- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What’s the Value of Chase Ultimate Rewards Points?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Chase points value when booking through the portal

Chase points value when transferring to partners, chase points to dollars calculator, credit cards that earn chase ultimate rewards® points, how did we determine the value of chase points.

Chase Ultimate Rewards® points are some of the most sought-after travel rewards points out there ( here's how they compare to AmEx Membership Rewards ). They are flexible, popular and valuable. But how valuable?

Based on our most recent analysis , Chase points are worth between 1 cent and 2.2 cents each, depending on how they’re used and which card they were earned with.

This wide range of values is due to the complexity of Ultimate Rewards® redemption options. Like most credit card reward points, they have a baseline value when used to either book travel directly through a portal or they can be transferred to partners. But Chase adds an additional layer of complexity by offering separate baseline values depending on the card. Let’s break it down.

» Learn more: The best Chase credit cards

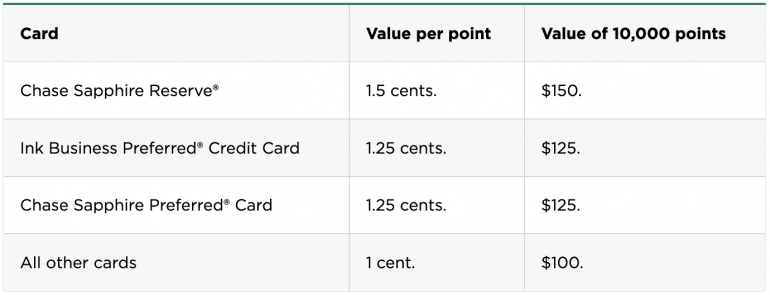

In Chase's travel portal, the Chase Ultimate Rewards® points value depends entirely on which card you have — or rather, which card is associated with the points you’re using (if you have several cards).

Note: These values only represent the simplest and most direct way of using Chase points. And there isn’t any wiggle room here; you can’t search for deals that will yield more than 1.5 cents per point with a Chase Sapphire Reserve® , for example. The values are fixed when using points to book through the travel portal.

» Learn more: The guide to Chase's travel portal

There’s lots of wiggle room here. So much, in fact, that it’s hard to pin down a specific value across all of Chase’s transfer partners. Our estimate of 1 cent to 2.2 cents is based on the higher-value transfer options, but that doesn’t mean all the options are equal — far from it.

The table below shows the transfer partners for which we have data-driven point and mile valuations. In short: The estimated value of Chase Ultimate Rewards® points when redeeming with Chase partners ranges from 0.7 cents to 1.9 cents.

Of course, the value of Chase points depends on the value of these transfer partners, but there is another factor to consider: how many high-value transfer partners the Chase Ultimate Rewards® program has. This affords more options for travel rewards hobbyists who are willing to dive into these programs and find the best deals.

» Learn more: The best Chase transfer partners

Comparing Chase points to other programs with fewer high-quality transfer partners is like comparing a $100 bill to a $100 Olive Garden gift card. They’re technically worth the same amount, but one has a broader range of uses than the other.

» Learn more: How to transfer Chase Ultimate Rewards® points to travel partners

Use our Chase points calculator below to determine the value of any number of Chase Ultimate Rewards® points to dollars. This is useful for comparing the value of promotions and sign-up offers or in assessing the value of an existing cache of points.

Note: Chase's cash-back credit cards technically earn that cash in the form of Chase Ultimate Rewards®. One point equals 1 cent in those cases.

Chase Sapphire Preferred® Card

5 points per $1 spent on all travel purchased through Chase.

3 points per $1 spent on dining (including eligible delivery services and takeout).

3 points per $1 spent on select streaming services.

3 points per $1 spent on online grocery purchases (not including Target, Walmart and wholesale clubs).

2 points per $1 spent on travel not purchased through Chase.

1 point per $1 spent on other purchases.

Through March 2025: 5 points per $1 spent on Lyft.

Sign-up bonus: Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

» READ OUR REVIEW of the Chase Sapphire Preferred® Card

Chase Sapphire Reserve®

10 points per $1 spent on Chase Dining purchases through Chase.

10 points per $1 spent on hotel stays and car rentals purchased through Ultimate Rewards®.

5 points per $1 spent on air travel purchased through Chase.

3 points per $1 spent on travel and dining not booked with Chase.

Through March 2025: 10 points per $1 spent on Lyft.

Sign-up bonus: Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

» READ OUR REVIEW of the Chase Sapphire Reserve®

Chase Freedom Flex℠

5% cash back on rotating bonus categories, on up to $1,500 spent per quarter (cash back comes in the form of Chase Ultimate Rewards®).

5% back on travel purchased through Chase.

3% back at restaurants.

3% back at drugstores.

1% back on all other purchases.

Sign-up bonus: Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

» READ OUR REVIEW of the Chase Freedom Flex℠

The Chase Freedom Flex℠ replaced the original Chase Freedom® , but holders of the original card were able to keep using it. That card offers the same 5% in rotating categories and 1% elsewhere, but not the bonus rewards on travel, dining and drugstores.

Chase Freedom Unlimited®

6.5% cash back on travel purchased through Chase during your first year, 5% after that.

4.5% back at restaurants during your first year, 3% after that.

4.5% back at drugstores during your first year, 3% after that.

3% back on all other purchases during your first year, 1.5% after that.

Note that all first-year elevated earn rates are applied only up to $20,000 in total spending during the initial cardholding year.

Sign-up bonus: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

» READ OUR REVIEW of the Chase Freedom Unlimited®

Ink Business Preferred® Credit Card

3 points per $1 spent on the first $150,000 per year in combined spending on travel and select business categories.

1 point per $1 spent on all other purchases.

Sign-up bonus: Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠.

» READ OUR REVIEW of the Ink Business Preferred® Credit Card

Ink Business Cash® Credit Card

5% cash back on office supply store purchases and internet, cable and phone services, on up to $25,000 spent per year combined.

2% back at gas stations and restaurants, on up to $25,000 spent per year combined.

Through March 2025: 5% back on Lyft.

Sign-up bonus: Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening.

» READ OUR REVIEW of the Ink Business Cash® Credit Card

Ink Business Unlimited® Credit Card

1.5% cash back on all spending.

Sign-up bonus: Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening.

» READ OUR REVIEW of the Ink Business Unlimited® Credit Card

» Learn more: The best travel credit cards

For our NerdWallet estimate of 1 cent to 2.2 cents per Ultimate Rewards® point, we factored in three variables:

The value of these points when used to book travel directly with the credit card’s travel portal.

The value of the airline and hotel points to which these points can be transferred, when applicable (based on separate analyses).

The number of top-tier travel transfer partners, as determined by our expert panel.

The overall value is determined as: A weighted average between (1) and (2), with the weight determined by (3). The program with the largest number of high-value partners receives a 100% weight on (2), and a program with zero high-value partners receives a 50% weight on (2).

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1%-5% Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% on Chase travel purchased through Ultimate Rewards®, 3% on dining and drugstores, and 1% on all other purchases.

$200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

Chase Ultimate Rewards: How to earn, redeem, and maximize your points in 2024

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The Chase Ultimate Rewards® rewards program is frequently considered one of the top credit card point systems available today — and for good reason. Ultimate Rewards points, which you can earn from some of Chase's best credit cards , offer some of the most generous and diverse travel redemption options you can find.

But you don't have to redeem rewards for travel if you don't want to. You can cash them out, trade them for gift cards, or even pay for your Amazon cart with them at checkout. Not all these redemptions are a good idea, but it's nice to know all your options.

Chase Ultimate Rewards Guide

Let's take a look at all the ways to earn and redeem Chase points.

How to earn Chase Ultimate Rewards points

The only way to earn rewards in the Chase Ultimate Rewards ecosystem is by opening and using a Chase card that operates within this program.

Fortunately, Chase points-earning cards are some of the best travel credit cards available today, and each offers a generous welcome bonus and ongoing rewards for everyday spending.

Credit cards that earn transferable Chase Ultimate Rewards points

If you're looking to open a Chase rewards card, you may be wondering whether you should get the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®. The Chase Sapphire Preferred® Card has a lower annual fee of $95 compared to the Chase Sapphire Reserve®, which has a $550 annual fee. The Reserve comes with higher points-earning rates and more bells and whistles, such as a $300 annual statement credit for travel purchases.

Read our Chase Sapphire Preferred vs. Chase Sapphire Reserve card comparison for more details.

If you're a small business owner, on the other hand, you may want to opt for the Ink Business Preferred® Credit Card, or another of the best Chase business credit cards .

What to know before applying for a Chase Ultimate Rewards card

Most credit card issuers have some guidelines that dictate whether or not they will approve you for their cards. Often they have to do with your credit score, but in the case of Chase there's also a limit on opening new cards to keep in mind.

The "5/24" rule from Chase means that you won't be approved for most Chase credit cards if you've opened five or more credit cards in the last 24 months. This doesn't mean five or more credit cards from Chase; this means five or more credit cards from any issuer. Keep this limitation in mind if you're planning to open multiple rewards credit cards in the near future, and strongly consider prioritizing applications for Chase cards so you don't run into this limit.

Chase cards like the Chase Sapphire Preferred® Card and the Chase Sapphire Reserve® require high credit scores in the good to excellent range. An excellent credit score is anything above 800, according to the FICO scoring model. While you may get approved for one of these cards with a score in the high 600s and above, it's key to avoid taking on debt you can't pay off each month. No credit card rewards will make up for the high interest fees you'll incur.

How Much are Chase Ultimate Rewards Points Worth?

Chase Ultimate Rewards® are among the most valuable travel rewards you can earn. These points offer high upside thanks to Chase's lucrative roster of 11 airline and three hotel transfer partners, as well as a respectable value floor when you redeem directly with Chase for travel and statement credits. As a result, Chase Ultimate Rewards points have an average redemption value of 1.8 cents per point in Business Insider's most recent valuations .

How to use Chase Ultimate Rewards points

If you're considering a Chase credit card that earns Chase Ultimate Rewards points but want to make sure you'll be able to utilize your points, it helps to know all your options ahead of time.

The important thing to note is that if you don't have either the Chase Sapphire Preferred® Card, Chase Sapphire Reserve, or Ink Business Preferred Credit Card, you won't have as many redemption options. You won't be able to transfer points to airline and hotel partners, and your points will only be worth 1 cent apiece toward travel booked through the Chase Ultimate Rewards website.

If you do have one of the above cards, Chase lets you pool all your points in one place for optimal redemptions. So you can move points over from, say, the Chase Freedom Unlimited® to the Chase Sapphire Preferred® Card and get 1.25 cents per point for travel booked through Chase, or transfer your Ultimate Rewards to an airline or hotel program to book an award.

Here are the main redemption options you can look forward to:

Redeem for statement credits or gift cards (1 cent per point)

No matter which Chase card you have, you can trade points for statement credits at a rate of 1 cent per point. This option can be a good one if you don't want to travel or if you want to use your points to cover a splurge purchase of some kind. All you have to do is charge the purchase to your credit card, then redeem your points at a rate of 1 cent each in order to wipe all or part of the charge away.

Gift cards are another redemption option Chase offers, and you'll normally get 1 cent per point if you go this route. Sometimes Chase even offers gift cards with a better value for specific retailers, which can be a good deal. It's not unusual to see gift cards for retailers like Apple, Panera Bread, or Old Navy for 2,250 points per $25 gift card.

Pay for merchandise (point values vary, not a good deal)

If you prefer to shop directly with your points, you can redeem them for purchases on Amazon.com , PayPal, or with Apple. You'll get 0.8 cents per point when you use points to shop on Amazon or with PayPal, and 1 cent per point when you purchase electronics through Apple.

However, this isn't a good deal. Considering you can redeem points for statement credits to cover any purchase you want at a rate of 1 cent per point, you should make the purchase on your card (and you'll earn points for the purchase). Then, you can erase the charge from your statement by cashing in points for a statement credit at a rate of 1 cent each.

Book travel through the Chase Travel℠ Portal (up to 1.5 cents per point)

You can also book hotels, airfare, vacation rentals, activities, and rental cars directly through the Chase Travel ℠ Portal , which is similar to an online travel agency. If you have the Chase Sapphire Reserve card, you get a 50% bonus when you book with points, thus giving your points 1.5 cents each in value.

With the Chase Sapphire Preferred or Ink Business Preferred Credit Card, you get a 25% bonus when you redeem points through the portal, or 1.25 cents per point.

As far as the top travel destinations you can visit with Chase Ultimate Rewards points, the sky is pretty much the limit (well, the entire globe, not the sky). You can use points to book flights and accommodations almost everywhere. But as far as value goes, the Chase Travel Portal will usually get you the best value for cheap hotel stays and flights, while transferring Ultimate Rewards points to partners is generally a smarter move if you're looking to book a first-class flight or an expensive luxury hotel.

Pay Yourself Back with Chase points (up to 1.5 cents per point)

During the pandemic, Chase introduced a compelling new way to redeem points for everyday, non-travel expenses. Chase Pay Yourself Back lets you redeem Ultimate Rewards points toward purchases in eligible categories.

However, this option has become less lucrative with Chase's recent devaluation of Pay Yourself Back. The return you'll get for your points varies depending on the card you have, with the best value coming from the Chase Sapphire Reserve card (1.25 cents per point in eligible categories, 1.5 cents per point for charitable donations) and Ink Business Preferred Card (1.25 cents per point in eligible categories).

If you don't have any travel plans in the near future, this could be another option for using your rewards to cut down on expenses — and you don't have to feel any guilt about missing out on optimal points value.

Transfer points to airline and hotel partners (2 cents per point or more)

Similar to Amex Membership Rewards , Chase Ultimate Rewards lets you transfer points to a wide range of airline and hotel partners. All Chase transfer partners let you move your points at a 1:1 ratio, which is not only valuable but also easy to understand.

Transferring your Chase Ultimate Rewards to Chase's travel partners is the best way to get the most value from your points, since there's no limit to how much your points can be worth. It all just depends on what kind of award flight or hotel stay you book — and if you book a first-class flight or luxury hotel, you could be looking at hundreds if not thousands of dollars in value.

Because most of Chase's airline partners are in an alliance, you can redeem your airline miles (after you transfer points from Chase) on any of the carrier's alliance partners.

For example, you could transfer your Chase points to United Airlines, then use your United miles to book award flights on Star Alliance partners like Air Canada, Lufthansa, or Singapore Airlines. The same goes for British Airways (Oneworld alliance, which includes American Airlines and Cathay Pacific) or Air France-KLM Flying Blue (SkyTeam alliance, which includes Delta and Korean Air).

Redeem points for experiences (point values vary)

You can also use Chase Ultimate Rewards points to book special experiences, including one-of-a-kind events hosted by Chase. It's hard to say what your exact point value will be for these redemptions since Chase often sets the "price."

Past examples include VIP dining experiences, sports games with VIP seating, and Broadway-style shows. Point requirements are all over the place from as low as 10,000 points for a single-day ski resort lift ticket to 760,000 points for a VIP weekend experience at the Sundance Film Festival. These redemptions were largely put on hold due to the pandemic, but are ramping up again.

Best ways to redeem your Chase points

While the best way to use points depends on your personal goals, there are plenty of redemptions that can pay off in a big way. Here are some of the most valuable ways to cash in your rewards if your goal is to book epic and unforgettable travel experiences for free.

Score cheap flights through the Chase Travel Portal

While transferring Chase points to airlines is often the best deal, don't forget that you can also save big by booking flights through the Chase Travel Portal. This is especially true when you find a cheap fare online because the lower the price, the fewer points you'll need to book through Chase.

Here's a good example of how this works in practice: When I was trying to find award flights to Milan, Italy for my family of four and my parents, I almost booked using 30,000 American Airlines miles each plus airline taxes and fees each way.

I ultimately found cheap one-way flights on TAP Air Portugal for $287.80 each. Since you get a 50% bonus value (1.5 cents per point) when you book flights through the Chase portal with points from the Chase Sapphire Reserve®, I was able to book six one-way flights worth $1,726.80 in total through Chase for just 115,120 Chase Ultimate Rewards points.

That's a much better value than redeeming American Airlines AAdvantage miles . With the American AAdvantage program, I would have paid 180,000 American miles plus around $100 per person (or $600 for six of us) in airline taxes and fees.

Transfer points 1:1 to Southwest Airlines

If you're OK with flying economy and mostly travel in the US and to the Caribbean or Mexico, you'll definitely want to consider transferring points 1:1 to Southwest Airlines. This frequent flyer program is revenue-based, meaning lower prices mean you can score award flights for fewer points. In fact, you can frequently find one-way flights for as little as 5,000 points during one of Southwest's countless sales.

Southwest also gives each customer two free checked bags, making it a good choice for families who travel with checked luggage. Finally, the airline has a generous cancellation and rebooking policy which means you can usually reschedule your flight — even at the last minute.

Fly cheap economy to Europe with Air France-KLM Flying Blue

Flying Blue (the loyalty program for Air France and KLM) is a truly underutilized Chase Ultimate Rewards partner. This partner lets you fly for cheap to and from Europe from most major cities, and often for less than you'll pay with other airline programs.

You can frequently find one-way awards to European cities like Amsterdam and Paris for less than 30,000 miles one-way with this program, making them a solid option to check out if you're dreaming of a European getaway. Best of all, awards are generally plentiful and you can usually find four or more economy awards on any given flight.

Transfer to airline partners to fly business class

Using airline miles to fly business class makes a lot of sense, and this is particularly true with airlines that have fixed award charts. Fortunately, Chase has several airline partners that make it easy to book premium cabins for a reasonable number of miles.

For example, you could transfer your Chase points to these airlines for an epic redemption:

- Use 107,000 Singapore Airlines miles to fly business class from the West Coast to Singapore with Singapore Airlines

- Use 50,000 Virgin Atlantic miles to fly Delta One from the US to Europe (outside of the UK)

- Use 87,500 Air Canada Aeroplan points to fly business class from the US to Asia (under 11,000 flown miles) on Star Alliance partners

These are just a few of the options to consider, although there are many, many ways to utilize Chase points for profitable transfers to airline partners.

Book hotels through the Chase Travel Portal

While the Chase Ultimate Rewards program partners with IHG Rewards, Marriott Bonvoy, and World of Hyatt, it's important to price shop awards before you transfer Chase points to these programs.

For example, you may find that a Marriott stay that costs 50,000 points will only set you back 12,000 Chase points through the portal. In that case, it makes more sense to book your hotel stay with points through Chase than it does to transfer all those extra points over to book the same room.

Here's a good example of the exact same hotel stay on the same dates with the IHG Rewards program. While you can book the Holiday Inn Montego Bay Resort for 50,000 IHG points through IHG.com, the same hotel on the exact same dates will only set you back around 18,000 points through Chase Ultimate Rewards with the Chase Sapphire Reserve.

Also note that the Chase portal lets you book hundreds of thousands of independent and boutique hotels and resorts, meaning you can use your points to shop around for a good deal.

Book fun excursions you don't want to pay for

Another way to use Chase Ultimate Rewards is for fun day trips and excursions you wouldn't normally want to pay for. Think of snorkeling trips in the Caribbean, a sunset booze cruise in Hawaii for your anniversary, or a cooking class in Florence, Italy. You can use Chase points to book these experiences and more, and often for less than you think.

Remember that you'll get 25% more travel for free when you use points from the Chase Sapphire Preferred to book travel through the portal, but this amount goes up to 50% more travel if you have the Chase Sapphire Reserve.

I have used Chase points to snorkel with stingrays in Grand Cayman, swim with sharks in Bora Bora, and see some of the world's oldest ruins in destinations like Italy and Greece. I see splurging for excursions as a fun way to treat myself and my family. And they're my points to spend, so why not?

Chase Ultimate Rewards FAQs

Whether Chase Ultimate Rewards are worth it depends on your spending habits, travel goals, and financial priorities. For frequent travelers and those who use credit cards strategically, Chase Ultimate Rewards can offer significant value. With opportunities for earning points on everyday purchases and the flexibility to redeem them for travel, cash back, or other benefits, many find the program to be highly rewarding. However, it's essential to assess your individual needs and compare the benefits of Chase Ultimate Rewards to other credit card rewards programs to determine if it aligns with your financial goals.

Chase Ultimate Rewards is a versatile and highly regarded rewards program offered by Chase Bank. It allows cardholders to earn points on their purchases, which can be redeemed for a variety of benefits, including travel, cash back, gift cards, and more. With Chase Ultimate Rewards, you have the flexibility to choose how you want to use your points, making it a valuable addition to your financial toolkit.

Chase Ultimate Rewards do not expire as long as your account is open and in good standing. Unlike many other rewards programs, your hard-earned points remain available for you to use whenever you're ready, giving you flexibility and peace of mind.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Pet Week 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

What are chase ultimate rewards points worth, chase ultimate rewards® points can be very lucrative depending on how you redeem them. select explains the best way to spend the points you earn with a chase credit card..

Chase Ultimate Rewards® offers cardholders a wide range of redemption options — from cash back to booking luxury travel. But the value that you'll get from your Chase points depends on which redemption option you use.

At the very least, you should get one cent per Chase Ultimate Rewards® point when r edeeming for cash back . However, by taking advantage of the other redemption options, you may be able to get much more value from your Chase points.

The first step is understanding all of the choices. Let's dive into all your options for redeeming Chase points so you can have a better understanding of what your Chase points are worth.

How to earn Chase Ultimate Rewards points?

Before we dive in, here's a quick overview of Chase credit cards that earn Ultimate Rewards points:

- Chase Sapphire Preferred® *

- Chase Sapphire Reserve® *

- Ink Business Preferred® Credit Card *

- Chase Freedom Flex℠

- Chase Freedom Unlimited®

- Ink Business Cash® Credit Card

- Ink Business Unlimited® Credit Card

* You must have one of these cards to transfer Chase points to travel partners.

Chase Sapphire Preferred® Card

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Welcome bonus

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

Regular APR

21.49% - 28.49% variable on purchases and balance transfers

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater

Foreign transaction fee

Credit needed.

Excellent/Good

Terms apply.

Read our Chase Sapphire Preferred® Card review .

Chase Sapphire Reserve®

Earn 5X total points on flights and 10X total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3X points on other travel and dining & 1 point per $1 spent on all other purchases plus, 10X points on Lyft rides through March 2025

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

22.49% - 29.49% variable

5%, minimum $5

Read our Chase Sapphire Reserve® review.

Ink Business Preferred® Credit Card

Earn 3X points per $1 on the first $150,000 spent in combined purchases in select categories each account anniversary year (travel; shipping purchases; internet, cable and phone services; and advertising purchases with social media sites and search engines), 1X point per $1 on all other purchases

Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

21.24% - 26.24% variable

Good/Excellent

Read our Ink Business Preferred® Credit Card review.

What's the value of Chase points for cash back?

Chase Ultimate Rewards points can be redeemed for cash back at a rate of one cent per point. No matter which Chase Ultimate Rewards card you have — from no-annual-fee Chase Freedom cards to the luxury Chase Sapphire Reserve® with its $550 annual fee — you'll get the same one cent per point redemption rate.

You can opt to have the cashback credited to your account as a statement credit, or you can direct deposit your cash-back earnings into most U.S. checking and savings accounts . If you opt for a statement credit, it's important to note that this won't count as a payment. You'll still need to make at least the minimum payment on your bill.

For the Chase credit cards branded as cash-back cards , redeeming points for one cent per point in cashback is the primary way to use your Chase Ultimate Rewards points. However, cardholders of other Chase Ultimate Rewards cards (such as the Chase Sapphire Preferred® Card ) can get a higher value of 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 75,000 points are worth $937.50 toward travel.

What's the value of Chase points for gift cards?

Chase cardholders can generally redeem Ultimate Rewards® points toward gift cards at a rate of one cent per point. That means there's no advantage to buying gift cards with Chase points rather than redeeming points for cash back.

There's one exception. Chase will sometimes discount the number of points you need to buy gift cards. You can often get 10% to 15% off, which increases the redemption value to 1.11 to 1.18 cents per point.

What's the value of Chase points for travel?

Chase Ultimate Rewards points can be used to book travel through the Chase Travel℠ . The redemption rate that you can get will depend on what type of Chase credit card you have:

- Chase Sapphire Reserve : 1.5 cents per point

- Chase Sapphire Preferred Card : 1.25 cents per point

- Ink Business Preferred® Credit Card : 1.25 cents per point

- All Freedom-branded and other Ink-branded cards: One cent per point

To get this redemption rate, you'll need to book travel through Chase Travel℠ . Through Chase, you can book flights, hotels, rental cars, cruises and activities. You'll search for the travel you want to book and at checkout, you can pay with a combination of points and cash.

What's the value of Chase points for eligible purchases through Pay Yourself Back?

Eligible Chase cardholders can redeem Chase Ultimate Rewards for eligible purchases through the Pay Yourself Back feature at a rate between 1 and 1.5 cents per point.

This redemption option is a bit tricky, but it can yield a slightly higher value. The eligible rotating categories and redemption rate depend on the type of Chase card you have.

Chase Sapphire Reserve cardholders can typically redeem points for 1.25 to 1.5 cents per point. Chase Sapphire Preferred and Freedom cardholders can expect a redemption rate of up to 1.25 cents per point. Categories for consumer cards have included purchases at grocery stores , gas stations , contributions to eligible charities and others.

Chase Ink Business Preferred , Ink Business Premier℠ Credit Card and Chase Ink Plus cardholders typically have a redemption rate of 1.25 cents per point. The no-annual-fee Ink Business Unlimited® Credit Card and Ink Business Cash® Credit Card both usually can redeem points for 1.1 cents each toward purchases in Pay Yourself Back categories. Typical rotating categories for business cards include internet, cable, phone services and shipping.

Check out all the details on the latest Chase Pay Yourself Back categories .

The best use of Chase points: Ultimate Rewards transfer partners

The option to redeem Chase points at a fixed value between one and 1.5 cents per point is great. However, the way to get outsized value from your Chase Ultimate Rewards points is by transferring points to Chase's travel partners.

By utilizing the right Chase partner, you can book hotel rooms for 5,000 points per night or business-class award flights to Europe for 50,000 points each way. These high-value redemptions can yield much more than 1.5 cents per point in value.

The catch: not all of Chase's airline and hotel partners provide the same value. IHG Rewards and Marriott Bonvoy points are typically worth less than one cent per point. So for partners like this, it can make more sense to redeem Chase Ultimate Rewards points through the Chase Travel Portal rather than transferring points to these programs.

Instead, you'll want to focus on options like British Airways, Iberia, United Airlines, Virgin Atlantic and World of Hyatt. And you'll generally get the best redemption value for luxury travel — such as business-class flights and suite night awards.

For example, you can transfer Chase points to Iberia and book a one-way off-peak business-class flight from New York JFK to Madrid on Iberia for just 34,000 Iberia Avios points and around $109 in taxes and fees. That flight currently costs $2,129, yielding a net value of nearly six cents per point.

Virgin Atlantic Flying Club is a great way to book Delta awards to Europe. You can fly round-trip to Europe in Delta business class for 100,000 Virgin Points. That may seem like a lot of points, but the same flights cost $4,500 or more — that's a 4.5 cents per point redemption rate.

Or you can use Hyatt points to book nights at luxury hotels, like the Park Hyatt Maldives for 25,000 to 35,000 points a night. Rooms at these hotels can go for $1,000 or more, getting you a redemption rate of around three cents per point.

The worst uses of Chase points

Chase gives cardholders the ability to use Chase Ultimate Rewards points to Shop With Points, but these options should be avoided . For example, Chase points can be redeemed for 0.8 cents per point for Amazon purchases.

There's no reason to go for this redemption rate. You'll save points by making an Amazon purchase with your Chase credit card and then use the cash-back option to redeem points at one cent per point to cover the purchase.

Combining points to boost their value

If you have the right combination of Chase credit cards , you can move points between accounts and boost the value of those points.

For example, the Chase Freedom Flex℠ earns 5X points on up to $1,500 in combined purchases in a rotating category each quarter , then 1%. If you only have the Chase Freedom Flex card, you can only redeem these points for cash back at one cent per point. However, you can boost that redemption rate by combining the points you earned with your Chase Freedom Flex with points earned with a Chase Sapphire Preferred , Ink Business Preferred , or Chase Sapphire Reserve account.

By moving your points to one of these accounts, you can then transfer these points to Chase's airline and hotel transfer partners or redeem them at a higher rate through the Chase Travel Portal or Pay Yourself Back. If you fully maximize your spending and redeeming, you can get 7.5 cents per dollar spent by earning at 5X through the Chase Freedom Flex and then redeeming those points for a higher value with the Chase Sapphire Reserve .

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Bottom line

Chase Ultimate Rewards points can be worth less than one cent per point or over 4 cents per point — depending on which Chase card you have and which redemption option you use. At the very least, all cardholders should aim to get one cent per Chase point, which is the value when you use the cash-back option.

Chase Sapphire Preferred and Ink Preferred cardholders should aim to get at least 1.25 cents per point, as that's the redemption rate for booking travel through the Chase Travel Portal . And Chase Sapphire Reserve cardholders should try to get at least 1.5 cents per point. However, with a little planning, Chase Sapphire and Ink Preferred cardholders can get even more value than this by transferring points to Chase's airline and hotel partners .

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date

Information about the Chase Freedom Flex℠ has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

- First-time homebuyer grants: What you need to know Kelsey Neubauer

- Earn elevated perks during Amex's Platinum Card anniversary celebration Andreina Rodriguez

- How to use the Chase Sapphire Preferred hotel credit Jason Stauffer

What Are Chase Ultimate Rewards Points Worth?

Vault’s viewpoint on chase ultimate rewards.

- Chase Ultimate Rewards worth starts at 0.8 cents per point in value, yet it can climb up to 1.62 cents per point or higher with the right redemption.

- Having a Chase travel credit card unlocks the potential for more lucrative travel redemptions, either through Chase Travel or transfers to airline and hotel partners.

- Chase Ultimate Rewards flexibility is a key benefit of this program since users can redeem their rewards for cash back, statement credits, merchandise, gift cards, travel and more.

Credit Cards That Earn Chase Ultimate Rewards

Before we dive into Chase Ultimate Rewards points value by redemption option, here’s an overview of credit cards that earn rewards in this program.

Redeeming Chase Ultimate Rewards for Cash Back

All credit cards that earn Chase Ultimate Rewards get the standard redemption value of 1 cent per point when redeeming for statement credits or cash back. With this redemption rate, 10,000 points are worth $100, and 60,000 points are worth $600.

Note that you can redeem cash back as a statement credit to your account or have the money directly deposited into most U.S. checking or savings accounts , according to Chase.

Redeeming Chase Ultimate Rewards for Travel

All Chase Ultimate Rewards cardholders can redeem their points for travel through Chase Travel at a minimum value of 1 cent per point. Better yet, the Chase portal lets users redeem their points for airfare with any airline, hotel stays around the world, car rentals, experiences, cruise excursions and more.

However, cardholders with select Chase travel credit cards qualify for better redemption rates. Eligible cards include:

- Chase Sapphire Preferred: 25% more value when you redeem travel through Chase Travel

- Chase Sapphire Reserve: 50% more value when you redeem travel through Chase Travel

- Ink Business Preferred: 25% more value when you redeem travel through Chase Travel

With the elevated redemption options above, this means Chase points can be worth 1.25 to 1.5 cents each when redeeming for travel through Chase Travel with the right credit card.

Redeeming Chase Ultimate Rewards for Point Transfers

Chase Ultimate Rewards points value can be highest when cardholders transfer their rewards to an airline or hotel partner for a premium travel redemption. In this scenario, credit card customers actually transfer their points out of their Chase accounts and into a frequent flyer or hotel loyalty account with a different travel brand.

All Chase transfer partners are available with a 1:1 transfer ratio, but not all Chase credit cards allow this option directly. In fact, you can only transfer points to Chase airline and hotel partners if you have the Chase Sapphire Preferred, the Chase Sapphire Reserve or the Ink Business Preferred.

Once you transfer your points away from Chase and into a partner account, the value of your rewards varies based on how you redeem them. However, many redemptions through transfer partners can be worth up to 1.62 cents per point or more.

According to Newsweek valuations, these cards’ average values when redeeming toward transfer partner travel are as follows:

- Chase Sapphire Preferred: 1.38 cents per point

- Chase Sapphire Reserve: 1.62 cents per point

- Ink Business Preferred: 1.38 cents per point

Take this example with the World of Hyatt program. When we searched for hotels in Miami, Florida, for dates in July of 2024, we found an option to book the Hyatt Regency Miami for 9,000 points or $196 points per night.

When you divide the nightly cash rate by 9,000 points, you can see that this redemption gets you more than 2.1 cents per point.

Important : While not all Chase credit cards let you transfer your rewards to airlines and hotels directly, Chase lets you pool points earned in almost all of their accounts for better redemption options. This means you have the chance to use cash back earned through Chase for point transfers, but only if you have the Chase Sapphire Preferred, the Chase Sapphire Reserve or the Ink Business Preferred to combine points with.

Redeeming Chase Ultimate Rewards for Gift Cards

Redeeming Chase points for gift cards makes it easy to treat yourself or someone else, and you may even get more than one cent per point in value when you do. That’s because Chase frequently features gift card options for 10% off, meaning you can get a $100 gift card for 9,000 points when this promotion applies.

Outside of promotional offers, Chase points are worth 1 cent each for this redemption. Gift card options offered through Chase vary widely but include plenty of fan favorites can include:

- Ruth’s Chris Steakhouse

- Virgin Experiences

Redeeming Chase Ultimate Rewards for Amazon or PayPal Purchases

Chase also lets you pay with points at checkout with your PayPal account or on Amazon.com. This redemption option probably seems convenient—and it is—but you’ll want to be aware of the fine print before you go this route.

Points redeemed through Amazon or PayPal are only worth 0.8 cents each, which is less than you would get if you used your card for purchases and then redeemed for statement credits instead.

Redeeming Chase Ultimate Rewards for Dining and Experiences

Chase Sapphire cardmembers can also use their points to book dining options and experiences. Values for these redemptions vary widely but normally work out to approximately 1 cent per point.

Experiences we have seen available to Chase Sapphire cardmembers include options like Peloton classes in New York, New York for 3,500 points or $35 per person, or New York Knicks tickets with hospitality club access and a post-game photo for 38,000 points per $38 per person.

You could even use Chase Ultimate Rewards for a Five Iron Golf Weekend Warrior 3-month pass if you want to fork over 100,000 points (versus $1,000 per person). These can change so check the experiences and dining options currently available at any given time.

Redeeming Chase Ultimate Rewards for Pay Yourself Back

Chase also offers a program called Pay Yourself Back through its rewards program, which was born out of the COVID-19 pandemic. While Pay Yourself Back originally came about as a way to help cardholders get more value for their rewards when travel was limited, this program still exists and offers an elevated redemption rate in certain categories.

For example, cardholders with the Chase Sapphire Reserve previously qualified for the following promotions through Pay Yourself Back:

- 50% more value for charitable contribution redemptions (through March 31, 2024)

- 25% more value for redemptions to cover gas station purchases (through March 31, 2024)

- 25% more value for redemptions to cover grocery store purchases (through March 31, 2024)

- 25% more value to cover annual card membership fees (through March 31, 2024)

Note, however, that Pay Yourself Back options are subject to change and vary by card type.

How To Get the Best Chase Ultimate Rewards Points Value

Because transfers to Chase airline and hotel partners can get you up to 1.62 cents per point in value or more, depending on the card you own, this is the most lucrative option for Chase points by far. However, transferring rewards to another program won’t make sense for everyone, and there are situations where booking travel through the Chase Travel portal yields more flexibility than transfer partners can.

At the end of the day, the best way to use your Chase points depends on the redemption you want to make and your current priorities. This may mean using points to plan a much-needed vacation in a far-flung locale, but it could also mean redeeming rewards for gift cards so you can splurge for something you want. When it comes to Chase Ultimate Rewards points, rewards are yours to use as you want.

Frequently Asked Questions

Does chase let you combine points in one account.

Chase lets you combine all your points from various Chase cards into one account with its “combine points” feature. Not only can you combine cash back earned into travel card accounts, but you can also combine points with another Chase credit card customer as long as they are a member of your household or the owner of the company (in the case of business credit cards).

Do Chase Points Expire?

Chase points have no expiration date as long as your account is open and in good standing. If you close your account without using or transferring your points, you may forfeit your rewards.

Does It Make Sense To Book Travel Through Chase?

Booking travel through Chase Travel is an excellent way to use your points. After all, the Chase portal offers more flexibility with the option to with nearly any airline, hotel or car rental company you can book with elsewhere. If you have the relevant Chase travel credit card, you can also get 25% to 50% more value for your points when booking travel through the portal.

The post What Are Chase Ultimate Rewards Points Worth? first appeared on Newsweek Vault .

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

How I Would Redeem 75,000 Chase Points for Maximum Value

Katie Seemann

Senior Content Contributor and News Editor

342 Published Articles 52 Edited Articles

Countries Visited: 28 U.S. States Visited: 29

Stella Shon

News Managing Editor

89 Published Articles 638 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Keri Stooksbury

Editor-in-Chief

34 Published Articles 3186 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Table of Contents

How i would use 75,000 chase ultimate rewards points, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

It’s time to get excited — there are new elevated welcome bonus offers on 2 popular cards:

- Chase Sapphire Preferred ® Card : Earn 75,000 points after spending $4,000 on purchases in the first 3 months.

- Chase Sapphire Reserve ® : Earn 75,000 points after spending $4,000 on purchases in the first 3 months.

Of course, we love getting outsized value here at Upgraded Points, so I am going to show you how I would use 75,000 Chase points for maximum value — upwards of $3,000 in value!

Earning 75,000 Chase Ultimate Rewards points with just a single welcome offer is excellent. If you redeemed those points through Chase Travel , you’d get $937.50 in value with the Chase Sapphire Preferred card (1.25 cents per point) or $1,125 in value with the Chase Sapphire Reserve card (1.5 cents per point.)

That’s excellent, but I’ll show you how you can do even better . My favorite way to redeem Chase points is to transfer them to the World of Hyatt program . By doing this, I consistently get higher than average values from my points.

2 Nights at Park Hyatt Zürich

Last year, I stayed at Park Hyatt Zürich in Switzerland and thought it was a superb choice.

Centrally located within walking distance of the Old Town area, it was a great base to explore Zürich on foot. It was about a block and a half from Lake Zürich and was just under a 20-minute walk from the main train station, Zürich HB.

This luxurious hotel can cost upwards of $1,000 per night during peak travel seasons. As a Category 8 hotel, it costs 35,000 points per night (off-peak), 40,000 points per night (standard), or 45,000 points per night (peak). It’s a splurge on points, but one that’s worth it, in my opinion.

With the 75,000-point welcome offer on the Chase Sapphire Preferred card or the Chase Sapphire Reserve card, you can get 2 nights at Park Hyatt Zürich (2 off-peak nights — or 1 standard and 1 off-peak night.)

I priced out a random 2-night stay in October, and the cost was either 70,000 Hyatt points or $1,567. It’s awesome that you can earn enough points for that stay with just the new welcome bonus offer .

3 Nights at Grand Hyatt Kauai Resort & Spa

Hawaii is a dream destination — and you can use Chase Ultimate Rewards points to help turn that dream into a real vacation! A couple of years ago, I transferred Chase points to Hyatt to book a stay at the Grand Hyatt Kauai Resort & Spa , and it was fantastic.

You could use your 75,000-point welcome offer to book 3 nights at off-peak pricing at this Category 7 hotel . We found lots of availability in early December 2024 at this price. It would cost over $3,000 to book 3 nights during this time with cash — which means you’d be getting incredible value by using points.

Grand Hyatt Kauai Resort & Spa made our list of the best Hawaii hotels for families to book with points .

5 Nights at Andaz Savannah

Andaz Savannah is a boutique hotel that’s centrally located in Savannah’s historic district. As a Category 4 hotel, it’s a great option for those Category 1-4 free night certificates or for booking with Hyatt points .

Rooms here cost just 12,000 (off-peak), 15,000 (standard), or 18,000 (peak) points per night. I found lots of availability for standard and off-peak nights from June through September and from December through January.

You could pay for 5 nights at standard pricing or 6 nights at off-peak pricing with your welcome offer from either the Chase Sapphire Preferred card or the Chase Sapphire Reserve card.

4 to 6 Nights at Hyatt Regency Chicago

Last December, I visited Chicago for a quick weekend trip. I stayed at the Hyatt Regency Chicago and loved its central location and excellent Regency Club . Even better, anyone who has club access gets a full breakfast in the hotel’s restaurant instead of a continental breakfast in the lounge . That’s why I think this hotel is an excellent option when you have a Club Lounge Access Award to use.

The 75,000 bonus points can pay for up to 6 nights at this hotel . I found lots of availability for points bookings, including 5 consecutive off-peak nights over the Fourth of July holiday . These nights are bookable for 12,000 points each (or you could pay 18,000 points per night for a room that included Club Lounge access.) The cash cost for these 5 nights is just under $1,500.

We estimate Chase Ultimate Rewards points to be worth ~2 cents each. I’ve been able to get at least that much value (and often much more) by transferring my Chase points to Hyatt to book hotel stays.

The new elevated welcome bonus offer for the Chase Sapphire Preferred card and Chase Sapphire Reserve card is a great deal. And fortunately, there’s a lot you can do with that many Chase points.

My personal favorite way to use them is to transfer them to Hyatt to book hotel stays. Whether you’re looking for a budget stay during a road trip, a centrally located hotel in a big city, or a luxury beach resort, your points can go far when you book with Hyatt.

Was this page helpful?

About Katie Seemann

Katie has been in the points and miles game since 2015 and started her own blog in 2016. She’s been freelance writing since then and her work has been featured in publications like Travel + Leisure, Forbes Advisor, and Fortune Recommends.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Dream, discover, book with Chase Travel

Go further when you book with Chase Travel

Competitive rates.

Take advantage of competitive rates at thousands of hotels and resorts, with no booking fees.

Seamless booking

Smoothly plan and book your whole trip, from coveted hotels and convenient flights to cars and must-do local experiences.

Premium benefits

Make the most of your card rewards. Access exclusive benefits and earn and redeem like never before.

Find inspiration

Don’t just dream it. Discover your next adventure with help from fresh trip recommendations and curated picks for unforgettable stays.

Get rewarded

Earn and redeem Ultimate Rewards points with your eligible Chase card, including Chase Sapphire, Freedom, Ink Business credit cards and more.

Earn up to 8,000 bonus points or more

Eligible cardmembers can purchase a trip through Chase Travel with their eligible Chase credit card and get rewarded with 5,000 bonus Ultimate Rewards points when purchasing 2 qualifying travel components, or 8,000 when purchasing 3. Choose from hotels, flights, cars and cruises.

Haven’t traveled with us in a while? You may be eligible for an extra 2,000 bonus points.

Activate and book March 1 to May 31, 2024 for stays through the end of the year.

What are points and miles worth? TPG’s May 2024 monthly valuations

Editor's Note

One of the questions people often ask us is, "How much is a point or mile worth?"

The true answer varies from point to point and person to person. It also depends on your travel goals and how much you maximize a particular loyalty currency. Still, some rewards credit cards are worth more than others, and our goal is to give you a sense of how they stack up.

Historically, TPG has valued points and miles based on a combination of factors: the price at which we would purchase the miles, award costs in the program (factoring in availability and fees) and our expertise in the inner workings of the programs. However, we now use extensive data for the top six U.S. airline loyalty programs to better estimate the value you should aim to get from your rewards. Read our explainer post on our data-driven valuations for a full methodology breakdown.

Note: These valuations are not provided by card issuers.

What are credit card points and miles worth?

What are airline points and miles worth.

*Calculated using TPG's data-backed valuations methodology launched in September 2023.

What are hotel points worth?

Points and miles news.

It's no secret that the Chase Sapphire cards are two of our favorite credit cards here at TPG, so we're thrilled that both the Chase Sapphire Preferred® Card and the Chase Sapphire Reserve® currently offer 75,000 Chase Ultimate Rewards points after you spend $4,000 on purchases in the first three months from account opening.

We often recommend the Chase Sapphire Preferred as an ideal starter card if you want to get into the world of points and miles but don't know where to start. Meanwhile, the Chase Sapphire Reserve is great for frequent travelers seeking to maximize their points.

Along with generous welcome bonuses, both cards earn bonus points for travel and dining. You can access the impressive Chase Sapphire lounges with your complimentary Priority Pass membership if you are a Chase Sapphire Reserve cardholder. Currently, there are six locations open:

- Washington, D.C.'s Dulles International Airport (IAD) : Lounge opened March 2024

- New York's John F. Kennedy International Airport (JFK) : Lounge opened January 2024

- New York's LaGuardia Airport (LGA) : Lounge opened January 2024

- Austin-Bergstrom International Airport (AUS) : Terrace opened March 2023

- Boston Logan International Airport (BOS) : Lounge opened May 2023

- Hong Kong International Airport (HKG) : Lounge opened October 2022

But perhaps the most valuable perk of the Chase Sapphire cards is the Ultimate Rewards points they earn, which we value highly in our monthly valuations because they are so flexible. Whether you want to redeem your points for hotel stays, domestic flights within the U.S. or even business-class flights to Europe, there are many ways to redeem Ultimate Rewards points for maximum value .

Related: Chase Sapphire Preferred vs. Sapphire Reserve: Should you go mid-tier or premium?

Travel credit card offers

There is no shortage of cards offering great welcome bonuses ; here are a few of our favorites this month.

Chase Sapphire Preferred® Card

Although we discussed this card above, it's great, so we'll cover its benefits in more detail here. After all, the Chase Sapphire Preferred® Card is currently offering 75,000 Chase Ultimate Rewards points after you spend $4,000 on purchases in the first three months from account opening. Per our valuations, that's worth $1,537 when you leverage transfer partners or $937 if you redeem through Chase Travel℠ at 1.25 cents per point.

The card comes with a $95 annual fee, travel protections and additional perks — like a $50 annual hotel credit for reservations made through the Chase Travel portal and a 10% anniversary points bonus based on your previous year's spending. For more details, check out our Chase Sapphire Preferred Card review .

Of course, you may want to spring for the Chase Sapphire Reserve® instead. While the card has a higher $550 annual fee, it includes perks like Priority Pass lounge access , a $300 annual travel credit and a Global Entry or TSA PreCheck credit .

Official application link: Chase Sapphire Preferred Card

Capital One Venture X Rewards Credit Card

On the higher end of the spectrum is the Capital One Venture X Rewards Credit Card , one of the market's most exciting travel credit cards, thanks to great earning rates and included perks.

The card currently offers a welcome bonus of 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening — worth $1,388, according to our valuations, thanks to Capital One's excellent airline and hotel transfer partners .

Check out our Capital One Venture X Rewards Credit Card review for more details.

Official application link: Capital One Venture X Rewards Credit Card

Capital One Venture Rewards Credit Card

The standard Capital One Venture Rewards Credit Card offers the same welcome bonus as the Venture X. You can earn 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening. Like the Venture X, the Venture card earns at least 2 miles per dollar on everything you purchase.

Check out our Capital One Venture Rewards Credit Card review for more details.

Official application link: Capital One Venture Rewards Credit Card

The Platinum Card® from American Express

With the current welcome offer on The Platinum Card® from American Express , you'll earn 80,000 Membership Rewards points after you spend $8,000 on purchases in the first six months of card membership — though you may be targeted for a higher offer through the CardMatch tool . (This offer is subject to change at any time.)

Of course, the Amex Platinum Card is jam-packed with benefits like airport lounge access and hotel elite status . The card has a $695 annual fee (see rates and fees ). Enrollment is required for select benefits.

For more details, check out our Amex Platinum review .

Official application link: The Platinum Card from American Express

American Express® Gold Card

One of the most popular cards with TPG staffers, the American Express® Gold Card offers 60,000 Membership Rewards points after you spend $6,000 on eligible purchases on your new card within the first six months of card membership. This welcome offer is worth $1,200 based on our valuations, but be sure to check the CardMatch tool to see if you're targeted for an even higher offer. (This offer is subject to change at any time.)

The Amex Gold Card is great for many everyday purchases. You'll earn 4 points per dollar spent on groceries at U.S. supermarkets (on up to $25,000 in purchases per calendar year, then 1 point per dollar) and 4 points per dollar spent on dining at restaurants. The card has a $250 annual fee (see rates and fees ).

For more details, check out our Amex Gold review .

Official application link: American Express Gold Card

The Business Platinum Card® from American Express

The Business Platinum Card® from American Express offers 150,000 Membership Rewards points after you spend $20,000 on eligible purchases with your card in the first three months of card membership. Per our valuations, this welcome offer is worth at least $3,000, but you can get even more value when redeeming for high-end airfare.

You'll find many lesser-known Amex Business Platinum perks similar to (but slightly different from) the personal version. Check out our comparison of the Amex Platinum and the Business Platinum to see which card fits your wallet better.

For more details, check out our Amex Business Platinum review .

Official application link: The Business Platinum Card from American Express

Capital One Venture X Business

The Capital One Venture X Business card launched in September 2023. The card currently offers a welcome bonus of 150,000 miles after you spend $30,000 in the first three months from account opening. While that's a large spending requirement, those rewards can go a long way toward your next trip.

The Venture X Business features perks that are nearly identical to those on the personal version of the card — including a $300 annual credit for bookings through Capital One Travel , extensive airport lounge access and 10,000 bonus miles each year after your cardholder anniversary.

For more details, check out our Capital One Venture X Business review .

Official application link: Capital One Venture X Business

Ink Business Preferred® Credit Card

The Ink Business Preferred® Credit Card offers a generous welcome bonus of 100,000 Ultimate Rewards points after you spend $8,000 in the first three months after card opening. This is worth over $2,000, based on our current valuation. It could be a great option for business owners looking to benefit from a six-figure welcome bonus who might not reach the higher spending requirements of the Capital One Venture X Business welcome offer .

This card also offers 3 points per dollar on the first $150,000 in combined purchases each year on travel; shipping; internet, cable and phone services; and advertising purchases made with social media sites and search engines.

For more details, check out our Ink Business Preferred Credit Card review .

Official application link: Ink Business Preferred Credit Card

Airline credit cards

Delta and Amex announced changes to the Delta Amex cards in February. Here are the current welcome offers:

*Bonus value is based on TPG valuations and is not provided or reviewed by the issuer.

Check out our list of the best travel credit cards for other options that could fit your wallet.

Related: How to choose the best credit card for you

For rates and fees of the Amex Platinum Card, click here . For rates and fees of the Amex Gold Card, click here . For rates and fees of the Delta Gold Card, click here . For rates and fees of the Delta Gold Business Card, click here . For rates and fees of the Delta Platinum Card, click here . For rates and fees of the Delta Platinum Business Card, click here . For rates and fees of the Delta Reserve Card, click here . For rates and fees of the Delta Reserve Business Card, click here .

IMAGES

COMMENTS

10 points per $1 spent on hotel stays and car rentals purchased through Ultimate Rewards®. 5 points per $1 spent on air travel purchased through Chase. 3 points per $1 spent on travel and dining ...

Points earned with the Ink Business Preferred® Credit Card have an average value of 1.25 cents per point meaning that 10,000 points is equal to about $125.. Chase Ultimate Rewards travel portal: 1.25 cents per point. The Ink Business Preferred Credit Card offers a 25% boost to the value of points redeemed through the Chase Travel portal.

Chase Ultimate Rewards points value via the Chase portal. You can also book travel through the Chase travel portal and redeem points for your plane tickets, hotel stays, rental cars or experiences at a fixed cash value per point. As a Chase Sapphire Preferred or Ink Business Preferred Credit Card cardholder, each point is worth 1.25 cents.

ANA's The Room business class. ERIC ROSEN/THE POINTS GUY Book via Chase Travel. You can book through Chase Travel and redeem points for your plane tickets, hotel stays, rental cars or experiences at a fixed cash value per point. As a Chase Sapphire Preferred or Chase Ink Business Preferred cardholder, each point is worth 1.25 cents.

Transferring Ultimate Rewards to travel partners is, in our opinion, the best way to redeem your hard-earned points. Using Chase transfer partners is certainly your best shot at getting maximum value. You can transfer Ultimate Rewards points to 11 airline programs: Aer Lingus AerClub. Air Canada Aeroplan.

Chase Ultimate Rewards ® is a credit card rewards program offered by Chase that helps turn your everyday purchases into exciting rewards. As a cardmember, you have the opportunity to earn rewards points while you shop, dine or travel. One of the most valuable parts of the program is the built-in flexibility that allows you to earn rewards, then easily redeem or transfer them when you're ready.

So if you have the Chase Sapphire Reserve and Ink Business Preferred, all points can be redeemed for 1.5 cents each toward the cost of a travel purchase. As you can see, this establishes a base value of 1.25-1.5 cents per Ultimate Rewards point, depending on which card you have. Redeem points for 1.5 cents each toward the cost of a travel purchase.

Rewards. Earn 5x points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases ...

A collection of 100,000 Chase points is worth $2,000, according to our valuation of 2 cents each. With 100,000 Chase points, you could have enough for a round-trip business class flight to Japan or Europe, which is a tremendous value. This could have a cash equivalent anywhere from $7,000 to $14,000.

Redeeming Chase Ultimate Reward points. As a general rule of thumb, one point equates to $0.01 in redeemable value. This can fluctuate, however, depending on how you decide to redeem your points. When it comes to travel there are three main ways to redeem Ultimate Rewards points: Booking travel directly through the Chase travel portal.

Earn bonus points on select purchases and redeem for travel, gift cards, cash back and more. Earn 1-15 bonus points per $1 spent at 450+ stores with Shop through Chase. Turn your rewards into a statement credit or a direct deposit into most U.S. checking and savings accounts. Use your card and points to attend exclusive events curated around ...

5 points per dollar on flights and 10 points per dollar on hotels and car rentals when purchasing travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually.

Chase Ultimate Rewards® offers cardholders a wide range of redemption options — from cash back to booking luxury travel. But the value that you'll get from your Chase points depends on which ...

Chase Points Value. Ultimate Rewards points are worth 1 to 1.5 cents in value per point on average. This means 10,000 points are worth anywhere from $100 to $150 depending on which credit cards you have. You can obtain as much as 2 cents or more when transferring points to partners. ... Receive a 25% boost to point value on travel booked ...

While we value Chase points at 2.05 cents apiece, that figure serves as a basis to help you decide whether to use your points when you're planning travel. There are times when you can knock our valuation out of the park by leveraging Chase's 14 transfer partners, sometimes giving you well over 5 cents per point in value.

Chase Ultimate Rewards worth starts at 0.8 cents per point in value, yet it can climb up to 1.62 cents per point or higher with the right redemption. Having a Chase travel credit card unlocks the ...