Travel Policies

Booking uw travel and requesting reimbursement.

It is the responsibility of the traveler to adhere to UW policies and to be aware of the reimbursement limitations. ECE follows UW travel policies outlined on the UW Travel website.

1. Request Approval to Travel – Required

- Obtain authorization to travel out of state* from your PI or from Department Head (ECE Chair or ECE Administrator) before you travel. This can be done via email and combined with the funding approval authorization outlined below.

- Obtain authorization to use UW funds from your PI or from Department Head (ECE Chair or ECE Administrator) before you travel. This can be done via email and combined with the request to travel out of state as described above.

*There is a blanket approval on file for faculty to travel out of state so this typically only applies to students or staff traveling.

2. Book your Flights & Lodging

- Please see this page for more information and policies regarding reimbursing airfare at UW

- Please refer to the “How to pay for travel” table below for details on how to book airfare and lodging

3. Review UW Travel Policies and prepare for your trip

- UW Travel Policies must be followed

- Itemized receipts in PDF format (see below for receipt requirements and allowable expense reimbursements)

4. Organize your documentation and request reimbursement

- Provide a PDF copy of the approval to travel and charge UW funds

- Provide all receipts and required documentation from your trip in PDF format

- Review UW Travel policies if you have questions about what can or cannot be reimbursed

- Only request reimbursement for the amount approved by your PI / Unit Head

- Once the UW Connect form has been submitted, it will route to the Engineering Shared Environment for processing

- Please reach out to your PI or Grant Manager for UW Worktag information if it was not provided in your request to use UW funds to travel. The ESE does not provide worktag information for travelers.

Pre-trip Reimbursement

- It is allowable to reimburse travel expenses prior to the trip as long as it meets all other travel compliance requirements. The most common expenses include airfare, registration, and lodging.

How to pay for travel

Additional travel information, per diem rates.

- Current Domestic Per Diem Rates

- Current Domestic Non-Contiguous Per Diem Rates (Alaska, Hawaii and other U.S. territories)

- Current International Per Diem Rates

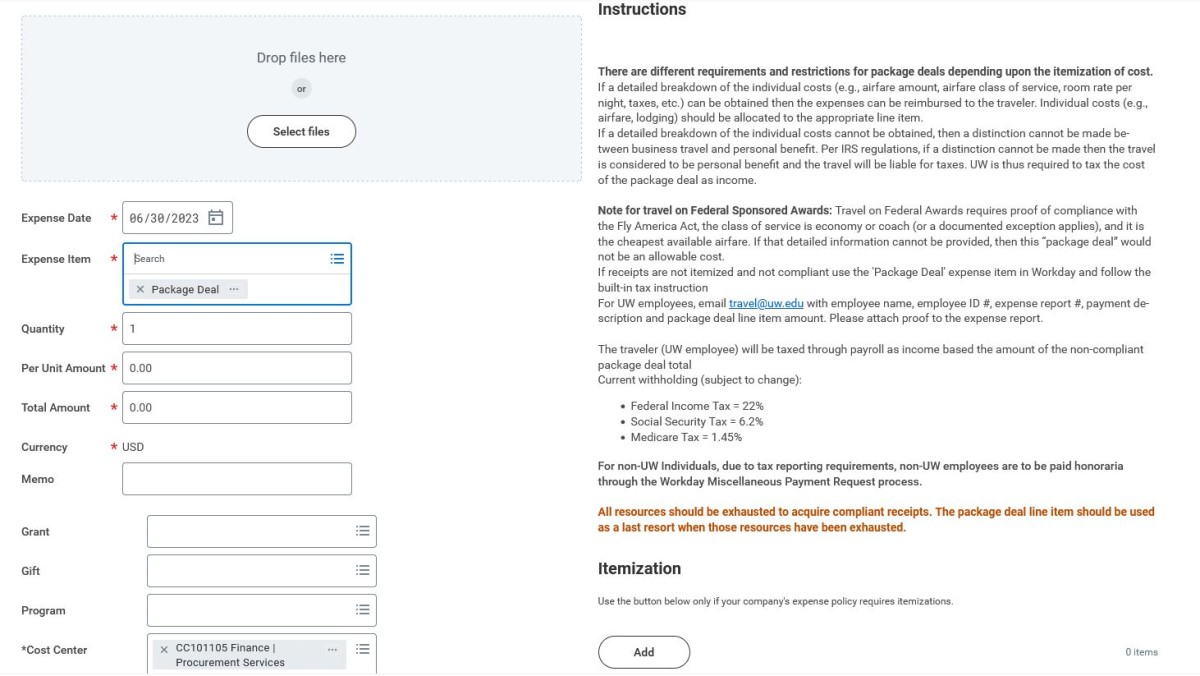

Travel packages

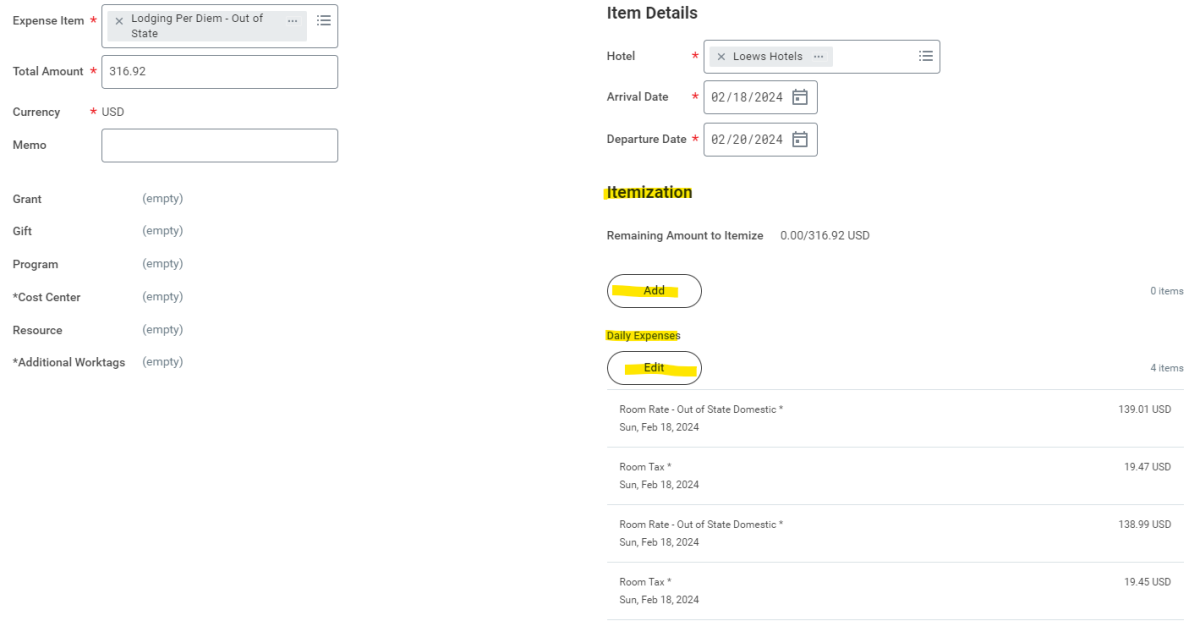

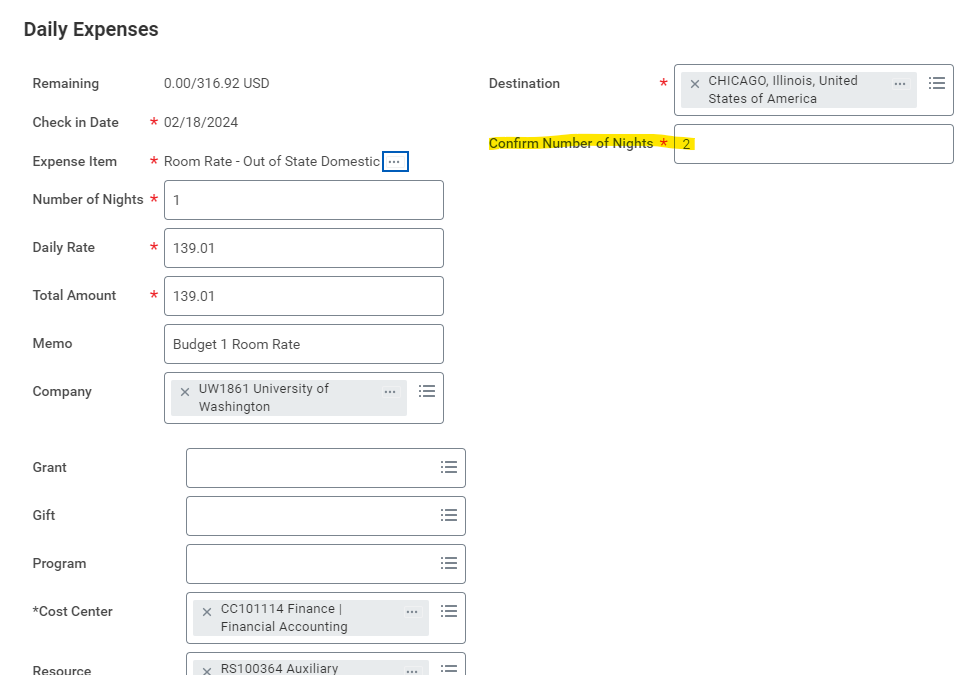

Travel packages are only reimbursable as a travel expense if components of the travel package can be itemized (airfare, airfare tax, lodging room rate per night, lodging tax per night, etc.)

If package deals are reimbursed without detail, it is not an allowable travel expense, and the reimbursement counts as taxable income for the traveler and is taxed through payroll.

Visit UW’s policy on package deals .

Travelers must indicate if meals were provided by other sources. For example, if you are attending a conference and lunch is included. Your conference itinerary must be included in your reimbursement request.

Meal per diem starts when you are in travel status. Documentation examples include airfare itinerary, train reservation confirmation, or POV departure time.

You will not be reimbursed for alcohol. For additional information on meals and/or alcohol during travel, please see UW’s policy on meals .

Lodging per diem

Before you book, verify lodging per diem rate for your travel destination . Reimbursement is limited to per diem rate unless an exception exists.

Exceptions in which lodging costs in excess of the per diem rate is allowable include:

- Hotel is adjacent to conference listed in program – limitations apply

- Lower cost overall to stay in more expensive hotel (vs. combined cost of staying in cheaper hotel and taking a taxi to conference or renting a car) – limitations apply

- Concerns for health and safety

- Special event or disaster

For additional information on lodging, please see UW’s policy on lodging .

Personal time

If taking personal time, you will need to provide documentation comparing airfare costs showing your personal time did not incur additional costs.

Comparison airfare

If you are taking personal time off, comparison airfare is the airfare you would have booked if you only stayed for the allowable business days. For example, a conference is Monday-Thursday, and you want to take personal time from Thursday-Sunday. You will need to provide comparison airfare for the Monday-Thursday dates, along with the airfare you purchased with personal time. If the purchased airfare exceeds the comparison cost, you will only be reimbursed the lesser of the two.

For additional information on comparison airfare, see UW’s policy on comparison airfare .

Mileage for long distances

If requesting mileage for long distances, you will need to provide other transportation comparisons to show what the cost would have been if taking other means of transportation (e.g. train, airfare, bus, etc.). For example, if you were traveling from Seattle to Portland, you will need to provide documentation on cost of airfare, mileage, and/or other means of transportation (e.g. bus or train).

Compact or sedan (5-person car) is the standard allowable car rental. Upgrades are allowable with appropriate justification. For example, requesting a van to transport supplies and equipment necessary to complete field work is an appropriate justification.

For additional information on car rental or other transportation, see UW’s policy on car, insurance, mileage and other transportation .

Mileage rates for privately owned vehicle

All mileage starts from the university campus on weekdays, during work hours 8am- 5pm. If travel begins outside of work hours, you may use your home as your starting point for mileage. You cannot claim reimbursement for BOTH mileage and gas. The mileage rate accounts for gas and wear and tear.

- Entries feed

- Comments feed

- WordPress.org

Be boundless

Connect with us:.

© 2024 University of Washington | Seattle, WA

Quick Links

- UW HR Resources

- DOM Intranet

- GIM Intranet

Reimbursement

The process.

1. While traveling, save your receipts! The UW requires original receipts for all expenses over $75 for reimbursement. (Please save and submit all receipts whenever possible, even if the expense is under $75.)

2. Complete and sign the GIM Travel Reimbursement Request Form .

3. Submit reimbursement request and receipts to the individual responsible for completing eTravel expense reports (ER). (This process is usually completed by a Research Assistant or Program Coordinator. Ask your unit or section head if you are unsure who handles this.)

4. Approval process:

- Faculty: The Division Head must approve travel for faculty members in the Division of GIM. Please add Rebekah Zaharia as an ad hoc approver in eTravel. If grant funds are used to reimburse a trip and the traveler is not the PI, the PI must also approve the request before it is sent to the Division Head. Add the PI as an ad hoc approver in eTravel or attach a written approval from the PI to the expense report.

- Staff: The PI or supervisor of the staff person should approve the eTravel expense report.

- For ALL Travelers: Lodging expenses should be reviewed prior to travel, and approval is required for lodging costs that will exceed the 150% allowance. The Division Head must approve the Exception to the Maximum Lodging Allowance form prior to the travel taking place. If this is not requested prior to the travel taking place, then it should be done prior to the ER being submitted.

5. After the eTravel expense report is submitted and approved, you will receive reimbursement via direct deposit.

For more information, visit Department of Medicine Intranet .

eTravel: Electronic Expense Reports (ER)

- The expense report should include the name of the traveler, dates of travel, destination(s), and conference name or other purpose of travel.

- A conference, meeting, or other travel agenda must be attached to every expense report.

For more information, visit Department of Medicine Intranet .

When are extra approvers required?

- For all ERs (faculty, staff, non-UW): Add Research Center Manager or Section Administrator before Compliance Approver.

- For faculty ERs: Add Interim Administrator (Dana Panteleeff) before Compliance Approver. (The Division Head will be added as an approver by the Associate Administrator after she has reviewed and approved the ER.) Please note that this (and many) procedures will change in July 2023 as part of UW's Financial Transformation.

Reference the UW mileage chart in your expense report comments.

One of the following is required for claiming personal auto mileage:

- PDF of directions with starting and destination points created from Mapquest, Google Maps, or a similar website. You may have multiple PDFs for multiple trips on one ER. Please ensure that the mileage number recorded in the ER exactly matches the mileage referenced in the PDF.

- Mileage log. This is recommended for multiple mileage claims on one ER (e.g., multiple site visits for blood draw purposes). The mileage log must contain name of the traveler, dates of travel, odometer start and end readings, project name, descriptions of travel, and budget number(s).

See the UW Travel website for information on meals per diem .

See the UW Travel website for information on lodging per diem .

See also Exceptions to Lodging Allowance .

Getting Reimbursed

How to get reimbursed for UW–Madison travel-related and non-travel-related expenses.

UW–Madison employees are reimbursed for out-of-pocket travel-related expenses in accordance with UW–Madison travel policy.

Employees are responsible for following travel policy, retaining required receipts, and submitting expense reports in a timely fashion.

Quick Links for Reimbursement

- Deadline for reimbursements More

- How to get reimbursed More

- What can be reimbursed More

- Receipt requirements More

- Other supporting documentation More

- Non-travel reimbursements More

- Reimbursement roles and responsibilities More

- Using the My Corporate Card More

- Training More

- Policies and procedures More

Deadlines for reimbursement

Expense reimbursements must be submitted within 90 days of:

- The end of the trip (for travel-related expense reimbursements)

- The date of the purchase (for non-travel-related expense reimbursements)

- The end date of the course (for tuition or job training expense reimbursements)

Expense reimbursements sent back to the traveler for correction must be resubmitted within 90 days of being sent back.

Travelers may seek reimbursement for airfare, registration fees, lodging, and vehicle rental reservation guarantees at the time payment is made. All other travel expenses are reimbursable after the trip is complete.

Back to top Back to top

How to get reimbursed

Employees get reimbursed by submitting an expense reimbursement through e-Reimbursement. Once submitted, expense reimbursements are reviewed by at least two levels of approval. Once an expense reimbursement has been fully approved, the reimbursement amount is directly deposited into the employee’s bank account within 5 business days.

Access e-Reimbursement How to create, modify, and resubmit an expense reimbursement

What can be reimbursed

All reimbursable expenses must comply with UW–Madison travel policies and procedures .

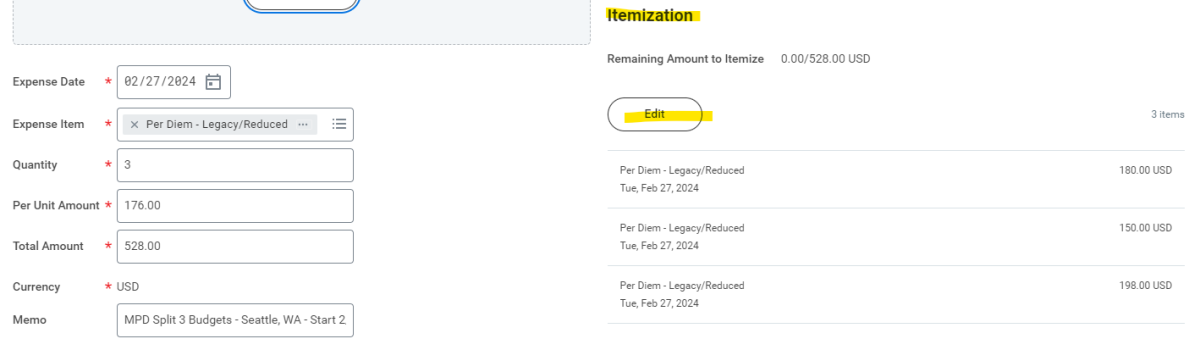

Meals are reimbursed on a per-diem basis, not for actual costs.

Meals Policy

Accommodations for required overnight business-travel stays.

Lodging Policy

Moving expenses as permitted by the appropriate approving authority.

Relocation Policy

Transportation

Reimbursement for airfare , rental vehicle, personal vehicle mileage , train, bus, taxi, or any other necessary means of transportation.

Transportation Policies

International Travel

Including visa/passport fees, vaccinations/inoculations, currency exchange fees, and foreign transaction fees.

International Travel Policy

Receipt requirements

All required supporting documentation must be attached electronically to the expense reimbursement. Electronic receipts must be clear and legible. Efforts must be made to redact any sensitive information from receipts in order to comply with HIPAA and campus privacy policy .

Receipts are always required for:

- Vehicle Rentals

- Gasoline for vehicle rentals

- Long-distance train or bus fares

- Hosted meals/events

- Required inoculations/vaccines for international travel

- Currency processing/foreign transaction fees

- Internet for business use — while in travel status

- International calling/data plans for business use

- All non-travel purchases

- Expenses paid on the Purchasing Card — retain these receipts with Purchasing Card supporting documentation

Receipts are required when the expense exceeds $25 for:

- Local transportation (taxi, limo, bus, rail, etc.)

Receipts are required when the expense exceeds $30 for:

- Baggage and seat fees

Receipts are never required for individual meals which are reimbursed as a meal per diem.

Other supporting documentation

In addition to receipts, it may be necessary to keep other documentation to support a reimbursement claim such as an airfare cost comparison or conference brochure/agenda. The expense report and its attached documentation must provide enough information for an approver, auditor, or post-payment auditor to review the validity of the expenses without any follow-up.

Non-travel reimbursements

If other payment options are not available, it may be appropriate for an employee to be reimbursed for non-travel-related out-of-pocket expenses. A receipt is always required for non-travel reimbursements.

Expense reimbursement roles and responsibilities

This is an accordion element with a series of buttons that open and close related content panels.

Travelers/Claimants/Employees seeking reimbursement

Employees are responsible for submitting their own expense reimbursements in a timely fashion and following UW travel policies. An employee may assign an Alternate to create and modify an expense reimbursement on their behalf, but the employee is ultimately responsible for submitting their own expense reimbursements.

Alternates are responsible for creating and submitting Expense Reimbursements on behalf of others. Employees who seek reimbursement can assign an Alternate to create and modify expense reimbursements for them, but the Employee must submit their own. Expense reimbursements for Non-Employees or recently-terminated Employees are created and submitted by Alternates.

Procedure – How to Assign an Alternate

Working as an alternate

Non-employees seeking reimbursement

Reimbursement payments for Non-Employees are processed through e-Reimbursement by an Alternate. Do not confuse this with payments for services, which must be processed on a Payment to Individual Report (PIR).

Reimbursing Non-Employees

Approvers and auditors

Approvers: Upon submission, expense reimbursements are first reviewed by an approver (also referred to as Required Departmental Approver). Approvers are responsible for reviewing supporting documentation, expense reimbursements for policy compliance, and funding being charged.

Auditors: Expense reimbursements are reviewed by an auditor after the approver. Auditors are responsible for reviewing expense reimbursements for policy compliance and properly routing expense reports which require special approvals .

Both auditors and approvers should be familiar with the review and approval procedure for expense reports:

Procedure 3024.9 – Expense Report Review and Approval Procedure

Division coordinators

Division Coordinators are responsible for maintaining their division’s e-Reimbursement approval assignments , relaying updates and other communications to their divisions, and serving as a policy reference for travelers, alternates, approvers, and auditors in their respective division.

Find your Division Coordinator

Using the My Corporate Card

In addition to being reimbursed for out-of-pocket expenses, employees can use e-Reimbursement to pay their My Corporate Card balance.

My Corporate Card information How to work with My Corporate Card and My Wallet in e-Reimbursement

Expense reimbursement training

There are two types of expense reimbursement training–see descriptions below:

Traveler/Alternate

Learn how to create an expense report, assign an alternate, and review pending/completed expense reports. Recommended for frequent travelers and alternates.

Note: Travel policy is not included in this training. The new Canvas Travel Policy Training is a recommended prerequisite for this course.

Approver/Auditor

Learn how to approve/deny/send back expense reports and how to use SFS queries and resources. Required for all e-Reimbursement approvers and auditors.

Note: Travel policy is not included in this training. but the new Canvas Travel Policy Training is a requirement for all new approvers and auditors as of September 2023.

Important : In order to be set up as an expense reimbursement approver or auditor, individuals must have completed both the Expense Reimbursement approver/auditor procedure course as well as the Canvas Travel Policy Training .

Register for Expense Reimbursement Training

- Delegation of e-Reimbursement Approver/Auditor responsibilities More

- My Corporate Card application More

- Non-employee Profile Set-up and Change Form More

- Concur More

- e-Reimbursement More

- Meal & Per Diem Calculator More

Policies and procedures

- Travel Policy and Procedure Index More

- Expense Reimbursement Policy and Procedure Index More

You might also be looking for...

- UW-3039 Business Meals Policy More

- Hosting a UW event More

- UW-3075 Official Functions and Expenses Policy More

Travelers and departmental staff should contact their Divisional Business Office for policy or procedural questions.

Divisional Business Offices may email [email protected] with questions.

Quick Links

- UW HR Resources

Reimbursement and Travel

License reimbursements, washington state medical license:.

To renew your Washington State Medicine License, AHR recommends submitting the online renewal application at least 6 weeks prior to your license expiration date. Due to Department of Health staffing shortages, submitting medical license renewal forms by mail are encountering significant delays.

For reimbursement , please do the following:

- Make a copy of your new WA State Medical License.

- Send this copy, along with a completed UWP License Reimbursement Form (fill out all top fields except Department Approval) to [email protected] .

Reimbursement typically takes around two weeks to process.

DEA License:

To renew your Washington State DEA License, follow the instructions outlined on the sheet. DEA License Renewal Instructions . Lisa Lawless at [email protected] serves as UWMC’ & HMC’s Certifying Official, not Dr. Susan Stern. Do NOT pay the $731 Fee, the University of Washington is a Fee-Exempt Institution.

Travel Reimbursements:

Your expense report for reimbursement will be done online (by Finance) after you submit hard copy (or email) receipts (see Travel Reimbursement Procedures). You will then receive an email to approve your expense reports online. Payment is direct-deposited for UW Employees to the account used for payroll.

After your trip, please submit the following:

- Original Receipts: Regardless of cost for Lodging, Car Rental, Meals paid on behalf of others, and Laundry. Also submit original receipts for anything over $75, for anything under $75, (except as noted for "regardless of cost" items) please make a note of the expense or send the receipt (this might include taxi, parking, etc).

- Detailed Flight Itinerary: Departure and arrival dates and times are used to determine your total allowable meal per diem. Per diem rates vary from city to city and may fluctuate depending upon the time of year.

- Meals: No receipts are required for meals; you will automatically be paid meal per diem. Note if any meals were provided by the conference or paid for by anyone else, as these cannot be reimbursed. Your daily per diem will be reduced accordingly. If no meals were provided, please note this as well. This information is usually in the conference brochure.

- Conference Brochure: Or provide a link to the conference brochure with dates, agenda, etc.

Submit all items to [email protected] , and contact the Finance Team with any questions regarding reimbursement.

Reimbursement Resources:

- UWP Medical License Reimbursement Form

- DEA License Renewal Instructions

- Travel Reimbursement Form

- Non-Travel Reimbursement Form

- Travel Procedures

- Information Technology

- Commuter Services

- Human Resources

- Campus Safety

- Building Coordination

- Building Hours and Addresses

- Campus Lactation Stations

- Conference Rooms

- Notary Services

- Policies & Procedures

- Printing on Campus

- Open Public Meeting Act (OPMA)

- Federal, State, and Media Requests

- Admin Council & Fiscal Fitness

- ASTRA Access

- Audit Services

- Toolkit for Campus

- Toolkit for Suppliers

- Frequently Asked Questions

- Cashier’s Office

- Contract Management

- Food Approvals

- Forms and Guides

- Procurement

- Reimbursements

- FAS Shared Environment

- Operating Budget

- Contact IPB

- Campus Design Review Team (CDRT)

- Innovation Hall

- Residential Village

- Completed Projects

- 2017 Campus Master Plan

- Guiding Principles

- Key Insights

- Key Opportunities

- Optimization Projects

- Feedback Summary

- Review Process

- Campus Community Safety & Well-Being Advisory Council

- Campus Advisory Committee for Environmental Sustainability

- Meet with the Vice Chancellor

The Fiscal & Audit Services staff are here to help guide and facilitate the process of travel purchases and reimbursements for faculty, staff, students and visitors. FAS complies with the UW Travel Services Policies .

Review our Travel Guides for helpful information on what you need to know before, during and after travel:

- UW Employee Traveler Guide (Coming Soon): For UW Faculty, Staff, and Student Employees

- Non-UW Employee Traveler Guide (Coming Soon): For Guests, Speakers, Visitors, Candidates, UW Students

- Comparison Airfare Guide : Requirements and necessary documentation

- Central Travel Account (CTA) Guide : Requirements and necessary documentation

UW Travel Agencies

Booking – tangerine travel.

Tangerine Travel is local to Bothell, Washington and is a diverse and women owned small business. Book online using the self-service website: Tangerine Travel Booking or contact a travel agent by phone at (425) 822-2333. It is strongly encouraged that departmental guests and candidates (non-UW) work directly with Tangerine Travel for UW business travel booking.

For more information, visit the Tangerine Travel Guide .

Booking – Christopherson Business Travel (CBT)

Christopherson Business travel offers services such as booking airfare, lodging, and rental cars. Book online using the self-service website: Christopherson AirPortal or contact a travel agent by e-mail or phone: [email protected] or (888) 220-1072.

For more information, visit the Christopherson Business Travel (CBT) Guide.

Pre-Travel Approval Form

Out-of-state travel is defined as travel outside of Washington, Oregon, and Idaho. All out-of-state travel, including registration, MUST be pre-approved by the appropriate parties using the Pre-Travel Approval Form .

The Pre-Travel Approval Form must be completed prior to making any travel arrangements. The form is completed by the traveler or administrative support person in the department, and forwarded to the appropriate supervisor and budget authority for approval. However, grant funded travel does not need advance written approval if travel was specifically budgeted for in the grant proposal, and travel was approved by the sponsor.

Personal time

An airfare comparison must be obtained when personal time is combined with UW business. The dates for the comparison airfare should match the days of business without personal time. Visit the UW Travel Services for more information on airfare.

Central Travel Account for Airfare

UW Bothell has a Central Travel Account (CTA) card managed by Fiscal and Audit Services and can be used if the airfare meets specific requirements. CTA booking requests must be submitted at least five business days in advance. For more information, please see the CTA Guide and CTA Flow Chart .

Per diem is an allowance method by which UW handles lodging and meal reimbursement to an individual.

To be eligible for per diem, the traveler must be in travel status and staying at a commercial lodging facility. AirBnB and VRBO are considered commercial lodging facilities and only reimbursed to the traveler who paid directly, even when the facility is shared among multiple travelers.

Visit the U.S. General Services Administration (GSA) website and UW Travel Services website to find more information on domestic meal per diem.

The conference brochure must be submitted with the reimbursement request for meals claimed during a conference. Provided meals must be zeroed out on traveler’s expense report. When travelers include personal time with their trip, meals will be reimbursed based on the traveler’s actual time in travel status.

As part of Fiscal & Audit Services policy accountability, expenses paid on behalf of others will require a written statement from the claimant.

Ground Transportation

UW Employees should utilize the corporate discounts at Wally Park and MasterPark for SeaTac parking rather than parking at the airport. Travelers must provide a Husky Card to identify themselves as UW travelers.

UW Employees should use the Enterprise and National Car Rental Contract when renting cars.

Registration Fees

The department administrative support specialist can pay registration fees on the departmental Procurement (ProCard) or you may pay yourself and claim reimbursement. Conference brochure/agenda must be submitted for reimbursement. Membership associated with travel registration fees may be reimbursed if mandatory and unavoidable for attending conference.

Package Deals

What are package deals? “Package Deals” are travel deals sold by services such as Expedia and Travelocity, which bundle services such as airfare, hotel and rental car for one combined price.

Why do I need to stop purchasing package deals? Due to new IRS documentation requirements starting January 1, 2018, the University cannot reimburse the traveler if receipts do not display each type of expense separately as itemized amounts . (Package deals typically do not list itemized travel expenses.)

Travel Reimbursement

Check with your department or school for reimbursement procedures. All travel related expenses are reimbursed via Workday. Include the Pre-Travel Approval Form and all receipts in one combined PDF when submitting a reimbursement request.

- Travel Reimbursement Claim Form – UW Employee

- Travel Reimbursement Claim Form – Non UW Employee

- Point Person List

Important Reminders:

- When attending a conference, the conference brochure/agenda showing when the conference started and ended, which meals were provided (if claiming meal reimbursement) and location of conference (if claiming lodging) must be provided as a PDF for reimbursement. A link to the brochure is not acceptable.

- If personal time is added to a trip, a comparison airfare must be provided (if claiming airfare reimbursement). In addition, all expenses (meals, parking, lodging, etc.) will only be reimbursed for the business portion of the trip.

- Transportation receipts must include a business purpose, addresses to and from, and proof of payment (showing method of payment). See Comparison Airfare Guide .

- Foreign currency exchange must include the actual receipt AND either a credit card statement (foreign transaction fees are non-reimbursable) OR an Oanda Currency Converter printout.

- Exceptions to lodging per diem includes conference hotel, comparative advantage, suite required, special event or disaster, ADA or safety health, and Non-UW. See Traveler Guide (Coming Soon) for more information.

Non-Reimbursable Examples

The list below is not comprehensive; these are just common examples of expenses that are not reimbursable. For more details, visit the UW Non-Reimbursable page.

- Expenses purchased with rewards program

- Expenses purchased with mobile payment service (Venmo, Zelle, Cash App)

- Personal expenses and personal convenience

- Exchange of funds between travelers

- Travel Insurance (Car rental, trip protection, travel cancellation package, etc.)

Questions? Contact us via FAS Service Request Form .

Shared Support Services

- Fiscal Services

- Training & Resources

- Workday Finance

- Policies & Forms

Travel Services

Main content, helping you get where you're going.

In conjunction with the UW Travel Office , UW Tacoma Procurement Services assists departments and travelers with training , understanding their responsibilities , obtaining proper pre-approvals and navigating policies and procedures related to campus travel needs.

Many UW Tacoma travel processes have been updated

In an effort to help create more sustainable travel practices under Enhanced Monitoring and in the long-term, several familiar processes have been changed. Please read carefully below to learn more.

Travel Updates

For General Travel Updates , including up-to-date COVID-19 restrictions and guidelines, visit UW Travel Services .

Travel Authorization

Travel pre-authorizations with proper justification and supporting documentation are required for all travel with a conference fee or overnight stay , regardless of destination, and must be signed by the appropriate approving authority* prior to purchases being made. This includes in-state travel (WA/OR/ID) due to restrictions under Enhanced Monitoring.

Blanket travel authorizations are no longer permitted under Enhanced Monitoring. Active blanket authorizations will be suspended beginning October 1, 2022.

Under Enhanced Monitoring, conference travel is permitted for professional development, session presenters, leaders in hosting organizations, those traveling on external or grant funding, and required (e.g. accreditation) attendance. To ensure timely processing of authorization, attach all relevant supporting documentation and provide detailed justification of the Trip Purpose.

UW Tacoma Travel Pre-Authorization Form - Revised 9/2023

*Approving Authority

Accepted approval on Travel Pre-Authorizations may come from the Executive/Vice Chancellor, Dean or pre-determined delegate. Delegates are limited to one per department and must report directly to the E/VC or Dean. Delegate travel must be approved by the E/VC or Dean per usual review policy.

Should your department wish to assign a delegate, please email [email protected] .

Consider utilizing cost-effective options for space:

- UW Seattle Botanic Gardens

- Lake Washington Rowing Club

- Various UW Seattle venues

- UW Tacoma Conference Services

- Union Club Tacoma

- The Pioneer Collective

- Court House Square

- Regus Downtown

- Point Defiance Pagoda

- The Mountaineers Tacoma Program Center

- Greater Tacoma Convention Center

- Marriott Tacoma Downtown

Do you know of an affordable or little-known venue in the area? Email suggestions to [email protected] so we can add them to the list!

UW Tacoma Central Travel Account (CTA) Purchases

The UW Tacoma CTA** is managed by Procurement Services and is used to charge airfare, rail and bus tickets, and specified lodging to a centrally billed account when traveling on official UW business.

Personal Time and Travel

Adding personal time/travel with a business trip is allowable. However, certain restrictions apply and therefore the CTA may not be used when adding personal time to business trips. For more information, please visit Personal Time/Travel .

Lodging Requirements

The CTA may be used to charge lodging only for:

- UW Students

- NON-UW travelers

- Five or more UW travelers attending a conference/group event in the U.S. or British Columbia, Canada where the UW is reserving and paying for the block of rooms and prior written approval has been obtained from the UW Travel Card Administrator.

** Restrictions apply.

How to Arrange Travel

Travel may be booked through a travel agency, directly with an airline or an online agency of your choice.

If requesting the use of the Central Travel Account (CTA) for purchasing flights, requests must be submitted no less than two weeks prior to the travel departure date. Please utilize one of our preferred travel agencies:

- Travel Leaders

- Corporate Travel Management

- Tangerine Travel

- Christopherson Business Travel

- WA State Contracted Agencies

If requesting the use of the CTA for purchasing local lodging, please utilize one of our contracted hotels:

- Marriott Courtyard Downtown Tacoma

- Holiday Inn Express Tacoma Downtown

- Hotel Murano

For UW business only. Please email [email protected] with reservation information.

Please refer to the Travel Contacts list below for specific lodging contact information and alternates to contracted hotel lodging.

UW Tacoma Travel Contacts

Travel Reimbursement

Travel reimbursements are processed through Workday as an Expense Report. For Non-UW travelers, travel reimbursements are processed as a lump sum on a Miscellaneous Payment. Be sure to include the new travel form on the UW Travel website. For additional details on how to process expense reports, please visit UW Travel .

Please note, receipts are required for any expense over $75. Perjury statements will not be accepted for required receipts. For details, see Receipts .

Additional Resources

- Policies and Procedures

- Training and Webinars

- Mileage Rates

- Domestic Per Diem Rates

- How to Create an Expense Report

- Required Receipts

- UW Global Travel Security

Office Hours:

- Academic advising

- Academic calendar

- Schools and programs

- Study Abroad

- Teaching and Learning Center

- Campus Safety

- Equity & Inclusion

- Financial Aid

- Information Technology

- Student Life

- University YMCA Student Center

- Administration

- Institutional Research

- Parking & transportation

Quick links

- Make a Gift

- Directories

Travel portal

Use the Travel portal to submit pre-trip authorization requests, to book a flight, to pay conference registration, and to submit a travel reimbursement request.

All postdoctoral scholars, graduate students, and staff must obtain approval prior to incurring any UW-covered travel expense. Prior approval is not required for faculty as this has been delegated to them by the Chair.

Travel reimbursements, complete with all supporting documents, must be submitted within 75 days of return from your trip.

Complete travel policy for the Department of Chemistry: Department Travel Policy

Prior Approval

To obtain prior approval, postdocs, graduate students, and staff must complete the Travel Request Form (UW NetID required).

Please be sure your entry is complete. Your cost estimate should include all expenses for the entire trip – transportation, lodging, per diem, and registration fees. The request will be routed electronically via UW Connect to a travel specialist in the Chemistry Purchasing & Accounting Office who will review the form, request additional information or clarification if needed. If you already have supervisor approval, please attach it to your REQ. If supervisor approval is not provided, we will route for approval.

Once approval is secured, the travel specialist will authorize charges to the Department Corporate Travel Account as needed. Upon completion and return from travel, the travel specialist will work with the traveler to prepare a travel Expense Report for reimbursements.

Faculty Travel

Prior approval is not required for faculty travel. For reimbursement, faculty should use the travel portal at top of page.

Travel reimbursements are handled by the travel specialist in the Chemistry Purchasing & Accounting Office (109P Bagley Hall). Please provide the travel specialist through the portal the complete information, receipts, and supporting documentation shortly after travel has been completed.

International Travel

All graduate and undergraduate students are required to register international travel itineraries with the Office of Global Affairs. The UW Office of Global Travel facilitates safe and successful travel for UW faculty, staff, and students. Students are also required to obtain UW Student Abroad Insurance. This provides major medical insurance benefits while overseas and evacuation services for medical, security, and natural disaster emergencies, which is not provided by regular GAIP insurance.

Please see the UW Office of Global Affairs website for more information.

Chemistry Corporate Travel Account

The Department has a corporate travel account (CTA) for airline, other transportation and specified lodging. If you wish to have the Department pay for any travel expenses in advance of your trip with the CTA account, complete the Request to Charge CTA form (PDF) (fillable pdf).

Send the completed request form to [email protected] in the Chemistry Purchasing & Accounting Office. Please note the prior approval requirement outlined above.

Travel Basics

- See our Travel FAQ document (PDF) for answers to common questions related to UW travel.

- Plan ahead. This ensures the desired flight times, best prices, and preferred accommodations.

- The State of Washington requires travelers to select travel options that are the most economical.

- Business or first-class travel is allowable only under very special circumstances and with prior approval from the Dean of the College of Arts & Sciences. Contact Angie Mullen ( [email protected] , 206.685.2333) for more information.

- International travel supported by Federal funds must use a U.S.-based air carrier (e.g., Alaska or American instead of British Airways; United instead of Air Canada; Delta instead of KLM). Contact the travel specialist, Patrick Arroyo (109P Bagley Hall, [email protected] , 206.897.1894) or Angie Mullen ( [email protected] , 206.685.2333) if you have questions.

- As soon as possible following your return, submit your reimbursement request to the travel specialist, Patrick Arroyo (109P Bagley Hall, [email protected] , 206.897.1894) .

UW Travel Cards

Faculty or staff who take at least two business trips each year may want to consider obtaining a UW Travel Card. This is an individual liability card, i.e., the card holder is responsible for paying the expenses incurred. As long as reimbursements are filed in a timely fashion, the Travel Card bill will typically not be due before you receive your reimbursement. Unfortunately, the UW Travel Card is not available to student employees. Please see the UW Travel Office website for more information about the UW Travel Card.

Please direct any questions to the travel specialist, Patrick Arroyo (109P Bagley Hall, [email protected] , 206.897.1894) or Angie Mullen ( steuerma @uw.edu , 206.685.2333) in the Chemistry Purchasing & Accounting Office.

- Newsletter

- News Feed

- Faculty & Staff

- University of Wisconsin System

Reimbursement

Expense reimbursement requirements, the following procedures and operational standards summarize the requirements associated with filing expense reimbursements, in accordance with university travel policy., account coding of reimbursements.

Appropriate account coding of all travel reimbursements is required for accurate University reporting of expenditures.

See Chart of Accounts Select " Account Codes and Definitions " for the current Fiscal Year. Then select " Travel and Type - Expenses" from the drop down to find the appropriate account code.

ACCOUNTING FOR TRAVEL AND RELATED EXPENSES

All travel expenses reimbursed from university-administered funds must be done in compliance with the university travel policies, regardless of the funding source (i.e. federal grants and contracts, auxiliary operations, general operating funds, restricted funds, outside reimbursements) or traveler affiliation (employee, non-employee, student, consultant, etc.).

Regardless of payment method or reimbursable costs, all travel related expenses are to be timely reconciled on a travel expense report for full accounting of the total trip cost and be documented with an official University business purpose. Some institutions utilize the purchasing card log as part of this accounting, so travelers must use their institution’s process to account for both purchase card prepayments and reimbursements. For travelers with pre-paid transactions on another person’s purchasing card, at minimum the cardholder’s name must be included on the expense report and the expenses recorded as prepaid on the travel expense report for record keeping purposes.

Expenses recorded on a travel expense report must be recorded by travel expense type, location of expense, supplier (if required for expense type), date expense was incurred, payment method (i.e. University pre-paid/ Purchasing Card, corporate travel card, personal forms of payment, personally paid expenses (non-reimbursable) and/or cash advance). Accounting for trip expenses in this manner satisfies IRS requirements for business travel record keeping.

Travelers may not claim travel or related expenses for other travelers. When traveling together, each traveler must pay for their own travel expenses. To reduce out-of-pocket expenses and related reimbursements, if allowed by the institution, use of the department’s Purchasing Travel Card is recommended for prepayment of airfare, lodging and/or required deposits and registration fees.

The traveler must personally approve, sign and submit the expense report attesting to the accountability statement.

Inquiries concerning travel policy or the submission of expense reports should be directed to your institutional travel office .

UNIVERSITY REQUIREMENTS FOR ACCOUNTABLE PLAN

Per 1200-General Travel Policy for reimbursements to be considered non-taxable income, the University’s travel and expense reimbursement policies, including procedures for expense reporting must comply with the IRS Accountable Plan Rules. To be considered an Accountable Plan an employer’s business expense reimbursement arrangement must meet the following conditions and IRS Safe Harbor requirements:

- Business Connection: Reimbursements and advances provided to the traveler or employee under the plan must be for business related expenses only. Any advance payments must be related to the business expenses that a traveler or employee is expected to incur.

- All travel related expenses must be substantiated in writing and include any required itemized receipts within 90 days after the trip completion date or will not be reimbursed by the University.

- Non-travel related business expenses (defined as expenses that are not travel related or incurred while in travel status) must be substantiated in writing and include any required itemized receipts within 90 days of expense date or will not be reimbursed by the University .

- For cash advances, travelers must substantiate expenses and return any excess advanced amount within 30 days after the trip completion date .

CURRENCY EXCHANGE AND TRANSLATION FOR INTERNATIONAL RECEIPTS (AND OTHER DOCUMENTATION)

Internationally incurred expenses paid and receipted in foreign currency must be submitted for payment or reimbursement in U.S. dollars using the exchange rate in effect on the date of payment. Include documentation indicating what exchange rate was used to make the conversions. Currency exchange rates can be found at OANDA , the University’s standard application for conversion and Google is recommended for translation . When converting, choose the appropriate interbank rate for the transaction. If purchases were made via credit card, use the exchange rate provided on the credit card statement.

NON-REIMBURSABLE EXPENSES

Per 1200-general travel policy the following is a non-inclusive list of typical expenses that will not be paid or reimbursed by university funding sources:.

- Expenses which are not UW business related

- Expenses not filed within the 90 day requirements

- Expenses paid or reimbursed from outside sources

- Alcoholic beverages

- Spouse, family member’s or travel companion costs (Chancellor’s and President’s spouse/partner may be allowable under separate policy)

- Any expenses incurred as a result of voluntary cancellation of travel reservations (air, car, hotel, etc.) or supplier assessed penalties unless formally justified as exception.

- Domestic phone calls

- Lost/stolen cash or personal property

- Personal items and services, e.g., toiletries, luggage, clothes, haircuts, etc.

- Expenses for social events or non-business related activities, such as sightseeing tours, sport outings, excursions, etc.

- Traffic citations, parking tickets and other fines

- Additional charges incurred for personal reasons involving vehicle rentals

- Locksmith charges for personal vehicles

- Repairs, towing service, lubrication, etc. for personal vehicles

- Excess cost of circuitous or side trips for personal reasons

- Parking costs at the assigned headquarters

- Meals included in business meetings, conference registrations, etc.

- Pay for view movies in hotel/motel room

- Personal entertainment

- Additional costs for extra person(s)

- Charges incurred for late lodging checkout

- Lodging costs incurred at unlicensed facilities

- Lodging within 50 miles of the home or headquarters city

- Flight insurance

- Trip Insurance

- Extra baggage charges for personal items, such as golf clubs, skis, etc.

- Airline, car, hotel, corporate club or other membership dues

- Childcare costs

- Kennel fees

- Late payment penalties and interest on corporate card

- Greeting cards

- Any incidental expenses included in the per diem

RECEIPT REQUIREMENTS

Original, itemized receipts are required based upon the expense types and dollar limits listed below. Credit card statements alone to not meet the receipting requirements.

Definition of original receipt:

An original receipt is a written acknowledgement that the vendor has been paid for providing goods or services. To be considered original it must show:

- The name & address of the vendor providing the goods or services

- The date that the specific services were received or items were purchased

- Itemization of the services and/or goods and pricing

- Final amount due and evidence that it was paid

Scanned receipts are accepted as originals providing they meet the same requirements for paper receipts. Keep in mind that if you're planning to scan your receipts or other required documentation, the scan must be clear, legible and saved in a format that allows opening and printing.

Registration fees that often include other types of expenditures must include the following information on the receipt:

- Dates of conference, convention, seminar, etc.

- Location and title of event

- Amount of fee and a breakdown of specific costs (meals, etc.) covered in the fee.

Note: This may require obtaining both a payment receipt and a copy of the applicable page from the registration website, registration form, brochure, application etc.

The I.R.S. recommends that business travelers always keep receipts for personal tax filing purposes. University policy requires that the following receipts be provided with any reimbursement request. For E-Reimbursement users, attach receipts and supporting documents using the attachment features in the application.

Lawmakers expensed millions in 2023 under new program that doesn’t require receipts

Critics say the program’s lack of transparency and record-keeping opens it up to abuse.

A previous version of this article said that Rep. Matt Gaetz (R-Fla.) was the reimbursement program's top spender for 2023. That analysis was based on data released by the House as of last week. But additional data The Post reviewed Tuesday showed that Rep. Jack Bergman (R-Mich.) was reimbursed for more than Gaetz was. The article has been corrected.

More than 300 House lawmakers were reimbursed at least $5.8 million for food and lodging while on official business in Washington last year under a new taxpayer-funded program that does not require them to provide receipts.

The program, which kicked off last year after a House panel passed it with bipartisan support, was intended to make it easier for lawmakers to cover the cost of maintaining separate homes in D.C. and their home districts. But critics argue that its reliance on the honor system and lack of transparent record-keeping makes it ripe for abuse.

The reimbursement scheme’s lack of receipt requirements is a “ridiculous loophole,” said Craig Holman, a lobbyist for the good-government group Public Citizen. “Clearly it becomes very difficult to tell whether or not it’s a legitimate payment and whether it’s proper,” Holman added.

The program has only a few strict rules: Lawmakers cannot be repaid for principal or interest on their mortgages, they can only get reimbursement for days they’re actually working or flying to D.C., and they can’t ask for more back than their actual expenses. They’re also subject to daily spending caps determined by the General Services Administration. Members are “strongly encouraged,” but not required, to keep records of their expenses, according to guidance issued by the House Committee on Administration.

The same rules apply to every member. But lawmakers’ reimbursements requests have varied widely, and because the program doesn’t require receipts or detailed public disclosure of what members are expensing, taxpayers have to take lawmakers’ word that they’re playing by the rules.

The office of the House’s chief administrative officer continuously gathers expense reports from members of Congress and periodically updates the House’s website to reflect the latest filings.

As of Tuesday, that data showed that 154 House Democrats, 171 House Republicans and three nonvoting delegates participated in the reimbursement program last year.

Rep. Jack Bergman (R-Mich.) was the program’s top spender last year. He was reimbursed more than $32,000 for lodging and nearly $12,000 for meals in 2023, according to data released by the House as of Tuesday.

Bergman’s office did not respond to a request for comment.

Rep. Matt Gaetz (R-Fla.) was the program’s second-highest overall spender, according to filings released as of Tuesday, with over $30,000 in lodging expenses and more than $11,000 for meals in 2023. A spokesperson for Gaetz said he was reimbursed for lodging expenses on days when the House was out of session but Gaetz remained in Washington on official business for depositions related to his post on the select subcommittee on weaponization of the federal government.

“Rep. Gaetz has always complied with House rules regarding congressional reimbursements,” a spokesperson for Gaetz said in an emailed statement. “In 2023, Rep. Gaetz dedicated significant time to his work on the Weaponization Subcommittee, requiring his presence to be in Washington, D.C., on days often when there were no votes, which incurred additional reimbursement expenses to conduct depositions.”

Other members of the weaponization committee expensed significantly less than Gaetz.

Some members of Congress who own homes in the Washington area, including Reps. Patrick T. McHenry (R-N.C.), Ro Khanna (D-Calif.) and Michael McCaul (R-Tex.), have chosen not to participate in the program at all. Rep. Jim Banks (R-Ind.), who owns a $1 million home in Virginia, was reimbursed less than $1,500 each month.

But other D.C.-area homeowners, including Reps. Nancy Mace (R-S.C.) and Eric Swalwell (D-Calif.), requested significantly higher reimbursements than Banks did for some months in 2023.

Mace, who co-owns a $1,649,000 Capitol Hill townhouse she purchased in 2021 with her then-fiancé, Patrick Bryant, expensed a total of $27,817 in 2023, an average of more than $2,300 a month, according to the data released as of Tuesday. She expensed over $3,000 for lodging in January, March and May , and over $4,000 for lodging in October.

Swalwell, who purchased a $1,215,000 home in the Eckington neighborhood of Washington, was reimbursed more than $20,000 for lodging expenses in 2023, according to the data released as of Tuesday. In May 2023, he received $2,838 in lodging reimbursement.

As homeowners, Mace and Swalwell aren’t allowed to ask taxpayers to cover their mortgage payments and can only expense taxes, insurance, maintenance, utilities and other ancillary costs.

“There’s nothing ‘average’ about having three children and a wife who are trying to live between two expensive areas,” Swalwell spokeswoman Cassie Baloue said in a statement. “The Congressman’s expenses reflect the actual cost of working in D.C. and are signed off by House Administration.”

Swalwell owed about $1,144 per month in taxes and insurance alone, according to figures provided by his spokeswoman, and incurred other home maintenance costs she declined to specify.

“Every month is different as to what maintenance costs Rep. Swalwell is reimbursed for,” she added. “Everything he does is allowable.”

Mace was told by people involved with her office finances that she could not justify claiming more than about $1,800 a month for expenses on the townhouse, according to two people familiar with the discussions, who, like others interviewed for this report, spoke on the condition of anonymity to disclose private conversations. One source showed The Post a document laying out Mace’s monthly expenses for the townhouse and calculating them as $1,726.

Mace instructed her staff to seek the maximum reimbursement each day the House was in session, regardless of her actual expenses, two former members of her staff and one other person familiar with the matter alleged to The Post. Mace denies that allegation.

Mace denied wrongdoing and declined to explain her expenses in detail. Her office did not answer questions about maintenance and other costs related to the house she co-owns with her ex-fiancé. Mace owns 28 percent of the home, according to the deed, but did not answer questions about what percentage of the bills she paid.

“We follow all the rules for reimbursements,” said Gabrielle Lipsky, a spokeswoman for Mace, who said the office found $300,000 in other savings last year unrelated to the reimbursement program.

Mace has been at war with a group of her former staffers for months. Her former chief of staff, Daniel Hanlon, took steps this year to run against her in a primary. He later bowed out . Mace’s main opponent in a hotly contested June 11 primary is Catherine Templeton, a former South Carolina gubernatorial candidate who has accused Mace of flip-flopping “for fame.”

Misusing taxpayer funds under the members’ allowance could violate both House rules and federal law, said Kedric Payne, a former deputy chief counsel of the Office of Congressional Ethics who now serves as the vice president of the Campaign Legal Center, a nonpartisan government watchdog group. Payne said that anyone who misuses the program could face corruption charges similar to those brought against Aaron Schock, a former congressman from Illinois who used government and campaign funds to remodel his Capitol Hill office in the style of the TV show “Downton Abbey.”

“The new travel reimbursement rules cover very specific expenses and have strict dollar limits,” said Payne. “Any member who violates these rules and submits false reimbursement claims can face civil and criminal penalties. The Office of Congressional Ethics frequently investigates members’ blatant misuse of taxpayer dollars. Voters have a right to know that their elected officials aren’t using public funds for personal expenses.”

The member reimbursement program has been popular, but any perception of unfair enrichment could endanger it. Congress is already one of the least trusted government institutions, and 81 percent of American adults believe that members of Congress do a somewhat or very bad job at keeping their personal financial interests separate from their work in Congress, according to a Pew Research poll released in September.

The bipartisan House Select Committee on the Modernization of Congress suggested the member reimbursement account program in 2022 as an alternative to raising members’ salaries. Defenders of the program have argued that it matches benefits offered to lawmakers’ counterparts in the private sector and the executive branch and encourages diversity of representation.

Members of Congress make $174,000 per year, which is about twice the median U.S. household income, but they must usually maintain two households: one in Washington, an expensive metro area, and another in their home districts. Many commute long distances at great expense .

Some good-government and anti-corruption groups argue that higher lawmaker salaries would make public service more attractive to a wider array of Americans and discourage corruption. But members of Congress have not given themselves a raise since 2009, as voting to do so is considered politically unpalatable. Some lawmakers have turned to living in their own offices to defray the costs.

“I wish members would give themselves a raise that they probably deserve and then we’d all move on,” said a staffer involved with congressional accounting, who spoke on the condition of anonymity because they were not authorized to discuss the program publicly. “But they don’t have the backbone to do that, so [they gave] members a raise through this backdoor way that allows for abuse because there is no record-keeping and there’s no receipts.”

Leigh Ann Caldwell and Alice Crites contributed to this report.

Why You Should Consider Saving Your Receipts When Shopping For Souvenirs

F or the most part, receipts are a nuisance. Unless you need to safekeep them for tax purposes, they're simply pieces of paper that function as proof that you've purchased a product or service. They're tangible reminders of how much you've spent on something, like splurging on a ridiculous $15 on fancy coffee or overpaying for a pair of shoes.

More often than not, it's better to throw away or shred receipts you have no use for — considering how most of them were found to be quite toxic. According to a Skip the Slip report, many paper receipts contain harmful chemicals that can cause adverse effects on one's body. If you really need a receipt for tax and money management, it might be better to ask for a digital copy instead. That way, you can cut back on waste, and the receipt can linger forever within the depths of your phone or computer for later reference.

It's a different story when it comes to travel, though. If you're fond of shopping abroad, especially in countries that offer VAT refunds, you'll benefit from keeping paper receipts — at least right up until you leave the country. You may be surprised to know that those pieces of paper, no matter how pesky they can be to organize, can save you money and even help you fly past customs agents.

Read more: Safety Items You Should Pack For Your Next Road Trip

VAT Refunds

Fancy shopping during your overseas travels? If you're the type to go all out with your spending when you travel abroad, particularly in countries that charge value-added tax (VAT), you can recoup some of that money with the help of receipts. Over 170 countries charge VAT on top of retail prices of goods and services, and if you're a tourist, there's a huge chance that you can get a refund on the VAT before — and sometimes even after — you fly back home. You just have to present receipts.

Note that these refunds normally don't apply to food, accommodation, transportation, and services, but all other purchases are usually eligible. You may not get a refund on a baguette you bought from a French bakery, but if, say, you purchased clothing and accessories from a store and have met the minimum spending requirement for a VAT refund, you'll be able to get a certain amount back. Not all stores offer refunds, either, and minimum purchase requirements vary from country to country, so it pays to ask store clerks before going on a shopping spree and read up on relevant VAT rules before your trip. For instance, France has a €100.01 (about $150 USD) minimum, and Italy has €154.94 (approximately $230 USD) minimum. Meanwhile, purchases made in Japan have to be at least ¥5,000 (roughly $35) to be eligible for a VAT refund, and South Korea has a minimum spending requirement of ₩30,000 (around $23).

Claiming Your Reimbursement

Before anything else, it's important to confirm whether a certain store offers VAT refunds. The minimum thresholds are also not cumulative and instead apply per transaction, so a single purchase must meet the minimum spending requirement to qualify for a refund later on.

Now, when it comes to claiming said refund, the process also varies per country and per store. Some establishments even process refunds automatically. But within the EU, at least, the European Commission notes that most shop clerks may require you to fill out a form and then — along with the receipt or invoice — return the form so you can present it to customs officers, who will then stamp it. Without showing proof of purchase, they won't be able to stamp your refund form, rendering you unable to claim a refund. You then mail your refund form to the address the shop provides when you return home. The good news is bigger airports have counters that allow you to claim your refund right away. Countries like South Korea even have self-service kiosks that yield refunds like ATM machines in exchange for scanned passports and receipts. It's also worth noting that keeping receipts handy can speed things up when customs agents question your purchases.

It may seem like more trouble than it's worth, but hey — at least you'll be getting your money back. In this day and age, every dollar counts.

Read the original article on Explore .

Lawmakers expensed millions in 2023 under new program that doesn’t require receipts

More than 300 House lawmakers were reimbursed at least $5.2 million for food and lodging while on official business in Washington last year under a new, taxpayer-funded program that does not require them to provide receipts.

The program, which kicked off last year after a House panel passed it with bipartisan support, was intended to make it easier for lawmakers to cover the cost of maintaining separate homes in D.C. and their home districts. But critics argue that its reliance on the honor system and lack of transparent record-keeping makes it ripe for abuse.

The reimbursement scheme’s lack of receipt requirements is a “ridiculous loophole,” said Craig Holman, a lobbyist for the good government group Public Citizen. “Clearly it becomes very difficult to tell whether or not it’s a legitimate payment and whether it’s proper,” Holman added.

Advertisement

The program has only a few strict rules: Lawmakers cannot be repaid for principal or interest on their mortgages, they can only get reimbursement for days they’re actually working or flying to D.C., and they can’t ask for more back than their actual expenses. They’re also subject to daily spending caps determined by the General Services Administration. Members are “strongly encouraged,” but not required, to keep records of their expenses, according to guidance issued by the House Committee on Administration.

The same rules apply to every member. But lawmakers’ reimbursements requests have varied widely, and because the program doesn’t require receipts or detailed public disclosure of what members are expensing, taxpayers have to take lawmakers’ word that they’re playing by the rules.

Of the 435 voting members of the House, 319 members - 153 Democrats and 166 Republicans - received reimbursement for some food or lodging expenses last year, alongside three delegates from U.S. territories. The other 116 members received no money from the reimbursement program, according to a Washington Post review of the first 11 months of data released by the House.

Rep. Matt Gaetz (R-Fla.), the program’s overall top spender, was reimbursed for nearly $30,000 in lodging expenses and more than $10,000 for food in 2023. He was reimbursed for more than $4,000 for lodging in two different months and more than $3,000 in five different months.

A spokesperson for Gaetz said he was reimbursed for lodging expenses on days when the House was out of session but Gaetz remained in Washington on official business for depositions related to his post on the select committee on weaponization of the federal government.

“Rep. Gaetz has always complied with House rules regarding congressional reimbursements,” a spokesperson for Gaetz emailed in a statement. “In 2023, Rep. Gaetz dedicated significant time to his work on the Weaponization Subcommittee, requiring his presence to be in Washington, D.C., on days often when there were no votes, which incurred additional reimbursement expenses to conduct depositions.”

Other members of the weaponization committee expensed significantly less than Gaetz.

Some members of Congress who own homes in the Washington area, including Reps. Patrick T. McHenry (R-N.C.), Ro Khanna (D-Calif.) and Mike McCaul (R-Tex.), have chosen not to participate in the program at all. Rep. Jim Banks (R-Ind.), who owns a $1 million home in Virginia, was reimbursed less than $1,500 each month.

But other D.C. area homeowners, including Reps. Nancy Mace (R-S.C.) and Eric Swalwell (D-Calif.), requested significantly higher reimbursements than Banks did for some months of 2023.

Mace, who co-owns a $1,649,000 Capitol Hill townhouse she purchased in 2021 with her then-fiancé, Patrick Bryant, expensed a total of $19,395 over the nine-month period ending on Sept. 30, 2023, an average of more than $2,000 a month. She expensed over $3,000 for lodging in January, March and May.

Swalwell, who purchased a $1,215,000 home in the Eckington neighborhood of Washington, was reimbursed nearly $19,000 for lodging expenses over 11 months in 2023. In May of that year, he received $2,838 in lodging reimbursement.

As homeowners, Mace and Swalwell aren’t allowed to ask taxpayers to cover their mortgage payments, and can only expense taxes, insurance, maintenance, utilities and other ancillary costs.

“There’s nothing ‘average’ about having three children and a wife who are trying to live between two expensive areas,” Swalwell spokeswoman Cassie Baloue said in a statement. “The Congressman’s expenses reflect the actual cost of working in D.C. and are signed off by House Administration.”

Swalwell owed about $1,144 per month in taxes and insurance alone, according to figures provided by his spokeswoman, and incurred other home maintenance costs she declined to specify.

“Every month is different as to what maintenance costs Rep. Swalwell is reimbursed for,” she added. “Everything he does is allowable.”

Mace was told by people involved with her office finances that she could not justify claiming more than about $1,800 a month for expenses on the townhouse, according to two people familiar with the discussions, who, like others interviewed for this story, spoke on the condition of anonymity to disclose private conversations. One source showed The Post a document laying out Mace’s monthly expenses for the townhouse and calculating them as $1,726.

Mace instructed her staff to seek the maximum reimbursement each day the House was in session, regardless of her actual expenses, two former members of her staff and one other person familiar with the matter alleged to The Post. Mace denies that allegation.

Mace denied wrongdoing and declined to explain her expenses in detail. Her office did not answer questions about maintenance and other costs related to the house she co-owns with her ex-fiancé. Mace owns 28 percent of the home, according to the deed, but did not answer questions about what percentage of the bills she paid. She did not claim any expenses for the fourth quarter of 2023, but did not explain why.

“We follow all the rules for reimbursements,” said Gabrielle Lipsky, a spokeswoman for Mace, who said the office found $300,000 in other savings last year unrelated to the reimbursement program.

Mace has been at war with a group of her former staffers for months. Her former chief of staff, Daniel Hanlon, took steps this year to run against her in a primary. He later bowed out. Mace’s main opponent in a hotly contested June 11 primary is Catherine Templeton, a former South Carolina gubernatorial candidate who has accused Mace of flip-flopping “for fame.”

Misusing taxpayer funds under the members’ allowance could violate both House rules and federal law, said Kedric Payne, former deputy chief counsel of the Office of Congressional Ethics, who now serves as the vice president of the Campaign Legal Center, a nonpartisan government watchdog group. Payne said that anyone who misuses the program could face corruption charges similar to those brought against Aaron Schock, a former congressman from Illinois who used government and campaign funds to remodel his Capitol Hill office in the style of the TV show “Downton Abbey.”

“The new travel reimbursement rules cover very specific expenses and have strict dollar limits,” said Payne. “Any member who violates these rules and submits false reimbursement claims can face civil and criminal penalties. The Office of Congressional Ethics frequently investigates members’ blatant misuse of taxpayer dollars. Voters have a right to know that their elected officials aren’t using public funds for personal expenses.”

The member reimbursement program has been popular, but any perception of unfair enrichment could endanger it. Congress is already one of the least trusted government institutions, and 81 percent of Americans believe that members of Congress do a somewhat or very bad job at keeping their personal financial interests separate from their work in Congress, according to a September 2023 Pew Research poll.

The bipartisan House Select Committee on the Modernization of Congress suggested the member reimbursement account program in 2022 as an alternative to raising members’ salaries. Defenders of the program have argued that it matches benefits offered to lawmakers’ counterparts in the private sector and executive branch and encourages diversity of representation.

Members of Congress make $174,000 per year, which is about twice the median U.S. household income, but they must usually maintain two households: one in Washington, an expensive metro area, and another in their home districts. Many commute long distances at great expense.

Some good-government and anti-corruption groups argue that higher lawmaker salaries would make public service more attractive to a wider array of Americans and discourage corruption. But members of Congress have not given themselves a raise since 2009, as voting to do so is considered politically unpalatable. Some lawmakers have turned to living in their own offices to defray the costs.

“I wish members would give themselves a raise that they probably deserve and then we’d all move on,” said a staffer involved with congressional accounting, who spoke on the condition of anonymity because they were not authorized to discuss the program publicly. “But they don’t have the backbone to do that, so [they gave] members a raise through this backdoor way that allows for abuse because there is no record keeping and there’s no receipts.”

Leigh Ann Caldwell and Alice Crites contributed to this report.

All the UW Current Site

- Faculty & Staff

Frequently Asked Questions

- Click question to view answer.

- Search all categories or a specific category selected from the list at right.

A Travel/Cash Advance (previously Per Diem Advances) are requested through the Spend Authorization task and Expense Report module. Reconciliation of a Travel/Cash Advance is completed through the Expense Report module. Learn more .

Living Allowance: A department may issue a Living Allowance to defray costs that a non-UW Foreign National may incur while in Seattle for UW Business. Living Allowances will be submitted through the Miscellaneous Payment module.

Restrictions:

•limited to the GSA meal per diem rate for actual dates of stay in Seattle

•payment will not be released until all required foreign national documentation is attached to the expense report

•may not be used to defray expenses for others

Time Limitations:

•allowance may not exceed 30 days at a time

•WT/B2 visa types limited to 9 days reimbursement every 6 months

Learn more .

It depends. The Fly America Act mandates the use of U.S. certificated air carriers for federally funded international travel. Learn more.

- Effective January 1st, 2018

- To ensure expenses are properly accounted for, documentation must comply with the IRS Accountable Plan

- If itemized receipts are obtainable and compliant with IRS Accountable Plan, reimburse expenses as usual on their appropriate line items

- If receipts are not itemized and not compliant with the IRS Accountable Plan, use the 'Package Deal' line item in Ariba and follow the built in tax instruction

- Federal Income Tax = 22%

- Social Security Tax = 6.2%

- Medicare Tax = 1.45%

- For non-UW Individuals, due to tax reporting requirements, non-UW employees are to be paid honoraria through the Miscellaneous Payments process

**All resources should be exhausted to acquire IRS Accountable Plan compliant receipts. The package deal line item should be used as a last resort when those resources have been exhausted.

Contact Accounts Payable (checks) at [email protected] and provide the check # of the check you wish to cancel. The check # can be obtained by checking my FD.

To reissue the payment, a new ER will need to be processed after confirming the live check has been cancelled.

Please make a comment on the old ER stating the check number and confirmation that it has been cancelled. After confirming cancellation, on the new ER, please make a comment stating that it is replacing the previous ER.

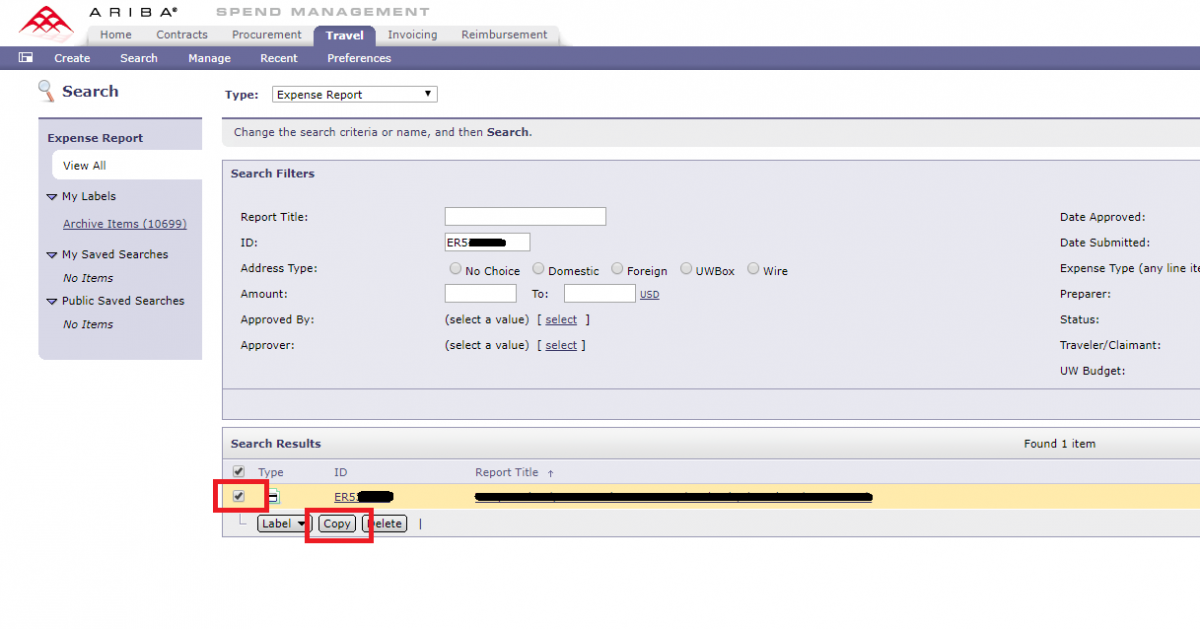

To speed up the process, you can use the ‘copy’ function in Ariba. Note that all attachments will need to be reattached and all comments will need to be re-added. Here are the instructions:

1. Locate the previous Expense Report by searching for it

2. Select the Expense Report by marking the check-box to the left of it (do not actually open the report)

3. Click on the 'copy' button, which will be right below

4. Click the travel tab at the top of Ariba, the copy report will be in the 'My Documents' section of your dashboard

5. Please attach all of the required receipts/documents, as they won’t be automatically copied

6. Please re-create line item comments and overall comments, as they won’t be duplicated either

Here is a screenshot example:

*Signature from previous report may be attached as long as the expense line items/amount has not been changed.

- select UW box

- have the check sent to yourself

- reroute the check through the us postal service

Sending checks to foreign addresses is highly discouraged as they tend to take a long time to reach their destination and more often than not they are lost. Additionally, most foreign banks do not accept US checks. We recommend processing a foreign wire in lieu of a check to a foreign location.

Tips for transportation, such as taxis and shuttles are ok to reimburse, any other tips are considered an incidental expense which is included in the meal per diem as meal per diem has an added amount for incidentals.

Please prorate the car rental. Take the total amount and divide by the number of days. Multiply the daily rate by the total number of business days (please also do this if they rented at a weekly rate but business days were less).

►Mozilla Firefox:

Go to : Tools -> Options -> Advanced Panel -> Network -> Cashed Web Content -> Clear Now After clearing cache log out of all browsers and restart the computer.

►Internet Explore (IE9):

- Close all browser sessions (if needed restart computer)

- Open a new Internet explorer browser, and go to delete browsing history Go to : Tools -> Internet Options -> Browsing History -> Delete or ctr+shift+del

- Make sure “ Preserve Favorites website date ” is unchecked and “ Temporary Internet Files ” and “ Cookies ” are checked