- e-ATM Order

- Share Market News

- FindYourMojo

- Live Webinar

- Relax For Tax

- Budget 2024

- One Click Mutual Fund

- Retirement Solutions

- Execution Algos

- One Click F&O

- Apply IPO through UPI

- Life Insurance

- Health Insurance

- Group Health Insurance

- Bike Insurance

- SME Insurance

- Car insurance

- Home Insurance

- Sovereign Gold Bonds

- New Bonds on Offer

- Government Securities

- Exchange Traded Bonds

- ICICI Bank FD

- Top Performing NPS Schemes

- NPS Calculator

- NPS Important FAQ and Disclosures

- Equity Trending News

- Self learning

- Customer Service

- Corporate Services

- Open Account

- Masters of the Street

- Features and Products

- Will Drafting

- Goal Planner

- Retirement Planning

- Brokerage Fees and Charges

- Business Partner

- Business Partner Opportunity

- Business Partner Earning Calculator

- Business Partner App

- Partner Universe

- Insurance – POSP

- Travel Card Loan

- Credit Card

- Two Wheeler

- More Business Loan SME LOAN FOREX & REMITTANCE TRAVEL CARDS

- Introduction

- REGISTERING YOUR TRAVEL CARD

- Features and Benefits

- MANAGING TRAVEL CARD FUNCTIONS

Get smart, convenient and reloadable foreign-currency with the smartest travel card.

ICICI Travel Cards offer you:

Join the growing number of smart global travellers with ICICI Travel Cards. With the convenience of the card and the security of a check, your ICICI Travel Card will allow you to travel abroad without the worries of carrying foreign currency in cash.

Say goodbye to forex procuring hassles with your Smart ICICI Travel Card.

Browse through our wide range of travel card variants to choose the one that fits you best. All ICICI Travel Cards are accepted globally across international stores and online shopping sites.

About International Travel Card

Travelling abroad for business or leisure? Can’t decide how much money to carry? Now you can say goodbye to all the forex-procuring hassles with ICICI Travel Card. Carry forex smartly, safely and conveniently on your travel card and access a world of rewards and benefits. The prepaid Travel Card is your perfect alternative to carrying foreign currency; it is the ideal travel companion for all your international trips.

Choose from a wide range of Travel Card Variants by browsing through our website. Our travel cards are globally accepted across international retail stores and online shopping websites.

Travel Card Functions and Facilities Accessible on the Self Care Portal

- Change/ Regenerate your ATM/POS PIN: My Profile My Setup Repin

- Change/Regenerate your online Login/Transaction passwords: My Profile My Setup Change Password

- Temporarily block/ unblock Travel Card: My Accounts Support Functions Change Card Status

- E-Com Activation: My Profile My Setup e-com Activation

- View/download your transaction history: My Accounts Statement View

- Instant Wallet to Wallet transfer: My Profile Fund transfer Wallet to Wallet

How to Register a Travel Card?

Register your Travel Card on the Self Care Portal in 3 easy steps

Enter your Travel Card number and your 4-digit ATM PIN

Define your user id, login password and transaction password, set your security questions, input their respective answers and submit to create user id, manage travel card through imobile/ internet banking.

You can now link yours and your close relatives’ Travel Cards to your Savings Account to view, manage and update basic Travel Card details on the go through Internet Banking and iMobile app*.

Features of Travel Card

EXCLUSIVE FEATURES

- Safe and convenient mode of carrying forex

- Globally accepted mode of payment

- Available in 15 foreign currencies

- Facility to check balance on travel card at ATMs worldwide

- Facility to recharge the travel card on-the-go via mobile or net banking

- Doubles as ATM-cum-debit card

Benefits of Forex Card

- Load up to 15 currencies on the same card

- No additional charges levied on PoS swipes

- Better exchange rates than buying forex currency in cash

- Reward points on every swipe

- Exclusive discounts at select retail stores and restaurants worldwide

- High daily withdrawal limit of USD 2000 or its equivalent amount

Managing Travel Card Functions via Internet Banking and Imobile

View the balance amount in your travel card, view last 10 transactions, reload your travel card instantly, update e-mail id & domestic & international mobile number, block or unblock your travel card, online refund of your travel card, pin generation of your travel card.

Travel Card FAQs

What is the use of forex prepaid card.

Forex Prepaid Card is a smart, convenient and secure alternative to carry foreign currency while travelling overseas.

How do forex cards work?

Forex Card/Money Card/Travel Card/Currency Card are Prepaid Cards. Once an amount is loaded in a currency wallet, it can be used for transactions by swiping at merchant outlets or at e-commerce sites, as well as for cash withdrawal at ATMs

What is ICICI Bank Forex Prepaid Card?

ICICI Bank Forex Prepaid Card is a Prepaid Card offering 15 currency wallets. It is a smart, convenient and secure alternative to carry foreign currency while travelling overseas

What is the benefit of Forex Prepaid/Travel Card?

Forex Prepaid/Travel Cards provide a convenient and secure alternative to carry foreign currency while travelling overseas. Moreover, it allows the customer to store multiple currencies in a single card, in case they are travelling to different countries. Unlike Credit and Debit Cards, there is no extra charge associated with POS and e-commerce transactions. They are universally accepted. Exchange rate is fixed during loading of the card and there are no Dynamic Currency Conversion charges

What is a multi-currency card?

A multi-currency card features multiple wallets of different currencies in a single card. ICICI Bank currently offers loading of up to 15 currencies in a single multicurrency card.

Can you transfer money from a Forex Prepaid/Travel Card to a bank account?

Yes. Once requirement of forex is over, the remaining amount in the Forex Prepaid Card can be refunded to the linked bank account

How can I apply for a Forex Prepaid/Travel Card?

Request for Forex Prepaid Card can be submitted at the nearest ICICI Bank Forex Branch. ICICI Bank Savings Account holders can apply through iMobile too.

How do you put money in a Forex Prepaid/Travel Card?

You can put/load money in an ICICI Bank Forex Prepaid/Travel Card online, through Internet Banking or iMobile app. If the account is not linked, the request can be submitted at the nearest ICICI Bank Forex Branch by the cardholder or any third party

How can I activate my Forex/Travel Card?

With a fresh load, the Forex/Travel Card will be automatically activated. However, if your ICICI Bank Forex Prepaid Card is inactive/temporary blocked, please call ICICI Bank Customer Care to get it re-activated.

I am unable to withdraw funds from ATM using my Forex Prepaid/Travel Card, what should I do?

If you are unable to withdraw funds from the ATM using your Forex Prepaid/Travel Card, kindly check the balance in the card, for confirmation on whether you can withdraw the amount. If there is balance, check that you are not exceeding the daily withdrawal limit (includes ATM withdrawal charges). If it is within the limit and still you are unable to withdraw using an Active Forex Prepaid/Travel Card, please call ICICI Bank Customer Care.

What is the limit for cash withdrawal from ATM in my Forex Prepaid/Travel Card?

The daily limit of withdrawal is USD 2,000 or equivalent (including withdrawal charges and tax), unless otherwise specified.

TRAVEL Cards

- Personal Loan

- New Car Loan

- Two Wheeler Loan

- Business Loan

- Credit Cards

- Forex & Remittance

Travel Cards

ICICI Bank Travel Card is the perfect travel companion for all your international trips. Get the Travel Card of your choice by browsing through the ‘Travel Cards – Variants’ section. The power-packed ICICI Bank Travel Card is a smart, convenient and secure alternative to carry foreign currency while travelling overseas. Now avoid currency rate fluctuations and save cross currency charges by loading your card with 15 foreign currencies - USD, GBP, EUR, CAD, AUD, SGD, AED, CHF, JPY, SEK, ZAR, SAR, THB, NZD, HKD. Load and instantly activate your Travel Card to start using it immediately for booking your international flight and accommodation. You can make payments only on international websites and merchant outlets overseas

Online Account Management facility

No need to visit a branch or call Customer Care. It’s time to relax and manage all your Travel Card functions yourself at comfort of your home. ICICI Bank Travel Cards is providing digital interfaces that are simple to use where end users would be able to view, handle minor issues and information requests that would otherwise go to the service desk. Now log on to ‘Self Care Portal’ or ‘Internet Banking’ or ‘iMobile app’ and start managing Travel Card with just a click.

Self Care Portal

'Self Care Portal' is an exclusive real-time account management portal designed for ICICI Bank Travel Card customers. This facility provides 24*7 access to monitor spends, block/ unblock card, reset ATM PIN, instant wallet to wallet fund transfer and much more.

Travel Card functions available through Self Care Portal

- Change/ Regenerate your ATM/POS PIN: My Profile My Setup Repin

- E-Com Activation: My Profile My Setup e-com Activation

- Change/Regenerate your online Login/Transaction passwords: My Profile My Setup Change Password

- View/download your transaction history: My Accounts Statement View

- Temporarily block/ unblock Travel Card: My Accounts Support Functions Change Card Status

- Instant Wallet to Wallet transfer: My Profile Fund transfer Wallet to Wallet transfer

How to register Travel Card to Self Care Portal?

- Enter your Travel Card number à Enter your 4-digit ATM PIN

- Define your User ID, Login Password and Transaction Password

- Set your security questions and their respective answers and Submit to create User ID

Manage Travel Card through iMobile/ Internet Banking

You can now link yours and your close relatives’ Travel Cards to your Savings Account to view, manage and update basic Travel Card details on the go through Internet Banking and iMobile app*.

Travel Card functions available through Internet Banking and iMobile:

- View Travel Card balance and last 10 transactions

- Instant reload of Travel Card

- Update e-mail ID & mobile number (domestic & international)

- Block or unblock Travel Card

- Online refund of Travel Card

- PIN generation of Travel Card

How to link your Travel Card?

Travel cards faqs.

Forex Prepaid Card is a smart, convenient and secure alternative to carry foreign currency while travelling overseas.

Forex Card/Money Card/Travel Card/Currency Card are Prepaid Cards. Once an amount is loaded in a currency wallet, it can be used for transactions by swiping at merchant outlets or at e-commerce sites, as well as for cash withdrawal at ATMs

ICICI Bank Forex Prepaid Card is a Prepaid Card offering 15 currency wallets. It is a smart, convenient and secure alternative to carry foreign currency while travelling overseas

Forex Prepaid/Travel Cards provide a convenient and secure alternative to carry foreign currency while travelling overseas. Moreover, it allows the customer to store multiple currencies in a single card, in case they are travelling to different countries. Unlike Credit and Debit Cards, there is no extra charge associated with POS and e-commerce transactions. They are universally accepted. Exchange rate is fixed during loading of the card and there are no Dynamic Currency Conversion charges

A multi-currency card features multiple wallets of different currencies in a single card. ICICI Bank currently offers loading of up to 15 currencies in a single multicurrency card.

Yes. Once requirement of forex is over, the remaining amount in the Forex Prepaid Card can be refunded to the linked bank account

Request for Forex Prepaid Card can be submitted at the nearest ICICI Bank Forex Branch. ICICI Bank Savings Account holders can apply through iMobile too.

You can put/load money in an ICICI Bank Forex Prepaid/Travel Card online, through Internet Banking or iMobile app. If the account is not linked, the request can be submitted at the nearest ICICI Bank Forex Branch by the cardholder or any third party

With a fresh load, the Forex/Travel Card will be automatically activated. However, if your ICICI Bank Forex Prepaid Card is inactive/temporary blocked, please call ICICI Bank Customer Care to get it re-activated.

If you are unable to withdraw funds from the ATM using your Forex Prepaid/Travel Card, kindly check:

The balance in the card for confirmation on whether you can withdraw the amount.

If there is balance, check that you are not exceeding the daily withdrawal limit (includes ATM withdrawal charges).

If it is within the limit and still you are unable to withdraw using an Active Forex Prepaid/Travel Card, please call ICICI Bank Customer Care.

The daily limit of withdrawal is USD 2,000 or equivalent (including withdrawal charges and tax), unless otherwise specified.

- Get CIBIL Score

- Get Call Back

- Give a Missed Call

How to activate e commerce payment on icici forex card?

- Post author By Forex Academy

- Post date 9 March, 2023

- No Comments on How to activate e commerce payment on icici forex card?

ICICI Bank is one of the leading financial institutions in India that provides a range of services to its customers, including forex cards. A forex card is a prepaid card that can be loaded with multiple currencies for use overseas. It is an excellent alternative to carrying cash or using a credit card while travelling…

Step 1: Login to your ICICI Forex Card Account

Step 2: click on ‘cards’ and select your forex card, step 3: click on ‘activate now’, step 4: enter your card details, step 5: generate otp, step 6: confirm activation, in conclusion.

Related posts

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Customer Care Number

Internet banking

- NRI Banking

- Money2World

- Money2India

Offers especially for you!

Open an Insta Save Account.

No Paperwork, No Branch Visits, No Hassle!

ICICI Bank Credit Cards

Save more on your everyday expenses.

ICICI Bank Personal Loans

For your safe, comfortable, and convenient travel needs

ICICI Bank Home Loans

The key to your Dream Home, within easy reach

Campus Power - from a dream to a degree, with you at every step.

Solutions for student, parents and institutes.

Just getting returns on your investment?

Save Tax too, while you build your corpus!

Manage all your utility bills, smartly.

Pay bills easily, using Internet Banking.

ICICI Bank Two-Wheeler Loan

Get your dream bike now!

ICICI Bank FD

Choose certainity during uncertain times.

ICICI Bank PPF Account

A blessing for wealth creation is here for you!

Your guide to Personal Finance

A refreshing way to learn all about Personal Finance.

All it takes is 5 minutes!

Instant payout on selling shares, with the ICICIdirect Prime Account.

ICICI Bank Car Loan

Experience a seamless Car Loan process!

- Personal Banking

- Online Transactions

Want us to help you with anything? Request a Call back

Thank you for your request..

Your reference number is CRM

Our executive will contact you shortly

- Payment at Merchants

- ATM Cash Withdrawal

Your reference number is CRM 786578956

Sorry! Please check back in a few minutes as an error has occurred.

How to do online / e-commerce transactions.

- Internet Banking – Cards & Loans > Forex & Prepaid Cards > Manage Cards > Transaction Settings

- iMobile Pay App - Cards & Forex > Forex Prepaid Cards > Transaction Settings

- Self-Care Portal – My Profile > My Setup > E-Com Activation

- Log on to the international merchant website

- Select Credit Card as the mode of payment

- Enter Card details and billing information

- Confirm to make payment

Don't have a Forex Prepaid card ? Click here to apply

- Best Credit Cards

- Lifetime Free

- Forex Credit Cards

- RuPay Credit Cards

- International Travel

- Fintech Cards

- Credit Card Guides

- Credit Card News

- Offers & Rewards

- Credit Score Guide

- Credit Card Limit

- Lounge Access

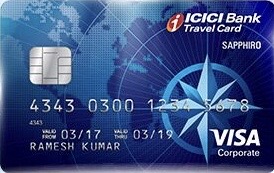

ICICI Bank Sapphiro Forex Prepaid Card

ICICI Bank Sapphiro Prepaid Forex Card is a premium forex card by the bank as it comes with quite a high issuance (joining) fee of Rs. 2,999 (Rs. 999/annum chargeable second year onwards), and offers benefits like complimentary international lounge access, discounted rates on hotel/flight bookings, and many more. Unlike credit cards, however, ICICI Sapphiro Prepaid Forex Card does not have any reward structure.

Since it is a prepaid card, you need not satisfy any income-based criteria to be eligible for Sapphiro Prepaid Forex Card. You can apply for the card either online or you can simply walk into any of the ICICI Bank’s forex branches and submit your application offline. Read on to learn more about this premium forex card by ICICI Bank.

Joining Fee

Renewal fee, best suited for, reward type.

Reward Points

Welcome Benefits

Movie & dining, rewards rate, reward redemption.

2 complimentary airport lounge access per annum with Dragon Pass, no cross-currency usage fee, comprehensive travel insurance policy, 5% cashback on hotel and flight bookings

Domestic Lounge Access

International lounge access.

2 complimentary access every year

Insurance Benefits

Comprehensive insurance policy including an air accident cover worth Rs. 10 lakh and a lost card liability cover worth Rs. 5 lakh

Spend-Based Waiver

Rewards redemption fee, foreign currency markup.

Nil (no foreign currency mark-up fee and no-cross currency usage charges)

Interest Rates

Fuel surcharge, cash advance charges.

USD 2 (or currency equivalent) on cash withdrawals from ATMs, 0.5% of the transaction amount on cash withdrawals from POS

- Central shopping voucher worth Rs. 500 and Uber vouchers worth Rs. 1,000 as a welcome gift.

- Complimentary Dragon Pass membership with 2 international lounge access per annum.

- Complimentary OneAssist complete card protection cover.

- 5% cashback on online hotel/flight bookings (max cashback capped at Rs. 3,000 per month).

- Comprehensive travel insurance including a personal air accident cover worth Rs. 10 lakh and many other travel-related insurance covers.

- Free replacement card provided with the primary card in the welcome kit.

- The card can be used for shopping at duty-free stores at airports within India.

- Exciting deals around the world on stay, traveling, dining and shopping.

- Discounts on international roaming packs.

- Complimentary lost card liability cover worth Rs. 5 lakh.

ICICI Bank Sapphiro Forex Prepaid Card Welcome Benefits

You get the following two benefits complimentary at the time of card issuance-

- Central shopping voucher worth Rs. 500.

- Uber discount vouchers worth Rs. 1,000.

ICICI Bank Sapphiro Forex Prepaid Card Travel Benefits

- 2 complimentary international lounge access at airports worldwide with Dragon Pass membership.

- 5% discount on hotel and flight bookings with a monthly max cap of Rs. 3,000 on the cashback.

- No mark-up fee on cross-currency usage.

You get a complimentary comprehensive insurance plan with the card. The following table summarises that all the insurance covers that you get under this comprehensive plan-

Other Benefits

- A free replacement card is provided in the welcome kit.

- The card can be used for shopping at duty-free stores at international airports across India.

ICICI Bank Sapphiro Forex Prepaid Card Fees and Charges

- An initial fee of Rs. 2,999 (plus GST) is chargeable at the time of card issuance.

- An annual membership fee of Rs. 999 (plus GST) is to be paid second year onwards.

- No foreign currency mark-up fee and no cross-currency usage charges.

- A cash advance fee of USD 2 is applicable on cash withdrawals from ATMs. If you withdraw cash at POS, you have to pay a withdrawal fee of 0.5% of the withdrawn amount.

How to apply

- You can apply for ICICI Sapphiro Forex Prepaid Card through internet banking, iMobile Pay app or by visiting any of the forex branches of the bank.

- In order to proceed with the application, you are required to submit copies of your PAN card, Aadhar card, Passport (with Visa) and Form A2 along with the card application form.

ICICI Sapphiro Forex Prepaid is one of the few forex cards that come with an annual membership fee. In the case of most other forex cards , you only pay an initial issuance fee. For this reason, the Sapphiro Forex Prepaid card can be a good pick for someone who is a frequent international traveler as, unlike most forex cards, Sapphiro Forex Prepaid Card also offers plenty of premium benefits like complimentary international lounge access, zero cross-currency mark-up and discounted rates on hotels and flights, that usually, only credit cards offer. Keeping in mind the zero mark-up fee on cross currency usage and all the other premium benefits that the card comes packed with, it would be safe to conclude that ICICI Sapphiro Forex Prepaid Card does justice to its high joining and annual fees.

Write A Comment Cancel Reply

Save my name, email, and website in this browser for the next time I comment.

Find the perfect credit card in India by comparing the most rewarding options in one place!

Quick Links

- Privacy Policy

- Terms & Conditions

Contact Info

© Copyright 2024 Card Insider

Made With ❤ in India.

Type above and press Enter to search. Press Esc to cancel.

Add cards to start comparing

Already Swamped at Work?

Offload Your Tax Worries to Us ?

AI Summary to Minimize your effort

ICICI Bank Credit Card: How to Activate ICICI Credit Card?

Updated on : Jun 6th, 2024

10 min read

ICICI Bank, one of India's leading bank and financial services companies, stands out for offering a diverse range of credit card options, each tailored to meet the various requirements of its customers. Besides ensuring a secure transaction experience, an ICICI credit card is widely known for its easy activation process, which can be done in multiple ways.

In this article, we will walk you through a detailed guide on different ways of activating your ICICI Bank credit card while providing you insights on how to generate the PIN.

How to Activate ICICI Bank Credit Card Through Internet Banking?

The following is a step-by-step guide on how to activate an ICICI credit card through Internet banking :

Step 1: Visit the ICICI Bank Internet Banking portal .

Step 2: Login by entering the User ID and password.

Step 3: Navigate to the ‘Cards & Loans’ tab and click on it.

Step 4: Choose the ‘Credit Card’ from the list of options.

Step 5 : Click on ‘Manage Your Card’ and select your credit card number.

Step 6: Click on ‘Edit’ under the ‘Manage Credit Card Usage’ tab.

Step 7: Enable the ‘International/Online/Tap & Pay Transactions’ options.

Step 8 : Enter the OTP you will receive on your registered mobile number to activate the card.

How to Activate ICICI Bank Credit Card Through Mobile App?

Here is a stepwise process you need to follow with due diligence to activate the ICICI Bank credit card via the bank’s mobile application :

Step 1: Download and install the iMobile Pay app on your preferred device.

Step 2: Open the app and click on the ‘Cards & Forex’ tab.

Step 3: Choose your ICICI credit card.

Step 4: Click on ‘Manage Your Card’.

Step 5: Enable the ‘International/Online/Tap & Pay Transactions’ options.

How to Activate ICICI Bank Credit Card Through ATM?

Here are the steps to activate an ICICI Bank credit card through an ATM :

Step 1: Visit your nearest ICICI Bank ATM.

Step 2: Insert your card in the ATM card slot.

Step 3: Choose your preferred language.

Step 4: Select the ‘PIN Generation’ option from the right-hand corner of the screen.

Step 5: Follow the instructions displayed on the screen to activate your credit card.

How to Activate ICICI Bank Credit Card Through Customer Care?

Here’s how you can activate the ICICI credit card through the customer care services of the bank:

Step 1: Contact the ICICI credit card customer care support team by dialling this (1800 1080) toll-free number. This has to be done from the registered mobile number of the cardholder.

Step 2: Follow the instructions provided by the Interactive Voice Response (IVR) and specify your credit card details to activate it.

How to Activate ICICI Bank Credit Card Through SMS?

Currently, there is no SMS service provided by ICICI Bank to activate the credit card . However, you can activate an ICICI bank credit card through Internet banking, mobile application or by calling the customer care number.

How to Activate ICICI Credit Card PIN?

Upon successfully activating your ICICI credit card, the next step is to generate the PIN . There are two ways of doing so, either through the ICICI internet banking portal or the ICICI mobile banking application .

Internet Banking

Given below are the steps guiding you on how to activate the ICICI credit card PIN using the Internet banking method:

Step 3: Navigate to the ‘Cards & Loans’ tab and click on it.

Step 5: Under the left menu, click on the ‘Generate Credit Card PIN Online’ option.

Step 6: Select your credit card, specify your CVV number and tap on ‘Submit’.

Step 7: You will receive an OTP on your registered mobile number. Enter the OTP.

Step 8: Click on the ‘Set New PIN’ tab and click ‘Submit’.

Mobile Application

Listed below are the steps that will guide you on how to activate the PIN for your ICICI credit card via the bank’s mobile app :

Step 1: Install and open the iMobile Pay on your preferred device.

Step 2: On the main page, navigate to the 'Cards & Forex' tab and click on it.

Step 3: Select the ICICI credit card.

Step 4: Tap on ‘Generate PIN’.

Step 5: Provide your credit card PIN and tap on ‘Submit’.

The ICICI credit card comes with a straightforward activation process which can be easily completed through various methods. Whether you choose to activate your card online or offline, all methods can be quickly initiated without any hassle, allowing you to unlock its other benefits and unique features.

Related ICICI Articles: 1. ICICI Net Banking, Online Banking, Login 2. ICICI Bank Holidays List 2024 3. ICICI Mobile Banking - How to Register, Login and Transfer Funds? 4. ICICI Credit Card Cash Withdrawal Charges 5. ICICI Bank Locker Charges Other Related Articles: 1. How To Activate HDFC Credit Card? 2. How To Activate SBI Debit Card?

Frequently Asked Questions

To generate a PIN for your ICICI credit card, you can either visit the official Internet banking portal of the bank or download its mobile application. Apart from the online mode, you can choose to do the same offline by visiting your nearest ICICI Bank ATM or consulting the bank’s customer care representatives.

The ICICI credit card activation online can be easily done through the iMobile Pay app. All you need to do is navigate to the ‘Cards & Forex’ tab on the main page and specify your credit card details.

When it comes to activating your ICICI credit card PIN for the first time, you have several options to choose from based on your convenience. These options include utilising the internet banking portal or mobile application of ICICI Bank, consulting the customer service representative of the bank or visiting your nearby ATM.

An ICICI Platinum credit card can be activated like any other type of credit card offered by the bank. For this, you can consult a bank representative regarding the procedure while applying for it.

ICICI Bank credit cardholders can activate their card for international online transactions by visiting the official internet banking portal. All you need to do is surf the website and navigate to the 'Manage Credit Card Usage' tab. Under this tab, click on the 'International' option to activate this feature on your card successfully.

One can easily deactivate the auto-debit in their ICICI credit card by following a few easy steps. For this, you need to visit the internet banking website of ICICI Bank and navigate to the ‘Cards & Loans’ tab. Under the tab, choose ‘Credit Cards’, select the credit card and click edit option under ‘Manage Credit Card Usage’. Next, disable the ‘Auto Debit Setup’ and submit.

About the Author

Mayashree Acharya

I am an advocate by profession and have a keen interest in writing. I write articles in various categories, from legal, business, personal finance, and investments to government schemes. I put words in a simplified manner and write easy-to-understand articles. Read more

Public Discussion

Get involved!

Share your thoughts!

Quick Summary

Was this summary helpful.

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

- Personal Finance

- Today's Paper

- T20 World Cup

- Partner Content

- Entertainment

- Social Viral

- Pro Kabaddi League

All you should know about Adani One and ICICI Bank's co-branded credit card

The adani group enters retail finance with travel-focused credit cards via the adani one app. earn rewards, access airport lounges, and enjoy discounts with icici bank and visa..

)

Adani One logo

- Earn up to 7% reward points on Adani Group spends.

- Airport benefits like free lounge access, meet-and-greet services, and priority parking.

- Discounts on duty-free shopping and airport dining.

- Reward points on groceries, utilities, and international spends.

- Adani One ICICI Bank Signature Credit Card (Rs. 5,000 annual fee with Rs. 9,000 joining benefits)

- Adani One ICICI Bank Platinum Credit Card (Rs. 750 annual fee with Rs. 5,000 joining benefits)

UK's Graduate Route Visa to continue: Key benefits for Indian students

Wpl 2024 points table: delhi capitals remain on top as warriorz beat giants, impact of uk visa rules on caregivers: stranded indian workers seek help, explained: how indians can now get five-year, multi-entry schengen visa, icici bank to report q4 results on april 27; here's what analysts expect, sensex, nifty rout: from fds to invits, here're low-risk investment options, election results: use mkt volatility to buy into nifty50 funds, large caps, ai in finance: how algorithms are shaping personal wealth management, how illegal sites allowed bets on lok sabha election results 2024: decoded, vistara summer sale: book air tickets until 7 june, fares start at rs 1,999.

- 7% Reward points on Adani One ecosystem

- Earn 1.5% as Adani Reward points on other domestic spend categories (excluding fuel and rent payment)

- Earn 2% as Adani Reward points on intrnational spend category

- Earn 0.5% as Adani Reward points on utility and insurance spends

- Hotel voucher worth Rs 2,000 on card activation

- Holiday voucher Rs 2,000 on card activation

- Earn Rs 5,000 flight voucher on spend of Rs 25,000 within 60 days of card activation

- Enjoy 2 Meet and Greet services per year (1 on card activation and second on Rs3 Lakh spend)

- Enjoy 4 premium lounge upgrades every quarter

- Avail 4 valet parking every year

- Avail 4 premium car parking every year on card activation

- Avail 8 porter services every year

- Enjoy 2 complimentary international lounge access per year after card activation

- Enjoy 4 complimentary domestic lounge access per quarter after card activation

- Welcome vouchers worth Rs 5000 on card activation

- 3% Reward points on Adani One ecosystem

- Exclusive benefits of 4 Porter and 2 premium Car parking services per year at Adani managed airports

- 8 Domestic lounge access and premium upgrades at Adani managed airports

- Buy one ticket and get 25% off upto Rs 100 on the second ticket, twice every month through BookMyShow

- Earn 1% as Adani Reward points on all other domestic spends categories (excluding fuel and rent payment)

- Earn 1.5% as Adani Reward points on international spends category

- Enjoy 2 complimentary domestic lounge accesses per quarter after card activation

- Avail 1% fuel surcharge waiver on all fuel transactions of up to Rs 4,000 at any fuel outlet

- Hotel voucher worth Rs 1,000 on card activation

- Holiday voucher worth Rs 2,000 on card activation

- Earn Rs 2,000 flight voucher on spends of Rs 10,000 within 60 days of card activation

- Milestone Benefits

- Annual fee waiver in spends of Rs 3,00,000 and above in a calendar year

- Enjoy 2 premium lounge upgrades every quarter

- Avail 2 instances of valet parking every year

- Avail 2 instances of premium car parking every year on card activation#

- Avail 4 porter services every year#( 2 porter services on every 1 lakh spent, maximum of 4 porter services every year)

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jun 05 2024 | 11:20 AM IST

Explore News

- Suzlon Energy Share Price Adani Enterprises Share Price Adani Power Share Price IRFC Share Price Tata Motors Share Price Tata Steel Share Price Yes Bank Share Price Infosys Share Price SBI Share Price Tata Power Share Price

- Latest News Company News Market News India News Politics News Cricket News Personal Finance Technology News World News Industry News Education News Opinion Shows Economy News Lifestyle News Health News

- Today's Paper About Us T&C Privacy Policy Cookie Policy Disclaimer Investor Communication GST registration number List Compliance Contact Us Advertise with Us Sitemap Subscribe Careers BS Apps

- ICC T20 World Cup 2024 Budget 2024 Lok Sabha Election 2024 Bharatiya Janata Party (BJP)

Adani ICICI Bank Card: Rs 9k gift cards, Rs 5k flight ticket voucher - All about Gautam Adani's latest offering

Adani ICICI Bank Card: Billionaire Gautam Adani has ventured into retail finance by introducing a new credit card in partnership with ICICI Bank. This move, launched via the group's digital platform Adani One, aims to challenge established players such as Tata, Reliance, and Aditya Birla in the highly competitive Indian market.

Adani ICICI Bank Card: Two Variants with Attractive Rewards

Adani one signature credit card.

- Welcome Vouchers: Worth Rs 9000 on card activation

- Reward Points: 7% on Adani One ecosystem, Adani managed airports#, Trainman, gas, electricity, and more.

- Exclusive Airport Benefits: Includes 2 Pranaam, 8 Porter, and 8 premium/valet car parking services per year at Adani-managed airports.

- Flight Ticket Voucher: ₹5,000 valid on flight booking through Adani One.

- Domestic Lounge Access: 16 accesses and premium upgrades at Adani-managed airports.

- Entertainment Offers: Buy one ticket and get up to Rs 500 off on the second ticket, twice every month through BookMyShow.

Adani One Platinum Credit Card

- Welcome Vouchers: Worth Rs 5000 on card activation.

- Reward Points: 3% on Adani One ecosystem*, Adani managed airports#, Trainman, gas, electricity, and more.

- Exclusive Airport Benefits: Includes 4 Porter and 2 premium car parking services per year at Adani-managed airports.

- Flight Ticket Voucher: ₹2,000 valid on flight booking through Adani One.

- Domestic Lounge Access: 8 accesses and premium upgrades at Adani-managed airports.Entertainment Offers: Buy one ticket and get 25% off up to Rs 100 on the second ticket, twice every month through BookMyShow.

Competition Heating Up in Retail Finance

IMAGES

VIDEO

COMMENTS

Simply follow these steps to register you on the portal. Enter the number on your Forex Prepaid Card. Enter your four-digit ATM PIN. Define your User ID, login password and transaction password. Set your security questions and enter their respective answers. Submit this information to create your user ID.

Refresh your finances with a fulfilling credit card from ICICI Bank. Explore Now. Loans. Personal Loan ... Get a free international sim card for your travel abroad. Lost Card/Counter Card liability coverage of INR 5,00,000. ... Account Activation Process; Important Information Related to Digital Lending; Other.

Register your Travel Card on the Self Care Portal in 3 easy steps. Enter your Travel Card number and your 4-digit ATM PIN. Define your User ID, Login Password and Transaction Password. Set your security questions, input their respective answers and submit to create User ID.

Call on 1800 1080. Select your language preference > Select Option 2 for Credit Card or Prepaid Cards > Then enter the 16 digit Card number. In case, you are travelling abroad and calling from the local international number of the following countries, please use the 24-hour International Toll free numbers and follow the dialing pattern set by ...

A Credit Card offers financial convenience but before enjoying the perks, you need to activate the card. When it comes to ICICI Bank, Credit Card activation is quite easy. The activation process ensures that your card is ready for secure transactions. Safeguarding your Credit Card against unauthorised use ensures that you make the most of your ...

Travel Cards. ICICI Bank Travel Card is the perfect travel companion for all your international trips. Get the Travel Card of your choice by browsing through the 'Travel Cards - Variants' section. ... Load and instantly activate your Travel Card to start using it immediately for booking your international flight and accommodation.

Enter your 16 digit card number ::: ...

Step 2: Visit the ICICI Bank Forex Card Web Portal. To load or reload your ICICI Bank Forex Card, you can visit the dedicated web portal provided by the bank. Open your web browser and navigate to the ICICI Bank Forex Card page. You can easily find this page by searching for "ICICI Bank Forex Card" on any search engine.

Step 2: Login to your account. Once you receive your ICICI forex card, you need to login to your account to activate it. You can do this by visiting the ICICI Bank website and clicking on the 'Login' button at the top right corner of the page. If you don't have an account, you can create one by clicking on the 'New User' button.

The forex card can be activated online through the bank's website or mobile app. Here are the steps to activate the forex card ICICI: 1. Visit the ICICI bank website or open the mobile app. 2. Click on the 'Forex & Travel Cards' tab. 3. Select the 'Forex Cards' option. 4. Enter the forex card number, expiry date, and CVV code. 5.

Here is how to activate international transactions on ICICI debit card through the iMobile app: Step 1: Install the iMobile app on your mobile phone. Step 2: Log in to your ICICI Bank iMobile Banking app with the login PIN. Step 3: Select 'Services' from the list. Step 4: Click on the 'Manage Card' option from the list.

Interest Rates. Gold Rate Today. Service Charges and Fees. Forex Prepaid Card in India - Buy or reload forex prepaid card for your foreign trips to save money at ICICI Bank. Buy smart, cost effective, convenient and secure Forex Prepaid card with ICICI Bank and enjoy your travelling aborad.

This can be done through the online portal, mobile app, or by visiting an ICICI Bank branch. You can choose the currencies and the amount you wish to load onto the card based on your travel destination. 3. Activate the Card: Before your trip, make sure to activate your Forex card by following the instructions provided.

ICICI Bank CMS Travel Card Portal Registration and FeaturesCMS Portal Link - https://www.icicibank.com/Personal-Banking/cards/Consumer-Cards/travel-card/trav...

Step 1: Login to your ICICI Forex Card Account. The first step to activating e-commerce payment on your ICICI forex card is to log in to your account. Visit the ICICI Bank website and click on the 'Forex & Travel Cards' tab. Select 'Login' and enter your user ID and password. If you have not registered for an account, click on the ...

Get a Manchester United branded football on activation Movie ticket benefit - Buy 1, Get 1 free ... ICICI Bank Instant Platinum Credit Card/ ICICI Bank Instant Gold Credit Card/ Fixed Deposit Instant Credit Card 2.49% ... Travel Credit Cards - Travel more, spend less with a travel credit card that earns you rewards, miles, and perks on every ...

Adani One Platinum Credit Card. Welcome vouchers worth Rs 5000 on card activation. 3% Reward points on Adani One ecosystem*, Adani managed airports #, Trainman, Gas, Electricity and more. Exclusive benefits of 4 Porter and 2 premium Car parking services per year at Adani managed airports. 8 Domestic lounge access and premium upgrades at Adani ...

The ICICI Bank Forex travel card is a very secure alternative to carrying foreign currency. The card offers instant loading and activation, thereby enabling you to start using the card instantaneously. You receive an absolutely free Replacement Card, which can be activated easily, in case you happen to misplace or damage the Primary Card.

How to do Online / e-commerce transactions. Activate online transactions for your Forex Prepaid Card by following the path -. Internet Banking - Cards & Loans > Forex & Prepaid Cards > Manage Cards > Transaction Settings. iMobile Pay App - Cards & Forex > Forex Prepaid Cards > Transaction Settings. Self-Care Portal - My Profile > My Setup ...

ICICI Bank Sapphiro Forex Prepaid Card Travel Benefits. 2 complimentary international lounge access at airports worldwide with Dragon Pass membership. 5% discount on hotel and flight bookings with a monthly max cap of Rs. 3,000 on the cashback. Discounts on international roaming packs. No mark-up fee on cross-currency usage.

Listed below are the steps that will guide you on how to activate the PIN for your ICICI credit card via the bank's mobile app: Step 1: Install and open the iMobile Pay on your preferred device. Step 2: On the main page, navigate to the 'Cards & Forex' tab and click on it. Step 3: Select the ICICI credit card. Step 4: Tap on 'Generate PIN'.

Self Care Portal. User ID Password

"The cards come with a plethora of benefits designed to enhance the cardholders' lifestyle and elevate their airport and travel experience. They offer up to 7 per cent Adani Reward Points on spends across the Adani Group consumer ecosystem like the Adani One app, where one can book flights, hotels, trains, buses, and cabs; Adani-managed airports; Adani CNG pumps; Adani Electricity bills, and ...

Welcome Vouchers: Worth Rs 5000 on card activation. Reward Points: 3% on Adani One ecosystem*, Adani managed airports#, Trainman, gas, electricity, and more.