An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock Locked padlock icon ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Card/Account Holders and Approving Officials Travel Training

Lesson 1: Travel Program Overview

What is the gsa smartpay® program.

Established in 1998, the GSA SmartPay program is the world’s largest government charge card and commercial payment solutions program, providing services to more than 250 federal agencies/organizations and Native American tribal governments with 4.5 million total accounts. GSA SmartPay payment solutions enable authorized government employees to make purchases on behalf of the federal government in support of their agency’s mission. The GSA SmartPay program includes the following business lines:

- GSA SmartPay Purchase.

- GSA SmartPay Travel.

- GSA SmartPay Fleet.

- GSA SmartPay Tax Advantage Travel.

- GSA SmartPay Integrated.

Through the Master Contract with multiple banks, the GSA SmartPay program enables agencies/organizations across the federal government to obtain payment solutions to support mission needs. The Master Contract, administered by GSA, is a fixed price, indefinite delivery, indefinite quantity (IDIQ) contract. The maximum base period for the initial order is four years with three, three-year options.

Agencies/organizations issue a task order under the GSA SmartPay 3 Master Contract to one of the GSA SmartPay contractor banks – Citibank or U.S. Bank. Then, the awarded bank provides payment solutions to the agency.

Through the task order, your agency/organization program coordinator (A/OPC) sets up accounts for the card/account holders, manages the accounts using the bank’s Electronic Access System (EAS), and resolves issues or questions by working directly with a bank representative.

Specific to travel, the GSA SmartPay program provides card/account holders with a means to pay for all travel and travel-related expenses. Additionally, the GSA SmartPay program is the primary mechanism used to purchase airline, rail, and bus tickets at significantly reduced fares under the GSA City Pair Program (CPP) .

What are the benefits to using the GSA SmartPay Master Contract for obtaining payment services?

The GSA SmartPay program has continued to grow through increased adoption as agencies/organizations realize benefits afforded under the program.

Utilizing the GSA SmartPay Master Contract means:

- A faster contract acquisition process and reduced risk of protest, as compared with a full and open competitive procurement.

- Favorable negotiating platform and contract terms.

- Awards to contractor banks based on a competitive bidding process.

- Established relationships with contractor banks.

- A broad range of flexible products and services for agencies/organizations as well as the flexibility to add products and services.

- Ongoing support for your agency/organization.

What are some of the overall benefits to using the GSA SmartPay program?

Agency refunds.

Agencies have the opportunity to earn refunds based on the dollar volume of transactions and the speed of payment.

Safety and Transparency

The GSA SmartPay program provides secure solutions for efficient payment transactions. Customers also have access to tools that provide increased transparency to spend and performance data.

Electronic Access to Data

Through the GSA SmartPay contractor bank’s electronic access system (EAS), account managers and card/account holders have immediate access to complete transaction-level data, helping to mitigate fraud, waste and abuse.

Worldwide Acceptance

Through the use of commercial payment infrastructure, customers are able to use GSA SmartPay solutions anywhere in the world where merchants accept cards.

Identification for Discount Programs

GSA SmartPay solutions provide automatic point-of-sale recognition for many GSA discount programs, including Federal Strategic Sourcing Initiative (FSSI), the GSA City Pair Program (CPP) and more.

Other Benefits

GSA SmartPay payment solutions provide other less tangible benefits including travel insurance and eliminating the need for imprest funds or petty cash at the agency.

Why does the U.S. Government have a travel payment solutions program?

The Travel and Transportation Reform Act of 1998 (Public Law 105-264) [PDF, 9 pages] mandates that federal government card/account holders use the travel card/account for official government travel expenses. Additionally, the Federal Travel Regulation (FTR) mandates use of the travel card/account in almost all cases (see FTR Subpart H §301-70.700 for exemptions ). The travel card/account allows individual card/account holders to pay for travel expenses and receive cash advances. In many instances, use of the travel/card account eliminated the need for agencies to issue travel cash advances. Government card/account usage provides streamlined, best-practice processes that are consistent with private industry standards.

What are some types of GSA SmartPay Travel cards/accounts?

Individually billed accounts (ibas).

- Most common travel card/account.

- Issued to an employee designated by the agency/organization in the employee’s name.

- Used to pay for official travel and travel-related expenses.

- Only issued to federal employees or employees of tribes or tribal organizations.

- May be used for local travel only if authorized by written policy of the agency/organization.

- Agencies/organizations reimburse employees only for authorized and allowable expenses.

- Card/account holders are directly responsible for all purchases charged to the IBA account.

- Payment may be made directly by the card/account holder, agency/organization or in the form of a split disbursement in accordance with agency/organization policy.

Centrally Billed Accounts (CBAs)

- Established by the bank at the request of the agency/organization to pay for official travel charges and official travel-related expenses.

- Generally used to purchase common carrier transportation tickets for employee official travel through third-party arrangements, such as the GSA E-Gov Travel Service (ETS) for civilian agencies, the Defense Travel System (DTS) for the Department of Defense or permissible equivalent travel system.

- Agencies/organizations may also make purchases through their Travel Management Centers (TMCs), commercial travel offices and through other government contracts.

- Agency is directly billed and is liable for making the payment.

- Payment is made directly to the bank by the government.

Tax Advantage Travel Accounts

- Used to pay for travel and travel-related expenses.

- Combines IBA and CBA transactions to provide tax exemption at the point of sale for rental car and lodging expenses.

- Charges for rental cars and lodging will be automatically billed to a CBA for payment, taking advantage of the government’s CBA tax exemption status for those types of accounts.

- Charges for other travel-related purchases, such as meals and incidentals, are billed to the IBA portion of the account and will still incur tax. The individual traveler will still be liable for payment to the bank for those charges.

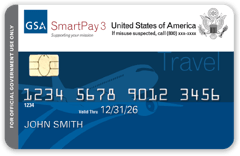

How do I recognize GSA SmartPay Travel cards/accounts?

Typically, travel cards have one of these designs:

Please note that card designs may vary.

GSA SmartPay Travel cards/accounts use the following prefixes:

For the travel business line only, the sixth digit will identify whether the account is a CBA or IBA.

Why is it important to understand your travel card/account type?

Tax exemption and liability differ depending on the travel card/account type.

Tax exemption considerations

- All GSA SmartPay CBAs should be exempt from state taxes.

- Federal government travelers using the GSA SmartPay IBAs may be exempt from state taxes in select states.

- Card/account holders should review and understand the state tax policy for the state where you will be traveling to and should make sure to have all necessary forms before traveling.

Liability considerations

Iba accounts.

- Liability for charges on the IBA rests with the individual card/account holder, not with the agency/organization.

- If the card/account holder fails to pay his/her account on a timely basis, the bank may suspend or cancel the account and assess late charges and fees.

- If the bank cancels an account due to delinquency, the bank may report that information to credit bureaus and the information will appear on the card/account holder’s personal credit report.

- The bank can pursue debt collection to obtain repayment of the charges.

- The agency/organization is never responsible or legally liable for the account.

CBA Accounts

- Liability for charges on the CBA rests with the agency/organization, not with the individual card/account holder.

- Because the account is a combination of both CBA and IBA, the liability will be determined by the type of purchase.

- If it is a CBA purchase, the liability rests with the government.

- If it is an IBA purchase, the liability rests with the card/account holder.

How would someone check tax exemption status?

Here is a typical example of how to check tax exemption status:

- Jo is planning an official government trip to the GSA SmartPay Training Forum in Orlando, Florida.

- During the planning stages for the trip, she checks the GSA SmartPay website to find out more information about tax exemption in Florida.

- Jo learns that IBA travel cards/accounts are tax exempt in Florida. In addition, while no form is required, Florida does allow hotels to require a “Certificate of Exemption”. She also saved the Florida Department of Revenue’s phone number in case any questions came up during her trip.

- Jo confirms that she has a GSA SmartPay IBA travel card/account – the first four digits are “4486” and the 6th digit is a “4”.

- Jo books the hotel room and follows up with a call to verify that the hotel is compliant with the state’s tax exemption policy. If not, she’s given herself plenty of time to find another hotel that does comply.

training.smartpay.gsa.gov

An official website of the General Services Administration

Department of Defense Travel Card Benefits

Progress informed from the past, and inspired by the future, cardholder guide.

Official travel for the Department of Defense just became easier with the Citi Department of Defense Travel Card. When you are preparing to use your new card, please read What To Do When I First Receive My New Card . For more information regarding your new card, please read the Department of Defense Cardholder Guide .

Department of Defense Travel Insurance

As a cardholder, you will receive global travel accident and lost luggage insurance so you feel safe and secure wherever you travel with a Citi ® Commercial Card.

- Travel Accident Insurance Guide

- Lost Luggage Insurance Guide

MasterCard Guide to Benefits

Visa Guide to Benefits

In addition to the card benefits provided by Citi, Visa provides card benefits such as Car Rental Insurance and Travel and Emergency Assistance. For full details, please read the Visa Guide to Benefits .

Travel Tips

For more information on your Citi Department of Defense Travel Card, please read What to do Before, During and After travel .

Online Tools

Citi's global online tool, CitiManager ® , enables you to manage business expenses from anywhere around the globe from your computer or mobile device; you can view statements online, confirm account balances, sign up for email and SMS alerts, and much more. If you have not already signed up for the CitiManager ® tool, please log on to www.citimanager.com/login and click on the 'Self registration for Cardholders' link. From there, follow the prompts to establish your account.

For more information on the CitiManager ® tool, view our CitiManager ® Cardholder Quick Reference Guide .

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

Government Travel Charge Card Program

GENERAL SERVICES ADMINISTRATION Washington, DC 20405

OAS 5740.1 CHGE 2 January 17, 2023

SUBJECT: Government Travel Charge Card Program

- Purpose . This Order provides guidance for the management and use of the GSA SmartPay® individually-billed account travel charge card (travel card) and centrally-billed account.

- Background . The Travel and Transportation Reform Act (TTRA) of 1998 (Public Law 105-264), as implemented by the Federal Travel Regulation and OMB Circular A-123 Appendix B, Improving the Management of Government Charge Card Programs , mandates that Federal Government cardholders use the travel card for official Government travel expenses. Public Law 112-194, the Government Charge Card Abuse Prevention Act of 2012, amends Section 2 of TTRA and outlines the minimum requirements to ensure effective management controls.

- Scope and Applicability . This Order provides policy, standards, instructions, and procedures governing the management and use of the travel card. The provisions apply to all GSA employees. This Order applies to the Office of Inspector General (OIG) to the extent that the OIG determines it is consistent with the OIG’s independent authority under the Inspector General Act and does not conflict with other OIG policies or the OIG mission. This Order applies to the Civilian Board of Contract Appeals (CBCA) to the extent that the CBCA determines it is consistent with the CBCA’s independent authority under the Contract Disputes Act and applicable Federal Court decisions and does not conflict with other CBCA policies or its mission.

- Cancellation . This Order cancels and supersedes GSA Order OAS 5740.1 CHGE 1.

- Summary of Changes . This Order updates policy where needed to reflect the transition of the program to GSA SmartPay® 3, expands the Responsibilities section to update duties of the Chief Administrative Services Officer and Agency/Organization Program Coordinator, changes the title of the Charge Card Coordinator to Travel Card Program Analyst, adds the use of Transportation Network Companies (TNCs) and Innovative Mobility Technology Companies (IMTCs), and removes the Travel Card Program Analyst appointing duties of the Regional Commissioners (RCs) to reflect the consolidation of Travel Card Program Analysts into the Office of Administrative Services (OAS). Minor editorial and clarifications are also made.

- Signature .

/S/ _____________________ BOB STAFFORD Chief Administrative Services Officer Office of Administrative Services

Problems viewing this page? [email protected]

Are you a GSA employee? Use the Directive Library on InSite to access referenced information.

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

IMAGES

VIDEO

COMMENTS

Travelers who do not have their own Government Travel Charge Card, or GTCC, may use a Centrally Billed Account (CBA) managed by their organization to pay for reservations. Payment of CBAs is the responsibility of the government. ... Travel Card 101 is available in TraX. To access TraX, you must have a Passport account. Training takes ...

Accessing Travel Card Program Training in TraX The DTMO Travel Card Program class educates DoD travelers on the basics of the Government Travel Charge Card (GTCC) and is also referred to as "Travel Card 101" training. You can access the class 24 hours a day, 7 days a week through the Travel Explorer (TraX). It provides essential

Authorized by the DoDI 5154.31, Volume 4 [PDF, 10 pages], the Defense Travel Management Office (DTMO) manages the card program, providing guidance, policy, and training, and serves as a liaison to GSA, the travel card vendor, and DoD Component Program Managers on travel card related issues.DTMO is also responsible for developing, coordinating, and maintaining the Government Travel Charge Card ...

Learn about the travel charge card, a payment option for official government travel and travel-related expenses. Find out the types of accounts, benefits, and how to use the card.

There are many laws and governing documents that frame how the travel card program operates. Some of the most important are listed below: • Public Law 105-264 • Public Law 107-314 • Public Law 109-115 • DoD Government Travel Charge Card Regulations • DoD Statement of Understanding You will learn more about each law and document in this

Welcome to the GSA SmartPay® Travel Training for Card/Account Holders and Approving Officials. As a federal government employee going on official government travel, you are expected to be familiar with the Federal Travel Regulations (FTR) and other government travel policies.. This training course is intended to teach you the basics about your roles and responsibilities as a card/account ...

back to your bank account, Government Travel Charge Card (GTCC), or both. DoD Travel News. Travelers MUST Re-Book Certain Rental Car Reservations Immediately; Highlights of GovTravels 2024; Rental Car Agreement #5 Effective April 1, 2024; Top Performers Recognized for Excellence in Practice Awards at GovTravels 2024;

Specific to travel, the GSA SmartPay program provides card/account holders with a means to pay for all travel and travel-related expenses. Additionally, the GSA SmartPay program is the primary mechanism used to purchase airline, rail, and bus tickets at significantly reduced fares under the GSA City Pair Program (CPP).

Test your knowledge of travel card policies and procedures with this set of 12 flashcards. Learn about benefits, account types, expenses, disputes, and more related to the travel card program.

For more information regarding your new card, please read the Department of Defense Cardholder Guide. Department of Defense Travel Insurance. As a cardholder, you will receive global travel accident and lost luggage insurance so you feel safe and secure wherever you travel with a Citi ® Commercial Card. Travel Accident Insurance Guide

Travel Card Program (Travel Card 101) Mandatory . Recommended for: Traveler | Series: Programs and Policies This web-based class is an overview of the DoD Government Travel Charge Card (GTCC) program. It includes sections on obtaining, using, and paying off balances on the GTCC. This course is mandatory for anyone who has and uses a GTCC.

- Launch the Programs & Policies-Travel Card Program (Travel Card 101) course. - Once the course is complete, print a copy of the certificate of completion. - Submit the completed training certificate with completed card application and Statement of Understanding to the S-1. **NOTE: APPLICATIONS WILL NOT BE SUBMITTED TO CITI AND EXISTING

'Government Travel Card Training'. Select SEARCH. The GTCC training report should be at the top of the search results. You can create a bookmark for this report if you will be using it often. Select Launch This Report. Select your specific organizational level and then run the report. If you are a current travel cardholder and your training ...

Vanessa is applying for an IBA. She completed the online application form and then completed the Program & Policies - Travel Card Program [Travel Card 101] training class and provided a copy of her completion certificate to her APC. What does Vanessa need to do next before she can receive a travel card?

The Travel and Transportation Reform Act (TTRA) of 1998 (Public Law 105-264), as implemented by the Federal Travel Regulation and OMB Circular A-123 Appendix B, Improving the Management of Government Charge Card Programs, mandates that Federal Government cardholders use the travel card for official Government travel expenses. Public Law 112-194 ...

INFORMATION PAPER: Accessing Training for Travel Card Misuse Defense Travel Management Office 4 March 2022 called Programs & Policies -Finding and Managing Travel Card Misuse.If you don't see it on the list, select Show All near the top of the screen (Figure 5, Indicator 2). 3. Select Launch to the left of the class.An information screen (Figure 6) opens.

Passport is a USG information system for authorized travelers to access travel services and information. You need a password or a CAC/PIV card to log in or register.

Full, on-time payment of an IBA bill is primarily the Government's responsibility., Which situation will result in an individual being issued a restricted travel card? A. The traveler's credit score check results in a 670 credit score. ... Travel Card Program [Travel Card 101] training class and provided a copy of her completion certificate to ...

The Government Travel Charge Card (GTCC) must be used by DoD personnel to pay for all authorized expenses, to include meals, when on official travel unless an exemption is granted. This includes temporary duty travel (TDY), and per Component guidance, local ... Complete "Travel Card 101" training initially and refresher training every three ...

The Government Travel Charge Card (GTCC) is mandated to be used by DoD personnel to pay for authorized expenses ( including meals ), when on official travel unless an exemption is granted. ... Travel Card Program Policies Travel Card 101 - [Mandatory] training course that is available on the TraX website. Cardholders will ensure a