For your holidays in Greece and abroad

Travel insurance for greece.

Greece, birthplace of democracy and the cradle of Western civilization, offers a glimpse of ancient history, breathtaking landscapes, and vibrant modernity. Its iconic whitewashed buildings against azure seas, ancient ruins like the Acropolis, and sun-drenched islands like Santorini beckon travelers worldwide. The warmth of its people, delectable cuisine, and a blend of ancient traditions with a lively contemporary lifestyle create an enchanting and unforgettable Mediterranean experience. In this guide, will discuss why having reliable travel insurance in hand can be a savvy move. From coverage against unforeseen trip cancellations to having assistance in case of medical emergencies, travel insurance offers you coverage while visiting Greece's ancient marvels and scenic beauty.

- What should your Travel insurance cover for a trip to Greece?

- How does Travel Insurance work in the Greece?

- Do I need Travel Insurance for Greece?

- How much does Travel Insurance cost for Greece?

- Our Suggested AXA Travel Protection Plan

What types of medical coverage does AXA Travel Protection plans offer?

Are there any covid-19 restrictions for travelers to greece, traveling with pre-existing medical conditions , what should your travel insurance cover for a trip to greece.

At a minimum, your travel insurance should cover trip cancellation, trip interruption and emergency medical expenses. When it comes to international travel, the US Department of State outlines key components that should be included in your travel insurance coverage. AXA Travel Protection plans are designed with these minimum recommended coverages in mind.

- Medical Coverage – The top priority is making sure your health is in order. With AXA Travel Protection, you can have access to quality healthcare during your trip overseas in the event of unexpected medical emergencies.

- Trip Cancellation & Interruptions – Assistance against unexpected trip disruptions can dampen the mood, AXA Travel Protection offers coverage against unforeseen events.

- Emergency Evacuations and Repatriation – In situations where transportation is dire, AXA Travel Protection offers provisions for emergency evacuation and repatriation.

- Coverage for Personal Belongings – AXA offers coverage for your belongings with assistance against lost or delayed baggage.

- Optional Cancel for Any Reason – For added flexibility, AXA offers optional Cancel for Any Reason coverage, allowing you to cancel your trip for non-traditional reasons. Exclusive to Platinum Plan holders.

In just a few seconds, you can get a free quote and purchase the best travel insurance for Greece.

How Does Travel Insurance Work in the Greece?

Picture this: you are sampling a local delicacy in Santorini and you suddenly start feeling queasy. With travel insurance, your policy can offer you support and assistance for covered incidents like sudden illnesses or injuries, including helping you get medical treatment at the nearest hospital. Here’s how travelers can benefit from an AXA Travel Protection Plan:

Medical Benefits:

- Emergency Medical Expenses: Should you fall ill or have an accident during your trip, your policy may offer coverage for medical expenses, including hospital stays and doctor's fees.

- Emergency Evacuation & Repatriation: In case of a serious medical emergency, your policy may include provisions for evacuation to the nearest appropriate medical facility or repatriation.

- Non-Emergency Evacuation & Repatriation : In non-medical crises (e.g., political unrest), your policy may cover evacuation or repatriation, subject to policy terms.

Pre-Departure Travel Benefits:

- Trip Cancellation: You may be eligible for reimbursement if you cancel your trip due to a sudden illness or injury.

- COVID-19 Travel Insurance: Coverage is available for trip cancellation and medical expenses related to COVID-19, subject to policy terms and conditions.

- Trip Delay: If your flight faces delays due to unforeseen circumstances, you may have coverage for additional expenses such as meals and accommodations.

Post-Departure Travel Benefits

- Trip Interruption: In case of an unexpected event, you could be eligible for reimbursement for the unused portion of your trip.

- Missed Connection: If you miss a connecting flight due to delays or cancellations, this coverage may help with expenses like rebooking fees and accommodations.

Baggage Benefits:

- Luggage Delay: If the airline delays your checked baggage, your policy might offer reimbursement for essential items like clothing and toiletries.

- Lost or Stolen Luggage: In the unfortunate event of permanent loss or theft of your luggage, your policy may offer reimbursement for its value, assisting you in replacing your belongings.

Additional Optional Travel Benefits

- Rental Car (Collision Damage Waiver): Exclusive to Gold & Platinum plan policy holders, this optional benefit gives travelers extra coverage on their rental car against damage and theft.

- Cancel for Any Reason: Exclusive to Platinum plan policy holders; this optional benefit gives travelers more flexibility to cancel their trip for any reason outside of their standard policy.

- Loss Skier Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate some costs associated with pre-paid ski tickets that you or your traveling companion cannot use due to specified slope closures.

- Loss Golf Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate the expenses linked to prepaid golf arrangements that you or your travel companion are unable to utilize due to specified golf closures.

Do I Need Travel Insurance for Greece?

Travel insurance is not mandatory for Greece, but it's highly advisable. It offers essential coverage for unforeseen incidents like medical emergencies or trip disruptions, offering assistance away from home. Why? There are several reasons:

Medical Emergencies: Your health is a top priority. If you face a sudden illness or injury in Greece, travel insurance offers the means to receive prompt and quality medical care.

Lost Baggage: Baggage mishandling by airlines can leave you stranded without essentials. Travel insurance covers the replacement cost of necessary items, helping you proceed with your journey smoothly.

Trip Cancellation Protection: Trip cancellation protection ensures coverage for canceling a pre-booked trip due to unforeseen circumstances. It covers expenses in eligible situations like illness or adverse weather conditions.

How Much Does Travel Insurance Cost for Greece?

In general, travel insurance costs about 3 – 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans:

- Total Trip cost: The total non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane tickets, cruise costs, etc.

- Age: Like any other insurance type, the correlation is rooted in increased health risks associated with older individuals. It's important to note that this doesn't make travel insurance unattainable for older individuals.

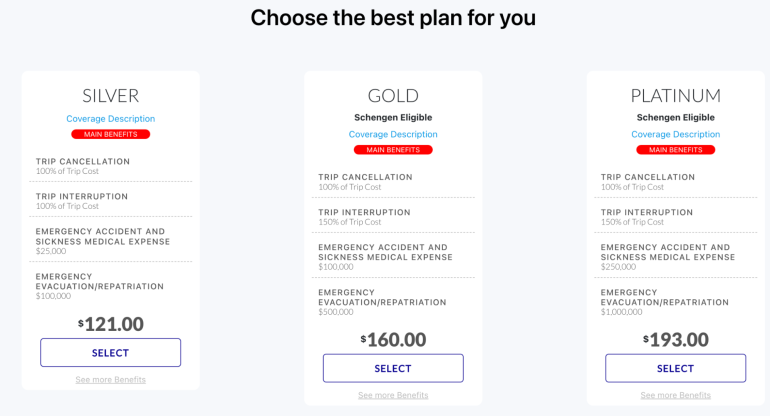

With AXA Travel Protection, travelers to Greece will be offered three tiers of insurance: Silver, Gold and Platinum . Each provides varying levels of coverage to cater to individual's preferences and travel needs.

Our Suggested AXA Travel Protection Plan

AXA presents travelers with three travel plans – the Silver Plan , Gold Plan , and Platinum Plan , each offering different levels of coverage to suit individual needs. Given that Greece hospitals often do not accept U.S. health insurance or Medicare, we genuinely recommend travelers to consider purchasing any of these plans, particularly for the crucial coverage they offer for emergency accident and sickness medical expenses. For sports enthusiasts visiting Greece, the Platinum Plan offers added advantages as it offers benefits like sports equipment rental coverage of up to $1000. This benefit offers reimbursement for the cost of renting sports equipment if the gear you've brought becomes lost, stolen, damaged, or delayed during your trip.

Emergency Medical: Can cover medical expenses, hospital stays, and even emergency evacuations, covering the expenses of hefty bills and ensuring access to quality healthcare while away from home.

Emergency Evacuation and Repatriation: Can cover your immediate transportation home in the event of an accidental injury or illness.

Non-Medical Emergency Evacuation and Repatriation: Offers assistance in unexpected situations such as political unrest or natural disasters, ensuring safe and timely relocation to a secure location or repatriation back home.

Greece has lifted all COVID-19 entry regulations, allowing unrestricted entry for all travelers. This decision to remove entry rules was announced on April 29th, 2022 by the Greek authorities.

Traveling with preexisting medical conditions can complicate your plans, but with AXA Travel Protection, we're here to support you during your trip. Our Gold and Platinum plans offer coverage for pre-existing medical conditions. The Platinum plan, in particular, is our highest-offered choice for travelers who want our highest coverage limits and optional add-ons,

What does this mean for you? If you've got a medical condition that's been hanging around, you can qualify for coverage under our Gold and Platinum plans with a pre-existing medical condition , so long as it’s within 14 days of placing your initial trip deposit and in our 60-day look-back period. We're here to ensure you travel easily, no matter your health situation.

1.Can you buy travel insurance after booking a flight?

You can buy travel insurance even after your flight is booked.

2.When should I buy Travel Insurance to Greece

It's advisable to purchase travel insurance for your trip as soon as you have made your initial trip deposit (prepaid and non-refundable trip costs.) AXA Travel Protection offers coverage as soon as you purchase your protection plan. We can give coverage against unforeseen events before you leave for your trip. Additionally, our policies offer coverage for preexisting medical conditions and Cancel for Any Reason if you purchase your protection within 14-days of making your initial trip deposit.

3.Do Americans need travel insurance in Greece?

Travel insurance isn't obligatory for Americans in Greece, but it's highly recommended.

4.What is needed to visit Greece from the USA?

If traveling from the USA to Greece, you only require a valid passport. Make sure your passport has a validity for at least six months beyond your arrival date in Greece.

5.What happens if a tourist gets sick in Greece?

If you become sick in Greece, travelers with AXA Travel protection can contact the AXA Assistance hotline 855-327-1442 . Contact information is typically provided within the insurance documentation. Please ensure to read through your policy details and information.

Disclaimer: It is important to note that Destination articles are for editorial purposes only and are not intended to replace the advice of a qualified professional. Specifics of travel coverage for your destination will depend on the plan selected, the date of purchase, and the state of residency. Customers are advised to carefully review the terms and conditions of their policy. Contact AXA Travel Insurance if you have any questions. AXA Assistance USA, Inc.© 2023 All Rights Reserved.

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

Get AXA Travel Insurance and travel worry free!

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip.

How to get Travel Insurance

Related articles.

Need Help Choosing a Plan?

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

AXA Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is AXA?

Axa travel insurance plans, which axa travel insurance plan is best for me, can you buy axa travel insurance online, is axa legit, what isn't covered by axa travel insurance, is axa travel insurance worth it.

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

In the era of staff shortages and extreme weather, your trip may not go exactly to plan. When that happens, travel insurance can be a big help. Although an insurance policy can’t prevent a delay or cancellation from happening, it can help relieve the financial burden if something unpredictable does occur on your trip.

But how do you know which insurance provider to go with? Here's a look at AXA travel insurance to help you determine if one of its plans is right for you.

AXA is a French insurance company that does business in over 200 countries. It offers many different types of insurance, including policies for travelers. These include coverage for baggage loss , trip cancellation and interruption, emergency evacuation and emergency medical costs. Cancel for any reason coverage is also offered.

AXA Assistance USA is part of the AXA Group.

» Learn more: How much is travel insurance?

AXA Assistance USA offers travelers three insurance plans: Silver, Gold and Platinum. The plans are underwritten by Nationwide Mutual Insurance Company and their affiliates in Columbus, Ohio. Here's the coverage you can expect from each policy.

Silver: This is the least expensive plan that offers 100% trip cancellation and trip interruption coverage, $25,000 in emergency accident and sickness medical coverage and $100,000 in emergency evacuation and repatriation coverage.

Gold: The mid-range Gold policy comes with 100% trip cancellation and 150% trip interruption coverage, $100,000 in emergency accident and sickness medical coverage and $500,000 in emergency evacuation and repatriation coverage.

Platinum: The AXA Platinum travel insurance plan includes 100% trip cancellation and 150% trip interruption coverage, $250,000 in emergency accident and sickness medical coverage and $1,000,000 in emergency evacuation and repatriation coverage.

If you want to add Cancel For Any Reason coverage, you’ll need to select the Platinum plan and purchase a policy within 14 days of paying the initial trip deposit. It’ll cover 75% of the prepaid nonrefundable expenses for your travel.

If you’d like coverage for pre-existing medical conditions , a waiver is available on the Gold and Platinum plans as long as you buy coverage within 14 days of your first trip payment.

» Learn more: How does travel insurance work?

Let’s compare AXA’s plans, the costs and coverage for a 19-day trip to Indonesia that costs $1,500 for a 36-year-old traveler who lives in Utah.

Coverage and limits for the Silver-level plan include:

Trip delay: $100 per day, with a $500 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 100% of the trip cost.

Baggage delay: $200.

Lost baggage: $750, up to $150 per article.

Missed connection: $500.

Emergency evacuation: $100,000.

Accidental death and dismemberment: $10,000 ($25,000 if on a common carrier).

Emergency accident and medical expense: $25,000.

The plan cost for our sample trip is $55.

For $79, the Gold-level tier offers the following coverage and limits:

Trip delay: $200 per day, with a $1,000 maximum.

Trip interruption: 150% of the trip cost.

Baggage delay: $300.

Lost baggage: $1,500, up to $250 per article.

Missed connection: $1,000.

Emergency evacuation: $500,000.

Accidental death and dismemberment: $25,000 ($50,000 if on a common carrier).

Emergency accident and medical expense: $100,000.

Collision damage waiver: $35,000.

Platinum is AXA’s highest tier level. This plan includes:

Trip delay: $300 per day, with a $1,250 maximum.

Baggage delay: $600.

Lost baggage: $3,000, up to $500 per article.

Missed connection: $1,500.

Emergency evacuation: $1,000,000.

Accidental death and dismemberment: $50,000 ($100,000 if on a common carrier).

Emergency accident and medical expense: $250,000.

Collision damage waiver: $50,000.

Lost golf rounds: $500.

Lost skier days: $25 per day.

Pet boarding fees: $25 per day (up to five days).

This level of coverage costs $95.

» Learn more: The best credit cards for travel insurance benefits

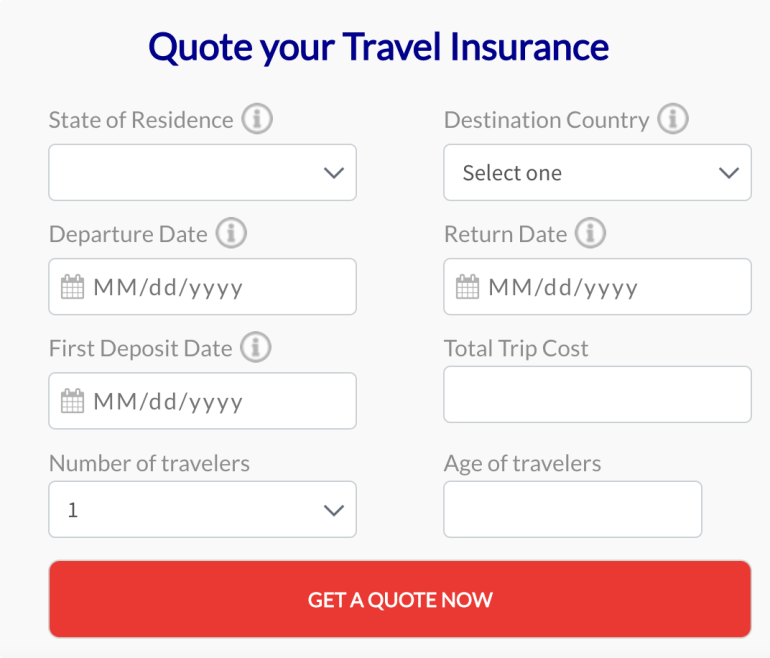

To get an AXA travel insurance quote, go to AXATravelInsurance.com and start by inputting your information in the quote box. Enter your state of residence, destination country, trip dates, date of first trip deposit, total trip cost, the number of travelers and their ages.

Once you’ve filled out the form, click on the “Get a quote now” button.

You’ll be presented with three quotes, one for each plan level. Make sure to click on the “See more benefits” link to get more information on each plan’s coverage limits. The plans with the highest coverage limits will be the most expensive.

If you need a pre-existing conditions waiver, select the Gold or Platinum plan. You’ll also have to purchase the plan within 14 days of making your initial trip deposit to be eligible.

The Gold and Platinum levels are also the two plans that offer Schengen zone coverage and a collision damage waiver . The Platinum plan is the only one that offers a Cancel For Any Reason add-on, so keep that in mind if you need more protection.

Overall, if you’re looking for emergency medical and emergency evacuation coverage specifically, the limits are good on all the plans, including the least expensive one.

To compare plans from multiple insurance providers at once, we recommend checking out Squaremouth, a travel insurance comparison site and a NerdWallet partner. The website helps you pick the right plan by displaying multiple quotes from many insurance providers, including AXA, in one spot.

AXA began in the early 19th century as a small insurance company specializing in property and casualty insurance.

Since then, the company has evolved, changing names and acquiring other insurance brands, until it became AXA in the 1980s. It is now one of the largest insurance companies in the world. In other words, yes, AXA is a legitimate travel insurance provider.

» Learn more: The best travel insurance companies

Every plan has different exclusions, so it's important to look at your coverage summary. Generally, pre-existing conditions without a previously purchased waiver are not covered.

Other limitations include:

Intentionally self-inflicted injuries.

Participation in bodily contact or extreme sports.

Traveling for the purpose of securing medial treatment.

Accidental injury or sickness when traveling against the advice of a physician.

Non-emergency treatment or surgery.

AXA handles more than 14 million cases each year, and every plan includes access to their 24/7 assistance hotline. The company is well established and has three plans for travelers to choose from.

AXA travel insurance covers several benefits including but not limited to 100% trip cancellation and trip interruption, medical emergencies, emergency evacuations, baggage delay or lost baggage, and accidental death and dismemberment. The Platinum plan also lets you add Cancel For Any Reason coverage.

AXA's least expensive plan, Silver, and its mid-range Gold policy do not have the option to add-on Cancel For Any Reason coverage. For travelers who opt to purchase the Platinum insurance plan, you can add Cancel For Any Reason coverage a la carte within 14 days of paying the initial trip deposit.

In the event that you need to make a claim, you can upload supporting documents online. If the claim is accepted, you will receive reimbursement within 30 days.

It's said that travel is the only thing you buy that makes you richer. But you don’t want to become poorer if something goes wrong before or during a trip. We don’t know what the universe has in store for us, so buying a travel insurance policy is one way we can protect our investment.

AXA offers budget, mid-range and premium policies that are easy to understand, provide adequate coverage and don’t cost a fortune.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best SEO Services (2024 Rankings)

- Best Mass Texting Services 2024

- Best SEO Software 2024

- Best Email Marketing Software 2024

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies (June 2024)

- Best Car Insurance for New Drivers

- Cheap Same Day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Travel Insurance for a Greece Vacation (2024)

Travel insurance for a Greece vacation can protect against emergency medical costs, reimburse you for cancellations and protect you from other unexpected issues.

in under 2 minutes

with our comparison partner, Squaremouth

Sabrina Lopez is an editor with over six years of experience writing and editing digital content with a particular focus on home services, home products and personal finance. When she is not working on articles to help consumers make informed decisions, Sabrina enjoys creative writing and spending time with her family and their two parrots.

Greece is one of Europe’s most well-known and beloved travel destinations. Cities like Thessaloniki and Athens have historic attractions, such as the Acropolis. Meanwhile, Greek islands like Santorini, Corfu and Mykonos boast some of the Mediterranean’s best beaches and liveliest party scenes.

The diverse list of attractions brings tourists from all over the world. More than 29 million visited in 2022, with many combining their Greece trip with stops in Italy, Croatia and other Mediterranean hotspots.

The U.S. State Department calls Greece a relatively safe destination. However, the travel industry is unregulated, making it challenging to choose reputable operators. Also, general labor strikes and demonstrations, earthquakes and petty theft can derail your travel schedule.

Comprehensive travel insurance plans can reimburse you for delays or cancellations so that you can return to your itinerary after experiencing problems.

Here is what you need to know to stay safe in Greece and select the best travel insurance for your needs.

Compare Greece Travel Insurance Companies

Why trust marketwatch guides.

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

Do I Need Travel Insurance for Greece?

Greece does not require travel insurance for tourists from the U.S. Because it is part of the Schengen area , visitors can stay for 90 days without pre-arranging a visa or meeting other conditions.

Even though it is not a legal requirement, tourists need travel insurance to avoid paying for emergency healthcare in Greece and if they wish to receive reimbursement for interruptions, cancellations, lost baggage or other travel problems that could ruin their trip.

Trip cancellation insurance offers protection before you arrive in Greece. Labor strikes are very common at European airlines and airports. Workers often choose the busiest travel season in the hope that it will increase their employers’ willingness to bargain. Cancellation and interruption coverage provides compensation for such delays so that you don’t have to pay out of pocket.

Finally, international travel is expensive. If you buy travel insurance, you can avoid sunken costs by getting reimbursement for the pre-booked portions of your vacation if you become ill or injured and are unable to travel.

Here are five coverage types you could include on your travel insurance policy.

Cancel for Any Reason Coverage

Standard trip insurance allows you to cancel your plans and receive reimbursement for the trip cost. However, to receive compensation, the cancellation must be due to unpredictable circumstances beyond your control.

Standard travel insurance plans have exclusions, which are unacceptable reasons for cancellation. The insurance company will not reimburse you if you cancel because of an appointment or event, a change in relationship status or financial problems.

Cancel for any reason (CFAR) insurance does not require you to prove the reason for the cancellation. CFAR coverage may increase premium costs, but the higher fee could be worthwhile if you book your trip far in advance and wish to protect against scheduling conflicts or other issues.

Gear Theft Protection

Gear theft protection covers valuables like phones, cameras, computers and other tech devices. It may also be useful for insuring equipment, such as diving gear, that you use in Greece.

Even though robbery is relatively rare in Greece, bag snatching is commonplace, and pickpockets often target phones or other small tech devices. These petty crimes make gear theft protection a good idea.

Comprehensive travel plans often include thefts. However, you need to check the limits of the policy. Some insurance providers only cover gear up to $1,000 (or even less). This amount won’t pay for the replacement of expensive devices. Insurers may offer stand-alone policies or add-ons to provide additional gear coverage.

Medical Emergency Insurance and Emergency Medical Evacuation

Medical emergency insurance is essential for travel in Greece. According to the State Department , private hospitals in the country will not admit patients without health insurance. Public hospitals will offer care but require cash payments before discharge.

Since most U.S. insurers, including Medicare, do not cover overseas treatments, even in an emergency, travel health insurance is necessary. It is the only option for most travelers to get medical care without paying out of pocket.

In addition to protecting you from high medical bills, policies often include evacuation insurance coverage. This type of travel medical insurance pays for transport to the U.S. if you need long-term care or procedures unavailable in Greece. It will also pay for repatriation if you pass away during your vacation.

Medical coverage is available in single-trip policies or as an annual or multi-trip package. All insurance covers necessary treatments for illnesses or injuries, but it may exclude certain pre-existing medical conditions. If you have pre-existing conditions , you should check the policy details and confirm coverage before departing.

Rental Car Protection

Car rental agencies in Greece usually require collision damage waiver (CDW) coverage. This policy pays for damage and often comes in two varieties: a cheaper version that requires you to pay a portion of repair costs and a more expensive variety that covers all damage.

You have several options for additional coverage.

- A credit card may offer auto insurance for rental cars if you use it to pay for the rental.

- Stand-alone auto insurance could be useful if you plan to drive extensively in Greece.

- A comprehensive travel insurance plan could include auto coverage, or the insurer may offer it as an add-on.

You should only rent from reputable agencies and use insurance when renting a vehicle in Greece.

Trip Cancellation Insurance

Trip cancellation insurance covers the cost of your Greece trip if it gets canceled due to unexpected circumstances.

Common reasons for cancellation can include the following:

- Selection for jury duty

- A subpoena to appear in court

- Military deployment

- A verifiable illness that you do not recover from before your departure date

- An injury that keeps you from traveling

- The death of a close family member

- A natural disaster or unexpected conflict in your destination

- Other duties you are legally required to complete

These policies do not cover cancellations due to social engagements, weddings or other events you are not legally obligated to attend.

Many cancellation policies also include trip interruption insurance. This coverage is for delays and cancellations after you depart from your home. It will pay for the costs incurred during delays from airport labor strikes, canceled flights or natural disasters.

Even if you feel the chance of cancellations is small, this policy can give you peace of mind knowing you won’t lose your travel investment if the worst happens.

How Much Does Greece Travel Insurance Cost?

The cost of travel insurance cover varies depending on several factors:

- The coverage you already have through a credit card or other insurance policy

- The length of your stay

- Your itinerary and planned activities

- The value of the gear you bring

- The level of medical assistance you need if you become ill or get injured

- Your home state

For some travelers, a cheap travel insurance policy provides sufficient protection. Comprehensive standard policies are often the most convenient option for the average traveler because they provide all the necessary components.

We requested quotes from ten travel insurance companies for their most affordable plan for a trip to Greece. The below quotes are for a 30-year-old traveler from Florida, traveling to Greece for ten days in September 2024, with a total trip cost of $4,000. Policies include coverage for cancellations, interruptions, delays, medical care and evacuation.

These quotes were collected in April 2024 for a trip in September 2024.

You can learn more about the costs of travel insurance here: How Much Is Travel Insurance?

How Do I Get Travel Insurance for Greece?

The first step in getting travel insurance for Greece is to define your insurance needs. You may already have some coverage. Ask yourself the following questions:

- Does your credit card offer cancellation coverage for airfares or hotel reservations?

- Does your credit card provide rental car insurance if you use it to pay for your vehicle?

- Will your health insurance work overseas?

- Does the airline offer cancellation insurance or have a policy that lets you cancel your flight for specific reasons?

These questions will help you decide how much coverage you need and the type of policy that best fits your travel plans.

You should always read the disclaimer text and check the fine print to ensure the policy will work in the chosen destination, cover any pre-existing conditions, and apply to the activities you have planned.

Greece Safety Tips

The State Department currently has a Level 1 travel advisory for Greece. Level 1 countries are safe to visit as long as you exercise normal precautions.

Here are the safety steps you should consider when traveling in Greece.

Crime and Safety

Violent crime is relatively rare. However, State Department advice mentions pickpockets and bag-snatchers, who work in crowded areas, such as tourist sites, trains and ferries. It also warns about thieves spiking drinks or targeting intoxicated tourists.

You can avoid these issues by leaving valuables at the hotel, hiding euro notes in a zippered pocket or money belt and never overindulging in alcohol in public settings.

Day Trips, Tours and Excursions

The tourism industry in Greece is not as heavily regulated as some other destinations in Europe. If you take day trips or tours, you should seek reputable operators who are well-reviewed online, recommended by trusted fellow tourists or connected by Greek guides and operators who provided you with good service in the past.

If you engage in adventure activities on land or in the water, you should always ensure you do not encounter challenges that exceed your skill level.

According to the U.S. Embassy in Athens, Greece has lifted all coronavirus-related restrictions. Masks are no longer required in public places, with the exception of healthcare facilities. You and anyone accompanying you will need to take a COVID-19 test when entering a hospital.

The Bottom Line: Is Travel Insurance for a Greece Vacation Worth It?

Because of the danger of disruptions due to labor strikes, earthquakes or airline cancellations, trip insurance is almost always a good investment when traveling to Greece. A comprehensive plan can also provide medical coverage and pay for evacuation by air if necessary.

Even if you do not have to make a claim, travel insurance will give you peace of mind and allow you to enjoy your trip instead of worrying about medical costs or interruptions.

Frequently Asked Questions About Travel Insurance in Greece

How do i claim compensation for cancellations in greece.

Greece follows EU aviation rules . You are entitled to compensation or rebooking if your flight is canceled. If it is delayed for more than three hours, the airline needs to cover the cost of accommodations, food and any other reasonable expenses.

You get compensation from airlines in the U.S. under similar circumstances. However, rebooking on a different flight could affect hotel reservations and other parts of your trip.

Is travel insurance necessary in Greece?

Greek authorities do not require travel insurance, but without it, you may have to pay medical costs, and you will not be reimbursed for cancellations or expenses incurred during trip interruptions.

How much does travel insurance for Greece cost?

Costs vary depending on your coverage needs. Standard comprehensive policies are between $84.21 and $117 for a two-week trip in August 2023.

Can I buy travel insurance the day before my trip?

You can buy travel insurance the day before your trip. However, it may not cover cancellations if the cause of the cancellation originated before you purchased the policy.

Many insurers also allow you to buy a policy while you are traveling, but they require a three-day waiting period before the coverage begins.

If you have feedback or questions about this article, please email the MarketWatch Guides team at editors@marketwatchguides. com .

More Resources:

Expat Travel Insurance in Greece

Expat Travel Insurance for EU Residents

Best expat travel insurance for eu residents at affordable price.

Provided you are a European resident, whatever your destination or your age (over 65s included), we’ve got you covered!

Our partnership with DAES London Market Insurance Brokers & Globelink (Cyprus) Insurance Agency & Sub-Agency Limited , one of the oldest and most respected names in the insurance business worldwide, ensures that you can embark on your trip with peace of mind. Whether it is delayed flights, lost luggage or an accident, travel without worrying about a thing!

Best Expat Travel Insurance Greece

High coverage limits, up to 95 years old travelers, 24 hours emergency medical assistance helpline, hassle-free and fast claims, 50+ pre-existing conditions covered.

John Paterakis - Founder insuranceline.gr

Expat travel insurance in greece, looking for the best expat travel insurance greece for european or greek residents.

Expat travel insurance is a term to describe a travel insurance policy required by expatriates working or living within the European Union. This type of insurance policy will cover you while abroad and can be purchased as a Single Trip Travel Insurance (max 31 days trip), Annual Travel Insurance (multiple trips) or Long Stay Travel Insurance (max of 365 days trip).

With any of our Travel Insurance plans, we will have you covered in case the unexpected happens such as illness, accidents, lost baggage, missed flights, theft or other international medical emergencies.

We offer affordable travel insurance policies with excellent coverage and a choice of cover levels to suit any budget.

Special Requirements? Ask for a Personalised Quote:

If our online ‘Quote & Buy’ system does not meet your special requirements, request a personalised quote.

Ready to insure your Trip?

If you are ready to buy a Travel Insurance Plan but our online ‘Quote & Buy’ system does not meet your special requirements, fill one of the application forms here and we will send you your policy contract by email within 48 hours.

Get a Quote & Buy International Travel Insurance Online

Why our travel insurance plans are the best in the market, high coverage limits, up to 10.000.000€ medical expenses, up to 2.000.000€ personal liability, up to 95 years old travelers covered, hassle-free & fast claims, 50+ pre-existing med. conditions covered, sport and activities coverage, covid coverage.

- Client testimonials

What our clients say

Honest and efficient.

The most frank, honest and efficient broker, fluent in English, I have come across in 20 years of insuring my car, home and business in Greece. Only too happy to recommend them for service of excellence.

Catherine Oloflin

Expat travel insurance frequently asked questions - faqs, what is covered by expat travel insurance.

Travel insurance is insurance that is intended to cover medical expenses, trip cancellation, lost luggage, flight accident and other losses incurred while traveling, either internationally or domestically.

Is COVID-19 covered by Expat Travel insurance?

Our Travel insurance plans will not cover any claim in any way caused by or resulting from coronavirus.

What is the best Expat Travel insurance?

Travel insurance protects you from financial loss related to unexpected events that may occur during a trip. It’s important to compare multiple plans before you buy and pay special attention to what each plan covers, coverage limits, and any deductibles you may need to meet.

Most Travelers will need trip cancellation and interruption coverage, but not everybody will need coverage for extreme sports. Frequent Travelers may want to consider an annual plan while others may need coverage for a single trip.

The best Travel Insurance is one that includes:

- Adequate Medical coverage. For emergency medical and dental care in the events of a sudden illness or injury on your trip.

- Pre-existing medical conditions (as many as possible) coverage. Provides protection against high medical costs that result from a recurring condition.

- Evacuation coverage. Arranges and pays for medically necessary evacuations.

- Baggage coverage. Provides replacement value for items that are lost, stolen, or destroyed on your trip, including the bag itself.

- Financial coverage. Provides reimbursement for payments made to a Travel supplier that completely ceases operations due to financial default or bankruptcy.

All our Travel Insurance Plans are insured by Lloyd's of London one of the oldest and most respected names in the insurance business worldwide. Our plans include coverage for 50+ pre-existing medical conditions with no additional cost! You can embark on your trip with peace of mind. Whether it is delayed flights, lost luggage or an accident, Travel without worrying about a thing!

"Remember, don’t buy cheap Travel insurance. Make sure you protect both your Travel investment and your health."

Are pre-existing conditions covered in Expat Travel insurance?

Yes. All our Travel Insurance Plans are insured by Lloyd's of London one of the oldest and most respected names in the insurance business worldwide. Our plans include coverage for 50+ pre-existing medical conditions with no additional cost! You can embark on your trip with peace of mind. Whether it is delayed flights, lost luggage or an accident, Travel without worrying about a thing!

Is there an age limit on Expat Travel insurance?

We offer affordable Travel insurance for seniors by Lloyd's of London. Whether your age group is over 65 - over 70 - over 75 - over 80 - over 85 or over 90, we provide the same Travel health insurance coverage! Check our website for age limits per policy type (Single Trip, Annual, Long Stay etc).

How much does Expat Travel insurance cost?

Travel insurance plans typically cost between 4-10% of the total trip cost. This is the general range. Basic ‘budget’ plans can be less than 4%, and premium plans can be over 12% of the trip cost.

Why Expat Travel insurance is important to expatriates?

It’s important to consider the cost of emergency healthcare in the country you are visiting. If you sustain an injury or get sick, it may cost you thousands of euros in medical bills.

Travel insurance protects you from financial loss related to unexpected events that occur during a trip. Different policies cover different events, but two general categories you need to consider are medical coverage and trip insurance.

What should be covered in Expat Travel insurance?

The Travel insurance policies are meant to protect any unforeseen monetary losses you may experience prior to or during your Travels and they should cover:

- Emergency medical and dental expenses

- Emergency medical transportation

- Emergency evacuation (medical and non-medical) and repatriation

- Trip cancellation, interruption, and delay

- 24-hour multilingual assistance

- Baggage protection

- Adventure sports and Dangerous activities (if applicable to your trip)

Is it worth it to buy Expat Travel insurance?

No matter how well you have organized your journey, there is always the possibility of the unexpected happening.

Typical risks for Travelers include:

- You experience a medical emergency. If you get sick or get injured on your trip, you will need your Travel insurance contact to arrange for emergency medical care and transportation.

- Your trip is canceled. If your trip is cancelled for any reason you will be able to recover the money you paid for the trip provided your Travel insurance plan covers trip cancellation.

- You need to be evacuated. Medical evacuations are highly expensive especially and if you are Traveling in a region where the local medical facilities cannot adequately treat your condition your Travel insurance will have to cover those expenses.

- Your luggage is damaged or stolen. You will be able to recover the money you paid for the luggage and its contents provided your Travel insurance plan provided such coverage.

- You need help or emergency assistance. Your Travel insurance will have provide help and assistance when you need it.

We have searched through all the available products in the insurance market in order to find the very best Travel insurance policies and coverage - at affordable prices. Whether it is delayed flights, lost luggage or an accident, Travel around the world and without worrying about a thing! Whatever plan you choose a personal advisor from insuranceline will be available for help.

Do you have questions? Read all our FAQs and get answers today!

Insuranceline is an Independent Insurance Agency with EU registration number GR9346. We value your privacy. Our website requires cookies. By continuing to use our website you are agreeing to our Cookie Declaration

Phone: (+30) 2831028310 (9am - 2pm, 6pm - 8pm) Mobile: (+30) 6947806290 (9am - 2pm, 6pm - 8pm)

18 Eleftheriou Venizelou Street Zografou, Athens 15773 Greece

10 Giaboudaki Street Rethymno 74100 Greece

Get a Free Insurance Consultation

- (+30) 2831028310

Switch language:

AXA XL restructures insurance underwriting in Americas

The company has structured its operations around large commercial, mid-market and professional business segments.

- Share on Linkedin

- Share on Facebook

AXA XL , a division of French insurer AXA , has announced a reorganisation of its insurance underwriting operations in the Americas.

The company has structured its operations around three main business segments: large commercial, mid-market and professional, aiming to better align with the diverse needs of its clientele.

Go deeper with GlobalData

COVID-19 Impact on AXA SA

Premium insights.

The gold standard of business intelligence.

Find out more

Related Company Profiles

AXA XL’s large commercial segment, now under the leadership of Donna Nadeau as head of large commercial, consolidates casualty, property, cyber, construction and energy, and specialty product lines including aviation and marine.

This segment also encompasses wholesale solutions, which includes excess and surplus and programmes, to cater to the multiline insurance requirements of AXA XL’s largest clients in the US, Bermuda and Canada.

Nadeau, with more than 30 years of industry experience, steps into this role following her tenure as AXA XL Americas chief underwriting officer.

The mid-market segment, overseen by Matthew Waters, targets businesses with less than $1bn (€920.25m) in revenue.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

This segment has expanded to include environmental, inland marine, and excess and lead umbrella insurance, as well as mid-size construction capabilities.

Meanwhile, the professional business segment remains focused on meeting specialised insurance needs related to director and officer, mergers and acquisitions, crime, and kidnap, ransom and extortion.

It is managed by the existing operating committee – Tony Giacco, John Burrows, Sean Hearn and Jim Koval.

AXA XL Americas CEO Lucy Pilko said: “After taking a close look at our structure, we are making changes to our regional model to optimise how we work and how our brokers and clients work with us. We are organising ourselves with the client in mind, giving our brokers and clients an easy access point to all product lines. We look forward to sharing more as our new structure continues to take shape.”

Last month, AXA XL introduced a new cyber insurance endorsement for public companies to comply with the US Securities and Exchange Commission’s new cyber incident reporting requirements.

The endorsement is designed to cover the costs of investigating a breach, including legal fees for compliance and disclosure.

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.

More Relevant

Fanhua partners with Baidu to develop AI insurance assistant

Appian and swiss re extend life insurance partnership in apac and emea, uk insurers must highlight esg commitments to attract brokers, uk’s broadstone launches insurance regulatory risk advisory division , sign up to the newsletter: in brief, your corporate email address, i would also like to subscribe to:.

I consent to Verdict Media Limited collecting my details provided via this form in accordance with Privacy Policy

Thank you for subscribing

View all newsletters from across the GlobalData Media network.

IMAGES

VIDEO

COMMENTS

If you become sick in Greece, travelers with AXA Travel protection can contact the AXA Assistance hotline 855-327-1442. Contact information is typically provided within the insurance documentation. Please ensure to read through your policy details and information.

As far as legalities go, no — travel insurance is not mandatory if you don't need a visa. However, when traveling abroad, being properly insured is never a bad call. Yes, Greece is generally very safe and tourist-friendly. However, it does have roughly 6,000 islands (only 200 of them inhabited though).

AXA is the number one provider of travel insurance for trips to Europe and offers assistance 24/7, as well as other options and tailor-made products. Other coverage available includes our Europe Travel insurance, costing €33 per week, or Schengen Multi Trip insurance, which is perfect for regular travelers and available for €328 for a year ...

It also allows you to obtain the travel insurance certificate required with your Schengen Visa application. Europe Travel insurance: guarantees a coverage of up to € 100,000 (about US$ 111,000) covers travellers for up to 180 days. bears the expenses linked to emergency medical care**, hospitalisation**, sanitary repatriation** or death**.

AXA travel insurance is accepted with all Schengen visa applications. Schengen visa insurance meets all the European visa requirements. It is approved and accepted by the consulates and embassies of all the countries of the Schengen Area. It guarantees coverage of at least €30,000 and up to €100,000 (depending on the chosen option).

This summary does not replace or change any part of your plan document. If there is a conflict between this summary and your plan document, the plan document will govern. Please contact AXA for additional information regarding plan features and pricing at [email protected]. Plans contain insured benefits and non-insurance assistance ...

Enter your travel details, such as the destination, travel dates, and number of travelers, select the type of insurance policy you need based on your travel plans and needs then review the coverage options and select the one that best fits your needs and budget. Enter your personal and payment information to complete the purchase.

The average trip cost for Greece is running at $6,561, based on data from Squaremouth, a travel insurance comparison site. That makes Greece the second-most expensive travel destination in the ...

Platinum. Platinum is AXA's highest tier level. This plan includes: Trip delay: $300 per day, with a $1,250 maximum. Trip cancellation: 100% of the trip cost. Trip interruption: 150% of the trip ...

The below quotes are for a 30-year-old traveler from Florida, traveling to Greece for ten days in September 2024, with a total trip cost of $4,000. Policies include coverage for cancellations ...

Given new restrictions, it's more important than ever for your customers to avoid travel inconveniences. Our Travel Rebound Insurance Product (TRIP) is designed to restore confidence in traveling by covering today's extra risks, such as denied boarding, missed departure, or being stranded abroad, with both medical and non-medical assistance.

If you are a U.S., Canadian or Mexican citizen you will not need a visa for short term travel to Greece, as these countries are among those with visa-free arrangements with the European Union (EU).However, it is worth noting that from 2023, citizens will need to apply for an ETIAS visa waiver before they travel, which can be obtained online and will cost €7 ($7.82).

With AXA travel insurance you benefit from assistance throughout your trip: before, during and after and everywhere in the world. Take advantage of our comprehensive guarantees: coverage of your medical expenses abroad, 24-hour medical assistance, teleconsultation, travel cancellation insurance, repatriation insurance and loss of luggage. ...

What does AXA Schengen Travel insurance for Greece cover? Up to €100,000 coverage in medical expenses · Medical repatriation · 24/7 medical assistance in English · Zero deductible

Expat travel insurance is a term to describe a travel insurance policy required by expatriates working or living within the European Union. This type of insurance policy will cover you while abroad and can be purchased as a Single Trip Travel Insurance (max 31 days trip), Annual Travel Insurance (multiple trips) or Long Stay Travel Insurance (max of 365 days trip).

31 May 2021 - 17:50. Trieste - Generali has completed the acquisition of AXA Group's Greek subsidiary, AXA Insurance S.A., following receipt of all necessary approvals from the relevant regulatory bodies and competition authorities. The acquisition was first announced on 31 st December 2020. As a result of the completion of the acquisition ...

The average cost of travel insurance is 5% to 6% of your trip costs, according to Forbes Advisor's analysis of travel insurance rates. For a $5,000 trip, the average travel insurance cost is ...

AXA XL, a division of French insurer AXA, has announced a reorganisation of its insurance underwriting operations in the Americas.. The company has structured its operations around three main business segments: large commercial, mid-market and professional, aiming to better align with the diverse needs of its clientele.