- +1 900 234 567

- Consumer Goods >

Australia Travel Insurance Market

Australia travel insurance market by age (millennials, generation x, and baby boomers), by income level (low-income travelers, middle-income travelers and high-income travelers), by coverage (medical coverage, trip cancellation coverage, baggage and personal belongings coverage, accidental death and dismemberment (ad&d) coverage), by days of coverage (short-trip insurance, standard trip insurance, extended trip insurance and multi-trip insurance) by end user (pilgrim travelers, education travelers, business travelers and family travelers) by distributional channel (insurance companies, banks, airlines, online platforms, insurance aggregators & comparison websites, and travel agents & tour operators) – opportunity analysis and industry forecast, 2024–2030.

Industry: Consumer Goods | Publish Date: Apr 2024 | No of Pages: 123 | No. Tables: 90 | No. Figures: 55

- Report Description

- List of Table & Figures

- Key Companies

Market Overview

The Australia Travel Insurance Market size was valued at USD 154.7 million in 2023 and is predicted to reach USD 622.7 million by 2030, with a CAGR of 20.6 % from 2024 to 2030. Travel insurance is a specialized insurance product designed to offer protection and coverage to travelers against a wide range of potential risks and unforeseen circumstances that may occur before or during their journeys. It serves as a crucial tool in mitigating the financial impact of various travel-related emergencies, disruptions, and inconveniences, providing travelers with peace of mind and security throughout their trips. One of its primary advantages is its ability to provide financial reimbursement and assistance in the event of trip cancellations or interruptions. This coverage extends to unforeseen circumstances such as illness, injury, or emergencies, allowing travelers to recover non-refundable expenses incurred for flights, accommodations, and other pre-paid arrangements.

The Growing Number of Online Platforms for Travel Insurance Drives the Australia Industry

The expansion of online platforms specializing in travel insurance has fundamentally changed the dynamics of the travel insurance industry in the country, enhancing accessibility and convenience for consumers. These platforms provide a diverse range of options, empowering travelers to effortlessly compare policies and select the most appropriate one based on their preferences and financial circumstances.

Additionally, the online availability of these platforms simplifies the purchasing process, eliminating the need for cumbersome paperwork or visits to insurance providers in person. Consequently, the growing ubiquity of online platforms has heightened competition within the industry, prompting insurance companies to innovate and offer more competitive rates and comprehensive coverage options to capture customers in the digital domain.

Evolving Travel Landscape Boost the Australia Market Growth

The travel industry in the country is constantly evolving as consumer preferences, travel habits, and global trends change over time. This transformation can be seen in the emergence of new destinations and innovative travel styles tailored to diverse interests and preferences. As travelers increasingly seek unique experiences and veer off the beaten path, they encounter a spectrum of new risks and challenges, from medical emergencies in remote locations to cancellations stemming from unforeseen circumstances. In response to these changing needs, travel insurance providers are adapting and developing new insurance plans tailored to meet the specific requirements of modern travelers. These providers may introduce specialized coverage for adventure activities, extended travel periods, or the lifestyle of digital nomads.

By offering insurance options that align with emerging travel trends and destinations, insurers attract a broader clientele and extend their market presence. This proactive approach not only addresses the evolving demands of travelers but also fuels market expansion by providing comprehensive solutions that offer peace of mind and protection across a wide range of travel experiences. Ultimately, the symbiotic relationship between the evolving travel industry and innovative insurance offerings propels market growth and ensures that travelers have access to appropriate coverage for their diverse travel needs.

Perceived High Costs Associated with Travel Insurance Hinder the Australia Market Growth

The perceived high costs associated with travel insurance can serve as a significant hindrance to market expansion in the country. Many travelers may view insurance premiums as an extra financial burden, especially when compared to the overall expenses of their trip. This perception could lead individuals to opt out of purchasing coverage, particularly for shorter or less expensive trips, despite the potential financial risks involved. Moreover, the complexity of insurance pricing structures and the lack of transparency in coverage terms can intensify concerns about value for money. To tackle this challenge, insurance providers need to prioritize educating consumers about the benefits of travel insurance, highlighting its value in mitigating financial risks associated with unforeseen events during travel. Additionally, offering competitive pricing and flexible policies tailored to different travel needs can help alleviate concerns about cost and encourage broader adoption of travel insurance, thus driving market growth.

Predictive Analytics for Risk Assessment Creates Ample Opportunity for the Australia Market Growth

The integration of predictive analytics for risk assessment presents ample opportunities for market growth within the travel insurance industry in the country. By harnessing advanced algorithms and data analytics techniques, insurers can analyze vast amounts of historical and real-time data to accurately assess risks associated with travel, such as medical emergencies, trip cancellations, and natural disasters. This proactive approach enables insurers to offer more personalized and precisely tailored insurance products to customers, based on their unique travel profiles and risk factors.

Additionally, predictive analytics can enhance underwriting processes, enabling insurers to price policies more competitively and accurately while minimizing the likelihood of adverse selection. Furthermore, by leveraging predictive insights, insurers can develop proactive risk mitigation strategies and preventive measures, ultimately improving customer satisfaction and loyalty. Overall, the integration of predictive analytics for risk assessment creates a pathway for market growth by enhancing product innovation, customer experience, and operational efficiency within the travel insurance industry.

Competitive Landscape

Several market players operating in the Australia travel insurance market include Allianz Group, AXA SA, Zurich Insurance Group Limited, American International Group, Inc., Chubb Limited, Aviva PLC, Nationwide, Berkshire Hathaway Speciality Insurance, Travel Insured International, Generali Group and Others.

Australia Travel Insurance Market Key Segments

By age .

Millennials

Generation X

Baby Boomers

By Income Level

Low-income Travelers

Middle-income Travelers

High-income Travelers

By Coverage

Medical Coverage

Trip Cancellation Coverage

Baggage and Personal Belongings Coverage

Accidental Death and Dismemberment (AD&D) Coverage

By Days of Coverage

Short-Trip Insurance

Standard Trip Insurance

Extended Trip Insurance

Multi-Trip Insurance

By End User

Pilgrim Travelers

Education Travelers

Business Travelers

Family Travelers

By Distributional Channel

Insurance Companies

Online Platforms

Insurance Aggregators and Comparison Websites

Travel Agents and Tour Operators

REPORT SCOPE AND SEGMENTATION:

1 INTRODUCTION

1.1 REPORT DESCRIPTION

1.2 RESEARCH METHODOLOGY

1.2.1 SECONDARY RESEARCH

1.2.2 DATA ANALYSIS FRAMEWORK

1.2.3 MARKET SIZE ESTIMATION

1.2.4 FORECASTING

1.2.5 PRIMARY RESEARCH AND DATA VALIDATION

2 AUSTRALIA TRAVEL INSURANCE MARKET – EXECUTIVE SUMMARY

2.1. MARKET SNAPSHOT, 2023 - 2030, Million USD

3 PORTER’S FIVE FORCE MODEL ANALYSIS

3.1 BARGAINING POWER OF SUPPLIERS

3.2 BARGAINING POWER OF BUYERS

3.3 DEGREE OF COMPETITION

3.4 THREAT OF SUBSTITUTE

3.5 THREAT OF NEW ENTRANTS

4 MARKET SHARE ANALYSIS

4.1 MARKET SHARE ANALYSIS OF TOP PROVIDERS, 2023

5 MARKET DYNAMICS

5.1 GROWTH DRIVERS

5.1.1 DRIVER 1

5.1.2 DRIVER 2

5.1.3 DRIVER 3

5.1.4 DRIVER 4

5.2 CHALLENGES

5.2.1 CHALLENGE 1

5.2.2 CHALLENGE 2

5.2.3 CHALLENGE 3

5.2.4 CHALLENGE 4

5.3 OPPORTUNITIES

5.3.1 OPPORTUNITY 1

5.3.2 OPPORTUNITY 2

6 AUSTRALIA TRAVEL INSURANCE MARKET BY AGE

6.1 OVERVIEW

6.2 MILLENNIALS MARKET

6.3 GENERATION X MARKET

6.4 BABY BOOMERS MARKET

7 AUSTRALIA TRAVEL INSURANCE MARKET BY INCOME LEVEL

7.1 OVERVIEW

7.2 LOW-INCOME TRAVELERS MARKET

7.3 MIDDLE-INCOME TRAVELERS MARKET

7.4 HIGH-INCOME TRAVELERS MARKET

8 AUSTRALIA TRAVEL INSURANCE MARKET BY COVERAGE

8.1 OVERVIEW

8.2 MEDICAL COVERAGE MARKET

8.3 TRIP CANCELLATION COVERAGE MARKET

8.4 BAGGAGE AND PERSONAL BELONGINGS COVERAGE MARKET

8.5 ACCIDENTAL DEATH AND DISMEMBERMENT COVERAGE MARKET

9 AUSTRALIA TRAVEL INSURANCE MARKET BY DAYS OF COVERAGE

9.1 OVERVIEW

9.2 SHORT-TRIP INSURANCE MARKET

9.3 STANDARD TRIP INSURANCE MARKET

9.4 EXTENDED TRIP INSURANCE MARKET

9.5 MULTI-TRIP INSURANCE MARKET

10 AUSTRALIA TRAVEL INSURANCE MARKET BY END USER

10.1 OVERVIEW

10.2 PILGRIM TRAVELERS MARKET

10.3 EDUCATION TRAVELERS MARKET

10.4 BUSINESS TRAVELERS MARKET

10.5 FAMILY TRAVELERS MARKET

11 AUSTRALIA TRAVEL INSURANCE MARKET BY DISTRIBUTIONAL CHANNEL

11.1 OVERVIEW

11.2 INSURANCE COMPANIES MARKET

11.3 BANKS MARKET

11.4 AIRLINES MARKET

11.5 ONLINE PLATFORMS MARKET

11.6 INSURANCE AGGREGATORS AND COMPARISON WEBSITES MARKET

11.7 TRAVEL AGENTS AND TOUR OPERATORS MARKET

12 COMPANY PROFILES

12.1 ALLIANZ GROUP

12.1.1 COMPANY OVERVIEW

12.1.2 COMPANY SNAPSHOT

12.1.3 OPERATING BUSINESS SEGMENTS

12.1.4 PRODUCT PORTFOLIO

12.1.5 BUSINESS PERFORMANCE

12.1.6 BUSINESS SEGMENTS

12.1.7 GEOGRAPHIC SEGMENTS

12.1.8 KEY STRATEGIC MOVES AND DEVELOPMENT

12.1.9 PRIMARY MARKET COMPETITORS

12.2 AXA SA

12.2.1 COMPANY OVERVIEW

12.2.2 COMPANY SNAPSHOT

12.2.3 OPERATING BUSINESS SEGMENTS

12.2.4 PRODUCT PORTFOLIO

12.2.5 BUSINESS PERFORMANCE

12.2.6 BUSINESS SEGMENTS

12.2.7 GEOGRAPHIC SEGMENTS

12.2.8 KEY STRATEGIC MOVES AND DEVELOPMENT

12.2.9 PRIMARY MARKET COMPETITORS

12.3 ZURICH INSURANCE GROUP LIMITED

12.3.1 COMPANY OVERVIEW

12.3.2 COMPANY SNAPSHOT

12.3.3 OPERATING BUSINESS SEGMENTS

12.3.4 PRODUCT PORTFOLIO

12.3.5 BUSINESS PERFORMANCE

12.3.6 BUSINESS SEGMENTS

12.3.7 GEOGRAPHIC SEGMENTS

12.3.8 KEY STRATEGIC MOVES AND DEVELOPMENT

12.3.9 PRIMARY MARKET COMPETITORS

12.4 AMERICAN INTERNATIONAL GROUP, INC.

12.4.1 COMPANY OVERVIEW

12.4.2 COMPANY SNAPSHOT

12.4.3 OPERATING BUSINESS SEGMENTS

12.4.4 PRODUCT PORTFOLIO

12.4.5 BUSINESS PERFORMANCE

12.4.6 BUSINESS SEGMENTS

12.4.7 GEOGRAPHIC SEGMENTS

12.4.8 KEY STRATEGIC MOVES AND DEVELOPMENT

12.4.9 PRIMARY MARKET COMPETITORS

12.5 CHUBB LIMITED

12.5.1 COMPANY OVERVIEW

12.5.2 COMPANY SNAPSHOT

12.5.3 OPERATING BUSINESS SEGMENTS

12.5.4 PRODUCT PORTFOLIO

12.5.5 BUSINESS PERFORMANCE

12.5.6 BUSINESS SEGMENTS

12.5.7 GEOGRAPHIC SEGMENTS

12.5.8 KEY STRATEGIC MOVES AND DEVELOPMENT

12.5.9 PRIMARY MARKET COMPETITORS

12.6 AVIVA PLC

12.6.1 COMPANY OVERVIEW

12.6.2 COMPANY SNAPSHOT

12.6.3 OPERATING BUSINESS SEGMENTS

12.6.4 PRODUCT PORTFOLIO

12.6.5 BUSINESS PERFORMANCE

12.6.6 BUSINESS SEGMENTS

12.6.7 GEOGRAPHIC SEGMENTS

12.6.8 KEY STRATEGIC MOVES AND DEVELOPMENT

12.6.9 PRIMARY MARKET COMPETITORS

12.7 NATIONWIDE

12.7.1 COMPANY OVERVIEW

12.7.2 COMPANY SNAPSHOT

12.7.3 OPERATING BUSINESS SEGMENTS

12.7.4 PRODUCT PORTFOLIO

12.7.5 BUSINESS PERFORMANCE

12.7.6 BUSINESS SEGMENTS

12.7.7 GEOGRAPHIC SEGMENTS

12.7.8 KEY STRATEGIC MOVES AND DEVELOPMENT

12.7.9 PRIMARY MARKET COMPETITORS

12.8 BERKSHIRE HATHAWAY SPECIALITY INSURANCE

12.8.1 COMPANY OVERVIEW

12.8.2 COMPANY SNAPSHOT

12.8.3 OPERATING BUSINESS SEGMENTS

12.8.4 PRODUCT PORTFOLIO

12.8.5 BUSINESS PERFORMANCE

12.8.6 BUSINESS SEGMENTS

12.8.7 GEOGRAPHIC SEGMENTS

12.8.8 KEY STRATEGIC MOVES AND DEVELOPMENT

12.8.9 PRIMARY MARKET COMPETITORS

12.9 TRAVEL INSURED INTERNATIONAL

12.9.1 COMPANY OVERVIEW

12.9.2 COMPANY SNAPSHOT

12.9.3 OPERATING BUSINESS SEGMENTS

12.9.4 PRODUCT PORTFOLIO

12.9.5 BUSINESS PERFORMANCE

12.9.6 BUSINESS SEGMENTS

12.9.7 GEOGRAPHIC SEGMENTS

12.9.8 KEY STRATEGIC MOVES AND DEVELOPMENT

12.9.9 PRIMARY MARKET COMPETITORS

12.10 GENERALI GROUP AND OTHERS

12.10.1 COMPANY OVERVIEW

12.10.2 COMPANY SNAPSHOT

12.10.3 OPERATING BUSINESS SEGMENTS

12.10.4 PRODUCT PORTFOLIO

12.10.5 BUSINESS PERFORMANCE

12.10.6 BUSINESS SEGMENTS

12.10.7 GEOGRAPHIC SEGMENTS

12.10.8 KEY STRATEGIC MOVES AND DEVELOPMENT

12.10.9 PRIMARY MARKET COMPETITORS

LIST OF TABLES

TABLE 1. AUSTRALIA TRAVEL INSURANCE MARKET VALUE, BY AGE, 2023-2030, (MILLION USD)

TABLE 2. MILLENNIALS, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 3. GENERATION X, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 4. BABY BOOMERS, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 5. AUSTRALIA TRAVEL INSURANCE MARKET VALUE, BY INCOME LEVEL, 2023-2030, (MILLION USD)

TABLE 6. LOW-INCOME TRAVELERS, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 7. MIDDLE-INCOME TRAVELERS, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 8. HIGH-INCOME TRAVELERS, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 9. AUSTRALIA TRAVEL INSURANCE MARKET VALUE, BY COVERAGE, 2023-2030, (MILLION USD)

TABLE 10. MEDICAL COVERAGE, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 11. TRIP CANCELLATION COVERAGE, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 12. BAGGAGE AND PERSONAL BELONGINGS COVERAGE, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 13. ACCIDENTAL DEATH AND DISMEMBERMENT COVERAGE, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 14. AUSTRALIA TRAVEL INSURANCE MARKET VALUE, BY DAYS OF COVERAGE, 2023-2030, (MILLION USD)

TABLE 15. SHORT-TRIP INSURANCE, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 16. STANDARD TRIP INSURANCE, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 17. EXTENDED TRIP INSURANCE, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 18. MULTI-TRIP INSURANCE, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 19. AUSTRALIA TRAVEL INSURANCE MARKET VALUE, BY END USER, 2023-2030, (MILLION USD)

TABLE 20. PILGRIM TRAVELERS, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 21. EDUCATION TRAVELERS, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 22. BUSINESS TRAVELERS, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 23. FAMILY TRAVELERS, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 24. AUSTRALIA TRAVEL INSURANCE MARKET VALUE, BY DISTRIBUTIONAL CHANNEL, 2023-2030, (MILLION USD)

TABLE 25. INSURANCE COMPANIES, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 26. BANKS, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 27. AIRLINES, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 28. ONLINE PLATFORMS, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 29. INSURANCE AGGREGATORS AND COMPARISON WEBSITES, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 30. TRAVEL AGENTS AND TOUR OPERATORS, MARKET VALUE, 2023-2030, (MILLION USD)

TABLE 31. ALLIANZ GROUP: COMPANY SNAPSHOT

TABLE 32. ALLIANZ GROUP: OPERATING BUSINESS SEGMENTS

TABLE 33. ALLIANZ GROUP: PRODUCT PORTFOLIO

TABLE 34. ALLIANZ GROUP: SALES BY BUSINESS SEGMENTS (2021-2023)

TABLE 35. ALLIANZ GROUP: SALES BY GEOGRAPHIC SEGMENTS (2021-2023)

TABLE 36. ALLIANZ GROUP: KEY STRATERGY

TABLE 37. AXA SA: COMPANY SNAPSHOT

TABLE 38. AXA SA: OPERATING BUSINESS SEGMENTS

TABLE 39. AXA SA: PRODUCT PORTFOLIO

TABLE 40. AXA SA: SALES BY BUSINESS SEGMENTS (2021-2023)

TABLE 41. AXA SA: SALES BY GEOGRAPHIC SEGMENTS (2021-2023)

TABLE 42. AXA SA: KEY STRATERGY

TABLE 43. ZURICH INSURANCE GROUP LIMITED: COMPANY SNAPSHOT

TABLE 44. ZURICH INSURANCE GROUP LIMITED: OPERATING BUSINESS SEGMENTS

TABLE 45. ZURICH INSURANCE GROUP LIMITED: PRODUCT PORTFOLIO

TABLE 46. ZURICH INSURANCE GROUP LIMITED: SALES BY BUSINESS SEGMENTS (2021-2023)

TABLE 47. ZURICH INSURANCE GROUP LIMITED: SALES BY GEOGRAPHIC SEGMENTS (2021-2023)

TABLE 48. ZURICH INSURANCE GROUP LIMITED: KEY STRATERGY

TABLE 49. AMERICAN INTERNATIONAL GROUP, INC.: COMPANY SNAPSHOT

TABLE 50. AMERICAN INTERNATIONAL GROUP, INC.: OPERATING BUSINESS SEGMENTS

TABLE 51. AMERICAN INTERNATIONAL GROUP, INC.: PRODUCT PORTFOLIO

TABLE 52. AMERICAN INTERNATIONAL GROUP, INC.: SALES BY BUSINESS SEGMENTS (2021-2023)

TABLE 53. AMERICAN INTERNATIONAL GROUP, INC.: SALES BY GEOGRAPHIC SEGMENTS (2021-2023)

TABLE 54. AMERICAN INTERNATIONAL GROUP, INC.: KEY STRATERGY

TABLE 55. CHUBB LIMITED: COMPANY SNAPSHOT

TABLE 56. CHUBB LIMITED: OPERATING BUSINESS SEGMENTS

TABLE 57. CHUBB LIMITED: PRODUCT PORTFOLIO

TABLE 58. CHUBB LIMITED: SALES BY BUSINESS SEGMENTS (2021-2023)

TABLE 59. CHUBB LIMITED: SALES BY GEOGRAPHIC SEGMENTS (2021-2023)

TABLE 60. CHUBB LIMITED: KEY STRATERGY

TABLE 61. AVIVA PLC: COMPANY SNAPSHOT

TABLE 62. AVIVA PLC: OPERATING BUSINESS SEGMENTS

TABLE 63. AVIVA PLC: PRODUCT PORTFOLIO

TABLE 64. AVIVA PLC: SALES BY BUSINESS SEGMENTS (2021-2023)

TABLE 65. AVIVA PLC: SALES BY GEOGRAPHIC SEGMENTS (2021-2023)

TABLE 66. AVIVA PLC: KEY STRATERGY

TABLE 67. NATIONWIDE: COMPANY SNAPSHOT

TABLE 68. NATIONWIDE: OPERATING BUSINESS SEGMENTS

TABLE 69. NATIONWIDE: PRODUCT PORTFOLIO

TABLE 70. NATIONWIDE: SALES BY BUSINESS SEGMENTS (2021-2023)

TABLE 71. NATIONWIDE: SALES BY GEOGRAPHIC SEGMENTS (2021-2023)

TABLE 72. NATIONWIDE: KEY STRATERGY

TABLE 73. BERKSHIRE HATHAWAY SPECIALITY INSURANCE: COMPANY SNAPSHOT

TABLE 74. BERKSHIRE HATHAWAY SPECIALITY INSURANCE: OPERATING BUSINESS SEGMENTS

TABLE 75. BERKSHIRE HATHAWAY SPECIALITY INSURANCE: PRODUCT PORTFOLIO

TABLE 76. BERKSHIRE HATHAWAY SPECIALITY INSURANCE: SALES BY BUSINESS SEGMENTS (2021-2023)

TABLE 77. BERKSHIRE HATHAWAY SPECIALITY INSURANCE: SALES BY GEOGRAPHIC SEGMENTS (2021-2023)

TABLE 78. BERKSHIRE HATHAWAY SPECIALITY INSURANCE: KEY STRATERGY

TABLE 79. TRAVEL INSURED INTERNATIONAL: COMPANY SNAPSHOT

TABLE 80. TRAVEL INSURED INTERNATIONAL: OPERATING BUSINESS SEGMENTS

TABLE 81. TRAVEL INSURED INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 82. TRAVEL INSURED INTERNATIONAL: SALES BY BUSINESS SEGMENTS (2021-2023)

TABLE 83. TRAVEL INSURED INTERNATIONAL: SALES BY GEOGRAPHIC SEGMENTS (2021-2023)

TABLE 84. TRAVEL INSURED INTERNATIONAL: KEY STRATERGY

TABLE 85. GENERALI GROUP AND OTHERS: COMPANY SNAPSHOT

TABLE 86. GENERALI GROUP AND OTHERS: OPERATING BUSINESS SEGMENTS

TABLE 87. GENERALI GROUP AND OTHERS: PRODUCT PORTFOLIO

TABLE 88. GENERALI GROUP AND OTHERS: SALES BY BUSINESS SEGMENTS (2021-2023)

TABLE 89. GENERALI GROUP AND OTHERS: SALES BY GEOGRAPHIC SEGMENTS (2021-2023)

TABLE 90. GENERALI GROUP AND OTHERS: KEY STRATERGY

LIST OF FIGURES

FIGURE 1. BARGAINING POWER OF SUPPLIERS

FIGURE 2. BARGAINING POWER OF BUYERS

FIGURE 3. DEGREE OF COMPETITION

FIGURE 4. THREAT OF SUBSTITUTE

FIGURE 5. THREAT OF NEW ENTRANTS

FIGURE 6. AUSTRALIA TRAVEL INSURANCE MARKET VALUE, BY AGE, 2023-2030, (MILLION USD)

FIGURE 7. MILLENNIALS, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 8. GENERATION X, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 9. BABY BOOMERS, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 10. AUSTRALIA TRAVEL INSURANCE MARKET VALUE, BY INCOME LEVEL, 2023-2030, (MILLION USD)

FIGURE 11. LOW-INCOME TRAVELERS, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 12. MIDDLE-INCOME TRAVELERS, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 13. HIGH-INCOME TRAVELERS, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 14. AUSTRALIA TRAVEL INSURANCE MARKET VALUE, BY COVERAGE, 2023-2030, (MILLION USD)

FIGURE 15. MEDICAL COVERAGE, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 16. TRIP CANCELLATION COVERAGE, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 17. BAGGAGE AND PERSONAL BELONGINGS COVERAGE, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 18. ACCIDENTAL DEATH AND DISMEMBERMENT COVERAGE, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 19. AUSTRALIA TRAVEL INSURANCE MARKET VALUE, BY DAYS OF COVERAGE, 2023-2030, (MILLION USD)

FIGURE 20. SHORT-TRIP INSURANCE, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 21. STANDARD TRIP INSURANCE, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 22. EXTENDED TRIP INSURANCE, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 23. MULTI-TRIP INSURANCE, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 24. AUSTRALIA TRAVEL INSURANCE MARKET VALUE, BY END USER, 2023-2030, (MILLION USD)

FIGURE 25. PILGRIM TRAVELERS, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 26. EDUCATION TRAVELERS, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 27. BUSINESS TRAVELERS, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 28. FAMILY TRAVELERS, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 29. AUSTRALIA TRAVEL INSURANCE MARKET VALUE, BY DISTRIBUTIONAL CHANNEL, 2023-2030, (MILLION USD)

FIGURE 30. INSURANCE COMPANIES, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 31. BANKS, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 32. AIRLINES, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 33. ONLINE PLATFORMS, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 34. INSURANCE AGGREGATORS AND COMPARISON WEBSITES, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 35. TRAVEL AGENTS AND TOUR OPERATORS, MARKET VALUE, 2023-2030, (MILLION USD)

FIGURE 36. ALLIANZ GROUP: NET SALES, (2021-2023)

FIGURE 37. ALLIANZ GROUP: PRIMARY MARKET COMPETITORS

FIGURE 38. AXA SA: NET SALES, (2021-2023)

FIGURE 39. AXA SA: PRIMARY MARKET COMPETITORS

FIGURE 40. ZURICH INSURANCE GROUP LIMITED: NET SALES, (2021-2023)

FIGURE 41. ZURICH INSURANCE GROUP LIMITED: PRIMARY MARKET COMPETITORS

FIGURE 42. AMERICAN INTERNATIONAL GROUP, INC.: NET SALES, (2021-2023)

FIGURE 43. AMERICAN INTERNATIONAL GROUP, INC.: PRIMARY MARKET COMPETITORS

FIGURE 44. CHUBB LIMITED: NET SALES, (2021-2023)

FIGURE 45. CHUBB LIMITED: PRIMARY MARKET COMPETITORS

FIGURE 46. AVIVA PLC: NET SALES, (2021-2023)

FIGURE 47. AVIVA PLC: PRIMARY MARKET COMPETITORS

FIGURE 48. NATIONWIDE: NET SALES, (2021-2023)

FIGURE 49. NATIONWIDE: PRIMARY MARKET COMPETITORS

FIGURE 50. BERKSHIRE HATHAWAY SPECIALITY INSURANCE: NET SALES, (2021-2023)

FIGURE 51. BERKSHIRE HATHAWAY SPECIALITY INSURANCE: PRIMARY MARKET COMPETITORS

FIGURE 52. TRAVEL INSURED INTERNATIONAL: NET SALES, (2021-2023)

FIGURE 53. TRAVEL INSURED INTERNATIONAL: PRIMARY MARKET COMPETITORS

FIGURE 54. GENERALI GROUP AND OTHERS: NET SALES, (2021-2023)

FIGURE 55. GENERALI GROUP AND OTHERS: PRIMARY MARKET COMPETITORS

KEY PLAYERS

Allianz Group

Zurich Insurance Group Limited

American International Group, Inc.

Chubb Limited

Berkshire Hathaway Speciality Insurance

Travel Insured International

Generali Group

Frequently Asked Questions

Travel insurance policies vary, but common coverage includes trip cancellation or interruption, medical expenses, emergency medical evacuation, lost or delayed luggage, travel delays, and assistance services such as 24/7 emergency assistance hotlines.

Regulatory challenges such as diverse and complex regulations imposed by governmental authorities across county restrain the growth of the market.

According to Next Move Strategy Consulting, North America is the dominant region in the travel insurance market.

Several market players operating in the travel insurance market include Allianz Group, AXA SA, Zurich Insurance Group Limited, American International Group, Inc., Chubb Limited, Aviva PLC, Nationwide, Berkshire Hathaway Speciality Insurance, Travel Insured International, Generali Group and Others.

By age group, millennials are the dominant segment in the Australia travel insurance market.

Enquiry For:

Download free sample.

Travel Insurance Market

Travel insurance market size, share & trends analysis report by insurance cover (single-trip travel insurance, annual multi-trip travel insurance, long-stay travel insurance), by distribution channel (insurance intermediaries, insurance companies, banks, insurance brokers, insurance aggregators), by age group (1-17 years old, 18-30 years old, 31-49 years old, above 50), by end user (senior citizens, education travelers, business travelers, family travelers, others) and by region(north america, europe, apac, middle east and africa, latam) forecasts, 2022-2030.

Market Dynamics

Regional analysis, report scope, segmental analysis.

- Recent Development

Top Key Players

- Report Overview

- Table of Content

- Segmentation

Download Free Sample

Market overview.

The global travel insurance market size was valued at USD 22780 million in 2021 and is estimated to reach an expected value of USD 48665 million by 2030 , registering a CAGR of 8.8% during the forecast period (2022 – 2030).

An insurance product called travel insurance is made to cover unforeseen circumstances that may arise while on the road, whether domestically or abroad. It typically offers coverages for unexpected medical costs, trip cancellation, aircraft delays, lost luggage, public liability, and other costs to reduce risks while traveling. Additionally, based on coverages, travel insurance providers offer a variety of plans by paying for expenses and losses related to travel. Additionally, several intermediaries in the supply chain, including insurance aggregators, banks, and brokers, give customers various options to evaluate goods and pricing and recommend appropriate insurance policies. Additionally, visitors visiting nations like Thailand, Cuba, Antarctica, Schengen nations, the United States, and the United Arab Emirates must purchase international travel insurance.

Online travel insurance sales through direct airline websites, online travel agents (OTAs), and company websites and applications are becoming increasingly popular. This is fueling the expansion of the online travel insurance sector. Additional market expansion factors include increased tourism by rising disposable income, simple internet travel bookings, package vacations, extended holiday coverage, etc. A surge in tourism brings about several incidents, including trip cancellations, luggage, critical document losses, medical emergencies, and others. Customers choose travel insurance to reduce these risks, a crucial element driving the market for travel insurance.

Market Driving Factors

Convenient shopping due to online comparison sites.

With increased internet usage for online comparison shopping, consumer preferences are changing and gaining a seamless experience for travel insurance purchases. Online portals such as direct airline sites, online travel agencies (OTAs), and company websites & applications drive the growth of the online insurance market, spreading awareness among users in the market. In addition, these online sites typically offer limited options from a single company, providing travelers with the easiest way to compare and buy travel insurance coverages from top-rated providers in the market. As a result, these factors behind comparison-shopping via online sites fuel the growth of the travel insurance premium during the forecast period.

For example, in 2019, a study conducted by TravelInsurance.com offered a way to compare multiple travel insurance companies and projected that online comparison sites to be the fastest growing sales channel for the travel insurance industry in the market.

Travel Rule and Regulations

Travel insurance providers in the market are adopting several model acts, laws & regulations to sustain the competitive environment. The new approaches by regulatory bodies include the development of prospective legislation and enforcement activity, accelerating the growth of travel protection products and services in the industry. The combination of enforcement & development of model laws drives the growth of travel insurance premiums; thereby, modernizing the unique nature of travel protection offerings across the industry. For instance, in the U.S., the National Association of Insurance Commissioners (NAIC) has proposed a new model act to promote public welfare and a comprehensive legal framework within the travel insurance industry. In addition, the regulatory body implemented a significant step for the industry to address growing consumer needs with standard laws and regulations.

Market Restraining Factors

Lack of awareness regarding travel insurance policy.

Lack of understanding and awareness regarding travel insurance coverages is a significant factor that restrains the growth of the travel insurance market. The consumers' experiences and adoption of travel insurance remain a primary concern, which needs to be addressed by eliminating knowledge gaps for travel insurance in the market. A survey conducted, in 2018, by TravelInsurance.com projected that 47% of the respondents were unaware of health insurance coverages included in the policy. In addition, misguidance toward premium rates, coverage provided, the value proposition of travel insurance, and the benefits it provides. As a result, these factors limit the market's growth of travel insurance premiums.

Market Key Opportunities

New technological developments in the travel insurance industry.

Growing market prospects for insurers are being created by technologies, including geolocation, application program interfaces (API), artificial intelligence (A.I.), data analytics, blockchain, and big data. With these advancements in technology, distribution channels for travel insurance should operate more efficiently and offer coverages at the point of sale.

Additionally, travel insurance companies may provide their clients with highly customized user experiences thanks to digital transformation. Further, to maintain market position, insurers are considering the use of big data analytics that offer possibilities of generating significant premiums.

In addition, technology helps in data collection, caters to customer-specific needs, calculates risk, and detects fraud. As a result, technology improvements that make travel insurance easy to get and convenient are predicted to generate profitable market prospects for insurers.

Region-wise, the global travel insurance market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific was the highest revenue contributor and is estimated to grow at a CAGR of 11.3%. It is considered the fastest growing region globally because of its emerging economies, growing population, and middle-income segment. The travel insurance market is particularly brisk in countries such as China, Japan, India, Indonesia, Korea, Australia, Hong Kong, Taiwan, New Zealand, and Singapore, with high G.D.P. growth and a rise in per capita income. Further, users such as senior citizens and baby boomers are opting for insurance intermediaries, owing to the long-term relationship and trust associated with travel insurance purchases. Insurance intermediaries provide better services and an understanding of the travel insurance policies in the market. In addition, nearly two-thirds of travel insurance policies sold in this region are carried out by traditional travel agencies and suppliers. Moreover, single-trip policies are popular policies among travelers in the region. The insurance intermediaries are the prime distribution channel for selling travel insurance policies in Asia-Pacific. Stringent laws and regulations regarding data protection in the travel insurance industry fuel the region's demand for the travel insurance market.

Europe is the second largest region. It is estimated to reach an expected value of USD 12145 million by 2030, registering a CAGR of 6.4%. The rise in the number of senior citizen travelers taking abroad and domestic trips and the increase in business travel spending are some of the factors that fuel the growth of the European travel insurance market. Furthermore, the increase in the trend of multigenerational travel also drives the growth of the travel insurance market in the region. In Europe, single-trip policies occupy the most significant travel insurance market share.

Additionally, the rise in business travelers and senior citizens is expected to boost the market sales of annual and long-stay travel insurance policies. Further, the majority of policies across Europe are sold through insurance intermediaries; therefore, this segment is expected to grow during the forecast period. For instance, Allianz Partners, which owns Allianz Global Assistance U.S., projected that 15 of the 26 Schengen nations currently require mandatory travel insurance for visitors, students, and ex-pats. These end users are creating profitable opportunities for travel insurance providers in the region.

North America is the third largest region. In North America, trip cancellation/interruption is the most popular policy and is expected to remain the same during the forecast period. In addition, the sale of travel medical insurance and evacuation insurance plans has witnessed a steady demand in the market. Senior citizens, family travelers, and backpackers are the significant buyers of travel insurance in this region, and most of the policies are sold via travel intermediaries. These industries are creating lucrative opportunities for insurance providers in the region. For instance, in 2018, a study by the U.S. Travel Insurance Association projected that consumers spent nearly $3,800 million on travel protection via a travel insurance policy.

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports

The global international travel insurance market is divided into insurance cover, end users, distribution channels, and regions.

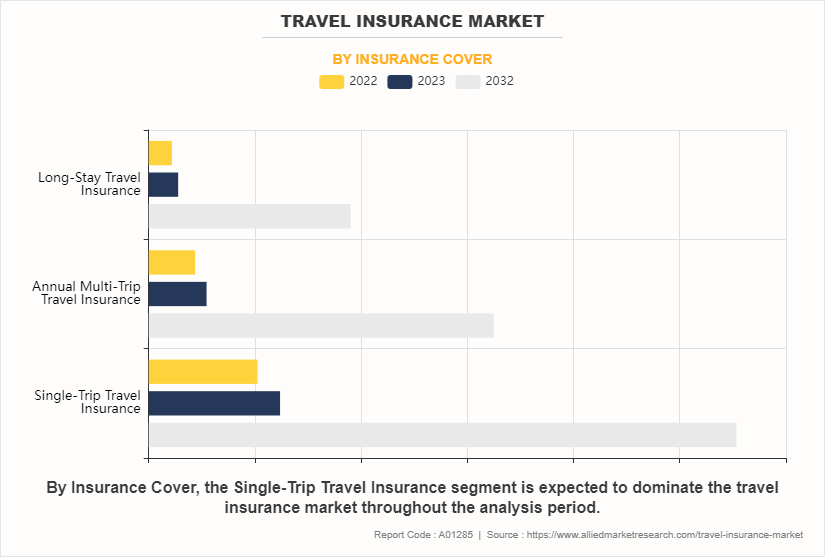

In terms of insurance cover, the global travel insurance market is segmented into single-trip travel insurance, annual multi-trip travel insurance, and long-stay travel insurance. The single-trip travel insurance segment was the highest contributor to the market and is estimated to grow at a CAGR of 7.8% during the forecast period. Single-trip policies are popular travel insurance policies across all regions. However, Asia-Pacific witnessed higher demand for single-trip travel insurance policies, owing to an increase in the number of multi-generation travelers such as grandparents, parents, and grandchildren.

The annual multi-trip travel insurance segment is the fastest growing. Business travelers tend to travel multiple times within a year. An annual multi-trip policy is best suited for these users, and its demand is expected to grow at the highest rate during the forecast period. In addition, an increase in business travelers in the Asia-Pacific region provides a promising opportunity for travel insurance providers in the market.

Based on distribution channels, the global travel insurance market is classified into insurance intermediaries, insurance companies, banks, insurance brokers, and insurance aggregators. The insurance intermediaries segment was the highest contributor to the market and is estimated at a CAGR of 7.9% during the forecast period. Insurance intermediaries are upgrading their businesses by incorporating software like the global distribution system (G.D.S.), which enables transactions between travel industry service providers such as airlines, hotels, car rental companies, and travel agencies. This software becoming a significant trend helps in determining customer behavior & increased purchases for travel insurance policies in the market.

The insurance aggregators segment is the fastest growing. Consumer buying behavior, insurers' participation in aggregator services, and an increase in travel and tourism are becoming significant trends in the market. For instance, a study conducted by Accenture projected that 83% and 60% of insurers in the U.K. and the U.S. are launching their aggregator sites for travel insurance. Furthermore, marketing expenditure by existing insurers for providing online travel insurance services boosts the segment's growth. Conversely, educating customers, assessing their product needs, and serving the right product via online portals are expected to create lucrative opportunities for insurance aggregators in the upcoming years.

Based on end-user users, the global travel insurance market is segmented into senior citizens, education travelers, business travelers, family travelers, and others. The family travelers segment was the highest contributor to the market and is estimated to grow at a CAGR of 7.1% during the forecast period. The rise in multigenerational travel trends among families is expected to increase the demand for travel insurance policies. In addition, the travel market no longer refers to the notion of a nuclear family. Instead, it defines "family" as a combination of four or more adults. This has become another growing trend in family travelers in the market. Moreover, due to the increase in adventure travel packages, families travel with children above 18. The young generation of travel influencers is growing rapidly, thereby boosting the segment's growth. On the contrary, healthier and more affluent grandparents have supplemented this growth with luxury travel, entertainment, and get-togethers among family members residing in different countries is the essential purpose of travel. Therefore, these factors provide lucrative opportunities for travel insurance providers in the upcoming years.

The business travelers segment is the fastest growing. A growing network of co-working and remote workers are rapidly integrating into the corporate travel booking ecosystem. This growing demand for corporate travel experience, including booking, expenses, customized travel insurance policies, trip management, and others, is becoming a significant trend in the market. Moreover, "Bleisure," a combination of business and leisure travel, is one of the biggest travel trends, which fuels t demand for travel insurance premiums in the market. With these increases in business travel spending, international business transactions have increased penetration of travel insurance among business travelers, dynamically targeting these travelers based on both sets of interests. Conversely, travel insurance providers can create corporate travel insurance plans with an option to extend coverage by leisure activities and respond to various factors such as health, safety, political or social change, security, natural disasters, and others. These factors create immense potential for insurers in the upcoming years. For instance, developing county, such as India, is expected to witness rapid growth in business travelers, owing to increased expansion in overseas businesses in the market.

Market Size By Insurance Cover

Recent developments.

- September 2022 - Allianz is recognized as a Sustainable Insurer by Dow Jones Sustainability Index.

- July 2022 - Zurich Insurance Group's (Zurich) health and wellbeing business has announced a collaboration with Polar Electro, a leader in wearable sports and heart rate and health technology, with customers of both companies now able to gain access to services that will help them reach their wellbeing goals. The collaboration will initially start with six countries – Brazil, Italy, Portugal, Spain, the U.K., and Ireland – and will expand to other countries in due course where Polar and LiveWell are present.

Frequently Asked Questions (FAQs)

Sample details.

- You will receive a link to download the sample pages on your email immediately after filling out a form

- A sample report will help you understand the structure of our full report

- The sample shared will be for our off-the-shelf market report

- The off-the-shelf report is curated considering a broader audience for this market, we have insights extending well beyond the scope of this report. Please reach out to discuss

- Should the sample pages not contain the specific information you seek, we extend the option to request additional details, which our dedicated team will incorporate.

- The sample is free of cost, while the full report is available for a fee.

Custom Scope

Connect with our analyst, we are featured on :.

- Terms & Conditions

- Privacy Policy

- Return Policy

Access Current Year Market Size Data for Travel Insurance

- Afghanistan

- Aland Islands

- American Samoa

- Antigua and Barbuda

- Bolivia, Plurinational State of

- Bonaire, Sint Eustatius and Saba

- Bosnia and Herzegovina

- Bouvet Island

- British Indian Ocean Territory

- Brunei Darussalam

- Burkina Faso

- Cayman Islands

- Central African Republic

- Christmas Island

- Cocos (Keeling) Islands

- Congo, the Democratic Republic of the

- Cook Islands

- Cote d'Ivoire

- Czech Republic

- Dominican Republic

- El Salvador

- Equatorial Guinea

- Falkland Islands (Malvinas)

- Faroe Islands

- French Guiana

- French Polynesia

- French Southern Territories

- Guinea-Bissau

- Heard Island and McDonald Islands

- Holy See (Vatican City State)

- Iran, Islamic Republic of

- Isle of Man

- Korea, Democratic People's Republic of

- Korea, Republic of

- Lao People's Democratic Republic

- Libyan Arab Jamahiriya

- Liechtenstein

- Macedonia, the former Yugoslav Republic of

- Moldova, Republic of

- Netherlands

- New Caledonia

- New Zealand

- Norfolk Island

- Palestinian Territory, Occupied

- Papua New Guinea

- Philippines

- Russian Federation

- Saint Barthélemy

- Saint Helena, Ascension and Tristan da Cunha

- Saint Kitts and Nevis

- Saint Lucia

- Saint Martin (French part)

- Saint Pierre and Miquelon

- Saint Vincent and the Grenadines

- Sao Tome and Principe

- Saudi Arabia

- Sierra Leone

- Sint Maarten (Dutch part)

- Solomon Islands

- South Africa

- South Georgia and the South Sandwich Islands

- South Sudan

- Svalbard and Jan Mayen

- Switzerland

- Syrian Arab Republic

- Tanzania, United Republic of

- Timor-Leste

- Trinidad and Tobago

- Turkmenistan

- Turks and Caicos Islands

- United Arab Emirates

- Venezuela, Bolivarian Republic of

- Virgin Islands, British

- Wallis and Futuna

- Western Sahara

Travel Insurance - Market Size

Scroll down to view last year's statistics, or provide your details to unlock more recent data.

Provide your details to unlock more recent data.

Curious about what drives these trends ? IBISWorld's Industry Report has got you covered.

Questions Clients Ask About This Industry

Access more trends and analysis for this report.

Our analysts spend hundreds of hours poring over statistics and trends so you don’t have to.

Industry Statistics Related to this report

Number of businesses, wage statistics, employment statistics, access statistics, trends and analysis on 1,000+ global industries.

Talk to one of our reps today about how an IBISWorld Membership can make you an expert in any industry.

Trusted by More Than 10,000 Clients Around the World

- Business and Finance /

- Insurance /

- Travel Insurance

Travel Insurance Global Market Report 2024

- February 2024

- Region: Global

- The Business Research Company

- ID: 5939422

- Description

Table of Contents

Executive summary.

- Companies Mentioned

Methodology

Related topics, related reports.

- Purchase Options

- Ask a Question

- Recently Viewed Products

- International

- Single-Trip Travel Insurance

- Annual Multi-Trip Travel Insurance

- Long-Stay Travel Insurance

- Medical Expenses

- Trip Cancellation

- Property Damage

- Other Coverages

- Insurance Intermediaries

- Insurance Companies

- Other Distribution Channels

- Senior Citizens

- Corporate Travelers

- Family Travelers

- Education Travelers

- Other End-Users

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 50+ geographies.

- Understand how the market has been affected by the coronavirus and how it is responding as the impact of the virus abates.

- Assess the Russia-Ukraine war’s impact on agriculture, energy and mineral commodity supply and its direct and indirect impact on the market.

- Measure the impact of high global inflation on market growth.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis.

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The impact of sanctions, supply chain disruptions, and altered demand for goods and services due to the Russian Ukraine war, impacting various macro-economic factors and parameters in the Eastern European region and its subsequent effect on global markets.

- The impact of higher inflation in many countries and the resulting spike in interest rates.

- The continued but declining impact of COVID-19 on supply chains and consumption patterns.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Report Scope

Companies mentioned (partial list).

A selection of companies mentioned in this report includes, but is not limited to:

- Allianz Group

- Berkshire Hathaway Specialty Insurance Company

- Zurich Insurance Group AG

- American International Group Inc.

- American Express Company

- Chubb Limited

- Seven Corners Inc

- Travelex Insurance Services Inc.

- Corporate Risks India Insurance Brokers Pvt Ltd

- New India Assurance – General Insurance Brokers

- Oriental Insurance Company

- ICICI Lombard General Insurance Company

- United India Insurance

- HDFC ERGO Non-Life Insurance Company

- Fanhua Holdings

- Insubuy LLC

- China Life Insurance Company Limited

- Insured Nomads

- Sompo Japan Nipponkoa Insurance Inc

- Mitsui Sumitomo Insurance Co. Ltd.

- Ping an Insurance Company of China

- People's Insurance Company (Group) of China

- China Pacific Insurance (Group) Co. Ltd

- New China Life Insurance

- Marsh & McLennan Companies UK Limited

- Aon UK Limited

- Arthur J Gallagher & Co

- Willis Towers Watson plc

- Lloyd's of London Limited

- Funk Gruppe GmbH

- Ecclesia Holding GmbH

- Hannover Re

- Crédit Agricole Assurances

- Sogaz Insurance Group

- Ingosstrakh Insurance Co

- Marsh McLennan

- Česká Pojišťovna

- MetLife Inc.

- Assicurazioni Generali

- RSHB Insurance

- Soglasie Insurance Company

- Sberbank Insurance Company LLC

- John Hancock Insurance Agency

- Trawick International

- USI Affinity Travel Insurance Services

- GoReady Insurance

- TU AGENCIA DE SEGUROS CO

- 111 Seguros Ltda

- Agencia de seguros

- BSB Capital Corretora de Seguros

- Indeniza Corretora em Balsas MA

- Emirates Insurance Co.

- Sukoon Insurance

- Union Insurance

- Doha Insurance Group

- Qatar Insurance Co

- KIB Takaful Insurance Company

- Gulf Insurance Group

- Misr Life Insurance

- QNB Alahli Life Insurance

- Care Line Group

- De Wet De Villiers

- Travelinsure

- Lensure Insurance Brokers Cc

- Travel Africa Insurance

- Oojah Travel Protection

- Takaful Insurance of Africa

- Bryte Insurance Company Limited

Table Information

United States Travel Insurance Market Competition Forecast & Opportunities, 2028

- Report

- August 2023

- United States

Europe Travel Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

Global Travel Insurance Market by Insurance Coverage (Annual Multi-Trip Travel Insurance, Long-Stay Travel Insurance, Single-Trip Travel Insurance), Distribution Channel (Banks, Insurance Aggregators, Insurance Brokers), End-Users - Forecast 2024-2030

Business Travel Accident Insurance Global Market Report 2024

Travel Insurance Market, Competition, Forecast & Opportunities, 2018-2028F

- October 2023

About the Travel Insurance Market

The Travel Insurance market is a sector of the insurance industry that provides coverage for travelers in the event of unexpected losses or damages incurred while traveling. This type of insurance typically covers medical expenses, trip cancellations, lost luggage, flight delays, and other related losses. It is important to note that travel insurance does not cover losses due to acts of terrorism or war. Travel insurance policies are typically tailored to the individual traveler's needs and can be purchased for a single trip or for multiple trips. Policies can also be purchased for a specific period of time, such as a year or more. Some of the major companies in the Travel Insurance market include Allianz, AXA, AIG, Chubb, and Zurich. These companies offer a variety of policies and coverage options to meet the needs of travelers. Show Less Read more

ASK A QUESTION

We request your telephone number so we can contact you in the event we have difficulty reaching you via email. We aim to respond to all questions on the same business day.

Request a Quote

YOUR ADDRESS

YOUR DETAILS

PRODUCT FORMAT

DOWNLOAD SAMPLE

Please fill in the information below to download the requested sample.

404 Not found

- Report Store

- AMR in News

- Press Releases

- Request for Consulting

- Our Clients

Travel Insurance Market Size, Share, Competitive Landscape and Trend Analysis Report by Insurance Cover, by Distribution Channel, by End User, by Age Group : Global Opportunity Analysis and Industry Forecast, 2023-2032

BI : Insurance

Report Code: A01285

Tables: 208

Get Sample to Email

Thank You For Your Response !

Our Executive will get back to you soon

Travel Insurance Market Research, 2032

The global travel insurance market was valued at $16.8 billion in 2022, and is projected to reach $106.8 billion by 2032, growing at a CAGR of 20.1% from 2023 to 2032.

Travel insurance is a type of insurance coverage that covers unexpected occurrences that may occur before or during a trip. It typically provides coverage for travel cancellations, interruptions, and delays, as well as medical expenses, emergency evacuation, and lost or stolen items. In addition, travel insurance can provide financial security against unanticipated incidents such as illness, natural disasters, or travel advisories. It is often recommended for international travel, where healthcare costs and other expenses can be significantly higher than usual.

Key Takeaways

By insurance cover, the single-trip travel insurance segment held the largest travel insurance market size for 2022.

By distribution channel, the insurance intermediaries segment held the largest share in the travel insurance market for 2022.

By end users, the business travelers’ segment is expected to show the fastest market growth during the forecast period.

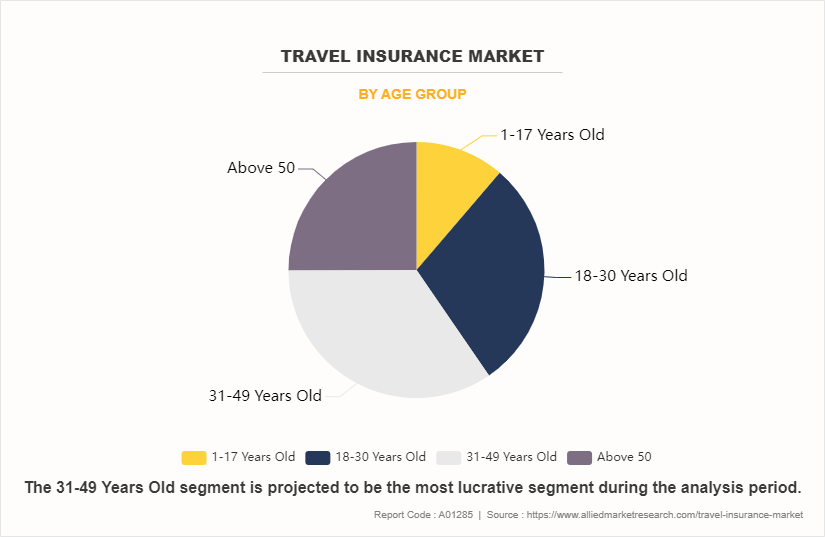

By age group, the 18-30 years old segment is expected to show the fastest market growth during the forecast period.

Region-wise, Europe held largest market share in 2022. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

The travel insurance market trends include, rapid growth in tourism, convenient shopping due to online comparison sites and travel rules & regulations primarily drive the growth of the travel insurance market. However, lack of awareness regarding travel insurance policy hampers the market growth. On the contrary, expansion of products & services and new technological developments in the travel insurance industry is expected to provide lucrative opportunities for the market growth during the forecast period.

Segment Overview

The travel insurance market outlook is segmented on the basis of insurance cover, distribution channel, end user, age group, and region. By insurance cover, it is fragmented into single-trip travel insurance, annual multi-trip travel insurance, and long-stay travel insurance. By distribution channel, the market is divided into insurance intermediaries, insurance companies, banks, insurance brokers, and insurance aggregators. By end user, it is classified into senior citizens, education travelers, business travelers, family travelers, and others. By age group, it is segregated into 1-17 years old, 18-30 years old, 31-49 years old, and above 50 years. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Insurance Cover

On the basis of insurance cover, single-trip travel insurance segment dominated the travel insurance market share in 2022 and is expected to maintain its dominance in the upcoming years owing to its affordability, flexibility, and suitability for the evolving needs of modern travelers, coupled with the increasing awareness of the importance of travel insurance in mitigating risks associated with international travel. However, the long-stay travel insurance segment is expected to witness the highest growth, owing to growing popularity of long-term travel among digital nomads, remote workers, students, and other travelers, coupled with the increasing recognition of the need for specialized insurance coverage tailored to extended journeys and immersive experiences.

By Distribution Channel

On the basis of distribution channel, insurance intermediaries segment dominated the travel insurance market in 2022 and is expected to maintain its dominance in the upcoming years owing to its widespread network, personalized customer service, and ability to offer a wide range of insurance products tailored to individual needs. However, the insurance aggregators segment is expected to register the highest CAGR during the travel insurance market forecast period, owing to the increasing popularity of long-term travel among retirees, digital nomads, and individuals seeking extended stays abroad for work or leisure.

By End User

On the basis of end user, family travelers segment dominated the travel insurance market in 2022 and is expected to maintain its dominance in the upcoming years owing to emphasis on safety and security, the financial investment involved in family vacations, the unique needs of families traveling with children, and the growing popularity of multigenerational travel experiences. However, the business travelers segment is expected to witness the highest growth, owing to resurgence of business travel, the specific needs and priorities of corporate travelers, the flexibility and convenience of multi-trip insurance plans driving demand for comprehensive travel insurance solutions.

By Age Group

On the basis of age group, 31-49 years old segment dominated the travel insurance market in 2022 and is expected to maintain its dominance in the upcoming years owing to their financial stability, active travel behavior, increased awareness of the need for travel insurance, and the convenience of accessing and purchasing insurance products online. However, the 18-30 years old segment is expected to witness the highest growth, owing to their adventurous mindset, financial flexibility, and heightened awareness of the importance of travel insurance in safeguarding their travel experiences in an increasingly uncertain world.

Region-wise, the travel insurance market was dominated by Europe in 2022 and is expected to retain its position during the forecast period, owing to the regions well-established travel infrastructure, high travel frequency among its population, and strong awareness about the importance of travel insurance, supported by robust regulatory frameworks. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to the increasing disposable incomes, rising travel expenditures, and growing awareness about the benefits of travel insurance among the region's population, which is driving the market growth.

Market Landscape and Trends

The technological trend for travel insurance market is focused on enhancing customer experience, improving operational efficiency, and mitigating risks which is driving the market growth. The integration of artificial intelligence (AI) and machine learning (ML) technologies is used to provide instant customer support through chatbots, personalize insurance offerings based on individual travel patterns, and analyse data to better understand and price risks. In addition, blockchain technology utilized to securely manage policies, process claims, and verify travel documents. Also, the mobile technology is playing a significant role, with insurers developing apps for policy management, claims filing, and real-time customer communication which provides travel insurance market opportunity.

Competitive Analysis

Competitive analysis and profiles of the major players in the travel insurance industry include American International Group, Inc., Assicurazioni Generali S.P.A., Aviva, AXA, Zurich, Just Travel Cover, PassportCard, Trailfinders Ltd., Staysure, and Insurefor.com. Major players have adopted product launch, partnership, expansion and acquisition as key developmental strategies to improve the product portfolio and gain strong foothold in the travel insurance industry.

Recent Developments in the Global Travel Insurance Industry

In September 2020, Insurefor.com has updated its policies, which is making it the first travel insurance market brand to provide cover when travelling against FCO advice whilst simultaneously protecting consumers against COVID-related issues both pre-departure and whilst abroad

In May 2022, Trip.com and AXA Partners announced a significant European expansion of new travel insurance products for German and French travellers. The two new insurance solutions provide a range of benefits such as medical, cancellation and baggage cover, which is selected while booking a flight on Trip.com. The cancellation-only ‘Basic’ insurance solution has proven especially popular in mainland Europe as travellers seek reassurance when booking their next trip and includes coverage if the trips are cancelled due to Covid. Whilst the Travel Plus medical insurance policy, made available to UK customers in September 2021, crucially protects customers for cancellation and medical costs if they contract COVID-19

In March 2024, Zurich Insurance partnered with travel and leisure e-commerce platform Klook to introduce FlyEasy coverage, which, powered by Zurich Edge platform with micro-services from Blink Parametric, aims to reduce customer stress from long flight delays at airports

In October 2023, Travel Insured International (Travel Insured), a leading travel insurance market provider, engaged Robin Assist, a tech-driven emergency travel assistance platform, to deliver responsive customer service, emergency travel and medical assistance, and claims to its insureds from any device, anytime, anywhere. The alliance provides Travel Insured’s customers with 24/7 support to help mitigate travel risk, and together with the Robin Assist team, service is available to travellers worldwide

Top Impacting Factors

Rapid growth in tourism.

The rapid growth in tourism is driving the growth of travel insurance market owing to the increase in travel volumes continue to surge, both domestically and internationally, the demand for travel insurance products has increased significantly. As the tourism sector grows, more people travel, by which increasing the chance of unexpected problems such as medical emergencies, lost luggage, airline cancellations, and natural catastrophes. The rise in travel activities increases the need for travel insurance as passengers seek financial protection against these risks. Rising demand for travel health insurance, increasing tourism for international travel, the aging population, and regulatory requirements for insurance which drive the market growth.

In addition, the surge in global travel, driven by factors such as increased disposable money, package trips, and easy internet bookings, raised traveler awareness of the significance of travel insurance. As more consumers recognize the potential inconveniences and financial losses connected with travel disasters, the demand for travel insurance market grows. For instance, a recent survey of 4,700 respondents from 11 countries around the world, conducted by the International Air Transport Association (IATA) in 2021, revealed that 57% of them were expected to be traveling within two months of the pandemic’s containment, and 72% of them are anticipated to do so as soon as they can meet friends and family.

Convenient shopping due to online comparison sites

Consumer preferences are changing and gaining seamless experience for travel insurance purchases with increase in use of internet for online comparison-shopping. Online portals such as direct airline sites and online travel agencies (OTAs) and company websites & applications which drive the growth of the online insurance market, spreading awareness among users in the market. In addition, these online sites typically offer limited options from a single company, providing travelers with the easiest way to compare and buy travel insurance coverages from top-rated providers in the market. As a result, comparison shopping through online sites is expected to fuel the growth of the travel insurance premium during the forecast period. For instance, in 2022, a study conducted by TravelInsurance.com compared different multiple travel insurance companies and projected online comparison sites to be the fastest growing sales channel for the travel insurance industry in the market.

Travel rules and regulations

Travel insurance providers in the market have adopted several model acts, strategies, and regulations to sustain in the competitive environment. For instance, in April 2022, AXA Partners, an AXA business unit, offering a wide range of solutions in assistance services, travel, and specialized insurance and credit protection, partnered with Trip.com to further expand the travel insurance product in Europe. Further, new approaches by regulatory bodies include development of prospective legislation and enforcement activity, accelerating growth of travel protection products and services in the industry.

The combination of enforcement & development of model laws drives growth of travel insurance premiums; thereby, modernizing unique nature of travel protection offerings across the industry. For instance, in the U.S., the National Association of Insurance Commissioners (NAIC) proposed a new model act to promote public welfare and a comprehensive legal framework within the travel insurance industry. In addition, the regulatory body implemented a significant step for the industry to address growth in consumer needs with standard laws and regulations. Thus, travel rules and regulations drive the travel insurance market growth.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the travel insurance market analysis from 2022 to 2032 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the travel insurance market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global travel insurance market trends, key players, market segments, application areas, and market growth strategies.

Travel Insurance Market Report Highlights

Analyst Review

The travel insurance market is experiencing significant growth due to the increased number of travelers and the availability of travel insurance through online vendors and intermediaries which contributed to a surge in adoption. This presents an opportunity for companies to capitalize on the growing customer base.

In addition, the partnerships and acquisitions by key players provide several opportunities for market growth. For instance, in June 2023, Blink Parametric and Newpoint's GetCover.com entered a strategic partnership to introduce a range of customized online travel insurance products. The collaboration focuses on incorporating a cutting-edge parametric flight delay solution into the travel insurance policies, catering to eligible policyholders. This innovative offering leverages real-time data to provide timely coverage and compensation in the event of flight delays. The partnership aims to enhance the overall travel insurance experience by offering tailored solutions that address the specific needs and concerns of travelers.

Furthermore, with the rise in demand for travel insurance covers, various companies have expanded their current services to continue with the rising demand. For instance, in June 2023, FijiCare launched a new travel insurance product. The comprehensive travel insurance product includes coverage for medical expenses, including hospitalization and COVID-19 coverage, the repatriation of mortal remains, accidental death, and trip curtailment.

- Travel Insurance

- Health Insurance

The travel insurance market is estimated to grow at a CAGR of 20.1% from 2023 to 2032.

The travel insurance market is projected to reach $106.8 billion by 2032.

Rapid growth in tourism, convenient shopping due to online comparison sites and travel rules and regulations majorly contribute toward the growth of the market.

The key players profiled in the report include American International Group, Inc., Assicurazioni Generali S.P.A., Aviva, AXA, Zurich, Just Travel Cover, PassportCard, Trailfinders Ltd., Staysure, and Insurefor.com.

The key growth strategies of travel insurance market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

The forecast period for travel insurance market is 2023 to 2032.

Travel insurance is a type of insurance coverage designed to protect travelers against a range of unforeseen events and risks that can occur before or during a trip.

Loading Table Of Content...

Loading Research Methodology...

- Related Report

- Global Report

- Regional Report

- Country Report

Enter Valid Email ID

Verification code has been sent to your email ID

By continuing, you agree to Allied Market Research Terms of Use and Privacy Policy

Advantages Of Our Secure Login

Easily Track Orders, Hassel free Access, Downloads

Get Relevent Alerts and Recommendation

Wishlist, Coupons & Manage your Subscription

Have a Referral Code?

Enter Valid Referral Code

An Email Verification Code has been sent to your email address!

Please check your inbox and, if you don't find it there, also look in your junk folder.

Travel Insurance Market

Global Opportunity Analysis and Industry Forecast, 2023-2032

Travel Insurance Market

Travel insurance market report by insurance type (single trip travel insurance, annual multi-trip insurance, long-stay travel insurance), coverage (medical expenses, trip cancellation, trip delay, property damage, and others), distribution channel (insurance intermediaries, banks, insurance companies, insurance aggregators, insurance brokers, and others), end user (senior citizens, education travelers, business travelers, family travelers, and others), and region 2024-2032.

- Report Description

- Table of Contents

- Methodology

- Request Sample

Market Overview 2024-2032:

The global travel insurance market size reached US$ 17.9 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 47.1 Billion by 2032, exhibiting a growth rate (CAGR) of 11% during 2024-2032.

Travel insurance provides financial protection for expenses or losses incurred due to unexpected events while domestic or overseas travel. It generally covers the costs of lost or stolen belongings, emergency medical care, accidental death, and trip cancellation and interruption. It takes into effect from the day of travel until the insured reaches back home. Nowadays, several companies are providing travel insurance with 24/7 emergency services, such as replacing lost passports, cash wire assistance and re-booking canceled flights. They are also offering customization options depending on the geographical location and as per the requirements of the insured individuals.

-(1).webp)

Travel Insurance Market Trends:

The substantial growth in the travel and tourism industry in recent years, on account of inflating disposable incomes, rising business travels and the easy availability of online travel bookings and discounted package holidays represents one of the major factors bolstering the global travel insurance market growth. Moreover, governments of numerous countries have made it mandatory to attach travel insurance documents while applying for a visa, which is also contributing to the market growth. Apart from this, leading players are incorporating digital tools, such as application program interface (API), artificial intelligence (AI), data analytics and global positioning system (GPS), for improving distribution systems and providing personalized user experience.

Note: Information in the above chart consists of dummy data and is only shown here for representation purpose. Kindly contact us for the actual market size and trends.

To get more information about of this market, Request Sample

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global travel insurance market report, along with forecasts at the global, regional and country level from 2024-2032. Our report has categorized the market based on insurance type, coverage, distribution channel and end user.

Breakup by Insurance Type:

- Single-Trip Travel Insurance

- Annual Multi-Trip Insurance

- Long-Stay Travel Insurance

To get more information about this market, Request Sample

Breakup by Coverage:

- Medical Expenses

- Trip Cancellation

- Property Damage

- Others

Breakup by Distribution Channel:

- Insurance Intermediaries

- Insurance Companies

- Insurance Aggregators

- Insurance Brokers

Breakup by End User:

- Senior Citizens

- Education Travelers

- Business Travelers

- Family Travelers

Breakup by Region:

To get more information on the regional analysis of this market, Request Sample

United States

- South Korea

United Kingdom

- Middle East and Africa

Competitive Landscape:

The report has also analysed the competitive landscape of the market with some of the key players being Allianz SE, American Express Company, American International Group, AXA SA, Berkshire Hathaway Specialty Insurance Company, Generali Group, Insure & Go Insurance Services (Mapfre S.A.), Seven Corners Inc., Travel Insured International Inc. (Crum & Forster), USI Affinity (USI Insurance Services) and Zurich Insurance Group AG.

Report Coverage:

Key questions answered in this report.

The global travel insurance market was valued at US$ 17.9 Billion in 2023.

We expect the global travel insurance market to exhibit a CAGR of 11% during 2024-2032.

The growing availability of booking holiday packages online, along with the rising demand for travel insurance to protect tourists from financial risks, is primarily driving the global travel insurance market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of the stringent lockdown regulations across several nations, resulting in the temporary intra-and inter-national travel restrictions, thereby limiting the demand for travel insurance.

Based on the insurance type, the global travel insurance market has been segmented into single-trip travel insurance, annual multi-trip insurance, and long-stay travel insurance. Currently, annual multi-trip insurance holds the majority of the total market share.

Based on the coverage, the global travel insurance market can be divided into medical expenses, trip cancellation, trip delay, property damage, and others. Among these, medical expenses coverage exhibits a clear dominance in the market.

Based on the distribution channel, the global travel insurance market has been categorized into insurance intermediaries, banks, insurance companies, insurance aggregators, insurance brokers, and others. Currently, insurance intermediaries account for the majority of the global market share.

Based on the end user, the global travel insurance market can be segregated into senior citizens, education travelers, business travelers, family travelers, and others. Among these, family travelers currently hold the largest market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global travel insurance market include Allianz SE, American Express Company, American International Group, AXA SA, Berkshire Hathaway Specialty Insurance Company, Generali Group, Insure & Go Insurance Services (Mapfre S.A.), Seven Corners Inc., Travel Insured International Inc. (Crum & Forster), USI Affinity (USI Insurance Services), and Zurich Insurance Group AG.

India Dairy Market Report Snapshots Source:

Statistics for the 2022 India Dairy market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports.

- India Dairy Market Size Source

- --> India Dairy Market Share Source

- India Dairy Market Trends Source

- India Dairy Companies Source

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Purchase options

Benefits of Customization

Personalize this research

Triangulate with your data

Get data as per your format and definition

Gain a deeper dive into a specific application, geography, customer, or competitor

Any level of personalization

Get in Touch With Us

UNITED STATES

Phone: +1-631-791-1145

Phone: +91-120-433-0800

UNITED KINGDOM

Phone: +44-753-714-6104