Ease My Trip share price target 2024, 2025, 2026, 2027, 2030 prediction: Buy or Sell?

Ease My Trip (EASEMYTRIP) is one of the leading online travel agencies in India, offering a comprehensive range of travel-related products and services for end-to-end travel solutions, including airline tickets, hotels and holiday packages, rail tickets, and bus tickets. In this article, we will look at the Ease My Trip share price target 2024, 2025, 2026, 2027, 2030 .

In this blog post, we will look at the overview, competitors, growth opportunities, SWOT analysis, financials, and key things to watch out for on Ease My Trip Stock.

Consider reading: Polycab Share Price Target

Page Contents

Ease My Trip share price target 2024, 2025, 2026, 2027, 2030

Ease my trip share price live chart and history, ease my trip share: buy or sell, competitors of ease my trip stock.

In the dynamic online travel agency (OTA) sector, Ease My Trip stands out amidst notable competitors. This comparison evaluates Ease My Trip against other key players in the industry, such as MakeMyTrip , Goibibo , Cleartrip , Yatra.com , and Gozoopla.com . We also consider direct booking channels offered by airlines and hotels.

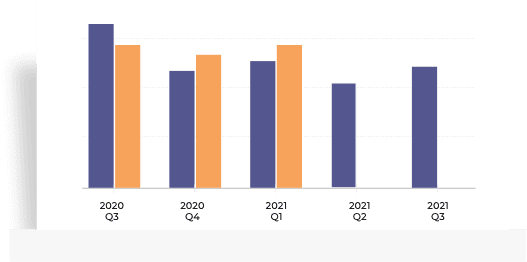

Financial Overview: The latest financial data highlights key performance metrics for these entities:

- Ease My Trip: Despite a challenging fiscal year (FY23), Ease My Trip demonstrated resilience. The company reported revenues of ₹674.9 crore, though it faced a net loss of ₹47.2 crore. Notably, Ease My Trip achieved a slightly positive EBITDA Margin of -0.2%.

- Competitors’ Performance: In contrast, competitors like MakeMyTrip, Goibibo, Cleartrip, Yatra.com, and Gozoopla.com experienced more pronounced financial struggles. Each of these companies reported a net loss of ₹1,057 crore and an EBITDA Margin of -0.4%. This trend suggests a broader industry challenge in achieving profitability.

- Market Valuation: The analysis of Price to Earnings (P/E) Ratios indicates that none of these companies, including Ease My Trip, had positive P/E ratios, signaling a universal issue with profitability in the current financial period.

Comparative Insights:

- Revenue Growth: Ease My Trip outpaced most of its competitors in terms of revenue growth, with Goibibo being the only exception.

- Financial Stability: Considering the debt-to-equity ratio, Ease My Trip showed greater stability compared to most competitors, with MakeMyTrip being an outlier.

Conclusion: This comparison elucidates the competitive landscape faced by Ease My Trip in the OTA market. While challenges are evident in terms of profitability and market valuation, Ease My Trip’s performance in certain metrics like revenue growth and financial stability positions it uniquely in this competitive sector.

Consider reading: Network 18 Share Price Target

Ease My Trip share price target 2024

Ease My Trip’s share price target in 2024 is expected to range between a minimum of ₹58.46 and a maximum of ₹72.84.

Growth Opportunity for Ease My Trip Stock

Ease My Trip has several growth opportunities to leverage its position as one of the leading OTAs in India.

Some of these opportunities are:

- Expanding its product portfolio to include more value-added services such as insurance products, travel assistance services, and loyalty programs.

- Increasing its market share by acquiring more customers through organic growth, partnerships, and acquisitions.

- Diversifying its revenue streams by entering new segments such as corporate travel, tourism, and leisure activities.

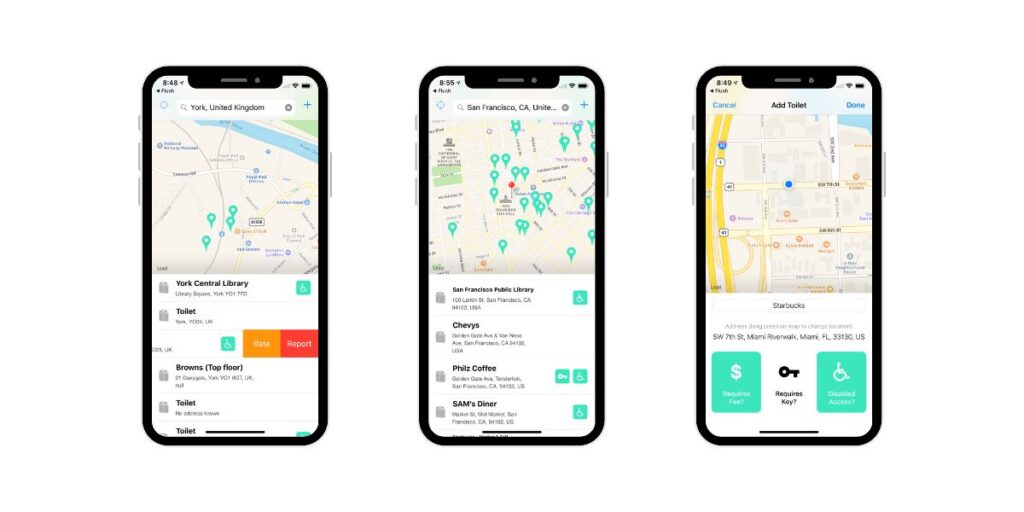

- Enhancing its customer experience by improving its website design, mobile app features, and customer service quality.

- Leveraging its data analytics capabilities to offer personalized recommendations, offers, and discounts to customers based on their preferences, behavior, and feedback.

- Optimizing its operational efficiency by reducing costs, increasing productivity, and improving quality control.

Ease My Trip share price target 2025

Ease My Trip’s share price target in 2025 is projected to fall within the range of ₹73.08 (minimum) to ₹91.05 (maximum).

Consider reading: BCG Share Price Target

SWOT Analysis of Ease My Trip Stock

A SWOT analysis is a strategic framework used for understanding the Strengths , Weaknesses , Opportunities , and Threats associated with a company or product. Below is a revised SWOT analysis of Ease My Trip stock, refined for clarity and SEO optimization:

- Cost-Efficiency : Ease My Trip’s low-cost, asset-light business model is a key advantage.

- Customer Loyalty : The company has a solid customer base, marked by strong loyalty.

- Extensive Network : Its wide network with offline partners and distributors broadens its market reach.

- Tech-Driven Platform : A data-driven and technology-enabled platform enhances operational efficiency.

- Leadership : The experienced and visionary management team drives the company’s strategic direction.

- Revenue Concentration : Heavy reliance on airline ticketing revenue presents a risk.

- Competitive Market : The high level of competition and price sensitivity in the travel industry is a challenge.

- Brand Recognition : There is a need for improvement in brand awareness and recall.

- Regulatory Risks : Potential regulatory and legal risks could impact operations.

- Industry Cyclicality : The seasonal and cyclical nature of the travel industry can affect stability.

Opportunities

- Service Expansion : Expanding the product portfolio and adding value-added services can drive growth.

- Market Penetration : Increasing market share and customer acquisition is a feasible target.

- Diversification : Diversifying revenue streams and segments can reduce risk.

- Customer Experience : Focusing on enhancing customer satisfaction and experience.

- Data Utilization : Leveraging data analytics for personalization and targeted marketing.

- Pandemic Impact : The ongoing Covid-19 pandemic and related travel restrictions pose significant challenges.

- Tech Evolution : Rapid technological disruptions and innovations require constant adaptation.

- Data Security : Cybersecurity and data privacy issues are critical concerns.

- Economic Factors : An economic downturn could impact consumer spending and travel habits.

- Socio-Environmental Issues : Environmental and social concerns are increasingly shaping consumer choices.

Ease My Trip share price target 2026

Ease My Trip share price target in 2026 is anticipated a span from a minimum of ₹91.34 to a maximum of ₹113.81.

Consider reading: Zomato Share Price Target

Ease My Trip Company Financials

The financial overview of Ease My Trip Company provides critical insights into its financial health and performance. This overview, updated for clarity and SEO optimization, includes key financial statements and ratios as of March 31, 2023.

Income Statement Highlights

- Revenue : Reported at ₹674.9 crores, showing a 55.3% decrease YoY.

- Expenses : Totalled ₹722.1 crores, indicating a 51.1% reduction YoY.

- Operating Profit : A loss of ₹47.2 crores was recorded, a significant downturn from the previous year.

- Profit Before Tax : Also stood at a loss of ₹47.2 crores.

- Profit After Tax : Mirrored the pre-tax figures with a ₹47.2 crore loss.

Analysis : The company faced substantial challenges, with a marked decrease in revenue and a shift from profit to loss, largely attributed to the impacts of the Covid-19 pandemic and related travel restrictions.

Balance Sheet Overview

- Total Assets : Remained steady at ₹1,200 crores.

- Total Liabilities : Reported at ₹0, indicating a debt-free status.

- Total Equity : Also stable at ₹1,200 crores.

Analysis : The balance sheet reflects a strong equity position with no reported debt, showcasing a potentially robust financial structure despite the operational challenges.

Cash Flow Statement Summary

- Operating Activities : Negative cash flow of ₹47.2 crores, a significant shift from the positive figures in previous years.

- Investing and Financing Activities : No cash flow reported in these categories.

- Net Cash Flow : Negative ₹47.2 crores, aligning with the operational cash flow figures.

Analysis : The negative cash flow from operations signals potential operational inefficiencies or market challenges during the year.

Key Financial Ratios

- Earnings Per Share (EPS) : -₹0.04, reflecting the net loss.

- Price to Earnings (PE) : Not applicable due to negative EPS.

- Return on Equity (ROE) : -3.93%, indicating a downturn in profitability.

- Return on Assets (ROA) : -3.93%, mirroring the ROE figures.

- Operating Margin : -6.99%, showing operational challenges.

- Net Margin : Also -6.99%, in line with operating margin.

- Asset Turnover : 0.56, suggesting moderate efficiency in asset utilization.

- Current Ratio : Not applicable.

- Debt to Equity : 0.00, reaffirming the company’s debt-free status.

Analysis : The key ratios highlight challenges in profitability and operational efficiency, yet the company maintains a strong equity position without reliance on debt financing.

Consider reading: Olectra Greentech Share Price Target

Ease My Trip share price target 2030

Ease My Trip share price target in 2030 is projected to have a target range between ₹223.01 (minimum) and ₹277.86 (maximum).

Key Things to Watch Out for Ease My Trip Stock

Ease My Trip’s stock is an emerging player in the travel sector, notable for its full suite of travel solutions. Its business model, characterized by low costs and minimal asset requirements, coupled with a robust customer base and loyalty, extensive partner network, and a cutting-edge data and technology framework, positions it strongly in the market. However, several industry-specific challenges and threats loom, including reliance on airline ticketing, fierce competition, brand recognition issues, regulatory hurdles, and the inherently fluctuating nature of the travel sector.

Crucial Factors to Monitor:

- Post-Pandemic Recovery : The rebound of the travel sector from Covid-19 and related restrictions is vital. The company’s revenues and profits are closely tied to air travel demand, which the pandemic has greatly impacted. Adapting to evolving consumer preferences and providing safe, hygienic travel options will be key to its resilience and growth.

- Technological Advancements : The impact of emerging technologies like AI, blockchain, cloud computing, and big data in the travel industry cannot be overstated. Ease My Trip’s ability to harness these technologies for platform enhancement and competitive differentiation is crucial for sustainable growth and profitability.

- Cybersecurity and Data Privacy : With the rise in digital platform usage and online transactions, protecting customer data against cyber threats and adhering to data protection regulations is imperative for maintaining the company’s reputation and smooth operation.

- Economic Factors : Fluctuations in consumer spending and broader economic trends could impact discretionary incomes and, consequently, travel budgets. The company’s success in offering cost-effective travel solutions and managing its costs will be influential in driving its revenue and profit margins.

- Environmental and Social Responsibility : The travel industry’s environmental footprint and societal impacts are increasingly under scrutiny. Ease My Trip’s commitment to sustainable and responsible travel practices, and its support for environmental and social initiatives, will play a significant role in shaping its brand perception and customer loyalty.

Consider reading: Bajaj Auto Share Price Target

Final Thoughts on Ease My Trip share price target 2024, 2025, 2026, 2027, 2030

Faqs on ease my trip share price target 2024, 2025, 2026, 2027, 2030, what is ease my trip share price target 2024.

Ease My Trip’s share price target for 2024 is anticipated to vary between ₹58.46 as the minimum and ₹72.84 as the maximum.

What is Ease My Trip share price target 2025?

IEase My Trip’s share price target in 2025 is forecasted to range between a minimum of ₹73.08 and a maximum of ₹91.05.

What is Ease My Trip share price target 2026?

Ease My Trip’s share price target in 2026 is expected to span from a minimum of ₹91.34 to a maximum of ₹113.81.

What is Ease My Trip share price target 2030?

Ease My Trip’s share price target in 2030 is anticipated to have a target range between ₹223.01 as the minimum and ₹277.86 as the maximum.

Hey there, I'm Raj! I've been navigating the investment world since 2005, from stocks to gold, and I'm here to share what I've learned.

As the brain behind We Invest Smart, I'm all about making finance fun and profitable for you. Let's achieve financial success together!

Similar Posts

Suzlon share price target 2024, 2025, 2026, 2027, 2030 prediction: Buy or Sell?

Infosys Share Price Target 2024, 2025, 2026, 2027, 2030 Prediction: Buy or Sell?

Bajaj Finance Share Price Target 2024, 2025, 2026, 2027, 2030 Prediction

AXIS Bank Share Price Target 2024, 2025, 2026, 2027, 2030 Prediction

CDSL Share Price Target 2024, 2025, 2026, 2027, 2030, and Long Term Prediction

Tata Power Share Price Target 2024, 2025, 2026, 2027, 2030, and Long Term

Leave a reply cancel reply.

Get the latest Market insights and recommendations! Get our Newsletter for FREE.

You have successfully subscribed to our blog!

There was an error while trying to send your request. Please try again.

Easy Trip Planners Share Price Target 2024, 2025, 2026 To 2030

Step into the realm of seamless travel experiences with the distinguished brand “ Ease My Trip .” Recognized as a prominent figure in the travel industry, the company presents an extensive range of travel-related products and services, all unified under its trusted flagship brand. Whether it’s facilitating effortless airline ticket bookings, arranging comfortable hotel accommodations, or curating exciting holiday packages, “Ease My Trip” ensures a complete and stress-free travel experience. Beyond these essentials, the company extends its services to cover aspects like rail and bus ticket arrangements, offering ancillary value-added services such as travel insurance, streamlined visa processing, and access to various activities and attractions.

This article will meticulously explore every aspect of this comprehensive travel companion, shedding light on its diverse offerings and exemplary services.

About Ease My Trip

Easy Trip Planners (EMT) stands out as India’s fastest-growing and second-largest profitable online travel portal, establishing itself as a leading OTA firm. Offering a comprehensive suite of travel-related products and services, EMT ensures end-to-end travel solutions, including airline tickets, hotels, holiday packages, rail tickets, and bus tickets. Its extensive travel agent network sets EMT apart, boasting a staggering 60,000 agents across India and operating through three distribution channels: B2C, B2E, and B2B2C. With over 90% of its current business directed towards B2C, the company effectively caters to individual travelers while maintaining a presence in the travel agent and corporate business domains.

EMT’s strategic approach involves noteworthy acquisitions and partnerships, such as the Spree Hospitality acquisition, aiming to expand its portfolio to 200 properties in the next five years. Additionally, the YoloBus acquisition and collaborations with Flybig, SpiceJet, and JustDial showcase EMT’s commitment to diversifying its offerings and enhancing customer experiences through exclusive partnerships in various travel segments.

Ease My Trip in Recent News

- In a bold move, EaseMyTrip has halted all flight bookings to the Maldives as a demonstration of solidarity with India. The decision comes in response to derogatory remarks made by some suspended ministers against India and Prime Minister Narendra Modi regarding his recent visit to Lakshadweep. Nishant Pitti, CEO of EaseMyTrip, announced the suspension on social media, emphasizing the company’s commitment to supporting the nation in the face of the online ‘Boycott Maldives’ campaign.

Defending the suspension of Maldives flight bookings, EaseMyTrip CEO Nishant Pitti cited the Maldivian President’s request to remove Indian military personnel by March 15, 2024, as the root cause. Highlighting the Maldivian government’s pro-China stance, Pitti stated that redirecting tourism revenue from Indians to Chinese tourists is fair. Despite potential financial risks, Pitti expressed gratitude for the 95% of Indians supporting the decision, while acknowledging that a political perspective may influence the remaining 5%. Talks between Indian and Maldivian officials are ongoing regarding the withdrawal of Indian military personnel.

How To Purchase Ease My Trip Shares?

Below are the trading platforms that you can use to purchase EMT shares:

➤ ICICIDirect

Ease My Trip Share Price Target 2024 To 2030

Ease my trip share price target 2024, ease my trip share price target 2025.

Anticipating a positive trajectory, Ease My Trip’s share price targets for 2025 demonstrate an upward trend. The projections indicate a maximum price of ₹70.32 and a minimum of ₹45.25 by December 2025. This outlook aligns with the company’s recent geographical expansion efforts in northern India, marked by new franchise stores in Ludhiana, Jalandhar, Delhi, and Agra.

Additionally, the exponential growth of the company’s Dubai office further signals its strategic expansion and market presence. Given these optimistic projections and expansion initiatives, investors will likely watch the company closely.

Ease My Trip Share Price Target 2026

Looking ahead to 2026, Ease My Trip’s share price forecasts suggest a robust performance, with projections reaching a maximum of ₹86.57 and a minimum of ₹55.71 by December.

Notably, the company’s revenue mix reveals a significant reliance on airline passage, contributing to 99.97% of its revenue, while hotel packages and other services play smaller roles. A noteworthy advancement includes the introduction of in-house Smart Voice Recognition Technology powered by advanced AI and ML, showcasing the company’s commitment to leveraging cutting-edge technology for enhanced services.

Ease My Trip Share Price Target 2027

In the trajectory for 2027, Ease My Trip’s share price is poised for growth, with projections ranging from a maximum of ₹105.54 to a minimum of ₹67.92 by December. Amidst this optimistic outlook, the company has strategically collaborated with DuDigital Global Limited for streamlined administrative processes related to visas, passports, and identity management.

Additionally, a partnership with BluSmart, India’s leading all-electric ride-hailing service and EV charging superhub operator, further enhances EaseMyTrip’s offerings. Impressively, the company maintains a low marketing cost, spending just 0.9% of revenue on marketing, coupled with a high Look to Book ratio of ~4%, indicating strong customer engagement.

Ease My Trip Share Price Target 2028

- January 2028: ₹82.81 (Minimum)

- December 2028: ₹128.66 (Maximum)

Ease My Trip Share Price Target 2029

- January 2029: ₹100.95 (Minimum)

- December 2029: ₹156.86 (Maximum)

Ease My Trip Share Price Target 2030

- January 2030: ₹123.07 (Minimum)

- December 2030: ₹191.23 (Maximum)

Ease My Trip Financial Condition: Last 5 Years

- Over the past five years, Ease My Trip has demonstrated notable financial growth.

- Sales have consistently increased from ₹101 Crores in 2019 to ₹430 Crores in 2023.

- Operating profit witnessed a substantial rise, improving from -₹11 Crores in 2019 to ₹185 Crores in 2023.

- The operating profit margin stands impressively at 43%.

- Net profit has steadily grown, reaching ₹147 Crores in 2023.

- Earnings per share (EPS) is recorded at ₹0.84.

- The company has shown prudent financial management, maintaining a 0% dividend payout in 2019, 2020, and 2023, with a peak of 35% in 2021.

- Compounded sales growth over the last 10 years is -3%, while over the last 5 years, it is 34%.

- Compounded profit growth over the last 10 years is 52%, and over the last 5 years, it is 103%.

- Return on equity has been consistently strong, reaching 47% in the last year.

- The stock price compound annual growth rate (CAGR) for 1 year is -12%.

What is Ease My Trip’s current market capitalization?

As of January 24th, 2024, Ease My Trip’s market cap is ₹8,274 Crores.

What is the current share price of Ease My Trip?

The current share price is ₹46.7 as of January 24th, 2024.

What is Ease My Trip’s projected share price for December 2024?

The projected share price for December 2024 ranges from a minimum of ₹43.68 to a maximum of ₹57.68.

What is Ease My Trip’s share price target for 2025?

In 2025, the share price is expected to reach a maximum of ₹70.32 and a minimum of ₹45.25 by December.

What is the expected share price for Ease My Trip in 2026?

The share price for 2026 is projected to range from ₹55.71 (minimum) to ₹86.57 (maximum) by December.

What is Ease My Trip’s marketing expenditure as a percentage of revenue?

In H1FY24, the company spent just 0.9% of its revenue on marketing.

How has Ease My Trip’s sales growth performed over the last 5 years?

The compounded sales growth for the last 5 years is 34%.

What is Ease My Trip’s current operating profit margin percentage?

The current operating profit margin is 43%.

What is Ease My Trip’s return on equity for the last year?

The return on equity for the last year is 47%.

What is the compounded profit growth for Ease My Trip over the last 3 years?

The compounded profit growth for the last 3 years is 64%.

What is the stock’s Price/Earnings (P/E) ratio as of now?

The stock’s P/E ratio is 51.7.

What is Ease My Trip’s target for 2030 share price?

The projected share price for January 2030 ranges from a minimum of ₹123.07 to a maximum of ₹191.23.

- Polycab India Ltd Share Price Target 2024, 2025, 2026 To 2030

- AXIS BANK SHARE PRICE TARGET 2024, 2025, 2026 to 2030

- J.K CEMENT SHARE PRICE TARGET 2024, 2025, 2026 to 2030

Strategic Overview and Considerations: Navigating the Trajectory – A Comprehensive Conclusion on Ease My Trip

In conclusion, Ease My Trip stands out as a prominent player in the travel industry, offering a comprehensive suite of services and showcasing commendable growth. The company’s commitment to seamless travel experiences is evident through its diverse offerings, strategic acquisitions, and exclusive partnerships. The decision to suspend flight bookings to the Maldives underscores its alignment with national sentiments.

While the projected share price trajectory from 2024 to 2030 indicates promising prospects and the company has delivered a robust 103% CAGR in profit growth over the last 5 years, potential investors should exercise caution. The stock’s current trading at 13.5 times its book value, a decrease in promoter holding, and challenges in liquidity management reflected in increased debtor and working capital days necessitate careful consideration.

Despite these considerations, Ease My Trip is anticipated to deliver a strong quarter, and its impressive 48.7% ROE over three years adds a positive dimension. Investors are advised to conduct thorough due diligence, weighing growth prospects against financial indicators and market dynamics before making informed decisions about their investment in Ease My Trip.

What did we learn?

- 1 About Ease My Trip

- 2 Ease My Trip in Recent News

- 3 How To Purchase Ease My Trip Shares?

- 4.1 Ease My Trip Share Price Target 2024

- 4.2 Ease My Trip Share Price Target 2025

- 4.3 Ease My Trip Share Price Target 2026

- 4.4 Ease My Trip Share Price Target 2027

- 4.5 Ease My Trip Share Price Target 2028

- 4.6 Ease My Trip Share Price Target 2029

- 4.7 Ease My Trip Share Price Target 2030

- 5 Ease My Trip Financial Condition: Last 5 Years

- 6.1 What is Ease My Trip’s current market capitalization?

- 6.2 What is the current share price of Ease My Trip?

- 6.3 What is Ease My Trip’s projected share price for December 2024?

- 6.4 What is Ease My Trip’s share price target for 2025?

- 6.5 What is the expected share price for Ease My Trip in 2026?

- 6.6 What is Ease My Trip’s marketing expenditure as a percentage of revenue?

- 6.7 How has Ease My Trip’s sales growth performed over the last 5 years?

- 6.8 What is Ease My Trip’s current operating profit margin percentage?

- 6.9 What is Ease My Trip’s return on equity for the last year?

- 6.10 What is the compounded profit growth for Ease My Trip over the last 3 years?

- 6.11 What is the stock’s Price/Earnings (P/E) ratio as of now?

- 6.12 What is Ease My Trip’s target for 2030 share price?

- 7 Strategic Overview and Considerations: Navigating the Trajectory – A Comprehensive Conclusion on Ease My Trip

EASY TRIP PLANNERS LTD

Price target, analyst rating, frequently asked questions.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Easy trip planners limited (easemytrip.ns).

- Previous Close 43.10

- Bid 43.90 x --

- Ask 43.95 x --

- Day's Range 43.20 - 44.00

- 52 Week Range 37.00 - 54.00

- Volume 1,832,405

- Avg. Volume 21,242,347

- Market Cap (intraday) 77.74B

- Beta (5Y Monthly) 0.27

- PE Ratio (TTM) 50.99

- EPS (TTM) 0.86

- Earnings Date --

- Forward Dividend & Yield 0.10 (0.23%)

- Ex-Dividend Date Dec 19, 2023

- 1y Target Est --

Easy Trip Planners Limited Overview Travel Services / Consumer Cyclical

Easy Trip Planners Limited, together with its subsidiaries, operates as an online travel agency in India, the Philippines, Singapore, Thailand, the United Arab Emirates, the United Kingdom, New Zealand, and the United States. The company provides a range of travel-related products and services, including airline tickets, hotels, and holiday and travel packages; rail tickets, bus tickets, air charter services, and taxi rentals, as well as value added services, such as travel insurance, visa processing, and tickets for activities and attractions. It also engages in the tour operations and other reservation activities. The company distributes its products and services through business to business to customer channels, as well as online. The company was incorporated in 2008 and is based in New Delhi, India.

Full Time Employees

Fiscal year ends.

Travel Services

Related News

GameStop, AMC shares skyrocket after meme stock trader posts for first time in 3 years

GameStop Stock (NYSE:GME): This Game Is Rigged Against You

Dow Jones Futures: Nvidia's New Buy Point; GameStop Extends 74% 'Roaring Kitty' Surge

Stone delivers a consistent quarter with adjusted net income of R$450 million, a 90% growth compared to the same time last year

AMC Set to Cash In on Meme-Stock Traders Driving Shares Higher

StoneCo Ltd. (STNE) Q1 Earnings Surpass Estimates

Dow ends hot streak, meme stocks pop on major rally: Market Domination Overtime

How Roaring Kitty's return impacted GameStop stock and some crypto assets

Meme trade roars back to life, OpenAI's GPT-4o: Market Domination

Home Depot Q1 earnings preview: Pro customers expected to offset fewer DIY shoppers

Home depot q1 earnings preview: 'well positioned for share gains' — will consumers doing home repairs over buying homes help.

Alibaba Stock Has Surged on China Growth Hopes. Earnings Could Derail the Rally.

Performance overview: easemytrip.ns.

Trailing total returns as of 5/14/2024, which may include dividends or other distributions. Benchmark is S&P BSE SENSEX .

1-Year Return

3-year return, 5-year return, compare to: easemytrip.ns.

Select to analyze similar companies using key performance metrics; select up to 4 stocks.

Statistics: EASEMYTRIP.NS

Valuation measures.

Enterprise Value

Trailing P/E

Forward P/E

PEG Ratio (5yr expected)

Price/Sales (ttm)

Price/Book (mrq)

Enterprise Value/Revenue

Enterprise Value/EBITDA

Financial Highlights

Profitability and income statement.

Profit Margin

Return on Assets (ttm)

Return on Equity (ttm)

Revenue (ttm)

Net Income Avi to Common (ttm)

Diluted EPS (ttm)

Balance Sheet and Cash Flow

Total Cash (mrq)

Total Debt/Equity (mrq)

Levered Free Cash Flow (ttm)

People Also Watch

- Option Chain

- Daily Reports

- Press Releases

14-May-2024 09:46

29-May-2024 | 83.5525

Lac Crs 393.87 | Tn $ 4.72

13-May-2024

- A+ | Reset | A-

- High Contrast | Reset

- Mutual Fund

You will be redirected to another link to complete the login

Quote - Equity

- In Top 10 today

Special Pre Open Session

- Price mentioned in band is Indicative Equilibrium Price (IEP) as on

Series : ( )

Announcements.

- Announcements XBRL

Annual Reports

Business responsibility and sustainability report, board meetings, corporate actions.

- Company Directory

Corporate Governance

Corporate information, daily buy back, event calendar, financial results, financial results comparision.

- Further Issues XBRL Fillings

Insider Trading

Investor complaints, promoter encumbrance details.

- Issue Offer Documents / Issue Summary Documents

Related Party Transactions

- SAST Regulations

Statement of Deviation/Variation

- System Driven Disclosures - PIT

- System Driven Disclosures - SAST

Secretarial Compliance

Share transfers, shareholder's meetings, shareholding patterns, unitholding patterns, voting results, intraday chart, security status, financial results (amount in cr.), shareholding patterns (in %).

Click here for Block Deals

To Read all the information, please Click here

Corporate Announcements

Announcement xbrl.

- All Values are in ₹ Lakhs.

Insider Trading (PIT) - Annual

No data found.

- Transfer Agent details

- Price mentioned in band is Indicative Equilibrium Price (IEP). The equilibrium price shall be the price at which the maximum volume can be matched.

- ATO stands for “At the Open”, any “market order” placed to buy or sell a stock gets traded as ATO

- Click here for more on Pre-Open Market Call Auction

(Period to )

( period to ), data for 52 week period:, yearly data for period:, monthly data for period :, delivery position, value at risk (%), industry classification, announcement xbrl details, quick links, quick links, for investors, for corporates, for members, old website, quick links for investors.

Dashboard for end of day reports download, quick market snapshot and important announcements.

Market Snapshot

Volume (Lakhs)

Value (Lakhs)

FFM .Cap (Lakhs)

Quick Links for Corporates

Dashboard for tracking corporate filings

Latest Corporate Filings

Showing 0 of 5 selected companies, latest circulars, quick links for members, members message area.

Exchange has published Member Help Guide and new FAQs for Access to Markets. Visit the link: https://www.nseindia.com/trade/all-member-faqs

Contact for Support

- EASY TRIP PLANNERS LTD.

- SECTOR : DIVERSIFIED CONSUMER SERVICES

- INDUSTRY : TRAVEL SUPPORT SERVICES

Easy Trip Planners Ltd. NSE: EASEMYTRIP | BSE: 543272

Expensive Performer

Easy Trip Planners Ltd. Live Share Price Today, Share Analysis and Chart

43.95 0.85 ( 1.97 %)

52W Low on Aug 23, 2023

1.9M NSE+BSE Volume

NSE 14 May, 2024 9:45 AM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

Easy Trip Planners Ltd. Live Price Chart

Earnings conference calls, investor presentations and annual reports, earnings calls, annual reports, investor presentation, easy trip planners ltd - 543272 - announcement under regulation 30 (lodr)-earni…, easy trip planners ltd - 543272 - announcement under regulation 30 (lodr)-analy…, easy trip planners ltd. results earnings call for q3fy24, easy trip planners results earnings call for q2fy24, easy trip planners results earnings call for q1fy24, easy trip planners results earnings call for q4fy23, easy trip planners ltd - 543272 - announcement under regulation 30 (lodr)-inves…, easy trip planners ltd. faq, how is the easy trip planners ltd. today, the easy trip planners ltd. today is trading in the green, up by 1.97% at 43.95., how has easy trip planners ltd. performed historically, the easy trip planners ltd. is currently trading up 1.97% on an intraday basis. in the past week the stock fell -4.56%. the stock has been down -7.67% in the past quarter and fell -5.28% in the past year. you can view this in the overview section..

- Consumer Services

Easy Trip Planners NSEI:EASEMYTRIP Stock Report

Easy Trip Planners Limited

NSEI:EASEMYTRIP Stock Report

Market Cap: ₹76.4b

EASEMYTRIP Stock Overview

Easy Trip Planners Limited, together with its subsidiaries, operates as an online travel agency in India, the Philippines, Singapore, Thailand, the United Arab Emirates, the United Kingdom, New Zealand, and the United States.

About the company

Earnings are forecast to grow 9.81% per year

Earnings grew by 18.7% over the past year

Risk Analysis

Dividend of 0.46% is not well covered by cash flows

Easy Trip Planners Limited Competitors

Lemon Tree Hotels

NSEI:LEMONTREE

Thomas Cook (India)

India Tourism Development

Chalet Hotels

NSEI:CHALET

Price history & performance, recent news & updates, there's reason for concern over easy trip planners limited's (nse:easemytrip) price.

Third quarter 2024 earnings released: EPS: ₹0.26 (vs ₹0.24 in 3Q 2023)

Easy trip planners limited declares interim dividend, easemytrip launches holiday packages and direct buses to ayodhya, investor sentiment improves as stock rises 27%, easy trip planners limited announced that it expects to receive inr 10 billion in funding, recent updates, easy trip planners limited approves interim dividend for the financial year 2023-2024, payable on or before 10 january 2024, easy trip planners limited unveils explore bharat - discover the soul of india travel program, why the 32% return on capital at easy trip planners (nse:easemytrip) should have your attention.

Second quarter 2024 earnings released: EPS: ₹0.27 (vs ₹0.16 in 2Q 2023)

Easemytrip.com launches its latest offering, easydarshan, easemytrip launches smart voice recognition technology that redefines customers travel booking experience, easy trip planners limited, annual general meeting, sep 29, 2023, consensus eps estimates fall by 18%, price target decreased by 14% to ₹47.00, first quarter 2024 earnings released: eps: ₹0.15 (vs ₹0.19 in 1q 2023), easy trip planners limited to report q1, 2024 results on aug 14, 2023, easy trip planners limited announced that it expects to receive inr 846.797864 million in funding from capri global holdings private limited, easy trip planners limited agreed to acquire 51% stake in guideline travels holidays india private limited, dook travels private limited and tripshope travel technologies private limited., co-founder recently sold ₹2.7b worth of stock, consensus revenue estimates fall by 12%, easy trip planners limited (nse:easemytrip) analysts just trimmed their revenue forecasts by 12%.

Earnings Miss: Easy Trip Planners Limited Missed EPS By 6.1% And Analysts Are Revising Their Forecasts

Full year 2023 earnings: EPS and revenues miss analyst expectations

Easy trip planners limited to report q4, 2023 results on may 26, 2023, investor sentiment improves as stock rises 16%, is there now an opportunity in easy trip planners limited (nse:easemytrip).

Insufficient new directors

Consensus eps estimates fall by 11%, revenue upgraded, third quarter 2023 earnings released: eps: ₹0.59 (vs ₹0.23 in 3q 2022), easy trip planners limited to report q3, 2023 results on feb 06, 2023, easy trip planners limited (nsei:easemytrip) entered into an agreement to acquire 55% stake in glegoo innovations private limited inr 30 million., easy trip planners limited (nsei:easemytrip) entered into an agreement to acquire 55% stake in glegoo innovations private limited., if eps growth is important to you, easy trip planners (nse:easemytrip) presents an opportunity.

Investor sentiment deteriorated over the past week

Easy trip planners limited (bse:543272) entered into a definitive agreement to acquire 75% stake in nutana aviation capital ifsc private limited., easy trip planners limited announces introduction of emtpro - an invite only, special programme for its elite customers, second quarter 2023 earnings: revenues exceed analysts expectations while eps lags behind, easy trip planners limited launches 2.0 self-booking tool for corporates, easy trip planners limited to report q2, 2023 results on nov 11, 2022, easemytrip.com to launch its new product line called save now buy later, easy trip planners limited, annual general meeting, aug 30, 2022, these analysts think easy trip planners limited's (nse:easemytrip) sales are under threat.

First quarter 2023 earnings released: EPS: ₹1.52 (vs ₹0.71 in 1Q 2022)

Easy trip planners limited to report q1, 2023 results on jul 29, 2022, here's why we think easy trip planners (nse:easemytrip) might deserve your attention today.

Full year 2022 earnings released: EPS: ₹4.87 (vs ₹2.81 in FY 2021)

Easy trip planners limited to report q4, 2022 results on may 25, 2022, investor sentiment improved over the past week, is now the time to put easy trip planners (nse:easemytrip) on your watchlist.

Easy Trip Planners Limited Approves the Appointment of Nutan Gupta for the Position of Chief Executive Officer

Third quarter 2022 earnings: revenues and eps in line with analyst expectations, easy trip planners limited (bse:543272) entered into a definitive agreement to acquire yolobus., easy trip planners' (nse:easemytrip) earnings are of questionable quality.

Second quarter 2022 earnings released: EPS ₹2.50 (vs ₹0.57 in 2Q 2021)

Company secretary & compliance officer preeti sharma has left the company, market participants recognise easy trip planners limited's (nse:easemytrip) earnings pushing shares 59% higher.

Full year 2021 earnings released: EPS ₹5.62 (vs ₹3.04 in FY 2020)

Shareholder returns.

Return vs Industry : EASEMYTRIP underperformed the Indian Hospitality industry which returned 76.2% over the past year.

Return vs Market : EASEMYTRIP underperformed the Indian Market which returned 39.6% over the past year.

Price Volatility

Stable Share Price : EASEMYTRIP has not had significant price volatility in the past 3 months.

Volatility Over Time : EASEMYTRIP's weekly volatility (5%) has been stable over the past year.

About the Company

Easy Trip Planners Limited, together with its subsidiaries, operates as an online travel agency in India, the Philippines, Singapore, Thailand, the United Arab Emirates, the United Kingdom, New Zealand, and the United States. The company provides a range of travel-related products and services, including airline tickets, hotels, and holiday and travel packages; rail tickets, bus tickets, air charter services, and taxi rentals, as well as value added services, such as travel insurance, visa processing, and tickets for activities and attractions. It also engages in the tour operations and other reservation activities.

Easy Trip Planners Limited Fundamentals Summary

Is EASEMYTRIP overvalued?

Earnings & Revenue

Last Reported Earnings

Dec 31, 2023

Next Earnings Date

How did EASEMYTRIP perform over the long term?

- Privacy Policy

- Historical Data

- Targets Short Term (Tomorrow, Weekly)

- Targets Long Term (Yearly)

Stocks To Watch Today - 1 May 2024: Piccadily Soars to All-Time High, Axis Bank Creates New 52-Week Peak & More

Stock To Watch Today - 30 Apr 2024: Piccadily Agro, Gallantt Metal, Mahindra & More!

Stocks To Watch Today (23 Apr 2024): Gallantt Metal Hits New All-Time High, TECHNOE Brews 52-Week High & More

Five Stocks to Watch Today (22 Apr 2024): TRIL, Gallantt, Berger, Winsome, and Bharat Road Witness Milestones

Hot Stocks To Watch Today (19 Apr 2024): TRIL, Gallantt, Berger Paints Hit Milestones Yesterday, Setting Stage for Market Surprises!

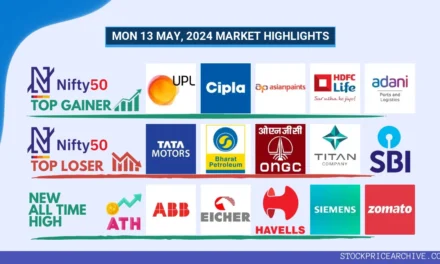

13 May 2024: Nifty at ₹22,104.05 Rose Slightly By 0.22% as Bajaj Auto, Tech Mahindra Post Contrasting Performances

10 May 2024 Market Recap: Nifty 50 Climbs 0.39% to ₹22,054 with Bajaj Auto Bullish; Hind Zinc, TVS Holdings Hit Record Highs

9 May 2024: Nifty Drops to ₹21,966.15 (-1.55%) on Energy Losses, While Bajaj Auto & Hero MotoCorp Emerge as Top Gainers with Promising Outlook

08 May 2024: Tata, TITAN Carve Distinct Paths; Oil India, Allcargo Present Watchlist Opportunities

07 May 2024: Nifty 50 closed at ₹22,302.50, down 0.63% - Hindustan Unilever & CDSL Create New All-Time Highs

Select Page

Home / Short Term Target / Easemytrip

Easy Trip Share Price Target - Tomorrow, Next Week & Next Month

Posted by Nippun | Predictions

- 1: Easy Trip Recent Performance

- 2: Chart: Easy Trip Share Price Target - Tomorrow

- 3: Table: Easy Trip Share Price Target - Tomorrow

- 4: Summary: Easy Trip Share Price Prediction For Tomorrow

- 5: Chart: Easy Trip Share Price Target - Next Week

- 6: Table: Easy Trip Share Price Target - Next Week

- 7: Summary: Easy Trip Share Price Prediction For Next Week

- 8: Chart: Easy Trip Share Price Target - Next Month

- 9: Table: Easy Trip Share Price Target - Next Month

- 10: Summary: Easy Trip Share Price Prediction For Next Month

Updated: Mon 13 May 2024

Easy Trip Recent Performance

Over the past 23 trading days, the value of Easy Trip's stock has decreased by ₹2.60 (-5.68%) . On 08 Apr 2024, one share was worth ₹45.75 and by 13 May 2024, the value dropped to ₹43.15 . During this period it created a highest high of ₹47.80 and lowest low of ₹42.10 .

Below Image represents line chart of daily close price of Easy Trip, helping you visualize how the price has changed day by day.

Chart: Easy Trip Share Price Target - Tomorrow

The line chart displays the Easy Trip daily closing prices for the past 23 trading days using a black line. The green line indicates the potential targets, while the red line shows the potential Stop-Loss (SL) levels.

For detailed target and stop loss values for Easy Trip shares for Mon 13 May 2024, see the table below.

Table: Easy Trip Share Price Target - Tomorrow

By analyzing Easy Trip stock with yesterday and past crucial price points and technical indicators we derived following targets for : Tue, 14 May, 2024!

Summary: Easy Trip Share Price Prediction For Tomorrow

Mon 13 May 2024: Easy Trip finished the day at ₹43.15, losing ₹-0.10 (-0.23%) in 1 day.

In summary, our analysis of Easy Trip for tomorrow predicts a rise of 1.15% to 3.47% with three potential targets T1: ₹43.65, T2: ₹44.10, T3: ₹44.65 and Stop-Loss (SL) at SL1: ₹43.00, SL2: ₹42.75, SL3: ₹42.41 .

Additionally, we've identified a support level at ₹42.10 — think of this as a safety net where the price might stop falling and there's also a resistance level at ₹43.40 , which is like a ceiling at which the price might have a hard time breaking through. These targets are based on our study of past trends and technical analysis using various indicators.

Over the last 23 trading days, the stock has dropped -5.68%, indicating it could be a good option for intra day trading as it has shown big price movements . During this period, its price fluctuated between 47.80 and 42.10.

After looking at tomorrow's share price prediction, let's now check what next week might hold for Easy Trip.

Stay ahead of the market! Get instant alerts on crucial market breakouts. Don't miss out on key opportunities!

Join our WhatsApp group

Join our Telegram group

Your phone number will be HIDDEN to other users.

Chart: Easy Trip Share Price Target - Next Week

The chart displays the Easy Trip weekly closing prices for the past 25 trading weeks using a black line. It also shows three targets using a green line, while the red line shows the potential Stop-Loss (SL) levels for next week.

For detailed target and stop loss values for Easy Trip shares for next week, see the table below.

Table: Easy Trip Share Price Target - Next Week

By analyzing Easy Trip stock with yesterday and past crucial price points and technical indicators we derived following targets for the next week!

Summary: Easy Trip Share Price Prediction For Next Week

As of Mon 13 May 2024, Easy Trip share price stands at ₹43.15, losing ₹-0.10 (-0.23%) in this week.

In summary, our analysis of Easy Trip for next week predicts a rise of 2.59% to 4.75% with three potential targets T1: ₹44.27, T2: ₹44.75, T3: ₹45.20 and Stop-Loss (SL) at SL1: ₹42.60, SL2: ₹42.17, SL3: ₹41.30 .

After looking at tomorrow's and next week's share price prediction, let's now check what next month might hold for Easy Trip.

Chart: Easy Trip Share Price Target - Next Month

The chart displays the Easy Trip monthly closing prices for the past 25 months using a black line. It also shows three targets using green line, while the red line shows the potential Stop-Loss (SL) levels.

For detailed target and stop loss values for Easy Trip shares for next month, see the table below.

Table: Easy Trip Share Price Target - Next Month

By analyzing Easy Trip stock with yesterday and past crucial price points and technical indicators we derived following targets for Next Month!

Summary: Easy Trip Share Price Prediction For Next Month

As of Mon 13 May 2024, Easy Trip share price stands at ₹43.15, losing ₹-3.35 (-7.20%) in this month.

In summary, our analysis of Easy Trip for next month predicts a rise of 2.66% to 4.75% with three potential targets T1: ₹44.30, T2: ₹44.75, T3: ₹45.20 and Stop-Loss (SL) at SL1: ₹42.84, SL2: ₹42.41, SL3: ₹41.30 .

After looking at tomorrow's, next week's and next month's share price prediction, you might wonder what this year or next year might hold for Easy Trip, we created a specific page for that check here: Easy Trip Share Price target for 2024 and 2025

As we wrap up, we hope you like our study on Easy Trip short term share price predictions, please kindly note that these forecasts are based on technical analysis, past trends, and machine learning models. They are for educational purposes only, not investment advice.

Methodology Behind the Prediction

The share price predictions present on our site are derived from a robust model that incorporates multiple economic indicators, technical indicators, company performance metrics, and industry-specific factors.

We have historical share price data of all stocks for which we present targets, so we analyze historical trends from those past data and overlay them with projected market conditions to estimate future share prices of a stock.

- Easy Trip Share Price History

- Easy Trip Price Long Term Target

- Easy Trip Dividend History

- Easy Trip Bonus History

- Easy Trip Split History

Disclaimer: Information is provided 'as is' and solely for informational and educational purposes, not for trading purposes or advice. We highly recommend to do your own research before making any investment.

About The Author

Hi, I’m Nippun, a tech enthusiast from Haryana, India. I have been coding since 2010 and using my coding skills in the share market since 2020. I have been coding scripts in Pinescript that work on Tradingview app/web. I love learning about new technology and applying it to solve real-world problems. Coding and share-market are my passions, and I enjoy finding and fixing bugs in code. I aim to share my skill set and experience that can positively impact society. Feel free to connect with me, and let’s learn from each other. My Twitter

Related Posts

Long-term share price prediction using technical analysis & machine learning.

March 9, 2024

Recent Posts

- Get 7 Days Free

Easy Trip Planners Ltd Ordinary Shares EASEMYTRIP

About quantitative ratings.

Morningstar Quantitative Ratings for Stocks are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Companies with quantitative ratings are not formally covered by a Morningstar analyst, but are statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat, fair value, and uncertainty rating.

Price vs Fair Value

Trading information, key statistics, company profile, comparables.

- Rategain Travel Technologies Ltd 543417

- Thomas Cook India Ltd THOMASCOOK

- MakeMyTrip Ltd MMYT

Financial Strength

Profitability, travel services industry comparables, sponsor center.

Easy Trip Planners Ltd (EASEMYTRIP) Share Price Target 2024, 2025, upto 2030

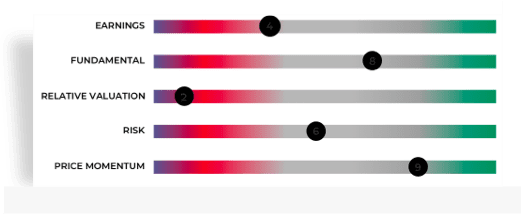

Easy Trip Planners Ltd is a company listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). In this detailed post, we will explore EASEMYTRIP share price target for 2024, 2025, 2026, and up to 2030. For long-term forecasts, we will use different technical analysis approaches to predict targets up to the year 2030.

In order to forecast the price of EASEMYTRIP up to the year 2030, we will use a machine learning approach where the forecasted data is trained on the past performance. Easy Trip Planners Ltd, known for its significant presence in the Indian share market, has shown various trends over the years. In this section, we discuss EASEMYTRIP's current market position, its growth trajectory, and how external market factors might influence its price performance leading up to 2030.

EASEMYTRIP Share Price Target 2024

Most of the Indian stocks like EASEMYTRIP have experienced an impressive Bull run in 2023. In the first quarter of 2024, the bullish sentiment of the market will likely stay the same with some consolidation in the beginning few months. As per technical data, the minimum share price target in 2024 for EASEMYTRIP is expected to be ₹47.46 and the maximum price target for 2024 will be ₹61.69.

Summary of EASEMYTRIP Share Price Forecast for 2024

- The initial price target for Easy Trip Planners Ltd in 2024 is projected to be ₹47.46.

- With favorable market conditions, the mid-year price target for Easy Trip Planners Ltd could reach ₹56.36.

- By the end of 2024, the price target for Easy Trip Planners Ltd is expected to potentially reach ₹61.69, considering bullish market trends.

EASEMYTRIP Share Price Target 2025

The share price of EASEMYTRIP is expected to reach a value of Rs. 63 by January 2025. If the Macro and Micro economic factors along with the industry trend support, we might see the target price of Easy Trip Planners Ltd reach Rs 69 by December 2025.

Summary of EASEMYTRIP Share Price Forecast for 2025

- The initial price target for Easy Trip Planners Ltd in 2025 is projected to be ₹63.

- With favorable market conditions, the mid-year price target for Easy Trip Planners Ltd could reach ₹59.

- By the end of 2025, the price target for Easy Trip Planners Ltd is expected to potentially reach ₹69, considering bullish market trends.

EASEMYTRIP Share Price Target 2026

As per technical data, The minimum share price target of EASEMYTRIP is expected to reach Rs. 70 and the maximum value that shares of EASEMYTRIP can reach is Rs. 81.

Summary of EASEMYTRIP Share Price Forecast for 2026

- The initial price target for Easy Trip Planners Ltd in 2026 is projected to be ₹70.

- With favorable market conditions, the mid-year price target for Easy Trip Planners Ltd could reach ₹66.

- By the end of 2026, the price target for Easy Trip Planners Ltd is expected to potentially reach ₹81, considering bullish market trends.

EASEMYTRIP Share Price Target 2027

Using Fibonacci projections, the estimated price target forecast for Easy Trip Planners Ltd (EASEMYTRIP) in the first half of the year 2027 will be between ₹83 - ₹78. By the second half of 2027, the share price of EASEMYTRIP may reach a maximum value of ₹93.

Summary of EASEMYTRIP Share Price Forecast for 2027

- The initial price target for Easy Trip Planners Ltd in 2027 is projected to be ₹83.

- With favorable market conditions, the mid-year price target for Easy Trip Planners Ltd could reach ₹78.

- By the end of 2027, the price target for Easy Trip Planners Ltd is expected to potentially reach ₹93, considering bullish market trends.

EASEMYTRIP Share Price Target 2028

Summary of easemytrip share price forecast for 2028.

- The initial price target for Easy Trip Planners Ltd in 2028 is projected to be ₹95.

- With favorable market conditions, the mid-year price target for Easy Trip Planners Ltd could reach ₹90.

- By the end of 2028, the price target for Easy Trip Planners Ltd is expected to potentially reach ₹108, considering bullish market trends.

EASEMYTRIP Share Price Target 2029

Summary of easemytrip share price forecast for 2029.

- The initial price target for Easy Trip Planners Ltd in 2029 is projected to be ₹110.

- With favorable market conditions, the mid-year price target for Easy Trip Planners Ltd could reach ₹102.

- By the end of 2029, the price target for Easy Trip Planners Ltd is expected to potentially reach ₹120, considering bullish market trends.

EASEMYTRIP Share Price Target 2030

Summary of easemytrip share price forecast for 2030.

- The initial price target for Easy Trip Planners Ltd in 2030 is projected to be ₹122.

- With favorable market conditions, the mid-year price target for Easy Trip Planners Ltd could reach ₹114.

- By the end of 2030, the price target for Easy Trip Planners Ltd is expected to potentially reach ₹138, considering bullish market trends.

Key Takeaways from Forecasted Price for EASEMYTRIP from 2024 to 2030

- In 2024, Easy Trip Planners Ltd (EASEMYTRIP) is expected to experience strong growth, with an initial target of ₹47.46. However, market volatility might lead to fluctuations mid-year, peaking at ₹58.13.

- For Easy Trip Planners Ltd in 2025, a bullish trend might take the stock to a mid-year target of ₹61, followed by a steady climb to ₹69.

- In 2026, a temporary decline in early months for Easy Trip Planners Ltd is possible, with a recovery expected by mid-year, aiming for ₹69.

- Anticipating mixed trends for Easy Trip Planners Ltd in 2027, with rapid movements both upward and downward, yet maintaining an overall upward trajectory towards ₹93.

- For 2028 and 2029, Easy Trip Planners Ltd is expected to show strong and steady growth, potentially breaking past previous highs and setting new records.

- By 2030, the cumulative impact of market dynamics could lead Easy Trip Planners Ltd to a substantial year-end target, surpassing previous expectations.

Final Words on Easy Trip Planners Ltd (EASEMYTRIP) Share Price Target up to 2030

To summarize, we have presented EASEMYTRIP share price target 2024, 2025, 2026, and up to 2030, based on the most recent trading data and algorithms. These targets serve as potential support and resistance levels for the coming years.

It's essential to note that while these price targets are based on technical analysis, other market conditions and news could also impact the stock's performance. Therefore, these hypothetical targets should be used as guidelines and not as financial advice. Always perform your own due diligence before making any investment.

We wish you all the best in your investing endeavors! Please read the Disclaimer below.

Latest articles

India’s costliest share declared dividend of 1940%, which mba is best for stock marketing, beml land assets ltd (blal) share price target tomorrow, bombay super hybrid seeds ltd (bshsl) share price target tomorrow, bhansali engg polymers ltd (bepl) share price target tomorrow.

Disclaimer : Stock targets and forecasts are for educational purposes only and may not be reliable for investment decisions. Use this information at your own risk. This is not an offer to buy or sell stocks. Dailybulls.in and its authors are not liable for any losses. It is not investment advice; seek professional advice before making any investment decisions. Exercise caution and be informed when investing.

Featured articles

May 7, 2024

April 14, 2024

Hindustan zinc rises before earning concall, Should you hold?

April 5, 2024

Exploring 5 Benefits of Debt Mutual Funds

Easy Trip Planners Ltd

Easy Trip Planners Ltd. is an online travel company.

Easy Trip Planners Ltd NSE:EASEMYTRIP

Intrinsic value.

Easy Trip Planners Ltd. is an online travel company. [ Read More ]

The intrinsic value of one EASEMYTRIP stock under the Base Case scenario is 19.26 INR . Compared to the current market price of 43.5 INR , Easy Trip Planners Ltd is Overvalued by 56% .

Persistent Overvaluation

Relative value, wall st target, negative free cash flow, valuation backtest easy trip planners ltd.

Run backtest to discover the historical profit from buying and selling EASEMYTRIP stocks based on their intrinsic value.

Analyze the historical link between intrinsic value and market price to make more informed investment decisions.

Fundamental Analysis

AI Assistant can make mistakes. Consider checking important information.

What unique competitive advantages does Easy Trip Planners Ltd hold over its rivals?

What risks and challenges does Easy Trip Planners Ltd face in the near future?

Is it considered overvalued or undervalued based on the latest financial data?

Provide an overview of the primary business activities of Easy Trip Planners Ltd.

Summarize the latest earnings call of Easy Trip Planners Ltd.

Show all valuation multiples for Easy Trip Planners Ltd.

Provide P/S for Easy Trip Planners Ltd.

Provide P/E for Easy Trip Planners Ltd.

Provide P/OCF for Easy Trip Planners Ltd.

Provide P/FCFE for Easy Trip Planners Ltd.

Provide P/B for Easy Trip Planners Ltd.

Provide EV/S for Easy Trip Planners Ltd.

Provide EV/GP for Easy Trip Planners Ltd.

Provide EV/EBITDA for Easy Trip Planners Ltd.

Provide EV/EBIT for Easy Trip Planners Ltd.

Provide EV/OCF for Easy Trip Planners Ltd.

Provide EV/FCFF for Easy Trip Planners Ltd.

Provide EV/IC for Easy Trip Planners Ltd.

Show me price targets for Easy Trip Planners Ltd made by professional analysts.

What are the Revenue projections for Easy Trip Planners Ltd?

How accurate were the past Revenue estimates for Easy Trip Planners Ltd?

What are the Net Income projections for Easy Trip Planners Ltd?

How accurate were the past Net Income estimates for Easy Trip Planners Ltd?

What are the EPS projections for Easy Trip Planners Ltd?

How accurate were the past EPS estimates for Easy Trip Planners Ltd?

What are the EBIT projections for Easy Trip Planners Ltd?

How accurate were the past EBIT estimates for Easy Trip Planners Ltd?

Compare the revenue forecasts for Easy Trip Planners Ltd with those of its competitors based on recent analyst estimates.

Compare the intrinsic valuations of Easy Trip Planners Ltd and its key competitors using the latest financial data.

Compare historical revenue growth rates of Easy Trip Planners Ltd against its competitors.

Analyze the profit margins (gross, operating, and net) of Easy Trip Planners Ltd compared to its peers.

Compare the P/E ratios of Easy Trip Planners Ltd against its peers.

Discuss the investment returns and shareholder value creation comparing Easy Trip Planners Ltd with its peers.

Analyze the financial leverage of Easy Trip Planners Ltd compared to its main competitors.

Show all profitability ratios for Easy Trip Planners Ltd.

Provide ROE for Easy Trip Planners Ltd.

Provide ROA for Easy Trip Planners Ltd.

Provide ROIC for Easy Trip Planners Ltd.

Provide ROCE for Easy Trip Planners Ltd.

Provide Gross Margin for Easy Trip Planners Ltd.

Provide Operating Margin for Easy Trip Planners Ltd.

Provide Net Margin for Easy Trip Planners Ltd.

Provide FCF Margin for Easy Trip Planners Ltd.

Show all solvency ratios for Easy Trip Planners Ltd.

Provide D/E Ratio for Easy Trip Planners Ltd.

Provide D/A Ratio for Easy Trip Planners Ltd.

Provide Interest Coverage Ratio for Easy Trip Planners Ltd.

Provide Altman Z-Score Ratio for Easy Trip Planners Ltd.

Provide Quick Ratio for Easy Trip Planners Ltd.

Provide Current Ratio for Easy Trip Planners Ltd.

Provide Cash Ratio for Easy Trip Planners Ltd.

What is the historical Revenue growth over the last 5 years for Easy Trip Planners Ltd?

What is the historical Net Income growth over the last 5 years for Easy Trip Planners Ltd?

What is the current Free Cash Flow of Easy Trip Planners Ltd?

Discuss the annual earnings per share (EPS) trend over the past five years for Easy Trip Planners Ltd.

Balance Sheet Decomposition Easy Trip Planners Ltd

Earnings waterfall easy trip planners ltd, free cash flow analysis easy trip planners ltd, easemytrip profitability score profitability due diligence.

Easy Trip Planners Ltd's profitability score is 76/100. The higher the profitability score, the more profitable the company is.

Exceptional 3-Year Average ROE

Exceptional 3-year average roic, positive gross profit, positive operating income.

EASEMYTRIP Solvency Score Solvency Due Diligence

Easy Trip Planners Ltd's solvency score is 91/100. The higher the solvency score, the more solvent the company is.

High Interest Coverage

High altman z-score, negative net debt, wall st price targets, easemytrip price targets summary easy trip planners ltd.

According to Wall Street analysts, the average 1-year price target for EASEMYTRIP is 43.86 INR with a low forecast of 41.41 INR and a high forecast of 47.25 INR .

Competitive Landscape

Shareholder return, easemytrip price easy trip planners ltd, easemytrip return decomposition main factors of price return, company profile, dividend yield, description.

Easy Trip Planners Ltd. is an online travel company. The company is headquartered in New Delhi, Delhi. The company went IPO on 2021-03-19. The firm is engaged in providing reservation and booking services related to travel and tourism through ease my trip-portal, ease my trip-app or in-house call-center. The Company’s segments include air ticketing, and hotels and packages. Its air ticketing segment offers an Internet and mobile based platform and call-centers that provides the facility to book and service international and domestic air tickets to consumer through business-to-customers (B2C) and business-to-business-customers (B2B2C) channel. Its hotels and packages segment provide holiday packages and hotel reservations through call-centers and branch offices. The firm offers travel-related products and services including airline tickets, hotels and holiday packages, rail tickets, bus tickets and taxis as well as ancillary value-added services such as travel insurance, visa processing and tickets for activities and attractions.

The intrinsic value of one EASEMYTRIP stock under the Base Case scenario is 19.26 INR .

Compared to the current market price of 43.5 INR , Easy Trip Planners Ltd is Overvalued by 56% .

© 2024 Alpha Spread Limited. All Rights Reserved.

www.alphaspread.com is not operated by a broker, a dealer, or a registered investment adviser. Under no circumstances does any information posted on www.alphaspread.com represent a recommendation to buy or sell a security. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. The information on this site is in no way guaranteed for completeness, accuracy or in any other way. In no event shall Alpha Spread Limited be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or available on www.alphaspread.com, or relating to the use of, or inability to use, www.alphaspread.com or any content, including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance.

Stock intrinsic value is the real worth of a company's stock, based on its financial health and performance.

Instead of looking at the stock's current market price, which can change due to people's opinions and emotions, intrinsic value helps us understand if a stock is truly a good deal or not.

By focusing on the company's actual financial strength, like its earnings and debts, we can make better decisions about which stocks to buy and when.

Backtesting is a powerful tool that simulates how a particular strategy or model would have performed on historical data. This process allows investors to evaluate the effectiveness of investment decisions based on past market data without risking actual capital.

1. Select Valuation Methods: Choose the valuation methods you believe best represent the true value of the stocks you're interested in.

2. Define Trading Criteria: Specify the buy/sell conditions based on the stock's valuation relative to its market price.

3. Run the Backtest: Initiate the process to see how your strategy would have performed historically.

4. Analyze Results: Review the outcomes to refine your investment strategies and improve future decision-making.

By leveraging historical data, backtesting provides a window into how investment strategies might perform under similar market conditions, offering invaluable insights for future investments.

Note: Past results don't guarantee future performance.

Free Cash Flow (FCF) is the money a company has left over after it pays for all its expenses and any investments it needs to make to keep the company running smoothly.

Think of it like your personal budget at home: after you pay for your necessities, like rent and groceries, and set aside money for future needs, like saving for a car or home repairs, the cash you have left is what you're free to spend or save as you wish.

It's a sign of a company's health and its ability to do things like grow its business, pay dividends to shareholders, or reduce debt.

Flexibility: Companies with more FCF can make big moves without having to borrow money or ask for more investment, giving them the freedom to grow or tackle new projects on their terms.

Rewards for Investors: When a company has extra cash, it can decide to give some back to its investors through dividends or by buying back shares, which can increase the value of the remaining shares.

A Healthy Sign: Regularly having more cash coming in than going out shows that a company is doing well, making smart decisions, and earning more than it spends.

Price return decomposition is a method of analyzing the factors that contribute to the changes in the market capitalization of a company.

The price return decomposition breaks down the market cap return into two main components: the change in the price-to-earnings (P/E) multiple and the change in company earnings (as well as the change in revenue and net margin).

The change in the P/E multiple reflects the effect of changes in investor expectations and sentiment towards the company. A higher P/E multiple means that investors are willing to pay more for each dollar of earnings, indicating higher expectations for future growth. Conversely, a lower P/E multiple indicates lower expectations.

The change in earnings, on the other hand, represents the actual changes in the company's earnings over the given period.

The change in revenue and net margin are two other factors that can impact a company's market cap. An increase in revenue indicates that the company is generating more sales, while an improvement in net margin indicates that the company is becoming more efficient and generating more profit from each dollar of sales.

Intrinsic Value is all-important and is the only logical way to evaluate the relative attractiveness of investments and businesses.

- Sector: Services

- Industry: Online Service/Marke...

Easy Trip Planners Share Price

- 43.55 0.45 ( 1.05 %)

- Volume: 6,65,234

- 43.60 0.53 ( 1.23 %)

- Volume: 44,996

- Last Updated On: 14 May, 2024, 09:25 AM IST

Easy Trip Planners Shar...

- Shareholdings

- Corp Actions

- English English हिन्दी ગુજરાતી मराठी বাংলা ಕನ್ನಡ தமிழ் తెలుగు

Easy Trip Planners share price insights

In the last 3 years, only 4.62 % trading sessions saw intraday gains higher than 5 % .

Company has spent less than 1% of its operating revenues towards interest expenses and 11.68% towards employee cost in the year ending 31 Mar, 2023. (Source: Consolidated Financials)

Stock gave a 3 year return of 263.9% as compared to Nifty Midcap 100 which gave a return of 103.64%. (as of last trading session)

Easy Trip Planners Ltd. share price remain unchanged from its previous close of Rs 43.10. Easy Trip Planners Ltd. stock last traded price is 43.10

Insights Easy Trip Planners

Do you find these insights useful?

Key Metrics

- PE Ratio (x) 55.46

- EPS - TTM (₹) 0.85

- Dividend Yield (%) 0.00

- VWAP (₹) 43.43

- PB Ratio (x) 22.46

- MCap (₹ Cr.) 7,632.18

- Face Value (₹) 1.00

- BV/Share (₹) 2.09

- Sectoral MCap Rank 15

- 52W H/L (₹) 54.00 / 37.00

- MCap/Sales 16.86

- PE Ratio (x) 54.86

- VWAP (₹) 43.41

- PB Ratio (x) 22.22

- 52W H/L (₹) 54.00 / 37.01

Easy Trip Planners Share Price Returns

Et stock screeners top score companies.

Check whether Easy Trip Planners belongs to analysts' top-rated companies list?

Easy Trip Planners News & Analysis

Announcement under Regulation 30 (LODR)-Press Release / Media Release

Easy Trip Planners Share Analysis

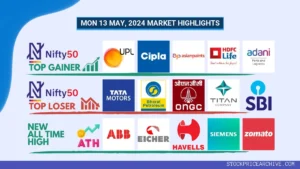

Unlock stock score, analyst' ratings & recommendations.

- View Stock Score on a 10-point scale

- See ratings on Earning, Fundamentals, Valuation, Risk & Price

- Check stock performance

Easy Trip Planners Share Recommendations

Recent recos.

Mean Recos by 2 Analysts

That's all for Easy Trip Planners recommendations. Check out other stock recos.

Analyst Trends

Easy trip planners share price forecast, get multiple analysts’ prediction on easy trip planners.

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

Peer Comparison

Easy trip planners stock performance, ratio performance.

Stock Returns vs Nifty Midcap 100

Choose from Peers

Choose from Stocks

- There’s no suggested peer for this stock.

Peers Insights Easy Trip Planners

Easy trip planners shareholding pattern, total shareholdings, mf ownership.

MF Ownership details are not available.

Top Searches:

Corporate actions, easy trip planners board meeting/agm, easy trip planners dividends, about easy trip planners.

Easy Trip Planners Ltd., incorporated in the year 2008, is a Small Cap company (having a market cap of Rs 7,641.04 Crore) operating in Services sector. Easy Trip Planners Ltd. key Products/Revenue Segments include Commission (Air Passage), Income From Advertisement, Other Services and Other Operating Revenue for the year ending 31-Mar-2023. For the quarter ended 31-12-2023, the company has reported a Consolidated Total Income of Rs 165.31 Crore, up 14.35 % from last quarter Total Income of Rs 144.57 Crore and up 18.19 % from last year same quarter Total Income of Rs 139.87 Crore. Company has reported net profit after tax of Rs 45.68 Crore in latest quarter. The company’s top management includes Mr.Nishant Pitti, Mr.Prashant Pitti, Mr.Rikant Pittie, Mr.Satya Prakash, Justice(Retd)Usha Mehra, Mr.Vinod Kumar Tripathi, Mr.Ashish Kumar Bansal, Ms.Nutan Gupta, Mr.Priyanka Tiwari. Company has S R Batliboi & Co. LLP as its auditors. As on 31-03-2024, the company has a total of 177.20 Crore shares outstanding. Show More

Nishant Pitti

Prashant Pitti

Rikant Pittie

Satya Prakash

Vinod Kumar Tripathi

Ashish Kumar Bansal

Nutan Gupta

Priyanka Tiwari

- S R Batliboi & Co. LLP S R Batliboi & Associates LLP

Online Service/Marketplace

Key Indices Listed on

Nifty 500, S&P BSE 500, S&P BSE 250 SmallCap Index, + 9 more

223, FIE Patparganj Industrial Area,East Delhi,Delhi, Delhi - 110092

http://www.easemytrip.com

More Details

- Chairman's Speech

- Company History

- Directors Report

- Background information

- Company Management

- Listing Information

- Finished Products

FAQs about Easy Trip Planners share

- 1. What's the Easy Trip Planners share price today? Easy Trip Planners share price was Rs 43.40 as on 14 May, 2024, 09:20 AM IST. In last 1 Month, Easy Trip Planners share price moved down by 3.13%.

- Stock's PE is 55.46

- Price to Book Ratio of 22.46

- 3. Which are the key peers to Easy Trip Planners? Top 10 Peers for Easy Trip Planners are Just Dial Ltd., Infibeam Avenues Ltd., Nazara Technologies Ltd., CarTrade Tech Ltd., Yatra Online Ltd., Matrimony.com Ltd., IndiaMART InterMESH Ltd., One97 Communications Ltd., FSN E-Commerce Ventures Ltd. and PB Fintech Ltd.

- Promoter holding have gone down from 71.3 (30 Jun 2023) to 64.3 (31 Mar 2024)

- Domestic Institutional Investors holding have gone down from 2.48 (30 Jun 2023) to 2.44 (31 Mar 2024)

- Foreign Institutional Investors holding has gone up from 2.54 (30 Jun 2023) to 2.78 (31 Mar 2024)

- Other investor holding has gone up from 23.67 (30 Jun 2023) to 30.48 (31 Mar 2024)

- 5. What has been highest price of Easy Trip Planners share in last 52 weeks? In last 52 weeks Easy Trip Planners share had a high price of Rs 54.00 and low price of Rs 37.00

- 6. What's the market capitalization of Easy Trip Planners? Easy Trip Planners share has a market capitalization of Rs 7,632.18 Cr. Within Services sector, it's market cap rank is 15.

Trending in Markets

- Indian Emulsifier IPO

- Veritaas Advertising IPO GMP

- Mandeep Auto Industries IPO GMP

- Auto stocks

- Aztec Fluids and Machinery IPO

- Asian Paints Share Price

- Q4 results today

- Best flexi cap mutual funds

- Care Ratings Q4 Results

- Go Digit IPO

Easy Trip Planners Quick Links

Equity quick links, more from markets.

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.