An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

Privately owned vehicle (POV) mileage reimbursement rates

GSA has adjusted all POV mileage reimbursement rates effective January 1, 2024.

* Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs).

For calculating the mileage difference between airports, please visit the U.S. Department of Transportation's Inter-Airport Distance website.

QUESTIONS: For all travel policy questions, email [email protected] .

Have travel policy questions? Use our ' Have a Question? ' site

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

MileIQ Inc.

GET — On the App Store

Mileage Reimbursement Rules for Employees and Employers

Mileage reimbursement is a form of compensation businesses provide their employees for using personal vehicles at work. As the name suggests, reimbursements are based on distance traveled and can be completely tax-free if calculated using the standard mileage rate provided by the Internal Revenue Service. The rate is updated annually to reflect the ever-changing gas prices, insurance, depreciation, and other car maintenance costs.

In addition to mileage rates, the IRS specifies what is considered business-related travel and can be reimbursed without paying income tax. For example, daily commuting from home to the regular workplace is not counted as business-related travel.

While mileage reimbursements aren’t mandatory on a federal level, they’re considered a standard procedure, especially in professions that require frequent driving. They’re a crucial mechanism for employers to keep their staff happy and fairly compensated for their business travels.

Understanding Mileage Reimbursement Rules

Employee mileage reimbursement is the process of compensating employees for work-related driving using their personal vehicles. This type of reimbursement is not mandatory in most states, but in many industries, it’s considered a standard procedure that helps maintain employee satisfaction through fair compensation. The only states that require businesses to reimburse employees for using their vehicles for work are California, Illinois, and Massachusetts.

For reimbursements to be tax-free, companies need to use standard mileage rates provided by the IRS. In 2024, it means that companies can issue tax-free reimbursements at the maximum rate of 67 cents per mile.

Any vehicle reimbursement higher than that is considered taxable income. Still, companies sometimes may choose to offer higher reimbursement rates based on factors like:

- Local fuel and maintenance costs

- Difficult driving conditions

- Industry standards

Therefore, a well-crafted mileage reimbursement policy guarantees accurate travel payment for employees and significantly contributes to attracting and retaining staff.

It’s also worth mentioning that to keep employees happy, some companies choose to implement different compensation methods like a car allowance. In that case, employees have more freedom around using the benefit since it’s not dependent on mileage.

Download MileIQ to start tracking your drives

Automatic, accurate mileage reports.

What Are Employee Reimbursement Methods ?

Mileage-based reimbursements are quite common. They usually result in fair compensation, and they’re quite easy to implement, especially with the help of a mileage-tracking app like MileIQ.

However, other methods may be more suitable for companies and employees, depending on the specific situation.

For example, the actual expenses method is considered more accurate and can result in higher compensation, but it requires much more detailed recordkeeping and accounting for all vehicle-related expenses.

Then, there’s the fixed and variable rate (FAVR) method, which combines the mileage-based approach and the actual expense method.

A slightly less popular method is providing a car allowance. It’s a fixed benefit added to salary, which can be spent entirely according to the employee’s preferences. Remember, that some employers might have usage guidelines that need to be followed.

IRS Mileage Reimbursement Rates

Before we talk about the current rates, it’s necessary to point out that the standard rates set by the IRS only specify the maximum rate at which businesses can reimburse employees for mileage tax-free. In other words, reimbursement payments under or at the IRS limit do not count toward an employee's taxable income.

Because there’s no federal law enforcing mileage reimbursements, companies in most states can set their own rates that can be lower or higher than the standard. Any amount exceeding the standard rate has to be considered a taxable income.

For 2024, the standard mileage rate for business use is set at 67 cents per mile, which means it increased by 1.5 cents compared to the previous year. As always, the IRS determined the rate through an annual study of the fixed and variable costs of operating a vehicle, taking into account factors like:

- depreciation

- maintenance

- fuel prices

Mileage Allowance

Another method of mileage reimbursement is mileage allowance. This is a fixed amount given to employees each month to cover their driving expenses. It’s probably the easiest method of vehicle reimbursement for employers.

However, it is fully taxable, so it may not be the most optimal method from a fiscal standpoint. On top of that, it’s also the most inaccurate form of compensation. Depending on their vehicle use every month, employees usually will be reimbursed either too generously or not sufficiently enough.

Still, it’s often appreciated by employees as it gives them complete freedom in terms of how exactly they spend their allowance.

FAVR (Fixed and Variable Rate)

The Fixed and Variable Rate (FAVR) is a unique reimbursement method that combines a flat monthly allowance with a variable rate per mile driven. This method is sanctioned by the IRS, allowing companies to reimburse employees tax-free for business driving using their personal vehicles.

FAVR takes into account both the fixed costs (depreciation, insurance, license fees) and variable costs (fuel, maintenance, repairs) of operating a vehicle. One of the main reasons for its introduction was to allow companies to build their own reimbursement systems that reflect specific costs and conditions in different geographic areas.

Legal Requirements for Mileage Reimbursement

Only three states require companies to reimburse employees for their use of personal vehicles: Illinois, California, and Massachusetts. Everywhere else, mileage reimbursements are optional, so businesses can create their own policies as long as they align with the IRS regulations.

However, there are general rules for employee reimbursement in the Fair Labor Standards Act. For example, if an employee’s business expenses (such as gas) effectively reduce their income below the federal minimum wage, they must be reimbursed to match the difference.

You can find more reimbursement regulations in the Tax Cuts and Jobs Act. Since its introduction in 2017, employees can’t claim unreimbursed expenses as tax deductions.

Calculating Mileage Reimbursements

The formula for calculating mileage reimbursement is quite simple.

But before you go through the numbers, you should make sure that you track and categorize all your business miles properly throughout the year. There’s quite a wide range of tools that can help you track and prepare documentation for the IRS.

While it’s still possible to keep records in a notebook or a simple spreadsheet, it’s much more convenient to use a mobile tracking app that helps you with all the steps of the process, from mileage tracking to calculating and preparing documents for your tax return.

But if you prefer the traditional way, here’s the formula for calculating mileage reimbursement:

business miles driven * mileage rate = reimbursement

While calculating, remember that not all companies use the IRS standard mileage rates. It’s possible that your employer has a different rate, but if the reimbursements are still based on mileage, the formula remains the same.

Documenting Mileage for Reimbursement

In addition to mileage, the IRS requires a few other details to allow tax-free reimbursements. Records about each trip have to include:

- purpose of the trip

- starting and ending point

- odometer readings

Any missing information may lead to an IRS audit and costly penalties, so that’s another reason to keep your records accurate. Be sure to hold on to any relevant documentation for at least three years — which is typically how far back the IRS checks records during an audit.

Best Practices for Employers

The most important part for employers is choosing the right reimbursement method that will be easy to manage and fair for employees. The basic mileage-based method can work out just fine, but there are situations in which it may be insufficient. For example, if a profession requires not only driving but also renting vehicles, it may be better to use the FAVR method or car allowance.

Communication is another crucial aspect. The mileage reimbursement policy has to be perfectly clear to ensure that employees understand what to expect when it comes to mileage reimbursement.

It’s also important to leave room for discussion and potential optimization. Just like standard mileage rates are updated yearly, employees may ask for the policy update if the rate doesn’t reflect growing prices of gas and other vehicle-related expenses.

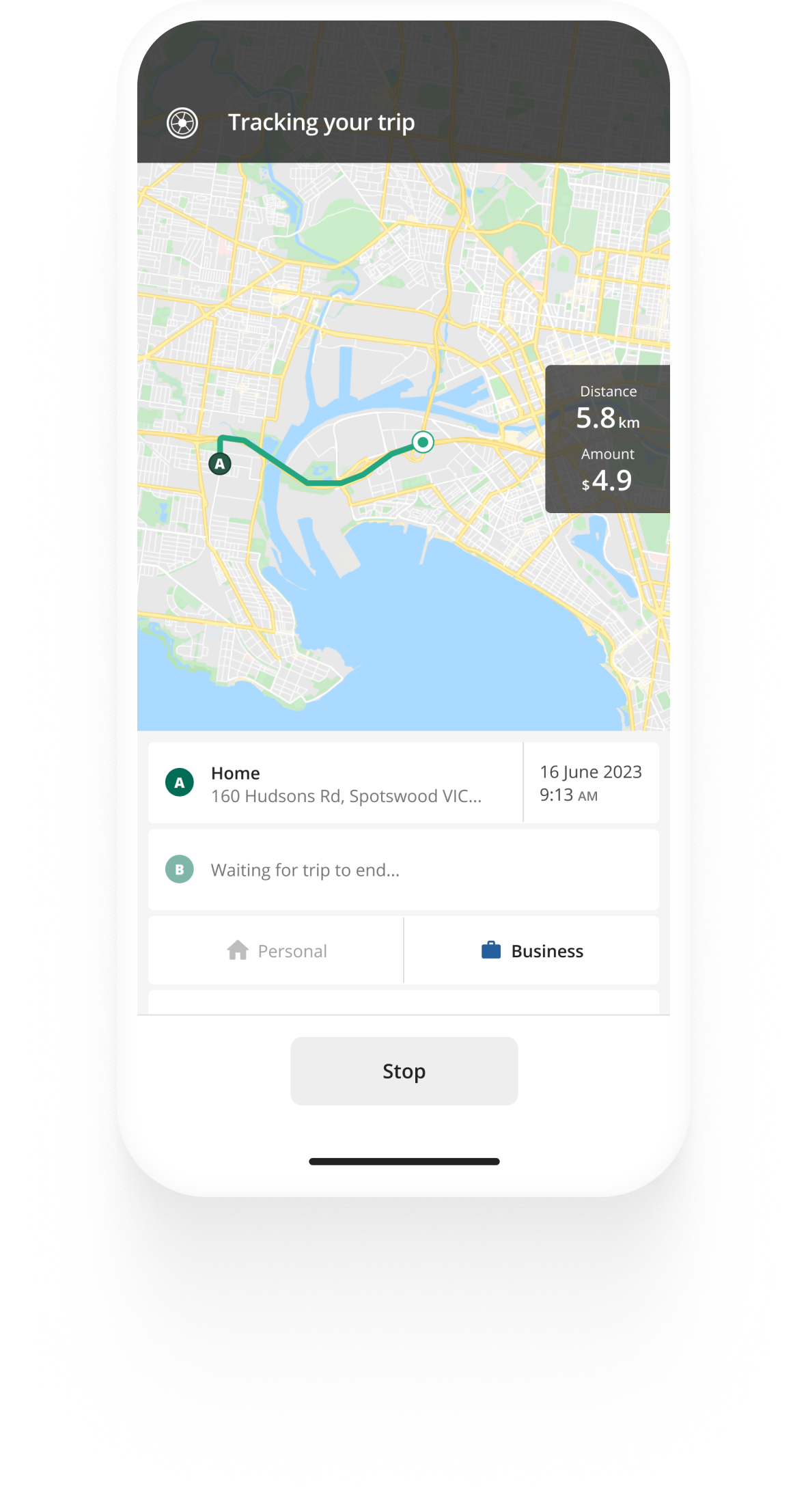

Automating Mileage Tracking

Mileage tracking software and apps, like MileIQ, make employee reimbursements much more manageable by automating the most tedious parts of the process..

Trips can be tracked with just a few clicks, and reports for the IRS can be easily generated at the end of the year. And on top of that, you don’t need to worry about misplacing any crucial documents.

Common Questions and Concerns

There’s always a risk of an IRS audit if there’s any missing documentation or miscalculation, so businesses need to pay close attention to all the records backing tax-free reimbursements. They may review the mileage log and sometimes even ask for supporting documentation proving the purpose of a trip.

That’s why, as an employee, you should make sure to record each business-related trip, including all the relevant information about purpose and date. That way, you’ll have the necessary proof for the IRS and your employer.

Still tracking miles by hand?

Check out more mileage guides.

- English (UK)

- English (CA)

- Deutsch (DE)

- Deutsch (CH)

The complete guide to corporate mileage reimbursement

A guide to corporate mileage reimbursement policies.

- Corporate mileage reimbursement enables taxpayers to claim back money when using personal vehicles, but the system is complex. Here we explain how it works for both employees and business owners.

- Each country has its own standard mileage rate. We look at how the IRS and other revenue agencies calculate these benchmark figures.

- The article provides specific instructions on what both employees and independent contractors must do to claim mileage reimbursement.

How does mileage reimbursement work?

- To go and see a client

- To attend a meeting

- To go and see another employee or manager

- To go and collect business supplies

- To run an errand on behalf of the company

- The time and date of each journey.

- The total distance covered (odometer readings can be useful for noting business miles).

- The destination of each drive.

- A brief description of the purpose.

Does an employer have to pay mileage?

How is mileage reimbursement calculated.

- 67 cents per mile for self-employed and business miles driven (up 1.5 cents from 2023)

- 22 cents for every mile driven for medical or moving purposes.

- 14 cents per mile driven in service of charitable organizations.

- UK £0.45 per mile

- Germany €0.30 per km

- Belgium €0.42 per km

- Spain €0.19 per km

- Portugal €0.36 per km

- Austria €0.42 per km

- Finland €0.53 per km

- Sweden €2.25 per 10 km

- Switzerland the equivalent of €0.76 per km

- Czech Republic the equivalent of €0.19 per km

- Hungary the equivalent of €0.038 per km

- Croatia the equivalent of €0.27 per km

See how much you get back with our mileage reimbursement calculator

Are there any alternatives to the standard mileage rate, does mileage reimbursement need to go through payroll, what is the mileage rate for independent contractors.

- Driving from your workplace to a job site.

- Travel between two work sites.

- Meeting clients.

- Attending meetings away from your usual workplace.

- Returning to your workplace.

?)

Make business travel simpler. Forever.

- See our platform in action . Trusted by thousands of companies worldwide, TravelPerk makes business travel simpler to manage with more flexibility, full control of spending with easy reporting, and options to offset your carbon footprint.

- Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Our latest e-books and blog posts have you covered.

- Never miss another update. Stay in touch with us on social for the latest product releases, upcoming events, and articles fresh off the press.

- Business Travel Management

- Offset Carbon Footprint

- Flexible travel

- Travelperk Sustainability Policy

- Corporate Travel Resources

- Corporate Travel Glossary

- For Travel Managers

- For Finance Teams

- For Travelers

- Thoughts from TravelPerk

- Careers Hiring

- User Reviews

- Integrations

- Privacy Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

- All online calculators

- Suggest a calculator

- Translation

PLANETCALC Online calculators

- English

Distance Cost Calculator

This calculator calculates the cost of travel by multiplying the distance traveled in kilometers (or miles) by the rate per kilometer (or mile).

Calculating the cost of distance travelled is an important task for many people, including drivers, transportation companies, and anyone who needs to budget for travel expenses. The process is fairly simple - the distance travelled is multiplied by the rate per kilometer (or mile) to determine the total cost. For example, if a driver travels 100 kilometers and the rate per kilometer is $0.50, the total cost would be $50.

There are several factors that can affect the rate per kilometer/mile, including fuel prices, vehicle maintenance costs, and labor costs. Transportation companies may also need to factor in other expenses, such as insurance and taxes, when determining their rates. In addition, some companies may offer discounts or special rates for certain types of travel or customers.

Distance Price calculator

Similar calculators.

- • Comparing prices using cost per square meter

- • Cost of one hour (or kilometer)

- • Cost per unit of volume

- • Discount calculator

- • Ton-kilometer. Conversion based on the cost of a kilometer

- • Life section ( 121 calculators )

Share this page

- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

Cents per kilometre method

Check how sole traders and some partnerships can use the cents per kilometre method for car-related business expenses.

Last updated 29 June 2023

This method

Only use this method if you are a sole trader or partnership (where at least one partner is an individual) claiming for a car .

The cents per kilometre method:

- uses a set rate for each kilometre travelled for business

- allows you to claim a maximum of 5,000 business kilometres per car, per year

- doesn't require written evidence to show exactly how many kilometres you travelled (but we may ask you to show how you worked out your business kilometres, for example diary records)

- uses a rate that takes all your vehicle running expenses (including registration, fuel, servicing and insurance) and depreciation into account.

Rates are reviewed regularly. The rate is:

- 85 cents per kilometre for 2023–24

- 78 cents per kilometre for 2022–23

- 72 cents per kilometre for 2020–21 and 2021–22

- 68 cents per kilometre for 2018–19 and 2019–20

- 66 cents per kilometre for 2017–18.

How you use this method

To work out how much you can claim, multiply the total business kilometres you travelled by the rate.

Things to remember

- Apportion for private and business use

- Understand the expenses you can claim

- Keep the right records

Language selection

- Français fr

Reasonable per-kilometre allowance

If you pay your employee an allowance based on a per-kilometre rate that is considered reasonable, do not deduct CPP contributions, EI premiums, or income tax.

The per-kilometre rates that the CRA usually considers reasonable are the amounts prescribed in section 7306 of the Income Tax Regulations. Although these rates represent the maximum amount that you can deduct as business expenses, you can use them as a guideline to determine if the allowance paid to your employee is reasonable. The type of vehicle and the driving conditions are other factors used to determine whether an allowance is considered to be reasonable.

The CRA considers an allowance to be reasonable if all of the following conditions apply:

- The allowance is based only on the number of business kilometres driven in a year

- The rate per-kilometre is reasonable

- You did not reimburse the employee for expenses related to the same use of the vehicle. This does not apply to situations where you reimburse an employee for toll or ferry charges or supplementary business insurance, if you determined the allowance without including these reimbursements

When your employees fill out their income tax and benefit return, they do not include this allowance in income.

Reasonable allowance rates

For 2024, they are:

- 70¢ per kilometre for the first 5,000 kilometres driven

- 64¢ per kilometre driven after that

In the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometer allowed for travel.

For prior-year rates, see Automobile allowance rates .

You own a consulting firm. You have ten employees and four out of ten are engineers and are often on the road. The company does not own any vehicles. The engineers use their own vehicles when they are on the road for work. The company pays them an allowance based on the reasonable per-kilometre rate prescribed in section 7306 of the Income Tax Regulations.

In this example, the allowance is not considered a taxable benefit because:

- the allowance is based on the number of business kilometres driven in a year

- the rate per kilometre is considered reasonable

- the employee is not reimbursed for expenses related to the same use of the vehicle

The allowance should not be included in the employees' income.

Page details

Access to our Brisbane, Canberra and Melbourne offices is currently restricted. To visit us at these locations, call 1300 366 979 to arrange an appointment.

- Income support

- Medical treatment

- Workplace rehabilitation services

- Attendant care services

- Household services

- Aids, appliances and modifications

Travel costs

- Long-term injury or impairment

- Entitlements following a work-related death

You may be entitled to be reimbursed for the cost of travel to attend medical treatment that you need as a result of your work-related injury or illness.

Before you travel

If you want to claim the cost of travel, make sure you meet the requirements and have the necessary evidence and approval before you travel.

Eligibility

To reimburse travel costs, the medical treatment you need must be as a result of your work-related injury or illness.

You must also need to travel:

- in an ambulance, public transport or taxi because of your work-related illness or injury, or

- by private motor vehicle more than 50 kilometres round trip to a single treatment session.

If the type of treatment you need is available from another medical provider who practices within the 50-kilometre round-trip limit, you are not eligible to be reimbursed for travel unless we determine there are special circumstances.

Payment is made at a specific rate per kilometre travelled . This rate is reviewed regularly and updated as appropriate.

How to make a claim for travel costs

Employees of an australian government agency or statutory authority, travel by public transport or taxi.

- Talk to your medical practitioner about your transport needs.

- If your medical practitioner decides that you need to travel by public transport or taxi to your treatment due to your work-related injury or illness, you need a medical certificate or letter from your medical practitioner confirming this.

- Submit the Medical Services Claim form (PDF, 95.9 KB) to us with the medical certificate, together with evidence that you attended the treatment and receipts for your travel.

Travel in an ambulance

- If your medical practitioner considers that you need to travel in an ambulance to your treatment, you need a medical certificate or letter from your medical practitioner confirming this.

- Submit the Medical Services Claim form (PDF, 95.9 KB) to us with the medical certificate or letter, together with the receipt for your travel in an ambulance.

Travel in a private motor vehicle

- Talk to your Comcare claims manager about your transport requirements for medical treatment.

- If the agreed private motor vehicle travel is more than 50 kilometres round trip, complete your journey details on a Medical Services Claim form (PDF, 95.9 KB) and send the form to us.

To submit a form to Comcare:

- email to [email protected]

- mail to Comcare, GPO Box 9905, Canberra ACT 2601.

Employees of a self-insured licensee

If you work for an organisation which is a self-insured licensee, a staff member in your organisation or a third-party provider manages your claim. Speak with your human resources team for more information.

See a list of corporations and organisations with a self-insurance licence .

If you disagree with the determination

If you disagree with our determination, you can ask us to reconsider it. You need to submit an application for reconsideration within 30 days of our determination or apply for an extension of time.

For more information about this process, see Apply for a reconsideration .

Comcare GPO Box 9905, Canberra, ACT 2601 1300 366 979 | www.comcare.gov.au

Date printed 27 May 2024

https://www.comcare.gov.au/claims/supports-benefits/travel-costs

Travel & Expense

Procure-to-pay, integrations, spend management transformation in the ai era: a framework, finance transformation readiness checklist, solving automotive accounts payable challenges with ai automation, demo on demand, mileage allowance payments: complete guide [2024].

Home / Mileage Allowance Payments: Complete Guide [2024]

- Last updated: September 26, 2023

- Travel and expense management

Growth Marketing Manager

When it comes to business travel, there are many times when you want to make sure your mileage allowance covers the distance of your journey.

This guide will explain how to calculate and track your mileage allowance so that you can manage your journey in the most effective way possible.

First off, let’s explain what ‘mileage allowance’ is.

What is mileage allowance and why is it important?

Mileage allowance is essentially a sum of money that employees receive based on the number of miles they drive for work-related purposes using their personal vehicle.

This allowance is important because it helps cover the cost of gas, wear and tear on the vehicle, and other expenses incurred during travel. Without this allowance, they would have to bear these costs out of their own pocket.

What qualifies as business mileage?

Business mileage refers to the distance you travel for work-related purposes using a personal vehicle. It’s an essential aspect of financial tracking for businesses, ensuring that travel expenses related to vehicle use are accurately recorded.

Business mileage includes travel to various locations, such as client meetings, site visits, conferences, and other job-related tasks.

These business expenses are distinct from personal mileage, which pertains to trips made using your own vehicle but for personal reasons, like grocery shopping or commuting to and from your primary workplace.

To qualify as business mileage, a trip must meet certain criteria:

Work-related destination : The trip’s primary purpose must be business-related. This could involve visiting clients, attending work meetings, or making deliveries.

No personal detours : While en route to a business-related destination, any stops or detours for personal activities are not considered business mileage. For instance, if you drive to a client meeting but stop at a coffee shop for personal reasons, that portion of the trip isn’t business mileage.

Home office to work site : If you work from a home office and need to travel to another location for work purposes, the mileage from your home to the work site is typically considered business mileage.

Temporary work sites : If your job requires you to travel between temporary work sites, the mileage between these locations qualifies as business mileage.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

How is mileage allowance calculated?

There are generally two methods for calculating mileage allowance:

Standard mileage rate : Many countries offer a standard mileage rate set by tax authorities. This rate is designed to simplify the reimbursement process. Employees track their business mileage, and the employer reimburses them at the specified rate per mile. The standard rate considers various expenses, including fuel, maintenance, insurance, and depreciation.

Actual expenses : Alternatively, some employers opt for a more detailed approach, where employees track and report their actual expenses associated with business mileage. This includes costs such as fuel, maintenance, insurance, registration, and depreciation. Employers then reimburse the employee based on these documented expenses.

Mileage allowances can differ depending on the industry, company policy, and location, among other things. A good approach is to calculate the average distance you travel for business and multiply it by the applicable mileage rate.

Organizations often provide a standard rate, but you can also find various government websites that list the current rates, so you’re not left guessing.

Mileage tracking methods

Accurate mileage tracking is essential for businesses to reimburse employees and claim tax deductions. There are various methods to track business mileage:

Manual logs : Maintain a physical logbook where you record trip details, including the starting and ending odometer readings, destination, and purpose.

- Odometer readings : Simply record the starting and ending odometer readings for each trip. Keep a record of the purpose and destination.

Mobile apps : Many mobile apps allow you to track mileage automatically using GPS. These apps can record trip details and provide comprehensive reports.

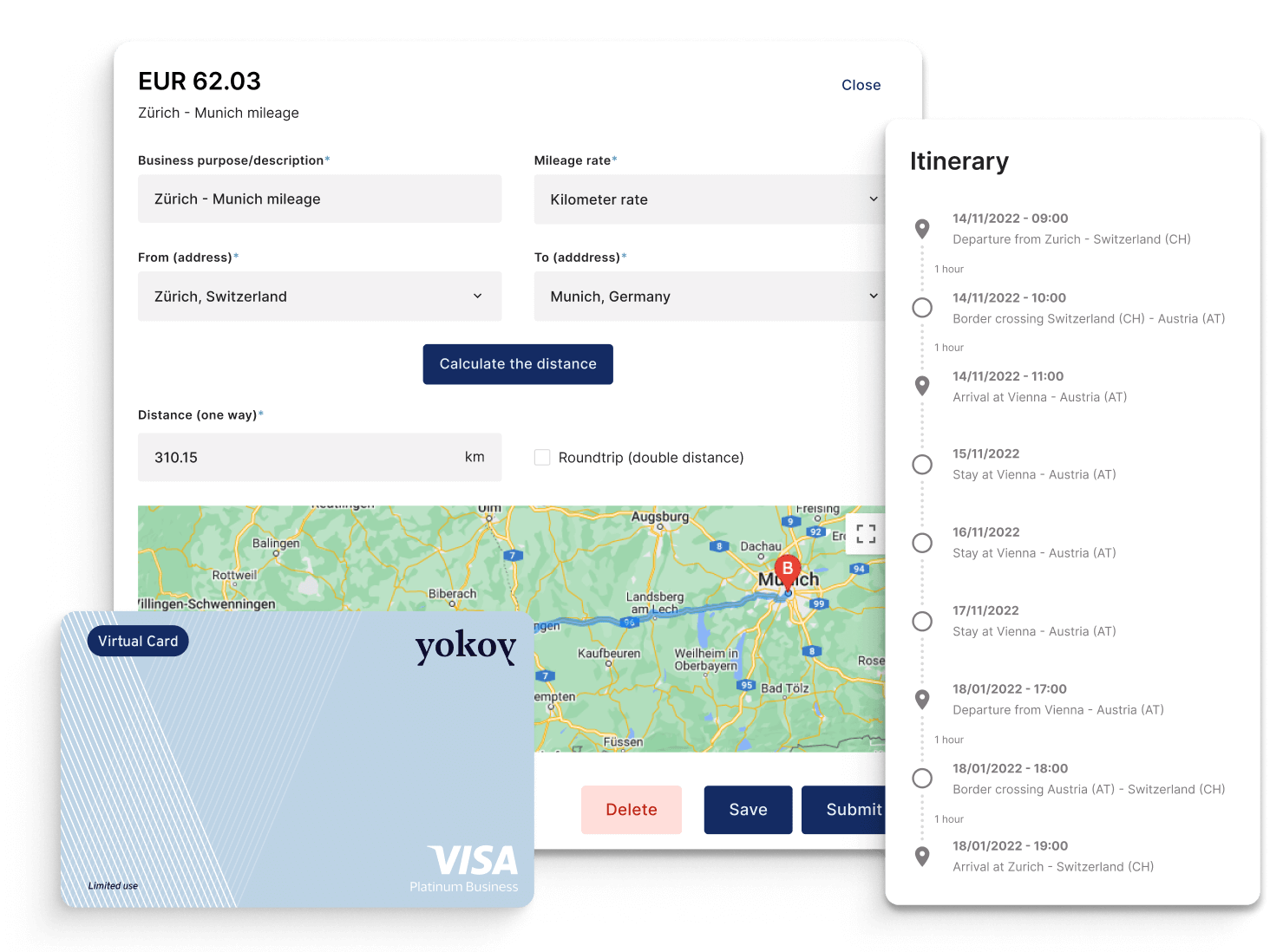

For example, Yokoy’s travel and expense module makes it very easy to track mileage. You only have to add your starting address and destination place, and the rest is calculated for you automatically.

Who pays mileage reimbursements?

Businesses often reimburse employees for business mileage to cover the cost of fuel and vehicle maintenance costs. The approved amounts for reimbursement rates may vary and can be based on factors like company policy or government guidelines.

The standard mileage rate set by tax authorities can be a reference for businesses when determining reimbursement rates.

What are official mileage allowance rates?

Mileage allowance rates vary by country, and it’s essential to stay updated with the latest rates to ensure accurate reimbursement. Here are the official mileage allowance rates for several countries.

Mileage allowance in the UK

In the UK, mileage claims and reimbursement are calculated and paid according to HMRC rules. Whether you’re an employee or self-employed, understanding these rules is essential to ensure you receive accurate mileage reimbursement for your business-related mileage.

If you use your personal vehicle for business-related driving, your employer can reimburse you for your business miles.

This reimbursement, known as Mileage Allowance Payment (MAP), covers expenses like fuel, servicing, maintenance, insurance, and road tax for business-related driving. This HMRC mileage allowance is typically provided on a monthly basis and can be a per-mile rate or a lump sum.

In simple terms, if your trip is for business purposes, it qualifies for mileage reimbursement according to HMRC. Business trips include:

Travel between your permanent workplace and temporary work locations (e.g., visiting clients or suppliers).

Travel between temporary workplaces.

Travel between two workplaces within the same employment.

Travel from your home to another workplace if your home is your permanent workplace due to job requirements.

Commuting from home to work or personal trips unrelated to business do not qualify for reimbursement.

As of the 2023/2024 tax year, the the approved mileage rates are as follows:

Car mileage, which covers cars and vans:

45p for the first 10,000 business miles.

25p for each business mile after 10,000 miles.

For motorcycles:

24p per business mile.

For bicycles:

20p per business mile.

It’s important to note that these approved mileage allowance payment rates have remained unchanged since 2011.

HMRC mileage rates cover various vehicle expenses for your business miles, including fuel, servicing, repairs, maintenance, depreciation, insurance, and road tax. However, they do not cover road tolls, parking fees, congestion charges, speeding or parking fines, or other road-related offenses.

If your employer does not reimburse you, you can claim a mileage allowance from HMRC, known as Mileage Allowance Relief, provided you meet the requirements for business-related driving and maintain an HMRC-compliant mileage log.

Mileage allowance in Austria

Austrian government recognises the below mileage allowances as a flat-rate for all costs incurred for the usage of private vehicles for a business trip. This amount can be recognised for a maximum of 30,000 kilometre per calendar year.

Car – 0.42€/Kilometer

Motorbikes – 0.24€/Kilometer

Passengers – 0.05€/Kilometer

Bicycle – 0.38€/Kilometer

If the company decides to pay more than the government rates (see table above), the difference in amount is considered as taxable income and needs to be accounted for as such (different accounting booking needed for the excess mileage rates).

Compliance in Austria

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates in Austria, while Yokoy keeps you audit-ready.

Mileage allowance in Germany

Mileage expenses are aimed to cover the employee’s commute cost for business trips when using a private vehicle apart from the daily allowance/Per Diem. The German government recognises the below mileage allowances as a flat-rate for all costs incurred for the usage of private vehicles for a business trip.

0.30€ per Kilometer for Car

0.20€ per Kilometer for a Motorcycle

If the employee receives the amount more than what’s recommended by the government, the additional amount falls under income tax.

For example: The government recommends 0.30€ Per kilometer; however,if the employee receives 0.50€ per kilomoter, the difference of 0.20€ per kilometer would be subjected to income tax and needs to be accounted differently.

Compliance in Germany

Stay up-to-date with rules and regulations around per diem rates – including the midnight rule and 3-month rule, mileage allowances, proof of receipt, and VAT rates in Germany, while Yokoy keeps you audit-ready.

Mileage allowance in Spain

Companies can reimburse employees to compensate expenses incurred for the usage of private vehicle for a business trip. In such cases, the employees are entitled to receive 0.19€ per kilometer as “Mileage allowance” recommended by the government.

Mileage allowance in Switzerland

According to Swiss code of obligations, employees are entitled to receive mileage allowances for using their private vehicles for business purpose. The official mileage rates set by the Swiss government are:

CHF 0.72 per kilometer (upto 10,000 Kilometer per year)

CHF 0.60 per kilometer (more than 10,000 Kilometer per year)

For Motorcycle the employees are entitled to receive CHF 0.40 per Kilometer

For Bicycle the employees are entitled to receive CHF 0.30 per Kilometer

Compliance in Switzerland

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates in Switzerland, while Yokoy keeps you audit-ready.

Is mileage allowance tax deductible?

Business mileage can have tax implications. In some countries you can deduct business mileage expenses from your taxable income.

To do this, you must maintain accurate records of your business mileage. The tax authorities typically provide guidelines on how to claim these deductions.

- For example, in the United Kingdom, mileage allowance can be tax-deductible. As shown above, HMRC provides mileage rates that employers can use as guidance for the amount of allowance they should provide to employees. If your employer reimburses you at or below these approved rates, your mileage allowance is not taxed as income. However, if your reimbursement exceeds these rates, the excess amount is considered taxable income.

- In Austria, mileage allowance is tax-deductible for self-employed individuals and employees who use their private vehicles for business purposes. It’s important to maintain accurate records of your business-related mileage and the associated expenses to claim this deduction.

- In Germany, mileage allowance can be tax-deductible for self-employed individuals and employees. The tax authority in Germany provides specific mileage rates for tax deductions. To qualify for the deduction, you need to keep detailed records of your business-related mileage, including the purpose of each trip and associated expenses.

- In Spain, mileage allowance is tax-deductible for self-employed individuals and employees who use their private vehicles for business purposes. The tax authority in Spain provides specific mileage rates for tax deductions. To claim this deduction, maintain accurate records of your business-related mileage and the associated expenses.

Best practices for mileage allowance calculation

To ensure fair and accurate mileage allowance calculation, consider these best practices.

Use reliable mileage tracking tools : Employers and employees should use reliable mileage tracking tools or apps to record and report business mileage. This reduces errors and ensures accuracy.

Compliance with tax regulations : Stay compliant with tax regulations and adhere to the standard mileage rates established by tax authorities.

Regular reimbursement : Aim to reimburse employees promptly for their business mileage expenses. Timely reimbursement is a sign of respect and appreciation.

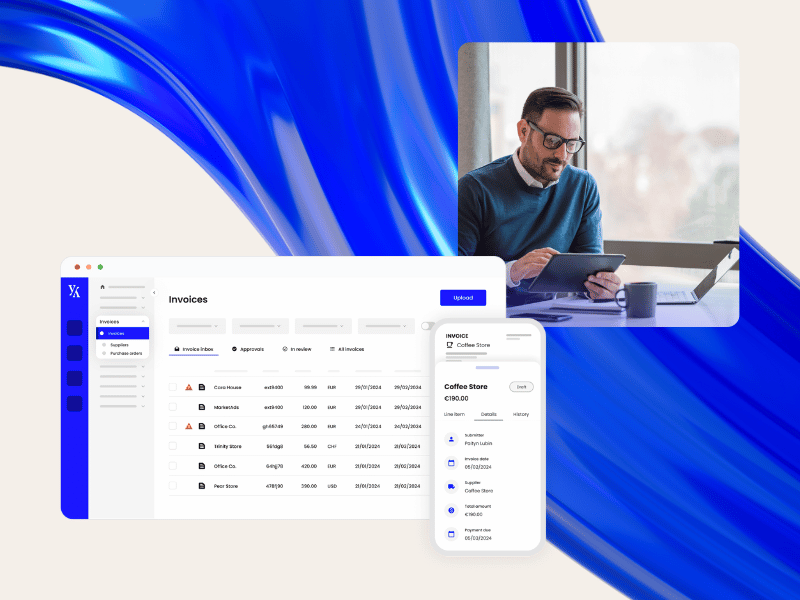

Yokoy’s travel and expense management can help simplify mileage tracking business expense management by automating the entire process, from expense submission and claim to employee reimbursement .

Moreover, through its built-in compliance checks, the Yokoy app ensures all expenses are within company policy, preventing fraud in mileage reimbursements .

If you’d like to see what Yokoy can do for your travel and expense management, book a demo below.

Yokoy Expense

Streamline your travel and expense management

Say goodbye to manual data entry, lost receipts, and complicated reimbursements. Yokoy handles everything from start to finish, for simple T&E management at any scale.

Simplify your spend management

Related content.

If you enjoyed this article, you might find the resources below useful.

Time for Change: Modernising Travel and Expenses at Breitling

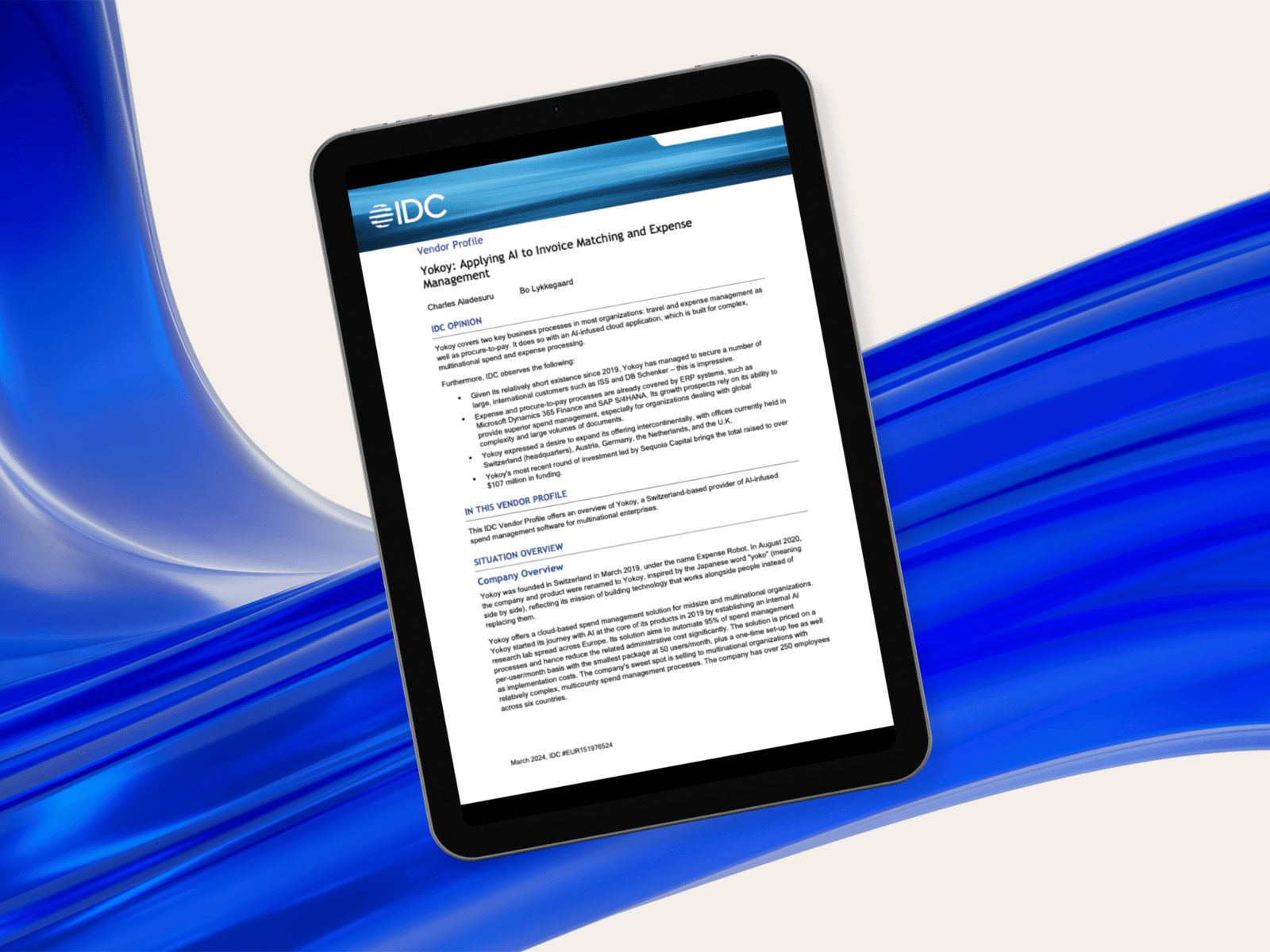

IDC: Yokoy Applying AI to Invoice Matching and Expense Management

Common Challenges in Manual Spend Management Processes

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Track mileage automatically

- The Cents per Kilometre Method

In this article

Requirements for using the cents per km method, how to calculate your claim with the cents per km method, records you need to keep for the cents per km method, the logbook method as an alternative to the cents per km method.

The cents per kilometre method allows you to deduct your car expenses for business-related travel throughout the year. You can deduct a predetermined rate per business kilometre. The rate is set by the ATO every year and is meant to cover the expenses of running your car, including registration, insurance, fuel, maintenance and repairs, as well as car depreciation.

The ATO cents per km rate for the 2023-2024 tax year is 85 cents. Read more about what the rate set by the ATO covers .

The cents per kilometre method allows you to claim up to 5,000 business kilometres per car each year.

You can use the ATO cents per kilometre method to claim your car expenses if you fulfil the following requirements:

- You are an employed individual, and your employer has not reimbursed you for your business kilometres.

- You are a sole trader or a part of a partnership where at least one of the partners is an individual.

- You own or lease the car or hire it under a hire-purchase arrangement.

- Your claim is only for work-related kilometres.

- You claim expenses for a car, which the ATO defines as a vehicle that can carry a load of less than 1 tonne and fewer than 9 people, including the driver. Motorcycles, buggies and other similar vehicles are not considered cars.

Kilometre tracking made easy

Trusted by millions of drivers

Calculate your cents per km claim for car expenses by multiplying the number of business kilometres you travelled in the car by the rate per kilometre for the tax year.

For example, throughout the 2023-2024 tax year, you travel a total of 3,000 km with your car for business. You will be able to claim 3,000 km x $0.85 = $2,550 in work-related car expenses for 2023-2024.

You can also use our ATO cents per kilometre calculator to quickly work out how much you will be able to claim at tax time.

You need to be able to show that you own or lease the car you are claiming for and how you work out your business kilometres.

While employees need to keep records that show how they work out their business kilometres, sole traders and those who are in a partnership aren't required to provide written evidence to show exactly how many kilometres they travelled. However, the ATO may still ask to see how sole traders and those in partnerships worked out their business kilometres.

We recommend that everybody, as a minimum, keep a record of:

- The date of each trip

- Whether it was business or private

- The distance travelled in km

This information is sufficient for you to work out the number of kilometres you can claim a tax deduction for.

Your records can be a physical logbook, a spreadsheet, or a system, such as a mobile app (this is exactly what we do here at Driversnote).

You must keep your records for 5 years from your tax claim submission in case of audits and tax checks by the ATO.

As an employee, a sole trader or somebody in a partnership driving a car for business purposes, you can choose to claim car expenses by the logbook method instead of the cents per kilometre method.

The logbook method allows you to claim the actual car expenses instead of using a set rate per kilometre. These are fuel, oil, registration, insurance, lease payments, services, repairs, tyres, electricity expenses, interest charges and car depreciation.

The logbook method requires that you keep all receipts associated with your car expenses and a detailed logbook, making it more complicated than the cents per km method. This is not to say the method doesn't have its upsides, including lifting the limit of 5,000 kilometres of the cents per km method.

We have also compiled advice and considerations on how to choose if the cents per km or the logbook method is for you .

How to automate your mileage logbook

ATO Mileage Guide

- For Self-Employed

- For Employees

- For Employers

- The Logbook Method

- ATO Log Book Requirements

- Claim Car Expenses In 5 Simple Steps

- Calculate Your Car Expenses Reimbursement

- ATO Car Expenses Deductions

- Car Fringe Benefits Tax

- Is Mileage Reimbursement Taxed?

- Historic Cents Per KM Rates

- ATO Cents Per KM Rate 2021/2022

- ATO Cents Per KM Rate 2020/2021

Automate your logbook

Choose your country or region.

Login Register

Pay calculator tool

Find wages and penalty rates for employees.

Leave calculator tool

Work out annual and personal leave

Shift calculator

Rates for your shifts

Notice and redundancy calculator

- Accessibility

- Subscribe to email updates

- Visit Fair Work on YouTube

- Visit Fair Work on Twitter

- Visit Fair Work on Facebook

- Visit Fair Work on Instagram

- Visit Fair Work on LinkedIn

Automatic translation

Our automatic translation service can be used on most of our pages and is powered by Microsoft Translator.

Language help

For professionally translated information, select your language below.

Popular searches

- minimum wages

- annual leave

- long service leave

Vehicle & travel allowances in the Electrical Award

The vehicle and travel allowances paid to an employee depend on:

- where they start and finish work

- if they’re offered transport by the employer

- if they make their own way to work.

Start and finish at registered office or depot

Employees who start and finish work at their employer’s registered office or depot don’t get paid the motor vehicle allowance, travel time allowance or the start and/or finish on job allowances.

Motor allowance

Employees asked to use their own vehicle for work are paid a motor allowance of $0.91 per kilometre. An example of this is travelling between work sites.

Starting and/or finishing work at a job site

Motor vehicle allowance.

Employees who agree with their employer to use their own vehicle are paid a motor vehicle allowance of $0.91 per kilometre for the distance they travel:

- between their employer’s depot and job sites

- to or from distant work

- when they’re called back to the job to work overtime

- that is more than the distance they usually travel from their home to their employer’s workshop or depot when the job site is more than 50 kilometres from their employer’s registered office or depot.

Travel time allowance

Employees are paid a travel time allowance of $6.77 each day they present themselves for work. The allowance is also paid on rostered days off. Apprentices are paid their apprentice percentage of this allowance.

Start and/or finish on the job allowances

Employees are paid the start and/or finish on the job allowances depending on how far the job site is away from the employer’s registered office or depot.

Less than 50 kilometres from the registered office or depot

When employees start and/or finish work on the job site, they’re paid:

- $22.02 per day when the employer doesn’t offer transport free of charge, or

- $3.95 per day if employer offers transport free of charge.

More than 50 kilometres from the registered office or depot

When employees start and/or finish work on the job site and their employer doesn’t offer transport free of charge, they’re paid:

- $22.02 per day

- their ordinary hourly rate for time spent travelling beyond 50 kilometres, with a minimum payment for 15 minutes.

Employees will also be reimbursed for incidental expenses actually incurred while travelling, such as toll charges. They won’t be reimbursed for motor vehicle expenses if they’re being paid the motor vehicle allowance.

When employees start and/or finish work on the job site and the employer offers transport free of charge, they’re paid:

- $3.95 per day

- their ordinary hourly rate for time spent travelling beyond 50 kilometres.

All rates contained in this article are current as at the first full pay period on or after 1 July 2022.

Electrical Award

What to do next

- Use our Pay and Conditions Tool to calculate pay rates, allowances and penalty rates (including overtime).

- Not sure this is your award? Use Find my award to find out which award applies to you.

- Get help with pay .

You might also be interested in these articles

Give us feedback on this article.

Use our Feedback form to give us feedback about the information in this article.

If you have a question about pay or entitlements or need our help with a workplace issue, you can submit an online enquiry .

The Fair Work Ombudsman acknowledges the Traditional Custodians of Country throughout Australia and their continuing connection to land, waters, skies and communities. We pay our respects to them, their Cultures, and Elders past, present and future.

Bookmark to My account

- Get priority support!

- Save results from our Pay, Shift, Leave and Notice and Redundancy Calculators

- Bookmark your favourite pages

- Ask us questions and save our replies

- View tailored information relevant to you.

Log in now to save this page to your account.

- Fair Work Online: www.fairwork.gov.au

- Fair Work Infoline: 13 13 94

Need language help?

Contacting the Translating and Interpreting Service (TIS) on 13 14 50

Hearing & speech assistance

Call through the National Relay Service (NRS):

- For TTY: 13 36 77 . Ask for the Fair Work Infoline 13 13 94

- Speak & Listen: 1300 555 727 . Ask for the Fair Work Infoline 13 13 94

The Fair Work Ombudsman is committed to providing you with advice that you can rely on. The information contained in this fact sheet is general in nature. If you are unsure about how it applies to your situation you can call our Infoline on 13 13 94 or speak with a union, industry association or a workplace relations professional.

Printed from fairwork.gov.au Content last updated: 2022-07-01 © Copyright Fair Work Ombudsman

- Salary & Income Tax Calculators

- Mortgage Calculators

- Retirement Calculators

- Depreciation Calculators

- Statistics and Analysis Calculators

- Date and Time Calculators

- Contractor Calculators

- Budget & Savings Calculators

- Loan Calculators

- Forex Calculators

- Real Function Calculators

- Engineering Calculators

- Tax Calculators

- Volume Calculators

- 2D Shape Calculators

- 3D Shape Calculators

- Logistics Calculators

- HRM Calculators

- Sales & Investments Calculators

- Grade & GPA Calculators

- Conversion Calculators

- Ratio Calculators

- Sports & Health Calculators

- Other Calculators

Mileage Reimbursement Calculator

You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving.

You can calculate mileage reimbursement in three simple steps:

- Select your tax year.

- Input the number of miles driven for business, charitable, medical, and/or moving purposes.

- Click on the "Calculate" button to determine the reimbursement amount.

Tax Year 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015

Business Rate (1/1 through 6/30/2022) $ per mile

Business Rate (7/1 through 12/31/2022) $ per mile

Medical / Moving Rate (1/1 through 6/30/2022) $ per mile

Medical / Moving Rate (7/1 through 12/31/2022) $ per mile

Charitable Rate $ per mile

Miles Driven in H1 2022 for Business Purposes

Miles Driven in H1 2022 for Medical Purposes

Miles Driven in H2 2022 for Business Purposes

Miles Driven in H2 2022 for Medical Purposes

Miles Driven in 2022 for Charitable Purposes

Understanding Mileage Reimbursement

If you regularly use your personal vehicle for work purposes, you are permitted to deduct the vehicle expenses from your tax return. You have two options available to you when calculating mileage expenses:

- You can keep all your receipts when you pay for any services associated with using your car for work purposes. For example, gas, oil, parking, insurance, lease payments , maintenance, repairs, etc.

- You can simply multiply the number of miles you have driven for work purposes by the IRS standard mileage rate, changes on an annual basis. This approach is referred to as the standard mileage deduction. You can also use this approach to deduct any expenses that you incur while driving for charity, medical, or moving purposes.

The standard mileage rates for 2024 are as follows:

2024 Standard Mileage Rates: IRS Notice 2024-08

IRS Standard Mileage Rates

You may also be interested in our free Lease Mileage Calculator

- Currently 4.77/5

Rating: 4.8 /5 (570 votes)

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

IRS issues standard mileage rates for 2024; mileage rate increases to 67 cents a mile, up 1.5 cents from 2023

More in news.

- Topics in the News

- News Releases for Frequently Asked Questions

- Multimedia Center

- Tax Relief in Disaster Situations

- Inflation Reduction Act

- Taxpayer First Act

- Tax Scams/Consumer Alerts

- The Tax Gap

- Fact Sheets

- IRS Tax Tips

- e-News Subscriptions

- IRS Guidance

- Media Contacts

- IRS Statements and Announcements

IR-2023-239, Dec. 14, 2023

WASHINGTON — The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes.

Beginning on Jan. 1, 2024, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

- 67 cents per mile driven for business use, up 1.5 cents from 2023.

- 21 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces, a decrease of 1 cent from 2023.

- 14 cents per mile driven in service of charitable organizations; the rate is set by statute and remains unchanged from 2023.

These rates apply to electric and hybrid-electric automobiles as well as gasoline and diesel-powered vehicles.

The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. The rate for medical and moving purposes is based on the variable costs.

It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Taxpayers also cannot claim a deduction for moving expenses, unless they are members of the Armed Forces on active duty moving under orders to a permanent change of station. For more details see Moving expenses for members of the armed forces .

Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates.

Taxpayers can use the standard mileage rate but generally must opt to use it in the first year the car is available for business use. Then, in later years, they can choose either the standard mileage rate or actual expenses. Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen.

Notice 2024-08 PDF contains the optional 2024 standard mileage rates, as well as the maximum automobile cost used to calculate the allowance under a fixed and variable rate (FAVR) plan. In addition, the notice provides the maximum fair market value of employer-provided automobiles first made available to employees for personal use in calendar year 2024 for which employers may use the fleet-average valuation rule in or the vehicle cents-per-mile valuation rule.

Subsidy rates

Employee guidance on travel times and payment

On this page, in-between travel payments for employees, payment per average travel distance, calculating average travel times, how the ibt system works out payments, exceptional travel, if you disagree with your payment, if your payments are less than you received before ibt, keeping a travel log, future changes to ibt, example 1 – standard travel, example 2 – round trip exceptional travel, example 3 - standard travel and exceptional travel.

The IBT Agreement sets out how employees will be compensated for travel spent between seeing clients.

The legislation sets out the detail needed to put that into effect — including the:

- mileage rate

- qualifying distance

- qualifying time, and

- maximum travel distance.

IBT includes payment for travel time, distance and Exceptional Travel.

The payment is based on average travel distance across the sector, not actual travel distance.

The average distance travelled by support staff is 3.7km. This is multiplied by the approved mileage rate per km.

The current approved payment is $.635 (63.5 cents) per kilometre.

The distance payment is reimbursement and therefore not taxable. Travel to the first visit is not included.

The average travel time for support workers is calculated at 8.5 minutes. The travel time includes an allowance for time from your car to the door of the client’s home.

How average times were calculated

Data was collated for support worker actual travel time and distances.

This data showed that the majority of support worker visits were less than 5 km. Based on the information provided, the parties agreed on a one band model based on average journeys, that was simple and easy to administer. The calculations are based on averages that are specified in the legislation.

There is an amount built into the ‘time’ payment to allow for circumstances such as travel during peak traffic, poor roads, the time it takes to find a park and time taken to get from my car to the client’s door.

The legislation and guidance to your employer sets out how to work out payments according to time and distance.

The payments compensate for travel time and costs between clients. Your normal hourly rate is paid for time with clients which does not currently include hourly payments for travel costs.

For example, if you providing care for 1 client for 2 hours you do not get paid for the second hour if it's continuous with the first hour and doesn’t require a second separate visit.

The travel payments replace any travel allowance that has been paid previously.

If you visit the same client twice in one day

You will be paid for both visits as long as it is not the first client of the day (except when the first client of the day is an ACC client), and each visit is logged as an appointment in your roster.

Payments for visiting clients who receive ACC support

ACC, while not a party to the IBT settlement, agreed to enter into similar arrangements in respect of the home and community-based support services that it funds.

Payment under ACC will be paid in the same way as IBT funding. ACC will continue to fund for first visits each day.

Reimbursement for walking, bussing or biking

You will be paid in the same way as everyone else. For exceptional travel you will be paid as if you were driving in-between clients.

Under IBT, Exceptional travel is paid when:

- you are required to travel a distance more than 15 km one way to a client

- there is no other employee available who can meet the specific needs for the client

You will be paid for the actual distance and time spent travelling. This applies to:

- first visits each day

- travel home from last visit each day

- in-between clients throughout the day.

The IBT settlement specifies the band for distance travelled and a mileage payment. Exceptional travel is paid after the banded range has been exceeded.

You should speak to your employer in the first instance. If you need to take matters further, you can use the dispute resolution provisions of the Employment Relations Act. You may wish to seek union, or other employment relations, advice at this point.

The legislation states that no employee employed before the Interim Solution that started on 1 July 2015 will be financially disadvantaged by the change to the payment system.

If your entitlement for travel time and costs is less overall under the new system than it was prior to the interim solution, you will be compensated to make sure you are not disadvantaged.

You only need to keep a travel log for trips that are for exceptional travel and if your employer doesn’t have systems to collect the time and distance for these trips. Even a travel log isn't required, it may be useful to keep one initially.

There may be adjustments to IBT once it is in full operation in the sector.

For that reason, there will be ongoing engagement with the settlement parties and other key interested groups and our guidance will be updated where appropriate.

The legislation provides for an annual review of the IBT schedule of payments.

Monitoring issues

A monitoring group has been set up with representatives from Unions, Providers, Health New Zealand, ACC and the Ministry to look at a range of issues going forward, including increasing the minimum mileage rates, the impact the wage increases have had, and financial disadvantage for support workers.

Payment examples

The following examples have been calculated using band level 0

A car leaves home and travels: 4km to Client A unpaid (ACC will pay for first visit), 10km to Client B paid $5.66, 5km to Client C paid $5.66, and 3km home unpaid.

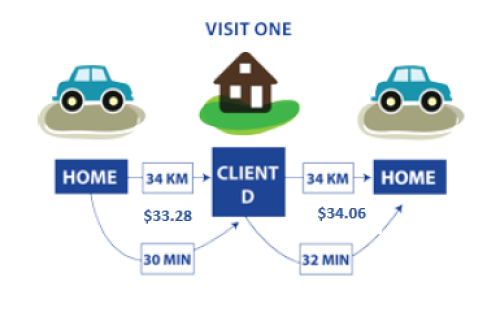

A car leaves home and visiting 1 client. It travels: 34km to Client D for 30 minutes and is paid $33.28, then travels 34km home for 32 minutes and is paid $34.06.

A car makes 3 visits. It travels 4km to Client E unpaid (ACC will pay for first visit), 16km to Client F for 30 minutes and paid $21.85, 5km to Client G paid $5.66, and 21km home for 25 minutes paid $23.08.

- Travelling for treatment and rehabilitation

Request help with travel expenses when you travel for rehabilitation.

You can only get help if we cover your injury.

On this page

Specified kind of rehabilitation.

We can reimburse for travel services described on this page when you travel to the following types of rehabilitation:

- rehabilitation assessment or reassessment

- obtaining an aid or appliance, or having an aid or appliance fitted

- a programme provided under the training for independence

- in-patient rehabilitation that we have approved

- residential rehabilitation that we have approved

- an out-patient rehabilitation programme that we have approved

- a specific programme, service, or course, such as a trial of an employment option or maintenance of pre-incapacity employment, that we require the injured person to attend as part of vocational rehabilitation.

Travel costs we can help with

We can help with the expenses of the following non-emergency travel services:

- private motor vehicle, like a car

- public transport

- other travel, like a taxi service

- accommodation.

Emergency travel

If you received an invoice for emergency travel service or accommodation, get in touch. We may be able to help if it was for an injury we cover.

Get prior approval

In case you need taxi services, other travel services like a hired car or driving companion, or air travel, we ask that you talk to us about them in advance to ensure they're appropriate for your circumstances. Please give us as much notice as possible. We will either organise these services for you with one of our vendors or agree on reimbursement.

Travel by private motor vehicle

A private motor vehicle can be a car, a van or a truck for which you didn't pay a hire fee to use.

We will pay 29 cents, GST inclusive, per kilometre travelled by private motor vehicle if your travel meets any of the following criteria:

- you travel more than 20km from the starting point of your journey to the nearest place for rehabilitation within 14 days after the injury date

- the total distance accumulated from all your journeys to rehabilitation is more than 80km within any calendar month.

Please see the 'Calendar month' section for more details.

Travel by public transport

Public transport can be a bus, train or ferry if it operates on the ground or water and runs on a schedule.

We will reimburse the actual cost you spent travelling by surface public transport, such as bus, train or ferry if your travel meets any of the following criteria:

- You travel more than 20km from the starting point of your journey to the nearest place for rehabilitation within 14 days after the injury date.

- The total distance accumulated from all your journeys to rehabilitation is more than 80km within a one-month period, for example, 15 May to 14 June.

- You spend more than $46 on journeys to rehabilitation within any one-month period.

Travel by other transport services

Other transport category includes services such as taxi, water taxi, e-scooters, e-bicycles, hired car or driving companion service.

We will reimburse the actual cost you spend travelling by other transport services if we agree in advance that:

- it is the best way of getting to your treatment or rehabilitation and

- there are no natural supports available, for example, a driving family member or walking

- you can’t use public transport because of your injury.

Otherwise, the law requires us to pay 29 cents, GST inclusive, per kilometre travelled if your travel meets any of the following criteria:

- the total distance accumulated from all your journeys to rehabilitation is more than 80km within any calendar month

- you spend more than $46 on journeys to rehabilitation within any calendar month.

Calendar month

The calendar month is the period from the same date of one month to the same date of the following month.

For example, if you travelled on 21 February 2021, 22 March 2021 and 1 May 2021, we would consider the following periods as a 'calendar month':

- 21 February 2021 to 20 March 2021

- 22 March 2021 to 21 April 2021

- 1 May 2021 to 31 May 2021.

We can consider any travel that falls within one of these periods towards specific travel criteria, for example, ‘more than 80km in a calendar month' criteria.

For air travel, we must agree in advance that it is the best way of getting to your treatment or rehabilitation because of the long-distance and or your injury. We will either book a flight for you with one of our vendors or reimburse you.

Accommodation

If you can't get home after your appointment, we will contribute $57.55, GST inclusive, per night of accommodation, for a maximum of two nights per week. We don't pay this if you're staying at the treatment or rehabilitation centre.

If your friends or whānau are travelling with you and sharing accommodation, the rate remains fixed at $57.55, GST inclusive, per night, not per person.

Travel by your friends and whānau

We can pay towards your friends and whānau travel expenses if they accompany you on your journey to rehabilitation for any of these reasons:

- the injured person is 18 years or younger

- the medical condition of the injured person requires someone to accompany them

- travel services provider requires someone to accompany an injured person on their journey

We can pay towards your friends and whānau travel expenses if they visit you while you're receiving rehabilitation for any of these reasons:

- your friends and whānau have to make a single journey that is more than 80km in one direction, for example, they have to drive from Hamilton to Auckland, which is 121km

- the injured person is receiving in-patient rehabilitation or residential rehabilitation

Depending on what travel service your friends and whānau use, they must also meet the criteria outlined for travel by that service including that only one return trip per week can be funded. This includes obtaining prior approval for the services outlined in ‘Get prior approval’ section.

If your friends and whānau travel in a private motor vehicle, like a car, with you, we will only pay one person in this instance - yourself or your friends and whānau.

Applying for reimbursement of travel expenses

Complete the ACC250 form and provide necessary supporting information, such as verification from providers and receipts. You'll find more information in the ACC250 form.

ACC250 Request for travel reimbursement

We will assess your request and notify you of our decision. It can take us up to 21 days to make a decision.

If we have your mobile phone and email verified, you will receive an SMS or email notification as soon as we have made a decision. Otherwise, we will send you a letter in the post.

If you want to verify your contact details, have any problems or want to know more about how we can help, contact our claims team:

Phone 0800 101 996 (Monday to Friday, 8am to 6pm) Email [email protected]

Send us your request

If you can't email your request, you can send it via postal services.

If you live in Northland, Auckland, Waikato or Bay of Plenty send to:

ACC Hamilton Hub PO Box 952 Hamilton 3240

If you live in Taranaki, Manawatū-Whanganui, Hawke's Bay, Wellington or the South Island send to:

ACC Dunedin Hub PO Box 408 Dunedin 9054

Types of ongoing support

- Getting aids and equipment to help with an injury

- Help at home after an injury

Transport and getting around after an injury

- Support with childcare and education after an injury

- Counselling and therapy

Related topics

Getting someone to talk to us on your behalf.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Single Trip Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

How single trip travel insurance works

How to choose between travel insurance companies, best plans for single trip travel insurance, other tips for travel insurance for a single trip, travel cards that come with complimentary travel insurance, single travel insurance for a trip recapped.

There are many types of travel insurance, including plans that’ll reimburse you for emergency medical expenses or unexpected travel delays. Along with coverage types, there are also different durations of travel insurance.

Single trip travel insurance will cover you during one vacation, while multitrip or annual travel insurance can last for multiple outings. Let’s take a look at single trip travel insurance, what kind of coverage you can expect and how to choose a plan that works for you.

Purchasing a travel insurance plan is fairly simple, as is making a claim. It generally goes like this:

You gather a few quotes from travel insurance companies.

You pick a plan that suits your needs and customize it to your liking.

You purchase your plan and include a date for it to start.

You go on your trip.

If something happens (such as a flight delay), keep the proof.

You make a claim with your travel insurance company.