- Disney Cruise Line / News

Update To Disney Cruise Line Vacation Protection Plan

by Sarah Phillips · March 5, 2021

Think about booking a Disney Cruise Line Vacation? Guests need to be aware that as of Feb. 3, 2021, the existing cancellation policy regarding the Vacation Protection Plan (VPP) is now being enforced.

The policy establishes that once the Vacation Protection Plan has been paid in full, it will no longer be refundable, with the exception of a “10-day look-back period” post-purchase to give insured guests appropriate time to review the full policy.

Please note this enforcement does not apply to bookings made before Feb. 3, 2021, with the exception of situations where a non-refundable charge (i.e. air) is associated with the reservation.

This policy is included in the confirmation of coverage Guests receive after purchase. It is also outlined on page 3 of the Policy Document, as well as on the Vacation Protection Plan page.

The policy reads as follows:

If you are not satisfied for any reason, you may cancel under this Certificate to Aon Affinity Travel Practice, 900 Stewart Avenue, Garden City, NY 11530-9998 , within 10 days after receipt. Your premium will be refunded, provided you have not already departed on the Trip or filed a claim. When so returned, all coverages under this Certificate are void from the beginning.

Disney Cruise Vacation Protection Plan Update Credit: Disney

R eady to experience disney for yourself there are many magical packages available for 2021 and 2022 fill out our form below for your free, no-obligation quote with an authorized disney vacation planner with mickeytravels .

Do you want more help planning your next Disney vacation? As an Authorized Disney Vacation Planner, my goal is to help you plan the Magic your way. I also create customized itineraries, book advanced dining and FastPass+ reservations, monitor for discounts for your vacation, and much much more! Also, did I mention that my services are FREE? Get in touch toll-free at 1-800-454-4501, via email at [email protected] or follow me on Facebook!

Tags: DCL Disney Cruise Line Vacation Protection Plan

Sarah Phillips

Sarah is a wife, a mother of two awesome little boys, and a Disney fanatic. She has turned her passion into a dream career sharing Disney advice with the readers at MickeyBlog and helping families plan their perfect Disney Vacations with MickeyTravels. Reach out for a FREE, no obligation quote at 1-800-454-4501 or email at [email protected]!

Get a FREE Quote!

Interested in booking a Disney Vacation? Look no further! The award winning agents at MickeyTravels are ready to help you book a truly magical vacation!

- Name * First Last

- Number of Adults *

- Number of Children *

- Ages of Children *

- Select Your Destination * *hold ctrl or shift to select more Walt Disney World Disney Cruise Line Disneyland Adventures by Disney Aulani Hawaii Disney Special Event Tickets Universal Orlando

- Approximate Travel Dates *

You may also like...

Waterfalls Not Working at Disney’s Polynesian Village Resort This Morning

February 7, 2022

Spotlight On: Kids Activities at Boardwalk’s Community Hall!

January 26, 2022

If You Haven’t Seen Disney’s TikToks You Don’t Know What You’re Missing!

May 2, 2021

Recent Posts

The 2024 EPCOT Cheat Sheet Everyone Needs

Pros and Cons of Disneyland Resort Hotels

Andrew Stanton Will Seemingly Direct ‘Toy Story 5’

Sign-up for Our Newsletter

EPCOT / Walt Disney World

June 8, 2024

Disney California Adventure / Disneyland Park / Disneyland Resort / Downtown Disney / Resorts

News / Pixar

A Disneyland Club 33 Manager Dies After “Tragic Accident” Backstage

- Facebook Group

Chip and Company

Stay Up to Date on the Latest Disney, Universal News and More!

Disney Cruise Line Vacation Protection Coverage Increases

Guests sailing with Disney Cruise Line have the option of adding the cruise line’s travel insurance to their reservation. The Vacation Protection Plan coverage was recently increased.

Related – Disney Cruise Line updates Covid testing requirements for all sailings departing from the U.S

The Medical and Trip Cancellation/Trip Interruption coverage included with Vacation Protection Plan (VPP) for Disney Cruise Line has increased from $10,000 to $20,000 per person. With this update, there will also be an increase in the maximum premium a Guest may be charged for VPP.

The cost of VPP will still be 8% of the Voyage Fare per Guest (all ages). The minimum charge per Guest remains the same at $35; however, the maximum a Guest may be charged in premium will now increase from $800 to $1,600 maximum. The maximum per person charge for VPP is based on the Insurance Effective Date (the date VPP is paid in full).

Related – Disney Cruise Line Alaska Travel Season is underway

Disney highly recommends purchasing the Vacation Protection Plan when you sail with Disney Cruise Line.

If you’d like to plan your next cruise, contact me today! I am a travel agent with Destinations to Travel and I’d love to help you plan a magical vacation .

Let our friends at Destinations to Travel help you book your next Disney Vacation. They are the preferred Travel Agency of Chip and Company and Disney Addicts, and who we use ourselves.

Get started below for your FREE No Obligation Quote.

Book With our friends at Destinations to Travel

For the BEST in Disney, Universal, Dollywood, and SeaWorld Theme Park News, Entertainment, Merchandise & More follow us on, Facebook , Instagram , and Youtube . Don't forget to check out the Chip and Company Radio Network too!

Written by:

Sara 4,719 Posts

Related posts.

Club Level Guests Save 20% on a Disney Private VIP Tour

Disney Munchlings New Release Event Coming to Disney Springs

Disney Makes Changes to Cancellation Policy at Walt Disney World

Shop the latest disney items.

Make a Splash with This Minnie Mouse Vacation Style Poolside Ear Headband at Loungefly!

Roar for Style! Loungefly Releases Limited Edition Lion King 30th Anniversary Simba Plush Backpack!

Sweeten Your Style with the Adorable Mickey Mouse Donut Loungefly Backpack!

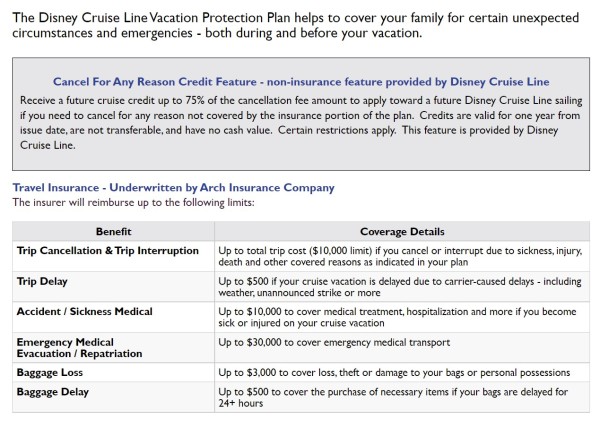

The Disney Cruise Line Vacation Protection Plan covers your family for certain unexpected circumstances and emergencies—both before and during your vacation.

This plan includes travel insurance benefits underwritten by Arch Insurance Company and a 24 hour helpline provided by CareFree Travel Assistance.

How to Purchase Vacation Protection

This plan may be added to your reservation as an option to your online cruise reservation. Payment for the Vacation Protection Plan must be made by the earlier of: the final payment date; or, the date any charges on the reservation become non-refundable, such as Concierge deposit or air cancellation fees for Restricted Fares.

Important Information

- View specific Terms, Conditions, and Exclusions

- This plan provides cancellation coverage for your trip and other insurance coverages that apply only during the covered trip.

- You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of this policy with your existing life, health, home and automobile policies. If you have any questions about your current coverage, call your insurer, insurance agent or broker.

- This optional coverage may duplicate coverage already provided by your personal auto insurance policy, homeowner's insurance policy, personal liability insurance policy or other source of coverage.

- Purchasing travel insurance is not required in order to purchase any other products or services offered by Disney Cruise Line

- Plan may not be available in all jurisdictions.

- Payment for the Vacation Protection Plan must be made by the earlier of: the final payment date; or, the date any charges on the reservation become non-refundable, such as Concierge deposit or air cancellation fees for Restricted Fares.

- The coverage goes into effect upon payment of the total Vacation Protection Plan fee.

Restrictions for the Cancel For Any Reason Feature (Non-insurance Feature)

- The Cancel For Any Reason cruise credit feature is equal to 75% of the non-refundable cancellation fee imposed by Disney for your use toward a future cruise.

- Credits are valid for one year from issue date, are not transferrable, and have no cash value.

- To be eligible for credits, notification of cancellation must be given to Disney Cruise Line prior to the ship's departure and a cancellation claim must be filed with Aon Berkely.

- If the credit is applied to a cruise booking of lesser value, the credit will be considered used, and the difference will not be carried forward or redeemed for cash. Credit may not be used toward deposit.

- If, after credit is applied to a booking, that booking is cancelled, the credit will not be carried forward to any other booking.

- Credit is non-commissionable to travel agents.

- Residents of Minnesota, Missouri and New York are not required to purchase the Disney Cruise Line Protection in order to access the cancel for any reason credit feature. Please contact 1-888-722-2195 for details.

The Disney Cruise Line Vacation Protection Plan is underwritten by Arch Insurance Company, with administrative offices in Jersey City, NJ. (NAIC #11150) under Policy Form series LTP 2013 and applicable amendatory endorsements. This is a general overview of insurance benefits available. Coverages may vary in certain states and not all benefits are available in all jurisdictions. Please refer to your certificate of benefits or policy of insurance for detailed terms, conditions and exclusions that apply.

This program was designed and is administered by Aon Affinity. Aon Affinity is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc. (TX 13695); (AR100106022); in CA & MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in OK, AIS Affinity Insurance Services, Inc.; in CA, Aon Affinity Insurance Services, Inc. (CA 0G94493), Aon Direct Insurance Administrators and Berkely Insurance Agency and in NY, AIS Affinity Insurance Agency. Affinity Insurance Services is acting as a Managing General Agent as that term is defined in section 626.015(14) of the Florida Insurance Code.

† Guests under 18 years of age must have their parent or guardian's permission to call this number. DSY_040122

Ready to book your trip? Start planning today!

Disney Cruise Travel Insurance - 2024 Review

Disney cruise travel insurance.

- Available at Check-Out

- Strong Insurance Partner

- Good Cancellation Protection

- Low Medical Coverage

- Low Medical Evacuation Coverage

- No Coverage for Pre-Existing Medical Conditions

- Cancel For Any Reason is Cruise Credit

Sharing is caring!

Known for their amazing trips for families, Disney cruises also provide spectacular cruises for adults as well. Adults can enjoy exciting nightlife, intimate dining experience and luxurious spa treatments. Plus, with Disney's signature service, attention to detail, and rich storytelling are some of the reasons why Disney cruises are voted among the best at sea.

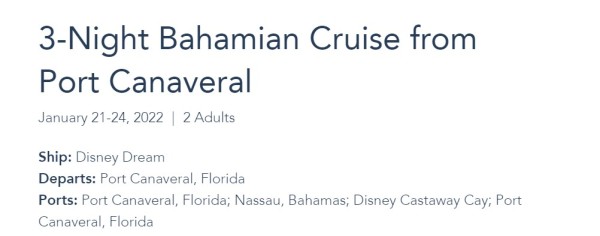

Our Cruise – 3-Night Bahamian Cruise

Our trip is a 3-day Caribbean cruise to the Bahamas, January 21 – 24, 2022 for 2 travelers aged 62 and 60. It leaves from Port Canaveral, FL and cruises to Nassau and on to Disney’s own island – Castaway Cay, before returning to Port Canaveral.

Total cost for the cruise and a cabin with a private veranda is $1,767.08. As pricing for airfare, if needed, can vary greatly depending on when purchased, we have not included it in our example.

Upon checkout, we’re asked if we’d like to purchase the Disney Protection Plan for an additional $126.24. Interestingly, this plan can be individually purchased, so one traveler could purchase the insurance (for $63.12), while the other traveler could decline.

What Disney Cruise Travel Insurance Includes

The Disney Protection Plan is a basic policy covering Trip Cancellation and Trip Interruption (up to $10,000 maximum trip cost), $10,000 for medical coverage and $30,000 for medical evacuation. The plan also comes with a Cancel For Any Reason (CFAR) benefit which will provide a 75% future cruise credit valid for one year. While this is nice, we always prefer cash as you may not be able to cruise next year.

Comparison Quotes

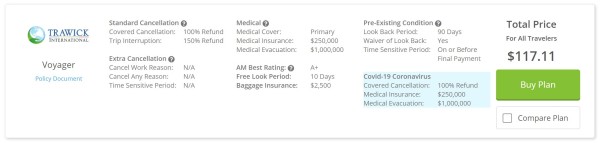

Based on our sample couple, ages 62 and 60, we created comparison quotes using TripProtectors travel insurance marketplace engine. The trip cost used for the comparison is the cruise cost for both travelers is $1,767.08.

When traveling outside the United States, we recommend a minimum coverage of $100,000 in Medical Insurance, $250,000 in Medical Evacuation, and a Pre-existing Medical Condition Waiver. We used these criteria to choose the selected quotes.

The least expensive plan with adequate coverage on our quote from TripProtectors is the Trawick Voyager . This plan would be comparable to the Disney Vacation Protection Plan without the Cancel For Any Reason (CFAR) option.

This policy provides $250,000 of medical coverage and $1 million of medical evacuation per person. Unlike the Disney Vacation Protection Plan, it also provides a waiver to cover any pre-existing medical conditions provided you purchase the policy on or before the final trip payment is made. Total cost for both travelers is $117.11. This policy has 25 times the medical coverage and 33 times more medical evacuation coverage for $9.13 LESS than the Disney Vacation Protection Plan.

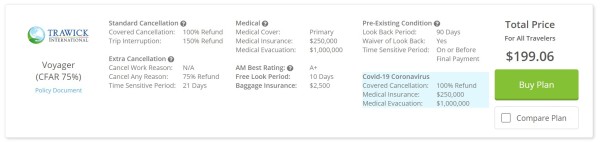

For a Cancel For Any Reason policy, we chose the Trawick Voyager (CFAR 75%) , because it is the least expensive plan with Cancel For Any Reason (CFAR) benefits and would be comparable to the Disney Vacation Protection Plus Plan.

This policy is similar to the Trawick Voyager but adds the Cancel For Any Reason (CFAR) benefit. This policy also provides $250,000 of medical coverage and $1 million of medical evacuation per person as well as a waiver to cover any pre-existing medical conditions provided you purchase the policy on or before the final trip payment is made. Finally, it provides the ability to cancel for any reason not listed in the policy and receive a 75% refund (in cash, NOT cruise credit) of the non-refundable trip cost. Total cost for both travelers is $199.06. This policy has 25 times the medical coverage and 33 times more medical evacuation coverage for a minimal $72.82 more than the Disney Vacation Protection Plan.

Next, we broke down the benefits of each policy in a side-by-side comparison.

Cost Comparison

Overall, the Disney Vacation Protection Plan has minimal coverage for traveling outside the US. Their Cancel For Any Reason (CFAR) coverage only provides a cruise credit valid for one year and does not refund in cash. This can be an issue for travelers who may not be able to travel the following year. Trip costs would be lost in this situation.

By shopping for cruise insurance through TripProtectors , our two travelers can save a bit over $9 purchasing the Trawick Voyager policy and have much better medical coverage and medical evacuation coverage than they would get from the Disney Vacation Protection Plan. If receiving a cash refund instead of a cruise credit is desirable, then the Trawick Voyager (CFAR 75%) would be a great option as it has much higher medical coverage and medical evacuation coverage and provides a refund in cash instead of a cruise credit, for about $73 more than the Disney Vacation Protection Plan.

In the following sections, we discuss know what to look for when shopping for travel insurance for your Disney cruise.

Trip Cancellation

A significant concern for travelers is Trip Cancellation . If you became ill or had an accidental injury prior to your departure date, you may have to cancel your travel arrangements, resulting in financial losses. While disappointing, Trip Cancellation is doubly painful without cancellation insurance.

The Disney Vacation Protection Plan permits cancellation for the following reasons:

- Unexpected injury, illness, or death of traveler, traveling companion or family member.

- Hijacking, quarantine, jury duty, subpoena

- Residence uninhabitable by natural disaster, fire, flood, burglary

- Involuntary termination (layoff)

- Revocation of military leave

- Trip delayed more than 50% of scheduled duration

Unfortunately, Disney’s list of cancellation reasons lacks some important coverages.

We recommend policies also include:

- Default or bankruptcy of the common carrier or travel supplier

- Cancel For Work Reason (should a traveler be required to work during the trip)

- Employer-initiated transfer of 250 miles or more

- Destination uninhabitable or unreachable by fire, flood or natural disaster

- Mechanical breakdown of a common carrier

- Mandatory evacuation

- Documented theft of passports or visas.

The Disney Vacation Protection Plans only pay a maximum of $10,000 for Trip Cancellation, instead of the full trip cost. It also does not cover any travel arrangements booked outside Disney.

Both the Trawick Voyager and the Trawick Voyager (CFAR 75%) policies can cover all travel arrangements, regardless of where you booked them. In addition, they both offer a 100% refund for covered Trip Cancellations, a 150% refund for covered Trip Interruptions, and a broad list of covered reasons, including cancelling due to contracting COVID.

Trip Interruption

A Trip Interruption is a situation during your trip that causes you to miss some or the rest of your vacation. It’s like Trip Cancellation but happens during your travels.

The most common trip interruption is the injury or illness of a traveler. If you had an injury or illness on your vacation but can continue traveling after treatment, trip interruption reimburses the unused portion of the trip, and the cost to rejoin the trip in progress.

Trip interruption also includes a family member who had a sudden grave illness or passed away. If your covered situation requires curtailing the trip and going home early, Trip Interruption also reimburses for the unused portion of the trip, plus the added cost of going home early.

In the Disney Vacation Protection Plans, Trip Interruption benefits share the same list of covered reasons as Trip Cancellation and have the same $10,000 cap.

Travel insurance plans like the Trawick Voyager and Trawick Voyager (CFAR 75%) offer 150% of trip costs for interruption. Therefore, they cover up to 100% of the unused costs, plus up to an additional 50% to cover transportation costs to return home.

Cancel For Any Reason

Cancel For Any Reason cruise insurance provides the highest level of flexibility and reimbursement if you must cancel your trip for any reason not covered by the policy.

If you cancel your Disney cruise for a reason not listed in the Disney policy, they grant future credits for 75% of the prepaid, non-refundable cancellation fees paid to them. Credits expire after one year, are non-transferrable and not redeemable for cash. Disney, not their insurance policy, provides this part of the Vacation Protection Plan. When it comes to refunds, we always prefer cash since future credits may not be used.

Alternatively, travel insurance policies like Trawick Voyager with Cancel For Any Reason included pay a 75% cash refund of all prepaid, non-refundable trip costs including arrangements made outside of Disney. This could include flights, hotels, rental cars, excursions, and transfers.

Cancel For Any Reason policies have several stipulations:

- Purchase the policy within 10 - 21 days (depending on policy), of your initial payment or deposit date and

- Insure 100% of the prepaid trip costs subject to cancellation penalties or restrictions. For additional prepaid non-refundable payments made after the purchase of the policy, insure within 10-21 days (depending on policy), of each subsequent payment added to your trip, and

- Cancel your trip 2 days or more before your scheduled departure date.

Medical Insurance for Emergency Treatment

One of the most important factors in selecting trip insurance is having adequate Medical Insurance when you travel. Anything can happen, including accidental injuries or sudden illness.

If you have a medical emergency when traveling and don’t have proper medical insurance coverage while overseas, you could find yourself with huge, unexpected hospital bills. Many Americans mistakenly believe countries with universal health care will treat them for free. Unfortunately, this is not the case.

Instead, Americans receive treatment at private hospitals, not public, and must pay like anyone else. Admission for inpatient care can cost $3,000-$4,000 per day, plus the cost of treatment, x-rays, surgeries, and specialists.

A common misconception is that Medicare will pay for hospitalization overseas. Unfortunately, they won’t. Medicare does not pay providers outside the US. Some Medicare supplements do cover overseas, but have lifetime limits or reduced benefits, and pay for emergencies only. They can still require you to pay 20% of the costs. As a result, you could go on vacation and end up with medical bills in the thousands.

TripProtectors urges overseas travelers to take travel medical insurance of at least $100,000 per person . In a medical emergency, $100,000 provides ample health care and helps protect your retirement savings from unexpected financial burdens.

The Disney Vacation Protection Plan provides a $10,000 benefit for Medical Insurance. Trawick’s Voyager policies includes $250,000 per person of Medical Insurance, so you can receive proper treatment without ending up in debt.

Emergency Medical Evacuation

Medical Insurance isn’t the only potentially expensive part of a trip. Emergency Medical Evacuation transports you from the place of injury or illness to the closest hospital. Once you’re stable enough for transport, Medical Evacuation brings you home via commercial flight or, if necessary, private medical jet.

Medical flights can cost up to $25,000 per hour and regular health insurance does not cover it. In addition, the US State Department does not offer any medical treatment or evacuation assistance for US citizens. TripProtectors advises travelers to get at least $250,000 Medical Evacuation to assure there’s enough coverage to get them back home from almost anywhere if they experience a serious medical event.

The Disney Vacation Protection Plan includes Medical Evacuation up to $30,000 total. The Trawick Voyager plan provides $1,000,000 per person for Medical Evacuation, so you can feel secure knowing you have adequate coverage to transport you back home if needed.

Pre-existing Medical Conditions

A significant concern for senior travelers can be pre-existing medical conditions. A Pre-Existing Medical Condition is one in which you’ve received medical treatment, testing, medication changes, added new medications, or received a recommendation for a treatment or test that hasn’t happened yet. Most travel insurance policies exclude pre-existing conditions unless you purchase the policy within the required time period from your initial trip deposit date (called the Time Sensitive Period). Otherwise, the insurer will look backward 60, 90, or 180 days (depending on the policy) from the date you purchased the insurance to see if there are any pre-existing medical conditions they won’t cover. This is called the Look Back Period. Any medical conditions older than this Look Back Period, unchanged or stabilized with no medication dosage changes are covered, as are any new conditions that arise after you purchase the policy.

If you must cancel, interrupt, or seek medical treatment for a medical condition while traveling, travel insurance policies typically exclude claims related to pre-existing medical conditions. However, if you purchase the policy within a few days of your Initial Trip Payment or Deposit date, many policies add a Waiver to the policy that covers pre-existing Conditions. As a result, there is no Look Back Period and pre-existing conditions are covered.

The Disney Vacation Protection Plan does NOT cover pre-existing medical conditions.

However, the Trawick Voyager policy DOES cover pre-existing medical conditions as long as you purchase the insurance on or before the final trip payment.

Price and Value

The Disney Vacation Protection Plan carries minimal coverage and can be more expensive than other viable options. They limit the maximum trip cancellation or interruption refund to $10,000 total. In addition, the medical insurance coverage is only $10,000, and only $30,000 for medical evacuation, which may not be adequate for a serious illness or injury. Cancellation reasons are limited and the Cancel For Any Reason option only grants future cruise credits that expire after a year. Overall, the Vacation Protection Plan offers limited value for the price.

In contrast, by comparison shopping, we found the Trawick Voyager was less expensive than the Disney Vacation Protection Plan. It includes superior medical and evacuation benefits, 100% refund for trip costs for covered cancellation, 150% refund for covered trip interruption, and a robust list of cancellation reasons.

The Trawick Voyager (CFAR 75%) plan was $73 more than the Disney Vacation Protection Plan but provided much better coverage all around and most importantly refunds 75% of trip costs back in cash, rather than future credit.

The Disney Vacation Protection Plan provides travelers with a minimal insurance policy that could leave travelers unpleasantly surprised during an emergency. Medical coverage and medical evacuation limits are low, and there are a limited number of covered cancellation and interruption reasons, as well as insufficient trip cost reimbursement. Though they have a strong partner in Disney, the insurance itself is rather weak. Overall, we rate it a 7 out of 10.

Travelers planning a Disney cruise vacation will find the best value for their money and peace of mind when they shop for travel insurance at TripProtectors Travel Insurance Marketplace. There, you can review dozens of options and select the best policy to fit your needs.

To help you find the best policy, TripProtectors recommends having at least $100,000 in travel medical coverage and $250,000 emergency medical evacuation when traveling outside the US. And, if you purchase the policy within the 14-21 days of initial trip payment, please consider a travel insurance policy with the pre-existing condition waiver included to ensure the most coverage for your money.

If you are planning a Disney cruise in 2022, be sure to pack insurance before you travel. You never know when you may need it.

Have questions? Chat with us online, send us an email at [email protected] or alternatively call us at +1(650) 397-6592 . We would love to hear from you.

Safe Travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Excellent service and policies! This is the second time I have used…

This is the second time I have used AARDY. Their prices and coverage are great, but just as important, their agents are awesome! Destiny was my agent this time and she did an amazing job of answering my many tedious questions (she was very patient) and she explained everything very clearly. Emails with quotes arrived immediately and it was easy to reach them by phone. Extremely happy with the service and travel insurance policies.

Amanda was great

Amanda was friendly, quick and efficient. She explained the coverage I would be getting and I feel secure with the coverage.

Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

- CDC & State Department Advice

How Much Is Disney Cruise Vacation Protection Plan

Don't miss, caribbean cruises 2022 all inclusive, where do alaskan cruises depart from in seattle, best cruises for singles over 50, which cruise lines include alcohol, cruises from new jersey 2022, what is the best cruise line to see alaska, what cruise lines sail out of bayonne nj, msc cruises cancellation policy.

For bookings made through March 31 for MSC cruises through March 31, 2023, passengers can change their cruise up to 48 hours before departure.

“They can move their money to another cruise that sails on or before March 31, 2023 ,” Stephen Schuler, vice president of communications for MSC, told USA TODAY on Wednesday. “The only exception to this is guests booked on MSC World Cruise or World Cruise segments.”

How Do I Buy Cruise Insurance

If after reading this guide, you find yourself wondering how you can purchase the Carnival Cruise Line vacation protection plan. Then contact them on 1-888 CARNIVAL or contact your travel agent or personal vacation planner.

You can also, always buy cruise insurance from an independent travel insurance company.

Does Disney Offer Travel Insurance

The Disney Parks do offer a Travel Protection Plan through their booking website. However, to find the best and most robust insurance for your unique trip, it’s advisable to look at travel insurance reviews and then buy travel insurance for your trip from a third-party source. Often the types of travel insurance plans offered with vacation packages tend to be limited in their coverage and may not include the essential benefits you need for your individual comfort and safety. It is advisable to review the policy and coverages carefully, comparing the benefits to other recommended travel insurance plans. You can easily do this by answering a few questions about your trip in our quote generator , or calling our Customer Care team.

You May Like: Cruise Lines In Mobile Al

Trip Cancellation/interruption Insurance Coverage

The most basic cruise insurance policies cover you in case your trip is canceled or interrupted. These policies reimburse you for actual losses up to your coverage limits when:

- You must cancel due to a covered reason.

- You have to return home early due to a covered reason.

- There is a covered departure delay.

Does Travel Insurance Cover Hurricanes In Disney

It is no secret that hurricanes are common for the state of Florida , particularly during hurricane season , which runs from June 1 – November 30. The number one concern of summer travelers researching travel insurance is how their trip will be affected by hurricanes or other severe weather events.

For concerned travelers, it is important to know that purchasing your travel insurance plan prior to a storm being named should provide you coverage for travel concerns that arise due to that storm. If a hurricane or tropical storm that affects your trip is predicted before you purchase a plan, your coverage may be extremely limited.

Oftentimes Disney does allow travelers to cancel or change the date of your tickets or vacation package in the case of a hurricane affecting the park . That means that if youre able to reschedule the trip or get a refund, you would not be reimbursed for those costs through comprehensive coverage. Only non-refundable costs are covered. However, your flight or other travel arrangements may not be refundable and would be covered under a comprehensive plan as long as you purchased your plan before the hurricane was a named storm .

Recommended Reading: Cruise Ships That Leave From New Orleans

A Look At Carnival Cruise Line

Carnival cruise is a cruise vacation company headquartered in Miami, USA. It has a vacation protection plan which it offers to its clients at a cost, in addition, to purchase of a cruise vacation. This vacation protection plan consists of three packages including Trip Cancellation waiver program, Travel insurance program and Worldwide emergency assistance program

Disneys Travel Protection Plan

Disneys Travel Protection Plan is the insurance policy that Disney offers to guests purchasing Walt Disney World vacation packages.

Much like auto and life insurance, one of the factors that goes into the pricing of insurance is age.

And, for people ages 70 and over, theyll often find that Disneys Travel Protection Plan will give them the best value.

So, if you are considering adding insurance to a trip and you have somebody in your room who is 70+, youll probably want to give Disneys insurance a second look.

Another nice thing to know about Disneys insurance is that it is easy to purchase since it is an option when you book a vacation. And if you prefer to wait, you can easily add it all the way up until your final payment.

That means you can hold off on purchasing it until later, which is something we recommend you do if you dont have a pre-existing condition .

If you are familiar at all with Disney technology, youll know that it can be a little, well, glitchy.

And those glitches always happen at the most frustrating times, like when a new promotion or discount drops and you want to modify your reservation to save some money.

One of the common reasons for guests not being able to modify a reservation online is having an extra component, like Memory Maker or travel insurance, attached to the package.

Another significant con to consider is that you cant use Disneys Travel Protection for Room Only reservations . It can only be added to packages.

Don’t Miss: Cruise Lines Departing From Norfolk Va

Making A Disney Cruise Line Reservation

Of course, you can call Disney Cruise Line directly for your reservations, but we recommend Dreams Unlimited Travel . Dreams Unlimited Travel has many unique programs for Disney Cruise Line guests. Most importantly, Dreams will constantly check for better rates and specials to lower your vacations overall cost. For example, if you make your reservation now, and in a month, a new promotion becomes available, Dreams Unlimited Travel will work to convert that reservation to the new program . While it cant be guaranteed with every reservation, its not an unusual occurrence when it happens. Also, Dreams will run special promotions regularly. Check the Disney Cruise Line Specials page to see what promotions are currently being offered. For more information on Dreams Unlimited Travel, .

Do I Really Need Travel Insurance For Disney World

The Travel Protection Plan costs $77.50 per adult and no additional charge for children when all adults in group add it. Guests can also choose to

Jul 22, 2020 Much like auto insurance, Disney Travel Protection Plan cost is quoted based on age. It costs around $82.50 per adult and $6.00 per child

Read Also: Best Time To Go On A Cruise To Bahamas

What Is A Disney Cruise Line Future Cruise Credit

During the Coronavirus pandemic, Disney Cruise Line has been forced to cancel sailings with impacted guests being offered a choice of a full refund, or a future cruise credit . In each phase of cancelations, we have been given the following blurb regarding the FCC.

*The Future Cruise Credit is equal to 125% of your original voyage fare and is only valid for sailings departing within 15 months of your original sailing. The FCC is applied per person and is non-transferable, non-refundable and has no cash value. Standard prevailing rates apply and Guests are responsible for any balance due after the FCC has been applied. If you end up not being able to use the FCC, you will be eligible for a refund up to the amount of your original voyage fare. Standard cancellation policies and terms and conditions apply to future sailings. Guests who previously received a FCC are not eligible for an additional Future Cruise Credit.

The good news, in it will keep you from having to wait on hold, FCC can be added to new sailings booked online instead calling the Disney Cruise Line which has traditionally been the procedure. The future cruise credit will be available to apply to your new online booking once you reach the checkout screen. Simply click the button on the checkout screen that says Future Cruise Credit to add it to your booking.

The Best Travel Insurance For Your Disney World Dream

IMPORTANT: Before purchasing a travel protection plan, please read our Coverage Alert for details on how our plans may limit or exclude coverage related to

Aug 22, 2018 To purchase a Travel Protection Plan for your Walt Disney World Resort vacation, please contact the Disney Reservation Center at 934-7639

You May Like: What Cruise Lines Sail Out Of Charleston

Cruise Insurance And Fee Waiver Programs: What To Know

People book cruises to visit multiple cities while saving on renting a car or flying in between destinations. Most cruises include accommodations, food and entertainment, so cruising can be an inexpensive way to travel. There is yet another cost savings consideration that comes with booking a cruise: whether to buy a cruise insurance policy. Savvy travelers use cruise insurance to protect their investment in case they miss their departure or get ill during the trip.

Cruise insurance is offered by cruise lines and independent insurance companies, so it pays to know the difference in coverage and what each type of policy costs. In this article, we’ll help you understand your options to determine if cruise insurance is right for you.

- Is cruise insurance worth it?

Disneys Travel Protection Plan Vs Travel Insured

Note: Some of the links below contain an affiliate link, meaning we receive a commission if you decide to make a purchase through it. We would not share this link unless it was a product we used and loved ourselves. If you prefer, however, you can review the information and purchase outside of the link by searching for the company name in your favorite web browser.

Weve talked before about some of the things you should consider before purchasing travel insurance .

And, our first suggestion is always to ask yourself: What is my reason for buying insurance?

Are you worried about your trip being interrupted?

Are you concerned about hurricanes or having your bags lost or maybe you want to be prepared with emergency medical protection?

Figure out what your main concerns are, and then youll want to zero in on a policy that covers your main worries for a price that fits your budget .

Dont Miss: Whats The Best Time To Go On An Alaskan Cruise

Don’t Miss: Best Month To Take Alaska Cruise

Cancel For Any Reason Coverage

A cancel for any reason policy costs more than regular travel insurance . You can cancel the vacation and receive part of your prepaid, nonrefundable trip costs back . Youre not tied to canceling only because of one of the reasons listed in a policy.

Do you need it? Consider that Disney lets you cancel for a full refund up to 30 days before your reservation. If youre within two to 29 days of the trip, theres a $200 cancellation fee but the rest of your package is refunded. If you cancel one day or less before the trip, then youre on the hook for the full price and wont get a refund.

If you have non-refundable plane tickets, check with the airline. Many have extended rebooking policies due to COVID-19, so you may find you have some leeway.

So if your main concern is only the one-day window before the trip, buying coverage may be a bad bet, unless you have other high-price non-refundable elements of your vacation.

What Is There To Do On A Disney Cruise

Disney is perhaps even more famous for its entertainment options than its food, and the Disney Cruise Line absolutely delivers with its robust entertainment options. Each night, passengers receive a schedule for the following days activities. There are usually a few different activity lists – one list for families, one for adults, one for each of the kids’ clubs.

Some activities include the classic entertainment options of bingo, poolside games, mixology classes, how to make paper airplanes, Broadway shows, movies in the theater, and so many more. Just like the Disney parks, one of the highlights is the opportunity to meet and greet Disney characters. This is an exciting part of the day, especially for the children. Lines may form, they may be long, but the character interaction is often well worth the wait.

Also Check: Best Months For Alaskan Cruise

What Is Carnivals Coverage Scope

Carnival cruise insurance coverage begins when your final payment for the insurance cover is received by the cruise line.

In the cases of trip cancellation and interruption, the coverage time is different. For trip cancellation, the coverage begins from the time the full payment of the cover is made. For trip interruption cancellation the coverage starts from the scheduled departure date.

Your vacation protection plan coverage ends the moment the cruise is completed or when you arrive at your return destination. It also ends the moment you cancel the vacation.

Carnival Cruise Line Cancellation Policy

Carnival Cruise Line warned passengers scheduled to cruise through Jan. 14 in an email obtained by USA TODAY that itinerary changes may happen as a result of omicron’s spread and said no refunds would be issued for missed port stops beyond pre-purchased excursions.

“We recognize that given the circumstances, some of our guests may want to consider sailing at a different time,” the cruise line said, noting that passengers should contact the company, their travel agent or planner to rebook or cancel for a full refund.

Cruise COVID-19 policies: Carnival Cruise Line updates onboard mask requirements as omicron spreads

Recommended Reading: Which Cruise Lines Depart From Galveston

How To Notify Disney About Your Accident At A Theme Park Hotel Or Somewhere Else

As soon as you are able to, you should send an email, fax and letter to Disney letting them know that you suffered injuries because of their negligence.

The letter and fax should be simple. You may want to send it to also the actual property where you were hurt. Ask them to preserve video footage of 12 hours before and 1 hour after your accident.

This doesnt just apply to Disney claims. It applies to all personal injury claims.

In a claim against Disney, this evidence may include:

- Receipts of any purchases made at the property where the accident happened

Receipts and other items may also reveal if you purchased alcohol before your accident . Likewise, receipts may show if a witness was drinking before the incident as well. This may affect the witness credibility. A drunk witness loses credibility.

Receipts and other documents may also help you remember your activities in the days before and after the incident at Disney which caused your injury. If you wind up suing, Disneys lawyer may ask you detailed questions about this.

Do I Need The Official Disney Travel Insurance

If youre buying a theme park vacation , your agent might suggest the Disney Travel Protection Plan . Although you dont have to buy it, reviewing its coverage gives you a good idea of what could go wrong when youre on your Disney dream vacation.

The plan includes:

Luggage delay. If your airline loses your luggage and its delayed by more than 12 hours, you can get reimbursed for the purchase of necessary personal items.

Baggage loss. Youll get up to $2,000 for lost, stolen, or damaged bags or personal effects.

Emergency assistance. Youre eligible for 24/7 travel assistance, medical assistance and emergency services.

Emergency evacuation and repatriation. If youre injured, the policy covers emergency medical transportation and other expenses.

Emergency medical protection. The policy provides up to $25,000 of coverage for an illness or injury sustained while traveling.

Trip cancellation and trip interruption. Youll get reimbursed for up to the total of your prepaid travel arrangements if youre injured or ill. It also covers non-medical reasons like a job loss or a change in military orders.

Travel accident. It provides up to $25,000 in the event of accidental death or dismemberment.

Trip delay. The policy reimburses you for expenses related to a delay, up to $600 .

Rental car damage. The policy will reimburse repair costs of up to $25,000 for collision, theft, damage or vandalism to rented vehicles.

You May Like: Norfolk Va Cruises

Can I Cancel A Carnival Cruise Without Incurring A Penalty

According to Carnivals site, if you cancel a trip before you make the full vacation payment there will be no charges incurred. However, if you had booked a promotional trip that has a non-refundable policy, there will be charges incurred.

Cancellation charges or penalties will depend on the length of your trip for example,

For cruises that are less than 5 days, you have up to 60 days to make a final payment before departure.

For cruises which are 6-9 days long, you have up to 75 days to make the final payment before departure.

For cruises that are 10 plus days, you will have up to 90 days to make the final payment before departure.

To avoid being penalized, you have to cancel the trip before the given days elapse provided you have not finished paying for your vacation cruise.

There are some promotions on Carnival that have a non-refundable policy such as the early saver, super saver, and pack and go travel packages. The deposits made for these packages are non-refundable after booking.

Once your booking enters into the cancellation penalty period, note that the penalties will increase the more the departure approaches.

Cruise Line Insurance Plan Comparison

When it comes to providing cruise insurance, Allianz Global Assistance is not the only boat in the harbor.

Many cruise lines also offer travel insurance plans.

That said, we like how we stack up against our friends in the cruise industry.

But opinions are like lifejackets during a cruise ship muster drill everyone has one. So, lets stick to the facts by comparing cruise insurance plans features, head to head. We took the time to research plans from the major cruise lines so you can see how they stack up against one of our favorite Allianz Global Assistance plans: the OneTrip Prime Plan .

Read Also: What Is The Biggest Disney Cruise Ship

More articles

New disney cruise ship 2021, cruise ship with central park, do disney cruises require vaccinations, popular articles.

© 2021 CruisesInfoClub.com

- Terms and Conditions

- Privacy Policy

Popular Category

- Exclusive 329

- Must Read 323

- Editor Picks 296

- Trending 296

- Popular 293

Editor Picks

How much does an alaska cruise cost.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Is Cruise Travel Insurance Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is cruise travel insurance?

What does cruise travel insurance cover typically, how much is travel insurance for a cruise, do i need it if i have other travel protections, is cruise travel insurance worth it.

Cruise travel insurance covers the cruise itself, not related travel.

It's usually purchased through the cruise operator, typically before booking.

Check to make sure your credit card doesn't offer similar insurance before buying cruise insurance.

Cruising is one of America's favorite travel experiences. According to a 2021 report from Cruise Lines International Association, an industry trade association, 82% of cruisers will cruise again. As well, 62% of non-cruisers are open to the idea.

And why not? Cruises often give travelers the chance to experience multiple destinations plus enjoy onboard entertainment, activities and dining for a set, all-inclusive price . Cruises simplify budgeting in a year when travel prices have been hard hit by inflation .

But what happens if something goes wrong with your ship, or you can’t make it onboard because of health concerns? Cruise travel insurance might be the answer. It protects your payment and covers you against illness or injury.

Before you pay for a cruise travel insurance policy, here's a look at what it is, how it works and if it's worth it.

Cruise travel insurance is add-on insurance coverage that — just like travel insurance — will reimburse you for delays, interruptions, medical situations or other problems during the cruise.

Depending on which cruise line you're traveling with, you might be able to buy a travel insurance policy when booking your trip (through the cruise line directly) or at a later date (either through the cruise line or separately from a third party).

Protecting travel costs can be a smart money move. A September 2022 survey of 737 past cruisers by InsureMyTrip found that the average trip cost for an insured cruise vacation so far this year is $6,367, an increase of nearly 15% from before the pandemic.

Can you buy travel insurance after booking a cruise? It depends. Some cruise lines require the purchase of a travel insurance policy before the final payment date when charges become nonrefundable. Others require the purchase of coverage a certain number of days before departure. Read the fine print to find out the deadline to purchase and the specifics of its coverage.

Circumstances covered by cruise travel insurance vary by policy and by issuer. Many cruise lines partner with an insurance company to underwrite its policy benefits.

Some common benefits available as part of travel insurance from a cruise line include:

Trip cancellation and interruption . If you cancel your trip or unexpectedly cut it short for an eligible reason, such as severe weather or illness, you'll get back some or all of the upfront costs, depending on the policy.

Cancel For Any Reason . This coverage tends to be more flexible, forgiving and expensive at time of purchase. Policyholders can cancel for any reason not listed in the policy and still receive a portion of their trip cost back, either as cash or as a future cruise credit (assuming they meet other eligibility requirements).

Trip delay . Cruise delay insurance protection protects expenses if your trip is delayed beyond a set number of hours.

Baggage protection . This insures your luggage if it is lost, stolen, damaged or delayed, and gives money to buy necessary items until bags are recovered.

Medical coverage . If you get sick or injured during the trip, the policy covers treatment and related expenses up to a limit.

Emergency evacuation . When emergency evacuation is necessary, the policy covers the transport cost up to a limit.

COVID coverage . If your trip is canceled or interrupted due to COVID, the policy covers the unused prepaid expenses, medical treatment and emergency evacuation, up to policy limits.

When comparing policies, choose a policy that includes all of the benefits, protections and coverage limits that are important to you. While you may be tempted to choose the lowest-priced option, that policy may not have the coverage you need.

We examined cruise insurance prices for a seven-day trip in February 2023 from the U.S. to Mexico. The example traveler was 35 years old, from Georgia, and planned to spend $2,500 on the trip, including airfare.

The average price of each company’s most basic coverage plan was $124. These policies didn't include optional add-ons, such as Cancel for Any Reason coverage or coverage for pre-existing medical conditions .

Separately, we looked at five different cruise insurance add-ons for a similar trip. With this option, the average cost of basic coverage was cheaper than a standalone policy at $111.20. Keep in mind that cruise insurance policies offered by cruise lines typically cover the cruise portion of the trip only, but do include some Cancel For Any Reason coverage.

If you already have a standalone travel insurance policy or a credit card with travel protections, you may wonder if you need to purchase a cruise travel insurance policy.

Credit card travel insurance

Many travel credit cards include travel protections such as trip cancellation, interruption, delayed or lost luggage reimbursement, and emergency evacuation benefits. Before buying a cruise travel policy, compare the coverage benefits and limits to determine if you already have coverage with a credit card.

One benefit that cruise travel insurance policies offer that credit cards don't is the ability to cancel for any reason. Although you may not get back 100% of the cruise price, these policies allow you to cancel for any reason and get a portion of the price back as a credit toward a future trip. If the policy is priced low enough, it may be worth buying the insurance offered through your cruise line for that benefit alone.

Travel insurance policy

Standalone travel insurance policies can be purchased to cover one person or a family for a specific trip or multiple trips within a period of time. These policies are available at a variety of price points to meet a traveler's budget. When comparing policy options, you can balance price versus coverage options.

If you're traveling multiple times within a short period of time, it may be more economical to buy a more comprehensive travel insurance policy instead of separate policies for each trip.

Cruise travel insurance can be worth it to address your concerns about traveling and protect your investments. These policies offer numerous protections that will cover your expenses in case your trip is canceled, interrupted or delayed, or if you get sick during the trip.

Before buying this coverage, compare your options against your credit card benefits. You might also shop for general travel insurance policies to see if you can get a better deal than what’s offered through your cruise line.

If you’re not covered by your credit card, cruise travel insurance can be worth the added cost. It will give you peace of mind before setting sail, when signing up for that adventurous land excursion and when clicking "Book" for an expensive vacation in the COVID travel landscape.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

This is the announcement bar for Poornima to test the Close Button. It will expire May 31 2024.

- Pre-Cruise FAQ

- Onboard FAQ

- Post-Cruise FAQ

- Cruisetours FAQ

- Special Offers Sign Up

- Cruise Deals

You have been logged out

Your window will update in 5 secs

Enjoy Even More Peace of Mind with Our New & Improved Princess Vacation Protection

Life can be unpredictable but you can rely on princess vacation protection.

One of the most common questions we hear from our guests is, ‘Should I buy travel protection?’ If you want to spend more time relaxing and less time worrying about the unexpected, the answer is ‘yes’. That’s why we offer Princess Vacation Protection (PVP), which provides a cancellation fee waiver1 plus travel insurance benefits2 and 24-hour worldwide CareFree™ Travel Assistance 3 . Help protect in the event of unforeseen illness, including COVID-19, trip delays, baggage issues and more. It’s a convenient way to help ease your worries before setting sail.

Your benefits just got better – and you can still enjoy low prices!

New improvements:.

- Increased benefits up to 150% of vacation cost for Trip Interruptions.

- Increased Emergency Evacuation benefits up to $50,000 for the standard plan and $75,000 for the platinum plan.*

Benefits at a Glance

Cancel for any reason 1.

Cancellation Fee Waiver 1 (Non-insurance features provided by Princess Cruises) Life is unpredictable… but you can rely on Princess Vacation Protection. If you need to cancel for specified reasons outlined in the Cancellation Fee Waiver section of the plan, you’ll receive a refund of your cancellation fees. If you need to cancel for any reason not listed in the plan, under the “Any Reason” Cancellation Enhancement feature, you’ll receive 75% of the cancellation fee amount in the form of future cruise credits under our Standard plan and 100% under the Platinum plan.

Trip Interruptions

If you need to interrupt your trip due to a covered reason such as an illness or injury, you are eligible for reimbursement of prepaid cruise/land arrangements made through Princess and/or the cost of one-way airfare to get you home.

Medical Evacuation

Princess Vacation Protection also provides coverage in case your medical condition requires emergency evacuation to an appropriate medical facility.

Medical Expenses

Most medical expenses are covered in case you become sick or injured during your trip.

Trip Delays

If you are delayed starting your trip or returning home, you may be reimbursed for expenses that were not arranged through Princess – including meals, hotel, and transportation.

Personal Belongings

Your baggage is also covered in the event it is damaged, lost, stolen, or delayed to your destination.

24/7 Support

Need help? You will have access to 24/7 worldwide assistance for travel, medical, and emergency services.

The plan terms, conditions and exclusions are available online:

Captain’s Circle Loyalty Benefit

Available in both a Standard and Platinum plan, choose the plan you want based on the coverage and plan price that works best for you. Captain’s Circle members who have achieved Ruby, Platinum or Elite status who elect to purchase Standard PVP automatically receive a complimentary upgrade to PVP Platinum; we’ll pay the difference in plan cost on your behalf.

3 Ways to Purchase Princess Vacation Protection

Princess Vacation Protection can be purchased at the time of booking or up until final payment. You are considered enrolled as soon as the plan cost has been paid.

- When you Book your Cruise on Princess.com

- Call 1-800-Princess or contact your Travel Advisor

- Already Booked Guests can purchase in Cruise Personalizer

Product Details

Cancellation Fee Waiver 1 (Non-insurance features provided by Princess Cruises)

Life is unpredictable… but you can rely on Princess Vacation Protection. If you need to cancel for specified reasons outlined in the Cancellation Fee Waiver section of the plan you’ll receive a refund of your cancellation fees. If you need to cancel for any reason not listed in the plan, under the “Any Reason” Cancellation Enhancement feature, you’ll receive 75% of the cancellation fee amount in the form of future cruise credits under our Standard plan and 100% under the Platinum plan.

Travel Insurance Benefits 2 (Underwritten by Nationwide®)

Sail through your vacation with less to worry about.

Trip Interruption: Up to 150% total trip cost reimbursement for missed, prepaid cruise arrangements and/or the cost of one-way airfare if you must start your vacation late or need to come home early due to illness, injury and more.

Trip Delay: Up to $500 for any pre-cruise trip delay expenses and/or post-cruise trip delay expenses up to $1,500 (not to exceed $1,500 for both pre- and post-cruise delays) for meals, hotel and transportation.

Baggage Delay: Up to $500 if your luggage is delayed during travel.

Baggage/Personal Effects: Up to $1,500 ($3,000 with the Platinum plan) if your stuff is lost, stolen or damaged.

Accidental Medical Expense: Up to $10,000 ($20,000 with the Platinum plan) if you become injured while traveling.

Sickness Medical Expense: Up to $10,000 ($20,000 with the Platinum plan) if you become sick while traveling.

Emergency Medical Evacuation/Repatriation: Up to $50,000 ($75,000 with the Platinum Plan) in the event your medical condition requires emergency medical transportation to an appropriate medical facility or in the event of your death, provides coverage to transport your mortal remains.

24/7 Worldwide Travel Assistance Services 3 (Non-insurance services provided by LiveTravel)

Need help while you travel? Assistance is there for you, 24 hours a day, 7 days a week, anywhere in the world.

Princess Vacation Protection can be purchased while booking your next cruise vacation on princess.com, by contacting your travel agent, by calling 1-800-PRINCESS, or on Cruise Personalizer. It is available for purchase up until final payment for your trip on all Princess Cruises, Princess Cruisetours, Princess Alaska Land Tours and Princess Canadian Rockies Land Tours, and is available at two levels: Standard or Platinum. Princess Vacation Protection is not in effect until the plan cost has been paid to Princess in addition to any required cruise deposits or payments.

1 Non-insurance feature provided by Princess. WA residents only, Trip Cancellation benefits are underwritten by Nationwide Mutual Insurance Company and Affiliated Companies, Columbus, Ohio (NAIC #23787).

2 Travel Insurance Benefits are underwritten by Nationwide Mutual Insurance Company and Affiliated Companies, Columbus, Ohio (NAIC #23787).

3 Travel Assistance services are non-insurance services provided by LiveTravel International.

This plan provides insurance coverage that applies only during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of this policy with your existing life, health, home and automobile policies. If you have any questions about your current coverage, call your insurer, insurance agent or broker.

Princess Vacation Protection – Standard To obtain your state-specific Certificate of Insurance providing the terms, conditions and exclusions of the certificate, visit PVP Standard .

Princess Vacation Protection – Platinum To obtain your state-specific Certificate of Insurance providing the terms, conditions and exclusions of the certificate, visit PVP Platinum .

Note that Princess Vacation Protection is not available to residents of the state of New York, British Columbia, Quebec, Puerto Rico, or Mexico.

Need to file a claim?

Frequently Asked Questions

Q: What happens if I test positive for COVID-19 and need to cancel the day before my cruise? A: Like with any illness diagnosed and treated by a medical professional, if you test positive for COVID-19 after purchasing the plan, you will be eligible to receive a refund to your original form of payment. If you do not have an official medical diagnosis, but feel unwell, you will receive a Future Cruise Credit.

Q: What if my spouse gets COVID-19 right before the cruise and we can no longer sail? A: You will be eligible to file a claim for a cash refund if you, your traveling companion or a member of your immediate family is diagnosed and treated for COVID-19, which causes you to cancel your cruise.

Q: What if my mother, who isn’t sailing with us, gets COVID-19, and we may have been exposed? A: Princess Vacation Protection has you covered! Even if they are not traveling with you, if someone in your immediate family is diagnosed and treated for an illness, you may request a refund to the original form of payment. If they are ill but are not diagnosed or treated, you may call us and receive a Future Cruise Credit for the cruise fare.

Q: What if I find out I was exposed to someone either on my way to my cruise or during the cruise, and I end up being isolated in my cabin for part or all of the voyage? A: PVP provides reimbursement for the days you are confined to your cabin if the confinement is ordered by a medical professional.

Q: Does PVP cover my medical expenses if I get COVID-19 during my cruise? A: Yes, PVP provides reimbursement for eligible medical expenses for any illness, including COVID-19.

Q: What if I want to cancel my PVP coverage? How does that work? A: PVP is refundable until final payment is due. For new bookings made within final payment, the PVP plan cost is only refundable within 10 days of purchase provided the person hasn't departed on the trip nor filed a claim.

Q: Am I protected by my Princess Vacation Protection plan if my mother, who is not traveling with me, develops pneumonia and I have to cancel my trip to care for her? A: Yes! Princess will refund the cancellation fees (up to the full value of the cruise vacation) if you have to cancel your trip because of a specified reason such as illness, injury or death of yourself, a traveling companion or either of your immediate family members.

Q: If I have a heart condition and am on continuing medication, am I protected if my heart condition flares up during my vacation? A: Yes! Princess Vacation Protection provides reimbursement for conditions that are stable during the 60-days prior to purchase, so if you have had no changes in your health (even if you are on continuous unchanged medication), you would be protected.

Q: What if my condition did change prior to purchasing Princess Vacation Protection? A: Rest assured, emergency evacuation benefits are still provided in the event of a medical emergency. Also, if you cancel your cruise vacation and do not qualify for cash reimbursement due to an unstable medical condition prior to purchase, you will have the benefit of cancel-for-any-reason protection from Princess.

Q: If my pet becomes ill and I have to cancel my trip as a result, will Princess Vacation Protection reimburse me? A: Although you would not qualify for cash reimbursement, as an added feature for purchasing Princess Vacation Protection, Princess will provide a credit toward a future cruise equal to 75% of the cancellation fees imposed (100% if Platinum Vacation Protection is purchased) if you choose to cancel for an ineligible reason. This benefit is provided by Princess Cruises and/or Princess Tours.

- Entertainment

- Newsletters

Disney cruise passenger with pending sex crimes case caught with child sex abuse videos, authorities say

Feds: he had just gotten off ship at port everglades.

Chris Gothner , Digital Journalist

FORT LAUDERDALE, Fla. – Federal agents caught a man facing two child sex crime charges in Ohio with child sexual abuse material on his phone after he disembarked a Disney cruise ship at Port Everglades, authorities said.

Dakota Anthony Ferguson, 22, of Columbus, Ohio, appeared in Fort Lauderdale federal court on Monday on charges of transportation and possession of child pornography. Authorities arrested him after a border search of his cellphone after he got off the Disney Magic on Saturday, a federal criminal complaint obtained on Tuesday states.

Recommended Videos

Franklin County, Ohio court records obtained by Local 10 News show that Ferguson is facing two counts of unlawful sexual conduct with a minor after being arrested by the Columbus Police Department. According to those records, Ferguson was indicted in that case in September 2022.

In the latest case, court documents state that U.S. Customs and Border Protection officials conducted a secondary examination on Ferguson and found “numerous videos” of child sexual abuse material on his cellphone, “the majority of which” depicted prepubescent girls being raped or otherwise sexually abused.

Authorities said Ferguson admitted that he began looking at child sexual abuse material three years ago and has viewed and shared it on platforms including messaging app Telegram and social media outlet X, formerly known as Twitter. Agents allege that he’s purchased videos depicting victims as young as 2.

In one instance, federal authorities said Ferguson sent a video to a Telegram user with a caption implying that the footage showed him raping a family member.

Ferguson “denied producing this video, stating his only intent was to give the perception of production,” Homeland Security Investigations Special Agent Katherine Leonard wrote in the criminal complaint.

Ferguson’s Ohio indictment shows that he’s accused of engaging in “sexual conduct” with a victim between the ages of 13 and 15 in 2021, when he was 19. Records show he has pleaded not guilty in the case.

Local 10 News has contacted Disney Cruise Line inquiring about its background check procedures for passengers.

Ferguson remained held in the Broward Main Jail as of Tuesday; he’s scheduled to appear again in front of a Fort Lauderdale federal judge for a bond hearing next Monday.

Copyright 2024 by WPLG Local10.com - All rights reserved.

About the Author

Chris gothner.

Chris Gothner joined the Local 10 News team in 2022 as a Digital Journalist.

Pay at Your Own Pace

Making your dream vacation at sea come true is easier than you might expect.

So Much Included

Exclusive disney entertainment, dining galore and more, freshwater pools and recreation, world-class accommodations, fun-filled youth clubs, disney castaway cay.

Broadway-Style Shows

Disney Character Encounters

Spectacular Deck Parties

Fireworks at Sea*

Imaginative Dining Experiences

Around-the-Clock Room Service

Sodas & Soft Serve Ice Cream

Quick-Service Eats

Family Pools & Aqua Play Areas

Water Slides & Aqua Coasters

Adult-Exclusive Pool Area

Sports Zone

Spacious Family Accommodations

Easy Transition from Day to Night

Daily Housekeeping & Turndown

In-Room Disney Movies

Kids Clubs Filled with Character

Trained Disney Youth Counselors

Exclusive Club for Tweens

Teens-Only Club

BBQ Lunch + Beach Amenities

Disney Characters

Exciting Activities

Adult-Exclusive Beach

What’s Included on a Disney Cruise?

Expect something more—where what’s included in the price may surprise you.

Entertainment & Activities

Accommodations & transportation, adult-exclusive activities, our private island, enchanting extras.

- Port Adventures

- Adult-Exclusive Fine Dining

- Salon & Spa Services

- Merchandise & Photos

- Alcohol & Specialty Treats

Magical Worldwide Destinations. Book a Cruise Today!

Should you repeat your vacation? Let's settle this once and for all.

- Travelers are divided on whether to repeat a vacation or try something new.

- There are good reasons to go back to the same place, including comfort, friends and family and special memories.

- But there are also good reasons to get out there and travel: it changes your perspective and makes your life more exciting.

Want to start an argument? Just ask a random family member where to take your next vacation. Specifically, should you play it safe by returning to the same place – or try something new?

But it's an argument worth having now. Here's why: The top destinations for the summer of 2024 are ridiculously familiar. Orlando, London and Cancun, according to the latest Allianz Partners survey . All those far-flung revenge travel destinations from after the pandemic are history. People want something safe and familiar.

But is that a good thing?

Check out Elliott Confidential , the newsletter the travel industry doesn't want you to read. Each issue is filled with breaking news, deep insights, and exclusive strategies for becoming a better traveler. But don't tell anyone!

Why everyone is arguing about vacation repetition

Experts say there's a reason that this is such a heated debate.

Learn more: Best travel insurance

"Typically, when people return to the same spot over and over again, they want predictability," said Thomas Plante, a psychology professor at Santa Clara University . "They know exactly what they are getting and how it works for them. This differs from those who want the unexpected by going to a new place each time they vacation."

Let me acknowledge my bias upfront: I'm part of the second group. I don't have a permanent residence and, as a travel writer, I get restless after being in one place for more than a week. So I had to ask an expert to explain our fondness for sameness.

As rewards credit cards face regulation, what are the alternatives?

"When a traveler finds a place that they like, there's a risk to going anywhere else," said Jeff Galak, who teaches marketing at Carnegie Mellon University’s Tepper School of Business ."We've all experienced bad vacations, so when we find one that just works, it's hard to leave it behind."

I'm going to hand the microphone to both sides of this argument in a minute. But first, let me tell you who is right: Yes, you can go back to the same place – but not in the way you think.

Here's why repeat vacations are great

Travelers have their reasons for coming back to the same place again and again. Shirleigh Brannon, a retired librarian from Marin County in Northern California, travels to Anaheim, California, twice a year to visit Disneyland.

Her love of Disney vacations goes back three decades when she brought her son to the Magic Kingdom for the first time. Experiencing the Jungle Cruise or Alice in Wonderland through the eyes of a four-year-old was special.

"Lots of fond memories," she said.

Even though she knows every inch of the park by now, it's those special memories that keep her coming back again and again.

Another reason to repeat is because your friends and family will be there. Janet Ruth Heller returns to Elkhart Lake, Wisconsin, every summer with her extended family.

Will new airline consumer protection rules help you when you fly this summer?

Tipping is 'not an entitlement': Should travelers stop tipping for everything?

"We have good memories," said Heller, a retired college professor. "Elkhart Lake has many activities for families, and it is conveniently located for our relatives."

There's also a comfort level. Bernard Nash, a medical school professor from New York, likes to explore the world. But he also has a timeshare in Aruba that he goes back to every year. He loves hanging out by the pool, taking long walks along the white-sand beaches, and dining in his favorite restaurants. And from time to time, he runs into people he knows, who are also there on vacation.

"It's the perfect place to go and just chill out," he said.

So, comfort, friends, family and special memories – those are all great reasons to repeat your vacation.

But I have to warn you: You're missing out.

Why you should get out there and experience something new

Other travelers would never repeat a trip. Marcy Schackne is one of them.

"When it comes to travel," she said, "It's one and done."

Schackne, a marketing executive for a healthcare company in South Florida, has been to all seven continents and is part of the exclusive century club, having visited more than 120 countries.

"There's too much world to see to go back and repeat a Groundhog Day experience," said Schackne, who is off to Greenland in July.

"Going to the same place every year would be boring," said Kathleen Panek, who owns a bed and breakfast in Shinnston, West Virginia. "There are so many things to see and do."