Check your browser settings and network. This website requires JavaScript for some content and functionality.

Bulletin – December 2022 Australian Economy The Recovery in the Australian Tourism Industry

8 December 2022

Angelina Bruno, Kathryn Davis and Andrew Staib [*]

- Download 940 KB

The Australian tourism industry is gradually recovering from the COVID-19 pandemic that brought global travel to an unprecedented standstill. International tourism fell sharply in early 2020 and has only slowly recovered since restrictions were lifted in the first half of this year. By contrast, domestic tourism spending bounced back quickly as local restrictions eased and is now above pre-pandemic levels. This article outlines the recovery in the Australian tourism industry following the pandemic, the challenges the industry has faced in reopening, and the uncertainties around the outlook for the tourism industry over the next few years.

Introduction

Restrictions to contain the spread of COVID-19 and precautionary behaviour by consumers significantly disrupted the movement of people both domestically and internationally during the pandemic period. This had a devastating impact on many Australian businesses that provided services to domestic or international tourists. Nevertheless, many of these businesses have shown considerable resilience and flexibility, aided by a range of government support packages, and are now expanding to service the recovery.

This article presents a snapshot of the tourism industry through the pandemic, before focusing on the recovery over the past year. While international tourism is recovering only slowly, domestic tourism spending has rebounded strongly – to above pre-pandemic levels – as many Australians have chosen to take domestic rather than overseas holidays. The article draws on information from the Bank’s regional and industry liaison program to discuss the challenges the tourism industry has faced in meeting this sudden increase in demand, and the outlook for tourism activity over the next few years. Many tourism businesses have found it difficult to quickly scale up to meet demand, and these supply constraints have limited tourism activity and led to higher prices. Looking ahead, a continued recovery in tourism activity is expected as supply-side issues are gradually resolved and international tourism picks up further. However, there are a number of uncertainties around the timing and extent of this recovery.

International tourism

The onset of the COVID-19 pandemic led to a sharp drop in international tourism, as governments around the world implemented travel and border restrictions (Graph 1). In April 2020, international tourism arrivals declined globally by around 90 per cent and Australia’s international tourist arrivals effectively came to a standstill for several months.

The timing and extent of the recovery in international tourism has been uneven across the world, as national governments removed restrictions at a different pace. Globally, international tourism arrivals picked up to be around three-quarters of their pre-pandemic levels by September 2022. In Australia, international tourist arrivals rose slightly in mid-2021 under the temporary operation of the Australia–New Zealand travel bubble, and also in November 2021 as border restrictions eased in some parts of the country. However, it wasn’t until February 2022 – when Australia removed border restrictions for vaccinated persons – that arrivals began to substantially pick up. Since July 2022, people have been able to travel to and from Australia without being required to declare their vaccination status.

Short-term overseas arrivals to Australia (which include tourists but also those visiting for less than 12 months for business, education and employment purposes) picked up to be around half of pre-pandemic levels by September 2022 (Graph 2). However, short-term departures of Australian residents have picked up more quickly than short-term arrivals of overseas visitors, and so the net outflow of travellers has been larger than pre-pandemic levels in recent months.

Reasons for travel

The recovery in short-term travel to and from Australia has been particularly pronounced among those visiting friends and relatives (VFR) (Graph 3). VFR accounted for just over half of all international visitors’ spending over the year to June 2022, whereas it accounted for just under one-fifth in 2019 (Table 1). Short-term travel for business and education purposes has also picked up. However, the recovery in outbound business travel (including conventions and conferences) has outpaced inbound business travel, with relatively few major business events held in Australia in 2022. Short-term travel for employment reasons has almost fully recovered to its 2019 levels. By contrast, the number of visitors arriving in Australia for holidays has picked up only slightly, to be around one-third of its pre-pandemic level (holiday visitors accounted for only 10 per cent of international visitor spending over the year to June 2022, compared to nearly 40 per cent in 2019).

Working holiday makers and international students who are in Australia for more than a year are not included in the short-term arrivals data, but they make a significant contribution to tourism spending. According to Hall and Godfrey (2019), visitors who state the main purpose of their trip as education stay longer and spend more than leisure and business tourists. International students and individuals on working holiday visas have a high propensity to travel within Australia, and often their friends and relatives come to visit. The number of international students and working holiday visa holders in Australia has risen to be around two-thirds and one-half of their pre-pandemic levels in the September quarter of 2022, respectively.

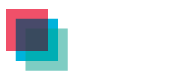

The recovery in international visitors to Australia has been uneven across source countries, reflecting both travel restrictions and the quicker recovery in VFR relative to other types of travel (Graph 4). The recovery in the number of visitors from India, New Zealand and the United Kingdom has been faster than for other countries, possibly due to the close relationships residents from those countries have with Australian residents (in the 2021 Census, England and India were the top two countries of birth for Australian residents, other than Australia). While there has been a notable pick-up in people from India visiting friends and relatives, there has also been a pronounced recovery in the number of Indian students coming to Australia. By contrast, the number of Chinese visitors remains more than 90 per cent below pre-pandemic levels, due to ongoing travel restrictions to control the spread of COVID-19 in China. This is significant for the Australian tourism sector as, prior to the pandemic, Chinese visitors were the largest source of tourist spending and contributed around 20 per cent of total leisure travel exports in 2019 (or nearly 30 per cent if education-related travel is included).

Domestic tourism

Domestic tourism activity was severely disrupted by the COVID-19 pandemic, due to the introduction of strict restrictions on household mobility (‘lockdowns’) across the country in March 2020 (Graph 5). At the same time, a number of states and territories implemented interstate border restrictions and quarantine arrangements. As a result, domestic tourist visitor numbers declined sharply. By April 2020, domestic tourist numbers were less than 20 per cent of pre-pandemic levels.

The first lockdown ended for most parts of the country by the end of May 2020, although some restrictions on household activity and state border closures remained in place for an extended period of time. Melbourne re-entered lockdown for much of the second half of 2020. By the end of that year, however, a number of states and territories had eased restrictions and reopened domestic borders, allowing domestic visitor numbers to recover to around 80 per cent of pre-pandemic levels over the 2020/21 summer and the 2021 Easter holidays (Graph 6).

A third major disruption emerged in mid-2021, as a sharp rise in the number of Delta-variant cases led to the reintroduction of lockdowns in New South Wales, Victoria and the ACT. Around half of the Australian population were under significant restrictions for most of the September quarter of 2021 and domestic visitor numbers declined to around 40 per cent of pre-pandemic levels.

Domestic tourism numbers rebounded again during the 2021/22 summer holidays as health restrictions eased once more, but not to the levels of the previous year; the Omicron outbreak in early 2022 tempered activity somewhat. As concerns about Omicron abated, domestic visitor numbers again recovered, and have been around 85 per cent of pre-pandemic levels since Easter 2022.

While domestic visitor numbers remain below pre-pandemic levels, total domestic tourism spending and the average spend per visitor have been above pre-pandemic levels since March 2022. Some liaison contacts report that domestic travellers are staying longer than they did before the pandemic and spending patterns have become more like those on overseas holidays, with domestic tourists spending more on tours and experiences to explore Australia. This higher spending also reflects an increase in domestic travel prices (see below).

The recovery in domestic tourism spending in 2022, to around or above pre-pandemic levels, is evident in all states and territories (Graph 7). Naturally, states that experienced longer and stricter COVID-19 restrictions had much more significant declines in tourism activity over 2020 and 2021. Western Australia experienced the least disruption to the tourism industry, partly due to having fewer restrictions on movement, but also because the closed state border meant that more Western Australians were holidaying in their own state. In recent months, the Northern Territory and Queensland have been the recipients of domestic tourism spending well above 2019 levels, perhaps because these travel destinations are regarded as closer substitutes for overseas holidays.

Travel to regional areas recovered more quickly and fully than travel to capital cities (Graph 8). Regional areas were less affected by lockdowns and liaison suggests that travellers preferred to avoid more densely populated areas. There was also a shift towards driving holidays, which has greatly benefited regions within two to three hours’ drive from capital cities.

Challenges in reopening the Australian tourism industry

While pandemic-related declines in domestic and international tourism weighed heavily on the Australian tourism industry, many businesses have proved resilient and have experienced a strong rebound in demand from domestic tourists in recent months. Nevertheless, many businesses have found it difficult to scale up to meet this demand, and supply constraints have acted to limit tourism activity and led to higher prices.

In 2022, the biggest constraint on the recovery in tourism activity has been difficulty finding sufficient labour to service tourism demand. The tourism industry lost a large number of experienced staff during the pandemic – and so when domestic tourism recovered, the sector had to rapidly hire workers in a tight labour market. Online advertisements for tourism jobs rose to record highs by mid-2022 (Graph 9). These jobs have been difficult to fill. Liaison contacts have suggested that many of the Australians who had worked in the tourism industry prior to the pandemic have since found jobs in other industries. Moreover, many tourism-related jobs had previously been filled by international students and, particularly in regional locations, working holiday makers – many of whom left Australia during the pandemic and have been slow to return. On top of the difficulties in attracting and retaining staff, illness-related absenteeism has been elevated more broadly through 2022.

Tourism businesses in many regional areas have had additional difficulties attracting staff, partly due to a shortage of housing. An increase in net migration to these areas has contributed to very low rental vacancy rates in many popular tourist areas. In response, some holiday accommodation providers have resorted to housing their own staff.

There have also been some changes in consumer behaviour resulting from the pandemic that have made it harder for tourism businesses to plan and have sufficient staff available to meet demand. Trends such as increased working from home and a reduction in business-related day trips have created a larger gap between peak and off-peak periods for many tourism businesses. There are also sharper peaks and troughs in demand because there are fewer international tourists, who often travel at different times to domestic travellers (e.g. filling accommodation mid-week and outside school holidays). Booking lead times substantially shortened during the pandemic, though there is some evidence that perhaps these are lengthening out again. Nevertheless, booking lead times have always been shorter for domestic travel than international travel, so the change in the composition of travellers has made it more difficult for tourism businesses to plan ahead.

While labour has been a constraint across most of the tourism industry, a lack of capital equipment has been an additional constraint for some businesses. Many tourism-related businesses sold off or retired vehicles, boats, aircraft and other equipment during the pandemic when they could not operate and were in need of cash (Grozinger and Parsons 2020). The sudden and stronger-than-anticipated recovery in domestic tourism in 2022, combined with supply chain issues delaying the manufacture and delivery of new equipment and vehicles, has meant that many businesses did not have the capital equipment they need to service the increase in demand.

These supply-side constraints (in both labour and capital) have limited the tourism industry’s ability to ramp up to meet demand. Liaison suggests many tourism operators are operating below their previous capacity – for example, many have had to limit their operating hours because of lack of staff, and some accommodation providers have not been able to offer all their rooms for booking as they do not have enough staff to service them. Labour shortages and supply chain delays have also weighed on aviation capacity and contributed to a decline in domestic airlines ‘on-time performance’ over 2022 (Graph 10).

Similar constraints are also weighing on the recovery in international tourism. Contacts suggest that the recovery has been held back by limited flight availability, the higher cost of travel insurance and, in many cases, the higher cost of flights. Liaison contacts have indicated that delays in visa issuance in 2022 have also been a barrier for those seeking to travel to Australia. Over the past few months, however, visa processing times have shortened somewhat, and visa processing for applicants located overseas – including applicants for visitor, student and temporary skilled visas – have been given higher priority to allow more people to travel to Australia (Department of Home Affairs 2022).

The supply-side constraints in the tourism industry, combined with a strong pick-up in domestic demand and the higher cost of inputs such as fuel, have led to a sharp increase in domestic travel prices (Graph 11). Liaison contacts suggest that consumers have been relatively accepting of price rises for services essential to travel, such as accommodation. However, smaller operators – particularly in highly discretionary services, such as tours – have had less scope to increase their prices, and their margins have been squeezed by the higher costs of inputs such as food, fuel, energy and insurance costs. Prices for overseas travel have also increased significantly in recent quarters, as demand for flights has outstripped capacity, alongside rising jet fuel costs and increases in prices for international tours (ABS 2022).

The outlook

Looking ahead, tourism activity is expected to continue to recover as supply-side issues are slowly resolved and international tourism picks up further. Most liaison contacts suggest a full recovery will not occur until at least mid-2023; many expect it to take a few more years. There are a number of factors that will affect the timing and extent of the ongoing recovery in tourism, including:

- The easing of supply-side constraints : It is unclear how long it may take for some of the supply-side constraints in the industry to ease, including whether planned changes in flight availability will be sufficient to meet changes in demand, and whether the sector will be able to fill more job vacancies over time and as migration returns.

- The return of international students and working holiday visas : Many people have recently had working holiday visas approved and are expected to arrive over the coming year. Liaison contacts also expect international student numbers to increase over the next few years. The return of working holiday and student visa holders will increase demand for tourism services, and will likely alleviate labour shortages as they take jobs in the sector.

- Australians’ preferences for domestic and international travel : Demand for Australia’s tourism services may decline if Australians’ preference for overseas rather than domestic holidays picks up before international inbound tourism demand increases further. It is possible that cost-of-living pressures, combined with the higher cost of international travel, could lead Australian households to continue to prefer domestic holidays for a time. Nevertheless, many households have significant savings and pent-up demand for international travel after planned trips have been deferred over the past few years.

- The global economic outlook : Global economic conditions and the exchange rate affect decisions about whether to travel the long distance to Australia (as they have in the past) (Dobson and Hooper 2015). Financial concerns and the rising cost of living could make expensive, long-haul travel less attractive.

- The timing and extent of recovery in Chinese tourism : As noted above, China accounted for a large share of tourism spending prior to the pandemic. The outlook for Chinese tourism (and international students from China) remains highly uncertain and will depend on a number of factors, including China’s policies to restrict the spread of COVID-19 , the outlook for the Chinese economy and the travel preferences of Chinese tourists more generally.

Restrictions to contain the spread of COVID-19 and precautionary behaviour significantly disrupted the movement of people both domestically and internationally throughout the pandemic. Since restrictions have eased, international travel has been slow to recover, but domestic tourism spending has rebounded to be above pre-pandemic levels and many tourism service providers are currently operating at capacity. Looking ahead, tourism activity is expected to continue to recover, as supply-side issues are slowly resolved and international tourism picks up further. Australia remains an attractive destination for both domestic and international tourists, and the resilience and flexibility demonstrated by Australian tourism businesses in recent years bode well for the opportunities and challenges that lie ahead.

The authors are from the Regional and Industry Analysis section of Economic Analysis Department. The authors are grateful for the assistance provided by others in the department, in particular Aaron Walker and James Holloway. [*]

ABS (Australian Bureau of Statistics) (2022), ‘Main Contributors to Change’, Consumer Price Index , June.

Department of Home Affairs (2022), ‘Visa processing times’, viewed 14 November 2022. Available at <https://immi.homeaffairs.gov.au/visas/getting-a-visa/visa-processing-times>.

Dobson C and Hooper K (2015), ‘ Insights from the Australian Tourism Industry ’, RBA Bulletin , March, pp 21–31.

Grozinger P and Parsons S (2020), ‘ The COVID-19 Outbreak and Australia’s Education and Tourism Exports ’, RBA Bulletin , December.

Hall R and Godfrey A (2019), ‘Edu-tourism and the Impact of International Students’, International Education Association of Australia, 3 May.

- Skip to navigation

- Skip to main content

- ImmiAccount

- Visa Entitlement Verification Online (VEVO)

- Select language Language Unavailable English

Overseas arrival and departure statistics

Overseas Arrivals and Departures (OAD) data refers to the arrival and departure of Australian residents or overseas visitors, through Australian airports and sea ports. OAD data describes the number of movements of passengers rather than the number of passengers . That is, multiple movements of individual persons during a given reference period are all counted.

OAD data will differ from data derived from other sources, such as Migration Program Outcomes, Settlement Database or Visa Grant information.

Passengers granted a visa in one year might not arrive until the following year, or might not travel to Australia at all. Some visas permit multiple entries to Australia, so passengers might enter Australia more than once on a visa.

Pivot tables

Pivot tables are available on our Overseas Arrivals and Departures web page on the data.gov.au website.

Definitions used in tables

For the definition of terms used in the Overseas Arrivals and Departures pivot tables, see Overseas Arrivals and Departure - Explanatory Notes on the Australian Bureau of Statistics website.

Need a hand?

Popular searches, your previous searches.

Tourism Forecasts for Australia 2022-2027

Summarises the outlook for domestic and international tourism in Australia.

Main content

This is the first time we have produced this report since the start of the pandemic. TRA present domestic forecasts at the national level and for each state and territory. We also present international forecasts at the national level and for selected markets and purposes of travel.

Download the report

Domestic and international forecasts.

TRA forecast total visitor expenditure to surpass pre-pandemic levels this year and total $227.7 billion by 2027. This includes:

- domestic overnight trip and day trip expenditure moving higher than their pre-pandemic peaks this year. They are projected to reach $137.9 billion and $41.1 billion respectively by 2027

- international visitor expenditure exceeding pre-pandemic levels in 2024. We forecast this to increase to $48.8 billion by 2027.

We expect the recovery of international tourism to take some time. It is likely to be uneven across markets and purpose of travel. Overall, we forecast visitor arrivals to move higher than pre-pandemic levels in 2025 and total 11.0 million by 2027. International spend will return to pre-pandemic levels earlier, in 2024.

The turnaround for domestic travel is progressing more quickly. Overnight and day trip expenditure this year are already above pre-pandemic levels. We forecast the number of visitor nights to surpass pre-pandemic levels in 2023.

By 2027, there are forecast to be:

- 465.8 million domestic visitor nights (up 11% on 2019)

- 126.2 million domestic overnight trips (up 7% on 2019)

- 244.4 million domestic day trips (down 2% on 2019).

Download the data

Spreadsheets contain the raw data. National, state and territory figures are provided for calendar years.

National Tourism Forecasts Tables

State and territory domestic forecasts tabes

Contact TRA

mail tourism.research@tra.gov.au

Footer content

- Minister for Trade and Tourism

- Special Minister of State

Senator the Hon Don Farrell

- Media Releases

- Transcripts

One year on, international tourism continues to bounce back

- Media release

A year to the day since Australia welcomed international tourists back to our shores, our dynamic and resilient visitor economy continues to recover with the support of the Australian Government.

According to the latest Australian Bureau of Statistics (ABS) data, international arrivals in December 2022 were at 60 per cent of December 2019 arrivals. That's a significant increase on March 2022, when international arrivals were at just 20 per cent of the number recorded in the same month in 2019.

International arrival numbers are expected to keep growing as aviation capacity increases, with Tourism Research Australia projecting international visitor expenditure to exceed pre-pandemic levels in 2024 and international visitor arrivals to exceed pre-pandemic levels in 2025.

The visitor economy, including long-stay international students, was Australia's fourth largest export sector before the COVID-19 pandemic. It was worth $166 billion annually to the economy.

To ensure the tourism industry continues to recover, the Australian Government is supporting a number of initiatives to help businesses get back on their feet after a challenging few years.

The $48 million Supporting Australian Tourism and Travel package, confirmed in the October 2022 Budget, is providing funding to assist tourism businesses to provide training and attract workers back to the industry, improve the quality of Australia's tourism offerings and return to the international market to support the recovery of the visitor economy.

Tourism Australia recently launched its $125 million global campaign, Come and Say G'day , which reminds the world why there's no place like Australia – through use of recognisable and beloved icons, stunning scenery and warm characters.

Since launching in October 2022 the short film, G'day , has had 102 million views across all channels and Tourism Australia is also launching more than 190 partnerships around the world, including 18 airlines.

Additionally, as part of the national THRIVE 2030 strategy, Austrade is working on international diversification in the visitor economy, connecting and building engagement with emerging markets in the region, while maintaining a share in existing key markets.

Together, these actions are designed to support the ongoing recovery of Australia's visitor economy and its growth into the future.

Quotes attributable to Trade and Tourism Minister Don Farrell:

“The Australian visitor economy is bouncing back, which is great news for our tourism operators and the hundreds of thousands of Australians working in the industry.

“Tourism is the lifeblood of many communities around the country who were hit hard by the global COVID-19 pandemic.

“The Albanese Government is supporting tourism recovery, and there are plenty of reasons to be optimistic with international travellers returning to our shores in growing numbers.

“That trend is forecast to continue and, to ensure it does, Tourism Australia is vigorously marketing our tourism offering in key markets around the world inviting travellers to Come and Say G'day .”

Media enquiries

- Minister's office: 02 6277 7420

- DFAT Media Liaison: (02) 6261 1555

International tourism, number of arrivals - Australia

Selected Countries and Economies

All countries and economies.

- Privacy Notice

- Access to Information

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here.

Travel, Tourism & Hospitality

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

- Number of international visitors to Australia FY 2010-2023

Number of international visitor arrivals to Australia from financial year 2010 to 2023 (in millions)

To access all Premium Statistics, you need a paid Statista Account

- Immediate access to all statistics

- Incl. source references

- Download as PDF, XLS, PNG and PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

September 2023

FY 2010 to FY 2023

international visitors aged 15 years or older

Australia's financial year runs from July 1 to June 30; for example, financial year 2017 starts on July 1, 2016 and ends on June 30, 2017. Values have been rounded.

Other statistics on the topic Travel and tourism industry in Australia

- Number of outbound tourists from Australia FY 2023, by destination

- Number of international visitors to Australia FY 2023, by country of residence

- Number of domestic overnight visitors Australia 2023, by state visited

- Direct tourism GDP growth rate Australia FY 2006-2023

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

You only have access to basic statistics. This statistic is not included in your account.

- Instant access to 1m statistics

- Download in XLS, PDF & PNG format

- Detailed references

Business Solutions including all features.

Statistics on " Travel and tourism in Australia "

- Share of the GDP of the tourism sector in Australia 2013-2028

- Direct tourism GDP Australia FY 2006-2023

- Tourism contribution Australia FY 2023, by industry

- Tourism contribution Australia FY 2023, by state

- Number of tourism businesses Australia 2023, by type

- Tourism sector employment Australia FY 2023, by state and type

- Number of international visitors to Australia FY 2023, by age group

- Number of international visitors to Australia FY 2023, by state visited

- Number of international visitors to Australia FY 2023, by purpose of visit

- International visitor trip expenditure Australia FY 2010-2023

- International visitor trip expenditure Australia FY 2023, by country of residence

- Number of outbound tourists from Australia FY 2006-2023

- Number of outbound tourists from Australia 2017-2024, by state of residence

- Outbound tourist trip expenditure FY 2019-2023

- Outbound tourist trip expenditure Australia FY 2023, by destination

- Leading tourism experience interests among outbound travelers Australia 2022

- Leading sport tourism experience interests of outbound travelers Australia 2022

- Number of domestic overnight visitors Australia 2014-2023

- Number of domestic overnight visitors Australia 2023, by purpose of visit

- Domestic overnight tourist trip expenditure Australia FY 2014-2023

- Domestic overnight tourist trip expenditure Australia 2023, by state or territory

- Number of domestic day visitors Australia 2023, by state visited

- Number of domestic day visitors Australia 2023, by purpose of visit

Other statistics that may interest you Travel and tourism in Australia

- Premium Statistic Share of the GDP of the tourism sector in Australia 2013-2028

- Basic Statistic Direct tourism GDP Australia FY 2006-2023

- Basic Statistic Direct tourism GDP growth rate Australia FY 2006-2023

- Basic Statistic Tourism contribution Australia FY 2023, by industry

- Premium Statistic Tourism contribution Australia FY 2023, by state

- Premium Statistic Number of tourism businesses Australia 2023, by type

- Premium Statistic Tourism sector employment Australia FY 2023, by state and type

Inbound tourism

- Premium Statistic Number of international visitors to Australia FY 2010-2023

- Premium Statistic Number of international visitors to Australia FY 2023, by country of residence

- Premium Statistic Number of international visitors to Australia FY 2023, by age group

- Premium Statistic Number of international visitors to Australia FY 2023, by state visited

- Premium Statistic Number of international visitors to Australia FY 2023, by purpose of visit

- Premium Statistic International visitor trip expenditure Australia FY 2010-2023

- Premium Statistic International visitor trip expenditure Australia FY 2023, by country of residence

Outbound tourism

- Premium Statistic Number of outbound tourists from Australia FY 2006-2023

- Basic Statistic Number of outbound tourists from Australia 2017-2024, by state of residence

- Premium Statistic Number of outbound tourists from Australia FY 2023, by destination

- Premium Statistic Outbound tourist trip expenditure FY 2019-2023

- Premium Statistic Outbound tourist trip expenditure Australia FY 2023, by destination

- Premium Statistic Leading tourism experience interests among outbound travelers Australia 2022

- Premium Statistic Leading sport tourism experience interests of outbound travelers Australia 2022

Domestic tourism

- Premium Statistic Number of domestic overnight visitors Australia 2014-2023

- Premium Statistic Number of domestic overnight visitors Australia 2023, by state visited

- Premium Statistic Number of domestic overnight visitors Australia 2023, by purpose of visit

- Premium Statistic Domestic overnight tourist trip expenditure Australia FY 2014-2023

- Premium Statistic Domestic overnight tourist trip expenditure Australia 2023, by state or territory

- Premium Statistic Number of domestic day visitors Australia 2023, by state visited

- Premium Statistic Number of domestic day visitors Australia 2023, by purpose of visit

Further related statistics

- Premium Statistic Inbound tourism of visitors from India to the Netherlands 2017, by quarter

- Premium Statistic Argentina: travel package tourism 2019, by South American country of origin

- Premium Statistic Argentina: share of travel package tourism arrivals 2019, by region of origin

- Premium Statistic Number of international visitors to Queensland Australia FY 2014-2023

- Premium Statistic Purpose of visit by visitors from Canada to the Netherlands 2014

- Premium Statistic Number of international visitors to Western Australia 2006-2018

- Premium Statistic Number of international visitors to Tasmania Australia FY 2014-2023

- Premium Statistic Argentina: tourism wineries jobs by type in Mendoza 2019

- Premium Statistic Number of international tourist arrivals in Seychelles 2015-2019

- Premium Statistic French travel industry: price projections by sector for 2016

Further Content: You might find this interesting as well

- Inbound tourism of visitors from India to the Netherlands 2017, by quarter

- Argentina: travel package tourism 2019, by South American country of origin

- Argentina: share of travel package tourism arrivals 2019, by region of origin

- Number of international visitors to Queensland Australia FY 2014-2023

- Purpose of visit by visitors from Canada to the Netherlands 2014

- Number of international visitors to Western Australia 2006-2018

- Number of international visitors to Tasmania Australia FY 2014-2023

- Argentina: tourism wineries jobs by type in Mendoza 2019

- Number of international tourist arrivals in Seychelles 2015-2019

- French travel industry: price projections by sector for 2016

Charted: How international travel bounced back strongly in 2022

According to latest estimates, international tourist arrivals could reach 80-95% of pre-pandemic levels this year. Image: Unsplash/blakeguidry

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Felix Richter

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} Travel and Tourism is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, travel and tourism.

- Three years after COVID-19 was declared a pandemic, optimism has finally returned to the tourism industry.

- Global tourism bounced back strongly in 2022, as international tourist arrivals more than doubled compared to the previous two years, finds Statista.

- And according to the latest estimates, international tourist arrivals could reach 80-95% of pre-pandemic levels this year.

While few industries have been spared by the impact of the Covid-19 pandemic over the past three years, even fewer have been hit as hard as the tourism sector . After Covid-19 had made 2020 " the worst year in tourism history ", international tourist arrivals increased by just 11 percent in 2021, as travel restrictions remained in place for protracted periods in many parts of the world. Now, almost three years after the WHO declared Covid-19 a pandemic, optimism has finally returned to the industry. "Tourism always comes back," UNWTO Secretary-General Zurab Pololiksahvili said at the inauguration ceremony of ITB Berlin 2023, as the world's leading tourism trade fair celebrates its first in-person event since 2019.

As the following chart shows, global tourism bounced back strongly in 2022, as international tourist arrivals more than doubled compared to the previous two years. The recent reopening of China further fueled optimism in the tourism sector as Asia lagged behind other regions in the recovery from the Covid-19 shock. According to UNWTO estimates , international tourist arrivals could reach 80 to 95 percent of pre-pandemic levels this year, depending on how quickly travel bounces back across Asia. Last year, international tourist arrivals in Asia and the Pacific trailed pre-pandemic levels by more than 75 percent, while Europe and the Middle East came within 20 percent of 2019 numbers.

Prior to the coronavirus outbreak, the global tourism sector had seen almost uninterrupted growth for decades. Since 1980, the number of international arrivals skyrocketed from 277 million to nearly 1.5 billion in 2019. As our chart shows, the two largest crises of the past decades, the SARS epidemic of 2003 and the global financial crisis of 2009, were minor bumps in the road compared to the Covid-19 pandemic.

Have you read?

Tourism is not just about travel, it's also about peace, how global tourism can become more sustainable, inclusive and resilient, international travel levels tipped to soar again in 2022, don't miss any update on this topic.

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} Weekly

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Industries in Depth .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

The energy transition could shift the global power centre. This expert explains why

Liam Coleman

June 4, 2024

Top 5 countries leading the sustainable tourism sector

Robot rock stars, pocket forests, and the battle for chips - Forum podcasts you should hear this month

Robin Pomeroy and Linda Lacina

April 29, 2024

Agritech: Shaping Agriculture in Emerging Economies, Today and Tomorrow

Confused about AI? Here are the podcasts you need on artificial intelligence

Robin Pomeroy

April 25, 2024

Which technologies will enable a cleaner steel industry?

Daniel Boero Vargas and Mandy Chan

Our Organisation

Our Careers

Tourism Statistics

Industry Resources

Media Resources

Travel Trade Hub

News Stories

Newsletters

Industry Events

Business Events

International visitor arrivals

- Share Share on Facebook Share on Twitter Share on WhatsApp Copy Link

Explore our statistics dashboard and discover results for international visitor arrivals and expenditures sourced from the Australian Bureau of Statistics (ABS).

Interactive Arrivals Dashboard

Use the date and market drop-down filters on the interactive dashboard below to view the number of international arrivals who visit Australia on a monthly and year ending basis.

Visitor arrivals highlights

- There were 668,300 million visitor arrivals during the month of May, up 9.7 per cent relative to the same period of the previous year.

- There were 9.3 million visitor arrivals for year ending May 2019, an increase of 3.3 per cent relative to the previous year

Upcoming release dates

Discover more.

We use cookies on this site to enhance your user experience. Find out more .

By clicking any link on this page you are giving your consent for us to set cookies.

Acknowledgement of Country

We acknowledge the Traditional Aboriginal and Torres Strait Islander Owners of the land, sea and waters of the Australian continent, and recognise their custodianship of culture and Country for over 60,000 years.

*Disclaimer: The information on this website is presented in good faith and on the basis that Tourism Australia, nor their agents or employees, are liable (whether by reason of error, omission, negligence, lack of care or otherwise) to any person for any damage or loss whatsoever which has occurred or may occur in relation to that person taking or not taking (as the case may be) action in respect of any statement, information or advice given in this website. Tourism Australia wishes to advise people of Aboriginal and Torres Strait Islander descent that this website may contain images of persons now deceased.

Has there been a surge in migrant arrivals? The answer may not be so straightforward

Australia today has 352,000 fewer people than expected because of the pandemic migration slump, according to an ANU professor.

The figure cuts against talk of a post-pandemic migration surge, which has been the subject of much political attention.

The Coalition has blamed that surge for pushing up house prices, and the government has sought to reassure that the numbers will soon fall, after net migration topped a record half-a-million people last financial year.

But Professor Alan Gamlen, director of the Australian National University's Migration Hub, said any surge was still dwarfed by the 'slump' that preceded it, when arrivals dried up thanks to border restrictions.

"Concern [about the surge] is misplaced," Professor Gamlen said in a short paper published this week.

"Most people think [it] means we have unusually high volumes of migration. But it's the exact opposite."

Migration still well below Coalition-era trend

Professor Gamlen's analysis breaks down the net migration figure into its two components — arrivals and departures — and compares each to the 'business as usual' trend set before the disruption of the pandemic.

Arrivals fell dramatically below trend during the pandemic. They have now returned to just above the trend, but nowhere near enough to make up for the pandemic shortfall.

Compared to the pre-pandemic trend, the slump in arrivals was 732,000 during the pandemic, but the surge by June 2023 was only 46,000.

"The down-spike was much, much larger than the up-spike," Professor Gamlen said.

"Arrivals haven't grown … [They] rebounded to just over … where we previously expected them to be by now. A bit high, but not crazy high."

On the other hand, departures spiked briefly when the pandemic hit as many temporary resident went home. But they soon dropped below trend, after the Morrison government decided to extend temporary visas to encourage people to stay.

Those visa extensions often lasted for several years, so the number of migrants leaving Australia remains low. The result is 334,000 fewer departures than expected since the pandemic began.

"[The] extensions have not all expired yet. As a result, departures are still at historic lows," Professor Gamlen said.

The lack of people leaving props up the net migration figures. But the departure slump isn't as big as the pandemic arrivals' slump, so putting the two together the result is 352,000 fewer people in Australia compared to the pre-pandemic trend.

"Over the past four years, there have been way fewer arrivals, way fewer departures, and way less NOM than we previously expected we'd have by this time. We've had a lot less migration, not more," Professor Gamlen said.

Could temporary migrants be capped?

Net migration figures are not yet available for the financial year that is about to finish, other than the first quarter. But the government's expectation, laid out in the federal budget, suggests the surge will not catch up with the slump.

The budget expects net migration of 395,000 this year, roughly 100,000 over expectations but not enough to cover the gap. After that, it expects migration to return to normal levels.

These numbers are predictions, not targets. The government does not typically have a target for net migration because it does not control the main entry pathways.

It does control permanent migration numbers, but this is only loosely related to the net migration since most people who receive permanent visas are already here on temporary visas.

The main temporary pathways are not capped, including international students, temporary workers and backpackers.

But the government now plans to cap international students on an institution-by-institution level.

It also plans to reduce the number of 'long-term temporary' workers in the country with a new migrant worker program focused on permanence for those with desirable skills – although an early consultation list raised eyebrows by failing to include many construction workers despite the substantial shortage in that industry.

The Coalition also wants to cap international students but has offered conflicting accounts of whether it has a specific net migration target, and how it would achieve such a target.

But Professor Gamlen warned that high net migration was important over the long term for demographic reasons.

"Without these added people, Australia's population would rapidly age and shrink, with too few working age people to support our large elderly population, leading to a rapid economic decline known as a 'demographic winter'," he said.

- X (formerly Twitter)

- Federal Government

- Government and Politics

- Travel Updates

- Travel Stories

Qantas slashes route amid $12b bombshell

A major change in the way millions of Chinese people are behaving is creating a $12 billion problem for Australia.

Picture reveals chilling reality for lone ship

‘Massive loss’: Cruise giant gone forever

‘I would die’: Terrifying beach find

Half the number of Chinese travellers are coming to Australia than before the pandemic.

The stark figures are a major concern for the tourism industry, given Chinese visitors injected more than $12 billion into the Australian economy in 2019.

Qantas announced last week it would be scrapping its Sydney to Shanghai route because of low demand, despite Shanghai being the top region in China that travellers are visiting Australia from, according to Tourism Research Australia.

The Aussie national carrier only resumed its Sydney-Shanghai service in October last year but Qantas International chief executive Cam Wallace said their planes were often half-full.

“Since Covid, the demand for travel between Australia and China has not recovered as strongly as expected,” he explained.

Chinese visitors were slow to return to Australia despite aviation capacity increasing, Tourism and Transport Forum Australia CEO Margy Osmond told news.com.au

“This has had a significant impact on the tourism industry, given China was one of our largest source markets for international tourism before the pandemic,” she said, explaining China is currently our fourth largest source country for international visitors.

“We’re also seeing an increase in domestic tourism within China.

“But we’re working hard to try and entice more Chinese visitors to come to Australia and we hope to see more Chinese visitors return to our shores.”

The latest data from the Australian Bureau of Statistics released last week shows in March this year, Chinese short-term visitor arrivals were only at 47 per cent of pre-Covid levels, when comparing with March 2019.

As for Australian residents travelling to China, the data shows those numbers are at 85 per cent of pre-Covid levels for March 2024, compared with March 2019.

The loss of Chinese travellers is of particular concern because of how much they spend when visiting Australia.

In the 2019 calendar year, Chinese visitors spent an average of $9336 per trip amounting to $12.4 billion.

In the same year, other top international markets spent significantly less.

New Zealanders spent $2004 on average per trip (totalling $2.6b), Brits spent $4999 (totalling $3.4b), and those travelling from the United States spent $5130 (totalling $3.9b), according to the International Visitor Survey from Tourism Research Australia.

What has turned Chinese tourists away

Three experts told news.com.au it was interesting Chinese visitor arrivals had not picked up the way they had from New Zealand, the US, UK and India when borders reopened.

Last year, as Chinese tourists came back to Australia, the number of Chinese visitor arrivals was only 38 per cent of the 2019 level. Their total spend in Australia was $5.8 billion.

Dr Maneka Jayasinghe from Charles Darwin University, and Professor Saroja Selvanathan and Professor Selva Selvanathan from Griffith University are co-authors of a 2022 study published in the Tourism Economics journal about deteriorating Australia-China relations and the impact on our tourism industry.

“The latest international visitor figures indicate that visitor arrivals from China is increasing but at a much slower rate than arrivals from other similar markets and it may take years to reach the pre-pandemic level,” they told news.com.au this week.

Some factors that may be keeping Chinese tourists away are political and trade tension, costly airfares, and the fact China’s economy is “not doing that well”.

“Travel to Australia (return airfare and accommodation) has become more expensive for the middle class Chinese population,” the researchers said.

“Tourists who have become more sensitive to processes during the pandemic with general cost of living-related hardships, may look for domestic travel or cheaper visa-free destinations in the Southeast Asian region.”

They also said after the pandemic, universities were offering fully online degrees meaning there was no need for those students to come to Australia.

“Pre-Covid when students came in large numbers to study in Australia, their families and friends also visited Australia in large numbers,” Dr Jayasinghe, Prof Selvanathan and Prof Selvanathan explained.

The experts warned that if the tourism industry does not bounce back to pre-pandemic levels within the next two to three years, “tourism operators, especially the regional and small scale tourism operators will continue to suffer”.

“The labour force in the tourism sector, may suffer from unemployment or be forced to look for employment opportunities in other sectors,” they said.

“It is important to look for alternative tourism markets if the visitor arrivals from traditional markets continue to show slow growth to keep the industry afloat.”

Tourism a ‘highly political phenomenon’

The academics’ 2022 paper explained the number of visitors from China to Australia increased by about 15 per cent a year from 2009 to 2018 – then the growth rate reduced drastically in 2018 and 2019.

“The growth rate drastically reduced even before the Covid-19 pandemic, to be almost stagnant,” Dr Jayasinghe said at the time the research was published.

This, they said, was because political and trade relations between the two countries began to deteriorate from 2018.

The paper warned the current state of Australia-China relations could have “serious and adverse implications” on the Australian tourism industry.

It said tourism was a “highly political phenomenon”.

“On the one hand, international tourism is a catalyst for reducing political tension and promoting world peace,” the paper read. “On the other hand, governments can exert political pressure through tourism to either promote tourism with friendly countries or restrict tourism with hostile countries.”

But the researchers told news.com.au fortunately relations between China and Australia “have improved substantially” since the Labor Government came into power in May 2022.

Tourism Australia ‘confident’ about recovery

Tourism Australia, the Australian Government agency responsible for attracting international visitors to Australia, is optimistic.

“Whilst travel with China reopened a year later than other markets, we are confident about its recovery as the market continues to steadily rebuild,” a spokesman told news.com.au.

Australia reopened its international border for tourists in February 2022, but at the time, Chinese nationals still had to complete 14 days of quarantine at a designated hotel or facility when they returned home.

China withdrew its advisory to citizens against foreign travel in January last year, and reopened its borders to foreign tourists a few months later in March. It wasn’t until August last year that it lifted its ban on group tours to Australia.

As for whether something needed to change to lure Chinese travellers back faster, Tourism Australia said it had remained active in China “even during the pause in travel”.

“And in June last year we launched the global ‘Come and Say G’day’ campaign to encourage Chinese travellers to plan and book an Australian holiday,” the spokesman said.

“Importantly, our partners on the ground, such as Ctrip, tell us that demand for Australia remains strong and that Australia is consistently the number one destination for long haul travel in China.”

It is understood there are 119 flights per week between China and Australia, and Qantas only made up five of those flights.

Dr Jayasinghe, Prof Selvanathan and Prof Selvanathan agreed the ‘Come and Say G’day’ campaign, launched in China in 2023, would have helped rebuild the tourism market, and advised further strengthening of promotional activities like this would help increase Chinese visitor numbers.

They also suggested a more simplified visa process and periodical visa fee waivers or discounts to help boost visitor arrivals.

More Coverage

“While taking steps to re-establish the Chinese market, it may be worthwhile exploring opportunities to re-establish the links with some of the traditional tourism markets, such as Japan, which was a major tourism market in the early 1990s but gradually declined thereafter,” they said.

“In addition, countries with a rapidly growing middle-class, such as India could have high potential to grow as reliable tourism markets.

“Due to their proximity to Australia, some of the Southeast Asian countries, such as Vietnam, Indonesia, Philippines, South Korea and Thailand could also be attractive tourism source markets for Australia.”

Add your comment to this story

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout

It was once a Queen of the ocean. But now, one of Australia’s most loved cruise ships faces a rather eerie fate.

One of Australia’s most famous companies will be no more after a shock announcement today.

A man strolling along a stretch of sand in Singapore has stumbled upon a creature some have described as the stuff of nightmares.

UN Tourism | Bringing the world closer

Share this content.

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

China recovers its position as top spender in 2023 as Asia and the Pacific reopens to tourism

- All Regions

China has recovered its position as top spender on international tourism in 2023 as Asia and the Pacific consolidates its recovery from the impacts of the pandemic. In 2022, the list of top spenders was headed by the United States. France, Spain and USA took the top spots for most-visited destinations.

Top Tourism Spenders in 2023

Chinese expenditure on travel abroad reached USD 196.5 billion in 2023, ahead of the United States (USD 150 billion), Germany (USD 112 billion), the United Kingdom (USD 110 billion) and France (USD 49 billion). Making up the top ten spenders for 2023 are Canada, Italy, India, the Russian Federation and the Republic of Korea. India jumped to 8th place, from 14th in 2019, confirming the growing importance of the country as a source market, while Italy rose from 10th to 7th position.

Top in arrivals and receipts: France, Spain and USA consolidate their positions

France consolidated its position as the world’s most visited destination in 2023 with 100 million international tourist arrivals. Spain was second with 85 million, followed by the United States (66 million), Italy (57 million) and Türkiye, which closed the top five with 55 million international tourists.

Completing the top ten most visited destinations in 2023 are Mexico, the United Kingdom, Germany, Greece and Austria. Compared to before the pandemic, Italy, Türkiye, Mexico, Germany and Austria all rose one position, while the United Kingdom rose from 10th to 7th and Greece from 13th to 9th.

On the side on international tourism receipts, the ranking is led by the United States, earning USD 176 billion in 2023, followed by Spain (USD 92 billion), the United Kingdom (USD 74 billion), France (USD 69 billion) and Italy (USD 56 billion).

Following the above, destinations earning the most from international tourism in 2023 include the United Arab Emirates, Türkiye, Australia, Canada, Japan, Germany, Saudi Arabia, Macao (China), India and Mexico which complete the top 15 list of tourism earners.

Upward movements in the ranking among the top earners include the UK jumping to the 3rd position from 5th pre-pandemic, the United Arab Emirates from 13th to 6th, Türkiye from 12th to 7th, Canada from 15th to 9th, Saudi Arabia from 27th to 12th, and Mexico from 17th to 15th.

Croatia (from 32nd to 25th), Morocco (from 41st to 31st) and the Dominican Republic (43rd to 34th) also moved up in the Top 50 ranking by receipts in 2023, as did Qatar (from 51st to 37th) and Colombia (50th to 44th).

Looking ahead to a full recovery globally in 2024

As per the latest World Tourism Barometer , in 2023 international tourist arrivals recovered 89% of 2019 levels and 97% in Q1 2024. UN Tourism’s projection for 2024 points to a full recovery of international tourism with arrivals growing 2% above 2019 levels, backed by strong demand, enhanced air connectivity and the continued recovery of China and other major Asian markets.

Total export revenues from international tourism, including both receipts and passenger transport, reached an estimated USD 1.7 trillion in 2023, about 96% of pre-pandemic levels in real terms. Tourism direct GDP recovered pre-pandemic levels in 2023, reaching an estimated USD 3.3 trillion, equivalent to 3% of global GDP.

Related links:

- Download News Release on PDF

- Tourism Barometer Data

- World Tourism Barometer PPT

Related Content

Un tourism commits to the antigua and barbuda agenda fo..., un tourism launches the tourism investment guidelines f..., un tourism connects leaders for investment conference f..., middle east members prioritize innovation and investmen....

IMAGES

VIDEO

COMMENTS

For visitor arrivals to Australia: A total of 761,050 short-term trips were recorded, an increase of 147,710 compared with the corresponding month of the previous year. The number of trips for March 2024 was 9.0% lower than the pre-COVID level in March 2019. New Zealand was the largest source country, accounting for 15% of all visitor arrivals.

Released. 16/02/2023. Source. Overseas Arrivals and Departures, Australia, December 2022. International travel in Australia has seen a resurgence throughout 2022, with over 19 million arrivals and departures combined across the year, according to data released today by the Australian Bureau of Statistics (ABS).

Globally, international tourism arrivals picked up to be around three-quarters of their pre-pandemic levels by September 2022. In Australia, international tourist arrivals rose slightly in mid-2021 under the temporary operation of the Australia-New Zealand travel bubble, and also in November 2021 as border restrictions eased in some parts of ...

In the year ending June 2022, over half Australia's visitors travelled to visit friends and relatives. Visiting friends and relatives accounted for 55% or 613,000 visitors. In the year ending June 2019, this figure was 30%. Holiday travel accounted for 17%, followed by business travel at 11%. Travel for employment was 6%.

Overseas Arrivals and Departures (OAD) data refers to the arrival and departure of Australian residents or overseas visitors, through Australian airports and sea ports. OAD data describes the number of movements of passengers rather than the number of passengers. That is, multiple movements of individual persons during a given reference period ...

Explore tourism statistics, including International Visitor Arrivals and International Visitor Spend and links to State and Territory organisations. Learn more today.

FOR MORE INFORMATION CONTACT: Beau Mitchem. M: +61 413 254 708. [email protected]. Tourism Australia has welcomed the return of overseas tourists on 21 February 2022, with the first international flights touching down in Australia since the reopening to all fully vaccinated travellers, and other visitors.

We forecast this to increase to $48.8 billion by 2027. We expect the recovery of international tourism to take some time. It is likely to be uneven across markets and purpose of travel. Overall, we forecast visitor arrivals to move higher than pre-pandemic levels in 2025 and total 11.0 million by 2027. International spend will return to pre ...

A year to the day since Australia welcomed international tourists back to our shores, our dynamic and resilient visitor economy continues to recover with the support of the Australian Government. According to the latest Australian Bureau of Statistics (ABS) data, international arrivals in December 2022 were at 60 per cent of December 2019 arrivals.

For visitor arrivals to Australia: A total of 648,970 short-term trips were recorded, an increase of 575,680 compared with the corresponding month of the previous year. The number of trips for December 2022 was 39.8% lower than the pre-COVID level in December 2019. New Zealand was the largest source country, accounting for 15% of all visitor ...

Leading sport tourism experience interests of outbound travelers Australia 2022; ... 2023). Number of international visitor arrivals to Australia in financial year 2023, by country of residence ...

Overseas Arrivals and Departures, Australia, April 2024Release date 12/06/2024 11:30am AEST Overseas Arrivals and Departures, Australia, May 2024Release date 12/07/2024 11:30am AEST Overseas Arrivals and Departures, Australia, June 2024Release date 15/08/2024 11:30am AEST Overseas Arrivals and ...

International tourism, number of arrivals - Australia World Tourism Organization, Yearbook of Tourism Statistics, Compendium of Tourism Statistics and data files. License : CC BY-4.0

Leading sport tourism experience interests of outbound travelers Australia 2022; ... Number of international visitor arrivals to Australia from financial year 2010 to 2023 (in millions) [Graph ...

In this section are two interactive dashboards that directly connect with the key tourism data sources: The market performance chart can be filtered by market of origin and will show a range of data including how much they spent, places they visited and trend charts on arrivals and spend.; The visitor arrivals chart further down the page will show more up-to-date statistics on international ...

International tourism on track to reach 65% of pre-pandemic levels by the end of 2022 International tourism showed robust performance in January-September 2022, with arrivals reaching 63% of pre-pandemic levels in the first nine months of 2022. An estimated 700 million tourists travelled internationally between January and September, more than double (+133%) the number recorded in the same ...

Data covers tourist arrivals, tourism share of exports and contribution to GDP, source markets, seasonality and accommodation (data on number of rooms, guest and nights) ... The pandemic generated a loss of 2.6 billion international arrivals in 2020, 2021 and 2022 combined; Export revenues from international tourism dropped 62% in 2020 and 59% ...

All travellers are asked their intended address in Australia upon arrival. For September 2022, the highest number of visitor arrivals for short-term trips was observed for New South Wales (128,980), whilst Tasmania recorded the fewest (3,030). ... Compares international visitor arrivals each month by source country for each state and territory ...

Global tourism bounced back strongly in 2022, as international tourist arrivals more than doubled compared to the previous two years, finds Statista. And according to the latest estimates, international tourist arrivals could reach 80-95% of pre-pandemic levels this year. While few industries have been spared by the impact of the Covid-19 ...

Visitor arrivals highlights May 2019. There were 668,300 million visitor arrivals during the month of May, up 9.7 per cent relative to the same period of the previous year. There were 9.3 million visitor arrivals for year ending May 2019, an increase of 3.3 per cent relative to the previous year; Upcoming release dates

International travel in Australia has seen a resurgence throughout 2022, with over 19 million arrivals and departures combined across the year, according to data released today by the Australian Bureau of Statistics (ABS). ... "Short-term visitor arrivals in 2022 remained lower than before the COVID-19 pandemic, with the number of arrivals in ...

Posted Sun 2 Jun 2024 at 1:36pm. Professor Alan Gamlen says the post-pandemic surge in arrivals was much smaller relative to the historic trend than the pre-pandemic slump. (AAP: Bianca Di Marchi ...

Australia reopened its international border for tourists in February 2022, but at the time, Chinese nationals still had to complete 14 days of quarantine at a designated hotel or facility when ...

International travel is on the rise, with provisional data for April 2022 showing 1.2 million international border crossings to and from Australia, according to data released today by the Australian Bureau of Statistics (ABS). The increase, up from 710,000 border crossings in March 2022, represented a large change from a year ago when there ...

4 Jun 2024. China has recovered its position as top spender on international tourism in 2023 as Asia and the Pacific consolidates its recovery from the impacts of the pandemic. In 2022, the list of top spenders was headed by the United States. France, Spain and USA took the top spots for most-visited destinations.

All travellers are asked their intended address in Australia upon arrival. For October 2022, the highest number of visitor arrivals for short-term trips was observed for New South Wales (150,840), whilst the Northern Territory recorded the fewest (2,560). ... Compares international visitor arrivals each month by source country for each state ...