Southwest Rapid Rewards ® Priority Credit Card

85,000 bonus points 85,000 bonus points

$75 Southwest ® Credit $75 Southwest® Credit

3X points on Southwest purchases 3X points on Southwest purchases

New cardmember offer

Earn 85,000 points.

after you spend $3,000 on purchases in the first 3 months from account opening. * Opens offer details overlay

At a glance

Receive a $75 annual southwest ® travel credit.

and 7,500 anniversary points each year. * Opens offer details overlay Plus, earn 3X points on Southwest purchases. * Opens offer details overlay

Interest Rate

--> 21.49 Min. of (8.50+12.99) and 29.99 %– 28.49 Min. of (8.50+19.99) and 29.99 % variable APR. † Opens pricing and terms in new window

--> $149 applied to first billing statement. † Opens pricing and terms in new window

Travel Credit Card Rewards & Benefits

New cardmember offer.

Earn 85,000 points after you spend $3,000 on purchases in the first 3 months from account opening. * Opens offer details overlay

This product is available to you if you do not have a current Southwest Rapid Rewards Credit Card and have not received a new Cardmember bonus within the last 24 months. This does not apply to Business Card and Employee Credit Card products.

Earn Points

Earn 3x points per $1.

Earn 3 points for each dollar spent on Southwest purchases. * Opens offer details overlay

Earn 2X points per $1

Earn 2 points for each dollar spent on Rapid Rewards ® hotel and car rental partners. * Opens offer details overlay

Earn 2 points for each dollar spent on local transit and commuting, including rideshare. * Opens offer details overlay

Earn 2 points for each dollar spent on internet, cable, and phone services; select streaming. * Opens offer details overlay

Earn 1 point for each dollar spent on all other purchases. * Opens offer details overlay

Southwest Cardmember Benefits

Exclusive benefits for cardmembers.

7,500 points every year on your Cardmember anniversary. * Opens offer details overlay

$75 Southwest annual travel credit. * Opens offer details overlay

4 Upgraded Boardings per year when available. * Opens offer details overlay

Unlimited tier qualifying points (TQPs): Earn 1,500 TQPs toward A-List status for every $5,000 you spend–there is no limit on the amount of TQPs you can earn. * Opens offer details overlay

25% back on inflight purchases. * Opens offer details overlay

10,000 Companion Pass ® qualifying points boost each year. * Opens offer details overlay

Southwest Perks

Enjoy all the benefits of flying southwest.

Bags fly free ® . * Opens offer details overlay

No change fees. * Opens offer details overlay

Unlimited reward seats with no blackout dates or seat restrictions. * Opens offer details overlay

Your points don't expire, a benefit of the Rapid Rewards program.

Explore Additional Benefits

Travel & purchase coverage opens drawer that reveals additional content.

You're covered with built-in benefits

Lost Luggage Reimbursement

If you or an immediate family member check or carry on luggage that is damaged or lost by the carrier, you're covered up to $3,000 per passenger. ^ Same page link to disclaimer

Baggage Delay Insurance

Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 3 days. ^ Same page link to disclaimer

Extended Warranty Protection

Extends the time period of the U.S. manufacturer's warranty by an additional year, on eligible warranties of three years or less. ^ Same page link to disclaimer

Purchase Protection

Covers your new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account. ^ Same page link to disclaimer

^ Same page link to disclaimer reference These benefits are available when you use your card. Restrictions, limitations and exclusions apply. Most benefits are underwritten by unaffiliated insurance companies who are solely responsible for the administration and claims. There are specific time limits and documentation requirements. Once your account is opened we will send you a Guide to Benefits, which includes a full explanation of coverages.

No foreign transaction fees † Refer to Pricing and Terms Opens drawer that reveals additional content

You will pay no foreign transaction fees when you use your card for purchases made outside the U.S. † Opens pricing and terms in new window For example, if you spend $5,000 internationally, you would avoid $150 in foreign transaction fees.

Contactless - Just Tap To Pay Opens drawer that reveals additional content

For fast, easy and secure checkout simply tap to pay where you see the Contactless symbol. For more information, please see www.chase.com/contactless Opens in a new window .

Spend Instantly Opens drawer that reveals additional content

Apply for a card, use it the same day.

Receive instant access to your card by adding it to a digital wallet, like Apple Pay ® , Google Pay ™ or Samsung Pay. Find out how at chase.com/digital/spend-instantly Opens in a new window .

Partner benefits Opens drawer that reveals additional content

Get one-year complimentary DashPass, a membership for both DoorDash and Caviar that provides unlimited deliveries with $0 delivery fees and lower service fees on eligible orders. After that, you are automatically enrolled in DashPass at the current monthly rate. Activate by 12/31/24. * Opens offer details overlay

Chase Pay Over Time SM Opens drawer that reveals additional content

Chase Pay Over Time * Opens offer details overlay lets eligible Chase customers break up credit card purchases into budget friendly payments. There are two potential ways to pay over time:

After purchase: Pay off an eligible purchase you've already made of $100 or more * Opens offer details overlay in smaller, equal monthly payments. No Interest- just a fixed monthly fee † Opens pricing and terms in new window with plan durations that range from 3-24 months. Start a plan by selecting an eligible purchase with the "Pay Over Time" option next to the transaction amount in your credit card activity.

At checkout: Chase Credit card members may have the option to create a payment plan at checkout on Amazon.com. Orders totaling $50 or more * Opens offer details overlay using your eligible Chase credit card at Amazon.com could be eligible for Chase Pay Over Time. You will be able to view Chase Pay Over Time plan options (including the fixed APR and durations) at checkout.

Keep in mind: Even though you may have an eligible card, access to Chase Pay Over Time is not guaranteed. Your ability to create a Chase Pay Over Time plan is based on a variety of factors, such as your creditworthiness, credit limit and account behavior, and may change from time to time.

For more information on Chase Pay Over Time features, please visit chase.com/chasepayovertime Opens in a new window .

Refer a Friend if you already have a Southwest Rapid Rewards Credit Card!

Earn up to 100K bonus points per year. You can earn 20,000 bonus points for each friend or business that gets approved for any Southwest Rapid Rewards ® Credit Card. Click the button below to start referring.

Browse credit cards by category

Offer details, offers may vary depending on where you apply, for example online or in a branch, and can change over time. to take advantage of this particular offer now, apply through the method provided in this advertisement. review offer details before you apply..

85,000 Bonus Points After You Spend $3,000 On Purchases In The First 3 Months From Account Opening: The product is not available to either (i) current Cardmembers of any Southwest Rapid Rewards ® Credit Card, or (ii) previous Cardmembers of any Southwest Rapid Rewards Credit Card who received a new Cardmember bonus within the last 24 months. This does not apply to Cardmembers of the Southwest Rapid Rewards Business Card and Employee Credit Card products. To qualify for your bonus points, you must make Purchases totaling $3,000 or more during the first 3 months from account opening. Please allow up to 8 weeks for bonus points to post to your Rapid Rewards ® account. ("Purchases" do not include balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable.) To be eligible for this bonus offer, account must be open and not in default at the time of fulfillment.

Earning Points: Rewards Program Agreement: For more information about the Rapid Rewards ® Priority card rewards program, view the latest Rewards Program Agreement (PDF) Opens in a new window . We will mail your Rewards Program Agreement once your account is established. If you become a Chase Online customer, your Rewards Program Agreement will also be available after logging in to chase.com Opens in a new window . How you can earn points: You'll earn points on purchases of products and services, minus returns or refunds, made with a Rapid Rewards ® Credit Card by you or an authorized user of the account. Buying products and services with your card, in most cases, will count as a purchase; however, the following types of transactions won't count as a purchase and won't earn points: balance transfers, cash advances and other cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable. 3 points: You'll earn 3 points for each $1 spent on purchases made directly with Southwest Airlines ® , including flight, inflight, Southwest ® gift card, and Southwest Vacations ® package purchases. 2 points: You'll earn 2 points for each $1 spent on purchases at participating Rapid Rewards ® hotel and rental car partners. 2 points: You'll earn 2 points for each $1 spent on purchases in the local transit and commuting rewards category. 2 points: You'll earn 2 points for each $1 spent on purchases in the following rewards categories: internet, cable, and phone services; select streaming services. 1 point: You'll earn 1 point for each $1 spent on all other purchases. 7,500 bonus points each account anniversary year: You'll receive 7,500 bonus points each account anniversary year. "Account anniversary year" means the year beginning with your account open date through the anniversary of your account open date, and each 12 months after that. 1,500 tier qualifying points: You'll earn 1,500 tier qualifying points (TQPs) for each $5,000 spent in purchases annually. TQPs can be used to count toward qualification for Rapid Rewards A-List or A-List Preferred status. "Annually" means the year beginning with your account open date through the first December statement date of that same year, and each 12 billing cycles starting after your December statement date through the following December statement date. Information about earning/transferring points to Southwest Airlines ® : Points earned during a billing cycle will be automatically transferred to Southwest Airlines after the end of each billing cycle. Losing points: You'll immediately lose all points that haven't been transferred to Southwest Airlines if your card account status changes, or your card account is closed for program misuse, fraudulent activities, failure to pay, bankruptcy, or other reasons described in the terms of the Rewards Program Agreement. Rewards Categories: Merchants who accept Visa/Mastercard credit cards are assigned a merchant code, which is determined by the merchant or its processor in accordance with Visa/Mastercard procedures based on the kinds of products and services they primarily sell. We group similar merchant codes into categories for purposes of making rewards offers to you. Please note: We make every effort to include all relevant merchant codes in our rewards categories. However, even though a merchant or some of the items that it sells may appear to fit within a rewards category, the merchant may not have a merchant code in that category. When this occurs, purchases with that merchant won't qualify for rewards offers on purchases in that category. Purchases submitted by you, an authorized user, or the merchant through third-party payment accounts, mobile or wireless card readers, online or mobile digital wallets, or similar technology will not qualify in a rewards category if the technology is not set up to process the purchase in that rewards category. For more information about Chase rewards categories, see chase.com/RewardsCategoryFAQs Opens in a new window .

$75 Southwest ® Annual Travel Credit: A statement credit will automatically be applied to your account when your Southwest Airlines Rapid Rewards ® Priority Card is used for Southwest Airlines ® purchases (excluding Upgraded Boardings and inflight purchases), up to an anniversary year maximum accumulation of $75. Anniversary year means the year beginning with your account open date through the first statement date after your account open date anniversary, and the 12 monthly billing cycles after that each year. Eligibility for a $75 Southwest Annual Travel Credit for accounts that switch to this product: Account open date is the date the switch is official in the Chase system. Statement credit(s) will post to your account the same day your Southwest Airlines purchase posts to your account and will appear on your monthly credit card billing statement within 1-2 billing cycles. The $75 Southwest Annual Travel Credit will be issued for the year in which the transaction posts to your account. For example, if you buy a Southwest Airlines ticket, but the airline does not post the transaction until after your current anniversary period ends, the cost of the ticket will be allocated towards the following year's Southwest Annual Travel Credit maximum of $75.

Southwest ® Upgraded Boardings: Each anniversary year you will be reimbursed for the purchase of up to 4 Upgraded Boardings which are positions A1-A15. Upgraded Boarding may be purchased via the Southwest app or Southwest.com beginning 24 hours before departure and ending 30 minutes prior to departure or at the departure gate or ticket counter on the day of travel only, when available. Price of Upgraded Boarding is based on your itinerary. Anniversary year means the year beginning with your account open date through the first statement date after your account open date anniversary, and the 12 monthly billing cycles after that each year. For accounts that switch to this product, account open date is the date the switch is official in the Chase system. After you make your purchase with your Southwest Rapid Rewards ® Priority Card, you will receive a statement credit for the price of the Upgraded Boarding. Statement credit and purchase of Upgraded Boarding may not post on the same statement; please allow up to eight weeks for the statement credit(s) to post to your account. You may purchase all 4 Upgraded Boardings at one time or on separate flights; you will only be reimbursed via statement credit for the first 4 Upgraded Boardings you purchase during your anniversary year. Account must be open and not in default at the time the statement credit is posted to your account.

25% back on inflight purchases on Southwest Airlines ® flights: You will receive 25% back on Southwest Airlines inflight purchases made with your Southwest Rapid Rewards ® Priority Credit Card for drinks and WiFi in the form of a credit card account statement credit. Statement credit(s) will post to your credit card account the same day as your purchase(s) and will appear on your monthly credit card billing statement within 1-2 billing cycles. You will also receive 25% back on inflight purchases made by authorized users on your account. To qualify for the 25% back, purchase must be made with your Southwest Rapid Rewards ® Priority Credit Card and your account must be open and not in default at the time of fulfillment.

Companion Pass: Companion Pass ® qualifying points are earned from revenue flights booked through Southwest ® , points earned on Rapid Rewards ® Credit Cards, and base points earned from Rapid Rewards partners. The following do not count as Companion Pass qualifying points: purchased points; points transferred between Members; points converted from hotel and car loyalty programs, e-Rewards ® , Valued Opinions, and Diners Club ® ; points earned from Rapid Rewards program enrollment, tier bonus points; flight bonus points; and partner bonus points (with the exception of the Rapid Rewards Credit Cards from Chase). No points nor tier or Companion Pass qualifying points will be awarded for flights taken by the Companion when flying on a Companion Pass reservation. Points earned during a billing cycle on a Southwest Airlines Rapid Rewards Credit Card from Chase are not available for redemption or qualification for Companion Pass status until they are posted on your billing statement and posted to your Rapid Rewards account. Only points posted on your billing statements and posted to your Rapid Rewards account during the same calendar year are available for qualification for Companion Pass status. For example, if you make a purchase after your December billing statement cycle date, the points on those purchases will not count toward Companion Pass status in the year the purchase was made; they will appear on your January billing statement and post to your Rapid Rewards account in January. Companion Pass Qualifying Points Boost: As a Southwest Rapid Rewards Cardmember, you will earn one boost of 10,000 Companion Pass qualifying points each calendar year. The boost will be deposited into your eligible Rapid Rewards account by January 31st each calendar year or up to 30 days after account opening. To receive Companion Pass qualifying points boost your credit card account must be open and not in default at the time of fulfillment. Only one credit card account per Southwest Rapid Rewards Member (Rapid Rewards Member must be the primary Cardmember on that account), is eligible for one boost of 10,000 Companion Pass qualifying points per calendar year. JPMorgan Chase Bank, N.A. is not responsible for the provision of, or failure to provide, the stated benefits and services.

Bags Fly Free: First and second checked bags. Weight and size limits apply.

No Change Fees: Fare difference may apply.

No Blackout Dates and Unlimited Reward Seats: No blackout dates and unlimited reward seats apply to flights booked with points.

Complimentary DashPass from DoorDash: When the membership is activated for the first time with a Southwest Rapid Rewards ® Priority Credit Card by 12/31/2024 you and your authorized user(s) will receive 12 months of complimentary DashPass for use on both the DoorDash and Caviar applications during the same membership period based on the first activation date. After the complimentary DashPass membership period ends, you and any authorized users will continue to be enrolled and charged the then current monthly DashPass rate for each membership activated. You can cancel anytime on the DoorDash or Caviar mobile application. Membership period for all users on this credit card account will begin and end based on when the first user activates the membership on the DoorDash or Caviar mobile applications, regardless of when subsequent memberships are activated. The same log in credentials must be used on DoorDash and Caviar in order for the DashPass benefit to be used on both applications. To receive the membership benefits, the primary cardmember and/or authorized user(s) must first add their applicable Chase credit card as a default payment method in the DoorDash or Caviar mobile applications, and then click the activation button. Once enrolled in DashPass, you must use your Southwest Rapid Rewards ® Priority Credit Card for payment at checkout for DashPass-eligible orders to receive DashPass benefits. Benefits of DashPass from DoorDash include no delivery fee on orders above the minimum subtotal (as stated in the DoorDash and Caviar apps and sites) from DashPass-eligible merchants (amounts subject to change). However, other fees (including service fee), taxes, and gratuity on orders may apply. Current value of the DashPass membership is as of 04/01/2022. DashPass orders are subject to delivery driver and geographic availability. Membership must be activated with a United States address. Payment through third-party payment accounts, or online or mobile digital wallets (like Apple Pay and Google Pay), or memberships purchased through third parties are excluded from this offer. If you product change to another Chase credit card during the promotional period, your benefits may change. You may experience a delay in updating your applicable benefits in the DoorDash or Caviar mobile application; please note, once you product trade, the benefits from your previous credit card are no longer available for your use. You can only access the benefits available with your current credit card. Mobile applications, websites and other information provided by DoorDash or Caviar are not within Chase's control and may or may not be available in Spanish. Chase is not responsible for the provision of, or the failure to provide, DoorDash or Caviar benefits and services. Your applicable Chase credit card account must be open and not in default to maintain membership benefits. See full DoorDash terms and conditions at: https://help.doordash.com/consumers/s/article/offer-terms-conditions?language=en_US . All deliveries subject to availability. Must have or create a valid DoorDash account. Qualifying orders containing alcohol will be charged a $0.01 Delivery Fee. No cash value. Non-transferable. See full terms and conditions at: help.doordash.com/consumers/s/article/offer-terms-conditions .

The Contactless Symbol and Contactless Indicator are trademarks owned by and used with the permission of EMVCo, LLC.

Cardmembers Eligible for Chase Pay Over Time: Eligible cardmembers are those with access to Chase Pay Over Time who use a participating Chase credit card for eligible purchases. Access to Chase Pay Over Time is not guaranteed, is based on a variety of factors such as creditworthiness, credit limit and account behavior, and may change from time to time. Participating Chase credit cards are consumer credit cards issued by Chase, small business cards are excluded at this time. For Chase Pay Over Time at checkout on Amazon.com, Amazon Visa and Prime Visa cards and Chase Mastercard credit cards are also excluded. Purchases Eligible for Chase Pay Over Time Set Up After Purchase: Purchases of at least $100 are eligible, excluding certain transactions such as (a) cash-like transactions, (b) any fees owed to us, including Annual Membership Fees, and (c) purchases made under a separate promotion or special finance program. Eligible purchases will be identified within your transaction history on chase.com Opens in a new window or the Chase Mobile App. Purchases Eligible for Chase Pay Over Time at Checkout on Amazon.com: Orders totaling at least $50 of eligible items on Amazon.com are eligible. Amazon may designate any item as ineligible, such as Amazon Fresh, Whole Foods, Amazon Prime Now, 1-Click Purchases and Subscribe & Save. If your order includes a recurring subscription, then only the first month's subscription fee will be eligible. If available for your account, the option to choose "financing offers available" will appear at checkout. Amazon, the Amazon.com logo, the smile logo, and all related logos are trademarks of Amazon.com , Inc. or its affiliates.

Chase Mobile App: Chase Mobile ® app is available for select mobile devices. Message and data rates may apply.

SOUTHWEST RAPID REWARDS ® PROGRAM INFORMATION

The Southwest Rapid Rewards Credit Card is brought to you by Southwest Airlines ® and Chase. Southwest Airlines is responsible for the redemption of Rapid Rewards points toward benefits and services. The number of points needed for a particular Southwest flight is set by Southwest ® and will vary depending on destination, time, day of travel, demand, fare type, point redemption rate, and other factors, and are subject to change at any time until the booking is confirmed. Rapid Rewards points can only be transferred to the primary Cardmember's Rapid Rewards account. All Rapid Rewards rules and regulations apply and can be found at Southwest.com/rrterms . Southwest reserves the right to amend, suspend, or change the program and/or program rules at any time without notice. Rapid Rewards Members do not acquire property rights in accrued points.

Southwest Rapid Rewards ® Credit Cards are issued by JPMorgan Chase Bank, N.A. Member FDIC. Accounts subject to credit approval. Restrictions and limitations apply. Offer subject to change.

You're now leaving Chase

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn't responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

Please update your browser.

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

Update your browser

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

We’ve signed you out of your account.

You’ve successfully signed out

We’ve enhanced our platform for chase.com. For a better experience, download the Chase app for your iPhone or Android. Or, go to System Requirements from your laptop or desktop.

You're now leaving Chase

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

Please update your browser .

Payments and Cards

Chase and Southwest Airlines® Expand Benefits for Southwest® Rapid Rewards® Cardmembers

Introducing new rewards categories, even more travel benefits, and best consumer points offer ever for new Cardmembers

WILMINGTON, DE — Oct. 19, 2021 — Today, Chase and Southwest Airlines Co. in their 25 th year of partnership, announced enhanced benefits to their lineup of award-winning* Southwest® Rapid Rewards® Credit Cards . Consumer and business Cardmembers now have even more rewards categories to earn Rapid Rewards points, new and enhanced benefits that provide an elevated travel experience, and inflight savings – with no increase to annual fees.

The same great cards now come with more to love: more points, more benefits, and more possibilities.

With these exclusive benefits, customers can now earn on everyday spend categories such as select streaming services, local transit and commuting including rideshare. Southwest Plus and Premier Cardmembers now have the ability to enjoy two EarlyBird Check-In® credits per year, and Premier and Priority Cardmembers have the ability to spend their way to A-List status. Cardmembers can enjoy these new perks in addition to their existing benefits, such as Anniversary Points, accelerated earn on Southwest purchases, and points on every purchase made with their card.

View the Text Version View Infographic Version

MORE POINTS. MORE BENEFITS. MORE POSSIBILITIES.

The award-winning Southwest® Rapid Rewards® Credit Cards now have even more!

All the benefits are automatic—there’s no activation required and no increase to a Cardmember’s annual fee. Cardmembers can continue to enjoy their existing benefits such as anniversary points, accelerated earn on Southwest purchases, and points on every purchase made with the card, that all count towards Companion Pass®.

Southwest Rapid Rewards Consumer Cards

Southwest Rapid Rewards Plus Card

· New benefit: 2X points per $1 spent on local transit and commuting purchases, including rideshare.

· New benefit: 2X points per $1 spent on internet, cable, phone services, and select streaming purchases.

· New benefit: 2 EarlyBird Check-In® per year.

Southwest Rapid Rewards Premier Card

· New benefit: 2 EarlyBird Check-In per year.

· Enhanced benefit: 3X points per $1 spent on Southwest purchases.

Southwest Rapid Rewards Priority Card

· Enhanced benefit: Unlimited tier qualifying points (TQPs) can be earned toward A-List status.

Southwest Rapid Rewards Business Cards

Southwest Rapid Rewards Plus Business Card

· New benefit: $500 fee credit per year for Rapid Rewards points transfers.

Southwest Rapid Rewards Premier Business Card

Southwest Rapid Rewards Performance Business Card

· Enhanced benefit: 4X points per $1 spent on Southwest purchases.

For more information about all card benefits, visit chase.com/Southwest .

To celebrate the addition of the new benefits, new consumer Cardmembers can earn up to 100,000 Rapid Rewards points now through Dec. 7, 2021, for most channels – the best points offer ever for Southwest Rapid Rewards consumer Credit Cards:

- New consumer Cardmembers can earn 50,000 Rapid Rewards points after spending $2,000 in the first three months of account opening, and an additional 50,000 points after spending $12,000 in the first twelve months from account opening

In addition, new business Cardmembers have the ability to earn up to 80,000 Rapid Rewards points:

- New Performance Business Cardmembers can earn 80,000 Rapid Rewards points after spending $5,000 in the first three months

- New Premier Business Cardmembers can earn 60,000 Rapid Rewards® points after spending $3,000 in the first three months

“We’re thrilled to enhance our partnership with Chase by bringing more benefits than ever before to our award-winning Rapid Rewards Credit Card program, and continuing to offer the best travel products to our Cardmembers,” said Jonathan Clarkson , Southwest Airlines Managing Director of Loyalty, Partnerships, and Products. “With perks like EarlyBird Check-in, Tier Qualifying Points toward A-List status, 25% back on inflight purchases, as well as expanded benefits to categories like local transit and commuting purchases, we’re giving Cardmembers more out of their everyday travel and spending for future adventures.”

“With the customer at the heart of everything we do, we’re always looking for more ways to enhance our Cardmember benefits. This means elevating the total travel experience from booking to boarding, getting them on the plane even faster and providing ways for them to earn even more points,” said Julia Ashworth, General Manager Chase Southwest Rapid Rewards Credit Cards. “This year, we’re celebrating the 25 th anniversary of offering our coveted Southwest Credit Cards by providing even more exclusive benefits to our customers.”

Additionally, Cardmembers are always able to take advantage of the carrier’s existing great benefits of flying Southwest, including:

- Points that don’t expire

- No blackout dates or seat restrictions when you redeem with points

- Bags fly free® (first and second checked bags, weight and size limits apply)

- No change fees (fare differences may apply)

- No cancellation fees (failure to cancel a reservation at least 10 minutes prior to scheduled departure may result in forfeited travel funds)

All points earned with a Southwest Rapid Rewards Credit Card count toward the coveted Companion Pass® , which allows a traveler to select one person to fly with them for free (not including taxes and fees from $5.60 one-way) every time they purchase or redeem points for a flight**

To learn more about the new benefits or apply for a card, visit Chase.com/SouthwestNewBenefits .

*Freddie Awards – Best Loyalty Credit Card for four consecutive years (2017-2020), 2020 USA Today 10Best List, among others.

**Companion Pass qualifying points are earned from revenue flights booked through Southwest®, points earned on Southwest Rapid Rewards Credit Cards, and base points earned from Rapid Rewards partners. Points earned during a billing cycle on a Southwest Rapid Rewards Credit Card from Chase are not available for redemption or qualification for Companion Pass status until they are posted on the billing statement and posted to the Member’s Rapid Rewards account. Only points posted on the billing statements and posted to the Member’s Rapid Rewards account during the same calendar year are available for qualification for Companion Pass status. The following does not count as Companion Pass qualifying points: purchased points; points transferred between Members; points converted from hotel and car loyalty programs, e-Rewards®, Valued Opinions, and Diners Club®; points earned from Rapid Rewards program enrollment; Tier bonus points; flight bonus points; and partner bonus points (with the exception of the Rapid Rewards Credit Cards from Chase). No points nor Tier or Companion Pass qualifying points will be awarded for flights taken by the Companion when flying on a Companion Pass reservation.

About Chase

Chase is the U.S. consumer and commercial banking business of JPMorgan Chase & Co. (NYSE: JPM), a leading financial services firm based in the United States with assets of $3.8 trillion and operations worldwide. Chase serves more than 60 million American households with a broad range of financial services, including personal banking, credit cards, mortgages, auto financing, investment advice, small business loans and payment processing. Customers can choose how and where they want to bank: More than 4,700 branches in 48 states and the District of Columbia, 16,000 ATMs, mobile, online and by phone. For more information, go to chase.com.

ABOUT SOUTHWEST AIRLINES CO.

In its 51 st year of service, Dallas-based Southwest Airlines Co. continues to differentiate itself from other air carriers with exemplary Customer Service delivered by more than 54,000 Employees to a Customer base that topped 130 million Passengers in 2019. Southwest has a robust network of point-to-point service with a strong presence across top leisure and business markets. In peak travel seasons during 2019, Southwest operated more than 4,000 weekday departures among a network of 101 destinations in the United States and 10 additional countries. In 2020, the carrier added service to Hilo, Hawaii; Cozumel, Mexico; Miami; Palm Springs, Calif.; Steamboat Springs; and Montrose (Telluride), Colo. Thus far in 2021, Southwest has initiated service to Chicago (O'Hare) and Sarasota/Bradenton both on Feb. 14; Savannah/Hilton Head and Colorado Springs both on March 11; Houston (Bush) and Santa Barbara, Calif. both on April 12; Fresno, Calif. on April 25; Destin/Fort Walton Beach on May 6; Myrtle Beach, S.C. on May 23; Bozeman, Mont. on May 27; Jackson, Miss. on June 6; and Eugene, Ore. on Aug. 29; and will begin service to Bellingham, Wash. on Nov. 7; and Syracuse on Nov. 14.

Book Southwest Airlines' low fares online at Southwest.com or by phone at 800-I-FLY-SWA®.

Media Contacts

Visit the Southwest Newsroom at swamedia.com for multimedia assets and other Company news. Media Relations Team: (214) 792-4847, option 1; [email protected]

Chase Card Services Clarissa Carlucci [email protected]

The Infatuation’s EEEEEATSCON Presented by Chase Sapphire® Returns to The Salt Shed Chicago July 13 – 14

Apr 18, 2024

Chase Launches Chase Media Solutions, a New Digital Media Business, Connecting 80 Million U.S. Consumers with the Brands They Love

Apr 3, 2024

The Infatuation’s EEEEEATSCON Presented by Chase Sapphire® Set For Summer Return to Los Angeles

Chase joins make-a-wish® as a national corporate partner to grant travel wishes for children facing critical illness.

Mar 21, 2024

You’re now leaving Chase

Chase's website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

How to Book a Southwest Flight with Chase Ultimate Rewards: A Quick Guide

As a frequent traveler, I’ve always looked for ways to maximize the value of my hard-earned credit card points. One of the best options I’ve found is booking Southwest flights using Chase Ultimate Rewards. The process is both convenient and rewarding, allowing me to fully benefit from my points while enjoying discounted travel with Southwest.

I learned that to book a Southwest flight with Chase Ultimate Rewards, it’s possible to transfer points from Chase Ultimate Rewards to Rapid Rewards at a 1:1 ratio, making it an easy and straightforward process ( The Points Guy ). Transfers typically process instantly, which means I can quickly redeem my points for award flights without any hassle.

In my experience, booking through Chase Ultimate Rewards can also offer me additional advantages, such as earning 5x points per dollar spent on the flight when using a CSP credit card, as opposed to booking directly through Southwest and earning only 2x points ( Reddit ). This enables me to accumulate even more rewards points for future travel.

Understanding Chase Ultimate Rewards

As someone who frequently travels, I find the Chase Ultimate Rewards program to be a valuable resource for earning and redeeming points, especially when it comes to booking flights on airlines such as Southwest.

Earning Points

From my experience, there are various ways to earn Chase Ultimate Rewards points. One of the most common methods is by using Chase credit cards like the Chase Sapphire Preferred or Chase Sapphire Reserve, which offer lucrative sign-up bonuses and reward points for everyday spending. I typically earn points on dining, travel, and other purchases, maximizing the rewards-earning potential of my card.

Another potential way to earn points is through the Chase Travel Portal , where I could purchase flights, book hotels, and reserve rental cars. Some credit cards, such as the Chase Sapphire Reserve, provide a higher point-earning rate when booking through the portal.

Redeeming Points

When it comes to redeeming Chase Ultimate Rewards points for Southwest flights, there are two main options. The first—and most straightforward—option is transferring the points from my Chase Ultimate Rewards account to my Southwest Rapid Rewards account at a 1:1 ratio, as explained by The Points Guy . Transfers typically process instantly, allowing me to conveniently book award flights directly through Southwest’s website.

Alternatively, I could use my Chase Ultimate Rewards points to book flights through the Chase Travel Portal . The booking process is quite straightforward, and the number of points required depends on the type of credit card I hold. For example, with a Chase Sapphire Preferred card, each point is worth 1.25 cents, while with a Chase Sapphire Reserve, each point is worth 1.5 cents. This means that I could potentially book a Southwest flight for fewer points with the latter card.

It’s important for me to remember that when redeeming points for airfare through the Chase Travel portal, I still earn miles on my flight, making it an attractive option for those looking to accumulate airline miles, as mentioned by NerdWallet .

Southwest Airlines and Rapid Rewards

I recently discovered the benefits of booking Southwest flights with my Chase Ultimate Rewards points. In this section, I’ll share details on two topics: why I prefer flying with Southwest Airlines and the perks of their Rapid Rewards program.

Benefits of Flying Southwest

Southwest Airlines is one of my top choices for airlines, as it offers a unique set of benefits over its competitors. First and foremost, I appreciate their policy of no blackout dates ; this means I can book my flights using my points for any day and time, even during peak seasons.

Secondly, Southwest offers two free checked bags per passenger, unlike other airlines that tend to charge fees for additional luggage. The flexibility of free checked baggage allows me to pack more for my trips without worrying about excess fees.

Southwest Rapid Rewards Program

The Southwest Rapid Rewards program is another key factor in my decision to primarily use Chase Ultimate Rewards for booking flights with them. Earning points in this program is easy and can be done through various methods, such as making purchases at over 850+ online stores using the Rapid Rewards Shopping platform, flying with Southwest Airlines, or even buying points if needed.

Booking a flight with these Rapid Rewards points is quite simple. I just need to log in to my Southwest account and input my desired flight details, and then choose the option to view fares in points. Once I’ve selected my preferred flight, I can proceed to the checkout process and input my details for confirmation. The fact that Chase Ultimate Rewards points transfer instantly to the Southwest Rapid Rewards program at a 1:1 ratio makes this process even more convenient and efficient. As a frequent traveler, having these benefits encourages me to use Southwest Airlines and the Rapid Rewards program, which adds value to my Chase Ultimate Rewards points.

Linking Your Chase and Southwest Accounts

Before I explain how to book a Southwest flight using Chase Ultimate Rewards, it’s essential to discuss linking your Chase and Southwest accounts. Connecting these accounts ensures a smooth transfer of rewards points between them.

To link your Chase and Southwest accounts, you’ll have to verify your account information on both platforms. For my Chase account, I logged in and checked my registered Ultimate Rewards program information. Then, I logged in to my Southwest Rapid Rewards account and confirmed the account number and details.

Once I verified my account information, I was ready to transfer my Chase Ultimate Rewards points to my Southwest Rapid Rewards account. This transfer process is simple and seamless, as they support a 1:1 ratio for transferring points (The Points Guy) .

After completing the transfer, I could view my Southwest Rapid Rewards points balance and use them to book reward flights directly with Southwest. It’s important to note that although you can’t book Southwest flights through the Chase Travel Portal with certain credit cards, the transfer process allows you to use your points to book flights on Southwest’s website.

In summary, linking your Chase and Southwest accounts is crucial for ensuring a seamless booking experience when using Chase Ultimate Rewards to book Southwest flights. Verify your account information and transfer points accordingly to get started with booking your next Southwest flight using your rewards.

Booking Your Southwest Flight with Points

As a Chase Ultimate Rewards member, I find it convenient to book Southwest flights using my accumulated points. In this section, I will guide you through the process of booking a Southwest flight using your Chase points, which includes searching for flights, selecting your flight and travel class, and completing the booking.

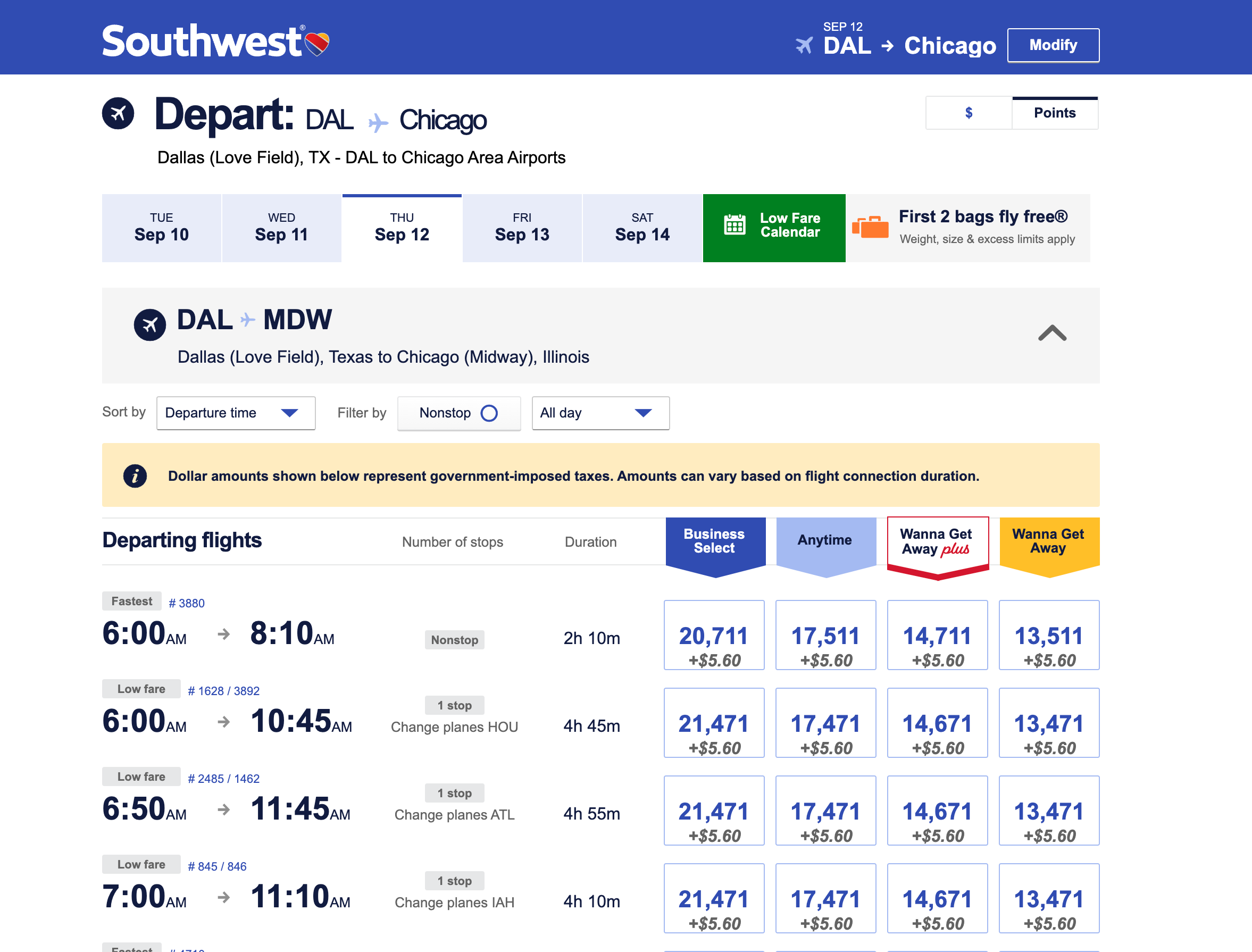

Searching for Flights

First, I log into my Rapid Rewards account on the Southwest homepage. After entering my flight information such as the departure and arrival cities, dates, and number of passengers, I click the radio button for Points and hit Search.

This allows me to browse through a list of available Southwest flights filtered to show fares in points, making it easy to identify and compare options that fit within my budget.

Selecting Your Flight and Travel Class

Once I have found a suitable Southwest flight, I take note of the corresponding travel class options, such as “Wanna Get Away,” “Anytime,” or “Business Select.” Each travel class comes with different perks and point requirements, so I pay close attention to this information to make the best decision for my travel needs.

After selecting a flight, I then move on to choose my preferred travel class by clicking on the appropriate option. Doing so ensures that my points will be applied toward that specific fare.

Completing the Booking

With my flight and travel class locked in, I proceed to the checkout page. Here, I review the details and point requirements of my selected flight, making sure everything is accurate before finalizing the booking.

It’s important to remember that I must transfer my Chase Ultimate Rewards points to my Rapid Rewards account at a 1:1 ratio before completing the booking. Once I have done this, I simply input my payment and contact information, and then click “Purchase” to confirm my reservation. That’s it; now, I just look forward to my upcoming Southwest flight!

Maximizing Your Points Value

In this section, I’ll be sharing some tips on how you can get the most value out of your Chase Ultimate Rewards points when booking a Southwest flight.

Transfer Points to Southwest

One of the easiest ways to maximize your points value is by transferring them from Chase Ultimate Rewards to Southwest Rapid Rewards. The transfer ratio is 1:1, and the process is typically instant. To complete a transfer, follow these steps:

- Log in to your Chase Account.

- Navigate to the “Ultimate Rewards” section.

- Select the “Transfer Points” option.

- Choose Southwest Rapid Rewards as the transfer partner.

- Enter the number of points you’d like to transfer and confirm.

By transferring your points to Southwest, you can book award flights directly through the Southwest website, giving you access to their entire inventory of flights, including Wanna Get Away fares, which offer the best value in terms of points per dollar spent.

Chase Travel Portal

Another option for maximizing your points value is by booking Southwest flights through the Chase Travel Portal. If you have the Chase Sapphire Reserve, your points are worth 1.5 cents each towards travel redemptions in the portal (The Points Guy) . Additionally, booking through the portal means your flight will be considered a revenue ticket, so you can still earn Rapid Rewards points and Tier Qualifying Points for the flight.

To book a Southwest flight using the Chase Travel Portal:

- Select the “Travel” option.

- Search for your desired flight, ensuring you toggle the option to pay with points.

- Select the flight and complete the booking process.

By considering both options – transferring points to Southwest Rapid Rewards and booking through the Chase Travel Portal – you can make an informed decision on which method provides the best value for your specific travel needs.

Tips and Tricks for Southwest Flights

Booking early.

As a frequent traveler, I’ve found that booking early can really pay off when it comes to Southwest flights. By getting my reservation in as soon as possible, I’m more likely to secure a lower fare and a better boarding position. This is especially important if I want to find a good seat and reduce the chances of having to gate-check my baggage.

Utilizing Southwest Sales and Promotions

I’ve noticed that Southwest frequently offers sales and promotions, making their already affordable flights even more accessible. In fact, Southwest often has sales on Tuesdays . By keeping my eye out for these deals, I can save money on my flights and stretch my Chase Ultimate Rewards points even further.

Another great way to maximize my rewards is by taking advantage of the Southwest Companion Pass . This pass allows me to bring a designated companion along on my flights for free, only paying taxes and fees. The more I fly and spend on my Southwest credit cards, the closer I get to earning this valuable perk.

In conclusion, when booking Southwest flights with my Chase Ultimate Rewards points, I make sure to book early and keep an eye out for sales and promotions. By doing so, I can maximize the value of my points and enjoy more travel experiences without breaking the bank.

Help us grow by sharing!

About the author.

Ryan Kangail

You probably want to read these too....

How to Book a JetBlue Flight with Chase Ultimate Rewards: A Simple Guide

Best Chase Ultimate Rewards Redemptions: Top Picks

Chase Ultimate Rewards Calculator: Maximize Your Points with Our Interactive Tool

How to Book American Airlines Flights with Chase Ultimate Rewards: A Quick Guide

- American AAdvantage

- United MileagePlus

- Delta SkyMiles

- British Airways Executive Club

- Southwest Rapid Rewards

- JetBlue TrueBlue

- Alaska Mileage Plan

- Marriott Bonvoy

- Hilton Honors

- IHG One Rewards

- World of Hyatt

- Accor Live Limitless

- Radisson Rewards

- Amex Membership Rewards

- Chase Ultimate Rewards

- Citi ThankYou Rewards

- Capital One Rewards

- Brex Rewards

- Bank Rewards Cards

- Airline Cards

- Hotel Cards

- Business Cards

- Cashback Cards

- 0% APR & Balance Transfer Cards

- Best Cards for Everyday Spending

- Best Cards for Dining

- Best Cards for Groceries

- Best Cards for Gas

- Best Cards for Travel

- Best Cards for Purchase Protection

- Best Cards for Elite Status

- Best Cards for Lounge Access

- How a Signup Bonus Works

- Types of Card Benefits

- Credit Card Application Rules

- Managing Your Credit Score

- Meeting Spending Requirements

- Buy Points and Miles Promotions

- Types of Reward Points

- Airline Partners & Alliances

- Which Flights Are Bookable With Miles

- Finding Award Availability

- Miles Needed for a Free Flight

- Track Your Points

- Mile Transfer Times

- Merchant Lookup Tool

- Reverse Merchant Lookup

- Credit Card Spend Analysis

- Transaction Analyzer

- Travel Trends

- Advertiser Disclosure

You Can Now Book Southwest Flights Through Chase Travel Portal, But You Might Not Want To

AwardWallet receives compensation from advertising partners for links on the blog. Terms Apply to the offers listed on this page. The opinions expressed here are our own and have not been reviewed, provided, or approved by any bank advertiser. Here's our complete list of Advertisers .

One of the more frustrating parts of redeeming points for Southwest flights has been the inability to book those flights via travel portals from Chase, Amex, Citi, and others. Sure, you could pick up the phone and call to make these bookings, but it's 2023. Well, nearly 2024 at this point. Luckily, we may have just moved into the 21st century.

Southwest Airlines flights are now showing in the Chase Travel portal (as first pointed out on Reddit ), making it a step in the right direction for convenience. And while this may not seem like a big development, this newfound ability to book flights online comes at an especially convenient time as Southwest plans to devalue its points in 2024 .

Here's why this new feature matters — and what you should be careful of before confirming your reservation.

Booking Southwest Flights With Chase Points Before Now

Sure, you could always move your Ultimate Rewards points to Southwest. After all, Southwest is one of Chase's transfer partners . Points transfer from Chase to Southwest at a 1:1 ratio and tend to show up immediately in your Rapid Rewards account.

So why the fuss?

Until now, you had two options for booking Southwest flights with your Chase points: Either call Chase Travel to book or transfer points to Southwest Rapid Rewards . Given that so many other ways to use Chase points provide better value , having to call to book Southwest flights fell low on the list.

Related: Can You Book Low-Cost Carriers With Amex, Capital One, Chase, or Citi Points?

Buying a flight with your Chase points has the advantage of counting as a paid flight. That means you'll earn points when you take the flight. Plus, booking a Southwest flight can provide better value than transferring points to Southwest. That's especially true for those with the Chase Sapphire Reserve ® , which allows cardholders to redeem their Ultimate Rewards through Chase Travel at 1.5¢ apiece.

Booking with Chase still provides a reasonable value for Chase Sapphire Preferred ® Card and Ink Business Preferred ® Credit Card cardholders, who could redeem points at 1.25¢ apiece in the portal.

Booking Southwest flights through the Chase Travel Portal also gives cardholders with no-annual-fee credit cards a way of booking Southwest points with their earnings, as these cardholders don't have the option to transfer points to Southwest.

Related: Benefits of Booking Flights via the Ultimate Rewards Travel Portal

Now: Booking Southwest Flights Online Using Chase Points

Who wants to wait on the phone to book a flight? Not us. It's much better to be able to see your flight options and book directly online. Plus, you won't have to go through the trouble of reading off your name, date of birth, trusted traveler number, Chase card information, etc.

Finding your Southwest flights in the Chase portal is obviously simpler, but there's a huge catch here. The flights are sometimes considerably more expensive.

Consider this flight on March 23, 2024 from Los Angeles (LAX) to Las Vegas (LAS). The 9:50 p.m. flight (flight 487) prices at $44 when purchasing directly from Southwest.

In the Chase portal, that same fare is $83 — nearly double the price!

However, not all flights priced differently. This flight from Atlanta (ATL) to Orlando (MCO) on March 13, 2024 prices the same. It's $99 from Southwest.

And it costs the same $99 through Chase.

The moral of the story is that you should definitely comparison shop.

It's also worth pointing out the timing here. Southwest has announced plans to devalue its points by 4% next year , so gaining another option for using your points online (and seeing the prices clearly, rather than someone telling you over the phone) is great. Prices may shift in Chase's favor starting next year.

Bottom Line

The ability to book Southwest flights in the Chase portal (rather than needing to call) is excellent news for those who want to use their Chase points for Southwest flights. It provides an extra layer of ease. But make sure you aren't paying more for this convenience. Some flights we saw were priced higher (sometimes much higher) in Chase's portal than what Southwest was charging on its website.

As Southwest moves to devalue its points in the new year, the ability to book online with the Chase portal may gain additional fans.

The comments on this page are not provided, reviewed, or otherwise approved by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Click here to cancel reply.

Notify me of followup comments via e-mail Notify me of followup posts via e-mail

Southwest Rapid Rewards: Complete guide to earning, redeeming and maximizing points

Editor's Note

Southwest Airlines prides itself on its "transfarency" philosophy — low fares and no change fees , hidden fees or unexpected bag fees. Regardless of your fare type, each passenger can check two bags for free, and Rapid Rewards points are some of the most easily redeemable when compared to other loyalty rewards. Therefore, it's no surprise that some TPG staffers regard Southwest as one of the top airlines .

Keep reading to learn some of the best ways you can earn and redeem Southwest Rapid Rewards points.

Related: Southwest raises fees for EarlyBird check-in, upgraded boarding

Southwest Rapid Rewards program overview

Like Southwest Airlines itself, the Rapid Rewards frequent flyer program has amassed a loyal following. Despite not having a standard award chart or being part of an airline alliance , its promise of no blackout dates and the ability to earn Southwest's famous Companion Pass make Rapid Rewards an excellent choice for couples, families and those with not-so-flexible schedules.

As with JetBlue's TrueBlue program , all Southwest award tickets are priced based on the ticket's cash value. This means the more expensive the ticket you want to book, the more points you'll need. TPG currently values Rapid Rewards points at 1.3 cents per point, meaning 10,000 points should give you around $130 in value.

However, depending on your ticket, you may get more or less.

Southwest elite status

Southwest offers two elite status tiers: A-List and A-List Preferred.

Southwest A-List elite status

To qualify for A-List status, you must fly 20 qualifying one-way Southwest flights or earn 35,000 tier-qualifying points in a calendar year.

Tier-qualifying points include those earned from paid flights booked with Southwest (flights booked with Southwest's new Cash + Points option don't count) or through qualifying purchases made with Rapid Rewards partners. You can also earn 1,500 tier-qualifying points for every $5,000 spent on the Southwest Rapid Rewards® Priority Credit Card , the Southwest Rapid Rewards® Premier Credit Card , the Southwest Rapid Rewards® Premier Business Credit Card or the Southwest Rapid Rewards® Performance Business Credit Card . Purchased points, tier bonus points, flight bonus points, partner points and points earned from Rapid Rewards program enrollment and credit card bonuses do not count toward A-List or A-List Preferred status.

The information for the Rapid Rewards Premier has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

With Southwest A-List status, you'll get the following:

- Priority boarding

- 25% bonus on points earned from paid flights

- Free same-day standby/changes (taxes and fees may apply)

- Priority check-in and security lane access

- Dedicated A-List member phone line

Southwest A-List Preferred elite status

A-List Preferred status requires you to fly 40 qualifying one-way Southwest flights or earn 70,000 tier-qualifying points in a calendar year. You'll receive all the benefits of A-List status, as well as:

- 100% bonus on points earned from paid flights

- Free inflight Wi-Fi

- Two free premium drinks on flights of 176 miles or more

Related: Southwest A-List status: What it is and how to earn it

How to earn Southwest Rapid Rewards points

There are a few ways to earn Southwest Rapid Rewards points — and some don't require flying.

Earn Rapid Rewards points by flying

As you might expect, you can earn Rapid Rewards points every time you fly on a paid Southwest Airlines flight. The number of points you'll earn depends on the cost of your flight, your elite status, the type of ticket and your payment method.

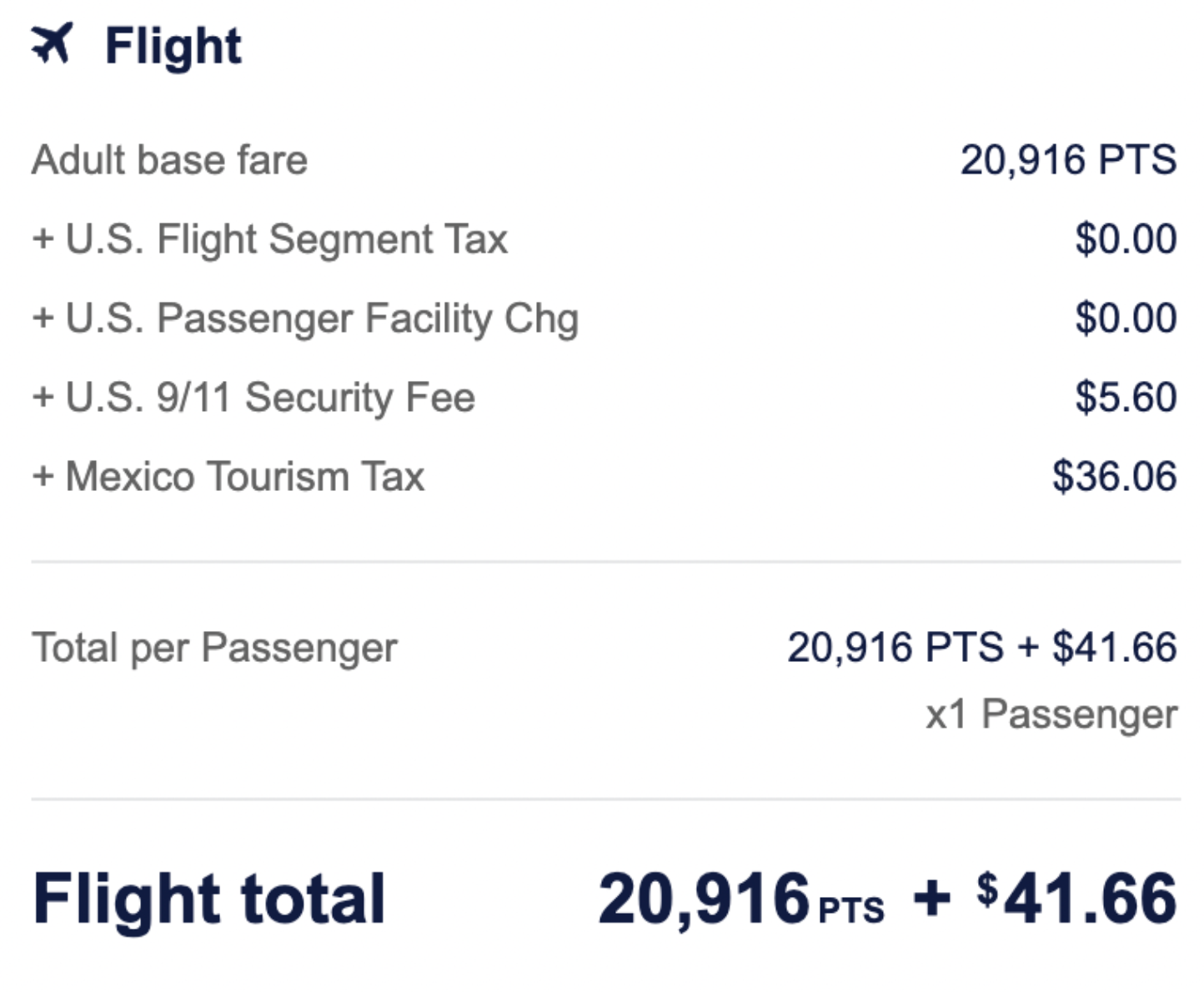

Southwest has four ticket classes. Each includes different benefits, with the highest fare — Business Select — including priority boarding and a free alcoholic drink on board. Here's how many points each fare class earns:

- Wanna Get Away : 6 points per dollar

- Wanna Get Away Plus : 8 points per dollar

- Anytime : 10 points per dollar

- Business Select : 12 points per dollar

You'll earn points on your ticket's base fare, excluding any associated taxes and fees. When you purchase a Southwest ticket, you can view your flight's base fare on the airline's website.

So, if you purchased a Wanna Get Away fare with a $100 base price, you'd earn 600 Southwest Rapid Rewards points after you take your flight. On the other hand, a Wanna Get Away Plus ticket would earn 800 points, an Anytime ticket would earn 1,000 points and a Business Select ticket would earn 1,200 points.

As mentioned, Southwest A-List and A-List Preferred elite status holders earn even more points on paid flights. Each status tier earns the following bonus on paid flights:

- A-List : 25% bonus

- A-List Preferred : 100% bonus

Using the above $100 base fare example, an A-List member would earn 750 Rapid Rewards points on a Wanna Get Away fare, while an A-List Preferred member would earn 1,200 Rapid Rewards points. The points bonus is arguably the most valuable perk of Southwest elite status and can help you rack up tons of extra points throughout your travels.

Earn with Southwest credit cards

Southwest Airlines has several cobranded credit cards issued by Chase. Currently, the airline offers three personal and two business credit cards , each with varying benefits, welcome bonuses and annual fees.

At this time, you can earn 85,000 bonus points after spending $3,000 on purchases in the first three months from account opening with the following consumer cards:

- Southwest Rapid Rewards® Plus Credit Card

- Southwest Rapid Rewards Premier Credit Card

- Southwest Rapid Rewards Priority Credit Card

Southwest also offers the following business cards:

- Southwest Rapid Rewards Premier Business Credit Card : Earn 60,000 points after you spend $3,000 on purchases in the first three months of account opening.

- Southwest Rapid Rewards Performance Business Credit Card : Earn 80,000 bonus points after you spend $5,000 on purchases in the first three months of account opening.

In addition to an attractive welcome bonus, each card has unique benefits. For example, the Southwest Priority card includes an annual $75 travel credit and 7,500 bonus points (worth $97.50 per TPG's valuations). Together, these completely offset the card's $149 annual fee and will help you earn more points throughout the year.

Additionally, you can transfer points from Chase Ultimate Rewards to Southwest Rapid Rewards at a 1:1 ratio. If you don't mind missing out on the Southwest-specific perks, you may consider applying for the Chase Sapphire Preferred® Card since it earns 2 points per dollar spent on travel and 3 points per dollar spent on dining purchases.

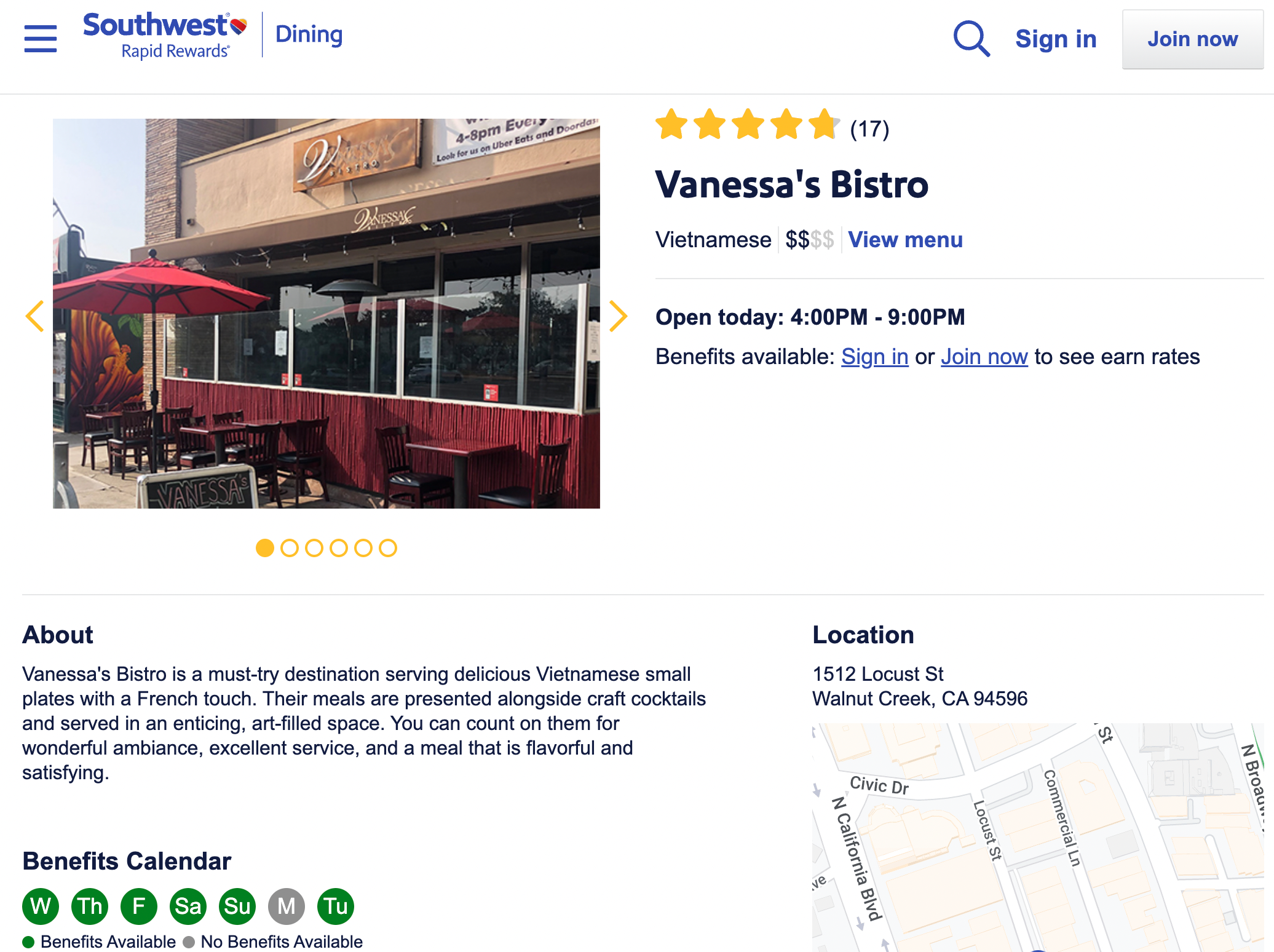

Earn points while you eat with Rapid Rewards Dining

Like many airlines, Southwest offers a dining rewards program where you can earn points. Create a Rapid Rewards Dining account and link your credit cards to earn Rapid Rewards points every time you dine at a participating restaurant. This is in addition to the rewards you'd earn with a credit card, so link a card that earns bonus points on dining to maximize your points-earning.

Make sure to sign up for email notifications when you enroll in Rapid Rewards Dining; this allows you to earn 3 points per dollar spent at participating restaurants. Opting out of email notifications will drastically cut your earnings to 1 point per $2 spent.

The Rapid Rewards Dining program offers an attractive set of welcome bonuses. You'll earn 500 bonus points after you spend $25 and review a participating restaurant in the first 30 days, and you can earn additional points by leaving reviews and performing other tasks . You can search for participating restaurants on the Rapid Rewards Dining website .

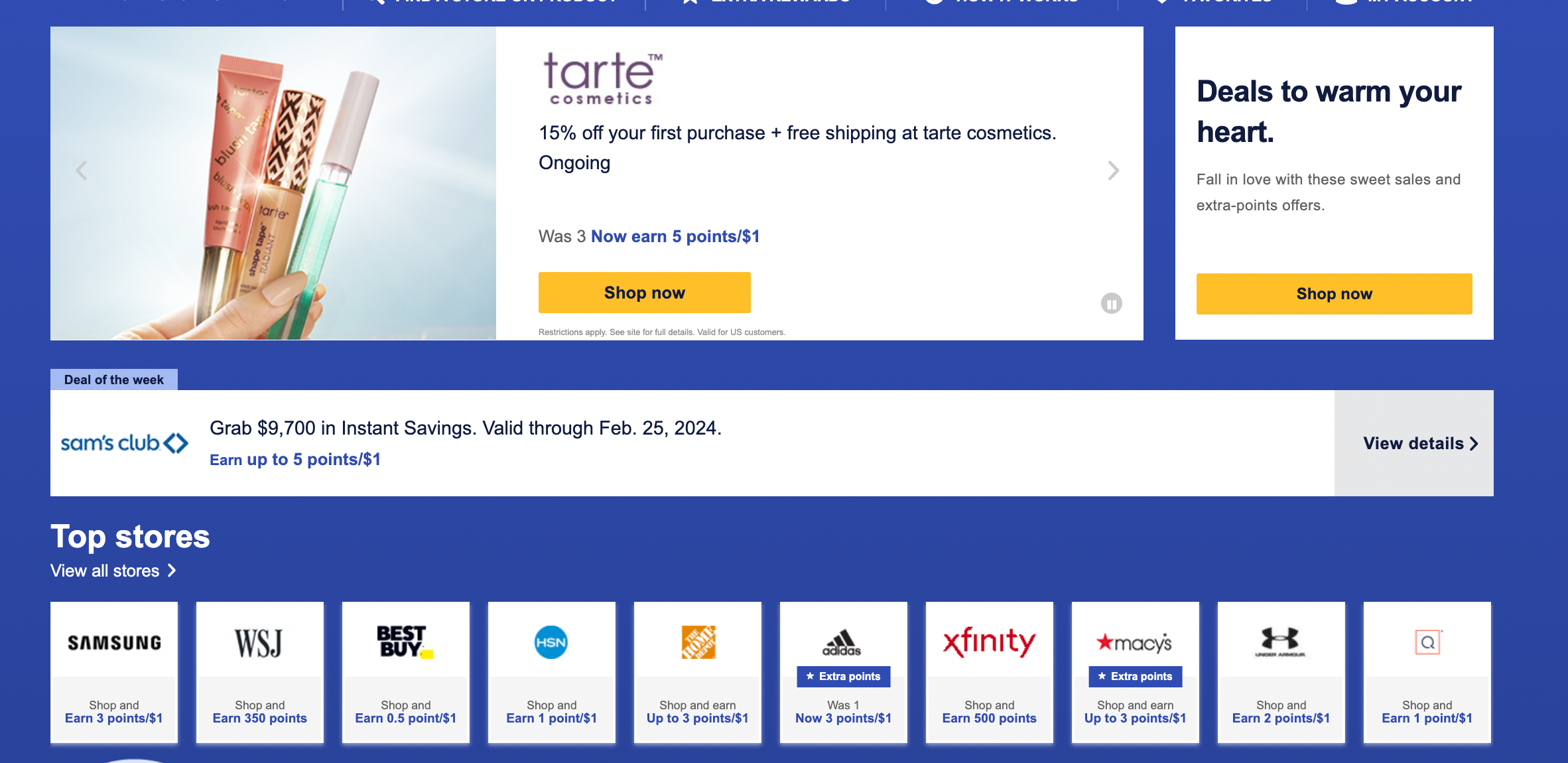

Make purchases through Rapid Rewards Shopping

You can earn bonus points when you shop online with Rapid Rewards Shopping . As with Rapid Rewards Dining, the points you'll earn with this shopping portal are in addition to the points you earn with a credit card.

Using Rapid Rewards Shopping is simple: Sign up for an account, find your merchant on Rapid Rewards and click through its link before making a purchase. Points are usually credited to your Rapid Rewards account within a week of making a purchase, but some merchants may take longer to process.

The number of points you'll earn per dollar spent varies by merchant and changes frequently. The portal often has promotions that offer bonus points when you spend a set amount of money, so keep an eye on the Rapid Rewards Shopping website to see when these promos are happening.

One last thing: Always check a shopping portal aggregator like Cashback Monitor before you shop through Rapid Rewards Shopping. The merchant you're ordering from may offer more points elsewhere.

Book hotels

Southwest has partnerships with some of the major hotel companies, allowing you to earn Rapid Rewards points instead of hotel points on stays. But we generally don't recommend this option because the earning rates are low.

You can earn up to 10,000 points per night by booking hotel rooms with Southwest Hotels or Rocketmiles . Always check rates with both, as well as other options like credit card travel portals , before deciding which platform best suits your needs.

With Southwest Hotels, the number of points you'll earn often correlates to the price of your hotel room, and you'll earn more points when you book Points Plus properties. Remember that you cannot earn hotel points or use hotel elite status benefits on these bookings; you'll generally need to book directly with the hotel to use these benefits.

Many boutique hotels are available through Southwest Hotels, so it may be worth booking these through Southwest if they otherwise wouldn't earn points. Just be sure to compare pricing with the hotel's website to ensure you're getting a comparable rate through Southwest Hotels or Rocketmiles.

Related: Easy ways to earn more Southwest Rapid Rewards points

How to redeem Southwest Rapid Rewards points

Now that you've earned Rapid Rewards points, let's discuss how to redeem them.

There are several ways to redeem your points, but you'll almost always get the most value if you redeem them for travel on Southwest flights. Other redemption options like gift cards and merchandise will yield much less value.

The process for redeeming Rapid Rewards points for flights is largely the same as booking a paid flight. Head to the Southwest homepage, enter your search criteria and select the "Points" option. Click the yellow search button to see your flight options.

You'll see award pricing to the right of each available flight. You can filter flights by the number of layovers and departure times using the buttons at the top of the page. Then, click on the ticket price of your desired flight and follow the on-screen prompts to book.

Which fare type should I choose?

You can redeem points for flights in any of the four Southwest fare types. The least expensive option, Wanna Get Away, is best for most travelers. As with all fare types, Wanna Get Away fares include two free checked bags and carry no fees to change or cancel your flight. Although these tickets are nonrefundable, you'll get a flight credit if you cancel — or, if you booked with points, you'll get your points and fees refunded.

Wanna Get Away Plus is slightly more flexible, with free confirmed and standby same-day flight changes. Additionally, these fares let you transfer flight credits to another person if you cancel your flight.

Anytime fares have the same benefits as Wanna Get Away Plus, as well as priority security and EarlyBird check-in . Anytime cash fares are fully refundable, but remember that all fare types are refundable when booked with points.

Finally, the benefits of Business Select fares are hardly worth the additional cost. These tickets include A1 to A15 boarding , expedited security at select airports and a free alcoholic drink on board. Usually, they cost more than triple the points cost of a Wanna Get Away fare, so we recommend staying away from them in most cases.

Can I change Southwest award tickets for free?

Like all Southwest fares, you can change or cancel Southwest award tickets for free. If you opt to change a ticket, you're only liable for paying the new ticket's fare difference if it's more expensive. On the other hand, if you switch to a cheaper flight, Southwest will refund the difference in points. With this in mind, we highly recommend keeping an eye on award pricing after you book a flight — if the fare decreases , you'll be refunded the points difference.

Canceling a Southwest award ticket is just as simple. When you cancel your ticket, the points you used to book will be refunded to your Rapid Rewards account with no cancellation fees.

Do I have to pay taxes and fees on award tickets?

You are liable for paying certain types of taxes and fees, starting at $5.60 one-way, when you book Southwest award tickets. If you cancel your award flight, the fee amount will be refunded to your method of payment.

Can I redeem for partner award tickets?

As mentioned above, Southwest is one of the few airlines without international airline partners.

Related: 10 countries you didn't know you could fly to on Southwest

Maximize your points with the Southwest Companion Pass

The Southwest Companion Pass is undoubtedly one of the most valuable perks of the Rapid Rewards program. After earning the pass, you can choose a companion to travel with you for just the cost of taxes and fees on any Southwest flight you book, whether with cash or points. You can use the Companion Pass on as many flights as you'd like, effectively doubling the value of your Rapid Rewards points.

You can earn a Companion Pass by flying 100 Southwest one-way flight segments or — more practically for most — earning 135,000 qualifying points. Qualifying points include Rapid Rewards points earned by flying, spending on credit cards and making purchases via Rapid Rewards Dining and/or Rapid Rewards Shopping.

Welcome bonuses on Southwest cobranded credit cards count toward the Companion Pass, so you can make some serious progress by opening one of the Southwest credit cards featured earlier. Additionally, all Southwest credit card holders get 10,000 Companion Pass-qualifying points deposited into their account annually.

Unfortunately, transfers from Chase Ultimate Rewards do not count toward the Companion Pass.

Your Companion Pass will be valid for the remainder of the year in which it's earned and the entirety of the following year. If you plan on earning your Companion Pass through credit card welcome bonuses , try to time your spending to earn the required points at the beginning of the year. This will give you the most time to enjoy your hard-earned Companion Pass, since it will be valid for almost two years.

You can only designate one companion at a time, but you can change your companion three times per year by calling Southwest at 800-435-9792. Remember that your companion will not earn Rapid Rewards points on their flight, but you'll still earn points if you fly on a paid ticket.

Related: 15 lessons from 15 years of having the Southwest Companion Pass

Bottom line

Southwest Rapid Rewards points are extremely easy to earn and redeem, and the incredibly valuable Companion Pass sets Southwest apart from other airlines. Don't miss your fast track to a Companion Pass with the right cobranded credit card.

On the other hand, Southwest has had its fair share of operational issues . Not to mention, its top-tier elite members and full-fare Business Select customers aren't guaranteed a bulkhead- or exit-row seat, which could make Southwest's transcontinental and Hawaii flights uncomfortable for taller travelers.

Still, the program remains popular with all kinds of travelers, especially families.

Now you know how to make an informed decision about Southwest's Rapid Rewards program so you can decide if it's right for you.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Chase Transfer Partners

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Which Chase Sapphire transfer partners are the best?

Chase airline transfer partners: the complete list, chase hotel transfer partners: the complete list, chase points calculator, how to earn chase ultimate rewards® points, chase travel cards with transfer partners, how do you transfer chase points, using chase transfer partners: is it worth it.

Chase Ultimate Rewards® are some of the most valuable transferable points available. Called Chase Ultimate Rewards® points, they can be redeemed for travel through Chase's travel portal for 1 cent each on certain cards. However, they can be redeemed at a higher value of 1.25 cents each if you have a Chase Sapphire Preferred® Card or an even more impressive 1.5 cents each if you have a Chase Sapphire Reserve® . That type of exchange on its own makes for an excellent way to redeem Chase Ultimate Rewards® points .

However, that's not necessarily the best way to redeem Chase points because three specific Chase cards available in 2024 offer what might be potentially far more value.

The cards at play here are the:

Chase Sapphire Preferred® Card .

Chase Sapphire Reserve® .

Ink Business Preferred® Credit Card .

» Jump to learn more about these card options .

★ LIMITED TIME OFFER

Heads up! For a limited time, both the Chase Sapphire Preferred® Card and the Chase Sapphire Reserve® are offering elevated sign-up bonuses that can be worth more than $900 for the Preferred card and more than $1,100 for the Reserve. Learn more and apply here.

With those cards, you have the additional option to send those points to one of Chase's transfer partners , which are generally hotel chains and airlines. And assuming you hold (or someone in your household owns), one of those three Chase cards, you'll very likely unlock even greater value out of your spending rewards when you use one of the Chase Ultimate Rewards® transfer partners. That's because converting Chase points to hotel points or airline frequent flyer miles can often maximize their value.

» Learn more: The best travel credit cards right now

Before we dig into the best Chase Sapphire transfer partners, here's a complete overview of the estimated value of transferring Chase points to each transfer partner, sorted in alphabetical order:

Using that estimated value stated above, here's the ultimate NerdWallet power ranking of the six best Chase transfer partners (with No. 1 being the best) are:

World of Hyatt.

Virgin Atlantic Flying Club.

JetBlue TrueBlue.

Southwest Airlines Rapid Rewards.

Air Canada Aeroplan.

Air France/KLM Flying Blue.

Best airline partner for Chase points

As far as Chase's airline transfer partners go, Virgin Atlantic Flying Club is Chase' best airline transfer partner. Even still, you can easily get more than 1 cent per point in value from Chase points when you transfer points from Chase to fixed-value programs like Southwest Rapid Rewards and JetBlue TrueBlue.

Other airline transfer partners can be hit-and-miss, such as Emirates, which is generally a miss when points are transferred to book Emirates economy class . But, it's usually a massive hit if you can transfer Chase points to be used for booking the incredibly-swanky Emirates business class on points.

Best Chase hotel transfer partner

Meanwhile, World of Hyatt comes out on top as the best Chase hotel partner. And not only is it the best hotel partner, but it's the best travel partner period given that eye-popping value over 2 cents.

NerdWallet's estimated value is exactly that — an estimate. You might find individually great redemptions while using other Chase transfer partners for specific trips.

Of the 14 Chase Ultimate Rewards® transfer partners, 11 are airline mileage programs, which are:

Aer Lingus AerClub

Aer Lingus AerClub became one of the Chase travel partners in 2017. While not officially part of the Oneworld alliance, Aer Lingus partners with several Oneworld airlines — most notably British Airways, Iberia and Qatar .

Air Canada Aeroplan

There are plenty of reasons not to overlook Aeroplan — the newest of the Chase Sapphire airline partners. Air Canada is a Star Alliance member, so you can use Aeroplan points to book award flights on any Star Alliance airline, including United.

Seek out those Aeroplan sweet spots to help boost the value of Aeroplan points to 1.4 cents for award tickets.

» Learn more: A guide to Air Canada’s Aeroplan rewards loyalty program

Air France-KLM Flying Blue

Flying Blue is the loyalty program of Air France, KLM, Kenya Airways and a few smaller airlines. Because many Flying Blue airlines are members of the SkyTeam alliance , you can transfer points from Chase to Flying Blue to book award flights on other SkyTeam member airlines, such as Delta Air Lines.

The Flying Blue program offers a monthly Promo Rewards promotion that discounts certain routes by up to 50% — which can make Flying Blue sweet spots even a better deal.