- Travel, Tourism & Hospitality ›

- Leisure Travel

Online travel market - statistics & facts

How big is the online travel market, what are the leading online travel agencies (otas), what travel products do consumers book online, key insights.

Detailed statistics

Online travel market size worldwide 2017-2028

Distribution of sales channels in the travel and tourism market worldwide 2018-2028

Most popular travel and tourism websites worldwide 2024

Editor’s Picks Current statistics on this topic

Online Travel Market

Market cap of leading online travel companies worldwide 2023

Further recommended statistics

Industry overview.

- Premium Statistic Market size of the tourism sector worldwide 2011-2024

- Premium Statistic Travel and tourism revenue worldwide 2019-2028, by segment

- Premium Statistic Distribution of sales channels in the travel and tourism market worldwide 2018-2028

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Revenue of the travel apps industry worldwide 2017-2027

- Premium Statistic Estimated EV/Revenue ratio in the online travel market 2024, by segment

- Premium Statistic Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Market size of the tourism sector worldwide 2011-2024

Market size of the tourism sector worldwide from 2011 to 2023, with a forecast for 2024 (in trillion U.S. dollars)

Travel and tourism revenue worldwide 2019-2028, by segment

Revenue of the global travel and tourism market from 2019 to 2028, by segment (in billion U.S. dollars)

Revenue share of sales channels of the travel and tourism market worldwide from 2018 to 2028

Online travel market size worldwide from 2017 to 2023, with a forecast until 2028 (in billion U.S. dollars)

Revenue of the travel apps industry worldwide 2017-2027

Revenue of the travel apps market worldwide from 2017 to 2027 (in billion U.S. dollars)

Estimated EV/Revenue ratio in the online travel market 2024, by segment

Estimated enterprise value to revenue (EV/Revenue) ratio in the online travel market worldwide as of April 2024, by segment

Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Estimated enterprise value to EBITDA (EV/EBITDA) ratio in the online travel market worldwide as of April 2024, by segment

Online bookings

- Premium Statistic Travel product online bookings in the U.S. 2024

- Premium Statistic Travel product online bookings in Canada 2024

- Premium Statistic Travel product online bookings in the UK 2024

- Premium Statistic Travel product online bookings in China 2024

- Premium Statistic Travel product online bookings in India 2024

- Premium Statistic Importance to book a trip fully online among travelers worldwide 2023, by generation

Travel product online bookings in the U.S. 2024

Travel product online bookings in the U.S. as of March 2024

Travel product online bookings in Canada 2024

Travel product online bookings in Canada as of March 2024

Travel product online bookings in the UK 2024

Travel product online bookings in the UK as of March 2024

Travel product online bookings in China 2024

Travel product online bookings in China as of March 2024

Travel product online bookings in India 2024

Travel product online bookings in India as of March 2024

Importance to book a trip fully online among travelers worldwide 2023, by generation

Share of travelers who think it is important to be able to book their trip entirely online worldwide as of July 2023, by generation

Market leaders

- Premium Statistic Revenue of leading OTAs worldwide 2019-2023

- Premium Statistic Marketing expenses of leading OTAs worldwide 2019-2023

- Premium Statistic Marketing/revenue ratio of leading OTAs worldwide 2019-2023

- Premium Statistic Number of employees at leading travel companies worldwide 2022

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Premium Statistic Most popular travel and tourism websites worldwide 2024

Revenue of leading OTAs worldwide 2019-2023

Leading online travel agencies (OTAs) worldwide from 2019 to 2023, by revenue (in million U.S. dollars)

Marketing expenses of leading OTAs worldwide 2019-2023

Marketing expenses of leading online travel agencies (OTAs) worldwide from 2019 to 2023 (in million U.S. dollars)

Marketing/revenue ratio of leading OTAs worldwide 2019-2023

Marketing to revenue ratio of leading online travel agencies (OTAs) worldwide from 2019 to 2023

Number of employees at leading travel companies worldwide 2022

Number of employees at selected leading travel companies worldwide in 2022

Market cap of leading online travel companies worldwide as of September 2023 (in million U.S. dollars)

Number of aggregated downloads of leading online travel agency apps worldwide 2023

Number of aggregated downloads of selected leading online travel agency apps worldwide in 2023 (in millions)

Most visited travel and tourism websites worldwide as of April 2024 (in million visits)

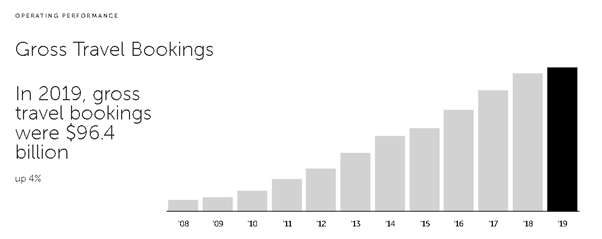

Booking Holdings

- Basic Statistic Revenue of Booking Holdings worldwide 2007-2023

- Premium Statistic Number of bookings through Booking Holdings worldwide 2010-2023, by segment

- Premium Statistic Operating income of Booking Holdings worldwide 2007-2023

- Premium Statistic Net income of Booking Holdings worldwide 2007-2023

Revenue of Booking Holdings worldwide 2007-2023

Revenue of Booking Holdings worldwide from 2007 to 2023 (in billion U.S. dollars)

Number of bookings through Booking Holdings worldwide 2010-2023, by segment

Number of bookings through Booking Holdings worldwide from 2010 to 2023, by business segment (in millions)

Operating income of Booking Holdings worldwide 2007-2023

Operating income of Booking Holdings worldwide from 2007 to 2023 (in billion U.S. dollars)

Net income of Booking Holdings worldwide 2007-2023

Net income of Booking Holdings worldwide from 2007 to 2023 (in billion U.S. dollars)

Expedia Group

- Premium Statistic Revenue of Expedia Group, Inc. worldwide 2007-2023

- Premium Statistic Revenue of Expedia Group, Inc. worldwide 2017-2023, by business model

- Premium Statistic Operating income of Expedia Group, Inc. worldwide 2007-2023

- Premium Statistic Net income of Expedia Group, Inc. worldwide 2007-2023

Revenue of Expedia Group, Inc. worldwide 2007-2023

Revenue of Expedia Group, Inc. worldwide from 2007 to 2023 (in billion U.S. dollars)

Revenue of Expedia Group, Inc. worldwide 2017-2023, by business model

Revenue of Expedia Group, Inc. worldwide from 2017 to 2023, by business model (in million U.S. dollars)

Operating income of Expedia Group, Inc. worldwide 2007-2023

Operating income of Expedia Group, Inc. worldwide from 2007 to 2023 (in million U.S. dollars)

Net income of Expedia Group, Inc. worldwide 2007-2023

Net income of Expedia Group, Inc. worldwide from 2007 to 2023 (in million U.S. dollars)

- Premium Statistic Airbnb revenue worldwide 2017-2023

- Premium Statistic Airbnb revenue worldwide 2019-2023, by region

- Premium Statistic Airbnb operations income worldwide 2017-2023

- Premium Statistic Airbnb net income worldwide 2017-2023

Airbnb revenue worldwide 2017-2023

Revenue of Airbnb worldwide from 2017 to 2023 (in billion U.S. dollars)

Airbnb revenue worldwide 2019-2023, by region

Revenue of Airbnb worldwide from 2019 to 2023, by region (in billion U.S. dollars)

Airbnb operations income worldwide 2017-2023

Income from operations of Airbnb worldwide from 2017 to 2023 (in million U.S. dollars)

Airbnb net income worldwide 2017-2023

Net income of Airbnb worldwide from 2017 to 2023 (in million U.S. dollars)

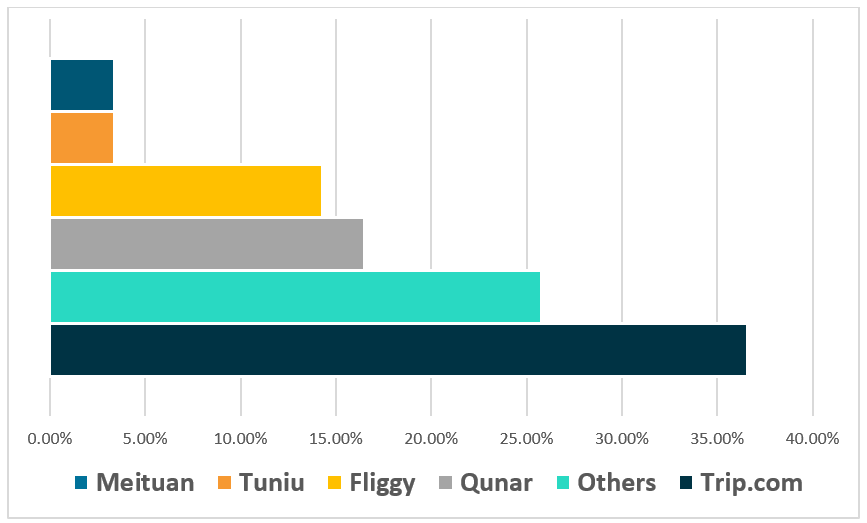

Trip.com Group

- Premium Statistic Total revenue of Trip.com Group 2013-2023

- Premium Statistic Revenue of Trip.com 2013-2023, by product

- Premium Statistic Revenue of Trip.com 2017-2023, by region

- Premium Statistic Net income of Trip.com 2013-2023

Total revenue of Trip.com Group 2013-2023

Total revenue of Trip.com Group Ltd. in China from 2013 to 2023 (in billion yuan)

Revenue of Trip.com 2013-2023, by product

Revenue of Trip.com Group Ltd. from 2013 to 2023, by product (in million yuan)

Revenue of Trip.com 2017-2023, by region

Revenue of Trip.com Group Ltd. from 2017 to 2023, by region (in million yuan)

Net income of Trip.com 2013-2023

Net profit of Trip.com Group Ltd. from 2013 to 2023 (in million yuan)

Tripadvisor

- Premium Statistic Revenue of Tripadvisor worldwide 2008-2023

- Premium Statistic Revenue of Tripadvisor worldwide 2017-2023, by business segment

- Premium Statistic Revenue of Tripadvisor worldwide 2012-2023, by region

- Premium Statistic Operating income of Tripadvisor worldwide 2008-2023

- Premium Statistic Net income of Tripadvisor worldwide 2008-2023

Revenue of Tripadvisor worldwide 2008-2023

Revenue of Tripadvisor, Inc. worldwide from 2008 to 2023 (in million U.S. dollars)

Revenue of Tripadvisor worldwide 2017-2023, by business segment

Revenue of Tripadvisor, Inc. worldwide from 2017 to 2023, by business segment (in million U.S. dollars)

Revenue of Tripadvisor worldwide 2012-2023, by region

Revenue of Tripadvisor, Inc. worldwide from 2012 to 2023, by region (in million U.S. dollars)

Operating income of Tripadvisor worldwide 2008-2023

Operating income of Tripadvisor, Inc. worldwide from 2008 to 2023 (in million U.S. dollars)

Net income of Tripadvisor worldwide 2008-2023

Net income of Tripadvisor, Inc. worldwide from 2008 to 2023 (in million U.S. dollars)

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Report Store

- AMR in News

- Press Releases

- Request for Consulting

- Our Clients

Online Travel Market Size, Share, Competitive Landscape and Trend Analysis Report by Service types, Platforms, Mode of Booking ,and Age Group : Global Opportunity Analysis and Industry Forecast, 2022-2031

CG : Travel & Luxury Travel

✷ Report Code: A01415

Tables: 196

Get Sample to Email

Thank You For Your Response !

Our Executive will get back to you soon

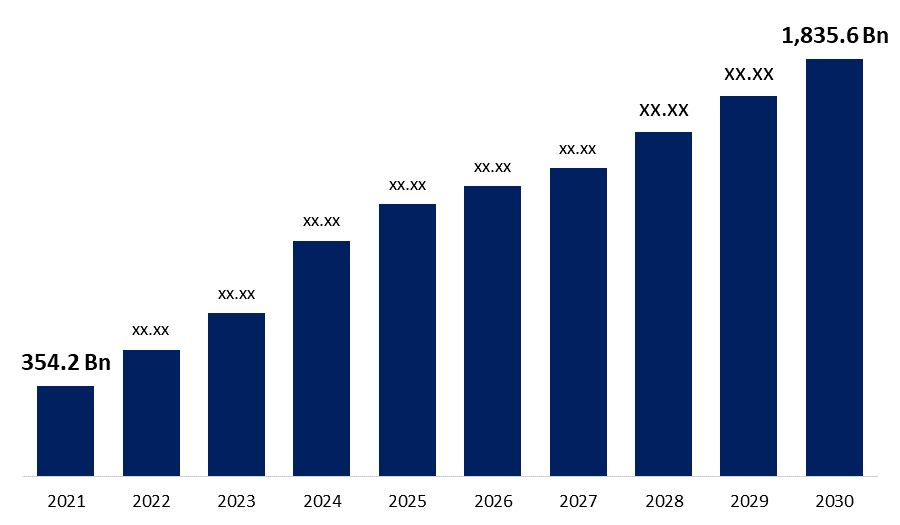

The global online travel market size was valued at $354.2 billion in 2020, and is estimated to reach $1,835.6 billion by 2031, registering a CAGR of 14.8% from 2022 to 2031.

Online travel providers aim to ease travel planning and bookings for travelers. The online travel industry is being pushed by quick and easy flight and hotel bookings, an increase in customer trust in online payment, and the option to compare numerous available travel alternatives.. Market players are extensively offering travel services through mobile websites and apps, as it is one of the most preferred mediums of travel bookings, particularly among the young professionals.

The emergence of internet has led to intense exposure of people to social media sites. People first browse through websites, gather detailed information, and review the required product or service before making a purchase. In addition, social media such as Facebook, Twitter, and travel blogs have become a common medium for people to discuss travel plans. Social media acts as a platform for online travel service providers to advertise their services and special offers for online bookings garnering the online travel market growth during the forecast period.

Transportation segment helds the major share of 41.2% in 2020

Social and political disturbances affect the travel & tourism industry in specific regions. Customers tend to avoid these conflict prone areas even if they get travel services at affordable prices. Government of several nations have also declared instructions for travelers to refrain from traveling to countries affected with epidemics or social/political unrest. This, limits the scope of online travel booking to those countries thereby affecting the sales of the online travel market.

The online travel market segmented into service type, platforms, mode of booking, age group, and region. On the basis of service type, the market is categorized into transportation, travel accommodation, and vacation packages. By platform, it is segmented into mobile and desktop. On the basis of mode of booking, it is segmented into online travel agencies (OTAs) and direct travel suppliers. On the basis of age group, market is segmented into ¬22-31 years¬ 32-43 years¬ 44-56 years¬ and >56 years. Region-wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, UAE, Saudi Arabia, South Africa, and rest of LAMEA).

Desktop segment helds the major share of 69.3% in 2020

According to the online travel market trends, on the basis of service types, the travel accommodation segment was the considerable contributor to the market, with $123.7 billion in 2020, and is estimated to reach $719.5 billion by 2031, at a CAGR of 16.0% during the forecast period. Travelers are increasingly being offered a diverse range of hotel options at reasonable costs by market players.. Customers compare accommodation options at several websites to get the best affordable deal. Travelers choose specialized online accommodation providers such as Airbnb, Inc. and OYO Rooms because they provide a wide range of lodging alternatives.. Thus, above mentioned factors are attributable for the growth of the market through travel accommodation segment.

According to the platforms, the mobile segment was the significant contributor to the market, and is estimated to reach $617.9 billion by 2031, at a CAGR of 15.8% during the forecast period. Increase in usage of mobile and innovative mobile travel apps majorly attribute for the growth of the market through mobile segment. Technology has changed the way people communicate and travel across the globe. With evolving technology and increase in use of mobiles, easy and efficient methods are being developed to make traveling easy and comfortable, thus increasing the growth of travel industry. Mobile travel apps are gradually gaining pace in the market and are preferred by travelers to make their travel arrangements. Thus, increase in usage of the smart phones and growth in digital literacy is likely to proliferate the growth of the online travel market.

Direct Travel Suppliers segment helds the major share of 55.7% in 2020

On the basis of mode of booking, the direct travel suppliers segment was accounted for major share in global online travel market and is expected to sustain its share throughout the forecast period. Direct travel suppliers are the major revenue contributors in the product market. However, this segment witnesses an increase in threat from the growing online travel agencies (OTAs) market share. To remain competitive, airlines such as Lufthansa AG choose to circumvent OTAs by charging additional fees for bookings made through the OTAs.. The online travel industry through direct travel suppliers is developing at a slower rate, because customers are constantly using OTA platforms..

According to the online travel market analysis, on the basis of age group, the 22-31 Years segment was the considerable contributor to the market, with $102.0 billion in 2020, and is estimated to reach $539.2 billion by 2031, at a CAGR of 15.0% during the forecast period. The age group of 22–31 years comprises the young population, which are the early starters in their professional career. When compared to travelers in the older age groups, these travelers are more likely to spend more money on travel and visit new places. These travelers have changed the travel business because of their extensive use of technology, . Smartphones and other mobile devices are largely preferred to make travel arrangements. Furthermore, social media platforms are utilized to evaluate various travel service providers, locations, modes of transportation, and lodging. As a result, the industry is experiencing strong growth in the 22–31 year age group sector..

32 - 43 Years segment helds the major share of 33.6% in 2020

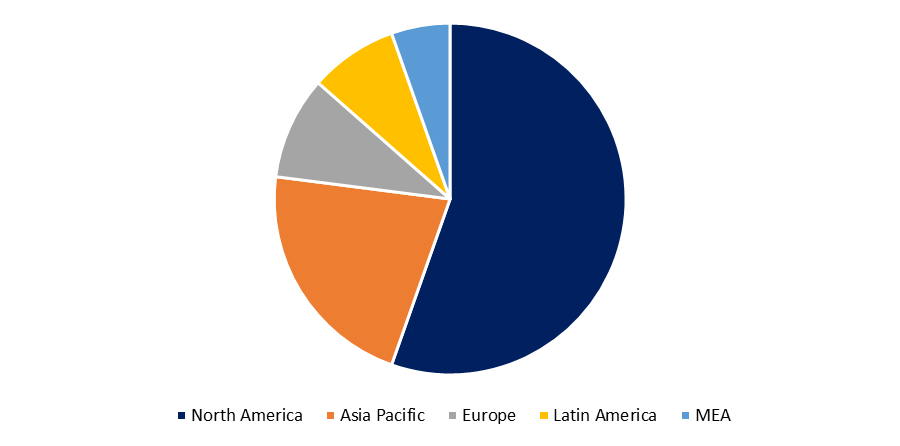

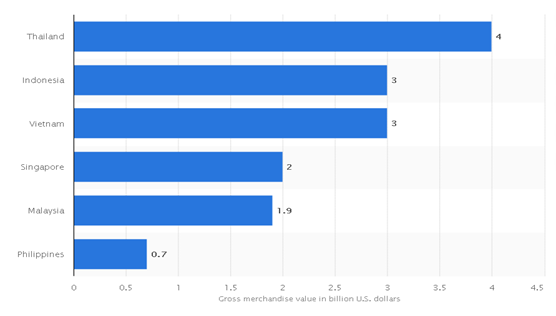

According to the online travel market opportunities, region wise, Asia-pacific gained significant online travel market share and is expected to sustain its share throughout online travel market forecast period. It possesses the highest growth potential in the online travel market, India and China being the most lucrative markets. The growth is attributed to the increase in disposable income, rise in middle-class segment, and greater penetration of internet facilities. Ctrip is the leading player in online travel market in China, whereas MakeMytrip, Yatra, and Cleartrip are the major online travel agencies (OTA) in India.

The players operating in the global online travel industry have adopted various developmental strategies to expand their market share, increase profitability, and remain competitive in the market. The key players profiled in this report include Expedia Group, Inc., Ebury Partners UK Ltd, Fareportal Inc. , Hostelworld.com Limited, Hurb Co S/A, HRS, MakeMyTrip Ltd., Oracle Corporation, Priceline (Booking Holdings Inc.), SABS Travel Technologies, Tavisca Solutions Pvt. Ltd., Thomas Cook India Ltd., travelomatix.com, Trip.com Group, Tripadvisor, Inc., and WEX Inc.

North America region helds the major share of 33.3% in 2020

Key Benefits For Stakeholders

- The report provides a quantitative analysis of the current trends, estimations, and dynamics of the market size from 2020-2031 to identify the prevailing opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis and the market size and segmentation assist to determine the prevailing market opportunities.

- The major countries in each region are mapped according to their revenue contribution to the market.

- The market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players in the online travel market.

Online Travel Market Report Highlights

Analyst Review

The global online travel market is anticipated to witness robust growth in the emerging market of Asia-Pacific. The growth is attributed to increase in disposable income, rise in middle-class segment, and greater penetration of internet facilities. Business travel has also fueled market growth in Asia-Pacific. Approximately, 90% of corporate travelers in the region own either a smart phone or tablet. More than 50% of these travelers manage their travel through these devices. Companies cater to the needs of travelers through innovative mobile travel apps to gain market share. Apps with various features are being developed to stay connected to travelers throughout their journey and to assist them whenever required. Travel apps offer flexibility to travelers, thus becoming an important differentiating factor for the consumers while choosing a travel company. In addition, customers download hotel and airline apps for quick view and booking status. Thus, proliferation of mobile usage and innovative mobile travel apps are expected to foster the growth of the online travel market in the future.

- Travel Destinations

- Luxury Accommodations

- Travel Packages

- Adventure Travel

- Luxury Travel Experiences

- Travel Planning

- Outdoor Activities

Total Market value of Online Travel report was valued at $354.2 billion in 2020.

14.8% is the CAGR of Online Travel Market

You can request sample from the website (www.alliedmarketresearch.com) or you can call our sales representative on U.S. - Canada toll free - +1-800-792-5285, Int'l : +1-503-894-6022 and for Europe region + 44-845-528-1300.

2022 to 2031 would be forecast period in the market report Market

Expedia Group, Inc., Ebury Partners UK Ltd, Fareportal Inc. , Hostelworld.com Limited, Hurb Co S/A, HRS, MakeMyTrip Ltd., Oracle Corporation, Priceline (Booking Holdings Inc.) and SABS Travel

The online travel market segmented into service type, platforms, mode of booking, age group, and region

India online travel market was valued at $12.4 billion and is expected grow at 21.1% during the forecast period.

By the end of the 2031, Asia-Pacific is expected to dominate the online travel market.

Online travel market was negatively impacted the growth of the market and is expected grow at highest CAGR growth rate after COVID-19 scenario.

Loading Table Of Content...

- Related Report

- Global Report

- Regional Report

- Country Report

Enter Valid Email ID

Verification code has been sent to your email ID

By continuing, you agree to Allied Market Research Terms of Use and Privacy Policy

Advantages Of Our Secure Login

Easily Track Orders, Hassel free Access, Downloads

Get Relevent Alerts and Recommendation

Wishlist, Coupons & Manage your Subscription

Have a Referral Code?

Enter Valid Referral Code

An Email Verification Code has been sent to your email address!

Please check your inbox and, if you don't find it there, also look in your junk folder.

Online Travel Market

Global Opportunity Analysis and Industry Forecast, 2022-2031

- Global Locations -

Headquarters

Future Market Insights, Inc.

Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware - 19713, United States

616 Corporate Way, Suite 2-9018, Valley Cottage, NY 10989, United States

Future Market Insights

1602-6 Jumeirah Bay X2 Tower, Plot No: JLT-PH2-X2A, Jumeirah Lakes Towers, Dubai, United Arab Emirates

3rd Floor, 207 Regent Street, W1B 3HH London United Kingdom

Asia Pacific

IndiaLand Global Tech Park, Unit UG-1, Behind Grand HighStreet, Phase 1, Hinjawadi, MH, Pune – 411057, India

- Consumer Product

- Food & Beverage

- Chemicals and Materials

- Travel & Tourism

- Process Automation

- Industrial Automation

- Services & Utilities

- Testing Equipment

- Thought Leadership

- Upcoming Reports

- Published Reports

- Contact FMI

Online Travel Agencies Market

Exploring the Online Travel Agencies Market: A Comprehensive Examination by Transportation, Vacation Packages, Accommodation

Transforming the Travel Landscape- Exploring the Expanding Online Travel Agencies Market and the Influence of Artificial Intelligence on Personalized Travel Experiences. Find more with FMI

- Report Preview

- Request Methodology

Online Travel Agencies Market Outlook (2023 to 2033)

As per newly released data by Future Market Insights (FMI), the online travel agencies market is estimated at US$ 465.1 million in 2023 and is projected to reach US$ 1,694.2 million by 2033, at a CAGR of 13.8% from 2023 to 2033.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Revenue of Online Travel Agencies from 2018 to 2022 Compared to Demand Outlook for 2023 to 2033

As per the FMI analysis, the market for online travel agencies secured a 6.70% CAGR from 2018 to 2022, touching US$ 355.4 million in 2022.

The technological development in the tourism industry has digitalized the entire process of travel bookings. Nowadays traveler makes more use of online services for travel booking as they feel it is a convenient and hassle-free process.

The online process has led to the growth of the tourism and hospitality industry. Therefore, online travel agencies play a significant role in the tourism industry.

Online travel agencies comprise various travel bookings, hotel bookings, transportation service bookings, and many more.

Online travel agencies serve the purpose of selling travel services on online platforms. In the last few years, there is a significant rise in the growth of online travel agencies. The growth has helped to revolutionize the tourism industry.

The above-mentioned factors augur well for the online travel agencies market future trends, where it is predicted that the market likely reaches US$ 1,694.2 million by 2033 at 13.8% CAGR through 2033.

What are the Features and Convenience of Use that Drive the Demand for the Online Travel Agencies?

- Online travel agencies offer a range of services either directly from their own companies or act as intermediaries between travel and booking agencies and end users.

- The main purpose of online travel agencies is to provide booking services online, covering everything from selecting a service to the point of sale on the Internet.

- Online portals offered by these agencies provide various services including price comparison, cost estimation, accommodation options, destination information, transportation modes, and even tour packages.

- The convenience, speed, and ease of booking provided by online travel services attract travelers, offering a convenient and efficient way to plan their trips.

- By utilizing online travel services, travelers can save both time and money, making it an appealing option for those seeking efficient and cost-effective travel arrangements.

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

What is Fostering the Expansion of the Market Size: The Rise in Disposable Income and New Development Initiatives?

- Increasing disposable income among individuals has played a significant role in driving the demand for online travel agencies, as people now have more financial resources to explore and travel to various destinations worldwide.

- Online travel agencies have successfully established a global reach, expanding their services and operations across different regions and countries, catering to the diverse travel needs and preferences of customers.

- To meet the evolving demands of the market, online travel agencies continuously adopt new strategies and upgrade their technologies, ensuring enhanced service offerings and improved customer experiences.

- The inclusion of travel insurance and baggage insurance by online travel agencies provides an added layer of security and peace of mind for travelers, contributing to the overall convenience and reliability of their services.

- Transparency throughout the booking process is a key focus for online travel agencies, ensuring customers have access to comprehensive information and pricing details, fostering trust and confidence in their decision-making.

- The initiatives taken by online travel agencies, such as integrating advanced technologies and providing comprehensive travel solutions, have successfully attracted the new generation of tech-savvy travelers, generating a strong demand in the market.

- Despite the challenges faced during the pandemic, the online travel agencies market remains resilient and continues to evolve, adapting to changing customer expectations and emerging market trends.

What Impact Does the Increasing Number of Solo Travelers Have on the Growth of the Online Travel Agencies Industry?

- There has been a significant increase in the number of solo travelers in recent years, driven by specific reasons such as leisure, recreation, and engaging in activities like water sports, hiking, riding, skiing, and more.

- The influence of social media has played a major role in attracting a wide audience to explore different regions, leading to a rise in online travel agencies' booking transactions.

- Online travel agencies offer comprehensive tour plans, including vacation packages, and assist solo travelers in making travel, food, and accommodation arrangements through convenient platforms such as phones or other devices.

- This convenience and affordability make online travel agencies a preferred choice for solo travelers, who may lack extensive knowledge or prefer cost-effective options.

- In recent years, online travel agencies have surpassed offline tour operators and travel agents in terms of popularity and usage among solo travelers.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Country-wise Insights

What is the growth outlook for the europe online travel agencies industry.

The growth outlook for the Europe online travel agencies industry is positive, with a value share of 22.30% in 2022. The industry is expected to continue growing steadily, supported by various factors such as increasing online travel bookings, technological advancements, and evolving customer preferences.

The CAGR of the United Kingdom at 5.00% from 2023 to 2033 indicates a promising growth trajectory for the market. The rising adoption of online platforms for travel planning and booking, along with the convenience and extensive range of services offered by online travel agencies, are driving the industry's growth.

The industry is likely to witness further advancements in mobile applications, personalized travel experiences, and innovative marketing strategies, contributing to the expansion of the Europe online travel agencies market in the coming years.

How Online Travel Agencies Market is Progressing in India?

In India online leading companies like Yatra.com, Kesari Tours, Veena World, Make My Trip, others are dominating the tourism industry in India, contributing to the country’s anticipated CAGR of 6.0% from 2023 to 2033.

India attracts many foreigners to discover and explore its culture and diversity. Foreigners find Indian travel agencies more affordable than booking tours from abroad. Hence, they use Indian online travel agencies’ websites for booking accommodation and transportation.

Meanwhile, India being one of the leading countries in the count of internet users, it can be concluded that the vast majority of the population is tech-savvy. Thus, online travel agencies try various marketing tools to connect with travelers and encourage them to avail of their services.

The attractive advertisements, loyalty programs, and offers from leading online travel agencies have influenced the domestic market. Therefore, the known online agencies have gained the trust of domestic travelers of the country over the years.

What are the Factors Driving the Online Travel Agencies Industry in the United States of America?

As per the FMI analysis, the market for online travel agencies in the United States was predicted to garner a value share of 5.50% in 2022.

United States is one of the major markets of tourism with millions of travelers visiting every year. Domestic travelers in the United States of America use online travel agencies’ websites and applications extensively.

Apart from this, the airline service is availed by United States citizens majorly. Therefore, there is a high demand for travelers using online travel agencies’ websites for airline travel booking.

With the high standard of living and high disposable income due to the high value of currency travelers are ready to spend a high amount of money on traveling and exploring new adventures. Thus, there is a high demand from travelers for luxury tourism, adventure sports, and various type of outdoor activities.

Category-wise Insights

Which service type is more preferred by travelers in online travel agencies market.

According to the analysis, in terms of service type the transportation service is widely preferred by travelers with the sub-segment holding a 22.0% value share in 2022.

Transportation services generate a high demand for their services. Few the transport services such as car rentals or bus travel agencies are in heavy demand as they are the part of daily mode of transport for many travelers.

Apart from this the attractive offers and schemes from the transportation services attract travelers to use these online services more often. Lastly, the transportation services are having a wide coverage of travelers as compared to the tour/vacation packages or accommodations as they generate demand only when there is a need.

How is the Competitive Landscape in the Market for Online Travel Agencies?

Leading players operating globally in the market are focusing on the expansion of their business. Also working on their service and creating advanced technology to attract new customers.

The competitive landscape in the market for online travel agencies is intense and dynamic. Numerous players, ranging from established companies to emerging startups, compete for market share.

Key industry players strive to differentiate themselves by offering unique features, enhanced user experiences, and a wide range of travel services.

They invest in advanced technologies, such as artificial intelligence and machine learning, to provide personalized recommendations and streamline booking processes. Additionally, partnerships with airlines, hotels, and other travel service providers are crucial to expand their offerings and provide competitive pricing.

Continuous innovation, customer-centric strategies, and effective marketing campaigns are vital for online travel agencies to gain a competitive edge in this rapidly evolving market.

Key Players

- Expedia Group Inc.

- Booking Holding Inc.

- Trip Advisor Inc.

- MakeMyTrip Pvt. Limited

- Hostelworld Group PLC (HSW)

- Trivago N.V

- Thomas Cook India Ltd.

- Lastminute.com Group

- Orbitz Worldwide

- Walt Disney World

For instance:

- In the year 2018, Booking.com announced a new product version of the booking.com application and website at Vacation Rental Management Association (VRMA). The new product features allow users to select the product of a partner’s brand beyond booking.com own products. Also, they introduced group connect, guest management, and enhance connectivity features in their new application.

- Recently in 2022, Expedia Group announced an Open World Technology platform. The technology is developed for partner agencies. The platform has a complete e-commerce suit, with various blocks like payments, chatbot, services, and fraud detection, and is perfect for the agency planning to enter the newly in online travel business.

Segmentation Analysis

By service type:.

- Transportation

- Vacation Packages

- Accommodation

By Device Platform:

By payment modes:.

- Debit / Credit Card

- Others (Vouchers, Discount Codes)

By Booking Type:

- Online Travel Agents

- Direct Travel Agents

By Customer Segment:

- Corporate Traveller

- Individual Traveller

By Age Group:

- 15-25 Years

- 26-35 Years

- 36-45 Years

- 46-55 Years

- 66-75 Years

- North America

- Latin America

Frequently Asked Questions

How is the historical performance of the market.

During 2018 to 2022, the market grew at a 6.70% CAGR.

Who are the Key Market Players of this market?

Airbnb, Trip Advisor Inc., and Trivago N.V. are key market players.

What factors contribute to the attraction of this market in Europe?

Increasing online travel bookings raises the market.

How Big is this market?

This market is valued at US$ 465.1 million in 2023.

How Big will be this Market by 2033?

This market is estimated to reach US$ 1,694.2 million by 2033.

Table of Content

Recommendations

Travel and Tourism

Travel Agency Services Market

Published : June 2023

Managed Travel Distribution Market

Published : October 2022

Explore Travel and Tourism Insights

Talk To Analyst

Your personal details are safe with us. Privacy Policy*

- Talk To Analyst -

This report can be customized as per your unique requirement

- Get Free Brochure -

Request a free brochure packed with everything you need to know.

- Customize Now -

I need Country Specific Scope ( -30% )

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

- [email protected]

- +1 9726644514

- +91 9665341414

Adroit Market Research - Industry Insights

Major players profiled in the study include Expedia Group, Ebury Partners UK, Fareportal, Hostelworld Limited, Hurb Co S/A, HRS, MakeMyTrip, Oracle Corporation, Priceline, SABS Travel Technologies, Tavisca Solutions, Thomas Cook India, travelomatix.com, Trip.com Group, Tripadvisor, WEX. among others.

Latest Developments

- Expedia Group just revealed an Open World Technology platform for 2022. Technology is created for partner organisations. The platform is ideal for the agency looking to launch a new online travel business since it includes a comprehensive ecommerce suit, with several blocks including payments, chatbots, services, and fraud detection.

Online Travel Agencies Market Scope

Key Segments in the global Online Travel Market

By Service Type, 2019-2029 (USD Billion)

- Transportation

- Vacation Packages

- Accommodation

By Device Platform, 2019-2029 (USD Billion)

By Payment Modes, 2019-2029 (USD Billion)

- Debit / Credit Card

- Others (Vouchers, Discount Codes)

By Region, 2019-2029 (USD Billion)

North America

- Rest of Europe

Asia Pacific

- Rest of Asia Pacific

South America

- Rest of South America

Middle-East and South Africa

Frequently Asked Questions (FAQ) :

What is the market value of online travel agencies market in 2032, what is the growth rate of online travel agencies market, which are the top companies hold the market share in online travel agencies market.

1. Introduction o Introduction o Market Definition and Scope o Units, Currency, Conversions, and Years Considered o Key Stakeholders o Key Questions Answered 2. Research Methodology o Introduction o Data Capture Sources o Market Size Estimation o Market Forecast o Data Triangulation o Assumptions and Limitations 3. Market Outlook o Introduction o Market Dynamics ? Drivers ? Restraints ? Opportunities ? Challenges o Porter’s Five Forces Analysis o PEST Analysis 4. By Service Type, 2019-2029 (USD Billion) • Transportation • Vacation Packages • Accommodation 5. By Device Platform, 2019-2029 (USD Billion) • Mobile • Desktop 6. By Payment Modes, 2019-2029 (USD Billion) • UPI • E-Wallet • Debit / Credit Card • Others (Vouchers, Discount Codes) 7. Regional Overview, 2019-2029 (USD Billion) North America o U.S o Canada Europe o Germany o France o UK o Rest of Europe Asia Pacific o China o India o Japan o Rest of Asia Pacific South America o Mexico o Dental o Rest of South America Middle-East and South Africa 8. Competitive Landscape o Company Ranking o Market Share Analysis o Strategic Initiatives ? Mergers & Acquisitions ? New Product Launch ? Others 9. Company Profiles • Expedia Group • Ebury Partners UK • Fareportal • Hostelworld Limited • Hurb Co S/A • HRS • MakeMyTrip • Oracle Corporation • Priceline • SABS Travel Technologies • Tavisca Solutions • Thomas Cook India • travelomatix.com • Trip.com Group • Tripadvisor • WEX. 10. Appendix o Primary Research Approach ? Primary Interview Participants ? Primary Interview Summary o Questionnaire o Related Reports ? Published ? Upcoming

Leaving without a Sample Report?

Enter your details and we shall send you a free sample report

Global Online Travel Agent Market Report By Service Types (Transportation, Travel Accommodation, Vacation Packages), By Platform (Mobile/Tablet Based, Desktop Based) And By Regions - Industry Trends, Size, Share, Growth, Estimation and Forecast, 2023-2032

- Transportation

- Travel Accommodation

- Vacation Packages

- Mobile/Tablet Based

- Desktop Based

- North America

- Asia Pacific

- Latin America

- Middle East and Africa

- Single User License: $3,950.00

- Upto 10 Users License: $5,450.00

- Corporate User License: $8,600.00

- DataPack License: $2,100.00

Avail customized purchase options to meet your exact research needs:

- Buy sections of this report

- Buy country level reports

- Request for historical data

- Request discounts available for Start-Ups & Universities

- Define and measure the global market

- Volume or revenue forecast of the global market and its various sub-segments with respect to main geographies

- Analyze and identify major market trends along with the factors driving or inhibiting the market growth

- Study the company profiles of the major market players with their market share

- Analyze competitive developments

- Client First Policy

- Excellent Quality

- After Sales Support

- 24/7 Email Support

Key questions answered by the report

- What is the current market size and trends?

- What will be the market size during the forecast period?

- How various market factors such as a driver, restraints, and opportunity impact the market?

- What are the dominating segment and region in the market and why

Need specific market information?

- Ask for free product review call with the author

- Share your specific research requirments for a customized report

- Request for due diligence and consumer centric studies

- Request for study updates, segment specific and country level reports

USEFUL LINKS

- Upcoming Reports

- Testimonials

- How To Order

- Research Methodology

FIND ASSISTANCE

- Press Release

- Privacy Policy

- Refund Policy

- Terms & Conditions

UG-203, Gera Imperium Rise, Wipro Circle Metro Station, Hinjawadi, Pune - 411057

- [email protected]

- +1-888-294-1147

BUSINESS HOURS

Monday to Friday : 9 A.M IST to 6 P.M IST

Saturday-Sunday : Closed

Email Support : 24 x 7

© , All Rights Reserved, Value Market Research

- Other Reports

Online Travel Market

Online travel market report by service type (transportation, travel accommodation, vacation packages), platform (mobile, desktop), mode of booking (online travel agencies (otas), direct travel suppliers), age group (22-31 years, 32-43 years, 44-56 years, above 56 years), and region 2024-2032.

- Report Description

- Table of Contents

- Methodology

- Request Sample

Global Online Travel Market:

The global online travel market size reached US$ 512.5 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 1,267.1 Billion by 2032, exhibiting a growth rate (CAGR) of 10.4% during 2024-2032. The escalating penetration of smart devices, easy access to high-speed internet connectivity, the rising popularity of solo travel, and an increasing number of business travelers are some of the major factors propelling the market growth.

Online Travel Market Analysis

- Major Market Drivers: The widespread adoption of the internet and mobile technology, making it easier for travelers to find the best deals online and make informed decisions, is primarily driving the growth of the market.

- Key Market Trends: The ongoing innovation, the development of user-friendly online travel booking platforms, and the integration of advanced search functionalities and personalized recommendations are creating a positive outlook for the overall market.

- Competitive Landscape: Some of the leading online travel market companies are Expedia Group Inc., Fareportal Inc., Hostelworld Group plc, HRS, Hurb, MakeMyTrip Pvt. Ltd., priceline.com LLC (Booking Holdings Inc.), Thomas Cook India Ltd. (Fairfax Financial Holdings Limited), Tripadvisor Inc., and Yatra.com, among others.

- Geographical Trends: According to the report, North America was the largest market. The region has a highly developed and digitally advanced economy, with a large population of tech-savvy consumers. Moreover, North America has widespread internet access and a high level of smartphone penetration, making it conducive for online travel activities.

- Challenges and Opportunities: Challenges in online travel booking include ensuring data security, maintaining competitive pricing amid fluctuating demand, and addressing customer service issues effectively. However, opportunities arise from technological advancements such as AI-driven personalization, mobile booking convenience, and expanding markets in emerging economies, enhancing user experience and market reach.

.webp)

Online Travel Market Trends:

Increase in Internet and Mobile Penetration

The increasing penetration of the internet and mobile technology has been a significant driver of the market. With more people gaining access to the internet and owning smartphones, the ability to plan and book travel online has become increasingly accessible. Moreover, various travel companies are extensively investing in creating an online presence via social medical platforms in order to expand their reach, which is positively influencing the online travel market outlook. For instance, as of April 2024, there were 5.44 billion internet users worldwide, which amounted to 67.1% of the global population. Of this total, 5.07 billion, or 62.6% of the world's population, were social media users. Moreover, during the third quarter of 2023, global users spent almost 60% of their online time browsing the web from their mobile phones. The increasing availability of the internet is allowing travelers to easily research destinations, compare prices, and make bookings through online platforms, making the process more convenient and efficient.

Increasing Desire for Education in International Universities

The rising preference for overseas education is one of the significant trends propelling online travel market revenue. This can be attributed to the quest for quality education, enhanced employability, and cultural enrichment, which attract students seeking global experiences and language proficiency. For instance, the world's two most populous nations, China and India, have the highest numbers of students studying overseas. According to data published by UNESCO, more than 1 million Chinese students were studying abroad in 2021. India’s total was close to half of this, with around 508,000 students living in other countries. The United States was the largest destination country for students studying abroad, with over 833,000 students there in 2021. It was followed by the United Kingdom with nearly 601,000 students, Australia with around 378,000 students, Germany with over 376,000 students, and Canada with nearly 318,000 students. Online travel agencies capitalize on this trend by offering tailored packages and flexible booking options to cater to the needs of student travelers. Additionally, the global reach of international universities attracts a diverse pool of students, driving the online travel market demand for cross-border travel services and cultural experiences.

Competitive Pricing and Deals

The competitive nature of the market is resulting in aggressive pricing and attractive deals. Travel booking companies are taking initiatives to attract customers by offering exclusive promotions, discounted packages, and last-minute deals. Moreover, the facility to book online allows travelers to compare prices across multiple platforms to find the best available options and secure the most cost-effective deals. Additionally, loyalty programs and reward systems offered by these platforms further incentivize travelers to book through their platforms, enhancing customer loyalty and engagement. For instance, in July 2023, the Expedia Group revamped its loyalty program to allow members to earn and redeem rewards across its three most popular brands: Expedia, Hotels.com, and Vrbo. This simplified loyalty program rewards members with 2% OneKeyCash for every dollar they spend, and elite status based on every travel segment they book. Moreover, various financial institutions are also offering rewards and discounts for online travel bookings in order to increase the utilization of their financial products, like credit cards, which are anticipated to augment the online travel market share. For instance, in March 2024, Wells Fargo launched a transferable travel rewards program, in which a card user will be able to transfer Wells Fargo Rewards points to six travel loyalty programs. Moreover, in April 2023, Expedia launched a New Feature Powered by ChatGPT to help plan travel. This innovative integration aims to enhance the travel planning experience for Expedia users by providing them with a personalized and conversational approach to trip planning. With this new feature, users can engage in natural language conversations with the ChatGPT system, similar to chatting with a virtual assistant.

Note: Information in the above chart consists of dummy data and is only shown here for representation purpose. Kindly contact us for the actual market size and trends.

To get more information about this market, Request Sample

Global Online Travel Industry Segmentation

IMARC Group provides an analysis of the key trends in each segment of the global online travel market report, along with forecasts at the global, regional and country levels from 2024-2032. Our report has categorized the market based on service type, platform, mode of booking and age group.

Breakup by Service Type:

- Transportation

- Travel Accommodation

- Vacation Packages

Travel accommodation dominates the market

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation and vacation packages. According to the report, travel accommodation represented the largest segment.

The dominance of travel accommodations as the primary service type in the market is driven by several key factors. The widespread presence of online travel platforms has made it easier for travelers to access a range of accommodation options, which is positively influencing the online travel market’s recent prices. Similarly, online travel accommodations are also making it easier for hotels and resorts to list and market their properties and attract a wider consumer base. For instance, in April 2024, Spree Hospitality, a subsidiary of EaseMyTrip, announced the opening of its newest property, ZiP by Spree Hotels Bella Heights, nestled in the picturesque hill station of McLeod Ganj, Himachal Pradesh, India. Besides this, the travel accommodations segment of online travel platforms offers a comprehensive inventory of hotels, resorts, vacation rentals, and other types of accommodations, providing travelers with extensive choices and convenience. Apart from this, the ability to compare prices, read reviews, and view photos of accommodations that empower travelers to make informed decisions is contributing to the market growth.

Breakup by Platform:

- Desktop

Desktop holds the largest share in the market

A detailed breakup and analysis of the market based on the platform has also been provided in the report. This includes mobile and desktop. According to the online travel market report, desktop accounted for the largest market share.

The desktop platform typically involves accessing travel websites through web browsers installed on desktop computers, which offer larger screens, full-sized keyboards, and a mouse or trackpad for navigation. Desktop platforms provide travelers with a robust and comprehensive online experience for researching, planning, and booking their travel arrangements. Moreover, various online travel agencies install desktops on a large scale for their employees to easily navigate clients’ travel bookings. In addition to this, desktop platforms provide greater processing power and stability, enabling faster loading times and smoother functionality for complex booking processes, thereby accelerating the product adoption rate.

Breakup by Mode of Booking:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

Direct travel suppliers are the most popular mode of booking

A detailed breakup and analysis of the market based on the mode of booking has also been provided in the report. This includes online travel agencies (OTAs) and direct travel suppliers. According to the report, direct travel suppliers accounted for the largest market share.

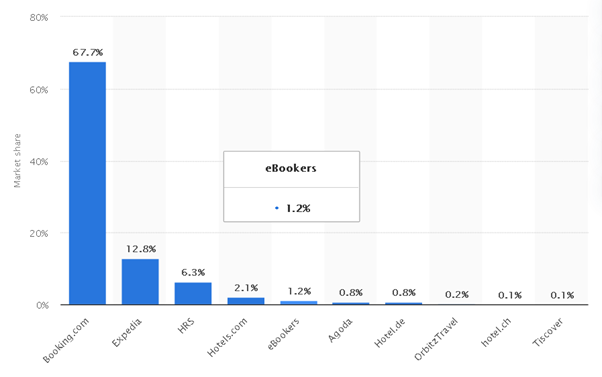

Direct booking allows travelers to have a direct relationship with the travel supplier, whether it's an airline, hotel, or car rental company. The online travel market overview by IMARC indicates that this direct interaction gives travelers more control and the ability to personalize their travel experience, including selecting specific preferences, customizing packages, and accessing loyalty programs or exclusive offers. For instance, according to a data report by Statista Consumer Insights 2023, 72% of travelers prefer booking directly from online platforms, whereas only 12% favor booking through a travel agency.

Breakup by Age Group:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

32-43 years dominates the market

A detailed breakup and analysis of the market based on the age group has also been provided in the report. This includes 22-31, 32-43, 44-56, and above 56 years. According to the report, 32-43 years accounted for the largest market share.

The dominance of the 32-43 years age group in the market is driven by several key factors. This age group represents individuals in their prime working and earning years, typically with more disposable income to spend on travel. They are often at a stage in their lives where they have fewer family responsibilities and greater flexibility to plan and embark on trips. Moreover, online travel market statistics by IMARC indicate that the 32-43 years age group is tech-savvy and comfortable with using digital platforms for various activities, including travel planning, and booking, thereby accelerating the product adoption rate.

Breakup by Region:

To get more information on the regional analysis of this market, Request Sample

United States

- South Korea

United Kingdom

- Middle East and Africa

North America exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest market.

The dominance of North America as the leading region in the market is driven by several key factors. North America has a highly developed and digitally advanced economy, with a large population of tech-savvy consumers. The region has widespread internet access and a high level of smartphone penetration, making it conducive for online travel activities. Moreover, familiarity and adoption of online platforms for various transactions, including travel bookings, are contributing to the dominance of North America in the market. In addition to this, the presence of prominent market players in the region is also contributing to the market growth. Furthermore, these market leaders are increasingly investing in online booking platforms to make them more personalized and user-friendly. For instance, in July 2023, TripAdvisor partnered with OpenAI on a travel itinerary generator. The AI-powered planning tool will create personalized day-by-day trip itineraries using traveler reviews.

Competitive Landscape:

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Expedia Group Inc.

- Fareportal Inc.

- Hostelworld Group plc

- MakeMyTrip Pvt. Ltd.

- priceline.com LLC (Booking Holdings Inc.)

- Thomas Cook India Ltd. (Fairfax Financial Holdings Limited)

- Tripadvisor Inc.

- Yatra.com

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Online Travel Market Recent Developments:

- May 2024: Travel group booking startup, Joyned, announced the launch of an artificial intelligence planner. This AI planner allows users to share information while providing vendors with additional insight into what information consumers are seeking.

- April 2024: Online travel agency, MakeMyTrip, announced a new exclusive charter service between Mumbai and Bhutan. This service is a part of its holiday packages, and the exclusive charter will depart once a week. The service has been launched due to the increasing popularity of Bhutan among Indian travelers.

- February 2024: Flipkart-owned online travel aggregator, Cleartrip, rolled out a new product, Out of Office (OOO), for corporate travelers. Cleartrip said in a statement that OOO is a corporate travel booking tool designed for small, medium, and large enterprises. The platform houses around 300 SMEs and 10 large corporations as active transactors. The new product claims to handle a monthly business volume of INR 20 crore.

Global Online Travel Market Report Scope:

Key benefits for stakeholders:.

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the online travel market from 2018-2032.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global online travel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global online travel market was valued at US$ 512.5 Billion in 2023.

We expect the global online travel market to exhibit a CAGR of 10.4% during 2024-2032.

The expanding travel and tourism industry and the rising utilization of online travel agencies across numerous hotels to ensure more visibility and increase their overall sales and profitability are some of the online travel market recent opportunities, bolstering the growth of the market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary restrictions on national and international travel activities, thereby limiting the overall demand for online travel.

Based on the service type, the global online travel market has been segmented into transportation, travel accommodation, and vacation packages. Among these, travel accommodation holds the majority of the total market share.

Based on the platform, the global online travel market can be divided into mobile and desktop, where desktop currently exhibits a clear dominance in the market.

Based on the mode of booking, the global online travel market has been categorized into Online Travel Agencies (OTAs) and direct travel suppliers. According to the online travel market forecast by IMARC, direct travel suppliers account for the majority of the global market share.

Based on the age group, the global online travel market can be segregated into 22-31 years, 32-43 years, 44-56 years, and above 56 years. Among these, 32-43 years age group currently holds the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global online travel market include Expedia Group Inc., Fareportal Inc., Hostelworld Group plc, HRS, Hurb, MakeMyTrip Pvt. Ltd., priceline.com LLC (Booking Holdings Inc.), Thomas Cook India Ltd. (Fairfax Financial Holdings Limited), Tripadvisor Inc., and Yatra.com.

India Dairy Market Report Snapshots Source:

Statistics for the 2022 India Dairy market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports.

- India Dairy Market Size Source

- --> India Dairy Market Share Source

- India Dairy Market Trends Source

- India Dairy Companies Source

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Purchase options

Benefits of Customization

Personalize this research

Triangulate with your data

Get data as per your format and definition

Gain a deeper dive into a specific application, geography, customer, or competitor

Any level of personalization

Get in Touch With Us

UNITED STATES

Phone: +1-631-791-1145

Phone: +91-120-433-0800

UNITED KINGDOM

Phone: +44-753-713-2163

Email: [email protected]

Client Testimonials

IMARC made the whole process easy. Everyone I spoke with via email was polite, easy to deal with, kept their promises regarding delivery timelines and were solutions focused. From my first contact, I was grateful for the professionalism shown by the whole IMARC team. I recommend IMARC to all that need timely, affordable information and advice. My experience with IMARC was excellent and I can not fault it.

The IMARC team was very reactive and flexible with regard to our requests. A very good overall experience. We are happy with the work that IMARC has provided, very complete and detailed. It has contributed to our business needs and provided the market visibility that we required

We were very happy with the collaboration between IMARC and Colruyt. Not only were your prices competitive, IMARC was also pretty fast in understanding the scope and our needs for this project. Even though it was not an easy task, performing a market research during the COVID-19 pandemic, you were able to get us the necessary information we needed. The IMARC team was very easy to work with and they showed us that it would go the extra mile if we needed anything extra

Last project executed by your team was as per our expectations. We also would like to associate for more assignments this year. Kudos to your team.

.webp)

We would be happy to reach out to IMARC again, if we need Market Research/Consulting/Consumer Research or any associated service. Overall experience was good, and the data points were quite helpful.

The figures of market study were very close to our assumed figures. The presentation of the study was neat and easy to analyse. The requested details of the study were fulfilled. My overall experience with the IMARC Team was satisfactory.

The overall cost of the services were within our expectations. I was happy to have good communications in a timely manner. It was a great and quick way to have the information I needed.

My questions and concerns were answered in a satisfied way. The costs of the services were within our expectations. My overall experience with the IMARC Team was very good.

I agree the report was timely delivered, meeting the key objectives of the engagement. We had some discussion on the contents, adjustments were made fast and accurate. The response time was minimum in each case. Very good. You have a satisfied customer.

.webp)

We would be happy to reach out to IMARC for more market reports in the future. The response from the account sales manager was very good. I appreciate the timely follow ups and post purchase support from the team. My overall experience with IMARC was good.

IMARC was a good solution for the data points that we really needed and couldn't find elsewhere. The team was easy to work, quick to respond, and flexible to our customization requests.

- Competitive Intelligence and Benchmarking

- Consumer Surveys and Feedback Reports

- Market Entry and Opportunity Assessment

- Pricing and Cost Research

- Procurement Research

- Report Store

- Aerospace and Defense

- Agriculture

- Chemicals and Materials

- Construction and Manufacturing

- Electronics and Semiconductors

- Energy and Mining

- Food and Beverages

- Technology and Media

- Transportation and Logistics

Quick Links

- Press Releases

- Case Studies

- Our Customers

- Become a Publisher

134 N 4th St. Brooklyn, NY 11249, USA

+1-631-791-1145

Level II & III, B-70, Sector 2, Noida, Uttar Pradesh 201301, India

+91-120-433-0800

30 Churchill Place London E14 5EU, UK

+44-753-713-2163

Level II & III, B-70 , Sector 2, Noida, Uttar Pradesh 201301, India

We use cookies, including third-party, for better services. See our Privacy Policy for more. I ACCEPT X

- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Online Travel Market Research Report Information By Platform Type (Mobile/Tablets Based and Desktop Based), By Mode of Booking (Online Travel Agencies and Direct Travel Facilitators), By Service Type (Transportation, Accommodation, and Vacation Packages), And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) – Market Forecast Till 2030.

- Segmentation

- Table of Content

- Methodology

- Infographic

- Download PDF

Online Travel Market Overview

Online Travel Market Size was valued at USD 984.6 billion in 2021. The online travel market industry is projected to grow from USD 1100.78 Billion in 2022 to USD 2403.22 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 11.8% during the forecast period (2024 - 2030). Shifts in consumer behavior, social media, rising disposable income, increased government initiatives to spread tourism, and a growing inclination toward adventure travel ly are key factors driving the growth of the online travel market revenue.

Figure 1: Online Travel Market Size, 2024-2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

- Online Travel Market Trends

Higher mobilization rate amongst people to drive market growth

The growing consumer awareness in developing countries is expected to fuel growth in the online travel market. Growth is steady in countries with an existing consumer database; however, more growth is expected in regions with many untapped consumers. With the market penetration of IT and the internet, market revenue is expected to reach new heights. Another factor is the increase in the number of international students who opt to study in international colleges to gain more exposure. For instance, more than 1.1 million students from India were studying in 85 other nations as of January 2021. According to official statistics from the Higher Education Statistics Agency, the United Kingdom was home to over 605,130 students from backgrounds outside the country. In 2021, it was estimated that more than 30% of international students were of Chinese descent.

Online travel agencies (OTAs) provide market insights and tools for attracting tourists, securing, and processing reservations, communicating with guests, and managing reviews. In addition, the internet offers virtual representations such as 3D interactive tours to give a clear impression of the travel destinations, allowing an indirect experience beyond traditional travel agencies' capabilities. As a result, the conventional booking method through travel agents has transformed into a quick, last-minute booking strategy made possible by information & communication technologies (ICTs). This results in a positive outlook for the market revenue and the growing appeal of solo travel. The rapid development of communication and transportation and the rising number of business travelers worldwide are expected to aid the market's expansion in the upcoming years.

Online Travel Market Segment Insights

Online travel platform type insights.

The online travel market segmentation, based on platform type, includes mobile/tablets based and desktop based. The mobile/tablets-based segment held the majority share in 2021, contributing to around ~52-55% of the online travel market revenue. This can be credited to increased mobile and internet usage and penetration worldwide. The busy schedules of young, working consumers and the availability of reputable online travel agencies are also contributing to the market's expansion. The segment's growth is further attributed to marketplace platforms' easy and quick travel, hotel bookings, and extensive service offerings via mobile applications. Additionally, quick, mobile-friendly, and easy-to-use smartphone applications are being released by travel booking agencies, accelerating the segment's market growth over the forecast period.

Online Travel Mode of Booking Insights

The online travel market segmentation, based on the booking mode, includes online travel agencies and direct travel facilitators. Online travel agencies dominated the market in 2021 and are expected to be the fastest-growing segment over the forecast period, 2022-2030, driven by an increase in people booking travel packages, hotel bookings, and other services through online travel agencies due to the tailored experience and convenience. Additionally, major initiatives by market players, like online advertising campaigns and social media ads, are anticipated to entice potential customers to initiate their booking process through the online booking mode, which is predicted to accelerate industry growth. In addition, ization has driven the market in recent years, increasing the middle class in developing economies and rising disposable income.

Online Travel Service Type Insights

The online travel market segmentation, based on the service type, includes transportation, accommodation, and vacation packages. Transportation accounted for the largest market share in 2021, largely due to trends in rising consumer spending, urbanization, broadband accessibility rates in emerging market economies, and a growing propensity for travel among the world's emerging affluent class. The market's growth is driven by an increase in online booking for buses, trains, and flights. Additionally, the preference for travel for different reasons, such as business and adventure, across Asian nations like China and India has increased the demand for online travel booking in these regions, supporting industry growth over the forecast period.

Figure 2: Online Travel Market, by Service Type, 2021 & 2030 (USD Billion)

Online Travel Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia Pacific online travel market is expected to grow at a significant CAGR during the study period, accounting for USD 451.93 billion in 2021. Increased spending power and higher living standards are major factors attracting people to the travel & tourism sector, fueling regional online travel market growth. Furthermore, regional economic growth, the convenience of travel restrictions, growing competition, and aggressive promotion techniques used by the sector's involved players have significantly encouraged and accelerated the group travel business, which is expected to accelerate the online travel industry growth over the assessment period.

Moreover, the major countries studied in the market report include the United States, Germany, Canada, France, the United Kingdom, Italy, Spain, India, Australia, Japan, South Korea, China, and Brazil.

The European online travel market is the second largest in the world due to increasing income levels across the region, an enhanced business environment in European nations, and government initiatives to encourage tourism and travel activities. Besides, there is a high demand for travel tourism because Europeans enjoy exploring new areas. Moreover, this region's growing number of independent/solo travelers and the expanding number of online travel agencies are expected to fuel growth during the forecast timeline. Further, the Italy online travel market held the largest market share, and the German online travel market was the fastest-growing market in the European region.

The North American Online Travel Market is anticipated to expand at the fastest CAGR from 2022 to 2030, with the United States leading the regional market share. The dominance of this region can be attributed to its strict licensing laws, higher travel and tourism expenditures, extensive use of digital media, and higher consumer spending power. The increase is expected to be fueled by an increasing number of international students who prefer to continue their education in the United States. Canada is becoming a popular destination for international settlers looking to relocate to another country. The Canadian government has made significant investments to encourage more migrants to settle there, which serves as a revenue-generating factor for expanding the regional market.

Online Travel Key Market Players & Competitive Insights

The major players in the online travel market have implemented various developmental strategies to grow their market share, boost profitability, and maintain market dominance. Online travel industry players are releasing new and improved mobile applications that entice young travelers with amazing travel deals and hassle-free booking. Most young travelers also prefer booking their travel online via a mobile device due to its usability, comfort, and accessibility. Market players are increasingly providing travelers with a wide selection of hotels at affordable prices. Customers compare accommodation options across various websites to find the best deal.

Key industry players rely on strategies like introducing new services and company expansion to grow their market shares and stay in the spotlight in the online travel booking sector. Furthermore, leading online travel booking companies focuses on aggressive promotional activities such as advertising online & television (TV), billboards & sponsorships, social media, and other promotional strategies.

Thomas Cook Group PLC (UK) is an online travel agency that provides package holidays, hotel-only stays, city breaks, and other services to destinations worldwide. In October 2020, Thomas Cook and Accor, a leader in augmented hospitality, entered into a partnership. The companies would launch Holiday Safe together as part of this collaboration. The launch would focus on reassuring customers with comprehensive health and safety protocols incorporated through Thomas Cook India, SOTC's Assured Safe Travel Program, Apollo Clinics, and Accor's Cleanliness and Prevention ALLSAFE label established with and vetted by Bureau Veritas.

Also, Expedia Group Inc (US) operates as an online travel agency. It offers a wide range of services, such as reserving hotel rooms, airline seats, rental cars, and other destination services via its travel partners. These services are provided under several brands, such as Expedia.com, Vrbo, Hotels.com, Hotwire, Orbitz, CheapTickets, ebookers, CarRentals.com, Travelocity, Expedia Partner Solutions, and Wotif Group. Expedia Group provides customer service through call centers, private label companies, alternative distribution channels, and mobile bookings. The company also operates in the advertising and media industries and the travel management sector. Expedia and Qtech Software announced a partnership in April 2022 to provide high-quality hospitality and technology content to business travelers.

Key Companies in the online travel market include

Expedia Inc (US)

Booking Holdings Inc (US)

TripAdvisor Inc (US)

FlixMobility GmbH (Germany)

Ryanair DAC (Ireland)

Thomas Cook Group PLC (UK)