- ENVIRONMENT

- FOREIGN POLICY

- REAL ESTATE

- WHAT’S ON

- LATEST NEWS

- GREEK EDITION

Bank of Greece: Tourist receipts soar in 2023

Greece saw a surge in tourist arrivals, reaching 32 million visitors from January to November 2023, according to data from the Bank of Greece released on Monday.

The inbound travel movement surged by 17.3%, totaling 31.97 million travelers compared to 27.25 million in 2022. This surge resulted in a 15.4% rise in travel receipts, reaching €20.1 billion.

Regarding transportation methods, air travel rose by 12.5%, and road border crossings surged by 34.5%.

Travel receipts from EU residents increased by 11%, amounting to €10.9 billion, while receipts from non-EU residents rose by 18.4%, totaling €8.4 billion. Germany, France, the United Kingdom and the United States were major contributors, with receipts from Russia experiencing a 22.8% decline.

Subscribe to our Newsletters

Enter your information below to receive our weekly newsletters with the latest insights, opinion pieces and current events straight to your inbox.

Tourism minister meets with foreign ambassadors over joint ventures

Over 82,000 jobs lost when tourism season ended

Ministry seeking to make Greece a ‘top of mind’ destination

Passenger traffic in Athens airport set record in 2023

Ticket price hikes on Greece-Italy ferry in line with EU emission regulations

Tourism contributed 24 bln euros to Greek GDP last year

Bank of Greece: 2021 tourism revenues at 10.65 billion euros, -40% compared to 2019

The increase in the services surplus is almost exclusively due to the improvement in the travel services balance - the current account deficit stands at 10.6 billion euros.

The data of the Bank of Greece

Current account balance, capital balance, total current balance of transactions and capital, financial transaction balance.

Latest News

Όταν ο μυτιληναίος συνάντησε την ούρσουλα, η γραβάτα παπαλεξόπουλου, τα ξεθωριασμένα εασ και η εταδ καλεί ταιπεδ.

Greece’s Assets Body Launches Tender for Business Park in Fyli

Once completed, the Fyli business park will serve as a national transport hub, creating jobs and revenues for Western Attica.

ELSTAT: 3.4% Rise in Retail Trade Turnover in Q1 – 2.9% Drop in March

Regionally, Thessaly experienced the highest increase in turnover in the first quarter of 2024 compared to the same period in 2023, with a 5.3% rise.

Fruit and Vegetable Exports Increase by 5.8% in Value in Q1, 2024

Conversely, the import of fruits and vegetables surged in the first quarter of 2024, increasing by 17.1% in volume and 20.9% in value compared to the same period in 2023.

Greek Shipowners in 1st Place for New Orders and Secondhand Ships

Research at Allied QuantumSea shows Greek ship holders are also first in ship sales, showing they are modernizing their fleets

PDMA: Yield of Greek 10-Year Bond Set at 3.51%

Bids surpassed expectations, exceeding the 250 million euros initially offered by approximately 3.5 times, totaling 835 million euros.

IOBE: Olive Oil Drives April Food Inflation to 5.4% in Greece

This discrepancy occurs because the weighting of olive oil in the consumer price index, as prescribed by Eurostat regulations, is significant due to its historically high consumption by Greek households

UK Tourists Boost Growth in Greece’s Off-Peak Season

British Airways has significantly contributed to this growth, reporting a 6.6% increase in passengers in the first four months of this year compared to last year.

INSETE Report: Greece a Hotspot for European Vacationers

Greece among top five countries on travelers' itineraries from Germany, France and the UK

Study: Cost of Basic Food Basket in Greece and Other Countries

The findings are based on IELKA's regular report, which includes a price comparison study using data from price comparison platforms in each country and direct price checks from supermarket chains.

DBRS: Greece’s Economic Reforms Boost Growth Prospects, But Investment Gap Remains

However, despite these advancements, Greece still faces a substantial investment gap compared to its eurozone peers.

Οι «πτήσεις» του Βασιλάκη, το μουσείο του Τσαμάζ και τι μισθούς δίνει ο Φουρλής

Χτυπάει πάντα πάνω από δυο φορές

Συνεχίζονται οι τοποθετήσεις στη Λεωφόρο Αθηνών, με το βλέμμα στις 1.540 μονάδες του Γενικού Δείκτη

Podcast: Τα μυστικά των φορολογικών δηλώσεων

Δειτε επισησ.

Γιατί καθυστερούν οι επενδύσεις του Ταμείου Ανάκαμψης

Που αποδίδεται η αναντιστοιχία μεταξύ προεγκρίσεων και εκταμιεύσεων

Στα 79 εκατ. το μέρισμα της Πειραιώς στους μετόχoυς - Στις 28 Ιουνίου η ΓΣ

Το ποσό αυτό αντιστοιχεί σε 0,063 ευρώ ανά μετοχή

Ποιοι κλάδοι αύξησαν και ποιοι μείωσαν τις θέσεις εργασίας μετά την κρίση [Γραφήματα]

Τι δείχνει έρευνα της Eurobank για την πορεία της απασχόλησης στην ελληνική οικονομία

Αδύναμος και πάλι ο Dow Jones, δεν ακολούθησε τα ιστορικά υψηλά του Nasdaq

Θολή ήταν και η εικόνα της εβδομάδας, καθώς ο S&P 500 κατάφερε να κλείσει οριακά θετικά, ενώ Dow υποχώρησε περίπου 2,3%. Ο Nasdaq όμως, σημείωσε άνοδο 1,4%

Οι αλυσίδες fast food σε πόλεμο προσφορών

Οι αλυσίδες προσπαθούν να προσελκύσουν μεγαλύτερη μερίδα των φτωχότερων Αμερικανών

Οικονομία που «συγκλίνει με την Ευρώπη» ή «μαγική εικόνα»;

Κόντρα των πολιτικών αρχηγών για την ακρίβεια

Το «μπαξίσι» της Χαλκίδας

Πρέπει να υπάρξει αποφασιστική δράση

Τα εμπόδια της πράσινης μετάβασης - Λείπουν 4 εκατ. εξειδικευμένοι εργαζόμενοι στην Ευρώπη

«Ο ΑΔΜΗΕ προσπαθεί συνεχώς να εξελίσσεται σε μία ελκυστική εταιρεία για την αγορά εργασίας», ανέφερε ο αντιπρόεδρος του Διαχειριστή

«Πράσινα Ταξί»: 13 δικαιούχοι θα λάβουν επιδότηση για αγορά ηλεκτρικών ταξί

Εγκρίθηκε η καταβολή του ποσού των 244.143 ευρώ σε 13 δικαιούχους του προγράμματος «Πράσινα Ταξί»

Οι ελλείψεις πλοίων έφεραν κέρδη στις ναυτιλιακές μεταφοράς containers – Η ανάλυση από Alphaliner για το α΄ τρίμηνο 2024

Αισιόδοξες οι διοικήσεις των ναυτιλιακών εταιρειών τακτικών γραμμών για τις επιδόσεις του 2024

Χόλιγουντ ή AI; - Το παρασκήνιο της κόντρας Σκάρλετ Γιόχανσον και OpenAI

Στο επίκεντρο, η χρήση του έργου των καλλιτεχνών στην εποχή της δημιουργικής τεχνητής νοημοσύνης

Καλές προοπτικές για καρπούζι και πεπόνι – Βραχνάς παραμένουν τα ατυποποίητα

Τι δείχνουν τα στοιχεία για τις εξαγωγές φρούτων και λαχανικών έως τις 24.5.2024

ΤΕΡΝΑ: Παραδόθηκε στην κυκλοφορία η νέα Γέφυρα Ευήνου

Η νέα Γέφυρα του Ευήνου έχει συνολικό μήκος 242,7 μέτρα και συνολικό πλάτος 13,5 μέτρα (συμπεριλαμβάνοντας και τα πεζοδρόμια), ενώ το κατάστρωμά της είναι πλάτους 7,5 μέτρων

Πόσα πληρώσαμε στα ακτοπλοϊκά για τους δημοφιλείς προορισμούς το Πάσχα

Την Μεγάλη Εβδομάδα του 2024 από τον Πειραιά επιβιβάστηκαν 135.230 επιβάτες

Οι διαφορετικές επιδόσεις σε Ευρωζώνη και G7 – Η Ερυθρά Θάλασσα και η ΕΚΤ

Τι αναφέρει η Consensus Economics στη νέα της έκθεση για τις οικονομίες G7 και τη Δυτική Ευρώπη

ot.gr | Ταυτότητα

Διαχειριστής - Διευθυντής: Λευτέρης Θ. Χαραλαμπόπουλος

Διευθύντρια Σύνταξης: Αργυρώ Τσατσούλη

Ιδιοκτησία - Δικαιούχος domain name: ΟΝΕ DIGITAL SERVICES MONOΠΡΟΣΩΠΗ ΑΕ

Νόμιμος Εκπρόσωπος: Ιωάννης Βρέντζος

Έδρα - Γραφεία: Λεωφόρος Συγγρού αρ 340, Καλλιθέα, ΤΚ 17673

ΑΦΜ: 801010853 , ΔΟΥ: ΦΑΕ ΠΕΙΡΑΙΑ

Ηλεκτρονική διεύθυνση Επικοινωνίας: [email protected] , Τηλ. Επικοινωνίας: 2107547007

Latest News

Euroleague final 4: greek basketball’s prominent presence, piraeus bank board proposal 79 mln€ in dividend for fy23, things to do in athens this weekend may 24-26, blue flag global list: greece remains in second place on, authorities scrutinize spending of arrested tax bureau employees, latest cinema releases: what to see this week in athens may 23-30, on this day in history: may 24, eurobarometer spring 2024: greeks pessimistic about ecoonomic situation, elstat: greek merchant fleet sees 0.4% decline in numbers in march 2024, ec refers greece to ecj for failing to transpose directive into national legislation, athens hotel occupancy rises in early 2024, but still falls short of expectations, greek pm mitsotakis in parliament debate: we are battling inflation, gender inequality for working women in greece, eu persists, mitsotakis to meet ex-french president hollande, ec presidential candidates hold debate ahead of elections, america hits the global snooze button, andros top greek isle for germans seeking thematic vacations, ‘flower moon’ shines over greece thursday night, rotd: salmon with creamy tomato sauce, 3.9r quake west of corfu early friday, inside israel, it’s a very different war, bank of greece: tourism revenues up by 27.1% in jan. 2024, this reflects a surplus of 112.6 million euros in january 2024 for the tourism balance, compared to a surplus of 54.6 million euros in the same month of 2023, related article.

Tourism Trends: Visitor Profiles in Greece

Favorite destinations in Greece for most visitor profiles are the islands, namely Santorini, Mykonos and Crete which are high on their preference, followed by Corfu, Kos, Paros and Lesbos.

Tourism Revenue

- Bank of Greece

- Greece tourism

Related Articles

Greek Tourism in 2024 Set to Break Last Year’s Record

The well-known northern Greece holiday 'magnet' of Halkidiki has the most Blue Flags in Greece among prefectures, with 104. Crete, as a whole however, has 146 Blue Flags

- Celebrities

Greek Edition

© 2023 TOVIMA.COM • All rights reserved.

- Terms of Use

- Privacy Policy

© 2024 tovima.com • Publishing Partner: The Wall Street Journal • All rights reserved.

Travel, Tourism & Hospitality

Travel and tourism in Greece - statistics & facts

What are the leading inbound tourism markets in greece, outbound and domestic tourism in greece, key insights.

Detailed statistics

Travel and tourism's total contribution to GDP in Greece 2019-2022

Distribution of travel and tourism expenditure in Greece 2019-2022, by type

Travel and tourism's total contribution to employment in Greece 2019-2022

Editor’s Picks Current statistics on this topic

Travel and tourism: share of GDP in the EU-27 and the UK 2019-2022, by country

Leisure Travel

Leading international travel markets in Greece 2019-2023, by arrivals

Further recommended statistics

- Basic Statistic Travel and tourism's total contribution to GDP in Greece 2019-2022

- Basic Statistic Travel and tourism: share of GDP in the EU-27 and the UK 2019-2022, by country

- Basic Statistic Distribution of travel and tourism expenditure in Greece 2019-2022, by type

- Basic Statistic Distribution of travel and tourism expenditure in Greece 2019-2022, by tourist type

- Basic Statistic Travel and tourism's total contribution to employment in Greece 2019-2022

Travel and tourism's total contribution to GDP in Greece 2019-2022

Total contribution of travel and tourism to GDP in Greece in 2019 and 2022 (in billion euros)

Share of travel and tourism's total contribution to GDP in European Union member countries (EU-27) and the United Kingdom (UK) in 2019 and 2022

Distribution of travel and tourism spending in Greece in 2019 and 2022, by type

Distribution of travel and tourism expenditure in Greece 2019-2022, by tourist type

Distribution of travel and tourism spending in Greece in 2019 and 2022, by type of tourist

Travel and tourism's total contribution to employment in Greece 2019-2022

Total contribution of travel and tourism to employment in Greece in 2019 and 2022 (in million jobs)

Inbound tourism

- Premium Statistic Number of inbound tourists in Greece 2005-2023

- Premium Statistic Leading international travel markets in Greece 2019-2023, by arrivals

- Premium Statistic Average duration of stay by inbound tourists in Greece 2022, by country

- Premium Statistic Number of inbound tourist visits to Greece 2019-2022, by region

- Premium Statistic International travel receipts in Greece 2003-2023

- Premium Statistic International tourist expenditure in Greece 2019-2023, by purpose of trip

Number of inbound tourists in Greece 2005-2023

Number of international tourists in Greece from 2005 to 2023 (in 1,000s)

Leading inbound travel markets in Greece from 2019 to 2023, by number of arrivals (in 1,000s)

Average duration of stay by inbound tourists in Greece 2022, by country

Average length of stay of international visitors in Greece in 2022, by country (in number of overnight stays)

Number of inbound tourist visits to Greece 2019-2022, by region

Number of international visits to Greece from 2019 to 2022, by region (in 1,000s)

International travel receipts in Greece 2003-2023

Value of international travel receipts in Greece from 2003 to 2023 (in million euros)

International tourist expenditure in Greece 2019-2023, by purpose of trip

Value of international travel receipts in Greece from 2019 to 2023, by purpose of travel (in million euros)

Inbound tourist destinations

- Premium Statistic Number of international air arrivals in Athens, Greece 2010-2023

- Premium Statistic Number of international air arrivals in Thessaloniki, Greece 2010-2023

- Premium Statistic International air arrivals to South Aegean region of Greece 2010-2023, by island

- Premium Statistic Number of international air arrivals in Crete, Greece 2010-2023

- Premium Statistic Leading inbound travel markets in Crete, Greece 2019-2022, by number of visits

- Premium Statistic International air arrivals on the Ionian Islands, Greece 2010-2023, by island

- Premium Statistic Leading inbound tourist markets in the Ionian Islands, Greece 2019-2023

Number of international air arrivals in Athens, Greece 2010-2023

Number of international air arrivals in Athens, Greece from 2010 to 2023 (in 1,000s)

Number of international air arrivals in Thessaloniki, Greece 2010-2023

Number of international air arrivals in Thessaloniki, Greece from 2010 to 2023 (in 1,000s)

International air arrivals to South Aegean region of Greece 2010-2023, by island

Number of international air arrivals on selected islands in the South Aegean region of Greece from 2010 to 2023 (in 1,000s)

Number of international air arrivals in Crete, Greece 2010-2023

Number of international air arrivals on the Greek Island of Crete from 2010 to 2023 (in 1,000s)

Leading inbound travel markets in Crete, Greece 2019-2022, by number of visits

Number of inbound tourist visits to the Greek Island of Crete from 2019 to 2022, by country of origin (in 1,000s)

International air arrivals on the Ionian Islands, Greece 2010-2023, by island

Number of international air arrivals on the Ionian Islands in Greece from 2010 to 2023, by island (in 1,000s)

Leading inbound tourist markets in the Ionian Islands, Greece 2019-2023

Leading inbound tourist markets in the Ionian Islands in Greece from 2019 to 2023 (in 1,000 visits)

Domestic tourism

- Premium Statistic Total number of domestic trips in Greece 2015-2021

- Premium Statistic Number of domestic trips in Greece 2015-2021, by type

- Premium Statistic Number of domestic overnight trips in Greece 2015-2021, by purpose

- Premium Statistic Number of domestic overnight trips in Greece 2015-2021, by transport

- Basic Statistic Domestic tourism spending in Greece 2019-2022

Total number of domestic trips in Greece 2015-2021

Total number of domestic trips in Greece from 2015 to 2021 (in 1,000s)

Number of domestic trips in Greece 2015-2021, by type

Number of domestic trips in Greece from 2015 to 2021, by type (in 1,000s)

Number of domestic overnight trips in Greece 2015-2021, by purpose

Number of domestic overnight trips in Greece from 2015 to 2021, by purpose (in 1,000s)

Number of domestic overnight trips in Greece 2015-2021, by transport

Number of overnight domestic trips in Greece from 2015 to 2021, by mode of transport (in 1,000s)

Domestic tourism spending in Greece 2019-2022

Domestic tourism expenditure in Greece in 2019 and 2022 (in billion euros)

Outbound tourism

- Premium Statistic Number of outbound tourists from Greece 2005-2023

- Premium Statistic Leading outbound travel destinations from Greece 2016-2023

- Premium Statistic Outbound travel expenditure in Greece 2003-2023

- Premium Statistic Outbound travel expenditure by Greek residents 2016-2023, by destination

Number of outbound tourists from Greece 2005-2023

Number of outbound travelers from Greece from 2005 to 2023 (in 1,000s)

Leading outbound travel destinations from Greece 2016-2023

Leading destinations for outbound travelers from Greece from 2016 to 2023 (in 1,000s)

Outbound travel expenditure in Greece 2003-2023

Value of international travel payments by residents of Greece from 2003 to 2023 (in million euros)

Outbound travel expenditure by Greek residents 2016-2023, by destination

Value of international travel payments by residents of Greece from 2016 to 2023, by country of destination (in million euros)

Accommodation

- Basic Statistic Number of tourist accommodation establishments in Greece 2013-2022

- Basic Statistic Number of nights in tourist accommodation in Greece 2013-2022

- Basic Statistic Number of tourist accommodation establishments in Greece 2022, by type

- Premium Statistic Number of hotels and similar accommodation in Greece 2013-2022

- Premium Statistic Travel and tourism revenue in Greece 2017-2027, by segment

Number of tourist accommodation establishments in Greece 2013-2022

Number of travel accommodation establishments in Greece from 2013 to 2022

Number of nights in tourist accommodation in Greece 2013-2022

Number of overnight stays spent at travel accommodation establishments in Greece from 2013 to 2022 (in millions)

Number of tourist accommodation establishments in Greece 2022, by type

Number of travel accommodation establishments in Greece in 2022, by type

Number of hotels and similar accommodation in Greece 2013-2022

Number of hotels and similar accommodation establishments in Greece from 2013 to 2022

Travel and tourism revenue in Greece 2017-2027, by segment

Revenue of the travel and tourism market in Greece from 2017 to 2022, with a forecast until 2027, by segment (in million U.S. dollars)

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

This website stores cookies on your computer. These cookies are used to collect information about how you interact with our website and allow us to remember you. We use this information in order to improve and customize your browsing experience and for analytics and metrics about our visitors both on this website and other media. To find out more about the cookies we use, see our Cookies Policy .

If you decline, your information won’t be tracked when you visit this website. A single cookie will be used in your browser to remember your preference not to be tracked.

Greece Visitor Arrivals Growth

- Greece Visitor Arrivals grew 26.0 % in Feb 2024, compared with an increase of 16.0 % in the previous month

- Greece Visitor Arrivals Growth rate data is updated monthly, available from Jan 2006 to Feb 2024

- The data reached an all-time high of 884.3 % in Apr 2022 and a record low of -97.7 % in May 2020

- In the latest reports, Greece Visitor Arrivals recorded 721,336.2 person in the month of Feb 2024

- Tourism Revenue of Greece reached 312.2 USD mn in Dec 2023, an increase of 19.6 % change from the previous month

View Greece's Visitor Arrivals Growth from Jan 2006 to Feb 2024 in the chart:

What was Greece's Visitor Arrivals Growth in Feb 2024?

Greece Visitor Arrivals grew 26.0 % in Feb 2024, compared with an increase of 16.0 % in the previous month See the table below for more data.

Visitor Arrivals Growth by Country Comparison

Buy selected data, accurate macro & micro economic data you can trust.

Explore the most complete set of 6.6 million time series covering more than 200 economies, 20 industries and 18 macroeconomic sectors.

Greece Key Series

More indicators for greece, request a demo of ceic.

CEIC’s economic databases cover over 200 global markets. Our Platform offers the most reliable macroeconomic data and advanced analytical tools.

Explore our Data

UN Tourism | Bringing the world closer

Share this content.

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

EBRD and UNWTO Facilitate Tourism Recovery in Greece

· EBRD and UNWTO joined forces with the Ministry of Tourism in Greece to support tourism recovery · Four key recovery projects were implemented and completed · Focus on economic recovery, marketing, and institutional strengthening

UNWTO and the European Bank for Reconstruction and Development (EBRD) have successfully worked alongside the Greek Government to help the country's tourism sector recover from the impacts of the pandemic.

As part of a wider effort to boost resilience and accelerate recovery in the wake of the worst crisis in the history of tourism, the Bank selected several areas of UNWTO's "COVID-19 Tourism Recovery Technical Assistance Package" to implement in Greece. This package was built around three main pillars of intervention: economic recovery, marketing and promotion, and institutional strengthening and building resilience.

Four projects of critical importance for the tourism sector at the time were selected and implemented in partnership with the Ministry of Tourism of Greece, namely:

- Measurement of COVID-19's impact and development of monitoring guidelines : Within this project, tourism data needs were aligned between the Bank of Greece, the Hellenic Statistical Authority, and the Ministry of Tourism. Ten areas of intervention were identified, along with 25 actions for improvement of monitoring, and training was provided to seven representatives from the Ministry of Tourism, the Bank of Greece and the Hellenic Statistical Authorities.

- Preparation of a roadmap to support tourism MSMEs and job retention : The project included reviewing the existing support measures for MSMEs, interviewing tourism national associations, MSMEs, and professionals, and designing a seven-action roadmap. Moreover, 41 tourism professionals, travel agencies, hotels, and secondary accommodation establishments were trained on a range of topics, including digital marketing tools, HR management, analysing tourism data to identify opportunities, and improving the quality of services and the overall tourist experience.

- Updating the Tourism Marketing Strategy: Key international and domestic markets trends were analysed both during and post-pandemic. Six areas of intervention were identified, and the passenger survey questionnaires of the Athens International Airport and the 14 regional airports operated by Fraport have been updated to measure newly selected indicators. The strategy was also presented at a seminar with the foreign offices of the Greek National Tourism Organisation, in collaboration with its headquarters.

- Development of a Tourism Crisis Management Plan : The first such plan for the Ministry of Tourism, identifying various types of crises, outlining concrete response mechanisms, roles, and processes, and introducing a case study simulation.

Along with the UNWTO and EBRD teams working on the project, a team of experts in crisis management, statistics, marketing, and MSMEs was brought in to spearhead the implementation, transfer knowledge and work closely with the Ministry of Tourism and stakeholders for the delivery of the project activities envisaged.

Recovery Package Delivers Results

As a leading destination, both within Europe and worldwide, Greece has consistently maintained its relevance in the global tourism market and emerged resilient during the long-lasting financial and economic crisis of the past decade. In the context of the pandemic, Greece then managed to sustain and increase the contribution of its tourism sector to its national economy and was one of the first European countries to reopen to international visitors in the aftermath of the pandemic.

Looking ahead, the work done under the Tourism Recovery Technical Assistance Package will enable the Ministry of Tourism to monitor closely the performance of the sector and systematically respond to and address any crises that might occur affecting the tourism sector of Greece. EBRD continues to support the Greek tourism sector through targeted investments or financing that promote sustainable and inclusive tourism and enhance youth employment and backward linkages with local economies. UNWTO remains active in Greece to support the tourism development of local destinations through projects on the ground while strengthening the close and continuous collaboration with the country.

Related Links

- Download the News Release in PDF

- UNWTO: Technical Cooperation

- UNWTO: Regional Department for Europe

Related Content

Un tourism joins launch of ireland’s first sustainable ..., un tourism and hotelschool the hague to drive innovatio..., european committee of the regions and un tourism break ..., un tourism and croatia to establish research centre for....

- Hospitality

- Land Transportation

- Travel Operators

- Marketplace

- Top Archaeological Sites

- Tourism Education

- Niche Markets

- Trade Associations – Gov – Org

- Greek Hotels Reopening

- The Day After

- Local Actions

- Investment News

- Thought Leaders 2023

- Business Talk

- Recruitments

- 2024 – International Women’s Day

- 2021 – International Women’s Day

- 2018 – International Women’s Day

- Northern Greece

- Calendar of events

- Greek Hospitality Awards

- Tourism Awards 2019

- ITB Berlin 2024 Special

- ITB Berlin 2023 Special

- ITB Berlin 2019 Special

- ITB Berlin 2018 Special

- ITB Berlin 2017 Special

- 100% Hotel Show

- Philoxenia 2014 Special

- WTM London 2023 Special

- WTM London 2022 Special

- WTM London 2019 Special

- WTM London 2018 Special

- WTM London 2017 Special

- GTP Careers in Tourism

- GTP Ferry Connections

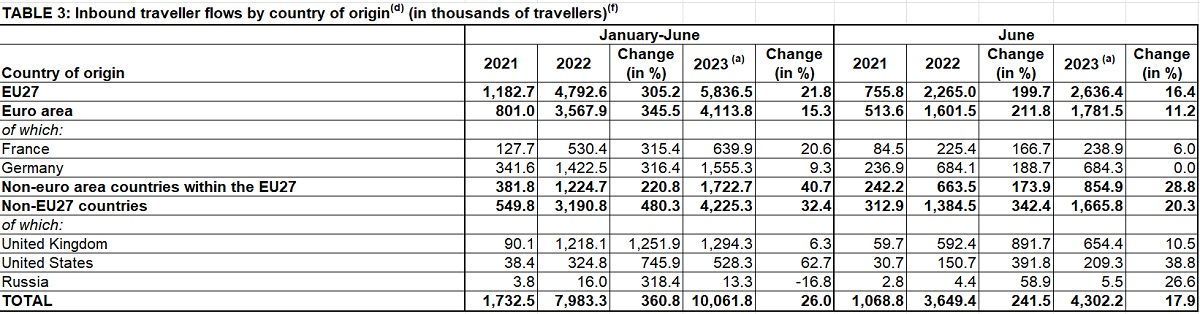

BoG: Greece Welcomed Over 10 Million Tourists in First Half of 2023

Inbound traveler flows rose by 26.0 percent in the first half of the year boosting travel receipts by 23.9 percent and reflecting the country’s strong tourism dynamic.

According to data released by the Bank of Greece this week, the number of international arrivals from January to June this year increased to by 26.0 percent to 10,061.8 thousand (over 10 million) compared to 7,983.3 thousand (some 7.9 million) in the same period a year ago.

The number of arrivals through Greece’s airports rose by 19.4 percent and by 52.8 percent through road border points with EU arrivals up by 21.8 percent year-on-year to 5,836.5 thousand and non-EU residents arrivals up by 32.4 percent to 4,225.3 thousand.

Source:BoG.

Main source markets for Greece in the six-month period under review were Germany , with traveler numbers up by 9.3 percent to 1,555.3 thousand, France up by 20.6 percent to 639.9 thousand, the UK by 6.3 percent to 1,294.3 thousand, and the US by 62.7 percent to 528.3 thousand. Travel flows from Russia dropped by 16.8 percent to 13.3 thousand.

In June, inbound traveler flows increased by 17.9 percent to 4,302.2 thousand pushing travel receipts up by 17.2 percent.

Tourists on Rhodes.

Arrivals through the country’s airports rose by 11.9 percent year-on-year and by 46.1 percent through road border points. Central bank analysts attribute the positive performance for June to stronger traveler flows from both within the EU (up by 16.4 percent) and outside the EU (up by 20.3 percent).

Source markets supporting Greek tourism in June were Germany with 684.3 thousand travelers visiting Greece, France up by 6.0 percent to 238.9 thousand arrivals , the UK up by 10.5 percent to 654.4 thousand, the US up by 38.8 percent to 209.3 thousand and Russia with arrivals up by 26.6 percent to 5.5 thousand.

- Join the 15,000+ travel executives who read our newsletter

About the Author

Tourists returning to rhodes in numbers, flight delays compensation: your guide to alternative travel options.

I’d take the figures with a pinch of salt unless people are using all inclusive hotels the footfall on Crete in Sissi me resorts is well down Stalida and Agios Nicolas tavernas and bars empty compared to seven years to ten years ago. The prices on Crete are killing tourism people not returning and choosing more favourable destinations.

Please note that many Italians arrive by sea and land and so the airport data underestimate them vs those arriving only by air.

Add your comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Join our Newsletter

Join our GTP Headlines free daily newsletter

Signup to receive our daily travel-tourism industry newsletter.

SUBSCRIBE TO RSS

Copyright notice.

The team | About GTP Headlines

Greek Travel Pages, 6, Psylla str. Athens GR 10557 Call center: +30 210 324 7511

Contact Details

Guest posts are welcome. Read the editorial guidelines here.

- Publications

- Key Findings

- Interactive data and economy profiles

- Full report

Travel & Tourism Development Index 2024

1. About the Travel & Tourism Development Index 2024

The index provides a strategic benchmarking tool for business, governments, international organizations and others to develop the travel & tourism sector..

First introduced in 2022, the Travel & Tourism Development Index (TTDI) benchmarks and measures the set of factors and policies that enable the sustainable and resilient development of the Travel & Tourism (T&T) sector, which in turn contributes to the development of a country. The index is a direct evolution of the Travel & Tourism Competitiveness Index (TTCI), which has been published biennially since 2007. By allowing cross-country comparison and by benchmarking countries’ progress on the drivers of T&T development, the index informs policies and investment decisions related to the development of T&T businesses and the sector as a whole. It also offers unique insights into the strengths and areas for improvement of each country to support their efforts to enhance the long-term growth of their T&T sector in a sustainable and resilient manner. In particular, the TTDI provides a strategic and holistic overview of the tourism economy, including internal and external enablers of T&T development and their interdependent nature. Furthermore, it provides a valuable platform for multistakeholder dialogue, enabling stakeholders to formulate appropriate policies and actions at local, national, regional and global levels.

The 2024 edition of the TTDI was produced in collaboration with the University of Surrey. As the index knowledge partner, the university provided valuable technical and strategic support for the TTDI and related content. This edition of the index also includes several improvements that are designed to take advantage of newly available data such as the World Travel and Tourism Council (WTTC)’s recently developed indicators on the environmental and social impact of T&T, to make the index more T&T-specific, concise and consistent in its country coverage.

Please note that the changes made to the index limit its comparability to the previously published TTDI 2021. Therefore, this release of the index includes recalculated 2019 and 2021 results, using new adjustments. TTDI 2024 results reflect the latest available data at the time of collection (end of 2023) .

Many of the improvements made to the index are based on stakeholder feedback and input from the TTDI Advisory Group, which includes representatives from Bloom Consulting, the European Travel Commission (ETC), the Global Sustainable Tourism Council (GSTC), the Hong Kong Polytechnic University, the International Air Transport Association (IATA), JLL Hotels & Hospitality Group, Mastercard, New York University, the Pacific Asia Travel Association (PATA), Trip.com Group, the United Nations World Tourism Organization (UN Tourism), the University of Surrey, Visa, the World Bank and WTTC.

In addition, the index relies on close collaboration with the following data partners: AirDNA, Bloom Consulting, CoStar, Euromonitor International, GlobalPetrolPrices.com, IATA, the International Civil Aviation Organization (ICAO), the International Union for Conservation of Nature (IUCN), MMGY TCI Research, Tripadvisor, UN Tourism and WTTC.

For more detailed information on the TTDI methodology and the new framework, country peer and income-group classification, indicator details and partner information, and to explore the index results through interactive data visualizations, please visit the index website or see the Technical notes and methodology section of the report.

1.1 Index overview

The index is comprised of five dimensions, 17 pillars and 102 individual indicators, distributed among the different pillars. However, the five dimensions are not factored into the calculation of the index and are used only for presentation and categorization purposes.

Figure 1: TTDI framework

The Enabling Environment dimension captures the general conditions necessary for operating and investing in a country and consists of five pillars:

- Business Environment : This pillar captures the extent to which a country’s policy environment is conducive to companies doing business and investing.

- Safety and Security : This pillar measures the extent to which a country exposes locals, tourists and businesses to security risks.

- Health and Hygiene : This pillar measures healthcare infrastructure and accessibility and health security.

- Human Resources and Labour Market : This pillar measures the availability of quality employees and the dynamism, resilience and equality of the labour market, as well as the level of protection for workers. It consists of the Qualification of the Labour Force, Labour Market Dynamics and Labour Market Resilience and Equality subpillars.

- ICT Readiness : This pillar measures the availability and use of information and communication technology infrastructure and digital services.

The T&T Policy and Enabling Conditions dimension captures specific policies or strategic aspects that affect the T&T sector more directly and consists of three pillars:

- Prioritization of T&T : This pillar measures the extent to which the government actively promotes, tracks and invests in the development of the T&T sector.

- Openness to T&T : This pillar measures how open a country is to visitors and facilitating cross-border travel.

- Price Competitiveness : This pillar measures how costly it is to travel or operate in a country.

The Infrastructure and Services dimension captures the availability and quality of physical infrastructure and tourism services and consists of three pillars:

- Air Transport Infrastructure : This pillar measures the extent to which a country’s infrastructure offers sufficient air connectivity and access for travellers domestically and internationally.

- Ground and Port Infrastructure : This pillar measures the availability of efficient and accessible ground and port transportation services and infrastructure.

- Tourist Services and Infrastructure : This pillar measures investment in, and the availability and productivity of, tourist services and infrastructure.

The Travel & Tourism Resources dimension captures the principal “reasons to travel” to a destination and consists of three pillars:

- Natural Resources : This pillar measures the available natural capital as well as the development of outdoor tourism activities. Natural capital is defined in terms of landscape, natural parks and the richness of the fauna. To an extent, this pillar captures how natural resources are promoted rather than the actual existing natural heritage of a country.

- Cultural Resources : This pillar measures the availability of cultural resources such as archaeological sites and entertainment facilities. To an extent, this pillar captures how cultural resources are promoted and developed rather than the actual existing cultural heritage of a country.

- Non-Leisure Resources : This pillar measures the extent and attractiveness of factors that drive business and other non-leisure travel, including the presence of global cities, major corporations and leading universities.

The Travel & Tourism Sustainability dimension captures the current or potential sustainability challenges and risks facing T&T and consists of three pillars:

- Environmental Sustainability : This pillar measures the travel and tourism sector’s energy sustainability and the general sustainability of an economy’s natural environment and the protection of natural resources. It consists of the T&T Energy Sustainability, Pollution and Environmental Conditions, and Preservation of Nature subpillars.

- T&T Socioeconomic Impact : This pillar measures the economic and social impact of T&T, including induced economic contribution, the provision of high-wage jobs and workforce gender equality.

- T&T Demand Sustainability : This pillar measures factors that may indicate the existence of, or risk related to, overcrowding, demand volatility and other potentially unsustainable demand trends.

1.2 Data and methodology

Most of the dataset for the TTDI is statistical data from international organizations, with the remainder based on survey data from the World Economic Forum’s annual Executive Opinion Survey, which is used to measure concepts that are qualitative in nature or for which internationally comparable statistics are not available for enough countries.

The sources of statistical data include, but are not limited to, AirDNA, Bloom Consulting, Euromonitor International, IATA, ICAO, the International Labour Organization (ILO), the International Telecommunications Union (ITU), the IUCN, CoStar, Tripadvisor, the United Nations Educational, Scientific and Cultural Organization (UNESCO), UN Statistics Division, UN Tourism, the World Health Organization (WHO), the World Bank, the CIA World Factbook, the World Trade Organization (WTO), WTTC and the World Database on Protected Areas (WDPA).

The overall TTDI score is computed through successive aggregations of scores, from the indicator level (e.g. the lowest, most disaggregated level) through the pillar levels, using a simple average (i.e. the arithmetic mean) to combine the components. Scores on each indicator are first normalized and rated on a common scale of 1 to 7, with 1 being the worst and 7 being the best outcome.

1.3 Economy coverage

The TTDI covers 119 economies. Economies that were covered in the TTDI 2021 but are not covered in the TTDI 2024 are Cape Verde, Chad, Hong Kong SAR, Lesotho and Yemen. Economies added to the 2024 TTDI are Algeria, Barbados, Iran, Jamaica, Oman, Uzbekistan and Zimbabwe.

Mobile Menu Overlay

The White House 1600 Pennsylvania Ave NW Washington, DC 20500

FACT SHEET: Kenya State Visit to the United States

Today, President Biden welcomes President Ruto of Kenya for a State Visit and Dinner to celebrate and deepen ties between our two nations. This visit marks 60 years of official U.S.-Kenya partnership. This partnership is founded on shared values, deep cooperation, and a common vision for the future. The two leaders’ agenda showcases how our ties deliver tangible benefits to the people of our nations in areas including Democracy, Human Rights, and Governance; Health Partnerships; People-to-People Ties; Shared Climate Solutions; Trade and Investment; Debt, Development, and Sustainable Finance; Digital, Critical, and Emerging Technology Cooperation; and Peace and Security Cooperation.

Democracy, Governance, and Human Rights

Our countries are bonded by our shared democratic values and mutual commitment to advancing human rights and strengthening political institutions. This historic State Visit is about the Kenyan and American people and their hopes for an inclusive, sustainable, and prosperous future for all. Our countries endeavor to guard against the erosion of political checks and balances, counter misinformation and disinformation, mitigate hate-fueled violence targeting members of vulnerable communities, and tackle corruption by building transparent and accountable governance systems. The State Visit highlights new areas of cooperation to safeguard rights and freedoms in the face of rising authoritarianism, expand avenues for dialogue, and elevate our shared global commitment to protecting democracy.

- Delivering Democracy: The United States has programed nearly $40 million for democracy, human rights, and governance programming in Kenya, including through Presidential Initiative for Democratic Renewal programs that defend democratic elections and political processes, increase women’s political participation and leadership, counter Gender Based Violence, and advance digital democracy. Additional support for activities in Kenya under the Presidential Initiative for Democratic Renewal build on Kenya’s important work as a member of the 14-country Global Partnership for Action on Gender-Based Online Harassment and Abuse, which is advancing global policies to address online safety for women and girls, including targeted violence against women political and public figures.

- Supporting Independent Civil Society: President Ruto executed on May 9 the legal instruments required to operationalize the 2013 Public Benefits Organization Act, which institutionalizes groundbreaking, global best practices for civil society protections. The United States announced $700,000 in new assistance to support this effort in addition to the $2.7 million the United States is providing to improve civil society engagement in and oversight of governance processes. The U.S. Agency for International Development (USAID) also announced an additional $1.3 million youth empowerment program aimed at strengthening political engagement at the subnational level and $600,000 to advance disability inclusion.

- Bringing Transparency to Government: The United States and Kenya commit to strengthening the Open Government Partnership (OGP), which Kenya co-leads and the United States co-founded, including through robustly fulfilling our open government commitments at home. USAID Administrator Power plans to represent the United States at the OGP event on the margins of the UN General Assembly High Level Week in September. This event gathers world leaders for an opportunity to showcase the powerful global coalition on open government and democracy and to consider opportunities for further collaboration.

- Promoting Human Rights: The United States and Kenya affirm their commitment to upholding the human rights of all. Together they stand with people around the world defending their rights against the forces of autocracy. Kenya and the United States commit to bilateral dialogues that reinforce commitments to human rights, as well as a series of security and human rights technical engagements with counterparts in the Kenyan military, police, and Ministry of Foreign Affairs aimed at strengthening collaboration on security sector governance, atrocity prevention, and Women, Peace and Security in Kenya and regionally.

- Combatting Corruption: The Administration intends to provide $500,000 for a new Fiscal Integrity Program to make county budget processes more transparent and inclusive and increase citizen engagement, and $500,000 to broaden the reach and effectiveness of anti-corruption advocacy by empowering civil society actors to create and disseminate multimedia content that engages citizens and mobilizes action against corruption. To support the Government of Kenya to combat corruption, the Administration is providing $250,000 through the Global Accountability Program, and $300,000 to support Kenya’s proposed Whistleblower Protection law to strengthen Kenya’s anti-corruption legal architecture. In addition, USAID has provided $2.7 million to support the improved enforcement of policy and laws that deal with fraud, waste, and abuse in the delivery of public services to Kenyan citizens.

- Gathering Anti-Corruption Professionals: With support from the U.S. Department of State’s Bureau of International Narcotics and Law Enforcement Affairs, the UN Office on Drugs and Crime and the East African Association of Anti-Corruption Authorities convened a regional conference from May 20-23, 2024, in Nairobi, Kenya, gathering anti-corruption practitioners and policymakers from countries participating in the East Africa Anti-Corruption Platform.

- Strengthening Police Reform Efforts: Building on a longstanding partnership to further police capacity building and reform efforts, the United States and Kenya announced a new $7 million partnership to advance and strengthen the modernization and professionalization of Kenya’s National Police Service, with a focus on staff and training development.

- Reducing Prison Overcrowding and Improving Detention Conditions: The United States and Kenya are committed to further advancing Kenyan-led efforts to improve the oversight of and conditions within Kenya’s prison service. The United States announced a new $2.2 million initiative to provide training, mentoring, and technical assistance to implement priority reforms.

- Combatting Transnational Organized Crime and Supporting Criminal Justice Sector Reform: Recognizing the regional role Kenya plays in combating transnational organized crime, the United States intends to provide $4.9 million in new funding for Kenya and other East African countries to improve cooperation and coordination in combating criminal networks and holding criminals accountable. Funding also supports capacity building and reform efforts within the Kenyan police and justice sectors.

- Supporting Investigative Journalism: The United States seeks to amplify Kenya’s leadership in building Africa’s digital resilience by supporting linkages between well-known international investigative organizations and select Kenyan NGOs, media outlets, and citizen journalists to build up Nairobi as a regional hub for exposing issues in the public interest. This support also helps journalists in their pursuit of public information. Pursuing these efforts in Kenya – a regional media and technology leader – positively impacts East Africa and the broader continent, particularly as Kenyan recipients connect with counterparts in the region.

- Strengthening Kenya’s Frameworks for Free and Fair Elections: Working with Congress, the Administration intends to provide $1.5 million in new technical assistance to support Kenya’s electoral legal framework reform process aimed at strengthening the election commission, political parties, and campaign finance. This funding aims to improve public awareness raising and advocacy around the reforms, laying the groundwork for a more inclusive, transparent and peaceful 2027 election. This support complements Kenya’s amendment to the Independent Electoral and Boundaries Commission Act, which passed the National Assembly on May 3 and is now with the Senate.

Health Partnership: Securing Our Collective Health

Decades of collaboration between the United States and Kenya in the health sector have resulted in tremendous improvements in health not only for millions of our citizens, but also for the broader global community. This cooperation is vital to developing medical innovations, preventing the emergence of future global pandemics, and ensuring that effective treatments are widely available. Our governments are working in lockstep with the private sector, which is developing new manufacturing capacity in Kenya that can serve Africa and the world. The efforts showcased during the State Visit build upon these successes to ensure a healthier, more prosperous future for all.

- Continuing the Fight against HIV/AIDS: The United States and Kenya are developing a “Sustainability Roadmap” to integrate HIV service delivery into primary health care, ensuring quality and impact are retained. With more than $7 billion in support from the President’s Emergency Plan for AIDS Relief (PEPFAR) spanning two decades, Kenya has successfully responded to the HIV epidemic and strives to end HIV as a public health threat in Kenya by 2027. These efforts improve holistic health services for the 1.3 million Kenyans currently receiving antiretroviral therapy and millions more benefiting from HIV prevention programs, while allowing for greater domestic resources to be put toward the HIV response, allowing PEFPAR support to decrease over time.

- Partnering for Global Health Security: Kenya and the United States announced a formal proclamation between the U.S. Center for Disease Control and Prevention (CDC) and Government of Kenya for sharing information, identifying best practices, and defining steps toward the development and full launch of the Kenyan National Public Health Institute. As a gateway to East Africa through Port Mombasa, Kenya’s capacity to prevent, detect, and respond to infectious disease threats is critical. To support our health partnership, Kenya and the United States plan to develop and launch a customized Public Health Emergency Management training program to enhance health security across all 47 counties in Kenya.

- Reducing the Impacts of Malaria: Through the President’s Malaria Initiative (PMI), the United States contributed $33.5 million in 2023 to fight malaria in Kenya, providing vital financial and technical assistance to the Government of Kenya. The United States supports resilient health systems to deliver care by training health workers, strengthening supply chains, improving data monitoring, and reinforcing national health policies and guidelines. These investments have contributed to a 50% reduction in malaria prevalence over the last decade. In support the Government of Kenya’s localization goals, PMI is expanding its procurement of pharmaceutical supplies from Kenyan manufacturers and intends to procure up to an additional 5 million malaria treatments and 475,000 preventive treatment doses from Kenyan producers in 2024.

- Growing Health Manufacturing: Kenya committed to working with lawmakers to advance the Kenyan Pharmacy and Poisons Board (PPB) Act, a necessary step to boost local manufacturing of medical products and expand private American investment in the sector. Securing and diversifying global supply chains by promoting local and regional manufacturing of health products is a priority of the United States. The implementation of the PPB Act has the potential to increase manufacturing capacity in Kenya and Africa to ensure the availability of life-saving medicines, diagnostic tests, and devices. This should also mitigate the impact of global supply chain shocks, which were so evident during the COVID-19 pandemic. To further these goals, USAID provided $2.3 million in support to Revital Healthcare to develop rapid diagnostic tests for HIV, malaria, hepatitis B and C, dengue, and pregnancy, and to build a manufacturing plant capable of producing 240 million tests per year. Additionally, USAID and the Kenyan Ministry of Health are partnering to equip all neonatal clinics with Revital-made continuous positive airway pressure machines for babies requiring respiratory support.

- Partnering with the Private Sector in Healthcare: The U.S. International Development Finance Corporation (DFC) is investing in Kenya’s vibrant private sector by making a $10 million direct loan to Kenyan company Hewa Tele, which provides an affordable and regular supply of medical oxygen to healthcare facilities in Africa, and two rounds of equity investment totaling $4 million to Kasha Global, a Kenya-based e-commerce company that provides personal care, health care, and beauty products to low-income women in Kenya and Rwanda.

- Expanding Joint Research: Kenya and the United States recommitted to our long-standing partnership through a Memorandum of Understanding (MoU) between the CDC and the Kenyan Medical Research Institute (KEMRI) to support Kenya’s Applied Science Hub, building on 45 years of research partnership on malaria, HIV, tuberculosis, vaccine-preventable diseases, maternal and child health, emerging infectious diseases, and COVID-19. The research in the Applied Sciences Hub aims to expand surveillance, answer critical public health questions, and introduce novel diagnostic methods, including advanced molecular and serology-based methods, and training in public health laboratory core competencies. This year, the United States provided an estimated $12.9 million to support research efforts by KEMRI through CDC, the National Institutes of Health (NIH), and the Department of Defense. In FY 2023 NIH supported over 250 grants to U.S. organizations that collaborated with Kenyan organizations, covering a wide range of relevant biomedical research topics, and approximately 90 of these collaborations include researchers at KEMRI.

- Meeting Kenya’s Digital Health Goals: The United States announced over $31 million to advance Kenya’s efforts to set up a digital superhighway to enable a holistic view of health care delivery. The United States has worked closely with the Kenyan Ministry of Health to build and deploy digital health solutions to support disease programs and improve the ability to prevent, detect, and respond to public health threats. This includes $4 million through USAID Power Africa’s Health Electrification and Telecommunications Alliance to support solar power solutions for health facilities and activities to strengthen community and facility information systems to improve patient care and expand access to emergency medical services for mothers and newborns. Additionally, the NIH Harnessing Data Science for Health Discovery and Innovation in Africa (DS-I Africa) program focuses on facilitating the use of data science to impact health outcomes in Africa and supports a data hub and training and educational development programs in Kenya.

People-to-People Ties: Improving and Enriching Lives

The American and Kenyan people have deep ties that go far beyond the 60 years of official cooperation between our governments. These relationships – rooted in family, friendship, and community – improve and enrich our lives. They drive our cooperation, underpin our shared values, and elevate our aspirations. The benefits of these ties are particularly evident in our cooperation in educating the next generation of leaders, entrepreneurs, and visionaries. The State Visit builds on this fundamental strength, catalyzing stronger partnerships through a series of groundbreaking education and exchange programs.

- Strengthening Connections Between U.S. and Kenyan Educational Institutions:

- Kennedy-Mboya Partnerships: As the United States and Kenya celebrate 60 years of bilateral relations, and recalling the positive and enduring impact of the Kennedy-era student airlift, the newly announced Kennedy-Mboya Partnerships support a new scholarship program that promotes intellectual, academic, and innovative exchange. The Administration intends to provide $3.3 million for a U.S. Department of State program for sixty Kenyan undergraduate students to study for a semester in the United States, with a focus on STEM. This program supports the development and success of the next generation of Kenyan scientists, researchers, and engineers.

- Partnership 2024 : The Administration intends to provide $500,000 for Partnership 2024 to support the development of Kenyan students, scientists, researchers, and engineers by encouraging U.S. universities to increase investment in relationships with Kenyan universities and research institutions. Faculty and research collaboration are planned to bolster the program, supported by Fulbright Specialists to provide additional expertise.

- EDTECH Africa: The Governments of Kenya and the United States, in collaboration with Microsoft, Mastercard’s Center for Inclusive Growth, Howard University, Spelman College, Clark Atlanta University, and Morehouse College announced the establishment of EDTECH Africa. This initiative serves as an emerging technology bridge between Historically Black Colleges and Universities (HBCUs) and African scholars, aimed at cultivating educational exchanges in the ever-evolving landscape of emerging technology. This initiative expands Mastercard’s existing investment of $6.5 million for the Atlanta University Center Consortium Data Science Initiative and $5 million for Howard University’s Center for Applied Data Science and Analytics, actively involving African scholars with HBCU students and faculty in the journey toward greater proficiency as data scientists. Microsoft will invest an additional $500,000 to support HBCU and Kenyan students engaged in research at the Microsoft Africa Research Institute (MARI) in Nairobi, Kenya, complementing its recent contribution of $350,000 for the Atlanta University Center Consortium Data Science Initiative to establish a network of data science faculty across HBCUs. USAID intends to invest $850,000 to facilitate this partnership between HBCUs and Kenyan universities.

- National Science Foundation (NSF) International Activities : NSF has committed to offering workshops, planning grants, or supplements to U.S. universities to strengthen connections between U.S. and Kenyan universities, jointly identify research foci, and facilitate collaboration in research, education, and workforce development.

- Employment Pathways for Youth : USAID announced $6.5 million to support a partnership between Edison State Community College in Piqua, Ohio, and Kenya’s United States International University of Africa to strengthen up to 40 Kenyan technical vocational education and training institutions in the high-growth sectors of information and communications technology (ICT) and manufacturing of pharmaceuticals and textiles.

- Framework for Cooperation: The United States and Kenya signed a Framework for Cooperation to support higher education partnerships for STEM education. The Framework describes U.S. and Kenyan priorities and is accompanied by a commitment from Microsoft, Micron, Mastercard, and several U.S. and Kenyan universities expressing their support for STEM education. The Framework fosters higher education partnerships and commitments to partner private sector stakeholders, Kenyan institutions, and U.S. institutions to build mutual capacity in information and computer technology, microchip manufacturing, and other STEM-related education and career opportunities.

- Collaboration with the National Museums of Kenya: The Smithsonian Institution announced a $150,000 project funded by the U.S. Department of State to assess opportunities, challenges, and possible enhancements to support the National Museums of Kenya continued evolution as a leader in cultural and natural heritage preservation. Smithsonian officials plan to work collaboratively to identify possible areas for enhancement and growth, including facilities, collections care and conservation, curation, digital infrastructure, exhibitions, and research programs.

- Supporting Primary Education: USAID intends to provide $24.5 million for the Kenya Primary Literacy Program (KPLP), a new nationwide early grade literacy activity implemented in close partnership with Kenya’s Ministry of Education. KPLP programs are delivered in English and Kiswahili to all public primary schools and select private schools. KPLP expands new innovations to address literacy needs of grade 1-3 learners while building more inclusive, accountable, and resilient education institutions and systems.

- Bolstering Kenya’s Creative Workforce: The United States and Kenya announced new initiatives and programs to strengthen the creative economies between our two countries. In partnership with the Recording Academy, the University of Southern California School of Cinematic Arts, and other leading private sector and civil society institutions, the United States envisions new programs to promote collaboration, build capacity, and bolster professional creative industry ecosystems. We seek to assist emerging leaders in television, film, and music to learn new skills, build networks, and participate in international festivals. The two countries also promote cultural heritage and tourism by supporting the preservation of the archaeological site of Takwa through the prestigious U.S. Ambassadors Fund for Cultural Preservation.

- Expanding Emerging Technology Training Program: The Johns Hopkins School of Advanced International Studies intends to launch a new fellowship program this fall, funded in part by Meta, bringing together high-achieving mid-career government officials from select African countries. This program equips the next generation of leaders across the continent with the policy and technical expertise needed to help their governments translate the digital transformations underway – including in AI and other emerging technologies – into broadly shared growth for their societies. In recognition of the technology sector leadership demonstrated by both the Kenyan public and private sector, Kenya is the first country to be added the inaugural fellowship cohort.

- Increasing Diplomatic Exchange: The United States Foreign Service Institute and the Kenyan Foreign Service Academy plan consultations with the intention of enhancing cooperation and further exchanges between the two institutions. Sharing a mutual interest in promoting best practices for the training of diplomats, the United States and Kenya commit to exploring Kenya’s participation in an emerging international community of practice for diplomatic training.

- Strengthening U.S.-Kenya Research Ties with Kenya’s Health Workforce: The Academic Model Providing Access to Healthcare (AMPATH) Kenya is a partnership between Moi University, Moi Teaching and Referral Hospital, and the AMPATH Consortium of global universities around the world led by Indiana University. With $20.7 million in annual funding from USAID, these partners are reaching 120,000 Kenyans on life saving antiretroviral treatment. Through AMPATH, the universities commit to continuing the education of healthcare providers, medical students, residents, and community health workers.

- Increasing Consular Capacity: The U.S. Embassy in Nairobi expanded the number of staff working in the Consular Section to expedite the review and issuance of visas for travel of Kenyan citizens to the United States. The Consular Section issues visas for students, tourists, businesspeople, and workers, and also processes visas to reunite families. At the same time, our Consular Section provides services to American citizens living in or visiting Kenya. These people-to-people links are the bedrock of our bilateral relationship.

Shared Climate Solutions: Fostering Growth and Resilience

President Biden and President Ruto have a shared climate vision as not just an existential challenge of our time, but as the most significant economic opportunity of the 21 st century. It is a generational opportunity for Africa to become a leader in the global clean energy economy. Closer partnership is generating greater advances in clean energy supply chains, mobilizing climate-related investment, sustainable agriculture, adaptation, and resilience.

- Launching the U.S.-Kenya Climate and Clean Energy Industrial Partnership: During the State Visit, we announced the launch of a U.S.-Kenya Climate and Clean Energy Industrial Partnership to elevate climate action and green industrialization as a critical pillar of our bilateral relationship. We also signaled our intent to implement a new green growth framework throughout Africa. Through this partnership, the United States and Kenya prioritize cooperation across the three, mutually-supportive areas of clean energy deployment, clean energy supply chains, and green industrialization. To support these activities under the Partnership, the United States and Kenya intend to work with international financial institutions and multilateral trust funds to identify mechanisms to mobilize investment for clean energy manufacturing and services. The two sides intend to strategically leverage concessional finance and risk mitigation tools at the multilateral development banks and climate funds to lower the cost of capital for clean energy deployment and supply chains in Kenya and the region, including a portion of the $568 million in catalytic finance that the United States provided to the Clean Technology Fund in 2023.

- Humanitarian Disaster Response: To date in FY 2024, USAID has provided $42 million in emergency humanitarian assistance to Kenya. Including this assistance, USAID’s Bureau of Humanitarian Assistance has provided nearly $1.3 billion over the last 12 years to respond to humanitarian needs in Kenya, including those caused by natural disasters.

- Connecting Homes, Businesses, and Institutions to Reliable Clean Energy: USAID, through the Power Africa Initiative, announced $300,000 to support women’s entrepreneurship and gender-equity in the Kenyan energy sector and committed $3.6 million in to support the accelerated connection of more homes, businesses, and institutions in Kenya to cleaner electricity as part of its Empowering East and Central Africa program. In addition, Power Africa inter-agency partners, including the U.S. Department of Energy, DFC, and USTDA, announced key deliverables that, in partnership with the Government of Kenya, advance Power Africa’s mandate to alleviate energy poverty.

- Investing in Hydropower : Virunga Power, a U.S. company and Power Africa partner, announced a pipeline of six run-of-river hydropower projects in advanced stages of development in Kenya. With a total expected investment of $100 million, the hydropower projects will be constructed in sequence over the next five years and are expected to provide 31 megawatts of clean, baseload renewable energy. The power generated should improve the stability of Kenya Power’s distribution network in Western and Central Kenya and enable new connectivity and industrial and economic growth in rural areas of the country.

- Deepening Government-to-Government Cooperation on Clean Energy and Carbon Management: The U.S. Department of Energy and Kenyan Ministry of Energy announced their intent to sign a MOU in June in Nairobi intended to enhance bilateral collaboration and partnership in the development of clean energy, carbon management technologies, and decarbonization strategies. This MOU establishes a framework to facilitate the sharing of technical knowledge, advice, skills, and expertise across numerous sectors – including geothermal energy development and industrial decarbonization. The framework forms the basis of sustainable and climate-adaptive economic growth across our countries and regions.

- Investing in Electric Vehicle Startups: DFC announced a $10 million direct loan to BasiGo, an electric vehicle company that leases and sells electric buses to public transport bus operators in Kenya. The loan facilitates procurement of buses and batteries for sale in Kenya and is a key e-mobility project supporting Kenya’s ambitious climate goals. Additionally, DFC announced a $10 million loan to Kenyan company Roam Electric that supports its assembly and production of electric motorcycles on-site in its Nairobi production facility. The U.S. Department of State also announced $100,000 for technical assistance to support accelerating the transition to zero-emissions vehicles in Kenya, including through policy development and implementation, capacity building and peer-to-peer learning, and workforce development.

- Growing Kenya’s E-mobility Sector: DFC recently announced a $10 million loan to Mogo Auto Kenya to support affordable financing for cars, motorcycle taxis, and logbook loans in Kenya. The transaction supports President Ruto’s Africa Green Industrialization Initiative, building upon DFC’s longstanding support for the e-mobility economy in Kenya.

- Launching the MCC-Kenya Urban Mobility and Growth Threshold Program: The United States and Kenya are scheduled to launch a seminal partnership to deliver a more connected, mobile, and green Nairobi. The $60 million grant from the Millennium Challenge Corporation funds a four-year program focusing on the transportation needs of underserved groups, safer options for women and pedestrians, and climate-friendly public transportation, generating benefits for over four million residents and increasing urban mobility while decreasing transportation sector emissions.

- Increasing Plastic Recycling: USAID recently expanded its support for the Kenyan recycling company T3, now totaling over $2 million. T3 plans to leverage nearly $13 million in additional private investment to expand plastic collection and acquire a “bottle-to-bottle” processing line, the first in Kenya. The line enables production of food grade recycled PET resin and is projected to more than double the amount of PET plastic recycled in Kenya. The T3 initiative is projected to create 200 jobs and indirect economic opportunities for approximately 8,000 collectors, mainly women and youth.

- Supporting Community-Led Conservation: The Southern Kenya Conservation Project (SOK) and the Kenya Rhino Range Expansion Project (KRRE) are building partnerships for the conservation of the southern Kenya landscape and the expansion of rhino range in Kenya. The partnerships aim to raise significant funds to increase wildlife numbers, restore landscapes, open up wildlife corridors, and spur economic opportunity. USAID is providing $300,000 to develop landscape and fundraising strategies to help Kenya leverage funds and access financing for both projects. SOK and KRRE will help Kenya build climate resilience and achieve their 30×30 goal of conserving 30 percent of their land and oceans by 2030.

- Promoting Wildlife Conservation: To assist the Government of Kenya with combatting wildlife trafficking and other nature crimes, the U.S. Department of State and the U.S. Department of the Interior have collaborated to station a permanent U.S. Fish and Wildlife Service law enforcement attaché at the U.S. Embassy in Nairobi, strengthening the longstanding wildlife conservation partnership between our two countries. This position was designed to assist with law enforcement coordination and consultation, facilitation of intelligence sharing and investigative support, and access to U.S. Fish and Wildlife Service forensic and technical support resources.

- Amplifying Scientific Partnership: The United States welcomes Kenya’s leadership in hosting the upcoming Smithsonian’s ForestGEO international analytical gathering in Nanyuki, Kenya, co-hosted by the Mpala Research Centre, the National Museums of Kenya, and the Karatina University, from June 29 to July 13, 2024. The Smithsonian ForestGEO network studies the diversity and dynamics of forests, the forest carbon cycle, and the impact of climate and global change on forest biodiversity and function.

- Improving Weather Forecasting: DFC recently announced a $1 million loan to Ignitia AB, a tropical weather forecasting service designed for smallholder farmers in Kenya, Ghana, and the Democratic Republic of the Congo. This loan was part of the Africa Small Business Catalyst program in partnership with the U.S. African Development Foundation (USADF) and USAID.

- Fostering High-Integrity Carbon Markets: The United States and Kenya established a partnership to support Kenya’s efforts to be a global leader in delivering high-integrity and high-quality carbon credits. In support of this partnership, the U.S. State Department and USAID announced $1 million in targeted technical assistance and analytical capabilities to support development of Kenya’s framework for high-integrity carbon markets and to strengthen Kenya’s ability to engage in related transactions.

- Investing in Carbon Capture: The U.S. Department of Energy, through Pacific Northwest National Laboratory, announced a one-year project to accelerate the commercial readiness of carbon dioxide (CO2) removal approaches that leverage the reactive CO2 mineralization storage potential in Kenya’s volcanic-hosted geothermal systems. The project aims to develop and implement a characterization protocol to evaluate potential strategic basalt CO2 storage sites through a knowledge exchange process; parametrize a static geologic model to facilitate evaluation of CO2 injection and mineralization storage strategies; and establish the institutional foundation for sustained Kenyan collaboration within the international mineralization storage research and development community.

- Announcing New Scientific Collaboration: The Smithsonian Institution announced a new research fellowship program in Kenya, funded by education entrepreneurs Dennis and Connie Keller, to build capacity, train, and exchange knowledge. Alongside Smithsonian scientists, Kenyan Shared Health Science Fellows study impacts of changes in climate, pollution, stressors, and toxicants on wellbeing, health, and physiology in humans, plants, animals, and our shared environment. Over the next four years, the program aims to provide six fellows with two years of training at the Mpala Research Centre and spend time at the Smithsonian Institution in Washington, D.C.

- Deepening U.S.-Africa Nuclear Industry Cooperation: The U.S. Department of Energy, in partnership with Kenya and Ghana, plans to host the second installment of the U.S.-Africa Nuclear Energy Summit (USANES) on Industry Readiness in Nairobi, Kenya in August 2024. Recognizing the historic relationship between the United States and Kenya, USANES 2024 envisions U.S. and African policymakers, technical experts, and industry leaders convening in Nairobi to address critical issues impacting industry readiness and the future of nuclear energy on the African continent. The Summit comprises educational workshops, stakeholder engagement sessions, and multilateral discussions on topics from financing and workforce development to supply chain preparedness. The Summit aims to underscore the opportunities nuclear power presents to reach Net Zero by 2050 and further strengthen the robust ties between the United States and Kenya.

Trade and Investment: Generating Prosperity

The trade and investment partnership between the United States and Kenya is driving our shared prosperity, generating well-paying jobs, expanding economic growth, protecting the rights of workers, and spurring new innovations with global benefits. This partnership spans the full spectrum of large to small businesses. Both countries are partnering with the private sector to further strengthen these economic ties, including in the critical areas of clean energy technology, agriculture, and affordable housing.

- Advancing a U.S.-Kenya Strategic Trade and Investment Partnership: The U.S. and Kenya have made significant progress on the U.S.-Kenya Strategic Trade and Investment Partnership (STIP) . We are negotiating high standard commitments in a range of areas with a view to increase investment; promote sustainable and inclusive economic growth; benefit workers, consumers, and businesses (including micro-, small-, and medium-sized enterprises); and support African regional economic integration. The U.S. Trade Representative and Kenya’s Cabinet Secretary for Investment, Trade, and Industry committed in May to work towards concluding an agreement by the end of 2024.

- Signing a U.S.-Kenya Commercial and Investment Partnership: The United States and Kenya intend to sign a Commercial and Investment Partnership, affirming a mutual commitment to deepening commercial and investment ties between our two countries. This Partnership, with robust participation from the private sector, aims to promote a strong business-enabling environment and to facilitate trade and investment opportunities in Kenya focused on key priority sectors including infrastructure, agriculture, and the digital economy.

- Opening a DFC Nairobi Office: DFC announced it plans to open an office in Nairobi, playing a key role in driving DFC’s pipeline development across key sectors in Kenya such as agriculture, health, e-mobility, energy, infrastructure, and financial inclusion, including on-lending to small and medium sized enterprises and women entrepreneurs.

- Establishing A Framework Agreement with Coca-Cola: In Atlanta, President Ruto visited Coca-Cola HQ to sign a framework agreement focused on policy engagement, mango juice production, and plastic recycling. His visit also celebrated 70 years of Coca-Cola in Kenya, along with the company’s partnership on drought response and clean water, use of its supply chains to distribute COVID vaccines and protective equipment, and a new $175 million investment in its economy.

- Reaping Benefits from AGOA: Vivo Fashion, a leading Kenyan women’s fashion brand in East Africa, announced the opening of its first retail storefront in the United States in Atlanta, Georgia. Vivo Fashion is part of a growing Kenyan apparel industry that benefits from market access to the United States under AGOA, the largest single component of U.S. trade with Kenya.

- Improving Food Security through Jobs: USAID is investing in the future with $15 million for new activities designed to reduce poverty and malnutrition and address global food security by expanding investment opportunities. By creating over 50,000 new jobs, catalyzing over $200 million in new agricultural sales, and mobilizing over $200 million in new finance for agriculture, these activities improve food security and nutrition outcomes for over 800,000 Kenyans.

- Investing in Kenyan Businesses: