Travel Protection Plus

Your pet became sick? No problem! You can cancel or change your reservation— no change fees! Price gone down since you booked? No worries! United Vacations can guarantee our lowest price on select vacations! Unexpected mishap while on vacation? We've got you covered!

Our Travel Protection Plus helps give you some peace of mind, before and during travel. Cancel or change your vacation at any time, guarantee our lowest price on select vacations, receive during travel coverage and more.

What is Travel Protection Plus?

Pre-departure penalty waiver provided by united vacations vacations and other non-insurance services provided by generali global assistance’s designated provider.

- Cancel for Any Reason Waiver: You may cancel your vacation for ANY reason prior to departure and receive a full refund for your vacation, less the cost of the Travel Protection plan, including, non-refundable airfares booked through United Vacations.* Non-refundable hotel rates are not included. Your refund is made in the original form of payment unless at the time of purchase you elect to receive a portion or all of your refund in the form of United Vacations travel credits**.

- Price Guarantee***: Guarantees the lowest price on the vacation booking! If the price of the hotel on your vacation drops after booking the reservation, just let us know and we'll adjust the reservation to the lower price. Valid on Africa, Asia, Australia, Caribbean, Central America, Europe, Hawaii, Mexico, South America, and South Pacific vacations.

- No Change Fees: Need to make a change? Any United Vacations fees for the FIRST instance are automatically waived with no charge or reactivation fee when there are no supplier change fees. For changes that require a complete cancellation and rebook, the new booking must be finalized within 7 days of the initial cancellation.

- Note to Minnesota, Missouri, and New York residents only: You are not required to purchase the Post-Departure Travel Insurance in order to purchase the Pre-Departure Penalty Waiver. Contact 1-877-538-3815 for details

- Hurricane Travel Credit*^: If a Category One or greater hurricane disrupts a vacation for 24 hours or more, travelers will receive a refund for unused or interrupted vacation nights plus a future vacation discount certificate. Valid for reservations departing June through November.

Travel Credit Policies

- Travel credits are valid for travel commencing within 395 days of original departure date.

- Travel credits are nonrefundable, nontransferable, not redeemable for cash, and must be used by expiration date.

- Travel credits will be issued in the names of the passengers on the original reservation.

Post-Departure Travel Protection Benefits^ Underwritten by Generali U.S. Branch

- Trip Interruption: Reimburses (up to the total trip cost) unused hotel arrangements plus additional transportation costs such as a new airline ticket if you can't travel due to circumstances such as illness or injury to you, a family member, or traveling companion, jury duty, or a traffic accident on the way to the airport.

- Trip Delay: Reimburses you up to $1,000 per person for expenses such as meals, lodging, and local transportation costs should you be delayed 6* or more hours due to a covered event, such as a Common Carrier Delay, lost or stolen passport or other covered events.

- Missed Connection: The plan reimburses you up to $1,000 for unused land or water arrangements and additional transportation should you miss your Cruise or tour departure due to a delay of at least 3* hours due to a covered reason, such as a flight delay from adverse weather.

- Emergency Evacuation: Under certain circumstances detailed in the Plan, the Plan can pay for the transportation expenses Incurred to evacuate You to the nearest qualified hospital and/or to return you home.

- Baggage/Personal Property: Reimburses you for baggage or items lost, stolen or damaged during your vacation.

- Medical Expenses: Reimburses medical costs should you incur hospital charges or other medical bills as a result of an illness or injury during your vacation.

- Baggage Delay: Reimburses for the purchase of necessary personal items if your bags are delayed by the airline for 6* hours or longer. The plan covers you for the purchase of necessary items up to $300 in the event your luggage is delayed by a common carrier for more than 6* hours en route to your vacation.

- Travel Accident: Accidental Death & Dismemberment – Travel Accident coverage in the event of loss of life, limb or sight resulting from an injury occurring during Your Trip.

Travel Protection Plus Pricing*

*Price is per person. Valid for of all vacation packages and destinations (except scheduled air only vacations). Holiday Pricing (departures 12/18-12/30): Add $30.00 per adult ages 13 +; add $15.00 per child 12 and under ( maximum $114.99 ).

Plan payment includes: 1) A fee for Part A Non-Insurance Cancel For Any Reason Waiver, 2) Part B Insurance Benefits, and 3) a fee for non-insurance assistance services. You may obtain information on the Part A fees and/or plan fees by emailing Trip Mate . View plan details and important disclosures .

How Do You Purchase Travel Protection Plus?

While you are building your vacation, you can select Travel Protection Plus from the Add-Ons menu, or add it during the first step of the check-out process in the Travel Protection section. Travel Protection Plus can only be purchased online during the booking process. To add travel protection after you have made your reservation, call your travel agent or United Vacations customer service at 888-584-3899. Travel Protection Plus may only be added within 7 days of your initial deposit, provided you have not yet made your final payment.

Insurance benefits are underwritten by: Generali U.S. Branch

Non-Insurance Services: are not insurance benefits underwritten by Generali U.S. Branch. The plans also contain non-insurance Travel Assistance Services provided by Generali Global Assistance and FootprintID®.

Plan Administrator: Trip Mate, a Generali Global Assistance and Insurance Services brand, P.O. Box 527, Hazelwood, MO 63042, 1-866-389-5378.

* Canceling or changing their vacation at any time before departure without costly revision fees does not include non-refundable properties. Supplier-imposed fees such as airline/hotel revision penalties will be covered for the first revision instance. If used to cover supplier-imposed fees, Travel Protection Plus will need to be reapplied to the reservation at 75% of the original price in order to maintain the program benefits or the traveler is subject to any subsequent revision or cancel fees.

*** For the Price Guarantee to apply to the hotel portion of the reservation, the price adjustment must be made to the reservation while the lower United Vacations rate is available. Price Guarantee also covers the air portion of exclusive nonstop vacation air vacations.

*^ The Hurricane Travel Credit applies for vacations departing June through November. While in destination, if your United Vacations trip is interrupted for 24 hours or more due to a Category One or greater hurricane, you will receive a refund for unused or interrupted vacation nights plus a "Fresh Start" certificate for a future vacation. "Fresh Start" certificate amounts: $100 per adult, $50 per child for Exclusive Nonstop Vacation Flights1 and $25 per person for Scheduled Air Vacations. "Fresh Start" certificates are non-transferable and are not redeemable for cash and can be used on a United Vacations Vacation for travel any time (excluding holidays) for one year from the original departure date. A qualifying disruption occurs when your hotel requires you to be displaced from their room for 24 hours or more due to the result of a Category One or greater hurricane and does not apply to hurricane watches, warnings or tropical storms. The Hurricane Travel Credit Plan applies to the nights you are displaced from your hotel if a comparable hotel of equal or greater hotel rating is not provided.

^ Travel Protection Plans are administered by Trip Mate, a Generali Global Assistance & Insurance Services brand, located in San Diego, CA. Plans are available to residents of the U.S. but may not be available in all jurisdictions. Benefits and services are described on a general basis; certain conditions and exclusions apply. Travel Retailers may not be licensed to sell insurance, in all states, and are not authorized to answer technical questions about the benefits, exclusions, and conditions of this insurance and cannot evaluate the adequacy of your existing insurance. This plan provides insurance coverage for your trip that applies only during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of this policy with your existing life, health, home and automobile policies. The purchase of this plan is not required in order to purchase any other travel product or service offered to you by your travel retailers. If you have any questions about your current coverage, call your insurer, insurance agent or broker. This notice provides general information on Generali’s products and services only. The information contained herein is not part of an insurance policy and may not be used to modify any insurance policy that might be issued. In the event the actual policy forms are inconsistent with any information provided herein, the language of the policy forms shall govern. Travel insurance plans are underwritten by: Generali U.S. Branch, New York, NY; NAIC # 11231. Generali US Branch is admitted or licensed to do business in all states and the District of Columbia. For the operating name used in certain states, and other important information about the Travel Protection & Assistance Services Plan, please see https://www.generalitravelinsurance.com/customer/disclosures. The Travel Protection Benefits are underwritten by Generali U.S. Branch, provided through Trip Mate, a Generali Global Assistance & Insurance Services brand, P.O. Box 527, Hazelwood, MO 63042, 1-866-389-5378. Non-insurance Services: are not insurance benefits. Generali Global Assistance 24-Hour Assistance Services are provided by their designated provider and a Personal Portable Health Record Provided by FootprintID®. Benefits on this page are described on general basis only. There are certain restrictions, exclusions and limitations that apply to all insurance coverages and services. This advertisement does not constitute or form any part of the Plan Description or any other contract of any kind. Plan benefits, limits, and provisions may vary by state jurisdiction. Note to Minnesota, Missouri and New York residents only: If you would like to purchase either the Pre-Departure Penalty Waiver or the Post-Departure Travel Protection contact 1-866-389-5378 for details.

To view the full plan details please visit: www.tripmate.com/wpGR430U and view your state specific plan document.

Please update your browser.

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

Update your browser

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

We’ve signed you out of your account.

You’ve successfully signed out

We’ve enhanced our platform for chase.com. For a better experience, download the Chase app for your iPhone or Android. Or, go to System Requirements from your laptop or desktop.

Credit Cards

Checking Accounts

Savings Accounts

Chase for Business

Commercial Banking

- ATM & branch

- Show Search

Travel Protection

Please turn on javascript in your browser.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

- United Card Events from Chase

- Luxury Hotel & Resort Collection

- Cardmember offers

- Manage your account

United℠ Explorer Card

United℠ Explorer Cardmembers enjoy built-in travel protection benefits that give you peace of mind while traveling near and far.

Baggage Delay Insurance

Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 3 days.

Lost Luggage Reimbursement

If you or an immediate family member check or carry-on luggage that is damaged or lost by the carrier, you're covered up to $3,000 per passenger.

Trip Delay Reimbursement

If your common carrier travel is delayed more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses made with your United Explorer Card, such as meals and lodging, up to $500 per ticket.

Trip Cancellation/Interruption Insurance

You can be reimbursed up to $1,500 per person and $6,000 per trip for your pre-paid, non-refundable passenger fares, if your trip is cancelled or cut short by sickness, severe weather and other covered situations.

Travel Accident Insurance

When you pay for your air, bus, train or cruise transportation with your United Explorer Card, you’re eligible to receive accidental death or dismemberment coverage of up to $500,000.

Auto Rental Collision Damage Waiver

Decline the rental company’s collision insurance and charge the entire rental cost to your United Explorer Card. Coverage is primary and provides reimbursement up to the actual cash value of the vehicle for theft and collision damage for most rental cars in the U.S. and abroad.

For assistance with all United Explorer Card protection benefits, please call 1-888-880-5844 or 1-804-673-1691 . International charges may apply; please contact your service provider for additional details.

Chase Survey

Your feedback is important to us. Will you take a few moments to answer some quick questions?

You're now leaving Chase

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

Travel information

Flight and gate status, what to expect on your trip, baggage information.

- Carry-on baggage

- Checked baggage

- More baggage information

Traveling with animals

- In-cabin pets

- Service animals

Accessible travel

- Children traveling alone

- Traveling while pregnant

- Traveling with children

- Flight delays and cancellations

Airport and aircraft information

- Aircraft details

- Airport processing times

- Airport check-in counters

- Airports and terminal maps

- Boarding process

- Documentation requirements

- Expedited airport programs

- United Club℠ lounges

Onboard experience

- United Polaris ®

- United First ®

- United Business ®

- Premium transcontinental service

- United Premium Plus SM

- United Economy ®

- Economy Plus ®

- Basic Economy

- Preferred Seating

Onboard services

- Entertainment

- Inflight power

- Inflight Wi-Fi

- Receipts from inflight purchases

- Seating options

Destination information

- Destinations served

- International travel

- Transportation partners

Mobile tools

Contract of carriage.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Airline Travel Insurance vs. Independent Travel Insurance: Which Is Right for You?

Alisha is a freelance writer and photographer. She is the creator of travel and adventure site Terradrift.com and has written about travel and rewards for many publications, including American Way and Johnny Jet.

Mary Flory leads NerdWallet's growing team of assigning editors at large. Before joining NerdWallet's content team, she had spent more than 12 years developing content strategies, managing newsrooms and mentoring writers and editors. Her previous experience includes being an executive editor at the American Marketing Association and an editor at news and feature syndicate Content That Works.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Airline travel insurance

Independent travel insurance, which one is right for you.

You’ve planned your travel, found a flight, and can’t wait to book the trip on the airline’s website. But right before you hit the payment button, you have one seemingly simple question to answer: Do you want to add travel insurance?

It’s a booking option that has stumped many a traveler. You may think you need it, but what does that airline insurance even cover? And would it be better to purchase separate travel insurance from an independent company instead? Here, we’ll help you break down that decision and figure out which one is right for you.

For starters, every airline’s travel protection coverage is different. Some airlines, like Southwest, don’t offer any sort of trip protection for purchase with regular flights, but they do have an insurance option for Southwest Vacations.

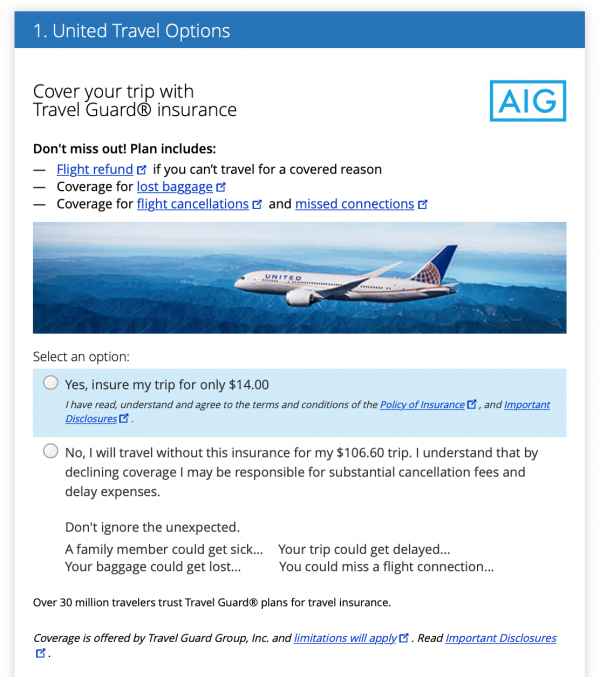

United, on the other hand, offers full travel insurance through a partnership with AIG, while British Airways offers protection with Allianz. So be aware that while you may purchase insurance through the airline, your policy is likely underwritten by a third-party insurer.

Airlines offer a wide variety of travel insurance policies with varying benefits, so ensure you read the fine print to understand your specific coverage. Here are some examples:

Trip cancellation or interruption, meaning you’ll get a refund of whatever you have paid (up to a certain amount) if you have to cancel or postpone your trip due to a covered reason.

Reimbursement for lost or delayed baggage.

Emergency medical coverage and/or assistance while traveling.

And coverage isn’t the only thing that can vary; so does price. One airline might sell a policy for less than $15, while others may be more than five times that amount. This is another instance in which it’s critical to compare the details of what you’re actually getting. Here are two example policies we found for sale via United and Alaska:

A few cons to consider

One potential downside of purchasing travel insurance through your airline is that you only have the option of that airline’s partner provider — which may not be your first choice, or may not offer the coverage you want or need.

United, for example, offers protection through AIG, which covers 100% of your trip cost if you have to cancel travel plans. British Airways, on the other hand, offers a plan through Allianz that only covers up to $1,000 for trip cancellation and protection (often less than the cost of a single international flight).

When booking travel protection or insurance through an airline, you usually won’t have the option to fully customize your plan. For example, if you’ll be participating in activities that aren’t approved by some plans (like bouldering, ballooning or even some volunteer work), you may not be able to upgrade to a plan that covers riskier activities.

However, if you’re not expecting to need any special coverage (though some would argue that you never expect to need it), clicking that box on the checkout page while booking your flight is often an easy and inexpensive option. Just make sure to read the fine print so you know exactly what’s covered and what’s not to avoid disappointment if you ever have to make a claim.

» Learn more: What to do if you get sick while traveling overseas

Independent travel insurance, on the other hand, gives you the ability to shop around and choose a plan that’s right for you.

Using a comparison portal like SquareMouth (a NerdWallet partner) or an independent insurance agent will ensure you get coverage tailored to your trip and will allow you to select plans based on price or features.

For example, if packing important or valuable materials in your checked luggage, you may want a plan that has a higher baggage loss reimbursement. If traveling to a country where there’s a higher risk of contracting malaria or another disease, you may want insurance that offers more overseas medical coverage or medical evacuation. And hand-selecting the exact coverage you want or need is something you can only do if you shop around outside any coverage your airline offers.

» Learn more: How to find the best travel insurance

Which option is right for you comes down to what type of coverage you need and how complex your travel plans are. If you’re taking a quick domestic trip to visit friends and family in a familiar destination and don’t plan to participate in any risky activities, airline-provided travel insurance may be enough protection for you.

On the other hand, if you’re planning the trip of a lifetime with multiple destinations, opportunities for volunteer work, participation in what some companies consider dangerous activities or travel to regions with limited medical care and higher chances of getting sick, it may be wise to consider independent insurance.

Remember that if your trip involves multiple airlines, car rental companies, accommodations and activities, it may be easier to deal with one independent insurance company that will cover your whole trip.

» Learn more: The majority of Americans plan to travel in 2022

Also, you may already have a credit card that comes with some travel protections if you use the card to purchase your trip. Check the fine print to see what protections your card might offer.

Whatever you choose, travel safe.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

IMAGES

COMMENTS

United Airlines' travel insurance aims to protect you if your trip is delayed, your baggage is lost or other travel mishaps occur. But the United Airlines flight insurance plan is far...

Our Travel Protection Plus helps give you some peace of mind, before and during travel. Cancel or change your vacation a t any time, guarantee our lowest price on select vacations, receive during travel coverage and more.

Travel Accident Insurance. When you pay for your air, bus, train or cruise transportation with your United Explorer Card, you’re eligible to receive accidental death or dismemberment coverage of up to $500,000.

Whether you get in a car accident in your rental car or your flight is canceled and you’re stranded overnight, you’re likely covered by your United credit card travel insurance.

What to expect on your trip. Learn how we’re putting safety and cleanliness at the forefront of your travel experience. Baggage information. Carry-on baggage. Checked baggage. More baggage information. Traveling with animals. In-cabin pets. Service animals. Accessible travel. Children traveling alone. Traveling while pregnant.

Travel insurance and assistance with UnitedHealthcare Global’s SafeTrip international travel insurance plans - medical, accident, trip cancellation and more.

United, on the other hand, offers full travel insurance through a partnership with AIG, while British Airways offers protection with Allianz. So be aware that while you may purchase...

AIG Travel’s travel insurance plans are currently available to the airline’s customers in the United States, Canada, Mexico and many countries throughout Western Europe. AIG Travel is a part of AIG’s market-leading Personal Insurance business.