Gadget insurance: compare cover for your laptop, smartphone, smartwatch and more

Navigate the options when it comes to gadget insurance

If you’ve never lost your smartphone, cracked the screen of your tablet, or chipped, scraped, smashed or drowned another high-value electronic item, then quite frankly, we salute you. We can see why you'd laugh in the face of gadget insurance.

But the fact is the vast majority of us fall have at one time or another fallen foul of our own clumsiness. And with our devices becoming increasingly expensive – not to mention important to our everyday lives – it’s no wonder specialist gadget insurance is an ever-growing industry.

Traditional home and travel insurance policies are becoming outdated and sometimes fail to cover our mobile devices; the very items that are most likely to get lost, stolen or damaged.

That’s why it's only natural to want to protect our gadgets with an additional insurance package, and you’re in the right place to find out what your gadget policy will cover, what it won’t cover, and who the best insurers are.

What does gadget insurance cover?

Gadget insurance policies can cover a whole array of items – perhaps more than you’d think – encompassing emerging tech as well as old school essentials. The products covered can include smartphones , tablets (including iPads), laptops (including MacBooks), iMacs, smartwatches, sat navs, e-readers (including Kindles) , digital cameras, MP3 players, portable games consoles, VR headsets, drones and more.

- Specifically looking for smartphone cover? Head to our guide on mobile phone insurance

Why do I need gadget insurance?

If you’re prone to losing and damaging your devices, a good gadget insurance policy could save you a lot of time, money and hassle in getting a replacement.

What your insurance covers depends on the insurer and the policy plan. Always take a careful note of exactly what your gadget insurance policy stipulates so you don’t get surprised on a technicality and prevented from redeeming your insurance when you need it.

A typical gadget insurance policy will cover you for accidental damage to your devices, theft, loss and breakdown. Other circumstances you may be covered for (but not always) include liquid damage, the cost of unauthorised calls, texts and data when your phone has been stolen, and malicious damage if someone has taken their anger out on your poor device.

Is there anything my gadget insurance won't cover?

As above, this will depend on your products, the insurer and the specific policy you sign up for, so make sure you read the wording carefully. Water damage and breakage through carelessness, for example, may be covered by some policies but not by others.

Additional factors that could prevent you from being covered are the age of the product (a device you’ve had for two or three years may not fall into the policy), a cap on the pay-out for a single incident, and a limit on the number of incidents the insurer will pay out for each year.

Can I get gadget insurance for travelling?

Yes, you can. Aimed at backpackers and holidaymakers alike, there are insurance policies specifically made to cover gadgets while you travel.

If you already have a travel insurance policy, don’t assume this will cover your gadgets on your trip as many don’t. What may be available, however, is an add-on which extends the travel policy to cover your electronic devices.

You may find that these add-ons aren’t as extensive as a specialist travel insurance policy for gadgets, so if you carry a lot of devices while you travel or they’re of particularly high value, it may be worth shopping around for a separate policy.

For those looking for gadget insurance while travelling, World Nomads are perhaps the major player in the market, but you may also want to get a quote from True Traveller who can offer you a policy even if you’ve already begun travelling.

Doesn't my home insurance cover gadgets like these?

If you're currently using your home insurance hoping that will cover your phone, think again. Home insurance only covers the device when in the house and even then it's usually in the event of a burglary or a home fire only.

We have more information on this question in our dedicated Q&A: does my home insurance cover gadgets?

Which gadget insurance providers should I compare?

Among the most popular and well-reviewed gadget insurance policies are Protect Your Bubble, Row.co.uk (covering liquid damage and unauthorised calls as well as the more typical issues) and Loveit Coverit Premium (including unlimited worldwide cover).

If you’re pretty locked in to Apple ’s ecosystem in terms of the devices you own, AppleCare+ may be the insurance policy for you, as this can provides specialist technical support and hardware coverage for iPhones, iPads, Macs, Apple Watches, Apple TV, HomePods and iPods.

Of course, the major mobile networks also offer their own insurance products (you’ve almost certainly had the sales pitch if you’ve bought a device in-store!). For smartphones, the annual cost of these range from £100 to £180, with Three, EE and Vodafone able to replace your phone the very next day. O2 takes 5-7 days with its policy.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

This is how I plan to explain AI PC to my confused friends and relatives

Samsung's new Galaxy Book4 Edge laptop is a trifecta of next-gen AI power

Best Buy is slashing prices on big-screen TVs for Memorial Day: save up to $1,000

Most Popular

- 2 I tried Samsung’s best OLED TV with its flagship Dolby Atmos soundbar, and the audio combo is out of this world

- 3 Pilates instructor recommends these 5 moves to undo the damage of sitting at a desk all day

- 4 30TB hard drives will finally become mainstream next year — Japanese rival to Seagate and Western Digital reveals plans to launch two 30TB+ HDDs in 2025 using two different technologies

- 5 Nifty eSIM provider offers free mobile data for life whenever you are but there's a big catch — Firsty gives you 60 minutes of data anywhere in the world, but you will have to watch an advert if you want more

- 2 Samsung Galaxy A35 review: a Samsung Galaxy S24 for the rest of us

- 3 Google is bringing back classic search, with no AI – and I couldn't be happier about that

- 4 Fujifilm's most affordable medium-format camera gets a whopping $1,000 reduction

- 5 Forget Intel and AMD - Nvidia's next big competitor might be a company you've never heard of

- Help and Support

- Travel Insurance

- Gadget Insurance

Gadget cover

Cover for all the tech you couldn’t live without, up to £1.5k cover.

For gadgets that are lost, stolen or damaged in a trip

5 Star rated cover

Our Platinum Travel Insurance has Defaqto's highest rating

Unlimited gadgets

From your camera to your smart watch and more

What’s gadget insurance?

Gadget insurance, also known as gadget cover, is a travel insurance add-on which covers tech items like cameras or mobile phones. It pays for either repairing or replacing lost, stolen or damaged gadgets while you’re travelling. If you choose to add gadget insurance to your travel insurance, we’ll pay up to £1,500 for the gadgets that you need to claim on in a single trip.

Do I need gadget insurance?

Gadget insurance is useful for anyone travelling away with high-value gadgets like cameras, laptops or phones.

You should check whether you're already covered elsewhere:

- On your home or contents insurance - home insurance policies often cover gadgets away from home

- With your phone provider - your phone might still be under warranty, although this usually only applies to mechanical faults

What gadgets we cover

Digital cameras, smart phones, we also cover:.

- Audiovisual and television equipment

- Electronic book readers (Kindles)

- Telescopes and accessories

Check your policy book for the full list.

We'll cover these gadgets up to £1,500 if you bought them new; we can only cover refurbished gadgets from the manufacturer or a reputable retailer.

Guide to your Travel Insurance cover

What isn't covered, gadgets left in public places.

Including tents, cars, hotel storage rooms, or as checked-in baggage.

Wear and tear

We don't cover general wear and tear or gradual deterioration of performance. As the value of gadgets declines over time, we also don't pay out the full cost if the gadget is more than a year old.

Unattended gadgets

We don't cover gadgets you leave unattended unless locked in a safety deposit box where available, or stored safely and hidden from plain view in your locked accommodation.

Mechanical faults

This includes damage caused by the failure of electrical equipment, software, or any associated equipment.

Check your policy book for the list of exclusions.

How to add gadget cover to your policy

For new customers, you can add gadget cover as a policy upgrade when buying your travel insurance . If you’re an existing customer, you can add it to your policy through your travel portal .

How to claim on your gadget insurance

Below are the most common claims, but get in touch with us if you're unsure.

My phone's been stolen

If your phone has been stolen, you need to:

- report any theft to the police or your transport operator within 24 hours

- get a police or property irregularity report for the items stolen

- contact your network provider within 24 hours

- have receipts and any other supporting documents ready

- visit our make a claim page to register your claim with us

Remember to check your excess limits.

I've lost my gadget

Contact your accommodation or transport provider to report your gadget lost in case they locate it. When you're sure it's lost, you need to:

- have receipts, evidence of loss or any other supporting documents ready

My gadget's been damaged

If your gadget's been damaged, you need to:

- take pictures of the damage to your gadget with another device

- have receipts, proof of ownership or any other supporting documents ready

Your excess limits

Excess is the amount of money you pay to your insurance provider if you need to claim. This applies to each insured person for each type of claim you make. For gadget insurance, your excess limits are:

- £50 for Admiral policies

- £50 for Admiral Gold policies

- £50 for Admiral Platinum policies

Always check your policy schedule, as your excess limits might differ if you don't buy directly through us.

Still have questions?

We've answered a bunch of your frequently asked questions.

Useful travel guides

Are your personal possessions insured for travel?

Ultimate guide to hand luggage restrictions

Travel insurance jargon buster

Choose the pdf relevant to your policy start date....

Travel Advice: Important information about cover for Coronavirus. Read more . View the latest travel warnings here .

- Car Rental Excess

Gadget Pack

Phones equal life, right? Take out a little extra insurance to cover your digital BFFs against damage and theft. The gadget add-on is good for your devices devices including mobiles, laptops, GPS, cameras & other devices.

Extra cover for up 5 devices including mobiles, laptops, GPS & cameras.

If you select the Travel by Us Device add-on at the time of buying your policy, and you have paid the required additional premium, you will have cover for up to five devices.

If while you are on your trip during the period of insurance, your device is lost, stolen or damaged, we will at our discretion either:

- pay you the value of the device after allowing for depreciation

- or, arrange and pay for repairing or replacing the device with an item in the same condition.

Keep in mind

- Gadget means any computers (including laptops, notebooks and tablets), mobile phones, global positioning devices, personal music/recording/gaming devices, cameras and other electronic items of a similar nature as deemed by us, which are intended for personal use .

- Very specific and strict conditions apply. Not all rules and exclusions have been listed here. Please see the Combined Product Disclosure Statement and Financial Services Guide for full details.

Understand your cover

Conditions and exclusions apply to every cover level and optional pack. View our Combined Product Disclosure Statement and Financial Services Guide for full details. Sub-limits apply. Not sure? Our friendly team are here to help. Get in touch

- Travel Insurance

- Mobile Phone Insurance

- Gadget Insurance

- iPhone Insurance

- Google Pixel Phone Insurance

- Samsung Phone Insurance

- my loveit coverit

- How to Claim

- Policy Documents

- Policy Excesses

- Key Exclusions and Conditions

- Fraud Policy

- Phone Recycling

- Tablet Insurance

- Smart Watch Insurance

- Laptop Insurance

- Games Console Insurance

- Headphones Insurance

- Camera Insurance

- Annual Travel Insurance

- Couples Travel Insurance

- Cruise Travel Insurance

- Family Travel Insurance

- Group Travel Insurance

- Medical Travel Insurance

- Single Trip Travel Insurance

- Winter Sports Insurance

- Cover Levels

- Mobile Phone and Gadget Insurance

For medical emergency, medical expenses, repatriation and evacuation claims

In the event of an emergency, you should call us right away.

Please call the 24-hour emergency assistance number: +44 0203 0931749

- Google Pixel

- Samsung Phones

- Gadget News

- Travel News

- The Changing World

- loveit coverit News

- Please wait...

- iPhone insurance

- Apple watch insurance

- loveit coverit login

- Couples travel insurance

- iPhone 13 insurance

- Nintendo Switch insurance

- Airpods insurance

- Samsung insurance

- HP laptop insurance

- Ibiza travel insurance

Phone, Gadget and Travel Insurance

Award-winning insurance you can trust, with instant free quotes

Award-winning insurance you can trust, with instant free quotes Trustpilot

With thousands of reviews on Trustpilot, we’re proud of the consistently positive feedback we receive from our satisfied customers.

If we repair your phone we offer a 12 month warranty on those repairs.

Protect what matters most with the insurance brand that has served over 1 million customers.

Get the coverage you need from the insurance experts with over 30 years of experience.

Get the insurance coverage you want, with the flexibility of a 14-day money back guarantee.

Peace of mind, just a phone call away – our UK based customer service team is ready to help.

loveit coverit: created to protect the things you love

Welcome to loveit coverit, we believe that insurance should be simple, comprehensive, and delivered with a human touch. Our travel insurance, phone insurance , and gadget insurance are designed to offer simple processes, high-quality policies, and peace of mind, so you don't have to worry about a thing. Since being founded by the seaside in South-East Essex, we have sold over 1 million policies, offering an award-winning level of care that no one else comes close to. Our goal is to make sure our customers are not left in the lurch, with easy processes from getting a great quote to making a claim, we are here to assist and help you protect the things you love. As a modern brand with a forward-thinking mindset, our teams of tech and travel enthusiasts stay on top of the latest trends and technologies in the mobile phone and gadget world as well as the hottest (or coolest!) destinations around the globe. Join the loveit coverit family today and experience insurance that goes beyond just protection. With our affordable prices, you can enjoy the benefits of comprehensive mobile phone, gadget and travel insurance without breaking the bank. We are authorised by the Financial Conduct Authority, rated as Excellent on Trustpilot, and have won service awards 5 years running!

Changing World

- Privacy & Cookie Policy

- Affiliate Programme

- How to Make a Claim

- Considering Cancelling Your Policy?

- loveit coverit Ireland

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Gadget Cover

Gadget cover for travel

These days phones and other gadgets are essential on many travel packing lists. We provide limited cover under our standard policies. Our Gadget cover is a way to increase the amount we cover and includes additional gadgets and devices that you may take with you. Add it with ease with our optional gadget cover by paying a little extra.

Add up to £2,000 optional cover for gadgets like phones, tablets and smart watches

Once upon a time, going away involved passports, insurance papers, boarding passes and more. Now you can travel with just your passport and phone. But many of us take lots of other tech too.

Snapping photos on your phone? Reading on your tablet? Watching a film on your laptop? Keeping kids entertained on a console? Gadget cover can give you the added protection you need.

We cover a range of devices and gadgets

To make sure you’ve got the cover you need, we offer cover for a range of gadgets, including:

Mobiles, smartphones and tablets

Digital and video cameras

- Bluetooth headsets and speakers

Laptops and game consoles

Satnavs, smart watches and wrist-worn activity trackers

For the full list, please read the policy wording .

Ready to get a quote?

Let’s find the protection that’s right for your travels. Get a quote for Post Office Travel Insurance.

An award-winning provider

Best travel insurance provider.

Post Office won a ‘Best Travel Insurance Provider’ award at the Your Money Awards in 2021, 2022 and 2023

Post Office won a “Best Travel Insurance Provider” award at the British Travel Awards in 2023

Defaqto 5-star rated cover

Our travel insurance policies with premier level cover are Defaqto 5-star rated

Common gadget cover questions

What is the gadget cover option.

Our gadget cover is an optional extra for travel insurance. It provides protection for technology you take away on holiday. You can add it to your policy to provide cover for a long list of devices you might want to take with you.

Why add the post office gadget cover option to your policy?

Our standard travel insurance policies will only provide limited cover for electronic items such as mobile/smart phones, camcorders and their accessories, all photographic/ digital/ optical/ audio/ video media and equipment, iPods, MP3/4 players or similar and/or accessories, E-book readers, and satellite navigation systems up to the single article limit.

- Economy cover: £150

- Standard cover: £250

- Premier cover: £400

Our gadget cover option is a way to increase the cover provided on our standard policy for the above listed items, as well as providing cover for other devices or gadgets that you may take with you. Just pay an extra premium to add it to your policy. See below for what extra gadgets and devices can be covered.

Is this the same as Post Office Gadget Insurance?

No, gadget cover in this sense is an add-on for Post Office Travel Insurance policies only. It’s different from Post Office Gadget Insurance , which provides everyday protection for gadgets rather than on your travels.

What does the optional gadget cover provide?

Gadget cover offers protection for various devices including:

- Mobile phones and smart phones

- Laptops (including custom built)

- Digital cameras

- Games consoles

- Video cameras

- Camera lenses

- Satellite navigation devices

- Headphones and earphones

- Smart watches or wrist-worn health and fitness trackers

- All accessories for these items

What about items covered by my home insurance?

You'd only be covered for items on your home contents insurance if you chose out-of-home cover. Even then your cover might have a limit well below £2,000.

If you have home contents insurance, check whether it includes cover for gadgets you want to take on holiday. You may need supplementary cover.

- Read more travel insurance FAQs

Need some help?

Travel insurance help and support.

For emergency medical assistance, to make a claim, find answers to common questions about our cover or get in touch:

Visit our travel insurance support page

Travel insurance policy types

Single-trip cover.

- Cover for a one-off trip in the UK or abroad

- Perfect for one-off trips or longer holidays of up to 365 days (1)

- No age limit

Annual multi-trip cover

- Cover for multiple-trips for a 12-month period

- 31-day trip limit, with extensions available up to 45 and 60 days

- Available for everyone aged up to 75 years

Backpacker cover

- Cover for a one-off trip up to 18 months

- Option to return home for up to 7 days on 3 occasions.

- For people aged 18 – 60 wanting to travel the world for a gap year or career break

Related travel guides and services

We all know the feeling – getting to the airport, then a wave of panic comes ...

It's a proud feeling when children turn eighteen and start holidaying on their ...

If you're travelling abroad as a family, it makes sense to take out insurance ...

Fancy trekking in a remote Asian rainforest? A wild time in New York? Flying ...

Learn the difference between embassies and consulates, and why you might need ...

With festivals overseas becoming the new norm, festivalgoers need to do a bit ...

Perched on the northern tip of Africa, Morocco’s long been a popular ...

It may be a short hop away, but a trip to France is not without its travel ...

Canada is a vast country of diverse delights – everything from bustling cities ...

For many UK holidaymakers, India is an intriguing and diverse culture with ...

Thailand’s idyllic beaches, azure-blue sea, buzzing cities and exciting ...

The white stuff is alluring, so make sure you can enjoy it safely, are ready ...

The status of Schengen visas for international students resident in the UK is ...

Every year, millions of holidaymakers from the UK head to Spain for its ...

The famous cliché of America is that it's big. And it is. Across its six time ...

Heading down under for a trip to or around Australia? Make sure you’ve got the ...

Today, Cuba is more accessible than it has been for many decades, and those who ...

Do UK residents need travel insurance for Ireland? And what healthcare is ...

Planning on living the high life with a trip to the UAE’s iconic mega-city, ...

Booking a last-minute holiday can get the blood pumping with the sudden thrill ...

Find out about medical care available to Brits in Mexico, as well as travel ...

Find out about the safety of travelling to Italy as well as the medical care ...

Make sure you’re travelling safely in Egypt with the latest advice and risks, ...

For your first time on the slopes, preparation can help you get the most out of ...

Taking your best friend on holiday with you is everyone's ideal situation, but ...

If you’re jetting off to Japan soon make sure you have good travel insurance to ...

How safe is South Africa to visit and why is having travel insurance important ...

Find out what medical care Brits can access in New Zealand and travel risks to ...

There’s nothing worse than falling ill while away from home. Along with the ...

Travel’s a great way to unwind, see the world, open the mind and expand ...

People flock to the Canary Islands from all over Europe. No wonder, with such ...

Greece and the Greek islands have long been a popular travel destination for us ...

Dark mornings, cold hands, heating bills and chapped lips are among the most ...

A trip to Turkey offers toasty beaches and tourist treats aplenty. No wonder ...

Learn about the different types of travel insurance available from Post Office, ...

There’s no better feeling than planning an amazing trip to an exotic ...

It’s your holiday too, and good preparation can take some of the worry out of ...

The opportunities to combine business and leisure have never been greater. You ...

Ready to jet off on a much-needed break but worrying about what you can take ...

Having your son or daughter go on holiday without you for the first time can be ...

ATOL stands for Air Travel Organisers' Licensing, a scheme that helps make sure ...

The arrival of Airbnb has helped to transform the travel industry in recent ...

A ski packing list has the potential to run to many pages. With a bit of ...

Whether you’re travelling solo because of business, you’re hoping to meet ...

Travelling with high blood pressure is fine – but it’s important to make sure ...

The whole idea of lounging around on the beach is to switch off and enjoy the ...

Over 60 million people travel from the UK most years for holidays or business. ...

Enjoy that precious time away with your grandchildren, and take some of the ...

There are several ways to get to the top of the class on your flight – whether ...

If you're travelling to an EU country from the UK, make sure you take a Global ...

The last thing you want to happen on holiday is standing the luggage carousel ...

Lots of people who need assisted travel at airports are missing out simply ...

If you're living with cancer but love to travel, can you get travel insurance ...

Going backpacking is one of life’s great adventures. But before you set off ...

It’s one of the most popular holiday hotspots for UK holidaymakers. But what ...

You should be able to get the right cover to travel abroad if you’re diabetic, ...

Most of the time, getting a flight is a hassle-free event. If you only take ...

Exploring the globe can be scary, but there’s so much to find at the edge of ...

From airboarding to snow-tubing, here's our list of unusual winter sports ...

Finding out that your airline or holiday company has gone bust is a shock – ...

Holidays for teenagers can take some imagination to make sure they’ve got the ...

Do you need travel insurance for your trip? Is travel insurance worth it? And, ...

So, you’ve booked your flights, accommodation and activities. What next?

Satisfy your travel craving while making your holiday budget go further. We’ve ...

Whether you’re heading to the beach for a much-needed break or boarding a boat ...

Travel insurance for a holiday in the UK isn't something you must have, but it ...

If you're the type of sunchaser who looks forward to that sizzling summer ...

In an average year, millions of Britons go abroad without the right travel ...

Some vaccinations for Thailand are recommended and some are mandatory in ...

As you get older, being able to go where you want when you want is all part of ...

Adventurous holidays can take many forms, from action-packed itineraries in ...

With the winter sports season upon us, we conducted a Winter Sports Survey for ...

Travelling solo means freedom and independence, making new connections and ...

About our travel insurance

Post Office® Travel Insurance is arranged by Post Office Limited and Post Office Management Services Limited.

Post Office Limited is an appointed representative of Post Office Management Services Limited which is authorised and regulated by the Financial Conduct Authority, FRN 630318. Post Office Limited and Post Office Management Services Limited are registered in England and Wales. Registered numbers 2154540 and 08459718 respectively. Registered Office: 100 Wood Street, London, EC2V 7ER. Post Office and the Post Office logo are registered trademarks of Post Office Limited.

These details can be checked on the Financial Services Register by visiting the Financial Conduct Authority website and searching by Firm Reference Number (FRN).

(1) For economy, standard and premier policies, the single-trip policy will cover you for one trip up to:

365 days for persons aged up to and including age 70

90 days for persons aged between 71 and 75

31 days for persons aged between 76 and above

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Travel Gadgets

Even people who love traveling don't really love travel — the cramped seats, the long flights, the endless search for a place to charge your phone. Inventors are constantly coming up with ways to smooth and improve the travel experience. Some of these are worth trying, while others will just clutter your suitcase. We take a closer look at some new travel gadgets. Remember to protect all your possessions — and yourself — with travel insurance from Allianz Global Assistance

Share this Page

- {{errorMsgSendSocialEmail}}

{{articlePreview.snippet}} Read More

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Telephone Hours

Opening Hours

- Mon-Fri: 8:30am - 8pm

- Sat: 9am - 5:30pm

- Sun: 10am - 5pm

Bank Holiday Opening Hours:

- 6th May: 9am-5pm

- 27th May: 9am-5pm

- Mon-Fri: 9:00am - 8:00pm

- Sat: 9:00am - 5:30pm

- Sun: 10:00am - 5:00pm

Gadget Cover

Going on holiday and want to take your gadgets with you? AllClear can offer add on gadget cover - so that you can enjoy a well deserved holiday knowing your most valueable items are protected. For peace of mind, get a quote today!

Page contents

What is travel insurance with gadgets cover, what does gadget cover include, why do i need to cover my gadgets with travel insurance, what to consider when travelling with gadgets, why more than 3 million people have chosen allclear.

When travelling abroad we buy insurance to protect ourselves, but why not buy add on cover to protect our gadgets aswell? Gadget cover protects your most valuable items such as your camera, phone, tablet etc – giving you peace of mind wherever you go.

Will you want to take pictures when you’re on holiday? who doesn’t! Nowadays, most people use their smartphones to take pictures so nearly everyone will travel with at least one gadget when they go on holiday – and these will often be your most valuable items.

Getting cover for your phone, camera, tablet or laptop, eases the financial pressure of replacing them when you come home if they get damaged or lost on your travels.

You’ll need to make sure you’ve got the right policy so here’s what to look for in travel insurance including gadget cover.

Travel insurance with Gadget Cover insures you for the loss or theft of items such as your camera, mobile phone, tablets and laptops and is usually available as an optional add-on to your policy.

It’s important to remember that standard baggage insurance often does not include any of your gadgets and most standard policies offer levels of cover for single items that won’t be enough to repair or replace expensive gadgets.

With an AllClear policy, ‘Gadget Cover’ is available in the ‘Extras’ section of our quote process. We offer three levels of cover, giving you peace of mind that your valuables are insured around the world!

Gold – maximum 7 items up to £3,000

Silver – maximum 5 items up to £2,000

Bronze – maximum 3 items up to £1,000

Benefits of AllClear Cover

What’s included in Gadget Cover will vary by the provider, and some will offer different levels of insurance to help you tailor your policy.

Here’s a summary of what’s included on an AllClear policy:

Simple 3 step quote process

1. call us or click a quote button on our site, 2. complete our simple medical screening process, 3. get your quotes.

We did some research [1] and found that 6 out of 10 people value the gadgets they take on holiday at over £650. But 4 out of 5 people who had made a claim for lost or stolen gadgets while on holiday have had that claim rejected or only received partial payment. This is because they did not have specialist cover in place.

Gadgets are getting more expensive. They are already an essential part of our everyday lives. So, it’s highly likely that you’ll be taking one or more costly items with you when you travel. Protect your possessions with dedicated Gadget Cover, and have peace of mind.

If you’re travelling with gadgets, there are a few precautions you should take even if you’ve bought insurance. This will help to ensure everything runs smoothly on your trip and that you don’t invalidate your policy.

- Protect your devices – screen covers, cases and waterproof bags are usually cheap and worth buying as they help protect against cracked screens and water damage – which tend to be the most likely cause of damage

- Lock gadgets up – when you aren’t using your gadgets, leave them out of sight in your hotel room. Lock them in a safe if you have one available.

- Turn roaming off – roaming charges are costly, and most destinations have free wi-fi available.

- Back your data up – back-up your data on portable storage devices or in the cloud to ensure your vital pictures and documents are protected

- Take extra security measures – make sure your phone is locked with an access code or similar and if you are going to use public wi-fi networks, consider buying security software. You can also register your devices’ serial numbers on a site like Immobilise , which makes your gadgets easier to recover if lost or stolen.

We compare cover from up to 61 insurance providers, and 97% of customers rate us ‘Great’ or ‘Excellent.’

“ Very easy service .

My first breakaway after two years since my diagnosis for cardiomyopathy, found the service very easy to use. i’m fully covered while on holiday and also chosen to cover my gadgets. now just got to sit back relax and enjoy my break away”, kevin tyrrell – trustpilot, read allclear trustpilot reviews.

We hope you found this information on gadget insurance helpful and you enjoy your next holiday!

If you’d like to start a quote, click the quote now button below.

Written by: Russell Wallace | Travel Insurance Expert Last Updated: 7 June 2021

† Based on Trustpilot reviews of all companies in the Travel Insurance Company category that have over 70,000 reviews as of January 2024. AllClear Gold Plus achieved a Which? Best Buy.

Policy Wordings

Modern Slavery Statement

MaPS Travel Insurance Directory

Earn rewards by sharing with friends

Cards, Loans & Savings

Car & home insurance, pet insurance, travel insurance, travel money card, life insurance.

Travel insurance with gadget cover

Cover for your camera, laptop and phone when you're abroad

Underwritten by Great Lakes Insurance UK Limited

Gadget and mobile cover abroad

From mobile phones and tablets to smart watches and eBooks, high-tech gadgets are the go-to holiday essentials when you’re travelling abroad. And if they’re ever lost, stolen or damaged, you don’t want to have the added stress and cost of replacing them.

With Sainsbury’s Bank Travel Insurance , there’s no need to worry. Our single trip and annual travel insurance includes gadget cover as standard – so you can scroll till your heart’s content knowing we’ve got your back.

What’s covered

Our Silver, Gold and Platinum travel insurance policies include mobile phone and gadget cover for when you’re abroad.

That means we’ll pay the repair or replacement costs if your phone or gadget is lost, stolen or damaged abroad. As there are limits to the cover we may not pay the full amount out depending on the cost of the gadget.

If your phone’s stolen abroad, we’ll also refund the cost of unauthorised calls, messages and downloads made from it (unless your network provider already covers you for that). You can choose even more protection by adding our enhanced gadget cover for an extra cost.

We’ve outlined the different levels of cover below and what amounts you’re covered for.

Standard gadget cover

Optional enhanced gadget cover.

Terms, conditions, excesses, exclusions and limitations apply. You can find out more about the terms of our cover in our policy booklet .

Camera travel insurance

For many, your cameras are your babies, your pride and joy. You need to give them the protection they deserve. That’s why our cover includes your camera, video camera and your lenses. That leaves you free to enjoy taking the pictures of your life, without worrying about your expensive equipment.

Laptop travel insurance

We’ve got you covered for travel insurance that covers your laptop and camera, along with many other gadgets for when you’re abroad. So there’s no need to wait until you get home to edit your holiday snaps.

What gadgets are covered when you’re abroad?

When you’re abroad we’ll cover any of the gadgets listed below if they’re lost, damaged or stolen:

- Mobile phones

- Tablets and laptops

- Digital cameras, video cameras, camera lenses

- Earphones, headphones and bluetooth headsets

- Games consoles

- Satellite navigation devices

- Portable health monitoring devices (such as a blood glucose or blood pressure testing kit)

- Wearable technology such as smart watches or health and fitness trackers

You need to give us proof that you own the gadget when you submit a claim – for example the original receipt. If you bought it second-hand or got it as a gift, you’ll also need a signed letter from the original owner, along with the original purchase receipt confirming that it’s yours.

This letter should include:

- IMEI (International Mobile Equipment Identity) (where applicable)

- Serial number, make and model of your gadget

- The date the gadget was gifted to you (where applicable)

If certain parts of your gadget have been stolen or damaged, we’ll only repair or replace those specific parts.

Don’t see your gadget listed above? Get in touch to double check if it’s covered by your policy.

What’s not covered

You’ll find a full list of our conditions in our policy document. But to give you an idea, your phone or gadget won’t be covered if:

- The loss or theft isn’t reported to the police within 24 hours of discovering the incident, with an accompanying police crime reference number

- The damage happened before you went on your trip

- You can’t confirm when and where it was lost, stolen or damaged

- Your device was in the possession of a third party other than a relative

- Your device needs repaired as a result of misuse or wear and tear

- The damage is cosmetic only and has no effect on its functionality

Making a claim

You should first contact the appropriate local police authority within 24 hours of your gadget being lost or stolen.

If your mobile phone or other SIM-enabled device is lost or stolen, you’ll also need to report it to your network provider.

When it comes to making your claim, simply follow the instructions and provide any applicable supporting documentation, such as:

- Police crime reference number (if applicable)

- Proof that your phone’s identification number (IMEI) has been blacklisted (if applicable)

- Proof of reported theft or loss

- Proof of violent and forcible entry (if applicable)

- Proof of travel dates

Get gadget cover for your trip abroad

With cover for lost, stolen and damaged gadgets, we’ll have your back – wherever you are in the world.

Helpful travel guides

Get all the advice and information you need with our handy travel guides.

Dealing with disruption

See what you’re entitled to if your travel is delayed or cancelled

Keep your money safe

Practical tips to look after money, cards and valuable items abroad

Losing documents abroad

Find out what to do if your important documents go astray while you're away

Questions about travel insurance with gadget cover?

Gadgets, phones, cameras, laptops and any other devices that are valuable to you are important to us. If you need us, we’re here. Check out our most frequently asked questions about travel insurance . If you still need to talk to us, our friendly team will be happy to help.

Call 0345 305 2621 .

Sales and service lines are open 9am-5pm Monday to Friday. Closed weekend and Bank Holidays. Calls may be monitored or recorded. Calls are charged at local rates from landlines and mobiles.

Helpful phone numbers .

Terms and conditions

* Up to 20% discount applies when you tell us your Nectar card number. Discount does not apply to premiums for pre-existing medical conditions or enhanced gadget cover. You won't be eligible if you buy through a price comparison website. We reserve the right to change or cancel this offer without notice.

Sainsbury’s Bank Travel Insurance is underwritten by Great Lakes Insurance UK Limited. Great Lakes Insurance UK Limited is a company incorporated in England and Wales with company number 13436330 and whose registered office address is 10 Fenchurch Avenue, London, United Kingdom, EC3M 5BN. Great Lakes Insurance UK Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Firm Reference Number 955859. You can check this on the Financial Services Register by visiting; register.fca.org.uk.

Sainsbury’s Bank Travel Insurance is sold and administered by Hood Travel Limited, registered at Companies House 08318836. Hood Travel is authorised and regulated by the Financial Conduct Authority under registration number 597211. Hood Travel Limited’s registered address is at 52/54 Alexandra Street, Southend-on-Sea, Essex, SS1 1BJ. Hood Travel is an insurance intermediary providing a non-advised service. We act for and on behalf of the insurer.

Section 14 (Gadget Cover) is underwritten by Great Lakes Insurance UK Limited. The cover is arranged and claims administered by Taurus Insurance Services Limited (Taurus). Taurus is an insurance intermediary licensed and authorised in Gibraltar by the Financial Services Commission under Permission Number 5566 and authorised by the Financial Conduct Authority in the UK under registration number 444830. GLISE, UK Branch, is authorised by BaFin and subject to limited regulation by the FCA and PRA: registration number 769884.

Where do you live

All persons to be insured must reside at a permanent address within the EEC ( Excluding Switzerland, Russia, Belarus, Montenegro and the Ukraine) to be eligible for cover.

Can I take out this insurance if I am already travelling?

When cover is purchased after an Insured Person has departed their home to commence their journey, there is a fixed period of 48 hours prior to cover commencing. Any illness arising during this initial 48 hour period will be an excluded Pre-existing Medical Condition. In the event of serious injury in connection with an accident, you will be covered from the date you take out cover subject to the accident being independently witnessed and also verified by a Medical Practitioner.

There is no 14 Day Cooling off Period and no premium refund will be made if the insured Person has already travelled.

family family

Definition of a couple

A couple is defined as 2 adults who have been permanently living together at the same address for more than six months, who intend to travel together.

If you do not qualify as a couple, please select individual(s)

Annual Multi-Trip Durations

Annual Multi Trip policies are designed for multiple short holidays leaving from and returning to your home country.

Annual Multi Trip trip limits:

Standard policy - 30 days

Premier policy - 70 days

If you need continuous cover for a year (home visits allowed on policies over 4 months long) select Single Trip or One Way. You can travel around as much as you like, to as many different countries as you like, with a Single Trip or One Way policy.

One Way Trip

Please note a Single Trip policy can cover travels with no return ticket booked, a One Way policy is intended for:

Emigrating to new country where you intend to permanently live

Returning to your home country permanently

All cover ceases upon arrival at final destination

Select the type of policy most suitable for your needs.

Single Trip: A flexible policy with no limits on how many countries you visit or how long you’re away for. Suitable for all types of travel whether it be short term/long stay or backpacking. No return ticket required and unlimited home visits offered on policies over 4 months long.

One Way Trip: Means you are Emigrating to a new country where you intend to live permanently or, returning to your home country permanently. Cover will end upon arrival at your final destination. Please note: There is no cover for emergency return travel expenses if you do not have an original return ticket.

Annual Multi-Trip: This policy covers an unlimited number of trips throughout the 12 month Period of Insurance. Each trip has a maximum stay validity depending on the type of policy chosen. For example, for Standard Policies, the maximum duration of any trip shall not exceed 30 days and for Premier policies, the maximum duration of any trip must not exceed 70 days.

If you are already travelling it is not possible to purchase the annual multi-trip policy.

Geographical Areas

Europe: Europe means the continent of Europe West of the Ural Mountains, and includes the Isle of Man, the Channel Islands, Iceland, Jordan, Madeira, the Canary Islands, the Azores and Mediterranean Islands as well as all countries bordering the Mediterranean. Australia & New Zealand: a) For any period of cover purchased, a 48 hour stop-over anywhere in the World for both outward and return travel will be included. b) If the period of cover purchased is two months or more, a stop-over of 7 days/nights anywhere in the World will be included. Worldwide excluding North America & Mexico: (North America means the USA, Canada & Mexico.) a) For any period of cover purchased, a 48 hour stop-over anywhere in the World for both outward and return travel will be included. b) If the period of cover purchased is two months or more, a stop-over of 7 days/nights anywhere in the World will be included. Worldwide including North America & Mexico: Worldwide means anywhere in the World including the USA, Canada & Mexico.

Automatic Trip Extension If the Insured Person is prevented from completing their travel before the expiration of this Insurance as stated under the Period of Insurance on the Booking Invoice or Validation Certificate (as applicable) for reasons which are beyond their control, including ill health or failure of public transport, this Insurance will remain in force until completion but not exceeding a further 31 days on a day by day basis, without additional premium. In the event of an Insured Person being hijacked, cover shall continue whilst the Insured Person is subject to the control of the person(s) or their associates making the hijack during the Period of Insurance of a period not exceeding twelve months from the date of the hijack. Please ensure you arrange cover for the entire duration of your travel

Where you normally reside

Where do you normally reside? Where do you normally reside? Please use the drop down box to choose your country of residence. Note we can only insure residents of the UK & EEA Countries. Can I take out this Insurance if I’m already abroad? If you are normally a resident of the UK or EEA Countries and your insurance has run out, you may take out cover online with us. This is on the understanding that nothing has occurred at the time of taking out the cover which has led to a claim or may lead to a potential claim. Note you cannot take out our Multi-Trip Insurance if you are already abroad. Do you have minimum residency requirements? No. If you are, for example, a British Passport holder and have right of abode in the UK, we are not concerned as to how many months in the past year you have been in the UK provided at the time of arranging this insurance you have a UK residential address.

Age Restriction Error

We are unable to quote, Please ring our Offices on 0333 0033 161 for further assistance.

Get a Quote

Whatever you're doing, we've got you covered.

Single trip.

A Single Trip is ideal for most holidays, whether you're going on a business trip, a Gap Year, or Backpacking around the world. You can travel to as many different countries as you like. You can tailor it too, so you can add cover for things like Trekking, Sky diving and WWOOFing.

Already Travelling

It’s not uncommon for people to head off on their travels without taking out insurance, or to find out once they are already overseas that their travel insurance has run out. But, we can still provide you with cover, or we can extend your existing insurance to cover the rest of your travels

An Annual Multi Trip policy is designed for Multiple short holidays or business trips, up to 30 or 70 days at a time, throughout the year. You can tailor it, too. It’s possible to add cover for Adventurous activities, Winter Sports, or bring the excess down to £0.

a One Way policy can cover emigrating to new country where you intend to permanently live or returning to your home country permanently.

Please note all cover ceases upon arrival at final destination

Backpackers

A Backpackers policy is designed for long trips for Gap year travellers, students, and people of all ages up to 69 embarking on an extended trip abroad. You can choose to include cover for things like Gadgets & Valuables and Cancellation, on our great value policies.

Winter Sports

Big Cat’s Winter Sports Extension provides great-value cover for those wishing to make the most of the snow. As well as standard skiing and snowboarding, you’ll be covered for cat skiing, snow skiing, cross-country skiing, off-piste skiing / snowboarding, and snowmobiling.

What makes us special?

Great value.

Big Cat is big on value. Our three levels of price-busting cover is sure to match your budget and the insurances you require.

Activity Specialists

Adventure is something we love at Big Cat. That’s why we specialise in providing cover for an extensive range of adventure activities fit for thrill-seekers.

Extend Cover while abroad

If you realise you’re not quite ready to return home, you can extend your insurance to include the remainder of your trip. Even if you don’t have a Policy with us.

24/7 Emergency Response

We’ll be there for you when it matters. Our Medical Emergency Assistance is just a phone call away, 24 hours a day, 7 days a week.

Baggage & Personal Effects

Cover for, luggage, clothing, personal effects, personal money, tickets or documents of any kind is included up to the value of £2,000

Gadgets & Valuables

Protect your gadgets (mobile phones, iPods, iPod touch and/or accessories, ), sports equipment & other valuables such as watches and jewellery up to £1,000.

Big Cat Travel Insurance Services, a trading name of Flynow.com Ltd (registration No.FRN 745388) is an Appointed Representative of Campbell Irvine Ltd (registration No.306242) who are authorised and regulated by the Financial Conduct Authority. You may check this on the Financial Services register www.fca.org.uk or by contacting them on (0) 800 111 6768. © 2023 Big Cat Travel Insurance Services. All rights reserved.

A fantastic plugin that allows you to display age restriction message to the visitors while visiting site

List of automatically covered medical conditions that do not need to be declared

Acne, ADHD, Allergic reaction (Anaphylaxis) provided that you have not needed hospital treatment for this in the last 2 years, Allergic rhinitis, Arthritis (the affected person must be able to walk independently at home without using mobility aids), Asthma (the diagnosis must have been made when the affected person was under the age of 50, and the asthma be controlled by no more than 2 inhalers and no other medication), Blindness or partial sightedness, Carpal tunnel syndrome, Cataracts, Chicken pox - if completely resolved, Common cold or flu, Cuts and abrasions that are not self-inflicted and require no further treatment, Cystitis - provided there is no on-going treatment, Deafness, Diabetes (which is controlled by diet or tablets only), Diarrhoea and vomiting - if completely resolved, Eczema, Enlarged prostate - benign only, Essential tremor, Glaucoma, Gout, Haemorrhoids, Hay fever, Ligament or tendon injury - provided you are not currently being treated, Macular degeneration, Menopause, Migraine - provided there are no on-going investigations, Nasal polyps, PMT, RSI, Sinusitis - provided there is no on-going treatment, Skin or wound infections that have completely resolved with no current treatment, Tinnitus, Underactive Thyroid (Hypothyroidism), Urticaria, Varicose veins in the legs.

Important information

If you have a medical condition in addition to any of the automatically covered medical conditions, all conditions will be excluded from cover unless declared to the medical screening helpline.

What is classed as a medical condition?

a Any respiratory condition (relating to the lungs or breathing), heart condition, stroke, Crohn’s disease, epilepsy, allergy, or cancer for which you have ever received treatment (including surgery, tests or investigations by your doctor or a consultant/ specialist or prescribed medication).

b Any psychiatric or psychological condition (including anxiety, stress and depression) for which you have suffered which you have received medical advice or treatment or been prescribed medication for in the last five years.

c Any medical condition for which you have received surgery, in-patient treatment or investigations in a hospital or clinic within the last 12 months, or for which you are prescribed medication.

Any premium for medical screening quoted can be paid directly. This can be done either before or after taking out a policy with us. The policy and medical extension connect automatically, no reference numbers need to be exchanged.

Choosing not to declare a medical condition will not invalidate cover, but any costs incurred in relation to an undeclared condition will not be covered.

If making a declaration all medical conditions must be declared, you can't choose to only declare certain conditions.

Medical conditions can only be declared for up to 12 months at a time. A second declaration will have to be made after 12 months if necessary.

You are about to leave the site, this text will be refined later.

Introduction to VisitorsCoverage Travel Insurance

- Types of Policies Offered

- VisitorsCoverage Cost

- Customer Service and Support

How to File a Claim with VisitorsCoverage Travel Insurance

- Why You Should Trust Us

VisitorsCoverage Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

The process of buying travel insurance can be tedious and stressful as you scour the internet for the best travel insurance companies . VisitorsCoverage exists to simplify the process by showing you all the options available for your particular travel details.

Since 2006, VisitorsCoverage has helped more than 1 million travelers check peace of mind off of their packing list, no matter the destination. It partners with popular travel insurance companies as a broker, so it can quote policies and manage payments on its website.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Diverse travel insurance plans for solo and group travelers

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers medical insurance for US visa holders for up to two years

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers plans designed for missionaries and international volunteers

- con icon Two crossed lines that form an 'X'. VisitorsCoverage does not underwrite or service travel insurance plans

- con icon Two crossed lines that form an 'X'. Claims experiences may vary widely based on which carrier you buy your plan from

VisitorsCoverage is a travel insurance marketplace that allows you to sort through the best travel insurance policies for your travel details and compare policies against one another. The information it provides on each policy is thorough and straightforward, so you don't have to wade through dense legalese to understand your policy. You can purchase travel insurance directly on VisitorsCoverage's website as well as manage your policy and adjust your coverage.

You'll have to file claims directly with your insurer, but VisitorsCoverage has a Claims Assistance Hub that will contact your insurer on your behalf to expedite the process and provide updates. The Assistance Hub is a great asset given that claims offices are infamously inaccessible and uncommunicative.

While VisitorsCoverage excels as a platform for travel insurance, VisitorsCoverage doesn't field customer reviews of insurance products, which you can find with some of its competitors like Squaremouth and InsureMyTrip. This isn't a major exclusion, but it means you have to conduct additional research for that information, which isn't ideal for a service that exists primarily to simplify the buying process.

Types of Policies Offered by VisitorsCoverage

VisitorsCoverage partners with many travel insurance providers to offer comprehensive coverage options. If you're looking for cancellation protection, baggage protection, and other standard coverages, it can provide many options based on your residence, destination, and costs.

It also works with carriers specific to Europe and Schengen visas. Europe-bound travelers also enjoy medical evacuation and repatriation protections. The descriptions are straightforward, and the site offers options to search for doctors, manage your plan, and more on its website,

If traveling with family, friends, or coworkers, its website may prompt you to consider group travel insurance. Coverage protects up to five travelers with health coverage in the event of an accident or illness at a reduced rate of up to 20% compared to identical coverage for five individual travelers. If you're traveling for business, you may also want to consider its business coverage, which covers lost luggage, trip interruption, and terrorism, along with emergency medical care (including emergency medical evacuation).

One thing this travel website brings to the table is variety. As an online broker, customers can get multiple quotes at once. However, its partnerships allow it to expand the most common understanding of what travel insurance covers , catering to less common travel scenarios such as non-US residents (including Americans working full-time abroad) traveling to the U.S., missionaries, and visa applicants.

Additional Coverage Options (Riders)

VisitorsCoverage has filters that can tailor your insurance search based on your needs. You'll find specific search functions for the following types of travel insurance :

- AD&D insurance coverage: This provides a lump sum benefit to the insured's beneficiary in the event of accidental death. The insured can also collect a benefit after an accidental dismemberment (losing a limb).

- Pre-existing condition insurance: This plan is designed for travelers with diagnosed conditions (existing before applying for travel medical insurance) who want to see the world without fear of what to do should a medical emergency arise. Coverage includes emergency services like hospitalization, surgery, and even medical evacuation.

- Cruise insurance: This short-term trip insurance protects cruisers from losses related to delays, cancellations, illnesses, injuries, etc., while at sea.

- Immigrant/Green Card insurance: This type of plan offers short-term coverage (up to two years) for individuals needing medical insurance coverage while visiting the United States. It's ideal for visa applicants who ideally obtain long-term healthcare through their employer once their work visa is approved.

- Student visa insurance: Students spending a semester away from their home country or attending university in a foreign country often require travel insurance that meets certain standards.

VisitorsCoverage Travel Insurance Cost

The average cost of travel insurance is around 4-8% of trip costs. Travel insurance premiums of $100-$200 per trip are standard, especially when traveling internationally. A cancel for any reason rider raises travel insurance premiums by about 50% with most travel insurance companies. However, many travelers enjoy the peace of mind of eliminating denials for excluded causes.

Individual policy premiums are based on benefits offered plus criteria unique to each traveler, including age, health status, and the length of the trip. Because VisitorsCoverage partners with many popular travel insurance providers, shoppers can compare the cheapest options with more substantial coverage and decide which plan works best for them.

VisitorsCoverage Customer Service and Support

VisitorsCoverage has very good online customer reviews, receiving an average of 4.8 out of five stars on its Trustpilot page and 4.6 stars from Google Maps reviews left on its company headquarters located in Santa Clara, California. Negative reviews often pertain to customer experiences with unresolved claims, which isn't necessarily a reflection on VisitorsCoverage, but the actual insurance provider.

It's worth noting that VisitorsCoverage's customer support team is extremely responsive to customer reviews, usually responding within one or two business days to Trustpilot and Google Maps reviews.

VisitorsCoverage is not your travel insurance company but a liaison between you and different travel insurance providers. As such, it's no surprise that it does not handle your claims. However, it can assist you in navigating your claims and will attempt to reach out to your insurance provider if the process is delayed.

If you input your policy number on its website, the company can identify which travel insurance company you purchased your plan from. Then it will direct you to the right website or offer the address and correct claims forms. If you don't have your policy number, its website lists the different insurers it partners with and basic claims information. If you need to file claims, the most its customer service agents can do is direct you to the right company and plan administrator.

Remember to file your claim as soon as possible, especially when seeking reimbursement for covered medical expenses. In addition to the claim form, be prepared to provide the plan administrator with copies of your passport plus any medical bills/receipts.

VisitorsCoverage Frequently Asked Questions

You can contact VisitorsCoverage by calling 1-866-384-9104 or email us at [email protected]. Business hours are from 7: a.m. - 5:00 p.m. PT, Monday to Friday. You can also chat with an agent through VisitorsCoverage's website chat function.

Yes, VisitorsCoverage has a specific search function for international trips as well as international travelers visiting the U.S.

VisitorsCoverage allows you to filter your search to only include policies that cover pre-existing medical conditions.

VisitorsCoverage doesn't have its own claims filing process, but has tools to make your filing process with your insurance provider more user-friendly. It will also contact unresponsive claims offices on your behalf.

You can filter your insurance search based on companies that offer adventure activities. You'll need to conduct your own independent research to see if your particular sport is covered under a particular policy.

Why You Should Trust Us: What Went into Our VisitorsCoverage Travel Insurance Review

When writing this review, we researched and compared popular travel insurance companies based on myriad factors, including policies offered, add-ons, cost, convenience, claims process, and customer satisfaction. Information on numerous travel insurance products is used in the process, and opinions expressed are based solely on facts gleaned.

Neither marketing tactics nor standalone online reviews were used in compiling these ratings. As most customer reviews come from individuals who have yet to file a claim, an emphasis is placed on plans offered instead of services rendered. VisitorsCoverage is unusual because it's not the travel insurance company, but we reviewed it based on the support provided, its partners' coverage, etc.

You can learn more about how Business Insider rates insurance products here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Travel Insurance and Rental Cars: What’s Covered?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If you’re planning on renting a car while traveling, you’ll want to make sure that you’re covered with insurance. Most rental car companies offer some coverage at an extra cost, but these options tend to be expensive. But affordable rental car insurance is out there — it just takes some effort to coordinate.

Many general travel insurance policies offer rental car coverage either as part of their standard plans or as an add-on. Plus, you may have a credit card with rental car insurance already included .

Here's a look at how car rental travel insurance works, what it covers and other options for making sure you’re insured while on the road in a rented car.

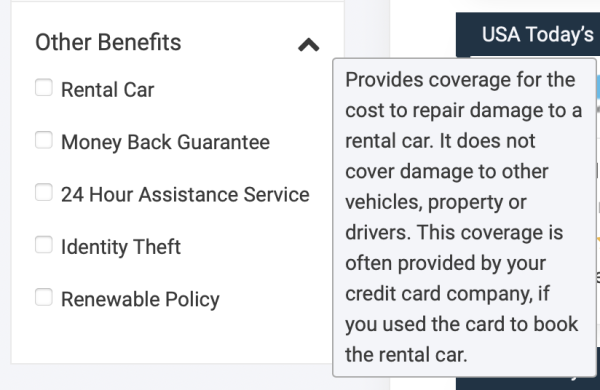

Does travel insurance cover car rentals?

Yes, many travel insurance policies include some form of rental car coverage. If it’s not already included in your plan, there may be an option to customize coverage by adding rental car insurance.

Costs vary depending on the overall plan, the coverage limit of the rental car insurance and whether the insurance is primary or secondary.

Primary rental car coverage is the first entity to pay out; "secondary" means the insurance will only cover costs not already paid for by other policies. This is also known as car rental excess insurance, meaning that rental car excess insurance kicks in only after other coverage is exhausted.

If you own a car and have an insurance policy, check if you already have rental car coverage. In the U.S., personal car insurance tends to cover rentals.

» Learn more: Rental car insurance explained

Travel insurance on a rental car

When considering a specific travel insurance policy, comb through its plan documents to see what type of car rental coverage is included.

In general, rental car insurance provided by a travel insurance policy is limited. Unlike a personal car insurance policy or rental car insurance from a credit card, the plan likely won’t cover liability or medical expenses incurred in an accident.

» Learn more: How your credit card has you covered with rental car insurance

Travel insurance policies often offer a collision damage waiver (CDW), which means that the damage your vehicle sustains in an accident will be reimbursed. CDWs may also include coverage for theft.

Some policies exclude specialty vehicles from coverage, while others won’t insure you for cars rented in certain countries.

Of course, it’s also possible to opt for the insurance offered by the rental car company, which can be a hassle-free way to ensure that you don’t end up on the hook in case of an accident.

» Learn more: How to find the best travel insurance

Finding travel insurance with rental car coverage

To find a policy with rental car insurance, head to a travel insurance provider comparison sites like TravelInsurance.com or Squaremouth.

Here's a search on Squaremouth as an example.

First, input your travel information, including when you’re departing, where you’re going, age and state of residence.

Then, the search engine will create a list of all available policies, which can be filtered to those that include rental car insurance.

Note that the terms of each policy can differ, especially how much coverage you’ll receive for a rental car.

» Learn more: Declining rental car insurance abroad? Know the risks

Credit cards that offer travel insurance with rental car coverage

To get rental car insurance while traveling, you may first want to check your credit cards. Many credit cards offer complimentary rental car insurance for bookings charged to that card.

You’ll find this benefit on a variety of cards, including travel credit cards and cash back credit cards. Here are some options:

on Chase's website

on Bilt's website

Primary rental car coverage with reimbursement up to $75,000.

Primary auto damage collision damage waiver. New York residents are eligible only for secondary coverage.

Primary rental car coverage up to the cash value of most rental vehicles.

Primary coverage when renting for business purposes with reimbursement up to the actual cash value of most rental vehicles.

Travel insurance and rental cars recapped

It makes sense to look for a travel insurance policy that also covers a rental car, especially if you’re driving somewhere unfamiliar.

While it’s possible to purchase the insurance plans offered by the rental car company, these tend to be overpriced and overkill for many drivers. Instead, you could consider a travel insurance plan with included rental car coverage, which means you won't have to without needing to make an additional purchase.

Also, check out any personal auto insurance policy you already have to see if it has provisions for rental cars. And before you settle on buying a travel insurance policy, double-check if a credit card you already have offers complimentary rental car insurance.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Six Travel Mistakes to Avoid

No travel medical insurance? Unnecessary luggage and hotel fees? Here are the biggest travel mistakes people make and how you can avoid them.

- Newsletter sign up Newsletter

Even the most seasoned tourists can make travel mistakes when planning a vacation. Some blunders can be minor infractions, but others can cost travelers a lot of money and heartache.

But there are steps you can take to avoid travel mistakes. Here are six slip ups that travelers may make this year, plus tips on how to avoid them.

1. Overlooking travel medical insurance

Christopher Elliott , a consumer advocate and founder of the nonprofit Elliott Advocacy , says many people don’t consider purchasing travel medical insurance . “People often think nothing bad will happen before or on their vacation, but then they get injured overseas and need to go to the hospital, and the next thing they’re looking at is a $10,000 hospital bill.” Indeed, nearly one in four Americans report they’ve experienced a medical issue while traveling abroad, according to a 2023 survey sponsored by GeoBlue, an international health insurance company.

Subscribe to Kiplinger’s Personal Finance

Be a smarter, better informed investor.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.