Welcome to Online Banking

Sign in to online banking, help - client card or username.

Enter the 16-digit number from the card you use for debit and ATM transactions. If you don’t have a card, you can use the number you were given at the branch to access Online Banking.

If you have set up a username, you can enter it in this field to log in to Online Banking.

Help - Remember your client card or user name

Check this box if you’d like to save your Client Card number or username on this computer, so you don’t have to enter it again the next time you log in to Online Banking.

We don’t recommend this option if you’re using a public or shared computer.

If you delete the cookies on your computer, you’ll erase any saved Client Card numbers or usernames.

Help - RBC Security Guarantee

We’ll fully reimburse any unauthorized transactions made in RBC Royal Bank Online Banking.

New to Online Banking?

Discover Opens new tab what it can do for you.

Other Online Services Other Online Services RBC Direct Investing Dominion Securities Online RBC InvestEase Avion Rewards PH&N Investment Counsel RBC Royal Trust RBC Bank USA RBC Caribbean RBC Express RBC Global Trade Other Services

How can we help you.

Royal Bank of Canada Website, © 1995-2024

- Book Travel

- Credit Cards

Best ways to earn:

Best ways to redeem:.

RBC Avion points are an incredibly useful, transferrable reward currency for Canadians.

Its diverse suite of transfer partners and ease of earning make it a great program to include as part of your points-earning endeavours.

Before we go further, it’s important to distinguish between the different tiers of RBC Avion Rewards. There are subtypes of Avion points: Avion Select, Avion Premium, and Avion Elite.

Avion Elite is the highest Avion Rewards tier, and has the most redemption flexibility. Both Avion Elite and Avion Premium points are earned through RBC credit cards, and can be transferred from one account to the other, if you hold a credit card that earns Avion Elite points.

Comparatively, Avion Select points are a recent addition to the RBC Avion program, and these aren’t nearly as valuable as the other two tiers.

Avion Select points are earned through applicable shopping activity, and can’t be combined with Avion Elite or Avion Premium points.

In this guide, we’ll be focusing on Avion Elite points, while exploring the possibilities of earning Avion Premium points for the sole purpose of converting the Premium points into Elite points.

Earning RBC Avion Points

The main way to earn RBC Avion points is through RBC credit cards. You can rack up Avion points through credit card welcome bonuses and through everyday spending.

Credit cards will earn either Avion Elite points or Avion Premium points.

The credit cards that earn Avion Elite points include all from the RBC Avion lineup.

Meanwhile, the cards that earn Avion Premium points are from the RBC ION lineup.

As long as you have at least one of the RBC Avion cards from the first list, you’ll be able to freely transfer Avion Premium points earned from the ION cards in the second list to your Avion Elite rewards account.

Transferring Avion points from Premium points to Elite points will give you a lot more redemption options.

Credit Card Welcome Bonuses

The best way to earn RBC Avion points is through welcome bonuses.

Welcome bonuses fluctuate depending on the current promotion. However, you can usually expect an RBC Avion card to come with a welcome bonus of 15,000–35,000 Avion points, with the bonus sometimes getting as high as 55,000 Avion points if you’re able to meet the associated spending requirements.

Despite having similar welcome bonuses, the Avion cards do all have slight differences in the benefits they offer, their earning rates, and their annual fees.

The RBC® Avion Visa Platinum†, RBC® Avion Visa Infinite†, and RBC® Avion Visa Business all have an annual fee of $120 (all figures in CAD).

Meanwhile, the RBC® Avion Visa Infinite† Business has an annual fee of $175, and lastly, the RBC® Avion Visa Infinite Privilege† card has the highest annual fee at $399.

With the higher annual fees, you can usually expect to also see additional benefits, such as higher earning rates and access to airport lounges.

By comparison, the RBC ION cards seriously lag behind in terms of welcome bonuses offered, often ranging from 3,500–7,000 Avion Premium points.

However, the ION cards do have minimal annual fees, with the RBC® ION Visa having no annual fee, and the RBC® ION+ Visa charging a fee of only $4 per month.

Credit Card Spending

In addition to earning the welcome bonus, you’re also able to earn Avion points on your day-to-day purchases.

The RBC Avion-branded credit cards come with the following earning rates on daily spending:

RBC® Avion Visa Infinite†

- 1.25 Avion points per dollar spent on all travel purchases (flights, hotels, car rentals, etc.)

- 1 Avion point per dollar spent on all other qualifying purchases

RBC® Avion Visa Platinum†

- 1 Avion point per dollar spent on all qualifying purchases

RBC® Avion Visa Infinite Privilege†

- 1.25 Avion points per dollar spent on all qualifying purchases

RBC® Avion Visa Business

RBC® Avion Visa Infinite† Business

The RBC ION cards, earning Avion Premium points instead of Avion Elite points, have better earning rates than the cards above, despite fetching little to no annual fees.

Although the ION cards earn less valuable Avion Premium points, you can easily transfer the Avion Premium points earned through ION cards to Avion Elite points at a rate of 1:1, if you hold one of the Avion cards listed above.

The two cards through which you can earn Avion Premium points have the following earning rates:

RBC® ION Visa

- 1.5 Avion points per dollar spent on qualifying grocery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming, and digital subscriptions

RBC® ION+ Visa

- 3 Avion points per dollar spent on qualifying grocery, dining, food delivery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming, and digital subscriptions

- 1 Avion point per dollar spent spent on all other qualifying purchases

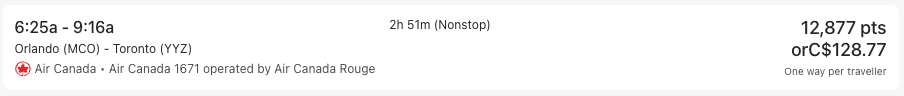

Avion Rewards

A relatively recent addition to the RBC Avion program is Avion Rewards, which is open for RBC clients and non-clients alike.

Since all points transactions are made under its platform, those with an Avion or ION card product have automatically been registered to Avion Rewards, while those with other RBC products may use their existing RBC credentials to enroll.

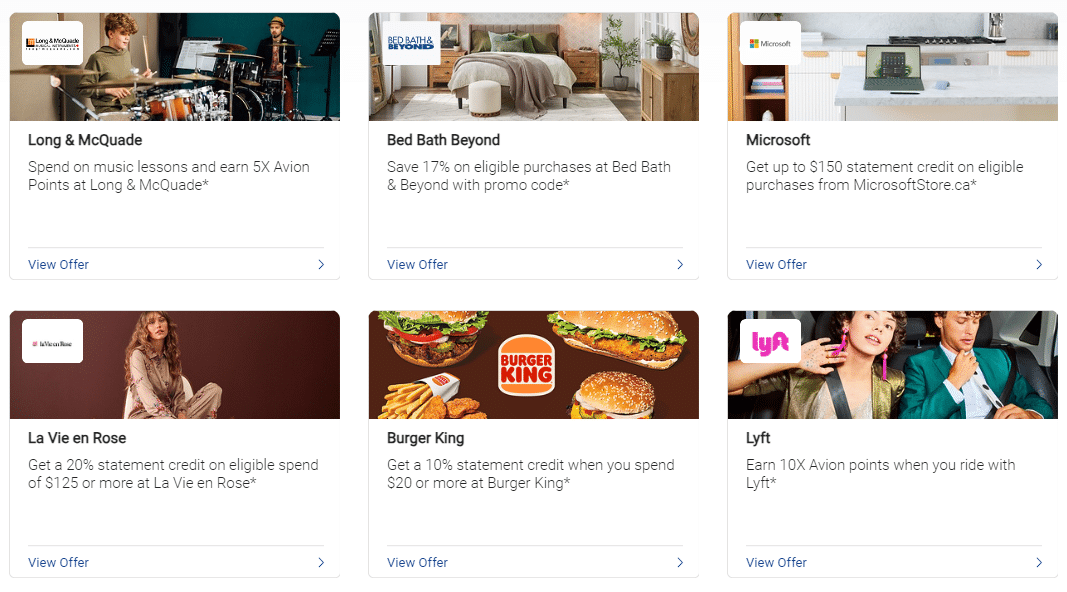

Under Avion Rewards, you may benefit from two types of offers: “save & earn” offers, and “shop now” offers.

The former lets you earn Avion points, discounts, and cash back when you use your eligible RBC card at participating online and in-store establishments. Meanwhile, the latter lets you earn cash back on online purchases, akin to the Aeroplan eStore and Rakuten.

Examples of save & earn Avion points offers are as follows:

- Earn 1,000 Avion points when you spend $300 or more at participating Marriott Bonvoy hotels in Canada

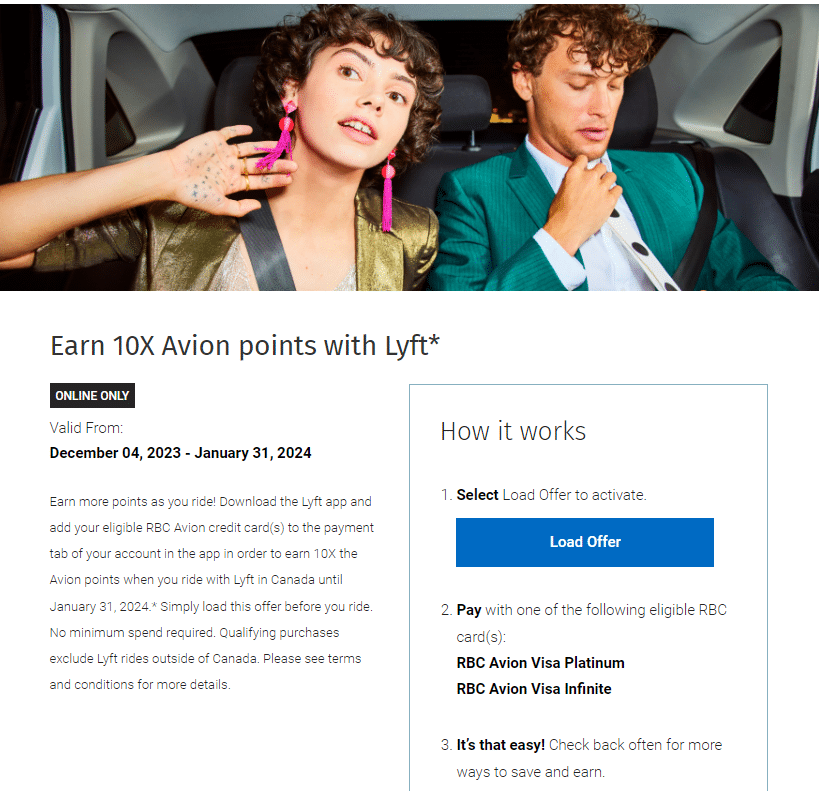

- Earn 10x Avion points on Lyft rides

- Earn 2x Avion points on eligible Apple purchases

For save & earn offers, you must opt into each offer by logging into your Avion Rewards account.

Redeeming RBC Avion Points

The best feature of the RBC Avion program is the flexible nature of Avion points.

Avion Elite points can be transferred to airline loyalty programs, redeemed through RBC’s Air Travel Redemption Schedule , or cashed out through gift cards or statement credits.

Comparatively, Avion Premium points aren’t quite as valuable on their own.

Avion Premium points can only be transferred to WestJet Rewards , or they can be cashed out for statement credits and gift cards. Notably, Avion Premium points cannot be transferred to any other airline loyalty program and can’t be used to book travel through RBC’s Air Travel Redemption Schedule.

Given this, the best use of RBC Avion Premium points is simply to transfer them to RBC Avion Elite points, which you can easily do as long as you have a Avion credit card.

Even if you don’t currently have an Avion credit card, it’s still best to save your Avion Premium points, and make plans to get an Avion credit card in the future.

For this reason, we’ll look exclusively at the redemption options for RBC Avion Elite points.

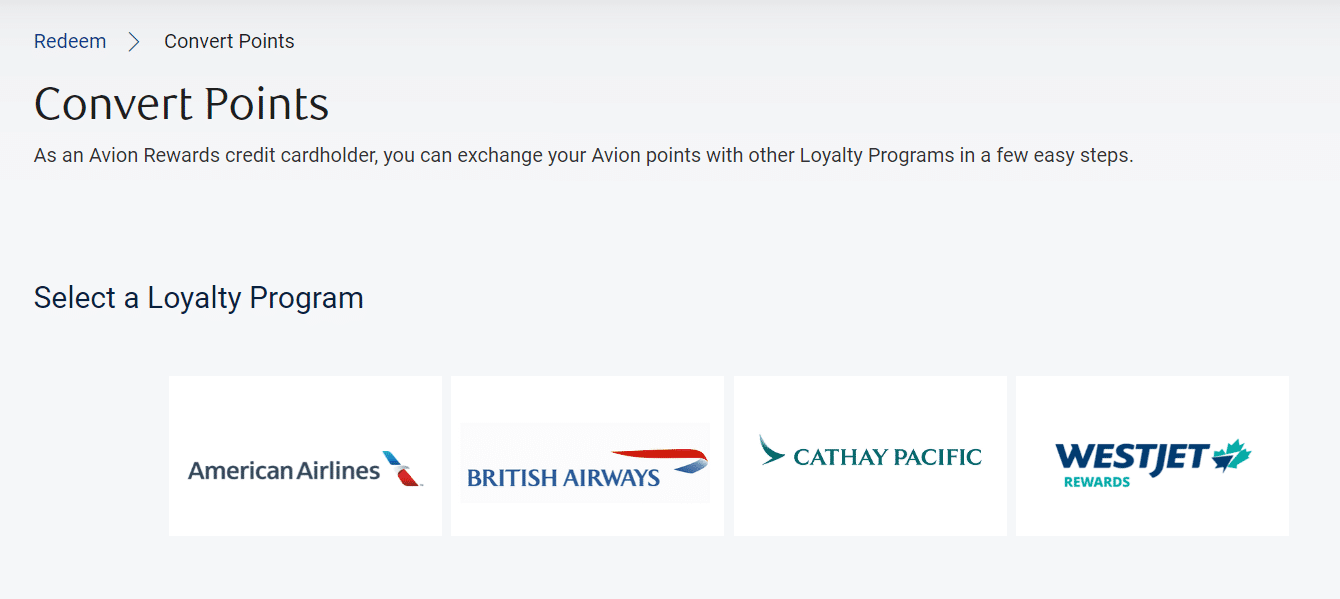

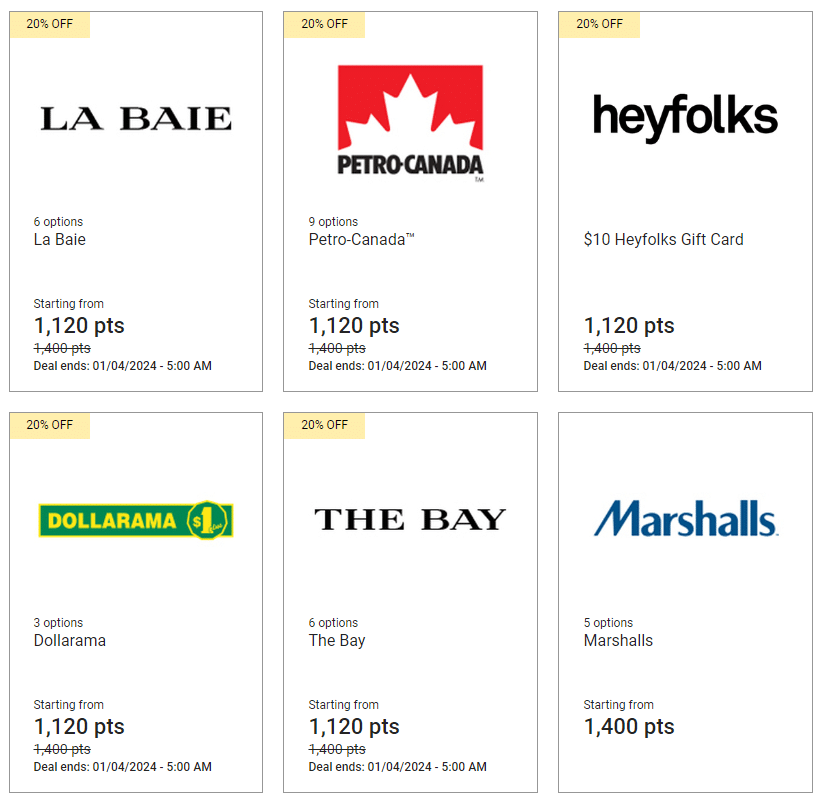

Transferring to Partner Programs

You can transfer your RBC Avion Elite points at a 1:1 ratio to British Airways Executive Club (Avios) and Cathay Pacific Asia Miles, and to WestJet Rewards at a rate of 1 Avion point = $0.01 in WestJet Dollars (WSD).

You can also transfer Avion Elite points to American Airlines AAdvantage at a rate of 10 Avion points = 7 AAdvantage miles.

British Airways Executive Club is great for short-haul journeys, as well as long-haul trips in economy class.

One amazing sweet spot is transferring British Airways Avios to Qatar Airways Avios at a 1:1 ratio. From there, you can book Qatar Airways QSuites one-way from North America to Doha for only 70,000 Qatar Airways Avios.

It’s also worth noting that RBC regularly offers transfer bonus promotions from Avion to British Airways Executive Club. Historically, the most common promotional offer is a 30% bonus on point transfers.

Lastly, keep in mind that there are a few restrictions on the ability to transfer points to these partners. In particular, for British Airways Avios, American AAdvantage, and Cathay Pacific Asia Miles, you need to transfer a minimum of 10,000 Avion points at a time. However, there is no such restriction for transfers to WestJet Rewards.

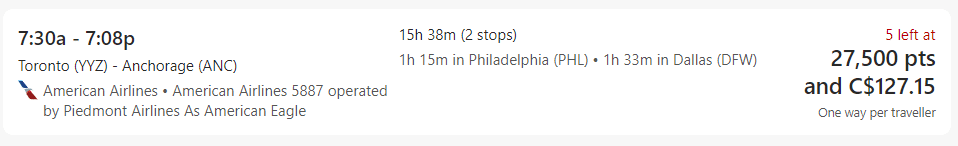

RBC Air Travel Redemption Schedule

If you’re not interested in transferring your Avion points to an airline loyalty program, you can still get great value by redeeming points through the RBC Air Travel Redemption Schedule.

While you won’t be able to get outsized value for your points, you’ll still get more value through this avenue than if you redeemed Avion points for a statement credit or for gift cards.

Through the Air Travel Redemption Schedule, you’ll be able to redeem Avion Elite points at a fixed rate for the base fare of any flight booked through the Avion Rewards portal, powered by Expedia.

Each redemption option allows you to use the specified number of points towards a listed maximum base fare.

It’s important to note that you’ll be responsible to pay for any base fare amount that’s over the maximum base fare listed in each category, as well as for the taxes and additional fees.

If you wish to redeem Avion points for the additional costs, you can choose to do so, albeit at the lower redemption rate of 1 cent per Avion point.

When using RBC’s Air Travel Redemption Schedule to book a flight, you’ll get a value of up to 2.3 cents per Avion point, depending on the origin and destination of your trip and the cost of the base fare.

The maximum value of 2.3 cents per Avion point can be found in the “Quick Getaway” category when you redeem 15,000 Avion points for the maximum return-trip base fare of $350.

In all the other categories, the maximum value you’ll be able to extract is 2 cents per Avion point, when booking a round-trip for the maximum base fare amount.

As an example, if you were to redeem 100,000 Avion points for a round-trip flight from Toronto to Lima with a base fare cost of $1,700, you would receive a value of 1.7 cents per point.

Notably, with the Air Travel Redemption Schedule, the number of Avion points required for a redemption in each category doesn’t fluctuate with the cost of the base fare.

Using the above example of the round-trip flight between Toronto and Lima, even if the base fare was only $900, you would still need to redeem 100,000 Avion Elite points.

Based on this, to extract maximum value from your Avion points when using the Air Travel Redemption Schedule, you’ll want to aim to redeem for base fares that are as close to the category’s maximum base fare as possible.

For this reason, the fixed-rate redemption chart can be particularly valuable for bookings during busy times of year, such as holiday seasons, when travel costs are elevated.

This is because the fixed-rate nature of the Air Travel Redemption Chart allows you to book these more expensive dates of travel for the same number of points as a cheaper date of travel (assuming the base fare remains below the maximum threshold for the category).

Travel Credit

Another option for redeeming your Avion Elite points is for fixed-rate travel statement credits through the Avion Rewards platfo.

By booking through this avenue, most cardholders will receive a fixed rate of 1 cent per point, and if you hold the RBC® Avion Visa Infinite Privilege† or the RBC® Avion Visa Infinite† Business , you’ll have access to a fixed rate of 2 cents per point if you’re booking a business class or First Class flight.

When compared to the Air Travel Redemption Schedule , this may seem like a similar or even slightly worse valuation; however, it can actually prove to be better in certain scenarios.

As we mentioned above, when redeeming Avion points through the Air Travel Redemption Schedule, you are required to redeem the set number of points regardless of the cost of the base fare, as long as it’s under the maximum amount.

Looking at the “Explore North America” category from the Air Travel Redemption Schedule, this means that even if the base fare ends up being less than the $750 maximum listed, you’ll still have to pay the full 35,000 Avion points.

Taking a deeper dive, based on the redemption rate of 1 Avion point = 1 cent, the 35,000 Avion points required for this booking is equal to $350.

This means that if you’re looking at redemptions using the Air Travel Redemption Schedule and you find a base fare within this category for less than $350, you’ll be better off booking the flight on your own and then redeeming your Avion points for a travel credit.

Other ways to Redeem Avion Points

Beyond what’s already been mentioned, RBC provides a number of additional options for redeeming Avion points through the Avion Rewards platform. However, these options are not particularly valuable.

For example, you can use points to send e-transfers, pay bills, add to your existing investments, make a mortgage payment, or even pay off your credit card.

For most of these financial redemption options, you’ll get a value of 0.83 cents per point, and if you want to pay your credit card directly, the value is only 0.58 cents per point.

You can access better value than this by redeeming Avion points for gift cards, with some options offering value as high as 1 cent per point (and occasionally higher during promotions), but the best value can still found by transferring Avion Elite points to partner airline loyalty programs.

One additional option is to redeem Avion points for merchandise, but similarly to the other non-travel redemption options, this doesn’t offer nearly as much value for your Avion points.

RBC Avion is an important rewards program that can help unlock some amazing sweet spots through transfers to partnered airline loyalty programs, such as British Airways Executive Club and Cathay Pacific Asia Miles.

Thanks to its unique set of transfer partners, the relative ease of accumulating points via RBC’s Avion- and ION-branded credit cards, and the frequency of transfer promotions, Avion points are extremely useful to collect as a way to supplement the other major Canadian points programs.

How to redeem Avion Rewards points for financial rewards

When logged into RBC Rewards, if you look under the Shop & Redeem menu, you’ll see there’s an option to use your points for RBC financial rewards. Assuming you have financial products with RBC, you can use your points for the following:

- Add to your existing investments

- Mortgage payments

- Repayment to your line of credit.

It takes 12,000 RBC points to get $100 in financial products which gives you a value of .83 cents per point. At first glance that may seem like a lot, but think about the long term. With mortgage and line of credit payments, you’re basically paying off your loan earlier which you immediately save on the interest. If you’re adding to your investments, you can take advantage of compound interest which could make your redemption very valuable in the long run.

If you use your points for a financial reward that’s put towards your RRSP , you could also get a tax break. Putting in your TFSA would allow you to invest with tax free gains. It’s a win-win situation, but you won’t see the reward for many many years.

Redeeming Avion Rewards points for merchandise, statement credits, and charitable donations

The final three redemption options for your RBC Rewards points are merchandise, statement credits, and charitable donations. Although the RBC Rewards merchandise catalogue is quite large and there are some quality products available, the number of additional points required for the value is not worth it at all. I would advise avoiding using your points for merchandise. That said, there are occasionally discounts on merchandise redemptions, so sometimes the transactions aren’t a terrible deal.

Using your points for a statement credit is an even lower value. It takes 17,200 points to get $100 off your statement. That means your points would be worth .58 cents per point. Unless you’re facing financial difficulties, you’re better off redeeming your points for anything else.

RBC Avion points transfer partners

I love programs that let you convert points to other loyalty programs since it adds flexibility and value. Avion Rewards has one of the most extensive and valuable lists of conversion partners when it comes to Canada’s bank travel reward programs. American Express Membership Rewards is better, in my opinion, but RBC Rewards isn’t far behind.

Here is the list of programs you can convert Avion points to, but note that except WestJet Rewards, only Avion cardholders can transfer their points to the following partners:

- WestJet Rewards : 1,000 RBC points = $10 WestJet dollars

- Hudson’s Bay Rewards : 1,000 RBC points = 2,000 HBC Rewards points (worth $10 at Hudson’s Bay)

If you are an Avion cardholder you can also benefit from these conversion options:

- American Airlines : 10,000 RBC points = 7,000 AAdvantage miles

- Cathay Pacific Asia Miles : 10,000 RBC Points = 10,000 Asia Miles

- British Airways : 10,000 RBC points = 10,000 Avios miles

It’s hard to put an exact value on airline miles since there are so many variables, but generally speaking, their value is around a minimum of 1.5¢ per mile for economy tickets. Often you can get double the value if you’re booking in business class. That said, WestJet Rewards uses a dollar system, so they have a fixed value.

It’s a good idea to log into RBC Rewards often since they have many redemption promotions throughout the year, which boost your points’ value. In addition, RBC Rewards had a few transfer bonuses (10% to 30% bonus points) for Westjet, Asia Miles, British Airways Avios Miles, and American Airlines AAdvantage Miles. That meant you got extra value when transferring your points to a partner.

Of particular interest is how you can transfer your points to WestJet dollars. Nothing stops you from holding an RBC Avion card and the RBC WestJet World Elite Mastercard. Both cards come with good sign up bonuses so you could quickly rack up those WestJet dollars. For example, the RBC Avion card typically has a welcome bonus of 15,000 points which can be transferred to WestJet for $150 WestJet dollars. The WestJet RBC World Elite Mastercard’s standard bonus is $250 and a companion voucher. When you combine the two, you’ll have $400 in WestJet dollars without having to spend much. No purchase is required to get the bonus with the Avion card, and you only need one purchase with the WestJet Card.

Do RBC Rewards points expire?

There’s a lot of conflicting information out there about when RBC Rewards points expire. I have confirmed that RBC Avion points don’t expire as long as you have an active eligible RBC Royal Bank credit card. If you cancel your card, you have 90 days to redeem them before losing them. The first-in, first-out rule you may have read about online is an old outdated article. RBC really needs to delete that page. If you’re unsure when your points expire, you could always call customer service to confirm.

How RBC Avion compares to others

RBC Avion Rewards is easily one of the best travel loyalty programs of Canada’s big five banks. There are many reasons why I rank RBC Rewards so high, including:

- No blackout dates

- No minimum number of points to redeem

- A fixed points flight program

- Many transfer partners to convert points to

- Many promotions for redemptions

- Value of points

In my opinion, RBC Rewards is only second to American Express Membership Rewards . American Express holds the first place because RBC Rewards lacks an option to book travel on your own (you can only book through their portal) and because RBC Rewards credit cards don’t really have any increased earn rates which limit how fast you can earn points. You can also read my reviews of CIBC Rewards , BMO Rewards , TD Rewards and Scene+ to see how RBC Rewards compares.

How to earn RBC Avion Rewards

To earn RBC Rewards, you must have a credit card account that earns you RBC Rewards. As you can imagine, the easiest ways to earn points are via credit card sign up bonuses and everyday purchases you make on your RBC Rewards credit card. Currently, there are six personal credit cards and two business credit cards that will earn you RBC Rewards points. To make things a bit complicated, RBC Rewards has two tiers of RBC Rewards points: regular and Avion RBC Rewards points. Points from an Avion account have more redemption options, and these options are the most valuable ones. With this in mind, the RBC Visa Infinite Avion card is arguably the best card to earn Avion points and is one of the best RBC credit cards .

RBC Avion Visa Infinite Card

- $120 annual fee

- 35,000 Avion points on approval

- Earn 1.25 Avion points for every $1 spent on travel purchases

- Earn 1 Avion point per $1 on all other purchases

- Comprehensive travel insurance

- Mobile device insurance up to $1,500

The sign up bonus for new cardholders is typically 15,000 points which isn’t much compared to some of the best travel credit cards in Canada . That said, the RBC Visa Infinite Avion Card often has promotions where the welcome bonus is 25,000 – 35,000 points, and the annual fee for the first year is waived. Whenever a promo like that comes around, it’s worth signing up for the card.

The earn rate of 1.25 points per $1 spent on travel is decent, while the 1 RBC Reward point earned per dollar spent on all other purchases, including bill payments, is pretty common. Here’s something that many people don’t realize. You don’t need to make any purchases to get the bonus. The terms and conditions say you get it after the first statement.

Another little-known trick is that you can switch from the RBC WestJet World Elite Mastercard to the RBC Visa Infinite Avion Card and vice versa. This is useful if you’re not able to maximize your points and want to try something new. That said, be sure to use up your points before you make any changes.

The RBC Visa Infinite Avion Card also provides good travel insurance when travelling outside Canada. Not only do you get travel medical, but you’ll also be covered for trip cancellation/interruption, delayed and lost baggage, hotel/motel burglary and more. Obviously, some exclusions apply, so read the certificate of insurance for complete terms.

Link to your Petro-Points card

RBC has a deal in place with Petro-Canada where you can save 3 cents per litre at Petr-Canada, 20% extra Petro-Points, and 20% extra RBC Rewards points.

To be eligible, you just need to add your Petro-Points number to your RBC online banking account. You would link your Petro-Points card to all of your eligible RBC debit or credit cards.

Final thoughts

Avion Rewards is one of the best bank travel rewards programs . The RBC Visa Infinite Avion card may not give you the best signup bonus or have the highest earn rate, but there’s no denying that once you have the points, they’re easy to use. There are no blackout dates and no minimum points required to make a redemption, so you’ll never run into any issues using your points. If you’re a fan of RBC, check out my RBC InvestEase review and find out how you can reduce your investment management fees.

About Barry Choi

Barry Choi is a Toronto-based personal finance and travel expert who frequently makes media appearances. His blog Money We Have is one of Canada’s most trusted sources when it comes to money and travel. You can find him on Twitter: @barrychoi

97 Comments

Can you explain more on the comprehensive cancellation insurance for traveling? For flight

What I mean is you get travel medical, trip accident, trip cancellation, lost luggage, etc. You cAN READ THE FULL DETAILS HERE.

https://www.rbcroyalbank.com/credit-cards/travel/rbc-visa-infinite-avion/rbc-visa-infinite-avion-certificate-of-insurance.pdf

Barry choi, What about outright flight cancellation by company with no booking possibility ? this happened to me 5 years ago and Avion card could not do anything!

When saying trip cancellation … talking from whom??

What do you mean by company with no booking possibility? With fight cancellation, it only applies to reasons that are outlined in your insurance policy.

When should I pay for a flight as opposed to redeeming points. I want to go to Vancouver – Honolulu -L.A. – Vancouver. Points 45000 plus $266 Cash $960 Plse advise and thx,Lawrence

45,000 Rewards points would be worth $450 + $266 for taxes = $716. Since the value of your redemption via the fixed travel program is $960, you come out ahead using the fixed program.

How much is 28906 rbcrewards point please

10,000 points = $100 so you have $289 at the base value. Your points are worth more if you use the RBC Rewards Air Travel Redemption Schedule

Hi. I have 10500 pts and I purchased my ticket for $2000 whose base fair is $1400. What’s the best way to go with the schedule?

You need 15,000 points to make a claim within or to an adjacent Province/Territory/U.S. State. That fare has a maximum base price of $350 so you can’t use the fixed redemption schedule.

you could just 10,000 points to redeem $100.

Sorry Barry. I have 105000 points. I missed a zero. Can you please update your response?

If you’ve already paid for your ticket, you can’t use the air redemption schedule. Assuming you didn’t 100K points gets you a flight from any major gateway in Canada/U.S. to destinations in Asia, Australia, New Zealand, South Pacific, Middle East, Africa, South America

Hi Barry, thanks for the article and for all the Q&A work as well !!

I’m looking at making the switch to Amex. I have 160k reward points I’ve saved up over the years. Looking to cash out or use these points up somehow with the best value. Appears as tho 10,000 points for $100 value is about the best offer from RBC rewards? Also, do you know if these points expire if I got rid of my RBC Avion card?

Yup, 10K points for $100 is indeed the best value. You lose all your points if you cancel your card. Your best bet would be to transfer your points to WestJet Dollars or hotels.com giftcards as they have good value.

I product switched to the RBC British Airways Visa almost 4 months ago. My account has remained in good standing however, I haven’t received the welcome bonus of 15k points yet. I have called RBC multiple times and each time I have been told that BA awards the points but when I speak to BA, they say that RBC needs to award the points. Do you have any idea who should be awarding the points? Thanks in advance for any help you can provide.

In theory, it should be BA that actually issues the points but RBC would have to authorize it.

I would advise escalating the case with RBC first to see if that resolves anything.

If I wish to use my Avion Rewards points to pay off my credit card bill, is it straight 100 points/per every $1?

No, it takes 172 points to claim $1 in statement credit so you’re devaluing your points quite a bit if you were to go that route.

Is this card best to earn miles to book a points first class flight from Vancouver to Tokyo?

I just noticed RBC is offering 50% more points if converted to Avios, does the same offer ever happen with AA points?

The 50% bonus is quite rare. I’ve never seen it with AA.

Is it worth it to convert your Avion points to BA Avios given the 50% bonus on until Dec 15th? I live in Vancouver and typically fly to Hawaii in Winter and Europe in summer. Your insight is much appreciated.

If you plan on using those BA points, then yes, it’s a great deal. That said, I’m not sure which airlines you can use BA Avios points to get you from Vancouver to Hawaii.

Hi, is it worth buying the air Canada gift cards at a 10% discount? Are they easy to use and are there any hidden charges / rules to these we should know about?

Buying the gift cards gives you a guaranteed discount of 10%, but you might get better value if you used your points on the fixed travel program. It’s honestly a personal choice but I imagine you wouldn’t have any issues with using the gift cards. As far as I know there are no additional charges or rules, but read the fine print before you commit.

Do my RBC rewards expire at any point

Not as long as you have a credit card account that earns you RBC Rewards active with them that’s in good standing.

RBC Reward points expire after 3 years on a First In, First out basis.

That is incorrect. If you refer to handbook, the first page states that RBC points don’t expire.

https://www.rbcroyalbank.com/credit-cards/travel/rbc-visa-platinum-avion/rbc-visa-platinum-avion-benefits-guide.pdf

The reference to points expiring after 3 years is old and should have been removed from the website.

my mistake, you are correct. I believe my knowledge was outdated.

I just logged into my RBC Rewards and I see that I have a – 69K point balance. How is it possible to end up with a negative reward points balance?? I have never even used my rewards and forgot that it was even available. Any help would be appreciated.

You’d have to check with RBC about that

Do you think it is worth keeping the RBC Infinite Avion card beyond the first year? Is it worth the $120 per annum annual fee considering that I am also paying fees for amex gold card and BMO cash back card?

Thanks for your insight

Hi Viviene,

I personally wouldn’t keep three credit cards with annual fees. Of the three cards you mentioned, I’d probably drop the BMO cash back card but that’s because I prefer travel points. Who do you bank with? Do they waive the fee for any cards?

I bank with BMO but it’s a joint account and the waiver goes towards my partner’s BMO MC world elite card. I figure the cashback we get each year more than pays for the annual fee.

What does RBC Avion offer that justifies its fee? It seems as if it would take a long time to build up any significant number of points.

Well it’s really for you to decide based on your spending. E.g. if you moved all the spending from your cash back card to the RBC card, you could more in points for flights than what the annual fee would cost you. I think the RBC Rewards fixed flight travel chart offers good value especially if you’re looking at short haul flights. However, that may be redundant since you have the Amex Gold which also has a fixed points program.

How would you compared the two fixed points program? I tend to focus on transferring my Amex points to Avios and haven’t really looked at the Amex fixed points program. I also feel that the Amex Gold has more to offer than the RBC card in terms of travel insurance and flexibility on how to use points. But I may be wrong….

Both programs have their sweet spots. Amex is arguably better since you have more transfer partners. The Amex Gold has a slightly higher earn rate on travel. but RBC Rewards has occasional promos where if you transfer your points to BA, you get 25 or 50% more points.

I do agree that the Gold Amex is a better overall card.

Is there anyway I can browse through options for say a vacation package, that would be qualified for if I had 150000 points? For example my 150000 points would allow me to go to Cayo Largo Cuba, or Puerto Plata Dominican Republic or Cozumel Mexico…you get the idea.

It doesn’t give you an option to search for results based on X points. All really allows you to do is search by price from low to high after you’ve selected a country.

I have always been a fan of the RBC Avion program until today when I tried to change a departing flight and was told that all the flights I chose were “not available” although there were clearly seats for sale on both the airline website AND Expedia. RBC only offered a few very poor flight options. I thought “any flight” meant “any flight”. I have never encountered this before. We ended up buying new flights from the airline after spending over 30 minutes on hold, suffering through a painfully frustrating conversation with an agent and draining the battery on my phone.

I’m going to bail on Avion after learning that they recognize an Air Canada fuel surcharge of 570$ per ticket to europe in a time of extended, sustained low fuel prices. It was going to cost me 1100$= in fees when flights can be purchased outright for just over 1600$.

Value lost due to poor decisions at Avion….. adios!

That’s Air Canada’s fault, not Avion.

How long does it take to convert RBC points into Asia Miles? Is it instantaneous or do you have to wait 6-8weeks?

It usually takes 4-5 days for the transfer to Asia Miles

I have around 200k in avion points. I am trying to figure out the best option for using them as we are moving to Europe for a year. I looked into the flights but almost 1/2 goes to the taxes, etc. I was wondering if it was best to use them while we are there for short trips. So, what would be the best value? (ie rental car, hotels, ?), anything else?

Points for flights to Europe are typically of low value due to the fees. Using them within Europe is also not a good value since you wouldn’t be able to use the fixed travel program. You could use the RBC travel portal when you’re abroad and book points at 10,000 points = $100 in travel.

Alternatively, you could convert your points to WestJet dollars at a 1:1 ratio. On occasion, there are promos where you can convert to hotels.com giftcards which can be a good value.

Hi Barry, we have ~250,000 RBC Avion points and I’m trying to maximize getting to FCO (Rome) this summer from YYZ (Toronto.) We also have 90,000 in Aeroplan.

Traveling with a 15 month old so really wanted to optimize for lie-down seats. But they are pricey. ($8000 for two seats on AC’s direct flights.)

Can you suggest a way to optimize our points to make it work?

Flying from Toronto to Europe is one of the worst redemptions regardless of the program due to high airport taxes. With Aeroplan, you need 110K points for a return business flight so that won’t really work.

For RBC, I don’t think you can use your points for business so that doesn’t really help.

The best value I can think of right now and this is honestly not the greatest solution is to consider transferring your points to WJD. If you have the WestJet World Elite Mastercard, you can use the companion voucher for premium economy. I just booked two flights from YYZ to LGW for $2400. Of course, you would still need to get a flight to Rome and you’d only be redeeming your points at a 1% value.

IMO, you’re better off paying cash for this route and saving your points for later.

Help. We have 175000 Avion points. Looking to use them from YVR to LHR. If I use the points for 3 fares return it looks like another $700 each on top !!!! With Aur Canada. Flights in September are approximately $700 each return. Can you give any advice. I have not checked if BA charges the same.

Flights to Europe are a terrible value due to the high taxes. You’re better off saving your points for a different redemption.

Is it possible to use Avion points to pay for an upgrade on an already booked flight? Is it worth it? Looking at this for a flight from Houston to Auckland on Air New Zealand.

You’d have to call and ask. You definitely can’t do upgrades via the RBC Travel portal.

Is there a time limit to redeem accumulated points? And I wld like to purchase a gift card for electronics?

Your points don’t expire as long as you have an active RBC credit card that’s in good standing.

I am a bit lost with car rental points… if my rental was $800.00 how many points would I need

That falls under travel so it would cost you 80,000 points.

Barry, Can RBC Avion Visa Infinite cardholders redeem for a Premium Economy class seat instead of Economy class? Thanks!

RBC Rewards is a full service travel agency so you can book premium economy, but it’ll cost you more points. It’s unlikely you’d be able to book premium under the Air Travel Redemption Schedule since the price would exceed the maximum base price.

Barry, RBC Avion Visa Infinite redemption schedule From Canada to Hong Kong: 100,000 points. Maximum ticket price: $2,000.

Normally the Air Canada Premium Economy ticket from Canada to Hong Kong costs close to (less than) $2,000. It’s not worth to redeem Economy class, which is about $1,000 or less. That’s why I would like to know whether I can redeem Premium Economy class or not.

As long as the base ticket price is below $2,000, you should be able to redeem a premium economy flight using your RBC Rewards points.

Hi Barry, I’m totally torn between Scotia Passport and RBC AVion? Which one do you really prefer if we plan on going US visits and Asian Countries as well?

Both cards a bit different. The Scotiabank card is a good all-in-one card since it has no forex fees, but the RBC Avion has a fixed points travel chart which can be of good value. Since you’re based in Canada, Air Canada/Aeroplan cards are good for US travel thanks to the new Buddy Pass. WestJet companion vouchers can also be handy.

Barry, early thanks for answering my question. I am contemplating on utilizing approx. 111,000 Avion points for Best Western gift cards. I presume the gift cards are in Canadian funds? Travel contemplated is in the U.S. once the ban is lifted. How is the difference in currency handled by U.S. based Best Westerns?

The gift cards are only worth it if you’re getting an equal value to your RBC Avion points. E.g. 1,000 points = $10. Yes, the cards would come in CAD. If you use them outside of Canada, you would be subject to the exchange rate at the hotel which will definitely have a markup.

Avion $350 air fare fee for interprovincial travel is useless to many Canadians outside the Upper / Lower Canada belt. Many interprovincial one way tickets are $350 or more. I’ve amassed nearly a million dollars over the years on my Avion card, and travel with my family of 6, using the points. I always have to wait for airlines to post sale prices before I can use the points, because their reward amount is set too low. Its not a cheap card either. I’ve never complained, but its been the same price system for over 10 years. Hello! Inflation!

Paying the taxes on flights is also a bummer. I’ve often just bought sale priced flights with cash, because the Avion rewards taxes where close to half the flight cash amount. Didn’t see the point in wasting them.

How do I book a business class seat? We’d like to go back to Europe next year and want to fly business class. I have over 300,000 points with Avion.

Two years ago we booked two business class seats after transferring points to British Airlines, What a nightmare!

I swore that I’d move to another point card to get better service, connections, etc.

Please help.

RBC has a travel rewards portal where you’d book your flights and then redeem your points.

Aeroplan is a lot easier these days, it’s worth considering switching to a card that earns you Aeroplan points.

We have 215000 points with RBC and travel to Mexico, US and are thinking of going from Edmonton to Amsterdam and returning to Edmonton from Rome. What are the best way to use our points. Is transferring points to Westjet a better deal than buying Westjet gift cards .

To maximize your value, you should use the RBC Air Trave Redemption schedule – https://www.rbcrewards.com/#!/travel/redemptionSchedule

It’ll cost 65,000 points to get to Europe with a max ticket value of $1,300. That works out to 2 cents a point which is double the normal value.

Ad for WJD, it’s a better value to transfer your points directly instead of buying gift cards

Any luck with product switching lately and receiving the welcome bonus of 15,000 points for Avion Infinite?

Darn. Seems to still work for WJ MC. Perhaps makes sense to PS to a no AF card and then cycle back.

I recently “purchased” airline tickets using Avion points. Unfortunately I mistakenly selected the Flexible Points Pricing and as a result ended up using roughly twice as many points as would have been needed under the Fixed Points Pricing. The difference is somewhere around 35,000 points. I requested that Avion reverse this mistake but was advised that it was their policy to not allow such a change. I requested to talk to a manager, but they basically advised that this wasn’t going to happen (they told me it would take 6 weeks). Any advice.

Unfortunately, it’s unlikely they’ll reverse the charges. This happens with all points programs.

Hi Barry… I have over 1 Mil points… and on flight can I upgrade to Exec or 1st Class with my points ?? I don’t see it anywhere when i am looking at the booking … Any ideas. Thanks Mike

In the RBC Avion travel portal, you should be able to choose premium economy or business class seats for your flights.

What are the pros & cons of flex points vs flexible points booking w Avion? How do I know which we should use?

All rbc rewards and avion rewards points can be used on any travel purchase made through the RBC travel portal.

I have been reading your awesome feedback from Avion customers! I recently tried to receive information from the RBC Rewards program call centre and it was horrific – unprofessional and unknowledgeable agents, transferring me first to Expedia and then to Air Canada. They wore me down. I then went online and read reviews on the performance of the program – from what I saw, every customer who had to make a change on their travel booking experienced exactly the frustration I did.. Has this program gone down hill in recent years on their customer service assistance?

The program itself is fine, but I imagine every travel operator is experiencing customer service issues. I guess the real problem is knowing who to call. If you book travel through the Avion travel portal, technically speaking, you will go through them to make changes even if you booked an Air Canada flight.

Hi Barry, I’m unsure whether to use my avion infinite Visa card to pay a Europe bike tour purchase as the surcharge is 4 percent or pay with an e-transfer. The foreign currency rate I’m billed at was 1.49. I look forward to your response. Also, if I pay with an e-transfer will I have any travel protection? Thanks in advance! Barbara

Hey Barbara,

A 4% surcharge is quite a bit. That said, an e-transfer may come with fees too. I personally would just choose what’s cheaper. That said, if you don’t pay with your credit card, you don’t get any protection if you need to cancel your tour for a qualifying reason.

Hi Barry, Thank you for your responses. I really appreciate it! Barbara

Regarding financial rewards, more specifically applying a credit to an existing RBC mortgage: is the cash value going to be considered a lump sum payment or something else? I ask this because the options to pay down a mortgage faster are limited to double-up payments upon each scheduled payment, and one lump sum payment (aka prepayment) of up to 10% of the initial principal per year. I already used my yearly lump sum and I’m concerned that I wouldn’t be allowed to redeem my Avion points towards my mortgage or I may be allowed to do so, but I could be issued a penalty for not following the rules. I couldn’t find anything online about what the value of the points redeemed is considered to be.

Hey Stephanie,

If I had to guess, it would count as a prepayment. You’d have to call them to find out for sure.

Too old to travel. So thinking of using my Avion points to buy RBC merchandise. How can I see what is available if I don’t do any banking transactions on a computer?

You need to go to the RBC Avion website to see what items are available for redemption – https://www.avionrewards.com/index.html

On the web site that I see, the first thing that they want is your Visa number. And that is exactly why we don’t do money matters on line.

Avion Rewards is a credit card rewards program. Using your credit card number is how you log in.

Hello I redeemed 130,000 points for a flights to Barcelona from Toronto and had to cancel. What is the value of these points so that I can make a travel insurance claim

That’s a value of $1,300.

Hi Barry, Thought you might be interested in my experience being transitioned from HSBC World Elite MC to RBC Avion Visa. Since I don’t have anything that spells out the fees, conversion rate, etc. I called the RBC conversion team. They are waiving the $120 annual fee for the first year and that’s it. Although the HSBC card did not charge the 2.5% foreign conversion fee, the RBC card does. The extra points which HSBC gave for travel expenses are likewise not available with the RBC card. It seems to me that if I wanted this card I would be better off applying for it and getting the bonus. Very disappointing.

You should have received paperwork about the details of your new card. HSBC World Elite MC holders being switched the Avion Visa Infinite will still get no FX fees on their card.

You’re correct about losing the travel credit after the first year.

The Avion card is a clear downgrade, I mention a few other options in this article – https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-hsbc-clients-may-not-love-their-new-rbc-credit-cards-but-rbcs-avion/

Thanks Barry. I don’t subscribe to the Globe but I assume you suggested the Scotiabank Passport Visa as an alternative. I don’t want to take up your time with all this but I applied for the Scotia card and it developed into a real mess. I’m still trying to find out what happened, currently waiting to hear back from their Escalated Customer Concern team.

I suggested a few.

The Amex Cobalt for high earn rate, Rogers Mastercard for Costco (if you use Rogers), and Platinum for high end travel benefits. If you want no FX, the Scotiabank card is indeed good, but I like the EQ Bank card cuz it has no fees.

I’ll def check into the EQ card, thanks again.

Leave a Comment Cancel Reply

Get a FREE copy of Travel Hacking for Lazy People

Subscribe now to get your FREE eBook and learn how to travel in luxury for less

RBC Rewards

RBC Rewards is a powerful points program, and easily one of the best among the big 5 banks in Canada. These points can be redeemed for travel, gift cards, and much more.

There are two types of RBC points that are earned from different families of credit cards:

- RBC Avion Elite points (higher tier)

- RBC Avion Premium points (lower tier)

RBC Avion points can be redeemed for travel and also transferred to other airline partners, while general RBC Rewards points cannot.

RBC credit cards that earn Avion Elite points will have Avion in their name, such as the RBC Avion Visa Infinite credit card. On the other hand, there are RBC credit cards that earn Avion Premium points such as the RBC ION+ Visa credit card.

Throughout this page, we will use the term “RBC Rewards” to refer to both tiers of points to be consistent. However, we will note any differences between the two sets of points in the relevant sections below.

Earning RBC Rewards Points

There are two main ways in which you can earn points in the RBC Rewards program: credit card welcome bonuses and organic credit card spending.

Credit Card Bonuses

The most effective method to earn RBC Rewards points is through earning the welcome bonus on a RBC Rewards credit card. There are many RBC Rewards cards to choose from.

The most popular RBC Rewards credit cards are the RBC Avion Visa Infinite and RBC Avion Visa Platinum credit cards as they tend to offer the most bonus points and benefits for the lowest annual fee.

Credit card bonuses may also be earned through product switching .

Credit Card Spending

The RBC Rewards credit cards have a standard earning structure in that a set amount of RBC Rewards points are earned for every dollar spent on all everyday purchases with no extra points for spending in specific categories (such as groceries or transportation).

There is one exception as some RBC Rewards credit cards, such as the RBC Avion Visa Infinite, will earn 1.25 points for travel purchases, and the RBC Avion Visa Infinite Business/RBC Avion Visa Infinite Privilege cards earn 1.25 points on all purchases.

RBC Rewards Credit Cards

The table below shows the best RBC Rewards earning credit cards available. The RBC Avion Visa Infinite is arguably the strongest card with a very strong current welcome bonus. It also earns 1 point per dollar and 1.25 points for travel purchases.

Redeeming RBC Rewards Points

RBC Rewards is a highly flexible points program and can be redeemed for travel in a variety of ways, as well as redeemed for other types of rewards including financial rewards, merchandise, and gift cards.

As with most bank point programs, travel provides the highest redemption value. RBC Rewards can be redeemed for travel in three ways:

- Air Travel Redemption Schedule (Fixed Travel)

- Flexible Travel Reward

- Transfer to Airline Partners

Air Travel Redemption Schedule (Fixed Travel)

The RBC Air Travel Redemption Schedule provides the greatest value for redeeming RBC Rewards points for flights. However, as the name suggests, there are a few more rules to follow when redeeming your points this way. First of all, you can redeem RBC Rewards for one-way, round trip, and multiple destinations flights.

How many points are required for redemption through the Air Travel Redemption Schedule is fixed and based on the particular destination, according to the chart below. For a given destination, there is a maximum ticket price that the points can be redeemed for – this does not include taxes and fees.

If you exceed the maximum ticket price, you can pay the difference in points at a rate of 100 points = $1 CAD (the flexible travel rate). You can also pay for flight taxes by redeeming your points at this same rate of 100 points = $1 CAD.

There is one other restriction with the Air Travel Redemption Schedule: you must make the booking a minimum of 14 days before the departing flight. Keep this in mind when considering whether to redeem RBC points for flights using this method.

How to Redeem RBC Rewards Points Using the Air Travel Redemption Schedule

In order to make a flight booking using the RBC Rewards fixed travel program, you will need to go to the RBC Rewards Travel portal , which is powered by Expedia.

In order to initiate a flexible travel rewards booking, log into RBC Rewards and click “Travel Home” on the top bar. From there, click on the “Book Travel” button.

This will take you to the RBC Rewards Travel portal page. From here, you will be able to search for flights, hotels, car rentals, and vacation packages. In order to redeem through the fixed travel redemption program, you will need to click on flights.

From here, fill in your desired routing, dates, number of passengers, and ticket class, and click “Search” to generate a list of flights.

Once you can see the list of flights, you will see the total point cost using the fixed travel redemption in addition to the taxes and fees on the ticket. At the top of the screen, you can flip between fixed points pricing and flexible points pricing to determine which is the better deal.

In this case, fixed points pricing has all itineraries at 35,000 RBC Rewards points (as one would expect per the chart above).

On the other hand, if we were to make this booking with flexible rewards, we would be paying at a minimum an additional 21,000 RBC Rewards points. This is where the fixed rewards chart really shines.

Once we go through the portal and select our outbound and inbound flights, we are presented with a page summarizing the flights chosen and the total price. On the right-hand side, you can confirm that you are using the fixed travel redemption method by looking at the total point cost. Since this is an economy roundtrip fare within North America, 35,000 is the correct amount of points. From here, click “Check Out” to complete the rest of the booking process.

For this booking in particular, I was effectively able to redeem 35,000 RBC Rewards for $413 in base fare value (roughly 0.0118 cents per point). Since you can cover up to a $700 base fare with the 35,000 RBC Rewards fixed flight redemption, there is some additional value that could be extracted with the right flight. But if you were just looking to travel to Los Angeles, this is a great value for your points.

It is important to note that any flights that do not qualify for the Air Travel Redemption Schedule will automatically have flexible points pricing applied.

Flexible Travel Rewards

The other way to use RBC Rewards points for travel is through the flexible travel reward chart. This method allows you to redeem your RBC Rewards towards virtually any flight, hotel, car rental, and other travel expenses at a rate of 100 RBC Rewards points = $1 CAD (RBC sometimes refers to this as the “1% rate”).

So for example, 25,000 RBC Rewards points can be redeemed for $250 CAD worth of travel. What makes this method even more flexible is that you can pay for travel using any combination of points and payment via credit card.

In general, you would only want to redeem RBC Rewards points for flights using this method if your flights do not qualify for the Air Travel Rewards Redemption Schedule. Alternatively, you may already have lots of airline points from other programs like Aeroplan and prefer to use your RBC points for a hotel stay, car rental, cruise, or vacation package.

Also of note, holders of the following credit cards actually get a special 2x rate for flexible travel redemptions used towards Business (J) or First Class (F) airline tickets, meaning they can redeem 100 points for $2 CAD:

- RBC Avion Visa Infinite Privilege

- RBC Avion Visa Infinite Business

- RBC Commercial Avion Visa

How to Redeem RBC Rewards Points for Flexible Travel Rewards

Redeeming RBC Rewards for flexible travel rewards can be done entirely through the RBC Rewards Travel portal , which is a search engine powered by Expedia. In order to redeem points through this method, you do need to book through the portal and cannot apply points to a pre-existing booking made elsewhere.

This will take you to the RBC Rewards Travel portal page. From here, you will be able to search for flights, hotels, car rentals, and vacation packages. The process is the same no matter what you are redeeming your RBC Rewards for.

For our how-to, let’s take a look at booking a hotel in Las Vegas for August. Select “Stays” at the top, and select the desired destination, your dates, and the number of travelers. Click “Search”.

Once you search, a variety of hotels will be displayed that meet your travel criteria. You are able to filter or sort if desired to find the perfect hotel to suit your needs. Once you find the hotel you are interested in, click on it to be brought to the hotel-specific page with property details and room types that are available for this booking.

Scroll down and you will see the rooms that are bookable. Once you find the one that you like, click on Reserve to be taken to the payment page.

Once you are on the payment page, this is where you can elect to use your points to pay for the booking through the flexible travel rewards option. You are able to use a portion or all of your points when making a flexible travel booking, however, the default is to use all of your points (or the maximum number of points to pay the booking off completely).

As you update the points and cash payment split, the price summary on the right-hand side of the screen will update. This will give you insight into what you will be paying for this booking when you confirm in addition to any on-property fees (such as a resort fee in Las Vegas).

Once you are happy with the price summary, simply fill in the rest of the details and click “Complete Booking”. Any applicable points will be withdrawn from your account and you will receive an email confirmation of the booking.

Convert RBC Rewards to Airline Partners

If you are pursuing a flight redemption on another airline, you might find value in converting your RBC Rewards points to a specific airline loyalty program. RBC Rewards is partnered with American Airlines AAdvantage, British Airways Executive Club, Cathay Pacific Asia Miles, and WestJet Rewards.

You can convert RBC Rewards points at the following rates:

The RBC Rewards program also offers transfer bonuses from time to time. For example, in recent years we have seen promotions that give cardholders an extra 30% British Airways Avios Miles when transferring. This can create some strong value propositions in making dream trips much more accessible, such as redeeming Avios for Qatar Airways Qsuites .

If you hold any of the RBC Avion credit cards, you will be able to transfer to any of the partners listed above. On the other hand, if you hold a card that earns Avion Premium points, you will only be able to transfer your points to WestJet Rewards. (However, you can fix this by either switching the card to an Avion card or by applying for another Avion card and transferring the Rewards+ points to the Avion card).

You can see the current transfer ratios, including any bonus promotions, by viewing our Miles & Points Transfer Partner Tool .

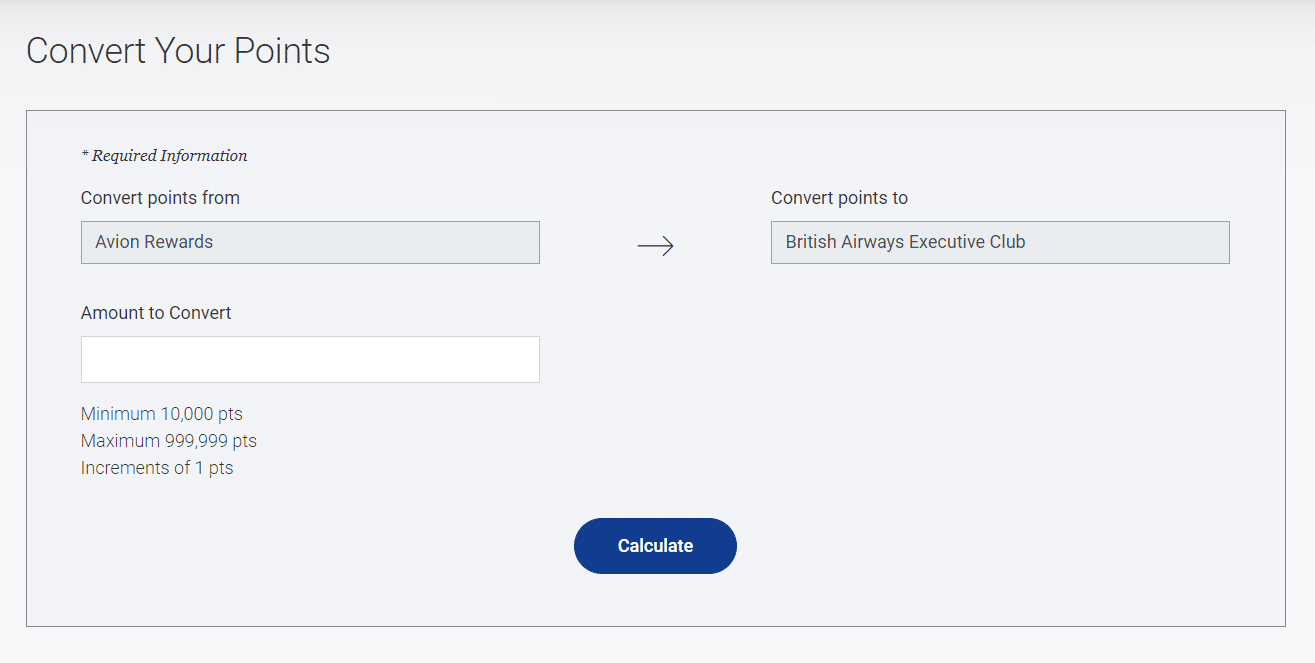

How to Convert RBC Rewards to Airline Partners

To convert your RBC Rewards points to airline partners, go to the ‘Shop RBC Rewards’ portal. You can access this from the account summary page of any of your RBC credit cards.

Then from the RBC Rewards portal home page, select ‘Manage Points’ from the main navigation menu and then ‘Convert Points’ from the submenu.

From the next screen, you’ll be prompted to select which loyalty program you would like to transfer to and then the number of points. You will also be prompted to input your membership number for whatever program you are transferring points to, as well as an email address for confirmation (optional).

RBC often offers promotions of 20-25% off on gift card costs for various retailers so there may be value there (which is atypical as for most points programs, redeeming points for gift cards offers terrible value).

The best value is consistently hotels.com or Fairmont as both can be purchased at 1 cent per point without any promotions required. However, there have been previous promotions for hotels.com and Fairmont, in which we have seen up to 25% off.

If you have a Rewards+ earning RBC credit card (not Avion), you can also redeem at 1 cent per point for Amazon.ca gift cards.

Other Redemption Options

RBC Rewards can also be redeemed for merchandise, a statement credit, or financial rewards. These methods are not viable from a value perspective and it is strongly recommended that you do not redeem RBC Rewards using any of these methods as you are effectively throwing money away.

The RBC Rewards merchandise catalog has various products to purchase with points. The value for redeeming points for merchandise varies widely but is generally underwhelming and not recommended. You would be better off redeeming points for a gift card and purchasing the merchandise outright on many occasions.

Points can be redeemed towards a statement credit for your Royal Bank of Canada credit card account. If you were to redeem points through this method, 10,000 RBC Rewards points would be worth a $58 statement credit. It doesn’t take a mathematician to understand the terrible value that this offers.

Finally, RBC Rewards can be redeemed towards RBC financial rewards. This means that if you hold a mortgage, personal loan, or registered account with RBC, you can redeem points to financially fund that account. If you were to use this option, 10,000 RBC Rewards points would be worth $83 in your financial account. Again, not a great value when you can easily redeem points for at least 1 cent per point.

Frequently Asked Questions

As long as you hold an active RBC Rewards or Avion credit card, the points tied to that card will not expire. If you cancel an RBC credit card that still has points remaining, you will have 90 days to either redeem those points or transfer them to another active RBC Rewards or Avion credit card that you hold.

RBC Avion Elite points are RBC Rewards points earned by Avion cardholders. They are a higher tier of points than the basic RBC Avion Premium points and, unlike RBC Rewards, Avion Elite points can be redeemed for travel and also transferred to other airline partner programs.

You can redeem points to redeem for flights through two methods: via the fixed travel award chart or the flexible travel option. The fixed travel award chart allows you to redeem points for round-trip flights to destinations around the world for a set amount of points and up to a certain ticket value. For example, a round-trip economy flight anywhere in North America will always cost you 35,000 RBC Rewards points. The ticket can have a maximum value of $750 CAD. Flexible travel redemptions allow you to redeem points at a rate of 100 RBC Rewards = $1 towards any travel booked through the RBC Rewards travel portal.

Some select flights are not available to book on RBC’s Travel portal. If this is the case, you can instead opt to book the flight yourself and receive statement credit from RBC in exchange for your points. To do this: 1. Navigate to Support from the RBC Travel homepage 2. Select the popular topic “Book with a statement of credit on an Avion flight” 3. Go through the process outlined therein You must call and receive authorization from an RBC travel agent before making the booking. Then you must complete a manual form before you will be credited with statement credit and the appropriate amount of RBC points removed from your account. This method can be used to redeem using the Air Travel Redemption Schedule rates or the 1% flexible travel rate.

Yes, you are able to combine RBC Rewards points between any RBC Rewards credit cards that you hold. When you log into RBC Rewards, click “Transfer Points” and you will be able to choose the account you want to transfer points from and the destination account. You can also quickly combine points between all of your accounts using this feature.

No, you cannot transfer points to a different cardholder.

The value of an RBC Reward point varies, depending on how you choose to redeem them. We recommend using a base value of 1 cent per RBC Reward point when making your redemptions.

The RBC Rewards program team can be contacted via phone at 1-800-769-2512.

Posts about RBC Rewards

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Subscribe to our newsletter .

This site uses Akismet to reduce spam. Learn how your comment data is processed .

5 comments on “ RBC Rewards ”

I just tried the RBC Rewards Travel Portal to see how much a fixed point redemption would cost and it was not as advertised. One person, return trip from Vancouver,BC to LHR leaving Dec 16th and returning Dec 23rd, 2023 would cost 65,000 fixed points (should be worth up to $1,300 excluding tax and fees) plus $935.66 out-of-pocket. I compared this against Expedia and the out-of-pocket trip cost would be $1,140.66 (breakdown is $805.00 in air transportation charges, plus $335.66 for taxes and fees). So, the 65,000 RBC Avion points only saves me $200 in travel costs – this is pathetic! It should have saved me the $805 flight cost! What is going on here; is RBC devaluing their own points? …I ‘m considering changing credit cards if this is the case. Thanks for your advice.

$1300 is the max ticket price, not the guaranteed value. Are you comparing the exact same flight on Expedia and on RBC? The $935 out of pocket seems strangely high but I wonder if its on an airline like BA which have notoriously high taxes and fees. You’d be better off booking a flexible travel redemption and taking $650 off instead.

Personally I find best use of RBC to be transfers to airline partners like BA Avios, Cathay, etc.

Hi Reed. Thanks for your reply. Maybe I’m not quite understanding the ticket price vs guaranteed value. To clarify, the comparison was for the exact same flights, carrier (Air Canada), and dates. Expedia “Air transportation charges” (I assume this is the ticket price portion?) showed as $805 so this was what I expected RBC to cover but they don’t. I did another comparison tonight with different dates (July 6-20, 2024 flying with Iceland Air) and the Expedia cost was $976 for “Air transportation charges” plus $277.96 for “taxes and fees” (total cost $1,253.96). RBC wants 65,000 points plus $621.96. So, out of the total cost of $1,253.96 RBC is only covering the difference of $632 with my 65,000 points (about a 1% points vale); still extremely terrible “value” from RBC. They should cover the $976 flight cost. What am I missing? Can I send you a screenshot? Thanks again.

Yes – I emailed you.

I was not allowed to choose Level of economy flight from basic to the next two levels of economy this is a situation on Air Canada site that allows me to increase my level of comfort

Editorial Disclosure: Opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities. For complete and current information, please consult the entity's website.

RBC Avion : How to Use Your RBC Avion Points for Travel Rewards

RBC Avion Rewards Credit Cards

There are several RBC Avion credit cards part of the Avion Rewards program . One of the best is the RBC Avion Visa Infinite Card .

It has excellent insurance, including one for mobile devices, which is rare. In addition, as a welcome offer, it offers a lot of points with little effort.

Other cards that earn Avion Points are:

- RBC Avion Visa Infinite Card

- RBC ION+ Visa Card

- RBC ION Visa Card

- RBC ® Avion ® Visa Infinite Privilege* Card

- RBC Avion Visa Platinum

- RBC Avion Visa Infinite Business Card

- RBC Avion Visa Business Card

With this offer for the RBC Avion Visa Infinite Card, you can earn 35,000 Avion points upon approval . No purchase necessary!

You can use your Avion Rewards points for travel or redeem them with other loyalty programs such as :

- American Airlines AAdvantage

- British Airways Executive Club (and Qatar Airways Privilege Club)

- Cathay Pacific Asia Miles

- WestJet Rewards

The current welcome offer, for example, gives you the equivalent of 35,000 British Airways Avios or 350 WestJet Dollars .

With the RBC Avion Visa Infinite Card, you earn 1 point per dollar and 1.25 points for travel purchases.

What’s more, you’ll benefit from a wide range of insurances: trip cancellation and interruption insurance, out-of-province or out-of-country emergency medical care insurance, collision and damage insurance for rental vehicles, and mobile device insurance.

How to Use Your Avion Points for Travel Rewards

Use the fixed fare chart for airline tickets.

One way to use your Avion points for travel is with the purchase of an airline ticket. This is the best way to get the most value out of the RBC Avion Rewards program . This is described in detail in this article .

Depending on the destination, 15,000 to 100,000 Avion points are required per ticket.

RBC Avion Rewards points can be used to travel anywhere in the world with a round-trip ticket. A one-way trip requires half as many Avion points. Here is the airfare table for a round-trip flight:

On average this equals about 2 cents per Avion point .

Use the Flexible Fare Chart for Airfare

The Flexible Fare Plan uses 100 Avion points for a $1 discount on your airfare. The transaction must be made directly on the Avion Rewards website, using the flight search tool.

For example, with the flat rate fare, 35,000 points will get you a round-trip ticket anywhere in Canada and the U.S., up to a value of $750.

If you choose to purchase that same $750 ticket with the flexible fare structure , you will need 75,000 points. So using the flexible fee schedule would be more of a disadvantage in this case. It’s up to you to make your calculations, depending on the number of points you have banked.

Redeem Avion Points for Any Trip

For even more flexibility, book your hotel, car rental, cruise or airline tickets as you wish on the Avion Rewards site to have your account credited.

Avion credit cardholders can redeem 100 Avion points to deduct $1 from this travel expense. For example, for a night at the hotel that cost $200, 20,000 points are required to bring the balance down to zero.

For ION and ION+ credit card holders, it’s different. They redeem their points using a conversion rate of 172 points = $1.

Buy Gift Cards

There are approximately 250 gift cards to purchase with Avion points. About ten of these geared towards travel. For example, buying a gift card for future stays at Fairmont or Best Western hotels. Or Tim Hortons, for roadtrips !

Generally, the cost is 1 cent per Avion point, so 5,000 points for a $50 gift card .

Uber is different, with 7,000 points for $50.

Transfer to Other Airline Loyalty Programs

Did you know that it is possible to transfer your Avion points to other airline loyalty programs? We explain how in our tutorial on this subject:

Another way of exchanging RBC points in the event of technical problems

Occasionally, the Avion Rewards site may experience technical difficulties or your flight may not appear in the search results.

During that time, call Avion Rewards Customer Service at 1-800-769-2512.

- Get an authorization number to book the flight you want;

- Book your own flight directly on the desired airline’s website;

- Send an e-mail to [email protected] with your authorization number obtained earlier from Customer Service, your name, the number of tickets reserved, proof of ticket purchase and itinerary details.

Avion Rewards will then deduct the required points from your RBC Rewards points account to credit the cost of your airline tickets, according to their fare structure.

Frequently asked questions about the Avion Rewards program

How many avion points are needed for a free airline ticket.

Depending on the destination, 15,000 to 100,000 Avion points are required.

Can I buy a ticket for another person?

Yes , make sure that the person’s personal information is written down perfectly at the time of booking.

What is the definition of a basic Avion Rewards account?

These are the people enrolled in the Value Program , who earn Avion Rewards points.

Where can I redeem my Avion Rewards points for travel?

Go to the site Avion Rewards or click on the Avion Rewards icon in your RBC Direct Banking session. Then go to the Travel section.

All posts by Caroline Tremblay

Suggested Reading

By Sandra MacGregor

Fact Checked: Scott Birke

Updated: May 13, 2024

Play article

( mins)

( )

More rewards programs

- Best travel rewards programs

- Best loyalty rewards programs

- Best Aeroplan credit cards

- Aeroplan guide

- Best Air Miles credit cards

- Air Miles guide

- Scene+ guide

- Aeroplan vs. Air Miles vs. Avion

RBC Credit Cards

- Best RBC credit cards

- RBC Avion Visa Infinite review

- WestJet RBC World Elite Mastercard review

- RBC ION+ Visa review

- RBC Visa Platinum Card review

Avion Rewards guide 2024

Rbc rewards are now avion rewards.

RBC Avion Rewards, overseen by the Royal Bank of Canada, the biggest of the Big Five banks, is one of the most popular loyalty programs in Canada. Though it offers an impressive variety of redemption options overall, the program is particularly appealing to frequent fliers who covet the bank’s Avion credit cards. Whether you’re a more casual Avion Rewards earner or a seasoned jet setter, our RBC Avion Rewards guide will help you decide if Avion Rewards is the loyalty program you’ve been looking for, or if you should keep up the hunt for the perfect spending and travel companion.

How do you earn Avion Rewards points?

The best way to earn RBC Avion Rewards points is by making purchases with an RBC Avion credit card such as the RBC Avion Visa Infinite and RBC ION+ Visa. Our full list below and summary RBC Avion Rewards chart shows all the RBC credit cards you can use to rack up points and how much they earn.

- RBC Avion Visa Infinite

Get notified about new welcome offers by email

- Rates & Fees

- Eligibility

- Pros & Cons

Earn 1 Avion point for every dollar you spend*.

extra Avion points on eligible travel purchases

mobile device insurance

savings on fuel at Petro-Canada and always earn 20% more Avion points

Be Well points for every $1 spent on eligible products at Rexall

off at Hertz and earn 3x the Avion points

delivery fees for 12 months from DoorDash

Purchase APR

Balance Transfer Rate

Cash Advance APR

Annual Fee $50 for each additional card

Recommended Credit Score

Required Annual Personal Income

Rewards program is highly flexible, transferable, and includes a slew of non-travel-related reward options

Partnerships with other retailers like HBC and Petro-Canada

Provides excellent travel insurance

New cardholders earn 35,000 welcome Avion points on approval*

Solid option for looking for a travel-centric points program

The points-to-dollars ratio is only average and there are few opportunities for accelerated earning.

The $120 annual fee isn’t cheap

High annual income requirement: Personal: $60,000 or Household: $100,000

- Card details Less details

- RBC ION+ Visa

Avion Ion points† per $1 on qualifying grocery, dining, food delivery, gas, rideshare, public transit, EV charging, streaming, digital gaming and online subscriptions

Avion Ion point per $1 on all other purchases

Balance Transfer Rate 21.99 for Quebec residents

Cash Advance APR 21.99% for residents of Quebec

Annual Fee $4 per month

Full list of Avion Rewards credit cards that earn Avion points

The following RBC Royal Bank credit cards earn Avion points on net purchases and are points-earning credit cards:

- RBC Avion Visa Infinite Privilege

- RBC Avion Visa Infinite Privilege for Private Banking

- RBC Avion Visa Platinum

- RBC ION Visa

- RBC Rewards Visa Preferred

- RBC Visa Gold Preferred

- RBC Visa Platinum Preferred

- Signature RBC Rewards Visa

- RBC Rewards Visa Gold

- RBC Rewards+ Visa

- RBC U.S. Dollar Visa Gold

- RBC Visa Classic II

- RBC Visa Classic II Student

- RBC Mike Weir Visa

- RBC Avion Visa Business

- RBC Avion Visa Infinite Business

- RBC Royal Bank Visa CreditLine for Small Business

- RBC Commercial Avion Visa

Refer to RBC Page for up to date offer terms and conditions.

There's no distinction between the points earned from a standard RBC card vs. an Avion card, like the RBC Avion Visa Infinite . Both cards earn Avion Rewards points—though some Avion cardholders may mistakenly refer to their points as such. The difference between an Avion card and a standard RBC rewards card is that Avion cards are intended to appeal to those looking specifically for travel rewards cards. Avion cards have higher annual fees, better welcome offers, and feature additional travel-friendly perks (like good travel insurance packages and exclusive experiences). Finally, though both Avion and non-Avion cardholders use the same travel portal to redeem points, Avion cardholders get better value for their points when redeemed for travel.

If you don’t feel comfortable using credit, keep in mind that you can still earn RBC Rewards points with a debit card. If you enrol an eligible RBC bank account (such as the RBC Day to Day Banking or Advantage Banking accounts) in the Value Program you can earn RBC points every time you use your debit card.

What can Avion Rewards be used for?

Avion Points value varies substantially depending on how they are redeemed, and Avoon Rewards can be redeemed for a wide variety of purposes, including travel, merchandise, charitable donations, paying with points and gift cards. You can also use the Avion Rewards ShopPlus browser extension to earn money back when shopping online.