Book now - aliancetransfer

Aliancetransfer.

How far in advance do we need to book ?

Where do we find our driver , where does the shuttle leave from , how long do we wait for the journey to start , what happens if my flight is delayed , if my flight is cancelled what happens , how long does the transfer take , what amount of luggage is one person allowed , what is the difference between a service shuttle and a private transfer , are you able to book at the last minute , booster seats are available if so do we need to book them , is it possible to cancel a booking, can we pay the driver in cash , sobre nosotros, transfers / shuttle.

We are one of the largest service providers in Reus airport(REU) and Barcelona Airport(BCN).

Experiences

We have an extensive catalog of excursions for groups the territory.

We offer pre-designed travel packages to offer the highest qualitthroughouty at a competitive price.

We offer customized circuits to our clients, without obligation.

Transfers - aliancetransfer

More information Accept cerrar -->

- Our history

- Allianz Advantage

- Global footprint

- Social responsibility

- Travel protection

- Tuition protection

- Event ticket protection

- Bankcard services

- Assistance services

- Technology solutions

- Allianz Fusion

- Allianz TravelSmart

- Stories & insights

- In the news

- Press releases

- Vacation confidence index

- Internships

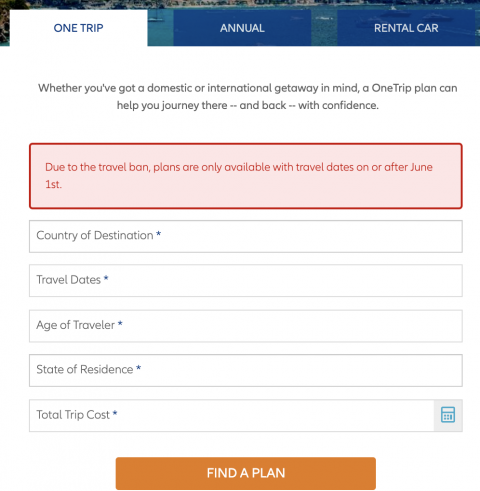

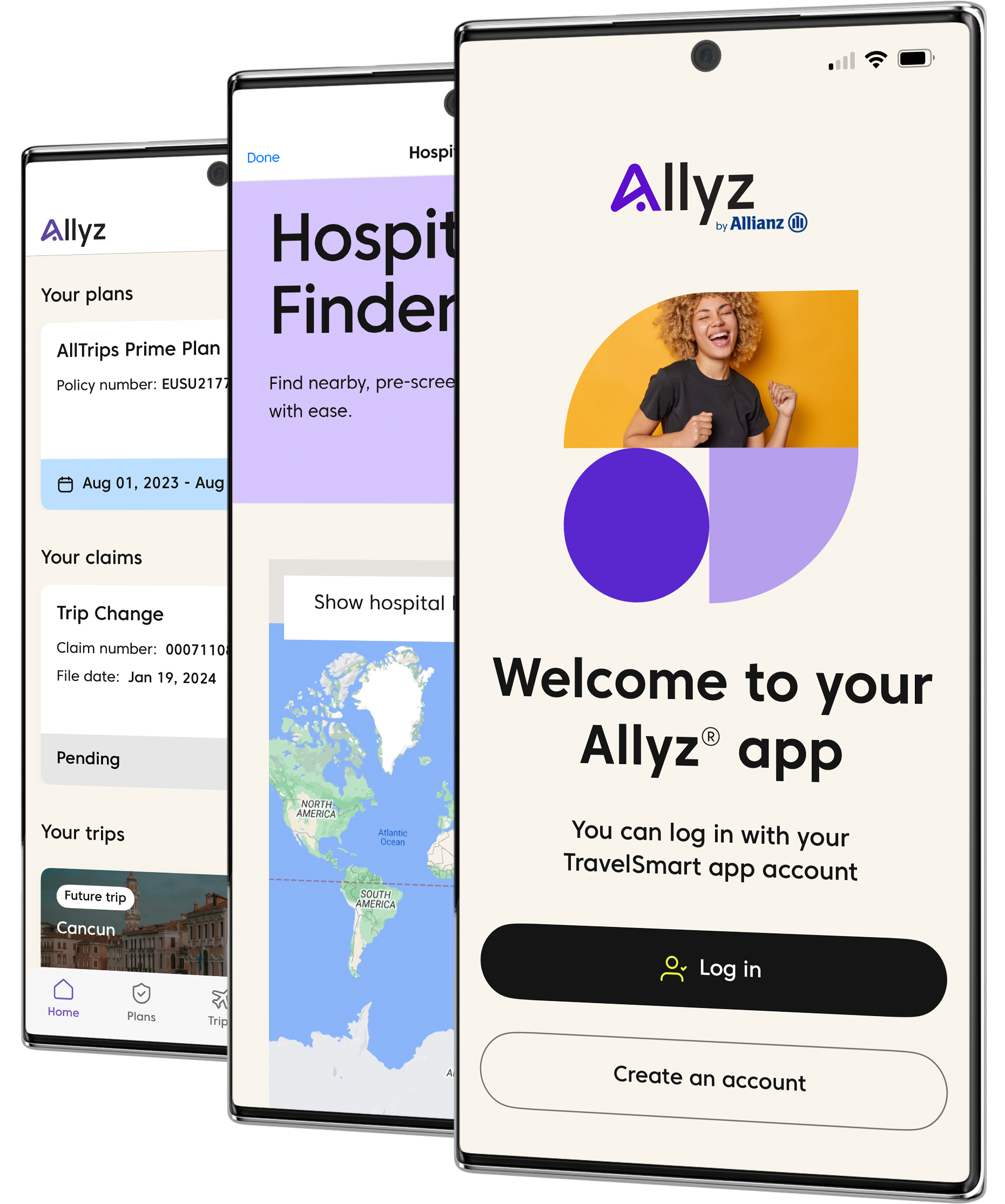

Allianz TravelSmart® App

The allianz travelsmart® app, featured by forbes as one of " the best travel insurance apps ," helps our customers make the most of their trip and their allianz travel insurance policy. it’s an easy-to-use tool that keeps them safe and their trips on track—no matter where they’re going..

With Allianz TravelSmart, our customers can:

- Get instant access to their coverage benefits while traveling the globe

- File a claim and track its progress on the go

- Connect to 24-hour assistance in just a few clicks

- Get instant location-based alerts about events that may impact your travels

- Stay a step ahead with real-time flight updates and boarding gate information

- Locate nearby, pre-screened medical facilities in an emergency

- Stay prepared with local emergency numbers at their fingertips

- Be clear when it counts with medical translations in 18 languages

Featuring the new alerts center

Video cannot be shown without accepting cookies

Learn more and download

Have questions about our products or services?

contact us — we’re here to help. .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Allianz Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does Allianz Travel Insurance cover?

Allianz single trip plans, allianz annual/multi-trip plans, which allianz travel insurance plan is best for me, can you buy allianz travel insurance online, what isn't covered by allianz travel insurance, is allianz travel insurance worth it.

- Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Travel Insurance is provided by Allianz Global Assistance, an insurer that operates in 35 countries and serves 40 million customers in the U.S. The company offers several types of travel insurance plans depending on your needs.

Travel insurance will help protect you if unexpected events affect your vacation. Whether you’re looking for a comprehensive plan or emergency medical coverage only to supplement the travel insurance you have from your credit cards , Allianz Global Assistance offers plenty of options.

Allianz trip insurance plans fall into two categories: single trip and annual/multi-trip plans. We evaluated several single trip and annual/multi-trip plans to help you figure out which policy makes sense for you.

Depending on what type of coverage you’re looking for, Allianz offers several different travel insurance options. Allianz’s plan choices fall under single trip or annual/multi-trip plans.

Single trip plans are designed for individuals who are leaving their home, visiting another destination (or destinations) and returning home. These travel insurance plans are the most comprehensive and provide benefits like trip cancellation, trip interruption and medical coverage.

Annual/multi-trip plans are designed for those who like to take a lot of little trips throughout the year as well as for business travelers. Because the coverage period is longer, these plans are more expensive.

Some of these plans include medical coverage only while others also provide more comprehensive travel insurance perks. There’s coverage for business equipment as these plans are geared toward work travelers.

Allianz offers five travel insurance plans for single trips, including a plan that's mainly focused on emergency medical coverage.

The OneTrip Cancellation Plus plan is geared toward domestic travelers who are looking for trip cancellation, interruption and delay coverage but don't need post-departure benefits like emergency medical or baggage loss. This plan is Allianz’s most affordable option.

OneTrip Basic, Prime and Premier are three comprehensive travel insurance plans.

OneTrip Basic is the most economical plan and offers trip cancellation, interruption and delay benefits along with emergency medical and baggage loss.

OneTrip Prime provides all the benefits of the Basic plan but with higher limits, a few extra coverage areas and complimentary coverage for children 17 and under when traveling with a parent or grandparent.

OneTrip Premier offers the most coverage, doubling almost every post-departure limit of the Prime plan with more covered cancellation reasons.

If you don't need pre-departure trip cancellation and interruption protections or you already have coverage through a premium travel credit card , the standalone OneTrip Emergency Medical plan may be a good choice. The plan mainly provides emergency medical protections along with some baggage loss/delay benefits.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Allianz single-trip plan cost

Here's a look at the cost of an Allianz travel insurance policy for a one-week, $1,500 vacation to Croatia in August 2020 taken by a 30-year-old from Texas.

The OneTrip Premier is the most expensive plan and provides the highest level of protection, especially for emergency medical events.

However, if you’re OK with lower limits on emergency medical, a OneTrip Prime or Basic plan could be a more appropriate choice. These costs represent a range of 3.4%-7.5% of the total cost of the trip, which is in line with typical costs of 4%-8%, according to the U.S. Travel Insurance Association.

» Learn more: How to find the best travel insurance

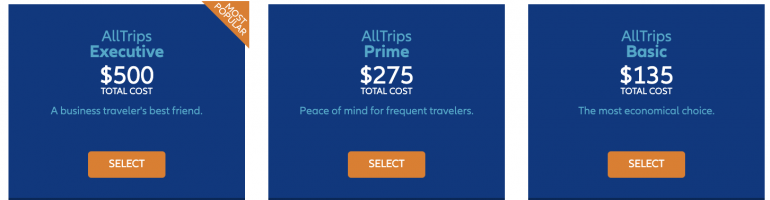

Allianz offers four different annual/multi-trip plans.

AllTrips Basic is suitable for those who would like emergency medical coverage while abroad but don't need trip cancellation and interruption benefits. The AllTrips Prime, Executive and Premier plans provide an entire year of comprehensive travel insurance benefits.

The Executive and Premier plans offer various levels of trip cancellation and interruption benefits. The Executive plan is specifically designed for business travelers since it offers protection for business equipment.

Allianz annual/multi-trip plans cost

Let's look at an example of an annual Allianz travel insurance plan that starts in July 2020 for a 50-year-old from Illinois.

Coverage under these plans is offered for trips up to 45 days in length.

The AllTrips Executive plan costs significantly more than the other plans; this is mainly due to higher trip cancellation coverage, emergency medical and business equipment protections. The Executive coverage amount for trip cancellation can be increased beyond what is quoted here, driving that plan's price up to as much as $785.

If you’re not concerned with pre-trip cancellation benefits and don’t need the increased level of medical coverage, the Basic plan is the most affordable option.

For trips longer than 45 days, the AllTrips Premier plan might be a better choice as it offers coverage for up to 90 days. Using the same search parameters but with 90 days of coverage per trip, the cost of the annual plan is $475.

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re abroad.

If you have a premium travel card (e.g., the Chase Sapphire Reserve® ): These cards often offer some trip cancellation and trip interruption coverage, so you may not need a plan that offers all the same coverage. In this case, getting the OneTrip Medical plan might be enough.

If you’re going on a trip and returning home: OneTrip Prime, Basic or Premier are good options to choose from while offering different levels of coverage.

If you’ll be going on multiple and longer trips: the AllTrips Premier plan might be best as it provides insurance benefits for trips up to 90 days in length. The remaining three annual AllTrips plans cover multiple trips, up to 45 days.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card: In these instances, it's best to choose a comprehensive plan depending on how much coverage you need and for how long. Consider one of the single trip or multi-trip plans.

» Learn more: Your guide to Chase Sapphire Reserve travel insurance

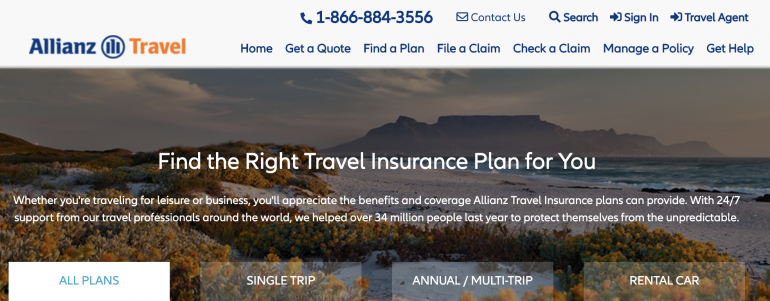

Yes, head over to AllianzTravelInsurance.com and choose "Find a Plan" from the menu on the top.

You will be able to view all plans or see plans categorized by single trip, annual/multi-trip and a rental car add-on option. Once you’ve decided on the plan you want, choose the "Get a Quote" option.

You will be required to input the relevant trip details before you can see which plans are available to you in your state.

» Learn more: Is travel insurance worth it?

Travel insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing, and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

Allianz has been offering insurance for more than 25 years. The company is well established and offers numerous single and annual travel insurance policies to fit many different needs.

Allianz travel insurance plans offer a wide array of benefits including (but not limited to): coronavirus-related coverage, trip cancellation, interruption, emergency medical coverage and transportation, baggage loss/damage, baggage delay, travel delay, change fee coverage, loyalty program redeposit fees, 24-hour assistance and many more benefits. Each plan is different, so you’ll want to look at the specific plans you’re considering to know exactly which benefits you’ll receive.

No, Allianz doesn't offer the Cancel For Any Reason optional upgrade. Review the policy details of the Allianz plan you’re considering to ensure you’re comfortable with the list of covered reasons. For example, the loss of a job can be considered a covered reason, but wanting to cancel a trip because you’re afraid to travel isn't.

Most often, you will need to file a claim with the insurer after you’ve incurred costs. If the claim is approved, you will receive a reimbursement. In other instances (e.g., covered baggage delay), the insurer will pay you a fixed amount per day and you won’t need to submit receipts.

Allianz Global Assistance offers several good travel insurance plans to choose from. If you’re looking for a travel insurance plan for a vacation, a single-trip plan is your best bet.

If you’re a frequent traveler or take lots of business trips, a multi-trip plan could be the way to go. If you have a travel credit card, look at what travel insurance benefits you may already have so you don’t duplicate your coverage .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Enable JavaScript

Please enable JavaScript to fully experience this site. How to enable JavaScript

Allianz Trip Insurance

Protect your travel experience

Read about Allianz Trip Insurance’s COVID-19 insurance coverage limitations and accommodations.

U.S. coverage alert Opens another site in a new window that may not meet accessibility guidelines.

Top reasons to buy trip insurance

- Financial reimbursement if you have to cancel or interrupt your trip due to a covered illness, injury, jury duty, and more

- Emergency medical benefits in and outside the U.S. – where many personal health insurance policies (like Medicare) won’t cover you

- 24-hour emergency assistance to help you solve medical and other travel-related problems on the go

Types of trip insurance plans

Allianz Trip Insurance comes in a variety of plans to fit your specific needs. Single-trip plans can protect one trip, annual plans can protect all your trips for an entire year, and rental car protection plans can keep your budget safe from accidental collision and damage to a rental vehicle.

All insurance is recommended / offered / sold by 3rd party, Allianz Global Assistance, not American Airlines. Underwriter: Jefferson Insurance Company or BCS Insurance Company. AGA Service Company is the licensed producer and administrator of these plans. AGA Service Company is a licensed producer in all 50 states plus the District of Columbia.

Get a quote Opens another site in a new window that may not meet accessibility guidelines.

Trip insurance benefits

Reimburses your prepaid, non-refundable travel expenses if you need to cancel your trip due to a covered illness, injury, and more.

Reimburses the unused, non-refundable portion of your trip and increased transportation costs it takes for you to return home early or to continue your trip due to a covered illness, injury, and more.

Reimburses expenses related to covered emergency medical or dental care incurred on your trip.

Provides benefits for medically necessary transportation to the nearest appropriate medical facility following a covered injury or illness.

Reimburses extra meals and accommodations you may need if your flight is delayed for 6 or more hours for a covered reason.

Reimburses you if your luggage is lost, damaged or stolen during your trip—keeping your travel plans on track.

Reimburses the purchase of essential items if your luggage is delayed for more than 24 hours.

Turn your trip into a VIP experience. Our travel experts can give you destination information, make restaurant reservations, find tickets to shows, and more.

Help is just a phone call away. Our team of multilingual problem solvers is available to help you with medical and other travel-related emergencies.

Provides primary coverage with no deductible.

Review period

If you’re not completely satisfied, you have 15 days (or more, depending on your state of residence) to request a refund, provided you haven’t started your trip or initiated a claim. Plans are non-refundable after this period.

Additional assistance

Coverage by country of residence.

- Frequently asked questions

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best’s 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive,Richmond, VA 23233 or [email protected]

Email [email protected]

PLEASE BE ADVISED: This plan contains insurance benefits (which may include disability and/or health insurance benefits) that only apply during the covered trip. This optional coverage may duplicate coverage already provided by your personal auto, home, renter’s, health, life, personal liability, or other insurance policy or source of coverage but may be subject to different restrictions. You should review the terms of this policy with your existing coverage. If you have any questions about your current coverage, call your insurer/health plan or insurance agent/broker. This insurance is not required to purchase any other products/services. Unless licensed, travel retailers and their employees may provide general information about the insurance, including a description of coverage and price, but are not qualified/authorized to answer technical questions about terms, benefits, exclusions, and conditions of the insurance or evaluate the adequacy of existing coverage. Plans are intended for U.S. residents only and may not be available in all jurisdictions. Rental Car Protector is not available to KS and TX residents, except when purchased as a separate policy and is not available in all countries or for all cars. This coverage does not provide liability insurance or comply with any financial responsibility law, or any other law mandating motor vehicle coverage and does not cover you for any injury to another party. Additionally:

California Residents: We are doing business in California as Allianz Global Assistance Insurance Agency, License # 0B01400. California offers a toll-free consumer hotline at 1-800-927-4357.

New York Residents: The licensed producer represents the insurer for purposes of the sale. Compensation paid to the producer may depend on the policy selected, or the producer’s expenses, volume of business, or profitability. The purchaser may request and obtain information about the producer’s compensation, except as otherwise provided by law.

Maryland Residents: The purchase of travel insurance would make the travel insurance coverage primary to any other duplicate or similar coverage. The Commissioner may be contacted to file a complaint at: Maryland Insurance Administration, ATTN: Consumer Complaint Investigation Property/Casualty, 200 St. Paul Place, Suite 2700, Baltimore, MD 21202.

Texas Residents: Before deciding whether to purchase this insurance plan, you may wish to determine whether your own automobile insurance or credit card agreement provides you coverage for rental vehicle damage or loss and determine the amount of deductible under your own insurance coverage. The purchase of this insurance plan is not mandatory. This coverage is not all inclusive, which means it does not cover such things as personal injury, personal liability, or personal property. It does not cover you for damages to other vehicles or property. It does not cover you for any injury to any other party.

Plan charge includes the cost of insurance benefits and assistance services. See your Plan Details for more information, or call Allianz Global Assistance at 800-284-8300.

AGA Service Company dba Allianz Global Assistance (AGA) compensates their suppliers or agencies for allowing AGA to market or offer products to customers of the supplier or agency.

*Terms, conditions, and exclusions apply, including for pre-existing conditions. Plans may not be available to residents of all states. Insurance benefits are underwritten by either BCS Insurance Company or Jefferson Insurance Company, depending on insured’s state of residence. AGA Service Company is the licensed producer and administrator of these plans.

- Commercial Motor Vehicle

- Roadside Assistance

- Public Liability

- General Property

- Management Liability

- Small business

- Tradies and contractors

- Retailers insurance

- Professional service providers

- Health and beauty professionals

- Real estate

- Cafés and restaurants

- NSW stamp duty exemption

- ACT | NT | TAS | WA claims

- NSW forms and resources

- VIC forms and resources

- ACT | NT | TAS | WA forms and resources

- Workplace mental health

- Training & webinars

- Compare Travel Insurance

- Caravan and Trailer

- Cyclone support

- Flood support

- Storm support

- Bushfire support

- Customer counselling program

- Financial hardship

- Scam warning

- Family violence support

- Deceased estates

- Financial institutions

- Insurance brokers

- Partner News Hub

- The Allianz Hub

- Login to My Allianz

- Make a payment

- Retrieve a quote

- Retrieve life application

- Travel Insurance

- Choose your plan

What is travel insurance?

Travel insurance is designed to cover you for a range of unexpected events that could happen when you’re travelling overseas or in Australia. Allianz Travel Insurance can cover costs like travel delays or emergency medical treatment, or the cost of replacing items that were lost or stolen during your trip. 1

We have Basic, Comprehensive, Domestic, and Multi-Trip Plans to choose from, with varying levels of cover to help you when you need it most. Our plans are available for singles, duos or families. Read through our Product Disclosure Statement (PDS) for detailed information about our plans to see which level of cover is right for you.

Find the right cover for your trip

Basic Travel Insurance

- Overseas emergency assistance 1

- Overseas medical and hospital expenses 1

- Personal Liability 1

Comprehensive Travel Insurance

- Overseas emergency assistance, medical and hospital expenses 1

- Unexpected trip cancellation 3

- Loss of or damage to luggage and personal effects 1

- COVID-19 benefits 2

Domestic Travel Insurance

- Travel delay expenses 1

- Rental vehicle excess 1

Multi-Trip Travel Insurance

Additional cover options.

For an additional premium, you can choose to add an Adventure Pack, Cruise Pack, or Snow Pack to eligible plans. Increased Item Limits Cover can also be added to insure your luggage, personal effects or valuables should something happen to them while travelling.

You have the option to vary the base excess when you buy your policy (premium adjustment will apply depending on the excess selected). The choice is yours.

Website review and travel remediation

Choose what suits your needs, single cover, family plan, ready to get started, frequently asked questions.

Without travel insurance, you run the risk of incurring some significant expenses that may take years to pay off.

If you’re travelling overseas, travel insurance is an important consideration for unexpected medical bills and hospitalisation. Other unforeseen expenses could include the replacement of lost or stolen luggage, delays or cancellations to your trip, and many other unfortunate scenarios.

We don’t cover medical expenses under our Domestic Travel Insurance policy. However, you may wish to take out insurance for domestic flight changes or cancellations, lost or stolen baggage, or rental vehicle excess. Refer to the Product Disclosure Statement (PDS) for more information.

Travel insurance may cover you for a range of unexpected events that may affect your trip, such as emergency medical assistance if you become ill or injured while travelling overseas, including arranging your evacuation if needed.

Other incidents that travel insurance may cover include costs due to unexpected delays and cancellations, rental vehicle excess, and personal liability. You also have the option to purchase additional cover for activities such as adventure sports or skiing, although this isn’t available on all plans.

Cover limits vary from insurance provider to insurance provider, as do policy terms, conditions, limits and exclusions, so it’s important to read the Product Disclosure Statement to make sure you fully understand what’s covered, the limits applying to the policy, and to make sure the policy is appropriate for your needs.

The length of your Travel Insurance policy is largely dependent on the travel dates you supply. When obtaining a quote, or buying a policy, you’ll be prompted to enter in your departure and return dates – this will be the period of cover for all benefits except the cancellation benefit, which begins from the date your policy is issued.

The period of cover is also shown on your Certificate of Insurance, which is sent to you at the time of purchase. You may want to extend the length of your holiday abroad (and therefore need an extension of your period of cover) and you may be able to do this within specified timeframes.

If you think you may travel more than once a year, you may wish to consider a Multi-Trip policy . Different start and end dates apply, refer to the Product Disclosure Statement for full details.

It’s up to you when you buy Allianz Travel Insurance, however, keep in mind these three things:

- You can buy our Travel Insurance up to 12 months in advance.

- You must buy Allianz Travel Insurance before you start your journey. Your journey starts when any traveller named on the Certificate of Insurance leaves home or work in Australia to begin travel.

- Depending on the plan you choose you may have trip cancellation cover, which covers unexpected trip cancellation, rescheduling or shortening from the date your Certificate of Insurance is issued. So, consider buying our Travel Insurance as soon as you’ve booked and paid for some or all your trip as you may be covered for such events before you depart.

Yes, if you change your mind after you buy your Travel Insurance policy, you may cancel it within 14 days of your Certificate of Insurance being issued.

You’ll be given a full refund of the premium you’ve paid, provided you’ve not started your journey and don’t intend to make a claim or exercise any other right under your policy.

When considering which policy is right for you, make sure you consider your needs, as well as your financial situation. Reading the Product Disclosure Statement and Target Market Determination (TMD) is a good place to start as they will give you more detail, so you can decide if the plan is right for you.

Allianz Travel Insurance offers a number of travel insurance plans – Basic , Comprehensive , Domestic , Non-Medical or Multi-Trip Travel Insurance . You can see more detailed information on our Compare Cover Options page .

This product has a general exclusion, with limited exceptions, against epidemics and pandemics. That means we don’t cover claims that arise from, or are related to, an epidemic or pandemic.

However, you’re covered under selected benefits in this product if, during your period of cover, you’re positively diagnosed as suffering a sickness recognised as an epidemic or pandemic, such as COVID-19.

Refer to the Product Disclosure Statement to see which benefits offer cover in the event that you contract a sickness recognised as an epidemic or pandemic, and the terms, conditions, limits and exclusions that apply.

Note: There is no cover under any benefit of this policy if your claim arises because you did not follow advice or a warning that has been issued by the Australian Government or a reliable mass media source. This applies even if an Australian government has given you permission to travel, or you fall under a specific exemption where there is otherwise a travel ban in place.

If you have any questions call us on 13 1000 .

If you need to shorten your journey while travelling, or are prevented from travelling due to a COVID-19 border closure or mandatory quarantine period, you may be entitled to receive a partial or full refund on your premium. Refer to the Product Disclosure Statement for more information.

Eligibility criteria applies. Contact us on 1800 440 806 or email us .

There is no cover under any benefit of this policy if your claim arises because you didn’t follow an advice or warning that a reasonable person would have been aware of, that has been issued by the Australian government (when a ‘reconsider your need to travel’ or ‘do not travel’ alert is in place), which can be found on Smartraveller ; or which was published in a reliable mass media source.

Before buying travel insurance, and while you’re travelling, check Smartraveller and Allianz Partners for travel alerts or advisories for your intended destination(s).

Note: This applies even if an Australian government has given you permission to travel, or you fall under a specific exemption where there is otherwise a travel ban in place.

Tip: Subscribe to Smartraveller to get travel alerts and advisory updates by email.

Refer to General Exclusions in the Product Disclosure Statement for a full list of exclusions.

If you have any questions, call us on 13 1000 .

A general exclusion, sometimes referred to as a policy exclusion or exclusion, is an exclusion that applies to all policy benefits.

Should a general exclusion apply, your travel insurance policy won’t provide cover for the specified event, activities or circumstances.

Refer to General Exclusions in the Product Disclosure Statement provided at the time of purchase for a full list of exclusions.

We're here to help

Give us a call, or send us a message, follow us on, *conditions apply.

- Terms, conditions, exclusions, limits and applicable sub-limits apply. Refer to the Product Disclosure Statement for full details.

- Policy terms, conditions, limits, exclusions, and sub-limits apply to particular types of losses, premium refunds (full or partial) or claims. This product has a general exclusion, with limited exceptions, against epidemics and pandemics. That means we don’t cover claims that arise from, or are related to, an epidemic or pandemic. However, you’re covered under selected benefits in this product if, during your period of cover, you’re positively diagnosed as suffering a sickness recognised as an epidemic or pandemic, such as COVID-19. Refer to the Product Disclosure Statement to see which benefits offer cover in the event you contract a sickness recognised as an epidemic or pandemic, and the terms, conditions, limits and exclusions that apply.

- Terms, conditions, limits, exclusions and sub-limits apply. Cancellation cover is only available on Comprehensive, Domestic and Multi-Trip Plans. Refer to Cancellation and General Exclusions sections of the Product Disclosure Statement for full details.

- Car Insurance

- CTP Insurance

- Home & Contents Insurance

- Building Insurance

- Landlord Insurance

- Life Insurance

- Caravan Insurance

- Boat Insurance

- Small Business Insurance

- Business Insurance Pack

- Workers' Compensation

- Renewals / Payments

- Manage Your Policy

- Policy Documents

- Customer Support

- How we help

- Sustainability

- Partnerships

- Work with us

Any advice here does not take into account your individual objectives, financial situation or needs. Terms, conditions, exclusions, limits and applicable sub-limits apply. Before making a decision about this insurance, please consider the relevant Product Disclosure Statement (PDS)/Policy Wording and Supplementary PDS (if applicable). Where applicable, the PDS/Policy Wording, Supplementary PDS and Target Market Determination (TMD) for this insurance are available on this website.

Travel Insurance is issued and managed by AWP Australia Pty Ltd ABN 52 097 227 177 AFS Licence No. 245631, trading as Allianz Global Assistance (AGA) as agent of the insurer Allianz Australia Insurance Limited ABN 15 000 122 850 AFS Licence No. 234708 (Allianz). Travel Insurance is underwritten by the insurer Allianz. Terms, conditions, exclusions, limits and applicable sub-limits apply.

+ The 10% off Travel Insurance ‘GETAWAY’ discount is available from 09:00am AEST 23/05/2024 until 11:59pm AEST 07/06/2024 by entering the valid promo code. The discount applies to new policy purchases and is based on standard premium rates (including optional extras). It applies automatically upon successful input of the promo code and applies to any changes, upgrades or amendments made to the policy prior to commencement of the journey. The discount may apply to changes made after commencement of the journey, contact Allianz Global Assistance to find out more. Not to be used in conjunction with any other offer.

We don’t provide advice based on any consideration of your objectives, financial situation or needs. Before making a decision, please consider the Product Disclosure Statement available on this website. If you purchase this insurance, AGA will receive a commission that is a percentage of the premium. Ask us for more details before we provide you with any services on this product.

Round The World Airline Tickets

Fly rtw with one world member airlines.

one world's Round The World tickets give you unprecedented access to hundreds of destinations in 170 territories. We offer three types of Round The World trips:

one world Explorer: a continent-based fare,

Global Explorer: a distance-based fare,

Circle Pacific: an inter-continental journey to explore continents that border the Pacific Ocean.

Where to first? The whole wide world is waiting for your Round The World trip.

one world Explorer

Continent-Based Air Travel

No matter where business or pleasure takes you, one world's vast network means your Round The World trip via one world Explorer fare makes it easy to travel from city to city, and continent to continent. And, for every dot you connect, you earn more miles and points to spend across the one world Alliance.

Global Explorer

Distance-Based Air Travel

For an even wider choice of where to travel, book your Round The World trip via Global Explorer, which grants you access to an even more extensive list of airlines, including Aer Lingus, Bangkok Airways, one world connect partner Fiji Airways , Jetstar, Jetstar Asia, Jetstar Japan, Jetstar Pacific, WestJet, and Qantas code-share flights operated by Air Tahiti Nui.

Circle Pacific

Multi-Continent Air Travel

If you prefer to visit multiple continents without actually flying all the way around the world, our Circle Pacific fare lets you explore the continents that border the Pacific Ocean. You can choose to start and finish your journey in one of the following continents:

Asia (Cambodia, China, Hong Kong, Indonesia, Japan, Korea, Malaysia, Philippines, Singapore, Taiwan, Thailand and Vietnam)

Southwest Pacific (Australia and New Zealand)

North America (USA and Canada)

South America

Contact a one world member airline or your travel agent to plan and book your Circle Pacific trip now.

Frequently Asked Questions

What is a round the world ticket.

The one world Alliance offers a way to visit many countries, around the world, all in a single itinerary.

On oneworld.com, you can choose to book either one world Explorer, where the fare depends on the number of continents you visit, or Global Explorer, where the fare depends on the distance you travel.

Circle Pacific, an inter-continental journey to explore continents that border the Pacific Ocean, can be booked by your travel agent and is not currently available for booking on oneworld.com.

Where Can I Fly With Round The World?

For one world Explorer and Global Explorer, one world member airlines and affiliate airlines cover six continental regions: Europe/Middle East (including Algeria, Armenia, Azerbaijan, Egypt, Georgia, Libya, Moldova, Morocco, Sudan, Tunisia, and Yemen); Africa (excluding countries listed above); Asia (including the Indian subcontinent, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan, but excluding countries named above); Australia, New Zealand, and the South West Pacific; North America (including the Caribbean, Central America, and Panama); and South America. Currently, it is not possible to begin your itinerary through Doha Hamad International Airport (DOH) through one world member Qatar Airways. Book both one world Explorer and Global Explorer on oneworld.com.

Through the one world Circle Pacific fare, one world member airlines and affiliate airlines cover four continental regions: Asia (including the Indian subcontinent, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan); Australia, New Zealand, and the South West Pacific; and North America. Ask your travel agent about booking a one world Circle Pacific fare. Routes are subject to change.

Where Can I Travel Now, Given COVID Restrictions?

View entry restrictions and COVID-19 travel requirements for countries around the world on our the one world Travel Requirements Information Portal . Use the map to get information on travel restrictions by country, including entry restrictions, as well as COVID-19 vaccination, testing, and quarantine requirements.

Is Round The World Ticket Business Class An Option?

Yes, Round The World tickets are available in Economy, Business, and First class. On our oneworld.com booking tool, there is a drop-down menu to select your preferred cabin class. Premium economy upgrades will show where available when you select flights.

Is Round The World Ticket First Class An Option?

How much does a round the world ticket cost.

Your Round the World fare is based on a few factors: the number of continents you visit or pass through or the distance travelled, the travel class selected, and the number of travelling passengers. Read on for more information about full fare rules and conditions [Note: Links open PDF in browser]:

What Are The Round The World Rules?

Read on for Round The World rules and conditions [Note: Links open PDF in browser]:

What Should I Know To Help Me Plan My one world Explorer Itinerary?

When planning your one world Explorer itinerary, here are tips to keep in mind:

Destinations are grouped into three zones and six continents:

Zone 1: North & South America

Zone 2: Europe, the Middle East and Africa

Zone 3: Asia and the South West Pacific

Your trip must be in a continuous forward direction, East or West, between Zone 1, Zone 2 and Zone 3. Backtracking within a continent is generally permitted, however some exclusions apply.

Your adventure can last from 10 days up to a year. Travel must be completed within 12 months of your original departure date.

Your trip must start and finish in the same city.

You must cross both the Atlantic Ocean and the Pacific Ocean on your journey.

Your journey can include three to six continents, and anywhere between three and 16 flights.

Review complete one world Explorer fare rules and conditions .

Can I Change Or Update My Round The World Itinerary?

Yes, one world Explorer, Global Explorer and one world Circle Pacific itineraries can be modified to accommodate changes to your Round The World plans.

If you booked your Round The World trip through oneworld.com, contact the ticketing airline (the airline you are flying on the first leg of your journey) to make changes to your itinerary.

If you booked your Round The World tickets through a travel agent, please contact the travel agent to make changes to your itinerary.

Will I Earn Frequent Flyer Points On A Round The World Trip?

Short answer: Yes, you will earn frequent flyer points on your Round the World trip.

Long answer: Yes. one world works in collaboration with all of our partner and member airlines to ensure that you’re rewarded no matter where you travel. On all eligible flights, you will accrue points or miles toward the airline of your choice and toward your one world tier status .

How Can I Pay For A one world Round The World Trip With Frequent Flyer Points?

Currently, it is not possible to use frequent flyer points to pay for a one world Round The World trip.

Does Your one world Explorer ticket include checked-in baggage?

Two free pieces of 23 kilos each shall be permitted. Additional allowances may apply. Refer to individual carrier websites.

Guide to United Airlines partners

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Credit cards

- • Travel credit cards

- • Rewards credit cards

- • Family finances

- Connect with Brooklyn Lowery on LinkedIn Linkedin

- Get in contact with Brooklyn Lowery via Email Email

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

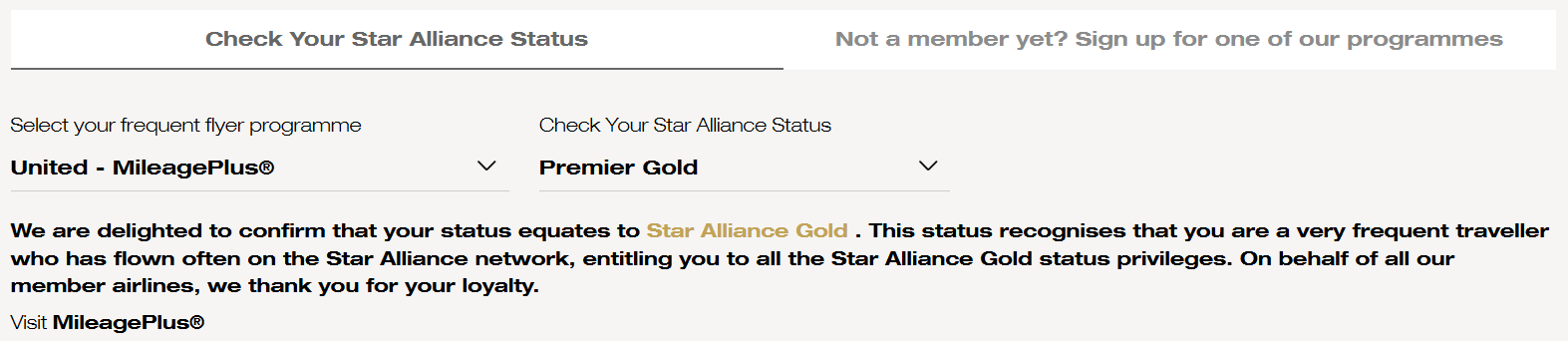

As a major domestic airline with plenty of partner brands, United Airlines can be a solid choice for your upcoming travels. When you fly with the airline itself or with one of United Airlines partner airlines, you can earn United MileagePlus miles. Those miles are redeemable for flights with United or its vast network of Star Alliance partner airlines as well as additional worldwide partners in the travel and hospitality spaces.

In this guide, we will dive into United’s partners and how to earn and use United miles.

United Star Alliance partners

United Airlines is a member of the Star Alliance, a global network of 20-plus airlines. These airlines offer flights to nearly every destination in the world. By flying on airlines within the same alliance, you can accrue miles and status more quickly, which can provide additional benefits and miles to redeem for award flights across the alliance.

- Air New Zealand

- All Nippon Airways (ANA)

- Asiana Airlines

- Brussels Airlines

- Copa Airlines

- Croatia Airlines

- Ethiopian Airlines

- EVA Airways

- LOT Polish Airlines

- Scandinavian Airlines (SAS). Note that SAS will be departing the Star Alliance in August 2024 to join SkyTeam, another global airline alliance.

- Shenzhen Airlines

- Singapore Airlines

- South African Airways

- TAP Air Portugal

- Thai Airways International

- Turkish Airlines

Benefits of Star Alliance Gold status

When you meet United’s Premier Gold requirements, you will automatically receive Star Alliance Gold status. This status entitles you to benefits that apply across all airlines within the alliance. Benefits of this status include priority airport check-in, priority baggage handling, access to airport lounges within the alliance network, priority boarding and more. These benefits can be quite helpful and make your next trip a breeze if you fly on airlines within the network.

In fact, meeting status with any of the Star Alliance partner airlines could qualify you for some level of Star Alliance status. You can check whether your airline status qualifies on the Star Alliance website .

Other United airlines partners

United has several partner airlines outside of Star Alliance. While benefits vary by airline, expect the option to accrue United miles on each airline as well as access flights to destinations not served by United nor its Star Alliance partners. For example, through its partnership with Virgin Australia, you can access cities such as Hobart on a single itinerary sold by United and accrue miles for the journey. Keep in mind, since these are not Star Alliance partners, some services such as mobile boarding passes, priority customer service or cabin options may not be available on these airlines.

- Air Dolomiti

- Boutique Air

- Discover Airlines (formerly known as Eurowings Discover)

- Hawaiian Airlines

- Olympic Air

- Silver Airways

- Virgin Australia

United hotel partners

United partners with several hotel chains providing yet another way to accrue miles. These partners operate more than 15,000 hotels worldwide so they likely offer a location near most destinations you could imagine. Benefits can vary by hotel brand and chain.

Partner hotels include:

Partner hotels

- Marriott Bonvoy

- IHG Rewards Club

- World of Hyatt

- Radisson Rewards

- Wyndham Rewards

- Choice Privileges Rewards

- Golden Circle

How to earn miles with United partners

Earn with star alliance flights.

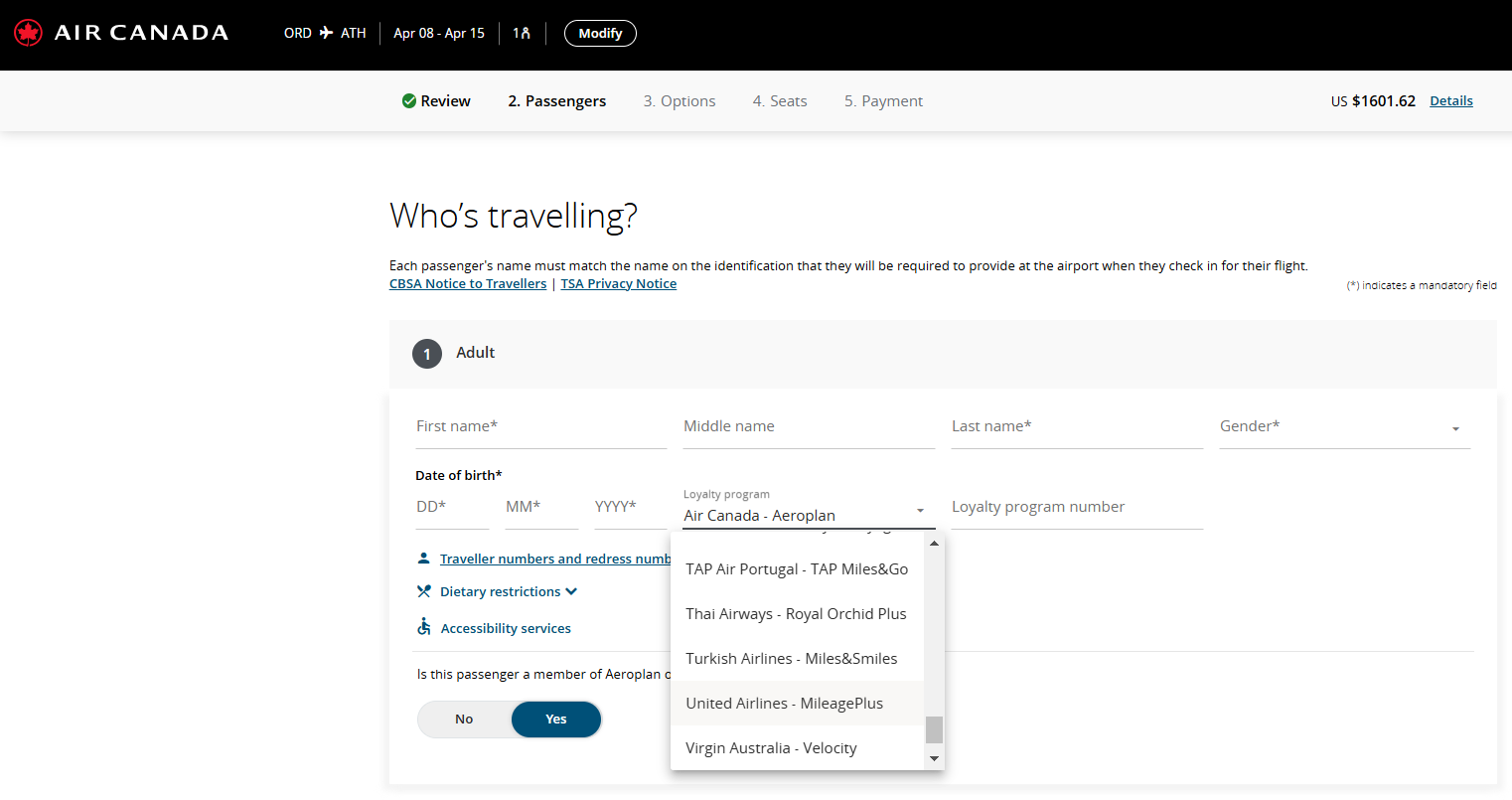

You can earn miles by flying with United partner airlines within the Star Alliance. When you fly with one of United’s airline partners, you can earn United miles simply by adding your MileagePlus number when you book your tickets. This option can often be found in the booking flow as you fill out the passenger information section, as it is for the Air Canada flight example.

Keep in mind that the amount of miles you earn can vary depending on how you booked the partner flight. If you bought your tickets directly from United, you’ll earn miles based on the fare and your MileagePlus status level. When you book a flight through a partner airline, you’ll earn miles according to the distance of your flight and your fare class.

If you’re seeking Premier status with United, Premier-qualifying credits can vary, and not all partner tickets are eligible for Premier-qualifying points. For a full rundown of Premier-qualifying credits with partners, you can visit this page on United’s website .

Lastly, each Star Alliance airline has its own rewards program and points are not exchangeable. If you have points on Lufthansa for example, you can not redeem those for United MileagePlus miles.

Earn with other partner flights

On top of the Star Alliance, United partners with additional worldwide airlines, so you’ll have even more options to earn MileagePlus miles. The ease of crediting these flights to United MileagePlus can vary by partner airline so be sure to check at booking or contact the partner airline to ensure it is credited correctly.

Earn with hotel partners

You can earn miles from hotel partners by connecting your MileagePlus account or by booking via United’s travel portal. The amount of points you can earn will vary depending on hotel partner, amount spent or length of stay. For example, for a stay at a Hyatt hotel, you can earn 500 miles per stay while a stay at a JW Marriott would earn 2 miles per $1 spent. Be sure to review the benefits by hotel to determine the best hotel choice for yourself if you want to maximize earning miles.

Earn miles with United credit cards

When it comes to earning United miles, credit cards can be a great option. United’s co-branded credit cards offer a way to earn miles directly from your purchases. In addition, you can use a flexible travel credit card , such as those in the Chase Ultimate Rewards program, that allows you to transfer those points at a 1:1 ratio to United MileagePlus. These are great opportunities to maximize your MileagePlus miles earning, plus take advantage of other card perks like no foreign transaction fees or travel protections. Here are a few credit card options you might want to consider:

United Explorer Card

The United℠ Explorer Card * offers entry-level loyalists an easy way to earn rewards on United purchases, for a reasonable $95 annual fee (waived the first year).

To start, the Explorer Card offers a 50,000-mile welcome bonus after spending $3,000 in the first three months. Plus you’ll receive 2X total miles on United purchases, 2X miles on dining and hotel stays booked directly with the hotels, as well as 1X miles on all other purchases.

A few additional perks of this airline credit card include your first checked bag free, up to $100 in credits toward your Global Entry or TSA PreCheck application fee, priority boarding and two one-time-use United Club passes at approval and each year after your account anniversary.

United Club Infinite Card

You’ll pay a hefty annual fee ($525) to own the United Club℠ Infinite Card *, but if you fly often enough with the airline and can take advantage of the card’s many perks, it can be worth it.

To start, you’ll earn 80,000 bonus miles after spending $5,000 in your first three months, as well as 4X miles on United flight purchases, 2X miles on all other travel, dining and eligible delivery services and 1X miles on everything else.

Premium perks of the Club Infinite Card include automatic United Club lounge membership, United Premier Access (meaning priority check-in, boarding and more), two free checked bags each for you and one companion, a few travel credits to expedite the airport security process and more.

United Business Card

If you’re a small business owner and frequently fly with United, the United℠ Business Card is a solid option to consider. For a $99 annual fee (waived the first year), you’ll earn 2X miles on United Airlines purchases, dining, gas station purchases and on office supplies, local transit and commuting (plus 1X miles on all non-category purchases).

The card offers a 75,000-mile welcome bonus after you spend $5,000 in the first three months, plus a variety of additional benefits: First checked bag free for you and a companion, $100 United travel credit after marking at least seven United purchases and more.

Chase Sapphire Preferred Card

Chase Ultimate Rewards points transfer at a 1:1 ratio to United MileagePlus, making the Chase Sapphire Preferred® Card a good option for traveling with United.

With the Sapphire Preferred, you’ll earn 5X points on travel through Chase Ultimate Rewards and 2X points on general travel, as well as 3X points on dining, select streaming services and online grocery purchases and 5X points on Lyft rides (through March 31, 2025). All other purchases earn 1X points.

There’s a $95 annual fee, but you’ll have the chance to earn a limited time 75,000-point welcome bonus after spending $4,000 on purchases in the first three months and can enjoy a wealth of travel protections. Other benefits include an annual $50 hotel credit and a 10 percent anniversary point bonus.

Chase Sapphire Reserve

The Chase Sapphire Reserve® is a great choice if you’re looking for a more premium travel card with access to the same Chase transfer partner perks.

To start, you’ll earn 5X points on travel purchased through Chase Travel and 3X points on general travel (after first earning your $300 travel credit ). The card also offers 3X points on restaurant purchases, 10X points on Lyft purchases (through March 2025), 10X points on Chase Dining purchases and 10X points on hotel stays and car rentals through Chase Travel (plus 1X points on everything else).

The card charges a steep $550 annual fee, but you’ll get Priority Pass Select lounge membership, a $300 annual travel credit (as noted), a Global Entry or TSA PreCheck credit, various travel protections and more. There’s also a limited time 75,000-point welcome bonus after spending $4,000 in your first three months.

How to redeem miles with United partners

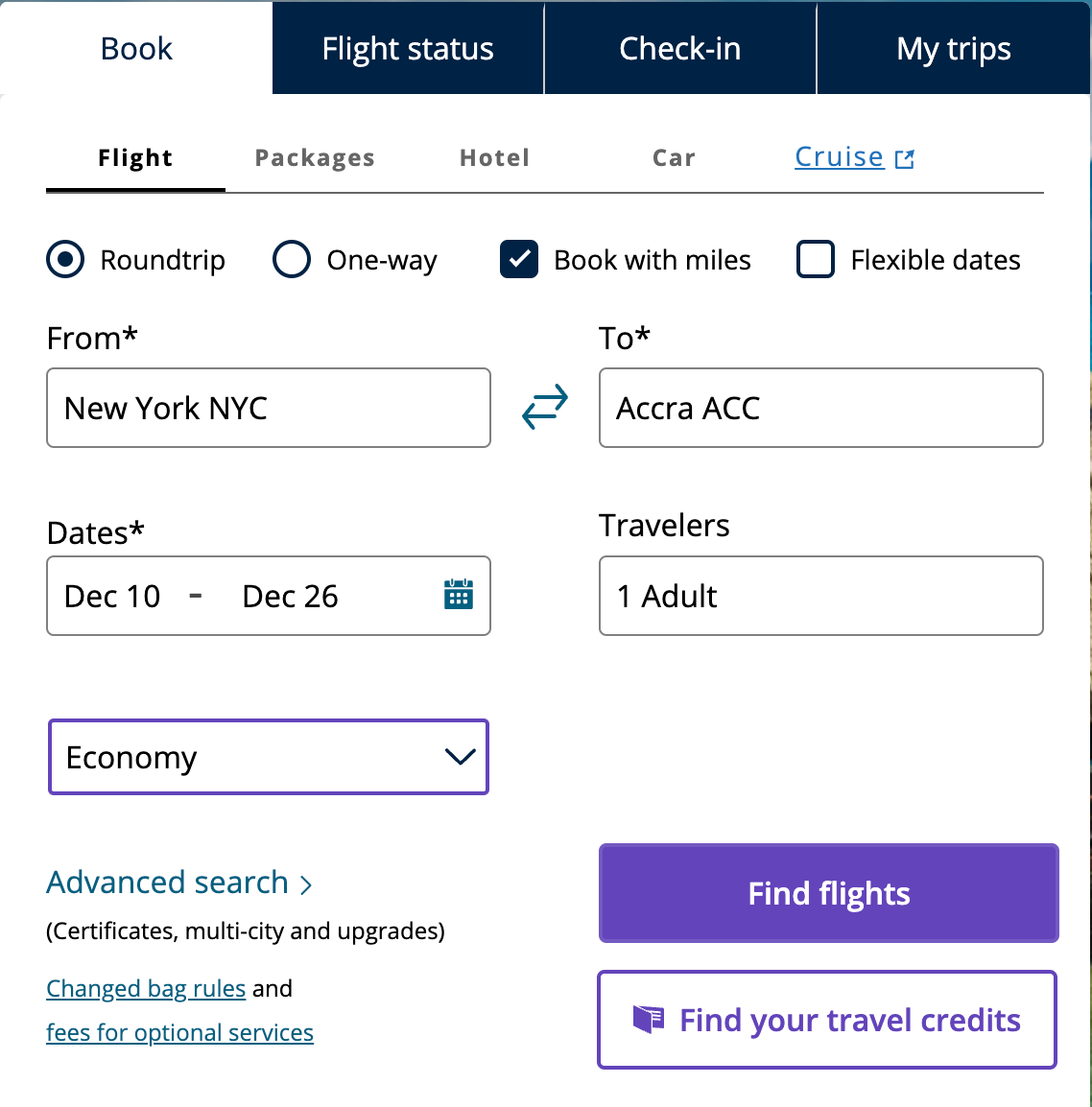

Once you’ve racked up enough United MileagePlus miles to redeem for an award ticket, you can check your options directly through United’s website or mobile applications. Searching for an award flight is simple. On the website or app, enter your desired departure airport or city and final destination alongside your travel dates, number of travelers and desired cabin class. Be sure to check the “Book with miles” box in order to see available flights that can be paid for in MileagePlus miles.

From there, you can view all award seats available to your destination with United, its Star Alliance partners and other partner airlines. You can then book your award flight using your miles.

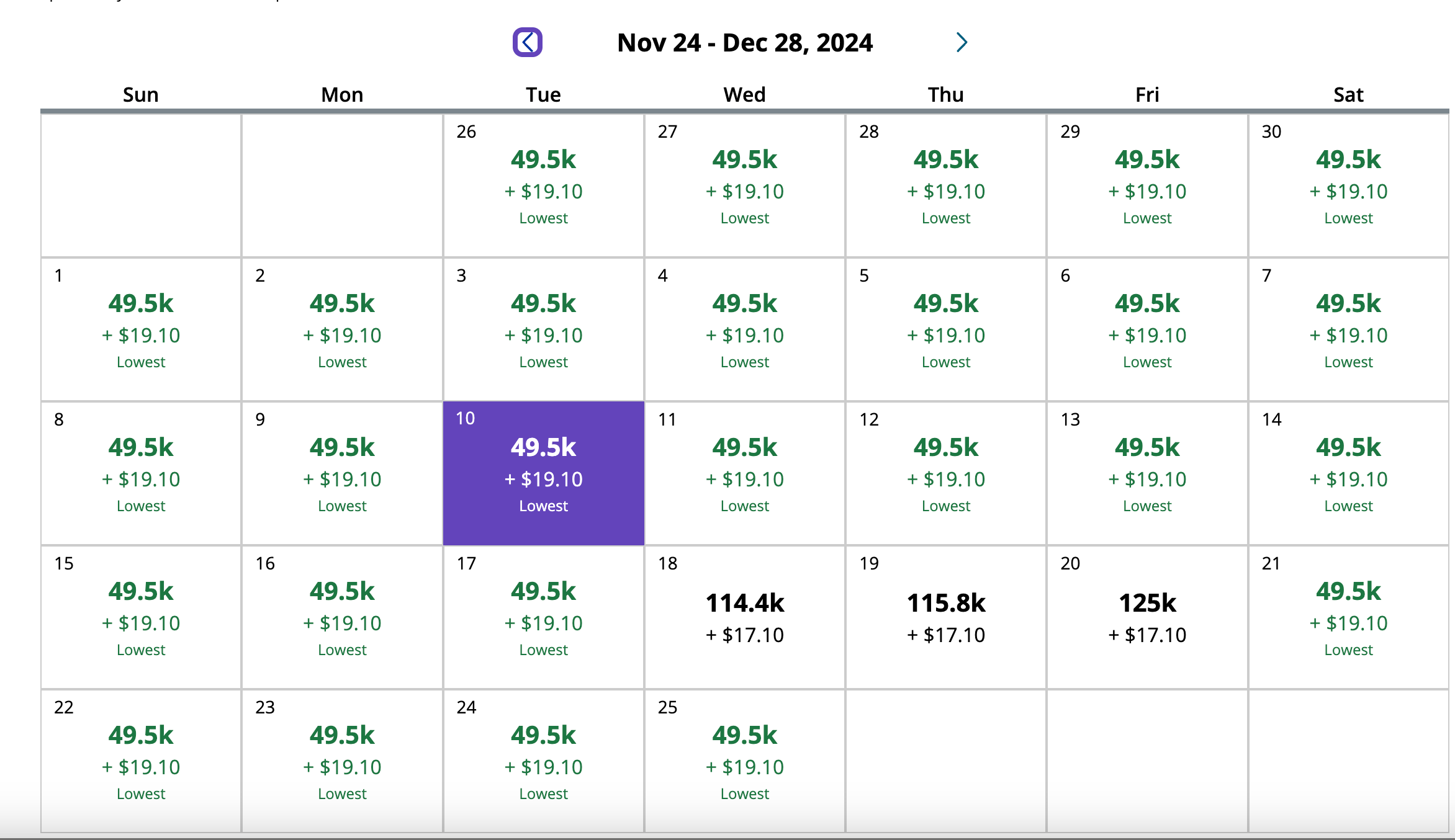

United also allows you to view a 30-day calendar to find which days have the lowest miles costs.

Frequently asked questions

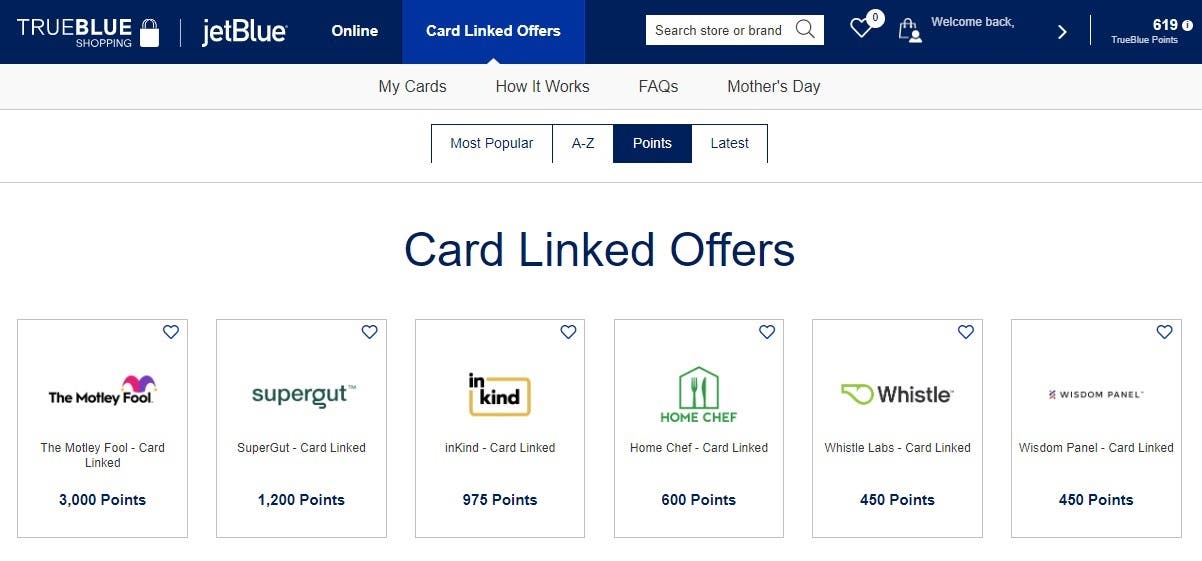

What other partnerships does united have, rental car partners, shopping and everyday spending partners.

- Harry & David

What are the best transfer partners for United?

Can i earn united mileageplus miles without flying, the bottom line.

With a global network of partner airlines, hotels and shops, there are numerous ways to earn and redeem United MileagePlus miles. If you’re a frequent traveler with United, its wide range of airline partners can help you stretch your MileagePlus miles even further with added destinations and access.

Just remember, your United miles will often go furthest when you book United flights directly through United. And to maximize your miles rewards over time , don’t forget to check for additional partner benefits when you book a hotel, rent a car or shop with partner retailers.

*The information about the United℠ Explorer Card and United Club℠ Infinite Card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

United MileagePlus Dining guide

Best United Airlines credit cards

- My View My View

- Following Following

- Saved Saved

Modi's alliance to win big in India election, exit polls project

- Medium Text

- Exit polls project BJP-led alliance to win 350+ of 543 seats

- Modi’s BJP projected to better 303 seats won in 2019

- Opposition alliance projected to win 125-182 seats

- India’s exit polls have patchy record

- Opposition dismisses exit poll projections

UNCERTAINTY LIFTED, ANALYSTS SAY

Sign up here.

Reporting by YP Rajesh and Krishn Kaushik; Additional reporting by Shivam Patel, Tanvi Mehta, Sakshi Dayal and Chris Thomas; Editing by Raju Gopalakrishnan and Giles Elgood

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

World Chevron

Uganda's sexual minorities face escalating human rights violations, with over 1000 cases recorded in the last nine months involving arrests, torture and house evictions among others, according to a report by a pressure group.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Your all-new here-for-anything travel companion

Take your protection further with Allyz® TravelSmart—your ultimate travel companion for any journey ahead. Use it to manage your Allianz travel protection plan on the go, and get exclusive access to digital services to help you during your trip.

Get more out of your policy:

+ File a claim right from your phone

+ Manage your travel insurance plans

+ View coverage details

+ Contact customer care in just a couple taps

Get help with your travel plans:

+ Organize itineraries in one spot

+ Locate a quality hospital when you need one

+ Translate common medical terms

+ Get destination-specific safety and security alerts

Download the app today and take along the ultimate travel companion.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Confirmed: Chick-fil-A is pursuing an Alliance location

- Chick-fil-a has three Stark County locations. It's expected to have two more in Alliance and North Canton.

ALLIANCE − It's no longer a rumor. The Carnation City has learned a developer plans a Chick-fil-A on West State Street.

The city has received a conditional use request for Chick-fil-A to have a location at 2381 W. State St. in Alliance. The request was submitted by Woolpert, Inc., for property near Carnation Court plaza, which is where Jalisco Mexican restaurant is located.

The popular fast food chain specializes in chicken. It first opened in Atlanta in 1967 by founder S. Truett Cathy. It now has more than 3,000 restaurants across the U.S., Canada and Puerto Rico, and more than 200,000 people are employed by independent owner-operators.

The possibility of a Chick-fil-A coming to the Alliance area had been rumored for a while.

Chick-fil-A already has three locations in Stark County − Massillon, Jackson Township and in Belden Village Mall. A fifth appears to be in the works, in North Canton. City officials there have said Chick-fil-A is planning to put a restaurant in the redeveloped plaza where Meijer recently opened. No construction has started.

"While we are still early in the process, Chick-fil-A is happy to share that we are actively pursuing locations in Alliance and North Canton. Each locally owned and operated Chick-fil-A restaurant creates 80–120 jobs in the area," according to a corporate statement.

Eat more cow: Chick-fil-A to remodel Jackson Township location, eliminate play area to add indoor seats

Alliance's Planning Commission will have a public hearing on the request at 4:35 p.m. June 19 in the second-floor conference room of the City Administration Building at 504 E. Main St. In the meanwhile, City Council members are expected to learn more about Chick-fil-A and other uses for the property on Monday night.

Reach Benjamin Duer at 330-580-8567 or [email protected] . On X (formerly Twitter): @bduerREP .

How to get maximum value from the United MileagePlus program

MSN has partnered with The Points Guy for our coverage of credit card products. MSN and The Points Guy may receive a commission from card issuers.

Editor’s note: This is a recurring post, regularly updated with new information.

A few weeks ago, United massively devalued its miles by increasing award rates on some flights by up to 122% .

Despite its numerous devaluations, we’ll help you get some great redemptions from the MileagePlus program. The carrier’s Star Alliance membership allows you to earn and redeem miles on partner airlines.

United MileagePlus is a 1:1 transfer partner of Chase Ultimate Rewards and Bilt Rewards , so travelers with cards like the Chase Sapphire Reserve®, the Chase Sapphire Preferred® Card and the Bilt Mastercard® (see rates and fees) can easily boost their MileagePlus balances through various travel and dining purchases. That said, we generally don’t recommend transferring Chase and Bilt points to United since we value United miles at just 1.1 cents each.

However, earning United miles is just one part of the puzzle. Knowing which redemptions to target can ensure you get a solid value from your United credit card sign-up bonus.

United MileagePlus overview

United’s MileagePlus program is free to join and miles never expire . Even if you don’t earn or redeem miles for a while, you don’t have to worry about losing your account balance due to inactivity .

The carrier has hubs at airports in seven cities across the U.S. — Newark Liberty International Airport (EWR) in New Jersey; Washington’s Dulles International Airport (IAD); Chicago’s O’Hare International Airport (ORD) in Chicago; Houston’s George Bush Intercontinental Airport (IAH); Denver International Airport (DEN); Los Angeles International Airport (LAX); and San Francisco International Airport (SFO) — and offers service to hundreds of destinations around the world. However, as a Star Alliance member, you can earn and redeem MileagePlus miles on carriers like Lufthansa , Air New Zealand and Singapore Airlines .

Related: The best websites to search for Star Alliance award availability

How to earn United miles

The simplest way for most people to earn United miles will be by flying with the carrier or one of its Star Alliance partners and crediting the flights to your MileagePlus account.

When you book a flight through United, you’ll typically earn miles based on the ticket’s base fare, with bonuses for elite members . However, flights booked directly with partner airlines and credited to your United MileagePlus account will earn miles based on the distance flown and your booked fare class. You can view this page on United’s website for full details.

As mentioned above, United is a 1:1 transfer partner of Chase Ultimate Rewards and Bilt Rewards. That means you can transfer points to your United MileagePlus account — a process that should be completed within minutes .

Marriott Bonvoy points transfer to United at a 3:1 ratio thanks to United and Marriott’s RewardsPlus partnership . You’ll get 10,000 bonus miles for every 60,000 points transferred to United MileagePlus. Transfers from Marriott Bonvoy to United MileagePlus take around three days .

If you’re starting from scratch or looking to save up for an expensive award, consider signing up for a United credit card . You’ll have your choice among entry-level and premium cards, as well as personal and business options:

- United Infinite Card: 80,000 bonus miles and 1,000 Premier qualifying points (PQP) after you spend $5,000 on purchases in the first three months from account opening.

- United Quest Card: Earn 70,000 bonus miles + 500 Premier qualifying points after you spend $4,000 on purchases in the first three months your account is open.

- United Explorer Card: Earn 60,000 bonus miles after you spend $3,000 on purchases in the first three months your account is open.

- United Gateway Card: Earn 30,000 bonus miles after you spend $1,000 on purchases in the first three months your account is open.

- United Business Card: Earn 50,000 bonus miles after you spend $5,000 on purchases in the first three months your account is open.

United’s cobranded cards are issued by Chase, meaning they’re subject to the 5/24 rule for new applicants.

Related: Earn up to 3,000 bonus miles when you join United MileagePlus Dining

Benefits of United Premier status

You can qualify for United elite status by earning Premier qualifying points (PQPs) and Premier qualifying flights (PQFs). To qualify for any status, you must fly at least four United and/or United Express segments annually. Earlier this year, United deposited extra PQPs into Premier members’ accounts. By spending on your United cobranded credit card , you can also earn bonus PQPs.

There are four published tiers of United Premier elite status that offer bonus miles and other perks. All United elites get placed on the list for complimentary premier upgrades , with higher priority for upper-tier elites. United elites also get access to complimentary Economy Plus seating, though depending on your tier, that might be available only at check-in or at the time of booking.

Related: What is United Airlines elite status worth?

Dynamic pricing for all flights

In 2019, United formally switched to dynamic award pricing for its own flights. In April 2020, the carrier pulled its Star Alliance partner award chart without advanced notice and increased prices on most routes by 10% .

With no award chart to reference, United is free to increase the prices on some of the most popular MileagePlus redemptions without warning. This happened in May and June 2023, when United significantly increased award rates without notice .

Related: Why I consider my United miles to be worth 5 cents apiece

Award sales

There’s plenty of doom and gloom news about devaluations, decreased award availability and the stripping of benefits from award tickets. However, one positive trend over the last few years is the launch of limited-time, discounted award sales. Historically, Delta has been one of the best airlines at offering award sales , but United is making progress on that front.

Earlier this year, United offered round-trip flights to the South Pacific from just 42,000 miles to celebrate its 42nd anniversary. We hope to see more of these sales in the future.

After working hard to build your stash of miles, keep your eyes on our website for deal alerts so you can jump on the next sale and stretch your miles even farther.

Related: The ultimate guide to getting upgraded on United Airlines

Premium cabin redemptions

United has heavily invested in its international premium experience , between Polaris lounges , taking delivery of new planes with sleek Polaris cabins and retrofitting its existing long-haul fleet. Best of all, booking United Polaris through MileagePlus is often cheaper than booking a partner airline’s business-class cabin.

Let’s look at a flight from Washington, D.C.’s Dulles International Airport (IAD) to Frankfurt Airport (FRA), a premium United route operated by its Star Alliance partner Lufthansa. A one-way business-class award on Lufthansa’s 747-8 would cost you 88,000 United MileagePlus miles. However, you may be able to book the same route on a United-operated flight for as low as 80,000 miles depending on the dynamic pricing calculator. Those 8,000 miles you save are worth $88 based on TPG’s most recent valuations .

The savings can be even more significant on other routes, like from the U.S. to South Asia. A business-class award on a Star Alliance partner can cost an extra 10,000 miles or more on these routes. Of course, this won’t always be true due to the unpredictable nature of dynamic pricing. Plus, some of United’s partners, like EVA and ANA , are worth paying a premium for. Still, these potential savings are worth keeping an eye out for.

Unfortunately, United is often stingy with its business-class award space, so you might be forced to book with a partner. However, you can use ExpertFlyer (owned by TPG’s parent company, Red Ventures) to set alerts for United and its Star Alliance partners if there’s no business-class award space on your desired date(s) of travel.

Related: Your ultimate guide to the United MileagePlus program

No fuel surcharges

The excitement of snagging a “free” trip using your miles can be dampened significantly by fuel surcharges . Those extra costs that many programs will add to award tickets. Other Star Alliance programs can add hundreds of dollars in fuel surcharges to their award tickets, but you can keep some serious cash in your pocket by booking through United, as it’s one of the few programs out there that doesn’t add these.

Of course, United’s award rates are generally higher than many of its partners. While the airline technically eliminated its close-in award booking fee, you might find award rates higher for close-in travel.

However, if you can save $500 or even $1,000 in fees on a single award ticket by booking through United, it can easily be worth it. Savings like that are easy to come by if you’re looking at certain awards, like Lufthansa first class between the U.S. and Europe, where taxes from other Star Alliance frequent flyer programs can easily exceed $1,000.

Related: United’s best kept elite status secret: How to earn PQP faster with partner flights

United Excursionist Perk

United MileagePlus doesn’t offer an unrestricted stopover like other frequent flyer programs, but it does offer the Excursionist Perk . If used strategically, it has the potential to be even more valuable. It allows you to add a qualifying, one-way flight to a round-trip award ticket without additional miles at its most basic level. Here are the rules United lists on its website:

- The Excursionist Perk cannot be in the MileagePlus-defined region where your travel originates (For example, if your journey begins in North America, you will only receive the Excursionist Perk if travel is within a region outside of North America.).

- Travel must end in the same MileagePlus-defined region where travel originates.

- The origin and destination of the Excursionist Perk are within a single MileagePlus-defined region.

- The cabin of service and award type of the free, one-way award is the same or lower than the one-way award preceding it.

- Only the first occurrence will be free if two or more one-way awards qualify for this benefit.