- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

World Nomads Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does World Nomads travel insurance cover?

World nomads single trip plans, which world nomads insurance plan is best for me, can you buy world nomads travel insurance online, what isn’t covered, is world nomads insurance worth it.

World Nomads

- Travelers can extend coverage mid-trip.

- The standard plan covers up to $300,000 in emergency evacuation costs.

- Plans automatically cover 200+ adventurous activities.

- No Cancel For Any Reason upgrades are available.

- No pre-existing medical condition waivers are available.

World Nomads offers the Standard and Explorer travel insurance plans and excels in sports/activity related travel insurance coverage while offering solid trip delay, baggage delay and lost luggage protections.

The provider offers insurance plans for travel to nearly any country and is available to residents of most countries. In the U.S., World Nomads policies are administered by Nationwide Mutual Insurance Company, a Fortune 100 company offering various types of insurance and financial products.

Here’s what you need to know about World Nomads travel insurance to help you decide which plan makes sense for your trip.

Before you buy a plan, check to see if you already have coverage through a premium travel credit card , and if so, verify whether those limits are sufficient. If they are, standalone emergency medical coverage may be adequate as the travel insurance provided by credit card often excludes healthcare expenses or offers a low limit (the Chase Sapphire Reserve® is one of the few cards to offer emergency medical and dental, however coverage is capped at $2,500 ).

Chase Sapphire Reserve®

World Nomads offers different coverage levels for its travel insurance options, but both qualify as single trip plans.

Single trip plans are designed for individuals who are leaving their home, visiting another destination (or destinations) and returning home. These travel insurance plans are the most comprehensive and provide benefits like trip cancellation, trip interruption and medical coverage.

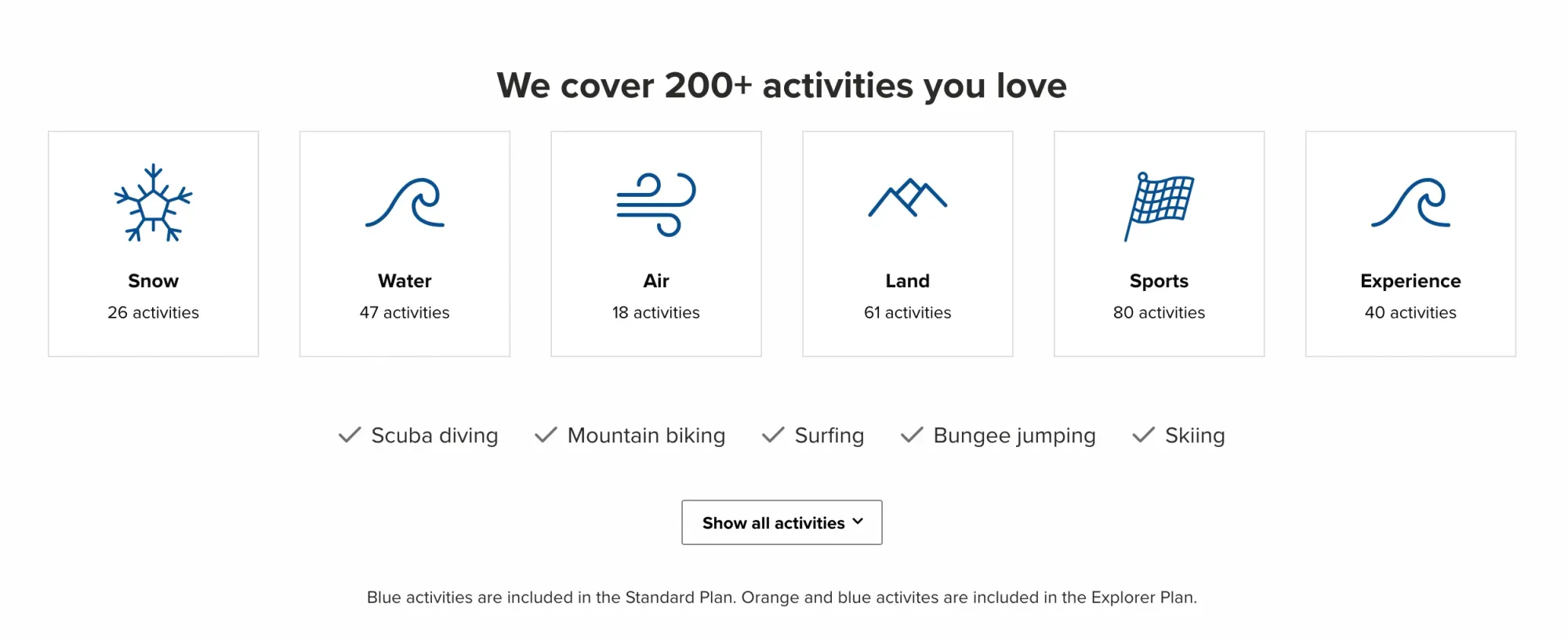

World Nomads is unique amongst other providers as it is a good fit for adventurous travelers. Its plans automatically include coverage for over 200+ activities, including skiing , rafting, backpacking and bouldering. Note that extreme sports are not covered.

All plans include trip protection, emergency medical insurance , emergency evacuation and coverage to protect your gear.

World Nomads offers two plans, with the latter offering higher limits and additional adventure sports coverage.

The plans can be purchased for trip duration up to a maximum 180 days, and you can extend your coverage mid-trip. The price of the policy will depend on the duration of the trip and the countries that you're visiting.

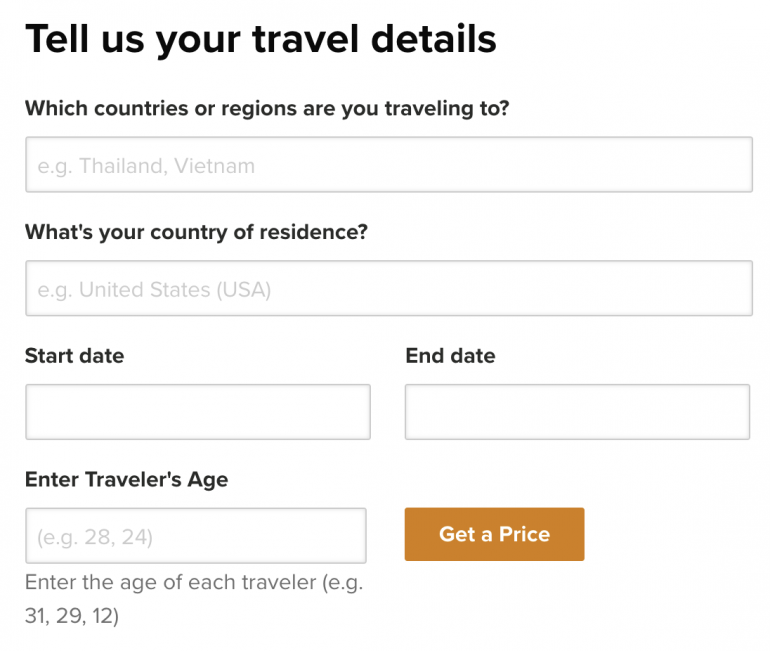

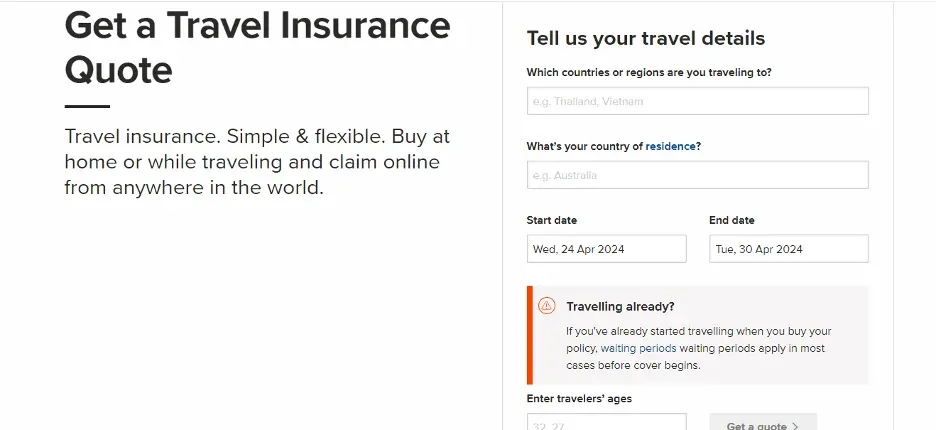

To see the cost of the insurance plan, you will need to input your trip details, your age and state of residence. Unlike many other insurers, you do not need to include the cost of your trip when searching for a World Nomads policy because trip cancellation and interruption benefits are capped at a specific dollar amount rather than a percentage of money spent.

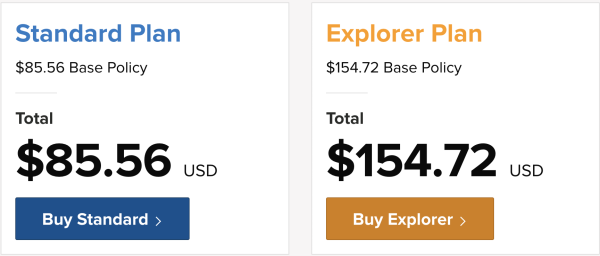

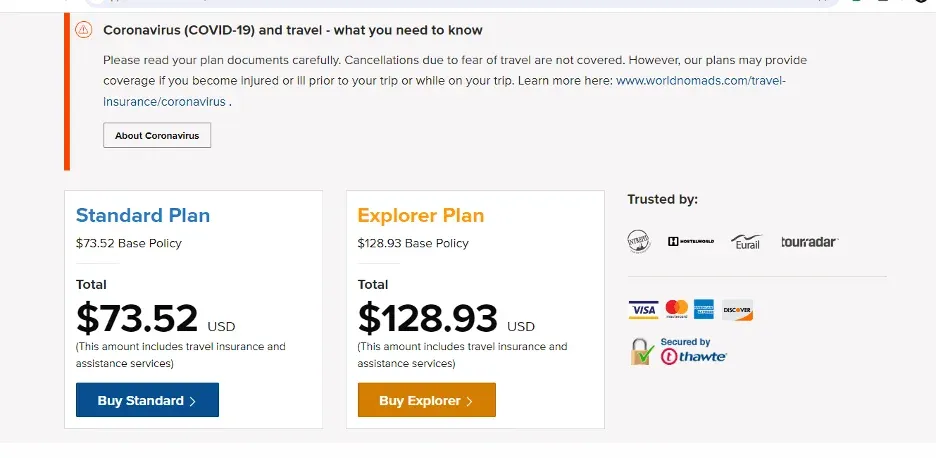

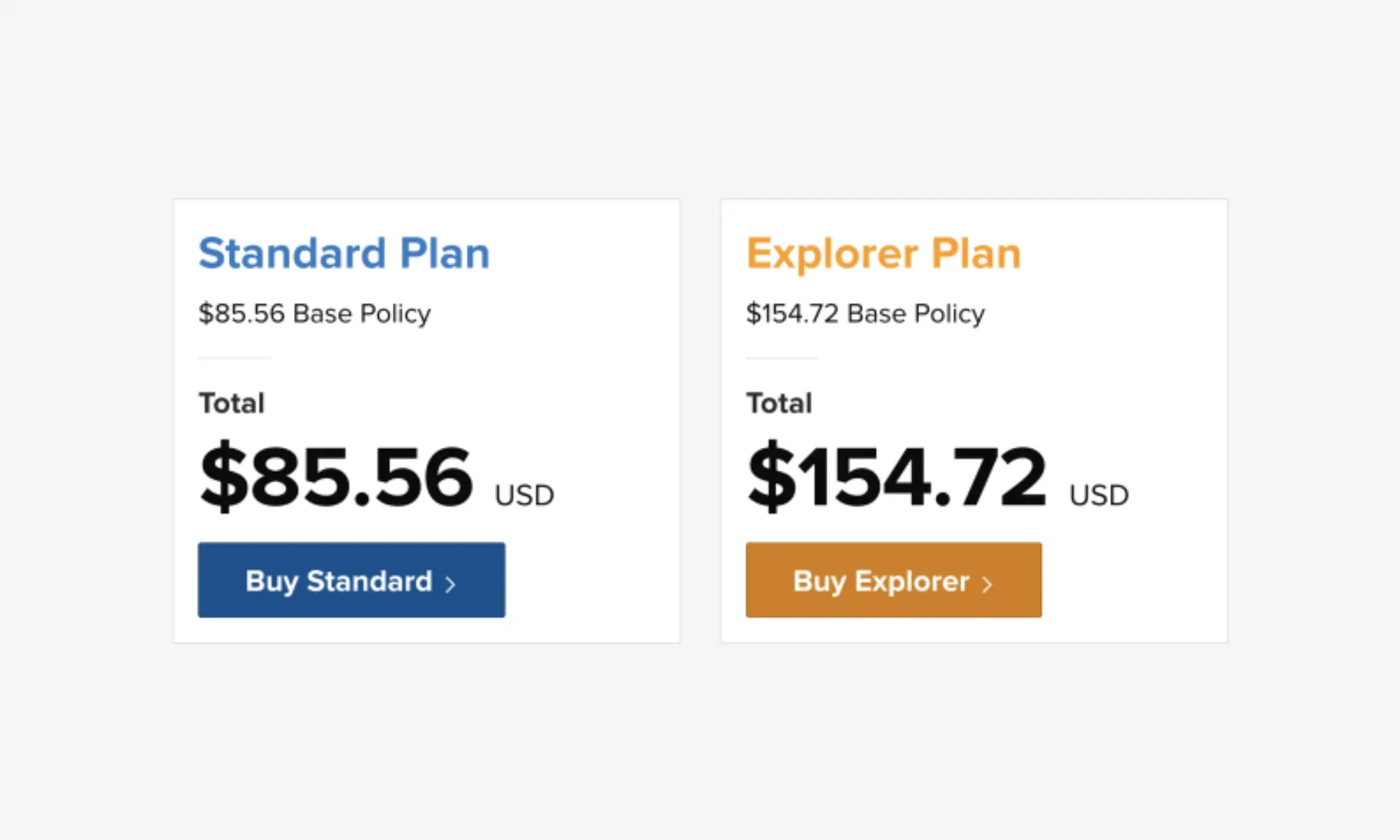

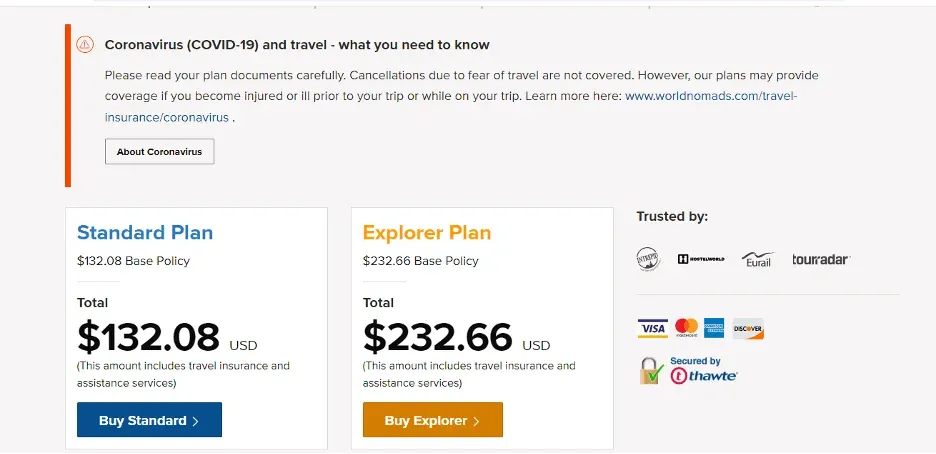

We input a sample trip of a two-week vacation in December 2023 to Italy by a 30-year-old from Illinois.

World Nomads single trip plan cost

Here are some example World Nomads insurance costs based on our example trip.

Standard Plan

The Standard Plan ($86) is a good choice for those who are satisfied with trip cancellation and interruption coverage of $2,500 or less, do not need rental car damage protection, find the limits to be sufficient and do not need coverage for certain adventure sports.

However, this plan still shines in sports coverage, covering activities like wind surfing and bungee jumping, which are seldom covered by travel insurance companies. A full list of covered sports by plan type is available on the World Nomads site.

Explorer Plan

The Explorer Plan ($155) includes all the benefits of the Standard Plan along with higher limits, rental car damage insurance (in the states where it is available) and adventure sports (e.g., skydiving, heli skiing) coverage.

This choice is also good for those whose trips costs less than $10,000 as this is the maximum trip cancellation and interruption protection.

A Cancel For Any Reason (CFAR) upgrade is not offered by World Nomads. If this option is a must, look for a travel insurance company that offers CFAR.

Selecting the appropriate plan for your travels involves understanding which coverage you’d like on the trip.

If you have a premium travel card : If you have a premium travel card that offers an adequate amount of trip cancellation / interruption benefits, you may only need to get a standalone emergency health care policy. For example, The Business Platinum Card® from American Express offers $10,000 per trip and $20,000 per year in trip cancellation benefits . Terms apply. Only the Explorer Plan ($10,000) has a comparable level of trip cancellation protection. Terms apply.

If the coverage provided by your card isn’t adequate or applicable: If you don’t have a premium travel credit card , the coverage provided by your card isn’t sufficient or you didn’t use the card to pay for your trip, then a comprehensive insurance plan like the Standard or Explorer plan might be the best choice.

More chill travelers: If you don’t need adventure sports coverage and your trip costs less than $2,500 (or you already have trip cancellation / interruption benefits from your credit card), the Standard Plan would be sufficient.

» Learn More: How to find the best travel insurance

Go to worldnomads.com and input your trip details.

If your country of residence is the U.S., an additional row will appear asking you to input your state.

» Learn more: Is travel insurance worth it?

Trip insurance plans are filled with exclusions, so you’ll want to pay attention to what is and isn’t covered so there aren’t any surprises. Here are some exclusions you can expect from World Nomads:

Pre-existing conditions: If you’ve sought treatment for any illness or condition in the 90-day period preceding the start of the policy and then seek medical care for the same illness/condition, you may be on the hook for the bill since World Nomads does not cover pre-existing conditions.

Intentional acts: Losses sustained from self-harm, intoxication, drug use or criminal activity are not covered.

Travelers with pre-existing conditions might consider policies from providers like Travel Guard by AIG or Allianz .

» Learn more: The best travel insurance companies right now (World Nomads is on the list!)

World Nomads has been offering insurance since 2002. The company is well established and offers two single trip travel insurance policies to fit many different needs.

Both plans offered by World Nomads include trip cancellation, interruption and delays; emergency accident and sickness medical expenses; emergency evacuation; repatriation of remains; non-medical emergency transportation; baggage and personal effects; baggage delay for outward journeys; rental car damage in certain locations; accidental death and dismemberment; Generali Global Assistance; and adventure sports and activities.

World Nomads does not include Cancel For Any Reason coverage, even as an add on.

You will need to file a claim with the insurer after you’ve incurred costs related to a covered expense. If the claim is approved, you will receive a reimbursement. In some instances, such as baggage delay, World Nomads pays you a fixed amount per day rather than 100% coverage for costs incurred.

World Nomads offers some good travel insurance plans for adventurous, single-trip travelers. This is also a good fit for anyone who is uncertain about their trip length (since you can add coverage during your vacation).

Insurance can be extended mid-trip.

You can insure trips up to 180 days in length — which makes it an attractive option for digital nomads .

Adventure sports coverage is more robust than many other plans.

Simple choice of two plans.

Extreme sports are not covered.

There is no annual plan option. A policy ends once you return within 100 miles of home, even if you’re only home briefly as part of a long trip.

Regardless of your trip cost, trip cancellation and interruption coverage is capped at a dollar amount rather than as a percentage of trip cost. The Standard Plan and Explorer Plan cover trips up to $2,500 and $10,000, respectively. If you’re going on a more expensive trip, you won’t be able to protect the entire trip.

You must be 70 years old or younger to qualify for coverage.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

A previous version of this article misstated World Nomads' insurance offerings. This article has been corrected.

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

Simple & flexible trip insurance for international or domestic travel. Buy & claim from anywhere in the world.

Don't travel unprotected! Complete the form for a free travel insurance quote Don't travel unprotected! Complete the form for a free travel insurance quote

Nomads Insurance

Travel insurance for nomads travelers and their families. You'd rather not think about all of the things that might go wrong on your trip, but these things can and do happen. World Nomads travel insurance has been designed by travelers for travelers, to cover your trip essentials. Even if you run out of travel insurance or leave without it, World Nomads can cover you. We don't just keep you and your family protected, with us, you'll travel smarter and safer.

FORM SAMPLE

Buy cover while traveling

If you're traveling and want to extend your trip, World Nomads lets you buy more cover to keep you on the road.

24/7 Emergency Assistance

Our multi-lingual assistance team can help you when you need it most, connecting you with medical treatment and transportation.

Cover for 200+ Adventure Activities

At WorldNomads, we love to explore our boundaries when we travel, so we've worked for over ten years developing one of the longest lists of covered activities.

Donate to local communities

We connect our customers to projects run by established charities so you can fund projects in destinations with the greatest need.

24/7 emergency assistance

Whether you need medical or dental assistance or advice, emergency evacuation or travel assistance, our team is available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact Generali Global Assistance: Telephone: +1 954-334-8143 (Collect outside the US) +1 877-289-0968 (Toll-free in the US and Canada)

Disclaimers:

We receive a fee when you get a quote from World Nomads using this link. We do not represent World Nomads. This is not a recommendation to buy travel insurance.

Plan features listed here are high level, provided for your convenience and information purpose only. Please review the Evidence of Coverage and Plan Contract (Policy) for a detailed description of Coverage Benefits, Limitations and Exclusions. Must read the Policy Brochure and Plan Details for complete and accurate details. Only the Terms and Conditions of Coverage Benefits listed in the policy are binding.

WorldTrips Producer Number: Alliance Parcel 28225-001

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

World Nomads Travel Insurance Coverage Review – Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

311 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3254 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Table of Contents

What is world nomads, plans and coverages offered by world nomads, how to get a quote, how does world nomads compare, filing a claim, why we like world nomads travel insurance, some drawbacks to world nomads travel insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Spending money on insurance to protect our assets is painful. Whether it’s home, auto, liability, or even business insurance, we rarely receive anything in return besides the peace of mind of knowing we’re covered if something should go wrong.

Travel insurance is different — things frequently go wrong. Whether it’s a flight cancellation, missed connection , weather delay , lost baggage , or other incident, chances are you’ve personally experienced some sort of disruption during your travels.

Perhaps you’ve even had to cancel a trip because you, or an immediate family member, became ill or had a fear of getting ill, during your travels.

It’s not difficult to find a reason to purchase coverage for your travels, but finding the right travel insurance policy for your specific needs can be a challenge.

Today we’re going to look at an organization that is operated by travelers just like us. It’s a company that knows the types of coverage travelers need and partners with highly-rated insurance companies to provide those coverages.

In this regard, World Nomads travel insurance is unique in the travel insurance marketplace. We’re taking the time today to invite you to learn more about the products and services it offers and why you’d want to consider the company when it’s time to purchase coverage for your next trip.

World Nomads is not an insurance company, but you could say that they’re better than an insurance company. World Nomads is an organization based in Australia that offers travel insurance options throughout the world and also gives back to local communities. The organization is made up of travelers, for travelers, so you’ll also find a group of storytellers who additionally provide downloadable guides, recommendations, scholarships , and other travel resources.

The travel insurance offered by World Nomads is underwritten in the U.S. by Nationwide Mutual Insurance Company and the company’s affiliates. Nationwide is highly rated by insurance financial rating company A.M.Best and has been in business for 95 years, so you know you’ll be dealing with an established, financially sound company. Different insurance companies underwrite World Nomad policies depending on the country.

World Nomads specializes in providing essential travel insurance coverages but also includes coverage for 200 activities, many of which you might not find coverage for with other companies.

Bottom Line: World Nomads is an organization of travelers that provides travel insurance that is underwritten by different insurance companies throughout the world. The company offers a core group of essential coverages plus coverage for up to 200 specific activities that are automatically included in each of its plans.

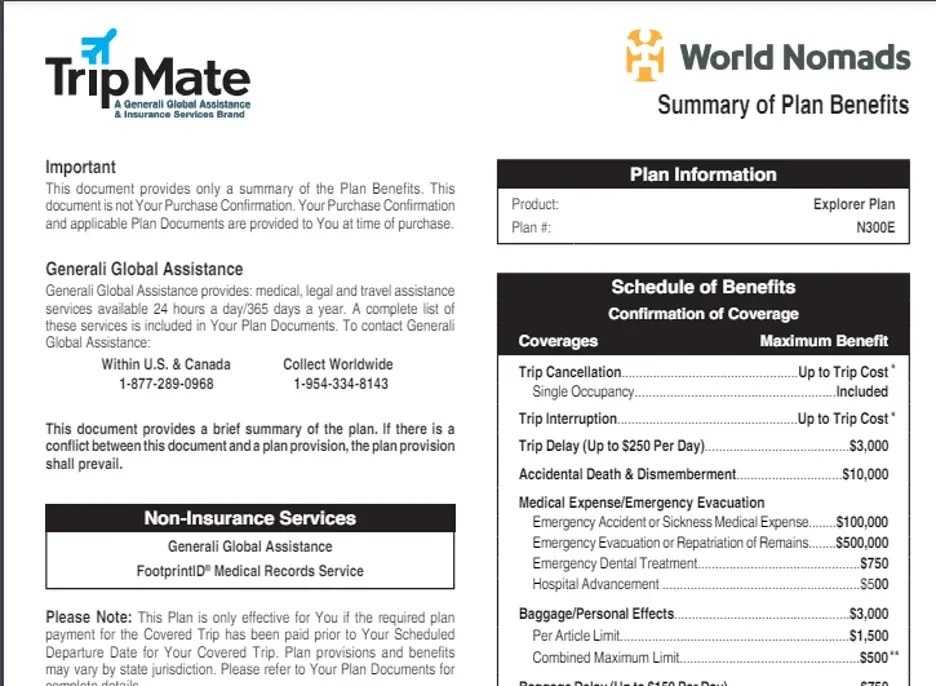

Travel insurance can cover a wide range of perils you might face during your travels. Here are the types of core coverages you can expect with the 2 plans World Nomads offers, the Standard plan (in the first column) and the Explorer plan (in the second column).

Medical and Emergency Dental Coverage

Both plan options offered by World Nomads provide up to $100,000 for emergency medical expenses, $750 for emergency dental, and $500 if you should need to make a deposit for any hospital admission. If your major concern is having medical insurance while traveling, either plan would work for meeting that requirement.

Plus, whether you’re planning on taking a polar plunge, bungee jumping, or finally making that indoor skydive, you’ll be able to find coverage with World Nomads for up to 200 such activities. The list of covered activities varies by plan.

Additionally, while it appears pre-existing conditions are not covered, World Nomads states that “the pre-existing condition doesn’t apply if the problem is treated or controlled solely by the taking of prescription drugs.” There are other limitations that do apply.

Sports and Activities Coverage

One of the reasons World Nomads stands out in the travel insurance arena is its inclusion of coverage for activities that other companies exclude or for which there may be a surcharge. Here are some examples of the 200 activities that can be included depending on the plan chosen.

Bottom Line: If you participate in adventure sports while traveling, World Nomads may have a plan that will cover you.

Evacuation Coverage

Evacuation can be expensive, but you’ll have peace of mind knowing that if you’re injured and need to be evacuated, you could have that expense covered. While having $500,000 in coverage is nice to have, according to Travelex Insurance , an evacuation can cost $25,000 within the U.S., up to $100,000 from Europe and $250,000 from more remote locations. So, $300,000 coverage could be sufficient.

World Nomad plans also include evacuation due to civil or political unrest, natural disaster, or if you are expelled from a county. Of course, terms and conditions apply.

COVID-19 Coverage

World Nomads does not sell Cancel for Any Reason insurance , which can cover you if you decide, for any reason, to cancel your trip, even for fear of getting ill. The company does, however, offer some coverage for COVID-19 related illnesses.

The company offers this explanation of coverage: “Cancellations due to the fear of travel are not covered. Our medical coverage includes benefits for serious illnesses, such as COVID-19, or being placed under strict quarantine by a physician or government mandate, among other scenarios.”

You’ll find some coverage for COVID-19 illnesses within the medical, trip cancellation, and trip interruption coverages.

Bottom Line: You won’t be covered if you cancel your trip due to the fear of getting COVID-19. If you should get ill with the virus, prior to or during your travels, there may be trip cancellation, interruption, or medical coverage (during travel) available.

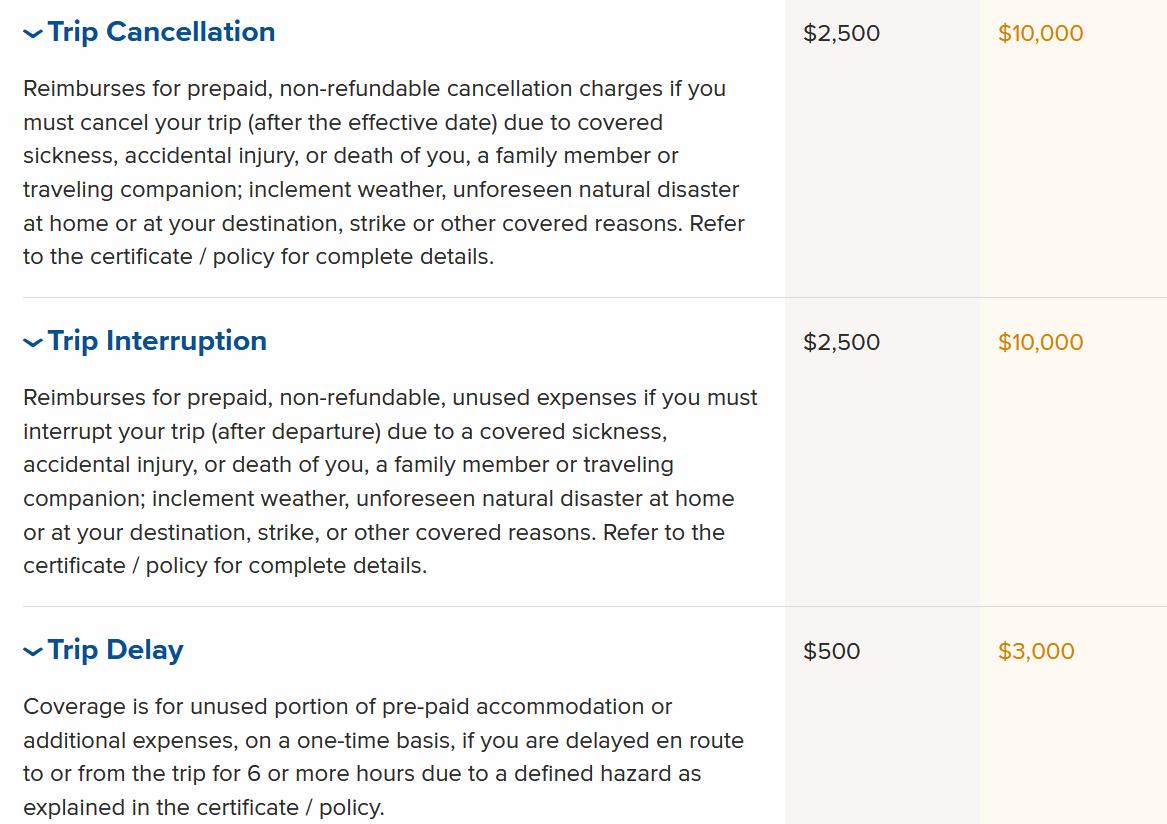

Trip Cancellation, Interruption, and Delay Coverage

When it comes to trip cancellation, interruption, and trip delay coverages , the 2 World Nomad policy plans offer very different coverage limits. You’ll want to select the level of coverage that is close to matching any expenses at risk should a covered loss occur prior to, or during, your trip.

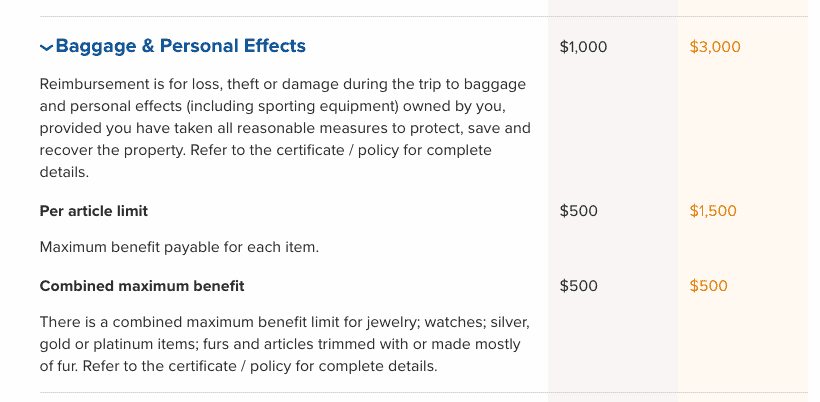

Delayed, Lost, or Stolen Baggage and Personal Effects Coverage

If you’ll be carrying a lot of electronics with you, you’ll want to make sure to select the proper level of coverage, paying close attention to the per-item limit.

Rental Car Coverage

The Explorer plan comes with $35,000 for damage or theft to your rental car. However, World Nomads warns that the coverage may not be accepted by all rental car companies and that the coverage is not available to residents of all states.

Assistance Services

Make just 1 call, 24/7, to receive assistance with emergency transportation, referrals for medical facilities, dentists, and translation services.

Accidental Death and Dismemberment

Both policy plans offer a benefit for accidental loss of life or limb — $5,000 for the Standard plan and $10,000 for the Explorer plan.

With every insurance policy, there are exclusions. Here is a quick summary of losses that are not covered with World Nomads.

- Pre-existing medical conditions that are not stabilized (terms apply)

- Participating as an athlete in professional sports

- War, insurrection

- Participation in military exercises

- Being under the influence of drugs or intoxicants, unless prescribed

- Travel to pursue medical treatment

This is just an abbreviated summary of exclusions. Each coverage has its own list of excluded losses and items that are not covered. You’ll want to read your policy documents thoroughly to be aware of which losses/items are excluded.

Bottom Line: World Nomads offers 2 plans of essential coverages you’d potentially need while traveling. Each plan offers different limits for specific coverages; the greatest differences between plans are for emergency evacuation, baggage insurance, personal effects, and trip cancellation/interruption/delay coverages. If your greatest concern is having medical coverage, either plan could work to meet that requirement.

On the World Nomads website , you can easily secure a quote and obtain immediate coverage. You’ll need to input the countries you’ll be visiting, the dates of your trip, your country/state of residence, how many people are you insuring, and the age of the traveler(s). You will then have the option to view coverages and select the plan you wish to purchase.

Here is a quote for a single traveler, residing in California, age 35, traveling to Mexico for 1 week.

Once you’re selected your preferred plan you can proceed to checkout, enter your personal and payment information, and receive coverage for the start date you requested.

After you receive your issued policy, you will have a 10-day period to review it and if you decide not to keep it, you will get a full refund.

While the cost of your policy will vary depending on the level of coverages selected, the length of your trip, the destinations, your age, and your place of residence, we did a quick comparison for similar coverage for a single traveler, age 35, traveling for 1 week in Mexico.

Above you’ll find the results for similar coverages, however, the medical coverage in our examples was just $50,000 compared to $100,000 with World Nomads. Also, John Hancock offers the additional option to purchase Cancel for Any Reason insurance (+$44) and both Berkshire Hathaway and Generali offer a waiver for pre-existing conditions if the policy is purchased within 14 to 15 days of the first trip deposit.

Bottom Line: In our limited sampling, World Nomads appears to deliver a competitive price with competitive core coverage offerings. Your results will vary based on your own criteria.

World Nomads walks you through submitting a claim with its simple 7-step process:

- Gather your documentation including receipts and invoices.

- Log in to your World Nomads account and select Make a Claim.

- Select the policy for which you’ll be making a claim; each event requires a new claim.

- Answer the questions relating to your claim.

- List your expenses supported by your receipts and invoices.

- Review your claim, summit, and expect an email confirmation.

- Follow up, communicate with the claims team via email , call 844-207-1930 (from the U.S./Canada), or 816-905-3963 from everywhere else in the world.

Remember to take pictures, file any police reports when necessary, and gather documents immediately after the event. It can be difficult to try to obtain supporting documentation once you’ve returned from your trip.

Hot Tip: Be sure to have your policy information with you when you travel, including all emergency phone numbers. Provide these numbers and policy information to any travel companions in case you are unable to make the call. You will be required to contact World Nomads to arrange any medical services and ensure coverage.

There are a lot of reasons to consider World Nomads travel insurance.

Here are some of the pros:

- The company was founded and is managed by travelers who understand the needs of travelers.

- Obtaining a quote and getting immediate coverage is simple.

- You can receive good value for the premium paid (prices will vary depending on your age, length of trip, destinations involved, level of coverages selected, and where you reside).

- Up to 200 activities are included automatically without additional surcharges (the list differs by plan).

- Coverage can be secured or renewed while you’re traveling.

The plans offered by World Nomads are perfect for healthy, active travelers that may travel for extended periods of time, but also serve well to cover just a week-long journey.

While there are a lot of compelling reasons to purchase your travel insurance policy from World Nomads, there are a few drawbacks and information to be aware of.

- World Nomads does not sell Cancel for Any Reason (CFAR) insurance . Granted, this coverage is expensive, does not cover the entire cost of your trip, and is not offered by every travel insurance company. However, it may be important to you if you want to be able to cancel your trip for any reason, including the fear of getting ill.

- If you’re in the U.S. and 70 years of age or older, you will not be able to purchase coverage via World Nomads. The maximum age for purchasing coverage can vary depending on your country of residence. You can, however, purchase via its partner company, TripAssure. To learn more about the best travel insurance options for seniors , check out our article on this specific topic.

- Policies are limited to 180 days in duration . However, World Nomads does offer the benefit of renewing online, even while traveling.

- There is a policy limitation for baggage and personal items. If you carry lots of electronics, as many travelers do, you’ll want to be aware of these limitations. It’s worth noting that some insurance plans do not cover personal items at all.

If you’re looking for travel insurance, it’s a good idea to check out World Nomads . Plus, if there’s a remote possibility you’ll be participating in any 1 of the 200 activities covered automatically on its plans, that’s even more of a reason to consider the company. Few companies cover all of these activities and some charge extra to do so.

The company’s plans may be the best fit for healthy, active travelers. While both plans offered include up to $100,000 in medical coverage, there is a pre-existing condition limitation for coverage. Once again, if you’re active and your primary medical concern while traveling is getting sick or having an accident, even a minor one, this coverage could be a good fit.

If your priority is securing Cancel for Any Reason insurance, covering pre-existing conditions that are not stable, or purchasing a multi-trip annual travel insurance policy, you may find a better travel insurance fit via insurance comparison sites such as InsureMyTrip , TravelInsurance.com , or SquareMouth .

Frequently Asked Questions

Is world nomads travel insurance worth it.

World Nomads is an excellent travel insurance company to consider if you participate in adventure sports or other related activities when you travel as the company covers up to 200 such activities.

Additionally, you can purchase (or renew) coverage while you’re traveling. Most companies have strict guidelines as to when you can purchase coverage and limit the transaction to a defined period preceding your trip.

In the U.S., World Nomad’s plans are underwritten (provided by) Nationwide Mutual Insurance Co., a highly rated, financially sound company.

Does World Nomads cover COVID-19?

World Nomads does not cover trip cancellation due to fear of getting ill. In fact, no insurance company does unless you purchase Cancel for Any Reason insurance.

You will find some coverage for severe illness, including COVID-19, under medical and trip interruption/cancellation insurance with World Nomads. Terms and conditions apply.

Does World Nomads offer annual travel insurance?

No, World Nomads does not offer an annual plan. However, the company does offer a plan for 180 days that can be renewed.

The company also offers the convenience of being able to purchase or renew coverage online while traveling.

Is World Nomads better than credit card travel insurance?

The travel insurance that comes with your credit card is not a substitute for a comprehensive travel insurance policy. Also, if you need medical insurance while traveling, you won’t find comprehensive coverage on a credit card.

In addition, most credit card travel insurance is secondary, meaning you must file a claim with any applicable insurance you have first. This could include airlines, travel providers, personal insurance, etc. Having a comprehensive travel insurance policy ensures you’ll have primary coverage in most situations.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

World Nomads Travel Insurance Review: What’s Included & What’s Not

I’ve used World Nomads as my travel insurance provider a lot over the years and, though I’ve written about travel insurance in the past, I’ve never properly reviewed World Nomads .

They were the first company I ever used and I’ve continued to use them throughout the years as I’ve traveled. Since I get asked a lot about them, today, I want to share my review of World Nomads Travel Insurance with you.

Here’s everything you need to know about World Nomads travel insurance:

Table of Contents

Who are World Nomads?

What’s included in world nomads insurance policies, emergency medical coverage, emergency dental treatment, lost or stolen baggage, trip cancellation, interruption, or delay, 24/7 assistance, what’s not covered by world nomads, what you can do with a world nomads policy, additional things to remember, travel insurance claims, my experience using world nomads.

World Nomads is a travel insurance distributor based in Australia. It was founded in 2002 by travelers who wanted to address the three key concerns: freedom, safety, and connection.

Now, the insurer provides coverage to people from more than 100 countries, offers overseas emergency medical and dental cover for sudden illness and injury, medical evacuation and repatriation coverage, 24-hour emergency assistance, some coverage for COVID-19, cover for lost, stolen or damaged baggage, cancellation cover, and coverage for over 150 types of adventure activities .

I originally found them via Lonely Planet (but they were also featured in National Geographic and Rough Guides). There are a lot of travel insurance providers out there, but World Nomads was designed for backpackers and budget travelers, which is why I decided to go with them on my first big trip around the world.

World Nomads has two plans: Standard and Explorer. The Explorer Plan typically has a higher premium because it has a higher level of coverage that includes all the benefits of the Standard Plan and a few more, with higher benefit limits.

Unlike most insurance companies, World Nomads covers some higher-intensity adventure activities and sports, even on the Standard Plan. Not all activities, sports, and experiences are covered under every plan though, and coverage varies by the country you’re visiting as well as where you’re from. Always check before purchasing a policy.

Other benefits and services may include:

World Nomads offers cover for overseas emergency medical expenses for accidents or sudden illnesses on both the Standard and Explorer plans.

Its policies also offer coverage for expenses related to medical evacuation or repatriation if you’re accidentally injured. For example, if you’re hiking in the woods and you break your leg, your policy may cover your evacuation to the nearest hospital or back to your country of residence (if deemed medically necessary).

In the images below, the coverage amounts in the left column are for the Standard Plan, while the prices in the right column are for the Explorer Plan.

World Nomads also covers emergency dental treatment for accidental injuries that occur during the trip. It does not include standard dental work, such as checkups or cleanings, fillings, or root canals and the like (or things that can wait until you get back home), however, if you get an injury then that may be covered.

World Nomads offers some coverage for events related to COVID-19, such as emergency medical, trip delay, and trip interruption coverage if you contract COVID-19 while traveling. Be sure to read the policy wording to understand what’s covered and what the benefits are as these vary depending on your country of residence.

Here’s a list of key items and situations not covered:

- Alcohol or drug-related incidents.

- If you’re reckless, acting in an irresponsible manner or not complying with local laws.

- Pre-existing conditions or general check-ups. Read the policy for full details.

- Lost or stolen cash (can vary depending on your country of residence or plan)

- Participation in a sport or activity not listed in the policy wording, or one that’s offered by World Nomads, but you haven’t purchased the required level of cover.

- Not following doctors’ orders: disobeying your treating doctor’s directions and/or those of World Nomad’s Emergency Assistance team.

- Stolen, lost or damaged personal belongings that were left unguarded (or left in a vehicle, even if it’s locked).

- Buy additional coverage if you extend your travel dates.

- Purchase a policy while already on a trip (waiting periods apply)

- Make a claim online

- Access 24/7 Emergency Assistance

- There are age restrictions that apply depending on your country of residence.

- They offer limited gear/electronics coverage.

- You can’t get “cancel for any reason” coverage.

- It doesn’t cover anything related to pre-existing conditions.

- World Nomads premiums vary in cost based on your age, destinations, where you’re from, and your country of residence.

- Rental car damage isn’t covered on Standard plans, and is not available to residents of NY or TX

I’ve been traveling for over 15 years and have only had to make a few claims during that time. Fortunately, for most travelers, travel insurance is something we buy but never have to use.

However, if you do get into a situation where you need to make a claim, there are a couple things that can help.

First, before a trip, I always make sure to save copies of all of my receipts and travel information in my inbox so that I can submit them to World Nomads if I need to make a claim. I also save their emergency phone and email contacts in my phone and inbox so that I can easily contact them in an emergency.

The more documentation you have about your claim, the faster and easier it will be processed. Claims can be submitted online; you simply start a claim, follow the prompts, and submit your documents. World Nomads will follow up if they need anything else from you.

Here are a few things that may make your claiming process easier:

- Injury or illness? Call their assistance teams ASAP and make digital copies of any related receipts.

- Take a photo of your luggage before your trip in case something happens to it (especially your valuable gear).

- If an airline loses your things, tell them straight away, fill in their paperwork and keep a copy.

- Theft? Report it to the police as soon as possible. Keep all documentation from the police.

- Check what refunds you can get first from your transport or accommodation providers. Only if they can’t help should you go to your insurance provider

Making a claim isn’t fun by any means, but it’s quick and simple to do thanks to World Nomad’s online portal. And, since they have 24/7 support, you can reach out to them if you have problems or questions.

Luckily, the airline paid me, and I didn’t need to be reimbursed by my travel insurance policy, but I learned through this process that if you have all your documents and proof, the claims process can be a lot easier.

Another time, in Argentina, I was suffering from anxiety and worried that it was something more. It felt like someone was stomping on my chest. I contacted Emergency Assistance and they took my information and symptoms and gave me a list of emergency doctors that they recommended. They were helpful, quick, and got me a doctor right away. I was very happy with the service and know that if something really does go wrong, they act quickly.

Nobody likes to think about what might go wrong when they travel. But if you plan ahead and ensure that you have suitable coverage, you can travel with confidence knowing that, should something go wrong, you’ll be made whole and have access to a team that can help you navigate the situation.

I never leave home without insurance. You shouldn’t either.

CLICK HERE TO LEARN MORE ABOUT WORLD NOMADS .

World Nomads provides travel insurance for travelers in over 100 countries. As an affiliate, we receive a fee when you get a quote from World Nomads using this link. We do not represent World Nomads. This is information only and not a recommendation to buy travel insurance.

Book Your Trip: Logistical Tips and Tricks

Book Your Flight Find a cheap flight by using Skyscanner . It’s my favorite search engine because it searches websites and airlines around the globe so you always know no stone is being left unturned.

Book Your Accommodation You can book your hostel with Hostelworld . If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

Don’t Forget Travel Insurance Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

- SafetyWing (best for everyone)

- Insure My Trip (for those 70 and over)

- Medjet (for additional evacuation coverage)

Want to Travel for Free? Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need Help Finding Activities for Your Trip? Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.

Hi, I’m Nomadic Matt, the New York Times best-selling author of How to Travel the World on $50 a Day and Ten Years a Nomad, as well as the founder of this website! And I’m here to help you save money on your next trip.

Got a comment on this article? Join the conversation on Facebook , Instagram , or Twitter and share your thoughts!

Disclosure: Please note that some of the links above may be affiliate links, and at no additional cost to you, I earn a commission if you make a purchase. I recommend only products and companies I use and the income goes to keeping the site community supported and ad free.

Related Posts

GET YOUR FREE TRAVEL STARTER KIT

Enter your email and get planning cheatsheets including a step by step checklist, packing list, tips cheat sheet, and more so you can plan like a pro!

World Nomads Travel Insurance Review: Is it Worth it?

On my last trip across Europe, I lost a dental filling. Not the worst thing in the world, but overseas, that minor issue could have easily turned into a major expense. Luckily, I had travel insurance, saving me from a potential nightmare .

The thing is, your regular health insurance rarely covers you abroad. That's why having travel insurance is so important . World Nomads promises to protect your trip, your stuff, medical emergencies, and even all those adventurous activities you might try.

But does World Nomads actually live up to that promise? Whether you're an adrenaline junkie or, like me, prefer a leisurely stroll and a good restaurant, this review will help you decide. Ready to find out if it's worth it? Let's dive in!

World Nomads

World Nomads is one of the first travel insurance companies designed for adventurous, independent travelers. They offer flexible coverage for medical emergencies, trip cancellations, lost or stolen gear, and a wide range of adventure activities. Pros

- Covers 200+ activities

- Offers multi-trip coverage

- Offers coverage up to 6 months

- For trips over 6 months the policy lapses and must be renewed

- Mixed customer service reviews

What We Like About World Nomads Travel Insurance

Getting protected is fast and easy.

One of the best things about World Nomads is how quick and simple they make it to get covered. Everything's done online – you can get a quote and buy your policy in just a few minutes, all on their website .

Your coverage kicks in as soon as your trip starts . And if you're the type who sometimes forgets things during pre-trip excitement (I know I do!), no worries. You can still get protected while you're already on the road , though there might be a short 72-hour waiting period.

Here's a quick rundown of how this travel insurance works:

Head to the World Nomads website and click "Get A Quote".

Pop in your travel details (where you're going, where you're from, and your dates).

Boom! Instantly see quotes for both their Standard and Explorer plans – pick the one that fits your adventure.

Double-check your coverage details and you're all set!

Plans are flexible and comprehensive

World Nomads always have the right plan for your trip, whether you're off on a short adventure or settling in abroad for a while. Let's break down what they've got.

Standard Plans vs. Explorer Plans

World Nomads keeps things simple with two main plans: Standard and Explorer . Both cover the essentials like medical emergencies, cancellations, and your gear. Naturally, Explorer plans boost your coverage limits and protect more activities – but they also cost a bit extra .

Here's a quick side-by-side to make the comparison easier:

- Trip protection : Stuff happens, unfortunately. Both plans have your back if you need to cancel for reasons like a family emergency or a natural disaster. Standard plans cover up to $2,500 , Explorer bumps that up to $10,000.

- Emergency evacuation: This covers transportation if a serious situation arises, like a family member passing away or needing urgent hospitalization. Standard offers up to $300,000 , Explorer up to $500,000 .

- Emergency medical care: Accidents and sudden illnesses can happen anywhere. Both plans have you covered for up to $100,000 for those unexpected medical needs.

- Lost or damaged gear: Take it from someone who's been there – this is very important! Both plans help replace your damaged, lost, or stolen bags, tech – all the important stuff. Standard covers up to $1,000, Explorer up to $3,000.

- Activities: They cover over 200 activities , but if you're an adrenaline junkie, definitely double-check what's included. More on that later in this review!

- Accidental Death: Standard plans will pay a death benefit of $5,000 , if you pass away because of an accident or are dismembered. Explorer plans will pay $10,000 .

Single and Multi-Destination Coverage

World Nomads works whether you're sticking to one country or traveling to multiple destinations .

Their multi-destination plans make things super easy – a huge relief if something like your passport goes missing on the road!

Long-Term Coverage

If you're a US-based digital nomad , World Nomads has you covered for up to 6 months at a time .

And if you're loving your temporary home abroad and those 6 months fly by, renewing your policy is extremely easy – it kicks in right at midnight the next day .

Adventure Without Worry with World Nomads

They cover your favorite activities, wherever you roam.

They cover over 200 activities

Let's be honest, if you were just going to work the whole time, you might as well stay home! World Nomads gets that exploring is a major part of the digital nomad lifestyle! So, they offer one of the best travel insurances for adventurous travelers, covering over 200+ activities .

In their Standard plans alone, World Nomads covers over 70 sports and activities, including:

- Soccer (or football, whichever you prefer!)

- Weight training

- Martial arts

Explorer plans go even further! But hey, every insurance plan has its limits, and super high-risk activities usually aren't included. So, before you start packing those hiking boots or your scuba gear, be sure to double-check their website for the full list of what's covered .

Some Things to Keep in Mind about World Nomads Travel Insurance

Common exclusions still apply.

Like any insurance, World Nomads has some limits on what they'll cover. If you get hurt doing something illegal, while under the influence, or that's considered seriously reckless...chances are World Nomads won't be covering you .

Pre-existing medical conditions also tend to be excluded . For this reason, it's always smart to read the not-so-fun parts of your policy – those exclusions – to make sure you understand them and ultimately find the best travel insurance for your circumstances.

It's not the cheapest option out there

World Nomads is perfect for adventurous travelers . But for someone like me whose main sport in the morning is a gentle yoga routine, or a dip in the ocean, you might find more budget-friendly travel insurance options .

After all, World Nomads covers a ton of riskier activities and emergency medical care , which understandably comes with a slightly higher price tag .

To give you an idea, a World Nomad Standard plan for a 45-year-old US resident traveling to Europe for 90 days (about 3 months) is roughly 3% more expensive than a comparable SafetyWing plan . That difference gets even bigger for younger travelers – almost twice as much for someone who's 25.

You might also be interested in:

Customer service reviews are mixed

While World Nomads offers 24/7 emergency assistance (which is crucial!), their everyday customer service gets mixed reviews.

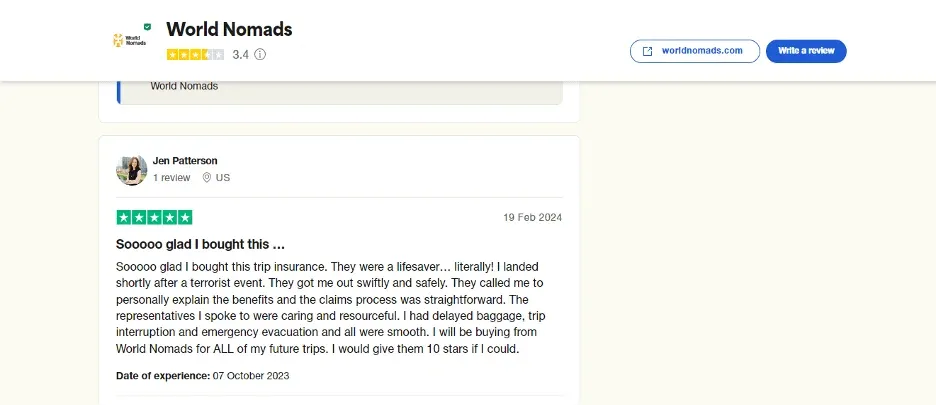

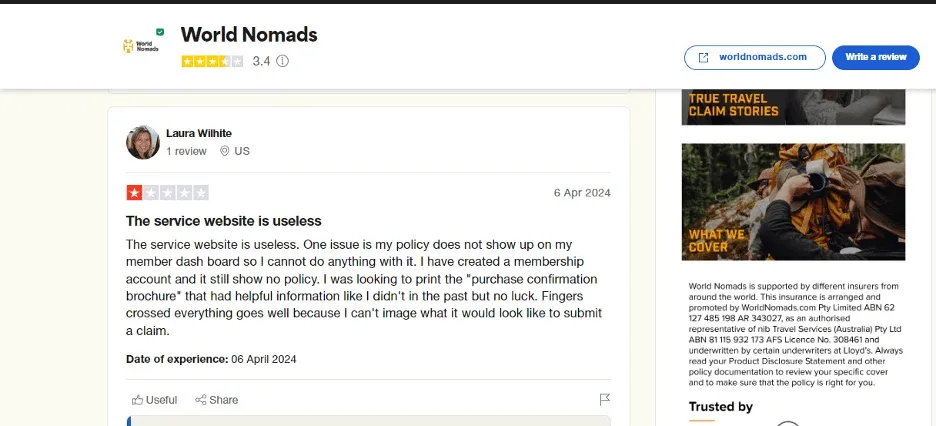

World Nomads travel insurance has 3.4 out of 5 stars on Trustpilot. There, you'll find plenty of happy customers praising their easy claims process and the support they felt in a crisis .

But, others mention issues with missing paperwork, their website, or frustrating claims experiences .

It's not ideal for long-term travelers

World Nomads does offer plans for longer trips, but if you're planning to be away for more than 6 months, there are some things to keep in mind:

- Coverage gaps: Ugh, the worst. Your policy will automatically expire after 6 months , and when you renew, there's a waiting period before your new coverage starts . Not ideal! Other travel insurance companies like Safetywing or Genki let you extend your policy without any breaks in coverage – kind of like a subscription service, which is definitely easier.

- Prices can vary: World Nomads prices your policy based on where you're going. Some other companies offer a flat rate for multiple destinations, which could potentially save you some money.

- Pre-existing conditions aren't covered : As discussed before in this guide, World Nomads excludes treatment for pre-existing conditions. You might find other travel insurance companies that provide that for long-term digital nomads or expats .

Making a Claim with World Nomads

World Nomads makes the claims process as straightforward as possible with an online guide – that's always a good sign!

But remember, they're not your everyday travel medical insurance . They're designed for those unexpected emergencies – hospital stays, evacuations, those major situations. For smaller issues, you'll probably need to pay upfront and get reimbursed later . And if it's a serious emergency, always contact their emergency assistance team first!

How you file a claim might change slightly based on your location, but the general process is the same:

Collect your receipts and keep them safe! You'll need them.

Head to their website , log in (or create an account) and click "Make a claim".

Select your policy in their dashboard and file a separate claim for each incident .

Answer their questions regarding your claim.

List your expenses and provide answers to their questions.

Upload those receipts and any other supporting documents they request.

Submit your claim – you'll receive an email confirmation from Trip Mate and your claims number.

If any further information is required, you'll be contacted by Trip Mate . Once all your information is received, they will make a determination about your claim within 20 business days . Claims are paid by electronic email or check .

Are There Any Travel Insurance Alternatives to World Nomads?

World Nomads isn't the only product on the travel insurance map. Other companies offer travel plans with different features and coverage amounts. Let's see the top alternatives.

SafetyWing offers pay-as-you-go coverage at affordable rates in over 180 countries . Their plans are nomad-friendly as you can pay upfront for a specific amount of time or continuously every 4 weeks, with the right to cancel at any time . Medical care doesn't have to be provided by a medical professional within their network, so you can visit any local provider and then file a claim.

The downside is the maximum amount of coverage they provide is $250,000 for medical coverage, property, and travel delay.

Genki provides both travel insurance and international health insurance . Their travel insurance plans resemble other policies regarding medical care, activities, and emergency transport. Where Genki really stands out is with its international health insurance plan, Genki Resident . This coverage is most like a comprehensive health insurance plan. It covers pre-existing conditions, check-ups, mental health treatments, pregnancy and more . You can choose a deductible to lower the cost of your travel health insurance and choose between the Standard and Premium of their international plans.

Heymondo offers annual multi-trip coverage and travel insurance with varying benefit levels to choose from. You can download their app to get assistance at the drop of a dime. You can chat, make emergency calls, and manage incidents all through the app.

The Bottom Line

World Nomads deserves kudos for becoming one of the first travel insurance companies to consider the needs of digital nomads , way before the world went remote due to Covid-19.

But the world of travel insurance has expanded since then , and so have our options as frequent travelers. If you're the type who needs coverage for serious adventure activities, World Nomads is still a great option. But, for those of us who prefer a budget-friendly plan with solid basics, there might be better deals out there .

So, before you commit to World Nomads, check out other travel insurance companies . You just might find the perfect fit for your travel style (and your wallet!).

Ready to Get Insured and Travel Safe?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

Sign up for our Newsletter

Receive nomad stories, tips, news, and resources every week!

100% free. No spam. Unsubscribe anytime.

You can also follow us on Instagram and join our Facebook Group if you want to get in touch with other members of our growing digital nomad community!

We'll see you there, Freaking Nomads!

Disclosure: Hey, just a heads up that some of the links in this article are affiliate links. This means that, if you buy through our links, we may earn a small commission that helps us create helpful content for the community. We only recommend products if we think they will add value, so thanks for supporting us!

Heymondo Review: Is It a Good Travel Insurance?

How to beat your post-travel depression: your guide to feeling better, how to create a healthy work-life balance while working remotely.

Suggested companies

Allianz partners usa.

World Nomads Reviews

In the Travel Insurance Company category

Visit this website

Company activity See all

Write a review

Reviews 3.4.

2,544 total

Most relevant

Easy to understand and know what to do

We haven't had a claim so only have experience with purchasing. Everything is clear and easy to compare with other companies. It offers what we need and when I've had a question, customer support has been very knowledgeable and quick to respond. I like that I get emails with reminders of how to contact them in an emergency before we leave on our trip so I can bookmark it for quick reference.

Date of experience : June 02, 2024

Reply from World Nomads

Hi Y - thanks so much for the 🌟🌟🌟🌟🌟 review! Hope you have an amazing trip. Safe travels - Belle ✈️ World Nomads

I wouldn't recommend World Nomads

I wouldn't recommend World Nomads. I had an accident abroad on holiday, ended up breaking both my feet, and ended up in a wheelchair for 8 weeks, with protective boots, then crutches, and only just starting to walk after 4 months. I was out of work for 3 months. I am an athletic person, and I am still not able to jog yet. The breaks in my feet took over 4 months to heal. World Nomads rejected my claim to cover me for the personal accident. I had to book new flights to fly back home, no compensation, and there was no help or assistance at all throughout the experience. I will make a complaint to have my claim reconsidered as I am suffering long-term pain.

Date of experience : December 08, 2023

Hi Hannah! I'm very sorry to hear about your experience 😥 I have forwarded your feedback onto the correct team to contact you. Safe travels - Leah ✈️ World Nomads

No discounts available?

This is my second time purchasing from World Nomads. I had troubles logging into my account and could not use the 7% discount for repeat customers. When I wrote customer service and asked about it, I was told "Unfortunately, due to financial service laws, we are not able to provide discounts of the plans for residents of the US." What the heck!!!!

Date of experience : May 30, 2024

Hi Charlotte! Sorry to hear about your experience 😥 I have requested more information so that we can look into this further. Safe travels - Leah ✈️ World Nomads

My trip was canceled due to some…

My trip was canceled due to some issues, I sent email and my account was refunded within 2 days with full credit thanks for your help and understanding my situation.

Date of experience : June 04, 2024

I’ve used World Nomads many times as…

I’ve used World Nomads many times as it’s very convenient to arrange your travel needs, a nice experience to begin my vacation.

Hi Mark! Thank you for the 5 ⭐⭐⭐⭐⭐ review! We are thrilled to hear that you loved your experience with us. Your kind words mean a lot to our team! Safe travels - Lucy ✈️ World Nomads

Easy and understandable as well as…

Easy and understandable as well as economical. This fits our needs very well. We haven’t had a claim so can’t speak to that aspect.

Hi Matt! Thank you for the 4 ⭐⭐⭐⭐review! We are so glad you had a positive experience Worldnomads. Your support is invaluable to us. Looking forward to seeing you again soon! Safe travels - Lucy ✈️ World Nomads

Loyal Repeat Customer Gets Run-Around

A Word Nomads repeat customer for many years, I finally had a claim--a small one involving trip interruption. The website says they process claims in 15 days, which is misleading. As far as I can tell, "process" means that's when an adjuster finally looks at your claim. Assuming it is approved, in "up to17 business days" supposedly payment will be made. At 7 weeks, and much emailing, calling, calls dropping, calls getting passed to different departments, and listening to Muzak, I am informed that I am "in process." Courtesy, both mine and theirs, does not seem to help. I am just glad this claim is not one involving an emergency or large hospital bill.

Date of experience : May 17, 2024

Hi Leigh, we're sorry to hear you had delay's with your claim. I have sent you a request for more information about your policy, so I can chase this up with the correct claims team. Leah ✈️ World Nomads

I think this company is a scam!

I think this company is a scam! I’m disgusted by their customer service and lack of ability to give me my compensation mentioned I will receive in the policy cover. They will reply to your emails with stupid questions that you had just answered and make you do so much work to try get compensation from the airline instead of them. I have been paying for their travel insurance for the past 16 years every time I travel and this is the first claim I’ve requested and they have not been any help to receive my compensation. Complete waste of money!!!

Date of experience : May 21, 2024

Hi Stephanie. We're sorry to hear you had a negative experience. Thank you for being a loyal customer of World nomads, Stephanie. I have sent you a request for more information about your policy, so I can look into further for you. Lucy ✈️ World Nomads

18 months later and they still haven't paid

I went to the emergency room in the US in November 2022 with my insurance card through World Nomads only to find out a few months later that they did not pay the hospital/emergency doctor! Took an entire year to get a majority of the medical bills properly paid. It is May 2024 now and turns out they STILL haven't paid a final portion of the medical bills. I spent hours on the phone and sent dozens of emails (no exaggeration) and every claims agent has no idea of the protocol and says something comepletely different. Truly an awful, stressful, needlessly tiring experience.

Date of experience : May 15, 2024

Hi Kathy, we're sorry to hear you had trouble with your claim. We don't want our nomads to feel this way. I have sent you a request for more information about your policy, so I can chase this up with the correct claims team. Belle ✈️ World Nomads

Good experience

Clear directions, fair price and fast results. I often use World Nomads for my travel insurance. Good to work with.

Date of experience : June 03, 2024

Hi Becky - thanks so much for the five star review 🤩 we really appreciate your comments. Safe travels - Belle ✈️ World Nomads

Change travel dates

I had to change my travel dates and the team ar world nomads customer service were awesome helping me doing this!

Date of experience : May 23, 2024

Hi Linda, Thank you for the amazing 5 ⭐ review! We really love to hear when our Nomads are happy 😍! Safe travels - Ayden ✈️ World Nomads

Lucky escape - feels like a scam

I feel like I've dodged a bullet in cancelling my plan after seeing my Certificate of Insurance, and reading the terms of the policy, and just how many eventualities they will not cover. I initially felt uneasy after it wasn't clearly stated on my certificate what my chosen excess was (.. because I wasn't given an option!) and things didn't seem transparent enough for me to feel confident in the even of making a claim. I bought my policy on the mobile browser, which is sadly lacking in some crucial pre-purchase formalities such as excess amount, sports/ activities you might do on your trip. These things were not mentioned at all. They were very quick to take my money after giving a quote, and then a lot of the information never materialised. Furthermore, when it came to canceling my policy, the desktop version of my account suddenly seemed to have some problems loading and it took several attempts to cancel. I was then immediately kicked out of my account with no way to sign in again. I'm still awaiting an email acknowledging my cancellation or confirming my refund. This is not how an established, professional and safe company operate; they're underwritten by Axa, I'm inclined to just take my money there.

Hi Emma! We're sorry to hear you had a negative experience . Our goal is always to provide excellent customer service, so we're disappointed that we didn't meet your expectations. I have sent you a request for more information about your policy, so I can look into it further . Lucy ✈️ World Nomads

50% increase….…

I received a quote for my upcoming trip. A couple of weeks heater I was reminded to purchase. When I clicked on buy now, the rate was an additional 50%.

Date of experience : May 20, 2024

Hi Gabriel! Sorry to hear about your quote 😥 please send an email to [email protected] with your travel details so that we can look into it. Safe travels - Lucy ✈️ World Nomads

Trip cancellation

World Nomads and Trip Mate made the process of submitting the necessary paperwork needed for my claim easy enough for someone with limited computer knowledge could do. Their review and response time was just a couple of days which surprised me it was so quick. It certainly made the process satisfying after the anguish of having to cancel my dream vacation.

Date of experience : April 20, 2024

Hi Gale - thank so much for the 5 star review 🤩 we're sorry to hear you had to cancel your dream trip, but we hope to travel with you again some day. Belle ✈️ World Nomads

Incapable insurance company in many ways

Once a claim is made they are incapable of replying and helping you resolve the issue. In December 2023-January 2024, I went on a trip where my bag got lost on the way there and I was left without any of my stuff. I made a claim as soon as I got home and it took them months to reply. Then they took weeks to reply to my emails and when they finally said they would send the money for the claim, they didn't and removed my claim and email so I could no longer email them. Since it's now May 2024 and I haven't received anything I thought I would give them a call and NOTHING! I was on hold twice for 30 minutes to be hung up on as soon as it sounded like someone picked up the call. This is completely unacceptable and disgraceful to any of their customers.

Date of experience : May 13, 2024

Hi Laura, 😢 We're very sorry to hear of your claim experience and would like to help! I have requested further information so we can take a closer look at your case and escalate this to the respective team - Ayden ✈️ World Nomads

I forgot to buy travel insurance before…

I forgot to buy travel insurance before I started my trip World Nomads had a short wait period but I was able to get covered. That is a big relief. I think their plan is perfect for those of us that are on the go.

Date of experience : May 19, 2024

Hi Rob, Thank you for taking the time to leave us a review. We are thrilled to hear that you loved your experience with us. Safe travels - Babita ✈️ World Nomads

We were of course super bummed when my…

We were of course super bummed when my husband was injured just over a week before our big Morocco/Southern Euro trip. I had no idea how insurance would pan out, but was so thankful that Trip Mate and World Nomads were so obliging and pretty expedient! It was about six weeks between filing the claim and getting our checks. When we rebook our trip, I will definitely go through this company again.

Date of experience : April 26, 2024

Hi Michelle - we're so sorry to hear about your husband's injury 🤕 but we're glad we were able to help! We hope we get to travel with you again in the future. Belle ✈️ World Nomads

During my trip to thailand I got sick…

During my trip to thailand I got sick and got Covid-19, stayed in hospital BH hospital in huahin. 5 days of treatment and medical care, Trip made was very supportive and helpful during my illness. And covered my expenses after I filed the claim and presented all the necessary documents.

Date of experience : March 21, 2024

Hi Gilles! I am sorry to hear that you were unwell on your recent trip to Thailand, I hope you have made a full recovery. We appreciate your feedback and are delighted to know you enjoyed our Service. Your satisfaction is our top priority, and we look forward to serving you again soon. Thank you again for the ⭐⭐⭐⭐⭐review! 😀 Lucy ✈️ World Nomads

Unable to log in to my account for over 2 months.

Getting claims paid out is good; it takes a bit of time, though. However, I can't log in to my account with the password reset option. World Nomads needs to update its website. Customer service is unresponsive when it comes to helping me log in.

Date of experience : April 29, 2024

Hi Vincent, It's great to hear that you were happy with your claim outcome! Let's help you fix your login issue. I have sent a request for more information in order to help you get access to your account again. Safe travels - Leah ✈️ World Nomads Hi Vincent, Thank you for providing your details. I have sent an email with instructions on how to fix your member account so you are able to login and view your policy online! Safe travels - Leah ✈️ World Nomads

The young lady l dealt with, Lauren, was fantastic. My problem was resolved upon her reply to my email. No back and forth, no nonsense. Perfect.

Date of experience : May 27, 2024

Hi Terence, Thank you for the ⭐⭐⭐⭐⭐ review! When our customers are happy, we are happy! We look forward to travelling with you again! Leah ✈️ World Nomads

- Best overall

- Best for exotic trips

- Best for trip interruption

- Best for medical-only coverage

- Best for family coverage

- Best for long trips

- Why You Should Trust Us

Best International Travel Insurance for June 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

If you're planning your next vacation or trip out of the country, be sure to factor in travel insurance. Unexpected medical emergencies when traveling can drain your bank account, especially when you're traveling internationally. The best travel insurance companies for international travel can step in to provide you with peace of mind and financial protection while you're abroad.

Best International Travel Insurance

- Best overall: Allianz Travel Insurance

- Best for exotic travel: World Nomads Travel Insurance

- Best for trip interruption coverage: C&F Travel Insured

Best for medical-only coverage: GeoBlue Travel Insurance

- Best for families: Travelex Travel Insurance

- Best for long-term travel: Seven Corners Travel Insurance

How we rate the best international travel insurance »

Compare the Best International Travel Insurance Companies

As a general rule, the most important coverage to have in a foreign country is travel medical insurance , as most US health insurance policies don't cover you while you're abroad. Without travel medical coverage, a medical emergency in a foreign country can cost you. You'll want trip cancellation and interruption coverage if your trip is particularly expensive. And if you're traveling for an extended period of time, you'll want to ensure that your policy is extendable.

Here are our picks for the best travel insurance companies for international travel.

Best overall: Allianz

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good option for frequent travelers thanks to its annual multi-trip policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Doesn't increase premium for trips longer than 30 days, meaning it could be one of the more affordable options for a long trip

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Some plans include free coverage for children 17 and under

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Concierge included with some plans

- con icon Two crossed lines that form an 'X'. Coverage for medical emergency is lower than some competitors' policies

- con icon Two crossed lines that form an 'X'. Plans don't include coverage contact sports and high-altitude activities

- Single and multi-trip plans available

- Trip cancellation and interruption coverage starting at up to $10,000 (higher limits with more expensive plans)

- Preexisting medical condition coverage available with some plans

Allianz Travel Insurance offers the ultimate customizable coverage for international trips, whether you're a frequent jetsetter or an occasional traveler. You can choose from an a la carte of single or multi-trip plans, as well as add-ons, including rental car damage, cancel for any reason (CFAR) , adventure sport, and business travel coverage. And with affordable pricing compared to competitors, Allianz is a budget-friendly choice for your international travel insurance needs.

The icing on the cake is Allyz TravelSmart, Allianz's highly-rated mobile app, which has an average rating of 4.4 out of five stars on the Google Play store across over 2,600 reviews and 4.8 out of five stars from over 22,000 reviews on the Apple app store. So, you can rest easy knowing that you can access your policy and file claims anywhere in the world without a hassle.

Read our Allianz Travel Insurance review here.

Best for exotic trips: World Nomads

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Coverage for 200+ activities like skiing, surfing, and rock climbing

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Only two plans to choose from, making it simple to find the right option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You can purchase coverage even after your trip has started

- con icon Two crossed lines that form an 'X'. If your trip costs more than $10,000, you may want to choose other insurance because trip protection is capped at up to $10,000 (for the Explorer plan)

- con icon Two crossed lines that form an 'X'. Doesn't offer coverage for travelers older than 70

- con icon Two crossed lines that form an 'X'. No Cancel for Any Reason (CFAR) option

- Coverage for 150+ activities and sports

- 2 plans: Standard and Explorer

- Trip protection for up to $10,000

- Emergency medical insurance of up to $100,000

- Emergency evacuation coverage for up to $500,000

- Coverage to protect your items (up to $3,000)

World Nomads Travel Insurance offers coverage for over 150 specific activities, so you can focus on the adventure without worrying about gaps in your coverage.

You can select its budget-friendly standard plan, starting at $79. Or if you're an adrenaline junkie seeking more thrills, you can opt for the World Nomads' Explorer plan for $120, which includes extra sports like skydiving, scuba diving, and heli-skiing. And World Nomads offers 24/7 assistance, so you can confidently travel abroad, knowing that help is just a phone call away.

Read our World Nomads Travel Insurance review here.

Best for trip interruption: C&F Travel Insured

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers 2 major plans including CFAR coverage on the more expensive option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cancellation for job loss included as a covered reason for trip cancellation/interruption (does not require CFAR coverage to qualify)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Frequent traveler reward included in both policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1 million in medical evacuation coverage available

- con icon Two crossed lines that form an 'X'. Medical coverage is only $100,000

- con icon Two crossed lines that form an 'X'. Reviews on claims processing indicate ongoing issues

- C&F's Travel Insured policies allow travelers customize travel insurance to fit their specific needs. Frequent travelers may benefit from purchasing an annual travel insurance plan, then adding on CFAR coverage for any portions of travel that may incur greater risk.

C&F Travel Insured offers 100% coverage for trip cancellation, up to 150% for trip interruption, and reimbursement for up to 75% of your non-refundable travel costs with select plans. This means you don't have to worry about losing your hard-earned money on non-refundable travel costs if your trip ends prematurely.

Travel Insured also stands out for its extensive "reasons for cancellation" coverage. Unlike many insurers, the company covers hurricane warnings from the National Oceanic and Atmospheric Administration (NOAA).

Read our C&F Travel Insured review here.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. A subsidary of Blue Cross Blue Shield

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers strong medical plans as long as you have a regular health insurance plan, but it doesn't have to be through Blue Cross

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers long-term and multi-trip travel protection

- con icon Two crossed lines that form an 'X'. Multiple complaints about claims not being paid or being denied

- con icon Two crossed lines that form an 'X'. Does not provide some of the more comprehensive coverage like CFAR insurance

- con icon Two crossed lines that form an 'X'. Buyers who do get claims paid may need to file multiple claim forms

GeoBlue Travel Insurance offers policies that covers emergency medical treatments when you're abroad. While GeoBlue lacks trip cancellation coverage, that allows it to charge lower premiums than the other companies on this list.

GeoBlue plans can cover medical expenses up to $1 million with several multi-trip annual plans available. It offers coinsurance plans for trips within the U.S. and 100% coverage for international trips. It also has a network of clinics in 180 countries, streamlining the claims process. It's worth noting that coverage for pre-existing conditions comes with additional costs.

Read our GeoBlue Travel Insurance review here.

Best for family coverage: Travelex Travel Insurance

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost