Travel money guide: Vietnam

Everything you need to know about using cash and cards in vietnam.

In this guide

Travel card, debit card or credit card?

These are your options for spending money in vietnam, compare travel credit cards, buying vietnamese dong in the us, a guide to the vietnamese dong banknotes, how much should i budget to travel in vietnam.

Travel money type

Compare more cards

Top picks of 2024

The official currency of Vietnam is the Vietnamese dong (VND). Because the dong is tied to the US dollar, you can use your money at most hotels and big shops. To make things easier, prices are often quoted in US Dollars in tourist areas. But beware — you’ll pay twice as much if you pay with your US dollars, so exchange your money before you arrive in Vietnam.

Credit cards, debit cards and cash are all accepted, but cash is by far the most accepted form of payment. Outside of major tourist areas, cash should be your primary go-to during your trip.

Our picks for traveling to Vietnam

40+ currencies supported

- 4.85% APY on USD balances

- $0 monthly fees

- Up to $100 free ATMs withdrawals worldwide

- Hold and convert 40+ currencies

Up to $300 cash bonus

- 0.50% APY on checking balance

- Up to 4.60% APY on savings

- $0 account or overdraft fees

- Get a $300 bonus with direct deposits of $5,000 or more

Free ATM transactions

- $50 waivable monthly fee

- 0% foreign transaction fee

- Securely move money domestically and globally

- 5 monthly out-of-network ATM reimbursements

- Free international HSBC ATM transactions

Credit cards can be used for big ticket purchases in Vietnam. For example, in Hanoi mid- to high-end hotels, restaurants and retailers will take Visa and Mastercard — you’ll struggle to find merchants who take American Express credit cards and prepaid travel cards. Everywhere else you’ll need to pay with cash.

If you bring your debit card, you can expect to pay between $1 and $2, on top on any fees your bank charges. Find a debit card that allows you to withdraw from any ATM without charging a fee. You should never use ATMs to withdraw money from your credit cards — they immediately charge high fees and interest on your withdrawal.

Vietnam is a popular destination for experiencing the rich culture and natural beauty for rock-bottom prices. Plan to bring a number of payment options on your Vietnamese vacation for peace of mind.

Credit cards are good for bigger purchases, and you can earn travel rewards, but cash is what you’ll need the most. Only carry the cash you need, keeping the rest on your debit or prepaid cash card.

Trying to decide how to pay for your vacation to Vietnam? Compare these travel money options and see what works best for you.

Using a credit card

Travel credit cards give you the most purchasing power on expensive items like hotels and flights when traveling in Vietnam. However, you’ll find credit cards less useful outside of major hubs or tourist areas.

Find yourself a credit card that waives foreign transaction fees to cut back on extra expenses, such as the Capital One VentureOne Rewards Credit Card . Carrying a credit card gives you the added benefit of travel insurance and discounts, depending on your provider (Terms apply, see rates & fees ).

Some travel cards that offer travel perks and waive fees may charge an annual fee, so make sure the fee is worth it before you bring it along on your travels. If you’re ever in a jam, credit cards also offer cash advances, though we don’t recommend it. You’ll pay high fees and interest rates apply the moment you get your money.

- Tip: It’s worth researching credit cards that offer travel benefits and rewards for things you’ll buy anyways like flights and hotel stays.

- Use for big ticket purchases

- Protected by PIN and chip

- Accepted worldwide

- May come with benefits like travel insurance

- Interest-free days when you pay your account in full

- Emergency card replacement

- Fees and interest for cash withdrawal

Explore top debit cards with no foreign transaction fees and travel credit cards by using the tabs to narrow down your options. Select Compare for up to four products to see their benefits side by side.

- Credit cards

Using a debit card

A travel debit card could be a good travel money choice to take to Vietnam. You’ll have access to cash each time you come across an ATM, without carrying lots of cash on you all at once. Because you’re spending your own money, you avoid interest charges.

A debit card that reimburses or waives international ATM fees, like one from Betterment Checking , is an ideal debit card to have on hand to cut down on extra costs.

- Tip: A debit card can be used to shop over the counter, online and for ATM withdrawals in Vietnam.

- Use at stores and hotels, online and ATMs

- Spending your own money means avoiding interest charges

- International ATM and currency conversion fees

- No access to cash advances

Using a prepaid travel card

Travel cards can lock in conversion rates once you load USD. Use it for purchases without worrying about rates each time you spend — debit and credit cards often charge 3% for each transaction.

Where you save in the conversion rates you may pay in fees. You’ll pay fees each time you load the card, ATM withdrawals and sometimes even an inactivity fee.

- Tip: Banks that provide travel cards make money by applying a higher margin to the exchange rate. Get a better rate using a debit card or credit card.

- Lock in exchange rate when you convert USD to VND

- Emergency card replacement and backup cards.

- Reloadable online

- Come with lots of fees for loading and reloading, inactivity and ATM withdrawals.

- Businesses won’t accept prepaid cards

Paying with cash in Vietnam

In Vietnam cash is king , so be sure you have access to plenty of it. Make sure you don’t get any damaged or ripped banknotes — merchants in Vietnam won’t accept them. Dongs are delicate, so carefully place money in your wallet rather than in the bottom of your bag or pockets.

- Tip: Exchange your money at banks or other licensed exchange stores — Vietcombank doesn’t charge a commission. There’s a black market for exchanging money in Vietnam that charges a lower exchange rate and — most importantly, it’s illegal.

- Payment flexibility

- Convenience

- More difficult to manage expenses

- High risk of theft

While you’ll get a better rate if you wait to get Vietnamese dong in Vietnam, you can purchase dong in the US from your bank or a foreign exchange provider like Travelex. If you’re flying into Vietnam directly, and you want to get a visa on arrival (VOA), be ready with cash to pay the fee when you pass through customs. Here are some popular ways to exchange your US currency into dong.

- Wise (TransferWise)

Refreshing in: 60s | Thu, Jun 13, 05:08PM GMT

The Vietnamese dong is the major currency used in Vietnam. The dong comes in denominations of 1,000, 2,000, 5,000, 10,000, 20,000, 50,000, 100,000 and 200,000, each a different color. Be sure to pay the right amount when you make your purchases, and always count your change. Familiarize yourself with what the currency looks like and how it works will avoid confusion when handling your money.

The main banks in Vietnam are:

- Vietcombank

- Bank for Investment and Development of Vietnam (BIDV)

- Military Bank

- Techcombank

- Saigon Commercial Bank (SCB)

- Maritime Bank

Using an ATM

Mastercard and Visa cards can be used to make cash withdrawals from a majority of ATMs in Vietnam. The maximum withdrawal limit varies depending on the machine.

Machines from American banks often have a higher daily withdrawal limit compared to Vietnamese banks. But Vietnamese banks often charge a lower withdrawal fee. You can sidestep some fees, such as international ATM fees, by using a debit card from a bank that reimburses such fees, such as Betterment Checking .

- Tip: Keep yourself and your money safe when using an ATM. Block your PIN from cameras and onlookers. And be sure to use ATMs in busy areas or inside a business.

ATMs in Vietnam

Your money will go along way in Vietnam. Accommodation, food and tourist activities cost a fraction of the price of what they cost in the US. If you want a travel on a backpacker’s budget, $40 or less a day will do.

For a more comfortable trip, you can budget $60 to $100 per day. If you have expensive taste, it’s easy to find a five star experience with prices to match at a budget of $200 a day. All prices are in US dollars.

Case study: Dean’s trip to Vietnam

We interviewed Dean, a finder.com user who traveled to Vietnam, and asked him about his experience using travel money. He spent two months in Southeast Asia, including a month adventure in Vietnam. He flew from Cambodia to Ho Chi Minh, finished his trip in Hanoi and took a bus to Laos. He was there for the Tet Festival in December — which Dean said is a must-have.

Do you have any other travel money tips?

Dean says make sure you do the following:

- Tell your credit card and debit card provider about your travel plans in Southeast Asia.

- You’ll be carrying cash on you so use caution and make sure it’s out of reach from thieves and pickpockets.

Kyle Morgan

Kyle Morgan is SEO manager at Forbes Advisor and a former editor and content strategist at Finder. He has written for the USA Today network and Relix magazine, among other publications. He holds a BA in journalism and media from Rutgers University. See full profile

More guides on Finder

How to pay, how much to bring and travel money suggestions for your trip to USA.

How to pay, how much to bring and travel money suggestions for your trip to South Africa.

How to pay, how much to bring and travel money suggestions for your trip to Sri Lanka.

How to pay, how much to bring and travel money suggestions for your trip to Mexico.

How to pay, how much to bring and travel money suggestions for your trip to Portugal.

How to pay, how much to bring and travel money suggestions for your trip to Hungary.

How to pay, how much to bring and travel money suggestions for your trip to Ecuador.

How to pay, how much to bring and travel money suggestions for your trip to Fiji.

How to pay, how much to bring and travel money suggestions for your trip to Japan.

How to pay, how much to bring and travel money suggestions for your trip to South America.

Ask a Question

Click here to cancel reply.

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

5 Best Travel Cards for Vietnam

Getting an international travel card before you travel to Vietnam can make it cheaper and more convenient when you spend in Vietnamese Dong. You'll be able to easily top up your card in USD before you leave the US, to convert seamlessly to VND for secure and flexible spending and withdrawals.

This guide walks through our picks of the best travel cards available for anyone from the US heading to Vietnam, like Wise or Revolut. We'll walk through a head to head comparison, and a detailed look at their features, benefits and drawbacks.

5 best travel money cards for Vietnam:

Let's kick off our roundup of the best travel cards for Vietnam with a head to head comparison on important features. Here's an overview of the providers we've picked to look at, for customers looking for ways to spend conveniently overseas when travelling from the US:

Each of the international travel cards we’ve picked out have their own features and fees, which may mean they suit different customer needs. Keep reading to learn more about the features, advantages and disadvantages of each - plus a look at how to order the travel card of your choice before you head off to Vietnam.

Wise travel card

Open a Wise account online or in the Wise app, to order a Wise travel card you can use for convenient spending and withdrawals in Vietnam. Wise accounts can hold 40+ currencies, so you can top up in USD easily from your bank or using your card. Whenever you travel, to Vietnam or beyond, you’ll have the option to convert to the currency you need in advance if it’s supported for holding a balance, or simply let the card do the conversion at the point of payment.

In either case you’ll get the mid-market exchange rate with low, transparent fees whenever you spend in VND, plus some free ATM withdrawals every month - perfect if you’re looking for easy ways to arrange your travel cash.

Wise features

Wise travel card pros and cons.

- Hold and exchange 40+ currencies with the mid-market rate

- Spend seamlessly in VND when you travel

- Some free ATM withdrawals every month, for those times only cash will do

- Ways to receive payments to your Wise account conveniently

- Manage your account and card from your phone

- 9 USD delivery fee for your first card

- ATM fees apply once you've exhausted your monthly free withdrawals

- Physical cards may take 14 - 21 days to arrive

How to apply for a Wise card

Here’s how to apply for a Wise account and order a Wise travel card in the US:

Open the Wise app or desktop site

Select Register and confirm you want to open a personal account

Register with your email, Facebook, Apple or Google ID

Upload your ID document to complete the verification step

Tap the Cards tab to order your card

Pay the one time 9 USD fee, confirm your mailing address, and your card will be on the way, and should arrive in 14 - 21 days

Revolut travel card

Choose a Revolut account, from the Standard plan which has no monthly fee, to higher tier options which have monthly charges but unlock extra features and benefits. All accounts come with a smart Revolut card you can use in Vietnam, with some no fee ATM withdrawals and currency conversion monthly, depending on the plan you pick. Use your Revolut account to hold and exchange 25+ currencies, and get extras like account options for under 18s, budgeting tools and more.

Revolut features

Revolut travel card pros and cons.

- Pick the Revolut account plan that suits your spending needs

- Hold and exchange 25+ currencies, and spend in 150 countries

- Accounts come with different card types, depending on which you select

- All accounts have some no fee currency exchange and some no fee ATM withdrawals monthly

- Some account tiers have travel perks like complimentary or discounted lounge access

- You need to upgrade to an account with a monthly fee to get all account features

- Delivery fees may apply for your travel card

- Fair usage limits apply once you exhaust your currency conversion and ATM no fee allowances

- Out of hours currency conversion has additional fees

How to apply for a Revolut card

Set up your Revolut account before you leave the US and order your travel card. Here’s how:

Download and open the Revolut app

Register by adding your personal and contact information

Follow the prompts to confirm your address and order your card

Pay any required delivery fee - costs depend on your account type

Chime travel card

Use your Chime account and card to spend in Vietnam with no foreign transaction fee. You’ll just need to load a balance in USD and then the money is converted to VND instantly with the Visa rate whenever you spend or make a withdrawal. There’s a fee to make an ATM withdrawal out of network, which sits at 2.5 USD, but there are very few other costs to worry about. Plus you can get lots of extra services from Chime if you need them, such as ways to save.

Chime features

Chime travel card pros and cons.

- No Chime foreign transaction fees

- No ongoing charges for your account

- Lots of extra products and services if you need them

- Easy ways to manage your money online and in app

- Virtual cards available

- You'll need to inform Chime you're traveling to use your card abroad

- Low ATM limits

- Cards take 7 - 10 days to arrive by mail

How to apply for a Chime card

Here’s how to apply for a Chime account and order a travel card in the US:

Visit the Chime website or download the app

Click Get started and add your personal details

Add a balance

Your card will be delivered in the mail and you can use your virtual card instantly

Monzo travel card

Monzo cards can be ordered easily in the US and used for spending in Vietnam and globally. Monzo accounts are designed for holding USD only - but you can spend in VND and pretty much any other currency easily, with no foreign transaction fee. Your funds are just converted using the network exchange rate whenever you pay or make a withdrawal.

Monzo doesn’t usually apply ATM fees, but it’s worth knowing that the operator of the specific ATM you pick may have their own costs you’ll need to check out.

Monzo features

Monzo travel card pros and cons.

- Good selection of services available

- No foreign transaction fee to pay

- No Monzo ATM fee to pay

- Manage your card from your phone conveniently

- Deposits are FDIC protected

- You can't hold a foreign currency balance

- ATM operators might apply their own fees

How to apply for a Monzo card

Here’s how to apply for a Monzo account and order a travel card in the US:

Visit the Monzo website or download the app

Click Get Sign up and add your personal details

Check and confirm your mailing address and your card will be delivered in the mail

Netspend travel card

Netspend has a selection of prepaid debit cards you can use for spending securely in Vietnam. While these cards don’t usually let you hold a balance in VND, they’re popular with travelers as they’re not linked to your regular checking account. That increases security overseas - plus, Netspend offers virtual cards you can use to hide your physical card details from retailers if you want to.

The options with Netspend vary a lot depending on the card you pick. Usually you can top up digitally or in cash in USD and then spend overseas with a fixed foreign transaction fee applying every time you spend in a foreign currency. You’ll be able to view the terms and conditions of your specific card - including the fees - online, by entering the code you’ll find when your card is sent to you.

Netspend features

Netspend travel card pros and cons.

- Large selection of different card options depending on your needs

- Some cards have no overseas ATM fees

- Prepaid card which is secure to use overseas

- Manage your account in app

- Change from one card plan to another if you need to

- You may pay a monthly fee for your card

- Some cards have foreign transaction fees for all overseas use, which can be around 4%

- Selection of fees apply depending on the card you pick

How to apply for a Netspend card

Here’s how to apply for a Netspend account and order a travel card in the US:

Visit the Netspend website

Click Apply now

Complete the details, following the onscreen prompts

Get verified

Your card will arrive by mail - add a balance and activate it to get started

What is a travel money card?

A travel money card is a card you can use for secure and convenient payments and withdrawals overseas.

You can use a travel money card to tap and pay in stores and restaurants, with a wallet like Apple Pay, or to make ATM withdrawals so you'll always have a bit of cash in your pocket when you travel.

Although there are lots of different travel money cards on the market, all of which are unique, one similarity you'll spot is that the features and fees have always been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees for common international transactions like ATM withdrawals.

Travel money cards also offer distinct benefits when it comes to security. Your travel money card isn't linked to your United States Dollar everyday account, so even if you were unlucky and had your card stolen, your primary bank account remains secure.

Travel money vs prepaid card vs travel credit card

It's helpful to know that you'll be able to pick from several different types of travel cards, depending on your priorities and preferences. Travel cards commonly include:

- Travel debit cards

- Travel prepaid cards

- Travel credit cards

They all have distinct benefits when you head off to Vietnam or elsewhere in the world, but they do work a bit differently.

Travel debit and prepaid cards are usually linked to an online account, and may come from specialist digital providers - like the Wise card. These cards are usually flexible and cheap to use. You'll be able to manage your account and card through an app or on the web.

Travel credit cards are different and may suit different customer needs. As with any other credit card, you may need to pay an annual fee or interest and penalties depending on how you manage your account - but you could also earn extra rewards when spending in a foreign currency, or travel benefits like free insurance for example. Generally using a travel credit card can be more expensive compared to a debit or prepaid card - but it does let you spread out the costs of your travel across several months if you'd like to and don't mind paying interest to do so.

What is a prepaid travel money card best for?

Let's take a look at the advantages of using a prepaid travel money card for travellers going to Vietnam. While each travel card is a little different, you'll usually find some or all of the following benefits:

- Hold and exchange foreign currencies - allowing you to lock in exchange rates and set a travel budget before you leave

- Convenient for spending in person and through mobile wallets like Apple Pay, as well as for cash withdrawals

- You may find you get a better exchange rate compared to your bank - and you'll usually be able to avoid any foreign transaction fee, too

- Travel cards are secure as they're not linked to your everyday USD account - and because you can make ATM withdrawals when you need to, you can also avoid carrying too much cash at once

Overall, travel cards offer flexible and low cost ways to avoid bank foreign transaction and international ATM fees, while accessing decent exchange rates.

How to choose the best travel card for Vietnam

We've picked out 5 great travel cards available in the US - but there are also more options available, which can make choosing a daunting task. Some things to consider when picking a travel card for Vietnam include:

- What exchange rates does the card use? Choosing one with the mid-market rate or as close as possible to it is usually a smart plan

- What fees are unavoidable? For example, ATM charges or top up fees for your preferred top up methods

- Does the card support a good range of currencies? Getting a card which allows you to hold and spend in VND can give you the most flexibility, but it's also a good idea to pick a card with lots of currency options, so you can use it again in future, too

- Are there any other charges? Check in particular for foreign transaction fees, local ATM withdrawal fees, inactivity fees and account close fees

Ultimately the right card for you will depend on your specific needs and preferences.

What makes a good travel card for Vietnam

The best travel debit card for Vietnam really depends on your personal preferences and how you like to manage your money.

Overall, it pays to look for a card which lets you minimise fees and access favourable exchange rates - ideally the mid-market rate. While currency exchange rates do change all the time, the mid-market rate is a good benchmark to use as it’s the one available to banks when trading on wholesale markets. Getting this rate, with transparent conversion fees, makes it easier to compare costs and see exactly what you’re paying when you spend in VND.

Other features and benefits to look out for include low ATM withdrawal fees, complimentary travel insurance, airport lounge access or emergency cash if your card is stolen. It’s also important to look into the security features of any travel card you might pick for Vietnam. Look for a card which uses 2 factor authentication when accessing the account app, which allows you to set instant transaction notifications, and which has easy ways to freeze, unfreeze and cancel your card with your phone.

When you’re planning your trip to Vietnam, bear in mind that cash is still a primary payment method, and many merchants and public service providers won’t accept a card. You’ll want a travel card which allows low cost cash withdrawals so you’ve always got some VND in your pocket - and you can also keep hold of your card as a convenient back up in case of emergency too. Choose a card with no ongoing fees and no inactivity costs, so you can use it for your next trip abroad to get the most possible use out of it.

Ways to pay in Vietnam

Cash and card payments - including contactless, mobile wallet, debit, credit and prepaid card payments - are the most popular ways to pay globally.

In Vietnam cash is a very popular payment method. While you may find cards are accepted in major hotels and chain stores or very busy tourist areas, many merchants prefer cash. Make sure you’ve always got some VND in cash in your wallet by making ATM withdrawals with your travel card whenever you need to.

Which countries use VND?

You’ll find that VND can only be used in Vietnam. If you don’t travel to Vietnam frequently it’s worth thinking carefully about how much to exchange so you’re not left with extra foreign currency after your trip. Or pick a travel card from a provider like Wise or Revolut which lets you leave your money in USD and convert at the point of payment with no penalty.

What should you be aware of when travelling to Vietnam

You’re sure to have a great time in Vietnam - but whenever you’re travelling abroad it's worth putting in a little advance thought to make sure everything is organised and your trip goes smoothly. Here are a few things to think about:

1. Double check the latest entry requirements and visas - rules can change abruptly, so even if you’re been to Vietnam before it’s worth looking up the most recent entry requirements so you don’t have any hassle on the border

2. Cash is a widespread payment method - so you’ll need some VND in your pocket when you travel to Vietnam. You can sort out your travel money by visiting an exchange office here in the US, or you can wait until you arrive and make an ATM withdrawal in VND at the airport when you land. Bear in mind that currency exchange at exchange offices at the airport, either in the US or in Vietnam can be expensive - so if you’re carrying USD in cash and need to exchange it, head into a town centre to do so.

3. Get clued up on any health or safety concerns - get travel insurance before you leave the US so you have peace of mind. It’s also worth reading up on any common scams or issues experienced by tourists. These tend to change over time, but may include things like rip off taxis or tour agents which don’t offer fair prices or adequate services.

Conclusion - Best travel cards for Vietnam

Ultimately the best travel card for your trip to Vietnam will depend on how you like to manage your money. Use this guide to get some insights into the most popular options out there, and to decide which may suit your specific needs.

FAQ - best travel cards for Vietnam

When you use a travel money card you may find there’s an ATM withdrawal fee from your card issuer, and there may also be a cost applied by the ATM operator. Some of our travel cards - like the Wise and Revolut card options - have some no fee ATM withdrawals every month, which can help keep down costs.

Travel money cards may be debit, prepaid or credit cards. Which is best for you will depend on your personal preferences. Debit and prepaid cards are usually pretty cheap and secure to spend with, while credit cards may have higher fees but often come with extra perks like free travel insurance and extra reward points.

There’s no single best prepaid card for international use. Look out for one which supports a large range of currencies, with good exchange rates and low fees. This guide can help you compare some popular options, including Wise, Revolut and Monzo.

Yes, you can use your local debit card when you’re overseas. However, it’s common to find extra fees apply when spending in foreign currencies with a regular debit card. These can include foreign transaction fees and international ATM charges.

Usually having a selection of ways to pay - including a travel card, your credit or debit card, and some cash - is the best bet. That means that no matter what happens, you have an alternative payment method you can use conveniently.

Yes. Most travel debit cards have options to make ATM withdrawals. Check the fees that apply as card charges do vary a lot. Some cards have local and international fees on all withdrawals, while others like Wise and Revolut, let you make some no fee withdrawals monthly before a fee kicks in.

Both Visa and Mastercard are globally accepted. Look out for the logo on ATMs and payment terminals in Vietnam.

The cards you see on this page are ordered as follows:

For card providers that publish their exchange rates on their website, we used their USD / VND rate to calculate how much Vietnamese Dong you would receive when exchanging / spending $4,000 USD. The card provider offering the most VND is displayed at the top, the next highest below that, and so on.

The rates were collected at 09:36:26 GMT on 25 May 2024.

Below this we display card providers for which we could not verify their exchange rates. These are displayed in alphabetical order.

Send international money transfer

More travel card guides.

You are using an outdated browser. Please upgrade your browser to improve your experience.

- Currency and payments in Vietnam

All photography by Christian Berg

With a wealth of affordable cuisine, hotels, and things to do, Vietnam is an excellent destination if you’re looking for value for money. Prepare for your first time in Vietnam by getting to know the local currency and payment systems, so you can enjoy your holiday here even more. Here’s a quick guide to money matters for travellers in Vietnam.

Vietnamese currency.

The official currency in Vietnam is the Vietnam đồng, symbolised by ₫ or VND. Vietnamese notes are a mix of small paper bills (no coins are used), and larger polymer bills, in values from 10,000 VND to 500,000 VND. If you’re confused by all the zeros, mentally remove three zeros to get a simpler number. To quickly convert from VND to USD, just remove three zeros and divide by 23.

TIP: The 20,000 VND bill and the 500,000 VND bill come in similar shades of blue -- double check before you pay.

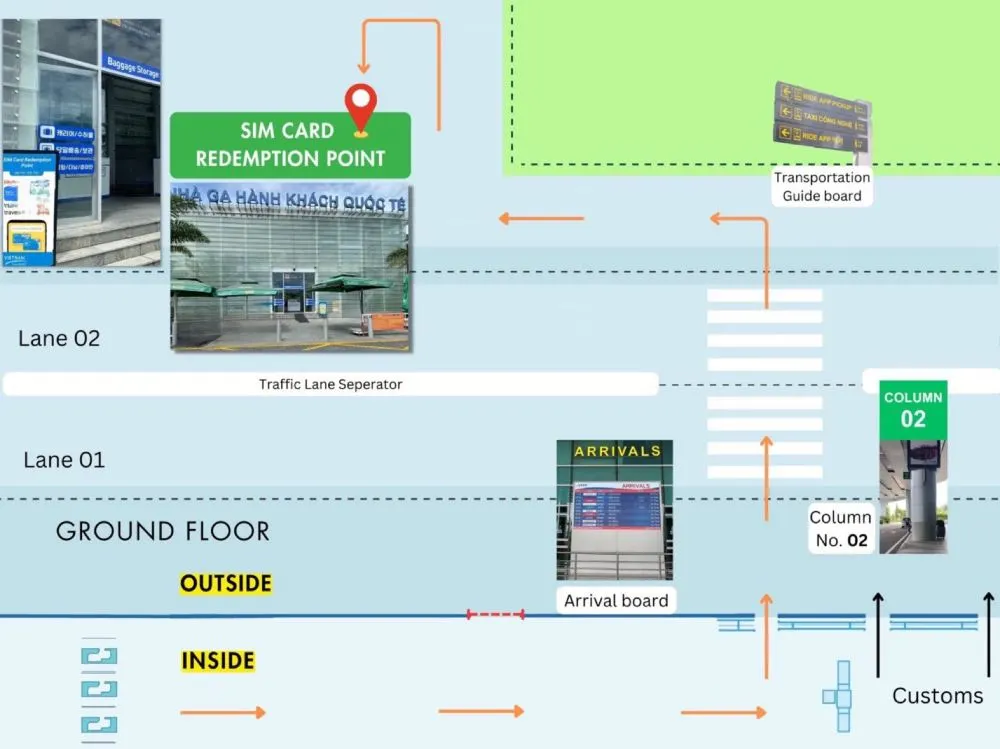

Cash withdrawal and exchange

Upon arriving in Vietnam, you’ll want to have some cash in the local currency. You can find ATMs accepting international cards just outside the arrival gates at all major airports. ATMs are a common sight in Vietnamese cities, and you should have no trouble locating one in most destinations. International cards such as Visa are accepted at more than 20,000 ATMs nationwide. If you need help finding the nearest ATM, just ask your hotel. Withdrawal limits per transaction range between 2 million VND (just under 100 dollars) and 3 million VND with local bank ATMs; and between 5 million VND to 10 million VND with international bank ATMs.

You can also find currency exchange vendors inside Vietnam’s international airports just before the exit gates. Once you’re in your destination, you can usually exchange currency at your hotel, in tourist hotspots and at local banks.

TIP: It’s a good idea to withdraw some extra cash before travelling to remote destinations in Vietnam, especially if you want to buy crafts or textiles directly from local artisans.

Card payments in Vietnam

While cash is used for small purchases and street vendors in Vietnam, most establishments accept payments from major credit card providers such as Visa. Hotels, tour operators, boutiques, restaurants, grocery stores, and spas all generally accept international debit and credit cards. Conversion rates and swiping fees will be set by your card provider. With few exceptions, your larger travel expenses in Vietnam can be covered by card, on the spot or online in advance, reducing the need to carry and convert large sums of cash on the road.

Local prices

Wondering how much money to prepare for your trip in Vietnam? If you’re on a budget, eating street food and staying in homestays is a great way to go, and will still give you an enriching experience of Vietnam. If you’ve got a little more to spend, Vietnam’s mid-range hotels and local restaurants offer wonderful value and heartfelt service. And if you’re here to indulge, our five-star properties and private tours offer superb quality and unforgettable moments. See the list below for some average prices:

Sidewalk coffee - 25,000 VND (1 USD) Street food meal with ice tea - 45,000 VND (2 USD) Cappuccino in a cafe - 55,000 VND (2.50 USD) Three-course restaurant meal - 450,000 (20 USD)/person Inner city taxi - 35,000 to 100,000 VND (1.50 to 4 USD) 60-minute foot massage at local spa - 350,000 VND (15 USD) Budget hostel - 300,000 VND (13 USD)/night Mid-range hotel - 700,000 VND (30 USD)/night Half-day group tour - 1 million VND (43 USD) Luxury hotel - 3.5 million VND (150 USD)/night

Safety and security

Vietnam is generally very safe for travellers, but use common sense to keep an eye on your money and avoid drawing attention to valuables while out in public. Use the hotel safe in your room to store cash, cards and valuable items when going out. Keep wallets and purses close to your person and take extra care when in crowded places. Cards with safety technology such as Visa’s 3D security system can help protect against loss or fraud, and lessen worries around the safety of your money.

TIP: Many businesses and taxi services in Vietnam now accept Visa contactless payments , done by tapping your card directly on a terminal. These payments add peace of mind and reduce health risks, as your card never leaves your hand.

Tipping etiquette

There’s no set rule about tipping in Vietnam as it’s not a normal part of Vietnamese culture. However tipping is increasingly common in some situations, such as in beauty salons and for private tour guides. Tipping in restaurants and cafes is not expected but always appreciated. When deciding how much to tip, considering that the cost for a local meal here is about 30,000 VND to 40,000 VND can help you decide the value of your tip to its recipient.

In casual shopping hubs and markets, bargaining is a common practice. If you’re shopping in an area that receives many tourists, you can usually get a price reduction through some gentle negotiation. Browse and inquire with a few shops or vendors to get a general idea of the price before you settle.

Want more Vietnam travel ideas? Sign up for our newsletter to receive our best stories in your inbox.

- You are here:

- Things to do

Create an account

Already have an account? Click here to sign in

By clicking submit, you agree to our Privacy Policy and Terms of Use

Sign in with your social accounts

Sign in with your email

Forgot password? Click here to get it back

Don't have an account? Sign up here

Forgot Password

The entered email has subscribed for Vietnam Tourism monthly newsletter

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

2 Best Travel Cards for Vietnam

Getting an international travel card before you travel to Vietnam can make it cheaper and more convenient when you spend in Vietnamese Dong. You'll be able to easily top up your card in AUD before you leave Australia, to convert seamlessly to VND for secure and flexible spending and withdrawals.

This guide walks through our picks the best travel cards available for anyone from Australia heading to Vietnam, like Wise or Revolut. We'll walk through a head to head comparison, and a detailed look at their features, benefits and drawbacks.

2 best travel money cards for Vietnam:

Let's kick off our roundup of the best travel cards for Vietnam with a head to head comparison on important features. Here's an overview of the providers we've picked to look at, for customers looking for ways to spend conveniently overseas when travelling from Australia:

Each of the international travel cards we’ve picked out have their own features and fees, which may mean they suit different customer needs. Keep reading to learn more about the features, advantages and disadvantages of each - plus a look at how to order the travel card of your choice before you head off to Vietnam.

Wise travel card

Open a Wise account online or in the Wise app, to order a Wise travel card you can use for convenient spending and withdrawals in Vietnam. Wise accounts can hold 40+ currencies, so you can top up in AUD easily from your bank or using your card. Whenever you travel, to Vietnam or beyond, you’ll have the option to convert to the currency you need in advance if it’s supported for holding a balance, or simply let the card do the conversion at the point of payment.

In either case you’ll get the mid-market exchange rate with low, transparent fees whenever you spend in VND, plus some free ATM withdrawals every month - perfect if you’re looking for easy ways to arrange your travel cash.

Wise features

Wise travel card pros and cons.

- Hold and exchange 40+ currencies with the mid-market rate

- Spend seamlessly in VND when you travel

- Some free ATM withdrawals every month, for those times only cash will do

- Ways to receive payments to your Wise account conveniently

- Manage your account and card from your phone

- 10 AUD delivery fee for your first card

- ATM fees apply once you've exhausted your monthly free withdrawals

- Physical cards may take 7 - 14 days to arrive (you can use your virtual card right away)

How to apply for a Wise card

Here’s how to apply for a Wise account and order a Wise travel card in Australia:

- Open the Wise app or desktop site

- Select Register and confirm you want to open a personal account

- Register with your email, Facebook, Apple or Google ID

Upload your ID document to complete the verification step

- Tap the Cards tab to order your card

- Pay the one time 10 AUD fee, confirm your mailing address, and your card will be on the way, and should arrive in 7 - 14 days

Revolut travel card

Choose a Revolut account, from the Standard plan which has no monthly fee, to higher tier options which have monthly charges but unlock extra features and benefits. All accounts come with a smart Revolut card you can use in Vietnam, with some no fee ATM withdrawals and currency conversion monthly, depending on the plan you pick. Use your Revolut account to hold and exchange around 30 currencies, and get extras like account options for under 18s, budgeting tools and more.

Revolut features

Revolut travel card pros and cons.

- Pick the Revolut account plan that suits your spending needs

- Hold and exchange 30+ currencies, and spend in 150 countries

- Accounts come with different card types, depending on which you select

- All accounts have some no fee currency exchange and some no fee ATM withdrawals monthly

- Some account tiers have travel perks like complimentary or discounted lounge access

- You need to upgrade to an account with a monthly fee to get all account features

- Delivery fees may apply for your travel card

- Fair usage limits apply once you exhaust your currency conversion and ATM no fee allowances

- Out of hours currency conversion has additional fees

How to apply for a Revolut card

Set up your Revolut account before you leave Australia and order your travel card. Here’s how:

Download and open the Revolut app

Register by adding your personal and contact information

Follow the prompts to confirm your address and order your card

Pay any required delivery fee - costs depend on your account type

What is a travel money card?

A travel money card is a card you can use for secure and convenient payments and withdrawals overseas.

You can use a travel money card to tap and pay in stores and restaurants, with a wallet like Apple Pay, or to make ATM withdrawals so you'll always have a bit of cash in your pocket when you travel.

Although there are lots of different travel money cards on the market, all of which are unique, one similarity you'll spot is that the features and fees have always been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees for common international transactions like ATM withdrawals.

Travel money cards also offer distinct benefits when it comes to security. Your travel money card isn't linked to your Australian Dollar everyday account, so even if you were unlucky and had your card stolen, your primary bank account remains secure.

Travel money vs prepaid card vs travel credit card

It's helpful to know that you'll be able to pick from several different types of travel cards, depending on your priorities and preferences. Travel cards commonly include:

- Travel debit cards

- Travel prepaid cards

- Travel credit cards

They all have distinct benefits when you head off to Vietnam or elsewhere in the world, but they do work a bit differently.

Travel debit and prepaid cards are usually linked to an online account, and may come from specialist digital providers - like the Wise card. These cards are usually flexible and cheap to use. You'll be able to manage your account and card through an app, although you can also often add money in person by visiting a branch - we've picked out the Westpac travel card and the Travelex travel card as popular prepaid cards with a branch network in Australia, for example.

Travel credit cards are different and may suit different customer needs. As with any other credit card, you may need to pay an annual fee or interest and penalties depending on how you manage your account - but you could also earn extra rewards when spending in a foreign currency, or travel benefits like free insurance for example. Generally using a travel credit card can be more expensive compared to a debit or prepaid card - but it does let you spread out the costs of your travel across several months if you'd like to and don't mind paying interest to do so.

What is a prepaid travel money card best for?

Let's take a look at the advantages of using a prepaid travel money card for travellers going to Vietnam. While each travel card is a little different, you'll usually find some or all of the following benefits:

- Hold and exchange foreign currencies - allowing you to lock in exchange rates and set a travel budget before you leave

- Convenient for spending in person and through mobile wallets like Apple Pay, as well as for cash withdrawals

- You may find you get a better exchange rate compared to your bank - and you'll usually be able to avoid any foreign transaction fee, too

- Travel cards are secure as they're not linked to your everyday AUD account - and because you can make ATM withdrawals when you need to, you can also avoid carrying too much cash at once

Overall, travel cards offer flexible and low cost ways to avoid bank foreign transaction and international ATM fees, while accessing decent exchange rates.

How to choose the best travel card for Vietnam

We've picked out 2 great travel cards available in Australia - but there are also more options available, which can make choosing a daunting task. Some things to consider when picking a travel card for Vietnam include:

- What exchange rates does the card use? Choosing one with the mid-market rate or as close as possible to it is usually a smart plan

- What fees are unavoidable? For example, ATM charges or top up fees for your preferred top up methods

- Does the card support a good range of currencies? Getting a card which allows you to hold and spend in VND can give you the most flexibility, but it's also a good idea to pick a card with lots of currency options, so you can use it again in future, too

- Are there any other charges? Check in particular for foreign transaction fees, local ATM withdrawal fees, inactivity fees and account close fees

Ultimately the right card for you will depend on your specific needs and preferences. If you're looking for a low cost card with the mid-market rate, which you can use in 150+ countries, the Wise card may be a good fit. If you'd prefer to pay a monthly fee to get higher no-fee transaction limits, take a look at Wise. And if you need to get a card in a hurry, check out a travel card from a provider with a physical branch network, like the Westpac card or the Travelex travel money card.

What makes a good travel card for Vietnam

The best travel debit card for Vietnam really depends on your personal preferences and how you like to manage your money.

Overall, it pays to look for a card which lets you minimise fees and access favourable exchange rates - ideally the mid-market rate. While currency exchange rates do change all the time, the mid-market rate is a good benchmark to use as it's the one available to banks when trading on wholesale markets. Getting this rate, with transparent conversion fees, makes it easier to compare costs and see exactly what you're paying when you spend in VND.

Other features and benefits to look out for include low ATM withdrawal fees, complimentary travel insurance, airport lounge access or emergency cash if your card is stolen. It's also important to look into the security features of any travel card you might pick for Vietnam. Look for a card which uses 2 factor authentication when accessing the account app, which allows you to set instant transaction notifications, and which has easy ways to freeze, unfreeze and cancel your card with your phone.

For Vietnam in particular, choosing a card which offers contactless payments and which is compatible with mobile wallets like Apple Pay could be a good plan. Card payments are extremely popular in Vietnam - so having a card which lets you tap and pay easily can speed things up and make it more convenient during your trip.

Ways to pay in Vietnam

Cash and card payments - including contactless, mobile wallet, debit, credit and prepaid card payments - are the most popular ways to pay globally.

In Vietnam, both card payments and cash payments are common. You'll be able to make Chip and PIN or contactless payments or use your favourite mobile wallet like Apple Pay to tap and pay on the go, but it's still worth having a little cash on you just in case - and for the odd situations where cash is more convenient, such as when tipping or buying a small item in a market.

Which countries use VND?

You'll find that VND can only be used in Vietnam. If you don't travel to Vietnam frequently it's worth thinking carefully about how much to exchange so you're not left with extra foreign currency after your trip.

What should you be aware of when travelling to Vietnam

You're sure to have a great time in Vietnam - but whenever you're travelling abroad it's worth putting in a little advance thought to make sure everything is organised and your trip goes smoothly. Here are a few things to think about:

1. Double check the latest entry requirements and visas - rules can change abruptly, so even if you're been to Vietnam before it's worth looking up the most recent entry requirements so you don't have any hassle on the border

2. Plan your currency exchange and payment methods - you can change AUD to VND before you travel to Vietnam if you'd like to, but as card payments are common, and ATMs widely available, you can actually leave it until you arrive to get everything sorted as long as you have a travel money card. Top up your travel money card in AUD and either exchange to VND in advance or at the point of payment, and make ATM withdrawals whenever you need cash. Bear in mind that currency exchange at the airport will be expensive - so hold on until you reach Vietnam to make an ATM withdrawal in VND if you can.

3. Get clued up on any health or safety concerns - get travel insurance before you leave Australia so you have peace of mind. It's also worth reading up on any common scams or issues experienced by tourists. These tend to change over time, but may include things like rip off taxis or tour agents which don't offer fair prices or adequate services.

Conclusion - Best travel cards for Vietnam

Ultimately the best travel card for your trip to Vietnam will depend on how you like to manage your money. Use this guide to get some insights into the most popular options out there, and to decide which may suit your specific needs.

FAQ - best travel cards for Vietnam

When you use a travel money card you may find there’s an ATM withdrawal fee from your card issuer, and there may also be a cost applied by the ATM operator. Some of our travel cards - like the Wise and Revolut card options - have some no fee ATM withdrawals every month, which can help keep down costs.

Travel money cards may be debit, prepaid or credit cards. Which is best for you will depend on your personal preferences. Debit and prepaid cards are usually pretty cheap and secure to spend with, while credit cards may have higher fees but often come with extra perks like free travel insurance and extra reward points.

There’s no single best prepaid card for international use. Look out for one which supports a large range of currencies, with good exchange rates and low fees. This guide can help you compare some popular options, including Wise, Revolut and Westpac.

Yes, you can use your local debit card when you’re overseas. However, it’s common to find extra fees apply when spending in foreign currencies with a regular debit card. These can include foreign transaction fees and international ATM charges.

Usually having a selection of ways to pay - including a travel card, your credit or debit card, and some cash - is the best bet. That means that no matter what happens, you have an alternative payment method you can use conveniently.

Yes. Most travel debit cards have options to make ATM withdrawals. Check the fees that apply as card charges do vary a lot. Some cards have local and international fees on all withdrawals, while others like Wise and Revolut, let you make some no fee withdrawals monthly before a fee kicks in.

Both Visa and Mastercard are globally accepted. Look out for the logo on ATMs and payment terminals in Vietnam.

The cards you see on this page are ordered as follows:

For card providers that publish their exchange rates on their website, we used their AUD / VND rate to calculate how much Vietnamese Dong you would receive when exchanging / spending $6,000 AUD. The card provider offering the most VND is displayed at the top, the next highest below that, and so on.

The rates were collected at 09:36:26 GMT on 25 May 2024.

Below this we display card providers for which we could not verify their exchange rates. These are displayed in alphabetical order.

Send international money transfer

More travel card guides.

What's the Best Currency to Take to Vietnam in 2024?

.jpg?auto=compress,format&rect=0,0,1629,1629&w=120&h=120)

Byron Mühlberg

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Are you travelling to Vietnam and wondering which currency you should take there? Vietnam uses the Vietnamese đồng, meaning that, except in tourist establishments, airports, or hotels, you normally won't be able to use major currencies like the US dollar or British pound to pay your way.

To pay while you're in Vietnam, you'll either need to buy Vietnamese đồng banknotes before or during your trip, use your credit card, or use a low-cost multi-currency debit card like Revolut 's or Wise 's travel cards.

In a rush? Here are our recommendations for how to pay in Vietnam if you're...

- from the UK: Revolut 's debit Mastercard

- from the USA: Chime 's VISA debit card

- from Canada: KOHO 's debit Mastercard

- from the EU, Australia, or Singapore: Revolut

- wanting local banknotes: ChangeGroup

In this short guide, we'll discuss what's the best currency to take to Vietnam, how you should pay when you're there, and what your cheapest options are to avoid paying hefty exchange rate charges.

Key Facts About Currency in Vietnam

Best currency to take to vietnam.

- 01. Currency in Vietnam scroll down

- 02. Best currency to take to Vietnam scroll down

- 03. How to pay in Vietnam scroll down

- 04. FAQ about currency in Vietnam scroll down

Overview of Currency in Vietnam

As we saw earlier, the currency in Vietnam is the Vietnamese đồng .

As the official legal tender in Vietnam, it's the sole currency recognized by the Vietnamese government, and you can use it to settle all financial obligations in the country, from paying for your hotel stay, to the entrance fee at the Temple Of Literature, to a bite to eat in Ho Chi Minh City.

Because it's the local currency and because you won't have any trouble buying goods with it, the best country to have on hand and spend while visiting Vietnam is, unsurprisingly, the Vietnamese đồng.

However, if you're taking another currency along with you, the US dollar is a safe bet, as it's highly exchangeable at banks and currency exchange offices in Vietnam, even if it's neither official nor used ubiquitously across the country.

You can check out the prevalence of a few of the most popular tourist currencies in Vietnam below:

Although US dollars aren't offically accepted in Vietnam, you can often use them anyway. Airports, hotels, or shops and restaurants in major tourist areas always let you pay in dollars, but even non-touristy establishments sometimes quote prices in both đồng and dollars. If you're from the USA, we recommend using Chime 's debit card, which charges no foreign exchange fees, to make low-cost card payments while travelling in Vietnam. However, out-of-network ATM withdrawal fees and over-the-counter advance fees may apply.

You cannot use British pounds to pay while visiting Vietnam. However, you can withdraw đồng from a local Vietnamese ATM or exchange your pounds for US dollars or đồng at a local bank or currency exchange office. If you're from the UK, we recommend using Revolut 's travel debit card, which has market-low currency exchange charges.

You cannot use euros to pay while visiting Vietnam. However, you can withdraw đồng from a local Vietnamese ATM or exchange your euros for US dollars or đồng at a local bank or currency exchange office. If you're from the European Union or EEA, we recommend using Revolut 's debit card, which charges no foreign exchange fees, to make low-cost card payments while travelling in Vietnam.

Although Vietnamese đồng is the best currency to use and the US dollar can be helpful at times too, exchanging currencies in the form of cash almost invariably leads to poor exchange rates for tourists (we've seen as high as 20% commissions, although the average is between 5% and 15% of the amount exchanged).

For this reason, it's generally a better idea to use your credit or debit card to pay at local points of sale wherever possible or (if cash is urgently needed) to withdraw some money from a local ATM. This will let your card provider handle the conversion, which is usually, although not always, a better deal than bringing foreign currency into Vietnam and exchanging it there. However, as we'll see below, a conversion-friendly debit card is the best choice of all!

ChangeGroup

ChangeGroup is a viable option If you need physical Vietnamese đồng in cash in hand before your flight abroad to Vietnam. When it comes to popular currency pairs like GBP to EUR , ChangeGroup maintains a low FX markup of approximately 2.2%.

For less common currency pairs like GBP to Turkish lira, however, their rates may be comparable to those offered by traditional services, hovering around 15%. This is why we tend to recommend Revolut and Wise for less common currencies.

- FX Margin : 2.2% - 28.7%, varies by currency pair

- Home Delivery: For a fee

- Cash Pick Up : Free

- Guaranteed Buyback: For a fee

- Availability: UK, USA, Australia, Germany, France, Austria, Spain, Denmark, Sweden, Finland

How to Pay in Vietnam

When it comes to paying your way in Vietnam, you'll have the following three options broadly speaking:

Method 1: Cash

As we mentioned earlier, cash is an important medium of exchange in Vietnam. Pretty much all shops, restaurants, and commercial establishments around the country will accept Vietnamese đồng banknotes, and we recommend having some on hand when you travel. Foreign cash can be purchased before your trip from your bank in your home country, or during your trip at a local Vietnamese bank or currency exchange office or (most affordably) from an ATM.

Note that in Vietnam, currency exchange offices normally go by the name tiệm đổi tiền , so if you want to exchange your home currency for Vietnamese đồng, be on the lookout for signage with this name.

- Cash prevalence in Vietnam: Very prevalent

- Cost to exchange: 5% - 15% on average

Method 2: Credit Card

Although cash is king in Vietnam, credit and debit cards issued by major global providers like VISA and Mastercard are commonly accepted too. If your card is issued by American Express, Diner's Club, or another card company, there's a good chance they'll also be accepted in Vietnam, but we recommend checking with your bank or card provider directly to make sure that Vietnamese đồng currency conversion is indeed supported, and that card machines and ATMs in Vietnam commonly support cards of this type.

- Card prevalence in Vietnam: Prevalent

- Cost to exchange: 2% - 5% on average

Method 3: Travel Debit Card

Just like credit cards, prepaid debit cards (which are also normally issued by VISA or Mastercard) provide an excellent way to pay while visiting Vietnam, the main difference being that you normally pay lower fees and exchange rates . Depending on where you live, you'll probably have options from your bank or a third-party provider to use a commission-free debit card or a multi-currency card which can help you dodge high Vietnamese đồng conversion costs, including DCCs .

According to our analysis of dozens of providers, the top two options for travelling to Vietnam, in general, are the following:

Revolut is an excellent option for paying in Vietnam. Its all-in-one mobile finance app and debit card offer competitive exchange rates to the Vietnamese đồng and low fees. What's more, you can easily manage everything through your money through Revolut's user-friendly app.

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

- Monthly fee: $0

- Card type: Mastercard debit

- Card payment cost in Vietnamese đồng: 0.5% - 1.5%

- Cash withdrawal fee: 0% - 2%

- Vietnamese đồng balance: No

- Vietnamese đồng bank details: No

Wise Account

The Wise Account is another great option for paying in Vietnamese đồng. It gives you the lowest possible currency exchange rates with complete transparency and no hidden fees. It also allows you to hold and manage over 50 currencies in one account and provides fast and secure cross-border money transfers at a fraction of the cost of traditional banks.

- Trust & Credibility 9.3

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

- Card type: VISA debit

- Vietnamese đồng balance: Yes

Wise and Revolut are excellent options that are available in many countries around the world. However, depending on where you live, you might have access to better deals still. We go over a few of them below:

United Kingdom

- Revolut : Best spending and budgeting app.

- Wise : Best for multiple foreign currency balances.

United States

- Chime ®: Best all around; no fees for non-USD transactions.

- Revolut : Best all-around spending app.

- Wise : Best for foreign currency spending and holidays.

- KOHO : No foreign transactions fees on Extra or Everything plan.

- Wise : Best for foreign currency spending and holidays.

European Union

- Revolut : Excellent for spending abroad.

- N26 : Best full bank account with low fees (even abroad)

- bunq : Best credit card (also a fully-licensed bank).

FAQ About Currency in Vietnam

The best currency to take to Vietnam is the local currency, the Vietnamese đồng. US dollars are also highly exchangeable at local banks and currency exchange offices. However, instead of converting physical banknotes, the cheapest way to pay in Vietnam is to use a multi-currency travel debit card like Revolut or Wise .

Generally, we don't recommend exchanging currency before travelling to Vietnam. Although having some Vietnamese đồng cash on hand can be helpful, we recommend drawing some from an ATM once you've arrived in Vietnam using a prepaid multi-currency card like Revolut to avoid the hidden currency exchange fees.

It depends on the country you're visiting and the expenses you will have. Credit cards are widely accepted in many countries, including Vietnam, and can offer benefits such as rewards points and fraud protection. However, some places may only accept cash, especially in more rural areas. It's a good idea to have both cash and credit cards on hand and to research the best way to access your money while travelling.

The best way to avoid currency exchange fees when travelling to Vietnam is to pay using a multi-currency travel debit card like Revolut or Wise . This way, you can make low-cost conversions to the Vietnamese đồng every time you tap your card or withdraw cash. Other excellent debit cards that don't charge conversion fees include Revolut in the UK and Chime in the US.

Take a Look at These Related Guides

Travelling to Another Country Too?

Take a look at the best currencies to take to other countries:

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

Exchanging Money in Vietnam: The Ultimate Guide

Exchanging currency in Vietnam can be confusing. After all, the exchange rate is around 24,600 Vietnamese Dong to a single US dollar. That conversion figure is already pretty staggering, and it’s rising all the time.

Those traveling to Vietnam really have no choice but to exchange money, though, because every part of Vietnam is still a cash-based economy. Only large businesses like hotels and grocery stores take cards, and it’s best to carry some cash around with you at all times.

Because cash is so important in Vietnam but obtaining and managing it can be tough, we’ve put together this guide. In it, we’ll look at how you can exchange your foreign currency for Vietnamese Dong in a safe, organized way and go over some other things you should know about Vietnam currency before your trip.

Table of Contents

Vietnamese dong overview (with denominations table).

To the comic delight of many travelers, the official currency of Vietnam is known as the Vietnamese Dong, abbreviated as VND. The currency comes in nine denominations, each of them a bill of a different denomination. Since the denominations are all in thousands, the zeros are denoted by the letter “k” in everyday use — for example, a 10,000 VND bill would usually be referred to as a 10k.

The lower bills (1k-5k) are made from cotton paper and the newer bills of larger denomination (10k-500k) are made from polymer. The polymer bills are waterproof, so you can dry your money if it falls in water or goes through the wash and it will be good as new! If your paper notes go through the washer, RIP.

The table below shows the nine denominations, along with the USD value of each one (as of March 2024), and the color of that denomination’s bill.

Vietnamese Dong Exchange Rate by Country

When you’re exchanging currency, you’ll obviously want to make sure you get a good rate. To do so, we recommend comparing the official exchange rate shown for your currency in the table below to the exchange rate at the money exchange location you go to in order to make sure the figures are similar.

Where to Exchange Money in Vietnam

We’ll look at our top picks for specific money exchange locations below, but first let’s talk about the different types of places to exchange money in Vietnam.

Airport Exchange Booths

Vietnam is home to many international airports — the major ones are Noi Bai International Airport in Hanoi, Tan Son Nhat International Airport in Ho Chi Minh City, and Da Nang International Airport in, you guessed it, Da Nang. Both the arrival and departure terminals of each one are packed with currency exchanges, so you can exchange your home currency for VND as soon as you arrive or exchange your VND for your home currency right before you leave.

Airport currency booths are convenient and work quickly but generally offer worse rates than any exchange you’ll find in the city center. If possible, you should refrain from exchanging any money at the airport. If you must, though, just exchange a little bit and exchange the bulk of your money at an exchange with a more favorable rate.

- Travel Agencies

Travel agencies usually have the same pros and cons as the airport when it comes to exchanging to and from Vietnamese currency. That is, they’re convenient and are always staffed with fluent English-speakers. They’re also quick and convenient. On the other hand, they usually offer pretty poor exchange rates in comparison to the next two options.

Vietnamese cities are full of big banks, from 100% domestic banks like Sacombank, Techombank, and SBV (State Bank of Vietnam) to banks that will be familiar to tourists like Citibank and HSBC. You’ll probably never be more than a few blocks from a bank branch if you’re in a big city, so they’re very convenient. And each of them offers currency exchange.

The main upside of exchanging money at a bank is that it is secure. You don’t run any risk of being scammed or receiving counterfeit bills.

Unfortunately, there are several downsides to exchanging money at a bank. The first is the hassle it may present. You’ll have to go to the bank during opening hours, wait for your turn to see a teller, present your passport, and wait for the bank to process the exchange before receiving your money. The exchange rate at banks is better than at the airport, although not as good as at most gold shops.

Gold and Jewelry Shops

The city centers of large Vietnamese cities are littered with gold and jewelry shops, and almost all of them serve as Vietnam currency exchange booths as well.

These shops often offer the best exchange rate since they have less overhead. They are also quicker and less of a hassle than exchanging at banks, which makes them the top choice for most travelers.

That being said, exchanging money in Vietnam at jewelry shops is not 100% safe like it is at banks. The shops are supposed to be licensed in order to offer currency exchange, but some are not; some unreputable ones have been known to distribute counterfeit money or even perpetrate scams by short-changing tourists. These situations are extremely rare, but they do exist and travelers should stay safe by only going to jewelry shops that look legit; well-kept shops with lots of customers are usually the best bet. Also, you should avoid risk and go with a bank instead if you are exchanging a huge amount of cash ($5000 and up) at one time.

Where to Exchange Money in Hanoi

Hanoi’s Noi Bai International Airport is packed with booths at which to exchange money, and its city center is full of banks and travel agents to do the same thing. The table below lists just a few of the best gold shops and banks to exchange to or from your country’s currency in Hanoi at good rates.

Where to Exchange Money in Ho Chi Hinh City

Tan Son Nhat International Airport has a lot of currency exchange booths, but you’ll find a better rate at money exchange locations near the city center. Some of the best places to exchange cash are specified in the table below.

Where to Exchange Money in Da Nang

Da Nang International Airport and the city center both have lots of opportunities to exchange currency. The table below highlights some of the best locations to check out for exchanging money in Da Nang.

Where to Exchange Money in Hoi An

You’ll probably be flying into Da Nang’s airport if you’re going to Hoi An and you can exchange your money there, but you’ll get a better rate if you wait and exchange the bulk of your cash at one of the locations in the table below.

Using ATMs in Vietnam

ATMs are widely available in large towns or cities in Vietnam, and withdrawing money from them is a great alternative to money exchange because they’ll dispense Vietnamese Dong even if your bank balance is normally displayed in your home country’s currency. Most Vietnamese ATMs take all Visa cards and Mastercard.

Be aware, though, that the foreign transaction fees at Vietnamese ATMs can be high. They don’t charge the exorbitant fees that ATMs in some countries do, but be prepared to pay around 100k extra at most ATMs just to use your non-Vietnamese bank card. There are a few foreign banks (e.g. Charles Schwab Bank in the US) that refund all ATM fees including foreign transaction fees, but most banks do not. Also know that most Vietnamese ATMs only allow you to take out 2 million or 3 million VND per transaction and you’ll have to pay the transaction fee for each time you withdraw money.

There are generally very few, if any, ATMs in small towns or villages in Vietnam. Even if there are a few, they may be out of order. So we recommend you take care of all your currency needs before traveling out of a big city.

Pro Tip: When an ATM asks if you want to accept a conversion as you withdraw money, decline the conversion! The “conversion” is just a way to shave money off the amount dispensed.

Pro Tip 2: Remember to phone your bank and put a travel notice on your account so your transactions are not blocked when you are withdrawing money at a Vietnamese ATM.

Using Credit or Debit Card in Vietnam

Most large establishments in Vietnam accept Visa and Mastercard. You can generally use a card at:

- Indoor Restaurants and Cafes (as a rule of thumb, if a restaurant or cafe has AC, they usually accept cards)

- Supermarkets

- Convenience Stores (e.g. Circle K, Family Mart, Mini Stop, GS25, 7-11, etc.)

You can also use your card for almost all online payments.

You never know for sure which businesses will accept cards or which businesses’ card readers will be broken. For that reason, you should always carry at least a little bit of Vietnamese Dong with you at all times.

Tips for Avoiding Scams

To avoid scams when exchanging money, you should keep a few tips in mind.

- Use your own calculator — When calculating how much Vietnam currency to give you during a cash exchange, the agent will enter in the amount of currency you hand over in a calculator and multiply by that currency’s exchange rate. They’ll then show you the result so you know how much VND you’re entitled to. Some unscrupulous exchanges trick tourists by using calculators modified to show a lower total, though. So you should do your own currency conversion by using the calculator on your phone, just in case.

- Go to crowded money exchanges — As we mentioned before, a crowded exchange is generally a reputable exchange. So, unless you’re going to one of the exchanges in one of the tables from the previous sections, you should make sure to stick to exchanges that already have at least a few customers in them.

- Use ATMs sparingly — Vietnamese ATMs charge foreign transaction fees or currency exchange rates when you use a foreign credit or debit card. What’s more, you may have to make a few withdrawals to take out the amount of money you need, since the ATMs in Vietnam only dispense a maximum of 100 USD or so most of the time. For that reason, you shouldn’t use an ATM to withdraw all the money you use on your Vietnam trip.

- Don’t use taxis — For whatever reason, Vietnamese taxis are an absolute hotbed for scams, even in 2024. We’d highly recommend you instead use a ride-hailing app like Grab, Gojek, Be, or Xanh SM. You can even electronically connect your credit card to the apps, though you’ll have to set that up beforehand and many tourists report issues with setting up electronic payment from within Vietnam.

Wrapping Up

Vietnam’s economy is about as capitalist as they come, and having cash money in Vietnam is virtually guaranteed to make your vacation there run smoothly. That’s why it’s essential you understand the Vietnamese Dong, know how and where to exchange your home currency for it, and know where you can use it. We hope this guide gave you all the info you need to call yourself a true Dongmaster.

For other resources you can use to do your research before your Vietnam vacation, check out:

- Vietnam visa overview

- A guide on flights to Vietnam

Related FAQs

As of March 2024, $1 is equal to 24,642 Vietnamese Dong.

Yes, $100 goes a long way in Vietnam. $100 is more than enough to pay for dinner, drinks, and a show for an entire family of 4 in most places.

Vietnamese Dong, abbreviated as VND, is the only currency widely accepted in most places in Vietnam.

Yes. Vietnam is not a tipping culture so tips are generally not expected, but a tip of 100 to 200 thousand Vietnamese Dong is always appreciated for above-and-beyond service.

You can find local street food meals for as little as 25 or 30 thousand Vietnamese Dong. Restaurant meals generally range from 70 to 200 thousand VND.

Written by Dustin Kemp

Join our community for free and unlock exclusive benefits.

We extend our thanks to our Ambassadors for their contributions to this post

You might also like

The Vietnam Tourist SIM Card Guide

Flight to Vietnam from Australia

Flight to Vietnam from Canada

Flight to Vietnam from Germany

66 B2 Street, Sala Urban Area, An Loi Dong Ward, Thu Duc City, Ho Chi Minh, Vietnam © 2024 Vietnam Is Awesome. All rights reserved. Terms of use | Privacy Policy

- Book Tours & Experiences

- Travel Insurance for Vietnam

- Flights To Vietnam

- Destination Guides

- Ho Chi Minh

- Mekong Delta

- Our Ambassadors

- Our Podcast

- Rising News

- You Are Awesome

- Redeem Vouchers

- Things To Do

- Food & Drink