Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The Best Ways To Fly to India With Points and Miles [Step-by-Step]

Ehsan Haque

Content Contributor

65 Published Articles

Countries Visited: 100 U.S. States Visited: 24

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3265 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Michael Y. Park

20 Published Articles 198 Edited Articles

Countries Visited: 60+ U.S. States Visited: 50

![amex india travel partners The Best Ways To Fly to India With Points and Miles [Step-by-Step]](https://upgradedpoints.com/wp-content/uploads/2020/05/Taj-Mahal-India.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Nonstop flights between the u.s. and india, best airline programs to book flights to india, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

India might be high on your travel bucket list if you’re a travel enthusiast. From jungle safaris to historic religious temples to inexpensive food, India has something to offer everyone.

India’s diverse languages, customs, music, architecture, and food draw travelers worldwide. But unfortunately, India is not particularly easy to get to from the U.S.

Although there are occasionally great cash fares to India, they typically involve inconvenient routing. You also have the option to use points and miles to fly to India.

Currently, only a few carriers operate nonstop flights to India. These include American Airlines, Air India, and United Airlines. On top of that, nonstop flights to India are only available from select U.S. gateways, including New York (JFK), Newark (EWR), Chicago (ORD), San Francisco (SFO), and Washington (IAD).

If you live in these cities, you are in luck. Being able to fly nonstop to one of the world’s most intriguing countries is great. However, if you are not based in these cities, you must have a connection or may have to take a repositioning flight.

In this guide, we’ll explore the best ways to fly to India with points and miles from cities across the U.S. Let’s get started!

Nowadays, there are fewer nonstop routes between the U.S. and India. Let’s quickly take a look at what airlines offer nonstop flights, the current routes, and how often these routes are offered.

American Airlines

- New York (JFK) – New Delhi (DEL)

- Chicago (ORD) – New Delhi (DEL): Daily

- New York (JFK) – New Delhi (DEL): Daily

- New York (JFK) – Mumbai (BOM): Daily

- Newark (EWR) – New Delhi (DEL): 4x weekly

- San Francisco – Bengaluru (BLR): 3x weekly

- San Francisco – New Delhi (DEL): Daily

- San Francisco – Mumbai (BOM): 4x weekly

- Washington (IAD) – New Delhi (DEL): 4x weekly

- United Airlines

- Newark (EWR) – New Delhi (DEL): 2x Daily

Let’s take a look at some of the best airline loyalty programs to use to fly to India.

Air Canada Aeroplan

The first option we will look at is Air Canada Aeroplan , an incredibly underrated program and one of our favorites here at Upgraded Points.

First, it is important to know that Air Canada is a member of the Star Alliance, which opens up plenty of award options.

Aeroplan uses a variable pricing method for its flights, which can significantly inflate redemptions. However, Aeroplan publishes a region-based award chart detailing exactly how many points you need to use for its partner-operated flights.

The program divides the world into 4 regions: North America, the Atlantic, the Pacific, and South America. India is part of the Atlantic travel zone for Aeroplan.

With Aeroplan’s award chart , award travel between zones varies depending on the distance flown. Most flights from the U.S. to India fall in the 6,001-to-8,000-mile distance band, aside from flights from San Francisco, which are in the next distance band up.

This opens up plenty of great redemption opportunities. If you were to fly an Air Canada partner airline, you could book:

- Economy from 55,000 miles one-way

- Business class from 90,000 miles one-way

- First class from 130,000 miles one-way

When it comes to what partner airline you can fly to India, you have plenty of options.

Here are some great Star Alliance partner options you can book:

- All Nippon Airways (ANA)

- Turkish Airlines

Air Canada Aeroplan also has non-Star Alliance partners, including Etihad Airways and Emirates.

We love Aeroplan because this program doesn’t pass on fuel surcharges and allows you to add stopovers for just 5,000 points.

We generally recommend searching for award availability via Aeroplan’s website. Here’s how:

- Visit Aeroplan’s website .

- On the top right, click Sign in and enter your Aeroplan number and password.

- On the resulting page, you’ll see a search box. Fill in the desired trip type, origin, and destination airports, travel dates, and number of passengers.

- Check the box that says Book with Aeroplan points .

- Click Search .

- Select your flight and pay for any taxes and fees.

Earning Aeroplan Points

Aeroplan is a transfer partner of American Express Membership Rewards, Bilt Rewards, Chase Ultimate Rewards, Capital One Miles, and Marriott Bonvoy. All programs aside from Marriott Bonvoy transfer at a 1:1 rate to Aeroplan. Marriott Bonvoy points transfer at a 3:1 ratio to Aeroplan. For every 60,000 Bonvoy points transferred, you get a 5,000-mile bonus.

Aeroplan also offers a co-branded credit card.

The Aeroplan card is a great option for Air Canada flyers looking to earn more points and receive automatic elite status.

Flyers based in the U.S. may think they wouldn’t have a need for a card like the Aeroplan ® Credit Card , it might be much better suited for you than you think.

Not only does Air Canada offer fantastic award redemptions, but adding the card to your wallet makes the program even more rewarding by offering elite status, more points, travel coverage, and more. Let’s take a closer look and see why the Aeroplan card might make a lot of sense for you.

- 3x points per $1 on Air Canada purchases, at grocery stores, and dining at restaurants (including takeout and eligible delivery services)

- 500 bonus points for every $2,000 you spend in a calendar month (up to a maximum of 1,500 bonus points)

- Receive Aeroplan 25K status for the remainder of the calendar year, plus the following calendar year, and continue to extend it beyond that by spending $15,000 on the card per calendar year

- $95 annual fee

- Does not earn transferable rewards

- Earn 70,000 bonus points

- Earn 70,000 points after you spend $3,000 on purchases in the first 3 months your account is open.

- $95 Annual Fee

- Redeem points for both international and domestic flights with the Aeroplan ® Credit Card.

- Fly to another continent and travel the world with the Aeroplan ® Credit Card.

- Earn 3X points for each dollar spent at grocery stores, on dining at restaurants, and Air Canada directly. Earn 1X point for each dollar spent on all other purchases.

- 500 bonus points for every $2,000 you spend in a calendar month - up to 1,500 points per month.

- Member FDIC

- APR: 21.74% - 28.74% Variable

- Foreign Transaction Fees: None

American Express has several personal and business cards that earn Membership Rewards points, which can be transferred to Aeroplan at a 1:1 ratio.

Recommended Amex Cards (Personal)

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card ® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR ® Plus Credit: CLEAR ® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck ® application fee for a 5-year plan only (through a TSA PreCheck ® official enrollment provider), when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR

American Express Membership Rewards

This is the best card for food lovers who dine out at restaurants (worldwide), order take-out and want big rewards at U.S. supermarkets!

The American Express ® Gold Card is a game-changer.

With this card, you can earn 4x Membership Rewards points at restaurants and you’ll also earn 4x Membership Rewards points at U.S. supermarkets on up to $25,000 per calendar year in purchases, then 1x.

There isn’t another card on the market that offers a 1-2 punch like this. Of course, there are several other benefits of the Gold Card as well, including extra monthly dining rewards and more.

- 4x points per dollar at restaurants, plus takeout and delivery in the U.S.

- 4x points per dollar at U.S. supermarkets, up to $25,000 per calendar year in purchases; and 1x thereafter

- 3x points per dollar on flights purchased directly from airlines or at AmexTravel.com

- $250 annual fee (see rates and fees )

- No lounge access

- Earn 60,000 Membership Rewards ® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards ® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards ® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards ® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express ® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

Bottom Line: Aeroplan takes the top spot here because it gives you a variety of airlines you can fly for competitive redemption rates without paying fuel surcharges. You can also add a stopover for just 5,000 miles to maximize your redemption value. It also partners with Amex, Capital One, Chase, and Marriott Bonvoy for transfers.

Avianca LifeMiles

Avianca is another Star Alliance member and a great option to book award flights to India. Its LifeMiles award program has great sweet spots, including award flights to Asia.

In late 2022, Avianca LifeMiles raised award costs to Asia without notice. Previously, you could fly from the U.S. to Asia for 35,000 miles in economy or 75,000 miles in business class. However, award prices are closer to 47,000 and 90,000 miles, respectively, after the devaluation.

For example, here is last-minute award space from New York to New Delhi that could be booked for 47,000 miles one-way plus taxes and fees.

Best of all, Avianca LifeMiles does not add on any fuel surcharges, minimizing your out-of-pocket cost.

To book Star Alliance partners with LifeMiles, follow these steps:

- Visit the Avianca LifeMiles website .

- Click on Travel in the top menu bar.

- Enter your desired destination and travel dates .

- Select Smart Search or Star Alliance .

- Select your flight.

One of the best perks of the Avianca LifeMiles program is that it does not tack on fuel surcharges.

Earning Avianca LifeMiles

Avianca LifeMiles is a transfer partner of American Express Membership Rewards, Citi ThankYou Rewards, Capital One Miles, and Marriott Bonvoy.

All programs aside from Marriott Bonvoy transfer at a 1:1 rate to LifeMiles. Marriott Bonvoy points transfer at a 3:1 ratio to LifeMiles. There is no 5,000-mile bonus for transfers to LifeMiles.

Recommended Citi Card

*The information regarding the Citi Premier card has expired and the card is no longer open to applicants.

The Citi Premier ® Card is an excellent option for anyone looking for an all-around travel rewards credit card. The card helps you earn points fast with great 3x bonus categories such as restaurants, supermarkets, gas stations, airfare, and hotels. Plus, it offers access to airline and hotel transfer partners, doesn’t charge foreign transaction fees, and has a reasonable annual fee!

- 3x points at restaurants, supermarkets, gas stations, airfare, and hotel purchases

- Access to Citi transfer partners

- Annual hotel credit

- Earn 60,000 bonus ThankYou ® Points after you spend $4,000 in purchases within the first 3 months of account opening. Plus, for a limited time, earn a total of 10 ThankYou ® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024.

- Earn 3 Points per $1 spent at Gas Stations, Air Travel and Other Hotels

- Earn 3 Points per $1 spent at Restaurants and Supermarkets

- Earn 1 Point per $1 spent on all other purchases

- Annual Hotel Savings Benefit

- 60,000 ThankYou ® Points are redeemable for $600 in gift cards redeemable for $600 in gift cards or travel rewards at thankyou.com

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

- APR: 21.24% - 29.24% Variable

Citi ThankYou Rewards

All Nippon Airways Mileage Club

Another great Star Alliance option to book award flights to India is with ANA Mileage Club .

ANA still utilizes award charts for both its flights and its partner airlines. However, there are some slight differences. ANA has 2 different applicable award charts: one for ANA international flight awards and another for partner flight awards.

For its flights, ANA prices based on the season: low, regular, or high.

Here is the award chart for ANA-operated flights between the U.S. (Zone 6) and Asia 1 (Zone 3), which includes India.

All the mileage above is for round-trip award redemptions. ANA only allows round-trip redemptions through Mileage Club.

Booking using the ANA international award chart could be useful, especially if you want to fly in ANA business class. Fuel surcharges can be high on ANA, but the mileage redemption rates are some of the best.

With ANA, you also have the option to book partner Star Alliance awards. ANA has a different award chart for its partner airlines. Although the partner award chart is zone-based, like the international one, there is no seasonality pricing.

Here is the award chart for its partner airlines for flights between the U.S. (Zone 6) and India, which is in Asia 1 (Zone 3):

ANA is also selective about passing on fuel surcharges to partner airlines. Although the mileage rates are incredible, redemptions are somewhat muted by the fuel surcharges, which can be upwards of $500 at times.

ANA Mileage Club has separate award charts for ANA domestic flight awards, for ANA international flight awards, and partner flight awards.

Here’s how to book awards with ANA miles:

- Visit ANA’s website .

- Choose ANA Mileage Club .

- Choose International, then Award Reservation .

- Log into your account.

- Enter your desired route and dates.

- Choose your desired class of travel.

- Choose your flights.

- Reserve your flight and pay for any applicable taxes and fees.

Earning ANA Miles

ANA Mileage Club is a transfer partner with Amex Membership Rewards and Marriott Bonvoy.

American Express Membership Rewards transfer to ANA at a 1:1 ratio.

Marriott Bonvoy points transfer to ANA at a 3:1 ratio. For every 60,000 Marriott Bonvoy points that you transfer, you receive a 5,000-mile bonus.

Recommended Marriott Bonvoy Cards

A great option for Marriott hotel fans who want a no annual fee card and automatic Marriott Bonvoy elite status.

Casual travelers who like to frequent properties that are part of the Marriott Bonvoy collection of brands may want to consider the Marriott Bonvoy Bold ® Credit Card.

The Marriott Bold card rewards cardholders for Marriott stays and gives them a boost towards Marriott Bonvoy elite status.

- Up to 14x points per $1 on Marriott purchases

- 2x points per $1 on travel purchases

- 15 Elite Night Credits each year (automatically gives you Silver Elite status)

- Lower point earn rate than other Marriott Bonvoy cards

- Marriott Bonvoy Silver Elite status is the lowest status tier

- Earn 30,000 Bonus Points after you spend $1,000 on purchases in the first 3 months from account opening.

- Pay no annual fee with the Marriott Bonvoy Bold ® Credit Card from Chase ® !

- Earn up to 14X total points per $1 spent at thousands of hotels participating in Marriott Bonvoy ® with the Marriott Bonvoy Bold ® Card.

- 1X point for every $1 spent on all other purchases.

- Your points don't expire as long as you make purchases on your card every 24 months.

- APR: 21.49%–28.49% Variable

Marriott Bonvoy

Marriott loyalists will love this card's annual Free Night Award, automatic elite status, and up to 17x points per $1 on Marriott hotel stays.

If you’re a frequent traveler and a Marriott loyalist, there’s a lot to love about the Marriott Bonvoy Boundless ® Credit Card . The card comes packed with several great benefits like a free hotel night once a year, automatic Silver Elite status (with a fast-track to Gold Elite status), and multiple options for redeeming points.

- Earn big when you use your card at thousands of participating Marriott Bonvoy hotels

- Earn big at grocery stores, gas stations, and dining

- Automatic Silver Elite Status

- $95 annual fee

- Marriott Silver Elite Status is the lowest status tier

- Earn 3 Free Night Awards (each night valued up to 50,000 points) after qualifying purchases.

- Earn 3X points per $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining.

- Earn 1 Elite Night Credit towards Elite Status for every $5,000 you spend.

- 1 Free Night Award (valued up to 35,000 points) every year after account anniversary.

- Earn up to 17X total points per $1 spent at thousands of hotels participating in Marriott Bonvoy ® with the Marriott Bonvoy Boundless ® Card.

- Receive 15 Elite Night Credits annually, automatic Silver Elite status, and path to Gold Status when you spend $35,000 on purchases each calendar year.

- No Foreign Transaction Fees. Your points don't expire as long as you make purchases on your card every 24 months.

The Marriott Bonvoy Bevy card gives you automatic Marriott elite status and helps you earn more Marriott Bonvoy points on your everyday purchases.

The Marriott Bonvoy Bevy™ American Express ® Card , the latest mid-tier offering in the Marriott Bonvoy lineup of cards, offers cardholders automatic elite status and ways to earn more Marriott Bonvoy points on each of their stays and daily purchases.

- 6x points per $1 at hotels participating in Marriott Bonvoy

- 4x points per $1 at restaurants worldwide and U.S. supermarkets (on up to $15,000 in combined purchases per calendar year, then 2X points)

- 2x points per $1 on all other purchases

- $250 annual fee ( rates and fees )

- Free Night Award certificate is not an automatic benefit

- Earn 85,000 Marriott Bonvoy bonus points after you use your new Card to make $5,000 in purchases within the first 6 months of Card Membership.

- Earn 6X Marriott Bonvoy ® points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy.

- Earn 4X points at restaurants worldwide and U.S. supermarkets (on up to $15,000 in combined purchases at restaurants and U.S. supermarkets per calendar year, then 2X points).

- Earn 2X points on all other eligible purchases.

- Marriott Bonvoy 1K Bonus Points Per Stay: Earn 1,000 Marriott Bonvoy ® bonus points per paid eligible stay booked directly with Marriott for properties participating in Marriott Bonvoy.

- With complimentary Marriott Bonvoy Gold Elites status, earn up to 2.5X points from Marriott Bonvoy ® on eligible hotel purchases with the 25% Bonus Points on stays benefit, available for Qualifying Rates.

- Marriott Bonvoy Bevy Free Night Award: Earn 1 Free Night Award after spending $15,000 on eligible purchases on your Marriott Bonvoy Bevy™ Card in a calendar year. Award can be used for one night (redemption level at or under 50,000 Marriott Bonvoy ® points) at a hotel participating in Marriott Bonvoy ® . Certain hotels have resort fees.

- 15 Elite Night Credits: Each calendar year with your Marriott Bonvoy Bevy™ American Express Card ® you can receive 15 Elite Night Credits toward the next level of Marriott Bonvoy ® Elite status. Limitations apply per Marriott Bonvoy member account. Benefit is not exclusive to Cards offered by American Express. Terms apply.

- Plan It ® is a payment option that lets you split up purchases of $100 or more into equal monthly installments with a fixed fee. Plus, you'll still earn rewards the way you usually do.

- $250 Annual Fee.

- APR: 20.99%-29.99% Variable

A premium card for Marriott fans who want perks like an annual statement credit and Free Night Award, plus a fast track to Marriott elite status.

The Marriott Bonvoy Brilliant ® American Express ® Card is a premium card designed with road warriors and Marriott Bonvoy loyalists in mind.

So is the card a worthwhile addition to your wallet?

- 6x points per $1 at hotels participating in Marriott Bonvoy program

- 3x points per $1 on flights booked directly with airlines and restaurants worldwide

- Steep annual fee of $650 ( rates and fees )

- 6x points per $1 is the same earn rate offered with lower annual fee alternatives like the Marriott Bonvoy Bevy™ American Express ® Card

- Earn 95,000 Marriott Bonvoy bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership.

- $300 Brilliant Dining Credit: Each calendar year, get up to $300 (up to $25 per month) in statement credits for eligible purchases made on the Marriott Bonvoy Brilliant ® American Express ® Card at restaurants worldwide.

- With Marriott Bonvoy Platinum Elite status, you can receive room upgrades, including enhanced views or suites, when available at select properties and booked with a Qualifying Rate.

- Earn 6X Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy ® . 3X points at restaurants worldwide and on flights booked directly with airlines. 2X points on all other eligible purchases.

- Free Night Award: Receive 1 Free Night Award every year after your Card renewal month. Award can be used for one night (redemption level at or under 85,000 Marriott Bonvoy points) at hotels participating in Marriott Bonvoy ® . Certain hotels have resort fees.

- Each calendar year after spending $60,000 on eligible purchases on your Marriott Bonvoy Brilliant ® American Express ® Card, you will be eligible to select a Brilliant Earned Choice Award benefit. You can only earn one Earned Choice Award per calendar year. See https://www.choice-benefit.marriott.com/brilliant for Award options.

- $100 Marriott Bonvoy Property Credit: Enjoy your stay. Receive up to a $100 property credit for qualifying charges at The Ritz-Carlton ® or St. Regis ® when you book direct using a special rate for a two-night minimum stay using your Card.

- Fee Credit for Global Entry or TSA PreCheck ® : Receive either a statement credit every 4 years after you apply for Global Entry ($100) or a statement credit every 4.5 years after you apply for a five-year membership for TSA PreCheck ® (up to $85 through a TSA PreCheck official enrollment provider) and pay the application fee with your Marriott Bonvoy Brilliant ® American Express ® Card. If approved for Global Entry, at no additional charge, you will receive access to TSA PreCheck.

- Each calendar year with your Marriott Bonvoy Brilliant ® American Express ® Card you can receive 25 Elite Night Credits toward the next level of Marriott Bonvoy ® Elite status. Limitations apply per Marriott Bonvoy member account. Benefit is not exclusive to Cards offered by American Express. Terms apply.

- Enroll in Priority Pass™ Select, which offers unlimited airport lounge visits to over 1,200 lounges in over 130 countries, regardless of which carrier or class you are flying. This allows you to relax before or between flights. You can enjoy snacks, drinks, and internet access in a quiet, comfortable location.

- No Foreign Transaction Fees on international purchases.

- With Cell Phone Protection, you can be reimbursed, the lesser of, your repair or replacement costs following damage, such as a cracked screen, or theft for a maximum of $800 per claim when your cell phone line is listed on a wireless bill and the prior month's wireless bill was paid by an Eligible Card Account. A $50 deductible will apply to each approved claim with a limit of 2 approved claims per 12-month period. Additional terms and conditions apply. Coverage is provided by New Hampshire Insurance Company, an AIG Company.

- $650 Annual Fee.

Turkish Airlines Miles&Smiles

Turkish Airlines is also part of the Star Alliance and is another excellent way to fly to India using points and miles. Its Miles&Smiles program has incredible sweet spots that include some of the lowest award rates of any program.

For award redemptions, Turkish Airlines utilizes a zone-based award chart for both its own flights and its partner airlines. There are 2 award charts : 1 for promotional award tickets and 1 for regular award redemptions.

For Turkish redemptions, focus on the promotional award chart, as those are considered Saver level awards and include the best redemption rates.

On its award chart, Miles&Smiles places India in its Central Asia region. Here is what it costs for flights between the U.S. and Central Asia:

- 34,000 miles one-way in economy or 68,000 round-trip

- 52,500 miles one-way in business class or 105,000 round-trip

- 77,000 miles one-way in first class or 154,000 round-trip

Flying to India for just 34,000 miles one-way in economy or 52,500 miles in business class is an incredible use of Turkish miles.

To book an award ticket with Turkish Airlines, here is what you need to do:

- Log into your Miles&Smiles account on the Turkish Airlines homepage .

- Check the box Award ticket – Buy a ticket with Miles.

- Enter your origin and destination airports, departure date, class of service, and the number of passengers.

- Click on the red arrow to the right to begin the award search.

- Find award space, book with miles, and pay applicable taxes and fees.

The Turkish Airlines website is sometimes unable to see Star Alliance availability. We recommend starting your search on United.com and locating flights marked as Saver awards. You can cross-reference award availability with another Star Alliance partner, such as Air Canada, to ensure you can book an award seat using your miles.

Along with the Star Alliance availability issue that arises when searching on Turkish Airlines, another problem often comes up. Some itineraries cannot be booked online with Turkish and require you to email a Turkish Airlines ticket office or book with the airline over the phone. Turkish Airlines Miles&Smiles staff can be reached at 800-874-8875.

Earning Turkish Airlines Miles&Smiles Miles

There are many ways to earn Turkish Miles&Smiles miles . Turkish Airlines is a transfer partner of Capital One Miles, Citi ThankYou Rewards, Bilt Rewards, and Marriott Bonvoy.

Bilt, Capital One, and Citi transfer at a 1:1 ratio. Transfers from Marriott Bonvoy occur at a 3:1 ratio, and you get a 5,000-mile bonus for every 60,000 Marriott Bonvoy points you transfer.

Alaska Airlines Mileage Plan

Alaska Airlines’ Mileage Plan also provides great award flights to India. Alaska Airlines is in the Oneworld Alliance, which includes American Airlines, British Airways, Cathay Pacific, and Japan Airlines, among others. Best of all, you can easily fly to India with any of the partners mentioned above.

In late 2022, Alaska simplified its award charts, including those for its partner airlines. Here are the award rates for flights to Asia using Alaska Airlines miles:

Check out our guide on the best ways to redeem Alaska Mileage Plan miles for maximum value .

When Alaska revamped its award charts, some of the changes weren’t great for members. The award charts for each airline partner have been changed to a “starting from” pricing method, meaning their redemptions can vary significantly.

Thanks to Alaska’s Oneworld partners, there are some great options for flying to India, especially on some of the world’s best airlines, including Cathay Pacific and Japan Airlines. In fact, both airlines are a great way to redeem Alaska miles

Mileage Plan also has one incredible perk: booking stopovers on one-way award flights. This allows you to get a 2-for-1 trip with a single redemption. For example, if you fly to India using Japan Airlines from the U.S., you could stop in Tokyo for a few days before heading to India.

To book award travel with your Alaska miles for partner airlines:

- Visit Alaska Airlines .

- Click the checkbox that says Use Miles to search for your routes and dates. Be sure to use Multi-city if you’re booking stopovers or open-jaws .

- Pick your desired flights and click Add to Cart .

- Log in to your Alaska Airlines Mileage Plan account.

- Complete the booking and pay any taxes and fees.

You can now find Cathay Pacific award availability directly on the Alaska Airlines website.

Earning Alaska Mileage Plan Miles

The major drawback of Alaska Airlines miles is that they only have 1 major transfer partner: Marriott Bonvoy. Marriott Bonvoy points transfer at a 3:1 ratio. With every 60,000 Marriott Bonvoy points that you transfer, you receive 5,000 bonus miles.

However, there are also 2 co-branded Alaska Airlines credit cards.

Provides the potential to earn plenty of miles to fly with Alaska Airlines or over a dozen partners. Plus, get an annual companion fare from just $122 ($99 fare plus taxes and fees from $23)!

With the Alaska Airlines Visa Signature ® credit card in your wallet, you could get great perks and earn miles at the same time. This is a win-win if Alaska is the airline you prefer to fly with! Plus, its annual companion fare is a great benefit for traveling couples.

- 3x miles per $1 spent on Alaska purchases

- 2x miles per $1 spent on eligible gas, local transit (including rideshare), cable, and select streaming services

- 1x mile per $1 spent on all other purchases

- LIMITED TIME ONLINE OFFER — 60,000 bonus miles plus Alaska’s Famous Companion Fare™!

- Get 60,000 Bonus Miles plus Alaska’s Famous Companion Fare™ ($99 fare plus taxes and fees from $23) after you make $3,000 or more in purchases within the first 90 days of your account opening.

- Alaska’s Famous Companion Fare™. Every year on your credit card account anniversary you’ll receive a companion fare which allows you to book a companion flight from $122 ($99 fare plus taxes and fees from $23). Valid on all Alaska Airlines flights booked on alaskaair.com.

- Free checked bag for you and up to 6 guests on the same reservation – that’s a savings of $70 per person roundtrip!

- Earn unlimited 3 miles for every $1 spent on eligible Alaska Airlines purchases, 2 miles for every $1 spent on eligible gas, local transit (including rideshare), cable, and select streaming services, and unlimited 1 mile for every $1 spent on all other purchases. And, your miles don’t expire on active accounts.

- 10% reward bonus on all miles earned on card with an eligible Bank of America checking, savings, or investment account.

- Priority boarding on Alaska Airlines when tickets are purchased with card.

- With oneworld ® Alliance member airlines and Alaska’s Global Partners, Alaska has expanded their global reach to over 1,000 destinations worldwide bringing more airline partners and more ways to earn and redeem miles.

- Flexibility with no blackout dates on Alaska Airlines flights when booking with miles or a companion fare.

- Plus, no foreign transaction fees and a low $95 annual fee.

- This online only offer may not be available elsewhere if you leave this page. You can take advantage of this offer when you apply now.

- APR: 20.24% - 28.24% Variable

Alaska Airlines Mileage Plan Frequent Flyer Program

American Airlines AAdvantage

Another excellent award program to utilize for award tickets to India is American Airlines AAdvantage. American Airlines is also part of Oneworld, meaning you can use American Airlines AAdvantage miles to fly both American Airlines and Oneworld partners from the U.S. to India.

For its flights, American Airlines uses a dynamic pricing method. However, partner awards with American AAdvantage are not subject to dynamic pricing , which opens up incredible redemption opportunities.

Because of the dynamic pricing on its own flights, it’s hard to get great value with your American miles. This is why we absolutely recommend you fly American’s Oneworld partners instead.

On AA’s partner award chart, India is placed in its Indian Subcontinent region.

Here is a look at what it costs for one-way awards on Oneworld partner airlines from the U.S. to the Indian Subcontinent:

One of the best ways to redeem American AAdvantage miles is for a business class flight to India for just 70,000 miles one-way. This includes options on partners like Qatar Airways, which offers its Qsuites business class on these routes.

Using American Airlines search engine is a great way to look for Oneworld alliance partner award space.

Here is how to book award travel with your American Airlines miles for partner redemptions:

- Head to American Airlines and log in to your AAdvantage account.

- Select your desired route, travel dates, and class of service.

- Click on Redeem miles .

- Search for award space.

- Book the flight online and pay the applicable taxes and fees.

Earning American Airlines AAdvantage Miles

Earning AAdvantage miles is relatively easy, as the program is a transfer partner of Bilt Rewards and Marriott Bonvoy.

Bilt Rewards transfer at a 1:1 ratio. You can transfer points from Marriott Bonvoy to AAdvantage at a 3:1 ratio. There is no 5,000-mile bonus if you transfer 60,000 Bonvoy points as with other programs.

There are also numerous co-branded credit cards offered by both Barclays and Citibank .

Using 70,000 American Airlines to fly Qsuites business class to India is a great way to redeem your miles.

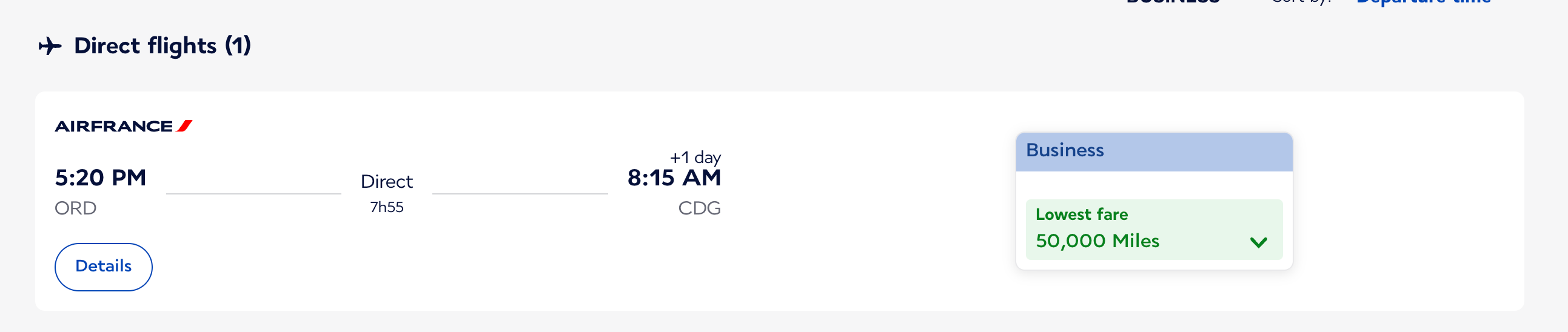

Air France-KLM Flying Blue

So far, we’ve looked at multiple options with Oneworld and Star Alliance. Now, let’s look at our first award redemption with a Skyteam member program: Air France-KLM’s Flying Blue loyalty program.

Flying Blue utilizes dynamic pricing. However, even with dynamic pricing, Flying Blue generally has the best pricing for SkyTeam awards. If you have some flexibility, you can save upwards of 100,000 miles on specific routes.

Check out some other of the best ways to redeem Air France-KLM Flying Blue miles for max value.

In 2022, Flying Blue introduced an interactive map with entry award rates. The interactive map shows the starting mileage prices for one-way flights operated by Air France or KLM.

However, this map is not a guarantee that there is any entry-level award space available. You have to go to Air France or KLM’s website to check actual award prices and confirm the space.

One-way award flights between the U.S. and India start at:

- 35,000 miles in economy

- 65,000 miles in premium economy

- 95,000 miles in business

However, finding those rates, especially in business class, can be tricky. It’s worth noting that Air France and KLM awards have fuel surcharges, often upwards of $300.

You can search for award availability through Air France-KLM and book awards entirely online:

- Go to the Air France website .

- In the top right corner, click My Account and log in with your Username and Password .

- After logging in and being returned to the homepage, click Use Your Miles .

- Type in your airport information, dates, number of passengers, and class type.

- Select your flights and pay for any taxes and fees.

Earning Air France-KLM Flying Blue Miles

Earning Flying Blue miles is quite simple, as the program is a transfer partner of many major programs, including American Express Membership Rewards, Bilt Rewards, Capital One Miles, Chase Ultimate Rewards, Citi ThankYou Rewards, and Marriott Bonvoy.

All the above points programs, besides Marriott Bonvoy, transfer to Flying Blue at a 1:1 ratio. You can transfer points from Marriott Bonvoy to Flying Blue at a 3:1 ratio. For every 60,000 Marriott Bonvoy points you transfer, there is a 5,000-mile bonus.

Recommended Chase Cards (Personal)

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- No elite benefits like airport lounge access or hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- APR: 21.49%-28.49% Variable

Chase Ultimate Rewards

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 75,000 points are worth $1125 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- APR: 22.49%-29.49% Variable

This all-purpose cash-back card offers great bonus categories, including bonus points for every purchase you make!

The Chase Freedom Unlimited ® is easily one of the best cash-back credit cards on the market. There aren’t many no-annual-fee credit cards that offer multiple great bonus categories like 5% back on travel purchased through Chase, 3% back on dining and drugstore purchases, and 1.5% back on all other purchases.

When paired with other Chase cards in the Ultimate Rewards family, you can transfer that cash back into points if you wish – making it one of the most lucrative cards in your wallet.

- 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- 5% back on travel purchased through Chase Travel

- 3% back on dining and drugstore purchases

- 3% foreign transaction fee

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited ® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

- APR: 0% Intro APR for 15 months on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- Foreign Transaction Fees: 3% of each transaction in U.S. dollars

The Freedom Flex card is an excellent no-annual-fee card that still earns big with 5% cash-back on travel and other bonus categories.

The Chase Freedom Flex℠ sure does pack quite a punch — especially for a no-annual-fee card.

The Freedom Flex card is an incredible option for those looking for a well-rounded cash-back card, or a powerful point-earner when paired with a premium card in the Ultimate Rewards family.

- 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49%-29.24%.

- Powerful cash-back earner: 5% back on quarterly categories and travel purchases through Chase Ultimate Rewards, 3% back on dining and drugstore purchases, and 1% back on all other purchases

- No annual fee

- 3% foreign transaction fees in U.S. dollars

- Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

- 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter!

- 5% cash back on travel purchased through Chase Ultimate Rewards ® , our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more

- 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- No annual fee - You won't have to pay an annual fee for all the great features that come with your Freedom Flex℠ card

- Keep tabs on your credit health - Chase Credit Journey helps you monitor your credit with free access to your latest score, real-time alerts, and more.

- APR: 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49%-29.24%.

Business owner? Check out our guide to the best Chase business cards .

Flying Blue typically offers the best pricing on many SkyTeam awards.

Other Options To Fly to India

Although many other programs can get you to India, we’ve covered the ones with the best redemption options.

There are several other frequent flyer programs you can use to fly to India, including Japan Airlines Mileage Bank, Cathay Pacific Asia Miles, Delta Air Lines SkyMiles, Korean Air SKYPASS, and Singapore Airlines Krisflyer. We did not include these in our main analysis for one or more of the following reasons:

- High fuel surcharges

- High award redemption rates

- Lack of transfer partners

- Unattractive flight products or subpar airline options

There are plenty of ways to fly to India with points and miles. Fortunately, some of the best airlines in the world have flights to India. These include airlines such as Qatar Airways, Turkish Airlines, and Japan Airlines.

It’s worth looking at the many different award programs we’ve covered to get an idea of the best program for booking an award ticket to India. Award availability, the points and miles you already have, and what class of service you want to fly can all point you to the right award program.

The information regarding the Citi Premier ® Card has expired and the card is no longer open to applicants. The information regarding the Marriott Bonvoy Bold ® Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Marriott Bonvoy Boundless ® Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Chase Freedom Flex℠ was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Alaska Airlines Visa Signature ® credit card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of the American Express ® Gold Card, click here . For rates and fees of the Marriott Bonvoy Bevy™ American Express ® Card, click here . For rates and fees of the Marriott Bonvoy Brilliant ® American Express ® card, click here .

Frequently Asked Questions

Can i use american airlines aadvantage miles to fly to india.

Yes you can use American Airlines AAdvantage miles to fly both American Airlines and Oneworld airline flights from the U.S. to India.

You can fly one-way between the U.S. and China for 40,000 miles in economy or 70,000 AA miles in business class. If you can find award space, you have the option to fly on some of American’s best partner airlines including Qatar Airways, Japan Airlines, and Cathay Pacific.

Can you use Alaska Airlines miles to fly to India?

Yes, you can. Alaska Airlines is part of the Oneworld Alliance with other partners such as American Airlines, British Airways, Cathay Pacific, and Japan Airlines among others.

There are a lot of airline options to fly to India using Alaska Airlines miles.

Can I use Air Canada Aeroplan points for flights to India?

What is the best airline to fly to india.

You have many options when flying to India.

Some of the best include Qatar Airways, Turkish Airlines, ANA, Japan Airlines, and Cathay Pacific.

Was this page helpful?

About Ehsan Haque

Ehsan is an avid traveler who has traveled to 100 countries, diligently using points and miles to fund his journeys. Currently, he holds 32 active credit cards and earns over a million points and miles annually, primarily using them for luxury hotels and long-haul premium cabins.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![amex india travel partners 8 Best Ways To Earn Lots of Asiana Airlines Asiana Club Miles [2024]](https://upgradedpoints.com/wp-content/uploads/2018/06/AdobeStock_343714198_Editorial_Use_Only.jpeg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

We are an independent publisher. Our reporters create honest, accurate, and objective content to help you make decisions. To support our work, we are paid for providing advertising services. Many, but not all, of the offers and clickable hyperlinks (such as a “Next” button) that appear on this site are from companies that compensate us. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear. While we strive to provide a wide range of offers, our site does not include information about every product or service that may be available to you. We strive to keep our information accurate and up-to-date, but some information may not be current. So, your actual offer terms from an advertiser may be different than the offer terms on this site. And the advertised offers may be subject to additional terms and conditions of the advertiser. All information is presented without any warranty or guarantee to you.

This page may include: credit card ads that we may be paid for (“advertiser listing”); and general information about credit card products (“editorial content”). Many, but not all, of the offers and clickable hyperlinks (such as a “Apply Now” button or “Learn More” button) that appear on this site are from companies that compensate us. When you click on that hyperlink or button, you may be directed to the credit card issuer’s website where you can review the terms and conditions for your selected offer. Each advertiser is responsible for the accuracy and availability of its ad offer details, but we attempt to verify those offer details. We have partnerships with advertisers such as Brex, Capital One, Chase, Citi, Wells Fargo and Discover. We also include editorial content to educate consumers about financial products and services. Some of that content may also contain ads, including links to advertisers’ sites, and we may be paid on those ads or links.

For more information, please see How we make money .

The Big Travel Guide to AMEX Membership Rewards Points: Part 8 – Best Ways to Fly to India and Middle East

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money .

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

You get lots of travel flexibility with AMEX Membership Rewards points. Because if you don’t have set travel plans for a future trip, these transferable points give you the option to choose from multiple airline and hotel partners when the time comes.

Folks in the miles & points hobby know earning transferable points, like AMEX Membership Rewards points, are the best way to get Big Travel. This can mean a First Class adventure around-the-world, a family trip to Europe , or so many other options! And it’s easy to earn AMEX Membership Rewards points from some of the best American Express cards .

The AMEX Membership Rewards points program has many direct airline and hotel partners.

Plus, you’ll get access to other indirect partners as well, which gives you choices for flights to the India , which an amazing travel destination! And you’ll have great options for travel to the Middle East too!

Or you can keep it simple and use AMEX Pay With Points to book flights through the Membership Rewards travel portal and get a fixed amount per point.

We’ll show you the best ways to use AMEX Membership Rewards Points for flights to India & the Middle East !

The Ultimate Guide to American Express Membership Rewards Points:

- Part 1 – Transfer Partners

- Part 2 – How to Transfer Points

- Part 3 – Best Ways to Fly Within Continental US

- Part 4 – Best Ways to Fly to Hawaii

- Part 5 – Best Ways to Fly to Canada & Alaska

- Part 6 – Best Ways to Fly to Caribbean & Mexico

- Part 7 – Best Ways to Fly to Europe

- Part 8 – Best Ways to Fly to India & Middle East

- Part 9 – Africa

- Part 10 – South America

AMEX Membership Rewards Points for Flights to India & Middle East

AMEX has several direct airline transfer partners that are great for flights to India & the Middle East.

India is an amazing favorite travel destination . And Mumbai is one of Emily’s top international shopping destinations.

If you’re planning a trip to India, you can read tips and experiences in our trip reports .

When you’re transferring AMEX Membership Rewards points to an airline partner for flights to India or the Middle East, consider:

- Destination you’d like to visit

- Which airlines fly from your home airport

- Your airline & alliance preferences

Keep in mind there are a limited number of non-stop flights from the US to India or the Middle East. So you’ll likely have to connect via Europe or Asia .

If you’re planning a trip to India or the Middle East, we recommend setting aside some time to plan your award flights .

These flights typically require a lot of points or miles. So you’ll want to confirm all the details with the airline partner before transferring AMEX Membership Rewards points.

1. Air Canada

You can transfer AMEX Membership Rewards points to Air Canada Aeroplan at a 1:1 ratio to use for flights to India or the Middle East!

Air Canada is part of the Star Alliance. This means you can redeem Air Canada Aeroplan miles for award flights on partner airlines like:

- Brussels Airlines

- LOT Polish Airlines

- Scandinavian Airlines (SAS)

- Turkish Airlines

- United Airlines

Keep in mind, you’ll pay fuel surcharges when you redeem Air Canada Aeroplan miles on certain airlines . These charges can range from ~$50 up to several hundred dollars.

From the US to India, one-way award flights cost:

- 50,000 Air Canada Aeroplan miles in coach

- 65,000 Air Canada Aeroplan miles in Premium Economy

- 75,000 Air Canada Aeroplan miles in Business Class

- 105,000 Air Canada Aeroplan miles in First Class

If you’re looking for non-stop flight options from the US, Air India flies these non-stop routes:

- Chicago and New York (JFK) to Delhi

- Newark to Mumbai

- San Francisco to Delhi

- Washington, DC to Delhi

And United Airlines flies non-stop to Delhi and Mumbai from Newark.

Air Canada also flies non-stop between Toronto and Delhi and Mumbai, and between Vancouver and Delhi. So you can connect from the US through one of these cities to India.

Keep in mind, it is very unlikely you’ll find Business Class or First Class award seats available on the non-stop flights.

For folks not in the non-stop departure cities or who would like better Business Class options, you’ll have to connect through Europe or Asia.

As an example, you can fly SWISS Air Business Class from New York (JFK) to Delhi with a layover in Zurich. You can book this one-way award flight online through Air Canada Aeroplan for 75,000 Air Canada Aeroplan miles .

And from the US to the Middle East, one-way award flights cost:

- 40,000 Air Canada Aeroplan miles in coach

- 67,500 Air Canada Aeroplan miles in Premium Economy

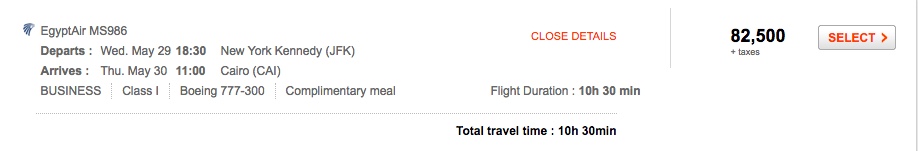

- 82,500 Air Canada Aeroplan miles in Business Class

- 115,000 Air Canada Aeroplan miles in First Class

These are the destinations Air Canada includes in the Middle East region:

- Canary Islands (Spain)

- Saudi Arabia

- Turkmenistan

- United Arab Emirates

As an example, you can use 82,500 Air Canada Aeroplan miles for a one-way, non-stop Business Class award flight between New York (JFK) and Cairo on partner airline Egypt Air.

To find available award seats to India or the Middle East on Star Alliance partner airlines , we recommend searching the United Airlines website for “ Saver ” level awards.

2. ANA

ANA is also part of the Star Alliance, which means you can book award flights to India or the Middle East on partners like Air India or United Airlines.

You can NOT book one-way award flights using ANA miles.

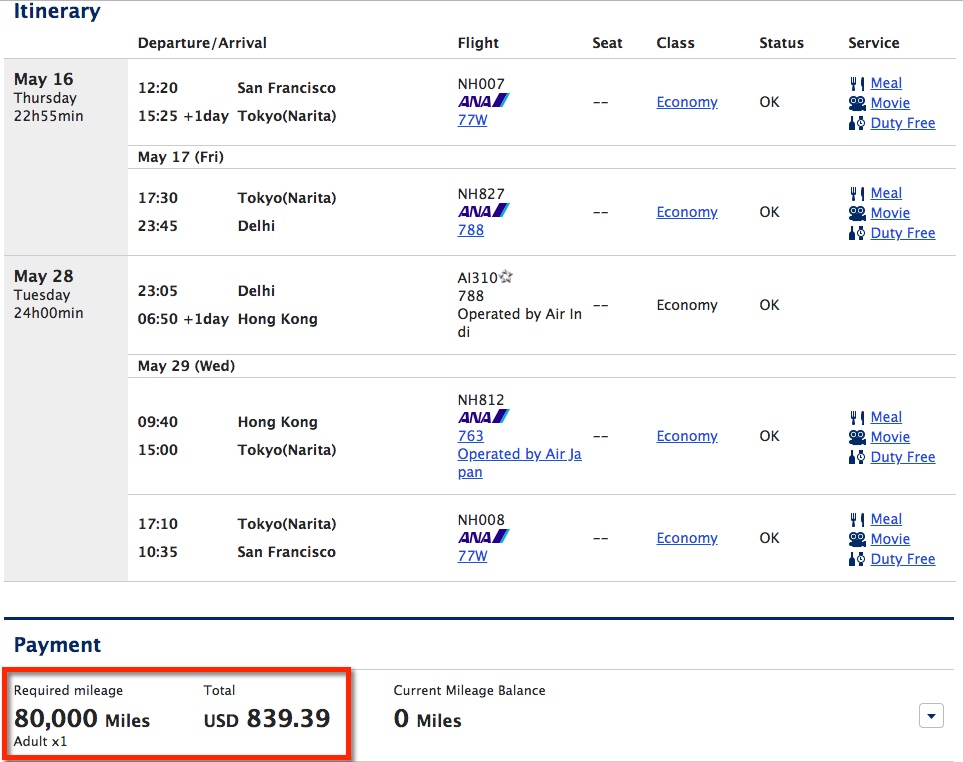

For a round-trip award flight to India, you’ll pay:

- 80,000 ANA miles in coach

- 136,000 ANA miles in Business Class

- 240,000 ANA miles in First Class

And to the Middle East, you’ll pay:

- 65,000 ANA miles in coach

- 104,000 ANA miles in Business Class

- 195,000 ANA miles in First Class

Keep in mind, ANA adds significant fuel surcharges (up to ~$1,000) on certain partner award flights.

For example, we found a sample round-trip itinerary from San Francisco to Delhi. You’ll pay 80,000 ANA miles plus ~$839 in taxes and fees. You’re likely better off paying cash for the same flight, but you’ll want to run the numbers.

But the sweet spot using ANA miles is for award flights to the Middle East, because the airline has a partnership with Etihad. And unlike other ANA partners, there are no fuel surcharges when you use ANA miles for Etihad award flights.

You can fly non-stop on Etihad to Abu Dhabi from:

- Los Angeles

- New York (JFK)

- Washington, DC

Then connect from Abu Dhabi to other destinations in the Middle East or India.

You’ll need to call ANA at 800-235-9262 to book Etihad award flights.

3. Singapore Airlines

Singapore Airlines is another Star Alliance airline. So you can transfer AMEX Membership Rewards points to Singapore Airlines to book award flights on partner airlines like Air Canada or Air India.

You can also redeem Singapore Airlines miles for award flights directly on the airline.

Here are the prices for one-way Star Alliance partner flights using Singapore Airlines miles from North America to India:

- 45,000 Singapore Airlines miles in coach

- 69,000 Singapore Airlines miles in Business Class

- 90,000 Singapore Airlines miles in First Class

And for one-way Star Alliance flights to the Middle East, you’ll pay:

- 55,000 Singapore Airlines miles in coach

- 110,000 Singapore Airlines miles in Business Class

- 145,000 Singapore Airlines miles in First Class

Singapore Airlines has different prices for their own award flights to India and the Middle East depending if you’re departing the US from the East Coast or West Coast.

From the West Coast to India, one-way award flights on Singapore Airlines cost:

- 46,000 Singapore Airlines miles in coach

- 98,000 Singapore Airlines miles in Business Class

- 138,000 Singapore Airlines miles in First Class

And from the East Coast to India, one-way award flights on Singapore Airlines cost:

- 55,000 Singapore Airlines miles in coach

- 110,000 Singapore Airlines miles in Business Class

- 145,000 Singapore Airlines miles in First Class

One-way award flights from the West Coast to the Middle East on Singapore Airlines cost:

- 52,000 Singapore Airlines miles in coach

- 102,000 Singapore Airlines miles in Business Class

- 143,000 Singapore Airlines miles in First Class

For award flight prices from the East Coast to the Middle East, you’ll have to call Singapore Airlines because the prices vary by route.

The good news is Singapore Airlines award flights are usually easy to book online . But if you plan to fly the airline to India or the Middle East, expect a lengthy flight itinerary. Because you’ll likely be connecting via Singapore to get to your final destination.

For example, I found a one-way Business Class award flight from Los Angeles to Delhi. But you’ll have 2 layovers, including in Tokyo and then in Singapore. The total travel time is 30+ hours.

Keep in mind, you’ll pay high taxes on Singapore Airlines award flights, which can be in the hundreds of dollars.

So it might not be worth redeeming miles for a coach ticket. But it could make sense to pay taxes for a Business Class or First Class seat, which might otherwise cost thousands of dollars!

4. Delta

Delta does not publish an award chart . So you’ll need to search specific award flights to find prices.

From our research, we found the cheapest one-way award flights to the Middle East cost:

- 35,000 Delta miles in coach

- 85,000 Delta miles in Business Class

And to India, the cheapest award flights we found cost:

- 40,000 Delta miles in coach

- 100,000 Delta miles in Business Class

Delta does occasionally offer award sales with even better prices, so watch out for those!

Keep in mind, you might find limited available Business Class award seats, especially when using Delta miles for partner airline flights.

Delta is part of the SkyTeam Alliance, so you can fly to India or the Middle East by connecting through Europe or Asia on partner airlines like:

- Virgin Atlantic

The best departure options are from Delta hub cities:

- Minneapolis

- Salt Lake City

Although redeeming Delta miles is not always the cheapest option for award flights, there are some advantages.

For example, the award calendar is easy to search. And you can book award flights quickly online.

5. Flying Blue

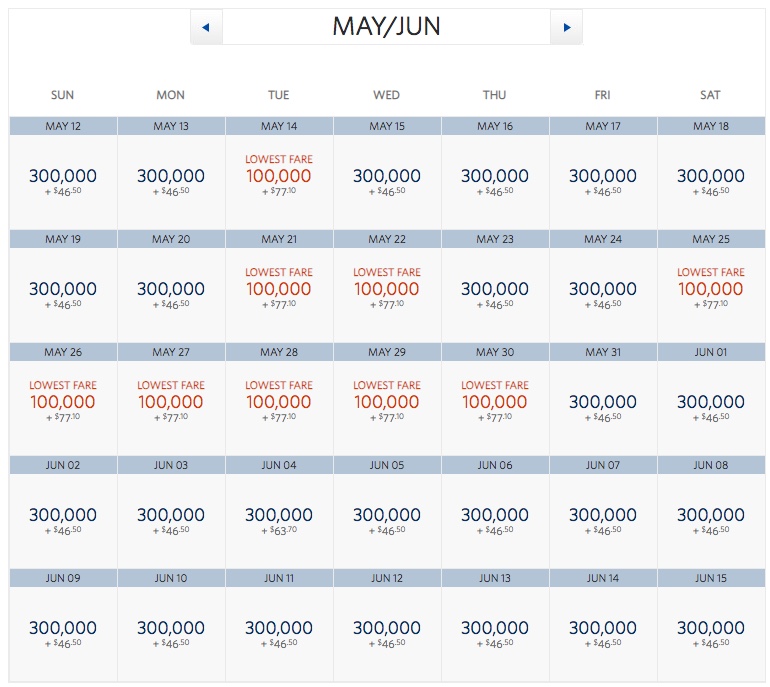

Flying Blue is the frequent flyer program for Air France and KLM. You can transfer AMEX Membership Rewards points directly to the program at a 1:1 ratio.

Folks planning to travel to Israel can find amazing deals using Flying Blue miles.

That’s because each month Air France and KLM discount award tickets on certain routes to Europe by 25% to 50%.

Flying Blue now has an award calculator tool to allow you to see how many miles a flight will cost, but you need to log into your Flying Blue account to get to it. And keep in mind, the taxes and fees vary by flight, but usually range from ~$200 in coach to ~$500 in Business Class.

Save Time (and Possibly Points) Using AMEX Pay With Points

If there are no award flights available for your desired travel dates, or you just can’t find an itinerary that meets your requirements, you can always redeem points for airfare using Pay With Points through the Membership Rewards travel portal.

When you use your AMEX Membership Rewards points towards air travel, you’ll get 1 cent per point towards your ticket. And folks with The Business Platinum Card® from American Express can effectively get ~ 1.54 cents per point using the Pay With Points perk to get 35% of their points back when they book coach seats on their selected airline, or Business or First Class seats on any airline.

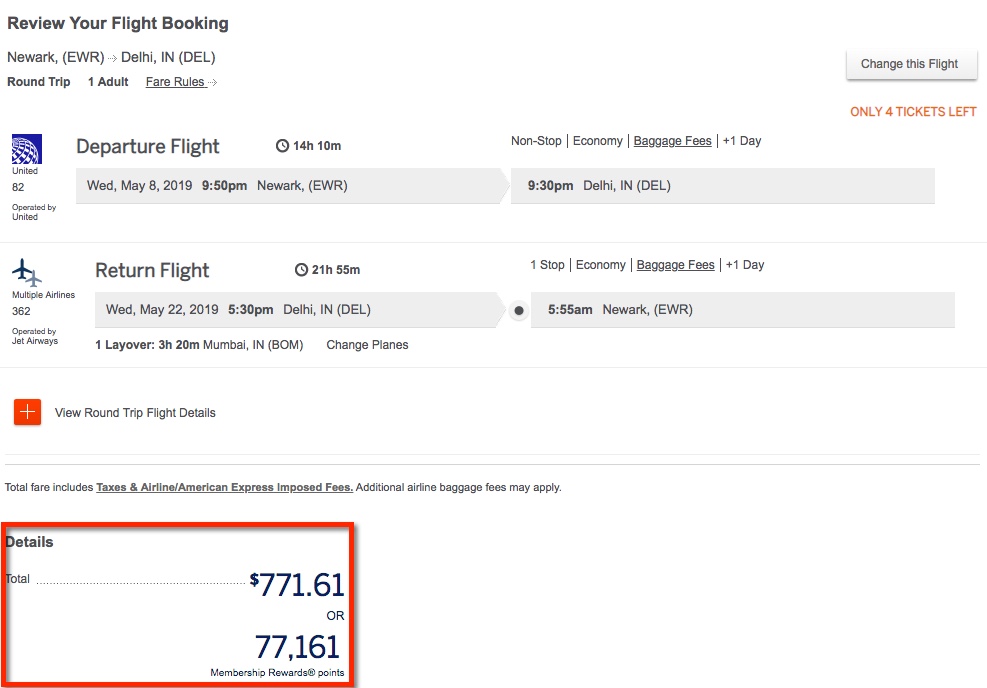

For example, we found a round-trip United Airlines coach flight from Newark to Delhi in May 2019. This flight costs ~$771 or ~71,000 AMEX Membership Rewards points.

You could book this same flight by transferring points to AMEX airline partners Air Canada or ANA. Assuming award flights are available on the same dates, you’d pay:

- 80,000 ANA miles

- 100,000 Air Canada Aeroplan miles

That means that booking through AMEX Travel is cheaper AND you can earn frequent flyer miles when you fly!

Folks with the AMEX Business Platinum can get an amazing deal using Pay With Points if the flight is on their selected airline or for a booking any airline in First or Business Class. These flights will get 35% of points back! So in this example, the net cost for a round-trip flight between Newark and Delhi would be ~50,155 AMEX Membership Rewards points (77,161 points – 35% rebate).

Bottom Line

For award flights to India & the Middle East , you’ll get the most options by transferring AMEX Membership Rewards points to Star Alliance partner airlines like Air Canada, ANA, and Singapore Airlines .

If you’re looking to fly Business Class , you’ll have more options if you connect through Europe or Asia , instead of flying non-stop.

Don’t forget certain airlines add fuel surcharges on partner award flights to India & the Middle East. So run the numbers to make sure you’re getting the best deal!

That said, you can find good deals without any fuel surcharges thanks to certain partnerships. For example, you can use ANA miles to book Etihad award flights to Abu Dhabi. But you’ll have to call ANA to book these flights.

If Israel is in your travel plans, keep an eye out for monthly Flying Blue Promo Rewards . During certain months, you can book a round-trip flight from designated US cities for as few as 25,000 Flying Blue miles plus taxes and fees, which is an amazing deal!

Or you can use AMEX Pay With Points through the Membership Rewards travel portal to book cheap coach airfare. This can be an amazing deal for folks with the AMEX Business Platinum booking a flight their selected airline or any Business or First Class flight because you’ll get 35% of your miles back!

Million Mile Secrets

Contributor

Million Mile Secrets features a team of points and miles experts who have traveled to over 80 countries and have used 60+ credit cards responsibly to accumulate loyalty points and travel the world on the cheap! The Million Mile Secrets team has been featured on The Points Guy, TIME, Yahoo Finance and many other leading points & miles media outlets.

More Topics

Credit Cards

Join the Discussion!

You May Also Like

BonusTracker: Best credit card bonus offers

June 14, 2021 4

Best Hilton credit cards: Improved weekend night certificates, earning rates and more

June 12, 2021 2

Our Favorite Partner Cards

Popular posts.

- Amex credit cards

- Transfer partners

- How to transfer Amex points

American Express Transfer Partners: A Comprehensive Guide for 2024

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: American Express® Green Card, Amex EveryDay® Credit Card, Amex EveryDay® Preferred Credit Card, Hilton Honors American Express Aspire Card, Marriott Bonvoy Boundless® Credit Card. The details for these products have not been reviewed or provided by the issuer.

- American Express Membership Rewards points are some the most valuable card rewards you can earn.

- You can get maximum value from Amex points by transferring them to airline and hotel partners.

- Strategic airline partners like Delta and Air Canada can help you score first-class award flights.

- Read Business Insider's guide to the best travel rewards credit cards .

Introduction to Amex transfer partners

When it comes to transferable credit card rewards points , you might automatically think of Chase Ultimate Rewards ® or Capital One miles . But the American Express Membership Rewards program was one of the first points currencies that allowed folks with associated credit cards to convert their hard-earned rewards into miles and points with various airline and hotel partners.

History and overview of the Amex Membership Rewards program

The Amex Membership Rewards program debuted way back in 1991 with just seven U.S. airline partners. Today, Membership Rewards works with 17 frequent flyer programs and three hotel loyalty programs. Those numbers are impressive in and of themselves – consider, Chase has just 14 partners total, and Citi ThankYou Rewards has 16.

What sets Amex apart even more, however, is the excellent quality of its partners, and the myriad redemption opportunities they represent. There are many benefits of transferring points to these airline and hotel partners, which we'll explore in more detail below.

In this comprehensive guide, we'll show you how to transfer American Express points for travel, and teach you our best tips for maximizing value for Amex Membership Rewards transfers. We'll also walk you through Amex points transfer ratios and policies, point out the best Amex airline transfer partners, and walk you through transferring Amex points to hotel loyalty programs.

The best cards for earning American Express Membership Rewards

Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel (on up to $500,000 per calendar year) and on prepaid hotels booked with American Express Travel. Earn 1X Points on other purchases.

See Pay Over Time APR

Earn 80,000 Membership Rewards® points

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Long list of travel benefits, including airport lounge access and complimentary elite status with Hilton and Marriott (enrollment required)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Annual statement credits with Saks and Uber

- con icon Two crossed lines that form an 'X'. Bonus categories leave something to be desired

- con icon Two crossed lines that form an 'X'. One of the highest annual fees among premium travel cards

If you want as many premium travel perks as possible, The Platinum Card® from American Express could be the right card for you. The annual fee is high, but you get a long list of benefits such as airport lounge access, travel statement credits, complimentary hotel elite status, and more.

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.