Trying to conceive?

« View All Posts

12 Common Embryo Transfer Questions, Answered by IVF Experts

May 2nd, 2024 | 13 min. read

By Sierra Dehmler

After an embryo transfer, it's only natural to want to do everything "right" to encourage successful implantation. Here's a breakdown of what to expect, some important do's and don'ts, and answers to the most frequently asked questions about embryo transfers.

In this article: The Embryo Transfer Day Milestone 12 Common Questions About Embryo Transfer Can I pee (or sneeze) out my embryo? When will I find out if I'm pregnant or not? What are the early signs of pregnancy after embryo transfer? Is bleeding or discharge normal after embryo transfer? What can I do to increase my chances of successful implantation? How long does it take for the embryo to implant after transfer? Can I have sex after embryo transfer? Is bed rest beneficial after embryo transfer? What should I avoid after embryo transfer? What if my embryo transfer isn't successful? Are there any side effects from an embryo transfer? What happens if I get sick after embryo transfer?

The Embryo Transfer Day Milestone

Throughout your in vitro fertilization (IVF) cycle, you've dealt with so many morning monitoring appointments, ultrasounds, medications, forms, phone calls, emails and consults with your doctor - you've probably stopped keeping count.

Now, the day of your long-awaited embryo transfer has finally arrived, and you want to make sure you do everything by the book in order to give that little embryo the best chance at successful implantation.

12 Common Questions About Embryo Transfer

While your Care Team will of course be on standby to provide individualized support, we understand that some things you may be wondering about may feel a bit awkward to bring up to your doctor or nurse.

That's why we're here - to bust some common embryo transfer myths and answer the most frequently asked post-transfer questions!

1. Can I pee (or sneeze) out my embryo?

If you've ever been worried about this, you're not alone! You'd be surprised just how many patients have similar concerns. After going through an entire IVF journey , it's only natural to want to be sure your little embryo will be safe and secure after transfer!

So...can you pee, sneeze, cough or jump too hard and stop your embryo from successfully implanting? Nope! Once that embryo is transferred, it's going to stay put.

Your embryo simply cannot be dislodged from the uterus post-transfer due to you sneezing, coughing, peeing or other bodily functions. Though the embryo will float around in your uterus a little before finding a comfortable spot to implant, these tiny embryos aren't as fragile as you may think!

In a nutshell, don't fret! Your embryo is safe and sound. And of course, if you have any concerns you can't shake, don't hesitate to reach out to your Care Team for reassurance.

2. When will I find out if I'm pregnant or not?

If there's one thing you know at this point in your fertility journey, it's that there is a lot of waiting involved. After your embryo transfer, you'll have to wait about 9-10 days before you return to your fertility clinic for an official pregnancy test (performed via a simple blood test).

Note: We strongly recommend waiting for that official pregnancy test instead of trying to do at-home tests during this 9-10 day waiting period post-transfer, as the medications involved in an IVF cycle can throw off your hormone levels, leading to inaccurate results.

We know it's difficult to hold off, but the blood test we do in the office will provide the most concrete answer (and save you a lot of confusion and anxiety).

3. What are the early signs of pregnancy after embryo transfer?

This is (understandably) one of the most frequently asked questions we hear.

After all this time and effort, you're looking for any possible signs of success. It's important to note that many of the "typical" early pregnancy symptoms can also be caused by hormonal changes caused by prescribed medications. Here's why:

- Medication mimicry: Many progesterone and estrogen medications used in IVF cycles cause side effects remarkably similar to early pregnancy symptoms. It can be impossible to distinguish if these signs are due to medication or an actual pregnancy.

- Individual variation: Everyone's body reacts differently to both embryo transfer and early pregnancy. Some might experience many symptoms, while others have none at all.

Common Signs of Early Pregnancy

Remember: Having (or not having) any of these symptoms doesn't indicate the success or failure of your embryo transfer.

- Spotting or implantation bleeding: Light spotting or brownish discharge around 6-12 days post-transfer could be implantation bleeding, when the embryo attaches to the uterine lining. It's not heavy and usually lasts only a couple of days.

- Cramping: Mild cramps (similar to menstrual cramps) can occur due to implantation or hormonal shifts.

- Breast tenderness: Increased breast sensitivity is common due to hormones, both from medications and potential pregnancy.

- Fatigue: The IVF process itself and rising hormones can lead to tiredness.

- Elevated basal body temperature: Closely tracking your basal body temperature may show a sustained spike, which can sometimes indicate pregnancy.

While it's tempting to analyze every twinge, try to relax and focus on caring for yourself during this waiting period. The blood pregnancy test around 9-10 days after transfer is the only sure way to confirm pregnancy.

Resist the urge to take early at-home tests, as they are less accurate and can lead to unnecessary anxiety.

Embryo Transfer Day 101

What happens before, during and after your embryo transfer? Is embryo transfer painful? A medical assistant answers FAQs to help you feel more prepared for the big day.

4. Is bleeding or discharge normal after embryo transfer?

Light bleeding or spotting after an embryo transfer is common, and looks like a light pink or brown discharge. It is not abundant and lasts up to 48 hours. You might only notice the spotting when wiping.

Note: Contact your Care Team right away if the bleeding is heavy, doesn't stop within a few days, or is accompanied by other symptoms, such as severe cramping or nausea.

If you notice extra vaginal discharge, don't panic! This can be caused by the influx of hormones and blood flow to the reproductive organs, and is one of the body's ways to protect the uterus from infections.

Discharge post-transfer is typically a result of any vaginal medications (like progesterone) that you may be on to encourage implantation. It can appear powdery or gel-like, depending on the situation.

5. Can I do anything to increase the chances of successful implantation?

Actually, yes!

While so many pieces of the fertility puzzle feel completely out of your control , there are some key things you can do surrounding your embryo transfer to help increase your odds of successful embryo implantation.

Here are a few tips:

- Laser acupuncture: This non-invasive, painless treatment has been shown to significantly increase implantation rates when performed before and after embryo transfer. At Illume, we even have an amazing Acupuncture Team on standby for your big day! Learn more about laser acupuncture and embryo transfer or reach out to our acupuncturists directly to get more information.

- Stress reduction techniques: While we will never tell you to "just relax" during your fertility journey, reducing stress around embryo transfer day is helpful (not just for your physical health, but your mental health). Speak with a friend or counselor , connect with our community , practice meditating with the help of an app or free YouTube video , dress in your comfiest clothes, and keep your environment as relaxing as possible.

- Follow your medication protocol closely: Reach out to your fertility nurse with any questions or concerns about timing or dosage. Also make sure you have enough of each of your medications, especially if you are traveling during your cycle. Your Care Team works hard to carefully design a personalized medication protocol to give you the highest chance of success!

6. How long does it take for the embryo to implant after transfer?

The answer to this question really depends on the maturity of your specific embryo, but generally, implantation typically takes place anywhere from 1-5 days after your embryo transfer.

7. Can I have sex after embryo transfer?

It's best to wait to have sex until after your official pregnancy test (9-10 days after embryo transfer). Here are the main reasons doctors recommend waiting to resume sexual activity:

- Uterine irritation: The transfer procedure itself can cause slight irritation to the cervix. Sex could potentially increase the risk of infection.

- Contractions: Orgasms involve uterine contractions. While minor contractions are unlikely to dislodge the embryo, some doctors recommend caution in the early stages of implantation.

Alternatives for Intimacy

- Stay close in other ways: Maintain a loving connection with your partner through cuddling, massages, or other forms of physical affection that don't involve intercourse.

- Open communication: Be honest with your partner about your anxieties and desires. Together, you can find ways to still feel close and in tune with each other during this time.

8. Is bed rest beneficial after embryo transfer?

Directly following your embryo transfer at Illume Fertility , you will rest for 20 minutes before you are discharged that day. Many patients ask if they need to go home and be on bed rest afterward, but there has been no benefit found to going on bed rest after transfer.

You can go about your daily life as you feel comfortable!

However, you should be mindful of how you're feeling, and not do any heavy lifting or intense exercise for the next few days, because we want you to feel confident that you have created the best uterine environment to allow implantation to take place.

9. What should I avoid after embryo transfer?

While your Care Team will provide specific instructions, here are some general tips on what to avoid after an embryo transfer to optimize implantation and your overall well-being:

Activities to limit:

- Strenuous exercise: While light exercise (such as walking or yoga) is encouraged, you should avoid anything that could put excessive strain on your body. This includes heavy lifting, high-impact sports, or activities with a risk of falling.

- Hot baths/jacuzzis: Excessively hot water can raise your body temperature, which isn't ideal for embryo implantation. Opt for warm showers instead.

- Heating pads: Avoid applying direct heat to your lower abdomen, as this could also potentially impact implantation.

- Douching: This disrupts the natural vaginal flora, potentially increasing your risk of infection.

- Smoking, alcohol, and drugs: As these substances can harm your developing embryo, it's important to avoid them completely during this time.

Dietary cautions:

- Excessive caffeine: Try to limit your caffeine intake, as high doses might negatively affect implantation.

- Processed foods: Whenever possible, opt for a balanced diet rich in fruits, vegetables, and whole grains. Processed foods are often high in unhealthy fats and low in nutrients, so do your best to minimize them.

Other recommendations:

- Reduce stress: While eliminating stress entirely isn't possible, finding ways to manage it (especially during this time) is crucial. Practice relaxation techniques like meditation, yoga, or deep breathing exercises. Surround yourself with supportive loved ones and consider joining a support group for people undergoing fertility treatments.

- Check your medications: Not all medications are safe during pregnancy. Double-check with your doctor about any medications you're currently taking to ensure they won't interfere with implantation or early pregnancy.

Thinking about IVF?

Download our free guide to IVF to learn more about how much IVF costs, how long it typically takes, and how this fertility treatment can help you achieve your family-building dreams.

10. What if my embryo transfer isn't successful?

While no one wants to receive the news that their embryo transfer wasn't successful, our team of reproductive endocrinologists here at Illume Fertility work hard to develop the optimal fertility treatment plan for each and every patient to maximize their chances of achieving a successful pregnancy.

Every situation is different, but sometimes, as frustrating as it is, it just takes a few cycles to achieve success. Know that you're in great hands as you move forward, and the odds are in your favor.

If your transfer doesn't result in a positive pregnancy test, it's only natural to feel upset - and then wonder what's next. Trust that your Care Team will come together to rally around you, offer support, and help you figure out the best next step.

11. Are there any side effects from embryo transfer?

The embryo transfer procedure has little to no side effects other than (hopefully) pregnancy!

So while there aren't any side effects typically associated with the actual embryo transfer itself, the side effects of taking progesterone and estrogen can often mimic early pregnancy symptoms - however, they tend to be mild.

Common side effects:

- Breast tenderness

- Constipation

- Bruising at the injection site

Everybody is different - some patients report little to no side effects, and some feel some discomfort. Always reach out to your Care Team if you have any concerns.

12. What happens if I get sick after embryo transfer?

Even if you happen to get sick after your embryo transfer and experience some vomiting, your embryo won't be bothered - it will stay right where it's meant to be, tucked cozily inside your uterus.

Minor illnesses shouldn't affect your embryo's ability to successfully implant in the uterus. However, you should always contact your doctor if you develop a fever or have concerns.

Get Your Hopes Up

The time after embryo transfer is filled with a variety of emotions. You've gone through so much just to get to this point. Be proud of how far you've come!

While your embryo embarks on its incredible journey of development, try to focus on your own physical and emotional well-being. Keep trusting in your body and the incredible world of science, and know that no matter the outcome, you are resilient.

If you've been through unsuccessful fertility treatment cycles before, it can be difficult to stay hopeful as you try again, because you don't want to be let down. But we see your strength and perseverance, and we're here to cheer you on and support you the whole way.

Struggling to shake your anxiety and remain optimistic? Our OB/GYN friend Dr. Shieva Ghofrany has some beautiful advice about why you should still celebrate each step and get your hopes up , even when it feels hard.

Disclaimer: This guide is not a substitute for medical advice. Always consult your doctor about any questions or concerns regarding your specific IVF treatment plan.

Sierra Dehmler

Sierra Dehmler is Illume Fertility’s Content Marketing Manager - and also a fertility patient herself. Combining empathy gained on her personal journey with her professional experience in marketing and content creation, she aims to empower and support other fertility patients by demystifying the fertility treatment process.

Everything You Need to Know About IVF

This comprehensive guide explains each step of in vitro fertilization (IVF) to help you feel more empowered.

More Fertility Resources

Building a family with love & reciprocal ivf | taylor & holly's story.

June 13th, 2024 7 min read

IUI vs. IVF: Success Rates, Differences, Cost & Timeline

June 10th, 2024 26 min read

From Hopeful Parents to LGBTQ+ Advocates | Stef & Denise's Story

June 4th, 2024 9 min read

IVF Attrition Rate: Why Don’t All Eggs Create Embryos?

May 30th, 2024 14 min read

Finding Hope After Failed IUI Cycles | Jessy & Phill's Story

May 21st, 2024 5 min read

A Day in the Life of An IVF Nurse: Go Inside a Fertility Clinic

May 6th, 2024 11 min read

A Twin Pregnancy After Years of Loss & Infertility | Kate & Mike's Story

April 26th, 2024 9 min read

Two Sets of Fraternal Twins in Three Years | Dionicio & Ruddy's Story

April 25th, 2024 8 min read

Finally Pregnant at 49: How IVF Made My Dream a Reality | Alicia's Story

April 22nd, 2024 10 min read

Trying to Conceive With a Unicornuate Uterus | Brittany's Story

April 20th, 2024 8 min read

Choosing Single Motherhood | Kaitlyn's Story

April 19th, 2024 8 min read

Our Journey to IVF Identical Twins | Christa & Aland's Story

March 27th, 2024 9 min read

23 IVF Questions to Ask a Fertility Doctor at Your First Appointment

March 20th, 2024 16 min read

Braving Recurrent Pregnancy Loss & Endometriosis | Katie's Story

March 14th, 2024 8 min read

Illume Fertility Joins the Fight to Protect IVF After Alabama Ruling

March 4th, 2024 17 min read

What Are My Chances of Success with Fertility Treatment?

February 27th, 2024 16 min read

We Don't Speak About Infertility | Shiraine's Story

February 22nd, 2024 11 min read

IVF Success After Endometriosis | Nicole's Story

February 21st, 2024 6 min read

$20,000 IVF Grants Offered to Local Families by Nest Egg Foundation

January 15th, 2024 9 min read

How Years of Infertility Led to Two Miracles | Deanna & Justin's Story

December 14th, 2023 11 min read

The Ultimate IVF Gift Guide for Fertility Warriors

December 5th, 2023 9 min read

How IVF and Genetic Testing Can Help Prevent Sickle Cell Anemia

November 29th, 2023 10 min read

From Injections to Self-Reflections: Your IVF Medication Breakdown

November 27th, 2023 13 min read

How to Pay for IVF Treatment Without Insurance

November 10th, 2023 12 min read

Login or sign up to be automatically entered into our next $10,000 scholarship giveaway

Get Started

- College Search

- College Search Map

- Graduate Programs

- Featured Colleges

- Scholarship Search

- Lists & Rankings

- User Resources

Articles & Advice

- All Categories

- Ask the Experts

- Campus Visits

- Catholic Colleges and Universities

- Christian Colleges and Universities

- College Admission

- College Athletics

- College Diversity

- Counselors and Consultants

- Education and Teaching

- Financial Aid

- Graduate School

- Health and Medicine

- International Students

- Internships and Careers

- Majors and Academics

- Performing and Visual Arts

- Public Colleges and Universities

- Science and Engineering

- Student Life

- Transfer Students

- Why CollegeXpress

- $10,000 Scholarship

- CollegeXpress Store

- Corporate Website

- Terms of Use

- Privacy Policy

- CA and EU Privacy Policy

Articles & Advice > Transfer Students > Articles

A Helpful 2-Year Timeline for Transferring Colleges

Planning to transfer to a four-year college or university? This timeline will help you keep track of what you need to do and when you need to do it!

by CollegeXpress

Last Updated: Jun 7, 2023

Originally Posted: Jun 20, 2011

Planning to transfer to a four-year college or university? Not all transfer students will have the same timeline, and not all transfer students will realize they want to transfer with two full years to plan it. So even though this timeline is based around community college students who are preparing to transfer in two years, it’s comprehensive enough to help any transfer student wherever in the process you are of deciding to transfer and going through the transfer admission process. Use the four-part timeline below to keep track of what you need to do—and when you need to do it!

Year one, fall semester

- Think about your interests, aptitudes, and career goals. The better you know yourself, the more likely you are to find the right college for your transfer.

- Meet with an advisor at your current school to discuss your transfer plans. Most community colleges offer extensive resources for students, including experienced transfer counselors who can help you navigate the process.

- Start researching colleges and universities you might be interested in. Consider such factors as location, size, degree programs, cost, academic and social environment, and job/internship opportunities.

- Look for schools that offer articulation agreements with your current school. Articulation agreements can greatly facilitate your transition to a new institution by guaranteeing the transfer of your earned credits, as long as you maintain a good academic standing.

- Attend transfer fairs. They are a great way to make contacts and get details on many different colleges.

- Focus on your schoolwork and grades. Your performance at your current school is factored heavily into the transfer admission process.

Related: 3 Important Factors to Finding Your Transfer College

Year one, spring semester

- Continue your college research. The more you know about different schools, the better your chances of choosing a college that’s the right fit for you.

- Meet with your advisor regularly. Be sure to keep him or her updated on your progress.

- Develop a “short list” of four or five schools that match your goals, priorities, and academic record.

- Contact the schools you’re most interested in and determine which of your credits will transfer to their degree program.

- Consider satisfying most of your general education requirements before you transfer. This will allow you to focus more on your area of interest once you’re at your new college.

- Visit the colleges on your list, if possible. Nothing will give you a better sense of what a campus is like than visiting it yourself.

- Talk to an admission counselor and at least one professor in your academic interest at the new school. Be sure to bring a list of questions.

- Collect applications from the schools you plan to apply to. Start thinking about essay topics , recommendations, and other materials you’ll need to prepare. Be sure to give your recommendation writers at least a month to complete their letters.

- Carefully record and keep track of all application and material deadlines. Plan to apply as early as possible, especially to schools that admit students on a rolling basis.

- Start researching financial aid . Look for scholarships, loans, and grants, especially within your specific degree program.

- Consider taking summer courses and/or internships. You’ll get an academic jump-start, gain valuable work experience, and bolster your transfer application.

Year two, fall semester

- File your FAFSA as soon as possible after October 1.

- Request a copy of your transcript, and review it carefully. Make sure the information is accurate and complete. In most cases, the school you’re currently attending will send your transcript directly to the colleges you’re applying to, so it’s important to ensure that the details are correct before it is sent.

- Schedule an interview at any schools you haven’t already visited. If you can’t visit in person, talk to admission staff via phone or online. It’s also helpful to contact professors, students, and alumni for questions on courses and campus life.

- Send applications. Make sure each application is filled out neatly, completely, and on time, and that all required materials, including application fees, are submitted.

- Keep a copy of all materials you send. Create a separate file for each college. Include your application, essay, transcripts, letters of recommendation, and any other materials. Note the date you sent each application.

Year two, spring semester

- Analyze your credit evaluation and equivalency statements, which list the courses and credits that will transfer toward your bachelor’s degree, before you decide on a college or send a deposit.

- Review your financial aid package and compare the bottom line for each college.

- Consult with your transfer advisor before you make a final decision . He or she can help answer your questions and clarify details that might affect your choice.

- Double-check deadlines for deposits, registration forms, and other materials, and get them in on time.

- Take advantage of orientation programs and other opportunities for transfer students at your new school. Meeting other transfer students and getting acquainted with campus life will help ease the transition.

Related: The Ups and Downs of the Transfer Experience

Not every transfer student journey is going to look the same. So if this timeline doesn’t perfectly fit the experience you’re going through, that’s okay. Use it as a general guide to help you complete everything you need to get done. In the end, your transfer will be worth it—but first, you need to put in the effort to make sure you prepare yourself and ease your way through the process with the help of the resources at your disposal.

Find more great advice that will fit your transfer journey in our Transfer Students section.

Like what you’re reading?

Join the CollegeXpress community! Create a free account and we’ll notify you about new articles, scholarship deadlines, and more.

Tags: college planning college search transfer admission transfer applications transfer students transferring

Join our community of over 5 million students!

CollegeXpress has everything you need to simplify your college search, get connected to schools, and find your perfect fit.

Ida Akoto-Wiafe

High School Class of 2022

I wanted a school that wasn't too far away from home and could provide me with a full-ride scholarship. CollegeXpress helped me put into perspective the money I had to pay to attend those schools, which ultimately drove me to choose to attend a community college first to get used to being in college before transferring to the University of Michigan–Ann Arbor, one of the colleges I was able to research further on CollegeXpress.

Farrah Macci

High School Class of 2016

CollegeXpress has helped me in many ways. For one, online searches are more organized and refined by filtering scholarships through by my personal and academic interests. Due to this, it has made searching for colleges and scholarships significantly less stressful. As a student, life can already get stressful pretty quickly. For me, it’s been helpful to utilize CollegeXpress since it keeps all of my searches and likes together, so I don’t have to branch out on multiple websites just to explore scholarship options.

Alexandra Adriano

$2,000 Community Service Scholarship Winner, 2016

I've used CollegeXpress quite a bit as a senior, particularly for colleges and scholarships, so it's been a very big asset in that respect! I would recommend it to anyone looking to pursue a college education, especially seniors! This scholarship will help me achieve my goals in ways I couldn't have before, and I know that there are opportunities like that for everyone on the website and in the magazines!

Anthony Vidal

High School Class of 2023

CollegeXpress has helped me in a series of different ways when it comes to finding scholarships and learning information about different universities. I actually found my dream university through CollegeXpress and am working on getting there.

Laura Wallace

High School Class of 2019

My favorite part of CollegeXpress is that it features student writers so I get an inside perspective from students slightly older and farther along than me. I realize that other college websites also utilize student writers; however, I relate the most to the college writers that I read articles from on CollegeXpress.

- Fighting for Your Education: An Expert Look Into Transfer Credits

- Our Best Advice for the Transfer Admission Process

- Great Colleges and Universities in the West for Transfer Students

- Great Colleges and Universities in New England for Transfer Students

- Great Colleges and Universities in the Northeast for Transfer Students

Colleges You May Be Interested In

The University of Texas at Tyler

Vermont State University

Randolph Center, VT

Houston Christian University

Houston, TX

Northeastern Illinois University

Chicago, IL

Carlow University

Pittsburgh, PA

Personalize your experience on CollegeXpress.

With this information, we'll display content relevant to your interests. By subscribing, you agree to receive CollegeXpress emails and to make your information available to colleges, scholarship programs, and other companies that have relevant/related offers.

Already have an account?

Log in to be directly connected to

Not a CollegeXpress user?

Don't want to register.

Provide your information below to connect with

- 7th Pay Commission

- Privacy Policy

- Post office

- Seventh Pay Commission

- 4th to 7th CPC

- Implementation of 7th CPC

- 7th CPC Recommendation

- Seventh Pay Commission Report

- 7th CPC Notification

- CGHS Clarification

- cghs empanelment

- CSD – FAQ

- Latest Price List and Contact Details

- CSD Purchasing Process

- AFD Dealer Contact Details for 4/2 wheeler prices

- Four Wheelers Available

- 2 Wheelers – Availability List

- List of Holidays

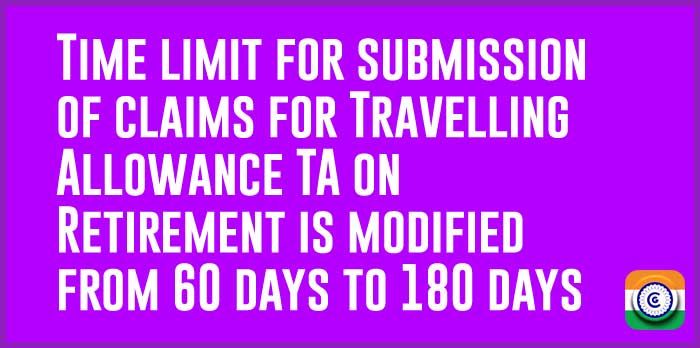

7th CPC TA Rules: Travelling Allowance on Transfer

RECOMMENDED FOR YOU

Siir, For transport of personal belongings by road our office is paying only the rate in km multiplied by the proportional(proportion of max weight allowed by steamer) weight, though the circular says by kilometer only. Is this the correct practice.

Transportation of personal effects by road is as per kilometer basis as per entitlement maximum weight only irrespective of weight of personal belongings.

Dear sir I am mahesh recently i have transferred from Hyderabad to Vijayawada, Hence what are the entitlements i will get and how much reupees i will get I have paid for personal effewcts Rs.13700/-, Bus ticket Rs.1200/- if any other benefits are there please inform

I am Level-3 Employee

Sir i joined a station after completing 3 years tenure on April 3rd,at that time Itook Joining time of 10 days ,on May 12 th Iwas promoted and posted to North East, I joined at present station after relieving and taking 6 days Earned leave on 31.05.2023. I want to know whether my 1st transfer and working for 2 months before relieving to north east will be considered as on tour or not

Sir, I am a defnce employee , was posted from kashmir to Rajouri , I have produced the bills for the transportation of goods to DDO , and due to some.health issues went on medical.leave after joining the station, The laugage what was booked by me was delivered to me by the transporter , now the ddo has initiated the disciplinary action against me stating that I have not shown the laugage to him . Under which rule.am I supposed to show him.the laugage please guide.

production of transportation bill is enough, need not to show the luggage being transported. if insisted approach your higher authority.

Sir my brother is transfered in bsf from ITBP can I take advance Transfer TA if yes what is rule position.

Sir, In my Office; Reimbursement of transportation of vehicle is calculated as follows:- Distance × Rate (15/25/50) × Unladen weight of vehicle ÷ entitled weight.

Please quote the rule position/ order for the above calculation, as it is asked by PBOR through RTI.

Your early reply will be helpful a lot.

Pls clarify i have been transferred from North Andaman(Diglipur) to South Andaman(Port Blair) and what shall be my Composite Grant .Is it 80% or 100%. I work for a Govt Sector in A&N islands

I am a central government officer. my transfer order for transfer from Chennai to Delhi was issued on 08/02/2021. My relieving delayed and relieved on 05.04.2021. I performed journey on 06/04/2021. However my family moved to Delhi on 31.03.2021 because of admission entrance exam for my kids in one school in Delhi. Now PAO in Delhi says my family is not allowed for ticket fare.

Kindly clarify.

tranafer entitlement for family is also applicable 1 month prior to Transfer orders and within 6 months of transfer orders. U can find this rule in Swamy handbook, Transfer TA section as well. PAD is wrong in ur case. quote the rule and reply.

As per rules, family can go 1 month early on new posting station, or upto 6 months later of joining

Sir I detaied tempary duty from sjm to other area (oc 2019 to june 2020) but ta da given to 6 month but recovery to 7 month tpt plus coution money how is posible sir

Sir I wanted to know that if a Cpl in IAF gets promoted on 04 Jul as Sgt and his date of posting is 28 Jul then he will get CTG and other posting entitlements as per the basic pay of Sgt or as per the basic pay of last month(that is of Cpl).

Entitlement of sgt,and basic pay of July

Sir I am serving in BSF at pay matrix 6 and I get transfer on promotion from 6 to 7 level.. Now I want to know that am I eligible to claim my car transport charges..? I was travelled through by train with my family. My languages transport by truck. And my car transported by another container through transport agency..

Sir I am a central govt. employee. I took Rs 50000/- advance on transfer for composite grant and other dues. My journey date is 12.09.2020. I submitted my bill on 04.12.2020 after more than two month. My composite Grant is Rs 45000/- and train fare is Rs4000/-. My office is saying that I have to return whole Rs50000/-. I want to know whether I will get the composite grant or not?

I transferred from portblair to Chennai on public interest. What are the TTA entitlements. Pay level 12.

Sir i am central govt employee transferred on compassionate grounds. Am I eligible for TA on transfer.

Sir I m serving in bsf and posted own request on medical treatment ground in state of Punjab from Himachal. I can claim transfer ta or not

Sir, am Ravi K presently working in BSF recently am attached with staff selection commission, Bengaluru for 3 years. I have a family persmission at old locatation i.e BSF with my own car purchased with permission of BSF MY PAY LEVEL 5. kindly inform what allowance my entailed during the attachment pse

Respected Sir Myself Jitender Sharma working in ncml Pvt ltd. As a Field Associate by third party. my joining 9 march 2017 & one year of provesion period. then i am working contineue to till date my cmpany has give the change of place order via email this is change location is 70 km from my old place. can may apply for the conyance of motorecycle or no any salary increase by employer. how can take the benefits of company.

Thanks & Regards

Jitender Sharma

Sir I m not living with my family at current place of posting and if I live with family at new place of posting with permission. Am I entitled for transportation of my personal effects and conveyance of my family from my home town to new place… what are the conditions

Since it is private transfer (individual), not allowed.

Sir, I m transferred from srinagar(j&k) to patna(bihar) availing travel time and earn leave. Am I entitled for transportation of my personal effects and conveyence from home town Delhi to patna. If so what are the conditions

If your transfer is in public transfer it will be allowed.

if i go on loan basis, will i be eligible for transfer allowance? kindly reply

Office is not doing Finances business. They are having some heads of funds in Budget allotment in so many times if any body has to go transfer the in the month of February/March T.A. funds may not available during that period, actually they have to barrow from outside with more interest & they have to proceed that transfer, otherwise their salary may not be given. If he goes new place of transfer then only his salary & his T.A. claim may be given in the next Financial Year funds only.

Your basic pay, service was protected & you will get increment on 7/18.

I had joined cisf on aug 2017 and joined department of post through proper channel (technical resignation) on march 2018.Am I eligible for transfer T.A.

No, it is not official duty. It is your request.

Sir I posted from Srinagar kashmir to tura Meghalaya north east reason.i have move there single.i am entitled to draw some more then plain area or some for language charge without showingshowing transpo charges slip.some one told me that in NE reasio transfer tax is more than plain area.kindly tell me procedure please

It will be recovered, advance amount with penal interest in your salary.

Sir, please clarify whether GST charged by truck owners over admissibility amount while transporting house hold goods is also reimbursible over restricted amount while restricting with per KM rate. eg A person paid Rs. 80000/- + GST 18% Rs. 14400 for transporting his house goods from A station to B station (distance 1400 KM). He is entitled for Rs.50/- per KM. Thus his entitlement restricted to Rs.70000/- . Whether 18% GST is also reimbursable to him over 70000/- or otherwise.

Entitlement restricted to total of Rs.70,000/- only.

Sir, I am working in central govt and my transfered order came on may 2017 but I relived on 27 Sep 17 and I joined new station on 28 Sep 17 and OM regarding submission of issued on ta bill on 13.03.18 and I have submitted my ta bill on 04.04.18. Pl let me know is it in submitted in due course of time or not?

Where can I download the form for TA. I have taken VRS and am shifting to native town.

how many days a govt servent spent on training with ta da

Sir, I am working in central government department, transferred on promotion in March 2018 and accordingly I drawn TTA advance . But my transfer defer up to 31/03/2019. please let me know can I give penal interest for TTA advance if I am not refund it or not ?

Sir I am working in swr. My transfer order came on may 2017. But l relieved on 31st October 2017. I joined on new place. But I vacated my railway quarter on 30th March 2018. Due to academic year..I claimed for CTG in April lst week.. Please clarify that it applicable or not.

Sir, I am working in central government department, transferred on promotion in August 2017 and accordingly joined at new station. An OM regarding submission of TA bill issued on 13.03.2018. I have submitted my transfer TA bill on 04.04.2018. please let me know is it submitted in due course of time or not ?

Sir, I am working in Central Govt. Department. i got transfer from chennai to Delhi. my lavel is 6. whether i am eligible for flight charges or not?

Sir,i am working central govt employe and my spouse also same dept,now we going to transferred west bengal to Gujarat.so,we avail transfer ta ?

Sir I have Resigned previous Department on 18.06.2017 and joined on 19.06.2017. later on I was transferred on 20.07.2017 (400km) and from there transferred on 20.08.2017 (500km). If I am Entitled for three Composite Transfer and Packing Grant??

Sir i transfered from phaphund to jhinjhak station as a sse/sig on 31/72017 which is exactly 20 kms according to by rail. Can i get a transfer allowance and joining leave.

Sir my transfer order is 15 /4/17 but department says you claim old basic pay Please confirm I claim old basic pay or new basic pay

Revision in Allowances is applicable from 01.07.2017, any journey date should be 01.07.2017 or future.

Same in my office ,they charge on the basis of weight not on the basis of kilometres… Don’t know which rule they follow… But in rule it is clearly mentioned that charges is applicable on km basis only. Don’t know about the rule.. If any body knows please reply here ASAP

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Frequently Asked Questions During a Fertility Journey

Fertility treatments can be overwhelming, and it is common for the individual undergoing these treatments to have questions. We asked our Clinical Care Coordinators to compile a list of frequently asked questions and their answers to help you prepare for your fertility journey.

- What did I do to become infertile? It is common to feel guilty about an infertility diagnosis and to think that it was caused by something you did, something you ate, or something you were exposed to. While there may be contributing factors, infertility is typically unprovoked. You may have a genetic predisposition to early ovarian insufficiency or perhaps lower semen parameters. Timing may also impact your fertility as age is the number one obstacle that women face with respect to their reproductive health.

- What are my odds for success with the most common treatments? Low tech treatments such as intrauterine insemination (IUI) produce results close to natural fertility. If a woman is under 35 years old, IUI has a success rate between 10 and 20%. If a woman is between 35 and 40 years old, IUI has a success rate of less than 10%.IVF success rates also vary by age. If a woman undergoes IVF with Preimplantation Genetic Testing for Aneuploidy (PGT-A) she achieves a pregnancy more than 50% of the time once she has a normal embryo.

- How long is a typical fertility treatment cycle? A fertility treatment cycle is timed around the start of a woman’s menstrual period and the timeline depends upon the treatment you are pursuing. For example, the intrauterine insemination (IUI) procedure occurs approximately 2 weeks after your period.However, the timeline for In Vitro Fertilization (IVF) i s different. An egg retrieval typically takes place two weeks after the start of your period, but the actual embryo transfer will follow one of two different timelines.If you choose to do a fresh embryo transfer, the transfer will happen 5 or 6 days after the egg retrieval.If you choose to have a frozen embryo transfer, the transfer can happen approximately 4 weeks after the egg retrieval; however, it may happen later as you determine with your physician. A frozen embryo transfer allows for preimplantation genetic testing for aneuploidy (PGT-A) and occurs after you receive the results of your embryos’ genetic screening.

- What exactly is PGT-A and why is my doctor recommending it? PGT-A is Pre-Implantation Genetic Testing for Aneuploidy and is offered during an IVF cycle. In this process, viable embryos (fertilized eggs) that you’ve created are biopsied. An embryologist at your clinic removes the shedding “trophectoderm” cells that would have become part of the placenta. The embryos are frozen, and the cells are processed and sent to a genetics lab. An embryologist will determine if the embryo is chromosomally normal or abnormal. Most people have 23 pairs of chromosomes that they inherited from their parents. Sometimes in embryo development there are duplications (trisomies) or deletions (monosomies) of chromosomes, which can cause pregnancy loss. PGT-A allows your physician to select the embryo most likely to result in a higher chance of pregnancy and lower chance of miscarriage.

- Should I undergo genetic carrier screening if my embryos will also be screened? We have thousands and thousands of genes that reside within our chromosomes. These genes make us the unique individuals we are. Quite often, a mutation can happen in one or more of our genes causing us to be carriers for certain diseases (i.e. cystic fibrosis, spinal muscular atrophy, beta thalassemia and many more). To be a carrier only means we have the gene mutation, but we do not have the actual disease or any symptoms. However, if a male patient has a gene mutation (is a carrier) and his female partner is a carrier for the same gene mutation, then there is a 1 in 4 chance (25%) that a child born from his sperm and her egg would not only be a carrier of the gene mutation but also have the disease. Expanded carrier screening allows for the identification of common gene mutations and can help identify which genes should be specifically tested. Preimplantation genetic testing for monogenic/single gene defects (PGT-M, formerly known as PGD) can be performed on those embryos to attempt to identify those which would lead to children who express that particular genetic disorder.

- What activity restrictions do I have during treatment? Always follow your provider/clinic guidelines for activity restrictions during treatment. As a rule of thumb, during the stimulation portion of your egg retrieval cycle, you should limit physical activity to walking, swimming or other low-impact physical exercises. Avoid yoga or any exercise that involves jumping and twisting at the waist or any jarring movements. Your ovaries may become swollen and feel heavy during this portion of treatment, and there is a slightly increased risk of ovarian twisting or “torsion.” Patients with torsion present with severe pain and nausea, and they may require surgical intervention.

- What are the side effects of the medications? How am I going to feel? While it’s true you will feel some side effects of the hormonal medications used during an IVF cycle, these effects are not too different from what you most likely feel during a regular menstrual cycle. Bloating, breast tenderness, and a mild emotional response are the most common side effects to expect, with an increased tendency toward those effects with higher doses and/or longer time on the medication.

- Is an egg retrieval painful? Will I need to take time off from work? The egg retrieval is a surgical procedure that is usually performed in less than 15 minutes. You will receive IV sedation/anesthesia for your procedure and therefore won’t be able to work or drive that day. However, this procedure is most frequently described as uncomfortable with mild to moderate cramping that typically lasts for a maximum of 24-48 hours. Most often this pain can be controlled with an over-the-counter pain reliever.

- How many embryos should I transfer? You should discuss how many embryos to transfer with your fertility provider. Progyny wants to ensure our members have the best chance for success and to minimize risk to both the member and their baby. Progyny follows ASRM’s recommendations for a single embryo transfer, which promotes a single gestation pregnancy and reduces the risk of multiples (twins, triplets, etc.). Women who are pregnant with multiples are considered high risk and have an increased chance of complications during and after pregnancy.

- If my treatment cycle is not successful, how long should I wait before I try again? If your IUI treatment isn’t successful, you’ll usually be able to start again with your next menstrual cycle, as long as a negative pregnancy test is confirmed. If your IVF treatment isn’t successful, your physician may advise waiting one month in between cycles to allow your body to return to baseline, or to allow the hormones to go back to normal. However, these decisions are clinic-specific and patient-specific.

For more information, contact your dedicated Patient Care Advocate or email [email protected]

Undergraduate Admissions

Bold Hearts. Brilliant Minds.

Continue Your Journey at UCR!

Your hard work has put your goals within reach, and UCR can help bring them closer. Our award-winning faculty will mentor you. Our diverse campus community will embrace you. And our transfer-specific resources will help you along your path to a degree — and beyond.

We've been waiting for a bold and brilliant Highlander just like you. Apply to UCR today !

Transfer Costs, Fees & Financial Aid

You can afford a UC education! The cost of attending UCR is extremely competitive compared with other University of California campuses and private schools. Living in Riverside is also considerably less expensive than living in nearby Los Angeles, Orange County, or San Diego. Read on to learn more about the programs available to help you pay for your UCR degree and how much that degree costs.

University of California Tuition Stability Plan

Tuition will be adjusted for each incoming undergraduate class but will subsequently remain flat until the student graduates, for up to six years. Learn more .

Financial Aid

A UC degree is more affordable than you might think! Grants, scholarships, loans and, work-study is offered to qualified students by UCR’s Financial Aid office.

of UCR undergraduate students who applied for aid were awarded aid.

of undergraduate students who were awarded aid received need-based scholarships and/or grants.

of need was met with need-based aid.

(Financial Aid Office, 2023-24)

UCR Financial Aid Applications School Codes

FAFSA : 001316 CADAA : 001316

To qualify for financial aid, you need to complete the Free Application for Federal Student Aid (FAFSA) or California Dream Act Application (CADAA) each year.

The simplified 2024–25 FAFSA is expected to be available for students to complete in December 2023 with a priority deadline of March 2. Late applications can be submitted after March 2, although California Student Aid Commission (CSAC) administered grant aid may not offered to late applicants.

Fill out the CADAA between Jan. 1 and the priority deadline of March 2. Late applications can be submitted after March 2, although CSAC administered grant aid may not offered to late applicants.

Additional Aid

Uc riverside foundation scholarships.

The UC Riverside Foundation offers scholarships, fellowships, internships, prizes, awards, and loans to qualifying UCR students. Use the online database to search for aid based on your college, major, financial need, career goals, and more. scholarships.ucr.edu

Eligible students can earn money for school through an approved on- or off-campus work-study job. Funds can only be used during the academic year, and you must meet financial need, academic, and other requirements to maintain your eligibility. careers.ucr.edu

Aid for California Residents

The state of California offers a number of financial aid programs for residents, including those listed below. The programs offer qualifying students grants and scholarships that do not need to be repaid to cover tuition, fees and related expenses (like books, housing and transportation). To be eligible, complete your FAFSA or CADAA by the March 2 priority deadline each year (late applications can be submitted after March 2, although CSAC administered grant aid may not offered to late applicants). Make sure your Cal Grant GPA Verification Form was submitted to the California Student Aid Commission by your community college.

Middle Class Scholarship Program

If your family has up to $217,000 in annual income and assets, and you meet other residency, income and academic requirements, you could have up to 40% of your UC systemwide tuition and fees covered by this scholarship. go.ucr.edu/mcs

If you meet GPA, family income, residency, academic, and other requirements, you can get grant money that will cover some of your educational costs and fees. csac.ca.gov/cal-grants

Blue and Gold Opportunity Plan

If your total annual family income is less than $80,000, and you meet other residency, income and academic requirements, you could have 100% of your UC systemwide tuition and fees covered by grants and scholarships through this plan. Students with greater financial need can qualify for additional aid to cover expenses like books, housing, and transportation. admissions.universityofcalifornia.edu

Additional Aid from the State of California

Check out more state of California financial aid programs on the California Student Aid Commission. csac.ca.gov/financial-aid-programs

2021–22 Estimated Costs for California Resident Undergraduates

New first years only : Add the $110 mandatory Highlander Orientation Fee to the total. New transfers only: Add the $75 mandatory Highlander Orientation Fee to the total. All new students: Add the $165 One-Time Document Fee to the total.

*Estimated USHIP = $1,768 (Undergraduate Fees including USHIP = $15,510; fees if USHIP is waived = $13,742.)

View estimated costs for out-of-state and international undergraduates.

Notes: Tuition, fees and charges are estimates based on currently approved amounts. These figures may not be final. Actual tuition, fees, and charges are subject to change by the Regents of the University of California and could be affected by State funding reductions. Accordingly, final approved levels (and a student’s final balance due) may differ from the amounts shown.

Some or all instruction for all or part of the Academic Year may be delivered remotely. Tuition and fees have been set regardless of the method of instruction and will not be refunded in the event instruction occurs remotely for any part of the Academic Year. Figures for tuition and fees represent currently approved or proposed amounts and may not be final. Actual tuition and fees are subject to change by the University of California as determined to be necessary or appropriate. Final approved tuition and fee levels may differ from the amounts presented. Added March 9, 2021.

Estimated Costs for Undergraduates

View estimated costs for attending UCR including tuition, fees, housing, books, transportation, and more.

UCR Net Price Calculator

Fill out the form at the UCR Net Price Calculator to get an estimate of what your full-time cost of attendance and financial aid package at UCR could be.

“UCR has been incredibly helpful, allowing me to pursue my degree so affordably. As a transfer student, it can be difficult to find resources. Many students in need find themselves having to choose between loans and finishing their education. Thanks to a generous financial aid package, UCR is helping me complete my degree without having to take out private loans. I’ll be the first in my family to finish a bachelor’s degree.”

Cesar, Class of '25 Public Policy (Economic Policy and Policy Institutions and Processes)

Applying to UCR

As a top-ranking university , UCR sets high admission standards. Incoming students are selected based on a wide range of criteria , including academic performance and the potential for success as an undergraduate. Prepare for admission to UCR with the Transfer Admission Checklist .

Minimum Transfer GPA Requirement

Student-to-Faculty Ratio

Guarantee Your Place at UCR

Through the Transfer Admission Guarantee (TAG) program your California Community College coursework and grades can ensure your admission to UCR. Here's how:

- Create Your Transfer Admission Planner (TAP). TAP is an online tool where you can track and plan the community college coursework you need to complete to be admitted to UCR. It's also your TAG application! Build your TAP today !

- Satisfy Your TAG Requirements. To qualify for TAG, you need to complete a minimum of 30 UC-transferrable units at your community college. Those units include first and second semesters of English composition, and the minimum math required by your major. Each major also has GPA requirements, which are outlined in the Getting into Your Major section below.

- Submit Your TAG Application. UCR offers fall and winter quarter admission to transfer students. Before you apply for admission, log in to your TAP to complete the UCR TAG application within the filing period for your chosen quarter: May 1–31 for winter admission; Sept. 30 for fall admission.

- Complete Your TAG Contract. Get ready to transfer to UCR by taking the classes necessary to complete a total of 60 UC-transferrable units at your community college. This will include any prep courses specified by your major. Don’t forget about your GPA requirements!

- Apply to UCR. All that's left to do is submit your UCR application within the filing period for your chosen quarter: July 1–31 for winter admission; Oct. 1-Nov. 30 for fall admission. Visit go.ucr.edu/apply when it's time to apply.

Secure your admission to UCR with TAG

Getting into your major.

In general, each major has prerequisite (major prep) coursework that you must take before transferring in order to get into your major.

Take the recommended lower-division/general education/breadth classes for your major. Some programs recommend the Intersegmental General Education Transfer Curriculum (IGETC), which is a series of courses that California Community College students can complete to satisfy first- and second-year general education requirements before transferring. Some programs want you to focus on prerequisites instead of IGETC. Use ASSIST.org to see what your major program recommends or contact a UCR admissions counselor for help. View the Assist Brochure for more information.

Each major has a minimum GPA requirement. Some majors require a GPA higher than that required for basic admission. Programs are selective. Strive to surpass your program’s minimum GPA. Remember: All transferable coursework will be taken into account.

Breadth Requirements You are strongly encouraged to focus on preparatory course work (mathematics, science and technical work) for your desired major rather than on IGETC completion. However, the Marlan and Rosemary Bourns College of Engineering (BCOE) does accept completion of IGETC as satisfying the majority of breadth requirements. Additional breadth coursework may be required after enrollment at BCOE.

Prerequisites Strong technical preparation is essential for success in the admissions process and, subsequently, in all coursework at BCOE. If you intend to transfer to an engineering major, you are expected to complete the equivalent of UCR coursework required in the first two years of the programs and apply for transfer starting your junior year. Use ASSIST.org to see the prerequisites you must take for your intended major (and to make sure your classes will transfer).

Minimum GPA Strive to surpass the 2.8 minimum GPA.

Learn more about transferring to BCOE .

Winter 2025 Majors The majors listed below are closed, but you can find many other exciting majors that are open for winter 2025. Choose your favorite and apply for winter admission by July 1-31.

- Computer Engineering

- Computer Science

- Computer Science/Business Applications

- Data Science

Breadth Requirements Complete IGETC or the UCR breadth pattern for the College of Humanities, Arts, and Social Sciences (CHASS).

Prerequisites Use ASSIST.org to see the prerequisites you must take for your intended major (and to make sure your classes will transfer).

Minimum GPA Strive to surpass the 2.4 minimum GPA and the 2.7 minimum GPA for neuroscience and psychology.

Learn more about transferring to CHASS .

Winter 2025 Majors The Art Studio major is closed, but you can find many other exciting majors that are open for winter 2025. Choose your favorite and apply for winter admission by July 1-31.

Breadth Requirements You are strongly encouraged to focus on preparatory coursework (mathematics, science and technical work) for your desired major rather than on IGETC completion.

Minimum GPA Strive to surpass the 2.7 minimum GPA.

Learn more about being a CNAS student.

Breadth Requirements IGETC or the UCR breadth pattern for the School of Business is highly recommended.

Prerequisites Complete community college courses equivalent to seven lower division UCR business major requirements as listed on ASSIST.org

Minimum GPA Attain a minimum GPA of 2.7 in all UC-transferable coursework and a minimum 2.5 GPA in the seven lower division major prerequisites. These GPAs are a baseline for consideration and are not a guarantee of admission.

Learn more about being a School of Business student.

Breadth Requirements Complete IGETC or the UCR breadth pattern for the School of Education (SOE).

Minimum GPA Strive to surpass the 2.4 minimum GPA.

Learn more about transferring to SOE .

Breadth Requirements Complete IGETC or the UCR breadth pattern for the School of Public Policy (SPP).

Prerequisites Use ASSIST.org to see the prerequisites you must take for your intended major (and to make sure your classes will transfer).

Learn more about being an SPP student.

Learn more about specific transfer requirements for non-residents.

Featured Video

How to apply to uc riverside.

Follow along as UCR students walk you through the process of filling out an admission application.

Apply to UCR

See dates and deadlines:

- For First Years

- For Transfers

How to Apply

Gather Your Information Before you begin, find out what important information is needed for an accurate admission application.

Personal Insight Questions Express who you are, what matters to you, and what you want to share with us by answering one required and an additional three out of seven personal insight questions .

Complete the UC Application The UC application opens on July 1 for winter admission and Aug. 1 for fall admission. The fee is $80 for each UC ($95 for international and non-immigrant applicants). You can apply for a fee waiver — provided you have your family’s income and the number of people supported by it — when you fill out the application. The winter application filing period is July 1–31 . The fall application filing period is Oct. 1-Nov. 30 . If you have difficulties, contact [email protected] or (800) 207-1710.

After You Apply Once you've submitted your application, there are just a few more steps to complete the process. These include printing your receipt, ordering test score reports, and updating your grades and course records.

UCR Undergraduate Admissions will email instructions on how to access your MyUCR admission portal account. Log in regularly to check your admission status, respond to messages, and track important dates and deadlines.

Winter admission notifications begin in September. Fall admission notifications begin in March. Access the next steps to UCR for admitted fall transfer students and winter transfer students .

Resources & Support

UCR is dedicated to your continued success on your degree journey, and offers a range of programs and resources to support you along your path to degree. Get guidance from faculty and student mentors. Excel in your courses with the help of a tutor or study group. Connect with a wellness department to take care of your physical, mental and emotional health. Develop as a leader in a campus organization.

Make a smooth academic transition to UCR with the guidance of faculty and student mentors through transfer or student success programs offered by our colleges and schools:

- Marlan and Rosemary Bourns College of Education: Engineering Transfer Student Center

- College of Humanities, Arts, and Social Sciences: CHASS Transfers F1RST Program

- College of Natural and Agricultural Sciences: CNAS Transfer Connections

- School of Business: Newly Admitted Transfer Students

- School of Education: Transfer Learning Community for Education Majors

- School of Public Policy: Student Success Programs

You can also get academic support with the Academic Resource Center's Transfer Success Program and connect with experienced/trained student leaders throughout your first year with Student Life's transfer student resources .

If you're admitted to UCR, you can ensure a smooth transition by following next steps for incoming transfer students .

Safety is a top priority at UCR. We have a 24/7, on-campus police department , an emergency notification system that sends text alerts, a no-tolerance policy against sexual violence and secure residence halls with video surveillance, restricted card access and live-in staff. At night, our Community Service Officers patrol halls and parking lots, and Campus Safety Escorts accompany students across campus.

The Career Center is your headquarters for the professional advice, skills, and strategies that will lead you to your ideal career.

- Handshake to find jobs, internships, and volunteer opportunities

- Career workshops to build skills (e.g., resume and cover letter writing and networking your way to a job)

- Career fairs

- Connections with top employers

- R’Professional Career Closet for professional attire

Discover community, find mentors, and develop as a leader with UCR's Ethnic & Gender Centers. Learn more about UCR’s commitment to diversity, equity and inclusion .

- African Student Programs

- Asian Pacific Student Programs

- Chicano Student Programs

- Foster Youth Support Services

- LGBT Resource Center

- Middle Eastern Student Center

- Native American Student Programs

- Undocumented Student Programs

- Women's Resource Center

UCR focuses on all facets of well-being. We offer many campus resources such as support groups, tutoring, community service, employment, emergency food resources, sports, and health care — which is all included in your tuition.

Parents and guardians are invited to the Highlander Family Network . It offers family-centered resources, programming, and civic engagement to help you support your UCR Highlander.

UCR welcomes student parents and offers support with a wide range of resources and accommodations.

- Center for Early Childhood Education (ECS) for students, staff, faculty, and/or members of the community who need child care services.

- Lactation rooms with privacy, a refrigerator, plush seating, and sanitary provisions.

- Oban Family Housing with one- and two-bedroom apartment homes adjacent to the campus. UCR’s ECS and Riverside’s public and private schools are nearby.

- R'Kids for students, faculty, and staff with children, are expecting children, or will have children. Parents can discuss experiences, learn from each other and offer advice, while their children are involved in activities and entertainment.

- SRC Youth Programs to promote a healthy and safe lifestyle using positive experiences, sports, activities, games, and educational instruction.

Student Life provides the total UCR experience with opportunities for learning, leadership, community building, and creative expression that go way beyond the classroom. Make friends and have fun with music festivals and concerts, guest speakers, films, performers, and over 350 student organizations!

Visit Transportation Services to learn about parking, public transportation (and student benefits), electric vehicle charging stations, UCR's Bike/Walk Program, and more.

Undergraduate Education cultivates student success by providing academic support, experiential learning, and research opportunities. Challenge yourself in our rigorous University Honors program. Participate in research projects with our renowned faculty. Intern for a government agency or NGO in Sacramento or Washington, D.C. Create and facilitate your own 1-unit course with R'Courses. Ace your classes and prep for graduate school exams with help from the Academic Resource Center.

Transfer Resources

Transfer brochures.

Undergraduate Admissions Brochure (Flipbook) Assist Brochure Puente Connection Brochure

General Brochures

Parent and Guardian Brochure (Flipbook) 54 Facts and Impacts Finish in Four Puente Connection Brochure Umoja at UCR Brochure Black Student Experience Brochure (Flipbook) Chicano/Latino Student Experience Brochure Native American Student Experience Brochure Student Veteran Success Guide

Transfer Dates & Deadlines

Find the dates of instruction at registrar.ucr.edu .

Fall Admissions: Transfer Students

Access the UC application

Submit your TAG application

Oct. 1–Nov. 30

Submit your UC application

Deadline to complete the Transfer Academic Update

Admission notifications begin Access the next steps to UCR for admitted fall transfer students

Housing contracts become available

Housing: Since campus housing is highly impacted and assigned first-come, first-served, it is recommended that you submit your Statement of Intent to Register (SIR), housing contract or application, and first housing payment as early as possible.

Deadline to submit your Statement of Intent to Register (SIR)

Deadline to submit your final transcripts/documents for coursework completed through end of spring

Fall quarter begins

Winter Admissions: Transfer Students

Submit your TAG application

Admission notifications begin Access the next steps to UCR for admitted winter transfer students

Housing: Since campus housing is assigned first-come, first-served, it is recommended that you submit your Statement of Intent to Register (SIR), housing contract or application, and first housing payment as early as possible.

Mid-September

Deadline to complete the Transfer Academic Update

Deadline to submit your final transcripts/documents for coursework completed through end of summer

Deadline to submit your final transcript/document for coursework completed through end of fall

Winter quarter begins

Access the Free Application for Federal Student Aid (FAFSA) and GPA form to apply for financial aid (UCR school code: 001316)

Access the California Dream Act Application at dream.csac.ca.gov (UCR school code: 001316)

Deadline to submit your FAFSA or California Dream Act Application (applications can be submitted after March 2) Verify that a certified GPA was submitted to the California Student Aid Commission by your community college

Find Your Transfer Counselor

- Chaffey College Counselor: Danielle Patrice Watson Transfer Admissions Counselor Phone: (951) 827-3903 Email: [email protected]

- Coastline Community College Counselor: Jesse Cruz Transfer Admissions Counselor Phone: (951) 827-4189 Email: [email protected]

- Fullerton College Counselor: Jesse Cruz Transfer Admissions Counselor Phone: (951) 827-4189 Email: [email protected]

- Golden West College Counselor: Jesse Cruz Transfer Admissions Counselor Phone: (951) 827-4189 Email: [email protected]

- Irvine Valley College Counselor: Jesse Cruz Transfer Admissions Counselor Phone: (951) 827-4189 Email: [email protected]

- Norco College Counselor: Maria Flores Senior Evaluation & Athletic Specialist Phone: (951)827-3635 Email: [email protected] Counselor: Diana Medina Transfer Admissions Counselor Phone: (951) 827-4445 Email: [email protected]

- Orange Coast College Counselor: Jesse Cruz Transfer Admissions Counselor Phone: (951) 827-4189 Email: [email protected]

- Saddleback College Counselor: Jesse Cruz Transfer Admissions Counselor Phone: (951) 827-4189 Email: [email protected]

- Santa Ana College Counselor: Jesse Cruz Transfer Admissions Counselor Phone: (951) 827-4189 Email: [email protected]

- Santiago Canyon College Counselor: Jesse Cruz Transfer Admissions Counselor Phone: (951) 827-4189 Email: [email protected]

- Antelope Valley College Counselor: Cesar Gonzalez Vargas Transfer Admissions Counselor Phone: (951) 827-3691 Email: [email protected]

- Cerritos College Counselor: Edward Barrera Admissions Counselor Phone: (951) 827-0673 Email: [email protected]

- Riverside City College Counselor: Maria Flores Senior Evaluation & Athletic Specialist Phone: (951)827-3635 Email: [email protected] Counselor: Diana Medina Transfer Admissions Counselor Phone: (951) 827-4445 Email: [email protected]

- Citrus College Counselor: Cesar Gonzalez Vargas Transfer Admissions Counselor Phone: (951) 827-3691 Email: [email protected]

- Cypress College Counselor: Jesse Cruz Transfer Admissions Counselor Phone: (951) 827-4189 Email: [email protected]

- East Los Angeles College Counselor: Kaisha Ross Admissions Counselor Phone: (951) 827-6401 Email: [email protected]

- Glendale Community College Counselor: Cesar Gonzalez Vargas Transfer Admissions Counselor Phone: (951) 827-3691 Email: [email protected]

- Los Angeles Mission College Counselor: Cesar Gonzalez Vargas Transfer Admissions Counselor Phone: (951) 827-3691 Email: [email protected]

- Los Angeles Pierce College Counselor: Cesar Gonzalez Vargas Transfer Admissions Counselor Phone: (951) 827-3691 Email: [email protected]

- Los Angeles Southwest College Counselor: Edward Barrera Admissions Counselor Phone: (951) 827-0673 Email: [email protected]

- Los Angeles Valley College Counselor: Cesar Gonzalez Vargas Transfer Admissions Counselor Phone: (951) 827-3691 Email: [email protected]

- Moorpark College Counselor: Camilla Valadez Admissions Counselor Phone: (951) 927-0672 Email: [email protected]

- Oxnard College Counselor: Camilla Valadez Admissions Counselor Phone: (951) 927-0672 Email: [email protected]

- Pasadena City College Counselor: Cesar Gonzalez Vargas Transfer Admissions Counselor Phone: (951) 827-3691 Email: [email protected]

- San Bernardino Valley College Counselor: Danielle Patrice Watson Transfer Admissions Counselor Phone: (951) 827-3903 Email: [email protected]

- Santa Monica College Counselor: Vacant Vacant position Phone: Vacant Email: [email protected]

- West Los Angeles College Counselor: Camilla Valadez Admissions Counselor Phone: (951) 927-0672 Email: [email protected]

- College of the Canyons Counselor: Camilla Valadez Admissions Counselor Phone: (951) 927-0672 Email: [email protected]

- Compton College Counselor: Cesar Gonzalez Vargas Transfer Admissions Counselor Phone: (951) 827-3691 Email: [email protected]

- El Camino College Counselor: Edward Barrera Admissions Counselor Phone: (951) 827-0673 Email: [email protected]

- Long Beach City College Counselor: Edward Barrera Admissions Counselor Phone: (951) 827-0673 Email: [email protected]

- Los Angeles City College Counselor: Edward Barrera Admissions Counselor Phone: (951) 827-0673 Email: [email protected]

- Los Angeles Harbor College Counselor: Edward Barrera Admissions Counselor Phone: (951) 827-0673 Email: [email protected]

- Los Angeles Trade-Tech College Counselor: Edward Barrera Admissions Counselor Phone: (951) 827-0673 Email: [email protected]

- Rio Hondo College Counselor: Kaisha Ross Admissions Counselor Phone: (951) 827-6401 Email: [email protected]

- College of the Desert Counselor: Maria Flores Senior Evaluation & Athletic Specialist Phone: (951)827-3635 Email: [email protected] Counselor: Diana Medina Transfer Admissions Counselor Phone: (951) 827-4445 Email: [email protected]

- Copper Mountain College Counselor: Maria Flores Senior Evaluation & Athletic Specialist Phone: (951)827-3635 Email: [email protected]

- Allan Hancock College Counselor: Camilla Valadez Admissions Counselor Phone: (951) 927-0672 Email: [email protected]

- American River College Counselor: Alexzander LeSueur Transfer Admissions Counselor, Military Admissions Counselor Phone: (951) 827-2776 Email: [email protected]

- Bakersfield College Counselor: Andrej Molchan Assistant Director of High School Recruitment and Evaluation Phone: (951) 827-3678 Email: [email protected]

- Berkeley City College Counselor: Savannah Richardson Admissions Counselor Phone: (951) 827-5594 Email: [email protected]

- Butte College Counselor: Alexzander LeSueur Transfer Admissions Counselor, Military Admissions Counselor Phone: (951) 827-2776 Email: [email protected]

- Cabrillo College Counselor: Jessica Verazas Assistant Director of Transfer Recruitment and Evaluation Phone: (951) 827-7689 Email: [email protected]

- Canada College Counselor: Savannah Richardson Admissions Counselor Phone: (951) 827-5594 Email: [email protected]

- Chabot College Counselor: Savannah Richardson Admissions Counselor Phone: (951) 827-5594 Email: [email protected]

- Cerro Coso Community College Counselor: Danielle Patrice Watson Transfer Admissions Counselor Phone: (951) 827-3903 Email: [email protected]

- City College of San Francisco Counselor: Savannah Richardson Admissions Counselor Phone: (951) 827-5594 Email: [email protected]

- College of Marin Counselor: Alexzander LeSueur Transfer Admissions Counselor, Military Admissions Counselor Phone: (951) 827-2776 Email: [email protected]

- College of San Mateo Counselor: Camilla Valadez Admissions Counselor Phone: (951) 927-0672 Email: [email protected]

- College of the Redwoods Counselor: Alexzander LeSueur Transfer Admissions Counselor, Military Admissions Counselor Phone: (951) 827-2776 Email: [email protected]

- College of the Sequoias Counselor: Andrej Molchan Assistant Director of High School Recruitment and Evaluation Phone: (951) 827-3678 Email: [email protected]

- College of the Siskiyous Counselor: Alexzander LeSueur Transfer Admissions Counselor, Military Admissions Counselor Phone: (951) 827-2776 Email: [email protected]

- Columbia College Counselor: Andrej Molchan Assistant Director of High School Recruitment and Evaluation Phone: (951) 827-3678 Email: [email protected]

- Contra Costa College Counselor: Savannah Richardson Admissions Counselor Phone: (951) 827-5594 Email: [email protected]

- Cosumnes River College Counselor: Alexzander LeSueur Transfer Admissions Counselor, Military Admissions Counselor Phone: (951) 827-2776 Email: [email protected]

- Cuesta College Counselor: Jessica Verazas Assistant Director of Transfer Recruitment and Evaluation Phone: (951) 827-7689 Email: [email protected]

- De Anza College Counselor: Savannah Richardson Admissions Counselor Phone: (951) 827-5594 Email: [email protected]

- Diablo Valley College Counselor: Savannah Richardson Admissions Counselor Phone: (951) 827-5594 Email: [email protected]

- Evergreen Valley College Counselor: Savannah Richardson Admissions Counselor Phone: (951) 827-5594 Email: [email protected]