Telus Launches an Unlimited Canada-US-Mexico Plan, Finally

Telus has finally added an unlimited Canada-US-Mexico plan to its slate of offerings, joining rivals Rogers and Bell.

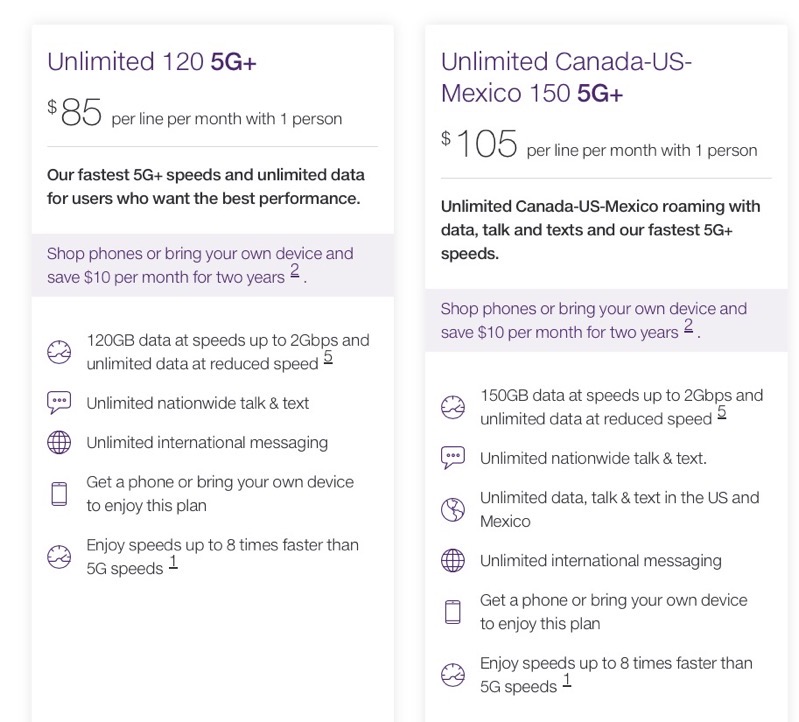

The Unlimited Canada-US-Mexico 5G+ plan costs $105 per month for bring your own device customers and included unlimited talk, text and data use in North America. The 150GB of data included offers 5G speeds at up to 2 Gbps, with throttled speeds once your data bucket is exhausted.

The other plan available right now is an $85/120GB plan that’s good just in Canada.

Right now, Bell’s Canada-US-Mexico plan is available at $90/150GB on a promo after a $10/month credit for 24 months. Rogers has the same offer but it is $95/month after a $10/month discount and Automatic Payments Discount. Both of these prices from Rogers and Bell require you to sign for 24 months to get the lowest price, but Telus does not. This allows you to switch to a new carrier easily.

Quebecor’s Freedom Mobile has their Canada-US-Mexico plan at $65/60GB after Digital Discount . This is far cheaper than the ‘Big 3’ but only includes 60GB of data, which is more than enough for the average user.

After Rogers launched a Canada-US-Mexico plan in July , Bell followed suit in September . Many wondered when Telus would match and it has finally done so in November. These North American plans target travellers that frequent the U.S. and Mexico, allowing for easy roaming without daily roaming charges.

Thanks Dean!

Other articles in the category: Telus

Starlink Video Experience Catching Up to Rogers, Telus, Bell: Study

Public Mobile Extends Canada-US Promo Plans

Public Mobile Offers New 4G Plans for Existing Customers

- Recent Headlines

- Stocks for Beginners If you’re looking for stocks for beginners, you’ve come to the right place! Our staff of experts help find some of the best beginner stocks for Canadians.

- Bank Stocks What are bank stocks? Bank stocks represent partial ownership in a financial institution that’s licensed to hold and loan money. Over time bank stocks have been relatively safe investments, as they offer products and services that most people need. How do you choose a good bank stock? 1. Look at the bank’s profitability First, you want to be sure the bank is even profitable. To do that, you can use the following metrics. Return on equity (ROE): this metric tells you how much profit a bank makes from its shareholder’s equity. The higher this metric, the more efficient a bank is using its stakeholder’s money. Return on assets (ROA): the ROA tells you the overall profit a bank makes in relation to its assets. The higher the ROA, the more profit a bank makes from its assets. Efficiency ratio: the efficiency ratio tells you how much revenue a bank uses towards its operating costs. The lower the efficiency ratio, the more revenue a bank theoretically has. 2. Assess the bank’s risks One of the biggest risks a bank has is losing money on an outstanding loan. As with profitability, a couple metrics could help you see how much banks are…

- Cannabis Stocks Motley Fool Canada’s cannabis content.

- Dividend Stocks What are dividend stocks? Dividend stocks are stocks that send you a sum of money (usually quarterly, but sometimes annually) simply for owning shares in the company. To be clear, this money isn’t a capital gain, which you earn when share prices go up or when you sell the stock for profit. A dividend is more like a “bonus” that comes to you in the form of cash or more shares in the company’s stock. Which companies have dividend stocks? It’s important to note that not all companies pay out dividends. Dividend-paying companies are usually older, more established corporations that have a long track history of positive growth and expansion. Usually when a company earns more money than it can reinvest in itself, it creates a dividend paying policy for shareholders. For that reason, you’ll rarely see growth companies, small caps, or start-ups issue dividends. In Canada, some top dividend stocks include: Procter & Gamble Pembina Pipeline Brookfield Infrastructure Partners Fortis Inc. Polaris Infrastructure [KevelPitch/] Check back here for the most up to date information about dividend stocks in Canada.

- Energy Stocks What are energy stocks? Energy stocks represent partial ownership in companies that supply electricity and fuel for the global economy. The energy sector in Canada is vast, comprising a large portion of the TSX. Energy stocks include: Electric utility companies Liquefied natural gas companies Natural gas companies Oil companies Renewable energy companies Solar energy companies How can you pick energy stocks? 1. Look for companies with a promising future It’s no surprise that the energy sector is under intense scrutiny. With climate change at the front of many people’s minds (from governments to investors), energy companies, old and new, are constantly adapting to a new world. Many people want cleaner energy. And it’s the energy sector’s challenge to make clean energy available — and profitable, too. For that reason, investors will do well to look for innovative companies that are actively solving contemporary energy problems. Though we’re not suggesting investors ignore bigger companies in oil or natural gas, we are suggesting you keep an eye on the future as you’re picking your energy stocks. Given the direction the world is going, ask yourself: who will be around in 20, 30, or even 40 years? That’s one of the biggest questions…

- Metals and Mining Stocks What are mining and mineral stocks? Mining and mineral stocks represent partial ownership in companies that find, extract, and process minerals and materials. The mining sector makes up a large portion of Canadian stocks, with the TSX having more mining stocks than any other market in the world. Here are some minerals these companies extract: Precious metals: gold, silver, platinum, palladium Industrial metals: iron, ore, zinc, cobalt, lithium, nickel, copper, aluminum Construction materials: sand, crushed stone, limestone Energy materials: coal, oil sands, uranium Fertilizers: boron, potash, phosphate How can you find good mining stocks? 1. Know the mining industry The mining industry is fairly complex. Not only do mining companies operate in a manner distinct from any other sector — they literally dig into the ground, not sit in swivel chairs — but also the vocabulary and industry terms can be complex, too. From the mining process to machinery to the minerals themselves, mining investors will do well to know exactly what a mining company does before buying its stocks. 2. Analyze its financial strength Investors should find mining companies that can withstand economic downturns and recessions. Two factors that will help you assess a mining company’s finances are production…

- Tech Stocks What are tech stocks? Tech stocks represent partial ownership in companies that produce, distribute, manufacture, and research new technology. The sector is vast and ever-changing with plenty of exciting opportunities for growth. Some examples of tech companies include: Artificial intelligence Blockchain Cybersecurity Computers and software Cloud services The internet The internet-of-things (IoT) Self-driving technologies Semiconductors Smartphones Why invest in tech stocks? The tech sector isn’t as stable as, say, banking. But that’s not always a bad thing. Tech companies, from startups to big corporations, often promise significant growth. And with new technologies moving as fast as they have in the last few decades, that growth could be exponentially large. Tech stocks can also help you diversify your investment portfolio. Investing in tech companies exposes you to a different sector in the market, helping you capitalize on gains, as well as minimize overall losses when market downturns affect other sectors. One example of diversification in action: tech stocks performed fairly well during the recent pandemic-induced recession, whereas other sectors, such as banking and energy, took a hit. Finally, with the sheer amount of great Canadian tech companies, you have plenty of choices between value and growth. If you lean more on…

- 5 Pullback Stocks

- 10 Top Stocks to Own for the Next 10 Years

- All in Buy Alert

- 5 Stocks Under $50

- Growth Stocks

- Undervalued Stocks

Dividend Stocks

- Blue Chip Stocks

- Safe Stocks

- Best Stocks to Buy

- Foolish Investing Philosophy

- Investing Strategies for Canadians

- Guide to Diversification

- Types of Stocks

- Start Investing in Canada

- How to Pick Stocks Wisely

- How to Buy Stocks in Canada

- How to Invest in Cryptocurrency

- Best Online Brokerages in Canada

- Best Stock Trading Apps in Canada

- Guide to Retirement Planning

- Best Canadian Retirement Accounts

- Guide to Tax-Free Savings Accounts

- Guide to Registered Retirement Savings Plans

- The Ultimate Personal Finance Checklist

- The Best Ways to Stick to a Budget

- How to Create a Budget You’ll Actually Keep

- How Much Home Can You Afford?

- How to Make the Most From Refinancing

- How to Manage Your Mortgage

- Get Organized for the CRA

- A Quick Guide to Cutting Your Taxes

- Audit-Proof Your Tax Return

- Our Top Picks for Credit Cards in Canada

- Our Top Picks for Cash Back Credit Cards in Canada

- The Best Rewards Credit Cards in Canada

- Our Top Picks for Balance Transfer Cards in Canada

- Our Top Picks for Secured Credit Cards in Canada

- How to Reduce Your Debt

- How to Choose the Right Credit Card

- Boost Your Credit Score in Months

- Don’t Cancel That Credit Card!

- What is a Good Credit Score?

- Our Purpose

To make the world smarter, happier, and richer.

Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people around the world achieve their financial goals through our investing services and financial advice. Our goal is to help every Canadian achieve financial freedom.

- Our Investing Analysts

- Our Investing Philosophy

- Our Services

How Much Will Telus Corporation Pay in Dividends This Year?

TELUS stock (TSX:T) paid out $947 million in dividends in 2023, and it looks like the payout could rise even higher this year.

- Latest Posts

- Should Investors Buy the Correction in Lundin Mining Stock? - May 24, 2024

- This Stock Is Miles Ahead of Its Industry: Is It a Buy Now? - May 24, 2024

- 3 Reasons NFI Stock Looks Like a Screaming Buy - May 24, 2024

Image source: Getty Images

TELUS ( TSX:T ) remains one of the biggest telecom companies in Canada. As the third-largest, this stock also comes with one of the largest and arguably most stable dividends on the TSX today. Even during trying times, the company continues to make efforts to increase its dividend year after year.

Yet how stable is it really? Today, we’re going to take a look at the dividend history of Telus stock, and whether that might change in the future.

Recent results

TELUS continues to demonstrate strong financial and operational performance. In the first quarter of 2024, the telco reported record customer growth, adding 209,000 new mobile and fixed-line customers, which is the highest for any first quarter in the company’s history. This growth was driven by increased demand for their mobility and fixed services .

Furthermore, TELUS stock saw 4.3% growth in adjusted earnings before interest, taxes, depreciation and amortization (EBITDA), reaching a margin of 37.6%, and an improved consolidated margin year over year . The company has also been effective in managing costs and driving efficiencies, which has contributed to robust financial results despite a challenging macroeconomic environment .

Then there was the company’s dividend program. TELUS stock announced a 7% increase in its quarterly dividend to $0.3761 per share, reflecting a strong commitment to returning value to shareholders and maintaining a high dividend yield, currently at 6.68% as of writing.

The history behind the dividend

When it comes to the history of that dividend, investors want to know if the company can keep it up, and if it has in the past. TELUS stock has a long history of paying dividends, as well as making increases. Over the past decade, the company has consistently paid quarterly dividends, while gradually increasing the payout.

In fact, TELUS stock has a history of increasing its dividend payments multiple times each year. For instance, in 2019, dividends increased from $0.2725 in early 2019 to $0.2815 by mid-year . Over time, the quarterly dividends have risen from $0.1125 in 2007 to over $0.38 in recent years, highlighting a consistent upward trend .

TELUS stock’s approach to dividends reflects its stable cash flow and strong financial performance, which has allowed the company to maintain and grow its dividend payouts consistently. In fact, in 2022, the company stated it would continue to make semi-annual dividend increases between 7% and 10% from 2023 through to 2025.

What you get now, and is it safe?

The focus on growing the dividend each year through 2025 would suggest that the dividend is safe. However, that would also mean the company might be using income to support a dividend, rather than grow the business. That’s why we need to look at the payout ratio.

In this case, TELUS stock currently operates with a payout ratio at 264% as of writing. This is far from its target of between 60% and 75%, and higher than what analysts would recommend. So, therefore, the company seems to be prioritizing cash for shareholders over investing in growth. And that could come around to bite shareholders later on.

For now, however, TELUS stock will be paying out $1.50 per share on an annual basis. In 2023, the company paid out $947 million in dividends, at a rate of $1.4544 per share. If that continues this year, the company could pay out about $977 million in dividends, a $50 million increase. As to where that money is coming from, we’ll have to wait and see.

More on Dividend Stocks

This 8% dividend stock pays cash every month.

May 24, 2024 | Sneha Nahata

Earn monthly cash of $154 with this 8% dividend stock.

Read more »

Think Oil Is Going Higher? 3 Dividend Stocks to Buy Now

May 24, 2024 | Robin Brown

Looking for steady dividend growth? These three Canadian oil stocks could provide substantial dividend income in the coming years.

This 7% Dividend Stock on the TSX is Worth Watching

May 24, 2024 | Daniel Da Costa

With this superb TSX stock now trading at the bottom of its 52-week range, it's certainly a dividend stock you'll…

2 TSX Dividend Stocks to Buy While They Still Offer Great Yields

May 24, 2024 | Andrew Walker

These top dividend-growth stocks now offer 7% dividend yields.

1 Magnificent Dividend Stock Down 23% to Buy Right Now Near a Once-in-a-Decade Valuation

May 24, 2024 | Kay Ng

Patient investors could be happy with this dividend stock a few years down the road.

Best Stocks to Buy in May 2024: TSX Real Estate Sector

May 24, 2024 | Jitendra Parashar

Besides yielding stable monthly passive income, these top TSX real estate stocks could help you earn high returns on your…

These 2 Dividend ETFs Are a Retiree’s Best Friend

May 24, 2024 | Tony Dong, MSc, CETF®

Retirees looking for steady income will love these two Canadian dividend ETFs

Safe and Sound Stocks for Canadians: My Top 5 Choices

May 24, 2024 | Demetris Afxentiou

Want some of the best stocks for Canadians right now? Here's my top 5 list of stocks to buy today…

Local news, paywall-free.

MinnPost’s timely reporting is available for free, all year round. But our work isn’t free to produce. Support our nonprofit newsroom with a tax-deductible donation today.

Nonprofit, independent journalism. Supported by readers.

Jen Roth serving Entrepreneurs’ Organization-Minnesota while building travel accessibility website, Wise Blue Yonder

Share this:.

- Click to email a link to a friend (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to print (Opens in new window)

When Jen Roth was in her junior year at the College of St. Benedict in St. Joseph, she packed up her luggage for a study abroad stint in London.

That might seem like a normal rite of passage for a college student, but Roth, at the age of 9, was diagnosed with systemic Juvenile Rheumatoid Arthritis, an affliction that causes joint inflammation and stiffness. In the years since, she’s had 14 surgeries and eight joint replacements.

“I cannot believe my parents let me go to London,” she said. “There were no phones, there was no social media. They sent me with a ginormous bag full of medicine and a backpack.”

The trip changed her life.

“It made such a difference,” she said. “It taught me that I am independent and that I can do this.”

And it led to a love for travel that has taken her around the world. Now, after several years in corporate marketing and a stint co-owning her own marketing firm, Roth is putting all of these experiences together with Wise Blue Yonder, which curates travel experiences and has a subscription-based web portal available with information aimed at making travel more accessible.

“After many, many years of fighting my disability and my disease, I now consider it a gift,” she said. “I got it for a reason and this is why. It’s taking my life experience with a disease a chronic condition, my love for travel and my success in corporate Americana bringing something to life that will help the world.”

Getting started

It’s been a long, winding road for Roth, who enjoyed her stint in the corporate world and met a lot of friends and mentors while there, but was probably destined to become an entrepreneur all along.

She grew up in Storm Lake, Iowa, a rural town with a big family. Her father ran his own accounting and law firm. Roth started at the College of St. Benedict as an accounting major, switching to English for her undergraduate degree when she realized finances were not her strong suit. She went on to get a master’s degree in business communication at the University of St. Thomas in St. Paul.

Roth went on to work for companies including CIGNA, United Health Group and Ceridian, the latter of which was where she worked her way into several senior executive roles. But when constant travel was getting in the way of spending time with a new husband and two children, she decided to start her own corporate consulting firm.

Ultimately, she and her partner at GrowthMode Marketing built the company onto the Inc. 5000 Fastest Growing Private Companies list. This is where a friend helped her get involved with Entrepreneurs’ Organization-Minnesota (EO), as she was seeking some guidance as the firm grew.

“We had signed a couple really big new clients that were going to double our business in a few months’ time,” she said. “We did not know how to manage it. I was talking to a friend who’s an entrepreneur and he said, ‘You need to join EO.’ I said OK.”

Selling and starting anew

Her group there helped GrowthMode grow significantly, advising and coaching her through the COVID pandemic, general growth and eventually the sale of her business.

While she was all in on GrowthMode expand, Roth had long dreamed of creating Wise Old Yonder. So, in 2022 she sold her stake in the marketing company to her business partner and, that same year, started the new venture.

“We provide travel solutions for senior travelers and travelers with limited mobility,” she said. “It’s our mission to provide fully curated travel experiences designed for people of all abilities.”

Wise Blue Yonder does small group tours. They’re spending a week in London later this year. The company also raised money through donations and through subscription access to its still-being-built Travel Resource Center database of information.

“It’s a dynamic resource for collecting information about how to plan travel if you have limited mobility,” said Roth, who was inspired not just by her own journey but by stories she’s collected over the years of folks with mobility challenges getting incorrect information when calling ahead about accessibility or simply being turned off of travel due to embarrassment or inconvenience.

She has had a tremendous time traveling the world but has been on the wrong end of such experiences, as well.

“We specialize in creating itineraries that allow every person, regardless of ability, to have a good time,” Roth said.

So far, she’s the only official employee, but she’s working with a web developer, a representative from a corporate travel and incentives business, some content people and a travel concierge on a contract basis as the site ramps up. She doesn’t know exactly where the business is headed, but she’s excited for the journey.

“When you are open to what sits in front of you, and you have an open mind, it’s amazing where the world will take you,” she said. “One of my favorite quotes is, ‘You don’t have to know where you’re going to be headed in the right direction.’ I just think that’s so true.”

Back into marketing

Roth always intended to do fractional marketing work as she established Wise Blue Yonder. But as that company was coming to fruition, she was contacted by some former employees and clients asking if she would ever consider starting another firm. So, she started Blue Sparq Marketing. The firm is a full-service agency and it supports Wise Blue Yonder.

“We have a great team and we have great clients and we’re growing steadily and safely,” she said.

Plenty busy already, Roth is also more committed to EO than ever. She recently took over as the local chapter president with goals of diversifying the local entrepreneurial community. She helped plan the popular Entrepreneur’s Rally held earlier this month in Bloomington that drew several hundred business owners.

Previous president, Patrick Donohue, CEO of Hill Capital Corp., called Roth one of the most dynamic entrepreneurs he knows. He said like many entrepreneurs, she is a visionary leader, but she’s one who has the capability to actually execute the plans, as well.

“That’s the key,” he said, adding that those skills have helped as EO has attempted to become a more inclusive organization, serving both members and others who are not officially tied to the organization. “Jen leans into that and we’re able to collaborate, partner with a number of organizations to make sure that all entrepreneurs are welcome.”

Roth is particularly busy this year but thrilled to be where she is, supporting an organization that helped her and building a company she thinks can help make the world better.

“That’s truly the legacy I want to leave,” she said. “I want to build the difference I want to make.”

Thanks to our major sponsors

We've recently sent you an authentication link. Please, check your inbox!

Sign in with a password below, or sign in using your email .

Get a code sent to your email to sign in, or sign in using a password .

Enter the code you received via email to sign in, or sign in using a password .

Subscribe to our newsletters:

- Daily Newsletter MinnPost's top stories delivered to your inbox Monday through Saturday.

- Events & member benefits Be the first to know about opportunities around MinnPost membership & events.

Sign in with your email

Lost your password?

Try a different email

Send another code

Sign in with a password

Privacy Policy

IMAGES

VIDEO

COMMENTS

Travel with Easy Roam and stay connected for less. Access data from your plan and get unlimited talk and texts for $14 per day in the US and $16 per day in 200+ other countries.*. Only pay for the days you use data, talk, send a text or check voicemail.

Koodo U.S. roaming plans. Pay-as-you-go: Koodo customers who choose to use their existing cell phone in the U.S. without a daily Easy Roam plan will pay $1.60/minute, $10 for 100 outgoing texts, and a steep $10/50MB. Daily plans: For $14/day, you can use your existing Koodo phone and plan while traveling throughout the United States on Easy Roam.

Telus international travel daily plans: Activate Roam Easy on your Telus Mobility account and you'll be able to use the minutes, texts, and even data from your regular plan while traveling almost anywhere in the world. With support for 150+ countries, Roam Easy adds $16/day to your month-end bill. Each "day" ends 24 hours after it's activated.

When you use your TELUS device while travelling, you make it easy for colleagues and clients back at the office to reach you without getting long distance charges or having to learn a new number. Plus, you can get convenient access to all your information including email and contacts. 4

Text and instant messaging. Depending on what travel coverage you have for your plan (Easy Roam, Roaming Pass or pay-per-use), this is how the use of text and instant messaging through our roaming partner's network will be charged. Receive incoming texts from any number (no pictures or videos) If you have Easy Roam.

Some Canadians will pay more to use their cellphones while travelling abroad beginning next week. Telus and Bell say they are raising roaming rates, effective March 8 and 9, respectively.. Telus ...

05-15-2023 03:04 PM. Just cancelled telus after 20+ years for being charged roaming fees for 3 days in the usa. We told them we explicitly turned of Roaming in settings. We used an eSim app (AirAlo) for travelling. the Primary (telus) line was off and the Secondary (eSim) was on. they went on some babble about the phone has to be in Airplane mode.

While on vacation suspension your plan cost will be reduced to $30, plus any TELUS Easy Payment® amount (s) for your device (s), if applicable. For wireless Wi-fi devices such as Smart Hub, portable internet hubs, and mobile internet keys, your plan cost will be reduced to $10. How to suspend service?

11-08-2021 08:37 PM. Hi, We will be leaving the country in December to travel. How can we suspend and how long we can suspend our Telus internet account for? Cheers, Weiwei. 11-09-2021 11:14 AM. Telus once had a Vacation Hold offering, which provided a discounted rate for your Home Services, and also for your mobility plan. Maximum of 6 months ...

My friend wants to upgrade his plan to be able to use it in while travelling to US. Please email me what steps to do. ... Report Inappropriate Content 06-05-2019 12:51 PM. Have a look at this support article describing the Easy Roam add on for mobility plans. NFtoBC If you find ... The TELUS team acknowledges that our work spans many ...

Telus has finally added an unlimited Canada-US-Mexico plan to its slate of offerings, joining rivals Rogers and Bell. The Unlimited Canada-US-Mexico 5G+ plan costs $105 per month for bring your own device customers and included unlimited talk, text and data use in North America. The 150GB of data included offers 5G speeds at up to.

Learn about roaming charges, how to avoid unexpected roaming charges while travelling or near the US border, and information for travelling across Canada.

For now, however, TELUS stock will be paying out $1.50 per share on an annual basis. In 2023, the company paid out $947 million in dividends, at a rate of $1.4544 per share. If that continues this ...

So, in 2022 she sold her stake in the marketing company to her business partner and, that same year, started the new venture. "We provide travel solutions for senior travelers and travelers with ...