- Asia Briefing

- China Briefing

- ASEAN Briefing

- India Briefing

- Vietnam Briefing

- Silk Road Briefing

- Russia Briefing

- Middle East Briefing

China’s Tourism Sector Prospects in 2023-24

Amid the post-pandemic recovery, China’s tourism sector is rebounding with vigor in 2023. We discuss the resurgence of outbound and domestic travel, evolving traveler behavior, and tech-enabled trends in this article. From cultural exploration to wellness escapes and digital integration, the stage is set for foreign businesses and investors to seize opportunities in this transformed landscape.

After enduring the significant impacts of the COVID-19 pandemic, China’s tourism sector is gearing up for a strong resurgence in 2023. Projections indicate that the total revenue from domestic tourism is expected to exceed RMB 4 trillion (approximately US$580.96 billion), marking an impressive 96 percent growth. Several driving forces contribute to this revival in China’s tourism landscape, including:

- Easing of travel restrictions;

- Increase in disposable income among Chinese consumers; and

- Growing popularity of domestic tourism.

In particular, the government’s support in revitalizing the tourism sector is evident through subsidies and tax exemptions provided to tourism enterprises. The robust resurgence of China’s tourism industry also serves as a positive indicator for the nation’s economy, with tourism being a significant driver of economic growth and expected to contribute notably to the country’s GDP. Overall, 2023 has seen a continuous stream of new policies, products, technologies, concepts, trends, and opportunities impacting the tourism industry.

China’s evolving tourism landscape

Insights from outbound tourism in h1 of 2023.

Both outbound and inbound tourism markets in the first half of 2023 have shown impressive vitality, surpassing the levels observed in the same period of 2019. Average expenditures for outbound travelers have exhibited a notable increase, with Hong Kong and Macao leading the resurgence of outbound tourism. The total number of inbound and outbound individuals has surged by approximately 170 percent.

Data from the World Tourism Alliance’s reports, reveal that the outbound tourism sentiment index reached 28 percent in the first half of 2023, marking a 21-point increase from the same period in 2019. The outbound tourism market has displayed a gradual “U-shaped” recovery, emphasizing a steady resurgence rather than an abrupt rebound.

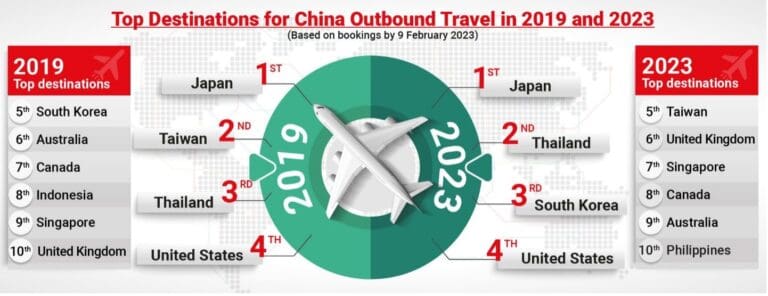

According to recent data from Alipay’s Overseas Spending Platform, the average expenditure per user for outbound travel in the first half of 2023 grew by 24 percent compared to 2019. Among popular destinations, the top 10 outbound travel destinations in terms of transaction volume for the first half of 2023 were:

- South Korea;

- United Kingdom; and

This data is supported by several favorable policies. Since the beginning of the year, the National Immigration Administration has continuously optimized and adjusted inbound and outbound management policies.

Starting from February 20, 2023, mainland cities within the Greater Bay Area initiated a pilot implementation of visa endorsements for cross-border talent to and from Hong Kong and Macao. On May 15, 2023, policies such as the nationwide implementation of group travel endorsements for mainland residents traveling to Hong Kong and Macao were fully restored.

The streamlined and optimized policies for travel to Hong Kong and Macao prompted provinces across the mainland to organize multiple tour groups, leading to a consistent rise in mainland visitors to these regions. According to data released by the Hong Kong Tourism Board, nearly 13 million visitors arrived in Hong Kong in the first half of 2023, of which approximately 10 million were mainland visitors, accounting for around 77 percent of the total.

Furthermore, based on recent data released by the National Immigration Administration, the first half of 2023 witnessed a total of 168 million inbound and outbound individuals passing through China’s immigration, marking a year-on-year increase of 169.6 percent.

At the same time, approximately 42.798 million entry and exit permits for travel to and from Hong Kong, Macao, and Taiwan were issued, indicating a significant 1509 percent increase compared to the same period in 2022.

These figures further underline China’s promising revival in outbound tourism. Indeed, Chinese tourists have once again become a significant force driving global tourism and offline consumption.

In terms of outbound travel numbers, the top 10 departure cities were: Shenzhen, Shanghai, Guangzhou, Beijing, Hangzhou, Foshan, Dongguan, Zhuhai, Chengdu, and Wuhan. This highlights that outbound travel is mainly concentrated in first-tier and new first-tier cities, with the “Guangzhou-Shenzhen-Foshan-Dongguan-Zhuhai” Greater Bay Area cities also playing a pivotal role in outbound tourism.

The primary reason driving Chinese tourists to travel abroad is leisure, with business and visiting friends and relatives (VFR) as the subsequent motivations. The rapid expansion of outbound tourism from China can be attributed to the rising incomes of the middle class , the growing desire among Chinese travelers to explore diverse countries and cultures, and the ease of obtaining visas and fulfilling entry criteria for various destinations.

Moreover, the retail sector captures the largest portion of Chinese tourists’ spending when traveling abroad and is anticipated to retain its dominant position in terms of outbound tourism expenditure over the projected timeframe.

The steady recovery of outbound tourism

Initial expectations for a robust rebound in outbound tourism this year have encountered a more precarious reality. Notable evidence of this transformation is seen in the changing preferences of Chinese leisure travelers. As reported by CNBC, the desire to travel abroad has surged from 28 percent to 52 percent among Chinese leisure travelers since last year, nearly doubling.

Business travel intentions have tripled, and interest in education, family visits, and medical tourism abroad is also on the rise. Other findings align, revealing that 50 percent of Chinese travelers plan to journey internationally within the next year.

A significant shift has also occurred in travel fears, particularly concerning Covid contraction. While it topped travelers’ concerns in 2022, it has diminished to the least worrisome aspect this year, as per Morning Consult’s survey. This shift reflects growing traveler confidence. Factors influencing this gradual recovery go beyond preferences. A recent report from the Mastercard Economics Institute reveals a shift in Chinese residents’ spending patterns.

Known for their shopping inclination, there’s a rising trend toward investing in experiences over possessions, particularly in a zero-Covid environment. Despite global economic uncertainties, Asia-Pacific’s, including China’s, travel recovery remains steady. As travel capacity grows, costs are anticipated to decrease, fueling a more dynamic travel landscape.

Contrary to an instant “boom,” China’s international travel revival is unfolding steadily. Though not as swift as initially projected, the evolving interests, changing attitudes, and gradual shift toward experiential spending all point to a growing and adaptive outbound tourism sector, offering a promising glimpse into the future.

The Chinese government’s recent efforts to revive outbound group travel

China’s Ministry of Culture and Tourism recently expanded outbound group tour destinations, including popular places like Japan and the US. A recent analysis provided by the EIU indicates that this move will aid global tourism recovery, benefiting countries with simplified visa procedures.

While the relaxed restrictions will moderately boost outbound tourism, obstacles and cautious spending persist. Nonetheless, domestic travel agencies are expected to see increased revenue, leading to employment and income growth in the sector.

However, challenges such as limited flights and labor shortages could hinder outbound tourism’s full recovery. A complete relaxation of restrictions is predicted in late 2023, but pre-pandemic outbound levels might not return until 2025.

Domestic tourism is thriving

In the first half of 2023, domestic tourism revenue (total tourist spending) reached RMB 2.3 trillion (approx. US$318 billion), marking a substantial increase of RMB 1.12 trillion (approx. US$155 billion) compared to the previous year. Notably, urban residents’ expenditures on travel accounted for a year-on-year surge of 108.9 percent, while rural residents’ travel spending grew by 41.5 percent.

The remarkable rebound of China’s domestic tourism sector can be attributed to a set of factors that differentiate it from the relatively slower recovery of outbound tourism. For one, the domestic tourism industry appears to be less affected by uncertainties surrounding employment and income growth compared to other service and retail sectors.

This is primarily due to the strong yearning of Chinese consumers to explore after years of mobility limitations imposed by the pandemic.

On the other hand, the prolonged revival of outbound flights has further bolstered the domestic tourism scene. Many individuals redirected their travel plans within China as international travel remained limited.

Notably, the return of international air traffic to approximately 80 percent of pre-pandemic levels is not expected until the fourth quarter of 2023, which creates a favorable environment for the vigorous resurgence of domestic tourism in the meantime.

Changing Chinese travelers’ preferences in 2023

In the wake of the COVID-19 pandemic and the subsequent travel restrictions, Chinese travelers underwent a transformation in their preferences and behaviors. Over the past three years, while international travel remained limited, domestic exploration thrived.

Around 8.7 billion domestic trips were taken, indicating an annual rate of around 50 percent of pre-pandemic levels. This period allowed the domestic market to mature, and travelers became more sophisticated in their pursuits, engaging in various new leisure experiences such as beach resorts, skiing trips, and city “staycations.”

As a result, the post-COVID-19 Chinese traveler exhibits distinct traits: heightened digital savvy, elevated expectations, and an appetite for novel experiences. These characteristics paint the profile of a typical Chinese traveler in 2023:

- Experiences matter: Survey data reveals that the rejuvenated Chinese tourist is driven by experiential travel. While outdoor and scenic trips remain popular, the preferences have evolved. Sightseeing and culinary experiences, highly valued in the initial survey series, are now joined by a growing interest in culture and history, beaches, and resorts, as well as health and wellness. This shift solidifies the trend towards experience-driven travel. Additionally, activities like skiing and snowboarding have gained popularity, possibly influenced by the 2022 Beijing Olympic Winter Games .

- Digital expert: Chinese travelers are among the world’s most digitally adept consumers, easily integrating mobile technologies and social media into their daily lives. The pandemic further propelled their online engagement. Short-form videos and livestreaming have emerged as dominant online entertainment options.

- Curious: The desire to explore novel experiences in unfamiliar destinations remains strong among Chinese travelers. Despite travel radius limitations imposed by policies, survey respondents express eagerness to visit new attractions. Instead of revisiting familiar places, 45 percent of participants prioritize short trips to new sites, while long trips to new destinations are the second most favored option.

Emerging trends and destinations

Cultural and heritage tourism.

A significant shift in China’s tourism landscape is the increasing emphasis on cultural tourism, where traditional heritage seamlessly intertwines with contemporary travel. As the nation preserves and celebrates its abundant historical and cultural treasures, a surge in cultural tourism activities like immersive experiences and interactive exchanges has taken center stage.

This trend is particularly pronounced in the realm of domestic tourism, where travelers are flocking to heritage sites and cultural landmarks to gain a deeper understanding of China’s rich heritage.

Moreover, the development of cultural and tourism industries constitutes a crucial component of China’s cultural confidence-building efforts. This sector has received significant attention from the government, evidenced by policies like the “14th Five-Year Plan for Cultural Development” and the “14th Five-Year Plan for Tourism Industry Development.” Such policies drive the integration of culture and tourism, increase the supply of cultural tourism products, and enhance the quality of such offerings.

Wellness tourism

In 2023, a remarkable shift in travel preferences among Chinese tourists has propelled wellness and health tourism to the forefront. As observed by Rung Kanjanaviroj, Director of the Tourism Authority of Thailand’s Chengdu office, Chinese travelers are displaying a distinct preference for destinations that offer a blend of sunny beaches and holistic well-being experiences.

This evolving trend has prompted destinations like Thailand to proactively adapt by refining their offerings. Through the enhancement of health tourism services and a focus on engaging student and youth travelers, Thailand has positioned itself as a prime destination for those seeking rejuvenation and self-care during their journeys.

The rise in wellness and health tourism reflects a broader shift in Chinese travelers’ priorities, as they seek destinations that not only provide scenic beauty but also nurture their physical and mental well-being.

Tech-enabled tourism in China’s innovative travel landscape

China’s tourism industry has evolved dramatically through the fusion of technology and changing consumer demands. In 2023, the landscape is marked by a growing emphasis on tech-enhanced experiences that cater to modern travelers’ evolving preferences that foreign businesses and investors in the sector can learn from.

- Smart appliances and IoT integration: China’s tech-driven tourism trend showcases the integration of smart appliances and the Internet of Things (IoT) into the travel journey. Travelers now wield the power to personalize their environment and encounters via smartphone apps. Innovations range from smart hotel rooms adjusting lighting, temperature, and ambiance to IoT-enabled transportation providing real-time updates, enhancing comfort and efficiency.

- Virtual and augmented reality immersion: Tech-savvy Chinese travelers are increasingly seeking immersive encounters. Virtual and augmented reality (VR/AR) have taken center stage, enabling tourists to explore historical sites, cultural landmarks, and natural marvels through virtual tours that breathe life into destinations. This not only enhances engagement but also serves as a potent tool for destination marketing.

- Seamless contactless services and digital payments : Contactless services and digital payments have become integral to China’s tech-enhanced tourism scene. Travelers can navigate touchpoints like check-in, security, dining, and shopping with minimal physical interaction. QR codes have revolutionized payment methods, enabling transactions through smartphones, and eliminating the need for physical currency or cards, in alignment with the country’s cashless society drive.

The city of Hangzhou offers a glimpse into the future of tech-enabled tourism. Hangzhou’s West Lake, a UNESCO World Heritage site, now features interactive kiosks that provide historical context, virtual guides, and navigation assistance to visitors. These digital enhancements blend seamlessly with the serene natural landscape, enriching the cultural experience.

Similarly, the China National Tourist Office uses VR to transport potential travelers to iconic destinations. Through immersive VR experiences, individuals can virtually explore the Great Wall, the Terracotta Army, and other renowned sites, sparking wanderlust and encouraging travel planning.

Preparing for the return of Chinese tourists to the international scene

The gradual easing of travel restrictions in China still presents a promising avenue for the recovery of the international travel and tourism sector. Amid this positive outlook, attracting Chinese tourists is becoming a priority for global businesses.

Chinese travelers, known for their enthusiasm to explore beyond their borders, are now seeking immersive experiences, quality accommodation, and exceptional service. Here are some strategies that foreign businesses can employ to entice and captivate the adventurous Chinese traveler.

Crafting authentic and familiar experiences

After a three-year hiatus from overseas travel, Chinese tourists are now yearning for high-quality experiences in familiar destinations.

They are looking beyond traditional shopping and sightseeing, expressing a keen interest in entertainment and experiential offerings. Theme parks, cultural activities, water sports, snow sports, and shows are among the sought-after activities.

The key is to offer authentic experiences that resonate with Chinese travelers’ desires for immersion, while still maintaining a touch of familiarity.

Businesses should leverage deep customer insights to design offerings that strike a balance between accessibility and authenticity, ensuring a comfortable yet exciting experience.

Harnessing the power of social media

Social media, particularly short videos, has emerged as a pivotal source of travel inspiration for all age groups. Tourist destinations have capitalized on this trend by launching engaging short video campaigns, maximizing exposure and engagement.

The burgeoning trend of city-walking , for example, where urban exploration is undertaken solely on foot, has not only captured the attention of locals but has also made significant waves across various social media platforms. Chinese netizens are embracing this form of experiential travel, and businesses can leverage social media to align with their preferences.

Platforms like Douyin, China’s counterpart to TikTok, have witnessed the rise of “city-walk content”. A recent video showcasing city-walk routes in Guangzhou amassed over 171,000 likes and found its way into the favorites of 72,000 viewers.

Furthermore, Xiaohongshu, a prominent lifestyle-sharing platform in China, reported a remarkable 30-fold increase in searches related to city walk during the first half of 2023 compared to the previous year.

Businesses can leverage social media platforms to connect with potential Chinese tourists, employing captivating content and innovative campaigns to pique their interest. Creating a strong presence on platforms like TikTok and engaging with influential figures can significantly boost visibility.

Collaboration with Internet giants

China’s tech-savvy travelers are deeply intertwined with the digital world, and internet giants like WeChat and Alipay play a pivotal role in their daily lives. Foreign businesses can tap into these existing digital ecosystems rather than starting from scratch.

For instance, Amsterdam’s Schiphol Airport offers a WeChat Mini Program providing information about the airport, including duty-free shopping and travel planning. Alibaba’s Alipay, renowned for its mobile payment capabilities, has partnered with tax refund agencies to streamline the tax refund process for Chinese travelers.

Such digital innovations enhance convenience and are fast becoming an expected norm.

Prioritize direct-to-consumer (D2C) channels

Navigating China’s intricate travel distribution landscape can be complex, as it encompasses diverse channels, such as online travel agencies (OTAs), online travel portals (OTPs), and traditional travel agencies. To make the most of this landscape, businesses can consider embracing D2C channels.

By leveraging social media platforms and official brand platforms, businesses can create a compelling value proposition that resonates with Chinese travelers. Investing in D2C channels not only enhances branding but also facilitates direct engagement with potential tourists, allowing for a personalized and enticing approach.

Key takeaways: Navigating China’s tourism resurgence

All in all, in 2023, China’s tourism is making a strong comeback, driven by key trends that reveal changing traveler preferences.

Domestically, easier travel rules and higher incomes are fueling local exploration. Internationally, outbound tourism is gradually recovering with a focus on immersive experiences, wellness, and cultural discovery.

Chinese travelers are becoming more tech-savvy, seeking out tech-enhanced experiences like virtual reality tours. This shift is boosting cultural, heritage, and wellness tourism.

Social media, especially platforms like TikTok and WeChat, are vital for engaging with Chinese travelers effectively.

In essence, China’s tourism resurgence is multifaceted, with travelers seeking enriched experiences, digital engagement, and authenticity.

Businesses that align with these preferences and capitalize on domestic and international opportunities are likely to thrive in the evolving travel landscape.

China Briefing is written and produced by Dezan Shira & Associates . The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at [email protected] .

Dezan Shira & Associates has offices in Vietnam , Indonesia , Singapore , United States , Germany , Italy , India , Dubai (UAE) , and Russia , in addition to our trade research facilities along the Belt & Road Initiative . We also have partner firms assisting foreign investors in The Philippines , Malaysia , Thailand , Bangladesh .

- Previous Article Exporting Food Products to China: A Step by Step Guide

- Next Article China Issues 24 New Measures in Clear Directive to Boost Foreign Investment

Our free webinars are packed full of useful information for doing business in China.

DEZAN SHIRA & ASSOCIATES

Meet the firm behind our content. Visit their website to see how their services can help your business succeed.

Want the Latest Sent to Your Inbox?

Subscribing grants you this, plus free access to our articles and magazines.

Get free access to our subscriptions and publications

Subscribe to receive weekly China Briefing news updates, our latest doing business publications, and access to our Asia archives.

Your trusted source for China business, regulatory and economy news, since 1999.

Subscribe now to receive our weekly China Edition newsletter. Its free with no strings attached.

Not convinced? Click here to see our last week's issue.

Search our guides, media and news archives

Type keyword to begin searching...

- My View My View

- Following Following

- Saved Saved

China expects sharp rebound in tourism this year

- Medium Text

Sign up here.

Reporting by Bernard Orr; Editing by Jacqueline Wong

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

World Chevron

South African vote tallying enters final stages with ANC on 40%

Vote tallying in this week's South African parliamentary election entered the final stages on Saturday, with the governing African National Congress (ANC) set to fall well short of a majority for the first time in 30 years of democracy.

Russia launched a barrage of missiles and drones on Saturday, damaging energy facilities in five regions across Ukraine, officials said.

What to expect from China’s travel rebound

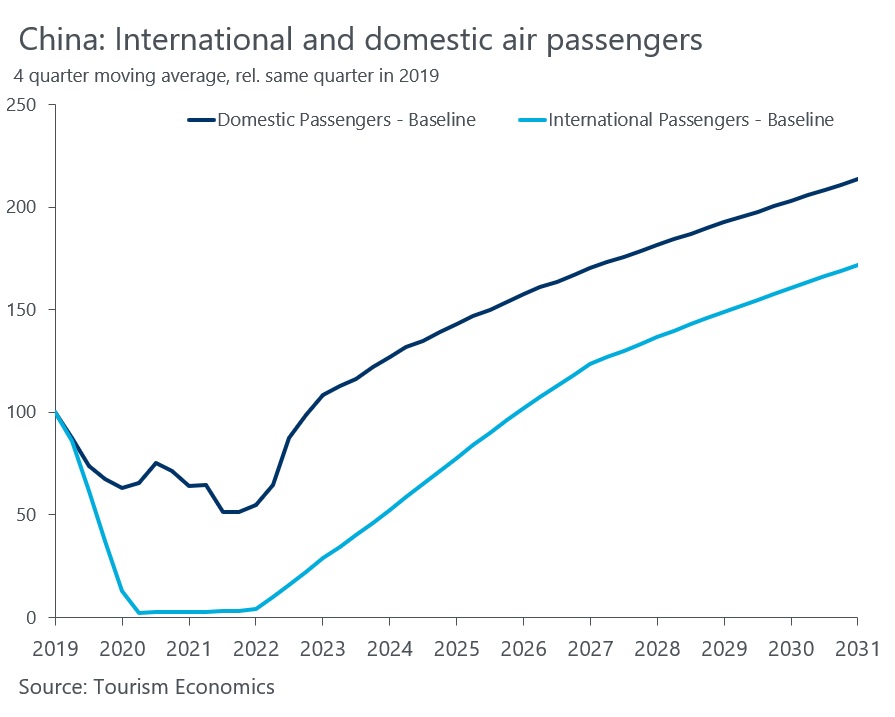

Back in 2019, mainland China was the world’s largest outbound travel market with over 150 million outbound travelers. 1 China’s Ministry of Culture and Tourism. Since then, strong COVID-19 safety measures, including quarantine on arrival, have all but eliminated China’s inbound and outbound travel.

China recently announced that quarantines will be removed on arrival from January 8 2023. This is similar to Hong Kong’s announcement in September 2022 that it would drop mandatory quarantine on arrival.

If mainland China’s air travel were to follow Hong Kong’s recovery curve, mainland China would see four million air passengers a month by April 2023, pushing air travel back up to 40 percent of preCOVID-19 levels (exhibit).

This raises two questions: Will mainland China’s rebound look like Hong Kong’s? And, are airlines ready for this demand boom?

Will mainland China’s rebound look like Hong Kong’s?

In all cases, globally, when travel restrictions ease, demand jumps. Travel to visit friends and relatives, to study, and urgent business travel rebound first. Leisure travel for vacations follows quickly afterwards.

Mainland China shares the same wanderlust as Hong Kong. There is massive pent-up demand for international travel of all types. In a recent McKinsey survey, 40 percent of Chinese travelers said they wanted their next trip to be international, with Australia/New Zealand, Southeast Asia, and Japan being the most desired destinations.

However, the resurgence will likely be slightly slower for mainland China than Hong Kong, for four reasons.

First, many travelers—maybe 20 percent—have had passports expire during the COVID-19 period, and China has not been renewing these passports. Renewals are now possible, but the backlog will slow travel’s rebound by a few months.

Second, most destinations require visas for mainland Chinese travelers. Some countries have deliberately restricted issuing these visas, in response to China’s tight inbound visa policy. This is likely to ease now, but again, backlogs will take time to work through. By comparison, most Hong Kong travelers do not need visas. Third, outbound tour groups from the mainland require approval for travelling, which will also take time.

Finally, inbound travel to China will return—but not immediately, given the current COVID-19 waves in the country combined with factors that may deter travelers such as China requiring a PCR test 48 hours before departure.

Put together, we expect a strong rebound, but it may be slightly later than observed in Hong Kong.

Are airlines ready for this demand boom?

The Chinese carriers seem ready for the opening up. Chinese airlines did put some aircraft into long-term storage, but fewer than 100 Chinese widebody aircraft remain in storage. There are over 200 large aircraft that can be reactivated quickly for international flying.

Pilots have been re-trained in expectation for a reopening. In December, the Civil Aviation Administration of China (CAAC) required airlines to give pilots the flying opportunities needed to reactive their licenses by January 6 2023. Few pilots in China left the industry. Airports in China have mostly retained staff. Airlines’ ground operations teams are at more than 90 percent of pre-pandemic size.

International carriers will likely take longer to rebound. Many international airlines continue to have challenges with too few long-haul aircraft. European carriers, for example, retired more than 10 percent of the widebody fleet during the pandemic, and have been caught short with the strong travel rebound. Some airlines, especially US carriers, have shortages of crew and pilots. Many international carriers have hub airport constraints, with some major hubs still struggling to handle pre-COVID-19 levels of demand.

These factors combined imply that international carriers are likely to be slower adding back capacity than the home-based Chinese carriers.

China’s travelers and travel industry welcome the relaxation of restrictions. The next few months will be a scramble to get capacity back in the air. A strong demand recovery, coupled with frictions in bringing back supply, is likely to mean ticket prices into and from China remain elevated for the coming months, until supply can fully come back online. For the longsuffering travel industry, the future is bright at last.

Steve Saxon is a partner in McKinsey’s Shenzhen office.

Explore a career with us

Related articles.

China’s theme parks face a new era

- China Edition

- China Daily PDF

- China Daily E-paper

Search Trends

- Learn Chinese

EXPLORE MORE

DOWNLOAD OUR APP

Copyright © 2023 CGTN. 京ICP备16065310号

Disinformation report hotline: 010-85061466

- Terms of use

- Privacy policy

Blog | 20 Mar 2023

China travel recovery: Timings are clear, but magnitude remains uncertain for 2023

Jessie Smith

Economist, Tourism Economics

The late December announcement of China’s intention to re-open its borders for travel took the international community by surprise, with little time to prepare. Border re-opening fell just before Lunar New Year, which proved to be significantly stronger than the last with domestic travel reportedly at 89% of 2019 levels and an initial surge in both inbound and outbound visits, albeit to levels well below those in 2019. With the Lunar New Year marking the kick-off of China’s re-opening, questions follow about the shape and scale of China’s return to travel across 2023. Some observers expect the rebound to be rapid, but there are reasons to take a more measured view.

We remain cautious in our Global Travel Service (GTS) outlook for China’s outbound travel recovery. For the first half of the year, focus will be on short-haul travel, particularly to Hong Kong, Macau, Thailand, and Japan. Hong Kong International Airport reported a 2,900% YoY increase in passengers in January 2023, following the easing of both its and China’s travel restrictions. Despite this growth, January visits only reached a third of pre-pandemic levels. Moving into the second half of the year we expect a wider-spread, longer-haul recovery.

There are several significant challenges to recovery, and it is possible that travel growth could be even weaker this year than in our conservative baseline outlook. Pre-existing capacity constraints will be worsened by the lack of clear communication around re-opening. The logistics involved with reinstating China to the global travel network takes time, and the lack of warning ensures both a delayed return to travel and some excess demand. In early February Chinese travel agencies resumed overseas package tour sales—a notable portion of pre-pandemic outbound travel—but initial bookings data indicate that demand remains subdued.

Significantly inflated prices, both due to limited flights and higher fuel prices, are perturbing some buyers. We expect supply constraints to loosen across the year, but in the short term some excess demand may arise from a lack of financially viable options for travellers. Higher air travel costs are likely to remain into the medium term as jet fuel costs remain elevated, placing pressure on air fares while many airlines service high debt levels accumulated during the pandemic. Long-haul travel from China to Europe in particular will also face higher costs for some carriers as longer routes may be required to avoid the air space restrictions imposed by Russia. The limited lead time also applies to passport and visa processing, which will constrain the bounce back in demand due to limited application processing capacity, which had been halted for the last three years.

Though household savings have accumulated throughout the pandemic, these are comparatively modest due in part to subdued income growth over the pandemic, capping the rate of consumer-led recovery . This reduced willingness to spend is also coupled with clouded consumer confidence. Although January 2023 held a small increase in Chinese consumer confidence from 2022’s record lows, it still sits well below levels seen in the past 20 years. Alongside a lack of consumer confidence, many individuals in China remain hesitant about travelling internationally, thus some domestic for international travel substitution will continue in the short term.

Chinese outbound travel had seen rapid growth pre-pandemic, attributed to a burgeoning middle-class coupled with falling prices. While the era of lower transport costs appears to be over, the growing wealth across China remains a key feature of its outbound travel growth potential. The key question is how strong the bounce back in Chinese outbound will travel be in 2023. Our upside scenario estimates Chinese outbound travel could reach 48% of 2019 levels in 2023, compared with 64% in our current baseline, amounting to 17.4 million additional Chinese travellers this year. However, as economic forecasts show hampered consumer spending due to low consumer confidence and depressed income growth, outbound travel recovery this year may not be as buoyant as people may hope.

While destinations eagerly await the return of Chinese travellers, outbound travel recovery relies heavily on sentiment change, and cautious behaviour is unlikely to disappear overnight. As one industry expert put it, “People have waited for three years—there is no need to rush.”

+44 1865 268 900

Oxford, United Kingdom

Jessie is an Economist within the Tourism team, publishing research and analysis on tourism and travel trends, with a particular focus on the Americas region. Jessie has also been involved in consultancy projects for a range of clients including Airbnb, Booking.com, and the World Travel and Tourism Council.

Jessie joined Oxford Economics after graduating with a first-class honours degree in Economics from the University of Exeter along with industry experience. After completing her placement year at the Department for Work and Pensions, specialising in Universal Credit strategy around children, Jessie also rebranded the Government economics schools outreach programme, improving the diversity of students studying economics in further education.

You may be interested in

Boosting Accommodation Supply and Affordability During Major Events

Flexible accommodation solutions made available on Airbnb enable destinations to host events, enhancing visitor experience and bolstering local economies.

Promising trends signal optimism for the hotel sector

The global travel recovery took great strides in 2023, with some destinations already reporting a full recovery back to pre-pandemic levels. Trends continue to suggest further growth in tourism activity going into this year, signalling optimism for the hospitality sector going forward. But risks stemming from inflation, geopolitical tensions and climate change will persist.

High satisfaction generates loyalty in the cruise industry, but experiences vary across segments and destinations

Tourism Economics’ latest cruise industry research briefing based on research among active cruisers identified strong underlying satisfaction with cruise experiences globally as nearly 90% rated their last cruise as good or very good.

Select to close video modal

Select to close video modal Play Video Select to play video

Reopening China: data indicates outbound travel rebound

Now that China has started to finally ease travel restrictions, Sabre has sifted through its extensive shopping and booking data to examine the impact of the reopening through February 9, 2023 on tourism in China, and globally. Key findings, following re-opening announcements on December 26, January 8, and January 20, include:

- A significant spike in shopping queries and requests, particularly for the outbound tourism industry;

- Strong demand among Chinese travelers for trips despite high air fares, with fares peaking at more than 2x in January, and 1.5x in February when compared to pre-pandemic prices;

- Demand is outstripping supply with Chinese airlines leading capacity growth;

- New booking habits suggest long-term travel confidence.

A surge in search and booking requests

Sabre’s shopping insights revealed that interest in inbound and outbound China routes surged in the week of 26 December, when China first announced plans to drop quarantine for overseas visitors, and again when mainland China reopened sea and land crossings with Hong Kong on 8 January.

Weekly searches for China-related routes (including the Special Administrative Regions of Hong Kong and Macau) have been increasing steadily after the announcements, and average weekly searches in the first 5 weeks of 2023 through to February 5, 2023 have been 78% higher compared to average weekly searches in Q4 2022.

Interest rose immediately after the announcement at the end of last year that China would re-open its borders. On January 8, China then opened sea and land crossings with Hong Kong, and ended a requirement for incoming travelers to quarantine, leading to another immediate increase in search and shopping requests, as travellers in China, many of whom hadn’t been able to visit family for years as a result of China’s previous zero-Covid policy, rushed to make bookings.

Another key factor, which has accelerated travel interest in the region, was the celebration of the first Chinese New Year without travel restrictions, with high levels of outbound, inbound, and domestic travel indicating strong travel demand and confidence in China.

On January 20, it was announced that the ban imposed on group travel would end on February 6. Bookings began to rise significantly, especially between January 30 – February 5, with bookings increasing 60% from average bookings in the previous 2 weeks.

Strong outbound bookings but inbound tourism remains stymied

The re-opening of China is already proving to be a key win for tourism recovery, and potentially providing economic growth, within the Asia Pacific region. In general, outbound travel has rebounded faster than inbound travel to the region, with Sabre data showing outbound bookings making up 43.5% of 2023 overall travel through February 9, compared to 37% for the same period in 2019.

As of February 9, Japan, Thailand and Korea are the top three destinations for Chinese outbound travel in 2023, with Korea rising to the 3 rd spot from 5 th in the same time in 2019. Bookings for the United Kingdom, Thailand and Philippines have bounced back the fastest versus bookings made in the same period in 2019. Indonesia, a top outbound destination in 2019, lost its spot in the top 10 to the Philippines.

It was reported that Indonesia slowed down on promoting their destination to China travelers during the pandemic, possibly impacting Indonesia’s position in the list. Australia’s fall to 9 th place may have been impacted by measures implemented on travel inbound from China.

However, while outbound travel is enjoying a strong rebound, restrictions in place for inbound travel appear to be limiting inbound travel recovery.

Long-awaited reunions fueling inbound bookings

Sabre’s booking data shows that the largest sources of inbound travel for China so far in 2023 are Taiwan, the United States, Thailand, Korea, the United Kingdom and Canada, with Thailand, the United Kingdom, and Canada bouncing back fastest in terms of recovery, as of February 9.

Given that inbound travelers must be holding a valid permit for work, study or reunion, a diplomatic visa or valid business cards, it is possible that one of the main motivations for inbound travel is for long-awaited family reunions, following the lengthy lockdown period. This generally aligns with population figures released in 2021, which showed countries with the largest number of overseas nationals were based in Thailand, Canada, and the United Kingdom.

Outbound travelers are also opting for longer stays, with the share of trips longer than two weeks increasing from 14% to 21%, when comparing 2019 to 2023 (through February 9). This could be due to travelers visiting family opting to make the most out of their trip after lengthy periods apart.

Long-term travel confidence and new booking habits

Although there is still some way to go before all travel restrictions are lifted for travel to and from China, Sabre data indicates the potential for long-term travel confidence. Booking windows can be a key confidence metric, as travelers are often happier to book further out if they feel confident about their plans.

As of February 5, 33% of all inbound bookings and 43% of all outbound bookings were made more than two months in advance, showing that there was a likely expectation that travel restrictions may ease further in the next two months and beyond. There were only 21% of outbound and 14% of inbound bookings made for travel within 2 weeks, versus 37% and 30% in the same period in 2019.

Travelers appear to be planning further ahead now, when compared to 2019 where there were more last-minute bookings. This may be due to new booking habits learned from the Covid-19 pandemic, where travelers have gotten used to pre-planning instead of impromptu trips, or the fact that capacity for China routes have yet to recover to pre-pandemic levels and there are fewer available for last-minute bookings.

Bookings are also slowly recovering to what we saw pre-pandemic, with outbound travel bookings made by February 9 for travel in first week of April reaching 70% of passenger bookings made by February 9 in 2019.

Demand outstrips supply and fare prices remain high

As of February 6, airline capacity for international routes to and from China (including Hong Kong and Macau) has recovered to only around 27%, compared to Q1 2019, with capacities expected to increase from April onwards.

Currently, most of the scheduled capacity is coming from Greater China airlines, along with carriers in Japan, Korea and Taiwan. Chinese airlines hold more than two thirds (65%) of total international route capacity, versus 60% in 2019. Global (non-Chinese) airlines have yet to add significant capacity for China, and SEA airlines also hold only 12% of international capacity for China, compared to 16% in 2019.

With what appears to be a slow recovery for capacity, Sabre ticketing data indicates that ticket prices for top Greater China inbound and outbound routes are reported to be higher compared to prices in 2019, with ticket sales increasing since September 2022. As airlines have begun to add in capacity, prices have lowered slightly to around 1.5 times pre-pandemic prices in February versus 2 times in January. Prices are however expected to remain higher until supply has been fully restored on the capacity front.

As demand has outweighed supply, resulting in higher prices, passengers appear to remain keen to fly, and are proving to be less price sensitive, possibly due to the “revenge travel” phenomenon resulting from the long lockdown period.

“The speed with which Chinese tourism started to rebound as soon as the announcements were made that restrictions were to be lifted demonstrates how high travel demand is for both inbound and outbound trips,” said Darren Rickey, Senior Vice President, Airline Global Sales, Sabre. “We know that airlines in China have been preparing for re-opening by ensuring they have the support of Sabre’s advanced technology to quickly respond to evolving industry conditions, to capitalize on recovery trends, and create their own growth momentum. We’re now excited to see what the rest of the year holds for Chinese travel.”

Sabre Corporation is a leading software and technology company that powers the global travel industry.

Related Articles

Top 10 online booking channels for 2023 revealed

Can fitness be a primary booking driver?

Which online resources lead to booking travel

VisitBritain launches ‘See Things Differently,’ driving bookings to Britain

Related courses.

You might also like:

Adapting to change: predictions and observations on business travel trends in 2024

Best practices to gain bookings on your hotel website

Putting a dollar value on a hotel

Why hospitality businesses win by putting people first – a mindset shift

Behind the numbers: understanding the impact of industry trends on lodging projects

Join over 60,000 industry leaders.

Receive daily leadership insights and stay ahead of the competition.

Leading solution providers:

BPN Solutions

OTA Savings by x·quic™

- Recovering China outbound, inbound travel boosting global tourism market

As China lifted more travel restrictions after it optimized its COVID-19 response, its recovering outbound and inbound travel is injecting new impetus into the global tourism market.

China on Wednesday began allowing travel agencies and online tourism services providers to offer group tours to a second list of 40 destinations, including France, Greece, Spain, Italy, Denmark, and Brazil, according to the Ministry of Culture and Tourism.

China's outbound group travel market was halted in early 2020 due to the COVID-19 pandemic. As the country has optimized its pandemic response, it has rolled out a pilot program to resume outbound travel to the first group of 20 countries, including Thailand, Indonesia, Maldives, Singapore, Egypt, Kenya, Switzerland, and New Zealand, from Feb. 6 this year.

Meanwhile, to further facilitate cross-border travel, China's visa authorities abroad resumed issuance of all categories of visas to foreigners starting Wednesday, according to the Chinese Foreign Ministry.

"We received the first order to travel to Spain and Portugal on the morning of March 11, the day after the circular on the second batch of 40 destinations was released," said Zhou Weihong, deputy general manager of Spring Tour Travel Agency.

Medium to long-distance destinations such as Serbia and Italy became the choices of Chinese tourists, and many planned to travel during the coming May Day holiday, Zhou said.

Travel agencies are introducing related products to cash in on the pent-up travel demand. Gu Wei, the general manager assistant of Shanghai Airlines Tours International (Group) Co., Ltd, said the company's products regarding traveling to Spain, France, and Switzerland have attracted considerable interest. Their group tours to Iran will leave in April.

Searches and bookings for group tours, airline tickets, and hotels surged on leading online travel agencies, including Trip.com Group, Tongcheng Travel, and Mafengwo.

With the number of outbound destinations for group tours reaching 60, travel agencies can offer more diversified and cost-effective products to cover destinations with similar geographical locations.

Over the past more than one month, Spring Tour has received nearly 10,000 outbound tourists, and its outbound tourists around the May Day holiday are expected to recover to more than half of the level in the same period of 2019.

Dai Bin, president of China Tourism Academy, said that China's outbound tourism market would see a sustained and accelerated recovery throughout 2023.

Chinese tourists are paying more attention to the flexibility and personalized experience of the trips, and the tour groups are becoming smaller, said Liu Ning, president of Shanghai Jinjiang Travel Holdings Co., Ltd.

China's recovering outbound travel demand has brought greater confidence to the global tourism industry. Thailand originally expected to receive 5 to 6 million Chinese tourists this year. But according to the current good recovery momentum, it further raised the forecast, Yuthasak Supasorn, governor of the Tourism Authority of Thailand, said in a recent tourism promotion event in Shanghai.

China's inbound tourism market is also steadily recovering with the removal of travel restrictions.

Wang Wei, president of Shanghai Spring International Travel Service (Group) Co., Ltd., said the company launched products to attract more overseas tourists to deeply appreciate Chinese culture and experience the life of Chinese people.

Dai of China Tourism Academy proposed to build several window cities for the exchange and mutual learning of world civilizations while building world-class tourism destinations to attract more overseas visitors.

"We will continue to share with other countries in the world the achievements of effectively coordinating COVID-19 responses with economic and social development and the opportunities from the tourism market recovery and development," Dai said.

Go to Forum >> 0 Comment(s)

Add your comments....

- User Name Required

- Your Comment

- As China lifted more travel restrictions after it optimized its COVID-19 response, its recovering outbound and inbound travel is injecting new impetus into the global tourism market.

- China Daily PDF

- China Daily E-paper

- Global Views

- Featured contributors

- Opinion Line

- Forum Trends

China can open a new chapter for inbound tourism

It has of late became easier for some foreigners to visit China. Under an experimental visa-free entry policy effective from Dec 1,2023, to Nov 30, 2024, ordinary passport holders from France, Germany, Italy, the Netherlands, Spain and Malaysia are now entitled to visa-free travel to China for up to 15 days. The policy is widely expected to boost inbound tourism to China.

Inbound tourism has played a significant role in China's modernization thanks to the country's reform and opening-up. It helped China earn foreign exchange, accelerated the formation of a modern tourism system, improved service quality, promoted continued opening-up of the tourism sector and enhanced people-to-people exchanges between China and the world.

China's inbound tourism has also had a worldwide impact, and China registered more than 145 million inbound tourist trips in 2019.

The world now has greater expectations of China's inbound tourism. Foreign visitors don't only want to visit beautiful landscapes, but also to see from close quarters people's lives in both rural and urban areas. Their purpose of vising China is to understand the country and hear its voice.

Because of the bright prospects China offers, foreign markets want to communicate closely with their Chinese counterparts, discover unique products and services and develop sustainably with China's inbound tourism market.

Meanwhile, China expects inbound tourism to help advance the Global Civilization Initiative and shape the landscape of tourism cooperation across the globe. For example, inbound tourism, which is part of cultural exchange, can enhance friendship between peoples from China and the world, bolster the high-quality development and advance high-level opening-up. China's inbound tourism should be and must be a global public product.

Currently, China's inbound tourism and global tourism depend on each other. China needs to interact with the world to promote its inbound tourism with regard to the development environment, tourism convenience, marketing, unique tourism attraction and talent cultivation.

First, the tourism authorities should guide the development of an inbound tourism market, closely monitor tourism market change among China and major tourist destinations, adjust management policies of tourist groups and make efforts to attract tourists from countries involved in the Belt and Road Initiative.

Second, the relationship between inbound and domestic tourism should be handled properly. Inbound tourism needs to be integrated with the development of domestic tourism and social situations at the destinations. Tourists should get easy access to local infrastructure, public services, transportation and the internet. Also, their requirements and expectations should be met by market entities in order to promote the sustainable development of inbound tourism.

Third, related departments should cooperate to establish mechanisms to improve the convenience of getting visa and integrate resources to address problems concerning tickets.

What's more, tourism entities should create themes and models to connect foreign tourists with China, and create market products related to China's modernization to attract foreign tourists. For example, people's daily lives, enterprises' innovation and the products concerning the BRI are all sources of tourist attractions.

Efforts should be made to train tourism professionals, introduce talent, improve their abilities and provide incentives. Travel experts and enthusiasts can be included into the industry to adapt to the new business models.

All these moves can boost the high-quality development of inbound tourism. China's tourism market should develop to meet new demands for foreign visitors by promoting urban, culinary and health tourism. Besides, the integration between culture and tourism needs to be boosted to help tourists experience China's rich culture and history. The development of inbound tourism requires long-term efforts but it has a bright prospect.

The author is director of the International Institute at the China Tourism Academy. The views don't necessarily reflect those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at [email protected], and [email protected].

Subscribe to our newsletter

China’s Sluggish Inbound Travel Will Recover in 2023: Report

China’s inbound travel market is expected to plummet in 2022 before witnessing a “remarkable recovery” next year, as the country is likely to further loosen quarantine rules and add more international flights, a newly released report said.

Some 20 million inbound trips are estimated to be made by the end of this year, far less than the 27.5 million visits in 2020, according to a report released Monday by China Tourism Academy, a research institution affiliated with the Ministry of Culture and Tourism. The number did slightly rise to 32 million trips last year, though it was still dismal compared with the 145 million trips in 2019.

The report comes as China has abruptly abandoned some of its strictest COVID control strategies after nearly three years of mass testing and lockdowns to keep the coronavirus at bay. Last month, the country also cut its quarantine policy for inbound travelers to five days at a designated facility and scrapped rules banning flights carrying infected passengers, though traveling to the country is still difficult.

Searches for international flights to China saw a “significant increase” in the past week, up by 351% year-on-year and close to 2019 levels, according to data from online travel agency Trip.com Group. Meanwhile, bookings for inbound flights to China also surged by 427% from the same period last year.

As of Saturday, 151 countries had scrapped all entry restrictions — including pre-arrival COVID tests, quarantines, and vaccinations — and reopened for tourism, according to American travel website Travel Off Path.

According to the Monday report, while the potential tourism demand to China has rebounded since the second half of the year, those who visit China for business, family visits, and study would constitute a large part of the inbound travelers in the coming period. After the country largely shut its borders in 2020, limited flights and costly tickets made it extremely difficult for those trying to come to China.

Meanwhile, the relaxation of COVID policies at home has seen a surge in domestic flight and hotel bookings, according to several online travel platforms. Flight ticket sales during the peak Lunar New Year travel season in January have also surged by nearly 8.5 times compared with figures prior to the relaxation of COVID curbs, according to Qunar.com.

Editor: Bibek Bhandari.

(Header image: Tourist visit the Forbidden City in Beijing, Dec. 11, 2022. IC)

- Terms Of Use

- Privacy Policy

Tu Lei co-leads the Global Times biz desk. She also covers topics on civil aviation and logistics.

An aerial drone photo taken on Feb. 22, 2024 shows scenery of the Zhangjiajie National Forest Park after snowfall in central China's Hunan Province.(Photo: Xinhua)

Chinese made 474m domestic trips during Spring Festival holidays, spending 632.6b yuan: Ministry of Culture and Tourism

China witnessed explosive growth in outbound tourism during this year's Spring Festival holidays (February 10-17), notably surpassing the ...

Travel, Tourism & Hospitality

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

- International tourist arrivals in China 2010-2023

Overseas visitor arrivals in China from 2010 to 2023 (in millions)

- Immediate access to 1m+ statistics

- Incl. source references

- Download as PNG, PDF, XLS, PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

2010 to 2023

*Estimate. Figures for 2020 and 2021 were taken from China Tourism Academy. Figure for 2022 was not released. International arrivals include travellers from foreign countries as well as travellers from Hong Kong, Macau, and Taiwan. The source does not provide a release date. The date given is the date of data access. Figures have been rounded.

Other statistics on the topic Tourism industry in China

- Number of visitors to the U.S. from China 2005-2028

- Number of outbound visitor departures from China 2010-2024

Leisure Travel

- Revenue from tourism in China 2012-2022

- International tourism spending of Chinese tourists 2008-2021

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

You only have access to basic statistics. This statistic is not included in your account.

- Instant access to 1m statistics

- Download in XLS, PDF & PNG format

- Detailed references

Business Solutions including all features.

Statistics on " Travel and tourism industry in China "

- Growth rate in tourism revenue in China 2012-2022

- Contribution of China's travel and tourism industry to GDP 2014-2023

- Number of travel and tourism jobs in China 2019-2033

- Number of travel agencies in China 2008-2022

- Tourism revenue during Chinese New Year in China 2017-2024

- Travel destinations planned by Chinese people for 2022

- Number of domestic tourist arrivals in China 2013-2023

- Quarterly domestic tourist arrivals in China Q1 2019-Q1 2024

- Expenses of domestic tourists in China 2013-2023

- Total number of local tourists during Chinese New Year in China 2017-2024

- Most popular domestic travel destinations of Chinese millionaires 2024

- China's revenue from international tourism 2000-2021

- Most popular international travel destinations among Chinese millionaires 2024

- Transaction volume of the Chinese online travel booking market 2013-2022

- Number of online travel booking users in China 2015-2023

- Penetration rate of online travel booking in China 2015-2023

- Market share index of leading online travel agencies in China 2019

- Revenue of Trip.com Group 2013-2023

- Tuniu's revenue 2014-2023

- Reasons to not travel long-haul to Europe worldwide 2023, by country

- COVID-19 coronavirus impact on domestic tourism in China 2020

- Travel sector employee employment situation during coronavirus pandemic in China 2022

- Unemployment length in travel sector during coronavirus pandemic in China 2022

- Expected time of traveling abroad after lifting quarantine restrictions in China 2022

- Preferred travel destinations after lifting quarantine restrictions in China 2022

Other statistics that may interest you Travel and tourism industry in China

- Premium Statistic Revenue from tourism in China 2012-2022

- Premium Statistic Growth rate in tourism revenue in China 2012-2022

- Basic Statistic Contribution of China's travel and tourism industry to GDP 2014-2023

- Basic Statistic Number of travel and tourism jobs in China 2019-2033

- Premium Statistic Number of travel agencies in China 2008-2022

- Premium Statistic Tourism revenue during Chinese New Year in China 2017-2024

- Premium Statistic Travel destinations planned by Chinese people for 2022

Domestic tourism

- Premium Statistic Number of domestic tourist arrivals in China 2013-2023

- Premium Statistic Quarterly domestic tourist arrivals in China Q1 2019-Q1 2024

- Premium Statistic Expenses of domestic tourists in China 2013-2023

- Premium Statistic Total number of local tourists during Chinese New Year in China 2017-2024

- Premium Statistic Most popular domestic travel destinations of Chinese millionaires 2024

International tourism

- Premium Statistic China's revenue from international tourism 2000-2021

- Premium Statistic International tourist arrivals in China 2010-2023

- Premium Statistic Number of outbound visitor departures from China 2010-2024

- Premium Statistic International tourism spending of Chinese tourists 2008-2021

- Premium Statistic Number of visitors to the U.S. from China 2005-2028

- Premium Statistic Most popular international travel destinations among Chinese millionaires 2024

Online travel market

- Premium Statistic Transaction volume of the Chinese online travel booking market 2013-2022

- Premium Statistic Number of online travel booking users in China 2015-2023

- Premium Statistic Penetration rate of online travel booking in China 2015-2023

- Premium Statistic Market share index of leading online travel agencies in China 2019

- Premium Statistic Revenue of Trip.com Group 2013-2023

- Premium Statistic Tuniu's revenue 2014-2023

COVID-19 impact on tourism industry

- Premium Statistic Reasons to not travel long-haul to Europe worldwide 2023, by country

- Premium Statistic COVID-19 coronavirus impact on domestic tourism in China 2020

- Premium Statistic Travel sector employee employment situation during coronavirus pandemic in China 2022

- Premium Statistic Unemployment length in travel sector during coronavirus pandemic in China 2022

- Premium Statistic Expected time of traveling abroad after lifting quarantine restrictions in China 2022

- Premium Statistic Preferred travel destinations after lifting quarantine restrictions in China 2022

Further related statistics

- Basic Statistic Number of UK tourists arriving in Lanzarote, by region 2014

- Basic Statistic Number of UK tourists arriving in Fuerteventura, by region 2014

- Premium Statistic Number of UK tourists arriving in La Palma, by region 2014

- Premium Statistic Italy: share of foreign tourist arrivals in 2015, by accommodation type

- Premium Statistic Italy: number of US tourist arrivals in 2015, by month

- Premium Statistic International overnight visitors to Dubai 2010-2018

- Premium Statistic Main origin countries for inbound tourism in Bolivia 2022

- Premium Statistic Number of outbound Thai travelers from Thailand 2019 by travel arrangement

- Premium Statistic Preferred holiday destination Philippines 2024

Further Content: You might find this interesting as well

- Number of UK tourists arriving in Lanzarote, by region 2014

- Number of UK tourists arriving in Fuerteventura, by region 2014

- Number of UK tourists arriving in La Palma, by region 2014

- Italy: share of foreign tourist arrivals in 2015, by accommodation type

- Italy: number of US tourist arrivals in 2015, by month

- International overnight visitors to Dubai 2010-2018

- Main origin countries for inbound tourism in Bolivia 2022

- Number of outbound Thai travelers from Thailand 2019 by travel arrangement

- Preferred holiday destination Philippines 2024

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

China’s Golden Week Travel Signals a Revival. Plus, Why U.S. Travel Is Still Lagging

Peden Doma Bhutia , Skift

May 30th, 2024 at 12:42 AM EDT

China’s outbound travel is coming back, driven by favorable visa policies, increased airline capacity, and a growing interest in diverse global destinations. However, challenges remain, particularly in travel to the U.S.

Peden Doma Bhutia

In a rebound of international travel, over 1.5 million Chinese citizens embarked on outbound trips during the recent Golden Week holiday , marketing technology firm China Trading Desk told Skift.

This surge points to a significant revival in global travel following the easing of pandemic-related restrictions.

The relaxation of visa policies between China and several countries has played a crucial role in this uptick. During the Golden Week in late April and early May, the growth rate of inbound and outbound bookings outpaced domestic tourism, Trip.com Group told Skift.

Popular Destinations and Emerging Trends

According to data from Trip.com Group, Chinese tourists visited nearly 200 countries and over 3,000 towns worldwide during the Golden Week period.

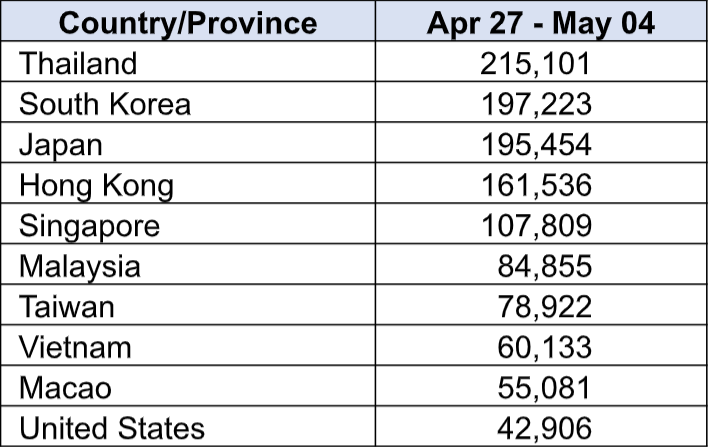

Thailand emerged as the top destination, with over 215,000 Chinese tourists between April 27 and May 4, according to China Trading Desk’s data. Factors such as visa-free entry offer by Thailand, shorter flight durations, and cost-effectiveness compared to other destinations have driven this trend.

While strong, the numbers still haven’t reached pre-pandemic levels, said Subramania Bhatt, CEO of China Trading Desk.

The popularity of outbound travel is further evidenced by Ctrip’s report of a 190% year-on-year increase in the number of outbound tourists. Alibaba’s Fliggy also noted a near doubling in outbound travel bookings during the five-day holiday, with per capita spending on outbound travel surpassing 2019 levels significantly.

Alipay transactions reflect this increased spending, with a 77% rise in overseas markets during the initial days of Golden Week, particularly in destinations like Thailand and Malaysia.

Challenges in US-China Travel

Travel to the U.S. still faces hurdles , with flight capacity between the two countries around 25% of pre-Covid levels. During the 2019 Labor Day holiday, 70,000 travelers journeyed from China to the U.S., but most recently it was around 42,000.

Bhatt cited several reasons for this:

- Limited Flight Availability: There’s a slower resumption of direct flights and connectivity between China and the US, impacting the ease of planning trips.

- Visa Processing Delays: Longer visa processing times have been a deterrent, likely due to staffing issues and backlogs caused by the pandemic.

- Geopolitical Tensions: Ongoing political tensions between China and the US may make some potential travelers hesitant.

- Concerns Over Racial Treatment: There is apprehension about the treatment of Chinese individuals in the U.S., which can influence travel decisions.

Airline Capacity and Pricing Trends

Though limited, there has been a gradual restoration of airline service and that has helped. Fliggy said that the average price per person for international air tickets dropped by more than 10% compared to the previous year.

The preference for Asian destinations remains strong, with 9 out of the top 10 outbound destinations being in Asia. Bhatt attributed this to the ease of travel, increased flight availability, and visa-free access in many Southeast Asian countries, as well as Hong Kong, Taiwan, and Macau.

Europe continues to attract Chinese tourists, with over 100,000 travelers heading to European countries excluding the UK during the holiday season, according to China Trading Desk’s data. Trip.com reported notable increases in travel to Spain, Turkey, Austria, Slovenia, Italy, and Georgia, with year-on-year growth exceeding 1.5 times.

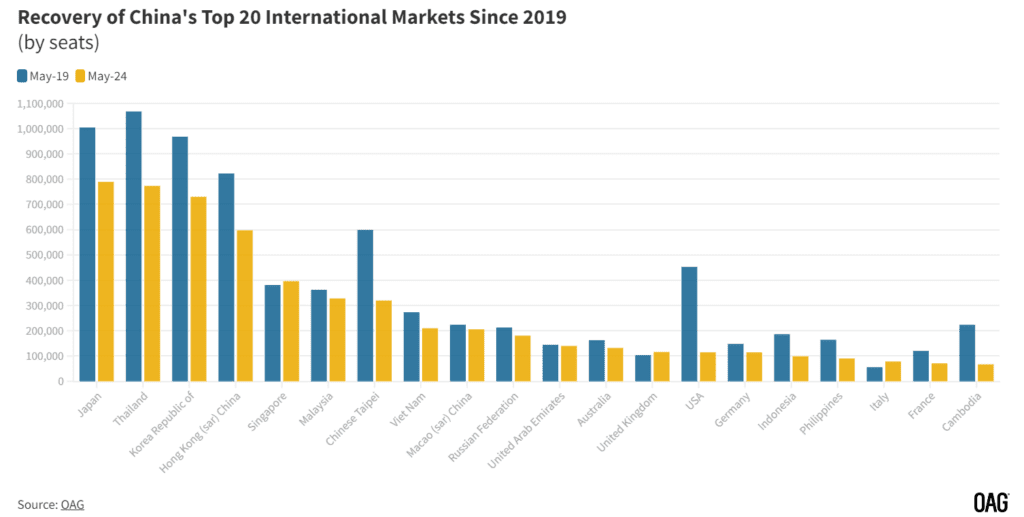

Domestic capacity in May still accounts for 92% of all seats to, from and within China this month, with international making up the remaining 8%, according to aviation data firm OAG .

Shifts in Travel Preferences

There is a notable shift towards exploring less traditionally frequented destinations. Austria, Turkey, Morocco, and other less traditionally frequented destinations by Chinese tourists saw the fastest growth rates in bookings, indicating a shift towards exploring new and diverse destinations

Fliggy also reported that bookings for long-distance travel to places like Austria, Turkey, Morocco, Russia, Portugal, Georgia, Egypt, Spain, Kazakhstan, and Brazil quadrupled compared to the previous year.

Additionally, Trip.com group noted significant increases in travel to Middle Eastern destinations such as Oman, Saudi Arabia, and Kuwait, with numbers more than tripling year-on-year.

Saudi Arabia and Qatar are set to increase the number of direct flights connecting China and Hong Kong, capitalizing on the resurgence of Chinese tourists. Having welcomed 140,000 Chinese tourists last year, Saudi Arabia aims to attract 5 million Chinese visitors by 2030.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: alibaba , alipay , asia monthly , china , china airlines , china outbound , coronavirus recovery , ctrip , fliggy , golden week , trip.com group

Photo credit: Fliggy reported that bookings to Turkey, Morocco, Georgia, Egypt and Kazakhstan have quadrupled compared to the previous year. Rachel Claire / Pexels

16 Countries That Travel The Most (And Their Top Destinations)

A s more people become more interested in places different from their countries of birth, there has been an increase in international travel. Whether it’s for work, school, adventures, or other reasons, there are certain countries around the world that travel the most. This is an interesting thing to study, especially since most people traveling from one place are usually headed for the same destination. This piece aims to inspire travelers by revealing the top countries that travel the most according to the latest outbound travel report by Research and Markets and also reveal the destinations they mostly travel to.

UPDATE: 2023/07/10 20:42 EST BY REENA JAIN

Countries That Travel The Most (And Their Top Destinations)

As mentioned in the UNWTO study, the first half of 2023 saw a revival in international travel, and the same pattern is anticipated for the months ahead. Two more countries that travel the most and spend the most on international tourism have been added to the list to reflect current trends.

The happiest country in the world , Finland, also deserves to be on this list for spending a lot on outbound travel. The Finnish people like exploring their own country as the nation is full of natural beauty, history, stunning water bodies, and modern marvels, but they prioritize traveling to different international destinations. Sweden is the most popular foreign travel destination for them followed by Estonia, Spain, and Norway.

From eateries where travelers can try tasty cuisine to fun and exciting activities and attractions that leave visitors amazed, there is so much to do and see in Denmark . Yet, residents travel to neighboring countries for leisure and to explore new international destinations. As mentioned in GlobalData’s report, there is a steep rise in international tourism in Denmark. And Danish residents travel the most to other European countries, specifically Sweden, Spain, Germany, France, and Italy.

Even though China has eased some of its COVID restrictions and is moving toward a tourism recovery, outbound travel has recovered more quickly than inbound travel to the area. Although China has countless beautiful beaches, mountains, islands, cities, and many natural and modern wonders , Chinese people also love to travel abroad. They prefer visiting nearby Japan, Thailand, and Korea for a short international trip, though other popular destinations include the Philippines, Thailand, and the United Kingdom.

According to GlobalData's report , outbound travel from Canada in 2022 increased by 312% to reach 22.3 million, the highest number since 2019. Although Canada is full of fantastic destinations, Canadians, after the pandemic, prefer to spread their wings and travel to distant regions, particularly in the United States, Thailand, Indonesia, and Europe. However, the majority of Canada's top ten international travel destinations are in the United States.

Following the Japanese government's decision to lower its travel warning for 34 countries and territories, Japan's outbound market is regaining strength, with an increasing number of people traveling abroad. According to data from Japan's Immigration Service Agency, there were 1045.7% more Japanese tourists abroad in February 2023 than in the same month in 2002. Furthermore, South Korea, the United States, Thailand, Singapore, and Taiwan are among the top international destinations for Japanese travelers.

Singapore is a traveler's dream destination with numerous breathtaking natural beauties as well as of man-made marvels . However, the people of this lovely nation also look for chances to travel to nearby countries for a short trip and faraway destinations for a long break. According to the e-Conomy SEA 2022 report , 52% of Singaporeans intend to travel abroad in 2023, an increase of 13% from 2022. And the majority of them spend three to four days on vacation in Thailand, Indonesia, Japan, South Korea, Malaysia, and Taiwan, which are their preferred international vacation destinations.

Since restrictions were lifted, outbound travel in Austria has continued to skyrocket. It now seems more people are trying to get out of the country than ever. For Austrians, Croatia is the favorite destination for outbound travel, although Italy and Germany are also favorite destinations for according to Statista’s outbound tourist numbers for Austria in 2021 .

Switzerland

There are plenty of interesting things to enjoy in Switzerland , but that does not stop millions of people from leaving the country every year and spending their vacations in European destinations. In 2019 before the pandemic, approximately 19.8 million people traveled abroad, and their favorite destinations are France and Germany.

Related: Switzerland Vs Austria: Which Has The Better Alps?

Italy has everything a person needs, from a destination, from archaeological sites to beautiful beaches and delicious food , and while those are popular among Italian travelers, they also love to travel abroad and check out some of their favorite destinations. In July, outbound travelers from Italy amounted to 3.2 million, and Romania was the country’s most beloved travel destination. Spain and France, however, are popular destinations among Italian travelers.

France has been responsible for the most outbound travels from Belgium. In 2019, approximately 4.5 million trips originating from Belgium landed in France, and although the number may have reduced, one can still expect this trend as more people resume outbound travel.

Russian outbound travel may be on a downward trend, but it remains a country with huge outbound tourism numbers. In 2022, Turkey was the main place of interest for Russian outbound travelers , and the UAE is also popular among Russian travelers.

The Netherlands

Before the pandemic hit, outbound trips from the Netherlands in 2019 were 22 million, and even though the country may not recover its previous number till 2024, the Netherlands remains one of the countries where people travel the most. Wellness travel is popular among travelers from the Netherlands; Germany is the country’s favorite destination, while Spain and Belgium are also popular among Dutch travelers.

United Kingdom

The Royals , castles, museums, and delicious food are not enough to keep people in the UK from being among the top outbound travelers in the world. In 2019, the country saw an outbound tourism number of 84.7 million, and according to GlobalData , this number is set to reach 86.9 million by 2024, and Spain remains the favorite holiday destination for UK travelers.

Being the most visited country in the world does not mean people in France just sit around and let other people do the traveling. They also travel in huge numbers, and French people typically prefer to visit other European destinations such as Spain, the U.K., and Germany.

Related: Want To Know A Secret? Here Are Some Strange France Facts