Labour might have, there'll be nothing super about it.

Sir Keir Starmer has said a big majority would be "better for the country", as the Tories continue to urge voters to proceed with caution and not hand Labour a "blank cheque".

With just 48 hours to go until polling day, Rishi Sunak has repeated the warning that Labour could achieve a "supermajority", allowing the party to raise taxes, which he claimed is in its DNA.

In an interview with The Times, Sir Keir said he needed a "strong mandate" to reform the planning system and improve the economy.

Asked if he was saying the bigger a majority, the better, he told the newspaper: "Better for the country.

"Because it means we can roll up our sleeves and get on with the change we need."

This follows weeks of warnings from the Conservatives of a Labour "supermajority", in a bid to prevent bleeding votes to Reform UK and the Liberal Democrats.

Speaking at a campaign event in Leicestershire, Mr Sunak said: "Once you've given Labour a blank cheque, you won't be able to get it back.

"And that means that your taxes are going up: your car, your pension, your savings, your work, you name it, they will tax it thousands and thousands of pounds.

"It's what they always do. It's in their DNA."

On Tuesday, the prime minister is expected to say: "If just 130,000 people switch their vote and lend us their support, we can deny [Keir] Starmer that supermajority."

Good morning!

We are in the last 48 hours of the general election campaign - and the gloves are well and truly off in the race to secure the keys to Number 10.

Here's what you need to know today:

It's been an early start for Prime Minister Rishi Sunak , who has already been packing people's shopping at an Ocado distribution warehouse this morning;

That won't be the last we see of him today, with a number of last minute visits planned in the South East on Tuesday;

Mr Sunak is telling voters that they have the power to dictate the future of Britain, with as few as 130,000 votes set to determine the result of Thursday's election;

Meanwhile, there's also no slowing down in the Labour camp. Sir Keir Starmer will be in the Midlands as his party warn of the risk of waking up to five more years of Conservative government;

Labour are today pushing plans to use High Street opticians like Specsavers to cut NHS waiting lists, as it's revealed patients are losing their eyesight while they wait for treatment;

And Sir Ed Davey continues his 1,343-mile five-day tour of constituencies from John O'Groats to Land's End ahead of Thursday's general election today.

We'll be discussing all this and more with:

- Maria Caulfield , Conservative candidate, at 7.15am;

- Labour's Wes Streeting at 8.15am;

- SNP's Westminster leader Stephen Flynn .

Follow along for the very latest in the general election campaign.

That's all from Politics Hub for tonight.

Scroll down to read our 10pm bulletin to catch up on all the day's political news.

Be sure to join us tomorrow as the final 48 hours of campaigning get underway.

Around ten days ago, Harry Potter author JK Rowling wrote a 2,000-word essay in The Times about how she could not vote for Labour or Sir Keir Starmer, based on their position on gender recognition (read more here ).

Speaking to the same paper tonight, Sir Keir has said he is hopeful he can meet with the writer - who has been critical of trans women accessing single-sex spaces.

In a social media post at the end of last week, Rowling said: "Do biological males with gender recognition certificates have the right to enter women-only spaces?

"It's a simple yes/no question."

Asked about this by The Times, Sir Keir said: "No. They don't have that right.

"They shouldn't. That's why I've always said biological women's spaces need to be protected."

Asked if he will he meet Rowling? "I've indicated a willingness [to do so]."

He adds: "Hopefully we can get that organised."

It's 10pm. Here is your round up of what happened today as we entered the final lap of the election race.

- Northern Ireland minister Steve Baker spoke candidly about his expectation the Tories would lose the election (see our 19:19 post for more );

- He also went into detail about why he thinks he should be the party's next leader (read his explanation in our 19.30 post );

- We've heard from Prime Minister Rishi Sunak , who promised to "work his socks off" for the British people;

- And we've also explained what the "supermajority" the PM keeps warning about actually is - and what it means in practice (spoiler: it's not really a thing, see our 14.50 post for more );

- Political correspondent Rob Powell has dug into why Mr Sunak keeps talking like he's lost the election, suggesting it may do little to help the Tories get their voters to the polls on Thursday ( see 14.30 post ).

- Labour leader Sir Keir Starmer was at a campaign event in Hitchin today, where he has urged the British public to "vote for a summer of change" with his party;

- He was also asked by our political editor Beth Rigby if he worries about his popularity, and potentially having the "longest wedding and shortest honeymoon" with the British public;

- Sir Keir said his record speaks for itself, claiming his "track record as a leader is clear" - and Labour is a changed party.

- And, in typical Liberal Democrat fashion, Sir Ed Davey partook in a spot of bungee jumping today - his message was to encourage people to "try something new" and vote for his party;

- He then took part in an outdoor Zumba class;

- Political correspondent Matthew Thompson - who has spent much of the campaign with Sir Ed - has explained what a successful day at the polls would look like for the Lib Dems ( see 15.35 post ).

Tomorrow will see us heading into the final 48 hours of the campaign.

Join us again as we keep across all the important updates as they happen.

Be the first to get Breaking News

Install the Sky News app for free

- ABBREVIATIONS

- BIOGRAPHIES

- CALCULATORS

- CONVERSIONS

- DEFINITIONS

Senior Trip 1995

Carla Morgan: "Hey Virus, I bet you've never made moves like this in your chess club. Wanna screw?"

Share your thoughts on this Senior Trip's quote with the community:

Report Comment

We're doing our best to make sure our content is useful, accurate and safe. If by any chance you spot an inappropriate comment while navigating through our website please use this form to let us know, and we'll take care of it shortly.

You need to be logged in to favorite .

Create a new account.

Your name: * Required

Your email address: * Required

Pick a user name: * Required

Username: * Required

Password: * Required

Forgot your password? Retrieve it

Quote of the Day Today's Quote | Archive

Would you like us to send you a free inspiring quote delivered to your inbox daily.

Please enter your email address:

Use the citation below to add this movie quote to your bibliography:

Style: MLA Chicago APA

"Senior Trip Quotes." Quotes.net. STANDS4 LLC, 2024. Web. 2 Jul 2024. < https://www.quotes.net/mquote/83942 >.

Know another quote from Senior Trip?

Don't let people miss on a great quote from the "senior trip" movie - add it here, the web's largest resource for, famous quotes & sayings, a member of the stands4 network, our favorite collection of, famous movies.

Browse Quotes.net

Are you a quotes master, what tv show has the quote "man hands on misery to man it deepens like a coastal shelf".

IMAGES

VIDEO

COMMENTS

National Lampoon's Senior Trip. National Lampoon's Senior Trip is a 1995 teen comedy film starring Matt Frewer and Valerie Mahaffey, and is directed by Kelly Makin. Genre: Adventure, Comedy. Director (s): Kelly Makin. Stars: Matt Frewer, Valerie Mahaffey, Lawrence Dane, Tommy Chong, Jeremy Renner. It's now officially 8:01, people; let's move it!

One day, you're gonna wake up and realize that you wasted all of your high school years studying. - Lisa Perkins: And you're gonna wake up one day and realize that you're a loser!". National Lampoon's Senior Trip quotes: the most famous and inspiring quotes from National Lampoon's Senior Trip. The best movie quotes, movie lines and film ...

National Lampoon's Senior Trip: Directed by Kelly Makin. With Matt Frewer, Valerie Mahaffey, Lawrence Dane, Tommy Chong. To embarrass his rival, a scheming senator uses nitwit Ohio teens who are invited to a Washington gathering on educational failure.

You kids, Man, you sure don't know how to party. When I was your age, well, we partied, Man. Steve Nisser: People think that we're nothing but a generation of losers. Sitting on our butts, playing video games and watching MTV. That's not true! Principal Todd Moss: Must be another senior skip day.

National Lampoon's Senior Trip: Directed by Kelly Makin. With Matt Frewer, Valerie Mahaffey, Lawrence Dane, Tommy Chong. To embarrass his rival, a scheming senator uses nitwit Ohio teens who are invited to a Washington gathering on educational failure.

It's now officially 8:01, people; let's move it! Come on, come on, while we're young! Herbert Jones, get off my car! Quickly, quickly, quickly.

A great memorable quote from the National Lampoon's Senior Trip movie on Quotes.net - Principal Todd Moss: If you'll all check your itineraries, you'll see that this is the only stop we're making between now and Washington. So I suggest you take care of whatever necessities come to mind. Now, I'm setting the alarm on my watch for ten minutes.

» More Quotes from National Lampoon's Senior Trip » More Quotes from Steve Nisser ...

View Quote Well, now that you've enlightened me as to the real problem here, perhaps you should tell the President about your concerns. In fact, I think you should all pool your ideas together. I want you to draft a 500-word letter to the President on what you'd like the Government to do in order to save our education system.

We've found several retirement quotes and sayings that will fit every personality and season of life. Browse these retirement quotes to celebrate any retiree. 100 Best Life Quotes That Will Inspire You. Retirement quotes for sharing good wishes with co-workers or friends. These retirement quotes and sayings will fit every personality.

Average price (up to 35% of score): We analyzed travel insurance quotes for two different trips, both with CFAR coverage and without, for travelers ages 65 and 70, to develop an average price for ...

Alternative Travel Quotes to Use Instead. "Because in the end, you won't remember the time you spent working in the office or mowing your lawn. Climb that goddamn mountain.". - Jack Kerouac. "The real voyage of discovery consists not in seeking new landscapes, but in having new eyes.". - Marcel Proust.

A great memorable quote from the National Lampoon's Senior Trip movie on Quotes.net - Principal Todd Moss: Well, now that you've enlightened me as to the real problem here, perhaps you should tell the President about your concerns. In fact, I think you should all pool your ideas together. I want you to draft a 500-word letter to the President on what you'd like the Government to do in order to ...

Top 50 Travel Quotes Of All Time. 1. "Adventure is worthwhile.". - Aesop. It doesn't get more simplistic than Aesop's take on traveling, the ancient Greek storyteller. This classic travel quote continues to inspire me. 2. "Traveling - it leaves you speechless, then turns you into a storyteller.". - Ibn Battuta.

It should, man, it's a Red. Horse tranquilizer. Miss Tracy Milford : But I saw you take a handful of them. Red : Oh, they don't work on me, man. That's why they call me Red. I'm immune! Reggie Barry : [to everyone in the back of the bus] Hey! Moss is in a coma. Let's party!

Keep climbing; you won't get a nosebleed. Button that up, Carla. Herbert. Early bird. Worm. Think about it. Pull, Wanda. Pull. Well, now that you've enlightened me as to the real problem here, perhaps you should tell the President about your concerns. In fact, I think you should all pool your ideas together.

Now wait just a minute. Have any of you considered the consequences if Principal Moss finds out?

National Lampoon's Senior Trip. 1995. Director: Kelly Makin. Stars: Matt Frewer, Valerie Mahaffey, Lawrence Dane, Tommy Chong, Jeremy Renner. Genre: Adventure, Comedy. Rating: R (Restricted) Runtime: 91 minutes. National Lampoon's Senior Trip is a 1995 teen comedy film starring Matt Frewer and Valerie Mahaffey, and is directed by Kelly Makin ...

National Lampoon's Senior Trip Quotes. National Lampoon's Senior Trip is a television program that first aired in 1970 . National Lampoon's Senior Trip ended in 1970. It features Wendy Grean, and Peter Morgan as producer. National Lampoon's Senior Trip is recorded in English and originally aired in United States. Each episode of National ...

Steve Nisser quotes View Quote Look, even though I'm probably going to get into Yale, doesn't mean that I don't suffer from the effects of teen angst. But I'm here to tell you that drugs and alcohol are not the answers to your problems!

1. "The truth will set you free, but first it will piss you off." — Gloria Steinem. Jim Spellman / WireImage. 2. "Don't worry about the world coming to an end today. It's already tomorrow in ...

Sophy Ridge is now asking the panel about concerns around people who want to vote not being able to because of delays to postal ballots being delivered - leaving some out of luck before setting ...

A great memorable quote from the National Lampoon's Senior Trip movie on Quotes.net - Steve Nisser: That's it! That does it! You leave me no choice! As student body president, I am placing you all under citizens' arrest! You are all confined to your rooms until I get Principal Moss!

Are you a quotes master? In which movie does this quote appear: "I don't like violence, Tom. I'm a businessman; blood is a big expense"? A great memorable quote from the Senior Trip movie on Quotes.net - Carla Morgan: "Hey Virus, I bet you've never made moves like this in your chess club. Wanna screw?"