Our homepage has a new look! Share your thoughts about it in a short survey

Alberta Blue Cross ® will be closed Monday, May 20. Regular hours resume on Tuesday, May 21. Our member site and app are available 24/7.

Information for Alberta Blue Cross ® plan members evacuated from their homes due to wildfires in Alberta. Learn more .

Looking for a COVID-19 immunization or an influenza vaccine? Find a participating pharmacy near you.

Give us your feedback

Pharmacy asymptomatic testing program.

Albertans are encouraged reach out to a participating pharmacy for more information about how to arrange a test. A list of participating pharmacies is available here .

This is banner news

Random info about things and stuff

- How to choose travel coverage

Travel advice

Have questions about travel?

Contents: Travel insurance

- Emergency Medical Care

- Trip Cancellation or Interruption coverage

- Visitors to Canada

- Top-Up insurance

- Cancellations and refunds

- Compare travel coverages

- Flight Delay Service

- Baggage loss coverage

- Accidental Death and Dismemberment

- Optional Protection: Pandemic

- Travel advisories

- Travel insurance eligibility

- Frequently asked questions

- Pre-travel checklist

- Comprehensive

- Travelling in Canada

- Study abroad

- Family vacations

- Weekend getaways

- Backpacking

- Winter escapes

- Romantic retreats

- Travel policy

How much travel coverage do I need?

Every trip is unique. Whether you’re taking a weekend getaway, visiting a sunny resort or trekking in a remote part of the world, you might be wondering what kind of coverage is best for you.

Here's a step-by-step guide to help you make an informed decision.

1 Consider your trip factors

These are a few factors to think about when deciding on what travel insurance you need.

Destination

If your destination has a higher risk of bad weather or natural disasters, the likelihood of cancelling or postponing your trip may be higher. With Trip Cancellation or Interruption coverage , you will be reimbursed for prepaid non-refundable expenses, such as airfare or hotel deposits.

Trip length

A lot can happen if you’re taking a long trip. And the longer you’re away, the more likely something could happen. You might need medical care at some point or there could be a flight disruption if you’re travelling to multiple destinations.

Multiple trips

If you’re travelling more than once this year, consider a multi-trip plan to help you save on Emergency Medical Care .

Don’t choose a plan based solely on the lowest cost—make sure you’re getting adequate coverage at a price you’re comfortable with. Consider paying optional deductibles (the amount you pay if you make a claim) to help lower the cost of your plan.

Your belongings

If you’re packing valuables, like jewelry, electronics or equipment, you may want to add Baggage loss coverage in case your belongings are lost, stolen or damaged.

2 Determine how much coverage you already have

Chances are you have some travel coverage—but it may come with a long list of restrictions based on age, trip length and pre-existing medical conditions.

Travel coverage through an existing health plan or credit card varies widely. Carefully review your coverage information to find out what’s included.

Credit card

Read the fine print in your policy. The number of days that are covered or your coverage amounts may be limited. Consider Top-Up Insurance to make sure you are fully covered.

Group or personal plan travel coverage

Some group plans may cover a small portion of emergency medical care or require a deductible.

Provincial coverage

Whether you travel within Canada or abroad, your Alberta Health Care insurance Plan (AHCIP) provides limited coverage. In some cases, you will need to pay upfront for services and submit a receipt for reimbursement. AHCIP does not cover major expenses like hospital transfers, ground or air ambulance and returning remains should you pass away while travelling.

3 Choose your coverage

Alberta Blue Cross ® offers comprehensive travel insurance. If there’s a gap in your existing coverage or a concern you’d like to cover for peace of mind, check out:

- Trip Cancellation or Interruption

- Top-Up Insurance

- travel add-ons to broaden your coverage

If you need help, let our experts help. Call toll free at 1-800-394-1965 to talk to our travel team about finding the right plan for you.

Get a quote

Finding the right coverage you need for your trip starts with a quote. Get started online or give our travel team a call. We are here to help you.

404 Not found

404 Not found

Eligibility for drugs, dental, vision and paramedical services

Home > Eligibility for drugs, dental, vision and paramedical services

The Alberta Blue Cross ® app and our member site contain important information about your plan including claim history, coverage maximums and next eligibility for product or service, such as dental check up or glasses. Our online services allow you to easily check your eligibility for drugs, dental, vision and paramedical services.

What are paramedical services?

Paramedical services refer to treatments from health care providers such as chiropractors, physiotherapists, massage therapists, podiatrists and acupuncturists.

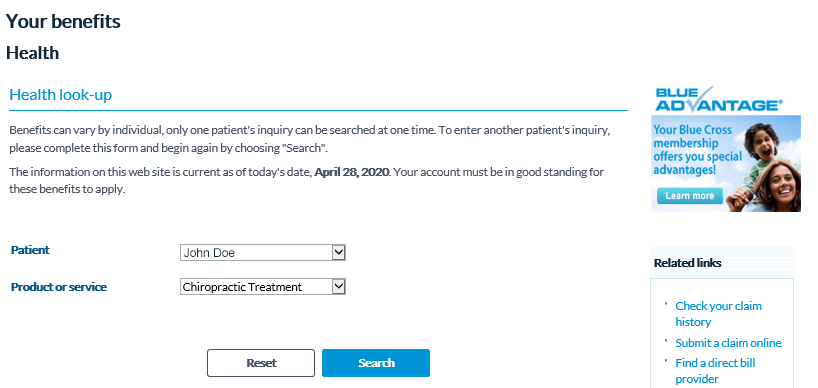

Health look up tool

Use the health look up tool to determine your eligibility for paramedical services, such as acupuncture, massage therapy and psychology services. For each eligible health benefit, you’ll be able to see the following:

- The amount you’ve used for the current benefit period.

- When you’ll be eligible for the full maximum.

- The maximum amount your plan covers per visit.

- The maximum frequency in which the benefit can be used.

- Any conditions that must be met to be eligible for the benefit.

- If dollar and frequency maximums are combined—for example, acupuncture assessments and treatments are combined under the total amount available for acupuncture services.

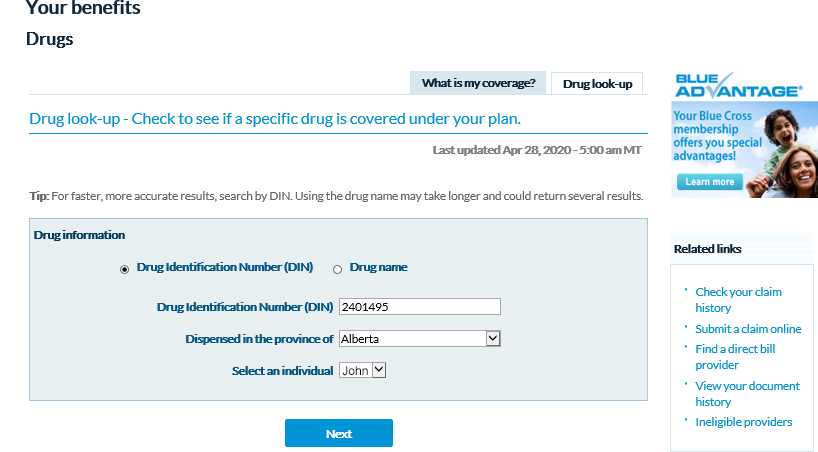

Drug look up tool

Use the drug look up tool to see if a specific drug is covered under your plan.You can search for a drug by the Drug Identification Number (DIN) or the drug name. We suggest searching by the DIN for faster, more accurate results. Searching by the drug name may take longer and could return several results.

The information provided by the drug look up tool reflects basic coverage under your plan, but some plans will have varying percentages paid for certain drugs. At the time of purchase, plan rules like percent allowed, dispensing fees, maximums and deductibles are applied to your claim.

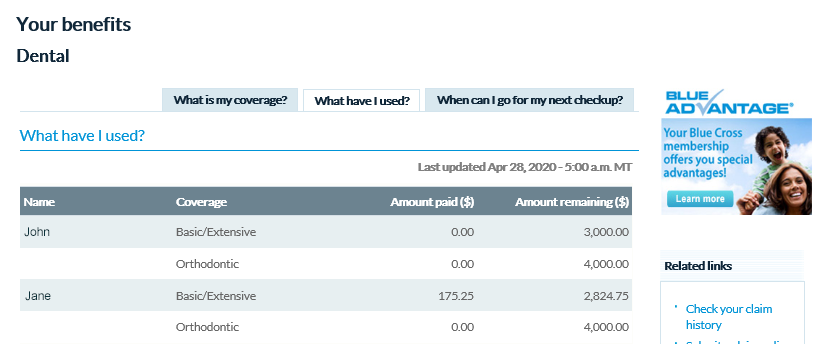

Dental and vision benefits

Under the dental and vision benefit sections of our member site or app, you’ll find a tab labelled “What have I used?”. Here, you’ll be able to see how much of your benefit coverage for the current benefit period you’ve used and how much you still have available.

Don’t forget, 100 per cent of health claims can be submitted online . Learn more here .

- Filing your taxes? February 7, 2024

- What you need to know about the Canadian Dental Care Plan February 23, 2024

- Your Individual Assistance Program (IAP): helping you live well July 27, 2023

- What you need to know about Ozempic September 11, 2023

- Top 10 health conditions based on drug claims for 2022 June 2, 2023

Recent Posts

- Courage to create with Built Together

- Top 10 health conditions based on drug claims for 2023

- Meet 2 of our Community Wellbeing grant winners

- Small gestures make a big difference

- What you need to know about the Canadian Dental Care Plan

NOBODY could negotiate this stupid site. ALL I wanted was a form to print for reimbursement for my eyeglasses.

Hi Lawrence, in case you didn’t know, you can submit your claim for eye glasses online. Just sign in the the member site and choose the vision option when claiming. For the claim for itself, if you visit our home page at the top there is a section called forms. Click that and you’ll see a list of claims forms. Second on the list of “Most commonly used plan member forms” is the ‘Health Services Claim form’. You can use that to submit your eye glasses.

I agree with Lawrence! I am trying to find my plan. not the site myplan but my actual plan and am having no luck at all.

Hi Luann, sorry to hear you are having trouble navigating the site. We will take down this feedback. To help you right now, please give our team a call and we’d be happy to walk you through this request. Our number is 1-800-661-6995. Thanks for commenting 🙂

Exactly. Where does vision come up on the site? Its not dental or drugs so why isn’t it under health? These comments are Years old and nothing has improved?

Hi Merrill, if you are looking for how to submit a vision claim, it can be found under claims on your homepage for your benefits. There is a section dedicated to vision.

where on this Blue Cross web site do you take feedback on coverage for specific drugS?

Hi Dan. You can go to the contact us section of the website and selecting “other” in the dropdown. https://www.ab.bluecross.ca/contact-us.php

Leave a Reply Cancel Reply

Save my name, email, and website in this browser for the next time I comment.

Previous Post It’s okay to grieve

Next post finding positivity during confinement.

- Browser support

- Terms of use

- Privacy Policy

Land acknowledgement

We begin by acknowledging that we are on traditional lands, referred to as Treaty 6, Treaty 7 and Treaty 8 territory, and all the people here are beneficiaries of these peace and friendship treaties.

This territory is the home for many Indigenous Peoples, including the Blackfoot, Cree, Dene, Saulteaux, Ojibwe, Stoney Nakota Sioux, and Tsuut’ina peoples, and the Métis Nation of Alberta and the Métis Settlements.

We respect the Treaties that were made on these territories, we acknowledge the harms and mistakes of the past, and we dedicate ourselves to moving forward in partnership with Indigenous communities in a spirit of reconciliation and collaboration.

© Copyright 2023 ABC Benefits Corporation. All rights reserved. ®* The Blue Cross ® symbol and name are registered marks of the Canadian Association of Blue Cross Plans ® , an association of independent Blue Cross ® plans. Licensed to ABC Benefits Corporation for use in operating the Alberta Blue Cross Plan ® . ®† Blue Shield is a registered trade-mark of the Blue Cross Blue Shield Association. ® Products displaying the registration symbol are registered marks of the Canadian Association of Blue Cross Plans ® .

- Alberta Blue Cross® home

For Members

Find a plan, advice center, common questions, frequently asked questions about travel insurance.

Buy Now Find a Plan Make a Claim

Travel Insurance & COVID 19

The Government of Canada has issued an official global advisory to avoid non-essential travel (Level 3) outside of the country to limit the spread of Coronavirus (COVID-19). As a result, coverage related to Coronavirus (COVID-19) will be affected:

Travel Medical Insurance For trips that depart on or after March 13, 2020, Coronavirus (COVID-19) related illness will not be covered unless you are fully vaccinated. You can learn more about how Government travel advisories impact coverage in our Travel Insurance FAQs .

Trip Protection Insurance (Cancellations/Interruptions) Effective March 12, 2020, we are considering Coronavirus (COVID-19) to be a known event for individually purchased Trip Protection. Travel insurance is intended to cover losses arising from sudden and unforeseeable circumstances. Any claims resulting from events known to a policyholder at time purchasing the trip are not covered.

Extensions Due to the current COVID-19 (Coronavirus) pandemic and in alignment with our policy terms and conditions, we will not be providing extensions of coverage until further notice.

These conditions will remain in effect until the advisory is lifted or otherwise stated by Pacific Blue Cross.

Learn why members should pack Pacific Blue Cross travel Insurance.

Are you a member? Save an additional 10% .

Get a Quote or call 1-877-PAC- BLUE .

COVID-19 and Our Emergency Medical Plans

COVID-19 Coverage is simple with a Pacific Blue Cross Emergency Medical plan:

Pacific Blue Cross Emergency Medical Plans will cover all travelers regardless of their vaccination status, according to all standard policy terms and conditions.

If you have had a recent COVID diagnosis, positive test, or symptoms, you could still be covered for COVID-19 medical or subsistence expenses while you travel, if you purchase our pre-existing condition waiver.

Simple as that.

Still have questions? See our FAQ below:

We support the Canadian Government’s official position on travelling vaccinated .

Pacific Blue Cross Travel Medical plans contain $10M in COVID-19 coverage at no additional cost for: All travellers As long as there is no advisory in place Fully vaccinated travellers Anywhere in the world, regardless of advisory level Travellers who have had COVID-19 When it is stable for as little as 7 days before departure as long as they purchase our pre-existing rider

- We support the Canadian Government’s official position on travelling vaccinated .

COVID 19 will be covered on our Emergency Medical plans for all travellers regardless of vaccination status except for:

- Anyone who has had COVID within the 30 days prior to departure; and/or

- An unvaccinated traveler in a region or destination where COVID-19 has a Canadian Government advisory against travel.

Our policy excludes coverage for any “medical condition resulting from an infectious disease or illness for which there is a travel advisory or health warning by a Canadian Government Agency that has been published or broadcast in the media prior to the Effective date of the Covered Person’s policy” unless the Covered Person is Fully Vaccinated as per our contract language.

It depends. Our Emergency Medical plans have a pre-existing condition clause that may prevent your claim from being paid. Please make sure that you familiarize yourself with your policy booklet and understand the exclusions that may apply to you. You may want to consider purchasing our Pre Existing Condition optional benefit for additional peace of mind.

Eligibility of Refund:

- Annual and Daily Emergency Medical plans are 100% refundable if they are cancelled PRIOR to the effective date.

- Annual and Daily Emergency Medical Plans that have started (after the effective date) are non-refundable, even if you did not leave or are no longer planning to travel.

- The unused portion of Annual Emergency Medical plans that have already started is non-refundable, even if your travel plans have changed.

- Plans that include trip cancellation are non-refundable, even if you have not left on your trip.

- We must receive your cancellation request by email to [email protected] prior to the effective date to be eligible for a refund.

Our Simple and Fast Cancellation Process:

- No need to wait on the phone! If your plan is eligible for cancellation, You can cancel your policy by simply sending an email to [email protected]. Please be sure to include your full name and your certificate number.

- We consider your request to be received in our office on the date you send your email, even if we are unable respond to you before the start date. One of our agents will call you back as soon as possible for your credit card details. (For your privacy, we ask that you please do not send credit card information by email.)

- As long as your plan is eligible as above, and your email is sent to us prior to your effective date , you will receive a full refund.

- When travelling internationally, you may be at risk for a number of diseases which are common in other parts of the world. Some countries may require vaccinations as part of their entry requirements. You can learn more about Travel Vaccines on our Vaccination page.

Vaccinations are not always appropriate for some Canadians such as children or immunocompromised individuals. If you are travelling to a country where there is a Government of Canada advisory warning against the outbreak of an infectious disease such as COVID-19, unvaccinated travellers will not be covered for this infectious disease regardless of their personal reasons for not being vaccinated. This only applies if there is an advisory in place, such as a level 3 or 4 risk level.

We recommend you always have appropriate insurance coverage when leaving British Columbia. While COVID-19 insurance may be included in some airline tickets, it’s important to understand the amount of coverage that you will receive and know any limitations or exclusions to the policy. It’s very important to also ensure you have appropriate travel insurance to cover other emergency medical situations that may arise. For example, these policies typically will not cover you for any other illness or injury that might happen on your trip, such as a broken leg or heart attack.

Testing is only included in your plan if it is ordered by a doctor in the course of an eligible emergency treatment. We do not pay expenses for COVID testing under any other circumstance.

Yes, COVID-19 is treated as any other Illness and would be subject to all eligibility requirements of your plan, including the pre-existing condition clause.

No, this is not covered as it is an expected expense.

You will be covered for eligible subsistence benefits of up to $300 per day to a maximum of $3,000 under your plan. This would not include costs for your travel companion, they must check with their own insurer .

Yes, you will be covered for eligible subsistence benefits of up to $300 per day to a maximum of $3,000 per policy if a positive COVID test is the cause of a delay in your return home.

COVID-19 and our Trip Protection Plans

For all Trip Protection plans that include trip cancellation or interruption purchased after March 13, 2020, COVID-19 is considered a known event.

Despite this fact, we have added some limited COVID-19 related benefits to all our Trip Protection plans purchased after June 1, 2022, at no additional cost.

Trip Cancellation – we will reimburse all eligible non-refundable, prepaid expenses if, while still in your home province, you, an immediate family member, or a travelling companion contract symptomatic COVID-19, and the symptoms still persist within the 14 days of your intended departure date, and they are serious enough to require you to cancel your trip.

Trip Interruption – after departure, if you or your travelling companion experience a COVID 19 Illness, positive test result, or Quarantine that causes your trip to be interrupted we will pay the following;

- $300 per person per day to a maximum of $6,000 per policy for accommodation, meals, essential phone calls, and transportation by taxi

- $500 per person to a maximum of $2,500 per policy for additional transportation costs including flight change costs, back to your departure point or to your next destination if mid trip.

A Pacific Blue Cross Trip Protection plan can also protect you against all the other situations not related to COVID 19, such as unexpected weather delays or lost baggage.

A Pacific Blue Cross Trip Protection plan is a great way to protect your travels!

Many airlines require you to purchase a certain fare level to receive free cancellation or they may only provide a flight credit or one-time change should you need to cancel or postpone your travel for a covered condition. Trip Protection insurance allows you to recover your pre-paid travel costs no matter the fare level purchased.

No, we only reimburse your eligible non-refundable trip costs if you purchased your plan after June 1, 2022 and are still sick with COVID-19 in the 14 days prior to your intended departure and you must cancel your trip.

No, the COVD-19 Trip Cancellation benefit only applies to symptomatic COVID-19.

Yes, as long as you purchased your plan after June 1, 2022 and she is still symptomatic in the 14 days prior to your intended departure date, your eligible non-refundable trip costs will be considered.

It depends. Our Trip Cancellation and Interruption plans have a pre-existing condition clause that may prevent your claim from being paid. Please make sure that you familiarize yourself with your policy booklet and understand the exclusions that may apply to you. And remember, the COVID-19 cancellation is only eligible for plans purchased after June 1, 2022.

You can purchase Pacific Blue Cross Travel Insurance up to 365 days before you depart for your trip. We also offer the flexibility of refunds on Travel Medical Insurance up to 48 hours before you depart. Trip Protection plans can be purchased at any time, even if your first payment for a trip expense was a number of months ago.

It’s important to check government travel advisories prior to travelling. Public health officials are currently recommending that Canadians avoid non-essential, international travel. Travelling when there is a government advisory before you are fully vaccinated may impact your travel insurance coverage.

Plans that include trip cancellation are not eligible for refunds. Please refer to your policy booklet under “Refund of Premium” for more details.

Frequently Asked Questions about Travel Insurance

You should be aware that your provincial coverage may not pay for all health care costs you may incur while outside of the province, and the difference can be substantial. For example, B.C. pays $75 (CAD) a day for emergency in-patient hospital care, while the average cost in the U.S. often exceeds $1000 (US) a day, and can be as high as $10,000 (US) a day in intensive care. For this reason, you are strongly advised to purchase additional health insurance from a private insurer before you leave the province, whether you are going to another part of Canada or outside the country. You are advised to purchase additional coverage even if you plan to be away for only a day.

When you purchase Travel Medical insurance for one or two parents, each dependent child 21 years of age or younger who is subsequently added to your travel policy will receive free emergency medical coverage for up to $10,000,000.

If the Covered person needs health care while out of the province, he/she must call Medi-Assist immediately. Within Canada and the USA: 1 888 699–9333. From all other countries: 1 604 419-4487 collect. Please have your travel certificate number and your Care Card number ready.

If you have a Pacific Blue Cross Extended Health Care and/or Dental plan you are eligible to receive a discount of 10% or more off your Travel Insurance premium. Simply enter your extended health or dental policy number and any applicable discounts will be automatically applied to your purchase.

If you have an Extended Health Plan with Pacific Blue Cross, your Travel Plan will be first payer. This protects the lifetime limit on your Extended Health Plan.

If you have additional coverage through a benefits plan outside Pacific Blue Cross, we will coordinate cost-sharing of claims with that plan and provider. This will impact your plan as outlined in your spouse’s policy. However, there will be no impact to your existing Pacific Blue Cross extended health coverage.

You may be able to extend your existing Travel Plan. Extensions must be purchased before your existing Plan expires.

Please contact Pacific Blue Cross – we'll review your Travel Plan to see if it is eligible for an extension.

Phone: 604 419-2200

Toll Free (within North America): 1 877 PAC-BLUE (1 877 722-2583)

E-mail: [email protected]

Our Government health plan covers a limited amount of expenses that are incurred outside the province. A Travel Plan will pick up costs not covered by our Government health plan. More information on the limitations of your BC Health Plan (MSP) coverage and why you should have travel insurance for trips within Canada is available on the BC Ministry of Health website .

An Annual plan provides the best value if you're taking two or more trips per year.

For example, at the 0-34 age group: Two 15-day Single trip plans: $86 One 15-day Annual plan: $52 Total savings with an Annual plan: $34

Plus, with an Annual plan, any additional 15-day trips within the year are covered under the same plan for even more savings.

This should be the average length of time that you typically travel at any given time. Don't worry, you can always add extra days or top-up your coverage if you end up planning a trip that is longer than your selected coverage.

This benefit will provide reimbursement of your travel costs if your trip is cancelled before departure due to a covered risk.

Trip Protection Insurance helps you recover non-refundable, prepaid expenses should an unexpected situation such as these arise:

- An event that leads the Government of Canada to issue a general recommendation not to travel to the region (plan must be purchased prior to the Government’s recommendation)

- Illness that requires a doctor’s attention prior to or hospitalization during your trip

- Adverse weather conditions resulting in cancellations or delays

- Unexpected death in the family

- New pregnancy that would mean the Covered person would be travelling during the 33 rd week or later of their pregnancy

- Jury duty (except for Law enforcement officers)

- Loss of employment (must be employed permanently for at least 1 consecutive year)

Trip Protection Insurance provides coverage when an unexpected situation impacts your travel plans. Deciding not to travel because you no longer want to go or you don’t think it will be safe (unless the Government of Canada has issued a general recommendation not to travel to the region) are not covered reasons. Check your policy’s details for a full explanation of what is covered.

It depends on the illness, its seriousness and its stability. Some illnesses are easily covered. Others require a three or six month stability period, depending on your age. Blue Cross offers the possibility of covering your illness with a medical questionnaire (available for persons aged 61 and over) filled out by your treating physician; Blue Cross’ medical team will then evaluate your condition. If authorized, you can travel worry-free: your chronic illness will also be covered.

A distinction should be made between a statement of health and a medical questionnaire.

A medical questionnaire is an option Blue Cross offers to cover pre-existing conditions for individuals over 61 years of age. You are not obliged to complete this questionnaire, however doing so gives you a definite advantage. In 80% of cases, the questionnaires result in coverage that may otherwise not be granted. Simply have your doctor complete the questionnaire and send it to us. Your health status will then be assessed by the Blue Cross medical director; if your pre-existing condition is stable and does not present an increased risk, it will be covered and you will be able to leave on your trip with true peace of mind.

The statement of health determines what will be covered, what will be excluded and the travel insurance premium. The premium is based on the risks inherent with age, the health condition and trip length.

Yes - Regardless of any existing conditions, we always advise members to still purchase coverage, as it will protect against all other accidents not related to that condition.

Travel insurance policies are designed to provide protection against unexpected emergency medical expenses, trip cancellation or interruption.

Depending on your age and the condition pre-existing medical conditions are covered if they are stable for a certain time period (as specified in your policy) before your policy's effective date.

It is important you review and understand any clauses or definitions in your chosen policy. Each travel insurance policy will uniquely define a pre-existing condition and there are many variations in wording. For example, policies may not cover conditions arising prior to the trip departure date:

- that are unstable

- where symptoms of an illness appeared

- that have been diagnosed or treated

- where medications have been changed

Travel policies will also specify a time frame, based on your age that relates to the evaluation of your pre-existing conditions. This time frame could be as short as 3 months but could be 1 year, 5 years or longer.

Some policies may provide coverage for your pre-existing conditions if you complete a more detailed medical questionnaire.

When purchasing our travel policy, we will evaluate pre-existing conditions for people 60 years and younger based on their health within the previous 3 months prior to the day their coverage begins. For people age 61 and over, we evaluate based on their health within 6 months prior.

Travel insurance policies often have limitations of coverage associated with pregnancy similar to the limitations within the travel industry at large. For this reason it is important you understand these limitations prior to commencing your travel.

In order for you to qualify to purchase travel insurance, you must have a valid Care Card number. Although, you are not required to provide it at time of purchase, we may request it later in order to process your claim.

When applying online, you must pay by using a major credit card.

However, you can mail in an application and enclose a cheque payable to Pacific Blue Cross for the premium. You can also come into our office and apply. Pacific Blue Cross must receive your application and cheque before you depart from BC.

- Out-of-Country and Out-of-Province Coverage and Claims — Click here to obtain claim forms and instructions for claiming emergency medical expenses.

- Trip Cancellation / Baggage Claim Form - Use this form to claim for Trip Cancellations or Lost Baggages.

- Visitors to Canada Travel Plan Claim Form - Use this form if you are claiming against a Visitors to Canada Travel Plan contract

If you wish to appeal a decision about a recent claim, contact our Call Centre . Often an issue can be resolved by simply providing you with more information about your claim or what is covered by your plan. If one of our customer service representatives is unable to resolve the matter with you, they can escalate your request to a Benefit Review Committee for further review. They will explain how to file your appeal and help you to provide all relevant information regarding your claim.

A request for a refund of premium can be made prior to the Effective date of the policy, A request for a refund of premium can be made prior to the Effective date of the policy, if the insured returns to his/her province or territory of residence prior to the expiry date of the policy, or when a Visitors to Canada or policyholder becomes covered under a provincial or territorial hospital/medical plan. Please fill-in and return the Request for Travel Premium Refund Form to [email protected] . No refund can be given if you are covered under Trip Cancellation, Emergency Return Benefit and / or an Annual insurance plan. Administrative charges may apply.

When travelling internationally, you may be at risk for a number of diseases which are common in other parts of the world. You can learn more about Travel Vaccines on our Vaccination page . Always remember to perform a Travel Health Check before you go.

Global Affairs collects and reports on health, safety and security across the world, and provides this information on their website for the benefit of travelling Canadians.

Each country is individually assessed and assigned one of four main risk levels. These may apply to the whole country, or a region within the country.

The first two levels are considered travel advice:

- Exercise normal security precautions – no significant health or security risks are present, and the situation is similar to what you might expect in Canada.

- Exercise a high degree of caution - there might be some health or safety concerns in the country, and monitoring local media is recommended. This level might be used if there has been some localized crime or violence that a traveller should be aware of so they can do their best to avoid the situation while they are exploring their destination.

The next two levels are official Government of Canada Travel Advisories and are only issued when the safety and security of Canadians is compromised. When advisories are issued, Canadians can expect to be at risk if they choose to travel when an advisory has been called.

- Avoid non-essential travel – there are specific health, safety and/or security concerns that put you at risk. You are strongly advised not to go if your travel can be avoided, unless it is absolutely essential.

- Avoid all travel – there is extreme risk to personal safety and security. You should not travel to this country, territory or region, and you should leave immediately if it is safe for you to do so. Access to healthcare is extremely limited or unavailable.

When a country has been assessed an official advisory, the reason for the advisory will be listed as well.

HOW ADVISORIES IMPACT MEDICAL PLANS:

When this advisory is related to an infectious disease or specific illness, then your policy will not cover you against this infectious disease or specific illness because you have been advised of this risk prior to your travel. You are still covered for illness or injury related expenses that are not associated with the advisory.

There are two exceptions:

- If the risk level is 3, and you are considered by us to be an essential traveler, then you would be covered for eligible medical expenses related to the reason for the advisory.

- If you are fully vaccinated against the infectious disease or illness that is the cause for the advisory, then you would be covered for eligible medical expenses related to the reason for the advisory.

If the official travel advisory is called while you are already at the destination, then you will be covered for eligible medical expenses related to the reason for the advisory, even if it is risk level 4.

Travelling to a country in which the risk level is 4 is strongly discouraged as your coverage will be extremely limited:

- If the reason for the advisory is related to infectious disease or illness, you will be travelling against the advice of Health Canada’s physicians and your medical claims would not be considered, even if you are fully vaccinated.

- If the reason for the advisory is related to war, terrorism, insurrection, civil unrest, acts of hostility, military, or other similar events, your related injury claims will not be paid.

Claims entirely unrelated to the reasons for a Risk Level 4 advisory may be considered, however are generally limited to accidental injury because travellers are advised that access to infrastructure and services such as healthcare are limited or unavailable.

HOW ADVISORIES IMPACT TRIP PROTECTION PLANS

When the Canadian government issues an official advisory of risk level 3 or 4 to your destination causing you to cancel or interrupt travel, it is considered an unexpected situation and is therefore eligible for Trip Protection benefits. However, your trip must have been purchased PRIOR TO the government issued advisory.

Travel Insurance is intended to protect consumers from sudden and unforeseen events that arise and leave them with out of pocket expenses that they did not expect to incur.

When a Level 3 or 4 advisory is issued by the Government of Canada, they are stating that Canadians can expect to experience health or safety concerns and so should not travel.

For any Trip Cancellation benefits, this means that a trip purchased after a Level 3 or 4 advisory is issued cannot be cancelled for the reason of this advisory. This is an expected event.

For any Interruption/Delay benefits, if you choose to depart on your trip after the Government of Canada has issued a Level 3 or 4 advisory, then all benefits on your plan are invalidated. You are not covered because it is expected that you could experience an issue causing a claim.

About Regional Advisories

When there are Regional Advisories — some geographic areas of your trip are assigned risk Level 1 and 2, but some parts are 3 or 4 — your benefits will be impacted if your claim occurs in the region assessed at risk level 3 or 4. All of the same medical and trip protection rules will apply to your travel in that region, as they would if your whole trip was in that area. It is vital that you understand the risk associated with your entire trip to know how your plan will respond.

When risk levels remain Level 1 or 2, all of your benefits are in force and applied according to the contract. This would include contracting COVID19 during your travel, or being delayed because of quarantine.

This information applies to all of our plans, single trip or annual, stand alone or packaged.

We always recommend that you read your travel policy booklet and check the Government of Canada website prior to any travel, especially when world conditions are changing rapidly.

For any pre-travel trip destination questions such as travel advisory, shots, visas or safety concerns, please contact Medi-Assist who have the most up to date information for your destination.

As always, our customer service representatives are here to help.

Vaccine recommendations for specific diseases will vary. Individuals should check the Health Canada guidelines to understand if they are an acceptable candidate for immunization. Local Travel Immunization clinics are helpful sources of information.

Children under the age of 18, travelling with fully vaccinated parents or guardians are covered when:

- They have been fully vaccinated according to the recommendations for their age; or

- There is no vaccine available for their age; or

- For children age 12 and under, regardless of vaccination recommendation.

Children of any age who are travelling alone or with parents or guardians who have not been fully vaccinated are only covered for COVID-19 or any other infectious disease if they have been fully vaccinated if there is a Government of Canada advisory in place at their destination related to that infectious disease.

If you are fully vaccinated, then the timing of the official advisory doesn’t apply. You will be covered if it was before or after your purchase or departure.

If you are not vaccinated, you will be covered for an infectious disease if the advisory was called before you depart . If you choose to travel while the advisory is in place, you will not be covered for the infectious disease if you are not vaccinated, regardless of your reason.

Choose one of our Travel Insurance plans below to get started

Emergency Medical

Comprehensive, flexible emergency medical care coverage for British Columbians while travelling outside of BC.

Trip Protection

Peace of mind coverage for travel costs related to unexpected cancellations, interruptions and delays.

Visitors to Canada

Emergency health coverage for tourists, workers, new immigrants and students visiting BC.

Call us if an emergency strikes

If you do experience an unexpected emergency while travelling, we are here to help.

During your trip, you can call our Medi-Assist service to determine your level of coverage and receive help:

- In Canada or the U.S., call toll-free: 1-888-699-9333

- Outside of Canada or the U.S. or where toll-free is unavailable, please call collect to 1-604-419-4487 and we will pay for the call.

Claims Process

Out-of-Province Emergency Medical Claims — Four simple steps

Trip Cancellation / Baggage Claim Form — Form for claiming Trip Cancellations or Lost Baggage [pdf]

Visitors to Canada Travel Plan Claim Form — Form for claiming against a Visitors to Canada Travel Plan contract [pdf]

Government Advisory Levels

- Level 1: Exercise normal security precautions.

- Level 2: Exercise a high degree of caution.

- Level 3: Avoid non-essential travel.

- Level 4: Avoid all travel.

Albertans keen to return to travel

Home » Albertans keen to return to travel

Albertans are eager to get back to travelling in 2023, according to a new study from Blue Cross®.

“More than three quarters of Albertans say they intend to travel this year, after several years of missing out on travel due to the pandemic,” says Brian Geislinger, Vice-President of Corporate Relations with Alberta Blue Cross®.

Blue Cross®, which provides emergency medical travel insurance as well as other related products such as trip interruption and baggage insurance, undertook a national survey at the end of 2022 of more than 2,000 Canadians to examine travel intentions for 2023.

While the upside of the survey indicated that seeking better weather was the top reason for wanting to travel among 44 per cent of Canadians, the downside of the survey revealed that more than half of Canadians have experienced issues during prior travel ranging from flight cancellations and lost baggage to experiencing medical emergencies needing medical attention.

“We increasingly hear from our customers that their motivation for buying travel coverage now goes beyond being prepared for medical emergencies, to wanting to be prepared for the potential for travel disruptions,” says Geislinger.

The survey found that 49 per cent of Albertans would never consider leaving the province without travel insurance.

As Alberta’s largest benefit provider, Alberta Blue Cross® provides health, dental, life and travel coverage to more than 1.8 million plan members.

More information about the survey results is available online at www.bluecross.ca/travelstudy.

This media release was shared as a news story on:

Chat News Today on Albertans wanting to travel in 2023

Benefits and Pension Monitor on Albertans eager to travel

Download PDF version

Comments are closed.

Previous Post Keeping young adults in touch with their health and wellbeing

Next post alberta blue cross® announces latest recipients of built together grant program.

- Alberta Blue Cross® Home

- Browser support

- Terms of use

- Privacy Policies

- Accessibility and inclusion commitment

- Connect with us

Land acknowledgement

- Previous years

IMAGES

COMMENTS

Get a quote. Finding the right coverage you need for your trip starts with a quote. Get started online or give our travel team a call. We are here to help you. Get a quote or buy online. Call us at 1-800-394-1965.

3 Choose your coverage. Alberta Blue Cross ® offers comprehensive travel insurance. If there's a gap in your existing coverage or a concern you'd like to cover for peace of mind, check out: If you need help, let our experts help. Call toll free at 1-800-394-1965 to talk to our travel team about finding the right plan for you.

Step 1: review your current coverage. Many employer-sponsored and personal benefit plans include emergency travel coverage. However, these plans often only cover you for trips up to a certain number of days, such as 10 or 30 days per trip, and usually don't include things like trip cancellation and interruption insurance or coverage for lost ...

Customers age 79 and younger are now able to purchase travel products online, such as emergency medical coverage and trip cancellation, trip interruption and baggage coverage. Please visit our website ab.bluecross.ca/travel to inquire or purchase travel insurance. You can also call 1-800-394-1965 and select option four to inquire or purchase ...

Personalstand plans; Group plans; Direct-bill services. Locate adenine direct-bill provider; Register or sign inbound to member side or app; Resources. Health and spa. Guide to withdrawal; Workplace fitness framework; New to Alberta; Care navigation. Chronic disease business; Mental health help; Live management; Connecting to healthy care ...

Having travel insurance has always given me peace of mind, especially seeing it work in action like that. Now, don't take that the wrong way and go do crazy stuff either people. That being said, purchasing medical travel insurance has never been easier thanks to Alberta Blue Cross ®. My favourite part is that I didn't have to go in and ...

Essential security for unexpected emergencies. Gets ready on your trip about Canada's #1 most dependable travel insurance. Feelings confident knowing you're protected from costly expenses past to a medical emergency, flight relay or cancellation, also lost baggage. Get an quote Buy now.

This post was originally published on February 18, 2021, and was updated for accuracy and reliability; however, due to recent updates, please refer to our latest travel blog for the most up-to-date information regarding travel insurance coverage and COVID-19.. As more and more Albertans are getting vaccinated against COVID-19 and the Government of Alberta is relaxing or lifting some of the ...

Emergency medical travel coverage provides financial protection for a wide range of services such as. accommodation. If you are travelling alone, it can provide coverage for someone to attend your bedside while in hospital, care for your children if you are hospitalized and much more. Your coverage can even ensure your pet is returned home ...

By Alberta Blue Cross® Date published: September 14, 2020. Home > Frequently asked travel questions. If navigating the current pandemic has taught us anything, it's to not take certain things in life for granted—one of those being travel. For many of us, COVID-19 has impacted travel plans near and far and we are itching to find out when it ...

If you need to change your dates of travel or have questions about your coverage, contact us prior to leaving. If you've already left and want to stay longer than initially planned, contact us to extend your trip coverage. Call us at 1-800-661-6995. Our office hours are 8:30 a.m. to 5 p.m. MT, Monday to Friday.

The comfort of CanAssistance. Every Blue Cross travel plan comes with the ultimate security of CanAssistance Emergency Travel Assistance. CanAssistance is ready to help you 24/7, before or during your trip. One toll-free call, day or night, and you'll be taken care of immediately, whether your emergency is medical, legal—or even to provide ...

Comprehensive Plans. Core, Essential and Enhanced Health include a little bit of everything, offered at higher levels to support you until you qualify for Alberta's Coverage for Seniors Plan at age 65. Each plan offers different levels of coverage allowing you to fine-tune your coverage to best suit your needs. Build-Your-Own Plans.

The Alberta Blue Cross ® app and our member site contain important information about your plan including claim history, coverage maximums and next eligibility for product or service, such as dental check up or glasses. Our online services allow you to easily check your eligibility for drugs, dental, vision and paramedical services.

You may be able to extend your existing Travel Plan. Extensions must be purchased before your existing Plan expires. Please contact Pacific Blue Cross - we'll review your Travel Plan to see if it is eligible for an extension. Phone: 604 419-2200. Toll Free (within North America): 1 877 PAC-BLUE (1 877 722-2583) E-mail: [email protected]

"More than three quarters of Albertans say they intend to travel this year, after several years of missing out on travel due to the pandemic," says Brian Geislinger, Vice-President of Corporate Relations with Alberta Blue Cross®. Blue Cross®, which provides emergency medical travel insurance as well as other related products such as trip ...