Your shopping cart is empty!

- International SIM Card Pakistan

Prepaid International SIM Card Pakistan

Voice Calls, SMS and Mobile Data Service in Pakistan + coverage in over 200 Countries

Get connected on the worlds fastest & most reliable mobile networks

The Wraptel International SIM Card offers low cost talk, text and data in over 200 countries.

- No contracts. No monthly fees

- Keep your unused airtime for future trips. Your International SIM does not expire

- 4G LTE/3G Data Speeds

- Data is charged in 10kb increments

- Voice Calls are charged in 20 second increments

- Receive SMS texts for free in all countries

- Add a US, Canadian or UK phone number or no number for Data only

- Mobile Service on over 400 Global Networks for Voice, SMS and Data

- Shares the same phone number and airtime balance as your SIM

- Free inbound calls in all countries

- Reduced rates on all outbound calls

- Excellent Voice Quality

- Call Recording

Fed up with paying high roaming charges when traveling abroad? Wraptel offers frequent travellers with a pre-paid international SIM card or a pre-paid international eSIM that can be used for voice calls, text messages and data in over 200 countries . The airtime is rechargeable and you get to keep unused airtime for future trips. There are no monthly fees or contracts to sign.

- Travel eSIM

- Install eSIM

- Delivery Options

Loading Cart

The best Prepaid SIM Card to travel in Pakistan. Choose the best SIM Card for your needs.

Best sim card operators, best market prices, pay as you go, 24/7 customer service, compare and buy the best simcard for pakistan, easy to get, get your sim cards with ease, choose destination.

Choose from over 200+ travel destinations worldwide

Select the best Pakistan SIM Card for you

Choose the best Pakistan SIM Card deal for your needs

Receive your SIM Card by mail

Select one of our reliable logistics partners at a low cost

SimOptions in the news

In the spotlight.

"SimOptions, The Revolutionary eSIM Marketplace"

"providing the best eSIM package for the best price"

"covers 160 countries across the world"

"SimOptions offers a prime eSIM bundle at the best price"

Frequently asked questions

Choose your destination, find your prepaid sim card, they trust simoptions, simoptions ratings, selected posts, the best sim cards for europe, the best sim cards for france, the best sim cards for the usa.

Operating from major hubs in Paris (France), Bangkok (Thailand), and Hong Kong, SimOptions is at the forefront of the international Prepaid SIM Card market. Our mission is to provide global travelers with a reliable solution to completely avoid roaming charges in Pakistan through the use of Pakistan Prepaid SIM Cards. We take pride in our diverse offerings that span continents, including Europe , Asia , Oceania , North America , and South America . When it comes to Prepaid SIM Cards for Pakistan, SimOptions is your go-to provider. Wondering about the shipment? We collaborate with global couriers such as DHL, UPS, FEDEX, ARAMEX, Australia Post, among others, ensuring prompt delivery to your doorstep in over 100 countries. Connect with SimOptions today and keep in touch with your family and friends back home!

Best sellers

Regional plans

- North America

- Latin America

- United Kingdom

All destinations

- Bosnia and Herzegovina

- Central African Republic

- Democratic Republic of Congo

- Dominican Republic

- Czech Republic

- El Salvador

- Faroe Islands

- Isle of Man

- Ivory Coast

- Liechtenstein

- New Zealand

- Papua New Guinea

- Philippines

- Puerto Rico

- Republic of Congo

- Saudi Arabia

- South Africa

- South Korea

- St. Pierre and Miquelon

- Switzerland

- The Netherlands

- Trinidad and Tobago

- Turks and Caicos

- United Arab Emirates

You haven't added products to the cart

Total: EUR € 0,00

Continue shopping

Choose a currency

Suggested languages

iPhone XS Max

iPhone 11 Pro

iPhone 11 Pro Max

iPhone SE (2020)

iPhone 12 Mini

iPhone 12 Pro

iPhone 12 Pro Max

iPhone 13 mini

iPhone 13 Pro

iPhone 13 Pro Max

iPhone SE (2022)

iPhone 14 Plus

iPhone 14 Pro

iPhone 14 Pro Max

iPad Pro (2018 and onwards)

Watch series 3

Watch series 4

Watch series 5

Watch series 6

Pixel 6 Pro

Pixel 7 Pro

P40 Pro (not including the P40 Pro +)

Mate 40 Pro

Galaxy Z Flip

Galaxy Z Flip 5G

Galaxy Z Flip3 5G

Galaxy Z Flip4

Galaxy Fold

Galaxy Z Fold2 5G

Galaxy Z Fold3 5G

Galaxy Z Fold4

Galaxy S21+ 5G

Galaxy S21 Ultra 5G

Galaxy S22+

Galaxy S22 Ultra

Galaxy Note 20 Ultra 5G

Galaxy Note 20

Galaxy S23+

Galaxy S23 Ultra

Galaxy S20 Ultra 5G

Rakuten Mini

Find X3 Pro

Find X5 Pro

Xperia 10 III Lite

Xperia 10 IV

Xperia 1 IV

Xperia 5 IV

Magic 4 Pro

Aquos Sense6s

Check out our guide on how to find out if my device is eSIM compatible or contact us on our online chat

If there have been changes in your plans and you no longer need your Holafly eSIM, we will provide you with a full refund .

If you purchased the eSIM and it turned out to be incompatible with your device, we will provide you with a full refund .

If your eSIM doesn't work due to an issue with Holafly or the network infrastructure of the destination country has problems and is unstable, we can offer you a full or partial refund .

eSIM with Unlimited Data in Pakistan

€ 7,00 Original price was: €7,00. € 6,00 Current price is: €6,00. EUR

Based on 38,209 reviews on

Description

Technical Specs

Unlimited data

Fast and reliable internet

No more roaming charges

- Enjoy your trip with unlimited data in Pakistan.

- Receive your QR code and connect instantly.

- Easy to set up. No registrations or subscriptions.

- Keep your WhatsApp number on your cellphone.

- Connect to the best network in Pakistan.

- Customize the duration of your plan to fit your needs

Connect to the Internet in Pakistan at 4G / LTE speed with an international eSIM with unlimited data . Use your favorite apps to call all your friends and family , such as WhatsApp or iMessage, without restrictions. You can keep your usual local SIM card to receive SMS and important calls. This eSIM for Pakistan connects to the Three HK network, the fastest in the country.

Travel digital SIMs are effortless to set up: You will receive a QR code immediately in your email. Scan it with your cellphone camera, and in a matter of minutes, you’re connected to the internet in Pakistan. It’s that easy!

- Installation: with a QR code or manually

- Activation: upon arrival to destination turn on your Holafly eSIM’s data roaming

- Compatibility: compatible with all smartphones with eSIM technology enabled. Operation on smartwatches and tablets is not guaranteed. Check compatibility here.

- Days of use: customizable plan duration

- Delivery time: immediate, after purchase

- Plan type: unlimited data

- Calls: No, only through apps (VOIP).

- Speed: 3G/4G/LTE/5G

- Speed reduction: if necessary. Some carriers may reserve the right to apply a Fair Usage Policy

- Hotspot: enjoy 500mb per day to share with others.

- Coverage: You will enjoy good coverage in Karachi, Lahore, Faisalabad, and other cities and tourist destinations in Pakistan.

- Networks: CMPak

Choose when your plan starts! Install the eSIM before your trip and activate the data upon arrival.

Start enjoying unlimited data

- % discount applied to all plans

Advantages of using Holafly eSIM in Pakistan

Change of plans? No problem at all!

Purchase your Holafly eSIM with added peace of mind. You have up to 6 months to request a refund.

Conoce por qué nuestra eSIM de viajes internacionales es tu mejor elección de datos móviles para tener internet en el extranjero y mantenerte conectado en tu próxima aventura.

Customize your plan

Decide how long you need your eSIM and adjust your plan accordingly! Say goodbye to running out of data or overspending on unused days.

Unlimited data plans

No more top-ups or worrying about running out of data. With a prepaid unlimited data in Pakistan, you can relax knowing we’ve got you covered.

Keep your WhatsApp number

You can call and message all your contacts on WhatsApp, like you’re at home. Don’t lose touch with family and friends.

24/7 customer support

The eSIM is easy to use, but if you have questions or experience technical issues you can reach us by email or our 24 hour chat support. We’re here to help.

Immediate delivery

If you’re in a rush or you’re already traveling, don’t worry about waiting for delivery. We send the Pakistan eSIM immediately to your email, so you can connect in seconds.

Share your data with family and friends

Share up to 500MB of data daily with family, friends, or fellow travelers. Use your smartphone to create a WiFi network and connect multiple devices.

How does the Holafly eSIM for Pakistan work?

Check your phone is compatible with esim.

Check if your smartphone is compatible now

Buy your prepaid eSIM

Chose the plan that suits you best and buy your eSIM card from our online store.

Scan the QR code

It’s easy. Just scan the QR code we send you and turn on data roaming from your settings. Now you can enjoy browsing the web.

Fast and reliable connection

- Clear video calls with no delays

- Share stories in just a few seconds

- Enjoy creating video content and super fast uploading

- Find your way wherever you go!

The best performace in all your apps

Discover the freedom of reliable connectivity with high speed 4G and 5G . Holafly keeps you connected, no matter the adventure!

What you should know about eSIMs

No local phone number.

This virtual SIM only includes data. It does not allow you to make cell phone calls or send SMS messages. You can still use WhatsApp or Skype to call your contacts.

Your phone must support eSIM

Make sure your phone is both unlocked and compatible with eSIM technology.

Install before you travel and take off

Scan the QR code from your smartphone settings and add the data plan. But don’t activate it until you land at your destination. Take the printed QR code on your travels just in case.

We will send you the eSIM to your e-mail

As soon as you complete your purchase, you’ll receive the instructions to install and activate your international travel eSIM and get unlimited internet on your adventure!

Installation instructions with QR code

Manual installation instructions

Holafly eSIM User Reviews

DON’T stress about your phone service when you travel abroad! I used Holafly to travel home to California this year. The instructions were super easy to follow and I had no problems with the service for the whole 20 days that I used it. It was nice not to worry about how much my phone company was going to charge me for service abroad.

I have used your Sim for my trip to the USA! I recommend it 100%. Thank you very much for your service.

I swear that Holafly has a customer service that is to cry with pleasure ;___; In no time will I buy another unlimited data SIM for Japan because the first time it worked wonderfully

A complicated request was solved urgently within 24 hours of traveling. They are wonderful and I recommend it to everyone. Thank you HolaFly team!

Frequently Asked Questions the eSIM Pakistan

When does my data plan begin?

Your plan activates immediately upon connecting your eSIM to any supported network. For example, if you bought a 1-day plan and you activate your plan at 10 AM, it remains active for a full 24 hours, concluding at 10 AM the following day.

Can I make phone calls and send messages with my Holafly eSIM?

The Pakistan eSIM only allows you to use mobile data. It does not include a local phone number for mobile calls or messages. You can still make calls using apps like WhatsApp to stay connected with your friends and family.

Which devices work with the eSIM card?

You can check if your smartphone is eSIM compatible here.

When will I receive my eSIM?

Once you purchase your eSIM, you will receive a confirmation email with instructions to install it immediately using a QR code or manual code. Remember that once the eSIM is purchased, it cannot be returned.

Can I keep my WhatsApp number?

You don’t need to do anything to keep your WhatsApp number. You’ll automatically keep your number, contacts and conversations.

How quick is the Holafly eSIM?

The Holafly eSIM plans offers maximum speed coverage (4GLTE). But bear in mind that in some areas of limited coverage there may be reduced speeds in connection.

Do I have to activate data roaming on my device?

Yes. To ensure that your eSIM gets the best coverage, you must turn on data roaming on your mobile settings. This will not incur any additional charges, as long as you have already set up the Holafly eSIM.

What do I do if I delete or lose my eSIM’s QR code?

If you cannot find the code, please contact our 24/7 customer support team at [email protected] or our online chat for further assistance. We will resend the code to your email.

What happens if I use up my data or my days of validity?

If you use all your data or run out of days, your eSIM card will no longer work and you won’t have an internet connection.

What Which eSIM plan is best for Pakistan?

Whichever is available for your destinations and suits your travel needs better! You can choose plans from 1 to 90 days.

Could the internet speed with my Holafly eSIM be reduced?

In a rare scenario, yes. Operators enforce an international measure called Fair Usage Policy to ensure fair internet usage and allow all users to enjoy optimal connection. This measure might be applied for a period of no more than one (1) day. It’s beyond Holafly’s control, but don’t worry! If this measure affects you, the restriction will be lifted the next day, and you’ll have your original plan speed back.

Is Holafly my best option?

It is! Of course if you ask us which eSIM card is the best, we will naturally answer it’s ours! Why? Because of our unlimited data, the flexibility to select a custom number of days, and many more special features.

What is an eSIM?

An eSIM (embedded SIM) is a digital SIM card that can be installed directly into your smartphone or other mobile devices. It is an alternative to the physical, removable SIM card you’re used to.

Can I renew or extend the data on my eSIM?

Yes, you can do so by logging into your customer panel on the Holafly Center. You will find the data plans you can purchase there. Once you’ve made your purchase, it will be activated immediately on the eSIM you have linked.

Can I share data with other devices?

Certainly! With the Pakistan eSIM, you have the capability to share up to 500MB of data per day across devices by creating a WiFi connection using your smartphone. Refer to your device instructions for guidance on setting up a WiFi connection via a mobile hotspot.

How do I set up the eSIM on my device?

After your eSIM purchase, we will send a QR code and manual instructions to your email. Either print the QR code or open it on your computer. On your cell phone, go to Settings > Mobile Data > Add Data Plan and scan the QR code. Your phone will allow you to assign a specific name to this data plan. You will now be able to switch between your Holafly data plan and the original plan from your provider. The Holafly data plan will only be operational once you arrive at your destination. Once you land, turn on data roaming on your cell phone settings and activate the Holafly data plan. Consult your phone’s user manual for more details on adding a data plan. All eSIM products come with comprehensive set-up instructions.

Should I install my eSIM before travelling?

Set up your eSIM before your departure. Once you reach your destination, just activate the data plan turning on data roaming. We recommend you print the QR code to take it and manual instructions with you on vacation, just in case. Remember that you need internet access to install the eSIM.

How can I check my data balance?

You can manage your eSIM plan details and access all purchased data plans by logging into your Holafly Center through the Holafly website.

How many times can I use my eSIM card?

If needed or when changing phones during your trip, you can transfer your eSIM. However, note that you can only transfer the eSIM to two devices—the original one and a new one. Once you’ve installed it on a different device than the original, you won’t be able to reinstall it on the original device and you must deliver the eSIM from the original device to install it in the second device.

Can I delete the Holafly eSIM once I’ve used my data?

Yes! But keep in mind that you don’t need to do so. As soon as your plan expires your eSIM will no longer work.

Can I use my physical SIM card and Holafly eSIM at the same time?

If you are using an Apple device, you can use your SIM card and your eSIM at the same time. Choose the SIM card for phone calls and SMS, and Holafly eSIM for data from your device. Please remember that if you leave your SIM card activated, your cellular network provider may apply data roaming charges to receive or make phone calls as well as SMS.

How do I get a refund?

At Holafly we are aware that our users may have unforeseen events after making the purchase. Therefore, you can request a refund in the following circumstances: – You bought the eSIM without checking the compatibility with your cellphone. – You canceled your trip or you no longer need the eSIM service. – Our eSIMs generally work fine, but if you experience connection issues, we can provide you with a full or partial refund. Once the refund is approved, you will receive the money on to the same account with which you made the payment. This process can take between 5 to 10 business days. For more details, terms and conditions, we invite you to read our Refund Policy .

To which mobile network or carrier will I connect at my destination?

Your eSIM will connect to all the local phone networks that Holafly partners up with. You can review them in the Technical Specs tab.

How long does it take to activate my eSIM?

Your eSIM data activates instantly once you enable roaming in the Holafly eSIM, initiating the data plan at that moment.

1 day unlimited data

Check that your device is compatible with eSIM

Don't worry! We are here for you.

If you have any questions during this process, remember we're here to assist you 24/7 through our Online chat.

123 Main Street, New York, NY 10001

- 123-456-7890

How to Buy a SIM Card in Pakistan in 2024

- June 6, 2024

Traveling to Pakistan offers a vibrant mix of cultural experiences, historical landmarks, and breathtaking landscapes. To stay connected during your visit, getting a local SIM card is essential. This guide provides a comprehensive overview of purchasing a SIM card in Pakistan, including where to buy one, the main operators, costs, and other crucial details. We’;ll also cover how to buy and use an eSIM in Pakistan .

Table of contents

Where can i get a sim card for pakistan, benefits of buying before you travel, buy your tourist sim card in pakistan, how to buy a sim card with jazz in pakistan, how to buy a sim card with telenor pakistan, how to buy a sim card with zong in pakistan, how to buy a sim card with ufone in pakistan, benefits of buying your sim card in pakistan, how much does a prepaid sim card in pakistan cost, using an esim in pakistan, why should i buy a sim card for pakistan, what if i have a problem with my sim card in pakistan, can i use wi-fi in pakistan, what are the mobile operators in pakistan, how much is a sim card in pakistan, how much does roaming cost in pakistan, can a traveler get a sim card in pakistan.

You can purchase a SIM card for Pakistan either before your trip or upon arrival. Each option has its own set of benefits.

Purchase Before You Travel

- Immediate Connectivity : Use your phone as soon as you arrive in Pakistan.

- Convenience : Avoid the hassle of searching for a SIM card store after a long journey.

- Preloaded Plans : Many online providers offer SIM cards with preloaded data and calling plans, allowing instant use.

Buying a SIM card before your trip can be done through various online platforms specializing in international SIM cards. These cards often come with preloaded credit, data, and calling minutes, making it easy to stay connected immediately upon arrival.

If you prefer to purchase a SIM card upon arrival, you can do so at the airport, mobile network stores, convenience stores, and authorized resellers across the country. Major entry points like Jinnah International Airport have kiosks and shops for the main mobile operators, making it convenient to buy a SIM card as soon as you land.

Who Are the Main Operators in Pakistan?

Pakistan has several major mobile network operators, each offering different plans, coverage, and services. The main operators are Jazz, Telenor Pakistan, Zong, and Ufone.

Jazz is the largest mobile network provider in Pakistan, offering extensive coverage and reliable service. You can purchase a Jazz SIM card at their stores, kiosks, and authorized retailers across the country. They offer a variety of prepaid plans, including data bundles, voice call packages, and text services.

Telenor Pakistan is known for its competitive pricing and range of services. Telenor SIM cards are available at their retail stores, kiosks, and partner outlets. They provide various prepaid plans tailored to different usage needs, from data-heavy packages to balanced voice and text options.

Zong is known for its innovative services and competitive plans. Their SIM cards are available at Zong stores and authorized dealers. They offer various prepaid plans, including data packages and voice call options, catering to different customer needs.

Ufone is another prominent mobile network operator in Pakistan, known for its reliable coverage and affordable plans. Ufone SIM cards can be purchased at their retail stores, kiosks, and authorized retailers. They offer a variety of prepaid plans, including data, voice, and text options.

- Local Rates : Avoid expensive international roaming charges.

- Flexible Plans : Choose from a variety of prepaid plans to suit your usage and budget.

- Reliable Coverage : Enjoy extensive network coverage across the country.

The cost of a prepaid SIM card in Pakistan varies depending on the provider and the plan you choose. Generally, SIM cards range from $1 to $5. Data plans start from around $5 for small data bundles, with larger data packages and combo plans available at higher prices. On average, you can expect to spend about $10 to $30 for a reasonable amount of data and calling minutes.

eSIM technology is increasingly available in many countries, including Pakistan. If your device supports eSIM functionality, check with Jazz, Telenor Pakistan, Zong, or Ufone to see if they offer this service. eSIMs provide the convenience of not needing a physical SIM card and can be activated online.

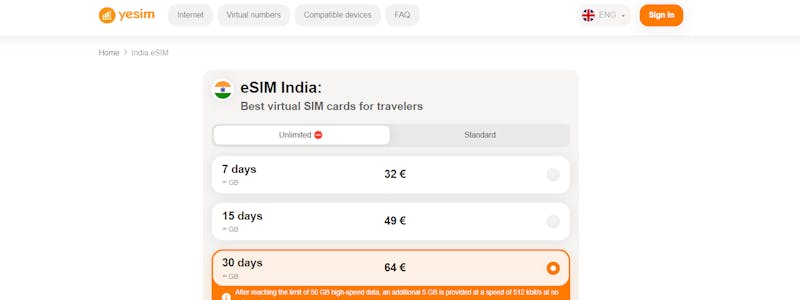

Guide to Using eSIM.net in Pakistan

Step 1: check device compatibility.

Ensure your smartphone supports eSIM technology. Most modern smartphones, including models from Apple, Google, and Samsung, offer eSIM functionality. Verify your device’s compatibility by checking its specifications or consulting the manufacturer’s website.

Step 2: Visit the eSIM.net Website

Navigate to the eSIM.net website to explore the available eSIM plans for Pakistan. Review the various plans offered, considering factors such as data allowances, validity periods, and pricing.

Step 3: Choose a Data Plan

Select an eSIM data plan that meets your needs in Pakistan. Consider the duration of your stay, expected data usage, and whether you plan to travel to other areas within the country. Choose a plan that provides sufficient data for your requirements.

Step 4: Purchase the eSIM

Once you’ve chosen a suitable plan, proceed to purchase it through the eSIM.net website. During the checkout process, ensure you provide a valid email address to receive your eSIM activation details. Double-check your order for accuracy before completing the transaction.

Step 5: Install and Activate the eSIM

After purchasing the eSIM plan, you’ll receive an email containing a QR code and instructions for installation and activation. Follow these steps to set up your eSIM:

- iOS : Go to Settings > Cellular > Add Cellular Plan .

- Android : Go to Settings > Network & Internet > Mobile Network > Advanced > Carrier > Add Carrier .

- Scan QR Code : Use your device’s camera to scan the QR code provided in the email. This action will initiate the eSIM installation process.

- Configure eSIM : Follow the on-screen prompts to complete the installation and configuration of your eSIM profile. You may need to specify whether the eSIM will serve as your primary or secondary cellular plan.

- Activate eSIM : Once the eSIM profile is installed, activate it by enabling cellular data on your device. Confirm successful activation by checking for network signal indicators.

Step 6: Test Connectivity

After activating your eSIM, verify that your device can establish a reliable internet connection. Test various functionalities such as web browsing, messaging, and calling to ensure seamless connectivity.

Additional Tips:

- Data Monitoring : Keep track of your data usage to avoid exceeding your plan’s limits. Use built-in data monitoring tools on your device or consider installing third-party apps for this purpose.

- Backup QR Code : Save a digital copy of the QR code and activation instructions for future reference. Store them securely in your email or cloud storage.

- Customer Support : If you encounter any issues during the setup process, contact eSIM.net’s customer support for assistance.

SIM Card Pakistan FAQs

Buying a local SIM card allows you to enjoy local rates for calls, texts, and data, avoiding high international roaming fees. It ensures you have reliable mobile connectivity throughout your trip, making it easier to navigate, communicate, and share your experiences.

If you encounter issues with your SIM card, visit the nearest store or kiosk of your service provider. Most providers have customer service centers and hotlines to assist with technical problems, account issues, or plan changes.

Wi-Fi is available in many hotels, cafes, restaurants, and public spaces across Pakistan. However, having a local SIM card ensures you stay connected even when Wi-Fi is unavailable.

The main mobile operators in Pakistan are Jazz, Telenor Pakistan, Zong, and Ufone. Each provider offers a range of prepaid plans and reliable network coverage.

A SIM card typically costs between $1 and $5. Data and calling plans vary, but you can expect to spend around $10 to $30 for a decent prepaid plan.

Roaming charges vary depending on your home country and carrier. It’s generally more expensive than using a local SIM card. Check with your home provider for specific roaming rates, or consider purchasing a local SIM card to avoid high fees.

Yes, travelers can easily purchase SIM cards in Pakistan. SIM cards are readily available at airports, mobile network stores, convenience stores, and authorized resellers across the country. Simply present your passport for registration, and you’ll be ready to enjoy reliable mobile connectivity during your visit.

Related Posts

How to Buy a SIM Card in Oman in 2024

Traveling to Oman, with its stunning landscapes, rich culture, and modern cities, requires reliable connectivity to navigate and communicate effectively.

How to Buy a SIM Card in Nigeria in 2024

Nigeria, known for its diverse culture, vibrant cities, and stunning landscapes, is a destination that requires reliable connectivity. Whether you’re

LOWEST PRICE | FAST & FREE SHIPPING | Money Back Guarantee

FREE SHIPPING OVER $60

- All Products

- Switzerland

- Czech Republic

- Netherlands

- New Zealand

- United Kingdom

- El Salvador

- Philippines

- South Korea

- UAE (Dubai)

- South Africa

- Europe eSIMs

- Caribbean eSIMs

- Middle East eSIMs

- Egypt eSIMs

- France eSIMs

- Travel Accessories and Necessities

- Travel Journals

- Packing Cubes

- Laundry Bags

- Best eSIM by Airport

- Best eSIM by Country

- Travel Tips And Hacks

- Travel Guides

- Login / Register

Buy Your Pakistan SIM Cards In USA. Best Prepaid Sim For Travel

Buy your Pakistan Sim Cards from SimCorner and stay connected without worrying about hefty international roaming fees. Best value Pakistani Travel Sim Card With Data Before You Fly! Perfect For American Tourists.

Need eSIM at Pakistan Airports ?

Over 19,000+ Reviews across

No physical sim products found.

No eSIM products available.

You May Also Like

Need eSIM At Wadi Ain Airport ? (In Yemen)

Need eSIM At Constantine The Great International Airport ? (In Serbia)

Need eSIM At Faro Airport ? (In Portugal)

Need eSIM At Horta Airport ? (In Portugal)

Asia sim card.

Asia is a region full of history, culture and most importantly kind, friendly people. With 60% of the world’s population living in this region alone, you’ll be sure to make a few friends during your travels. From the futuristic vibe of Tokyo, Japan to the stunning tropical islands of Indonesia, Asia is a place full of secrets to discover and experiences to be had. With US residents being one of the regions most-dedicated visitors, many places are increasingly accommodating English-speaking tourists. With there never being a better time to visit Asia, you’ll want to buy a SIM card that’ll let you keep in touch with friends and family while you’re away.

SimCorner offer individual Travel SIMs for all major countries in Asia, such as the Japan Travel SIM and India Travel SIM card to name some of our most popular. if you’re planning a visit to the region check out more of our country specific SIMs below.

In addition, we currently have two Multi Country SIMs on offer: 10 days and 15 days. If you’re only planning to spend a week travelling across Asia, the 10 day Asia SIM Card will be the perfect option. For example, in Hong Kong your SIM card will act as a Hong Kong Travel SIM, letting you use your 6GB of data to send pictures to friends while you explore. If you decide to carry on to China or Indonesia your SIM will work as a Indonesia prepaid SIM card or a China prepaid SIM until your plan runs out.

If you plan on extending your trip to two weeks, we’ve also got you covered. Our 15 day Asia SIM Card is great for trips to multiple countries in Asia, from South Korea and Japan to Vietnam and Sri Lanka. If you’re planning to spend a few days travelling from Delhi to the Taj Mahal, our SIM Card will be perfect as a travel SIM card for India. If you head on to China for another week of well-deserved holiday, the SIM will automatically become a China prepaid SIM. You can rest easy in the knowledge that you won’t have to face expensive roaming charges as you explore the bustling streets of Shanghai or Beijing’s Forbidden City.

Shop By Popular Destinations in Pakistan

- Choosing a selection results in a full page refresh.

- Press the space key then arrow keys to make a selection.

Popular Destinations

All Destinations

- Aland Islands

- Canary Islands

- Czech Republic

- El Salvador

- Europe & UK

- Faroe Islands

- Indonesia (Bali)

- Liechtenstein

- Middle East

- Netherlands

- New Zealand

- North America

- Philippines

- Saudi Arabia

- South Africa

- South America

- South Korea

- Switzerland

- United Arab Emirates (Dubai)

- United Kingdom

- United States of America

- Vatican City

Your cart is empty

🔥 BUY ONE, GET ONE 25% OFF EUROPE ESIMS 👉 SHOP NOW

Collection Pakistan is empty

What is an esim.

An eSIM, or Embedded SIM, is a digital SIM card alternative.

Instead of a physical chip, it's built directly into your smartphone or device. It simplifies the process of switching carriers and plans.

Hassle Free Travel

No more switching SIM cards or dealing with expensive roaming fees.

Say goodbye to pricey roaming fees and hello to cost-effective eSIM plans.

Global Coverage

Stay connected in over 190 countries without the hassle of switching SIMs.

How do eSIMs work?

1. check compatibility.

You can find the list of eSIM compatible phones

2. Buy your eSIM

Choose an eSIM plan that fits your travel needs and get it delivered instantly via email!

3. Scan & Activate

Scan the QR code in your email and turn on Data Roaming to activate your eSIM. Start using it right away!

Is my device eSIM compatible?

- iPhone 15, 15 Plus, 15 Pro, 15 Pro Max

- iPhone 14, 14 Plus, 14 Mini, 14 Pro, 14 Pro Max

- iPhone 13, 13 Mini, 13 Pro, 13 Pro Max

- iPhone 12, 12 Mini, 12 Pro, 12 Pro Max

- iPhone 11, 11 Pro, 11 Pro Max

- iPhone XS, XS Max, XR

- iPhone SE (2020, 2022)

- Apple watch SE

- Apple watch series 3, 4, 5 and 6

- iPad Pro 11″ (model A2068, from 2020)

- iPad Pro 12.9″ (model A2069, from 2020)

- iPad Air (model A2123, from 2019)

- iPad (model A2198, from 2019)

- iPad Mini (model A2124, from 2019)

- IPad 10th generation (2022)

*On iPhone 13, 14 & 15 models, you can have two eSIMs activated at the same time. *iPhones from mainland China and iPhone devices from Hong Kong and Macao (except for iPhone 13 mini, iPhone 12 mini, iPhone SE 2020, and iPhone XS) don’t have eSIM capability. *iPhone 14, iPhone 14 Plus, iPhone 14 Pro, iPhone 14 Pro Max, iPhone 15, iPhone 15 Plus, iPhone 15 Pro, and iPhone 15 Pro Max are not compatible with physical SIM cards in the USA.

- Samsung Galaxy S20, S20+, S20+ 5g

- Samsung Galaxy S20 Ultra, S20 Ultra 5G

- Samsung Galaxy S21, S21+ 5G, S21+ Ultra 5G

- Samsung Galaxy S22, Samsung Galaxy S22+, S22 Ultra

- Samsung Galaxy Note 20, Note 20 Ultra 5G

- Samsung Galaxy Fold, Z Fold2 5G, Z Fold3 5G, Z Fold4, Z Fold5 5G

- Samsung Galaxy Z Flip, Z Flip3 5G, Z Flip4, Z Flip5 5G

- Samsung Galaxy S23, S23+, S23 Ultra

- Samsung Galaxy S24, S24+, S24 Ultra

*The following Samsung devices are not compatible with eSIM:

- Samsung Galaxy S20 FE 4G/5G

- Samsung Galaxy S21 FE 4G/5G

- Samsung S20/S21 (US versions)

- Samsung Galaxy S23 FE (China/Hong Kong version)

- Galaxy Z Flip 5G (US versions)

- Samsung Note 20 Ultra (Versions from the US and Hong Kong)

- Certain models purchased in South Korea: (reach out to our team!)

- Samsung Galaxy Z Fold 2 (Versions from the US and Hong Kong)

- Pixel 2 (only phones bought with Google Fi service), 2 XL

- Pixel 3 (not including phones bought in Australia, Taiwan or Japan. Phones bought with US or Canadian carriers other than Spring and Google Fi don’t work with eSIM), XL

- Pixel 3a (not including phones bought in Japan or with Verizon service), 3a XL

- Pixel 4, 4a, 4 XL

- Pixel 5, 5a

- Pixel 6, 6a, 6 Pro

- Pixel 7, 7 Pro

- Pixel 8, 8 Pro

*Google Pixel 3 devices from Australia, Japan, and Taiwan are not compatible with eSIM. *Google Pixel 3a from South East Asia is not compatible with eSIM.

- Huawei P40, P40 Pro (The Huawei P40 Pro+ and P50 Pro are not compatible with eSIM)

- Huawei Mate 40 pro

- Motorola Razr (2019), Razr 5G, Razr 40, Razr 40 Ultra, Razr+

- Motorola Edge+, Edge 40, Edge 40 Pro, Edge 40 Neo

- Motorola G52J 5G, G52J 5G Ⅱ, G53J 5G

- Microsoft Surface Duo

- Xiaomi 12T Pro, 13, 13 Lite, 13 Pro, 13T Pro

- Oppo Find X3 Pro, Reno 5A, Reno 6 Pro 5G, Find X5, Find X5 Pro, A55s 5G

- Nuu Mobile X5

- Sharp AQUOS sense4 lite, sense6s, sense 7, sense 7+, AQUOS Wis, Wish 2 SHG08, Wish3, AQUOS zero 6, Simple Sumaho6, AQUOS R7, AQUOS R8, AQUOS R8 Pro

- Rakuten Mini, Big-S, Big, Hand, Hand 5G

- Honor Magic 4 Pro, Magic 5 Pro, Honor 90, Honor X8

- Sony Xperia 10 III Lite, Xperia 10 IV, Xperia 10V, Xperia 1 IV, Xperia 5 IV, Xperia 1 V, Xperia Ace III, Xperia 5 V

- Gemini PDA, Fairphone 4, DOOGEE V30, Oukitel WP30 Pro

- Oneplus Open, OnePLus 11, Oneplus 12

- HAMMER Blade 3, HAMMER Explorer PRO, HAMMER Blade 5G

- Nokia XR21, X30, G60 5G

- Vivo X90 Pro, Vivo V29 Lite 5G (eSIM Supported only in Europe)

eSIM Compatible Devices

- iPhone XS Max

- iPhone 11 Pro

- iPhone 11 Pro Max

- iPhone SE (2020)

- iPhone 12 Mini

- iPhone 12 Pro

- iPhone 12 Pro Max

- iPhone 13 mini

- iPhone 13 Pro

- iPhone 13 Pro Max

- iPhone SE (2022)

- iPhone 14 Plus

- iPhone 14 Pro

- iPhone 14 Pro Max

- iPad Pro (2018 and onwards)

- Watch series 3

- Watch series 4

- Watch series 5

- Watch series 6

- Pixel 6 Pro

- Pixel 7 Pro

- P40 Pro (not including the P40 Pro +)

- Mate 40 Pro

- Galaxy Z Flip

- Galaxy Z Flip 5G

- Galaxy Z Flip3 5G

- Galaxy Z Flip4

- Galaxy Fold

- Galaxy Z Fold2 5G

- Galaxy Z Fold3 5G

- Galaxy Z Fold4

- Galaxy S21+ 5G

- Galaxy S21 Ultra 5G

- Galaxy S22+

- Galaxy S22 Ultra

- Galaxy Note 20 Ultra 5G

- Galaxy Note 20

- Galaxy S23+

- Galaxy S23 Ultra

- Galaxy S20 Ultra 5G

- Planet Computers

- Rakuten Mobile

- Rakuten Mini

- Find X3 Pro

- Find X5 Pro

- Xperia 10 III Lite

- Xperia 10 IV

- Xperia 1 IV

- Xperia 5 IV

- Magic 4 Pro

- Aquos Sense6s

planet computers

rakuten mobile

oneplus Open

Frequently Asked Questions

Pakistan sim card.

Are you planning a trip to Pakistan? If so, make sure you’re equipped with one of our prepaid travel SIMs. With data speeds for all your travel needs and zero hidden costs, you’ll be your social media friends’ source of envy as you post your cheeky grinned selfies in front of Faisal Masjid to your socials.

If you’re still not convinced, perhaps the ability to stay in touch with loved ones, access your online banking, use your GPS/map phone apps or translation apps, the list goes on… A few of the many reasons as to why a prepaid travel SIM is an absolute necessity when it comes to overseas travel.

Luckily for you, we’ve got you covered. Affordable prices, ZERO sneaky fees, an extremely responsive customer support team, over 7000 verified 5-star reviews, and SIM card activation as soon as you land? What more could you need?

Whether you’re roaming the Badshahi Mosque or backpacking in the Shakarparian National Park, you’ll be able to choose from our many different data/call options until you find a Pakistan travel SIM that perfectly suits your itinerary.

The Pakistan SIM card you shouldn’t leave home without

Our SIMs are also completely hassle-free and come in all three SIM card sizes (standard, micro, and nano). They feature “plug in and play” compatibility with almost any unlocked device which means you’ll be able to post those cheeky selfies as soon as you land!

You’ll be able to enjoy premium data speeds that use local cell phone towers for up to 30 days (depending on which SIM you purchase), which will make it easy for you to document your entire trip as well as remain in touch with friends and family.

With fuss-free activation, a 100% money-back guarantee , and our support team ready and waiting to assist you with any questions or concerns, you can travel connected worry-free anywhere within Pakistan.

Take the stress out of scrambling around a new country trying to find a prepaid SIM card and let us take care of it - so that you can enjoy what really matters; your holiday!

Order a SIM from us today and start your Pakistan adventures with complete peace of mind.

If you have any questions, please feel free to contact us via our social media, our email or via our online chat (which can be found on our website), and we’ll be sure to get back to you as soon as possible.

Otherwise, if you’re simply after travel recommendations, get in touch with us and we’ll be able to recommend some of our favorite spots as well as the perfect SIM to go with it.

We also recommend visiting Travel Advisories before you take off on your journey.

Happy and safe travels!

The best SIM card for NZ

You have booked your trip to NZ and now you're thinking... What's the best NZ SIM card for my trip?

Well you're in the right place 👍

Here, you can find the best value NZ SIM cards that are super easy to use so when you land you will connect instantly and avoid the chaos of buying a SIM at the airport.

Keep reading or watch our video with all the available options so you can make the right choice.

All your options, compared.

Best bang for your buck: The 10GB New Zealand SIM

Other Aussie travellers like you rated the 10GB option the best with over 800+ 5 star Reviews.

Below are our options compared with Vodafone and Spark mobile, the major providers in New Zealand.

Small Plans

For the budget traveller looking to save money.

- Best suited for minimal data users

- Research restaurants, places and sites on the go

- Use google maps for your travels

- 200 mins & texts in NZ

- 100 mins & texts to Aus

- 30 day validity

- 300 mins to NZ & Aus

- Unlimited texts to NZ & Aus

For the full guide on how to use this SIM, view our SIM guide here.

Medium Plans

The 'all rounder'. There's a reason that Aussie travellers love this one.

Get this one if you:

- Want best bang for your buck

- Need access to a lot of apps including maps, social media etc.

- Unlimited mins & texts in NZ

- 200 mins & texts to Aus

- 60 day validity

- Unlimited calls to NZ & Aus

- 300 mins & texts to Aus

For the full guide on how to use this SIM, view our SIM guide here .

Large Plans

For the traveller who needs heavy internet usage on the go for 1 or multiple devices.

- Don't worry about running out of data

- Can hotspot to multiple devices

- Great for videos, maps, social media and big downloads

- Unlimited calls & texts in NZ

Bottom Line

You are looking for the right SIM for your needs and want to make the right choice so you can travel around New Zealand easily.

By choosing one of the SIM cards through SimsDirect you are avoiding the hassle when you land and getting the best value SIM cards for Aussie travellers.

Plus you get free delivery and 100% money back guarantee with every purchase.

You can't go wrong with the SimsDirect 10GB SIM that comes with unlimited calls & texts to NZ and Australian numbers.

Shipping and Delivery

When it comes to finding the best SIM card for Pakistan several factors need to be considered. Different providers offer various options tailored to meet specific needs. However, Simify is a reliable choice for obtaining a SIM card that works well in Pakistan With Simify's SIM cards, you can enjoy reliable coverage, affordable rates, and convenient features designed for travelers. Whether you're visiting Pakistan for business or leisure, Simify offers a range of plans suitable for data, calls, and messaging. Stay connected and make the most of your experience in Pakistan with Simify's SIM cards.

Absolutely! Getting a SIM card for Pakistan is highly beneficial for several reasons. By getting a local SIM card, you gain access to reliable and affordable mobile services while in Pakistan. Here are some advantages:

Cost savings: Using a local SIM card allows you to take advantage of local rates for data, calls, and text messages. It can save you significant expenses compared to using international roaming services.

Increased convenience: With a local SIM card, you have a dedicated local phone number, making it easier for locals and other travelers to reach you. It also eliminates the need for constantly switching SIM cards or relying on Wi-Fi for connectivity.

Seamless communication: Having a local SIM card ensures reliable communication with local businesses, hotels, transportation services, and emergency services. You can easily make local calls, send messages, and access the internet without any limitations.

Data access: A local SIM card provides you with affordable data plans, allowing you to stay connected, access maps, browse the internet, and use various apps while exploring Pakistan.

Overall, getting a SIM card for Pakistan offers convenience, cost savings, and a reliable means of communication. It enhances your travel experience by keeping you connected with ease. Consider getting a local SIM card for Pakistan to fully enjoy your stay and make the most of your time there.

Pakistan SIM cards are generally compatible with a wide range of unlocked mobile phones. Unlocked phones are not tied to a specific carrier and allow you to use SIM cards from various providers. This flexibility enables you to easily use a Pakistan SIM card in your existing phone or purchase a new unlocked phone if needed.

Most modern smartphones, including popular brands like Apple, Samsung, Google, and OnePlus, are compatible with Pakistan SIM cards. Additionally, older models and feature phones with support for the required frequency bands should work fine as well.

It's important to ensure that your phone supports the frequency bands used by the mobile networks in Pakistan to ensure optimal coverage and performance. You can usually find this information in your phone's specifications or by checking with the manufacturer.

If you're unsure about your phone's compatibility, you can contact the Pakistan SIM card provider or consult with a local retailer to get more specific information based on your phone model.

Yes, you can use your mobile or cell phone in Pakistan. However, there are a few potential issues to consider:

Network Compatibility: Your phone's compatibility with the network frequencies used in Pakistan may vary. Some phone models may not support all the frequency bands required for optimal coverage.

SIM Card: To use your phone in Pakistan you will need a local SIM card. Roaming with your home country's SIM card may result in higher charges for calls, messages, and data usage.

Unlocking: If your phone is locked to a specific mobile service provider, you may need to unlock it before using a local SIM card in Pakistan Unlocking requirements and processes can vary depending on your service provider.

Now, here's where Simify comes in to offer a solution:

Simify provides a convenient solution to overcome these issues:

Network Compatibility: Simify's SIM cards are compatible with the network frequencies used in Pakistan ensuring optimal coverage and connectivity.

SIM Card: Simify offers local SIM cards for Pakistan that provide cost-effective rates for calls, messages, and data. By using Simify's SIM card, you can avoid high roaming charges and enjoy affordable local rates.

Unlocking: If your phone is locked, you can still use Simify's SIM card. Simply unlock your phone by contacting your mobile service provider or using third-party unlocking services. Once unlocked, you can easily insert and activate Simify's SIM card.

By utilizing Simify's services, you can seamlessly use your mobile or cell phone in Pakistan without the concerns of network compatibility, expensive roaming charges, or locked devices. Stay connected with ease and affordability by choosing Simify's reliable SIM card solution.

Yes, at Simify, we offer Pakistan SIM cards to customers in the US. Our goal is to provide a seamless and convenient experience for travelers heading to Pakistan You can easily purchase our Pakistan SIM cards online and have them delivered to your location in the US prior to your trip. Our SIM cards are specifically tailored to offer reliable coverage and affordable rates while you're in Pakistan Stay connected and make the most of your travel experience with Simify's Pakistan SIM cards.

No, USA SIM cards typically do not work in Pakistan due to compatibility and roaming agreements between different mobile service providers. Using a USA SIM card in Pakistan may result in limited or no network coverage, high roaming charges, and unreliable connectivity.

To ensure seamless communication and avoid these issues, it is recommended to use a local SIM card in Pakistan. Simify offers dedicated Pakistan SIM cards that are designed to provide reliable coverage, affordable rates, and convenient connectivity for travelers. By using Simify's Pakistan SIM card, you can enjoy local rates, access local networks, and stay connected throughout your visit.

With Simify's reliable service, you can avoid the limitations and costs associated with using a USA SIM card in Pakistan. Make the most of your travel experience and stay connected with ease by choosing Simify's Pakistan SIM card solution.

Yes, at Simify, we offer Pakistan SIM cards to customers in Canada. We understand the needs of Canadian travelers heading to Pakistan and provide convenient options for staying connected during your trip. Our Pakistan SIM cards are designed to offer reliable coverage, affordable rates, and seamless connectivity in Pakistan. You can easily purchase our SIM cards online and have them delivered to your location in Canada before your departure. With Simify's Pakistan SIM card, you can enjoy local rates for calls, messages, and data usage while exploring Pakistan. Stay connected and make the most of your travel experience with Simify's Pakistan SIM cards.

Yes, at Simify, we offer Pakistan SIM cards to customers in Australia. If you're planning a trip to Pakistan we understand the importance of staying connected while abroad. Our Pakistan SIM cards are designed to provide you with convenient and cost-effective connectivity during your travels. You can easily purchase our SIM cards online and have them delivered to your location in Australia before your departure. With Simify's Pakistan SIM card, you can enjoy local rates for calls, messages, and data usage while exploring Pakistan. Stay connected and make the most of your travel experience with Simify's Pakistan SIM cards.

Yes, at Simify, we offer Pakistan SIM cards to customers in the UK. If you're in the UK and planning a trip to Pakistan we understand the importance of having reliable connectivity during your travels. Our Pakistan SIM cards are designed to provide you with convenient and cost-effective connectivity while exploring Pakistan. You can easily purchase our SIM cards online and have them delivered to your location in the UK before your departure. With Simify's Pakistan SIM card, you can enjoy local rates for calls, messages, and data usage, ensuring a seamless communication experience during your visit to Pakistan. Stay connected and make the most of your travel experience with Simify's Pakistan SIM cards.

Delivery times vary depending on your location, please refer to the shipping options below:

Shipping Method:

First Class Mail (3-5 business days) - Free Priority Mail (2-4 business days) - $8.99

All orders are shipped from our Baltimore office.

Same-day dispatch is available on orders placed before 4pm EDT Monday - Friday. Any orders placed after 3 pm will be dispatched the next day.

Once we've shipped your order, you will receive a tracking number via email. Click the View Order button in your confirmation email to monitor the status of your delivery.

If you're leaving soon and your order hasn't arrived, please contact us so we can arrange to have it delivered to you with free express shipping. It is important to us that we ensure your SIM card(s) arrive well before you take off.

Product Information

Yes! We offer 3 different sizes for each SIM card - Standard, Micro, and Nano. All you need to do is make sure that you pop out the correct size that is compatible with your device.

The SIM will only activate once you have inserted it into your device, which, in most cases, is when you have arrived at your destination.

You can find more specific activation steps here .

Zero. We're here to help you save money whilst abroad. With our SIM cards, you'll get all the data and outgoing calls that you pay for without any added surcharges or hidden costs. For as little as $2 a day, we offer the cheapest way of staying online while you're travelling.

If you purchased your device outright then it is most likely unlocked. Devices purchased alongside a contract are usually locked. If you are unsure, contact your service provider, they may even be able to unlock it for you (usually incurring a fee).

You’ll be able to track your data usage directly from your device, please click here for an in-depth guide on how to do so.

Traveling the Globe?

Check out the explorer collection, recently viewed, why we need activation dates.

- We need these dates to activate your SIM card so you can use them when you’re ready to travel.

- If you don’t give us an activation date, your SIM card will not work when you plug them into your phone.

Not sure on your dates yet?

- You can add in an estimated date for your SIM. Your SIM’s data & validity won’t start until you plug it into your device.

- Once you know your exact dates, please let us know via our live chat or at [email protected] so we can activate it for you at the right time.

What if you need to change the dates?

- You can reach out to us via our live chat or at [email protected] with your SIM number so we can change it for you.

Pakistan SIM Cards: Everything You Need To Know

by Melissa Giroux | Last updated Apr 18, 2024 | Asia , SIM Cards , Travel Tips

Visiting Pakistan soon? Make sure to know what to expect when it comes to purchasing a Pakistan SIM card .

Fortunately, Asia is one of the places where you can buy a SIM card easily.

You should be able to find an affordable SIM card pretty much anywhere in Pakistan. In fact, most data packages are relatively cheap, which makes the whole thing easier!

In this guide, we’ll explain where to buy a SIM card for Pakistan in person and online. We’ll also discuss prepaid travel SIM cards and eSIMs if your mobile supports them.

Before you read this guide, you may wonder if you actually need a SIM card in Pakistan.

If you don’t mind not having Internet, you’ll likely find free Wifi in restaurants, shopping malls, and hotels.

That said, if you need data to get around, call a cab, or translate Urdu – you may want to get a SIM card for your travels in Pakistan.

Best Pakistan SIM Cards

If you’re traveling in Pakistan, we recommend using a SIM card from Telenor, Ufone, Zong, or Airalo. (I’ll get back to Airalo later on, so keep reading to learn more!)

That said, if you’re planning on visiting other countries during your trip to Asia, you might want to make sure to pick a global option that offers coverage in other countries.

How To Buy A SIM Card In Pakistan

You can either buy a Pakistan prepaid SIM card in person in some international airports, mobile provider stores, convenience stores, or online.

Usually, you can expect higher costs and low data offers at the airport, so we don’t recommend buying a SIM card at the airport.

That said, you won’t necessarily find SIM card shops in every airport, so it’s essential to keep this in mind. And, when you see a shop, you might also have limited options.

For this reason, I’d recommend buying a SIM card directly from the mobile provider store. Note that you may need your passport to buy one.

Although, this means you won’t get data right upon your arrival. So, if you prefer to be connected at all times, you could use an eSIM or purchase a prepaid SIM card online.

Now, let’s take a look at the data plans offered by Telenor, Ufone, and Zong.

Telenor SIM Cards

Telenor offers four different types of tourist plans:

- 8 GB, valid for 7 days for PKR 190 ($0.67)

- 20 GB, valid for 7 days for PKR 240 ($0.85)

- 8 GB, valid for 30 days for PKR 370 ($1.31)

- 50 GB, valid for 30 days for PKR 700 ($2.48)

Ufone SIM Cards

Ufone has several different prepaid plans available:

- 750 MB, valid for 1 day for PKR 10 ($0.03)

- 16 GB, valid for 7 days for PKR 260 ($0.92)

- 18 GB, valid for 30 days for PKR 549 ($1.94)

- 30 GB, valid for 30 days for PKR 730 ($2.58)

Zong SIM Cards

Zong offers several main SIM-only plans for tourists:

- 1 GB, valid for 1 day for PKR 49 ($0.17)

- 40 GB, valid for 7 days for PKR 420 ($1.49)

- 20 GB, valid for 30 days for PKR 575 ($2.03)

- 40 GB, valid for 30 days for PKR 1249 ($4.42)

- 60 GB, valid for 30 days for PKR 1350 ($4.77)

Overall, we think Zong is the best option if you plan to buy your SIM card in person.

That said, any would do if you can’t find their store!

How To Buy A Pakistan Prepaid SIM Card Online

If you wish to have your SIM card ready for your arrival, you could purchase it online or on websites like Amazon.

You’ll find different SIM cards for Pakistan on Amazon. For example, the OneSimCard works in more than 200+ countries and gives you data for $0.01 per MB. Pakistan is included.

But there are many other options worth considering, so have a look and make sure the countries you plan on visiting are listed.

Browse your options on Amazon

Another option is to purchase a prepaid Pakistan SIM card on SimOptions .

They currently offer two packages that cover Pakistan:

- 1 GB, valid for 14 days for $49.90

- 10 GB, valid for 14 days for $49.90

Browse your options on SimOptions

Finally, the last option is to buy a Pakistan eSIM card plan.

How To Buy A Pakistan ESIM Card

eSIM is a new concept that allows you to have a virtual SIM card inside your phone.

If your mobile phone supports eSIM cards – it’s definitely one of the best options to get data in Pakistan.

Curious? Learn more about eSIMs for travelers on eSIM Roamers .

I started using eSIM as soon as my mobile phone supported it. To buy eSIMs, I usually use Airalo , a reliable eSIM provider.

Keep reading to learn more about the best eSIMs for Pakistan.

Airalo Pakistan

If you want a Pakistan eSIM, you could purchase one on Airalo .

This website offers many eSIM cards worldwide and special plans for Pakistan.

I’ve been using Airalo for several months, and it works fine. Learn more by reading our Airalo review .

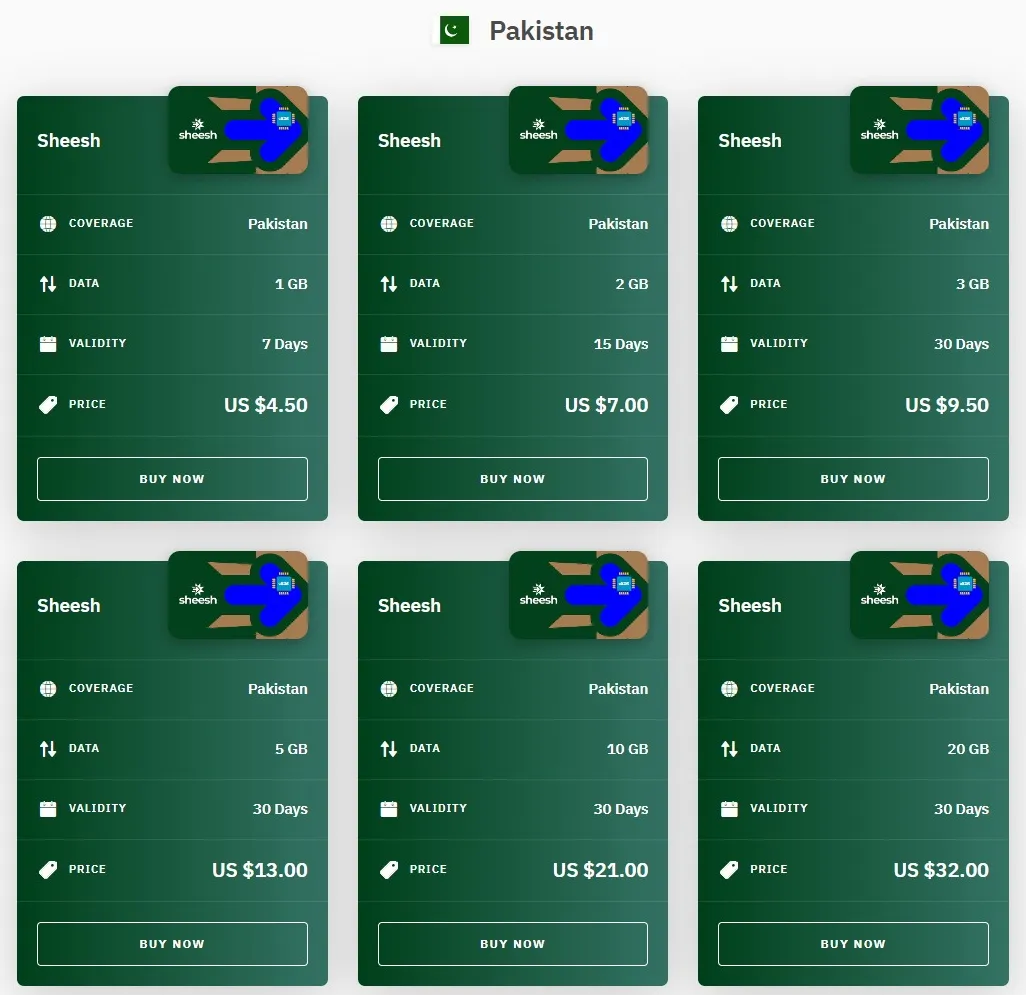

Here are the options available :

- 1 GB, valid for 7 days for $4.50

- 2 GB, valid for 15 days for $7

- 3 GB, valid for 30 days for $9.50

- 5 GB, valid for 30 days for $13

- 10 GB, valid for 30 days for $21

- 20 GB, valid for 30 days for $32

Go to Airalo

Holafly Pakistan

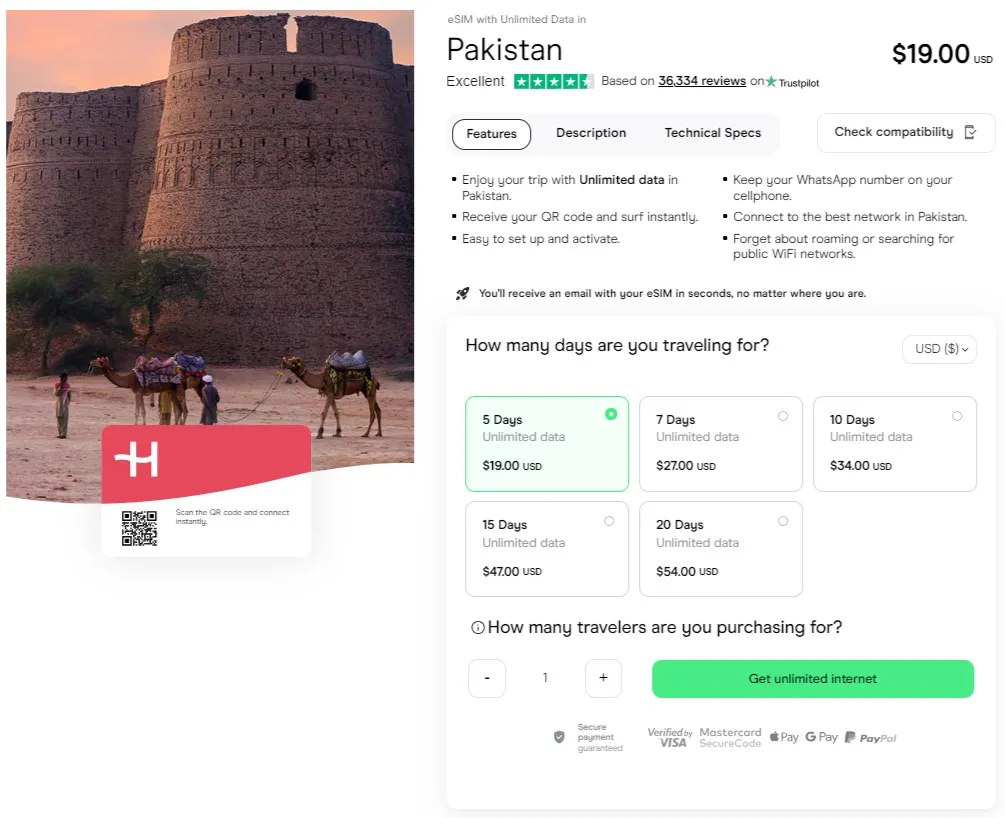

Alternatively, you could look at your options on Holafly .

You can read our Holafly review to learn more about this eSIM store.

Here’s an overview of the plans for Pakistan:

- Unlimited data, valid for 5 days for $19

- Unlimited data, valid for 7 days for $27

- Unlimited data, valid for 10 days for $34

- Unlimited data, valid for 15 days for $47

- Unlimited data, valid for 20 days for $54

Go to Holafly

Final Thoughts On SIM Cards In Pakistan

As you can see, getting a prepaid SIM card in Pakistan or even an eSIM for your travels in Pakistan is pretty straightforward.

You’ll even be able to stay connected wherever you go in Asia without changing your SIM card, especially if you purchase a global plan.

I believe the eSIM card is the most convenient way to get data in Pakistan if you wish to have data upon your arrival.

This way, you won’t need to go to a store to buy a SIM card.

However, you need to make sure your mobile phone supports eSIM first.

Traveling to Asia soon? Read one of the following blog posts:

- Uzbekistan SIM card

- Bangladesh SIM card

- Tajikistan SIM card

MY TOP RECOMMENDATIONS

BOOK HOTEL ON BOOKING.COM

BOOK HOSTEL ON HOSTELWORLD

GET YOUR TRAVEL INSURANCE

LEARN HOW TO START A TRAVEL BLOG

LEARN HOW TO VOLUNTEER ABROAD

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

3 Best Travel Cards for Pakistan

Getting an international travel card before you travel to Pakistan can make it cheaper and more convenient when you spend in Pakistani Rupee. You'll be able to easily top up your card in MYR before you leave Malaysia, to convert seamlessly to PKR for secure and flexible spending and withdrawals.

This guide walks through our picks of 6 of the best travel cards available for anyone from Malaysia heading to Pakistan, like Wise or BigPay. We'll walk through a head to head comparison, and a detailed look at their features, benefits and drawbacks.

3 best travel money cards for Pakistan:

Let's kick off our roundup of the best travel cards for Pakistan with a head to head comparison on important features. Here's an overview of the providers we've picked to look at, for customers looking for ways to spend conveniently overseas when travelling from Malaysia:

Each of the international travel cards we’ve picked out have their own features and fees, which may mean they suit different customer needs. Keep reading to learn more about the features, advantages and disadvantages of each - plus a look at how to order the travel card of your choice before you head off to Pakistan.

Wise travel card

Open a Wise account online or in the Wise app, to order a Wise travel card you can use for convenient spending and withdrawals in Pakistan. Wise accounts can hold 40+ currencies, so you can top up in MYR easily from your bank or using your card. Whenever you travel, to Pakistan or beyond, you’ll have the option to convert to the currency you need in advance if it’s supported for holding a balance, or simply let the card do the conversion at the point of payment.

In either case you’ll get the mid-market exchange rate with low, transparent fees whenever you spend in PKR, plus some free ATM withdrawals every month - perfect if you’re looking for easy ways to arrange your travel cash.

Wise features

Wise travel card pros and cons.

- Hold and exchange 40+ currencies with the mid-market rate

- Spend seamlessly in PKR when you travel

- Some free ATM withdrawals every month, for those times only cash will do

- Ways to receive payments to your Wise account conveniently

- Manage your account and card from your phone

- 13.7 MYR fee to order your physical card

- ATM fees apply once you've exhausted your monthly free withdrawals

- Physical cards may take 14 days to arrive (you can use your virtual card right away)

Here’s how to apply for a Wise account and order a Wise travel card in Malaysia:

Open the Wise app or desktop site

Select Register and confirm you want to open a personal account

Register with your email, Facebook, Apple or Google ID

Upload your ID document to complete the verification step

Tap the Cards tab to order your card, and pay the required fee

Confirm your mailing address, and your card will be on the way, and should arrive in 14 days

BigPay travel card

BigPay is a super popular app and card in Malaysia, which you can use for spending in Pakistan and globally.

You’ll be able to hold a balance in MYR and spend or make withdrawals in PKR, keeping track of everything in your app for convenience. There’s a low foreign transaction fee of 1% or less when you spend internationally, which can mean you save compared to using a bank card. Plus as your BigPay card isn’t connected to your bank account, it’s secure, no matter where in the world you are.

BigPay features

Bigpay travel card pros and cons.

- Very popular local app and card, with a large user base

- Earn AirAsia points as you spend

- Get extras like ways to pay bills and send money to others

- Ways to budget and plan your money conveniently

- Manage your account from the app wherever you are

- No foreign currency balance option

- 20 MYR card order fee

- 10 MYR ATM fee

- Up to 1% foreign transaction fee

How to apply for a BigPay card

Here’s how to apply for a BigPay account and order a travel card in Malaysia:

Open the BigPay website or download the app

Click Get BigPay

Complete the account application steps and get verified

Pay the card fee, and your card will be delivered by mail

Touch ’n Go travel card

If you have a Touch’n Go enhanced card you can use it for spending and withdrawals in Pakistan. Your MYR balance will be converted to PKR using the Alipay exchange rate at the point that you pay, so there’s no need to set up your travel money in advance. There are international ATM fees of 10 MYR if you choose to make withdrawals, but the Alipay rate may be better than the rate you get from your bank so it’s still worth comparing your options.

Touch ’n Go features

Touch ’n go travel card pros and cons.

- Popular option which can be easily used to pay road tolls, parking and more, as well as for spending

- Manage your card in the app wherever you happen to be

- Secure as not linked to your normal account

- Lots of local spending is free

- Exchange rates may include a fee

- 10 MYR international ATM fee

How to apply for a Touch’n Go card

Here’s how to apply for a Touch’n Go account and order a travel card in Malaysia:

Open the Touch’n Go website or download the app

Click the option to order an enhanced card

Pay any required fee, and your card will be delivered by mail

What is a travel money card?

A travel money card is a card you can use for secure and convenient payments and withdrawals overseas.

You can use a travel money card to tap and pay in stores and restaurants, with a wallet like Apple Pay, or to make ATM withdrawals so you'll always have a bit of cash in your pocket when you travel.

Although there are lots of different travel money cards on the market, all of which are unique, one similarity you'll spot is that the features and fees have always been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees for common international transactions like ATM withdrawals.

Travel money cards also offer distinct benefits when it comes to security. Your travel money card isn't linked to your Malaysian Ringgit everyday account, so even if you were unlucky and had your card stolen, your primary bank account remains secure.

Travel money vs prepaid card vs travel credit card

It's helpful to know that you'll be able to pick from several different types of travel cards, depending on your priorities and preferences. Travel cards commonly include:

- Travel debit cards

- Travel prepaid cards

- Travel credit cards

They all have distinct benefits when you head off to Pakistan or elsewhere in the world, but they do work a bit differently.

Travel debit and prepaid cards are usually linked to an online account, and may come from specialist digital providers - like the Wise card. These cards are usually flexible and cheap to use. You'll be able to manage your account and card through an app, although you can also often add money via the web or, if the card has physical branches, in-branch.

Travel credit cards are different and may suit different customer needs. As with any other credit card, you may need to pay an annual fee or interest and penalties depending on how you manage your account - but you could also earn extra rewards when spending in a foreign currency, or travel benefits like free insurance for example. Generally using a travel credit card can be more expensive compared to a debit or prepaid card - but it does let you spread out the costs of your travel across several months if you'd like to and don't mind paying interest to do so.

What is a prepaid travel money card best for?

Let's take a look at the advantages of using a prepaid travel money card for travellers going to Pakistan. While each travel card is a little different, you'll usually find some or all of the following benefits:

- Hold and exchange foreign currencies - allowing you to lock in exchange rates and set a travel budget before you leave

- Convenient for spending in person and through mobile wallets like Apple Pay, as well as for cash withdrawals

- You may find you get a better exchange rate compared to your bank - and you'll usually be able to avoid any foreign transaction fee, too

- Travel cards are secure as they're not linked to your everyday MYR account - and because you can make ATM withdrawals when you need to, you can also avoid carrying too much cash at once

Overall, travel cards offer flexible and low cost ways to avoid bank foreign transaction and international ATM fees, while accessing decent exchange rates.

How to choose the best travel card for Pakistan

We've picked out 3 great travel cards available in Malaysia - but there are also more options available, which can make choosing a daunting task. Some things to consider when picking a travel card for Pakistan include:

- What exchange rates does the card use? Choosing one with the mid-market rate or as close as possible to it is usually a smart plan

- What fees are unavoidable? For example, ATM charges or top up fees for your preferred top up methods

- Does the card support a good range of currencies? Getting a card which allows you to hold and spend in PKR can give you the most flexibility, but it's also a good idea to pick a card with lots of currency options, so you can use it again in future, too

- Are there any other charges? Check in particular for foreign transaction fees, local ATM withdrawal fees, inactivity fees and account close fees

Ultimately the right card for you will depend on your specific needs and preferences.

What makes a good travel card for Pakistan

The best travel debit card for Pakistan really depends on your personal preferences and how you like to manage your money.

Overall, it pays to look for a card which lets you minimise fees and access favourable exchange rates - ideally the mid-market rate. While currency exchange rates do change all the time, the mid-market rate is a good benchmark to use as it's the one available to banks when trading on wholesale markets. Getting this rate, with transparent conversion fees, makes it easier to compare costs and see exactly what you're paying when you spend in PKR.

Other features and benefits to look out for include low ATM withdrawal fees, complimentary travel insurance, airport lounge access or emergency cash if your card is stolen. It's also important to look into the security features of any travel card you might pick for Pakistan. Look for a card which uses 2 factor authentication when accessing the account app, which allows you to set instant transaction notifications, and which has easy ways to freeze, unfreeze and cancel your card with your phone.

For Pakistan in particular, choosing a card which offers contactless payments and which is compatible with mobile wallets like Apple Pay could be a good plan. Card payments are extremely popular in Pakistan - so having a card which lets you tap and pay easily can speed things up and make it more convenient during your trip.

Ways to pay in Pakistan

Cash and card payments - including contactless, mobile wallet, debit, credit and prepaid card payments - are the most popular ways to pay globally.

In Pakistan, both card payments and cash payments are common. You'll be able to make Chip and PIN or contactless payments or use your favourite mobile wallet like Apple Pay to tap and pay on the go, but it's still worth having a little cash on you just in case - and for the odd situations where cash is more convenient, such as when tipping or buying a small item in a market.

Which countries use PKR?

You'll find that PKR can only be used in Pakistan. If you don't travel to Pakistan frequently it's worth thinking carefully about how much to exchange so you're not left with extra foreign currency after your trip.

What should you be aware of when travelling to Pakistan

You're sure to have a great time in Pakistan - but whenever you're travelling abroad it's worth putting in a little advance thought to make sure everything is organised and your trip goes smoothly. Here are a few things to think about:

1. Double check the latest entry requirements and visas - rules can change abruptly, so even if you're been to Pakistan before it's worth looking up the most recent entry requirements so you don't have any hassle on the border

2. Plan your currency exchange and payment methods - you can change MYR to PKR before you travel to Pakistan if you'd like to, but as card payments are common, and ATMs widely available, you can actually leave it until you arrive to get everything sorted as long as you have a travel money card. Top up your travel money card in MYR and either exchange to PKR in advance or at the point of payment, and make ATM withdrawals whenever you need cash. Bear in mind that currency exchange at the airport will be expensive - so hold on until you reach Pakistan to make an ATM withdrawal in PKR if you can.

3. Get clued up on any health or safety concerns - get travel insurance before you leave Malaysia so you have peace of mind. It's also worth reading up on any common scams or issues experienced by tourists. These tend to change over time, but may include things like rip off taxis or tour agents which don't offer fair prices or adequate services.

Conclusion - Best travel cards for Pakistan

Ultimately the best travel card for your trip to Pakistan will depend on how you like to manage your money. Use this guide to get some insights into the most popular options out there, and to decide which may suit your specific needs.

FAQ - best travel cards for Pakistan

When you use a travel money card you may find there’s an ATM withdrawal fee from your card issuer, and there may also be a cost applied by the ATM operator. Some of our travel cards have some no fee ATM withdrawals every month, which can help keep down costs.

Travel money cards may be debit, prepaid or credit cards. Which is best for you will depend on your personal preferences. Debit and prepaid cards are usually pretty cheap and secure to spend with, while credit cards may have higher fees but often come with extra perks like free travel insurance and extra reward points.

There’s no single best prepaid card for international use. Look out for one which supports a large range of currencies, with good exchange rates and low fees. This guide can help you compare some popular options, including Wise and BigPay.

Yes, you can use your local debit card when you’re overseas. However, it’s common to find extra fees apply when spending in foreign currencies with a regular debit card. These can include foreign transaction fees and international ATM charges.

Usually having a selection of ways to pay - including a travel card, your credit or debit card, and some cash - is the best bet. That means that no matter what happens, you have an alternative payment method you can use conveniently.

Yes. Most travel debit cards have options to make ATM withdrawals. Check the fees that apply as card charges do vary a lot. Some cards have local and international fees on all withdrawals, while others let you make some no fee withdrawals monthly before a fee kicks in.

Both Visa and Mastercard are globally accepted. Look out for the logo on ATMs and payment terminals in Pakistan.

The cards you see on this page are ordered as follows:

For card providers that publish their exchange rates on their website, we used their MYR / PKR rate to calculate how much Pakistani Rupee you would receive when exchanging / spending RM20,000. The card provider offering the most PKR is displayed at the top, the next highest below that, and so on.

The rates were collected at 15:54:21 GMT on 19 February 2024.

Below this we display card providers for which we could not verify their exchange rates. These are displayed in alphabetical order.

Send international money transfer

More travel card guides.

Need Help? 1-866-533-3744, +1-617-333-8170 Recharge / Register Sim

- International SIM Card

- Pure Data SIM

- Pure Europe SIM

- Pure World SIM

Home > International SIM Cards > Pakistan SIM Card

Pakistan SIM Card

This specific country sim is not available. however, we now offer a better option for pakistan with much better coverage, the telestial pure world that will offer great low rates in pakistan and over the world. you can view details and order here: http://www.telestial.com/international-sim-card, great for international and local calls.

- Calls and texts in Pakistan and over 190 other countries